Tech Talk - natural gas pipelines and regulation

Posted by Heading Out on July 18, 2011 - 10:10am

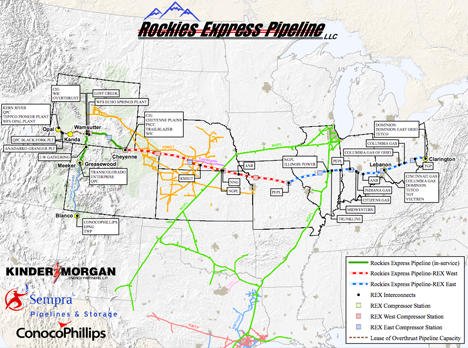

In the last post on this topic, I covered some of the earlier developments in the use of natural gas (NG) as a lighting source and began to discuss its evolution into a widely used fuel. That use, and the international marketing of NG, has largely come about as the increasing use of pipelines has made it easier to move NG from places where it is overly abundant to those where it is not. A recent example of this is the Rockies Express Pipeline (REX), which carries NG from Colorado to Ohio, and thence to points East. Out in the West NG is still abundant and so well head prices are low – in 2009, for example, it averaged $3.21 per kcf in Colorado. That same year in Maine, the residential price was $16.43 per kcf (against $8.80 in Colorado). The well head price in Ohio fell from $7.88 per kcf in 2008, the year before the pipeline was completed, to $4.36 in 2009.

As new fields such as those in the various shale layers that are now becoming popular are opened, they only become significant as the gas that is produced from the well is connected into a distribution network. Pipeline costs have been estimated as around $1 to $1.5 million per mile. After the pipe is in place it is often hard to see where it runs, in the USA at least.

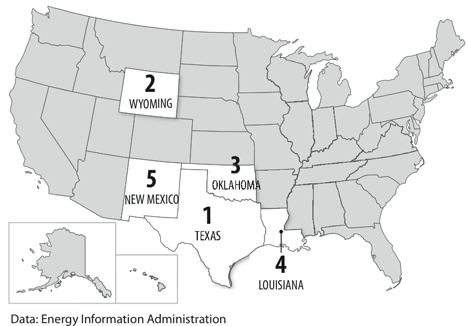

In 2009, the US used some 22 trillion cubic feet of NG (Tcf), moving ahead of Russia to again become the world’s largest producer and consumer. In that year the greatest production came from five Southern and Western states.

The need for a network to supply other states less fortunate in this resource has largely been met, with new pipelines being installed as needed. However, it should be noted that just having the production does not in itself create nirvana, since earlier this year New Mexico and the Southwest suffered from shortages when demand exceeded available supply due to an unexpected cold spell.

This network has made it much easier to ensure that gas is available to customers when they need it. And while this has recently become more of an issue as natural gas turbines are installed to provide back-up power to more intermittent power generators such as wind and solar farms, NG-fueled electric power stations have been the most - in fact, almost the only - conventional new power construction in the United States for several years.

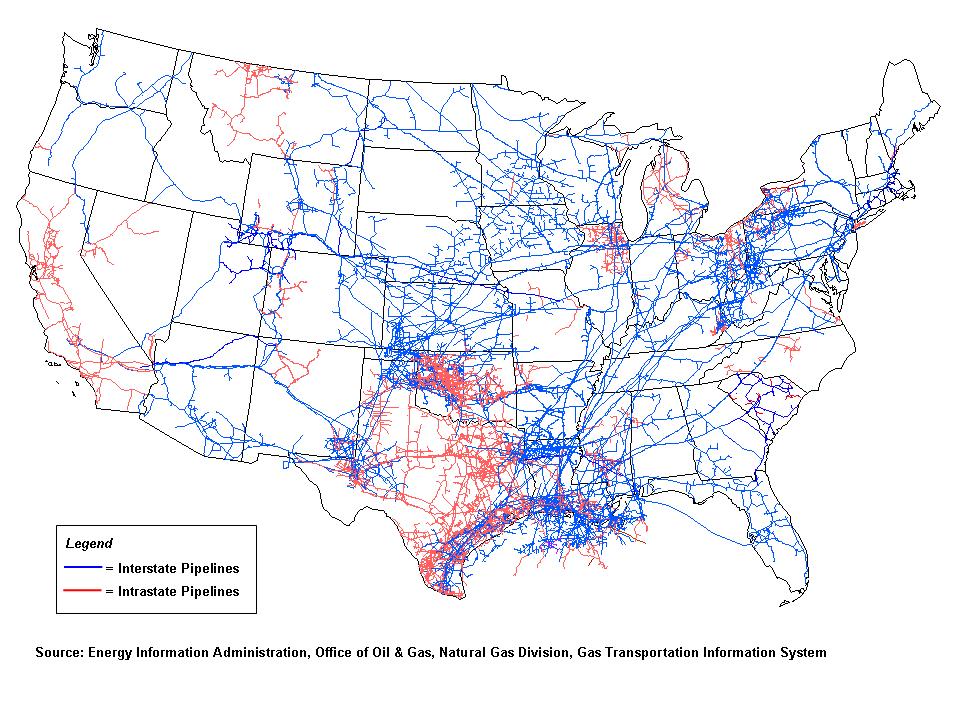

As the experience in New Mexico showed, just having a network of pipes in place is not in itself enough. The first need is that the gas must travel down the pipes to the customers at a given volume, and this requires that it be pumped under pressure. Rather than creating the driving pressure purely at the input end, the pipe travels through a series of compressor stations that raise the pressure along the pipeline length, as friction would otherwise reduce it to below viable levels. For safety reasons gas pressure is reduced as the pipes travel through urban areas, and the normal operating pressure can thus vary between 200 and 1,500 psi. For those that forget Boyle’s Law from high school science, at constant temperature, raising the pressure by a factor of 6 will cause an equivalent reduction in the volume of the gas that is being pumped.

However, if you consider the network as a schematic, you will note a couple of additional features.

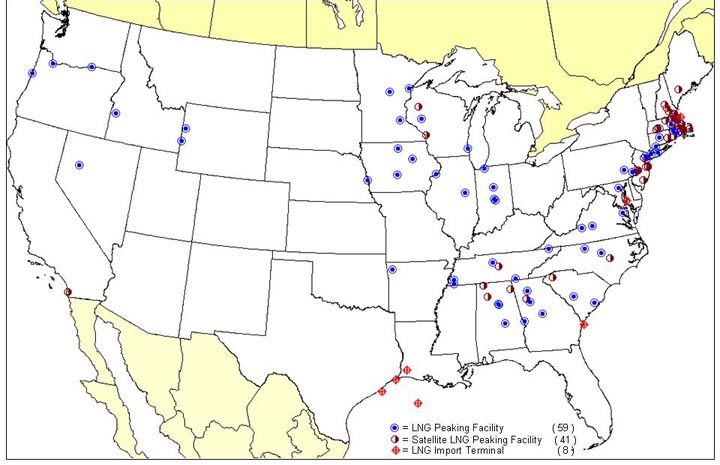

The two additions are for temporary storage of gas for use at times when demand is high (Note that there are none in the Southwest !). The gas can be stored either as a gas, or it can be cooled to a liquid (which reduces the volume by a factor of 600 and stored in that form. The LNG facilities need a re-gasifier, and if they are taking the gas from a pipeline, also a liquefaction unit to do the initial conversion. By using these facilities that are dotted around the country, pipelines don’t have to be as large to ensure that there is enough gas for the consumer at the high demand locations around the network.

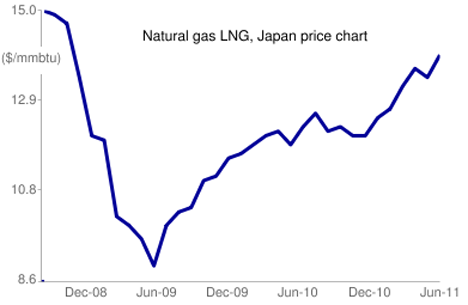

I have used a map that shows the location of LNG import terminals, since this is an additional source of NG for the United States. Again, the volume that is involved is a function of price, though often, to justify the cost of the parts of the supply train, there is a concurrent long-term commitment to a given price schedule, so that spot prices are not necessarily that valid and what is paid in Japan, for example, is not indicative of prices elsewhere. That is particularly true at present since the loss in power from the nuclear reactors in Japan is expected to result in a long-term increase in LNG demand to replace the lost power.

As I write this the current quoted import price for LNG into the United States is $6.78 per kcf, some $1.71 over the quoted Henry Hub price for NG.

One of the most powerful drivers in the growth of demand for natural gas has been as a result of its increased use in generating electricity. This is particularly evident as it takes market share from coal-fired power stations due to concerns over the emission of greenhouse gases.

Nationwide, coal-fired electric power generation declined 11.6 percent from 2008 to 2009, bringing coal's share of the electricity power output to 44.5 percent, the lowest level since 1978. Coal consumption at U.S. power plants paralleled the decline in generation, dropping 10.3 percent from 2008.

In sharp contrast, natural gas-fired generation increased 4.3 percent in 2009, despite the 4.1-percent decline in overall electric generation. The natural gas share of generation increased to 23.3 percent—,the highest level since 1970. Electricity's share of the total U.S. natural gas consumption has also risen rapidly, growing from 17 percent in 1996 to over 30 percent in 2009

There is a greater capacity for gas-generated power than these numbers reflect, since the utilities still tend to use coal over NG for longer-term operation as the costs are lower.

The growth of this market developed after the Second World War, and the development of a distribution network. However, in the years immediately after the war the industry was heavily regulated, both in terms of price and volume, in much the same way as the Texas Railroad Commission had regulated oil. But because the gas entered and left inter-state pipelines it was regulated under the Natural Gas Act of 1938, which among other things forbade the construction of a new interstate pipeline into a state that already had one. In 1954, the Supreme Court voted that the FPC should set wellhead prices for NG. This removed some of the incentive to develop new wells and from then until 1968 production and prices remained relatively steady. In 1968 however, reserve additions* fell from 20 Tcf to 12 Tcf, and in 1969 they were down to 8 Tcf. With the industry still controlled, reserve additions failed to keep up with demand for the next 12 years. However, the Arabian oil (and gas) embargo imposed in 1973 led the price of NG to multiply 750% between 1972 and 1976. Consumption fell at these higher prices, and the market re-equilibrated until 1980. But the over-regulation of the industry led to serious problems.(*Ed. note the word "additions" was originally missed out of the narrative, I am grateful to those who commented on this error).

The interstate pipeline experience during this period was an unmitigated disaster. To deal with the shortages in the interstate market, interstate pipelines submitted curtailment plans to the FPC describing how they would determine who got gas and who did not. The plans gave top priority to residential consumers. Boiler fuel users, such as electric utilities, were given lowest priority. Users who experienced curtailed deliveries could either shut down their operations or switch to alternate fuels. During the winter heating season of 1977-1978, gas deliveries in New York and New Jersey were curtailed for everyone except residential consumers. Commercial users received only 94.3 percent of requirements, industrial users only 79.2 percent of requirements and electric utilities only 13.5 percent of requirements.

Just as the regulations were being changed to help resolve these problems and de-regulate wellhead pricing, the Shah of Iran was overthrown, and prices took off again. This encouraged new drilling and in 1981 for the first time since 1968, more gas was discovered than was consumed that year. Unfortunately, this happened just as the rise in prices was moving consumers out of the product. The result was a drop in demand, which bottomed out in 1986. With the increase in supply this generated a “gas bubble.” In 1986, the Texas Railroad Commission changed the rules to ease sales of the gas to end users rather than just the pipeline companies; at the same time the Federal Energy Regulatory Commission began the series of changes that, by 1992, meant you no longer had to own a pipeline to be able to buy natural gas.

I’ll write about where that took us, and the evolution of the gas producers and market as I continue with this short topic next time.

I'm confused by this:

In 1968 however reserves fell from 20 Tcf to 12 Tcf, and in 1969 they were down to 8 Tcf.

Are those annual production or consumption figures? They seem way too low to be reserves.

According to Table 6.2 from this EIA Page, US dry gas production was 18.5 Tcf in 1968 and 19.8 Tcf in 1969. At that time, we weren't importing much (any?), so the amounts aren't production or consumption numbers. I do agree they sound low.

I am not aware of natural gas reserves being available back that far. The numbers must be from one of HO's other sources. I am wondering if they could be for part of the United States--certain gas basins, say.

Gail - Just a guess but it may hinge on the definition of "reserves". Currently to be classified as a reserve the convention requires the NG be producible at current prices. A particular basin may have proven "resources" of XX TCF but if there is no infrastructure to transport that NG then the reserves remain zero. Along those same lines prior to the 70's thousand of NG reservoirs were discovered in the US while drilling for oil but were plugged for lack of a sales market. As NG prices rose these known reservoirs were developed adding a sudden "boom" in NG discoveries. Also consider the huge amount of NG flared in order to recover associated oil. This volume not only represented "non-reserves" but also wasn't included in the production and consumption tallies.

http://www.eia.gov/dnav/ng/hist/rngr21nus_1a.htm

Proved reserves have been on the order of 200 TCF for some time. The link documents 208 TCF in 1979; at that time the total ultimate resource base was thought to be something like 1,000 TCF. (We've way exceeded that total, by the way.)

The historical R/P ratio for gas is around 10 years. It would make sense that in the late '60s proved reserves would have been on the order of 200 TCF.

The Annual Energy Review has production/storage data for NG that are pre-1970. Don't know why they don't mesh these with the rest of their series; too late for that now, with the budget cuts and all.

HO's link has your explanation, though - the author is talking about "reserve additions." His use of that term isn't quite accurate, since reserves actually contracted in 1968, about 5 tcf. "YOY" would fit the bill better.

"Nationwide, coal-fired electric power generation declined". And that makes a current situation in Texas difficult to understand. As I’ve reported a new coal-fired plant just began construction in the Texas coast literally on top of a NG field I’m currently developing. Currently we have several lignite (very low grade coal) plants burning local supplies. But this new plant will be burning low quality coal shipped by rail from Illinois. Adding to the apparent illogic of this investment is locating the new facility several miles from the South Texas Nuclear Facility. The STNF is the largest supplier of electricity in the state. And at the time the decision was made to build the new plant it was known the STNF was to shortly begin a 50% expansion of its output. But due to recent events in Japan this expansion has been cancelled. Obviously the coal-fired plants owners will benefit from this turn of events.

A new coal-fired plant in the #1 state in NG production when the rest of the country is switching from coal to NG? A state with such low NG prices that LNG was recently shipped to England. And then consider that NG transportation costs are lowest in the state while we’ll utilize our fixed rail capacity to ship coal half way across the country. I suspect Cho-cho Alan is not pleased. From an AGW/environmental consideration consider the plant just received its final Clean Air permit from the current administration. This would seem somewhat inconsistent with its stated desire to expand “green” investments and jobs. Perhaps a cynical question but one might wonder if the plant would have been approved if the coal were sourced from Wyoming.

According to Obama, the future will consist of "clean" coal. I am sure this coal will be "clean" as it will be washed prior to use. During Clinton's tenure, it depended on what the meaning of "is" is. Under Obama, clean energy depends upon what the meaning of "clean" and the "future" are. Oh, and since they received a clean air permit, I am sure the resultant air will be quite clean. Carbon dioxide is not dirty; it just has an annoying habit of keeping in the heat.

When confronted with situations like this, I pull out my copy of Alice in Wonderland for comfort.

"Alice laughed: "There's no use trying," she said; "one can't believe impossible things."

"I daresay you haven't had much practice," said the Queen. "When I was younger, I always did it for half an hour a day. Why, sometimes I've believed as many as six impossible things before breakfast."

Alice in Wonderland.

Alice through the looking glass.

clean coal= clean sh**

It probably reflects the regulatory and project economics of retrofiting pollution controls to old plants in the Northeast and Midwest, versus the regulatory requirements and project economics of building a new plant in Texas.

As for shipping coal, BNSF is making good money moving coal from Wyoming to the Midwest, which can replace the coal shipped to Texas.

By building the plant in coastal Texas, the operators can also use (or threaten to use) imported coal if it is cheaper.

Bronx - Might happen but from what I've learned such operations usually lock in coal contract prices for 10 to 20 years. Don't know any details on this deal but I douubt anyone would make such a large investment without having the costs fixed for a considerable time.

Back in 1985 I was selling NG in the shadow of the smoke stack of a coal-fired plant in Texas. And selling it for less than 20% of today's low price. They had been getting coal from WY until the state screwed up and raised the excise tax way up. So the plant, a Texas public utility, signed long term contracts for coal first from S. Africa and then Australia. Even if I had given the plant my NG for free they still had to honor those cotracts.

As one involved in the planning and permitting of these types of facilities, my immediate thought was how did such an "illogic investment" ever make it through the system of planning and approvals. In many ways (in Canada and the US) we have a very good system that supports energy development in a responsible manner - but it only works if it is followed (proponents) and managed (regulators). We "trust" the planners, constructors, operators and managers to do the right thing. As one can clearly see though "trust" these days seems harder and harder to come by. One of the things that bothered me with the Macondo well blowout was people said there was enough regulation. I believe that all the applications and authorizations were granted without due care and attention to some important details - as was the operations in those final days on the rig.

So why you approve the construction and operation of a coal fired electricity generating plant next door to a substantive existing generator on top of a developing gas field to burn crap (heat value) coal is beyond me. To me this particular process failed miserably - unless there are facts/realities that I am not taking into account. In reality this only causes misallocation of capital and poor return on investment - ultimately - save those few that greased all the wheels to make it happen. Until we realize that these self-serving actions at multiple levels only harm the process forward, we will continue to see such waste in energy, effort and resources.

Tahoe – The free market system may be acting exactly as designed. But maybe not as we would like. Someone is obviously going to make money on this deal. But who? I don’t know any of the details of this deal but I have seen similar big capex projects first hand. So I’ll indulge in a bit of tin foil hat theory now.

The project has to get financed. Bankers/venture capitalists like profits but not risks. So side deals are cut: use an Illinois coal source and permits won’t be a problem. Pay Illinois coal companies a premium so they have a nice nest egg for political contributions. Rail Road gets a nice fat long term contract at a premium price so they have a nice nest egg for contributions. Or maybe the Coal Company and Rail Road help fund an unrelated project that an involved party will benefit financially from. And with all the loose money floating getting spread around the project economics aren’t too robust but with the right “help” an IPO is issued and the gullible new shareholders get to bite the lemon. And the original principals in the deal walk away even richer. I once saw a $260 million IPO issued on the basis of an absurde oil reserve report. A year later they took a $240 million write down when the project failed. The management and finance folks made a small fortune...the shareholder were burned to death, of course. And nobody was even charged/sued.

As I said I have no evidence such trading was done or will be on this project. But I’ve seen similar games played a number of times in much more convoluted ways. So not how most of us would like to see capitalism function but it does…very day. There's doing the sensible/proper thing and then there's making money...for someone.

The free market system may be acting exactly as designed. But maybe not as we would like.

Yep.

I'll invoke Occam's razor here and look for the simplest explanation as to why someone would build a coal fired electricity plant in Texas - and my conclusion is that is it likely easier and faster to do so in Texas than anywhere else.

This is not to say that texas regulations (environmental, safety) are lax - quite possibly the opposite even. But, Texas rules are very clear, and understandable, and if you meet them, all, then you can do your project. The same could not be said if you wanted to build a coal fired plant in California, where you would be delayed with endless environmental lawsuits and possibly flip-flops from government.

So, if your business plan is to build, own and operate a coal plant, Texas is probably one of the better places to do it, and the cost of transporting the coal just has to be factored in. I would rather factor in known, annual costs of transporting coal than unknown costs and delays fighting lawsuits and changing government regulations.

Texas has always said it is open for business - I think this is a case of this business taking them up on it.

If they are smart, they will do a sideline in using the fly ash as a concrete additive. Fly ash increase the strength, durability and chemical resistance of concrete. Those would be desirable characteristics if you were going to use a lot of concrete to build, say, a nuclear power plant...

Just a guess based on the enormity of what I've seen, I'd say the amount of wind turbines needed to equal the output of one nuclear power plant requires more concrete than said nuclear power plant.

Problem is concrete for nuclear means also the entombment of the waste, and the occasional keep dumping concrete on the site to prevent nuclear waste from spilling into the environment. For an example of that there are 3-mile island, Chernobyl, and now 4 reactors at Fukishima. Lots and lots and lots of concrete for those guys.

Like Paul said above it is nice when the future is more predictable and wind power has very modest decommissioning charges unlike nuclear. Of course the comparison is apples to oranges since wind is not base power, but I would say the concrete estimates are soft numbers that do not consider, mining operations, waste removal, and decommissioning charges. They never include those, since the accountants are usually paid to make things look a certain way.

But back to the topic at hand.

Can the US or will the US overbuild gas pipelines beyond the ability of the system to produce for all those end users? Something has got to give. The use cannot be save with gas alone. It is going to deplete like everything else.

Oct - IMHO the US won't overbuild the NG transport system. But some greedy pipeliners might try. Historically pipeliners were the most conservative portion of the oil patch. If I made a NG field discovery and asked a pipeline to invest in correcting me to their system they wouldn't dream of taking my word on the reserves. Pipeliners make their money on volume. The pipeliners had their own geologists and engineers who did their own reserve estimate. If they didn't confirm the volume the line wouldn't be built. It varies a good bit but it isn't uncommon for a pipeline to take 5+ years just to recover the investment let alone make any profit.

But then along came the shale gas plays. Granted lots of new wells to drill as long as prices stayed high. But individual wells would deplete most of their reserves long before a pipeline would payout. So the only way to justify building a p/l was to assume new wells would be drilled as the older wells declined. That assumption worked well...until it didn't. can't quantify how badly some of the E Texas and N La. pipeliners got hurt but I've heard numerous sad stories. As old wells depleted and new wells didn't get drilled as fast the throughput volume dropped...along with cash flow/profit.

Maybe some pipeliners got sucked into expanding too quickly in the SG plays. But that won't happen again to any significant degree IMHO. The memories are still fresh.

Basically you are saying the pipeliners are the Swiss-bankers of the oil patch then. ;-)

I guess the issue is whether the new shale gas wells are close to other depleting wells. Then the connection to the existing infrastructure can be short, but it seems a lot of smaller pipes will be needed if shale gas is a more diffuse resource.

Oct - Excellent analogy. But only for the old school mainstream pipeliners. The SG hype sucked in a fair bit "pipeline investor ompanies" for lack of a better term. Easy to imagine how the greed factor kicked in with such folks when they heard of many trillions of cu. ft. of NG to be had by the SG drillers. With a p/l profit dictated by throughput volume: the bigger the reserve number the bigger the $ signs grew in their eyes.

I don't kno if the deal ever closed but Chesapeake was trying to cut a deal with StratOil, the Norwigians, in the Marcellus. StratOil would spend $billions for p/l infrastructure. The catch: CHK had to guarentee XXX number of wells drilled. It's very difficult to get the better of the Norwigians...they are true master of the trade. No hype...no emotions...just pure cutthroat businessmen. In a nice way, of course.

Do you always exaggerate like that? You're basically saying that eventually, all nuclear power plants require entombment. So far, only Chernobyl was entombed in concrete.

As far as externalities, I haven't even begun to address those with wind power. It's not just more concrete needed, but copper, steel, aluminum, etc, and all of those require mining. Can you sequester mine waste as easily as spent fuel? The hundreds of environmental disasters associated with mine wastes suggests you can't.

It's also interesting that your comment implies that you think the future of nuclear power involves old designs.

As far as depletion of natural gas, we're in agreement there. The fast developing world will quickly drink that milkshake.

Nuclear power is not really the discussion. The external costs at Fuskishima are unknown; it is a clear example of what will happen to many aging plants in due course. Yes, not just concrete but all types of equipment are going to be wasted and the plant will ultimately not break even in energy produced for society -- clearly.

If you think the costs which are only capped by huge govt subsidies and cost caps are gonna be cheap, then ask why TEMPCO is becoming a penny stock.

http://www.bloomberg.com/apps/quote?ticker=9501:JP#chart

"The external costs at Fuskishima are unknown; it is a clear example of what will happen to many aging plants in due course."

That answers my question as to whether you always exaggerate....

BTW, again, next generation nuclear power plants don't use 40+ year old designs.

Why is TEMPCO trading at <25% of its value if the next generation of nuclear power plants are so promising? Sounds like a pipe dream to me.

Only ideologues make arguments that R+D gives and will continue to give improvements to renewables technologies, but somehow the same thing won't work for another technology.

Renewables = breakthrough advancements just around the corner.

Nuclear power = advancement impossible - any concepts involving it are pipedreams.

You can't just wave your "New Technology" magic wand and make all those 40+ year old nuke plants go away. Besides, with all the extensions they're being granted, they will be around for another 40+ years. If they don't decide to do un-controlled shutdowns on themselves...

Not sure who that's a dig at, but my comment goes towards those who continue to use Fukushima as an example that nuclear power is a failed technology. It's a bit like being the person in the 1800s saying boilers were a failed technology when they were regularly involved in disasters.

Paul - Well said. Texas politicians are no less pragmatic then any others. Whether they accept AGW or not isn't relative. They represent the folks in Texas and given the choice between improving current economic growth and the environment generations down the road it's no contest.

The country may be on the verge of hearing more about the "Texas success story" then they ever wanted to if Gov Perry makes a run for president. Probably will still hear a lot even if he doesn't. Given that more new jobs have been created in Texas than the rest of the states combined and that Texas is R land I have no doubt it will be the new poster child for "change".

I don't recall the details of the plant engineer's explanation of what they were going to do with the fly ash but something about a new magic chemical that will lock up the nasties permanently. Just a guess but I suspect residue disposal was a bigger hurdle to get over in the state than air quality. All the airborne cr*p the plant puts out will drift over to La. No problem there. But folks here are touchy about what you put on the ground.

So I wasn't surprised about the plant getting approval from the state. Approval from the current White House administration was still a surprise despite the Illinois connection. A new coal-fired plant isn't going to mix well with campaign rhetoric about going green and supporting alts. Maybe they're expecting the MSM to ignore it. For certain the R's won't. Nice photo op: the president's face superimposed over a billowing smoke stack while they play one of his green speeches. Like shooting fish in a barrel.

A few thoughts from an electric utility engineer:

1)Texas electric grid is largely physically separated from the rest of the country.

1a)Texas is growing and therefore needs new power plants

2)Long-term base load electricity is generally cheaper from coal than from gas, unless gas gets even cheaper and can be expected to stay there permanently. A lot of combined-cycle gas power plant construction occurred based on $2 gas. Peaking and shoulder-peak plants are cheaper for gas, since the capital cost is spread across fewer MWH. Deregulation of the power industry also led to more gas plant construction since plants are being planned by 3rd parties on the basis of short-term returns, rather than being allowed by state commissions on the basis of keeping consumer prices low in the long term.

3)Texas has a very high fraction of natural gas power production, compared to the rest of the country. A diversified power production portfolio has value.

4)Most of the coal burned in this country is low btu, it's cheaper (Powder River Coal is primarily sub-bituminous).

5)New coal plants have BACT emissions controls and don't have to burn low-sulfur coal to keep SOX emissions down, hence low BTU, high sulfur

6)Delivered coal prices are up significantly over the past 10 years, this is primarily related to market power due to higher gas prices. Railroads are getting more of this than coal companies.

7)The relative marginal advantage of coal over gas in existing plants is reduced over the past couple years due to the higher (sticky) prices of coal, reduced price of gas, reduced consumption and increased flexibility of gas plants. The "market share" of coal will tend to come back with the economy (as the least efficient coal plants marginal competition shifts from combined cycle back to simple cycle gassers) and with time, as reduced consumption cuts freight rate rents back to compete with gas again.

Thanks Ben...nice to see some details. From your view point it looks like pricing may have been the major factor. NG is relatively cheap today and will probably remain so for a year or two IMHO. But during a 30+ year life cycle for the plant it very easy to predict at least short periods (a year or so) of very high prices and, possibly, supply disruptions.

The President doesn't make laws the Congress does. To the best of my knowledge there is no law against building coal fired plants or from putting Co2 into the atmosphere. If the plant met all the requirements of existing law for the President to deny permission for its construction would usurping the law. What we don't know is how many more hoops (compared with the previous administration)this administration made the project go through before granting approval.

Whether the project makes economic sense or not is really not up to President to determine but rather the Texas utility regulators who presumably have to grant the plant a certificate of public good or something similar.

Prices received by coal miners in Australia have gone through the roof in recent years. The reason is simple: China. The People's Republic of China has been building as much generation capacity as it can for years now and has been doing in just about every variety - coal, gas, nuclear, solar, wind. China wants all the coal Australia can produce and then some. When you look at the extraordinary rapid growth of coal consumption in China, you will see that changes in the internal US market are marginal. China drives the price and everyone else has to pay it as well, just to keep buying what they used to.

I don't think China is a determinative factor YET in US coal prices. Contributory, maybe. I'm sure it's different in countries set up for a lot of export.

Access free Oil & Gas Reports, Videos, Interviews and Resources at http://www.oilandgasiq.com

It looks to me as if the storage map includes ONLY LNG facilities, rather than more conventional compressed gas storage facilities. I know for sure that there are storage facilities in CA which are not shown, because I sell them electricity to run the compressors.

The map that Dave selected there is indeed only LNG facilities. The EIA has a separate map showing storages;

There is also a very interesting one showing the compressor stations;

That is a LOT of stations, and there must be a lot of energy being used to run all those. We never hear about the energy needed to find, produce, process, transport and store NG, but obviously there is some. It would be interesting to know how may GJ have been used per GJ delivered to the customer - that number must be out there somewhere.

There was a post here awhile back talking about GHG emissions from natural gas operations. It was mostly focused on leaks, as I recall, but I'm pretty sure there were some numbers in there for compressor station power. A lot of these are gas-fired and not particularly efficient. I know of at least one company installing steam-cycle generation (different working fluid) to run off the exhaust gas waste heat from existing gas-line compressors. Also, the system in some areas must be overbuilt, possibly for redundancy, because some of the electric-driven compressors never run (based on their bills). Some of these stations are immense. I've walked thru one with 80000HP of gas-fired compression with 2MW of aux loads provided by reciprocating-engine generators.

I know of at least one company installing steam-cycle generation (different working fluid) to run off the exhaust gas waste heat from existing gas-line compressors.

You must mean an ORC system, like Turboden or Pure Cycle. They are great for turning low grade heat into electricity. If you have 10MW of engine, you can probably get another 2MW of electricity out of the cooling+ exhaust heat via ORC.

Also, a smaller unit from a Reno company, 20-50kWe, so can run off the exhaust of a 200kW generator

www.electratherm.com

These ORC systems are ideal for low grade geothermal, and also solar thermal - will work on 80C water, but is more efficient the hotter it is. When you don't need to go to high temp and pressure steam, everything becomes much simpler and cheaper, so i think these systems will enable more geo /csp, and certainly more waste heat recovery.

I know somebody who owns a salt caverns storage unit. For him compression / heating costs are about 2% of the gas stored, and they use on site power generation (powered by NG) using the NG in the cavern. They actually use more energy to heat the gas which comes out of the cavern (it goes from about 3000psi to 30 or so, cooling off a lot so they have to heat it up) than for compression.

Rgds

WeekendPeak

For an idea of how cold that gas could get our college liquid air machine vented around 3kpsi to atmospheric and recycled the gold gas to cool the incoming gas. 3kpsi to 30 is going to get pretty cold.

NAOM

Rockman, I'm wondering what your take is on Stoneleigh's post this morning: July 19 2011: Fracking Our Future

Seems to me to be quite an indictment of shale gas in general, fracking specifically. Any thoughts will be appreciated, as always..

Ghung - I'll take it piece by piece as I go.

" But the drilling is taking place with minimal oversight from the U.S. Environmental Protection Agency. State and regional authorities are trying to write their own rules—and having trouble keeping up." From what I've read can't argue with that.

" Fracking was first implemented by Halliburton in 1949, but only became common much more recently in combination with horizontal drilling, and once the companies had been exempted from important environmental legislation." Perhaps true nationally but frac'ng has been very common in Texas for decades. Then again, from what I know, Texas set the rules for frac'ng during all that time...not the EPA.

"Many of the chemicals used are toxic or carcinogenic, and their use is highly contentious." Absolutely true. Even a bit of an understatement IMHO: potentially lethal/crippling if direct contact is made.

" These ponds can unfortunately leak, and evaporation of volatile chemicals can cause local air pollution. Disposal is expensive, both in financial and energy terms". Again, absolutely true. Why you shouldn't put this cr*p on open ground.

" It said that two years after liquids were legally spread on a section of the Fernow Experimental Forest, within the Monongahela National Forest, more than half of the trees in the affected area were dead." Which is why it's illegal to do this in Texas and has been for a very long time. You might have seen the recent law changes in PA and NY: they had to make it illegal for municipalities to dump this cr*p into their systems. You would think common sense alone would have been enough to prevent such actions.

" While the fracked formations are generally many thousands of feet below aquifers, poorly constructed well casings can leak." Also true but a relatively rare event. Airplanes crash also but we still let folks fly. A properly designed and MONITORED well casing program offers little risk.

" After her well water was contaminated by nearby fracking in 2006, Ernst decided to go public, showing visiting reporters how she could light her tap water on fire" Maybe caused by the frac job or maybe natural NG contamination. Happens a lot in that area as RMG has noted before. Can't judge that lady's claim specifically. But she could be correct: again, rare, but there have documented cases in Texas.

" For instance a well in Clearfield County, Pennsylvania, experienced a blow-out on June 3rd 2010 that was determined to have been easily preventable." There has never been a blow out that wasn't preventable. Almost always the accident was caused by human error.

"Make no mistake, this could have been a catastrophic incident," Sad but true. I've seen the dead/injured more times than I care to remember. But I've seen many more incidents on the highway. Always heartbreaking regardless of the particulars.

Too much else to take up more space. But in general: yes...frac fluids are very nasty and should only be disposed of safely regardless of the cost. In the last two years I've probably spent about $2 million for proper disposal of fluids from even my small operation. And none of that was nearly as dangerous as frac fluids. The frac'ng process itself offers little risk when done properly IMHO. The major risk is still improper disposal of the nasties. But there will always be some risk as with every other industrial activity. A properly designed and safely drilled/frac'd well offers low risk. Properly disposed frac fluids pose little risk. But just like every other human activity risk cannot be eliminated completely. In the end IMHO it should be up to the local folks to decide for themselves if the rewards are worth the risk. No right or wrong answer...just a decision that must be made.

Thanks, Rock! I know we've covered this stuff, but it's valuable to have it in a nutshell, so to speak, especially for pointing the 'uninitiated' to.

Foss concludes:

Of course, humans will continue to exploit these formations, and collectively, we won't learn from our mistakes,, but you can't blame the girl for trying. Reality will be the great teacher, not some blog entry. As for "Faustian bargains", nothing new there.

Ghung - I would make one amendment: "for the sake of short term private profits." Should add "and for the public's self interest". Much of the distasteful aspects of business wouldnt exist if the public did support such efforts for their own benefit. Lots of public sentiment against SG drilling. Wait until there's a severe winter and folks suffer for lack of NG. Attitudes of many will change quickly. Would be nice to see my Yankee cousins be as outraged over the govt's current effort to swap blood for oil in the ME. OTOH those shinny metal boxes coming thu Dover don't impact them directly so it's not too big a problem for them.

Yeah, Rock, folks are going to need it, and this seems to be the new environmental poster child. I guess mountaintop removal and 'clean coal' was last year's issue, way down there in West Virginia and Kentucky.

"A properly designed and MONITORED well casing program offers little risk."

"should only be disposed of safely regardless of the cost"

"little risk when done properly"

"A properly designed and safely drilled/frac'd well offers low risk."

"Properly disposed frac fluids pose little risk."

"Almost always the accident was caused by human error."

"You would think common sense alone would have been enough to prevent such actions."

"if the rewards are worth the risk"

Yes: Risk assessment.

You should buy or pay-per-view "Gasland".

These are salt-of-the earth people.

Their lives are destroyed.

They are lied to. They lose faith.

They had faith to begin with.

The story presented is that the operations are done willy-nilly by an assortment of contractors. Is this true?

K - "The story presented is that the operations are done willy-nilly by an assortment of contractors. Is this true?" Actually we don't use the term "willy-nilly". We actually say some of the folks involved are all FU'd. LOL. Really. This has always been the case in the oil patch (and all other businesses): during boom times more incompetent folks are doing more work to fast with less supervision...both corporate and regulatory. I handle operations for my company oand it's a constant battle to keep idiots off my wells. And it ain't easy to see the problems coming before they happen. Companies have reputations that track them and the bad ones are easy to weed out. But even with the good ones problems still slip thru the cracks.

I'm sure part of the problem my Yankee cousins are having is their distal location to the heart of the oil patch: Texas and La. Folks are stretched thin and the further away you are from Houston the less experience you'll find with the hands in many areas. Same problem with the regulators who are suppose to be the industry watchdogs. They obviously weren't up to the task.

Seen "Gasland". Excellent propaganda. Not saying it's misrepresenting the situation but just hyping it as you would expect many on either side of the issue would do. Unfortunately I don't think it adds to finding a solution but rather makes both sides entrench themselves even deeper in the "us against them" debate that won't solve the problem. Like everything in life there's a balance. The SG play in the NE will add desperately needed economic value. But there will be an environmental price to pay no matter how diligent the effort to avoid such problems. Again, as pointed out, it's risk assessment. But R/A for who? For a landowner a huge financial reward is adequate to justify his risk. But the downstream landowner not getting a fat check? Even if he accepts the risk as minor why would he support SG drilling if there's no direct benefit? Which one is right? IMHO both are. Conflict between different interests is constant surround us. For instance folks universally bitch about airport security. But if a loved one is killed due to lax security measures? The tone would change quickly.

But even if there's no obvious solution to the conflict of different interest the anxiety level could be greatly reduced if the local/fed regulators came down hard on the oil patch. The oil patch is very good at following any set of rules...if they are forced to do so. For us it's just the cost of doing business and we adjust accordingly.

A good answer. I can see why you are respected.

But the regulators are captive to the corporations.

Even the water quality requirements have been waved.

The tensions will grow?

I am quite familiar with Rosebud. They have a very nice dinner theatre there, as well as several good B&B's and a nice golf course. They don't have many good underground water formations in the area. It is an old coal mining region and has massive underground coal formations. There's coal everywhere and a lot of methane in the coal. If you drill a well, you are more likely to hit coal and/or methane than water. Most of the water they do find is heavily mineralized (arsenic, uranium, the possibilities are endless) or contaminated with bacteria from the extensive cattle operations in the area.

The provincial government brought good water into the town of Rosebud and invited people to take it from there. They don't guarantee the quality of well water in the area and won't pay to test it for people because they know it is almost certainly going to be bad.

Ms. Ernst doesn't own the mineral rights under her property nor does she own the water rights. The government does. She doesn't have the right to drill a water well without a permit. If she complains about the quality of her water, the government will just deny her a permit to use it, and invite her to truck in water from the town supply at her own expense. Good luck with that lawsuit.

Rockie - Great details..thanks. But it's also a shame to expose it as a misrepresentation. We both know there are instances where oil patch activities mess with the environment. Nothing is risk free. But when situations are exaggerated/falsified it diminishes valid claims. More importantly it reduces the conversation to name calling by both side...and nothing gets resolved.

I don't see any of the surface issues being too difficult to prevent with proper practices, but what about contamination of potable ground waters? If a bore is properly cased and cemented, can a deep fracking operation still frack all the way up to a relatively shallow aquifer and contaminate it?

I'm sure this subject has been brought up over and over here at TOD, but I don't use TOD enough to have read the pertinent threads.

s-a: The very short answer is that it's physically impossible for the fracs to reach the surface. But there's still the possibility of the frac fluids being forced upwards between the original hole in the rock and the casing (the annulus). When done properly this annulus is filled with cement to prevent this from happening. The second possible source of aquifer contamination is for the pressure to rupture the casing up shallow and inject the frac fluids into the aquifer. Both events are rare but has happened in the past. But always because of poor workmanship or inferior materials being used. Much of that risk can be eliminated with proper regs AND monitoring.

Despite all the hype about the wells and the frac pumping itself I've seen no documented evidence it causing one problem during the recent drilling boom. All the documented cases of contamination were the result of improper disposal of the frac fluids after they've been produced back to the surface.

Not that there haven't been some problems but there have been many thousand of wells frac'd in Texas over the decades and you heard nothing about the fear you hear today in the NE and elsewhere. And despite what many folks think Texas regulators are much tougher than my Yankee cousins in such matter. And our landowners (with very expensive lawyers in their back pockets) are very good at extracting their fair share of flesh from operators that screw up.

When they say "Don't mess with Texas" what they really mean is don't mess with the Rail Road Commission and the landowners...you will always lose.

Thanks for the reply.

For the most part, you and I are on the same page. I'm merely a geoscience nerd and only have a bit of official college level geology education, as opposed to being a working professional in a related industry, but my education and a reasoned approach to everything allows me to root out all the hyperbole and recognize the realities.

Maybe every now and again you can drop into a reddit thread on the subject and lay down a dose of reality. You're an industry expert preaching to a much smaller crowd here. Not a put down of TOD, it's just that this is a niche site, and isn't every going to reach a wide audience.

s-a: "I'm merely a geoscience nerd". Careful...that's how I got started and been trapped here for 36 years. At the risk of sounding like a total condesending *ss it would be a waste of time to preach to the general public. Been there...done that. LOL. It's not so much that so many folks are ignorant but for the most part they don't want to learn/understand. They have their opinions, right or wrong, and have little interest in re-evaluationg them.

As we say in Texas: Don't try to teach pigs to tap dance: it frustrates you and p*sses them off.