Countdown to $100 Oil - Deja Vu?

Posted by Euan Mearns on August 26, 2011 - 2:56pm

The general and simplified theory to be tested in this series of posts is that OECD economies cannot grow with average annual oil price over $100 / barrel. As of 16 August 2011, the annual average for Brent stood at $100.04 per barrel! Are there any signs that the global economy is buckling under this strain?

Disclaimer: the author does not currently hold any energy related investments that may be affected by the content of this post. Any forward-looking observations and comments should not be viewed as forecasts. I will return to this subject with updated charts as the story unfolds.

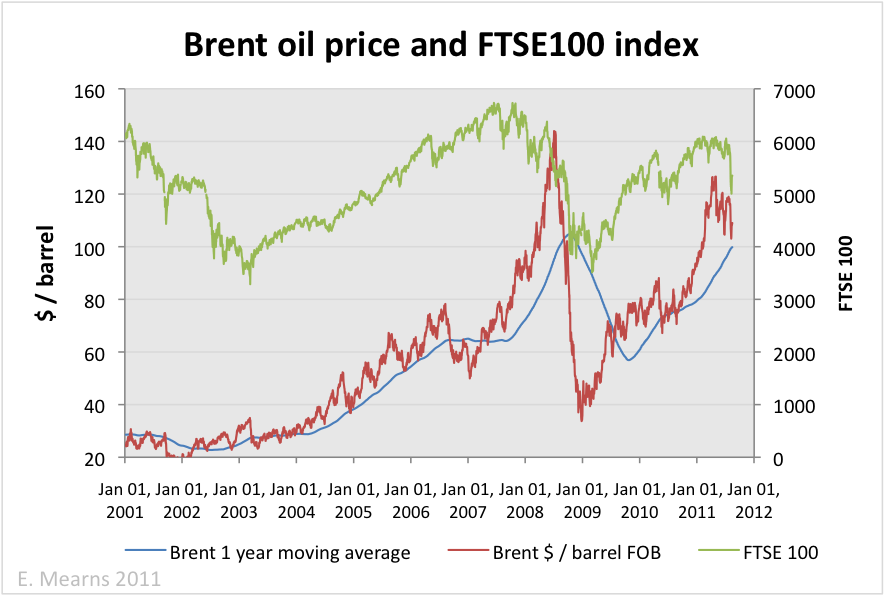

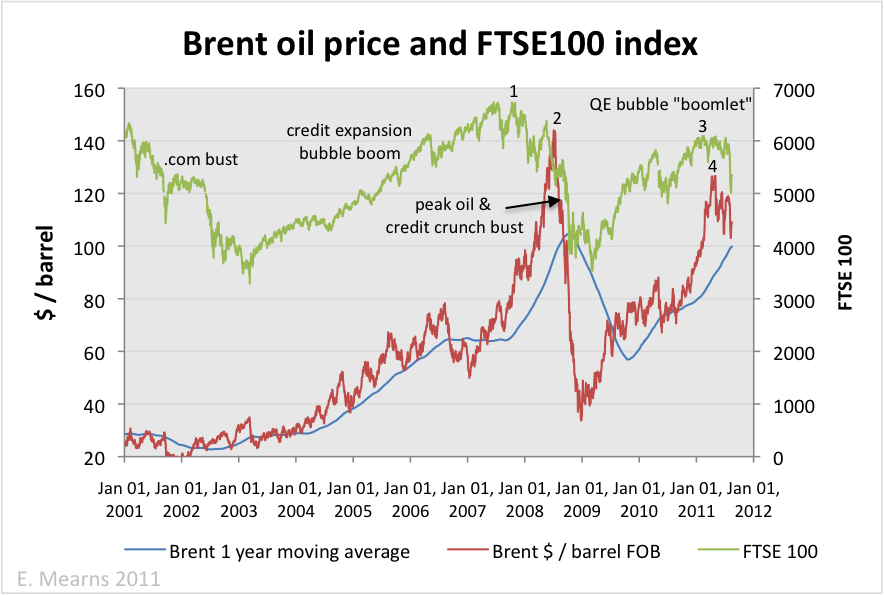

The FTSE 100 stock index provides valuation for the UK’s 100 largest companies. Whilst now top heavy in commodities stocks, it still provides a broad market measure similar to the US S&P 500 index. Back in 2007 – 09, the top of the London FTSE 100 index was 6731 on 12th October 2007 (1). The top of the oil price spike was $143.95 on 3rd July 2008, 8 months after the market top(2). Both oil price and markets had declined substantially by the time the Lehman induced crash came in October 2008.

The stage appears to be set for a rerun of these events. The recent high in the FTSE 100 was 6091 on 8th February 2011 (3). The top of the recent oil price spike was $126.64 on 2nd May 2011,3 months after the market top (4). And the European banking sector seems to be in desperate trouble. For example, Royal Bank of Scotland (RBS) formerly one of the UK’s largest banks, now owned 83% by the UK government, has seen its share price fall from 50p earlier this year to 20p. Reduced to penny status, this and other European banking stocks appear to be heading towards zero. Shares in Uni Credit, Italy’s largest bank were suspended from stock market trading on 23rd August.

The links between the health of the banking sector and high oil price is complex but can be reduced to a very simple argument constructed around economic growth. Over indebted sovereign governments require strong economic growth (3 to 5% per annum) to generate the tax revenues required for them to service their debts and to remain solvent. High oil and energy prices, caused by economic growth, have contributed to snuffing out the fragile recovery from the 2008/09 recession and growth has stalled across the major OECD economies. European High Street banks that own large amounts of European sovereign debt are therefore at risk of insolvency themselves should any government default.

Gavyn Davies, writing in the Financial Times last week, had this to say on: What went wrong with the global recovery?

The oil price increases, if permanent, would reduce consumer purchasing power in the developed economies by around 1 per cent this year. But the impact on GDP growth, through a complicated mix of supply and demand side effects, may be greater than this. One model, estimated by James Hamilton at the University of California in San Diego (who is probably the leading academic economist in this field), suggests that the oil shock may have reduced US real GDP growth by 1.1 per cent in the first half of 2011.

It is easier to identify these links than it is to prescribe a cure. The stage seems set for a major price reset of markets, energy prices, currencies and property that brings with it the prospect of a major socio-economic upheaval. John Kinhart's comic strip from October 2009 remains a fine summary of the peak oil predicament.

RBS would probably have a better reputation if it didn't treat its customers with such utter disregard. I have nothing but horror stories from people that have had the misfortune to use them.

Dinosaurs don't do well during catastrophe. Didn't nature already teach us that?

I doubt that it's RBS per se, so much as this apparent greed-based profit system("Matrix") it's plugged into:

I think you hit the nail on the head, sort of:

nature =! $

Could be.

Daily Telegraph http://www.telegraph.co.uk/finance/financialcrisis/8721151/Market-crash-...

Hmm ... maybe. If so ... China & USA stimulus response this time round?

Liquidity eh!

How much more liquidity, in the form of taxpayer bungs, do they demand? The fact seems to be that they won't lend to businesses that can't guarantee 100% success, which means practically every business, and they won't lend to the general public because they don't trust them to stay in jobs and thence be able to repay.

Just give us fiat money indemnified by the taxpayer, seems to be the bankers' demand, with the promise that it will create even more rich bankers and the money will consequently trickle back to the taxpayer as they spend it for us. In other words, just give the bankers all our money!

Now, if the government would grant me some 'liquidity' I could go out and spend too, and naturally I wouldn't pay it back, but would instead demand more liquidity. Just cut out the bankers then and we can all go out and play; until China wants its money back of course...

It would seem that if your goal is to examine whether "OECD economies cannot grow with average annual oil price over $100 / barrel" then you should be examining oil price versus GDP, not stock prices. There have been many studies showing very weak correlation between the stock market and the real economy.

Yes. Stock Casino would seem more accurate really, and a rigged one at that.

Rigged, yes. Just look at the weekly oil price up top right of the TOD: Check the downward spike Monday evening, Tuesday evening, perhaps a weak one Wednesday, Thursday and Friday. Today the lowering coincided with Bernankes speech. Some European markets reacted the same: big selloff at approx 1600 European time (11-12 am US time in top daily graph).

I guess these were big players with computers going out trying to bring the bears out triggering automatic sell orders to cover losses. It could have worked and resulted in -5%. Instead there was some part of the market that bought, oil, commodities, stocks, so it turned around to 0- -1% instead, one hour later at closing time. Good to see that some people and firms are still purchasing and using stuff and constructing something - it is not the EoTW. Nevertheless, sliding downwards to levels of -08 the next few months are not excluded, I hope not.

In the long run, theres gonna be some major restructuring of industry (again, even more...) the next ten years though.

Hopefully, the 'right sort' of 'restructuring'...

"Over indebted sovereign governments require strong economic growth (3 to 5% per annum) to generate the tax revenues required for them to service their debts and to remain solvent."

Since their debts are overwhelmingly in nominal terms, this should be rewritten as:

Over indebted sovereign governments require strong nominal economic growth (3 to 5% per annum) to generate the tax revenues required for them to service their debts and to remain solvent.

Real economic output does not have to grow to pay off nominal debts. Governments need to engineer wage (and hence tax revenue) inflation. This is effectively repudiation of these debts - but they'll have to be repudiated anyway whether by default or by inflation. Inflation is far less economically disruptive.

The debts incurred during the period of high real growth expectations can never be repaid in real terms - but they can be in nominal terms, it just takes the political will.

"Governments need to engineer wage (and hence tax revenue) inflation."

At which point corporations move the jobs offshore to avoid higher wages. We've seen real incomes drop relative to costs of living, and persistant unemployment in the west, the most effective response to increasing costs of energy and other resources. How do Govts. 'engineer' that away?

Note the reduced imports of oil by OECD nations over the last 5 years. 'Increased efficiency and productivity' as the corporations call it, or declining overall revenue generation?

"At which point corporations move the jobs offshore to avoid higher wages"

Maybe. But more likely is the fact that provoking wage inflation will be accompanied by a depreciating currency. So, if this was on a one-for-one basis, corporations would not have the incentive to offshore.

"We've seen real incomes drop relative to costs of living, and persistant unemployment in the west, the most effective response to increasing costs of energy and other resources. How do Govts. 'engineer' that away?"

Real incomes have to drop. That's the nature of an energy supply shock. Nominal incomes don't have to drop and indeed they should be boosted so that nominal household debt levels are no longer a major constraint on households.

Increased unemployment is partly due to the monetary/nominal_balance_sheet amplification of this real supply shock. The primary focus of government economic policy at the moment should be mitigation of this monetary/nominal_balance_sheet problem. The actual response of governments (austerity) has been to compound this monetary/nominal_balance_sheet problem.

Sounds pretty cryptic, 'merf. What's your plan, in more laymanish terms? Perhaps a lesson in "mitigation of this monetary/nominal_balance_sheet problem" for dummies (like me) would be helpful.

Here's my take on the past few years and the best way for societies to cope with the next few:

1) High debt levels that were expected to be repayable because of economic growth. But these debt levels are expressed as an amount of money - and money's whatever we, collectively, define it to be - this point is essential to the solution.

2) Relatively small supply shock (oil supply not yet declining but cannot expand, and more of this constant supply is going to Asia).

3) This meant real economic growth was obviously not going to happen and that the debt could not be repaid in full. This is 2008: some firms go bust, and some people default on their mortgages.

4) Everyone's connected though. Debt defaults by one party put a huge strain on economic activity by other parties. This is an amplification mechanism: the monetary/nominal_balance_sheet problem. The unemployment induced by this chain of credit defaults is more than is necessary to reduce economic activity back to within the bounds of the current energy supply.

5) This explains why oil prices have never regained their 2008 level, and consequently why investment in energy infrasture is not as high as it should be (a very sub-optimal response and an energy supply shock!)

6) The solution would be something like: suppose household has debt of $200,000 and income of $40,000. Debt repayments are severly curtailing their spending. Also cutailing spending of others on whom their employer depends and so their income is under threat; if we doubled everyone's income and the prices of all goods, then real economic activity would not immediately be affected but relative debt levels would be far less onerous. Fact that debt is less of spending means that economic activity actually expands.

7) Implies higher wages, even higher inflation (supply constraint has to mean we are relatively worse off), higher job security, less problem with debt. The boost to economic activity will push up the relative price of energy (real supply constraints still hold) and so produces incentives for investment in energy. This is what we want.

8) Obviously people on the other side of this debt/asset take the hit - but they "invested" in then-current (pre-2008) consumption to be repaid by richer future generation. This was a poor investment decision and so they deserve to take the hit.

dcomerf,

Thank you for your take - very accessible, very concise. You express nicely what I have thinking in a less organized form.

To expound upon your item 2): I would argue from my limited base of knowledge - I am a former oil field geologist/well logger but much of my knowledge of peak oil has been gleaned from reading TOD discussions and conducting follow-up research - that affordable global crude oil supply does in fact appear to be declining. I believe it is obvious that the shortfall in affordable "traditional conventional" crude is being made up by using more expensive forms of petroleum and alternatives (i.e., the new conventional is not so sweet and easy). It thus seems apparent that the formerly-economically-sustainable petroleum consumption model has to be replaced by a new model that includes lower consumption. It also seems apparent, again from my limited base, that many investors across the spectrum are aware of this at some level, and are waiting for signals as to what the new petroleum production/consumption paradigm will be - leading to your items 3-5).

I like your inflation plan and I'd personally like to see some inflation because as a debtor I would benefit, but all of our debtor interests are being suborned to those of our lenders. I don't think that the debtor-beneficial kind of inflation's going to happen until it can't be avoided.

Govts. engineer against capital flight by performing capital controls, with a modern example being China.

Reminds me...

Unlike the nation-state...

...Would it be more 'economical'/energy-efficient even if as a temporary measure, to bring the Somalis to the food, rather than the food to the Somalis? (What is-- or could be with retrofit-- the human carrying-capacity of China's new aircraft carrier?)

The market movements are a combination of electronic impetus and a herding instinct to rush to the other side of the deck, but notwithstanding this it does seem like @ $80/barrel is a cut off point for western growth. Doubtless if incomes fell to Chindese levels we might become competitive again, but then again our market would shrink further and our political/social concordat re pubic and government would likely fail totally; it is already stressed.

Hello,

There is no doubt that rapid growth in total energy expenditures in general slows economic growth (for net importers of oil/energy) for other sectors as expressed by GDP.

Through the last 2 - 3 decades economic growth was "supercharged" with year over year growth in total debt as illustrated for the US in the chart below.

Similar developments as illustrated in the chart above are also found in many other OECD economies.

For some economies total annual debt growth was well above 10 % of GDP!

Debt growth temporarily allowed compensating for (and also partially caused) the compounding effects from growth in energy prices and energy consumption.

As I see it, many countries are now at a (or has passed) point where the economic participants (private, corporate, public) has reached debt saturation. The emerging slow down (and possible reversal) in debt growth will in my opinion also affect near future demand and prices for oil and other energy.

Change in total debt growth will in my opinion be the dominant force for the near term economic development (GDP) and thus demand and price support for oil/energy prices.

Present high oil (and energy) prices also slows GDP development and may at some point in the near future become subject to the gravity from temporarily declining demand that feeds weaker oil/energy prices.

Structural high unemployment, declining house prices, uncertainty in the stock markets will all put additional strains on the economies as output and the tax base will shrink and also reduce demand for oil/energy.

Lowered oil/energy prices could in the near future produce false signals to the economic participants as this obscures the fact that many new discoveries (fields) now require a break-even oil price of $60 - 70/bbl to become economic.

Rune

I agree with everything - but you did not take it to the next step.

Your graph above indicates the next phase in the final two years in the US. Government steps in and generates larger and larger debt to compensate.

Government intervention is the "endgame" and will continue until it cannot.

I cannot see any way out of massive inflation and currency collapse combined with economic stagnation.

...now if you are in the 18-30 demographic in the OECD countries, with no job and no prospects ... I think the UK riots are just the start.

I also believe that.

In my opinion there is a myopic view on (Net) government debt to GDP ratio which allows comparing apples and bananas. The taxation policy/structure or rather government consumption as portion of GDP varies amongst countries. Thus comparing one country using 33 % of its GDP to a country using 45 % of its GDP for government consumption is a comparison on unequal terms.

Therefore I prefer to compare a country’s ratio of net government debt to total receipts. This in my view gives a truer metric of the debt load.

Presently the US government finances 30% of its outlays with debt. A balanced budget would thus roughly require an increase in receipts (taxes) of around 40 %, which of course would never happen. To get into a position where debt may be paid down receipts (and/or a combination of cuts) needs to be raised above said 40 %.

That's why the W.H. will not negotiate any deal that includes a balanced budget agreement, because it would render the govt. null and void overnight. Even if it tried to reduce spending to balance the budget, there would be riots in the streets from lack of sufficient SS, Medicare, Medicaid, food stamps, etc.

Meaning, there isn't the wiggle room to borrow trillions more to pay for stimulus in one form or another.

However, there is still Helicopter Ben's printing press in the form of QE's, and evidently he has not ruled out another round if deemed necessary. My question regarding QE's is, is there an inherent danger of hyper-inflation due to a watering down of the dollar?

In essence, are the OECD countries looking at two choices - default on debts, or hyper-inflation, and if QE's are the go to fiscal option when all else fails, then isn't the final outcome necessarily hyper-inflation?

Well, it becomes hard. I believe those in charge of economic policies are aware of the challenges ahead and to me it seems like they cannot choose from several good options, but increasingly will choose those that does least harm.

Having a sovereign currency gives more wiggle room, but when it comes to the US dollar it is also the world’s reserve currency…..so it is a difficult balancing act as to how much can be “printed”.

I have found no clear definition of hyperinflation, but an annual inflation of 25-30 % is devastating. In my opinion this is also very much a question about trust in fiat. If trust in fiat is lost, people will fast try to change their fiat for something they believe keeps value/wealth better.

High inflation also acts as a taxation.

Countries without a sovereign currency and a heavy debt load are likely to default, those with a sovereign currency and high debt load can always print.

Very interesting. Thanks Rune

"My question regarding QE's is, is there an inherent danger of hyper-inflation due to a watering down of the dollar?"

To get hyperinflation or even regular inflation, the wages must climb with the prices. But global wage arbitrage isn't letting that happen. If wages threaten to rise, the companies outsource to somewhere cheaper. So prices go up, jobs fall, demand drops, and prices fail to rise any further. But the standard of living has dropped by the increment of the price rise.

And tax revenues have dropped as well due to the unemployment, while expenses have increased due to the unemployment and that first price rise. So deficits grow rapidly.

PV

Remember 10 -15 years ago we were all sold on the benefits of globalisation. The claim was that we could all tap into the very low costs of production in the developing world. What we were not told was that we would also share in the same level of wages that are paid in the developing world. Real wage deflation in western countries will not stop until our wages mach those of China and India.

Just as now on Peak Oil, we were told, just that those doing the telling were dismissed as crackpots. I remember the warnings well.

As far as the US goes, inflation has been trending down over the long-term. Unempoyment, meanwhile, is quite high. Bernanke's comments today suggest that this is a situation the Fed wants to maintain. Meanwhile, all political momentum is in the direction of doing things that will keep unemployment high and make growth more difficult (e.g., the insane focus on the long-term debt in a time of recession and super-low interest rates).

It would be interesting to test the notion that, as I suspect, any sustained economic recovery would push oil prices so high that it would snuff that recovery out in the crib. This may in fact be what is actually happening. But since our political leaders are doing everything in their power to snuff out growth and rising living standards anyway, irrespective of energy prices, that proposition isn't really being tested.

“It would be interesting to test the notion that, as I suspect, any sustained economic recovery would push oil prices so high that it would snuff that recovery out in the crib.” Posted by Incandenza

Just a thought: Maybe Bernanke and the Fed and all the others realize that this is true, and they see no alternative than trying to keep things where they currently are. For if they were to goose up the economy and then things played out with a subsequent price spike followed by another crash, the role of oil price and supply issues will be too obvious to shove under the rug any longer.

In other words, TPTB will have to start confronting End of Growth issues. Having no solutions for this, mainting the present course seems to them as the least bad option.

Antoinetta III

Yes, that is a good way of seeing it. If they try to induce higher consumption through too much stimulus they 1) cast doubt on the long-term prospects of the govt because hyperinflation implies loss of control of the economy and power 2)waste the resources left through stupid needless building of things they know will not be useful anyway 3)give people the wrong idea so they won't settle down to ELP, which is the only way out.

So the government as a unit and as a voice talks a lot about trying to get back to growth....but secretly each person in the government is thinking "growth is impossible, what a blessing! we don't need another strip mall!" And probably OUTSIDE the government there are also people working for companies, banks, colleges, whatever, who are secretly cheering for the end of "growth" while pretending under masks to champion it from their desks.

Now there is a thought.

Bernanke and the Fed and at at least some of the others do understand the oil connection and are making a decision to let the economy wallow. The best way to transition the economy away from expecting cheap oil is to steadily keep it banging its head on $100 oil until demand shifts away from it permanently. At the same time the price of capital to do the needed retrofits is agreeably low.

What congress won't do with tax policy the Fed will have to do with a considerably less precise tool. On the plus side, since oil is traded globally, corporations can't evade the higher oil price by outsourcing, whereas they can evade the taxes that way.

I have tried to quantify the relationship between oil price (Brent), SP500 and recessions by dividing the SP500 with the price of oil. My conclusion is that when the SP500 divided by Brent falls below 14, it is a risk of recession and when the SP500/Brent goes under 12 it is a high probability of a recession. Right now SP500/Brent is approximately 10.6.

Those interested can read more about this on my blog, most recently here (apologies for the dubious language):

http://theoldinsane.blogspot.com/2011/08/growth-ceiling.html

Euan,

I think its wrong to think that any oil price will permanently prevent growth in the world economy. What happened in 2006-2008 was a very rapid increase from a long period of low oil prices ($30/barrel) to about $90. Since 2008 we have averaged about $85, so going to $100 in itself is not the problem. In time all economies can adjust to high prices, certainly consumers use a lot less in countries with high fuel taxes. The world has many energy options to replace oil but it takes time, to replace gas guzzlers, with much more fuel efficient ICE or even EV's, replace oil used to generate electricity, or to heat homes. For the US I dont think $4 gasoline is really high enough for the change to push consumers to better fuel economy but fortunately CAFE standards are being raised dramatically to drive this change.

The PHEV and EV revolution will soon be the real driver to replace a lot of oil consumption to the point that oil be be a much smaller percent of economy even if > $100/barrel ( or even >$200/barrel).

The USA can NOT sustain economic growth as it is currently defined in terms of

endless Wars, Auto Addiction and wanton wasteful consumerism.

However the US CAN easily reduce its oil consumption and greenhouse emissions

by 10% in a year by simply RUNNING Green public transit via Rail, Lightrail,

buses, shuttles, bicycles and walking.

Since 2008 over 150 US public transit systems have had cuts in service.

Simply restore those cuts, add more frequency for off-peak/weekend service on

existing Rail and light rail systems. Add shuttles for the last mile from train

stops and the US could begin to cut its oil usage to the 1/3rd to 1/2 of Europe

and Japan.

The Federal gas tax needs to be increased to $1 per gallon with the proceeds

going to Green Transit.

Yes, lots of things that "can" be done, but honestly what are the chances? There's way too much vested interest in what we have today.

Also, the skepticism surrounding AGW, particularly so-called "green solutions", is palpable.

Really, it's all too hard. Let's just get to this cliff ASAP and deal with it, before the next 2 or 3 billion souls arrive and compound the problem(s) further.

Cheers, Matt

I agree that OECD economies may adapt to higher energy prices. But with the stage fully dressed and set for a rerun of the 2008 crash, I really wonder what OECD governments have done in the intervening 3 years to address this problem - very little it seems since they are still loathed to admit to problem which would be the first step towards tackling it. They have also done very little to tackle the banks who are still paying massive bonuses whilst risking and / or losing vast amounts of tax payers money.

In the complex tangled machine that is global society and economy it is of course near impossible to link causes to effects. But with Brent just hitting $100 annual average it is interesting to observe growth stuttering once again.

Note that if you use calendar year averages, the prior peak for Brent was $97 in 2008, versus $112 for 2011 to date (through July).

Yes but how much time do we have before the sheeple really start noticing things around them and panic starts to set in. Hitler didn't come to power without some really bad economics and government policies. Our government seems to be controlled by reactionary situations and that can be good or bad. If oil supplies start declining---- than oil investing rather than u.s dollar will be the new currency of safety. I am waiting for one more downturn in oil to invest my 401 k in those companies related to oil but I might have already missed that opportunity.

At any rate, I'm excited. It's sort of like a real-life mutually-participatory cliff-hanger. (Where the cliff is the second ledge below the one we've already hung and fell off of. ;D

LOL

...If or when health-care, at least as dispensed by the nation-state/corporatocracy, becomes next-to-impossible, we may need all the medical marijuana and natural medicines we can grow, supportive communities notwithstanding.

Maybe the next cliff or three will take care of any further nuclear-plant funding too, while I'm thinking about it-- nuclear waste notwithstanding.

I'd like to propose a simplistic estimate the impact of oil price increases on US GDP. I shall work from the premise that a dollar price increase on a barrel crude diminishes GDP by one dollar. I'm assuming that consumption of crude remains the same even as the price increases but that ultimate consumption will absorb the added cost of production. Admittedly the assumption of constant consumption is wrong, but stay with me as this will likely lead us at least to a conservative estimate of impact.

Consider two stats. 1) The US consumes about 20 million barrels of crude per day, or 7.3 billion barrels per year. 2) US GDP in 2010 was $14.6 trillion. Thus a $1 marginal increase to the price of crude is 0.05% of GDP. In simpler terms, a $20 price increase will knock out 1% of GDP.

Now consider this. In a typical year, GDP grows about 3%. From mid-2007 to mid-2008, oil surged from $70 to $140/bbl. This $70 increase if sustained would easily have knocked 3.5% out of the economy. I suggest that a single hit of this magnitude is enough to send the US economy into a recession, which, as we all know, followed the 2008 price spike.

If solid economic growth requires oil priced below $60, then this simplistic analysis would imply $120/bbl as a critical threshold above which negative growth and recession are unavoidable. An economy with crude above $100 would be anemic at best. It should be no wonder that the recovery has stalled out given the price of oil earlier this year.

James Hilden-Minton