Tech Talk - NPRA and ANWR: Will They Help TAPS?

Posted by Heading Out on September 4, 2011 - 4:29pm

When I wrote about the Alaskan Pipeline last week, I noted that the pipeline was currently flowing at a volume of 495 kbd after the Alyeska folk who run the system had just issued a report indicating that there would be problems once the flow fell below 600 kbd. Checking the flow rate for August (posted on Sept 1), the flow rate has risen back to 539 kbd, with average flow for the year-to-date running at 568 kbd. (The EIA reported final average for 2010 was 589 kbd)

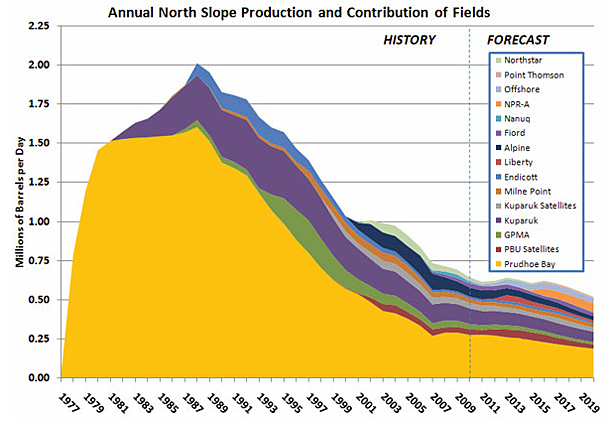

The problems that come with low flow (including reduced revenues) are recognized within the state and Alaskan Governor Parnell has urged that enough new wells be brought on line to allow flow to be raised back up to 1 million barrels a day (mbd) within ten years. With the ongoing decline of current reservoirs, one has, therefore, to look at the reservoirs that lie north of the Brooks Range, in what is known as the North Slope (though it is rather flat) and see what can be brought on line.

It should be remembered as a part of this, that despite talk of global warming, Northern Alaska is not a place where you can just drive a rig to a promising site and drop a new well in place within a couple of weeks. Nor has it the same level of Government scrutiny. For while the President has encouraged renewed drilling in the region, Shell, who was planning on a new program this year, has had to postpone it until next year because of an EPA concern over air quality permits. The nearest community to the planned wells in the Chukchi Sea is some 70 miles away, and has 245 inhabitants.

The need to find and develop a replacement for the Prudhoe Bay field and its adjacent fields is clear from the way in which the fields have been depleting.

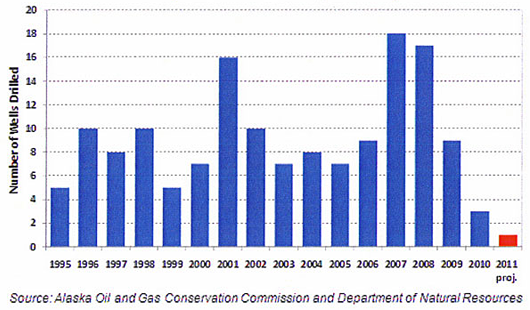

The impracticality of an immediate turn-around in the current decline is perhaps indicated by the fact that only one exploratory well will have been drilled in the state in 2011.

There must therefore be some incentives if companies are to drill in the future and the Governor believes that this will come about with a change in the tax incentives from the State. This need for some incentives is particularly true given the cost of operations that far North. Shell, for example, has spent close to $4 billion so far and has yet to start development. It is also expensively seeking to ameliorate some of the concerns raised after the Deepwater Horizon disaster.

Shell is proposing to use two drill ships, each capable of drilling a relief well for the other in case of the kind of blowout that destroyed the Deepwater Horizon rig. The company is also promising to add more testing and an extra set of shears to its blowout preventers and to keep emergency capping systems near drilling sites to capture any potential leaks.

But disregarding the politics, there is the question of how much oil is there?

The USGS has often given estimates of the technically recoverable resources that can be found in a region, but in the case of the North Slope they have taken this analysis one step further. A recent report took a review of the resources likely to be found in the National Petroleum Reserve- Alaska (NPRA) and applied some costs for the likely development of those resources, from which they came up with an estimate of the likely economically recoverable amount of oil that the NPRA holds. The analysis, both of what is there and its likely extraction cost, included some 30 exploration wells not previously considered. The analysis is also statistical in that, without actually drilling the rock, they can only estimate the likelihood of how much oil and gas are there. However, one thing that the exploration wells showed is that a lot of what was thought to be oil in the reserve is actually gas. Further, that the reservoir quality is worse than originally estimated. When the two are combined, the estimate of the likely oil to be found and recoverable fell from 10.6 billion barrels of oil (bbo) to 895 million barrels of oil (mbo), of which some 500 mbo are likely to be economically recoverable. (This is the mean estimate).

The USGS also considered the gas volumes present, and with no present way of getting the large quantities of natural gas that exist up there down to a consumer (and with costs likely at the moment to exceed those at which natural gas is available from other sources), they assumed that it will take at least 10 years for the gas to find a path to market. If it takes twice as long, then the amount of recoverable oil is likely to be only about 358 mbo. For a 10-year delay, the mean estimate for the amount of recoverable natural gas is 17.5 Tcf (trillion cubic feet) but this drops to 7.3 Tcf if it takes 20-years to get a pipeline in place. (Note that the amount of natural gas held in the NPRA is, at the mean, considered to be 52.8 Tcf). I am not going to go into the details of either the geological estimate, or the economic analysis but these are provided in the USGS reports. It is interesting, however, that they used a 12% decline rate (which they defend). The news about the condition of the reserves has apparently led some companies to relinquish their assets in the NPRA.

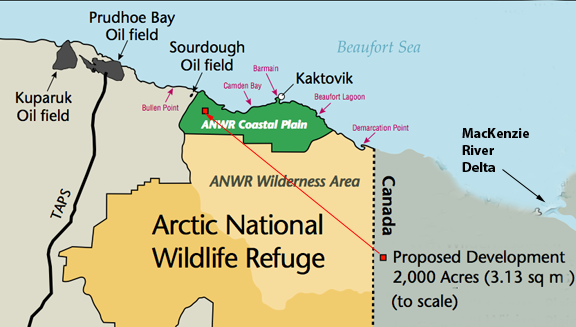

On the other side of Prudhoe Bay lies the Alaskan Wildlife Refuge, and particularly that part running along the coast that has been designated as ANWR – 1002, or more comprehensively, the ANWR Coastal Plain. Just north of the coast lies Camden Bay in the Beaufort Sea, and it is here that Shell has just had permits approved for four exploratory wells that should be drilled next year.

For the Coastal Plain itself, the USGS last updated their assessment in 1999, and using the mean values considered(the others are given in the report), the technically recoverable oil in place would be 7.7 bbo out of a total 20.7 bbo in Area 1002. If one assumes that the same sort of economic criteria apply to ANWR as applies to the NPRA, then one might assume that roughly 55% of that technically recoverable might be also economically recoverable, for a total potentially available from ANWR therefore as being around 4.3 bbo. However, it may also be that the same changes in both the reservoir rock and the type of hydrocarbon present may occur in ANWR as in NPRA, and if that comes to be the case, then the economically recoverable oil may fall to 10% of the current estimate, or around 430 million barrels. Not to be sneezed at, but not nearly as promising a number as has been discussed in the past.

While these numbers are still somewhat speculative, until a bit actually drills down to the rock and validates what is really there, the likely more critical conclusion at this time is that it is unlikely there will be enough new oil coming into the pipeline in the next few years to stave off continued decline and potential pipeline closure.

I had planned on writing about drilling in the Arctic and development and the off-shore fields, however I will put that off until next time.

It is true that exploration on the North Slope has declined the last couple of seasons. However, things are looking better for the 2011-2012 season. See North Slope Booms. While it is unlikely that all 28 wells mentioned in the article will get drilled, the coming drilling season is looking much better. (Onshore North Slope exploration drilling is done during the winter.)

Also, one nit picking point, that graph refers to North Slope wells. There have been several exploratory wells drilled "in the state" in 2011, notably in Cook Inlet.

While I do not dispute your correction, and thank you for it, had you clicked on the reference where I said "only one exploratory well" you would have been taken to the Alaskan Governor's Office and a page where they say exactly that for the state (its where I took the graphs from).

Actually, I did click on the link, and did read that

ourmy Governor's page said that. I was just trying to correct the record for TOD readers. Not the first time I've disagreed with him on something :-)This past summer, I came across the State of Alaska's decision on the TAPS property tax assessment from several years ago:

http://aws.state.ak.us/officeofadminhearings/Documents/TAX/TAX06SARB%20A...

In it, are the following stunner bullet points (see whole PDF for context):

94. For the evidence persuasively demonstrates that the affiliated producers would rebuild TAPS at a cost of billions of dollars (~19 billion to be precise) to transport ANS petroleum products to market if TAPS was not in existence as of the lien date.

100. The first tanker of crude oil left the VMT on August 1, 1977. At that time, ANS proven reserves were approximately 9.6 billion barrels. As of January 1, 2006, over 15 billion barrels had been transported through TAPS. As of January 1, 2006, there were more than 7 billion barrels of proven reserves on the North Slope to be transported to market through TAPS.

393. ... Dr. David Hite, in his expert report, cites to a number of sources that

estimate large quantities of technically and economically recoverable oil on the North Slope, including a federal evaluation and assessment of oil resources in Arctic Alaska that estimates there are 29.85 billion barrels of economically recoverable oil available for shipment down TAPS.

394 through 397 <>

407. ... The Royalty Trust stated in its 2006 SEC 10-K filing that “BP Alaska projects continued economic production [from Prudhoe Bay] at a declining rate until the year 2065 ….

509. Replacement cost and assessed value for taxes (see PDF)

Does anyone on the TOD staff care to comment on what they think about the clear disagreement regarding flow rates, proven reserves, and general life span of economic oil development in north Alaska? I am particularly interested if 393 is separate, overlapping, or redundant with Shell's recent estimates of 30B in artic off shore oil.

Thanks!

Cooter

I am certainly not a TOD staff member, but here are couple of points that might partially answer your question:

First off, Dave's expert witness report to the court presumably used, among other things, the 2002 USGS assesment of undiscovered oil in NPRA of ~10.6 billion barrels. In October 2010 (the same month this descision is dated), the USGS released their revised estimate of NPRA undiscovered oil of only 896 million barrels, or a reduction of about 90% for NPRA. I don't have the report Dave made to the court handy, so I would have to check regarding the other areas he included in his estimate.

Second, recall that the issue with TAPS (like PO in general) isn't about total reserves. The issue is about rate. In this case the rate of throughput that is required to keep TAPS in operation.

Correct.

Original specifications called for the pipeline to be shutdown below 300,000 bpd. That has since been rerated to 200,000 bpd.

But it is a flowrate issue. There is only so much turndown that the system can handle.

Somewhere I hava a pdf of an article quoting Henry "Scoop" Jackson (former Senator from the state of Washington) that had some claim that there were 100 billion barrles up there in the northern reaches of Alaska and that there should be serious consideration of building a second parallel pipeline to at least double the flow.

I think part of that was a response to how fast TAPs ramped up and part was associated with some other estimates of total oil in place. Of course, TAPs ran at maximum flow for only a short period of time and in retrospect it probably would have been better to build a smaller pipeline design (though there would also be problems with that, as well.

I think they grossly oversized TAPS because the oil companies wanted to make their investment dollars back in a hurry, and also because they expected to find other supergiant oil fields on the scale of Prudhoe Bay up there.

In retrospect that was a mistake because a smaller pipeline could keep running for much longer at lower flow rates, and no other Prudhoe Bay type fields have ever been found up there. The Alaska National Petroleum Reserve was downgraded from 10 billion to less than 1 billion barrels after it was drilled, and that is probably what will happen to the Alaska National Wildlife Reserve if they ever drill it.

Also in retrospect, running the pipeline to Anchorage and taking the oil from there to the Lower 48 by tanker was a mistake. If they had run it through Canada they could have accessed the Canadian oil fields in the Northwest Territories as well as those in Alaska.

Of course that didn't fit into the aspirations of the American nationalists who wanted an all-American pipeline on the assumption that the US would always have more oil than it needed. The oil companies really wanted to get the oil to Anchorage so they could export it to Japan and elsewhere in Asia. The oil crises of the 1970's put a stop to that plan.

I was also under the impression that lower flow rates create maintenance costs, but its doesn't mean the pipeline is defunct per se; it will just take more capital to operate. So the key question is when will flow rates drop below the operational minimum (~250k/bbl daily?).

On this note, the over-arching theme that really hit me as I was going through the filing was that TAPS exists because its the only economically viable option to ship north Alaskan oil. That implies any fields beyond Prudhoe bay, such as ANWR will have to go through TAPS. If this is true, then exactly how does Shell plan to ship that Beaufort sea production to market without TAPS? To me, this implies flow rates are going up in the future when Shell is able to get production flowing in the years ahead (obviously assuming thing work out).

One of the points in the document was "As of January 1, 2006, there were more than 7 billion barrels of *proven* reserves on the North Slope to be transported to market through TAPS." You cite undiscovered oil, which is a different animal correct?

Regards,

Cooter

Shell most likely intends to take oil out of any Beaufort Sea discovery by icebreaking tanker. If they hit something sufficiently big, it might provide enough additional volume to keep TAPS running for a long time. Failing that it would have to go direct to West Coast ports.

Having worked for a company that spent billions of dollars drilling on the Canadian side of the Beaufort Sea, and found nothing that was commercially viable, I expect Shell will have similar results. It's like drawing to an inside straight, if you win it's great, and if you don't it's a good thing you were betting with money you could afford to lose, like Shell is.

I suspect that much of the 7 billion barrels of proven reserves on the North Slope consists of extremely viscous heavy oil which will not flow through TAPS without heating. I don't think anybody is willing to spend the money to heat the pipeline through its entire length.

We all are waiting to see what flows out of the Shell offshore wells--hopefully they really will drill next season.

If the economically recoverable oil in ANWR and in NPRA each only come to about half a billion barrels the best we might be able to hope for from those two sources is enough oil to keep the TAPS flow above the 350,000 bpd Alyeska now says is the current safe shipping low volume threshold for an additional decade or two. And that of course is only if and when oil from those two areas actually comes on line.

I've heard that it's possible to make natural gas into liquid fuel.

http://en.wikipedia.org/wiki/Gas_to_liquids

Would it be possible for them to use that technique to make up for the shortage of oil?

Robert Rapier of TOD had a post on this and stated that only 60% of the original gas energy remains after conversion to liquid (propane, butane, heptane, etc). The natural gas price must remain less than half the cost of oil (per BTU basis) for this process to be economical. Unless the gas producer can be assured of the long term price differential I doubt gas to liquid plan would work (be profitable).

Actually back in the 70's Mobil Oil had a pilot plant in New Zealand that made gasoline (diesel?) from NG. But only because they got the NG free from the govt if I was told correctly way back then. If I understand correctly you can combine hydrocarbon chains into any compound you want but typcally at very noncommercial expense.

That plant in NZ made methanol from natural gas (in the conventional way) and then used the Mobil Process for methanol to gasoline. They did all this work to come on line in the early 80's just before world oil prices crashed. Same as you were left driving a taxi around Houston with $11/bbl oil, so too they shut down the MtG plant and just stuck with methanol for industrial use.

And given that the MtG process uses one liquid fuel - methanol - then makes another - di methyl ether - before finally making gasoline, and losing energy and adding cost at each step, you have to ask why bother? Just make methanol and use that directly as the fuel.

There was a proposal floated for doing a gas to methanol plant on the north slope, adding the methanol to the crude as a diluent, and then separating out at Valdez. Seems like a good idea to me, though I'm sure it is not as simple as it sounds.

I didn't realize that. Thanks for the information. I'll look up the article latter. Even if the process isn't normally profitable couldn't it still be useful in this situations? From reading Heading Out's last two posts the problems seems to be that the pipeline wont work unless it has enough oil. Can propane, butane or any of the other chemicals natural gas can be made into be mixed with the crude oil in order to create enough volume to keep things flowing? Heading Out's post said.

"The USGS also considered the gas volumes present, and with no present way of getting the large quantities of natural gas that exist up there down to a consumer (and with costs likely at the moment to exceed those at which natural gas is available from other sources), they assumed that it will take at least 10 years for the gas to find a path to market."

So they have natural gas there that they currently have no way of selling. It seems like the process might be a solution to both problems. I don't know enough about this type of thing to know if what I'm saying is at all feasible so I'm sorry if what I'm saying is nonsense.

Your idea certainly is not nonsense but one that could be considered to get the nat. gas into the energy market, but at a cost, while still keeping the pipeline usable at lower flow rates.

I am not an expert in refining nor grading oil, but the fact that the bitumen produced from tar sands is modified with such hydrocarbons to make it less viscous, does mean that such liquids could be added to the oil in Alyeska pipeline. Not sure how this would affect the quality of the oil and its cost at the delivery point (Valdez) though. Adding such smaller chain hydrocarbons (propane, butane and heptane) to the oil may make flow through the pipeline easier at lower temps, thus allowing lower flow rates in winter. Later refining would again separate these smaller chain hc's from the heavier fractions.

Yes, in principle that would work. Not only would this reduce viscosity, freeze point, etc., but API gravity would be raised.

Of course it is. It also happens to be the perfect example of an EROEI < 1 which has the possibility of making wonderful economic sense in an an environment short of normal, crude based fuels.

The EROEI from the inlet to the outlet of the plant is < 1. The same is true for a refinery.

Shell, Sasol and others are converting NG to liquid fuels via the FT process, in place like Qatar and Malaysia where there is an abundance of NG,not exactly stranded NG but no good use for it at that location. It certainly beats flaring it.

And with the sheer quantities available globally, it makes perfect sense in a value added type of way.

I think the majors have looked at about every imaginable idea to monetize the gas. I suspect the main issue is that it doesn't pencil out economically.

Another issue is that (at Prudhoe at least) once you start to blow down the gas accumulation, oil production will drop rapidly and soon cease. At present, nearly all the gas produced at Prudhoe is re-injected into the reservour to maintain pressure. There is also water injection, for the same reason. Without gas re-injection the reservoir pressure would rapidly fall and there would be no energy to move the oil to the surface.

One way around this, (and what will probably be done in any case if/when N Slope gas is marketed) would be to first use the gas from Point Thomson (~60 miles East of Prudhoe). Pt Thomson is a major gas field, with significant condensate, and a small oil rim. Pt Thomson has been in litigation between Exxon and the State of Alaska for several years (a long story in itself), but the State and Exxon appear to be close to some sort of agreement. Concurrently Exxon is trying to develop a gas cycling project at Pt Thomson to produce condensate. That project is currently hung up in a permitting issue with the Corps of Engineers, but when that is resolved, the project is expected to add about 10,000 bbl/day to TAPS. Not enough to reverse the decline, but every little bit helps buy some time.

Isn't Exxon planning to re-cycle the gas to recover condensate and NGL. That would mean that Exxon will have to import gas for several years to replace the liquid volume extracted and provide fuel for compression.

Here is a link:

http://www.akrdc.org/membership/events/breakfast/0809/haymes.pdf

Here is a layman explanation:

Point Thomson: Key gas field that’s challenging to produce

http://www.arcticgas.gov/point-thomson-key-gas-field

Yes, they will cycle the gas and produce the condensate, until there is a market for the gas. One of the reason's for the litigation between the state and Exxon is that Exxon has always viewed Pt Thomson as primarily a gas resource. Exxon wanted to sit on Pt Thomson until a gas pipeline was in place. They only started their plan to cycle gas and produce condensate when the state initiated action to dissolve the Pt Thomson Unit and take back the leases.

Remember that any use of the gas, whether down a pipeline or in some sort of gas to liquids project, would take many years to build before any of the gas was used. Even if such a project started today, Exxon has ample time to strip off the liquids and send them down TAPS.

I'm not sure I understand. Are you saying that the Pt Thomson site will buy the TAPS some time by adding 10,000 bbl/day of condensate to the pipeline?

Yes. Condensate from Pt Thomson would be carried west to tie into the Badami pipeline, which in turn ties into TAPS.

So where will the NG go? Back into the reservoir? Local consumption, on site power, and perhaps preheating the oil before it eneters the pipeline?

The plan for Exxon's current Pt Thomson development is to re-inject the gas back into the reservoir. This is what is refered to as "gas cycling". At Pt Thomson the gas will be produced, the condensate separated and sent down TAPS, and the gas then re-injected into the reservoir. Later, when/if a gas pipeline is built the gas can be produced again (the wells will be already in place) and sent down the pipeline.

Note that a great deal of gas (and some condensate) is produced with the oil at Prudhoe. This gas is all re-injected into the reservoir to maintain pressure for oil production (minus a small amount used for fuel at Prudhoe). If a gas pipeline were built, the plan would be to first produce the gas at Pt Thomson, while maintaining oil production as long as possible at Prudhoe. After Pt Thomson gas ran out, and the remaining oil had been produced from Prudhoe, then and only then would the Prudhoe gas be sent south.

"the Governor believes that this will come about with a change in the tax incentives from the State. This need for some incentives is particularly true given the cost of operations that far North."

Sure, that is what is needed - more government subsidies. (end sarcasm)

Hey, the faster we burn up all of the fossil fuels, the faster we can back to living within our means.

We will burn it all, everywhere...

We will burn it all, everywhere until...

1) We overheat the planet and cook ourselves, or

2) We develop adequate and affordable alternatives.

We didn't quit hunting whales for oil because we ran out of whales, but because we found an adequate replacement for whale oil at a better price.

How can this be? I actually agree with half of one of your posts.

How can what be?

If you want an answer to your question you'll have to flesh it out a bit....

Bob, we stopped hunting whales because we happened to find a replacement JUST BEFORE we run out of whales. The yearly whale catchments were falling like a rock as the whale population imploded. Crude oil saved the whales.

Now we are running out of oil. Are there a new replacement this time? Will we get lucky twice in a row?

We've got all sorts of replacements that, if we were to adopt them, would allow us to stretch our current supply of oil very much longer than it is going to last at the rate we're now burning it.

That would give us time to look for further answers.

Let's just look at one or two simple fixes.

Double the number of people in each commuting car. Do that and our 'commuting' oil lasts twice as long.

Make half our cars EVs or PHEvs. Double the time our oil lasts.

Move a lot of our long distance freight to rail rather than using 18-wheelers. Build some high speed rail and cut down on moderate length air travel. (It's working in Europe.)

Even if we don't have a 100% answer we have enough answers to buy us breathing room. It's not about having one great big solution. It's a 'death of a thousand cuts' assortment of solutions.

Has there been any recent news or speculation about KIC-1, the tight hole that was drilled in ANWR?

http://tech.dir.groups.yahoo.com/group/energyresources/message/780

Not really.

While as a geologist, you will never hear me say I don't want another point of well control, on the other hand, I wouldn't get too worked up about whatever secrets the KIC well holds. A couple of things to consider:

Neither BP nor Chevron (the two partners in KIC #1) have put much effort into pushing to open ANWR. In fact, quite a few years back BP dropped out of a lobbying consortium that was promoting opening ANWR. Their dues to that group was a pittance for a company of BP's size, but they apparently didn't think it was worth the money.

Another reason the KIC may not be that important is regional geology. The USGS believes that the Ellesmerian Sequence, which includes the main pay at Prudhoe (the Sadlerochit) is not present in the eastern half of the 1002 area. Based regional considerations and interpretation of seismic, the survey believes that in the eastern 1002 there is Kingak Shale on top of basement. Any oil accumulation in that area would need to be either in Brookian rocks or Kuparuk equivilent. While both of these produce oil elsewhere on the slope, neither is the mother load like the Sadlerochit.

Finally, the Aurora #1 was drilled in state waters only a few miles from KIC #1. It was specifically drilled by Tenneco and ARCO as a strat test to provide equivilent information as KIC #1. Quite deep, after penetrating multiple thrust sheets, Aurora found Kuparuk equivilent on top of Kingak. The combination of regional geology, seismic, and the Aurora well is why the USGS puts only 7.7 billion bbl as the mean recoverable oil in ANWR 1002. If there were a stronger case for Ellesmerian rocks in the 1002 area, their estimate would be much higher.

It needs to be said, however, that the 1002 has very compicated geology. Even our seismic is a rather blunt tool, and the ANWR data is > 30 years old. Those of use who drill wells for a living get kind of humble, since the earth is full of surprises. It is possible that the geology does change betwen the Aurora and the KIC wells. The USGS may be wrong, and there could be a much bigger prize. On the other hand they may also be wrong in the other direction, and there may not even be 7.7 billion bbls there. Only the drill bit will tell for sure.

What's the likelihood of Japan wanting this natural gas? It looks like they are going to move heavily to natural gas after their nuclear catastrophe. Do they have long term cheaper alternatives than Alaska?

Is there a sort of extra risk for first movers (new drillers)? If I invest in a new well, and hit oil, but no one el;se drills, so the pipeline must be abandoned, I know own a stranded oil well, and lose my shirt. I can only win, if both I hit oil, and eneough other people drill succesful wells, that the delivery infrastructure remains in place. I could imagine this could be a significant hurdle to overcome.

It depends.

For any longer term project there is certainly that risk. For example I'm sure that is a big consideration for Shell with their offshore Beaufort drilling plans. Even if they start drilling now, it will take many years before any oil they find could be brought ashore and into TAPS. If TAPS were to shut down before then....

For projects that take less time to develop and are not so far from infrastructure it is not such a risk. If one can develop new production in a couple of years then one can be reasonably sure that there will still be a pipeline to get it to market. Not only that, the mere fact of bringing that new production into TAPS slows the decline and buys more time for TAPS. A win-win for everyone.

There are a few smaller projects that are being developed. ENI has recently started production at Nikaitchuq, which if I remember correctly will bring about 23,000 bbl/day into TAPS. Pioneer is producing and drilling new wells at Oooguruk, another modest (by N Slope standards) accumulation. ConocoPhillips found a small extension to Alpine Field that they plan to develop, if and when they get their permit to build a pipeline across the Colville River.

Here is an interesting one:

Umiat:a North Slope giant primed for development

http://www.renaissancealaska.com/docs/OGJ%20Article%20Umiat%2001112010.pdf

Renaissance apparently sold the deal to Linc Energy:

Linc Energy to develop Alaska Umiat oil field

http://www.ogj.com/articles/2011/06/linc-energy-to-develop.html

One has to wonder why Exxon hasn't developed the field. Several interesting challenges:technological, environmental and political.

Umiat was discovered in the 1940's, during the Navy's Pet 4 exploration effort. The "official" estimate for Umiat is about 70 million bbls recoverable. However, that was based on 1940's era drilling and production techniques. I think almost everyone believes it would produce more that that with today's technology. Twice that would not be unreasonable, and based on the size of the structure and possible (currently untested) deeper zones, Umiat could be even bigger than that.

Back about 10 years or so ago, a group out of Denver picked up the main BLM leases at Umiat, then fleshed that out with some flanking state acreage. They tried to promote it for several years, and it was ultimately picked up by a small company called Renaissance, who shot a 3 D survey and initiated a number of other studies. They recently sold it to Linc, who appears to be ready to invest in some drilling and testing.

Umiat is a good ways west of TAPS (about 60 miles if my aging memory serves), so it would require a significant investment in pipeline to produce it. Also, until recently, the only available data was some ancient (1940's) well logs, and some almost ancient 2D (1970's) seismic data. For many years the majors no doubt had more attractive exploration projects to spend their money on.

Another reason they may have passed the opportunity is that there are some formidable technical and environmental issues. Part of the oil column is in the permafrost zone, so it is uncertain if and how that could be produced. There are also active surface oil seeps at Umiat. The fear may be that if one started to produce the field, which might involve melting (intentionally or otherwise) the permafrost, the seeps might increase. There is no doubt a fear of potential environmental liabilty.

On the plus side for Umiat, there is now some modern seismic over the field. UAF is doing a number of studies on production from within the permafrost. And the state is seriously considering building a road to Umiat. This would be a spur road west off of the Dalton Hwy (the "Haul Road"). Some have claimed that with a road in place (paid for by the state), Umiat would be very economic.

Stay tuned.

Yeah, the O & G Journal article is a little short on details, although they present some informative and colorful diagrams.

One of the things I don't quite understand: is the permafrost the caprock ? It appears the uppermost zone is exposed at the surface, cut by the Coalville river.

The permafrost may be at least part of the seal for the uppermost sands at Umiat. If I remember correctly there are several oil bearing zones. I don't beleive they all require permafrost for a seal.

Edit to correct a late nite fat finger typo.

What is your opinion of the Ugnu?

I assume you are refering to the heavy oil development? Not my area of expertise, but I will tell you what I know. There is a huge amount of heavy oil in place. There is a whole range of "heavy" oil in the Ugnu and Shrader Bluff Fms. There has been "viscous" oil production from the Schrader for some time.

Recently BP started their heavy oil pilot production, producing some of the really heavy stuff from the Ugnu. I think they have one well in production at the moment. The spin BP is putting on it is that it is doing quite well. How good it will do over time is the real question. There are some formidable technological challenges for this project. For example, the sand produced with the oil tends to erode the equipment.

Another issue that might limit heavy oil production over time is that the really heavy stuff doesn't flow down TAPS very well. To make it work, it is necessary to blend it with lighter crude from the conventional reservoirs. Thus in the long run, the amount of heavy oil that can be produces may be limited by the amount of conventional N Slope production.

Or syncrude made from the stranded natural gas.

In the graph entitled "Location of the ANWR Coastal Plain, relative to Prudhoe Bay ( ANWR)" it shows the text: 2000acres (3.13 sq m). What is this? One acre has about 4,048 sqm. Hence 2000 acres are about 8.0966 Million sqm. Or does the text mean something else but a conversion from acres to sqm?

It isn't metric, rather it is an acres to square miles conversion. One square mile = 640 acres. Therefore 2000/640 = 3.125 square miles.

HO got that map from a pro development website. There is currently no exploration activity in ANWR. The little 2000 acre red square is meant to show how small an area would be effected by a hypothetical development. With current N Slope development techniques (eg. at Alpine) the "footprint" of field development is much smaller than in older fields such as Prudhoe.