The Link Between Peak Oil and Peak Debt – Part 1

Posted by Gail the Actuary on July 13, 2011 - 10:58am

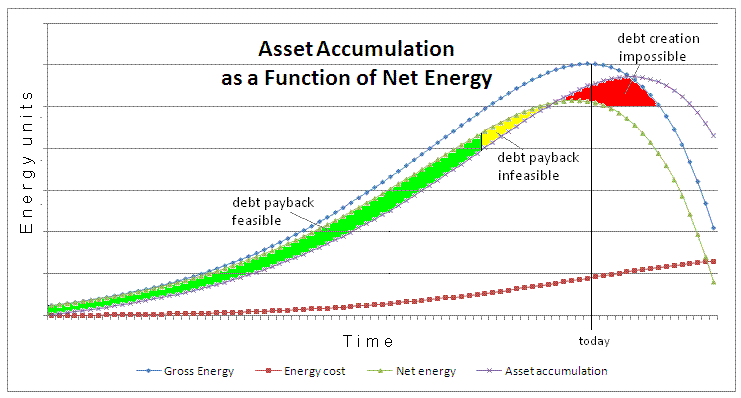

The economy is closely linked with the physical resources that underly it. Most economists assume debt can rise endlessly, just as they assume GDP can rise endlessly. But if there really is a limit that prevents oil supply from rising endlessly, it seems to me that there is also a corresponding limit that prevents debt from rising endlessly.

As I analyze the situation, it seems to me that here is really a two-way link between peak oil and peak debt:

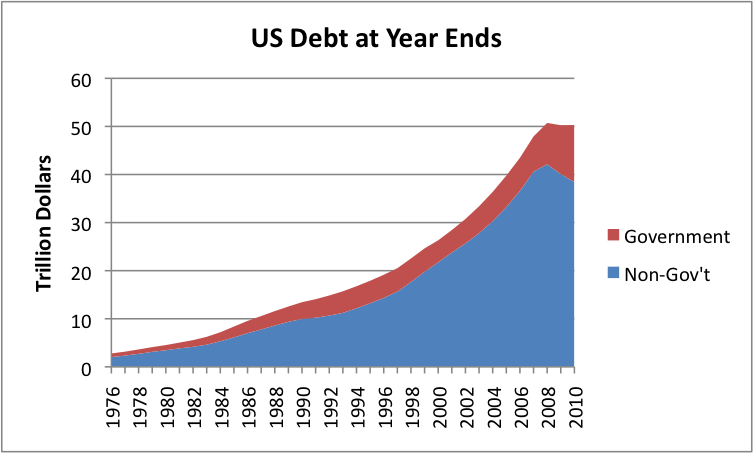

1. Peak oil tends to cause peak debt. Some will argue with me about this, because they believe it is possible to decouple economic growth from energy growth, and in particular oil growth. As far as I am concerned, though, this decoupling is simply an unproven hypothesis–the normal connection is that a flattening or decline in energy supply causes a slowdown or actual decline in economic growth, and this slowdown causes a shift from an increase in the amount of debt, to a decrease in the amount of debt, as it did for US non-governmental loans in 2009 and 2010 (Figure 1).

Governments try to step in and keep the growth rate in debt up, but the gap is too great for them to make up. This tendency of governments to take on new debt (together with problems related to the original slowdown in economic growth) are reasons many governments have been getting into financial difficulty recently, in my view.

2. Once debt growth peaks (shifts from growth to decline), we can expect a feed-back loop that will tend to make the peak oil decline even worse than it would otherwise be.

In the current post, called "Part 1", I will cover the first of these two issues; I will cover the second issue in Part 2.

The Relationship Between Growth and Debt

I have talked many times about the need for economic growth, in order to make our current system of borrowing money, and paying back loans with interest, work on the extensive basis that it is used today.

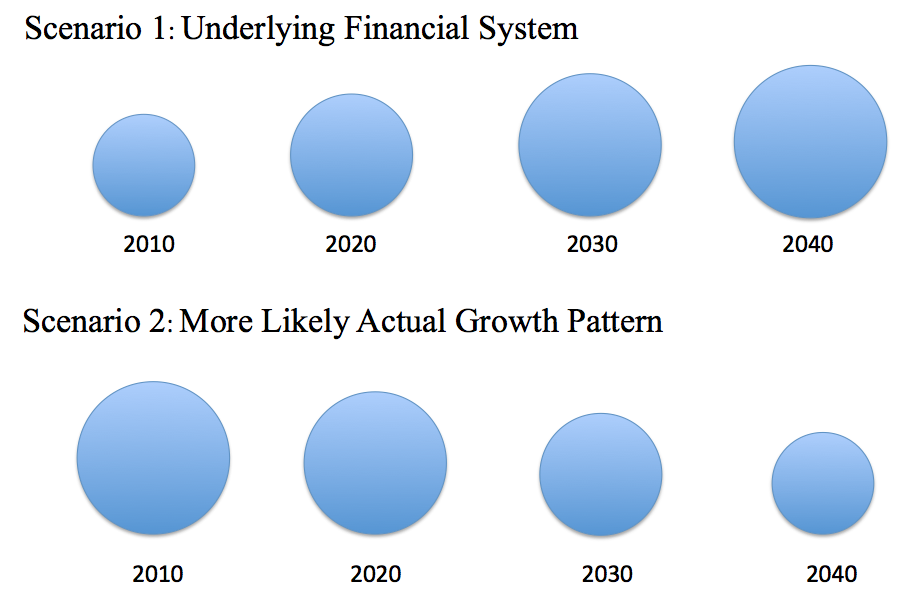

As long as the economy is expanding, as in Scenario 1, businesses feel confident that their future prospects will be better than they are today. As a result, businesses will borrow funds for new equipment and will be fairly confident they can pay back the loans with interest in the future. Governments will also borrow, knowing that they will likely have higher tax collections in the future. Because of these higher tax collections, the governments can expect to pay back the debt plus the interest on the debt.

In Scenario 1, even common citizens feel that debt is a reasonable prospect. If the individual loses his/her job, there is a good chance of getting a new one. With prospects for better wages in the future (or at least no worse wages in the future), it makes sense to take out an automobile loan, or a student loan, or even a loan on a new home.

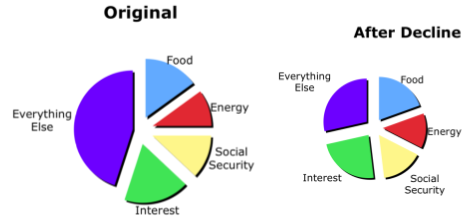

If the economy is expanding, promising Social Security benefits to future retirees looks like a safe prospect, as does promising Medicare benefits. Just as a “rising tide lifts all boats,” an expanding economic circle leaves room for more and more types of payments (Figure 3).

If the economy starts contracting as in Scenario 2 of Figure 2 (or even stays the same size) then it becomes much more difficult to repay debt with interest, and to fulfill promises of future benefits, as illustrated in Figure 4.

Of course, in a contracting economy, there may still be a few instances where debt “makes sense.” These might include very short-term business loans, for example, covering goods in transit. They would also include some business loans where the economic return is high enough so the loan would make “economic sense” even if the interest rate includes a fairly high charge for risk of default (because of the declining economy) as part of the interest rate.

This decline in the level of debt becomes a real problem for countries, because the availability of debt tends to add to reported GDP. For example, if a person takes out a car loan and buys a car, the cost of the car gets added to GDP, even though the car is not yet paid for. The availability of debt financing also makes it possible for businesses to obtain capital for expansion, so the business can, for example, build more cars, without waiting for sufficient profits to accrue to have enough revenue to finance the expansion. Both of these activities tend make it easier to increase reported GDP.

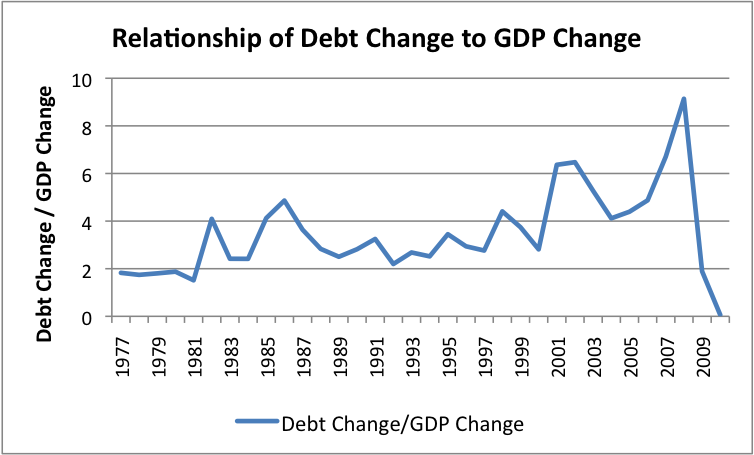

What has happened in recent years, at least for the US, is that it seems to be taking greater and greater increases in debt to create a given increase in GDP.

This changing relationship may reflect the greater headwinds the economy is encountering, now that oil supply is tighter and oil prices are higher.

Declining oil availability (manifested as high oil prices) tends to lead to economic contraction

Oil use, and energy use in general, tends to be tied to economic growth in many ways. Clearly there is a need for oil (or another energy product) to manufacture and transport goods, and to grow and transport food. Given the cars, trucks, trains, and farm equipment currently in use, it is not easy to change the dependence on oil quickly, either.

James Hamilton in his paper Historical Oil Shocks has shown that 10 out of 11 US recessions since World War II were preceded by oil price shocks. Charles Hall, Stephen Balogh, and David Murphy have shown that high oil prices tend to be correlated with recession. Robert Ayres and Benjamin Warr have analyzed the amount of work (in a physics sense) that is done by energy of various types. Using this data, they have developed a model explaining the vast majority of US real economic growth between 1900 and 2000, except for a residual of about 12% after 1975.

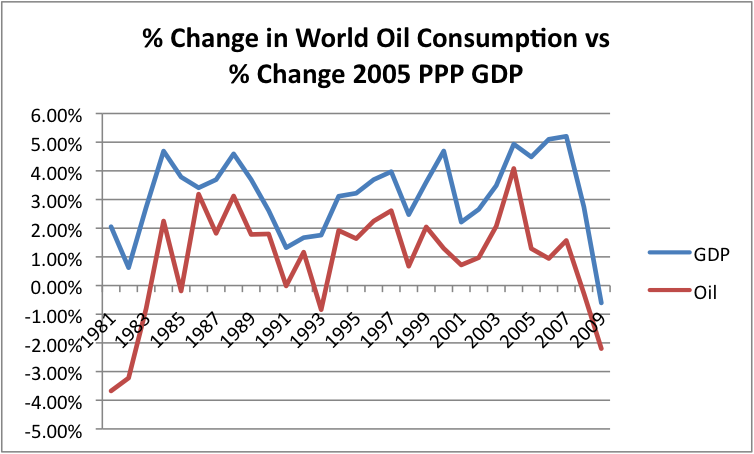

A comparison of annual increases in oil consumption with annual increases in world GDP in constant 2005 $ shows a close correlation.

In spite of all of this evidence, there are some who argue that it is not clear which direction the causation goes with respect to oil supply and economic growth–perhaps the only issue is that the world uses more oil when it is expanding, and less oil when it is contracting. With this belief, it is difficult to explain why oil price shocks would precede recessions, but some economists have learned this view in the past, and seem not to be open to looking at the evidence.

There is also a question as to whether we can move quickly away from this close relationship between oil and the economy. Vaclav Smil in Energy Transitions: History, Requirements and Prospects has shown that because of the very large amount of built infrastructure in place, in practice, energy transitions from one fuel to another take a very long time–30 to 50 years.

In spite of what Vaclav Smil has shown, there may be some possibilities for short-term decoupling. For example, if car-pooling suddenly becomes much more common, it could tend to change this relationship. It is not clear that such a change would be fast enough, or significant enough, to change the basic relationship, however.

Recent Debt Problems of Governments

Recent debt problems of governments seem to be related to a combination of (1) the tendency of high oil prices to cause recession and (2) the additional debt the governments have tried to take on, to stimulate the economy and to bail out failing banks and other businesses. Part of this debt may be taken on, to try to offset the decline in private debt.

In the United States, federal external debt started increasing more quickly immediately after oil prices hit their peak in July 2008 (Figure 7).

Even with these huge increases in federal debt, the increase in governmental debt has not been able to offset the decline in debt held by businesses and private citizens, as shown in Figure 1 near the top of this post.

Governments around the world have been finding this additional debt burden increasingly difficult to handle. If nothing else, if interest cost of this debt becomes very burdensome, unless interest rates are very low. Furthermore, even when they do try to intervene, their debt doesn’t have quite the right effect–their new debt may buy a new road, but it doesn’t buy a new car for the consumer.

This combination of problems–recession caused by limited oil supply, increasing need for government debt because of shrinking private debt and need to stimulate the economy–is likely the cause of the debt problems that so many governments (including the US government) are experiencing today. Many European countries are experiencing problems as well–Greece, Portugal, and Spain, for example.

In Part 2, we will look at some of the feedbacks of peak debt that may have an impact on the shape of the peak oil downslope.

This article was originally posted at Our Finite World.

Very clear article and I would like to add two points,

1. Recently a study was done that by 2037 the debt will be 36 times GDP (any much more than one times is possibly not sustainable). The govt. agency that plotted the debt stopped the chart in 2037 (but it would have kept compounding).

2. Not all nations are in debt. Countries like China, India, and oil producers in the middle east will continue to grow rapidly and so will energy consumption in other emerging markets.

What do you base that conclusion on? For how long do you really expect those countries to continue growing? China is not in debt? I think I can still find the links to back up exactly the opposite view.

Fm - I wonder if the proper phrase would be "net debt"? Of course, the key here would be the definition. Has China borrowed much capital? How much compared to our debt we owe them? I have no sense of even the scale of the answer. Be nice if someone has some real numbers to flesh it all out.

Got me on that one, ROCK.

Anyways here's a link from February 2010.

I don't think things have gotten a whole lot better since then.

Actually, Chinese Debt-To-GDP Is Enormous, And Regional Governments Need The Real Estate Bubble Stay Solvent

Read more: http://www.businessinsider.com/actually-chinese-debt-to-gdp-is-enormous-...

Sound Familiar?

I wrote a little about the debt issue in China is this post on Our Finite World. Many of the individual people now have a lot of debt, in comparison to their incomes. This, plus all of the other debt issues, is likely to be unsustainable, especially if rising coal costs lead to rising electricity costs, and people find their incomes squeezed. So far government has been trying to hold down electricity costs.

China uses so much coal that it is more vulnerable to rising coal costs. As the easy-to-get coal is exhausted, the coal that is extracted becomes more expensive. Imported coal (being used more now) is especially expensive. The situation is not too different from here with oil, but with coal, it seems to me.

FM - A real eye opener...thanks. Yes..sadly familiar. I guess communism and democracy have a lot more in common then I would have guessed: pandering politicians.

China has a fair amount of crony capitalism just like most places.

"Money poured into Greece, and was used to fund a huge boom in public-sector jobs, most of them linked to political patronage. Various forms of corruption permeated the system, where cash gifts in fakelaki or "little envelopes" were a fact of life, and where, crucially, the rich regarded paying tax as something that only the poor and stupid would ever choose to do. This latter fact meant that Greece was in certain vital respects a country without a functioning version of the social contract."

http://www.guardian.co.uk/world/2011/jul/13/eurozone-greek-debt-crisis-euro

_________________________________

The empty distraction, posturing, and rousing of ideology does not matter.

Timely Posting

While there are similarities, the differences are not unimportant.

Unlike China, almost all new US debt over the last 20 years was acquired not by the Federal or local Governments, but by private individuals. Even most of the unfunded obligations of the US government were acquired decades ago.

Let us be clear, almost the entire US problem that has developed in the past 20 years is due to the behavior of private individuals. Government bashing, is an attempt to hide from the truth. We are a nation of hypocrites. Further, the claim that the US Gov is close to insolvency is an absurd projection of fear and guilt.

The US gov debt as a percentage of GDP (~65%) is among the lowest in the West. There is simply no other place excess capital can go, both because other countries and borrowers are even less dependable and because they lack sufficient size to absorb this much capital. Indeed, US bond yields, including 10 year note, are at or below inflation. In essence, the government is making money by borrowing (inflation is decreasing real debt at a rate above the interest paid for the debt). Dramatically more so, if inflation is understated.

Given these truths, Krugman recently tried to explain the insanity of political efforts to restrain government spending now. I think he hit it on the head. Smart money recognized real returns on investment had become so absurdly low (given associated risks) that they moved into bonds. These individuals are terrified of inflation and may gain wealth during deflation.

http://www.nytimes.com/2011/06/10/opinion/10krugman.html?partner=rssnyt&...

Cheap money encourages debt. From an individual, it matters little whether debt is incurred by the gov't and paid by taxation or incurred by the individual and paid out of wages. If the the total load increases, his spending must decrease elsewhere.

The notion that bigger gov't debt is somehow preferable, or that the gov't should inflate to save the bad loans of major banks and investors, is laughable. The gov't should encourage employment and low inflation, not gov't growth and high inflation.

Let us be clear, that just because other nations have a more centralized economy is no reason to say the US should have one as well. The US has no business making money by borrowing if that money is made either by tax payers or by foreign obligations. The Constitution says we have to pay the US debts -- that's a far higher standard than any unsecured personal debt.

Truth is not the same as wisdom. That's like saying debt with positive cashflow is wise. Debt presumes upon the future and eliminates options, and our gov't has no blanket right to so bind its citizens.

What you find laughable, experts, who studied the last time the US found itself in a liquidity trap, call essential.

Incidentally, I am pretty much a founding member of Concord Coalition (the debt reduction group) and believe strongly that Gov debt is generally bad. In almost all cases, deficit spending should not occur during periods of economic growth.

Unfortunately, there is currently an atypically low level of aggregate private demand and investment opportunities, leaving the US Gov as both the spender and investor of last resort. Depression is one policy mistake away.

Last time was last time. There is no reason to expect that the same treatment will work again for an evolving illness.

This time we have fewer resources available and way more people. Then we were entering industrialization; today we're post-industrial. Then we were a farming country; today we're more of a service country. Then we had a small gov't; today we have a much larger one.

Lack of investment opportunity probably reflects the reality that banks can make better money on gov't investments. Heck, even I can make more on frequent flyer programs than I can in my bank.

To me, more easy money is a poor cure for easy money problems. It may have been a perfectly good cure for a resource-rich era with slack trade.

At some level, I probably agree with you. Reasoned government spending on investments with long term payoffs make sense. BAU (tax cuts) in the face of depleting resources cannot work for long.

However, the concepts behind a liquidity trap still seem valid. We have a demand deficiency problem.

Our apparent disagreement has to do with the underlying reasons for the lack of investment opportunities with reasonable return. If you or someone could explain to me where these opportunities will come from in a shrinking economy, perhaps then I could understand the viewpoint. Honestly, I am mystified.

I do not think transition and environmental protection will happen in a depression.

So we walk the razors edge. Life was never going to be easy.

I do not think VOLUNTARY transition will happen unless we have a major drawn out depression. As for environmental protection, unless the environment is seen valuable for survival, it most certainly will not be protected. Perhaps after a massive die off of humans, whatever is left of the environment as we know it will get a chance to begin to recover on its own... Who know in another 10 million or so years it might even be quite pleasant again.

And I, appreciate the consistency of your doomerism. While I am teasing you, I recognize you have good reasons for these beliefs. Could well happen.

One of my happy memories was the day I learned there are micororganism spread miles deep throughout the Earths crust. Life will survive, even if we nuke the planet.

Speaking of which, I lived through that period when planet nuking appeared imminent and I have to say that my personal survival seemed unlikely at the time.

Hey, perhaps we will find a way to reach sustainability.

Good to read an optimistic appraisal.

Frankly, I doubt that AGW will continue much more than 200 years after the die off, after which the natural cycle will resume. Of course, some believe that we will hit a tipping point, and the global conditions will never return to the past cycles, remaining 15 deg. C above present. If so, the tropics will be pretty much wasted, and the far north and far south will be uncomfortable. Persistent drought, wide spread desertification, and intermittent deluge are forecasts I read from some sources. Mostly I don't think anybody has the faintest notion what will be. Like you, I remember duck and cover in school drills, with a gloomy view that nuclear war was almost certain. Glad we made it past that (so far) at least.

Best hopes for sustainability.

Craig

Indeed! I think I heard something in the news about those very microorganisms in just the past couple of weeks or so. I had the exact same thoughts and feelings of elation.

I too have lived through a few interesting events in my life so far. My one and only deep regret in this life, despite my love for him, is having brought my son into this world. And I can't even bring myself to tell him how truly sorry I am. To be clear, I don't hide the truth as I know it, from him. He is just still too young and optimistic for the realities of life to have sunk in yet.

Yeah, let's keep on trying!

I suppose I shouldn't quibble about philosophy under a finance keypost (and a good one, thanks!). But the slow-living biota of deep rock probably aren't going to do much interesting between now and when the expanding sun boils the seas away. The earth is an old planet and doesn't have a lot of time left to evolve new lineages of complexity, which we large multicellular critters have come to value. Large critters are a statistical fluke; single-celled organisms rule. The leap to multicellularity is not an easy one, and there's no time for it to happen again here. Mars may still be full of bacteria, but odds are there ain't much going on macroscopically.

Obviously, we all must take our comfort where we can find it, like Frodo looking at a star and taking some consolation that Sauron might not corrupt it. However, the probable survival of bacteria would amount to a poor substitute for the dazzling array of complex beings, and of conscious awareness, which now exist, and could exist in the next half-billion years. We are thermodynamic beings all, and bacteria are arguably closer to convection cells or whirlwinds than they are to us. The qualitative difference between a bacterium and a sea lion is significant.

I realize this isn't the position of your post, but I've often heard people say "we can't hurt the planet, it will continue" as though that string of words meant something useful.

What is in existential jeopardy is evolved multicellular complexity, conscious awareness and thought. Thought may become a failed experiment, but the experiment is still running. I hope some of us will consider it worthwhile to undertake the metaphorical trip to mordor and use our resources to alter the odds in favor of conscious thought surviving. (disclaimer: this recommendation is a result of conscious thought)

What if there are no sound ways out? Nobody ever said every problem has a solution. If there is none, anything done is simply a waste, making the problem worse.

A year ago, there was a graph showing the falling marginal increase of GDP with each dollar borrowed. It was nearing unity -- if it crossed, then additional borrowing would only make things worse.

I don't think transition or environmental protection will happen, period.

Efficiency, reducing trade imbalance (especially energy imports), and bringing more labor-intensive manufacturing back home would be reasonable to attempt, at least.

Otherwise, investing in long-term durable goods (multi-generational) is at least more sensible than throw-away products.

Paleocon,

If there is no way out, then so be it. I have found no way to cheat death (yet). Doesn't keep me from planning for tomorrow.

Sorry, can't believe the graph you mention. Again, US gov debt is not that high as a percentage of GDP and the interest paid on the money costs nothing.

Further, I can't see how money invested in wind or solar can lose, particularly if things get worse in the future. Energy production in the bank for years.

Most of the arguments against solar and wind come from those who posit a brighter future. If these folks are right hallelujah, we made a less than efficient investment - you know like wasting 2 trillion or so on homes that are too big, use too much energy and are near nothing.

We are talking primarily about non government debt here. You seem to be focusing on government debt. It is private debt that is vital to the economy.

??? I don't see how you can reasonably believe that? If there ever was a self evident false statement that is one. Interest must come out of profit. If there is not enough profit to pay the interest then a business must go under because it is losing money. Interest paid on money cost dearly. When there is not enough profit to pay interest then the economy sinks. That is the whole argument. And you think that interest money cost nothing???, that it is free???.

The argument is not against solar or wind. However the EROI on solar and wind is very low. But the point is that it will not be enough to save us.

You must be referring to the chart posted by George below and explained very well here. You make no argument whatsoever, you just say that you can't believe it. But I understand very well why you can't believe it if you believe that interest paid on loans is free. If that be the case then you cannot understand anything about the economy.

RonP.

I was thinking of this Seeking Alpha article instead:

http://seekingalpha.com/article/136058-the-declining-usefulness-of-debt

The posting by Lounsbury is very confusing. Not once in the entire piece does he state that he is talking about National Debt. This is implied in his quote of Fekete “Keynesians take comfort in the fact that total debt as a percentage of total GDP is safely below 100 percent…”

With more digging: From his earlier post on the Welsh piece he is talking about total debt (public plus private).

In this light, the graph showing decreased return from increasing total (mostly private) debt makes more sense. The graph shows return on private investment has been steadily dropping, consistent with too much capital chasing too few opportunities. [Or the private sector investment is increasingly directed by idiots who do not know how to invest.] In either case, no argument from me, far to much of the increasing US income has been directed to the investing class.

Fundamentally different from the value of debt used by government to build infrastructure – ahhhh he seems to suggests this as a course of action several lines from the end. In my opinion, also different from most transfer payments that go to individuals who spend them (and thus raise aggregate demand).

Also, he notes that the value of increased debt generally spikes during recessions.

I don’t see how the facts presented even relate to direct government spending. It seems more like an argument against monetary expansion that places capital in the hands of private individuals. Or against further tax cuts for the investing class.

Indeed, the point of my initial comment was that private and not public debt was the cause of the current problem. Relatively speaking the US government is quite solvent.

About Interest on US debt, I quote myself from above (with an edit):

Indeed, US bond yields, including 10 year notes, are at or below inflation. In essence, the government is making money by borrowing (inflation is decreasing real debt at a rate above the interest paid for the debt). Dramatically more so, if inflation is understated.

Alright, perhaps calling this making money is not the best was to express the concept, although I don't know that there is a good way.

Paying negative real interest clearly means the real size of the debt decreases by an amount that is larger than the size of the interest payment.

Okay, got it. Although absurd, this example illustrates the point. In a year with no inflation, US treasury bonds are at -1% interest. Every year 1% of the bond value simply becomes the Govs for holding the money in an account. If someone gave me 1% of principle each year simply for keeping their money in my account, I would consider that making money. Of course the Gov does not keep the money in an account it spends it. Nevertheless, in contrast to paying 1% real interest, for example, the Gov appears to be making a 1% profit.

I am running with this. As of the 13th the 1 year treasury bill was yielding 0.16% annually versus a current inflation rate of 2-3%. Simply holding the note would yield nearly a 2-3% profit. Maybe we could fund the Gov this way! I know, it is not scalable.

About solar and wind:

Fortunately, if we build them now we can use energy from a variety of sources with much higher EROIs. Future energy in the bank that has increasing value as other energy becomes more difficult to produce. No question, solar and wind cannot support BAU. However, we do need saving; from our ignorant, materialistic, self-adsorbed viewpoint. Ron, you know this viewpoint would not possibly have changed if BAU continued. Energy decent will change societal dynamics creating the possibility of a better America.

I will check out the graphs and comment tonight. I have to work sometime.

There was an article with aerial photos of the richest American CEOs mansions posted on Yahoo news recently.

It was interesting to note the vast solar arrays all over Bill Gates' property. I guess he must be hedging his bets about the future.

Remember how George Walker Bush had solar on his ranch in Texas?

How about Ted Turner's farmland holdings?

Or the acres of land that gent from Enron bought? (the last one out the door with the big payoff just before Enron blew up and made it into the Enron movie)

You need to believe in quite a bright future for wind and solar to make sense, because they are generally add-ons to the electric grid. The electric grid needs oil to maintain it, both directly (to power trucks and helicopters to do repairs) and indirectly (to make and transport new parts, and to make roads to make it possible to transport repair trucks and replacement parts. Trains, if they are used, as they operate today, generally require diesel as well.

The financial system for the financing of all of this (wind, solar, electric grid, electric company selling the electricity) also depends on maintaining BAU. An electric company that cannot pay its workers doesn't stay in operation for long, even if it has wind and solar inputs.

Gail I'm not sure we are envisioning the same thing when you or I talk about solar. When I talk about it I'm referring to highly distributed relatively small scale community level and as much as possible off grid.

I think the more of that, that is built out while we can, the less anyone will have to rely on the centralized grids which are under the control of utility companies whose sole purpose is to make a profit off the backs of its consumers. I believe the entire profit motive paradigm needs to be reexamined but that's a project for another day...

Certainly true! However I am yet to be convinced that we can't prioritize our remaining fossil fuel use by drastic measures such as eliminating entire areas of it, say for instance the manufacturing of automobiles and their use for personal transportation. Make private cars untenable either by decree or by extremely severe disincentives such as taxing fuel for private consumption at exorbitant rates.

I guess if the financial system collapses then people will have work for food. I can certainly imagine an entire community getting together and pooling their resources in order to survive. If it means everybody getting together for a wind turbine raising so the community center can have electricity and freezer storage I don't see such things as being completely unlikely. Even if it means some people will get paid in buckets of humanure to fertilize their crops.

Yes, I have deliberately made statements that push the envelope of the credibly possible under our current BAU system, but that is precisely the point!

I agree with you. I suggested in a post called How to develop a more rational energy policy that if we expect anyone to take a responsible approach for manufacturing, we need to do it ourselves. We probably should be taxing imported goods and services. I know I used to be involved in with captive insurance companies set up in pleasant offshore tax havens. The boards of directors got nice vacations there every year (or more often). The companies paid very little taxes anywhere. Actuaries put together nice reports for them, showing how their insurance companies were doing, and how they might be expected to do in the future. Actuaries got to fly to the these nice islands themselves.

We now have many versions of these companies around the world (manufacturing as well as services), taking advantage of favorable tax laws or favorable wage differentials (or both). In some of these places, the energy is from cheap coal. The people there are happy to have work and any energy supply, so are not as offended by using coal.

Perpetuating the current system just leads to job loss in OECD countries and rising world CO2. Anyone who looks closely at the current "system," if you can call it that, shows that it isn't working. We need to quit pretending that minimizing CO2 emissions inside our own borders is a reasonable goal. We need to be looking at the problem more broadly, so that indeed, we end up with a reasonable results--jobs sill in this country, and world CO2 declining.

The way I see the downturn playing out is through more and more job loss, and more and more government programs being cut back or eliminated. There may even be worse things--governments themselves encountering huge problems, and defaulting on loans, or even ceasing to operate (possibly being replaced by a new government).

The problem of transition is one of finding things that people without jobs in the traditional economy can do to support themselves, and also ways that they can get around, when they cannot afford cars or much of anything else. They also cannot afford to pay taxes for new train facilities. It is questionable how much they need these trains as well.

Much "transition planning" is to me based on a wrong picture of the future, and the issues that need to be mitigated. The issue is how to take care of your sister's family, when no breadwinner in her family has a job, as well as your parents, when their social security income has been cut off. Government's taxes are likely to be way down as well, so it really can't help out.

We could shut down all traffic control lights and replace them with human traffic controllers.

In a modernized version of the old street-cop-on-every-corner, our traffic control people would be outfitted with head-worn web cams and radio connections to a computerized traffic control center. The traffic control people would report (in an intelligent way) what is happening from their point of view and the computerized traffic control center would respond accordingly by coordinating the actions of all traffic control people.

In particular, the system would be set up to reduce wasted burning of fossil fuels.

There you go!

A job for everyone willing to work, and ...

we save on petro burning as well.

[ i.mage.+]

________________________

p.s. By tomorrow morning a smart person in China will have this project under way while we in America debate for the next 10 years over whether it is in line with our "free market" ideologies.

"We have a demand deficiency problem."

Where exactly do we have a demand problem in this country?

I will let someone with more expertise than I speak:

http://www.bloomberg.com/news/2011-07-05/the-sorrow-and-the-pity-of-anot...

"I will let someone with more expertise than I speak"

Daniel I read it and I don't buy it, although his pointing toward Keynes and Krugman probably ruined any chance I would. Peter Schiff and Jim Rogers got it right, Ron Paul got it right in 2001 on the floor of congress, you can google that one.

One thing that Peter Schiff has said about the supposed lack of demand (I hope I don't butcher this) is that American's have plenty of demand, we demand bigger houses, nice cars, good food, big TV's, large yachts, but what we lack today is the productivity needed to be able to attain those items.

During the housing bubble our demand was allowed to take presedence over the fact that we as a people weren't productive enough to deserve what we demanded. "No income, no job, no assets no problem" That mantra made us believe that even the least productive among us deserved things we could never afford. Many of our leaders would love to re-inflate the bubble (any bubble) in order to get re-elected, they would do this by allowing our demand to make another bubble with no regard to our productivity.

They know we still have plenty of demand, but I hope we have the sense to control it!

" Then we were a farming country; today we're more of a service country"

But: according to http://www.agclassroom.org/gan/timeline/farmers_land.htm

In 1930 farmers were only 21% of the labor force. Hardly a farming country although a much larger fraction than today. We certainly have more people and fewer resources however the fact remains that the market is not creating jobs and that is a tremendous problem. Who but the govt has any resources to address the problem? Willy-nilly spending is, of course, no cure however someone should be doing something. It is a much greater problem than a debt equal to 65% of GDP and worth some govt investment.

Here is "doing something" that would help:

- Re-write mortgages across the board to 4% and 15 years, but require 25% down on new purchases. Home values would plummet to the affordable point. Banks would scream. Those making payments would instantly have new money to spend. Those in trouble might come out OK, but some would still be in trouble. Foreclose on the latter and clear the market. Split any proceeds from short-sales and foreclosures according to an equation based on down-payment and past payments -- banks and homeowners share in the upside and downside.

- Pay for any house owned in good standing to be highly insulated and efficiency enhanced. Insulation, new windows, etc.

- Invest in X-prize projects for efficiency projects - solar A/C, high-eff HVAC, better/cheaper GSHP, simplified installations (and standards and practices!) for PV systems, thermal storage, residential batteries, etc.

- Add incentives for CNG conversions (today the rules bias against practical duel-fuels cars and conversions for residential use)

- Invest in Alan's rail projects

- Add incentives for recycling and sewage harvesting

- Fund the stranded-wind ammonia effort

- drop minimum wage and add employment incentives instead of unemployment extensions.

I'm sure there are many other small and decentralized plus large centralized efforts that would make sense from many angles, including employment. Not any/all will be popular with everybody, most will make a lot more sense than perpetuating million-dollar banker bonuses.

That's quite the list, and I agree with much of it. except this;

but require 25% down on new purchases.

if you combine that with your later idea;

drop minimum wage

then how will young people ever save up the 25% needed to buy a house?

This policy would condemn them to be lifelong renters - those who are in the property game can stay there, but the bar is set impossibly high for young, new entrants.

I think a better approach would be to say something like the first $150k of a loan can be had for 5% down, and for anything greater, you have to have progressively higher down payments. You could also make it a one -off exemption for first time home buyers - though that doesn't help the guy trying to restart after being stripped of his house buy a divorce.

i would also change the rules about interest on home loans being tax deductible. Either remove the provision entirely, or make that only interest on the first $150k is deductible - if you choose to have a more expensive house, then you pay.

The idea of your rules is to prevent lots of bad loans and rampant property speculation, but young first time buyers are generally not guilty of that, but they get caught in your net. Make the net mesh wide enough that they can slip through, but you'll still prevent all the shenanigans with people buying holiday houses, condos in vegas etc

A major issue for first-time buyers is that they tend to buy all they can afford and then some, on a 30-year note. Often Mom and Dad pitch in on the down-payment, which makes it easier to buy more than they can afford, too. Then you need furniture for the larger house, and a car to match the neighbors, and a lawnmower, and, and, and....and then you're in the lifelong debt rat-race.

It is much better to encourage young people to buy fixer-uppers. I'd promote a Habitat for Humanity for EVERYBODY -- prospective homeowners putting sweat equity into refits for other people in return for eventual equity and help on their house. It's a Ponzi scheme I could get behind.

With newly cheaper houses, a fixer-upper should be nowhere near as expensive as today's average new house.

Still, I think your idea is a good one -- cheap money (but short terms) for the first modest range, and then higher restrictions after that.

I encourage my kids to plan for their first house to be a small, cheap duplex. That spreads your down-payment across twice the space, and somebody else buys the furniture and such for the other half, and pays you extra in rent for the privilege. Double-down on the payments where you can, and when it's paid for go find a nicer place and use the income from two rentals to pay for it. We'll see in a year or two if they take my advice.

Not only do people buy a house they can only afford, often they will find out the upkeep is unaffordable. Turns out everything breaks - the furnace, water heater, pipes, toilet, roof, garage door ... homes are, especially older not-so-well maintained ones, a money pit.

Renting on the other hand has a certain appeal for those willing to pay top-dollar, allowing one to max out the level of luxury that one can afford for however long one can - walking away is as easy as letting the landlord know.

Most European cities have a significant percentage of middle class and upper-middle class families that are "lifelong renters."

People who want to own a home often have to put down a lot more than 25%. Lifelong renting is not something that should have any kind of stigma attached to it.

I am glad you made that point concerning the Europeans, slight difference is a wider form of rent control. The concept of the necessity of owning needs to go away, there might even be some amero-centric solutions that

take advantage of some of the former bad choices. Many of the older suburb/developments (50's-70s) have pretty substantial lots, building two households into them for the future is an interesting play. Many of them

are even relatively close to commuting capabilities on bus routes. My township in Pennsylvania (2nd largest in the State), now allows two discrete buildings per lot but have to share a single sewer connection (lateral).

The thinking is (a) higher taxes (real-estate AND earned income) per lot, (2) many if not most of them are about taking care of relative in some manner - good for society, (3) a return to the original density considerations of

the 60's - 5-6 people per lot. The downside consideration had been car trips, but with the increasing fuel costs, they might just go back to the 60's level of trips even though technically there are more vehicles per lot.

There is substantial interest in the US government to design even cheaper housing to meet the financial capabilities of the US 20-30's, I'm arguing that either similar kinds of re-designing the single family home concept

or outright repurposing of emptying commercial and office buildings is where we need to focus some engineering/design/imagination.

Here is "doing something" that would help:

How about use the existing law, demand the wet ink note and see if your mortgage is bifurcated.

And if they can't produce the note per UCC or the note is bifurcated - sue for fraud and get your home free and clear.

The lack of demand for credit, to me, is a reflection of high oil prices, which is in turn an indication of an inadequate supply of cheap oil.

The reason for this connection is that businesses of all kinds find their food and fuel costs rising, when oil prices rise. They try to raise prices, but consumers don't have any more income--they didn't get raises, just because oil prices rose. Businesses often do end up raising prices to keep their profits from falling too badly, but then demand, which is sensitive to price, declines. Businesses end up laying off workers, and we see the economic contraction that is so typical.

The way credit gets involved is a business that is losing money and laying off workers has no need for additional money to expand its business, even at a low interest rate. Elsewhere, I have used the example of a pizza delivery business. If prices of food and fuel rise, it needs to raise the price of its product. But consumers have no more income, so they order pizza less often. The pizza business has no need for new delivery vans, but continues to pay off the loans on the ones it has. It also has no need to expand the facility where it makes pizza, so it continues to pay down the loan there. If business is bad enough, it may even default on its loans. Aggregate loan demand goes down, if other businesses run into similar issues.

Eventually, the reduced demand for new delivery vans, and expansion of buildings to make pizza, and for everything else that is associated with high oil price causes the price of oil to start going down. The pizza delivery business starts picking up. But the owner of the business doesn't need to start adding new capacity, until its business has built back up again, to use the trucks it already owns, and the space for making pizzas that it already has. This is the reason for the inadequate loan demand, for quite a while into the cycle.

There are similar cycles with consumer credit and with home mortgages, again built on high oil prices. People who do not have jobs generally don't buy more expensive replacement homes. Neither do people who are living at the edge, and find food and energy prices rising. It is likely that a few of these folks may even default on their loans. The lower selling price for their home means that the new loan on the home will be lower, so aggregate demand for credit will tend to drop.

There are a lot of promises that aren't debt. Social Security and Medicare falls into this category. So are guarantees on pension plans and bank accounts. There are also guarantees on Fannie Mae and Freddie Mac. Insurance companies aren't guaranteed, but we saw what happened with AIG.

As I see it, the US government has made a lot of promises that it won't be able to keep. A lot of these promises don't carry the label "debt" though--but they are just as real a problem.

Part of social security is explicit debt the 2500 billion dollars of IOUs from the federal government that the social security trust funds holds. The pols and the media want us all to forget this debt. There is likewise surplus medicare money that was "borrowed" by the federal government but I do not know how much.

These are crimes against the people of the United States of America. Not one head rolled. The money was used for improving the appearance of the political tableau.

To explain the Social Security situation a bit more:

On Social Security, at least for a while, we were collecting a little more money than was paid out in a given year in benefits. The US government promptly took the excess funds that were collected for Social Security, and spent them on whatever it else it chose--perhaps the war that was going on at the time, or for funding other government programs, like food inspection. This is the graph I made for a post on Social Security I wrote back in April 2010.

In place of the money that the government took from Social Security, it left non-marketable bonds, that are often not included in government debt calculations, because it is "internal debt". Since we "just owe it to ourselves," some folks don't think it matters. But it is the availability of this debt for funding that allows the government to say that the program is funded until the year 2036.

It seems to me that we are now collecting less in funding for Social Security than we are paying out on an annual basis, unless these interest payments are included. As you can see in the graph, the amounts are getting closer together. What is happening is that benefits are continuing to increase, but the amount collected in taxes was cut back as of 1/1/2011, from 12.4% of payroll to 10.4% of payroll (subject to the wage cap), as an attempt at stimulus, in a place where this amount wouldn't affect deficit calculations. This amounts to cutback to a cut in Social Security contributions of roughly 16%.

What shows up as Social Security debt (at least in some compilations) only relates to the amount collected in Social Security contributions that the government collected, and then spent on something else. There is no debt calculated with respect to benefits payable in the future, even if contributions now are far short of what is needed to fund these benefits.

Trying to raise the Social Security payroll tax again will have a very un-stimulating effect on the economy. But it is off in a program with funny accounting, so no one notices.

It's funny that Obama and others have included SS recipients in the leading line of those impacted if the gov't shuts down. If SS simply paid out based on income for SS alone, there would be hardly any shortfall.

The party line seems to be "SS is important, SS pays for itself, SS trust receipts aren't debt" and "SS is in the cross-hairs 30 seconds after we hit the debt ceiling". Can't have it both ways.

Do not forget that "debt" - a symbol - is measured as a "number" - yet another symbol - and the "money" - yet another symbol and is inflated as more money is printed.

To ask for real numbers of what can be argued as a construct of Man made from laws and, well, believe .... that becomes an inclined surface which a light density oil product is placed upon. And for the nearly 6 years of this OIL-ly drum there has been many an attempt to figure out the meaning of the symbols of debt, money and the numbers used for said symbols. So far - not much progress and one might say with Fosse/Gail and others going elsewhere to try and assign some kind of meaning or numbers to debt/money/energy .... odds are you won't find "real numbers" here :-(

To give a more solid, dare I state ROCK solid example:

Zimbabwean dollar. Due to re-evaluation attempts in 2006, 2008, and 2009 the "real numbers" went down because they were defined down. Just like how the number and size of the notes were "defined upwards" by the application of ink to paper and the creation of the paper.

As an aside or perhaps a happy ending for the Zimbabwean people - the Zimbabwean dollar is now gone - done away with in April of 2009 and by the end of 2009 the Zimbabwean people are now a shining beacon of hope with the new path of Fission power.

http://www.newzimbabwe.com/pages/china17.13493.html

Somebody stop the planet, I want to get off.

We need to know net external debt on a country by country basis. Internal debt can be dealt with by the nation declaring all debts void. The same is true of external debt with the cost that no one will lend to the nation for a few years and the interest rate will be higher when they do lend.

I would find it remarkable if China were not in debt. They plan on building 50 nuclear reactors. Where did the money come from? And how will that borrowed money be paid back if all that electric power cannot be paid for as Americas lose more and more money to buy cheap Chinese goods (things generally that are not necessary from my personal experience).

China is set on a course to overbuild China thinking US consumption will resume. But US consumption cannot resume if credit is being destroyed.

China hold 1000 billion dollars of US federal IOUs. If China wants to buy 50 nukes even at 5 billion apiece that is just 250 billion dollars. I see no need for the to borrow. In fact most work will be done in China by Chinese so more like 1 billion to Westinghouse or the Korean Nuke company so 50 billion a small investment for them. Where did they get the money? Slave labor. Or rather free labor with no right to unionize, strike, or protest and so poor that if they did strike they would starve. No debt just a lot of poor broken workers.

Can anybody track down the truth in this statement? I've done a bit of looking, but the closest thing I can find is this:

http://www.nationalreview.com/corner/261637/ticking-time-bomb-interest-o...

"Based on CBO projections, by 2037 our debt as a percentage of GDP will be 200 percent. "

Where is this 36x figure to be found? 36 times would be 3600%.

Received the following, yesterday, about this post:

Thanks,

I follow Gail religiously.

Jim

James Howard Kunstler

"It's All Good"

Thanks! I had a chance to visit with Jim at Charlie Hall's Biophysical Economics conference in Syracuse this spring. He, Joe Tainter, and I were the anchor outside speakers at the conference. I should write about the conference.

That'd be great! I'm sure me and lots of other people here would eat it up.

Gail

Excellent article as ever, but you ignore the Elephant in the Room - Land.

As you can see, Fred Harrison was ahead of the curve back in 2005, and I find his account of 18 year property cycles pretty convincing.

The fact is that over two thirds of dollars were created and issued as mortgage loans: ie they are deficit-based, but land-backed, by the use value over time of land and buildings.

I think therefore that oil follows the land-driven GDP curve, rather than vice versa.

IMHO land is the engine of the economy, and oil the lubricant.

Having said that, I think that it is pretty clear that the run up in oil prices from 2005 as the market became financialised and supply/demand became tight was probably a strong factor in spiking the property bubble at the point of what I called Peak Credit.

In that context you might be interested in the first seminar I recently presented at UCL's new Institute for Security and Resilience Studies, where I am a Senior Research Fellow working on 'resilient markets'.

Flight to Simplicity - Slides

Flight to Simplicity - Talk

This is a start. Land is the most obviously limiting factor in any economic model. We are not making any more... and oil is the lubricant that multiplies the natural fertility of land through the use of fossil energy, reducing the need for human mechanical energy. Then science and technology is another multiplying factor, as pesticides, GM crops, weather satellites, computer controlled combined harvesters etc. etc. combine to increase the fertility further. Of course, we have to take into account other limits like water - either the limits of the local hydrological cycle - rainfall and river irrigation water, or water pumped out of fossil aquifers faster than they can be replaced. For a fuller picture you need to include the oceans and their finite supply of fish , and the finite inputs of phosphate fertilizers, and all that machinery needs to be built from ores that are becoming more and more energy expensive to mine and refine, and we need to model the waste products, fertilizer run-off, chemical and salt pollution of the land, CO2 emission effects on the climate changing the land's fertility... and before you know it, you have quite a good version of the Limits to Growth computer model from 35 years ago.

I thought the earth basically produces about 10% of the usable stuff, and fossil fuels produce the other 90%. At the end of the day, fossils make the earth more productive at least in the ways humans currently consume. But this is interesting thinking.

What % of the real cost comes from natural flows of the earth (not created by fossils) and what % of what is produced comes from fossils directly or indirectly?

Some things are coming from the earth but the fossils are killing them on the backside like with greenhouse gases. So maybe the earth production level is falling even as the fossil level falls since the climate is getting nasty due to the GHG buildup.

In any case, we will be producing a whole lot less in the years to come, which means consumption and debt both have to lower per capita. But what am I saying? I am talking like the system can be fixed.

Thanks! I am thinking that in the years ahead, interest will shift to land for its crop-growing potential, rather than land because of the houses on them. Houses in the US will still be in surplus. Of course, the situation is likely to be different in the UK, where there are more people and less land and houses.

Farmland prices have skyrocketed the past year. The article below is for the Plains but I recently saw folks were paying close to 10K an acre for good land in Iowa. Prices have tripled over the last decade for most states. If the price of oil keeps inflating then the price of grains will keep inflating and then the price of farmland will keep inflating.

U.S. Plains States Farmland Boom Continues, with 20% Year over Year Gains

Gail

I just looked at Chris' presentation.

(Thanks Chris.)

Regarding your, Gail's, point on land. With land used for cropping, I guess the key to 'value' is what surplus crop/product can be sold to the wider (mostly urban) population. Sustained high crop surplus will depend (as Ralph comments above) on sustained yields: mostly needing inputs of NPK fertilizer and water and labor/machines; in other words, in the USA, a lot of fossil fuel. Traditionally, land produced very little surplus over and above the food needed by the people doing the farming. The best historical 'pre-fossil fuel' sustainable ratio of producers to external consumers I know of was around 1:5 (in mid-19thC England); but even this ratio could not be sustained historically in much of American farming. Soil fertility in large areas of USA was essentially mined until the 1930s, when fossil fuel largely in the form of fertilizer saved the day. Similarly some places were mined for water, for example using up a large part of the southern Oglalla aquifer. Despite these inherent vulnerabilities though, the current huge surpluses of US primary production (actually in money terms a very small part of total money value of US food) would need to be cut off at the knees (i.e. serious reductions in fertilzers, diesel, machinery replacement) before US 'food production' failed? That could not happen because of a financial crisis or the earlier stages after Peak Oil; or could it?

NB I was interested in Chris' "dirty little financial secret" of the last decades; that middle-class Americans (also Brits?) have become less able to stay solvent - "secular decline of purchasing power". This reminds me of Elizabeth Warren's penetrating analysis (2006? pre-crisis) of 'US mom/pop + 3 kids' purchasing power and increasing exposure to risk. Chris says with regard to the property price bubble; "Servicing this credit finally exceeded the financial capacity of the US population ..."

phil

Regarding whether food supply could be cut off because of a financial crisis or the earlier stages of peak oil, I think the big effects of peak oil are going to be on the political structure and also on our ability to do international trade.

Regarding international trade, this could affect our ability to get fertilizer and diesel.

Regarding the political situation, a person doesn't know where this leads. We assume that Obama will be succeeded by another elected leader, and that elected leader will be succeeded by another elected leader. If the government doesn't have the funds to pay for the services it promised, major changes could take place. See my post How can a government fix its debt problem? for more thoughts on the issue.

this could affect our ability to get fertilizer and diesel.

And that is why the 'save the oil for the farms' post was made.

The old poster stranded wind had electricity -> fertilizer plan with the only fertilizer that "renews".

All the others need the waste loop closed and cities as now done do a VERY poor job of that loop closing.

there will have to be a loop from city to farm...

When I lived in Germany, many yrs ago, there was a businessman nearby who collected human waste ("Honey") from disposal tanks. No using septic systems there!

The waste was processed and dispensed onto nearby fields. I remember watching it get literally thrown into the fields.

Plus, of course, plant stems and other organic waste was returned to the fields.

Who in the US of A still remembers how to do sustainable farming? Who makes tack for the plows and other equipment? Shucks, even the leather straps would be problematic today!

No doubt, close in farming will be needed. By the time we get to it, there will be far fewer mouths to feed. Of course that is just my opinion, and I guess I could be wrong. Someone talk me down here!

Craig

This is an interesting idea. Just fold up the remains of the Federal system and dissapear with it into the void, like grifters after a sting. Sort of a combination of creeping anarchy and the Ultimate Debt Jubilee rolled up into one event.

If you look at a Government as consisting of its laws and institutions, I suppose that it's maybe possible. A government also is a huge collection of information. Think of all the records that wouldn't exist except for the Federal system. The institutions might go away, but I bet the information doesn't.

If the information stored by the government is preserved, then it will nessecarily have some effect on the instituitions that replace it, no?

PH: do you have a reference for that 1:5 ratio in mid-XIX England?

And as I was told by an old man who was tutored by some old dude before him - Land prices are a function of interest rates. The cheaper or easier money is to get the higher land prices rise.

The demand for land is a function of 'location' and population. Land values could become far less if you are at the end of a road with no energy for transport and/or no population creating demand. Something to ponder if one is thinking about land and money.

Interest rates and expected growth rates.

Simplest model is that capital value of land is equal to:

current rental rate / (the interest rate - the growth rate)

So cheap money in an era of positive expected growth rates does imply high land values. Today's world will be one of a dawning realisation that expected growth rates are negative. Therefore even with zero interest rates (or lower!) we can expect land price falls.

The is the value of land in the market economy and then there is the value of land if you need a place to live and grow food. It may have zero sales value but still be keeping you and your family alive.

Y'all are forgetting that there are many uses for land. The one that exploded in '08 was the value as a home. Since most people do not make money from their home, that can be measured as the time value of the money it takes to purchase and own the land, and the average should be about 25% of the takehome pay of the average worker as a monthly increment driven by cost of maintenance, taxes, insurance, interest and principal payments. rule of thumb, value of home about 100 x monthly takehome pay / 4. If you make $3,000 a month, you can afford a home of $75,000. At $8,000 a month, $200,000. Homes are still way above what is affordable. The reason people still buy is because they are convinced inflation will take care of the excess, and the economy will grow, baby grow.

Arable land should be valued by the estimated value of crops that can be grown, on a sustainable basis, using diminishing mechanical (ICE powered) and increasing animal power, natural fertilizers (deposited by those animals, and of course you and your family), such water as falls from the sky, supplemented perhaps by a bit of diversion from local streams (or in extreme emergency maybe subterranean sources).

In the thread above we heard that one farmer:five urbanites was the medieval standard. We have not lost everything, and will not lose the knowledge that we have gained since then. I believe that a 30 acre farm should be able to sustain the family, plus exports to the bakers, founders, farriers, leather workers, clothiers, etc., plus a bit for trade for exotics from overseas.

I am not that sanguine that we will progress to the point that an idyllic existence will be possible. There are dangers ahead... and we have not, as a species, shown any indication that we will make the changes needed. When we do not, we will discover the true nature of Homo Sapiens Sapiens. And we will learn whether or not we, or most living things, will survive. We live in interesting times.

There's rioting in Africa

There's strife in Iran

What Nature doesn't do to us

Will be done by our fellow man.

Kingston Trio -John Foster Dulles song

Craig

Craig

Just one point.

That 1:5 ratio, of food producers to external consumers, was not the mediaeval standard. In the Middle-Ages it was much much lower ('worse'). The reverse in fact.

More like 5:1 or 10:1. That was why towns were so small. Nine tenths of the population were out there growing the food for themselves and could be 'taxed' only perhaps to the extent of a tenth of their production.

In the example I gave, mid-19thC England was after an agricultural revolution, but before the industrial revolution got significantly applied to agriculture. By 1850 some 22% of the population of England could just feed the rest in the growing mega-cities. Similarly in Scotland.(UK needed imports big time from then on - the population growth had not even reached the rate inflection point, and my ancestor farm laborers were adding 9 children to a family). Soil N had increased by as much as 3 times in parts of crop production by means of rotation of nitrogen-fixing grass/clover swards, and the animals that fed on them. Manures in that system are only recycling, with losses of course, the chemicals fixed in nature or in the case of P&K, released from minerals. Long term even 'organic' England would have needed some imported P&K.

phil

With nutrients depleted the way they are, and without a plan for recycling waste as fertilizer, I wonder if we wouldn't do worse than the middle ages. Also, some areas that are currently arable may not be, without external fertilizer and without irrigation. Areas that are very wet or very dry are likely to be particular problems.

2 points:

1) Clearly not the case that gross debt has to peak with peak energy usage. I may only consume a bowl of rice a day, but I can agree to loan $100,000,000 to my friend if I also receive a $100,000,000 loan from a friend (not necessarily the same friend but the loop must continue until it's closed). One person's debt liability is another person's asset. Net debt could be considered to be the important quantity - but we live on a closed world so on aggregate, net debt is zero.

2) What is important is that businesses and individuals have borrowed on the basis of growth expectations which will not now be realised due to peak energy. These businesses and individuals therefore cannot repay these loans in terms of the real payments that were originally envisaged. There are two solutions to this: (a) default on the debt leading to economic collapse; (b) inflation so that the nominal repayments can continue (which therefore represents a lower real rate of repayment), allowing economic life to continue. (b) is clearly a better solution that (a) and it mystifies me to read criticism of expansionary monetary policy from people who clearly get peak energy (I thinking of Chris Martenson and his ilk). This article would be accurate if everything was real - but we can't ignore the nominal characteristics of most debt currently in issue.

This article would be accurate if everything was real - but we can't ignore the nominal characteristics of most debt currently in issue.

And how much of the 'not money' parts of the situation are not subject to manipulation? Darwinian makes a case often about veracity of the Kingdom of Saudi Arabia. Depending on the day, the topic and the TOD moderation staff the veracity of various States, Corporations and people have been topics here. There is more than just 'debt' being gamed.

What is our solid ground upon which we can take the staff of knowledge and a pyramid of information to move the boulders which block the path of progress?

*starts singing*

What is the Real life?

What is just fantasy?

On the backside of de-ple-tion, no escape to reality.

Read the new posts, reload TOD and Seeeeeeeeeee

Eric, thank you. A bit of Freddy Mercury is definitely called for here.

I'd rather see more turning of square corners by the people in charge.

I tend to stay away from the "inflate away debt" issue, but clearly that is what governments would like to do. Once potential lenders understand that inflation is likely in the future, interest rates should go up (or lending will be cut back).

I discuss the "every lender has a saver" issue in Part 2. I think the critical issue is that a lot of this debt cannot really be repaid, if we no longer have cheap oil and a growing economy because of peak oil. Thus, both the liability and the asset disappear, simultaneously. The demand pumped up by these loans is in some sense not real, or not sustained by the ability to pay back the loan with interest. We saw an illustration of what a drop in credit can do in late 2008. Oil prices dropped greatly.

debt cannot really be repaid, if we no longer have cheap oil and a growing economy because of peak oil.

Lets say there was no peak oil. Eventually with a currency and system backed by debt - any time there is a halt to growth the debt issue will happen.

Potable water is limited and so is Phosphorous as noted elsewhere in this topic.

TOD has a set of oil-coated glasses and will be biased towards "Oil is the reason'.

A money and debt system with an interest element will hit a wall when growth hits a wall. So is the problem the wall, the interest or a lack of growth?

I agree. Your comment reminds me of the first post of mine that was published on TOD, as a guest post in early 2007. What I am saying hasn't changed a whole lot.

And some religions figured that out and banned it.

Those religions are less popular in places with a growth->interest cycle and when the persons suffer from the growth->interest money cycle interest in those religions grow.

Figuring out there is a money problem will help prevent hitting THAT brick wall in the future and Man can move onto doing new and exciting things wrong VS the same old ones.

Eric and Gail,

I do not agree. Oil is unique primarily because it already consumes a substantial fraction of national expenditure. Almost all items are substitutable or non-essential.

There are other items that are not substitutable. Blood. The environments capacity to absorb abuse. While the argument that some resource will become limiting in a finite world with geometric growth is true, uncritically applying the lesson of peak oil to any commodity experiencing a shortage is not valid.

For example, certainly not water, which is so cheap we use it to grow lawns and wash shit off our cars. My apartment unit provides unlimited amounts at no cost.

Further, it is likely that many of the increases in various commodities are due to increasing price of energy. Commodity production is usually a bulk process that requires large scale inputs.

Daniel,

May I recommend you travel more (whilst we still can)? Visit random points on the earth's (land) surface and look at how people manage to live there, and what are their primary concerns. Given a statistical spread, I think you will find that most people place water higher than oil on their list of concerns.

Or, read the Limits to Growth book (or one of its updates). Oil is energy in a very convenient format. We can grow oil, just not enough of it for our current population and lifestyle. There is nothing unique about it.

Agreed. There are plenty of places in Africa where walking is the exclusive transport for 90% of the people, and water is the make or break issue for individual/familial/communal life.

Putting in water wells, especially highly reliable solar powered water wells can be very rewarding...following food, and work, the next issue is education for their family. I've actually never

heard an aspiration in these situations for any oil based transport.

Gentleman, that is not the point. Since I have been alive, food and water shortages have plagued Africa. Clearly in the past this was not due to peak water or peak food but local resource limitation.

Oil is unique primarily because it already consumes a substantial fraction of national expenditure.

No, its PLACE is unique because the build out of resources were done on the under-priced status of oil to date.

Almost all items are substitutable or non-essential.

Almost all about you is that. Your point?

Decomerf, I think your points are totally unrealistic. First we must agree that we are going to measure total debt in constant dollars, not inflated dollars. That being said however, since inflation favors the borrower and punishes the lender, if we have runaway inflation debt will probably shrink because no one want's to lend except at unrealistic interest rates.

But concerning point 1: You give a hypothetical example which is just not realistic. People could behave like they do in your example, but they don't. Gail is talking about a realistic situation, not something that could happen if we lived in a fantasy world.

In example 2, businesses do not willy-nilly expect growth in the teeth of a recession. They do not borrow. You will notice from the Figure 1 up top that total debt has been flat since 2008. Government debt has grown considerably but non-government debt has been shrinking considerably. That is because business' have not been borrowing and banks have not been lending like they did before the recession. Businesses and banks behave in a rational way, as near as they can.

Also defaulted debt is taken off the books as a loss. Mortgages that have been foreclosed are not carried as debt owed to the bank, or assets. As more and more loans default debt shrinks. The foreclosed homes are carried as assets but not as debts receivable.

More importantly, as oil supply plateaus or shrinks, so goes the economy, we have recession. This leads to the drying up of the money supply, fewer lenders, fewer borrowers. Debt shrinks.

However I have not been able to tie all this to government debt. It seems to me that as long as the government can print debt instruments and sell them, government debt can continue to increase.

Ron P.

But I'm not talking prospectively. There is a lot of debt now because businesses and individuals took on a lot of debt when they expected good growth. That growth has not materialised and the level of debt will kill the economy unless it's inflated away or there're orderly default arrangements. Real debt needs to shrink. That's my point. Inflation is probably the most economically efficient way of doing this. If inflation is going to be a major part of enabling real debt to shrink then peak energy need not mean peak (nominal) debt.

In the UK the official inflation figure is floating around 4-5%, banks pay around 0.5% interest. The result is that anyone with savings is being robbed. This means they spend less, which means the economy shrinks.

I would actually put the inflation figure much higher, around 10%. The government does not include the cost of housing, which has rocketed. Also most people will cut back and only spend on food and fuel, not all the other luxury items which are included in calculating this figure. Its fuel and food which is going up, not TVs, cars, computers, etc.

Add to all this the fact that a lot of people have seen their salary frozen, some are being actively cut, and other people are being forced from full time to part time work.

Inflation won't work, if anything deflation is more likely.

Inflation that erodes nominal debt has to mean salary inflation. Salary inflation has to be high and positive for people to afford debt repayments. Since the real economy has to shrink, because of energy constraints, that means price inflation has to be very very high!

Salary deflation does look likely given the current political situation (US, UK and especially EU) - but it's a recipe for disaster.

My savings are losing value rapidly. My salary has been static for years and I am now facing a pay cut of probably more than 10%.

House prices have remained more or less static these last few years, even rising slightly where I live because demand continues to exceed supply. My house is with about 12 times my current income. It is a very ordinary 3 bed semi. I am really glad I am not starting out buying it today. Prices must fall soon. Food and energy inflation are far higher than the official figures.

The best return I can get on my savings is to buy property for rent. After posts, maintenance and tax are allowed for, I should get a 5% return on investment. Not earth shattering but it will be the best pension I can hope for.

My worry - do I accept falling real value of my savings in the hope that a rapid fall of house prices means I get a better return in the long run, or do I risk losing it all in financial collapse and bankruptcy of the banks that hold my money?

I am really glad I have been out of debt this last decade. My outgoings are still smaller than income.

It seems to me that for people to have increased ability to pay back loans, salaries of people have to increase (even if accompanied by inflation in the cost of goods). It is also helpful to have more people employed, because unemployed people have a hard time paying back their loans.

We have been running into inflation in food and energy costs, but it is not feeding back into the salary system, in such a way that people are more able to pay their debts back. So it really has not been very helpful.

Gail - Perhaps Houston in the oil boom of the late 70's stands as a good model for you. With the oil patch booming you would get a 15%+ raise or you jumped to another company. Made it easy to live with a 10%+ inflation rate and 16% home mortgages. And you had to buy a house RIGHT NOW! LOL. Home inflation was running an easy 10-15%. And it wasn't just the oil patch making money...it did trickle down. Bartenders were making $50,000+ in today's $'s. Real estate agents were becoming millionaires. And then came the oil patch bust. Couldn't get rid of that 16% mortgage if you couldn't pay someone $50,000+ to assume the note. I think I recall Texas had more bankruptcy filings than any other state or combination of states. So many filings that judges weren't doing individual dismissals: would have a couple of hundred folks raise their right hand, swear an oath and then dismiss all their debt at once. A geologist with 6 years experience went from making $60,000/yr to making less than $20,000 from part time consulting.