Tech Talk - Chemical floods to enhance oil recovery

Posted by Heading Out on June 4, 2011 - 11:08am

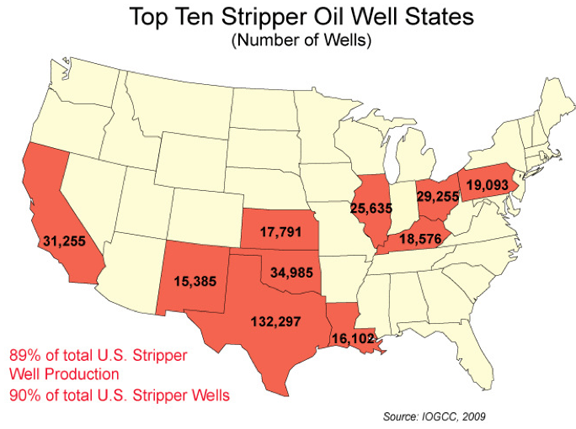

Before returning to look at the larger oilfields in the United States, I thought to describe ways of increasing the oil produced from the stripper wells that I mentioned last time. It seems appropriate to tie this to the time that I am writing about Texas, since some 41% or so of marginal oil well production comes from that state. And I would acknowledge again the help of the Stripper Well Consortium.

In the main, as Rockman has pointed out, the economics of production severely limit the options for increasing the flow of oil from these strippers. However, changes in market price and the reduction in costs of some of these treatments can make enhanced oil recovery (EOR) techniques worthwhile. And even if not presently economic, as research studies ways of lowering the cost, driven in part by the size of the market, and the need for oil, so the likely increase in the price of that oil will change the economics in a positive (for the well owner) direction. This post is therefore going to look at the use of chemicals to stimulate enhanced oil recovery with a particular thought for stripper wells.

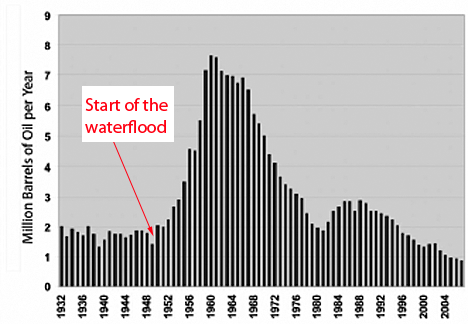

As an example I am going to consider the Lawrence field on the Illinois side of the Illinois:Indiana border, since this is part of an ongoing project.

The field had, by 1950, peaked and was in decline. However, by waterflooding the field at that time, generally recognized as secondary recovery, the water displaced the oil while maintaining pressure in the reservoir as fluid left, thus increasing production. though that too then began to decline.

Some time ago Stuart Staniford explained some of the problems with a water flood, in terms of ultimately recovering all the oil from a formation. The post itself deals with what is going on in the Ghawar oil field in Saudi Arabia, but to understand that, one has to understand a little of the physics of fractional flow in a multi-phase fluid. And so he provided that explanation, which I am now going to borrow:

If there is 10% water and 90% oil in a particular volume of rock (.........), then a well into that part of the rock would be receiving 10% water and 90% oil. Similarly, an area with 60% water and 40% oil might be producing at 60% water cut into a well in that area. However, this is not so: the difference is much more dramatic than that. The reason has to do with the physics of two phase flow in a permeable medium. If you want a mathematical treatment, try this, but let me try to illustrate the basic idea.

In a set of interconnected pores through which oil and water are being forced at pressure, the flow is too turbulent for large areas of the two fluids to separate out from one another. And yet, oil and water do not like to mix, and will tend to bead up in the presence of the other. If there is only a little water and a lot of oil, then the oil will form an interconnected network of fluid throughout the rock pores, whereas the water will tend to make small beads within the oil. Conversely, a little oil in a lot of water will result in a network of water throughout the rock, and small beads of oil within that network. Now, in either situation, the fluid that is interconnected can flow through the rock without making any change in the arrangement of beads and surfaces between oil and water. However, the fluid that is beaded up can only move by the beads physically moving around, and they are going to tend to get trapped by the rock pores.

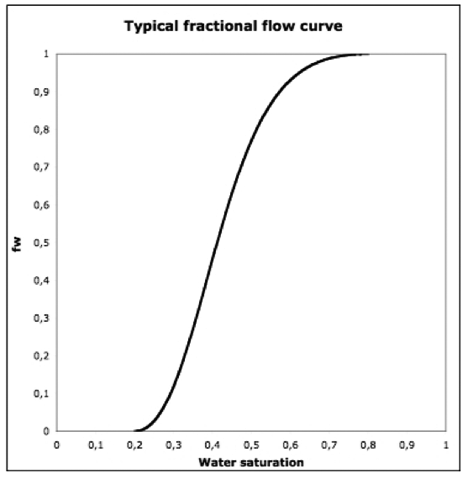

So for this reason, in a mixture of almost all oil, the water cannot flow at all. Conversely, once there is almost all water, the oil cannot flow at all (which sets an upper limit on the amount of oil that can ever be recovered by a water flood). In between, there is a changeover in which the proportion of oil flowing to water flowing changes much more rapidly than the changeover of the actual mixing ratio. The curve that describes this is called the fractional flow curve.

For example, the tutorial I referenced earlier shows this picture for a typical fractional flow curve:

"Typical" fractional flow curve (from this tutorial). Fw is the fraction of the flow out of the well that is water, i.e. a value of 1 is sensibly 100%. So, the way to read this is that when we are below 20% on the X-axis (less than 20% water in the oil), there is zero (water flow shown Ed) on the y-axis (the water will not flow through the rock at all). As we get above 20% water saturation, the flow of water increases rapidly, until above 80% water, there is no flow of oil at all. In the linear region at the center of the curve, the slope is about 3.6. That is, each 1 percentage point increase in water saturation results in a 3.6 percentage point increase in water flow in the rock.

Now this is not absolutely true, in that the mechanical motion of the water through the rock will drag a small fraction of oil along with it. Thus, at flows above 80% there will still be a small amount of oil that comes out with the water.

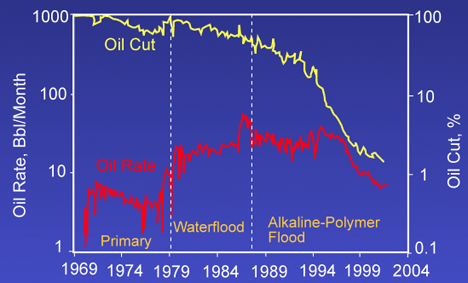

The amount of water that comes out of the well, as a percentage of the total flow, is known as the “water cut.” (And the obverse, or oil percentage is referred to as the “oil cut".) In Illinois, the wells in the Lawrence field are running at a water cut of 98%. In other words, for every 100 barrels of fluid pumped out of a well, only 2 barrels will be oil, and that must be separated from the water. In Saudi Arabia, one of the characteristics of production that initially caught Matt Simmons's attention was that the oil had a water cut of around 30 – 35%. But I’ll leave that issue to another day – though in passing, if you haven’t read Stuart’s post in it’s entirety (and the debate between him and Euan Mearns on Saudi productivity) it is well worth taking the time to do so.

What I want to return to for today is the remaining oil in the field. To put it simplistically, under normal conditions that oil is attached to the particles of rock in the formation, and the water flowing past only marginally can dislodge it and carry it to the well (hence the low oil cut numbers). Now if the chemistry of the oil could be changed, so that, for example, it did not cling quite as strongly to the rock, and, at the same time the viscocity of the oil was reduced, so that it would flow more effectively, then perhaps the water could carry a higher percentage of the oil away, increasing not only the oil cut, but also the total amount of oil that could be economically recovered from the wells. (This might also require getting the oil into an emulsion with the water).

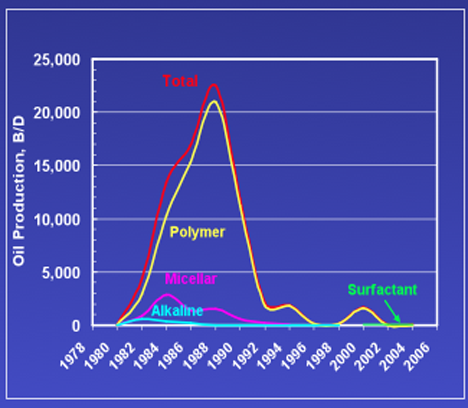

There are a number of different techniques and fluids that can be used to make this work. The idea is not new, and back in the ‘80’s the hot topic was “Micellar flooding”, although it, and its cousin ASP flooding, have not been that successful – in the United States.

The letters that make up ASP stand for alkaline, surfactant and polymer. Generally the chemicals are injected as a slug, or a series of slugs, into the water injection well(s) and then pass through the formation to the collection wells, being pushed through by subsequent injections of more water.

The first of these, the alkaline chemical (think caustic), is aimed to mix with the oil and lower its bond attachment (the interfacial tension) between the oil and the rock so that it can be removed more easily. By itself, however, it does not seem have that great a level of success in improving oil cut, but it sustains the flow of the oil for a longer period.

The S in ASP stands for surfactant, and this acts in much the same way as does the alkali in changing the adhesion of the oil, but acts more as a soap in helping to break the oil free. It has been shown to be more effective as a tool for improving recovery than the alkaline solution.

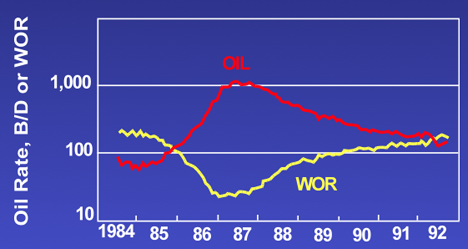

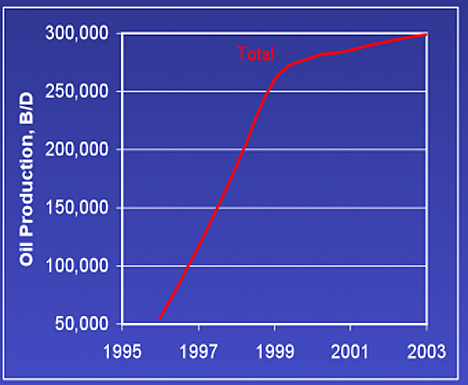

The polymer can either be used to thin the oil, so that it is easier to move, or to thicken the water so that it adds a more effective drag to move the oil. The benefits of this can be seen from a trial at the Sanand Field in India. Note that it also provides a more sustained effect.

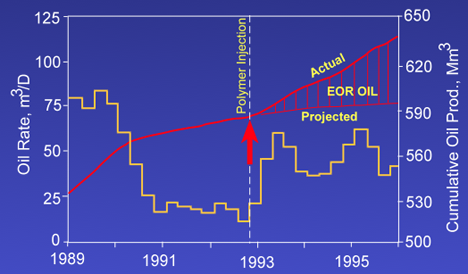

While each of these individually provided some gain, the impetus at present is to combine them in consecutive slugs (hence the acronym) and the benefit can be seen from the sustained improvement in oil recovery. (As you will note from the dates, this is not a totally novel concept).

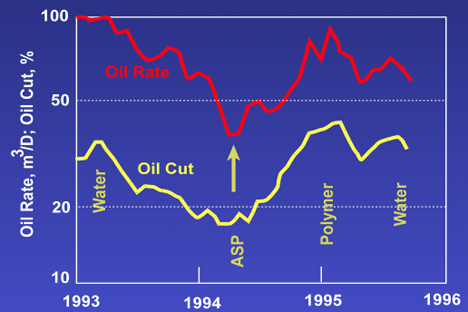

And here is a different example from Tanner, WY.

With this understanding of the background to the potential use of the ASP treatment, lab tests have shown that it might be possible with this technique to recover an additional 130 mbbl from the Lawrence field (until now it has produced a total of 400 mbbl). The potential, if the technology can be proven to work, is quite significant.

The big question that I included in my second paragraph, and that Rockman, (our resident realist) reminds us of, is the need for this to be a significant cost benefit to the operator before it will be implemented. Technically, chemical floods can increase the oil cut from 1 - 20% of the flow, but in the earlier tests the chemicals used cost more than the oil recovered. It is not a simple process, since it depends on the rock geology to ensure that the chemicals have the proper access to, and path from the oil in place. And the additional services to ensure this also cost. Lawrence was the site where Marathon tried using chemical EOR in the past and achieved the technical success of increasing the oil cut to 20% from 1%) but it was uneconomic. With the new program, Rex Energy is reporting in their first quarter report that the program is successful so far.

We are seeing positive results from the Middagh ASP project area with increasing oil cuts and oil production.

As a result, we have the confidence to increase our capital budget for the ASP program by $3 million to fund the larger 58-acre ASP project in the Perkins-Smith area. Results from the Middagh ASP are being analyzed to maximize oil recovery in the Perkins-Smith Unit. ASP injection on the Perkins-Smith Unit is expected to begin during the fourth quarter this year following brine water injection, which we expect to commence shortly.

The program is an area of considerable interest for the Stripper Well Consortium to whom I am indebted for some of the information in this post.

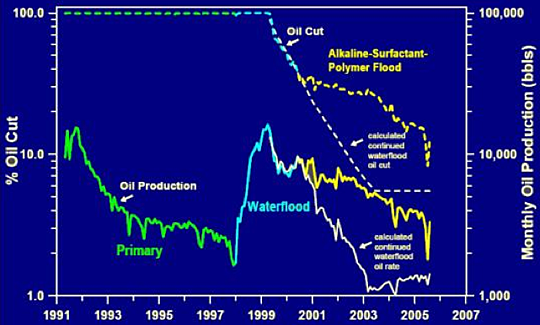

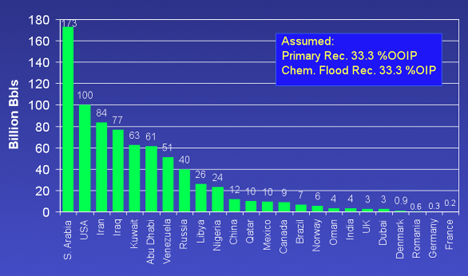

I would close, however, with a slide from Dr. Thomas’s presentation:

* The graphs identified as “Dr. Sara Thomas” were taken from the SPE Distinguished Lecturer Series 2005 – Dr. Sara Thomas “Chemical EOR – the Past, Does it have a Future?” (Abstract here )

Yes indeed, and as long as the true costs to the ecosystem, the commons and the rest of us poor oil addicted slobs continue to be externalized why should the well owners have any worries? At least until the day they end up tarred and feathered.

Fred, I am trying to understand what you are saying by "externalized". Is it that the wider human element is being marginalized from the equation?

IMO, I don't see any sense of scale in this analysis. It might as well read like a performance optimization analysis for a fast food franchise working with tight margins to extract any extra profit that they can squeeze out of the system. I also don't see how any big picture stuff like EROEI fits in, which puts pressure on other resources BTW. So the fact is, this kind of talk is excellent for the operators to extract more resource potential and thus paychecks from whatever is left in the ground, but for the rest of us there is essentially no context to place this in.

I think 99% of petroleum engineering as taught (having just looked at the textbooks and getting responses from these forums to what I say) is about wringing the last drop of extractive potential from the ground and the 1% rest to externalities such as the bigger societal picture or where this all fits into the depletion problem. As a contrast, when I compiled all the information I had gathered for writing The Oil ConunDrum, I chose not to place this kind of analysis in the book, even if I had as good a technical grasp on it as HO does. Instead, I did the best I could to understand on a larger scale the historical record of reserve growth and how that potential has been twisted beyond a reasonable scale. Heretical though it may sound, fractional flow is essentially meaningless analysis, or if not that, no one is willing to point out how meaningful the analysis is in the wider scheme of things.

There may be a good analogy for this in terms of Carnot cycle efficiencies for engines or solar conversion efficiencies for photovoltaics. For example, we know that we can get higher PV efficiencies if we choose to use exotic materials or if we start stacking up layered materials to capture a greater cross-section of the incoming light. But what does this give us if it takes a huge amount of effort or resources to get to that point? Perhaps it is worth it in the PV case, because we may be able to enter a renewable cycle. But for extracting the last bits of oil in the ground, unless we have plans to dedicate that for a path to renewal, it seems that we are only feeding the bottomline of the well-owners.

FWIW, that is my elaborate deconstruction of Fred's comment.

This article might help to illustrate what Fred is saying;

"Canada tries to hide Alberta tar sands carbon emissions

Greenhouse gas emissions from the tar sands are on the rise, but try finding that in Canada's official report to the UN"

http://www.guardian.co.uk/environment/blog/2011/jun/01/canada-tar-sands-...

But I am sure this has interest to WHT only from an analytical perspective.

Hey Rocky mountain guy Are you still convinced that the tar sands are environmentally benign?

They apparently included the data in the report, but buried it in the fine print.

Oil sands now account for about 6.5% of Canada's total GHG emissions, and Canada's GHG emissions are about 2% of the world total, or about 1/10 of US or Chinese emissions.

The biggest GHG emitter now is China, whose GHG emissions have nearly tripled since 1990 and now exceed US emissions, mostly due to their increased use of coal. The US and China combined now account for nearly half of world GHG emissions.

China also has 4 times the population of the USA, and has had an active (even brutal) population control programme for over a generation. Also, a lot of their GHG emissions are used to build trinkets they export to us, to buy on credit and then dump in landfill. (Us be US, UK, almost everywhere else).

Canada has very high per capita GHG emissions, and exports its oil to the US, which has one of the least oil-efficient economies in the developed world.

Much of Canada's high per-capita GHG emissions result from the fact that it exports most of its oil production, and a lot of its natural gas and electricity to the US, and much of its coal to Asia. The GHG emissions that result from producing that oil, gas, coal, and electricity are charged against the Canadian population rather than to the US or other consuming countries. If the US had developed its own oil shale reserves instead of importing Canadian bitumen, then the substantial GHG emissions from those projects would have been charged to the US instead.

Mind you, the same thing is also true of China. China produces half of the world's steel, mostly using coal, while most of the consumers of that steel live outside China. Other countries have basically outsourced their GHG emissions to China.

It's true, I can drive my Hummer everyday around the block for fun, fly to a sunny beach four times a year and sometimes a weekend to New York as well, leave the giant plasma-TV on all the time without really watching it, run SETI@home on my PS3 cluster 24/7 (electricity is cheap anyway), live in a poorly insulated concrete building and eat 100kg meat over the year. Yet on the scale of things my personal CO2 emissions are very small. You won't be able to measure the change in the atmosphere I'm responsible for, so don't look at me, it must because of someone else. Right?

*Our* CO2 emissions are quickly underway doubling the pre-industrial levels and are expected to do another doubling before the end of this century. But, ofcourse, you can always point a finger at someone else. It's easy, it's comforting but it's silly none the less.

I think what Fred was thinking, but thought was so obvious that he didn't state it was, what are the environmental consequences of these EOR techiques? The piece covered the techical end of the business case, but the rest of us are free to worry that environmental externalities (where do the chemicals end up) may not be part of the decision making process.

I'm not so worried about the EROEI case, the ecomonics/market should take care of that. That is unless there is major market interference like in the case of corn ethanol. But, I really doubt that is an issue for stripper wells. But whether regulation of the potential environmental dangers, should be a legitimate question.

Yes, that is pretty much what I was thinking. EROEI is not the full story and therefore the economics can only make sense if we include things like environmental degradation into the full costs.

And my bit is to add that we need to really do the statistics in depth.

The Tech Talks are starting to go in the direction of a pollster who decides that he has to survey every single voter to estimate who is going to win an election. This is done in spite of the knowledge that we have all the data we will ever need to infer how much more we can extract and what kinds of effects that will have. IOW, we need to start to apply our understanding of probabilities and the statistics of sampling techniques.

Yet the oil people actually want to do the equivalent of survey every voter because as Rockman says further down the thread that "With potential 100’s of $millions on the line" and "But could make me stinking rich...which is, after all, the prime reason I do this." (perhaps said in jest, but with a lot of truth behind it). With this attitude, macro statistics to affect policy is apparently out the window when the BAU of get-while-the-gettings-good still permeates the atmosphere.

That is the part that is painfully obvious to me. The survey analogy is my attempt to make it clear to everyone else. Cripes, if a pollster could get paid for every voter he surveys, he would probably hand out a questionnaire to everyone in his region! There is still essentially no incentive to alert anyone to think smart about the bottom-line trends. Fisheries people from my state Department of Natural Resources know how to do sampling of species better than the oil industry understands how to sample their resources. Of course that is true, because the DNR has no money to do it any other way. They have to work smart.

Fred's take is true as well and adds further salt in the wound.

Well written, Mr. Telescope, good points. but do you believe there is no hope? Will we not dedicate ourselves to the path to renewal? I would say there is still a chance. Mass media and now social media might enable such a transformation. I long ago concluded that the fall of the Soviet Union was enabled principally by the introduction of television to the FSU - i.e., when the citizens of the FSU were able to observe the lifestyles of the west, the end was written. Many have also made the case that the recent "Arab Spring" was enabled by social media. Witness North Korea where the dictator holds to power because the citizens are not allowed to observe the rest of the world.

My point is that more specific, more widespread, more real information is better. In this case, concepts that anyone could use in non-technical conversation - say with Senator Klobuchar or Franken. Someone mentioned memes on this blog recently and it started me thinking about the spread of information. I wrote a couple folks the following in response to an e-mail exchange about the oil patch:

"You know me, all I'm after is the truthiness : ) So, I take every opportunity to straighten out the myths about frac'ing. I believe that nuggets of truth are like memes, and often can self-replicate and literally spread throughout the world. I tell people (the ones who can comprehend the concept) first about the ethanol plant in Buffalo, MN. It's closed now, but when in operation an EtOH plant pulls millions of gallons per day from the aquifer they're tapped into and it's usually the same aquifer that the surrounding farms and homes are using. The heavy withdrawal creates a large cone of depression in the aquifer water surface - often miles across. The thing most people don't know is that methane is almost always present in the interstices of any given aquifer but is usually trapped in place by the pressure of the water. Any that wasn't trapped left long ago. (Gee this sounds a lot like a petroleum reservoir.) When the ethanol plant draws down the water level, the water pressure no longer holds the ethanol in place and it is free to leave. One of the routes it leaves by is straight up the water pipe in nearby drinking water wells. When it comes out the tap it is completely free and people like to set it on fire to make a you tube video. .... Exactly what happened years ago when the Buffalo plant started up. Folks figured the ethanol plant was somehow creating the gas - they just didn't know how or why. The other thing most people don't know (and the media doesn't report, go figure) is that frac'ing operations also require millions of gallons of water, so they often drill water wells near their frac'ing operation to supply the needed water. Same thing happens, except in the frac'ing case, people blame it on the frac'ing injection.

So spread this ethanol comparison to everyone who will listen, and let's see if it gets reported on the fake news."

Maybe a few folks on the TOD will also help this nugget along.

Jon, I don't have a lot of hope for a miraculous drill baby drill recovery, but more hope for renewal.

I did send info out to Franken a few months ago (mentioned your name too) but haven't heard back yet. I am kicking myself because I didn't think to chat with him when I saw him talk recently.

TOD authors and editors would prefer that the article threads relate directly to the MAIN article topic. Please review the Readers Guidelines at http://www.theoildrum.com/special/guidelines

More marginally related comments are always welcome in Drumbeat threads, which are basically the TOD open forums.

Best,

K.

I currently am working on an ASP flood and have been for the last 5 years. My plant is the second of 3 to do a flood with more planned. Another problem I would suggest is that once you stop pumping the polymer production drops off pretty quickly. I can also attest to different field geologies reacting differntly. The pilot plant had little problems but we are having big problems with scale coming up the wells due to the caustic used in the first stage of the ASP program. Production has increased though. And I'm not complaining about the over time asociated with being one of the newer learning curve plants!

How do these approaches (meaning, ASP) compare with CO2 flooding? Would CO2 flooding in conjunction with water drive increase total production beyond water flood then CO2 flood???

E. Swanson

HO – More outstanding then most. I hope all the TODsters take the time to read this post. They shouldn’t think it will be too technical to take in. You’ve done a great job of explaining one of the more complex aspects of reservoir dynamics without losing folks in technospeak.

Can’t improve perfection so I’ll add that bit of realism. There is one major stumbling block to all EOR methods regardless of gain: lack of “unitization”. The simple picture of a large field with uniformly distributed wells being produced by one company is more the exception that the rule. Typically there are multiple companies with wells somewhat scattered. The wells with improved recovery from EOR may not be owned by the company that owns the injection wells. Each state has laws that govern “unitizing” oil fields. When unitized each company is assigned a proportional share of the production as well as the cost of the EOR method. This is one of the most complex procedures in the oil patch. With potential 100’s of $millions on the line we shouldn’t be surprised to know there are as many lawyers involved as technicians. Unitization can and has been done many thousands of time but as we slide further down the PO trail there may be a need to modify existing rules to enhance the results. At least the lawyers will have the opportunity to make a lot more money.

On a related note is the tax considerations. Most fields with EOR potential are owned by small to very small companies that typically have limited capital. An EOR project might make economic sense on paper but if the companies don’t have access to the capital it won’t happen. Just like unitization we have nothing close to a one-size-fits-all solution. It will take a proactive effort by the states and feds to modify the tax code to open up EOR. Their choice is simple: max oil production or max tax revenue.

One of the problems with unitization in the US is that small oil companies have a strong incentive to stay out of the unit. Most US leases are extremely small, so while the unitized leaseholders pay for the costs of an EOR operation, companies that stay out can get a free ride - they can take advantage of the increased production from EOR, but don't have to pay the increased costs. It's the old "Tragedy of the Commons" scenario playing out again.

Most states have a compulsory unitization statute to eliminate this problem, but Texas, which is the largest oil producing state, is one of the few states without a such a statute. OTOH, in Oklahoma and other states, if (e.g.) two-thirds of the leaseholders (by acreage) agree to unitize their production, the remaining leaseholders are forced into the unit whether they like it or not. This maximizes unit production and minimizes unit costs, although individual operators have no opportunity to maximize their profit at the other companies' expense.

And, of course, the US has half the lawyers in the world, so they can be expected to complicate things at everybody's expense.

In most countries the point is moot because the government owns all the mineral rights and will just order the producers in a field to act as a unit to maximize government revenues.

ROCKMAN,

EOR is too important to be left to the dubious judgement of capitalists. The government should pay for the injection of CO2 into stripper wells as GW mitigation. It has been estimated by DOE that 15% of the OOIP will be extracted from wells by EOR.

The US produces 0.25 mbpd from EOR today.

http://fossil.energy.gov/programs/oilgas/eor/

http://fossil.energy.gov/programs/reserves/npr/CO2_EOR_Fact_Sheet.pdf

From the data above it looks like US stripper wells(<10bpd) produce about 500,000 bpd or 10% of US oil production.

Many of these low yield stripper wells have probably not even had anything more than primary extraction(as uneconomic) leaving 90% of OOIP. It would seem logical that CO2 EOR would just about double the output of stripper wells (going from a recovery rate of 10% primary only to 10%+15% for CO2 EOR). The immediate result could mean a 10 fold increase in bpd initially with a typical decay rate over time. It could mean increasing US oil production

from strippers from 500,000 bpd to ~2.5 mbpd initially. This would replace all oil imported from MENA(KSA, Iraq, Algeria) to the US.

But that leaves the question where to get the CO2.

CO2-EOR is carbon negative if a ton of CO2 yields 2 barrels of oil or less. Therefore to produce 2mbpd additional would take

1 million tons of CO2 which is the annual CO2 output of a single

small 150 Mwh IGCC-CCS coal plant running 5000 hours/year.

It would take 200 (25) ton rail tank cars per day to transport liquid CO2 to all the wellheads. All this is technically feasible.

The cost of sequestration is <$50 per ton of CO2 or $25 per ton of coal to produce $200 in oil plus $150 of electricity.

Unfortunately Big Oil is only interested in the Big Score and

is in denial mode when it comes to GW or Peak Oil( No more Big Score for you, API).

This IS the low hanging fruit though it maybe olives rather than watermelons.

maj - from your mouth to god's ear. LOL. Not really IMHO. Even with $60 oil a lot of projects will work. But changing the regs and the tax code could do a lot without the feds paying a dime. We blood sucking capitalist can do just fine on our own with just a little peripheral help. It's been my experience that free fed money with no strings attached doesn't tend to improve situations...at least not in the long run.

Why would you (or your fellow blood suckers) want to invest in a 1 bpd stripper well?

Answer is....you wouldn't.

The sheer numbers of stripper wells could only appeal to enviros who want to bury CO2 emissions and Peak Oil types trying to extract the last possible bit of OOIP.

The enviro/PO type interested in strippers is a 'rara avis' if not mythical beast, unless the government decides it needs to reduce CO2 and needs more domestic oil.

I am a blood sucking captalist, stripper well operator. My experiences with miscible flooding using polyomers and surfactants, with nitrogen huff and puffing, accoustic sound waves down casing and viscosity eating microbes have all been marginally profitable at best, most of them outright failures even at plus 50 dollar oil prices. My production occurs in naturally water driven reservoirs and after 60 years of careful management I believe my ultimate recovery rates of OOIP to be upwards of 40%. Patience and the price of oil represent my secondary and tertiary recovery plans and if left to my own finanical motivation and not regulated to death by my government maybe my EUR's will someday be higher than that. My wells are old and limping along with frail casing, bad cement isolation and irregular conate water patterns that can no longer be predicted; in some of my fields I have gone from 40 acres per well densities down to 2 1/2 acres. In other words, I think I am doing the best I can with what I got and I believe so is every other stripper well operator in the US. Chances are if it is doable, we already done it.

There is a reason that other countries in the world with no private oil and gas industry also have NO stripper well inventory. If my government, who cannot even balance its own check book, and who has run 60% of the deepwater fleet from the GOM completely off, were to nationalize my production for the collective good of society and start trucking in CO2 from 1000 miles away my 50 wells making 200 BOPD would be gone in record time, kapootski, done forever, adios. I say don't punish us with higher taxes, don't regulate us to death, open the gates off California and maybe in Alaska, get some kids out of law school and into PE school and we'll have about all the tertiary recovery we can get in this country.

maj - I would in a heart beat if I could get it at the right price. I know a couple who live south of San Antonio who operate abot 25 such wells making a little less than 1 bopd each. They are netting over $500,000/yr. It takes about 3 hours per day to manage them. And these wells will make that same revenue for at least the next 30 or 40 years.

Why don't I buy such wells? It would cost well above $2.5 million. And that's if you could get somone to sell. I tried years ago when oil was selling for much less and couldn't find a seller. OTOH my owner would't buy such wells: much too labor intense. OTOOH he might drill 50 horizontal wells at $2 million each if I can convince him the profit pontential of $10+ million per well is valid from these nearly depleted fields. Of course, no such efforts will change PO significanly IMHO. But could make me stinking rich...which is, after all, the prime reason I do this.

So an average 1 bpd well costs $2.5 million and yields of profit $20000 per year--a 125 year payback?

Sounds like a bunch of hillbillies who would'nt know how to take care of these oil reserviors in the first place.

Your boss sounds like a more normal greedy oilman.

LOL!

Realize a profit of $10M on a $2M investment(or yer fired!).

I don't think either of these extremes(greedy and dumb--no offence, R) are capable of managing these oil depleted fields.

The government scientists would be looking at the Weyburn Project

to get another 20 years of meaningful CO2-EOR production(better than horizontals).

http://www.netl.doe.gov/publications/proceedings/01/carbon_seq/2a1.pdf

I believe you have misinterpreted what the Rockman wrote. I'm pretty sure he meant >$2.5 for the whole lot.

minnie - I probably didn't give enough details. But yes...my 50 hz wells would cost around $100 mill. It would cost much less than $2.5 mill to drill a striper well in that that field making around 1 bopd per well. But it still wouldn’t be economical to drill. That's why the regulators need to be very careful about pushing small operators to abandon such wells. Once they are plugged they typically aren’t worth reentering let along re-drilling.

My hz project would take too long to explain its potential value but it has two key aspects. First, rapid payout of initial costs. It makes a huge difference in recovering 200,000 bo of one well pays out in 12 months and the other in 4 years. Both wells generate the same income but the long payout well wouldn’t be drilled by most operators. The second factor might be difficult to understand. Ultimately we plan to sell all our wells in a few years. Here’s the tricky part: two fields each have an estimated 2 million bbls to recover. Field A is brand new and its reserve estimate is based upon geology maps. Field B is a very old water drive reservoir where the wells are producing 1 bbl of oil for every 19 bbls of water…IOW only a 5% oil ct. Its reserve estimate is based upon decades of chartered water cut measurements. Both fields are making 3,000 bopd and cost about the same t operate. Field B, with the very high water cut, will command a higher price than brand new Field A. It would very easy for the reserve estimate on the new field to be off 20%...or more. Just the nature of the beast. The reserves for Field B are much more accurate.

If my project works as I anticipate the flush production will payout quickly but ultimately when we sell the wells will be fairly high water cut. I should probably avoid tossing out such abbreviated economics…it just takes too long to flesh it out clearly. But it’s true: all other things being equal and old worn out water drive oil field with a high water cut will command a higher price than brand new field with no water production. As I mention in the earlier post it’s very difficult to buy such fields at a reasonable price. Try to think of them more as an annuity than an oil field.

Rockman,

I'm not really a money guy but have absorbed the concepts that the money men live by, and coverage is key. That would also be the key in your example, yes? The uncertainty of Field A yields a risk premium that makes it less desirable than Field B. Field B is "money in the bank" as they used to say.

That kind of annuity I wouldn't mind. I know a couple guys with stripper wells. They buy the beer when we're pheasant hunting.

minnie - Exactly...every savvy player will low ball a bid to some degree to account for the risk. But negotiating tends to be a pain: you spend 100's on manhours to generate what you feel is a fair number and then some idiot bumps your bid by 50%. And it's typically either an investment group funded by "stupid money" (that really is the technical term we use) or a public oil company willing to swap $ for $ because it allows them to increase y-o-y reserves to make Wall Street happy. I've only made one good acquisition in the last 5 years and that was from a partner in production we already owned a piece of. They were in a real bind for time and took our low ball offer.

You see were not just evil bastards with the public but we'll eat our own kind if the profit is there. LOL.

Maybe but $2.5M/$.5M profit = 5 year payback

Hmm...?!

maj - yep...a very unique reservoir: gravity drainage...impossible to water or CO2 flood. They only pump for an couple of hours and then shut in for the rest of the day to allow that 1 bbl of oil (or less) to fill back up the tubing. Other than the electricity to run the pump jacks (which are less than 2' tall) there are no other production costs. Other than the operator's time to run around each morning and squirt lube into the pumps. I could handle that for half a mill a year. As I said: very easy to be jealous.

And that's why these folks won't sell: I can't pay more than 5 year payout because of net present value calculation but they can hang on to the field for 5 years, make $2.5 mill and selling it then. Or hang onto it for another 5 years. Sorta like getting a 20% return on you bank account with very little effort and almost no risk. At least as long as oil prices don't fall. OTOH they kept the field way back when they were selling for $7/bbl...a hefty H2S discount. But that's still over $30,000/yr in a county where one of the highest paying jobs is the clerk at the Diamond Shamrock gas station.

Jeeez,

My cat and a number of other people think I'm a pretty good guy, but I guess if truth be told I'm just another of those "Blood - Sucking" capitalist stripper well operators too.

In reality drilling 5 BBL/d or less wells make a lot of sense if you watch your cost and know what the hell you are doing. Round here we do it for $35,000 - $60,000 depending on depth, look for around a twelve month payout and 2 BBL/d or less after that. The first well on my lease was drilled in 1964 and is still producing.

With a new fracking technique using a "cold" breaker old wells are being brought back into production, and new wells are being drilled as we speak.

Drilling stripper wells is worth doing, but like most things you have to know what you are doing too.

Also I enjoy the work, the freedom of my time, and yes the money is getting a whole lot better, but I do not consider my self greedy. I'm just taking care of my business.

Rockman and OFT, updated my profile so give me a shout.

There was a small oilfield about 6 miles from my house here in South Arkansas that used CO2/water injection in the early 1980's. It did increase production but the corrosion down the wells was severe. The severe corrosion along with low oil prices in 1986 they P/A the whole field. I was told they would still be pumping today if they had never done the CO2.

My father now 75 years young worked both a spudder completing wells and a pulling unit fixing wells in the Lawrence field as a young man, I have the pictures and silent 8 MM film to prove it. He and his three brothers ran a fleet of oilfield service rigs and various equipment in the Illinois Basin for years. He has told me many times there is a lot of oil to be made from that field and what has kept it in the ground has been mismanagement and fragile egos, mostly when Marathon had it, I hope Rex has better luck.

My pops has over the years wound up with a hand full of wells in various formations that have made him a rich man through hard work and sweat, the badge of honor of the stripper well producer. He would still at his age invest in the 1 barrel a day well if like Rockman said, he could get it at the right price.

I just came back from the Permian Basin. They inject CO2 because it thins the oil and causes the oil to release from the rock. Water flood is out of the question in an area that has not had rain for 9 months. I not sure where they get all that CO2. There are many gas plants around maybe that's the source.

ido - Not 100% sure but I think most of that CO2 is pipelined in from AZ and NMex.

Natural CO2 fields in New Mexico and Colorado are the main sources. The Permian basis does have the advantage that there are conveniently available sources of CO2 nearby. Most oil fields are not so conveniently situated.

Oh, thats great. CO2 gas fields. Saves us the trouble of having to keep 'em old car motor engines rolling, we can now emit into the atmosphere without using it for stuff. Halelujah!

I assume that that CO2 must come out with the oil. So there is a gas/oil separation plant. And once the CO2 is through the GOSP, do they recycle it down to the ground or just let it out?

Thats how CO2 EOR works. A lot of people like to pretend that its a form of sequestration, but its often the exact opposite. CO2 is taken from underground and released into the atmosphere, bringing a bit of extra oil up with it.

I have followed dialogue on the drum for quite some time - and made no comment. I think there is no doubt we have passed the peak of cheap oil production (Campbell & Laherrere 1998). Any subsequent peak in production doesn't matter because it is so heavily underpinned by much more expensive modes of production. I don't give a damn if total global production peaks again even in 20 years due to intensification of production techniques. The central point is any future oil produced - either from old wells or new - will be so expensive we will never again have cheap oil. And that has enormous economic,social and political consequences.

Mr. Rockman you enjoy rock star status on this site and everyone seems to think you have the practical, real answers because you are an oily type guy. You have more patience with folks than I do; this Major person for example is clearly very anti-oily and more or less implies the we oily folks are greedy and dumb and need the government to fix us. I deal with that kind of ignorance every day but more or less don't turn the other cheek from it very well...my industry is constantly turning the other cheek and as a consequence the public is very uneducated about oil and natural gas, suspicious and considers us evil and greedy. So, better you that me I guess, though sometimes I wish you would get on these kind of folks a little more. They'll listen to you, why not?

I live with 1-2 BOPD wells and invest in them every day like my livehood depends on it; as I tried to imply in my post just about every effort I have made at EOR has proven to be uneconomical except infield drilling. Many reservoirs, fractured carbonates for instance, are not very receptive to water flooding or CO2 injection; in Caldwell County, Texas for instance I believe there are 8000 Austin Chalk wells that make less than 1/2 BOPD. Folks have been at that over there since 1922. Those wells have been fraced and re-fraced a dozen times, drilled 150 feet apart, horizontally and vertically, they still make 1/2 BOPD. Those folks over there are not greedy nor or they dumb, they are actually very good at what they do and people in this country ought to appreciate them, not second guess them. In the long run, as Mr. No Longer suggests, it boils down to what kind of bang you get back for your buck. Energy in versus energy out. Any notion that the federal government can operate stripper wells better than we can is a bunch of hooey.

We are uneducated about oil and gas because the oil and gas industry has never sponsored a comprehensive study of fossil fuel resource limitations. They must not have a conscience.

Jeez, I grew up understanding the electronics industry and science by watching all those educational films sponsored through Bell Labs.

http://www.youtube.com/watch?v=0lgzz-L7GFg

1958, Dr. Frank C. Baxter talking about climate change.

WEB - Not the oil industry...the public oil companies. And you would expect them to teach the folks why their companies have no long term future? Let's see: is that what the puter CEO's did who saw the dot.com bust coming? Is that what the auto industry CEO's did when they say the bottom falling out of their markets? Is that what the CEO's of the mortgage cos did when they saw the subprime bust coming?

As I've pointed out before: the oil patch, as well as all these other industries, ain't the public's momma. The American public has its govt with countless experts with a never ending supply of money. Maybe they should have been handling their responsibilities a tad better. Now if the TODster want to pass the hat and fund a few hundred $million for a nationwide TV promotion I can round up more than a few oil hands who would enjoy teaching the public just how ignorant they are.

Of course, that assumes the public would be willing to listen to the truth. Yep...that'll happen any day now. LOL

Yet that is exactly what Bell Labs did. They ushered in their own demise by educating the public about their research and technology. When I got out of school I went to work for IBM Watson Research, one of the few successors to Bell with a similar attitude. I hadn't seen one of those Baxter reels in years and when I saw it again just now, all those memories rushed back in and I realized why I went into science in the first place.

You can't rationalize these facts away. Some scientists and technologists have a conscience, others never had one and never will. For the latter, it's all really quite sad and pathetic. It is what it is now, and passing around the hat won't help any.

Of course, back in those days, Bell Labs was an integral part of a cushy, government-guaranteed, too-big-to-fail, nothing-whatever-at-risk, money-printing monopoly called AT&T. That behavior had a lot more to do with living in what seemed to be a sort of unending economic nirvana than it had to do with magically finding a staff possessing consciences superior to those of mere mortals.

So, as far as you're concerned three or more wrongs make a right? I have enormous respect for you ROCK, but that's still pretty lame. NO BLUEBELL FOR YOU!

FM - You missed my point...I probably didn't explain it clearly: there were "no wrongs". Corporations have a simple set of rules: don't break the law and maximize profits for the shareholders. They have no responsibility for teaching the public anything. Of course, they shouldn't lie but that's the not-breaking-the-law thing again. It's not illegal to spin a tale to one's benefit: nearly every person and corporations does from time to time and that's not illegal. It may not be admirable at times but not illegal.

Not three wrongs but three examples that indicate corporations are not the public's mommas. IMHO the primary responsibility for understanding PO and electing a political system to deal with it falls on the public. Unfortunately they would much rather focus on voting for the next American Idle. Or to put it more simply: if all of Big Oil started putting out the cold hard truth would anyone other than the TODsters be listening? We have large organizations with solid credibility trying to do just that and the public ignores their existence for the most part. And these are the same folks who'll spend hours studying the truthful words of an ExxonMobil reservoir engineer? Shhh...I rather be smoking what you are than eating BBIC. LOL. And the Blue Bell exclusion won't hurt me: except for a couple of slips I've been BBIC free for over a year. In another lifetime I did my share for the public interest and all I got out of it was a fractured vertebrae and not even a thank you letter. My obligations now are for my family, friends, and the folks around me that could use some help. The rest of the country is on their own. As a wise man once said: don't try to teach pigs to tap dance: it only frustrates you and p*sses off the pigs. In the end no one is happy with the results.

IMHO there is only one course for the American public to ever get even a small sense of PO and that's from a cooperative bipartisan effort from our political system. And even then I'm not sure how effective that would be. But that doesn't really matter because I doubt many of us expect such a transformation of our public servants.

There are people within the industries that will do the right thing. Many scientists won't work for a research company unless they are given freedom. The corporate leaders decide to either hire them or miss out on exciting new inventions. Obviously none of this kind of logic applies to the oil industry.

No need to be an apologist, you are one of the few given some sort of freedom, or at least show some kind of initiative.

Web - Certainly such logic doesn't apply to the public oils. I don't want to beat that horse to death but I suspect some folks think I exaggerate a tad when I talk about how public oils will not tolerate any resistance to plumping up reserves/potential to make Wall Street happy. Or their willingness to ignore the 800# PO gorilla in the room. Off the top of my head I've probably lost 3 or 4 contracts (and one job) for not signing off on bogus reserve reports. And that doesn't count the times I wasn't called back for more work. Once when I was the division development manager (for one of the worse public companies in the history of the oil patch) I refused to authorize a BS development well so they transferred in to the exploration dept. who approved and drilled that worthless dry hole. I didn't get fired because they needed me more than I needed them but they stil didn't have to follow my lead.

And don't mistake my motivation: it wasn't some spiritual or moral calling on my part. I just don't like being told I'm wrong and will readily back it up with willful discontent. An attitude I'm sure is very alien to your way of thinking. LOL.

Big Oil and Big Economic Talking Heads get the air time. Maybe sometimes a fellow with an American Association of Petroleum Geologists (most members work for Big Oil). But how many times have you seen the MSM quote a geologist/reservoir engineer who belongs to SIPES? SIPES = Society of Independent Earth Scientists. And by "Independent" it means just that...they have no more use for Big Oil's propaganda than you...and they aren't shy about expressing their feelings. I do from time to time supply some media types with my version of the truth. But impact? Only in my wildest dreams. LOL.

Ya see how good you are at that, Mr. Rock; man that was great. Thanks.

I often would like to know how much my 3/4 ton pickup costs to make in Detroit but I don't think that GM owes me an answer. And I don't think they owe me an assurance that I can buy the same truck 5 years from now for 5% more, in the same color package, either.

Some folks on this site believe essentially that the oil and gas reserves in this country belong to the American people and it is the obligation of free enterprise, public or private, to sponsor reserve studies and our reserve base right down to the last quart, that the government needs to confiscate stripper wells to make them produce more. I hate to use the N word but that is what it sounds like to me sometimes. Americans detest our very existence on this planet, oily folks, but at the same time demand a constant, cheap source of gasoline for their SUV's without feeling guilt, for instance in the case of a blowout they have to watch on TV for 3 months. Regulate them more, deny their permits, increase their taxes and take away their tax incentives (NOT to be confused with tax benefits); its ok if you guys make a mess in the GOM but stay the hell out of California and our beloved Florida, by the way...we understand you are in the oil business but take all the money you are making from our conservative efforts at using ONLY 22,000,000 barrels of crude oil per day and use it to find alternative sources, thats your obligation too. We're gonna need that pretty quickly, so hurry. You know when an oilman is lying? When his lips are moving.

Its confusing.

Anyway, got work to do. I am scraping the America Needs America's Oil sticker off my truck bumper this morning. Don't want to get shot at. Mr. Rockman, keep up the fight. If you need some help with the public thing I got my old workbags packed and I am standing by.

I don't know about that. Some of us think about the future, like to plan, and understand the meaning of the term "corrective action".

In scientific terms, this means use your imagination, set up a hypothesis, and devise an experiment. That is about as patriotic as it gets.

Clearly you are a scientist and I admittedly am just a dumb 'ol roughneck but I began planning for my future and my families well being about 50 years ago. I did that by not whining about things I can't control and essentially trusting in myself and my ability to adapt to whatever anybody threw at me. When the price of oil was 9 bucks a barrel I hung in there knowing someday it was going to be a hundred dollars. That took lots of imagination and corrective actions, trust me, as well as a lot of hard-ass manual labor, forgive my Bohemian. I use to believe I produced something my country needed. I have to pay 15% more taxes than most folks do just because I am self employed and provide jobs and work to many others. My taxes are going way up so lots of folks won't have to pay any taxes. I am by God patriotic. But now days because I am in the oil business I mostly feel loathed.

There has been nothing done in this country to promote energy conservation; nada, zip. Consumption goes up and up and up every year; take a drive down I-35 at 2 o'clock in the afternoon and tell me people are trying to conserve. We are sitting on vast oceans of natural gas that would ease our transportaion woes and scientists and politicians sit on their thumbs giving REAL money to folks erecting giant windmills and neat little rotating solar panels while 70% of our daily oil consumption gets sucked up in trucks and SUV's and jets. Go figger. Americans rant about tax incentives, getting even with Exxon, deepwater permits, excessive quarterly profits and fracking, keep us confined to one ocean and entirely out of another because its got prettier water, then hire politicans to send good kids to Iraq and Kuwait to defend their oil sovereignty....yes sir, its very confusing to me.

My industry for over 160 years has supplied this country with its energy needs; the oil and gas industry did not get us in this pickle, it kept us out of a pickle for a very long time. Along the way we became the greatest industrialized nation the world has ever known. I think folks in this county simply need to believe that if it can be done, the oil and gas industry is going to have already done it or by God it will find a way.

By the way, sir, every company, private or public, big or little, in this country that produces oil and natural gas at one time or another must report its estimated reserve base, volumetrically and by decline methods, to the Department of Energy. I have done it 3 times over the past 40 years, on forms that looked like small books, with the fear of imprisonment if I didn't, thats a fact. What the government then does with that information you'll have to give them a call. I don't know their number, sorry.

I guess we have differently configured radar screens.

I picked up these quotes from http://azimuthproject.org blog yesterday:

quotes by Thomas Fischbacher

Thank you Web, that is scary.It is about time the politicians were disenfranchised. This and peak oil have been known about for so long but but nothing has been done just 'load our pockets for today'. I'm a little lost that this has been so ignored, excuse me.

NAOM

Mikey - That's the difference between us: you're a straight shooter and I'm a patronizing *ss kissing manipulator. Well intentioned, of course, but with an agenda like everyone else. You and I could have a good chat about stroke rates. But this ain't the oil patch...this is TOD. I hang here for two reasons: I'm stuck in front of a computer monitor much of the day any way. And for the Eleven.

Rockman, I always enjoy your comments, you are what many people here in Europe would call a cynic, unfortunately they don't realise that cynic is really a synonym for realist.

yorkie - Thanks. Realist...maybe. But really more like someone who has surrendered to the situation. Bless all the folks who offer well thought out solutions to our situation. But nearly all ignore the realities of a system unable/unwilling to change. There have been occasions when major transformations have occurred but they stand out because they are so rare. I don't look for change unless I see a viable catalyst. And I don't consider panic as an efficient motivator.

Rockman,

I see panic as a very efficient motivator it certainly concentrates peoples mind on the problem in hand especially in the short term. The best example I can think of is my country Britain in 1940 when the Germans broke through and we had our backs to the sea at Dunkirk. Fortunately for us we had a crusty old bastard who could define the problem, and too use that quaint American expression kick a**, to get the job done, which was very simple get the army back prepare too defend the country and build up the R.A.F. Churchill had recognized the problem in 1935 but had been vilified and was a voice in the wilderness. I have great admiration for the old Bugger, although I was never too pleased with the way he sent troops in to break up the miner at Tonnypandy during the 1926 strike. I can still remember standing by his unassuming grave in Bladon Churchyard on a beautiful spring morning nobody else around apart from me and the birds, we would have buried him among kings, but he chose too be buried in a beautiful village churchyard surrounded by the local people, what a man.

In the medium term and the long term it is virtually impossible to get directed change on any scale and that is what is needed. I think one of the problems is simply the political and economic system that we use in the West. Our obsession with the the market knows best is screwing us. Bring up PO, which I have done on many occasions and peoples eyes glaze over and out comes the mantra of the market, when the price of oil rises then substitutes will become more economic and take its place, praise the lord and glory hallelujah, problem solved. I wonder if magical thinking programmed into our DNA.

As for Politicians taking PO seriously, you might just as well bang your head on the wall to try and cure a headache. Harold Wilson once said, the only true words to come out of his lips by the way, was that a week was a long time in politics. That is the limit for a politician when it comes to forward planing add to that an attention span of an advert to sell Coca cola or a cure for haemorrhoids, and that common sense is about as rare as Unicorn horns and rocking horse sh**, and you realize that we are F**k*d.

You might just want to have a quick look at these

http://1.bp.blogspot.com/_JiP5gn_rIac/SkHh54kKfRI/AAAAAAAAAac/B18YodJ0Pt...

not quiet on a par with Grants tomb but good enough, and this of Bladon Church

http://farm3.static.flickr.com/2089/2450225882_60ec39441c.jpg

Regards

Yorkshire Miner

Thanks, YM, great historical background.

Just a reminder that TOD members should be conscious of using profanity in posts becaise TOD is used by young students for research.

I'm not singling anyone out because it happens daily.

Cheers,

K.

If the use of profanity is held to be more offensive by some than the realities it describes, then to me that is a much bigger problem. As a father myself I have always thought it a disservice to shield my own son from the truth whether expressed profanely or not. Profanity certainly has a place as an expression of anger and frustration and can serve to get important points across.

To be clear, I don't intend to go against the rules of this forum I just have a deep disagreement with the underlying premise that any student old enough to be doing research on this forum needs to be shielded from words...

As a parent of four inquiring and astute minds, I would agree with your reasoning, but this is a long-standing TOD policy.

Various words trigger school filtering software, possibly making TOD only accessible at home, and not all students have access to home or public library computers.

Likely we also have adult readers who may prefer to not have posts peppered with words they avoid using.

Thanks for everyone's understanding and cooperation.

K.

YM

Rather well put and has my full on agreement. We are heading for the deepest doo-doo without a doubt.

yorkie - And that was sorta my point: given a common and obvious enemy a society can pull together and make the needed sacrifices. But when PO really begins to hurt who will be the uniting enemy: Us evil oil companies? Those damn Arabs? Those damn Chinese? Those damn politicians that won't let us drill? Those damn auto makers that didn't build more efficient cars? Those damn folks who wouldn't allow those wind turbines built off the New England coast? Those damn folks who delayed the pipeline to get Canadian oil to Gulf Coast refiners? Those damn corn growers who turned too much/too little of their crops into ethanol? Those damn wealthy Americans who keep their McMansions so cold/warm? Those damn conservative politicians that wasted so much money on the Dept. of Defense when it could have been spent on alts? Those damn liberal politicians who held back our military from developing its capability to secure "our" energy? Your damn neighbor with that gas guzzling car in the drive way? Those damn unions that drove all the alt developers overseas?

I think you get my point. If only we had one Hitler to focus our efforts against it would be different. But just look at the various components of society that are having fingers pointed at them today. And are we to expect the blame game to be set aside when PO gets really bad? And thus the source of my cynical/realist attitude.

But I could be wrong so please: point out 2 or 3 potential candidates to be our "Winston". LOL. IMHO in some ways war is easier: you try to kill the guy who is trying to kill you. Peace can be a tad more complicated.

Mikey,

Thanks for the post on real life. Maj vilifies anyone who does share his rather narrow field of view, and forgets that like it or not oil, coal and gas, not his beloved biofuels, powers the economy.

Wow! I didn't know that.

That Pennsylvania has more stripper wells than Louisiana or New Mexico; states I always associated more with oil production than PA.

I've seen "nodding donkeys" here in PA, but they're usually hard to spot, normally being back in the woods.

Pennsylvania gave birth to the oil and gas industry; I am sure there are very shallow wells tucked back in the woods that are 70 years old or more and 3rd generation oil folks prod them along, trying to make a buck, trying to squeeze everything they can out of them. Its the American way and its a great way, uh?

FOR ALL: the thread is about dead but to follow thru and make sure folks understand how these small operators survive on 1 bopd per well: 1 BOPD/well = 365 bo/yr/well = 365 X $80/bbl = $29,200/well/year = $22,000/yr (less royalty production taxes)= $15,000/yr/well (less operating expense...a very rough guess).

And if you have 10 such wells = $150,000/yr gross. And if you have 40 such wells = $600,000/yr gross. And if oil is selling for only $20/bbl? That's still $120,000/yr gross. There is a reason the average US well produces less than 10 bopd...it's damn good living if you know what you're doing. And no commute to work...no coat and tie...no boss (except the wife, of course).

I would like to add also that us grubby stripper well operators ( I office out of my pickup and tear up my underwear to use for rags) provide a much needed base to our oil and natural gas reserves in this country, a base that will be profitable, and available, I hope, long after all the Eagle Ford and Bakken flash in the pans are fizzeled out. We provide lots of work, keep lots of people employed. We pay lots of taxes, 15% more than most folks just for the privilege of being self employed in this great country. We might be making a few bucks these days but it was pretty tough when the price of oil was less than 10 dollars. Beenie Weenies for lunch and one pair of poka dot gloves a week were all we could afford.

So if you gotta hate oil, go ahead and hate Shell, or BP, get even with Exxon if you must, but don't hate us. We're just doing what we can with what we got to work with. Thank you.

I cut up old socks for rags (I draw the line at underwear) and use to wash my gloves in the wife's washer - after rinsing with diesel of course. Wonder what she's doing these days?

Thats good stuff. If she was smart she got out of the oilfield. I been saying that for 60 years.

Mine stuck but she complains all the time about the black splotches on my pickup truck from upwind swab tests and that I smell like oil all the time, even after a good Go-Jo scrubbin'. She's pretty handy reading a tally tape and keeps the Bud Lite cold so I hope she don't run off with a vaccum truck driver.

I am glad to know there are "others" out there. Keep a bind on it.

You boys are just depressing the hell of me. Not complaining mind you...got a fat paycheck every month and maybe a big payoff down the road. But I spend much of the week in front of a computer monitor unless I'm out logging a well. I've spent $140 mill (just our share) drilling the last 25 months. But there are days I long to be sitting under a live oak on a dusty creek in S Texas eating Vienna sausages and listening to a compressor hump along. But too long before I come to my senses.

Remember Mr. Rock, when oil was 14 bucks we never thought it'd be 140 and the days when gold was 300 dollars an ounce, who'd a ever thunk it be 1550.00? Gather up that 2.5 million and buy that Sommerset production. You'll think you was plumb intelligent in two years when oil is 200 dollars a barrel and you've raised that production 100%. Be inovative, play the plugging/liability card, remind them of the tax hickey they are going to take, give them a ride and pumping fees, finance it thru a production payment. Who knows, you might buy it. Where there is a will there is always a way.

Mikey - Actually about 15 years ago made I made a run at Sommerset. Same ole problem: couldn't come up with an acceptable price increase projection. That's the great thing about owning some old strippers you can live off during the low times: eventually it will be worth more. In the meantime you can cut your undies for rags and wear your gloves till they fall off. LOL. I wouldn't spend too much time now trying to buy oil production: way too much stupid money chasing it. That's why I'll try to go after some mineral owners that haven't had an offer to lease their depleted oil fields in over 40 years. Going to take some expensive horizontals to make it work but I won't have to pay $10,000/acre like the Eagle Ford. And my hz will cost about 1/3 of an EF. Just like the EF my wells won't be high rate for long but eventually we could end up with 100+ wells doing 30 bopd with a 95% water cut. I can live with that...easily. LOL.

Mr. Hubblescope, you used part of a quote from a post I made on this site on your personal blog. My words were taken out of text and implied that you are "taking on the oil industry" by taking me on. Please feel free to quote this; it seems only right that you do:

Mr. Hubblescope, I am just a little 'ol stripper well operator (50 wells) and I am flattered that you feel the need to "take me on." On behalf of my industry, I accept. You are very smart but you have a tendency to talk down to people that you don't think are as smart as you and who do not agree with you. Blogs are funny that way; folks that write them often seem to think their self importance is greatly enhanced. You seem to hold it against me that I am not a scientist. On the other hand you don't understand very much about the practical side of oil and gas exploration, of predicting reserves and reservoir performance but I don't hold that against you at all. Its hard to understand. Sometimes we don't understand it. There are lots of good books on the subject for you to read, however. In any case the pretty graphs and production data numbers you crunch are very important to making people aware of the comming energy crisis, thank you. Believe it or not you and I are almost on the same page on that.

For the record I actually PRODUCE oil; not very much, but enough that I feel like I make a contribution to my country's energy needs. I am worried about the future too, just like you, and capable of planning ahead and making changes to adapt, of using my imagination and certainly of experimenting with new EOR methods. You can't be self employed in the oil business and not be "imaginative." I believe I contribute to prolonging the inevitable doom you preach so I am unclear why you even feel you need to be antagonistic to me but its OK, I am use to it. I guess its kind of the vogue thing these days in America to drive around in SUV's using 22,000,000 barrels of oil per day loathing the oil and natural gas companies that find it and produce it. Seems a little hypocritcal to me, but thats just me.

It is not the responsibility of the oil and natural gas industry to "sponsor" a comprehensive study of our resource limitations in this country. We're kinda busy running 1700 rigs in the country right now moving forward trying to meet our energy needs on the basis we have no limitations. Restrictions maybe, thru increased taxation and regulations, but not limitations. All this resource shale stuff is kinda cool uh? As I said to you, which you failed to include in my quote on your personal blog, every entity in America producing American oil must submit its best guess at its reserve inventory to the Department of Energy. As the ultimate recovery of oil reserves is directly related to the price we recieve at the well head, and that price is historically unpredictable at best, we don't really know what we can squeeze out of the ground. All this never ending speculation gets a little tiresome. The end is near and bam...along comes the Bakken and the Eagle Ford and we bought ourselves a little more time. Hows the fussion thing going, by the way? Basically, however, if you say we are running out of oil, the oil and gas industry is not going to argue with you, we are. How much time we got left depends on traffic on the 405 and how many times we need to take Delta home to see Grandma for Christmas. I think that about sums it up.

But if you and other Americans think you need to put all that reserve data together call your congressman and tell him or her to use the information we have already provided to the DOE and get started ASAP. Use some of the 80 million dollars a day my industry pays in the form of federal income taxes to fund it.

I can't speak for Exxon but my conscience as an oil man is clear. I am proud of my industry, past, present and future.

You should be too.

Mike

I got a complement from someone like you on the DKOS site, so I guess the two anecdotes cancel :)

Rock, Mike you guys are killing me, do you all need a good pumpman for this? I remember when my forearms looked like Popeye's from spinning rod and pump wrenches, now I, like Rock set in front of a computer all day looking over well data recommending pump types...

Rock, you can live with that for sure but if and only if you well bore geometry will allow you to pump them with out cutting holes in the tubing or breaking rods every 6 weeks.

My experience for all the applications I have been involved in say;

Max curve build rate 6 degrees / 100' or less

Continuous rod help spread out the side load and do not focus it at the coupling or molded guide

Molded rod guides wear very fast at 200# or greater side load and increase friction and lead to rods being put into compression

Poly lined tubing to cut down on the side load friction

Use my mud/gas anchor for good separation and a very special patented pump we make that is killing it in the Bakken, Permian and other fields