U.S. Shale Gas: Less Abundance, Higher Cost

Posted by aeberman on August 5, 2011 - 10:15am

Arthur E. Berman and Lynn F. Pittinger

Lynn Pittinger is a consultant in petroleum engineering with 30 years of industry experience. He managed economic and engineering evaluations for Unocal and Occidental Oil & Gas, and has been an independent consultant since 2008. He has collaborated with Berman on all shale play evaluation projects since 2009.

Introduction

Shale gas has become an important and permanent feature of U.S. energy supply. Daily production has increased from less than 1 billion cubic feet of gas per day (bcfd) in 2003, when the first modern horizontal drilling and fracture stimulation was used, to almost 20 bcfd by mid-2011.

There are, however, two major concerns at the center of the shale gas revolution:

• Despite impressive production growth, it is not yet clear that these plays are commercial at current prices because of the high capital costs of land and drilling and completion.

• Reserves and economics depend on estimated ultimate recoveries based on hyperbolic, or increasingly flattening, decline profiles that predict decades of commercial production. With only a few years of production history in most of these plays, this model has not been shown to be correct, and may be overly optimistic.

These are not purely technical topics for debate among petroleum professionals. The marketing of the shale gas phenomenon has been so effective that important policy and strategic decisions are being made based on as yet unproven assumptions about the abundance and low cost of these plays. The “Pickens Plan” seeks to get congressional approval for natural gas subsidies that might eventually lead to conversion of large parts of our vehicle fleet to run on natural gas. Similarly, companies have gotten permits from the government to transform liquefied natural gas import terminals into export facilities that would commit the U.S. to decades of large, fixed export volumes. This might commit the U.S. to decades of natural gas exports at fixed prices in the face of scarcity and increasing prices in the domestic market. If reserves are less and cost is more than many assume, these could be disastrous decisions.

Executive Summary

Our analysis indicates that industry reserves are over-stated by at least 100 percent based on detailed review of both individual well and group decline profiles for the Barnett, Fayetteville and Haynesville shale plays. The contraction of extensive geographic play regions into relatively small core areas greatly reduces the commercially recoverable reserves of the plays that we have studied.

The Barnett and Fayetteville shale plays have the most complete history of production and thus provide the best available analogues for shale gas plays with less complete histories. We recognize that all shale plays are different but, until more production history is available, the best assumption is that newer plays will develop along similar lines to these older plays. There is now far too much data in Barnett and Fayetteville to continue use of strong hyperbolic flattening decline models with b coefficients greater than 1.0.

Type curves that are commonly used to support strong hyperbolic flattening are misleading because they incorporate survivorship bias and rate increases from re-stimulations that require additional capital investment. Comparison of individual and group decline-curve analysis indicates that group or type-curve methods substantially over-estimate recoverable reserves.

Results to date in the Haynesville Shale play are disappointing, and will substantially underperform industry claims. In fact, it is difficult to understand how companies justify 125 rigs drilling in a play that has not yet demonstrated commercial viability at present reserve projections until gas prices exceed $8.68 per mmBu.

CONTENTS

Production Volume and Reserve Growth vs. Profitability

Entry of Major Oil Companies Into Shale Plays

Evaluation of Shale Gas Well Performance

Well Performance Evaluation Methodology

Barnett Well Performance

Fayetteville Well Performance

Haynesville Well Performance

Comparison to Operator Claims

Matching Aggregate Production Profiles for Shale Gas Plays

Economics

Summary and Conclusions

Appendix

Production Volume and Reserve Growth vs. Profitability

Analysts, government agencies, academics and media pundits commonly equate large shale gas resource levels, production and reserve growth with commercial success. We do not dispute the impressive growth of shale gas resources, reserves or production. Examination of the balance sheets of the leading companies involved in shale gas development, however, reveals limited earnings or profit. We must ask the proponents of shale gas success to explain this fundamental discrepancy.

Some argue that price explains poor business results. First of all, whose fault is it that gas was over-produced to the point that prices were depressed other than the same companies that analysts praise for the shale gas revolution? Secondly, realized prices (the prices that results from hedging production volumes in advance of sales) over the past 5 or so years have never been higher because of high spot prices through mid-2008 and favorable hedge positions for much of the following period. This means that low prices cannot be blamed for lack of business success. The simple truth is that shale gas ventures are costly and profits are marginal at best.

Three decades of natural gas extraction from tight sandstone and coal-bed methane show that profits are marginal in low permeability reservoirs. Shale reservoirs have orders of magnitude lower reservoir permeability than tight sandstone and coal-bed methane. So why do smart analysts blindly accept that commercial results in shale plays should be different? The simple answer is found in high initial production rates. Unfortunately, these high initial rates are made up for by shorter lifespan wells and additional costs associated with well re-stimulation. Those who expect the long-term unit cost of shale gas to be less than that of other unconventional gas resources will be disappointed.

Entry of Major Oil Companies Into Shale Plays

Another common theme among shale advocates is that the entry of major oil companies into some of these plays proves that they are commercially viable. There are as many reasons for big companies to enter shale gas plays as there are big companies but the most obvious reason is reserves.

Reserve replacement has been a challenge for major oil companies for at least the last decade as opportunities in the international arena have contracted. North American shale gas plays offer a temporary solution. Whether big companies can find operational and technological ways to make these plays commercial is another question but, for the short term, shale plays provide a means to add reserves.

The notion that investment by large companies proves commercial success is disproved by recent history. We have to look no further than corn ethanol and other biofuel companies where optimistic claims of profitability are now seen to be unfounded. This is even with government mandated use, major subsidies, and import tariffs to protect domestic producers from competition. An excellent discussion of the details of this situation by Robert Rapier can be found at this link:

http://robertrapier.wordpress.com/category/pacific-ethanol/

Evaluation of Shale Gas Well Performance

Our analysis of shale gas well decline trends indicates that the estimated ultimate recovery (EUR) per well is approximately one-half of the values commonly presented by operators. The average EUR per well for the most active operators is 1.3 Bcf in the Barnett, 1.1 Bcf in the Fayetteville, and 3.0 Bcf in the Haynesville shale gas plays.

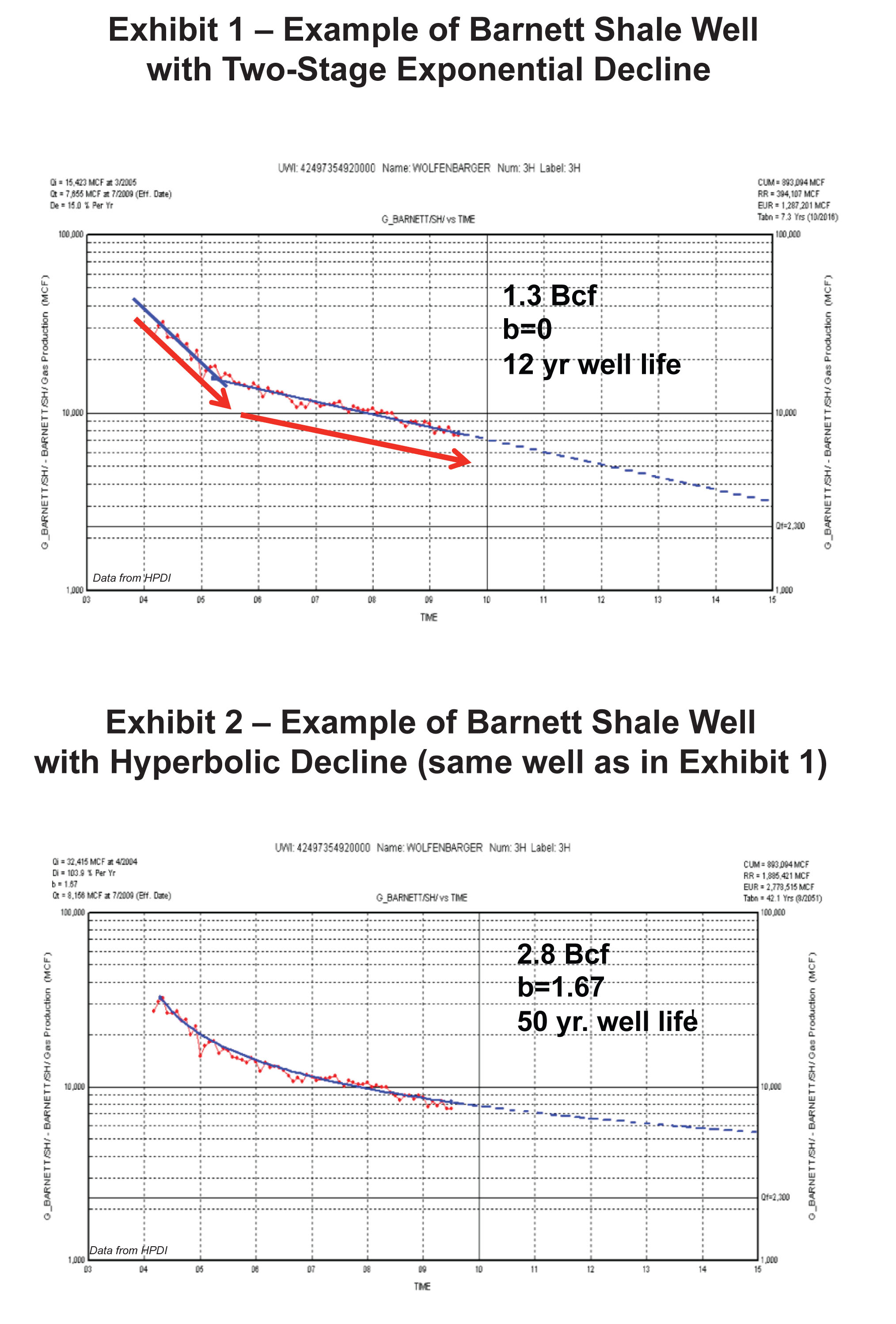

The primary difference between our analysis and the typical well profile proposed by operators is that we observe predominantly exponential (weak to moderate hyperbolic) decline in most of the individual well decline trends, rather than steadily flattening hyperbolic decline. For the Barnett and Fayetteville shale plays, we identify a two-stage exponential decline based on decline curve analysis (DCA) of individual wells; for the Haynesville Shale we observe predominantly exponential decline for individual wells.

Two-stage exponential decline is characterized by an initial ten- to fifteen-month period of steep decline followed by a stable, shallower rate of decline that continues up to the present life of wells (commonly for four or more years to date in the Barnett Shale). Our emphasis is on matching the relatively stable, shallower stage (Exhibit 1) because that is the portion of the decline history that best predicts future performance.

In contrast, most producers and industry analysts match the entire production history with a hyperbolic profile with resulting hyperbolic curvature, or “b”, exponents of more than 1.0 (Exhibit 2). This invariably results in a much higher EUR and longer well life because the decline rate progressively flattens beyond production history to very low terminal decline rates of a few percent.

We do not believe that it is appropriate to model the steep initial portion of the decline profile because it is not predictive of future behavior and is already accounted for in the cumulative production portion of the DCA (DCA is really about remaining reserves, after all).

Technical papers are mixed, but several peer-reviewed articles (see appendix) provide specific warnings against use of hyperbolic coefficients greater than 1.0, and specifically caution against including the initial steep transient decline rate in the matching process.

Aggregate production profiles for the Barnett, Fayetteville and Haynesville plays can be matched closely using the average well EUR presented in this study, providing an independent verification of these results. These points will be explained in more detail in subsequent sections including examples from different shale plays and operators.

Well Performance Evaluation Methodology

In this study, only horizontal wells were evaluated. With current technology and performance data, decline curve analysis (DCA) is the preferred technical approach to determine EUR for this analysis, supported by substantial empirical calibration from production histories for thousands of horizontal completions in the Barnett, Fayetteville and Haynesville shale plays. Other techniques such as volumetric calculations and reservoir simulation are limited by uncertainty and lack of calibration of recovery efficiency in the complex interaction between fracture stimulations, natural fractures and joints and shale matrix.

Investor presentations provided by operating companies typically show a group average composite curve normalized to the first month of production, combining well histories of varying duration. Our analysis indicates that this approach can be misleading, mainly because of survivorship bias (the increasing influence on the average over time by the survival of fewer and better performing wells) in the data but also by the inclusion of rate increases from re-stimulations that require additional capital investment. The older data points are representative of a much smaller sampling of wells.

We use a "vintaged grouping" method in our analyses to overcome much of the survivorship bias and effects of late-time well re-stimulations. First, we evaluate wells by operator because different operators have differing land positions that affect rock quality and well performance. Next, we vintage the wells by year of first production. This normalizes drilling and completion methods and permits recognition of performance improvement over time. Then we normalize wells within each vintaged group and do separate DCA for each group. Next, we use the number of wells that were active and the average EUR in each vintaged group to calculate a weighted average for each operator. Finally, we select a vintaged group with anomalously high EUR and conduct individual well DCA for all the wells in that group. We compare the average of the individual DCA with the the normalize group decline to calibrate our probable error for that operator. We do not adjust the weighted average EUR previously determined but this last technique gives us a measure of how much our DCA over-estimate EUR.

These points also will be explained in more detail in subsequent sections including examples from different shale plays and operators.

Barnett Well Performance

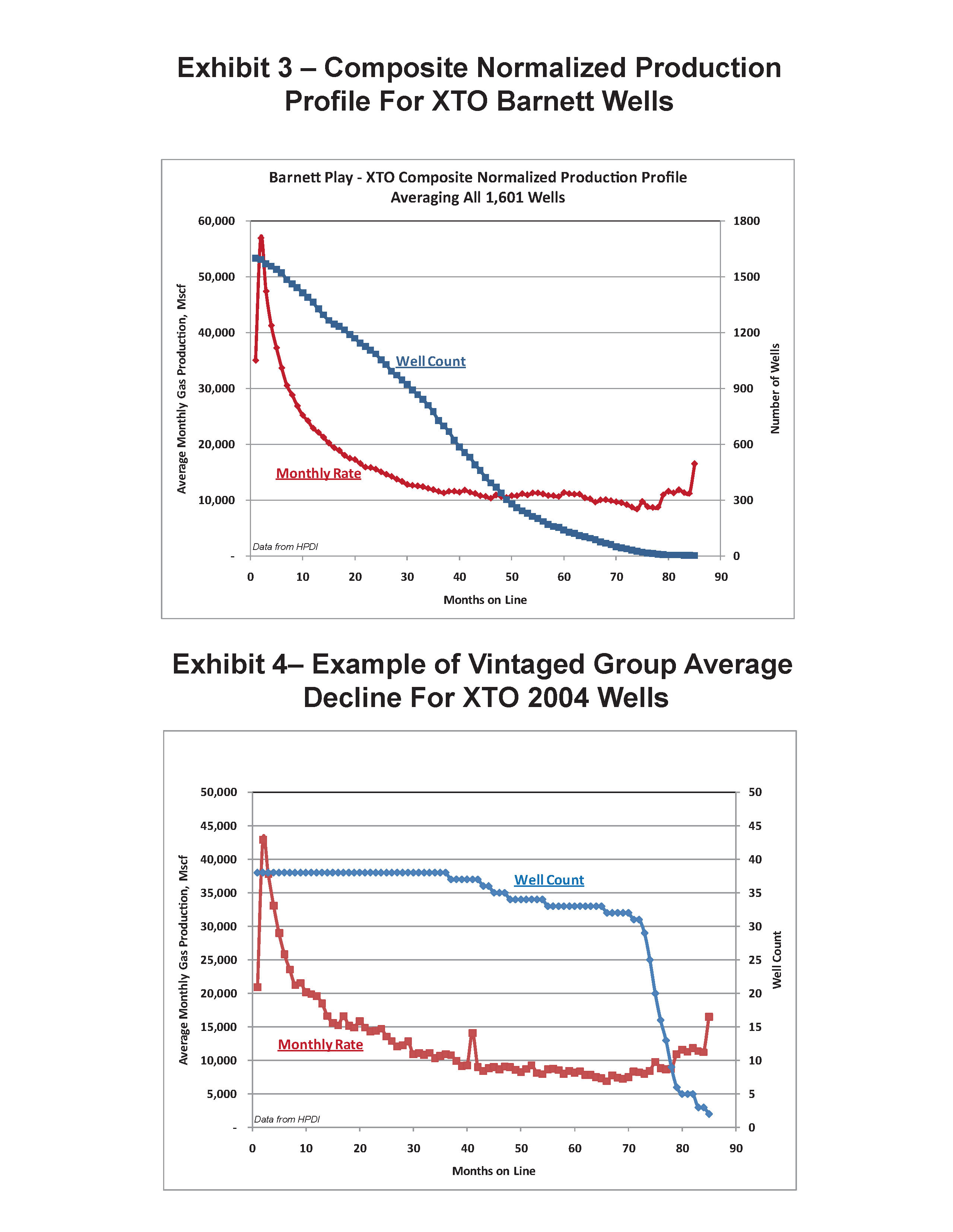

Exhibit 3 shows the group average production profile of 1,601 XTO wells in the Barnett Shale normalized to the first month of production. This example curve indicates virtually no decline for the last 4 years of production. The well count shows that the last year of the production decline trend is represented by less than 2% of the initial well count. The jump in average production after month 75 is the result of either survivorship bias (a few poorer wells drop out of the count resulting in an upward uplift because better wells survive) and/or re-stimulation.

Exhibit 4 features a subset of the wells in Exhibit 3 that is limited to wells with first production in 2004. Both Exhibits 3 and 4 show the effect of survivorship bias: as the number of wells decreases with time, the monthly rate flattens to a decline of almost zero because surviving high performance wells “lift” the average for later months. This flat decline profile is not seen in individual wells. This produces an artificially high EUR and long well life that is not real.

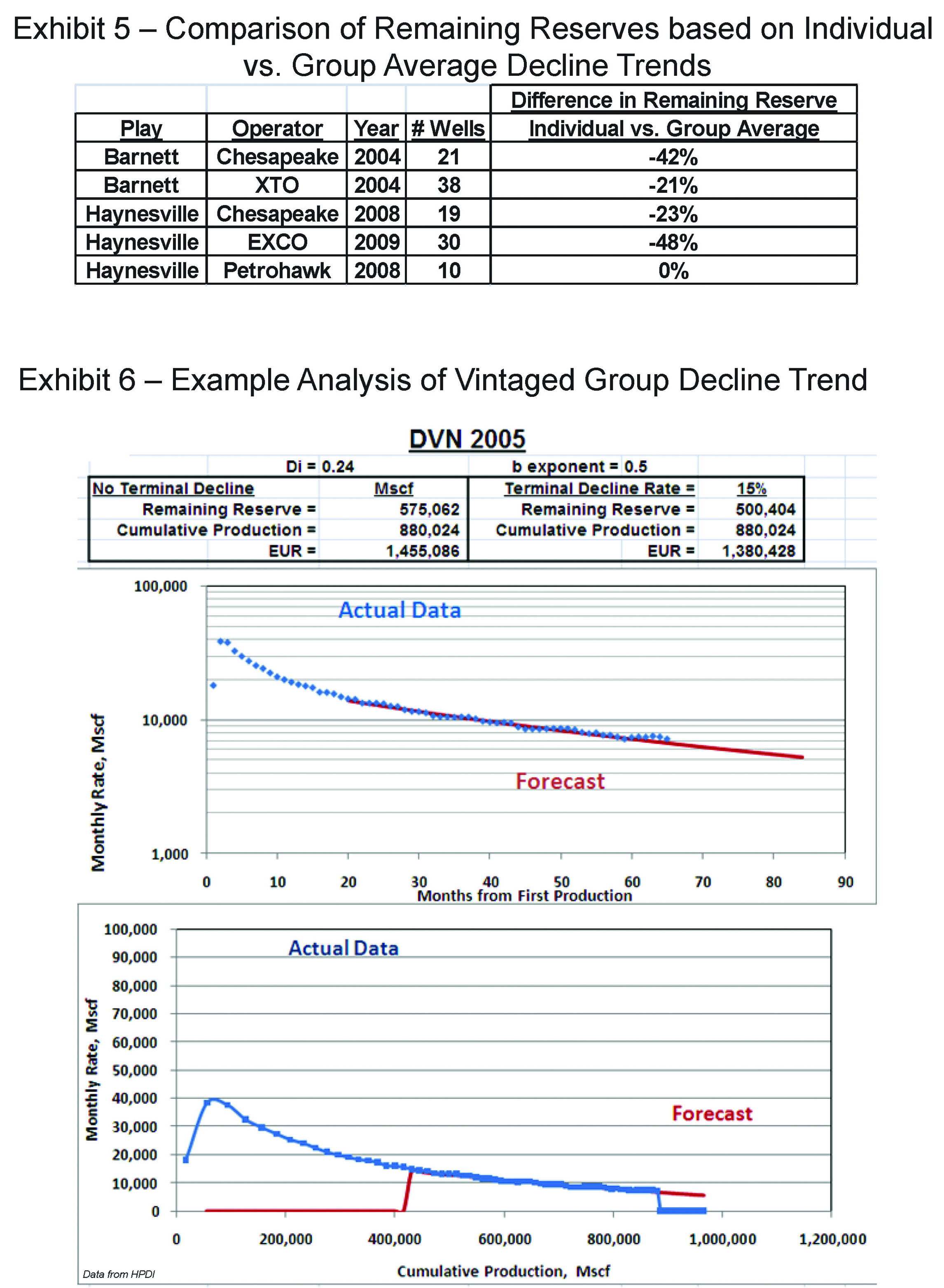

To test the accuracy of the vintaged group average approach, results were cross checked against the results of analyzing the individual decline trends for five different years and operators, summarized in Exhibit 5. This shows that DCA for individual wells is 21% to 48% lower. The average from individual well analysis will be more accurate than group averages (and therefore is considered the benchmark) because it eliminates survivorship bias and the distortion of the decline trend caused by stimulation work-overs (re-fracs).

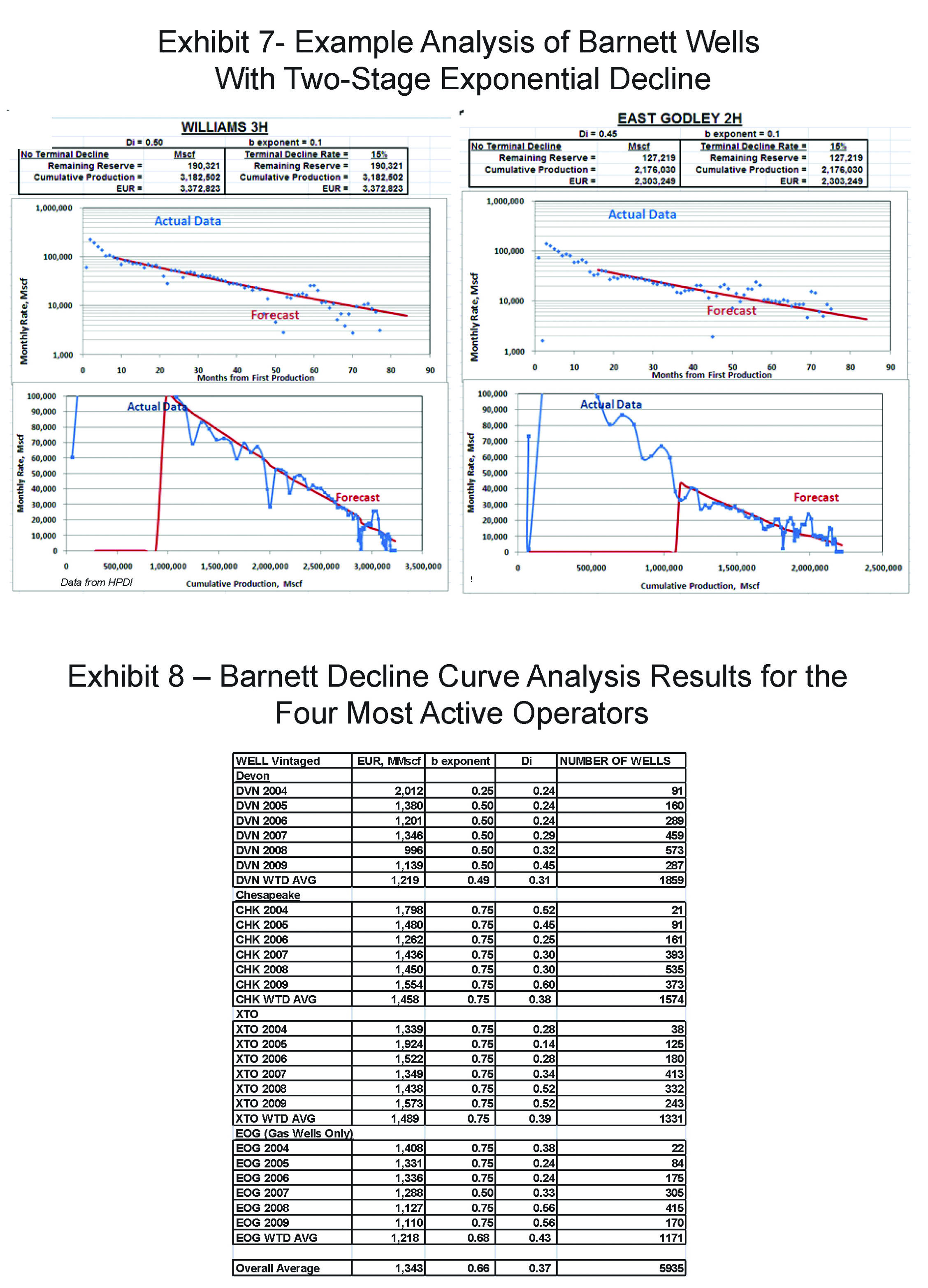

Exhibit 6 shows how we evaluate decline trends to determine remaining reserves, which are calculated from the extrapolation of the established decline trend until the well reaches its economic limit assumed to be 2,000 Mscf per month. One of the standard plots used in decline curve analysis is flow rate on a logarithmic scale plotted versus time as seen in Exhibit 7. This plot shows a typical example of individual decline behavior for a horizontal shale gas producer—a steep linear decline in the first 10-15 months followed by a second but flatter linear decline.

A straight line on this plot represents exponential decline with a constant decline rate, which typically indicates depletion of a boundary-dominated system or, in more technical petroleum engineering terms, pseudo-steady state flow. Exponential decline (coefficient b = 0) is a subset of hyperbolic decline. With a hyperbolic coefficient b > 0, the decline rate flattens, or decreases with time. This flattening can be observed in "infinite-acting" systems, or a system transitioning from the depletion of a near-wellbore high-permeability system to a lower permeability system with a larger pore volume. The flattening decline is caused by steadily increasing pore volume and drainage radius.

In Exhibit 7, please note the lower graphs showing monthly rate versus cumulative production, both on standard arithmetic scales. Exponential or boundary-dominated flows result in linear plots on this scale. This plot emphasizes deviations from exponential decay such as one would expect from hyperbolic decline. It also provides a useful reality check by putting into perspective the amount of remaining reserves being added to cumulative production used to calculate EUR.

Initial decline rates are steep but transition after 10-15 months to a flatter exponential decline trend that is the basis for extrapolating remaining reserves. This long period of flatter exponential decline represents depletion of a boundary-dominated system. Exhibit 8 summarizes EUR for the four principal producers in the Barnett Shale play based on our approach to DCA.

Fayetteville Well Performance

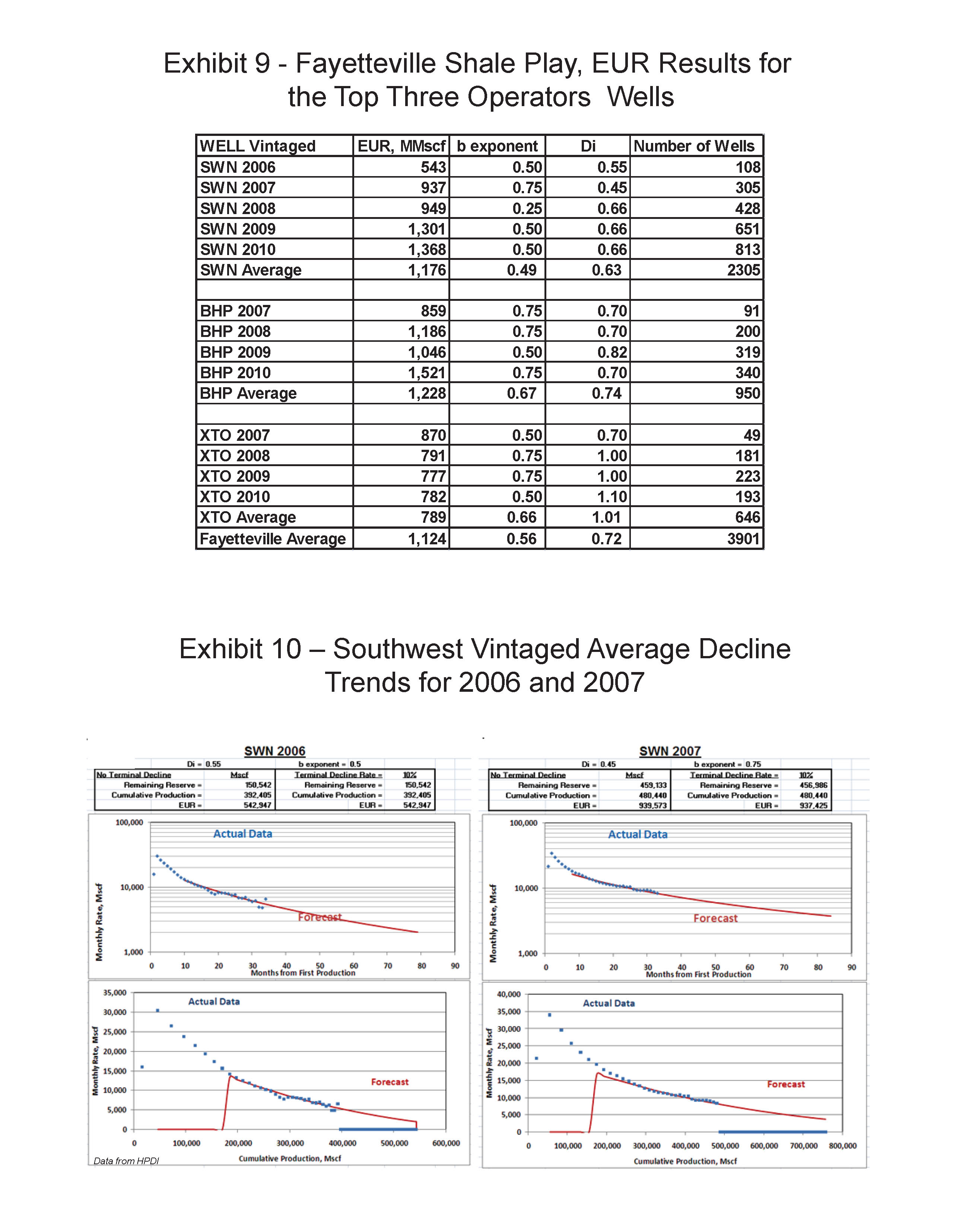

Based on our analysis of vintaged group curves that include 2,090 wells, the average EUR per well of the Fayetteville Shale play is 1.12 Bcf/well summarized in Exhibit 9. Southwestern- and BHP-operated wells (formerly Chesapeake) have the highest average at 1.2 Bcf/well, followed by XTO (formerly Petrohawk) at 0.8 Bcf/well. The decline trends were matched with moderate hyperbolic flattening (coefficient b=0.25 to 0.75), and initial decline rates, Di, averaging 72%/year, which is a steeper decline rate than observed in the Barnett Shale play.

Exhibit 10 is an example of Southwestern Energy’s 2006 and 2007 wells (group average of 108 and 305 wells) following a similar two-stage exponential decline trend similar to most Barnett wells. The curve fit focuses on the established decline trend that begins after the first 12-months of steep decline, and ignores the scatter of the last few data points affected by survivorship bias.

In contrast to the Barnett Shale play, both Southwestern- and BHP-operated wells show substantial improvement in performance in both initial rates and EUR/well with time in the Fayetteville Shale play. For Southwestern, the maximum average monthly rate doubled from 2006 to 2008. The decline rates also appear to have increased, resulting in a proportionately smaller increase of 64% in EUR/well.

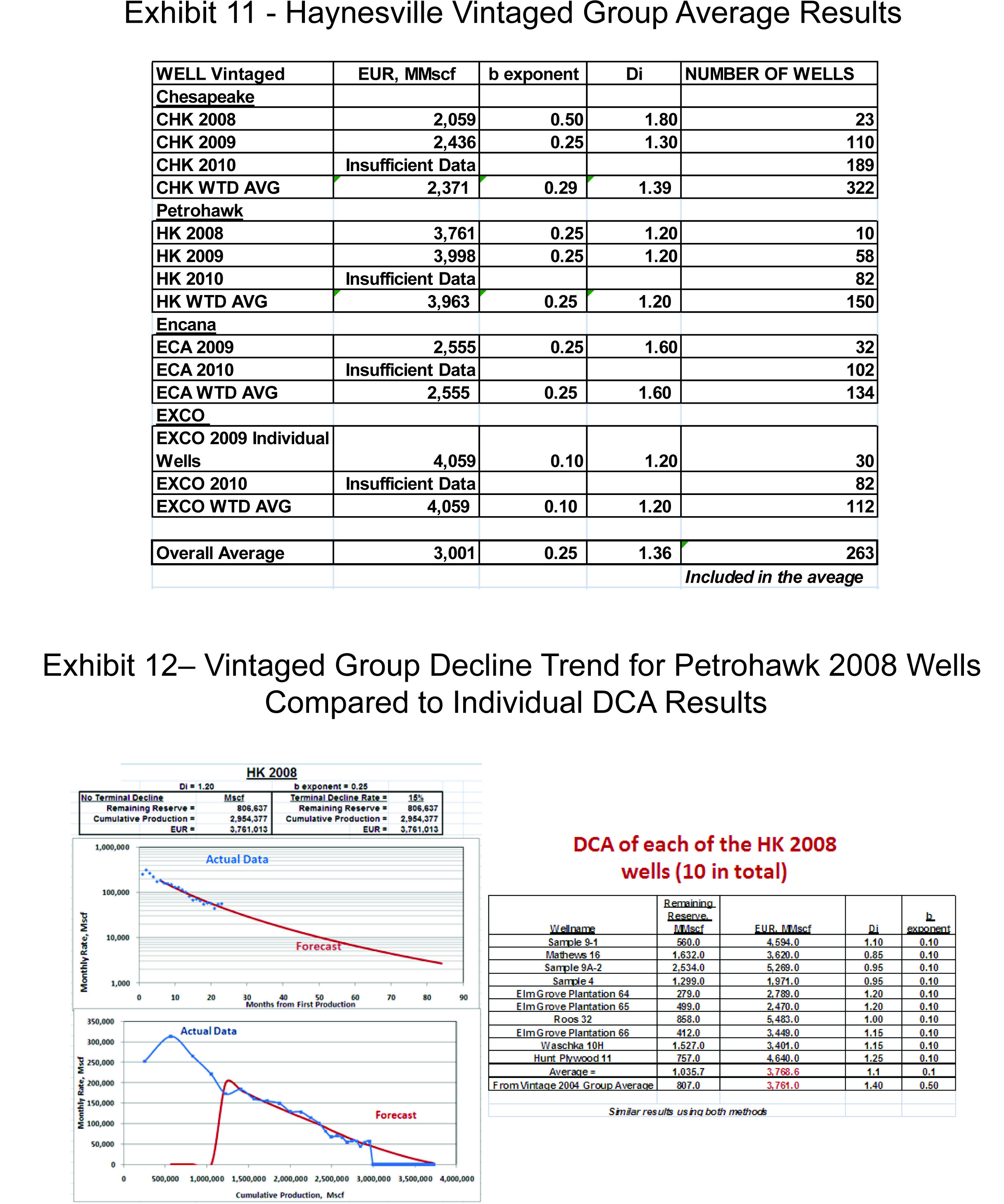

Haynesville Well Performance

The average EUR for Haynesville wells drilled by the four most active operators is 3.0 Bcf/well based on DCA trends from 263 wells. Petrohawk (now BHP) and EXCO results average 4.0 Bcf/well and are substantially better than Chesapeake and Encana results, which average 2.4 and 2.6 Bcf/well respectively. The better results achieved by Petrohawk and EXCO are probably because of their acreage positions in the core area of Desoto, Red River and Bossier parishes. Results are summarized in Exhibit 11. The vintaged average trends are matched with hyperbolic exponents ranging from 0.25 to 0.5, and initial decline rates, Di, averaging 1.4, the steepest decline of any of the shale gas plays evaluated.

An example group average decline trend is shown in Exhibit 12 for Petrohawk wells with first production in 2008. This trend is based on 10 individual well decline trends, and the table included in Exhibit 10 shows the results of analyzing each individual decline. In this case, the result of extrapolating the average group decline provides similar results to the average from evaluating the decline of individual wells. The most important finding, however, from evaluating the decline of individual wells is that the decline trends appear to be more exponential than the group average, providing further evidence that the moderate hyperbolic flattening of the group average results from combining large numbers of wells with varied decline trends and durations.

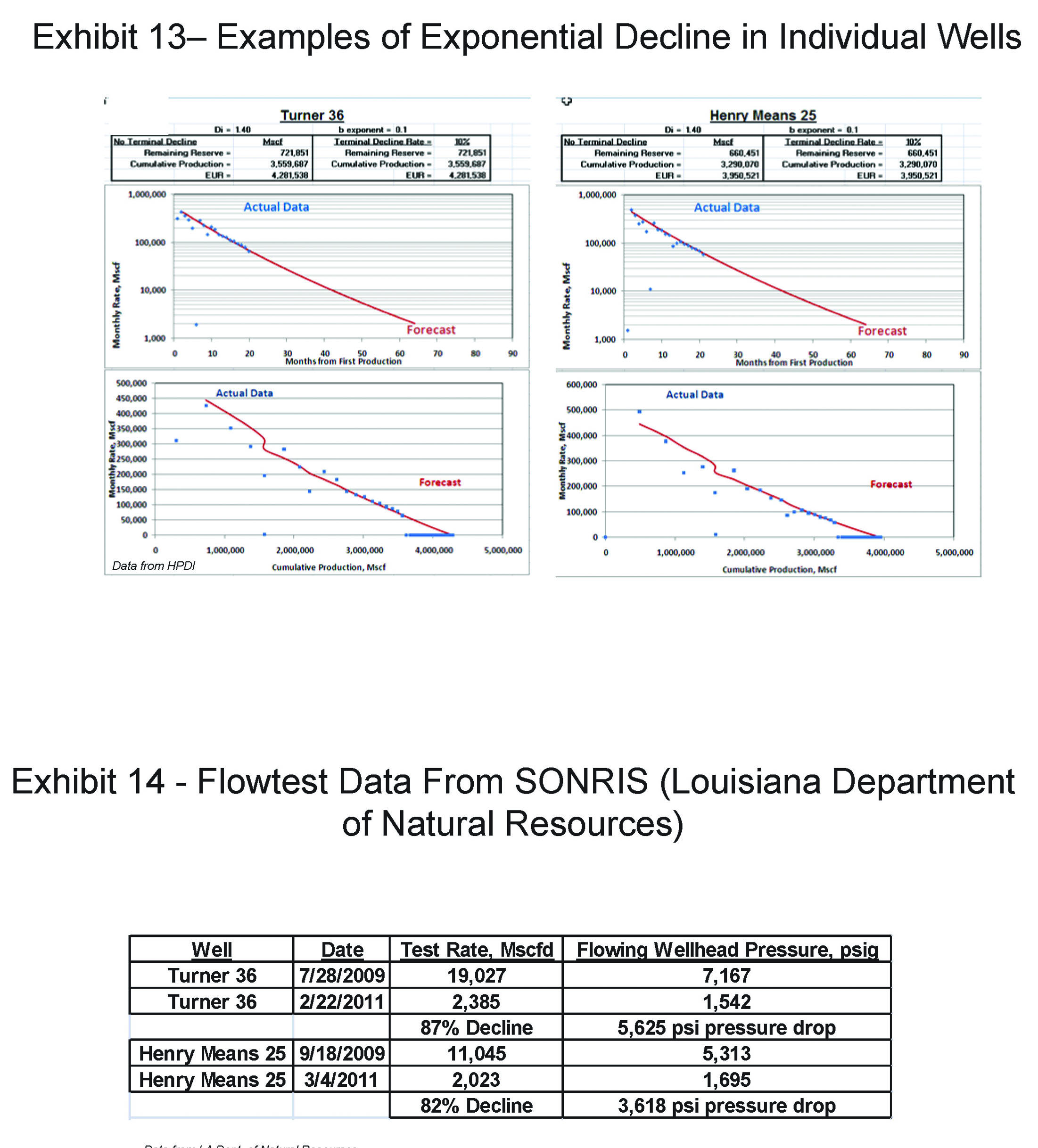

Exhibit 13 shows two examples of exponential decline in individual Haynesville Shale wells. Unlike the two-stage declines of the Barnett and Fayetteville plays, these trends continue to follow the same exponential trends established in the early months of production. The rate versus cumulative production plots show that these wells are mostly depleted, and remaining reserves are a small portion of the EUR.

An implicit assumption in DCA is that flowing wellhead pressures are relatively stable. Significant increases in flowing wellhead pressure will cause the extrapolation of the rate decline trend to be too conservative and decreases will cause the extrapolation of the decline trend to be optimistic. Well test results for the two wells in Exhibit 13 are shown in Exhibit 14. Flowing wellhead pressures have declined by more than 3,500 psi in approximately 18 months as rates have declined by more than 80%.

Extrapolating the exponential decline of wells with such large decreases in wellhead pressures will result in an over-estimate of remaining reserves. Although a systematic study has not been attempted incorporating the flowing pressure data, examination of several dozen Haynesville wells indicates that the prevalent trend is for flowing wellhead pressures of Haynesville wells to decline by several thousand psi in the first 18 months of production as flow rates decrease and flowing wellhead pressures approach pipeline pressures.

The Haynesville play is unique among the shale gas plays because it is highly over-pressured, ranging from 0.75-0.85 psi/ft. This overpressure results in much higher initial rates than in other shale gas plays, some as high as 30 MMscfd. But, with pore pressures approaching the lithostatic gradient, pore pressures probably play a role in keeping fractures open, at least initially. As pressures deplete, the pore pressure can no longer counteract the lithostatic gradient, hence fracture permeability is probably reduced as the wells are depleted and fractures close, potentially explaining the much steeper decline rates observed in this trend.

Comparison to Operator Claims

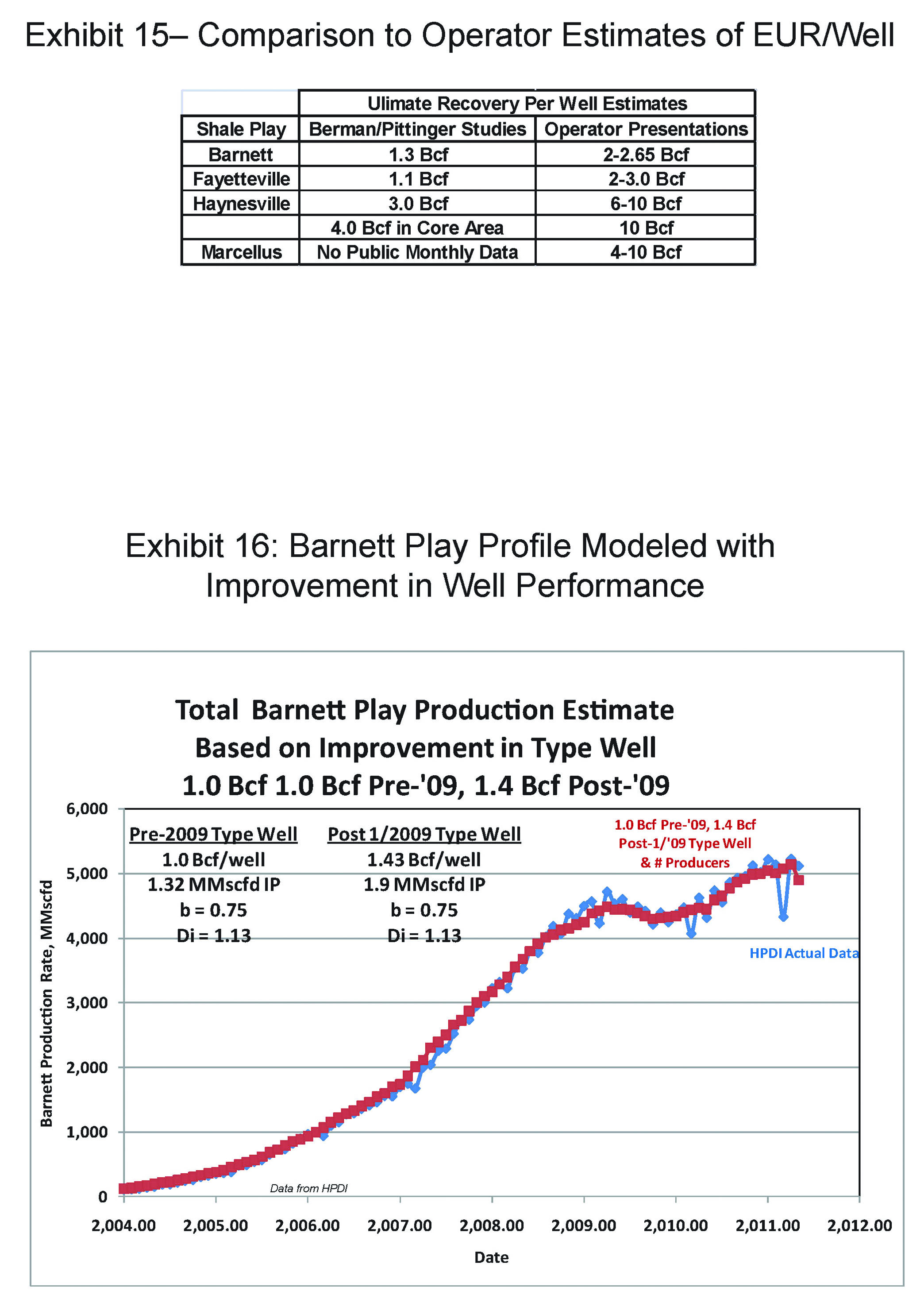

Our analysis indicates that an average EUR/well is approximately one-half of the value typically claimed by major operators in the Barnett, Fayetteville, and Haynesville plays. Exhibit 15 provides a comparison for each of the plays. By focusing on the top four operators in each play, we evaluate the portfolio-level performance of the each play. By evaluating each operator’s wells by year of first production, we are able to recognize performance improvement.

A potential explanation for the difference between our EUR estimates and those of producers may be that they are describing the performance of the core area, whereas our approach includes all wells regardless of location operated by each of the top four most active companies.

A more important difference between results from this study and operator presentations is the long-term decline behavior of the wells. In multiple studies we have analyzed several thousands of individual wells in the Barnett, Fayetteville and Haynesville plays. Most wells are characterized by stable, exponential decline trends after the first year of steep decline, as previously shown in Exhibits 10 and 12. Additional individual well decline examples are available on request in presentation format for 118 Haynesville wells included in the individual vs. vintaged group average decline comparison shown in Exhibit 15.

Matching Aggregate Production Profiles for Shale Gas Plays

An important validation of the average EUR/well for a shale gas play is whether a type well with average properties can be used to model the overall production rate for that play. More specifically, the test is whether the well count and rate profile of the type well may be used to construct an aggregate field production profile that matches the actual data. The calculation of total rate for a play is based on the number of wells added through time and the calculated rate for various vintaged wells using a type well for the production rate. If the macro-level rate is comparable to the actual data, this test provides an independent validation of the type well.

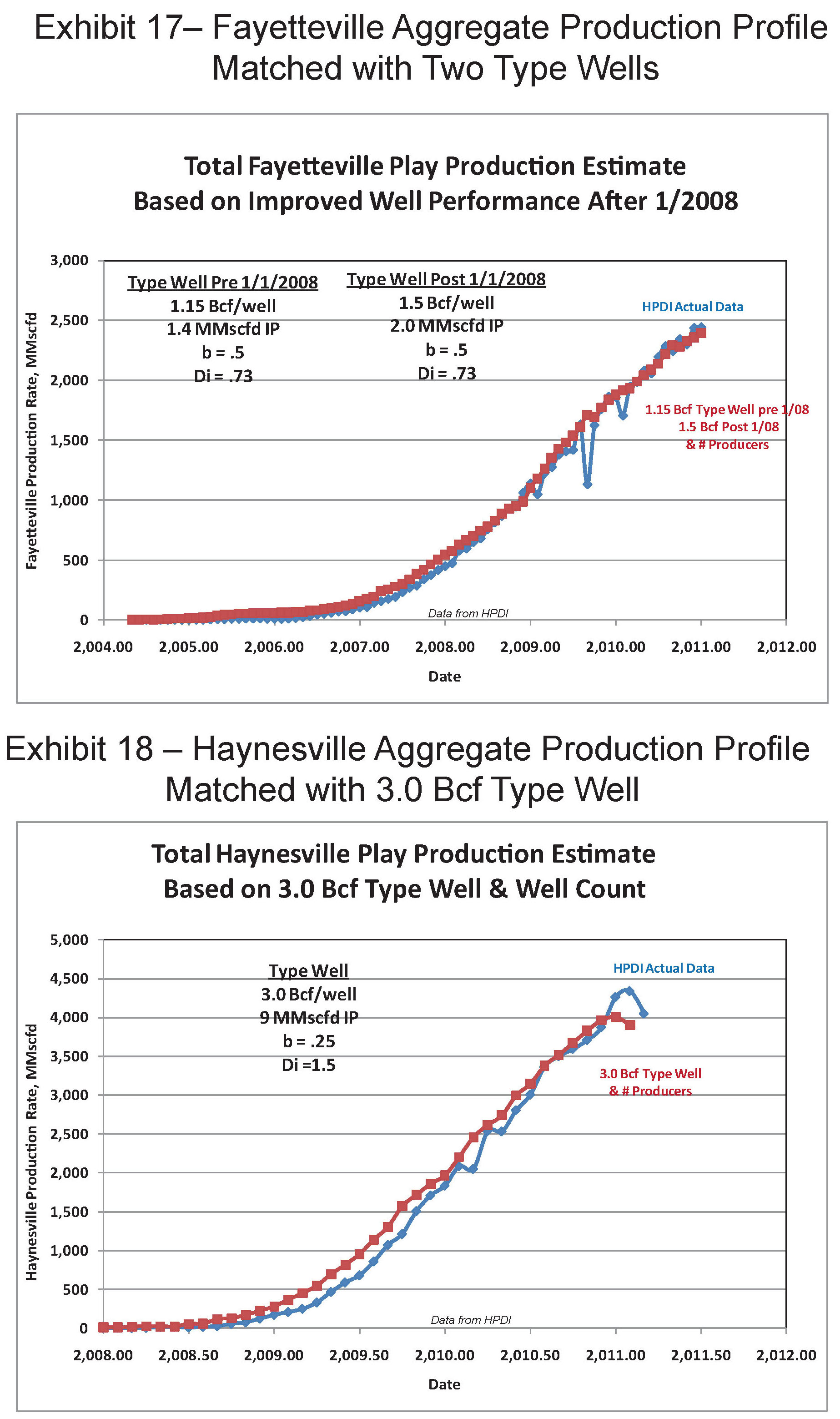

For the Barnett Shale play, a two-stage model shown in Exhibit 16 provides a good match with the actual rate data assuming a 1.0 Bcf type well prior to January 2009, improving to 1.43 Bcf after January 2009. Exhibit 17 shows a good fit with Fayetteville aggregate production rates using improved well performance beginning in 2008 for the most active operator in the play, Southwestern Energy. The aggregate production profile for Haynesville wells in Louisiana can be matched closely with a 3.0 Bcf type well, the average observed EUR for the play as shown in Exhibit 18.

Economics

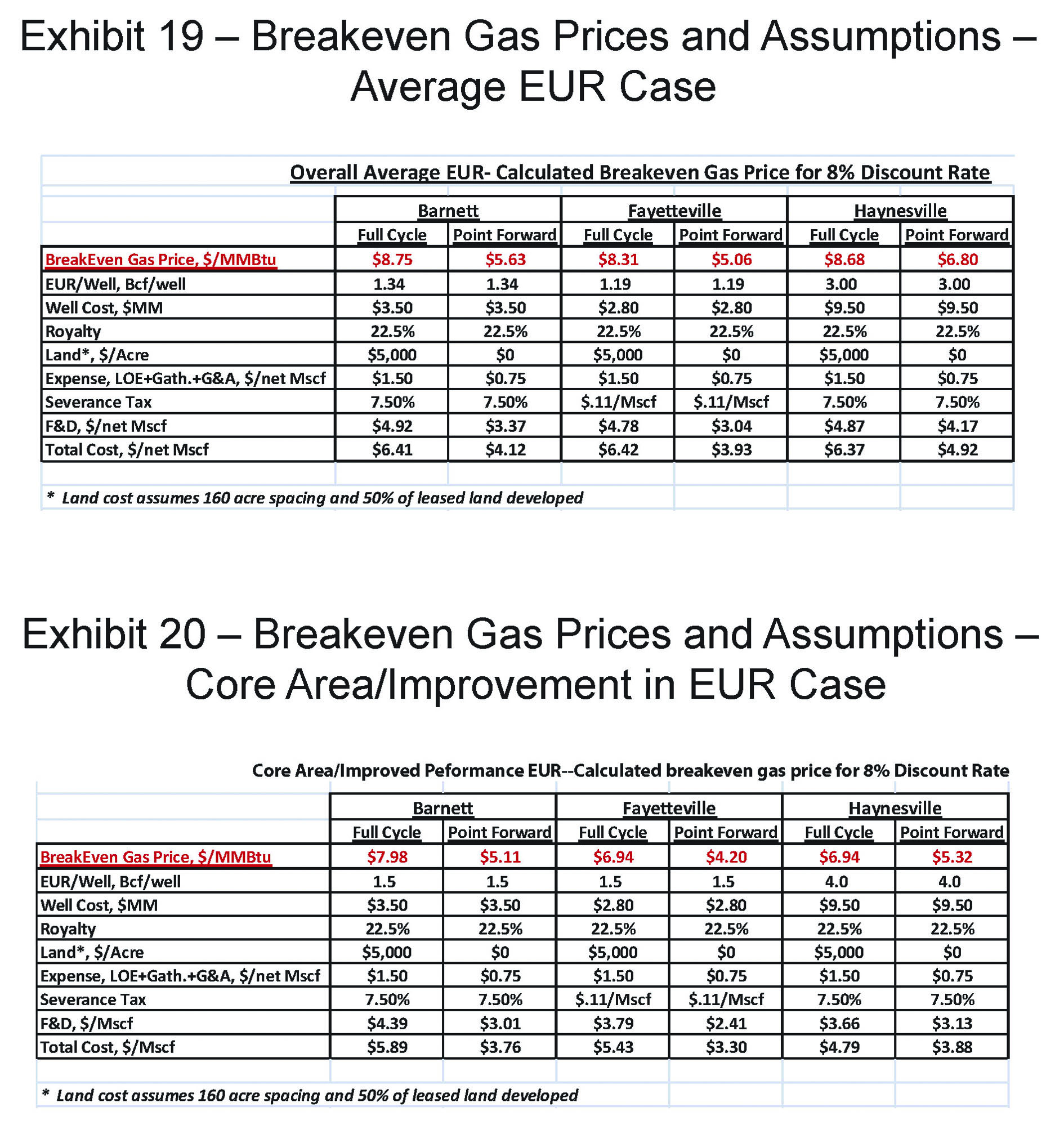

Discounted cash flow models were developed for each of the shale gas plays in this study to determine the break-even gas price. The EUR/well in each shale play is the most important assumption determining the breakeven gas price. Exhibits 19 and 20 show the breakeven gas prices for the average EUR/well values discussed in previous sections of this report. Assuming fully burdened costs including land acquisition, the breakeven gas price ranges from $8.31/MMBtu in the Fayetteville Shale to $8.75/MMBtu in the Barnett. With point-forward costs, which include only well drilling and completion costs and variable operating costs, the breakeven gas price is lower, ranging from $5.06/MMBtu in the Fayetteville to $6.80/MMBtu in the Haynesville.

The fully-burdened case is intended to represent the long-term profitability of shale gas operators at the corporate level, including the highly competitive land acquisition phase. The point-forward case represents the price point where drilling additional wells returns the cost of capital, ignoring past costs and fixed costs such as general and administrative expenses.

Land costs vary considerably among operators, depending on whether the company was early or late in entering the play. Land costs are based on $5,000/acre leasing costs, which is high for an early entrance, but low for late entry, especially compared to recent purchases. Total land cost assumes that only one-half of the purchased acreage is eventually fully developed, accounting for aggressive land purchases prior to delineation of the relatively small core area. Assuming that only one-half of leased land is fully developed effectively doubles the land acquisition cost. Finally, well spacing is assumed to be 160 acres/well. Some operators claim final well spacing of 80 acres/well, but interference is likely to impact 5,000 ft lateral length wellbores at this spacing.

Operating costs are assumed to be $1.50/net Mscf based on a review of financial statements from several shale gas operators. This figure includes lease operating, workover, gathering, and general and administrative expenses. The variable component assumed in the point-forward basis is assumed to be $0.75/net Mscf. Royalty is assumed to be 22.5% in all cases, and severance taxes and ad valorem taxes are assumed to range from $0.11/Mscf in Arkansas to 7.5% in Texas and Louisiana.

The discount rate used for all break-even calculations is 8%/year, reflecting a relatively low cost of capital that may not be warranted for pure shale gas operators. A 10% discount rate would increase the breakeven price by $0.15-0.30/MMBtu.

Summary and Conclusions

We have shown that the true structural cost of shale gas production is higher than present prices can support ($4.15/mcf average price for the year ending July 30, 2011), and that per-well reserves are about one-half of the volumes claimed by operators. Relatively long-lived production history data in the Barnett and Fayetteville shale plays is compelling. A shorter production history for the Haynesville Shale play permits more latitude in forecasting projections. There is, however, sufficient data to conclude that results for the play are disappointing.

Our work on the three most mature shale plays has profound implications. Facts indicate that most wells are not commercial at current gas prices and require prices at least in the range of $8.00 to $9.00/mcf to break even on full-cycle prices, and $5.00 to $6.00/mcf on point-forward prices. Our price forecasts ($4.00-4.55/mcf average through 2012) are below $8.00/mcf for the next 18 months. It is, therefore, possible that some producers will be unable to maintain present drilling levels from cash flow, joint ventures, asset sales and stock offerings.

Decline rates indicate that a decrease in drilling by any of the major producers in the shale gas plays would reveal the insecurity of supply. This is especially true in the case of the Haynesville Shale play where initial rates are about three times higher than in the Barnett or Fayetteville. Already, rig rates are dropping in the Haynesville as operators shift emphasis to more liquid-prone objectives that have even lower gas rates. This might create doubt about the paradigm of cheap and abundant shale gas supply and have a cascading effect on confidence and capital availability.

On the other hand, major oil companies, foreign investors and overseas energy companies have shown a surprising appetite for joint ventures and acquisitions of producers in these plays. Although this trend might result in a different cast of players, it may also introduce a stabilizing effect on the distress scenario described in the previous paragraph. The entry of better-capitalized producers does not change the economic fundamentals of shale gas, but it suggests that there may be strategic reasons for large companies to pursue market share in the North American gas arena.

We suspect that the current euphoria about shale gas will follow the path of other energy panaceas including coal-bed methane and tight sandstone gas. Shale gas will remain an important part of the North American energy landscape but its costs will almost certainly be higher, and its abundance less than many now believe. Producer behavior will be modified by the effect of changing perceptions on capital availability and the entry of new, more substantial players.

APPENDIX

Suggested references:

Cheng, Y. et al, 2005. Practical Applications of Probabilistic Approach to Estimate Reserves Using Production Decline Data. Paper SPE 95974 presented at 2005 SPE Annual Technical Conference, Dallas, TX, 9-12 October 2005.

Fan, L, et al, 2011. The Bottom Line of Horizontal Well Production Decline in the Barnett Formation. Paper SPE 141263 presented at the SPE Production and Operations Symposium in Oklahoma City, OK 27-29 March, 2011.

Fetkovitch, M. J. et al, 1990. Depletion Performance of Layered Reservoirs Without Crossflow. Paper SPE 18266 published in SPE Formation Evaluation, September 1990.

Ilk, D, et al, 2008. Exponential vs. Hyperbolic Decline in Tight Gas Sands – Understanding the Origins and Implications for Reserve Estimates Using Arp’s Decline Curves. Paper SPE 116731 presented at SPE Annual Technical Conference, Denver, CO, 21-24 September 2008.

Lee, W. J. et al, 2010. Gas Reserves Estimating in Resource Plays. Paper SPE 130102 presented at the SPE Unconventional Gas Conference in Pittsburg, PA 23-25 February 2010.

Mattar, L. et al, 2008. Production Analysis and Forecasting of Shale Gas Reservoirs: Case History-Basd Approach. Paper SPE 119897 presented at the Shale Gas Production Conference, Fort Worth, TX, 16-18 November 2008.

Vanorsdale, C. R., 1987. Evaluation of Devonian Shale Gas Reservoirs. Paper SPE 14446 published in SPE Reservoir Engineering, May 1987.

Outstanding summary Art.

Will you be presenting any of this at ASPO USA 2011?

Engineer,

Thanks for your comment. Yes, I will be presenting the highlights of this and, hopefully, more at ASPO USA 2011. See you there!

Art

Art and the "Rock" both pulled together the production data on Chesapeake's DFW Airport Lease, and they were kind enough to share the data with me. I've posted some info on this before, but Chesapeake paid $185 million for this 18,000 acre lease in the Barnett Shale Play, and they predicted that they would be producing 250 MMCFPD by the end of 2011, with an EUR upper end estimate of one TCFE (including some allocation for liquids) from the lease.

Production peaked in October, 2009 at 77 MMCFPD (from 93 wells), and they were down to 32 MMCFPD in May, 2011. What is interesting is that the decline rate accelerated in the first five months of 2011.

The overall annualized decline rate from October, 2009 to May, 2011 was 55%/year.

From October, 2009 to December, 2010 the annualized decline rate was 46%/year.

From December, 2010 to May, 2011 the annualized decline rate accelerated to 81%/year.

In any case, at the 55%/year decline rate, the DFW Airport Lease would be down to 23 MMCFPD in December, 2011, versus Chesapeake's projection of 250 MMCFPD.

Type curves(as currently in widespread use) are a convenient way of averaging apples and oranges. Type curves are also misleading because they are typically based on widely spaced wells. Zero-time alignment pre-assumes there is no well to well interference. More closely spaced wells will not perform according to type curves constructed from widely spaced wells.

Public traded companies have previously claimed, and may still be claiming in some cases, that for example 8 hz wells can be drilled on a section in the Haynesville. I don't know that any company has claimed 8X reserves, but such is strongly implied. Unsophisticated investors won't 'capture' the not so subtle distinction.

I'm not seeing type curves pitched about as they once were. The reason is probably obvious - they don't work.

Terrific data; Simmons of course demanded full disclosure of all the worlds reserve inventory from OPEC, etc.; we can't even get the straight skinny here in our own country.

I anxiously await a similar study of oil shales. Its early yet for the Eagle Ford and the Bakken but I have a feeling in the end the story will sound like deja vu all over again.

Mikey - I've been tracking the Eagle Ford production. As you know it takes 2 to 3 years to get enough decline rate to be able to make an accurate projection. There are just a small number (around 20) of EF wells with enough history to make a valid argument at this time IMHO. But in the next year or two we'll have at lot more wells to analyze. In the meantime all I can do is point out some obvious BS companies put. One company brought an EF well on at 947 BOPD and produced 181,000 bo in the first 12 months. They bragged about this well and offered that it MIGHT recover 500,000 bo. But in their press release they neglected to mention that the well declined from 947 bopd to 86 bopd in that one year. Yes...a 90% decline rate. So averaging around 500 bopd it made 181,000 bo and they say it MIGHT produce an another 320,000 in the future while averaging much less than 90 bopd. They are certainly free to express their OPINION. But opinions vary.

So, if they keep the thing active for another 30 years, that's ...

320,000 / 30 years / 365 days/year = 29.2 bpd average over 30 years.

Why is that unreasonable?

My answer would be that, in the Eagle Ford shale anyway, it appears most of those wells will go on gas lift within the first 18 months of their life, then once solution gas is dissapated those wells will have to go on rod lift. Once you begin producing 9000 foot, horizontal wells on rod lift, the patient has been diagnosed with cancer, its just a matter of how long its got to live. That rod lift well will reach economic limits for medium sized independents at around 12 BOPD, 8 BOPD net after royalty deducts, assuming 75 dollar oil. If they don't make water. If they make water the net BOPD must be more, lots more depending on how much water they make. So at some point in the decline those wells reach economic limits and they die a premature death, long before the ripe old age of 30. Add in a multitude of unknowns like lateral collapse and re-fracs, casing failure, falling oil prices, inflationary increases in the incremental lift cost per barrel, disposal costs, regulatory/environmental costs in the next 15 years, changes in tax laws; these shale wells down here in Texas won't live to be teenagers, must less young adults. The EUR's they are throwing at us in my opinion are bunk. I hope I am wrong, for those of us with 12 MPG pickups to drive to and from work...we need the nasty stuff, but I for one am NOT buying any CHK for my grandkids, thats for sure. Or Hess.

And if they keep producing 500 years they'll recover over 5 million bbls of oil.

Why is that unreasonable?

In general, I would agree with you that the EF is over-hyped. For instance, North Dimmit Co has some of the poorest well results yet leases are going for 10,000 / acre with wells IP'ing at <100 BOPD with EUR (EOG claims) of 350mboe. The same thing happened in the Haynesville in the past 2 years where wells in Panola, Shelby, Nacogdoches, and San Aug. were being claimed to have EURs over 6-10 BCF where, where common sense says this cannot possibly be the case (Reserve reporting of EUR is legally to be 90% confidence of meeting or exceeding). But at the same time, the CORE areas of all of these plays are extremely economic with EF wells in Karnes county producing 200 mboe in 1 year in some cases and still producing at 400 BOPD + related gas, and wells in the Haynesville shale have cum'd 2.5 BCF in 9 months in some cases.

I guess my main point is that the economics of business are rather unattached to the true economics of hydrocarbon development. Let's say I have an IRR hurdle of 25% in the company, any revenue produced beyond year 5 is going to be so heavily discounted that it is negligible. Public companies are generally valued on their reserve life and not on their present cashflow, so from the perspective of a stock, it is important that reserves are booked accurately (assuming all companies do so concurrently).

Ultimately, the wells that are being drilled usually have payout within the first 5 years. They are likely all over-estimating their recoveries, but this will not matter from an economic perspective because it is still profitable.

Banned,

You are correct. The shale gas companies used to publish type curves in every investor publication. Now they are hard to find. Instead we see graphs showing IRR at different gas and oil prices that are also open to serious doubt by anyone who knows what historical IRRs for the E&P industry have been. I suspect that the virtual disappearance of the type curves is more of a CYA than an admission that they don't work.

Art

This would depend on who is building the type curves. Take a dataset. Calculate the well spacing at the time of drilling, bin the wells by that spacing, use those groups to create type curves for each binned group. The problem with even an approach like this is that the dependency of the results is much higher on the geology for a given area than just the well spacing involved. Art appears to be discussing a binning by operator routine for his results, but two operators using identical drilling, completion, and production systems can get two completely different result distributions just because one happens to be in this county, and the other in that county.

Thanks for your very interesting write-up! One of the things that strikes me is that a price of $8.00 mcf or $9.00 mcf, natural gas will no longer be competitive with coal as a price for electricity. At a price of $4 mcf or $4.50 mcf, electricity is cheaper for coal than from natural gas.

In recent years, the only use of natural gas that has really been growing in electricity use. (Industrial use has been shrinking, as industrial jobs have shifted overseas in recent years, especially when the price of NG was high). At such a NG high price, it seems like electricity generation would shift back more to coal, and NG production would either fall, or not rise as rapidly, depending on other considerations (back-up needed for wind, for example).

I suppose NG for vehicle use would still be a possibility, but at the higher price, NG would represent lesser cost-savings relative to oil. Its growth in use would depend on the building of fueling stations, and people/businesses being willing to pay the cost of NG conversions.

Gail,

The threshold for coal-to-gas switching has been in the $5.25-5.50/mcf range for the last decade or so. In other words, all things being equal, if natural gas prices increase into or past this range, we should expect gas demand to decrease and price to drop. There are, however, other factors operating not the least of which is the EPA prompted retirement of hundreds of older coal power generation plants that will not meet new environmental standards. Also, the global coal market is tight as developing countries continue to build coal plants. This means that global demand may increase domestic price and shift the switching threshold upward.

Art

Art - Along those same lines if you hadn't caught my previous posts: a private company has just begun construction on a coal-fired plant right on top of a NG field I'm developing in coastal Texas. And just 6 miles from the largest power plant in the state: the South Texas Nuclear Facility. Obviously they must be projecting much higher NG prices in the future along with the abandoment of the older plants you've mentioned.

And given the "green" philosophy of the current administration you might be puzzled as to how they got their final Clean Air permit a few months ago. BTW: did I mention they have a long term contract to ship coal via rail from Illinois? Good to have a friend from the Land of Lincoln, eh?

Aw Rockman, Obama is just being nice to Texas. Who owns the rail lines? That will perhaps shed a little light on the deal as well.

So I am under the impression that NG is being held artificially low by (a) investment exuberance on the resource, which is likely overstated by a factor of 2; (b) poor demand due to offshoring to China.

Was offshoring overdone in retrospect? Wonder how this plays out. When will the price of NG creep back up again like it did in the early 2000s?

Scrolling through this, I haven't yet noticed any mention of the environmental disasters "fracking" can entail. Would someone please comment?

Yea, fracking is a poisonous mess like every other fossil/nuclear energy extraction endeavor -- but the big news here is that IN ADDITION to being poisonous, it's also not even much of an extender for industrial civilization.

But hey, since when has a sound, reality-based energy report been a basis for our fantasy-based energy policy?

Horse pookey. There has been no study done that proves fracking poses environmental harm to ground water short of a few isolated cases of ruptured casing, about as rare as mid-air collisions between two airliners. People still seem to be flying everywhere. Allow the industry to dispose of those liquids deep in the ground, as we have successfully for 110 years elsewhere in the oilfield, don't send those fluids thru sewage treatment plants then down rivers under regulatory constraints and don't go to anymore movies with burning tap water; fracking is not a problem. Its technology vital to keeping us off bicycles a while longer.

This is because non-disclosure agreements prevent ready access to the data to disprove your point. Most researchers are not going to be able to get subpoenas to get the data without knowing what the data is.

http://www.nytimes.com/2011/08/04/us/04natgas.html?hpw

Rev. K

Rev - I suspect you're referring to private lawsuits between landowners and companies. Yep...they are commonly sealed by mutual agreement. Thus we can only speculate on the matter. But ground water contamination in Texas and La. are violations of state law. Any company caught doing so might be sued by a land owner and the records sealed. But if such events occur that violate state regulations it's a matter of public record and cannot be sealed. The details of every violation any operator has been charged with is available from these two states. They cannot be sealed. So there are two historical sources: sealed civil cases and publicly available records.

So in that sense we're talking around each other a bit. It would be good if those sealed civil cases were released. So folks should lobby for a change in the law if they like. OTOH the fact remains: the publicly available records in Texas show that a well being frac'd has very rarely ever polluted the fresh water aquifer. OTOH in Texas there have been thousands of documented cases in the public record of oil patch activities polluting surface water and aquifers. Very bad in the ole days and much less common today.

Again, if you missed it, both NY and PA recently had to pass laws making it illegal for local municipal treatment systems to accept and then discharge frac fluids into the environment. Unlike I had speculated previously it wasn't all happening via illegal dumping. Apparently a good bit was happening "legally". I'm all for full discloser. Be nice if some of the folks up in PA and NY demand disclosure from the own politicians as to how much frac fluid was "legally" discharged from their own municipalities. And how much money those folks were paid to take in those nasty fluids. They didn't do it out the goodness of their hearts. So far I've seen no details being offered voluntarily. How many times have you offered a sermon about folks living in glass houses? LOL.

Serious, I appreciate you concern. I have an 11 yo daughter who drinks well water every day. Many of my fellow oil patch hands in Texas are in the same situation. We have zero tollerence for polluters down here. In my career I helped bust two illegal dumpers in Texas. A very satisfying feeling.

Meanwhile some people are actually doing some science. I would be interested in your response to this study Rockman. I personally have long felt that the frac fluids themselves are a red herring. But the damage to aquifers, in the form of methane in water wells, seems real. thanks.

http://www.pnas.org/content/early/2011/05/02/1100682108.full.pdf+html

Would have to (mostly) agree. The fracking itself generally takes place thousands of feet below the water table. If incompetent operators bungle the drilling than all bets are off - but I also wouldn't fly with a drunk pilot. What worries me is more what is done with the fracking fluid after it comes back out of the well...

To IBMikey and others who may not be inclined to read the NYTimes article Rev Karl linked to, a salient quote is:

Sorry, I've seen industry lie too many time to give them a free pass. When money is at stake, people will lie to their mother to make more of it.

aangel : Just a suggestion but the discussion really would go better without the insults: “To IBMikey and others who may not be inclined to read the NYTimes article…”. From statements like that it’s easy to respond like this: To aangel and others who may not be inclined to read the EPA report and understand the facts… And how does that foster productive discussion?

Why would I spend 5 minutes to read the NYTimes article when I can spend 2 hours reading the actual report and thus know the facts. The EPA concluded most of the contaminants in that particular well were naturally occurring and found in many of the wells in the region. But they did find one substance that could only come from the drilling activity: gel. Gel is a substance that is commonly used during the drilling process. The dominant component of gel is guar gum. The guar bean or cluster bean is an annual legume and the source of guar gum. Thickens the mud and makes it easier to lift the cuttings out of the hole. It is not a chemical used in the frac’ng process. In fact, efforts are made to keep the frac fluid as thin as possible…works much better that way. The EPA acknowledged that there was no clear health risk from the gel but given the unhealthy aspect of the naturally occurring contaminants and the uncertainty of the effect of the gel folks shouldn't drink the water. They actually didn’t condemn the water well but just recommended not drinking from it. Guess the Times missed those EPA conclusions. A shame since so many folks will try to judge the situation based on an incomplete 5 minute read.

So how did the gel get into the aquifer? Easiest question of all: from the original drilling of the NG well. It’s not uncommon when drilling thru the shallow fresh water sands to lose drilling mud into those aquifers. During my 36 years I’ve had it happen dozens of times on my wells. It’s clear that the aquifer was contaminated with the gel during the drilling phase…not from the frac job.

But there was a potential identified by the study that could have allowed frac fluid contamination. There are 4 nearby abandoned NG wells with no clear record that they were plugged properly. Had the frac fluids reached any of those wells it could have been pushed up thru one of them to the aquifers if they weren’t cemented properly. As I keep hammering: do like Texas does: our regulators do not allow the injection of any fluid (let alone frac fluid) into any reservoir in which there are any abandoned wells within a certain distance. Thus no chance of pushing the nasties back up to the surface.

Again, I wish folks would control their knee jerk reactions and pay close attention to someone who actually understands the process. For months I tried to get folks to stop worrying about a frac job inducing fractures from the formation all the way back to the surface: it’s physically impossible and has never happened. I'm still waiting for the Movie of the Week showing a school full of small children being destroyed by a fracture popping to the surface.

There are several obvious ways for those dangerous nasties to get into the water supply. But nearly all of the MSM fear mongering focused on the one aspect that could do no damage: fracturing the rock. I constantly warned my Yankee cousins the real threat was improper/illegal disposal of the frac fluid. Stop obsessing with those red Halliburton frac trucks and pay attention to those harmless looking waters tankers going down the road at 2 AM.

And Shazam! Some of the MSM finally confirmed my warning by documenting instances of improper/illegal dumping. What I failed to warn about was local govt actually participating (for financial gain) in the contamination problem. Both NY and PA had to pass laws to stop local municipal waste treatment system from allowing companies to dump their frac fluids into their facilities and then pumping them back into the environment untreated.

I’m sure folks are getting tired of me telling them how Texas does it right and thus there is very little (no such thing as zero risk in any mechanical operation) potential danger. But facts are facts. Texas requires all nasty fluids (not just frac fluids) to be injected into deep wells where they can do no harm. And even in those wells Texas doesn’t allow injection into reservoirs which are penetrated by nearby abandoned wells. And when accidental contamination does occur for any reason the regulators fine the hell out of the offending companies. And those charges are public records which are then used in civil lawsuits making them pretty much slam dunk sure winners.

So again: fractures cannot propagate to the surface. But there are other avenues for those dangerous frac fluids to contaminate the environment. And there are safeguards (though not 100% fool proof) that can greatly minimize the risk. Not allowing local govts to be paid by the disposal companies to continue dumping untreated frac fluids into the streams is a good start.

Rockman, agreed that was snarky and I apologize.

I haven't yet read the EPA report, true, and I am inclined to give your explanation a lot of merit because I trust you after spending the last few years around here.

However, it also seems to me that there are perfect conditions here to cover up something that may not have surfaced yet, especially in all the sealed settlement agreements.

You ask, "why read the NYTimes article?" My response is because you can find out some interesting things about the credibility of the people involved and that is very important during this discussion. We find time and time again that people are bald faced liars and very often they don't just lie about one thing they lie about a whole string of things as part of a coverup.

Now, I'm generally a very generous person. I'm often asking people here to be generous with other people when there is some doubt.

But how should a rational person respond to the following quote from the article?

Really? Just echoing what various state and federal regulators had said? I suppose the people who prepped him to give testimony to congress could have missed apparently the only EPA report on the topic or read it so quickly at 11pm at night that they missed the section on the water contamination that you so easily discovered. Yes, I suppose that is possible.

Now, I could be generous and give Mr. Tillerson the benefit of the doubt but that, to me, stretches credulity. Just like various Enron officials, I think he lied when he saw that he had a reasonable excuse to hide behind.

Recall that my ex-wife, a public defender, often caught police officers lying on the stand. It was incredibly frustrating to her. The judge would mumble something and let it go despite the fact that the officer's word no longer had integrity. She had to keep working with this person suspecting that other so-called truths were actually lies and struggled to give her client a fair trial. I spoke to another PD from San Francisco and she reported the same thing to me. Officers lied on the stand knowing that they had protection from someone behind the bench.

Think again if you think an oath and the penalty of perjury are enough to keep people honest.

I really do think I'm a generous person but I've also learned that when money is involved, people lie and then they attempt to cover up their lie.

Give the EPA the authority to unseal the records. Redact the settlement amount if they need to. I don't care how much money changed hands, personally I just want access to the evidence in those records.

If the companies have nothing to hide, why not?

aangel – No apologies required. I know you to be a reasoned person. We’ve chatted often so I just figured it was just a tad emotional issue for you. Any harshness in my reponse was meant for our general audience and not you. And your feelings are your right...whether me or anyone else fully agree. Too many folks have sacrificed for that right.

I appreciate your vote of confidence. It was no easy task to go thru the report…mucho pages often difficult to read. Had to do a good bit of searches to understand some aspects. And I fully agree: between sealed orders, intentionally misleading/confusing tech spin and outright lying it’s difficult to find the right balance of news. And that’s what really p*sses me off with the MSM. The big boys can well afford to pay for expert and independent analysis of any issue especially tech matters. In that regard I feel they greatly fail their responsibilty to the public.

“But how should a rational person respond to the following quote from the article?” I fully understand your frustration. I truly do detest reading such spin. I only read Big Oil press releases when someone on TOD throws them out. Otherwise I don’t waste my time. You would be hard pressed to catch them in a provable lie: they have top legal pros fact-check them. The dishonestly comes from more of what they don’t say. You’ve probably noticed I’m not shy about pointing out when the oil patch screws up. Accidents, careless or otherwise, happen. Environments get polluted. Fresh water gets contaminated. Hands get crippled/die. You may also notice I don’t make apologies for any of what other have done. I’ve made my share of mistakes and have never tried to shuck my responsibilities.

No activity we conduct is risk free. But life goes on and we have to make choices. I just ask all the facts, supportive and non-supportive, be put out there for everyone to see. When the first controversy over frac’ng in the Marcellu popped up Rex and the boys should have slammed the unsupported fear mongering hard. But they should have also made loud public statements about the potential for illegal/improper disposal of those nasty frac fluids to be a serious environmental nightmare. That’s what I did on TOD. And that also explains why I’m not the CEO of a Big Oil and never will be. LOL. I occasionally irritate my boss and the owner of my private company with my run-away mouth. But it’s also why they keep me around. One day my owner’s number two asked my opinion about one of our projects. Told him what I thought. He just said “Sh*t!”. But he also said I as one he always believes because I don’t give a cr*p if he’s going to like the answer or not. And no...I'm not that heroic/honest. I just tend to answer without worrying about the consequences. My big mouth has gotten me in trouble often. In fact, my current boss and good friend has fired me twice (at the insistance of his boss/board of directors) in the last 20 year. He actually enjoys telling folks those stories. He also tells them I'm the only geologist he trusts when it comes to engineering.

Same thing with my wife: she tends to be in one of two states - either really p*ssed or loves me to death. Come to think of it, my dogs are the only living ceatures that like me all the time. LOL.

I pretty much like what you have to SAY all the time, hows that?

I think you have to go back to the Carter Administration. Sigh... And I see on today's Drudge Report that they are once again invoking his administration to discredit the current one. Double sigh...

Rev. K.

Dave,

This post was focused on two subjects stated in the introduction: profitability and reserve confidence.

The hydraulic fracturing issue is perhaps a topic for a separate post. The part of that debate that will affect the present post is how much cost & time new regulations will add and how that will affect both profitability and the rate of new reserve addition.

Thanks for your comment.

Art

Art,

If survivorship effects distort long term average flow estimates, there must be non-survivors: wells which produced initially but are no longer in production (either P&A or suspended).

What happens to the long term averages if you add in these wells by adding in zero monthly production for each of the wells no longer producing?

Les

Les - There's also another category: wells drilled, completed and tested. But the flow rate doesn't justify setting production equipment and laying a NG line to the well. Such wells are plugged and abandoned as "non-commercial" and thus never end up being counted in the productive well catgory. In reality the percentage in this category may be rather small. But they are out there, their URR is zero and it takes a good bit of effort to dig that detail out.

Yes, I intended to include those in my P&A category.

Les' comment is right on.

It's amazing to me that such an important industry can develop and market metrics that any serious statistician would immediately reject. (I'm familiar with statisticians' pet peeves. -- I'm married to one.) Survivorship bias is only one example in a broader category of selection bias which plagues everything from scholastic testing to stock market indices to, apparently, the standard Decline Curve Analysis used in the oil and gas business.

Art and Lynn are absolutely on the right track in this analysis but I think we could take things a little further by doing some better data management from the outset. I would recommend creating a complete time series for every single well that is drilled within an area. Right now, wells that are no longer in production do not report any data. But even though those data are missing, they are not unknown -- big difference! All of those post-production production values are in fact zero and should be reported as such. (Any decent data analysis software will have no problem with the increased data volumes.)

There is a lot of interesting high-level analysis one could do with such a complete data series of all these wells and I'm sure people somewhere must be doing it (I hope). But I suspect most of that analysis is hidden in the corporate sector. Kudos to Art and Lynn for bringing some of it out into the open.

Best Hopes for Better Data Management and Statistical Honesty.

Jon

PS__ Is there a website where I can suck down some of the raw data from these shale gas plays and do some initial processing just to poke around?

jonathan - "Right now, wells that are no longer in production do not report any data. But even though those data are missing, they are not unknown -- big difference!"

Not sure if I follow you. My data base shows the production by month until the well goes off line and records the month of last production. The only wells in Texas that don't show up are pre-1970. If a shut in or abandoned well with the same API # starts producing again it will show back up. So I'm not sure what you mean by the data being missing. Maybe from the data base you're accessing. So if a well has produced and is now abandoned it's will still show its entire production history on my data base.

Also, any particular data set you would like I can pull off without violating my license agreement. You just have to show me as your data source and not my license. I have full access to the data base for my personal use but I can't allow others to access my license.

jonathan - Your P.S.: None that I know of but tell me what you're looking for and I can download to Excel and send your way...free of charge. Except, of course, for your eternal gratitude. LOL.

Les and Jonathan,

We have done what you both suggest--adding zeros for wells that either stop producing or wells that do not have sufficient history to influence out-month production. The effect of zeroing PxA, temporarily abandoned or recompleted in other zone wells is insignificant in the shale gas plays because of the sheer number of new wells constantly being drilled. Zeroing wells beyond their last month of production results in catastrophic group declines that are not workable.

We have done some tedious work with probabilistic distributions (perilous, perhaps, in a non-Gaussian data set) for one operator's 450 horizontal wells in the Barnett Shale. It shows that the median offers the closest proxy to a P50 case. This implies that the mean over-predicts group EUR by 10-20%. Since group EUR over-estimates the mean of the individual well declines that comprise it, one could do the easy group decline by operator and year of first production and discount it by 25-25% and probably be close.

Art

Art,

But isn't this precisely what they are supposed to do? The wells which (for one reason or another) have been completed, but now no longer produce, contribute data points for EUR simply because, for these wells, the EUR is a precise measurement rather than an estimate: what has already been produced. Such points will inevitably represent old technology, but if (for example) 50% of the wells drilled five years ago are no longer in production, then the lifetime production of these wells is significant in estimating future production.

Les

Art/Les/et al - Reading your posts again I wonder how your programs are handling non-producing wellss. Specifically my software makes a distinction between abandoned wells and wells not producing. A non-producing well might have zero production for a period of time. But an abandoned well isn't recorded as a zero value. Instead it's recorded as null. Thus it is no longer a part of the population.

Does that make sense and will using null value change your stats?

What about NGLs? These form the bulk of the economics for many natural gas wells - in fact, dry gas is often sold at a loss relative to production costs because the NGLs removed from the wet gas are so lucrative. While reserves may be well overstated, the economics of those reserves changes substantially when NGLs are considered (granted, not all wells produce NGLs).

Refuel,

NGLs are tough because they are not reported to state regulatory agencies. I doubt that they form the bulk of the economics for shale gas wells, as you suggest, but they may make the difference between losing money and losing less money, or even breaking even on plays that are rich in NGLs like the Woodford and Eagle Ford. I don't believe they are a factor or, at least, an important factor in the Fayetteville and Haynesville plays because these are both mostly dry gas. In the Barnett, I think it mostly depends on depth--basically dry gas in the deepest part of the play--(the Tarrant-Wise-Denton core area and increasingly NGL-richer farther updip.

The issue is that operators claim EUR for gas that is at least twice what we can project. If you want to add $0.75 to $1.25/mcf to the realized price of gas for NGLs, fine. Most plays still lose money at present gas prices. What about the abundant long-term supply? It's not there.

Art

refuel - And to add to Art's comment you might strip the NGL's out of the stream at the well head but in doing so you drop the BTU of your NG sales and thus get a lower price. Often when the yield isn't high enough it's better to not strip it at the well head or, if you're lucky, get the receiving facility to give you a cut of the NGL's they strip.

BTW: the economics of the Eagle Ford hinge on the oil yield...not the the NG or NGL's.

I used to design software to figure out whether to sell LNGs as liquids or as natural gas.

It all depended on relative prices, and the parameters changed from hour to hour. Sometimes it was best to deliver the gas from a particular well to a chemical plant Chicago to get the high price they were paying for petrochemical feedstock, and sometimes it was best to deliver it to an electric utility in California to get the high price they were paying for power plant fuel.

We would have thousands of multi-zone gas wells (producing gas with different compositions from each zone), dozens of partners, and dozens of sales contracts for each gas plant, and they would deliver into 2 or 3 different pipelines to different destinations.

The calculations for figuring out where to deliver the gas for each well zone to which customer on which contract were insanely complicated. However, the computers would read all the plant meters and recalculate it minute-by-minute. And then the plant control system would radio the gas wells and automatically adjust the wellhead chokes on each of the wells to maximize the company profit margins on a minute-by-minute basis.

It's not the easiest thing in the world to understand, which is why we people who could figure it out are now able to enjoy our comfortable retirements.

Art & rockman - NGLs can add several dollars to the economics of gas. It is true that stripping the NGLs out of wet gas lowers the BTU content, but $/MMBTU are much higher for NGLs than for dry gas (e.g. propane costs ~$20/MMBTU compared to $4.25/MMBTU for gas). One company in the Marcellus that I've looked at can realize $4.24 from NGLs per Mcf of wet gas, and the value of the gas only decreases by $0.82 in this example for a net gain of $3.42. Granted, this does nothing to extend reserve life and does not help those that are producing dry gas, but I have seen several companies where the NGLs are the difference between life and death.

Propane has much more value per BTU at a 4:1 ratio according to your math. But I see comparisons for home heating that show propane:methane NG at a 2:1 ratio instead. Some say propane is only 50% more for heating costs.

Does anyone understand how this can be?

Where are you seeing this comparison? If you can show a source I'd be happy to take a look.

My propane value calculation is based on 91,502 BTU/gallon of propane - using actual current prices from the EIA we get a spot price of $16.61/MMBTU of propane. Using the last available national average retail prices I could find from the past winter heating season, propane was approximately $30/MMBTU.

Could the images be reduced to their display sizes and linked to the full size files. At 1.5 MB per image they must be murdering some peoples bandwidth.

NAOM

NAOM,

Sorry about that. We haven't gotten any concerns about this other than yours. As you may imagine, it's a lot of work to put these posts out in the first place, and to re-size and re-attach all the figures is a lot more.

I will try to keep the size smaller in future posts.

Art

I'm on ADSL but each image takes about 10 seconds, given the number of images that adds up. For someone on dialup....................... Also it is hammering the TOD servers, every time someone looks at the page they get downloaded. With 26,000 page views a day you are eating a LOT of bandwidth with images that size. I guess TOD pays by bandwidth too. Far better to do a smaller image with increased JPG compression and link to the full size for those who want the details. The scaled images aren't all that readable either so the large original doesn't really help much either.

NAOM

yair...is that why I'm getting the empty box with the red exxes?

Half an hour and the page is still downloading. (I'm on dial up.)

Resizing images in MS Paint is a matter of seconds.

Yair...is anyone on here be able to offer an opinion on the possible decline rates of the forty thousand coal seam gas holes that are going to be drilled in midwestern Queensland...and what happens to the frac.fluids...I can't get a handle on the issues with my searches.

Possibly more important than the production cost of shale gas is the likely production rate given the fast initial declines. If conventional gas production falls off at a rate similer to the discovery curve, my analysis says that there is no way that shale gas can offset the conventional gas decline beyond 2012. Unfortunately I have never figured out how to post the analysis with the figures. I did send it to the TOD editors some months ago FWIW.

It would be helpful to see this analysis done by someone(s) with more expertise. I think USA NG production will decline sharply in the very near future. Murray

PS, my crudely estimated shale gas EURs and decline rates were close enough to those presented here that these do not invalidate my analysis.

Is this like your "analysis" from May 2009 :

I read that passage now and I laugh!!!

Seriously folks, I can't decide if this is funny or sad ... Production is THROUGH THE ROOF, spot prices have just dipped below $4, and storage has been trending up since about 2004.

I've been reading here and elsewhere for about 3 years that natgas production is on the cusp of some cataclysmic decline due to the rapid decline rates of shale wells. I'm still waiting. The sky is always just about to fall! What's sad is that none of the people making these predictions are bothering to look back on what they predicted 2 or 3 years ago. Maybe I shouldn't be surprised they're not bothering to do so, I would be pretty embarassed to do so if I were one of these people.

I'd be interested in seeing a straightforward rebuttal of Art's analysis in this post. It may look all rosy to you now, but Art's post makes it clear that it won't be for the long term. Are you saying that Art's analysis and its conclusion are wrong? If that is so, make your case.

Kheris,

Thank you for saying it so clearly!

I spoke with a reporter yesterday who had just spoken ANGA. He asked them what they thought about this post and our views. They said (according to him) that they dismissed our work as an outlier and extreme, and that there were more than enough experts who had a different opinion that it was clear that our work should not be taken seriously.

So, any fact-based work that falls outside of mainstream view should be dismissed outright.

That's a sound basis for getting things right! It sounds like the flat earth society again.

Art

Abundance,

Are you commenting on the comments or paying attention to the post?

The post is clear:

Shale gas has become an important and permanent feature of U.S. energy supply. Daily production has increased from less than 1 billion cubic feet of gas per day (bcfd) in 2003, when the first modern horizontal drilling and fracture stimulation was used, to almost 20 bcfd by mid-2011.

There are no dire predictions about the demise of shale gas in this post.

The issues are profitability and reserves.

The purpose of this post is to bring the discussion down to fundamentals. Look at the graphs and the data. All that we are saying is that, while the reserves are enormous, they may be less than the mainstream believes based on empirical data. It is useful to know what to expect so you can plan policy accordingly.

We are also saying that the present cost of extraction is higher than the price of gas and that cannot last for long. That's not a bad thing, it's just a basic fact of business.

The cost data comes from the shale company's own SEC 10-K filings. We didn't make up the numbers.

We show you both full-cycle and point-forward economics so there can be no confusing debates about whether or not sunk and fixed costs should or should not be included in the economics. The economics say that gas prices need to be higher than $5/mcf before anyone breaks even on a point-forward basis, and almost $9/mcf on a full-cycle basis.

Take your pick but we're not there yet. That's all. Punto.

Art

Art, I was responding to Murray's comment, not yours.

I just wanted to pipe-in and say that I was on the steering committee of an upstate NY landowners' association, and we met with a few different gas companies a while back, and the general concensus was that Marcellus Shale gas was not profitable until it reached the $6/mcf mark.

ot - A bit of friendly advice. If your committee is going to help your mineral owners negotiate leases I would suggest you find one of the law firms in Baton Rouge, La. that specializes in representing landowners. They aren't cheap but if spread across enough landowners it could be a great bargain. They know every trick and negotiating angle in the book. Not only upping the monetary take but maximizing environmental protection. These firms have backed the likes of ExxonMobil and Chevron into a corner many times. They already represent many billionaire families in La. When the companies sit down at the negotiation table and realize who's sitting across from they will pee on themselves. LOL. Good luck.

Like I said, that was a "back of the envelop" effort, based on pre shale gas conditions. Like pretty much every one else I failed to anticipate shale gas. Also see the qualifier "If conventional gas production falls off at a rate similer to the discovery curve". I can't be sure that it will. However, if it does, even my 2009 analysis will only have been wrong by about a year. Actually production is not "through the roof", and enough rigs have been mothballed to pretty much ensure that it won't be.

I would be interested in your abundance analysis. Or do you just like to deride the work of others?

Murray:

Why would you fail to anticipate shale gas?

We bought hundreds of acres of land in NW Pennsylvania in 2001 for a song ($600 per acre with all mineral rights) and have been discussing shale gas potential under it for most of the past decade from Trenton-Black River, Marcellus, and Utica, as well as potential for well restimulation of old oil wells in the area. We have had geologists out to look at it some time ago have been entertaining landmen since 2008 waiting for the right offer, which is now in negotiation.

This isn't a mysterious new source that only popped up 2 years ago that nobody could have known about.

Are you guys actually paying attention to what is going on in the industry or not?

I say this as a layman whose sole interest in this is ownership of land over these sources. How could someone supposedly watching the industry not have known about this at least 5 years ago?

Andrew - Sorry to butt into your debate but to back up your position: shale gas plays have been not only known but heavily drilled decades ago. In the late 70's, thanks to a rise in NG prices, there was drilling boom in the Austin Chalk trend in Texas. Makes what's going on today it the Marcellus, Eagle Ford, etc, look like a stroll through the park. Landmen were sleeping in the cars in front of mineral owners homes waiting to shove tons of cash into their hands when they woke up

Some folks might be confused: the Austin Chalk...not the Austin Shale? Chalk is the term we geologist use for those very fine grained rocks made out of carbonate minerals (like limestone is made of). Shales are very fine grained rocks made out of silicate minerals (like quartz). Thus the Austin Chalk is, from a practical stand point, a shale gas play. And the reservoir dynamics are essentially the same as the Marcellus Shale. The key component is the fracture system. The late 70’s Austin Chalk (Shale), when many thousands of vertical wells were drilled, was followed a decade later by a second boom when horizontal drill tech developed. Just like the shale gas plays today: long horizontals with many thousands of massive frac jobs…almost 20 years ago. And guess what the big debate was during that time? Decline rates and ultimate recovery estimates. Just as it is today for exactly the same reasons. And who were the dominant players? The public oil companies. And for exactly the same reasons as today.

As you understand better than most: by magnitudes the most profitable oil/NG investments I’ve ever seen firsthand have been made by companies that never spent a $ drilling a well. It was done by companies buying mineral rights. Unlike mineral leases, which typically expire in 3 to 5 years, mineral ownership never expires (except in La. under certain circumstances). But buying minerals is a long term proposition. Very difficult for most companies, especially public oil, to make such investments. But the same idea as investing in the stock market: buy low…sell high. And no one with any sense, who isn’t in desperate need, never sells their mineral rights. Lease for big bonuses and fat royalty checks…yes. Sell the mineral rights…never.

That is what shocked us when these fools sold us the land and mineral rights in oil and gas and coal country on land that had never been developed or drilled.

How can you say you failed to anticipate shale gas when the quote of yours I excerpted was about shale gas, two years ago?

I just gave you my analysis above: After two or three years of hearing, "the high decline rates of shale gas wells means production will soon fall off a cliff and/or the price will have to skyrocket to keep production up," we have natgas under $4 and production is going "through the roof." Yes, I would call it "through the roof." This is what "through the roof" looks like: