Clean and Green Investment Forum — Summary

Posted by JoulesBurn on June 20, 2011 - 6:53pm

The following guest post is from Jonathan Callahan, a PhD chemist currently working as a data management / information access consultant. Jonathan writes on energy issues and data management at Mazamascience.com.

On June 6 and 7, I attended Opal Financial’s Clean and Green Investment Forum. I was invited to take part in a panel on “Green Energy in Emerging and Frontier Markets”. The forum brought together clean tech entrepreneurs and investors as well as a few academics and analysts and proved very stimulating. The overall vibe was one of optimism and opportunity — we’re talking entrepreneurs and investors here. This post will discuss presentations in the following categories:

- Government policies and private investment

- Utilities and grids

- Electric vehicles

- Batteries and fuel cells

- Biomass and algae

- Wind

- Solar

Disclaimer — Opal Financial paid my airfare and hotel room and waived the conference fee.

Government policies and private investment

Several speakers addressed the importance of government policy action in supporting the adoption of renewable energy during their talks.

The keynote speech was given by Suedeen Kelly, who served three terms as FERC commissioner under Bush and Obama. Kelly emphasized how energy is different from other markets in that it is highly regulated by the government. She foresees significant action on the energy policy front but admits that change can be slow. Kelly described the Federal government’s role as providing the 3 M’s: Money in the form of grants and tax credits; Markets where the government is a large buyer of renewables; and Mandates ranging from open data requirements for public utilities to energy efficiency requirements in government agencies.

Patty Hargreaves described Ontario’s 2009 Green Energy Act (GEA) which aims to position Ontario as a leader in the adoption of renewable energy and the creation of clean tech jobs. Important features include a generous feed in tariff (20 years at 8x market rate) which has resulted in the creation of 15,000 jobs in the local solar industry. Also found in the GEA are simplified regulations for installation of solar panels as well as the closure of all coal fired plants by 2014. (By comparison, Washington state residential incentives amount to $0.54/KWh (7x Seattle retail) until 2020 for systems with Washington sourced components. Washington also plans to phase out coal by 2025.)

Ed Trello said “These are exciting and scary times for utility executives.” He described our aging energy infrastructure and suggested that $1 Trillion in capital will need to be spent on new generating capacity in the coming decades. Utility executives are unsure of what role renewables will (must?) play as there is no national energy plan. The US still has lots of coal and natural gas and these are the safe bets for many executives. (I’ll add my voice to those complaining about the lack of any Federal Renewable Portfolio Standards (RPS) or of any national policies aimed at decoupling utility revenue from electricity sales.)

Other speakers emphasized the importance of tax incentives and RPS in jump starting the US renewables market. Unfortunately, these are implemented primarily at the state and local level resulting in around 1900 financially separate electricity markets in the US. (Check out the DSIRE database.) Investors in energy technology have a difficult time penciling out returns with all this complexity, especially given the temporal nature of credits, rebates and RPS. All of these are subject to change every election cycle.

A few speakers described how venture capital has been slow to move into the renewables space as rates of return are perceived to be low despite the fact that the energy market in the US is a multi-Trillion dollar market. Clean tech is capital intensive and slow moving. It’s hard to imagine Google- or Facebook-like returns when manufacturing solar panels is a lowest-cost commodity market and returns on utility grade systems are subject to regulation.

Several institutional investors, on the other hand, described seeing increasing demand for “green” investment choices in retirement plans. Large net worth family funds are also seeking out green investments as a younger generation takes the reigns and demands alternatives to their parents’ investment choices. With limited investment options, some fund managers seem to see today’s green investments as “getting in early” on what they suspect will be a much broader generational shift in investor sentiment.

Utilities and grids

Based on what I heard from several speakers it seems like focusing on utilities and their electric grid is an excellent place to look for significant efficiency gains.

Lanny Sinkin of Solar San Antonio described how CPS Energy, the nations largest publicly owned utility, did an about face on conservation when they hired a new, younger director a few years back. (There’s that generational issue again.) Instead of lobbying for a new nuclear reactor, the utility now promotes energy conservation and distributed generation with wind and solar projects.

John Loporto of Power Tagging described their technology for sending packets of metadata around on the grid itself, making it easier to know how to reroute during outages and where voltage dips occur. Currently the grid operates near ~120 Volts in order to guarantee that ~110 V is available to each household. By knowing where additional voltage regulators are needed, utilities can reduce operating voltage throughout the grid to ~110 V resulting in a 6% efficiency gain. (Impressive!)

Another speaker talked about investment opportunities for fast-response, grid-scale storage — big batteries. He sees a whole new field of “digital electricity management” emerging and suggested that security concerns may push the development of “micro-grids”.

“Smart grids” didn’t get that much play at this conference even though a couple of people did mention the need to tread very lightly with respect to demand side management. For 100 years, utilities have been intensely focused on customer expectations of reliability and any whiff of intermittency goes against everything they stand for.

Clearly, there is a lot of work and a lot of opportunity for engineers and investors working at the utility and grid level.

Electric vehicles

As is already evident, Peak Oil will affect transportation much more severely than other sectors of the economy as it accounts for a large percentage of the energy used for transportation (95% in the US). The presentations on vehicles showed that steady progress is being made but cost is still a significant barrier to widespread adoption.

Ed Baxter described a new electric vehicle from China, the Zotye electric SUV, that he claims will do a much better job of meeting consumer expectations than current offerings. Marketing material claims it can travel up to 250 miles on a charge. The car should appear in the US sometime in 2012 with a 3 year/36,000 mile warranty as well as a 185,000 mile warranty on the batteries all for $30K. He expects 3 million EVs to be sold by 2015. (No wonder he’s investing in this!)

At a lower price point Mark Frohnmayer of Arcimoto presented their commuter vehicle which is designed to get a single person across town and back without getting wet. As a three-wheeled motorcycle it cuts a lot of corners compared to a real car but he is trying to design a “sustainable vehicle” for the sweet spot that meets perhaps 80% of driving needs — a single person traveling moderate distances without much stuff. Even though these vehicles will be hand built in Eugene, Oregon (of course) he expects to be able to sell them for under $20K.

Obviously Arcimoto is targeting a niche market but how low could the price get with a real manufacturing process and economies of scale? In the face of increasing fuel costs could an inexpensive enclosed electric 3-wheeler find a market among middle class commuters? I think the answer is a definite ‘maybe’. Both presenters agreed that EVs’ current role will be mainly as an extra vehicle for urban driving, not as a replacement vehicle. But urban driving accounts for a lot of miles!

Batteries and fuel cells

On the battery front we heard mostly about fuel cells though Phil Roberts of Ionex Energy Storage mentioned that lithium-ion battery costs are coming down and that graphene-enhanced lithim-ion batteries are moving out of the lab and into production and will dramatically improve charge-time, energy density and cycle life. One of the major uses for grid-scale battery systems is to store and even out the intermittent power coming from wind and solar. As battery technology improves, the viability of intermittent power sources will also improve as we learn to shape power on both the production and demand side.

Fuel cell presenters included folks from the California Fuel Cell Partnership, BTI/Fuel Cells 2000, UTC and First Element Energy.

I have not paid much attention to fuel cells recently after their failure to prove competitive in powering electric vehicles. I was surprised to find out that fuel cells are currently a $1 billion market (85 MW shipped in 2010) that is expected to grow to $5 billion by 2016. There are many different fuel cells with many different operating characteristics for different niche markets but they all offer high reliability, quiet operation and long operational periods. That’s why the military buys them. And telecom has been an early adopter of fuel cells for backup power. (Perhaps nuclear power plants should be required to have fuel cell backup power.)

It turns out there is one area of transportation where micro-fuel cells have caught on but it was a total surprise to me — fork lifts. Apparently, productivity is increased by longer run times and consistent voltage in cold storage. Recharge is only 2-3 minutes which means you no longer need the battery room, the recharge station or the guys manning either of these. Walmart sees an IRR (Internal Rate of Return) of 20% on capital spent on fuel cell forklifts.

Biomass and algae

Of the various sources of renewable energy, biomass is the one we hear the least about, probably because it doesn’t involve high tech innovation. Americans are fanatical about high tech solutions even when low tech solutions are more easily available. (We’ve all heard the US space pen vs. Russian pencil joke.) In northern Europe biomass is more in the forefront. The thing to remember about biomass is that it is baseload as opposed to intermittent wind and solar sources. This means that generators fed by biomass or biogas from animal waste digestors can operate when wholesale prices are high thus earning a higher rate of return on investment.

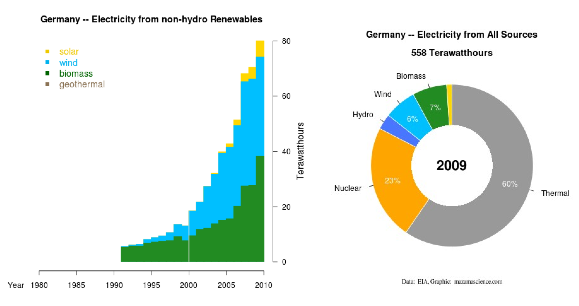

James Johnston of the Center for the Advancement of the Steady State Economy described how regulations in densely populated Europe de-incentivise landfills which thus increases the demand for incineration of waste. By comparison, Carey King of UT Austin stated that 50% of all municipal waste in the US is landfilled. He also described the animal waste resource as 1 billion tons annually — enough to generate over 50 Gigawatt hours of electricity per year (2% of US demand). (I wonder how much of that waste is currently used for fertilizer.) In my own talk on International Energy Trends I presented charts using EIA electricity data that clearly showed the importance of biofuels in some European countries. Figure 1), for example, shows the renewables trends and current state of German electric generation. Despite rapid growth in wind and solar, biomass still accounts for about half of renewable generating capacity.

Algae was the other big biomass theme. Several speakers made the case for algae based biofuels with the following list of reasons (I’m just reporting here, not vetting them):

- algae is 25-50% lipids by weight

- algae produces more lipids per acre than soy or canola

- algae uses 1/7 the water of soy

- algae’s proteins are often more valuable than the biodiesel generated

- refinery costs are lower

Jonathan Trent of NASA Ames had perhaps the most interesting talk in which he described the OMEGA project. Thinking outside the box, his group looked at California’s 2 billion gallons of wastewater per year (water + fertilizer) and algae’s prolific growth rates and determined that the only impediment to large scale algae farms was the cost of land. But moving the algae farms to floating pens just offshore solves that problem along with the need to stir the algae and dissipate the heat generated. Given that much of the world’s population lives in coastal cities without adequate sewage treatment, this idea may have legs.

Wind

Wind advocates at the conference reinforced the notion that the cost of wind is rapidly approaching grid parity in many locations.

Mark Crowdis of Think Energy described how “large wind” is growing in Europe and China and how capacity factors in the US have increased from 30% in 2003 to 50% today as turbines get both larger and lighter. Another speaker described how wind farm capital costs have come down because of low priced generators from China and how wind power was approaching grid parity in many parts of the world including the Windy City (aka Chicago). Ward Lenz of North Carolina’s Dept. of Commerce described their efforts to promote offshore wind turbines in part as a jobs measure — wind energy creates many more permanent jobs than nuclear, for example. In a recession, the jobs angle helps policy makers stand up to utility interests.

Corwin Hardham of Makani Power gave a presentation describing his tethered “Airborne Wind Turbine” system. It’s basically a small remote controlled plane that can act as a tethered kite once airborne and carve out a large path at high altitude with a fraction of the materials and weight of a typical wind turbine. It’s a very clever idea for Megawatt scale power generation and their site has some lovely animations of the basic concepts.

One of the reasons a conference like this one is interesting is that you can have conversations with the wind folks and then the battery folks and then the smart grid folks to get a glimpse of what the end-to-end system might look like. As inventors and investors of course they are all optimistic about the opportunities. And they left even a skeptic like myself quite impressed with the possibilities.

Solar

The various panelists discussing solar energy were perhaps the most confident in the future cost effectiveness and global scope of their solution. And more than one pointed out the equally distributed nature of sunlight and the universal scalability of the solar solution from utility deployments down to Bangladeshi off-grid households.

Suvee Charma of Solaria Corporation described ongoing cost efficiencies in producing crystalline silicon panels. They have actually gained ground on supposedly cheaper thin film products in recent years and he suggested they are headed below $1/Watt in the near future. Modularity is one of solar PV’s greatest strengths because the manufacturing process is identical for both residential and industrial applications. Other speakers concurred with the < 1$/Watt figure and said that installation was now a greater expense than the panels themselves.

In the session on Residential Solar, Tom Faust of Redwood Renewables and Marc Irvin of Sungevity talked about the hurdles to adoption in the US including primarily financing and, especially among women, aesthetics. They see residential solar as a very young and vigorous market right now (100% growth in 2010) with the potential to grow into a multi-trillion dollar industry. Lanny Sinkin described how San Antonio has worked with local credit unions to provide financing for residential solar that brings the cost down to $35/month and how this has resulted in the installation of $2.5 million worth of residential solar in Bexar county with the resulting boost in jobs.

Indeed, the distributed nature of residential solar generation and the blue collar jobs it creates may be one of its biggest appeals.

Conclusion

I have tried to give a meaningful recap of what I found to be a very stimulating forum. In the interests of space I have not covered every forum, skipping important topics like green construction and utility scale solar thermal. What is presented above reflects my own personal interests more than the quality or content of the presentations.

I have included the names of speakers and their companies when I wrote them down not in order to promote them but rather as a resource for any further investigation or fact checking readers may wish to perform. This was, after all, an investment forum and one would expect to hear only the rosiest of scenarios.

Nevertheless, I came away impressed with the amount of human energy and potential sources of capital that are poised to address energy issues. The key themes I came away with were:

- Implementing solutions at the institutional level is very challenging.

- Societal perceptions are very important but we are currently experiencing a generational shift in those perceptions.

- Job creation needs to be an integrated part of any energy solution.

- Solar panel prices will continue to come down.

- Energy solutions may occur at a much more local level than we have previously imagined.

Perhaps “Power to the People” is more than just a metaphor.

Thanks for the informative post. I am skeptical about most claims but am still harboring some optimism.

Skeptical is good, treeman. Unless energy opportunities have been proven, utility choices, however, are constrained by law to what is therefore fundable. Space Solar Power is a great example of a choice utilities should have but cannot make. From this weeks' Space News:

Green Power from NASA

Solar Power Satellites were a TOD thread a few weeks ago.

I think at the time of the NASA studies it was not nearly economical. So they did not build a prototype. Now what is taking the Japanese Space agency so long to do their prototype today is a better question.

The Space Based power cost model dictates launching solar panels for less than $100/kg. The space shuttle costs $10,000/kg. SpaceX is down to $1,000/kg, not bad but we still need another 10x reduction in costs.

Current technologies can get us there, we just need the political will. Prying loose the lobbyists grip on DC is our biggest problem.

National Renewable Portfolio Standard. Even George W Bush called for an national RPS at last years wind conference in Houston.

National Renewable Portfolio Standard.

National Renewable Portfolio Standard.

National Renewable Portfolio Standard. National Renewable Portfolio Standard.

National Renewable Portfolio Standard.

National Renewable Portfolio Standard. National Renewable Portfolio Standard.

National Renewable Portfolio Standard.

Is there an echo in here?

What about nuclear?

http://seekingalpha.com/article/276006-nuclear-power-is-here-to-stay

Regarding grid efficiency:

I would require some elaboration on this, as higher voltages usually result in higher efficiencies. It comes down to volts*amps=watts. Reducing voltage doesn't reduce watts consumed; it only ups the amperage, in most cases increasing losses via resistance. Maybe I'm missing something. Some sort of load balancing act perhaps?

BTW: The grid operates at much higher voltages than ~120. It only gets stepped down to 120 at residential/light commercial transformers, and only in the US (with perhaps a few other exceptions). Just a minor point.

Thanks for the post, Joules!

update: OK, I went and looked a bit; found this:

Voltage Conservation, Cellular Big Issues for Grid in 2011

More layers of complexity, more brittleness, more costs; I still can't see the following gains in efficiency of the overall system, just more ways to extract capital, or a way to manage brownout episodes. Applying this technology to small/micro/distributed grids may be beneficial, but we're a long way (and a lot of $$) from that.

grid weenies ....

Voltage control like this has a bunch of trade-offs that are increasingly difficult to evaluate. Reducing voltage would reduce power drawn more in the past with just resistive loads like resistance heaters and incandescent light bulbs. Lower voltage means lower current drawn. However this is changing. First, induction motors in refrigerators and air conditioners don't work this way. If you reduce the voltage a bit on a loaded motor, it will draw more current to keep turning the load at the same speed. Increased current in it's wires means it runs hotter to produce the same output power. This also means lower efficiency because of more heat generated. This is why fridges and A/C can be damaged by too low voltage i.e. <105 volts. Now with CFL and LED lamps, the same thing happens, the electronics keeps the load (fluorescent tube or LED) power constant by drawing more current as the voltage is lowered. I suspect the same thing happens with the new inverter type of A/C compressors. Every TV that I've seen in the past couple decades has a switching power supply that does the same thing too. No reduced power consumption. But more line loss because of higher current, therefore more I2R loss, in the distribution lines.

There have been plenty of studies in the past that evaluated using voltage control (lower the voltage to lower the utilities peak power drawn from the generating plant) as a way to shave peaks during peak time of the day. Many conflicting results all depending on the mix of load types.

"Reducing voltage would reduce power drawn more in the past with just resistive loads like resistance heaters"

And since the heater is on because you want heat, reducing the heat output per unit time keeps it on longer. No gain there.

The inverters make AC into DC, then switch it back to AC at some other frequency. They will pull as much power as they need, and as P = I * E, if E goes down, I goes up. No gain there.

The notion doesn't work as well as it used to in the days when most of the electric load was lightbulbs and toasters. (And the toaster would just stay on longer to toast the bread.)

If the utility company drops the voltage, the power supplies on computer equipment will automatically step up the amperage to compensate. This can be really bad if there are network server farms on the grid, because a big server farm can draw as much power as a small steel mill. The increased amperage can overload the distribution system and trip the circuit breakers.

A lot of other equipment operates less efficiently at lower voltages, and will compensate by operating longer hours at higher power levels.

I don't think they really thought the concept of lowering the voltage through all that well. It only works if there is a lot of dumb equipment on the grid, and there is less and less dumb equipment on it all the time.

I agree completely. Yet, when I worked at the rural electric co-op and talked to others in the industry, from Elster (mentioned in the original post) to other professionals, it was like a edict from the Bible that reducing voltage reduced power.

I couldn't get them to understand how today's equipment worked! Yet, these are the people pushing the "Smart Grid"!

In answer to all of the posters above.

I didn't hear anyone suggest reducing voltage at the outlet below 110 V. My understanding of the problem is this: Utilities need to maintain local, substation level grids at ~ 120 V because they don't have detailed information of the loads at the very local level and they don't know when and where additional load will come on line. If they keep the local grids at 120 V they can guarantee that the outlet voltage will always be 110 V even in the face of surprise loads. By making the grid "smarter" about the local load profiles, they can shave off some of that 120 V and still guarantee 110 V at your outlet.

I know there are a lot of readers here with electrical knowledge. (I have a little myself.) But I am somewhat surprised at how willing people are to assume that utilities and companies supplying don't understand the basics of electrical transmission and changing loads. I would assume they know a lot about these. It would be nice to see a comment from someone currently working in this domain.

Jon

I guess I'm not on the same

pagegrid, Jon. Grid voltages, transmission and distribution, are held well into the kilo-volt range. The only place 120/240 volts exists is near/at the point of use, the "secondary customer", including residential...http://en.wikipedia.org/wiki/File:Electricity_grid_simple-_North_America...

...and I still haven't seen it explained how reducing voltages increases efficiency without some form of load control. We're still stuck with kilowatts (KvA). Perhaps what's being discussed is load control via smart transformers.

Our local grid (the one I'm not connected to) recently increased the distribution voltage from 4Kv to 13Kv (IIRC) to increase capacity and efficiency....and, whoops!, someone screwed up, failing to change out some (dumb) residential transformers. When they restored the grid to these people, POOF! They fried virtually everything in these homes.

Thanks for that information Ghung. That chart is perhaps the best explanation of the overall grid I've seen.

Conservation Volltage Regulation (CVR) applies only to the "last-mile" for the secondary customers in the chart. Googling on "Conservation Voltage Regulation" I see a couple of companies working on this. Seattle area MicroPlanet has a great explanation on one of their pages:

That looks like a sales brochure instead of an engineering explanation.

Most modern equipment will show little efficiency difference across the 120±6-volts range. Resistive heating has been regulated by thermostat "forever", and will draw the same average wattage (by varying the duty cycle) irrespective of the voltage. Refrigeration will come very close. Electronic equipment including LED bulbs has regulated power supplies nowadays, which will also draw more current at a lower voltage. In both cases, the same wattage at a lower voltage means more current, and more loss in the line.

The major exception would seem to be incandescent light bulbs but even that is an illusion. The light output goes roughly as the 3.4 power of the voltage, so if one drops the voltage by 10%, from the top of the range to the bottom, light decreases by about 34%, which is rather drastic. The customer may well compensate by using the next-size-up light bulb - 100W instead of 75W would almost but not quite do it. That would increase power consumption around 18% drawing more current, and again increasing the line losses. (But this is a second-order or knock-on effect, so we can ignore it, right? After all, it's the noisily paraded good intentions that count.)

In reality, RMG is right that the system would be more efficient at 240 volts but we're stuck with history. And it might well be more efficient if shoots towards the top of the 120±6 range rather than the bottom, though that too might have side effects.

I'm guessing this nonsense caught on because some theoretician looked at Ohm's Law, E=IR, and had no clue that there might be overcompensating knock-on effects, and someone else said, gee, I can use this to persuade ignorant managers to buy more stuff. But then again, this is par for the course in the "green" world these days, theoreticians promoting poorly conceived wand-waving schemes that often prove impracticable, ineffective, or even counterproductive, at the social or scientific level or both.

You're absolutely right! As soon as I saw this quote "If power is delivered at a voltage higher than 114V, energy is wasted." I knew the person writing it didn't have a clue. It sounds just like these "devices" you can make to use the "wasted" power out from your car alternator to electrolyze water and use the hydrogen to run your car. There's no actual understanding of how these things work together in the real world. Almost any kind of device today, from A/C with either induction or inverter compressor to heater to fridge to TV to computer will draw the same average power over a range of voltage.

Your last paragraph describes the situation perfectly.

This statement "Currently the grid operates near ~120 Volts in order to guarantee that ~110 V is available to each household. By knowing where additional voltage regulators are needed, utilities can reduce operating voltage throughout the grid to ~110 V resulting in a 6% efficiency gain." is complete BS. Saying that just by reducing the voltage to 110 where it is now higher gives a 6% efficiency gain is BS!

PaulS and augjohnson. I appreciate the knowledgeable skepticism. That is what I come to TOD for and why I wanted to air some of these ideas out here.

But I'll continue playing the optimist even though I have no personal expertise regarding CVR. Would either of you care to care to explain what is wrong with the following technical presentation from a 2009, BPA sponsored Utility Energy Efficiency Summit?

Conservation Voltage Regulation

This page also has a nice collection of referenced articles with positions both for and against voltage regulation as an efficiency measure.

I'm not trying to be pollyanna here in continuing this conversation. But I see plenty of evidence from utility professionals that CVR is one of the tools they are spending millions of dollars to evaluate. It's hard for me to write off as "BS" a technical solution that is currently being deployed and evaluated by non-profit utilities.

Jon

The PDF is too long to do more than skim for now. It's filled with assertions. Much of the data seem to be old enough not to reflect modern (< 10 yrs old) device power supplies; in part they're shooting at a disappearing target. The "conservation" power law range of 0.5 to 1.5 is at least suggestive, since 1.5 might be obtained with the most ancient (and utterly un-"smart") sorts of loads (such as tube TVs back in the 1970s, or resistive entryway heaters having no thermostats, or inductively ballasted streetlights, all of which are gone or going away.)

There's also the little matter of confounding factors. They also did power factor correction (listed as "capacitors" on page 10), and load-balancing of the two sides of the feeders; if those things were bad enough to begin with, it can be reasonably (and genuinely) important to fix them.

Bottom line, though, is you increase line losses as you decrease voltage, for the same wattage. Period. (For ancient stuff, "the same wattage" may not apply, but that's the disappearing target.) That's an ironclad result of Ohm's law, and there's no arguing about it except possibly in the most absurdly contrived circumstances. At the extreme, it's also why normally we run only low-power appliances on 12 volts - otherwise the quantity of copper becomes absurd. (But it's confusing, as per what I said about incandescents. In the immediate term, drop the voltage and those draw less with an exponent of about 1.6, but in the longer term people will notice the dimness and put in bigger ones until they're back to what they prefer. Aging of the population will help that along a little, too. This is a bit like long-term versus short-term elasticity in economics, another concept wishful thinkers sometimes refuse to grasp.)

Ever fewer appliances are of the sort that draw significantly less power as voltage is cut (which might eventually affect grid stability - if everything had a properly functioning switching supply or induction-motor controller, you cut power draw ever so slightly by raising the voltage, since that cuts the (small) line loss.) If any appliances are working significantly better at 114V than at 120V, then there's a need for their makers and the electrical utility industry to have a long chat and decide on a nationwide nominal voltage everyone should shoot for, rather than have assorted theoreticians shooting for different targets based on devil's mixtures of science and mythology. I can imagine us carrying this to absurdity, by first getting most utilities to re-standardize on 114V instead of 120V, and then some genius says, gee whiz, let's rinse and repeat even better, go to 108V - then to 102V, and so on down the line.

IOW the voltage reduction itself is farcical on its face even without need of studies or papers, giving a dubious one-shot result, and giving it in a manner that compromises standardization and thereby might even hamper future conservation a bit (a pesky second-order effect of the sort that eager geniuses suffering from messiah complexes like to ignore.) A permanent voltage cut simply leads to everything being designed around the lower voltage, with its greater line losses. Much better to standardize on 120 volts simply because that's where most everyone is at, and tighten the tolerance downward from 5% if there's a good case for it, rather than confuse everything by forcing designers to chase moving targets.

Assuming that some devices draw constant power, if you lower the voltage by 5% you are going to increase the current by 5%. Since line losses are proportional to current squared times resistance of the transmission line, a 5% increase in current results in a 10% increase in power losses. You need to look at all the devices and how they behave after a drop in voltage.

Yes, you do. Still, in the end, the permanent voltage reduction makes no sense, regardless, because there will be a rebound as appliances (even any constant-resistance types that are left) are redesigned for the lower voltage. After a much longer time, of course, new or retrofitted building wiring may be made heavier to compensate for the losses. So it's just a game, where extra wiring losses will be incurred for decades, followed by a phase where extra deadweight copper costs are incurred forever.

Jon, I've written something. It's longer and more detailed than what PaulS wrote, but basically says the same thing. It's not that well written, I just quickly responded to what I saw in the presentation. If you want, I can email it to you or I can go ahead and post it.

Every thing mentioned in this “Conservation Voltage Optimization” scheme except lowering the voltage to 110 is actually something that should be done to reduce the losses in the distribution system. All of these will provide a benefit for the utility. Power quality will be improved. Not one will reduce billed energy usage by the consumer. I think someone decided to add a bit of the handwaving that PaulS mentioned, the waving hand is holding a paintbrush full of Green paint. Maybe they decided to jump on the Greenwashing bandwagon.

I know that the Rural Electric Co-op I worked for was always under tremendous pressure from the consumers who were always complaining about their electric bills and our rates. I see this as a way the the utility can add some fluff to a normal system upgrade that they can use to tell the consumers “we're doing something for you” and get the state corporation commission off their back for a little longer.

PaulS and augjohnson,

Thanks so much for the detailed responses. Again, this is why I come to TOD. I'll be attending a public Washington State Energy Strategy meeting next Tuesday and the comments you have provided may come in handy if I hear any too-rosy predictions about CVR.

augjohnson -- Why not append your comments to this thread. It will make it easier for me and anyone else to find in the future.

OK, here's my rough notes:

Page 8 – They show that they calculated Customer Energy Saved from this formula

= dE / dV x dV x Substation Annual kWh

E is probably the energy the customer used? It doesn't make sense. They are assuming that the voltage reduction squared is directly influencing the energy reduction! Where's the proof of this?

Why are they not just measuring the energy saved instead of the formula with a V2 in it? I'm guessing this comes from using the formula Power =V2/R. A few tests would show a difference, if there was one. There's a lot of “theoretical” in here, no measurement. I see that they continue to do all these "calculations" for the so called Energy saved. PaulS's Hand Waving? The data from the utilities records will never be clean enough to prove this over a year, the noise will be much larger than the supposed “savings” of 2.07% for the consumer. Also, doesn't anyone know about significant figures?

The second part of this page shows where the real improvements came from. These things were also done to improve the distribution system. Each of these makes very definite improvements.

Feeder load balance by phase – Make sure that the loads on the three phases of the feeder from the substation are equal. This makes the substation feeder transformer run cooler/with less loss. Systems get out of balance over time if single-phase loads are added/removed without keeping up on the balancing.

Feeder Power Factor – If you notice on page 10, capacitors were added as part of the CVR “experience”. This improved the power factors on the feeders and also contributed in two ways to lower losses. It again reduced the strain on the substation feeder transformer and it also reduced the line loss by reducing the current on the feeders.

Feeder Line Drop – Again referenced on page 10, they re-conductored the feeders, that means they increased the size of the wire to reduce the voltage drop. Better voltage at the end of the line. Another efficiency increase.

Page 9 – They say “Constant Power Load includes Resistive Heating and some Air Conditioning”. Constant power in what way? Resistive heating will, on the short term drop the power on lower voltage. Only “some” air conditioning? That's because A/C behaves the way that I and RMG said. Lower the voltage and the current goes up. Constant power. Sure feels like definitions are being played with. Also rather old stuff, modern equipment acts very differently with it's good switching power supplies..

Every one of the things on page 20 will improve efficiency and improve the voltage regulation and quality at the customer. Every distribution company should do these things, there are a lot of them that haven't done these in decades.

As you see from the list of articles that you provided, it's something that is of debatable use. I actually have read that paper in #2, about 6 years ago. It covers the things that PaulS and I mention. Some of the others are mentioning using capacitors to raise and lower the voltage. Well, that's a side effect of using capacitors to optimize the power factor on the line, there will be lowest loss when the power factor is highest. You are using the capacitive reactance of the capacitor to counter the inductive reactance of the motors and other inductive loads/transformers on the power line. This keeps the voltage and current on the line in phase.

Every thing mentioned in this “Conservation Voltage Optimization” scheme except lowering the voltage to 110 is actually something that should be done to reduce the losses in the distribution system. All of these will provide a benefit for the utility. Power quality will be improved. Not one will reduce billed energy usage by the consumer. I think someone decided to add a bit of the handwaving that PaulS mentioned, the waving hand is holding a paintbrush full of Green paint. Maybe they decided to jump on the Greenwashing bandwagon.

I know that the Rural Electric Co-op I worked for was always under tremendous pressure from the consumers who were always complaining about their electric bills and our rates. I see this as a way the the utility can add some fluff to a normal system upgrade that they can use to tell the consumers “we're doing something for you” and get the state corporation commission off their back for a little longer.

That's about it. Everything they did is of some value, with the exception that it's blindingly obvious that it's a bit wasteful in all but the very short run to reduce the voltage permanently, though it might possibly be ever so slightly helpful to regulate it more tightly. (Quite the opposite, 240V would have been better as RMG said, but, history.) The handy thing about electricity is that the physics is fairly "simple", so if one does the math properly one can feel reasonably confident about small savings that, empirically, will often be lost in the noise. Big savings, if any, will have to come from elsewhere, such as replacing old inefficient power plants and power-consuming equipment; that will not come free. (Smaller but measurable savings might come from such things as damping down the competition for ever-brighter outdoor lighting and directing it where it's needed instead of into the sky.)

I think we can categorise this whole CVR exercise as an "operational improvement" - it will, as pointed out here, make incremental improvements to, and eliminate some minor losses from, the grid. From that point of view, it is up to the utilities to decide if it is worth doing, to reduce the parasitic losses in their systems.

But no one should be kidding themselves that this is an any way a game changer of any sort.

A quick note on resistive loads - there are still plenty of them - domestic water heaters first and foremost, and baseboard electric heating, particularly in places with lots if cheap hydro, like the PNW, BC, Quebec. In the southern sun states, not so much! Again, up to each utility to work out if this is worth the effort. they may be better off to getr people onto ductless mini split heat pumps instead of baseboard, and to heat pump water heaters, or even the very simple but effective change that you can see here from the three element water heater as promoted by Hydro-Quebec. If everyone had those, that would likely solve more voltage problems than the CVR equipment

There will be other examples of incremental efficiency improvements to the grid, and these should be evaluated, and implemented where appropriate, same as any business tweaks its operations. But the greenwashing is unneccessary - often it is to shed the image if utilities as being stuffy, conservative entities - which they typically are - and, to some extent, should be. Like health care, police, or the fire dept, delivering electricity is a serious business - it does not need excessive "marketing" and "PR" to be done properly, it just needs to be done properly.

This comment pertains to the whole foregoing discussion of CVR, not to Paul's comment, which happens to contain the last mention of CVR at the time of my posting. In particular it pertains to the use of Ohm's Law in reasoning about how power systems work. There seems to be an assumption that electric resistance is a simple invariant concept. But resistance is temperature dependent, and heat is generated within *all* functioning electrical equipment from the smallest computer chip to the largest electric power generator. For all electric conductors the ohmic resistance depends on temperature. Typically for metallic conductors the resistance increases with increasing temperature, and for semiconductors the resistance decreases (and quite dramatically). These resistance changes must be accounted for in any reasoning about how things electrical actually work over time.

I am a supervising senior distribution engineer at a 5M meter IOU who did a training presentation on distribution voltage profiles to an internal audience of about 100 about 1.5 weeks ago. The CVR pdf appears to run together the effects of system upgrades necessary to implement CVR (without violating voltage tariffs), with CVR itself. If implemented as usually discussed, 'simply' turning the delivered voltage down, CVR actually reduces energy efficiency but provides some curtailment effect for loads which are not constant power over time (as discussed, some temperature-controlled resistive loads are constant power from a utility average perspective). CVR also reduces capital efficiency, since currents are higher, reducing how much load can be placed on existing facilities without overload. I had to laugh when I saw the "max feeder voltage drop of 3.3% or less." Yes if you spend enough capital to do that you will reduce losses. ANSI standard allows 7.5%. In practice I've seen 25%. This doesn't mean that CVR doesn't have a big following among futuristic types in the utility world. I will say that it doesn't usually include people who have spent very much of their career dealing with customer voltage complaints or individual circuit voltage settings/profiles. I think this issue is going to get clarified a lot by the voltage data from smart revenue meters.

P.S. over time utilization voltages have drifted UP, not down. 110 to 115 to 120V. Very little utilization equipment actually likes the bottom end of the utilization range.

yah its crap.

Actually its a matter of matching impedances for maximum power transfer. This is well understood ohms law and nothing new. You want higher voltages so that when you attach your home transformer you do not load the line down. True you can have voltage drops within the same building if the line is too long. This is just heating the wires. But this is not happening in most houses unless your name is Al Gore, which I would suspect has a more industrial 3 phase power system( higher voltages).

Looking at their other products, they may have started by making equipment to boost brownout voltages to normal.

I think the problem is not the electrical utilities, it is the casual observers (especially politicians) who don't understand the electrical system.

The power companies sell power in kilowatt-hours. The casual observers don't realize that kilowatt-hours = 1000 * volts * amps * hours. If you try to reduce the number of kilowatt-hours the consumers can get by reducing the volts they get, the consumers can still get the kilowatt-hours they want by increasing the amps and/or the hours. The equipment they use will do this for them by increasing the amps and/or the hours automatically. The consumers don't have to do anything.

The real solution is to increase the price the power companies charge per kilowatt-hour. The consumers will then want to consume fewer kilowatt hours, and program their equipment to do this for them automatically. You don't have to touch the voltage, the customers will reprogram the equipment themselves.

In reality, the electrical supply would be more efficient at 240 volts, but in North America Thomas Edison sold the public in the idea that it was too dangerous. Tesla had it right, 240 VAC is the way to go. (Pet peeve of mine).

Pet peeve of mine: Most utilities don't want customers to reduce their consumption. While consumption has dropped or leveled off in recent years, the utilities debt obligations have remained the same, causing utilities to raise their rates and reward higher consumption. Beyond the base rate, in our area, the more you use, the lower per KWH rate you pay.

This issue is hugely important and one where a national policy would help tremendously. And it has a specific name -- decoupling:

To date, conservation has been embraced primarily in Public Utility Districts (PUDs) in places like Seattle and San Antonio where there are no shareholders and no shareholder lobbyists.

On the issue of decoupling there is a lot of room for improved policy at every level of government.

Of course, if the utility is decoupled and it doesn't matter what it sells, it need not provide much of anything, including reliability. The knock-on consequences will likely include big-city folks being angry at constantly getting stuck for hours in trains or elevators (or feeling too afraid to dare to use them), and folks in general being angry that they can no longer rely on, say, refrigerators. Look for a lot of diesel generators, as in Pakistan, in places that go that route.

Of course, if the utility is decoupled and it doesn't matter what it sells, it need not provide much of anything, including reliability.

This is not true. The utility's job is to provide reliable provision of service. The customer pays a fee for service, which is completely separate to the commodity charge for whatever is being provided. If the utility does not provide service, it is in breach of contract with the affected customers, and there are well established contract terms and provisions for this sort of thing (force majeure, etc).

Since the utility (the delivery network) is the monopoly component, that is the part that gets government regulated. The utility gives up the opportunity for variable/unlimited profit in return for a lower but guaranteed profit margin. This is what most state/provincial Public Utilities Commissions are all about, and, when properly done, this system can work quite well.

In a completely decoupled system, it is up the to customer to decide where/who they buy the commodity from, and the utility just delivers it consider them to be the Fedex for your online purchases. So you have a market of electricity generators, and the customer can decide who they buy from, what terms etc.

In fact, we already have a functional example of a decoupled system - your internet service provider. You pay a basic fee for the connection and basic service, and more for a higher speed/bandwidth connection, but beyond that, the amount of content you use is independent of them. If you want to use pay per view internet sites, you can do so, and that is nothing to do with your ISP.

There is no real reason that electricity cannot be provided/sold in the same manner - they key is decoupling the transmission/distribution from the generation - something the electricity industry has traditionally resisted.

And there's a rub. The internet services I've seen are considerably less reliable than the electricity or the landline phone. More like the dodgy cell phone. Decoupling seems to lead to all sorts of gaming, which is why in some cases you don't have to induce companies to do it. (One of the many forms is what I've called ski-hill economics - sell as many lift tickets as possible for lift capacity you don't actually have.)

Hmm, my internet service has been fault free for four years - the only times I haven;t had it is during power outages, which I get about 3 times a year!

This is where the regulation part comes in - the electricity service providers, being a monopoly, and an essential service, have to provide a certain level of reliability, otherwise they should then lose their licence to operate. Excessively unreliable electricity is not only costly, it can be unsafe.

I think this can be, and is, managed appropriately. ISP's do not have to meet such standards, and neither is there any safety aspect, so they could game the system a bit more.

Having worked in the ski industry, I can tell you that effective lift capacity, for most resorts, is only approached on about ten days a year, and at many, not at all. Those are also the only ten days of the year when the resort actually makes a profit on mountain operations (as opposed to food and beverage, retail, real estate etc). Still, I have actually seen the case where a ski hill had to stop selling tickets because they had reached capacity - of their water supply and sewage plant - not their new $20m gondola! Another 500 people the next day would have seen the plant overflow into the alpine stream, in the national park, and led to immediate and indefinite closure! So, for the first time ever, they had to put up a "field full" sign!

We then did a top to bottom water efficiency retrofit project over the summer, dropping the per skier water use by 30%, saved them a bunch of money on operations, and Parks Canada were so impressed they finally approved their long standing application to use some water for snowmaking, which allows for earlier opening and later closing. Who says demand side management can't work!

Decoupling in California: More Than Two. Decades of Broad Support and Success

http://www.narucmeetings.org/Presentations/Risser.pdf

California: California was the first state to adopt decoupling. The Electric Rate Adjustment Mechanism was in place from 1982 until the California Public Utilities Commission began restructing the electric sector in 1996. After a disasterous experience with deregulation, the California legislature mandated a return to decoupling in 2001 California Act Chapter 8.2

http://www.stateinnovation.org/Publications/All-Publications/Utility-Rat...

I am confused. How does raising rates encourage higher consumption?

Sorry for the confusion. During the real estate boom the utility made a lot of upgrades to the system (many necessary) to accommodate new construction. When the real estate boom in our area crashed, projected growth stopped and a large number of customers either didn't materialize or were foreclosed. The remaining customers either cut back or were forced to by economic conditions. As a not-for-profit co-op (EMC), the utility is forced to balance it's books and make it's payments; any shortfall must be made up. Hence the rate increase. Note: a few years ago, customers (members, really) got a check/credit at the end of most years.

Part two: When the rates increased, the customers using over 15,000 KWH saw less of an increase beyond 15,000 (rate drops to 6.33 cents from 12.35 cents).

It's really been a good outfit, even if I don't buy their dirty (mostly coal) power. I noticed that they've adjusted the rates for folks using less than 2000 KWH/month to parity with those who use more. It used to be a bit higher. And they've been promoting solar farms, getting alot of complaints about it; spoiling the view and all that.

Beyond the base rate, in our area, the more you use, the lower per KWH rate you pay.

Ghung, you must love the air quality that results from that policy in your part of the world!

In my part of the world, we have the opposite - a conservation rate structure (and clean air). Any kWh not used in BC can be exported to California where it is worth much more.

BC Hydro Residential Conservation Rate;

The major "conservation" achieved here is to get people to use other energy sources for space heating.

"Ghung, you must love the air quality that results from that policy in your part of the world!"

Most of our air quality problems result from coal fired plants in the TN Valley (TVA), making power for the eastern metroplexes. Our air quality index is often worse than places like Atlanta and Charlotte, especially this time of year.

"The major "conservation" achieved here is to get people to use other energy sources for space heating."

Our local utility has had ongoing incentives for the 'all electric' home for quite a while. Clean, Green Electricity! The only other options are oil and propane, unless like me, you use passive/active solar and wood. The all electric folks have been getting hit hard lately, especially the ones with heat pumps this past winter.

Ah, yes, and long before greenery and greenwashing, that was the all electric Gold Medallion Home [PDF, lower right corner], powered by, ta-daa: Reddy Kilowatt...

Yes, marketing of things that don;t need to be marketed has been around for a long time.

I like Reddy Kilowatt though - I think he is due for a comeback, maybe even a movie deal in thses days of using every and comic book character.

In all seriousness, there is nothing wrong with an all electric house - these days it can be much more energy efficient than an electric +gas house, and likely safer, too.

An interesting little paragraph at the bottom of that 1962 newspaper page

There you go - first presidential ride in a car was in an EV! Quite the visionary that Teddy guy - wonder what he'd think of todays crop of politicians?

Hartford was the home of the Columbia car company. Their EV's got 40 miles on a charge, with the top speed a very civilised 15mph! One of their Ev's set a record by doing Boston to NY (250 miles) in 23 hours - not bad for including recharging time, and a 15mph top speed.

That's a great article!

I'll steal your comment for my EV history, if that's ok with you.

Be my guest.

This little anecdote also shows that the Presidential tradition of visiting car plants, and promoting them, and car making jobs, is old hat!

Would be interesting to try to find a photo of Teddy in that car.

There is some history if the Columbia car company here, you could probably find more with a little digging.

http://www.kcstudio.com/col00.html

One of the original partners was a fellow by the name of Hiram Maxim - of Maxim machine gun fame. He invented the gun silencer, using the same principles he developed in creating muffler for gasoline engines!

Interestingly, they were partnered with a battery company called Exide - who did better there!

That's great!

Here we go:

While it was President William McKinley who first rode in a motorcar (a Stanly Steamer in 1899), it was President Theodore Roosevelt that was the first to do it publicly, with full guarded accompaniment. On August 22, 1902, while on a campaign tour, he rode in a Columbia Electric Victoria Phaeton. The car had a maximum speed of 13 miles per hour which meant that the police guards could not keep up on foot. The solution was to put the police on bicycles. So that day in Hartford, Connecticut the presidential motorcade was born.

http://www.professorwalter.com/2010/08/the-first-public-presidential-mot...

So, the first ever presidential motorcade usd an electric vehicle and secret service guys on bikes - it doesn't get much more renewable than that.

That was in 1902, not 1912, so the paper got it wrong. Anyway, next year will be 110 yrs - maybe Obama should do a commemorative repeat of the exercise!

Hear, hear!

Barack my man, are you reading this thread?

....but it didn't take long before Presidents (or their SS handlers) decided that bigger is better...

Cadillac Series 452

Manufacturer Cadillac

Production 1930 (1930)-1937 (1937)

Successor Cadillac Series 90

Configuration 45° V-16 with 5-bearing crankshaft[1]

Displacement 452 cu in (7,410 cc)[1]

Cylinder bore 3 in (76 mm)[1]

Piston stroke 4 in (100 mm)[1]

Valvetrain OHV[1]

Compression ratio 5.3:1[1]

Fuel system 2 single barrel carburetors[1]

Fuel type gasoline

Oil system wet sump[1]

Cooling system water cooled[1]

Power output 165 hp (123 kW) between 3200 and 3400 rpm (1930)[1]

Here ya go!

http://www.fusionstudios.com/hill-climber/PaperTrail/History.html

Perhaps their time is yet to come. Electric engines seem to work pretty well in trains, trolleys and electric bicycles, SUVs, not so much...

The motors are fine for SUV's.. it's the storage, as ever. But even so, this 2002 model still beats much of what's touted coming out now. WHO KILLED the NIMH battery?

http://www.evnut.com/rav_owner_gallery.htm -(Testimonial #3 out of 57.. and several have 2 or 3 Rav4ev's in the family)

Sweet!

And don;t forget the Rav -4 "Long Ranger"

http://www.evnut.com/rav_longranger.htm

It is my understanding that part of the idea of the "Smart Grid" is that the utility company will have some level of control of when and how often a residential or commercial customers equipment operates, and this is where they will see any real savings by doing load control.

But most consumers fight this idea that the utility can control their thermostat on their furnace/AC or when their refrigerator, water heater, run - etc... I think most of us would rather find a way to go "Off Line" rather than give this level of control to some remote utility person.

The so called "smart grid" will enable this, eventually, but it will be up to the user to decide if they want to.

A version of this exists in industrial power use with interupptible rates, where the customer can agree, on request of the utility, to shed load for re-sale of the electricity - and get a cut of the resale amount. In some cases it is better for the mine to close for the day and pay its workers to have the day off, as it is making more money from the electricity resales!

if your facility is such that you can give control of the load management to the utility, so they don;t even have to ask, they just do, then they will pay you more for that, and use your load shedding first - good for business IF you have such discretionary load.

The thing is, you don;t need the smart grid for a homeowner to do this. The information about power loads/peak prices etc can be communicated via internet (or a smartphone) to the homeowner, and they can decide how to program appliances to game the system, and the utility would offer a couple of standard plans.

the thing is though, for all this effort, unless you are in a high peak price environment like southern California, the $ savings would only be $10's per month - hardly worth all that tech and complexity.

The simple programmable thermostats for heating (and possibly refrigeration) , and some simple tricks for water heaters, like this one, can do 80% of the job for 20% of the cost.

There are 60M households in the U.S. with a thermostat for space heating/cooling who don't have a programmable. DOE estimates the average savings of switching at $180/yr (payback in a few months). The U.S. public is largely devoid of any physical energy sense whatever, which is why leaving energy efficiency to the market doesn't work.

The 'smart grid's' major implication over the amortization period of smart meters is the laying-off of meter readers. Demand response has been in place, and easily expanded at the retail level for decades. This is mostly hype designed to allow the replacement of O&M by capital for rate-regulated utilities.

The U.S. public is largely devoid of any physical energy sense whatever

That's basically true, but might be a bit harsh. Basically, individual consumers have a lot to deal with, and energy is one small thing among many. Business has economies of scale - they can hire an energy manager, or some such, who specializes in dealing with this.

In the long term, Demand Response can be built into household equipment at the point of sale, with automated default settings that consumers basically never have to deal with. This will be especially important for EVs (and their variations, like PHEVs and EREVs).

We offset voltage drop, and vary voltage with load by doing things like turning on/off capacitors, using load-tap-changing substation transformers, and voltage regulators (with line-drop-compensation controls), and varying distributed generator power factor. Only an extremely underloaded distribution system (like that found in most houses) can maintain decent voltage without voltage-control equipment.

"The overall vibe was one of optimism and opportunity..."

These people are living in a world of fantasy. The world is living beyond its means (governments, consumers running doing massive borrowing...) and this situation won't continue much longer. People are suddenly going to find themselves much poorer. Governments won't have the money and will to provide "money, markets, mandates" to make these clean, green investors rich. So the question is how many of these ideas are viable in a world without government incentives and where the world is much poorer.

A few, but not many. Which ones?

I certainly agree that the current subsidies for green power are unsustainable. What is particularily infuriating is that the Ontario government is still offering 20 year solar pv contracts at 80.2 cents per kwh despite the significant drop in the price of panels. Other countries such as Germany have been ramping down their feed in tarifs for solar pv.

Besides that the feed-in tariffs in Ontario are currently too high given the prices for PV-modules and systems: http://www.solarserver.com/service/pvx-spot-market-price-index-solar-pv-...

Keep in mind, that the feed in-tariffs are paid by the rate payers and not by the tax-payers.

So, feed-in tariffs do create more tax-income (thanks to the taxed income of renewable industry employees, sales tax, business tax etc.).

In addition feed-in tariffs do lower the dependence on imported fuels (trade deficit) and lower wholesale electricity prices: http://www.tagesspiegel.de/wirtschaft/windkraft-macht-strom-billiger/753...

(German industries, which consume large amounts of electricity, are excluded from paying into the feed-in-tariff pot. So they directly benefit from the lowered electricity prices.)

My take on the Ontario feed-in tariffs is that they are not just about providing electricity and reducing import dependence. In large part they are about spinning up a new, local, solar industries and creating jobs. The feed-in tariffs in Ontario and Washington state are much higher for locally sourced components than for imported components.

As jobs bills go, I'd much rather see big dollars spent on building up a solar industry than on massive highway projects.

Ontario is already being challenged on the local content requirement because it violates free trade agreements. The jobs that have been created are not sustainable unless there is an endless stream of new contracts with the high FIT. It is extremely unlikely we could become an exporter of solar pv equipment unless this too is subsidized. It isn't as if companies in Ontario have developed solar pv technology that no one else has -- we are simply using technology developed elsewhere. I'm sure the early introduction of solar pv FIT in Germany enabled German companies to develop their own solar pv expertise, but in Ontario we got into this game far too late to generate the same benefit. Even in Germany, sales of locally manufactured equipment is being impacted by the importation of cheaper solar panels from Asia.

I agree that spending on massive highway projects is a waste of money. The province recently announced a major highway upgrade in the east end of Ottawa and with peak oil this will likely prove to be a poor investment. I also believe though that trying to establish a solar pv industry in Ontario is a waste of money.

Strong local content requirements can hurt the (international) search for more efficient products. So if the customer has to choose between Chinese panels at $1.50 per watt, and local ones at $4.00 per watt, and the rules make worthwhile for him to choose the local ones, what incentive does the local manufacturer have to reduce their cost/price? Done right subsidies can help infant industries get started, but done wrongly they can become a crutch for inefficient producers.

In a world that is much poorer in energy we will see factories powered by solar (CSP or PV) that operate only when the sun shines. They will be staffed by workers that live in the factory dormitory as there is no low cost transportation for a daily commute. Much like the textile mills of New England in the late 1800s. They will be located in sunny places like California and Arizona. Solar will be worth it as long as there is a profit to be made. Or are you planning to spin and weave your own cloths?

Some Machine-oriented factories like Textiles might just migrate back to Run of River power, which has a much more consistent power profile (well, it does when it does, ie, not in droughts and typhoons) while it has other downsides.. The Maine Coast had many companies running off 'Tide Mills' as well. You could pretty much clock your meals to them, tho' it might get a bit off-kilter every few weeks.. and you could go into extra shifts when you had big orders to complete. God I pray for a return of textile and other such factories coming back to Maine!

I could see the potential for a growth in 'Solar Factories' with heat-processes that time well with the working day. Baking and other Food Processing comes to mind, and yes, this would likely only happen in places like Phoenix where you've got a pretty good chance for Sun every day. Of course a number of washing businesses could take advantage of solar heat far more as well.

"Or are you planning to spin and weave your own cloths?"

Not yet, but somebody is. There is already a steady cottage industry in home Woven, Spun and Sewn Clothing, and with the access to several generations of modestly powered Sewing and Knitting machines, etc, and a lot of unemployment, and then the BUY LOCAL campaigning, don't be surprised to see a great deal of growth in those trades.

For me, I've got a growing folder of designs of Wood and Metal products I can manufacture, from Tools to Housewares to Toys, many of which are already fairly appealing, since their equivalents at the stores are frequently made of junk, and everyone knows it. Who wouldn't like a version in Solid Oak with real Brass Screws.. not just for show, but that too, but to know that the damn thing is actually solid and even repairable? I'm enjoying designing these for extreme simplicity, in order to require the least amount of labor and materials, and be items I can keep creating with hand or power tools well into my later years.. one of many backup plans.

Wind power in the upper Midwest where water is abundant could lead to reindustrialization. The water transport (Mississippi, Ohio, Missouri) is still there leading to almost anywhere.

Do you have a website? There are lots of people who would like to buy real solid products.

Thanks for asking, I appreciate it.

So far, I've just been building the prototypes, sketching additional versions and variations, and looking at this as a contingency plan.. but it seems reasonable to git 'er going and turn the idea into reality.

I do have a website, but it is for my work as a cameraman. www.jetpig.com Currently, just has links to a couple demo reels.

Bob

I think factories will migrate to places where there is cheap power which is on 24/7, not overpopulated, overpriced, water deficient, electricity importing places like California.

They will go to places like Brazil and Northern Canada where there is abundant cheap hydroelectric power. Once Norway's oil and gas run out and Norwegian oil workers are out of work, businesses will notice that 99% of Norway's electricity supply is hydroelectric.

I wouldn't be surprised if Fort McMurray, Alberta exceeds 1 million population by the end of the century. In addition to needing workers for the oil sands themselves, which will be one of the few sources of oil left by the end of the century, the oil sands plants are capable of generating large surpluses of nearly-free electricity as a by-product of their operations. A large industrial complex is likely to grow up around them to take advantage of it.

Who said that the grid will disappear when businesses install PV systems on their roofs?

Interconnected PV mainly lowers the load on the grid when demand reaches its peak. It doesn't have to replace efficiency, hydro, interconnected onshore and offshore windfarms, biomass, geothermal etc.

There's apparently a lot of money to be made in hosting such conferences. I just returned from Boston where I attended the "Clean Tech Conference and Expo," which is part of "Tech Connect" and runs parallel to "Nano Tech" and "Micro Tech." I suspect many of the same folks you saw were presenters at this conference as well. I also saw the same enthusiasm and optimism, as did I also see at the ARPA-e Expo in February.

Thanks for the write up though - I will be making a few posts on my blog regarding my takeaways from the Clean Tech Conference and Expo.

Absolutely correct. And the "guest speakers" are in it for the money too. It's about rhetoric and soothing noises. They are the bandits and the carbuncles on meaningful actions.

Electric cars are not the answer!

When are these people going to shake off their auto addicted vision?

Here are some facts which just came out on electric cars:

1)NY Times studied energy usage while driving gas vs electric cars

The gas powered Nissan Altima produced about 90 lbs of greenhouse

emissions vs the electric Nissan Leaf which produced 63.6 lbs

As usual this is ONLY counting energy costs to drive NOT the

lifecycle costs of materials to manufacture and ship a $30K car,

paving costs of 6 lane highways to drive it on, ambulance costs

for the 30,000 annual auto deaths and hundreds of thousands of auto injuries, traffic courts, traffic cops etc etc etc

2)Sweden which aggressively promoted electric and non gas powered

cars actually INCREASED their greenhouse emissions! :-(

http://www.commondreams.org/view/2011/06/10-3?page=1

Electric shuttles, vans, buses and bikes as part of a truly

Green public transit system could work.

But this would mean public transit which of course, despite

its obvious social utility in terms of reducing energy usage,

greenhouse emissions, land usage and providing mobility to the 30% (and growing for economic reasons)of people who cannot drive,

does not make as much $$$$$$$$$$$$$$$$$$$.

What does seem like a sustainable mass consumer niche for electric vehicles is electric bikes.

I was just at the Clearwater Hudson River Revival Music Festival

and they had some very impressive electric bikes including a folding e-bike for only $1100 which could be taken on most public

transit. (all Public transit in the NYC area allows folding bikes at all times)

But electric cars for the masses?

It is utter folly to subsidize it as it will not really save

energy, greenhouse emissions, green spaces lost to endless asphalt, or highway carnage.

Your source doesn't actually say anything about electric cars in Sweden. It says "hybrids, clean diesel vehicles, cars that run on ethanol." (Your source also lacks a source itself.)

Not that electric cars won't just be a bad thing if we run them off coal, but clearly the idea of them being green is that they will run off solar and wind. I tend to see folks who are adopting EVs now as trying to do a good thing, and often actually doing so. For example, the guy with a Leaf for whom I just helped install a solar system. OTOH, I do fear that in the future, late adopters will go EV purely because of high gas prices and won't install the solar.

I am also somehow rather skeptical that the the 100-mile range Nissan Leaf is going to drive further exurban development.

Aside from those nitpicks I generally agree with you. Best hopes for fewer people driving cars, and those that do driving solar powered ones. With any luck the thermodynamics of batteries and renewable energy will impose that without too much pain.

"With any luck the thermodynamics of batteries and renewable energy will impose that without too much pain."

Exactly what are these limits? I have been a registered user here on The Oil Drum for 5 years, and in only that amount of time seen limits that were given as "set by thermodynamics" shot past and exceeded repeatedly. This indicates that a lot of folks attribute to thermodynamics limits that were actually created by lack of knowledge and weak design.

The bigger issue is economics, as always, and on this I think we are all in agreement: Post oil energy will in so many ways cost more to produce, as long as relatively cheap oil and gas are available.

That calculation soon goes out the window however if we assume (as most true peakers do) that oil and gas in indeed getting more difficult to find and extract, and the EROEI of oil and gas is only going to go up in the future. By contrast, the EROEI of renewables should go down (with one caveat, which we will get to in a moment), meaning the two lines (EROEI of fossil fuels vs. EROEI of renewables) will cross, making the renewables the economic choice. In some places this is already happening.

The remaining caveat mentioned above is rare earth and strategic minerals: Many renewable energy alternatives require rare earth metals and minerals, and many of those are already climbing in price. The renewable industry is in direct competition with the consumer electronics market and the defense industries of the nations of the world for these minerals. These are not weak competitors to be up against. This is why the materials science people are looking so hard for ways to reduce the quantity of raw materials needed in renewable energy production (reduced metals in batteries, solar cells, etc. Mineral and metals availability will become critical for the renewable energy industry and for the world.

Of course, it seems the world has decided against concentrating mirror solar technology, the one tried and true method of solar power production which has proven to work year on year on year, and against thermal storage and geo-thermal, methods that again are low on consumption of minerals in construction, and based on tried and true technology. The old rule of technology still seems to apply: Never use the simple easy way when far more complicated and expensive means are still to be developed.

RC

Neither wind turbines nor EVs require rare earths.

While they don't need rare earths, many of the existing designs - any that use permanent magnets - do use rare earths.

Some of the wind turbines use large perm. magn generators as this allows them to be direct drive

This will change as the rare earths get more expensive and/or hoarded by China.

Well, maybe there will be substitution.

At present rare earths make for the 'best' room-temperature magnets, and direct drive is an advantage. But it's possible that better magnetic materials will be invented. We seem to be seeing quite a lot of that recently (inventing better materials, that is) - like the PNNL/Vor-X graphene-mixed battery that Jon linked to.

This (i.e. since about 1990) seems to be a new golden age for materials science. Some of the innovations seem really basic, too -- like the idea of continuous casting of silicon wafer for solar cells, which eliminates the waste and time incurred in cutting slices off ingots. Instant 50% cost reduction, if it gets out of the lab.