Drumbeat: June 6, 2011

Posted by Leanan on June 6, 2011 - 10:00am

Aramco Searches for Unconventional Gas in Northwest, Ghawar

(Bloomberg) -- Saudi Aramco, the world's largest crude exporter, is looking for so-called unconventional gas in the northwest and in the area of the Ghawar field, where gas infrastructure exists, Aramco said in its 2010 annual review.Aramco seeks to develop resources in shale rock and tight gas, trapped in impermeable sandstone, to reduce the burning of valuable crude for power generation.

Saudi Aramco sees Karan project complete by 2012

KHOBAR, Saudi Arabia (Reuters) - State oil giant Saudi Aramco said on Monday it will complete its first offshore non-associated gas field project, Karan, by 2012.Aramco had previously said it expected work on Karan to be completed in 2013 with the capacity to process 1.8 billion cubic feet per day (cfd) of gas.

Stuart Staniford: The US Crude Production Peak is not Symmetrical

People that worry about the peaking of global oil supplies often use symmetrical curves as simple models for how production will peak and then decline, with logistics and Gaussians being popular choices. This goes back to M. King Hubbert (and I've done some of this myself). The United States is the poster child for this kind of analysis, since this region was the first to be developed at scale and production peaked in 1970.However, it seems increasingly clear that the US production curve is far from symmetrical (perhaps driven by higher prices since the 1970s, and especially in the 2000s).

This fund manager sees another crash

The situation isn't irreparable; Rodriguez believes the government can keep rates from climbing too high if it starts making cuts of $350 billion to $500 billion per year. But he has little faith in its willingness to do so. If it were up to him, there would be serious tax reform, with all tax deductions (including mortgage interest) on the table. A former Republican, he describes himself as a "fiscal conservative but social moderate" who has grown disgusted with both parties: "I say, 'A pox on both their houses.'"So FPA's managers, guided by Rodriguez, are battening down again, trimming risk. FPA Capital now has 30% of its portfolio in cash and 38% in energy stocks because he believes the world's oil supply is declining. Still, even in that sector, he doesn't see many opportunities. (Forget other sectors.) He refuses to buy most bonds or long-term government debt. His restraint has rankled some investors: FPA New Income has begun to shrink again, and a few FPA Capital clients are grumbling.

Richard Heinberg: The China Bubble: Economic Growth’s Last Stand?

There is one more similarity between Japan and China that is worth mentioning. During the 1980s, real estate prices in Tokyo were jaw-dropping. In the Ginza district in 1989, choice properties fetched over 100 million yen (approximately $1 million U.S. dollars) per square meter, or $93,000 per square foot. Prices were only slightly lower in other major business districts in the city. By 2004, values of top properties in Tokyo’s financial districts had plummeted by 99 percent, and residential homes were selling for less than a tenth their peak prices. Tens of trillions of dollars in value were wiped out with the combined collapse of the Tokyo stock and real estate markets during the intervening years.Once again, China is following in Japan’s footsteps. Massive real estate projects—houses, shopping malls, factories, and skyscrapers—have been proliferating in China for years, attracting both private and corporate buyers. As prices have soared, investors have turned into speculators, intent on buying brand-new properties with the intention of flipping them.

Non-payment causes petrol shortage in Punjab

LAHORE: Parts of Punjab faced a serious petrol shortage due to the government’s failure to pay dues worth Rs 150 billion to Pakistan State Oil (PSO) and oil refineries.Sources said that PSO could not import oil due to the non-payment of dues by the government.

Pakistan: PM pledges to control price hike, electricity shortage

MULTAN (APP): Prime Minister Syed Yusuf Raza Gilani on Sunday said the PPP-led government would control price hike and energy crisis. Addressing a workers convention at the local Circuit House, Gilani said that government had initiated mega projects like Bhasha dam, Thar coal and CASA-1000 to overcome the energy crisis. The workers convention began with recitation from the holy Quran and later the participants offered Fateha for the late Hakim Ali Zardari, father of President Asif Ali Zardari, and the party workers including Khawaja Yasin, Munir Ahmad Khan and others who had died recently.

Petrol supply disruptions may spread to Dubai

Dubai: Petrol supply disruptions in Sharjah and the Northern Emirates may eventually come to Dubai as a major fuel retailer is rolling out a three-month upgrade of its network of ageing fuel dispensers in hundreds of pump stations in the emirate, XPRESS has learnt.As fuel dispensers - the boxes to which the refuelling nozzles are attached - are knocked down one by one and replacements take time to come on stream, consumers have found themselves stuck in massive car jams at stations where petrol is available.

Enoc will not raise fuel prices, said a top official of the company.The clarification comes amid petrol shortage in some of its outlets. Khalid Hadi, Director of Media and Corporate Communications, Enoc, told 'Al Bayan', that fuel shortage in some of its stations was due to the upgrade operations the company is carrying out at its 170 stations. As most of these outlets have six to 10 pumps, it has been taking a long time and hence the delay.

Norwegian Deputy Energy Minister Per Rune Henriksen today made a plea for global gas consumption, claiming the fuel is part of the global energy solution.

Canada crude-Keystone restart tightens heavy spreads

CALGARY, Alberta (Reuters) - Canadian heavy crude oil spreads tightened on Monday after TransCanada Corp restarted its Keystone oil pipeline, which was shut for a week following a small leak at a Kansas pump station.

Halliburton Loses as Supreme Court Backs Securities Suits

(Bloomberg) -- The U.S. Supreme Court made it easier for investors in some states to press securities fraud suits, siding with shareholders suing Halliburton Co., the company once led by Dick Cheney.The justices unanimously said the shareholders can sue as a group without first establishing that they lost money as a result of the alleged fraud.

A chef, Sharon Stone, and good foreign policy

Georgia has been a pillar of U.S. foreign policy since an ultra-strategic 1-million-barrel-a-day oil pipeline was built across its territory to the Mediterranean Sea. The U.S. worries about the democracy credentials of President Mikhail Saakashvili, whose police last week beat participants in a protest against the government in which there were four deaths including a policeman, but MacDonald seems a more effective way of spreading the message than finger-wagging.

Can renewable energy outshine fossil fuels?

I'm not popular with environmentalists when I tell them that renewables can only provide a small fraction of the energy that fossil fuels do in powering industrial civilization. In fact, I was recently called a liar at the screening of an anti-nuke film for suggesting so.

While he insists there is no single ‘right’ answer, MacKay points me to a ‘hedging scenario’, with maximum effort on all the demand-side measures, along with a strong emphasis on wind, coal with carbon capture and storage (CCS), and nuclear. This makes it look deceptively easy, lopping 92% off emissions by 2050. But the more we unpick the technological and political realities, the harder it looks to reach even the 80% target without resorting to unproven technologies or potentially unsustainable land-use.MacKay likes the hedging scenario precisely because it over-delivers. Simply aiming for an 80% cut would be too risky, he says, because some pathways are bound to fail or under-perform. What if the government can’t persuade people shift to public transport, or accept more onshore wind farms? What if CCS proves uneconomic? Better to aim to over deliver on a variety of pathways, he argues, “so that in 10 or 15 years time, when it becomes clearer what’s happening, you’ve got a chance of ending up still on track”.

Kurt Cobb - Kurzweil: the movie

In "Transcendent Man" it is a sadder than usual Ray Kurzweil who appears on the screen. The 2009 documentary film about Kurzweil, an acclaimed inventor and futurist, shows that the laws of entropy are at work on his body. He undergoes open heart surgery during the course of the film even as he continues to espouse the belief that technological developments over the next 30 years will make human immortality a reality.To bridge the gap between now and then, the 63-year-old Kurzweil downs 200 pills a day consisting of various herbs, vitamins or other supplements to "reprogram" his body's biochemistry and improve his chances of reaching what he calls the "singularity," a time after which technological change will occur at a pace so fast that the only way we will be able to understand it is to merge with our machines. Humans will at that point become human-machine hybrids.

James Hansen - Silence is deadly: I’m speaking out against Canada-U.S. tar sands pipeline

The scientific community needs to get involved in this fray now. If this project gains approval, it will become exceedingly difficult to control the tar sands monster. The environmental impacts of tar sands development include: irreversible effects on biodiversity and the natural environment, reduced water quality, destruction of fragile pristine Boreal Forest and associated wetlands, aquatic and watershed mismanagement, habitat fragmentation, habitat loss, disruption to life cycles of endemic wildlife particularly bird and Caribou migration, fish deformities and negative impacts on the human health in downstream communities.

When energy-saving does not mean saving energy

A newly published paper in the journal Energy Policy shows that even straightforward carbon-saving activities such as home insulation are not always quite what they seem. The problem is that making one change around the house leaves the door open for other changes – which might include "rebound effects" that undermine the carbon savings. If a driver who replaces their car with a fuel-efficient model takes advantage of the cheaper running costs and drives further and more often, then the amount of carbon saved is clearly reduced.

Michael Klare: How to wreck the planet 101

Here’s one simple fact without which our deepening energy crisis makes no sense: the world economy is structured in such a way that standing still in energy production is not an option. In order to satisfy the staggering needs of older industrial powers like the United States along with the voracious thirst of rising powers like China, global energy must grow substantially every year. According to the projections of the U.S. Department of Energy (DoE), world energy output, based on 2007 levels, must rise 29% to 640 quadrillion British thermal units by 2025 to meet anticipated demand. Even if usage grows somewhat more slowly than projected, any failure to satisfy the world’s requirements produces a perception of scarcity, which also means rising fuel prices. These are precisely the conditions we see today and should expect for the indefinite future.

Oil Falls for a Second Day on Signs Slowing U.S. Economy May Crimp Demand

Oil dropped for a second day in New York, extending last week’s 0.4 percent decline, on signs of a slowdown in demand as OPEC ministers arrived in Vienna to discuss production quotas.Futures fell as much as 1.1 percent as the highest U.S. jobless rate this year fueled concern that the recovery in the world’s largest economy is faltering. The Organization of Petroleum Exporting Countries is unlikely to change targets when it meets June 8, according to a Bloomberg News survey of 30 analysts conducted in the week to May 31.

Saudis to push OPEC to lift output, cut prices

VIENNA — Gulf Arab OPEC members led by Saudi Arabia will push for an increase in supplies at a meeting of the oil cartel this week in an effort to support flagging world economic growth by bringing crude prices back below $100 a barrel.Data indicating that economic recovery may be stalling in the West is worrying OPEC's core Gulf members Saudi Arabia, Kuwait and the United Arab Emirates.

Saudi and its fellow Gulf producers will argue that oil prices are undermining the economic growth that fuels demand for OPEC crude and that more supply is needed to balance demand in the second half of the year.

But Riyadh is not prepared to force-feed crude on to the market to push prices aggressively lower.

OPEC Upstaged by Qaddafi in Most-Hostile Meeting Since Gulf War

OPEC’s decision on production quotas this week may be complicated by hostilities in Libya as members meeting in Vienna find themselves supporting opposing camps of a military conflict for the first time in 21 years.

Saudi Aramco Cuts July Prices for Light Crude Oil Shipments to U.S., Asia

Saudi Aramco, the world’s largest oil exporter, cut official selling prices for light crude grades for July shipments to the U.S. and Asia. The company raised prices on the rest of its grades for July.

Saudi Arabia to double exports of crude oil to India

Saudi Arabia has agreed to double its crude oil exports to India in a move that would reduce the Asian country's dependence on Iranian crude.Annual Indian crude imports from the kingdom could rise to more than 800,000 barrels per day, an Indian official said yesterday in Riyadh on the sidelines of a Saudi energy conference.

Oil price 'should remain' under $80: Petronas CEO

KUALA LUMPUR: Malaysia state energy firm Petronas said on Monday that the crude oil market's current fundamentals call for lower oil prices."Given the current state of market fundamentals and cost environment, I believe prices should remain within the range of $75 to $80 a barrel," Shamsul Azhar Abbas, the oil company's chief executive officer said at an industry gathering.

The stage is set for a “golden age” for gas as consumers switch from competing fuels such as nuclear and it could account for more than a quarter of global energy demand by 2035, according to the International Energy Agency (IEA).

Gazprom will not revise Ukraine gas price in '11- CEO

(Reuters) - Russia's gas giant Gazprom will not consider revising the gas price for neighbouring Ukraine in 2011, the company's CEO Alexei Miller told journalists in Russia's Black Sea resort town of Sochi. He also said Ukraine would pay Gazprom around $500 per 1,000 cubic metres of natural gas in the fourth quarter of this year.

China shops for Latin American oil, food, minerals

CARACAS, Venezuela—Latin America is blessed with a wealth of natural resources such as oil, copper and soy, and seeks investment and loans to capitalize on them. China needs the commodities to keep its economy growing and has about $3 trillion in reserves to burn.

Venezuela: Relations with US are 'frozen'

Venezuela's top diplomat says relations with the United States are "frozen" and President Hugo Chavez's government does not perceive any possibility of improving them after Washington imposed sanctions on the South American nation's state oil company.

Lawmaker arrested on corruption charge

ABUJA, Nigeria — Nigeria's anti-corruption agency arrested one of the West African nation's top politicians Sunday night on suspicion of defrauding the oil-rich country, an official said.

Kuwait Energy, the privately owned oil and gas producer, has signed 20-year contracts to develop two gasfields in Iraq.The production service contracts for the Siba and Mansuriya fields finalise the Iraqi oil ministry's decision last October to award licences to the foreign consortiums that submitted winning bids for the fields in Iraq's oil and gas auction.

Oil storage tank attacked in southern Iraq

Violence has ebbed in Iraq, but oil infrastructure is still a favorite target for militants, mainly in central and northern Iraq. It is rare for oil infrastructure to be attacked in southern Iraq, where there has traditionally been less violence.

Tepco Falls Most on Record as Bankruptcy Concern Resurfaces

(Bloomberg) -- Tokyo Electric Power Co. shares fell the most on record after the head of Japan’s biggest stock exchange said the utility should follow the same route as Japan Airlines Co. in 2010 and file for bankruptcy protection.

Japan's Edano: must avoid court-led Tepco restructuring

(Reuters) - Japanese Chief Cabinet Secretary Yukio Edano said on Monday that a court-led restructuring of Tokyo Electric Power Co , the operator of the crisis-hit Fukushima Daiichi nuclear plant, must be avoided.

Japan May Tap Geothermal Power to Offset Atomic Loss, BNEF Says

Japan can increase the amount of electricity it generates using geothermal resources to offset power shortages as the government reconsiders its reliance on nuclear energy, Bloomberg New Energy Finance said.

Germany Must Find 10 Gigawatts of Capacity, Handelsblatt Says

Germany will have to generate as much as 10 gigawatts of energy capacity from alternative sources to make up the shortfall from its accelerated exit from nuclear power by 2022, Handelsblatt newspaper reported, citing draft legislation.

Libyan rebels seize mountain town

(Reuters) - Libyan rebels entered the mountain town of Yafran Monday, driving out Muammar Gaddafi's forces in a sign NATO air strikes in the region may be paying off.Yafran had been besieged by pro-Gaddafi forces for more than a month with food, drinking water and medicines running short.

Yemenis Cheer Flight of Wounded President Saleh to Saudi Arabian Hospital

Hundreds of thousands of Yemenis cheered the departure of wounded President Ali Abdullah Saleh to Saudi Arabia even as government spokesmen said he would soon return after receiving medical treatment.Saleh and other members of his government, including the parliament speaker, the prime minister and two of his aides, were being treated in the Saudi capital of Riyadh for injuries they sustained in a June 3 rocket attack on a mosque in the presidential compound.

Israel to Make Formal Complaint Against Syria

Israel will formally complain to the United Nations about what it said was Syria’s manipulation of Palestinian demonstrators during a violent confrontation in the Golan Heights, a Foreign Ministry spokesman said.

Pat is mostly a sensible guy except for his penchant for throwing in his lot with the "crunchy-con" side of things (deploring McMansions, conspicuous consumption, disco revival, etc). Back in 2008 we got into a back-and-forth about "peak oil," and I finally decided Enough!--let's have our own Simon-Ehrlich style bet on oil prices: I proposed that within three years oil would be back below $75 a barrel. Well, the three years is up, and Deneen is triumphantly demanding that I pay up!

Forget Peak Oil. Think Peak Renewables

None of these predictions dispute the peaking of oil production, but disagree only on when it will occur. How helpful is that?But we can also apply the idea of “peaking” to the renewable energy industry – wind, solar, biomass, hydro.

Cyclists bare all for World Naked Bike Ride

SCORES of people stripped off to take part in the World Naked Bike Ride in York.The bike ride is held in cities around the world and was picked up in York in 2006 as a protest against oil dependency and car culture.

U.S. Military Favors Biofuels for Waging Future Wars

The U.S. military isn’t keen on War Party member Devin Nunes’ proposal to ramp up the development of a coal-to-fuel technology, which has origins in Nazi Germany, to produce fuel for the empire’s thousands of ships, aircraft, tanks and military equipment.In testimony before the House Subcommittee on Energy and Power June 3, Tom Hicks, the Navy’s deputy assistant secretary for energy, questioned the wisdom of using coal-derived Fischer-Tropsch fuels to meet the needs of the Department of Defense.

Wheat Fields Wilt in Drought as Parched Earth Spreads From China to Kansas

The worst droughts in decades are wilting wheat fields from China to the U.S. to the U.K., overwhelming Russia’s return to grain markets and driving prices to the highest levels since 2008.Parts of China, the biggest grower, had the least rain in a century, some European regions are the driest in 50 years and almost half the winter-wheat crop in the U.S., the largest exporter, is rated poor or worse. Inventory is dropping 8.8 percent, the most in five years, Rabobank International says. Prices will advance 20 percent to as high as $9.25 a bushel by Dec. 31, a Bloomberg survey of 14 analysts and traders shows.

Damaging the Earth to Feed Its People

Humans are cultivating almost 40 percent of the land surface of the earth, and nearly a third of all the greenhouse gas emissions that are warming the planet comes from agriculture and forestry.

A Grass-Roots Fight to Save a ‘Supertree’

This spring, outraged by plans to uproot hundreds of trees to make way for a new subway line, thousands of Nanjing residents mobilized to oppose the action.

'Roads to Resources' locks up public lands

In the past few years, all of us have spent more than a billion dollars to "beef up" the road, which is owned and maintained by the State of Alaska and considered a "road to resources."But travel websites warn, "There is no public access to the Arctic Ocean from Deadhorse. You must be on an authorized tour."

At the end of a publicly owned, publicly maintained road, public resources are being extracted, but NO PUBLIC ACCESS.

Scramble for Arctic oil and gas puts pristine ecosystem at risk

The Arctic is becoming a battleground as Russia, Norway, Canada and the US vie for access to oil, gas and minerals – campaigners fear safety and the environment will be the losers.

Greenhouse gas emissions hit record highs - bad news for delegates at climate accord talks

BONN, Germany — Bad news awaits delegates from about 180 countries at the start of two weeks of climate talks beginning Monday to debate a new global warming accord.Greenhouse gas emissions are going up instead of down despite 20 years of effort, hitting record highs, according to a new report by the International Energy Agency.

Willie Walsh: 'keep emissions trading scheme to European airlines only'

Brussels must delay plans to charge non-European airlines under the emissions trading scheme (ETS), the boss of British Airways and Iberia has warned, or else passengers will be caught up in a trade war between the EU and the US and China.

Thousands rally in Australia for carbon tax

SYDNEY (AFP) – Thousands of Australians rallied around the nation on Sunday to support a tax on the carbon emissions blamed for global warming, as a new report outlined the risks of climate change for sea levels.

Report outlines worst-case climate damage

A new report on the risk of climate change to Australia's coasts predicts sea level rises could claim thousands of buildings and significant infrastructure by the end of the century.

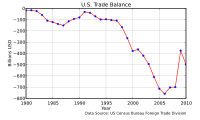

Okay, I know I'm a bit obsessed over the U.S. recovery and I promise I'll stop posting graph after graph on each Drumbeat but I came across some interesting graphs to showcase just how screwed the economic recovery is. Both in terms of unemployment but also, crucially in my opinion, the export/import balance.

Oh, yes Mr. Bernanke, please remove the QE II. I'm sure America will do just fine.

Uh, oh.

Additional commentary:

Read the whole thing.

Now, if you add Fannie and Freddie(which you ought to, I'm excluding future obligations for medicare just to be nice), then debt-to-GDP rises very closely to Greece's for America. Both nations share a similar deficit. Private debt in America is still around 265 %, despite years of deleveraging(this is higher than the peak of the Great depression).

Meanwhile, the Fed is artificially keeping up asset prices through Quantative Easing, since the house is the major source of wealth for most citizens. As QE withdraws, so will the artificial barrier to default and foreclosure for many citizens, which will compound the losses for the banks.

And a lot of these mortages are also contained on Fannie and Freddie, which the U.S. Gov owns.

The toxic is still there, and the deleveraging have been too slow to stave off further value shortfalls. A little-known newspiece came out a few days ago which stated that according to official statistics, the drop in housing prices is now great(from peak to current bottom) than it ever was during the Great Depression.

Last time QE was dropped, about the same time last year, the market fell nearly 20 % just over the course of the summer until the Bernank felt he had to step in and launch QE II to avoid a double dip into the abyss. Now it's almost time to drop QE II.

Are you watching Mystic report the "World News" on:

http://overthepeak.com/wordpress/

He's a real doomer.

Nope, I try to stay away from people/things called anything like 'Mystic'.

(I would advise you to do the same)

Instead, I enjoy these:

www.pragcap.com

www.calculcatedriskblog.com

And of course Krugman's blog.

Cato's got a few neoclassical blogs, if you want that perspective covered too(just remember that the Koch brothers are behind Cato, so keep it in mind. They have an agenda).

What a deep argument. Nothing like picking your company by their online handle. Good thing he didn't reference his skin color or political leanings. This guy has been publishing a video every weekday for years. And his links between peak oil and the banking woes are worth a listen. He also spends time trying to understand the EU issues. He is British, but lives in France. Just saying, not everything is in a name.

I read these too. And of course another great blog: http://www.nakedcapitalism.com

Leiten,

I appreciate your graphs, but what is your point? Yeah, growth is now harder to come by. The amazing thing about graph 1 is not the slow recovery in this recession, which has challenged fundamental assumptions and institutions, but rather the slow recovery from both the 1990 and 2001 recessions.

Coincidently (or not), this change in economic behavior corresponds (exactly) to the warping of our tax structure so middle class Americans no longer benefit from growth in the economy. No demand, no growth (once credit runs out), not rocket science. Unequivocally, the supply siders have won, we have plenty of capitol for investment - just no opportunities in the US with reasonable return. Of course investors chase ponzi (financial) schemes, no real investment provides the return they believe they are entitled too.

I don't really accept the US government debt arguments either (future problem yes, current problem no). Private debt has increased much more than public debt and is currently the problem because it is already unsustainable.

On exports, yeah, thats the bright spot in the US economy - I mean, it is - actually - not joking.

Thanks for sharing those graphs comparing unemployment during this current recessions to those preceding it. I hadn't seen such a striking comparison before. By following the most recent analogue occurring during the dot-com troubles of last decade, this recession will take approximately 3 times as long to recover from, assuming no other major disturbances. Its striking to see how quickly some of the early recessions in the post-war economy turned around in comparison. Paints quite a bleak prognosis for the short-term.

". . . , this recession will take approximately three times as long to recover from, . . ."

What makes you think we are going to recover at all from this recession? With oil imports down and continuing to fall for the U.S., I think economic growth is only in the past, not in the future.

Take a look at shadowstats.com; according to John Williams's numbers we are still in a recession, and rates of inflation are greater than the officially announced ones. I think his numbers are closer to reality than are the government numbers.

Our future is likely to be one of stagnation alternating with recession or depression. By 2020 I expect the headline inflation number will be about 20%, and there will be nothing that fiscal and monetary policy can do to return to economic growth so as to reduce the rate of unemployment. Already it is apparent that massive stimulus from monster federal deficits plus very easy monetary policy from the Fed has done little to stimulate the economy over the past couple of years.

The end of QE2 plus drastic budget cutting by governments (federal, state, local) will tend to reduce growth in the economy.

So my question comes down to: What recovery?

My sentiments exactly Don. Oil is the lifeblood of the economy and as long as the blood is draining slowly out there can be no recovery.

Don't you find it strange that none of the politicians, on the right or on the left, have connected the declining oil supply to the declining economy. Of course they all cite "oil prices" and some cry "drill, drill, drill", in the mistaken belief that this will fix the oil problem.

Of course nothing will fix the oil problem because we passed peak oil way back in 2006 and we passed peak net oil exports back in 2005. There is only one way to go from here.

Ron P.

I think almost all politicians and journalists buy into the "conventional wisdom" happy talk from EIA, IEA, USGS, CERA and the rest of the crowd that says, "No oil problem for the next twenty years."

How it is possible to ignore declining oil imports since 2005 is answered with one word: Denial. Note that denial is robust, because it uses selective inattention and selective perception to keep denying even obvious facts. For example, today the "Wall Street Journal" ran articles on the upcoming OPEC meetings. The journalists conclusions were that quotas would be changed to ratify existing production, which is in excess of OPEC's quota limits. There was discussion about the possibility of increasing quotas--and production--without the slightest hint that there might not be the excess production capacity available to increase production. In other words, the story was that although some members of OPEC want to increase production (KSA, Kuwait, probably UAE) the majority were opposed to this. Thus the failure to increase production is seen as purely a matter of internal OPEC politics and has nothing to do with a lack of excess production capacity. Such is the conventional wisdom.

Don, I presume you and others have noted that slow employment recoveries began when oil was cheap (1990 and 2001). At least that aspect of the current recovery is not new.

It is also said that major financial implosions take a lot longer to work through than ordinary business cycle recessions. We all know the proerty lending and debt is just mountains of toxic sludge, and it will take years to work out of the system.

I no longer find this behavior strange, once I understood that I wasn't looking at myself. Not just in words or semantics, I needed to "get" that whatever is going on in most other peoples' heads is not at all like how I think. "We don’t see things as they are, we see them as we are." (Anais Nin) The evidence is that they don't explore, or investigate, or challenge, never admit or even recognize when they're wrong (which is necessary for new learning).

Clearly, explanations and debate, with the intent of improving understanding, can be directed at some people. And when I say some people, I'm clearly lying, because it's actually less than a tenth of a percent of the population who have thinking to latch onto in their heads.

For everyone else, clearly a different solution path must be taken. Commanding, abandoning, coercion, manipulation, cajoling, bargaining, these are among the remaining solutions.

"Most people can't think, most of the remainder won't think, the small fraction who do think mostly can't do it very well. The extremely tiny fraction who think regularly, accurately, creatively, and without self-delusion – in the long run, these are the only people who count ... and they are the very ones who migrate when it is physically possible to do so." (Robert A. Heinlein, "Time Enough For Love")

At some point, the thinkers give up and leave to try something else.

I suspect that everyone thinks they are in that "special" catagory just like everyone is a better than average driver.

Interesting 710, of course I like to think I'm part of the small, thinking fraction. I think most on this site would be. Every once and a while I question whether I really am as open minded as you say this small fraction of thinkers is, because often in debates I will not relent. I keep on saying the same things over and over again, in different ways, usually to no avail. Is this because I'm butt-headed and narrow minded? In analysis, it seems that most people I lock horns with are indeed part of the larger non-thinking crowd. Sometimes if someone shows me evidence or convincing arguments that challenge what I hold to be true, I switch over and accept different explanations with little hesitation, if warranted. I guess that's why I like to call myself a scientist..... something we should all try to uphold as much as we can because you know what part of the crowd our leaders come from.

"The extremely tiny fraction who think regularly, accurately, creatively, and without self-delusion – in the long run, these are the only people who count ... and they are the very ones who migrate when it is physically possible to do so."

Interestingly, I just applied for immigration to New Zealand to get away from North America..... because the US is toast and I want to be nowhere near it when it collapses.

..and of course there is the old..

"I think, therefore I am."

..'DesCartes thinks he thinks, therefore he thinks he is..'

Don,

I couldn't agree more. In fact, I believe those who posit "the new normal" are going to be blindsided as things keep devolving. It's especially sad that many people will continue to structure their lives around a dead belief, i.e., growth is coming back, that the good times are around the corner.

Todd

I, also, agree completely. Declining available cheap oil for the US will slow growth as Jeff Rubin says.

Does anyone have a feel for how much of the high price of oil is due to the declining value of the dollar and how much is due to higher demand relative to supply?

Or how much due constant demand relative to the declining supply?

In all seriousness there has been some recovery in the oil supply since it hit bottom in early 2009. I doubt that net oil exports have recovered much at all but we don't have the 2010 data yet. I am betting it will be pretty flat in 2010 and down again in 2011 with the decline in Libyan supply along with the ever increasing consumption by most exporting nations.

In fact the EIA U.S. Petroleum Overview shows US net crude oil imports down 227,000 barrels per day, 2009 to 2010 and down another 575,000 barrels per day average for the first four months of 2011.

US Net Oil Imports, 2000 thru 2011 in thousands of barrels per day. The last point represents the average for the first four months of 2011.

Ron P.

Perhaps this is the answer - a comment on Zero Hedge this morning:

Ian Welsh in a posting today says that the Masters will keep the oil age going by any means necessary, whatever the consequences:

Ian Welsh comments from Canada, and has a pretty good record of analysis.

Yes, and for the unconventionals the beauty part is the Canadians gets all the environmental pollution.

I wish the Canadian had the sense or the control of their government to protect themselves.

Nonsense - the empire will have that energy, and the Canadians (fully part of the empire anyway) have no choice about it, and they will deal with whatever environmental consequences result. This is not a friendly playground game, this is for keeps.

Don't stop posting useful graphics. You know what they say about the worth of a picture...

So what is the meaning of your Gloom?

Why is the debt growing under Obama? We were running deficits for 8 years under the Bush tax cuts so when the economy crashed,economic activity and therefore tax receipts fell further.

Additional money was spent first fighting to save Wall Street and then to fight the recession itself aka unemployment insurance, etc.not to mention the idiocy of extending Bush's tax cuts and now payroll tax cuts.

The problem per Krugman is the stimulus was just too small to raise up the whole world economy. This should surprise no one,

the US lost $13 T in wealth and the stimulus was $1T($4T according to Krauthammer).

Thanks to market-friendly stupidity(starting with Bill Clinton), the US has literally shipped its industry overseas to China.

QE2 will end in August and there must be QE3. Contrary to

dire predictions, treasuries are holding up well despite massive

money creation. The dollar is still the reserve currency because it's better than all the other.

The free-market religion of Wall Street/GOP should have been put on trial for this disaster but they own America so we must blame

Obama who has almost no control over the economy(Congress has a lot more) for the fact that the economy is sputtering.

GOP now is intent on driving the US to default to gain some token political points.

What kind of brain thinks that threatening to default on the national debt will cause a economic revival?

The solutions are obvious.

Put Americans to work. Stop exporting jobs, export products.

Keep the economy from stalling at all costs. Coordinate international efforts to fight the Deflation.

Raise taxes to balance the budget(not reduce the debt). End the foreign wars.

"Put Americans to work. Stop exporting jobs, export products."

The problem is that everyone wants to be a net exporter. Someone has to run a trade deficit, but that eventually blows up your economy even if the people import from buy your debt. (the US is here) Ideally, China and India would now reverse and become net importers, and buy US products. This does not seem likely in the near future.

So export what to whom is indeed the great question.

Why can't the US just withdraw to the North American Continent, and trade amongst the States and Provinces? Wouldn't be much different than Europe.

There really are network effects, which mean that the larger your economic sphere the more specialized areas of the economy can grow and become efficient. I work on one end of the economy that is on the extreme end of that, computers and software. If you are designing one computer chip to service the entire globe (Intel) you can employ a team of thousands of experts (recruited from all over the world) to make advances. Split that level of investment up into a hundred competing projects and progress would be many times slower. Software is similar, hire the best of the world and market the result to the entire world, that works much better than every small state trying to replicate that for every application. Progress would slow to a crawl. Now for some industries, the network effect is pretty weak (think of say harvesting firewood, hard to make that work on a global scale).

I remember how well that worked for General Motors in the '70s when they had a virtual monopoly on the sale of cars in the US (52% of the market).

They got skotched by imports that started with a tiny fraction of the market. Its hungry folks, not monopolies, that innovate.

I suspect, after spending almost 40 years in factories, that there are limits to manufacturing efficiency also. When you reach a certain size you lose breadth of control.

Food,raw materials, energy to start.

The US has the large reserves of coal, natural gas and oil shale.

Of course we would have to reverse the Export Land Model.

In the early recessions on your graph, the US was an industrial economy. Coping with a recession was straightforward then. When people were laid off by the factories, increase government spending to stimulate demand for manufacuted goods and the factories would subsequently rehire.

One problem now is that we lost a lot of jobs in construction. But there is really now way to restart demand, since we are overbuilt in both residential and commercial buildings. It will take time for enough homes to burn or be bulldozed in order to restore demand for new housing. In the office building area, there is no shortage either. Companies continue to be more creative in use of space, with more jobs going off-shore, going to work at home, being done by people on the move, or being automated away. Retail is also well supplied, with on-line eating into demand for retail space.

So several million jobs connected with real estate construction will not be coming back soon.

The second, more fundamental, problem is that restarting a service economy is much harder than restarting a manufacturing economy, since output is not as much a direct function of labor input.

To take an example, if Bank A buys Bank B during a financial crisis, moves the Bank B accounts on its IT systems, and fires all the IT employees at Bank B, there is no reason for Bank A to hire more IT people when the crisis passes. What actually happened is that the service economy has been simplified and made less complex due to the need to maintain only one set of bank IT infrastructure instead of two. Bank A only hires more IT employees if it enters new businesses that require new and different applications.

This example was repeated many times in different companies, in various service business and in the "service departments" of all businesses during the recession. Once companies figure out how to do business with fewer employees in service occupation roles, they do not expand them very fast as business builds back. In fact, they found that getting efficiency in these areas was competitively advantageous and helped them get through the recession -- an advantage that they are unlikely to give up.

Yes, you make some very well thought out points.

When the U.S. switched from being the largest creditor nation in the world during the 80s to the largest debtor nation in the world, one way to keep increasing economic growth was through consumption, and especially consumption riddled with debt. And the best way to do that is through the housing market.

Now that the housing market will continue to fall due to oversupply for the near, and perhaps even medium term, that will cut at least 1 % in GDP growth. Add to this, the food and oil prices which are in highs not seen for decades. And they are both here to stay.

The Fed counts inflation with the so-called 'CPI'. This excludes food and oil prices because it's deemed 'too volatile'. The fact is that with both food and oil prices, growth falls to near zero or even sub-zero with QE II.

Your points on the retailing, service sectors visavi manufacturing are spot on and does not need any further commenting.

I personally see QE III as increasingly likely by the day.

But it may not be a large program like that. I've read the other day on Reuter's news service that the Obama administration is preparing a fresh new mortage package(note that TARP already allocated about $50 billion for distressed homeowners, as well as QE I & II buying up the bank's toxic loans, to homeowners).

This will be employed in the short term and if it doesn't stop the bleeding, then we will likely see more various kinds of packages. I don't think QE III will come in a single, major announcement(it will look bad politically). Instead, I think QE III will come out in parts, spread over a period of time and under different names and for different reasons. But QE III, whatever it's shape, form or name, will most likely come as QE II winds down. In fact, they've already begun on the mortage sector.

Whatever it is, it will not be called QE III, and it is possible that it will be done without being announced.

Normally the Fed controls interest rates by setting the overnight interest rate or other comparably short term interest rates. However, QE had the dual objectives of supplying additional liquidity and of suppressing the longer end of the interest rate curve through open market purchases of mostly Treasury Securities.

The financial system is awash in liquidity, so that rationale is no longer valid.

The long end of the interest rate curve is still a worry. 15 and 30 year mortgage rates are low, but if they start to tick up, it would be bad for the very weak housing market. Treasury has been extending the maturity of US debt, but if long term rates rise, then either Treasury has to bring down maturities or has to pay more interest on longer term debt. Shortening Treasury maturities increases rollover risks and is very undesirable.

On balance, I think that the Fed will probably not act immediately following the expiration of QE II, but instead they will keep their eye on the long dated Treasury interest rates and on the mortgage interest rates. If the latter rise, there may be some fairly targeted program for mortgage rates specifically. Pushing out more money into other long term debt is less likely.

Stimulus Needed for ‘Frustratingly Slow’ Recovery: Bernanke

Bernanke Admits Economy Slowing; No Hint of New Stimulus from CNBC.

Bernanke's speech is at The U.S. Economic Outlook

I think that the view is that there will be no QE III, but that the Fed will roll over its maturing Treasuries and not reduce its balance sheet as they mature.

It partially depends who's stats you believe. Shadow Government Statistics says we have contracted about 20% since 2001. Likewise it depends what you think inflation is. Could be that in constant dollars federal tax revenue is down a significant amount. I do not follow this in detail but my 50,000 feet view is significant inflation since 2001 and significant contraction in real terms. Might explain in part the high cost of food in grocery and the high cost of gas.

Yes without the 2.2 trillion (GAAP) deficit the GDP would be even lower. I think a dollar od deficit is more like 2 dollars of GDP. So 4.4 trillion lower?

As we can easily understand from your post Leiten, the trouble with relying on crutches (stimulus & QE's) is it becomes harder to walk (keep the economy buzzing) without one or both. Fact is the economy's expansion (rise in GDP) was facilitated by cheap oil. Now we are on to higher priced oil it's an uphill battle just to keep BAU.

Maybe they are crutches. But those crutches represent actual real live people who had jobs before they were laid off because of the concern over the deficit. Those real live people spend money which is part of aggregate demand which translates into GDP. But as was said above, the impact through the so called multiplier effect seems to not be as great as it used to be through leakage (imports) and the fact that the quality of the jobs created seems to have fallen. Half (literally) of the private jobs created recently was from McDonalds. That provides a pretty good clue as to the quality of private sector jobs.

Putting aside the gross numbers like GDP, the stimulus is real and useful if you spend it on things like conservation, better infrastructure, solar panels, wind energy, more efficient autos, more compact cities, etc. These are real things that would be useful as we descend from the peak.

Frankly, I don't think anyone has a very good handle on where we go from here. However, it may be futile if the primary focus is on GDP, which doesn't really do a very good job of measuring quality of life, anyway. At minimum, we must try to figure out how you employ people without the crude club of aggregate demand. That crude club doesn't seem to be working very well anymore.

Expensive oil is a given but it should not be used as an excuse to just throw up our hands. Suffering is a given but I think our current policies or lack thereof is just an excuse to do nothing. The primary imperative of those on the left is to keep taxes down on the rich. If everything else goes to hell, it is still mission accomplished.

The operative word there is if, as in if it had been spent on those things mentioned, but over 1/2 was on dumb redundant tax cuts which squandered a great opportunity to kickstart renewables on a really big scale.

GDP is the number that reflects economic activity. If you've got a better number or know how to talk the world out of that number then step forward and give a good yell.

As far as stimulus goes, no new stimulus will be approved by the House because deficits are too big.

OK, stepping forward and yelling at the top of my lungs...

OECD launches happiness index

http://news.yahoo.com/s/afp/20110524/lf_afp/oecdeconomygrowthindex_20110...

– Tue May 24, 5:35 am ET

Just try not to eat the E.coli infected brussel sprouts...

So OECD is promoting a composite number combining disparate elements using whatever set of weights some bunch of ivory-tower academics or bureaucrats pushing some fashionable agenda du jour feel like pulling out of ... well, let's call it thin air. Or, given the wonders of modern computers, whichever at-least semi-plausible set of weights creates the country-ranking that best fits said agenda. Ain't progress wonderful?

Never mind...

It beats GDP, which is a terrible metric, and looks like a step in the right direction to me.

Yep.

PS just hates it 'cause it points out that one more truism of his ideology is in fact a 'fals-ism.'

Rising GDP does not necessarily correspond with rising general welfare.

A moments thought would have made this obvious, but those enamored of outmoded economic models rarely find the time or energy to actually think for an entire moment.

Just pity any German tourists in Spain, at the moment. Their happiness index will be falling fast.

NAOM

If things change and most houses are built in wrong place this must be really bad. The major source of wealth would disappear and all the infrastructure built to support them would also be worthless. Roads, sewer systems, telecommunication, schools, hospitals absolutely everything.

I grow up in the Swedish country side and there is a lot of farms abandoned during the sixties or something like that then tractors and fertilizers became common. Most of the people moved to the cities there a lot of new suburbs there built during this time but it would totally different if they could not afford to stay because of energy bills.

Leiten:

Nice post.

But everybody knows the U.S. is in bad shape.

The only people who don't think this are the financiers, the talking heads in D.C. la-la-land, and perhaps some who think linkedin and groupon can somehow support an economy of 310 million people.

Mark my words, the savers of dollars and the bondholders are going to be wiped out. It's the only way at this point.

Get your money out of the banks and into precious metals, hard assets, durable goods, and perhaps stocks of good companies, especially in the mining/agriculture/energy sectors. Distressed real estate is probably OK, as long as it's in a decent location vis a vis food/water/energy/transportation/services. Put lots of money down and make absolutely sure that you do your homework and cross your t's, you don't want to deal with any monkey business in mortgages these days.

Get out of 401k's and retirement plans. We are soon going to realize that if it's not your money to do what you want right now, it's not your money at all.

Eliminate all and any unnecessary spending - entertainment and travel, in particular, come to mind.

If you want to be the sucker, then sure, save lots of cash and put it into banks and treasuries, even though it's earning no interest and food and energy are going up.

Of course, the trick is to remain just liquid enough to pay the bills and afford the stuff of daily living. Easier said than done. But there's no point saving lots of dollars.

I'm fighting back. The Fed can choke on it's debt and confetti currency for all I care.

Ben Bernanke just spoke about PEAK OIL!!!

"Indeed, OPEC's production of oil today remains about 3 million barrels per day below the PEAK level of mid-2008.

With the demand for oil rising rapidly and the supply of crude stagnant, increases in oil prices are hardly a puzzle. "

Live on bloomberg TV now.

Full speech:

http://www.federalreserve.gov/newsevents/speech/bernanke20110607a.htm

He is also said that gasoline prices are the major driver of current inflation. And at the end, he said the main priority is to control inflation. Well, I think we are in a global recession or the Fed has to tackle rising gas prices. The latter would be much more interesting than the former.

As he sees inflation as transitory and gas prices driving inflation, therefore, in his view, higher gas prices are transitory. While I think that gas prices may stabilize or go down a bit for awhile, I don't think transitory is the right word. In any event, the words he uses do not seem to be tethered to the real world, and by real world I mean the physical world that most of us are forced to inhabit. Monetary policy cannot overcome the effects of the reality of peak oil except to the extent that one addresses peak oil by continued recession and near depression.

I would like to know how the fed addresses rising gas prices without deepening the recession. I also don't see how the priority can be to control inflation at this time.

Maybe not. With these things, you always have to take the right number of derivatives (or sometimes just whatever number gives the sign you want.) "Inflation" is normally the current rate of change (derivative) of the general price level (except to the "Austrian School" who use their own impenetrable private definition.) So if, as you suggest, gas prices stay put for a while, then they cease to contribute directly to "inflation" for that time. That doesn't in any way imply that high gas prices themselves would be transitory, just that if they stayed put for a while, then the recent rising phase ("inflation") would have been.

Naturally, people wouldn't magically become able to afford the other stuff they used to buy with what they're now spending on gas, but from the viewpoint of rate-of-change, that's water under the bridge, analogous to a sunk cost. The affordability problem would remain, but for a while it wouldn't be getting even worse.

That is how I understand it to work, too. However, I believe the Fed might have the power to inspire a cultural revolution if the leading global capitalists so deem it necessary. That is the direction I see the Fed moving by making these comments. Unless I have missed something in the past, these comments are groundbreaking.

Even if you don't take higher commodity prices (its not just oil/gasoline folks) as temprary, the important thing Fed policywise, is will the increased consumer costs lead to generalized inflation (i.e. can it drive up the price of goods and services that don't require gas? The current opinion is no. Unemployment is enough of a threat, that employees can't damand their bosses give a a raise large enough to pay for the increased cost of gas & food. So it is not a threat to ignite general inflation. The economy price wise is working as it should, if commodities are more expensive (and imported), then in the collective average we end up poorer. If people had the power to demand extra pay to make up for it, then that forces other prices to rise, so staying even with such a shock is a receding horizon problem, and what you end up with if everyone tries to get more pay to maintance their status pre-spike, is seventies style inflationary spiral. But that doesn't look like a threat in the present environment.

If you didn't see the 60 Minutes episode on Wall Street High Speed Trading last night you should definitely watch it today at the link below.

How speed traders are changing Wall Street

This story should answer this question... for those who take the time to watch it anyway. It is 13.5 minutes long. The entire idea of high speed trading is to make money... and more money... and more money. Once you watch this episode it should be very clear to you exactly what is happening.

Ron P.

They aren't kidding about that 'blink of an eye' timescale. For interesting details google on market crop circles.

You know what they say about poker: "If you sit down at the table and you don't know who the patsy is ... you're the patsy."

Unfortunately, that seems to apply to the stock market these days. We left the table in 2001.

Jon

The analysis should be even simpler than that:

Why run an expensive high-speed trading operation?

Because there is more money to be made that way.

Where does the money come from?

Other traders.

Why would anyone who isn't a high-speed trader enter that market?

Because they didn't ask themselves the first two questions.

The answer is obvious ..

Don't try to play their game ..

I don't "trade" ..

I invest ..

All I care about when I choose to buy or

sell is that there is enough liquidity to

accommodate my transaction at the time

I place my order and that the

bid/offer spread is narrow ..

The HFTers in my view are providing

necessary liquidity to the marketplace ..

Triff ..

I invest, you trade, he speculates.

HFT machines aren't providing a service, they are making a profit for their owners. If that happens to benefit anyone else in any way it is purely incidental.

> I invest, you trade, he speculates.

The differences are quite simple.

An investment provides cash flow while you continue to own it. A stock provides dividends, a house provides rent, etc.

A trader knows, with 100% certainty, she can sell what she buys for more than she paid.

Everything else is speculation, gambling; although it's often called trading or investment to confuse the naive.

You are correct on the definitions, but people are notoriously bad at telling which of these they are doing.

Incorrect. When you come to the market to buy the stock you want to hold for the next year, you buy it from me, the guy who bought the stock with intent to hold for a few seconds (why yes, I am doing HFT).

Why do you buy it from me? Because a few seconds before you posted your order, I posted mine, and the broker brought you my way because I was offering the lowest price. If I'm not there, you get to buy from the next guy in the queue, and that costs you one penny more. This is the service I am providing. And I keep providing it so long as it makes me money.

Thats true, in theory, the traders add liquidity (and efficiency) to the market. I don't think thats how the high speed trading works. The idea is for their computer program to spot the good deals (the guy that threw out a sell order $.01 too cheap, and snap it up a millisecond before you find it. Then he makes it available to you for $.01 more than be bought it for. So the HFT guys are trying a make tiny amounts per trade, but make billions of trades. They are trying to skim the noise of the system for nickels and dimes. Mere mortals of course can only participate by giving our money to some fat-cat trading house.

What if neither me nor the seller require liquidity that second? What if getting the trade done that day (or even that hour) is sufficient?

Then you are providing a "service" that has no value to me or the seller, for a price that neither of us agreed to pay.

"What if neither me nor the seller require liquidity that second?"

I am not just offering you speed. I am also offering you a price better by one penny. If you do have all day, then you can post a limit order instead of a market order, and if it's not at the price I am posting, then we don't trade. Either somebody comes and fills your order at your price, or you don't get the stock. But if you don't have all day, my presence in the market gets you a better price.

You had to buy the stock from someone in the first place, for less than the price you sold it to me for, or there is no profit.

If you weren't in the middle making that first buy to flip right away then I might have been able to execute my trade directly against the seller you bought the stock from, for a penny less than you would have sold it to me for.

Someone might have beat me to it, but in your scenario you did beat me to it. You were just willing to sell again right away (at a profit to yourself).

"You had to buy the stock from someone in the first place, for less than the price you sold it to me for, or there is no profit."

And you weren't there to buy it from him. If you had been there, you would have gotten the better price. But you have other things to do from 9 to 5. So you bought it from me. And if I weren't there, you would be buying it from somebody else, possibly the specialist, which would guarantee a worse price for you.

"If you weren't in the middle making that first buy to flip right away then I might have been able to execute my trade directly against the seller you bought the stock from, for a penny less than you would have sold it to me for."

No. If you had been there a minute earlier, you would have pushed me out of the way (exchange regulations are on your side, not mine). But you weren't. So it was a matter of dealing with me or with a different middleman. I am the best middleman available to you. Before the likes of me came along, the middleman's fee was 12.5 cents a share. Now it is under a cent.

You're welcome.

The whole point of HFT is to spot those trades and get in the middle of them as quickly as possible.

To be the middlemen for the middlemen.

If you had only been there a second earlier you could have bought from the original seller instead of the millisecond-level HFT you did. You most likely sold to an HFT instead of me as well.

They might have only sliced a fraction of a cent off either end, but that is still money that came from someone else in the transaction chain. And those fractions of a cent add up to the point that HFT is a major driver of supercomputing and high-speed telecommunications technology.

We'll get back up to the $0.125/share for the retail investor soon enough, if we aren't there already, because as the margin per trade has dropped the number of layers of traders has increased.

"The whole point of HFT is to spot those trades and get in the middle of them as quickly as possible.

To be the middlemen for the middlemen."

No. The point is to be the most competitive middleman. Our competitive edge comes from automated trading, which allows us to profit from a tiny spread. Our predecessors required costly human oversight, which is why their fee was higher.

Sigh. No money is made in these activities. Great wealth may be accumulated, but really, no money is made.

The Red Queen has become a machine! Running to keep up.. "Jane, how do you stop this crazy thing?!"

We just had a family owned food-processing company in Portland get sold to an Ohio Company (Barber Foods), and will now be automated, putting many locals out of work. Kind of off-topic from what you're offering,.. and kind of not. http://www.kjonline.com/news/ohio-company-acquires-barber-foods_2011-06-...

Heaven help us.

And yet people watch CNBC much of the day for a "clue". Maybe they will just start playing CNBC to the machines. If they told the suckers the truth, CNBC would close down.

Imagine the consternation should the U.S. Government place a sales tax on "trades"?

Oh, you are vicious, what a wickedly pleasant thought. It would only have to be a fraction of a percent.

Wow, the Gov could nickel and dime the big investment firms the way the investment firms nickel and dime private investors.

Never happen.

I believe the economist Hazel Henderson proposed just this quite a while ago.

But, you're right, the boys will never allow their toys (or the games they play with them) to be diminished in any way.

Unless we force it.

The government already does this. It's called the SEC fee. It applies to SELL orders only, not BUY orders. Last time I checked, it was about $5.40 per $1,000,000.

Hello Hardhat,

I wrote to my two US Senators to suggest this about 20 years ago. This was bafck in the days when they would reply to every letter. Their replies were the most amazing display of bafflegab that I ever saw. The only real difference between the two was that the Democrat needed two pages to say nothing, while the Republican was able to say nothing on a single page.

For sure, that's a great report. It was claimed that the high speed trading "adds liquidity" to the markets, but it's rather obvious that what they are doing is removing substantial amounts of "capital" from the markets. One wonders whether these guys would do all this bit fiddling were it paper upon which the trades were recorded. Better yet, if they had to keep track of every purchase and sale to calculate capital gains taxes, they would drowned in data. Maybe taxing each trade would be a way to put a stop to this madness...

E. Swanson

Climate of fear: Australia scientists face death threats

The more obvious the climate trends become, the more certain the denialists are that the climate researchers are evil. Australia is doomed and the scientists are threatened as if it is their fault.

Australia is doomed

I don't know why so many people think this, when it's just not the case. Australia will be fine - its biggest threat is if the world economy collapses, as it does import a lot of manufactured goods.

Apart from that, it is self sufficient in everything except oil, and there is plenty of scope to reduce oil use, though this is not being done as aggressively as it could be.

As for global warming, it is already hot and dry! Of all the places that are used to living with hot and dry weather - that would be Oz (and Israel).

It is going to get hotter and drier! I think the saving grace for Australia is a small population. It is wealthy enough to do desalination for 20 million people.

Yes, the small population is the saving grace, as long as the Aust government decides to keep it that way.

so it will get hotter, and - maybe - drier - but maybe not. if the Indian ocean warms up there will be an increase in moisture coming onto the continent.

Desalination is already being done - there are enough plants operating or under construction for 1,300 ML/day - enough for the daily needs of about 5 million people.

The energy requirement for this is about 220MW - about 1/4 of a modern coal fired power plant - you could desalinate the domestic water requirements of the whole country for one 1000MW plant.

That said, the Perth and Sydney plants both use wind power.

The cost to produce desal water is about $2/cu.m - or, 50c per person per day. I'll pay ten times that if need be.

So, really, supply of drinking water is not a big problem. Given that Australia produces more than twice as much food as it eats, that is not a big problem either.

And energy, well, other than oil, there is plenty of fossil, and renewable energy to be had.

I just don;t see cause for the doom - we are used to hot and dry - many other countries/places are not. They are the ones that should be worried.

Would Australia get drier? If the tropic belts move south some parts should get wetter. Tasmania might get drier.

One thing that happens with higher temps, is that drying (or wetting, if you are in that phase, like Northeast last fall), happens faster. Evaporation rates go up exponentially with temperature, so a dry spell turns into a drought that much faster. And then when the rains come they are heavier, so it takes a shorter amount of time before it starts flooding.

Funny. I use to think of Australia as the western country in the world to be most seriously kicked in the rectum buy climate change. Already beeing the hottest and dryest country, you have very little margin to lose more to CC. And desalinting for 20 million is very expensive.

Re: reducing Asian dependence on Iranian oil:

6/6/2011

Iran needs $60 bn from foreign banks to stop 1 mb/d oil production drop by 2015. Anyone interested?

http://crudeoilpeak.info/iran-needs-60-bn-from-foreign-banks-to-stop-1-m...

Sound like an opportunity for China to buy oil cheap from Iran. They can do what they did with Brazil. We will pay all development costs and you will sell us oil for $20 per barrel for 30 years (Brazil might have been 20 years not sure).

Re: 'Roads to Resources' locks up public lands

I don't think the author realizes what is going on with these roads. I used to work in the Alberta oil industry, but I suspect Alaska is similar. The Alberta government used to build really first-class roads to oil fields. And then they would just end. Travel past that point was on oil company roads.

Now, the oil companies didn't really care if someone else used their roads, but the government would order us to take out a specialized kind of lease from them that allowed us to put up locked gates and NO PUBLIC ACESS signs (the ordinary sort of oil lease wouldn't allow us to do that). And then they would order us to put up gates and NO PUBLIC ACCESS signs.

Those are exactly the sort of people the government wanted to keep out. Hunters and fishermen (frequently poachers) who would kill all the animals and fish out all the lakes, and then race around on snowmobiles (frequently drunk), harassing and stressing out the animals they didn't kill.

The oil companies had their own rules - Maximum speed 50 mph, no guns in the vehicles, no hunting, no fishing, no smoking, and no drinking on the job. Unlike government rules, these rules were non-negotiable. The people who broke them didn't get fined, they got fired. No exceptions.

There were usually a lot of animals hanging around the oil fields. They were kind of dispassionately interested in what was going on, but otherwise just munched away on the grass and bushes. They felt safe on oil company property.

Jared Diamond mentioned an example of that in his book Collapse - I think it was Chevron in Malasyia - the land overseen by the oil co was in much better shape ecologically than what surrounded it. Also all the fauna traipsing around in the Chernobyl dead zone.

Author here is bemoaning his inability to get access to the ocean via the Haul road except via commercial tour, but the only roads ever built up that way have been for access to field development in the first place, both the Dalton Highway and the rough trail that preceded it, the Hickel "Highway." I'd say you've got an acceptable tradeoff there, all things being considered.

Or the DMZ between the 2 Korea's.

A bountiful wildlife sanctuary.

Or Rocky Flats in Boulder County, Colorado. Or maybe that's the future of the area around Fukushima.

Or interestingly White Sands missle range, which among other insults had the first atom bomb test.

There is a fair amount of controversy over the health of the fauna in the Chernobyl dead zone. This PubMed link paints a less sanguine picture of the situation:

http://www.ncbi.nlm.nih.gov/pubmed/20002052

My favorite example of "wildlife protection by people who you wouldn't expect to do that" is the military base at Suffield Alberta, which became the British Army's largest armoured training facility after Gaddafi kicked the Brits out of their training base in Libya.

Canadian Forces Base Suffield

My experience with Suffield is driving past and seeing hundreds of pronghorn antelope grazing on the military side of the barbed-wire fence. They appear to be unconcerned about the heavy artillery, having realized that the British Army is not shooting at them. Rumor has it that if hunters foolishly sneak through the barbed wire to poach antelope, the British Army sneaks up and practices counter-terrorism exercises on them. This keeps the number of poachers low.

The DMZ between North and South Korea is another wildlife sanctuary, and a valuable one for many Asiatic species.

Camp Pendleton in southern California would be 125,000 acres of tract houses and shopping malls if the US Marine Corps

wasn't there.

http://www.pendleton.usmc.mil/base/environmental/CO_Env_State_Policy_Let...

http://www.cpp.usmc.mil/

KLR, It was Papua New Guinea highlands, and Chevron did a good snowjob on Diamond. I was on some jobs in late 90s and there was no containment or treatment for cuttings or discharged mud. It all went over the side of the lease into the watersheds. Chevron were relatively "good", I suppose, in comparison with the big mine at the apex of the watersheds on Bougainville, but that was due most to the much smaller scale of the operation (drilling rig vs open cast mine), not benign environmental practice.

From the land of sensible shoes (and disco music that drives Australians wild)...

Sustainable Sweden

With close co-operation between companies, academia, state and its citizens, Sweden has many clean tech lessons for the UAE

See: http://gulfnews.com/gn-focus/sweden/sustainable-sweden-1.815778

Cheers,

Paul

Unfortunately Sweden is a long country with low poulation density. Most transporttion of goods is on the road. This put together makes us very transport dependant, second in the world only to the US.

There would be a solution though; costal transportation. We could "easily" build container transport hubs along the coast and move the bulk of the long distnse goods that way, saving up to 98% of fuel costs. Unfortunately no one is on to this.

It sounds like not much is moved by rail either - would not an expanded/upgraded rail network, at least for Stockholm to the S -SW part of the country, be a good option?

Our railnetwork is tuned in for personal transport. Goods on rail is only 4% of the total goods transported, and to make even a dent in that statistics would take silly amounts of investments. Also we had lots of problems with the rail system this and last winter (that were unusually snowy) with millions of man-hours wasted on delayed of canceled trains. Those rails are loaded with people to the max. Any further expansion of the network will be for moving people around.

That said, they do have plans to turn a big chunk of land north of my town (Hässleholm) into a goods transportation hub for all of Scandinavia. This will be, if it happen, a realy big project.

Our railnetwork is tuned in for personal transport.

Pretty much the opposite of N. America.

It would seem that you really need separate systems if you are going to do a lot of both, but that would be a major construction exercise.

The advantage for sea is that anyone with a suitable ship can do it, without waiting for the government.

Plus, there is also the matter of that Swedish truck building company to support, though they could probably learn to build trains too...

Rail transport in the United States

It's ironic that deregulation, decontrol, and private ownership have lead to a much higher usage of rail for moving freight in the US than in Europe. It's really that American freight railroads are much more efficient at moving freight than European railroads.

In 1939 there were 132 Class I railroads operating in the US. Now, as a result of deregulation and consolidation, there are only seven Class I railroads in North America, two of which are Canadian.

Re: The advantage for sea is that anyone with a suitable ship can do it, without waiting for the government. This.

Salish Sea Trading Cooperative, Ballard's (Seattle) community sail transport is holding our 2011 season planning meeting soon. We're cautiously expanding beyond the CSA by also sailing down wool from Whidbey Island and cider over from Port Ludlow. Also starting up a grassroots waterfront alliance, along the lines of NYC's Metropolitan Waterfront Alliance. Well, OK, smaller in scale just a little. :-)

Well, this Australian was never one for their disco music...

Sweden has done a lot on energy efficiency and biofuels, to be sure, but I don't know how much of that is applicable to the UAE, really.

Following on from our discussion yesterday about oil heating being replaced with wood pellets - that probably the area where Sweden has been the most aggressive. Not only were there a lot of homes using heating oil, but they have a lot of small (1-10MW) CHP plants, most of which used to be oil fired, and most of which now are pellet fired.

Last year Sweden used 1.9m million tons of pellets - and their domestic production of 1.6m is equal to the combined production of Canada and the US (1m and 0.6m tons) [source] More than half their pellet consumption is in these CHP plants.

For biofuels, they are now the single largest energy source for the country, which is an impressive effort;

A lot of that bioenergy is things other than pellets - waste to energy and (especially) pulp mills.

Also interesting that they report heat pump energy separately - this is the net heat gain from the heat pumps. They produced as much energy as wind power! IF we value the energy at $0.1/kWh, then the heat pumps collectively garnered $300m worth of energy from the air!

No statistics if any of it is still being used for disco joints...

So non-ff/nuclear is nearly fifty percent of the mix. That's impressive. Too bad they aren't going toward doing more transportation by sea. If they did, they would surely represent the most sustainable advanced country, I imagine.

There are lots of harbours but the competition from the electrified rail is to tough.

How large the rail investments should be has been a hot political debate for quite some time, they are large but should be bigger.

Thanks for that insight. I didn't know the electric rail system was so extensive.