Natural Gas: The Squeeze at the Bottom of the Resource Triangle

Posted by Gail the Actuary on August 29, 2011 - 10:00am

Theoretically, we have a very large amount of resources of many kinds available–oil, natural gas, coal, uranium, gold, fresh water. There is a relatively small amount of high quality, inexpensive-to-extract resources, and we tend to extract those first. From there, we move to lower quality resources that are more expensive to extract. The question comes: How do we reach limits for the extraction of any of the resources?

For oil, I have shown this chart:

I recently explained what I think is happening with oil, as we are extracting lower and lower quality resources, in my article Oil Limits, Recession, and Bumping Against the Growth Ceiling. High oil prices are squeezing the economy, leading to recession. I think this squeeze may ultimately lead to serious financial problems and reduced oil production.

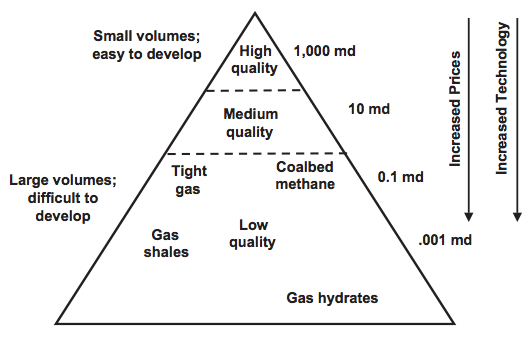

In this post, I want to discuss natural gas, instead of oil. Here we are also moving down the resource triangle, getting to lower quality, more difficult to extract resources as well.

Shale gas is very low on the resource triangle for natural gas, at least according to Stephen Holditch, in a paper authored under the Distinguished Author Series of the Society of Petroleum Engineers. It has even lower permeability (measured in millidarcies or md) than tight gas or coal bed methane.

It seems to me that in the United States we are, or will soon be, reaching a different kind of squeeze at the bottom of the triangle for natural gas–the squeeze of too low prices for shale gas producers to be profitable. If, somehow, natural gas prices do manage to rise sufficiently for the majority of shale gas producers to be profitable, the higher prices are likely to add to the oil’s high price squeeze on the economy that I noted in my earlier post.

In this post, I will explain what I see as happening with US natural gas supply and prices, and how this fits in with the natural gas supply controversy we have been reading about in the press recently.

1. The cost of extraction seems likely to increase as we move down the natural gas resource triangle, toward shale gas.

As we move toward more and more difficult to extract natural gas, located in less advantageous locations (next to cities, for example, as compared to in a location with few neighbors) I would expect the cost of extraction to get higher. This higher cost may relate to indirect costs related to extra precautions for protecting the environment in sensitive locations as well as direct costs of extraction.

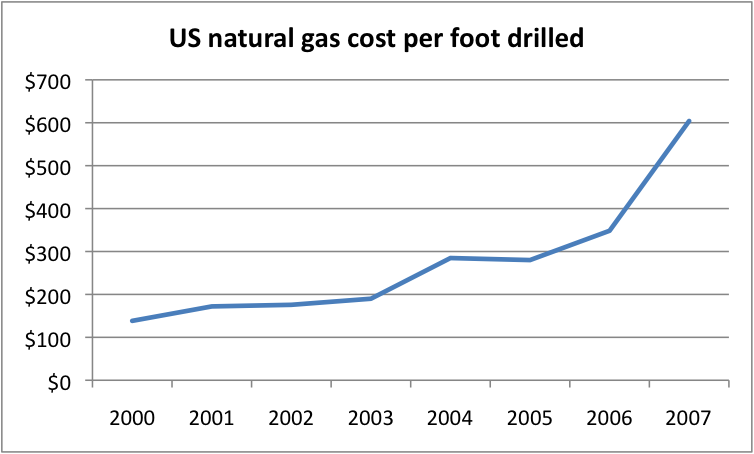

We know that if we look at US natural gas extraction, the cost per foot drilled rose more than four-fold between 2000 and 2007 (Figure 3), based on EIA data. At least part of the reason for this increase in cost is the greater use of fracking, which is very expensive.

In Figure 3, the amounts shown are averages for all types of natural gas wells drilled, including those that use little fracking as well as those that use a lot. Shale gas wells use a great deal of fracking, so would be expected to have higher costs than the average per foot drilled. (This is not complete proof that shale gas costs are higher, of course. If the fracked shale gas wells are extremely efficient, the benefit of the new wells could theoretically offset their higher cost.)

2. Part of the current shale gas controversy relates to how high the price of natural gas needs to be for shale gas to be profitable; part of the controversy relates to how much natural gas can be extracted from a given acreage.

There is a great deal of estimation that goes into figuring how profitable shale gas production will be. When a well is drilled, the producer hopes it will continue to produce natural gas for a very long time–30 or 40 years. One question is whether wells will really last that long, and continue to produce enough natural gas to remain economic. Another is whether it is possible to extrapolate favorable results for a few small areas to the entire acreage. It could be that the shale gas is concentrated in sweet spots, and these are drilled first.

A recent analysis by Art Berman and Lynn Pittinger is given in this recent Oil Drum post. According to their calculations, reserves in the aggregate appear to be overstated by more than 100% (suggesting that there is less than half as much natural gas per acre recoverable as what most operators are expecting), and the price needs to be more than double today’s price, for shale gas to be profitable.

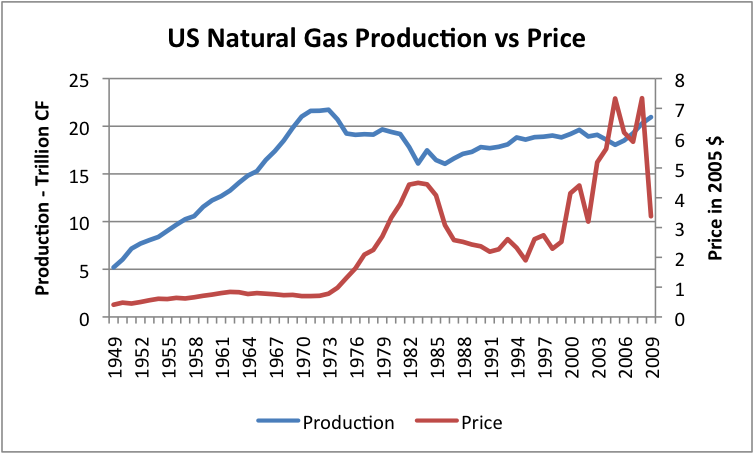

3. In the US, natural gas prices have been unstable. Current natural gas prices are low (around $4/mcf) in comparison to historical prices.

With oil prices, we are used to oil prices rising, as oil gets harder and harder to extract. This occurs because there is an international market for oil, and so a shortage of oil leads to higher prices for oil, enabling the extraction of lower quality resources (at least until recession sets in, and lowers price, in my view).

With natural gas, in the United States, the situation seems to be different (Figure 4).

Natural gas prices rise when there is a local shortage (1973-1983 and 2000-2008). But once the amount of gas extracted exceeds the amount that the market requires, prices drop sharply. Prices have been low, roughly in the $4 per thousand cubic feet (abbreviated mcf, where M is the Roman numeral for thousand) range, for about three years now–since late 2008. These low prices are what one would expect when there is an oversupply of natural gas.

The reason why prices drop when there is even a small oversupply of natural gas is because natural gas is difficult to store and transport. Once available storage space is full, there is no place to put the extra natural gas, and so prices can go to $0. Also, it is impossible to ship natural gas to buyers elsewhere in the world unless pipelines or liquified natural gas (LNG) facilities have been built in advance.

Furthermore, shipping natural gas is expensive. For example, one estimate for shipping natural gas by pipeline from Alaska to the 48 states was $2/mcf. If the selling price in the $48 states is only $4/mcf, the high shipping cost means that a producer in Alaska must produce gas for less than $2 /mcf, in order to make a profit, something that would be virtually impossible for most producers to do. Thus, high shipping costs can make long-distrance transport not feasible, unless a high price can be guaranteed in the receiving location, over the long term.

4. There is an un-level playing field in the cost of production of natural gas. The way costs are allocated, some producers can produce natural gas for practically nothing, while the cost of production is much higher for producers who must fully cover their true costs of production.

With oil, where there is a well-developed international market, we often hear, “The Easy Oil is Gone.” Oil companies sought out the cheap-to-extract oil first, and it is generally not available for new extraction. There may be some oil companies that are still extracting “cheap oil,” but if those companies want to find new resources, they pretty much have to go after expensive-to-extract oil.

With natural gas, the situation is different. Natural gas can be produced (1) virtually on its own, as with most shale gas production, or (2) almost as a bi-product of the extraction of oil in an oil field, or of natural gas liquids, in “liquids-rich fields”. When natural gas is produced as a bi-product, producers are often happy with a very low price, since the high price of the oil or natural gas liquids makes extraction profitable overall. Thus, some of today’s natural gas producers are happy with a $4/ mcf price.

The significant difference in the cost structure of production puts high-cost producers at a distinct disadvantage. While others can make an overall profit at a low price, they cannot.

5. Compared to the price of oil, the current price of natural gas in the United States is extremely low.

The price of natural gas now is around $4 /mcf, which is low in relationship to the price of oil. The usual conversion factor (based on equivalent heat energy) makes $ 4 /mcf gas is equivalent to $24 barrel oil, but in my view this is too low. Natural gas is harder to transport and has more distribution costs after it is extracted, so $4 gas is probably more equivalent to $40 barrel oil. But if West Teas Intermediate oil is at $85 a barrel and Brent is at $110 / barrel, the US natural gas price is still very low in comparison, no matter what conversion is used.

6. There is growing uncertainty about the volume of natural gas that is technically recoverable.

The United States Geological Surveys (USGS) recently issued a report on the Marcellus Shale (covering a large part of Pennsylvania, New York, West Virginia, and Tennessee). The USGS said that based on its evaluation, the Marcellus Shale has 89 trillion cubic feet of mean undiscovered natural gas resources. These resources are estimated to be technically recoverable, using currently available technology, but without consideration of price or accessibility or regulatory issues. Actual recoveries are expected to be lower, because some gas will be inaccessible, and because prices may not rise to a high enough level for some extraction.

The new USGS estimate is much higher than its previous estimate of 2 trillion cubic feet of mean undiscoverable resources, but it is not as high as the US Energy Information Administration (EIA) has been using in its estimates of resources available. The EIA had been using information from industry sources to base it future production estimates on. It is now saying that it will use the new USGS estimates in its model, and will sharply downgrade its estimates.

Some estimates in newspapers have claimed that the United States has 100 years of natural gas available. These estimates are based on reports of the Potential Gas Committee and the American Clean Skies Foundation. The Potential Gas Committee gives an estimate of recoverable resources for the Atlantic Region of 353 trillion cubic feet. This is about four times as much as the current USGS estimates for the Marcellus Shale, which would appear to cover a similar region.

We can’t know without actually doing the extraction how the amounts will actually work out, but this comparison indicates the range of estimates that researchers evaluating resources are coming up with.

7. A major part of the problem in getting demand for US natural gas to rise (so prices will rise) is the fact that US industrial use of natural gas has been declining for years.

If we look at US natural gas consumption, it has been close to level for many years (Figure 5).

What has happened is that over time, industrial use has dropped, partly because of the high price of natural gas in this country, and partly because manufacturing has been moving overseas, where labor is cheaper. Electrical use has risen to offset declining industrial use. Residential and commercial use (both of which are mostly space heating and water heating) have remained virtually flat. Vehicular use of natural gas is so small as to be invisible.

Figure 6 shows the same data as Figure 5, but as separate lines for the individual components. It may be easier to see the relative sizes and the extent of growth from Figure 6.

Electrical use is probably the easiest way to add use of natural gas, since building gas-fired power plants is relatively quick and inexpensive, and since coal has serious pollution issues. But historically, growth in the use of natural gas for electricity production has not been enough to raise total natural gas use because of the offsetting contraction of industrial use.

One advantage natural gas has had in the recent past has been its low price. At $4 /mcf, natural gas has also been cheaper than coal or wind for producing electricity. If the price of natural gas should double, there would likely be a price incentive to switch from natural gas back to coal.

Creating an increase in the industrial use of natural gas is likely to be difficult, unless the US economy is growing more than it is now, and unless potential users can be convinced that natural gas prices are likely to stay low for an extended period. There is also the wage difference, relative to emerging markets, to overcome.

Adding more commercial and residential use of natural gas would require changing things in such a way that some people who are currently using heating oil or propane could substitute natural gas for their current fuel source. In order for this to happen, three things would have to take place:

- Additional pipelines to homes and businesses would need to be built, and as well as pipelines connecting these lines to major pipelines.

- Additional caverns for storage of natural gas would need to be added, so as to have to be able to store natural gas pumped in summer for winter use.

- The people who currently have propane or heating oil furnaces would need to replace them with natural gas furnaces.

Given the cost and difficulties involved in making such a change, such a change is likely to take place slowly, if at all. More efficient furnaces and greater use of insulation are likely to have an offsetting impact, keeping total demand growth low for residential and commercial users in the future.

One possible source of growth in the use of natural gas would seem to be in the use of natural gas for vehicles, especially for vehicles like delivery vans and city busses that operate from a central location where they always do their refueling. Adding individual automobiles running on natural gas would be more difficult, since it would require adding a refueling network as well.

If we do convert many vehicles to natural gas, we will want to keep a close eye on the total amount of natural gas that is truly available. If in a few years we start running short of natural gas, we could find ourselves with a shortfall of natural gas both for electricity production and for vehicle fuel use.

8. Another situation which contributes to the oversupply of natural gas relative to demand is use-it-or-lose-it drilling rules.

The way natural gas leases work is that companies pay upfront fees, plus ongoing rental fees for leases of a specified term. Once companies have a lease, they effectively have no choice but to produce natural gas immediately from the property (or lose their initial investment, with no return). This means that companies tend to produce natural gas, even when prices are too low to cover their up front cost of investment.

Instead of looking at total profitability, what companies tend to look at when making a go/ non go decision regarding whether to drill (or to keep producing) is simply a comparison of future revenue compared to future costs (ignoring their sunk costs). Because many costs are front-ended, this means that low natural gas prices do not lead to a shut down in production of shale gas production, or for that matter, most any other kind of natural gas production, unless prices are extremely low. Thus, natural gas supply tends not to respond very quickly to low demand expressed as low price.

9. The way natural gas reserves are counted seems overly generous in oil company financial statements.

Oil and gas companies are concerned with “replacing their reserves” each year. In recent years, it has been getting more and more difficult to find locations where oil might be produced in the future, at reasonable cost, so companies are finding it more difficult to replace their oil reserves.

The way oil companies recently seem to be getting around this difficulty is by buying natural gas-producing companies, so that new reserves include a higher proportion of natural gas reserves, instead of oil reserves. The way that reserves are calculated is in terms of ”barrels of oil equivalent,” using a conversion in which 6000 cubic feet of natural gas is equivalent to one barrel of oil.

The thing that seems strange to me about this conversion is that value of the natural gas reserves is far lower than the value of the oil reserves they replace. An mcf of gas produces roughly 1/6 of the heating value of oil, so 6,000 cubic feet of natural gas are worth about 6 x $4 = $24, while a barrel of oil is worth something in the $85 to $110 range. Even if natural gas prices were not at their current very low level, the conversion factor would seem to be overly generous.

10. The situation in other countries is likely to be different.

The situation I have described relates to the United States. Eurasia is different, because Russia is a major producer, and a major trans-shipper, so can hold back natural gas (and not import gas) to produce the price it desires. The Far East is different, because rising demand from China and other emerging market nations tends to keep demand very high. Also, other countries of the world have not yet begun producing shale gas, to nearly the extent the United States does, so differences in cost levels may not be as much of an issue.

Over time, international trade may even out differences between countries. But for right now, the United States seems to have a tendency toward too low a natural gas price, relative to what appears to be the cost of production for some producers.

This article originally appeared on Our Finite World.

Thanks Gail for your insights.

USGS reports its steel producer price index (Table 1) increased 38% from 160 in 2005 to 221 in 2008, (relative to 100 in 1982). That only accounts for part of the 100% increase shown in Figure 3.

Does anyone have further details on other changes causing that rapid change in pipe costs? e.g. is this just supply and demand? Or did the average pipe size increase?

It is not just pipes themselves that raise costs. It is the cost of drilling (including the cost of diesel to do the drilling), and the cost of fracking, and the cost of new fancier drilling rigs that enable the drilling of long horizontal wells. People's salaries would be a component too, but I expect these do not increase as much.

Fracking seems to be a big part of the costs, which is why I mentioned it.

David - Pipe cost fluctuate wildly with demand. Back in mid-08 when I was with Devon drilling those E Texas SG wells the steel mills wouldn't even quote a price for pipe: when they were ready to ship they would post the price. You either accepted the price or they would just sell it to the next buyer waiting in line. A true sellers market.

But as Gail offers the major component of costs increases is the frac'ng. But it's not the cost of an individual frac (several hundred thousand $'s depending on the size) that has risen so much but the number of fracs per well. Several years ago wells had two or three "frac stages"...individual fracs. Now, depending on the trend, there may be 10 to 20 frac stages. I heard recently one well had 32 frac stages. Multiply the frac stages by a few hundred thousand $ each and some total frac jobs are costing almost as much as was spent drilling the well. One reason for the increased # of fracs stages: longer horizontal well bores. And those longer well bores cost more also.

Thanks much for the insight on frakking.

See my response to your earlier post on CO2-EOR.

I am interested in the question of extending natural gas to residential users who currently don't have it as an option. What are the economics of this? While these users are mostly in small towns and rural areas, this also applies to much of New England.

I understand that some users of heating oil and of propane are switching to heat pumps (run by electricity). This can be done without all of the costs associated with putting in natural gas supply.

I understand that one of the issues of putting in more residential gas pipelines is that to make the effort worthwhile, a fairly large proportion of the homes in the area need to switch to natural gas. If people already have a different type of furnace, and no one is paying the up front cost of the switch over, I expect it might be hard to get very many to switch, even if the fuel cost looks to be lower.

It would be interesting to hear from people who know more detail on this.

In Alberta, which has the largest rural gas distribution system in the world (most of the rural population is connected to it), the system was built from the bottom up. Rural people put in the pipelines and distribution systems themselves and then formed buyers cooperatives to buy natural gas from gas companies.

Federation of Alberta Gas Co-Ops Ltd.

Naturally the prices to rural co-op members were far lower than if they had waited for some giant multinational natural gas marketing company to do it for them. There is a zero risk to the gas producers, and they are bearing none of the capital costs, so why should they charge more than the cost of production plus a modest profit margin?

I am wondering if adding natural gas, both in rural co-ops in Canada and in the United States wasn't easier when there was a clear reason to make a change. If people were using wood or coal, natural gas would seem much easier and more modern. In the late 1970s and early 1980s, there was a real move away from heating oil, so changing to natural gas would almost be patriotic. Now there is no clear reason for the switch, except perhaps in areas where there is a high concentration of heating oil users.

Natural gas is substantially cheaper than the fuels currently being used (propane, heating oil, kerosene, electricity except for heat pump and places which get electricity from hydropower) so there is a clear reason for the consumer to change.

It will be interesting to see what actually happens, especially in the Northeast, where a lot of heating oil is still used. I know that some natural gas pipelines are being routed up that way. You would think that somehow, a way would be found to finance the changeover for individual homes and communities.

Well, the people in the Northeastern US (and Eastern Canada) are approaching a time when they will no longer be able to afford heating oil. It would be better if they put in an alternative heating source now, while they still have some money to put the infrastructure in place.

The advantage that the rural cooperatives in Alberta had was that they knew how much oil was left in Alberta and where prices were going in future. If they had any questions they could go up to an oil man in a local bar and ask him.

The people still using heating heating oil in other areas are ignorant of that information because the oil comes from somewhere else. They are assuming they will always be able to import it from other countries at a reasonable cost, and that is a rather rash assumption given the realities of global politics and geology.

The solution to heating oil and propane -- Wood.

The next solution we will need is enough land to grow sufficient wood. Wood probably would work in Canada, but in an area with more people and fewer trees, I don't think so.

Only 11.9% of U.S. residences (32.2% in the NE, 7.3% in the remainder of the country) use propane, heating oil, or kerosene as the main space heating fuel. Wood gathering on public lands is an adequate resource to fully replace that (and is currently cheaper). That said, wood has lower convenience (it's more work). The reason for bringing it into the conversation is that one of the primary objections to fuel switching (to natural gas or ground source heat pump) raised by those still using fuel oil is dependence on (or cost of extending) the network. A wood stove (as primary or backup) solves that objection.

Northeast heating oil industry market losses are actually pretty severe, down 10.8% 2000-2007 (I think that number is from NORA.) Natural Gas Utilities in the northeast generally already have half or more of the residential heating market, and are content to pick up another few percent every year, although National Grid, for example, is much more aggressive in pursuing residential conversions than, say, the Northeast Utilities system. (who are most actively pursuing commercial and industrial users burning #4, 5, and 6 oil.) In part this has to do with the ability to more easily convert the equipment, but residential heating fuel use is also a shrinking pie here; between 1980 and 2010 average heating fuel use is down significantly, and obviously that's not projected to improve. It's also a question of housing density, as once homes aren't very close together the economics of installing the distribution system don't work.

Of 69.4million U.S. households with natural gas already in the house, 13.8million were not using it as the primary space heating fuel, 10.9 million are not using it for water heating, 30 million aren't using it to cook, and 85% of clothes dryers purchased are electric.

There's also a high fraction of folks with gas in the neighborhood without a connection.

I hadn't run across those numbers. Do you have a link?

Natural gas prices have been high enough, for long enough periods, that many people will purchase an appliance using electricity (or some other fuel source) before choosing natural gas.

I know I replaced my gas dryer with an electric one a few years ago. The sales person in the store said:

1. The gas dry costs more to begin with.

2. If you don't have a hook up (but have other gas in the house), you will have to call a plumber to install the piping to the gas dryer.

3. Because of the high cost of gas (and the cheap price of electricity), the monthly costs could be expected to be more with gas.

I didn't verify the details, but am suspicious that what she said was, at the time, true. I expect the number of people switching to gas from electric was pretty low--many more switches the other way.

Numbers were from EIA's 2009 RECS, except for the clothes dryer number, which was from the back of my brain but is probably originally from an EIA or census source. The current population of residential clothes dryers per 2009 RECS, is 90.2 million, 71.8 million of which are electric, and 1 million of which are propane.

1)Gas dryers do have higher initial cost

2)If you don't have a gas dryer hookup it may cost a couple hundred bucks to get a plumber to add one (if you aren't comfortable doing it yourself).

3)The relative price of gas versus electricity depends on where you live. Most people live in places where gas is cheaper.

Note also, that the economic calculation depends on how much you use your dryer. My folks recently replaced their washer/dryer set (gas dryer, which I had bought them about 15 years ago) with an electric. Factors in their decision were: 1)They bought a stack unit, 2)their household size has declined to 2 from 7, 3)they have a 4cent off peak kwh rate, 4)they have a solar PV install (close to free after incentives and rebates) which supplies more than their current consumption of electricity.

pt - In general a company won't lay a p/l useless they have a guaranteed throughput volume over a specific time interval. If enough NG isn't transported over a set time the investment doesn't work. Often the local utility will guarantee a fixed rate of return to the NG supplier. Some folks have gotten very upset when many of the end users cut consumption because of risen prices and then found their costs per unit of NG used shoot up. So to reach the required revenue level if the used less NG they still had to pay as though they hadn't cut back.

Painful for sure but if a community wants a NG transporter to invest 41 billion in laying a line to their town they'll have to know they make a profit doing so. For the most part p/l companies are not risk taker.

Additonally the local distribution systems to individual homes are paid for directly by the local utility. Often that takes a bond vote by the locals to pay for it up front. These days it's difficult to get folks to vote for a tax increase on themselves.

In the age of AAA+ mortgage backed securities, you wonder how these kinds of accounting principles make it through our system. Heck accounting itself is losing credibility on Wall Street. For example, we knew that people could not pay their mortgages once they raised interest rates. And poof, the securities were worthless. Hence, we know that NG cannot be sold at this low price for much longer and poof, these reserves estimates for oil companies are statistical falsehoods -- the equivalent of AAA+-backed CDOs.

You have to wonder if the idea is to mask the hydrocarbon problems we are having with statistical trickery. Nah. Any clues as to why oil products are not counted based on their actual energy per dollar value over a longer 10-year period? It is not as if methane can be used for anything else than making heat. Maybe they are thinking we will be making a lot of methanol in the future for motor fuel.

The other thing to consider are the profits here. If there are true profits then all is well, but if these companies are not profitable in the shale gas drilling bonanza at current low prices, then Houston we have a problem.

Robert Rapier's blog has had discussion on methanol as transportation fuel.

I'm a regular reader but don't have a specific link, so, if interested, Google may be a useful tool.

Oct - Something to remember about those company press releases. They may use that 1:6 ratio but in their annual reports reserves are monitized using SEC regulated pricing assumptions. It used the be the price at closing on 31 Dec. Now they use some form of yearly average. So on a public company's books both oil and NG reserves are presented in $ values AFAIK.

The SEC has raised questions about some public companies' press releases re: reserve/flow rate estimates vs. costs. Companies will say the wells are costing $X to dril and complete. But they aren't using their lease costs associated with their wells. A well may have costs $7 million to drill and complete. But they may have paid a couple of $million for the leases that well was drilled on. Those $25,000 per acre lease blocks add up.

You may recall the westexas post about the Chesapeake DFW Airport lease. Not only did they grossly over estimate the URR of those wells but they didn't go out of their way to remind folks they paid $180 million just for the lease itself. Takes a good bit of production just to recover that part of the investment.

Good response. So land-use costs are not exactly being factored in as well.

oct - At least in the press release the companies have a lot of flexibilty. They can't out right lie but they aren't required to tell every detail. OTOH they have to disclose eveything in their outside audited annual report. OTOOH I don't know exactly how they handle those big front end costs like the leases. We all know there are various accounting moves to make the books look as good as possible. Maybe some CPA TODster can enlighten us.

Gail

in Point 9 you say "1,000 cubic feet of natural gas are worth about 6 x $4 = $24". Presumably this should be 6,000 cubic feet?

Bill

Bill - The typical unit we use is "mcf" = 1,000 cu ft. I think Gail is saying "6 mcf x $4 = $24

Thanks. I fixed it. It is one of those things that I originally had right, and then accidentally changed to the wrong number, when I was quickly making some other changes, and it somehow seemed wrong.

Nice post Gail, thanks.

I find it pretty soulless that you could write about natural gas and not mention the awful effects "frac-ing" has on areas that are drilled on. Yes, there is certainly lots of natural gas available in the US and all over Europe, but at what cost? Companies should not be rewarded with profits for causing destruction. Of course, this is all legal in the Energy Policy Act of 2005:

"This bill exempted fluids used in the natural gas extraction process of Hydraulic fracturing from protections under the Clean Air Act, Clean Water Act, Safe Drinking Water Act, and CERCLA. It created a loophole that exempts companies drilling for natural gas from disclosing the chemicals involved in fracking operations that would normally be required under federal clean water laws. The loophole is commonly known as the "Halliburton loophole" since former Halliburton CEO Dick Cheney was reportedly instrumental in its passage. The proposed Fracturing Responsibility and Awareness of Chemicals Act would repeal these exemptions."

Gasland is an incredible movie that talks about natural gas drilling. I cannot recommend it enough. I am sure many people on this site have seen it, but if you haven't, it is a MUST watch.

I sort of alluded to the problem in a paragraph near the top:

Trying to extract natural gas in a highly populated area is difficult at best. If it is necessary to overlay the problems with delivering huge amount of water for fracking, putting it down the wells, collecting the waste water that comes back up again, and properly disposing of the waste water, there is a potential for quite a few problems. We have a huge amount of experience in the West with fracking, but the East is different from the West--the rock is older and has more cracks in it naturally, and there are many more people.

I don't like movies like Gasland, because it is way too easy to take a distorted version of one side of the story, and make it sound like it is the Gospel truth. I don't know how you would make a truthful story though, because I am sure there are a lot of nuances to the truth, not something that could be explained easily in 90 minutes.

I think most of the potential problems are probably not from operators who are operating within the stated rules--The problems are more from Mom and Pop operations that are taking shortcuts, and trying to (illegally) save money. Each set of regulators will need to look closely at the issues in their areas, and decide what kinds of rules are needed, or if fracking should be prohibited entirely in an area, because of special circumstances--too close to New York City drinking water, for example.

If the cost of extracting natural gas using fracking (as is currently being done) is really prohibitively high, that would be an issue of itself arguing against trying to go after shale gas.

Our problem now is that we don't have very good choices for producing electricity. If a person wants to use wind or solar, natural gas is really needed as a backup. Coal is another logical alternative, but it has at least as many issues as natural gas produced by fracking. And we have just seen at Fukushima that nuclear can have issues as well. Most people would be reluctant to give up electricity though, because electricity is needed for other basic services--providing drinking water and running sewer systems, and pumping fuel for our cars and trucks. So there aren't easy answers.

I went back and read a critique of Gasland: http://www.energyindepth.org/2010/06/debunking-gasland/

Are there some minor technicalities that might have been twisted? Yes, but as far as I can tell, nothing grievous. Points like this one really seem to miss the point:

“But when the 2005 energy bill cleared away all the restrictions, companies … began to lease Halliburton technology and to begin the largest and most extensive domestic gas drilling campaign in history – now occupying 34 states.”

Once again, hydraulic fracturing has never been regulated under SDWA – not in the 60-year history of the technology, the 36-year history of the law, or the 40-year history of EPA. Given that, it’s not entirely clear which “restrictions” in the law Mr. Fox believes were “cleared away” by the 2005 energy bill. All the bill sought to do was clarify the existing and established intent of Congress as it related to the scope of SDWA.

They really seem to be missing the point. What Mr. Fox wants is accountability and responsibility. The energy companies got their ticket to drill, and anything bad that happened was water under the bridge.

Furthermore, do we trust the EPA? In 2004, the EPA found that hydraulic fracturing was safe and didn't warrant further study. In the years to come, they also presided over all kinds of skulduggery in which a lot of bad things happened.

It isn't just the "Mom and Pop" operations either:

"In April 2010 the state of Pennsylvania banned Cabot Oil & Gas Corp. from further drilling in the entire state until it plugs wells believed to be the source of contamination of the drinking water of 14 homes in Dimock Township, Pennsylvania. The investigation was initiated after a water well exploded on New Year's Day in 2009. The state investigation revealed that Cabot Oil & Gas Company "had allowed combustible gas to escape into the region's groundwater supplies."

Finally, this is a very good read on the real motivations behind the industry - http://www.nytimes.com/2011/06/26/us/26gas.html?_r=1&pagewanted=1&sq=mar...

frozen - You make some valid points. But you're too focused on the EPA and the feds IMHO. There have been many tens of thousands of wells frac'd in Texas over the last 60 years. And neither the EPA or the feds had anything to do with regulating or monitoring those projects. It was overseen by the Texas Rail Road Commission and other state agencies. In the early days the regs weren't tight enough. But not now. For every frac you've heard about in the NE there have probably been 10X that many in Texas and you see nothing in the news about it. And again, not because the state or locals don't care or are powerless. The efforts are highly regulated and monitored by Texas agencies. And not just by the regulators. We have very sophisticated land owners here...many with oil patch experience or consultants at hand. Break the rules or screw up in Texas and the civil law suits will kill what's ever left of you after the TRRC gets finished with you.

Very early on I kept recommending my Yankee cousins to just copy the TRRC regs and enforce them in their states. I also pointed out the most likely source of surface contamination was from the illegal dumping of frac fluids and not the actual frac'ng process itself. Turns out one source was actually legal dumping: local municipal waste treatment facilities were accepting those nasties (for a fee) and then discharging them back into the environment untreated. That's why both NY and PA recently passed laws to make this activity illegal. You would think they would not have to make it illegal for those city fathers to be polluting their own environment.

You don't need the feds to watch your back: the state can do it. And the industry will pay them to do it. In Texas the regulatory costs are covered by fees and production taxes the companies pay the state and the counties. As I also said early don't listen to the companies when they say doing so will make them stop drilling. In just one shale trend in Texas (the Eagle Ford) there are over 200 rigs drilling and frac'ng as fast as possible. Those companies pay...just the cost of doing business here.

That's interesting, thank you.

If you say so, in the US anyway. But I doubt it's true. In Australia, the fracking issue is like a huge boil, slowly forming a head. It's a matter of seething anger and discontent, and I suspect it's only a matter of time before it's banned (as it is in several other countries). Several recent studies have implicated fracking (or coal seam gas mining as it's known in Australia) with aquifer damage. It's a filthy business with potentially devastating and permanent destructive side-effects. I see no future for it in a warming world. One of the Australian state governments recently announced a ban on the use of toxic chemicals in coal seam gas mining, and a moratorium on fracking. A sign of things to come worldwide, methinks.

Farmers raise coal seam gas concerns.

I think you're confusing two different sources of natural gas: 1) shale gas, which is natural gas trapped in tight (impermeable) shale formations, typically at depths of a mile or more underground, and 2) coalbed methane, which is natural gas occurring in coal seams which are typically much more shallow.

Coalbed methane is commonly found in association with shallow water aquifers, and there is a real risk of contaminating the water with chemicals from the NG operations. The fractures produced by deep hydraulic fracturing will never propagate to surface water formations, so that is unlikely to be a source of contamination.

The biggest risk in developing deep shale gas formations is that there may be shallow gas formations in the same area and drilling activities may connect the shallow gas deposits to the shallow aquifers, causing methane contamination of the water sources. However, methane is not poisonous so the problem can be dealt with by just venting the NG off the water before it reaches the houses.

The biggest problem with coalbed methane is that the water in it is often very saline, and just dumping it on the ground can destroy the fertility of the soil. It has to be disposed of properly, e.g. by injecting it into deep salt water formations. The real problem is not fracturing but salt water disposal.

The trouble with press coverage is that it originates from areas which historically have had no significant oil and gas production. In mature oil and gas producing areas such as Texas, companies have fractured hundreds of thousands of wells over the past half-century with no known cases of groundwater contamination from the fracturing. In other words, it's a media-invented problem.

In the US, oil and gas production is regulated at the state level, so it's up to the individual state to regulate fracturing. In experienced states like Texas there are very extensive regulations and the state government monitors companies closely. The state government will know exactly what companies are injecting into wells and if they don't like something, they will stop it. In inexperienced places like New York, there are very few regulations and regulators don't know what to watch for.

Gasland was noteworthy mainly for being inaccurate and misleading. There was a great deal they did not tell the audience about what was going on.

I think Rockman has commented previously on what constitutes "awful" effects of hydraulic fracturing. To summarize, there aren't any, beyond an occasional failure of the casing or cement.

Wow, so "there aren't any" awful effects of fracking then? So, does flammable (or explosive) faucet/well water not qualify? How about massive groundwater contamination thanks to the secret mix of undisclosed chemicals pumped into the water table thanks to Halliburton loophole c/o Mr. "Undisclosed" himself, Dick Cheney? Fracking almost makes coal look good by comparison.

Flammable water comes from natural gas in the water. You can get that without fracking. It doesn't prove anything one way or the other. It comes from having natural gas in the area.

Companies are disclosing what the chemicals are, when they are asked to. With proper disposal, the chemicals end up deep underground, far below the water table.

Yes. We sometimes run into methane in municipal and domestic water wells in areas where there has been no fracking. It can just be a function of intersecting strata with residual organic material. Regarding the fracking chemicals, I am glad that the companies finally have to disclose them, but I would be more worried about above-ground disposal or well sealing problems than the chemicals that are left in deep underground strata.

Ooooohhhh, they are so super undisclosed that a few minutes of googling brings up several lists.

NAOM

Others seem to have answered this question sufficiently.

Methane in drinking water is, in many cases, a natural side effect of microbes and groundwater recharge. In some cases, it is so common, and so massive in the amounts of methane that it produces, that it creates a natural gas field. The production from the Antrim Shale in Michigan for example.

http://aapgbull.geoscienceworld.org/cgi/content/abstract/86/11/1939

Or the Medicine Hat or Milk River formations of Canada.

http://www.cspg.org/conventions/abstracts/2001abstracts/4AB-P-045.pdf

Unfortunate that sensationalism has replaced good journalism in America, but would Gasland have received much attention if, after lighting the faucet on fire, the narrator had said, "This type of combustion of drinking water is quite common in (fill in the appropriate, and large, size of some area where this is common) and we thought we would show you this so that people wouldn't confuse this with what happens near hydraulically fractured wells."

HARM - OK...it's all on you: name one specific DOCUMENTED case of a frac job causing a water well to produce NG. I can offer DOCUMENTED evidense of hundreds of cases of natural NG contamination of water wells. I'm asking you for just one. The stage is yours....

This flies in the face of recent studies that confirm fracking can do damage (you thinking injecting benzene and formaldehyde into the ground is harmless? ). For example, a study by a US Forest Service researcher found that wastewater from natural gas hydrofracturing in a West Virginia national forest quickly wiped out all ground plants, killed more than half of the trees and caused radical changes in soil chemistry.

). For example, a study by a US Forest Service researcher found that wastewater from natural gas hydrofracturing in a West Virginia national forest quickly wiped out all ground plants, killed more than half of the trees and caused radical changes in soil chemistry.

I see the SEC is looking into this too (see WSJ article: SEC Bears Down on Fracking )

The EPA's study on whether fracking affects drinking water is to be released at the end of 2012.

Also notable (pdf alert, 7 pages):

Pipe Dreams, What the Gas Industry Doesn’t Want you to Know about Fracking and U.S. Energy Independence

Regarding the study by the US Forest Service, the dumped huge amounts of fracking fluid on a forest, knowing full well that it would kill a large portion of the trees. It was a strange test. The intent is not to dump a large amount of the fluid on trees.

What the report said was:

Sodium chloride is common table salt. What they have established is that if you dump large amounts of salt water in a forest, it kills the trees. They really didn't have to do an extensive test to confirm that. Salt water disposal is one of the biggest problems in the oil industry, typically dealt with by injecting it into deep underground formations.

Hi Gail,

I don't understand why you assume that oil and gas reserves form a "resource triangle" with most of the reserves still untapped at the base. According to Richard Heinberg in "The Party's Over", the discovery of new oil fields, especially big ones, peaked worldwide back in the 1960's. Also, isn't Peak Oil (or peak natural gas) by definition the point at which half the recoverable reserves have already been tapped?

I think your analysis is overly concerned with absolute numbers rather than with the energy mix and how it will be distributed in the future. As less oil is available after Peak Oil, the percent of oil used in the energy mix will necessarily decline relative to natural gas. As demand for natural gas rises relative to oil, the price of natural gas will rise to spur new development.

One very large source of demand for natural gas that you left out of your analysis is nitrogen fertilizers. Though synthetic nitrogen fertilizers are an environmental disaster, they are how we manage to feed seven billion people on this little planet.

Thanks for your always cogent economic insights.

plant based

The discovery charts that Richard Heinberg and others show relate only to liquid oil, at the top of the triangle. This is part of the reason why a lot of non-peak oil people think that peak oil people are concerned about nothing. They feel if proper accounting were done, there is plenty of oil. I think we have to be able to address this issue--there truly is a huge amount of low-quality (low EROI) oil resources out there--far more than shown in Richard Heinberg's discovery chart.

It is convenient to think that other energy systems will reach out and fill in the deficit caused by depleted oil supply, but I think we have to examine the situation more closely. Our financial system needs economic growth, and with declining oil supply, it seems very likely that economic growth will disappear, changing to economic contraction. Are we going to be able to fix this problem? How do you build new facilities of any sort, with a broken financial system, so that you cannot, for example, import needed goods from other countries?

Pretty clearly, at some point, our system will go back to being 100% solar flows, similar to the way things were thousands of years ago. At that time, natural gas use will be 0%, as will oil and coal use.

Yes there is low quality oil, but as you have pointed out in other posts, the low ER0I stuff is too expensive to run an industrialized economy on and causes economic contraction. That is the point which is important in what constitutes recoverable oil, not adding reserves that are not economically feasible.

I don't expect that natural gas would come close to replacing the oil deficit, but as a practical economic matter, it will be scaled up relative to oil as long as it's EROI is economically worth it.

Ultimately, you are right of course, in the medium to long run, we are going to be off of oil and gas altogether and depend completely on real time solar. Personally, I don't think we are going to get from here to there without a lot of casualties. In all of our years on this planet we have yet to develop the social institutions to make the hard choices necessary to save ourselves.

Reserves by definition are economically feasible.

Technically recoverable resources may, or may not, be.

The EROEI of new oil sands projects is currently around 6:1, considerably better than that of fuel ethanol, which is closer to 1:1. The economics, with WTI at $89/bbl and Brent at $115, are quite favorable, too. The break-even point is around $45/bbl.

Of course they'd really like to put it into the Brent market and get that extra $26/bbl in profit margin, since the continental US market is now flooded with Canadian bitumen.

plant - Just a small point. Generally most folks frame PO as a matter of flow rate and not how far along we are with re: to URR. It's the max rate of oil/NG production ever attained. For the US that date was back in the early 70's. We may have produced more than 50% of our URR before that date or after but that won't change when we hit PO: about 1971. This has been one of the confusions with some of the huge estimates of future reserve VOLUME development: potential big numbers (like DW Brazil) but how fast will that oil come to market and how long will that rate be sustained. That answer will have an impact on PO...not the volume of those reserves. The impact on the global economy will come from the amount/price of oil available at a particular time...not how much is sitting under thousands of feet of rock.

Some, like me, don't see a global PO date per se. I see more of a peak plateau we may have begun several years ago. New discoveries might give small short term increases while the loss of older fields causes small bumps down. This undulation might last a few more years or a decade+. I don't have a good estimate myself. We have new huge fields coming online in the future but slowly and at rates that won't match the Ghawar's. And the Ghawar's and Cantrell's continue to slip away. Sometimes slowly...sometimes not.

I'll also add another distinction some of us recognize: resource vs. reserve. Opinions vary: there is a huge RESOURCE of frozen NG sitting below the bottom of the oceans. But zero reserves: no one has yet to develop an economic recovery method. Same with the "oil shales": enough bitumen RESOURCES to produce billions of bbls of oil...when someone develops an economic way to do so. Until then the oil shales represent zero oil reserves. The other confusing term is "technically recoverable reserves". IOW how much of a commodity might be produced if profit wasn't a factor. There are millions of "technically recoverable" ounces of gold in the oceans. But even at today's high prices it can't be done profitably. I see very little practical use for TR reserves unless someone is close to finding the magic bullet for their economic recovery.

At what point do you accept that, even though you can't see the solution in front of you today, there will certainly be a solution developed tomorrow?

Until the rotary table came into existence, reservoirs under water bearing formations contained only TR resources. The same with steel casing, wire rope, the tricone and PDC drilling bits, MWD and LWD. Until drilling off platforms came along, oil and gas under water were only TR resources. Until horizontal drilling came along, oil and gas under a town were only TR resources. Water and steam flooding, immiscible, miscible, polymer and CO2 flooding, WAG, SAGD, ESP and HSP, combinations of massive hydraulic fracturing and long length lateral sections in horizontal wells, with directed completion schemes. All technologies without which oil companies would be standing around, scratching their heads, wondering how in the hell they were ever going to convert those TR resources.

Except they did find those magic bullets.

What evidence do you have that the ingenuity to create more magic bullets stopped last week? Certainly your point of view is perfectly acceptable. TODAY. Based on the history of the industry, your point of view may be completely invalid. TOMORROW.

This is the entire point of the resource pyramid, which Gail is completely correct in using. Just because she can't see which particular solution comes along to allow mankind to delve ever deeper into the pyramid doesn't negate the observation that mankind has been doing it since before you were born and there is no evidence that we decided to stop last week.

This statement underscores a logical fallacy that never ceases to profoundly irritate me!

To put it in a nutshell, past performance is no guarantee of future results. To make the claim that there will certainly be a solution developed tomorrow is the epitome of wishful thinking. There is absolutely nothing about the future that we can be certain of today. We find ourselves faced with a bunch of predicaments and a whole slew of dilemmas. Only problems can be solved, predicaments and dilemmas can not!

MAGIC DOESN'T WORK!

You are absolutely correct. And yet it has happened more times than either of us can count in the industry in question. Does their occurrence in the past guarantee they will happen again in the future? Of course not. But can you claim that they will never occur again? Of course you can't.

So the question is, because neither of us can claim they assuredly will, or will not happen, how do we account for them in the future? If you ignore them, you underestimate what mankind can utilize in terms of resources. As has happened before. If you assume they come along when needed, advocates of this position can claim 99.5% recovery factors for all known oil fields and we can begin discussing dilithium crystals as a power source. Neither position is correct.

Spock - "At what point do you accept that, even though you can't see the solution in front of you today, there will certainly be a solution developed tomorrow?"

Wow...finally an easy question: when someone develops the solution. Remember what I do for a living: I evaluate exploration projects based upon proven technology that has been around for decades. And the majority of those efforts failed to produce oil/NG. And now you ask what my expectations are for finding oil/NG with technology yet developed? Rather minimal. Like I said: call me when you've found that next magic bullet. Until then I don't think we should use those "resources" in planning our future. Would be kinda like buying a lottery ticket as your retirement plan. LOL.

ROCKMAN,

I think that as far as human purpose is concerned calculating PO has to do with how much oil is economically recoverable at a price that the economy can still grow. That number appears to be around $100 per barrel. That's the wholesale price, when the cost of production reaches $100 per barrel, the oil game is over.

Plant – you’re definitely on a different page than the vast majority of us. That doesn’t necessarily make you wrong…just in the minority. Again, to most PO is not a calculation…it’s simply an observation: plot the curve and point to the highest peak. Hence "peak oil". Just pull up the oil production rate curve for the US...easy to Google. And you see what Hubbert predicted: the max rate of oil production in this country was in 1971.

Again, you’re certainly free to go with your definition. But you’ll confuse most and miss the points others make. Again, think about the effect on the world’s economies. Think about the situation with the Canadian oil sands. Billions of bbls of they would love to supply to the US market driving gasoline prices down. But it isn’t happening because of the lack of transport to get all that oil down here. Granted this a manmade situation but it’s the same situation as having a huge amount of reserves in the ground that are being slowly produced. It’s the rate those reserves can be brought to the market that effects us all…not how much is in the ground. Or most simplisticly: you might have a tank with a 100,000 gallons of water but can only draw out one tablespoon a day. You'll die of dehydration but a person very rich in water...but you're still dead. LOL

Yes it is true that "technically recoverable" reserves are really meaningless reserves. It doesn't matter if the oil is "technically recoverable" if you can never afford to produce it. You can't afford to drill a well every 10 feet and inject dry-cleaning fluid into the rock to flush most of it out, so there is no point in talking about it even if it is technically feasible.

OTOH, I remember that in 2003 Canada increased its oil reserves from 5 billion barrels to 180 billion barrels - which caused a lot of raised eyebrows in the international oil industry. The real message there was that there had been some technological breakthroughs, and that additional 175 billion barrels of oil sands was no longer just "technically recoverable" but was "economically recoverable" - i.e. could be produced at a profit. It took about $1 billion in research to get to that point, but it was money well invested.

There are about 1700 billion barrels of oil sands in Canada which are "technically recoverable", but in reality it's a meaningless number because most of it is uneconomic although it's definitely there in the ground.

However, the 175 billion barrels which were booked as reserves in 2003 are probably twice that at current prices - there is probably 350 billion barrels in Canada's oil sands which are recoverable at current oil prices. Economics are everything in the oil business.

Rocky - Exactly my point. Until the technology or economics change no resource becomes reserves. As someone pointed out so well about the bitumen oil resources: they've been just 5 years away from becoming commercial... for the last 60 years. LOL. And as you point out: Canadian reserves got a big boost from the price increase. And how much proven reserves would they lose if oil went to $40/bbl? And if Canada had made its economy decisions based on those now vanished reserves? Not any different than what happened on a corporate level when the shale gas players in E Texas invested $billions in those trends with TCF's of "proven NG reserves"...proven at $8.50/mcf. And when NG prices dropped below $4/mcf those reserves reverted to resources. I believe one fellow who forgot to remember the distinction personally lost $23 billion. At least he took a big gulp of the Kool-Aid he served his shareholders.

Remember I'm a career development geologist: I'm impervious to hype. LOL.

The 175 billion barrels in Canadian oil sands reserves wouldn't be reduced if oil fell to $40/bbl since that's the price they used to make the estimates. At $80/bbl there is more like 350 billion barrels (the amount the oil companies are privately working with) and at $120/bbl there would be more like 500 billion barrels. The official estimate is extremely conservative, and deliberately so for political reasons.

However, when someone is building a new oil sands project they tend to work with the $40/bbl number since they don't want to lose their shirts if prices go back down to that level. Anything above that is windfall money, to be scattered about for executive bonuses and the annual Christmas party.

The interesting thing about oil sands compared to conventional oil is that the oil sands players have very deep pockets and are quite capable of cutting their costs. When prices go down, they sharpen up their pencils and start cutting costs. When oil prices bottomed out around 2000, they managed to beat their operating costs down to $12/bbl.

At this point in time it's closer to $45/bbl, but mostly because they are building new facilities like mad and paying top dollar to attract workers. When the price is $80/bbl, welders get paid $1000 a day just for showing up, whether they do any welding or not. When it under $40/bbl they are told not to bother showing up at all.

Both the resource triangle and the Hubbert Curve are useful.

I'm not a cornucopian, but it's critical to note that human ingenuity has, in the last 20 years, made a lot of coalbed methane, tight gas, and shale gas economic.

And by a lot, I mean a lot. Hundreds of TCF, at least.

So the shape of the triangle and the placement of resources within it is malleable,

up to a point.

We've been producing coalbed methane in the San Juan basin for many many decades, but the shallow CBM in the Powder River Basin was off-limits, economically, until the 1990s. Everyone knew the Piceance Basin held a lot of gas, but it too was too far down the resource triangle to be of interest until better frac'ing was devised. Ditto shale gas.

As for this idea that $4 gas is cheap, and $8 gas is expensive, let's do a reality check. Maybe they both are cheap! One mcf of gas is as much work as a grown man can do in a year, so even at $8 bucks, it's a steal to the consumer.

Rudall,

I agree with you, regarding how successful we have been to date in making coalbed methane and tight gas economic. The EIA used to show tight gas separately, as part of unconventional gas, but now they put it in with conventional. I found a graph that I might have posted if I didn't have so many other graphs, showing how tight gas production had grown, and how coal bed methane gas had grown. Their growth was what keptUS total natural gas production from dropping, as the easier to extract resources depleted.

Regarding prices, prices in Britain and Europe are much higher than the US. Based on a chart I saw today, British spot prices are something like $9 MMBtu, and futures prices are in the $10 - $12 MMBtu range. In Europe, all of the other energy prices are high as well, and home heating needs are lower (smaller homes, more moderate climate). In the United States, we have coal becoming competitive at close to $4 MMBtu. Having low coal prices here and the economy not growing much helps keep prices down.

And your point about how much of a person's labor gas equates to is a good one.

Yair...can anyone point me to where I can find information on depletion rates of "typical" coalseam gas wells...that is to say do they have the same characteristics as shale or are they very different?

Thanks.

They are very different.

Figure 2 is something the author is calling "normal". Figure 5 is what you appear to be looking for I think.

P.S. Why was the reference provided stripped out of the post?

Fracking – in 2007?

Friend, using data from 2006 and 2007 in contemporaneous manner when discussing US Shale Gas is akin to using bond ratings on RMBS from the same period in the same manner.

Listen, pricing for Calendar strips 2012, 2013, 2014, and 2015 all made all-time new lows last week. 4.38, 4.87, 5.21, and 5.45, respectively. So, either the market is right, and articles like this are sent to the dust heap for the 5th year in a row, or there are diamonds in the sidewalk just waiting for you to take them away.

Instead of incessantly yelling at this resource, which is what the Artie Berrman’s of the world have done, now embarrassingly, for far too long, let’s embrace it. Find out how to use it – my bet is it would likely have a huge role in the comeback of this nation if we just stopped being jerks about it.

Gail you forgot to mention about the amount of water required for Fracking, water that we might not have.

I agree that using all that water isn't great, especially in places that are depleting aquifers to get their water, or are tying to find the water in a drought.

But it is hard to argue that the frackers can't have the water, when next door there are golf courses watering their lawns, using similar amounts of water, for not much reason.

When we get down to the bottom of the resource triangle, we do what we can to get natural gas out, even if it uses a lot of water.

Obligatory climate-health warning:

The worst thing we could do is burn the stuff.

Letting some or all of it leak to the atmosphere would be worse in greenhouse terms.

Thank you. I call it "magic thinking" but the straight truth of it is cold-blooded fraud.