Tech Talk - The Appalachian Basin, simple lessons from the beginning

Posted by Heading Out on May 1, 2011 - 12:57pm

There are a number of different ways of getting oil from a reservoir, and, to radically oversimplify, the harder that you try to maximize the rate of production of oil from a well, then the shorter the overall life of the well will be, and there is a strong likelihood that the amount of oil, in total, that the well recovers will also decline with that increased extraction rate. This lesson, that of controlling the extraction rate from a reservoir to maximize absolute production volumes is one that Saudi Aramco practices, and because of that approach, has me quite doubtful that they will ever produce more than 12 mbd. (At least as long as the present faction of the House of Saud remains in power). To do so would hurt their absolute recoveries, and with the slower and more controlled extraction, they have demonstrated that they can recover higher percentages of the total volume of oil originally present in the reservoir. It is not, however, a philosophy that is widely adopted. And yet, instead of the owners of the wells having that prescience, on occasion it has been other external forces that have driven the extraction rates from the wells, and thus controlled the length of their life and the total ultimate recoveries. The Appalachian oilfields in the United States, where much of this story began, has a history that helps illustrate some of these points.

The Oil Age is famously credited as having started with the drilling of the Drake Well in Titusville, Pennsylvania in 1859, although Ohio claims that the “First Oil Well”, was the Thorla-McKee well which was drilled and cased in oak in 1814. There is similarly a claim for the first great American oil well in Burkesville, Kentucky in 1829. I mention these as much to indicate that it was not that difficult initially to encounter oil in different parts of the country, and relatively close to the surface. The Drake well had only to extend down to 69.5 ft before it struck oil, and it made around 20 barrels of oil a day – but it was this well that opened the way to the oil industry of today.

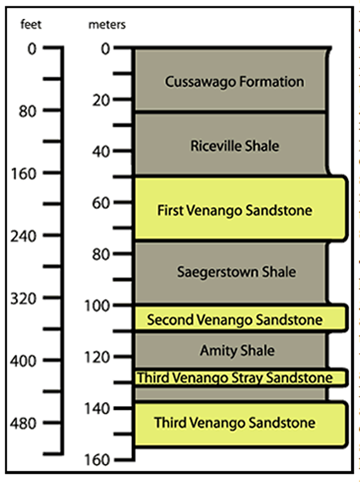

Geological column at the Drake well site. The oil was found in the Riceville Shale (The Paleontological Research Institution)

The Oil Age is famously credited as having started with the drilling of the Drake Well in Titusville, Pennsylvania in 1859, although Ohio claims that the “First Oil Well”, was the Thorla-McKee well which was drilled and cased in oak in 1814. There is similarly a claim for the first great American oil well in Burkesville, Kentucky in 1829. I mention these as much to indicate that it was not that difficult initially to encounter oil in different parts of the country, and relatively close to the surface. The Drake well had only to extend down to 69.5 ft before it struck oil, and it made around 20 barrels of oil a day – but it was this well that opened the way to the oil industry of today.

Following on from that development, the production of oil from the nearby oilfields, first of Pennsylvania and then also into West Virginia in what became known as the Appalachian Basin dominated early American crude oil supply. :

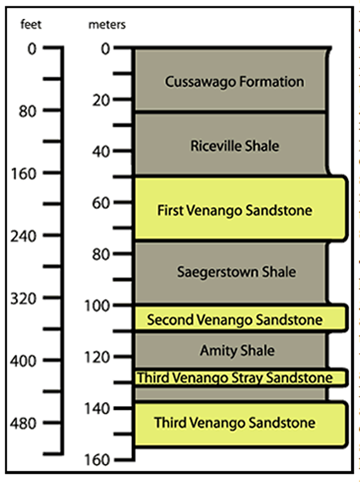

Consider this - Pennsylvania was responsible for 1/2 of the WORLD'S production of oil until the East Texas oil boom of 1901.Yet when we look at the map of the top oilfields ranked by proven reserves, as issued by the EIA, none of the fields in that region even appears today.

There are two thoughts that come from this. The first is that just because an area was productive of oil at one time does not mean that it can continue to be so. And as productive fields are exhausted and production moves elsewhere the remaining oil in the field becomes less attractive as a reserve to be developed. The original Drake well at Titusville, for example, stopped producing after two years. Yet many of the wells that continued production were not produced with the tools that drive higher production today, and so tended to last much longer, but at low levels of production.

Which brings me to a second thought, which is more exemplified by wells in the Gulf of Mexico that were damaged during the Hurricanes in 2005. Until then these platforms had been producing small quantities of oil on a regular basis. But after the hurricane destruction those small quantities of oil that could be still recovered did not frequently justify the increased financial investment in extensive new drilling and repair that would have been required to re-create productive wells. And so the remaining oil in parts of the area was abandoned. Many of the wells in Appalachia ended up in a similar state.

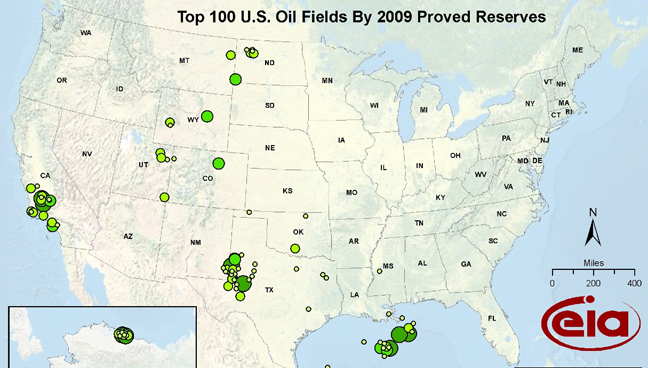

The oil and gas fields of PA lie in the upper left (North-West) corner of the state, and are, at the moment, under much greater scrutiny again because of the natural gas that is found in the Marcellus shale that runs through the state.

The Marcellus is not shown on the above map, but I showed its extent in the recent post on the EIA shale gas report. Twenty-four fields are currently listed. Conditions during the oil boom at the end of the 19th Century were more intense even than the gas boom of today.

Less than twelve months ago McDonald, Pennsylvania, eighteen miles west of Pittsburgh, was a sleepy and commonplace little coal-mining town. In six months it doubled in population and became the busiest and most typical oil town in the country.Interestingly as Caplinger notes

In this oil field on June 1st 1891 there were three completed oil wells. By November there were over three hundred wells in various stages, of which nearly one half were in and about McDonald.

Drilling and production in the United States have been governed by the price of oil, classic supply-and-demand responses to economic reality. After the initial discovery of oil at Drake’s well in 1859, prices were up to $16.00 a barrel, but high production quickly lowered the price to a fraction of this. Appalachian oil averaged $1.80 a barrel after the initial period of extremely high prices, reaching a low of 56 cents per barrel in 1892, and a high of $5.35 a barrel in 1920. Between 1859 and 1930 the price of oil in the United States averaged $1.34 per barrel. Well production in Appalachia averaged 0.6 barrels a day (the nation’s lowest), while the national average was 8.4 barrels per day.Of the 600,000 wells drilled in the United States between 1859 and 1930 about half were still producing in 1930, and of these 242,000 had been drilled in Appalachia, of which 20% were dry holes and 149,000 were still producing in 1930. The average cost to drill a well in Appalachia at that time was $11,474.

However, Appalachia’s oil wells were the longest-lived in the country, and proved their worth in long-term production. On average, they returned 2.9 percent of their initial drilling cost per year.

There were wells that were initially much more productive, but, as noted above, higher producers also tended to be shorter lived, (ibid)

The Funk (or Fountain) well produced 300 barrels a day for over a year before suddenly going dry. The Empire well, drilled in September of 1861, produced 3,000 barrels a day for eight months, slowing to 1,200 barrels by May 1862 before production dropped to nothing. In October of 1861, a well drilled by William Phillips on the Tarr farm on lower Oil Creek began flowing 4,000 barrels a day, probably the largest flowing well in the region’s history.The Tarr Farm property, which once controlled the price of crude, is now long gone.

Yet not all wells ran dry that quickly. The well at the McClintock property in PA was drilled in 1861, and with long term care, and low production, is still producing 150 years later. It has, however, never produced more than 50 barrels of oil a day, and today only produces 1 - 2 bd, which is largely sold to tourists.

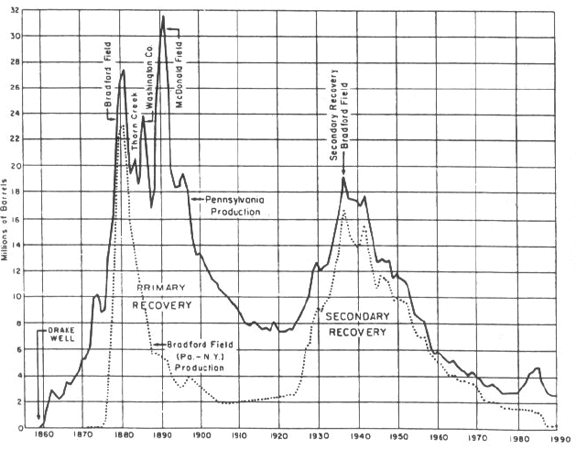

Unfortunately the typical well in PA was not that long lived, and the 350,000 that have been drilled, have collectively produced around 1.4 billion barrels of oil, since 1959. The Appalachian oil fields of PA oil had reached a production of 2 million barrels a year (mbpa) by 1862, and peaked at 32 million barrels a year (721 kbd) in 1892. By 1990 production had fallen to 2 mbpa again.

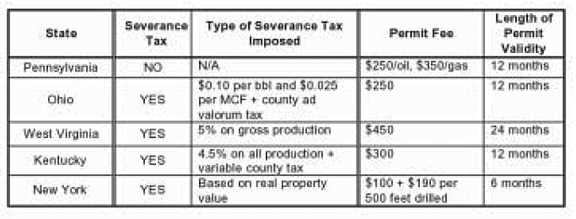

Oil production from the basin had fallen to not much more than a million barrels a year by 2001 and even though PA has no severance tax, as the following table shows, once a resource is gone . . . . .

There was some move to looking deeper (and more expensively) at regions of the state for more resources but that has been overtaken by the developments in the Marcellus Shale. Crude oil production from PA, however, rose from 1.3 mbpa in 1997 to 3.6 mbpa in 2008.

Ignacy Łukasiewicz

Wells in Azerbaijan, Galicia and Romania appear to precede Pennsylvania.

"The Oil Age is famously credited as having started with the drilling of the Drake Well in Titusville, Pennsylvania in 1859"

It depends how you define your terms. The first North American well was drilled in 1858 at Oil Springs, Ontario. Elsewhere in the world there were earlier wells. Canada Post issued a stamp in 2008 honouring the Oil Springs well as the beginning of the Oil Age, plus a matching stamp for the 50th anniversary of the Trans-Canada Pipeline.

Oil seeps have been used for millennia as waterproofing material. The Cree of northern Alberta used the Athabasca Tar Sands for their canoes, and the first European explorers into northern Alberta in the 1700s saw the deposits.

Also interesting to figure out when people first started looking and not necessarily drilling. The whole idea is one of technological advancement and that is what accelerates over time. So I agree that there is definitely a ramp-up time that culminated in the late 1850's.

It is interesting that a pharmacist and chemist was the first to distill kerosene from crude oil. Yale chemist Benjamin Silliman also figures in the development of fractional distillation of crude oil.

In the late 1850's, Bessemer develops the process for making cheap steel, which makes pipe, pumps, stills, etc. for drilling and refining much less expensive.

Breakthroughs are usually the result of a network of prerequisites coming together to create a new opportunity.

FWIW, I used the date 1838 to start a power-law growth rate model for discovery.

If we are to go down this road, there are several mentions of seep oil the Bible. For example that was the stuff Noa used to make his ark water proof. I don't know how much you believe in the book but it dont matter; they could not have written those stories if they did not know about the phenomena in the first place.

There is even an interesting story about a bad guy running away from a battle field. He run himself down in a tar pit and, with his heavy armor, drowned.

Those ancient people knew about oil, and where to get it. What matters to us is when industrial use begun.

Kinda looks like those old computer punch cards. Absolute peak of 32 mba in 1891 equates to 88 kb/d, so we're talking about dribs and drabs here. Haven't heard about a stripper boom in countries dominated by NOCs, unless you mean "stripper" as in exotic dancer. Those mineral rights are a dealbreaker, it seems.

In 2008 a lot of old wells were dusted off, or whatever the opposite of P+A is; I remember one story about an ancient well cranking out a barrel a week, and the owners would fill barrels and drive to the refinery some 35 miles away; with crude prices the way they were the gate price more than paid for transport costs.

Old Wells In Pa. Still Produce After Decades | www.fultoncountynews.com | Fulton County News

Also:

I was under the impression stripper wells as a whole produced more than that.

KLR – Not dusted off but called re-entries. A number of goals are possible: re-establish production in a formerly producing reservoir; to complete an unproduced reservoir that was never completed either because it wasn't economic at the time or not recognized as being producible; to side track out of the original well bore to directionally drill to another location. I’ve got a re-entry side track going right now in La.

Re-entries tend to be very risky from a mechanical stand point. Wells are P&A with the intent that hydrocarbons/salt water will never leak out. The producing reservoirs have cement pumped into them. And the tubing used to flow the oil/NG to the surface is either removed or have solid plugs run down them. Then often more cement is pumped over one or two intervals. And then the steel casing is cut some feet below ground level and removed. So there are many potential, and expensive, problems that can cause a re-entry to fail long before they try to produce the targeted zone. Actually just finding the exact location can be one of the biggest problems. One of the biggest problems can be inaccurate/incomplete P&A records. Remember you might be trying to work a mile or two down the inside of a 5.5” steel pipe. If you don’t know exactly how the previous operated P&A the hole you might never get down to your zone. I’ve seen $1-2 million lost unsuccessfully trying to re-enter. Older wells can have additional problems like badly corroded casing. Re-entry economics almost always look too good to be true: just zipped down, pop the new zone and sit back and collect your money. Reality often turns out much different. I’ve seen more than one re-entry cost more than drilling a new well.

Also, where did you find that statement? I’m pretty sure we weren’t producing 20+ million bopd in 2007 let alone that 4% from stripper. I’ve seen it reported for many years that the average production in the US was less than 10 bopd per well. Thus the vast majority of production is from stripper wells. I’ll pull the data base up Monday and document the actual numbers.

As of 2009, while 78.7% of U.S. oil wells produced less than 10 bpd, that amounted to only 13.2% of oil production.

The median well produced just 2 to 4 boe/d, and mean production was just 12.9bpd, but 52.5% of oil production was by the 1.6% of wells producing more than 100bpd. 32.9% was from the 0.15% of wells producing more than 800bpd.

http://www.eia.gov/pub/oil_gas/petrosystem/us_table.html

Thanks for the info, ROCK and ben. Statement was from the linked news article; they mean "supply" as in Product Supplied, not production. 4% of 20.7m = 828 kb/d = 15% of 2009 C+C Production of 5.5 mb/d. Thought it was more like 2 mb/d for some reason.

How many of those strippers are operated by majors? Yes, they don't go for new prospects on such a dinky scale but obviously operating Kern etc they do run a few pumpjacks. It's something to consider in the current War On Subsidies.

KLR/Luke – Thanks...makes a little more sense but I still won’t accept that low % until I check the data base. Couldn’t get to it today…logging a well all night and day. I’ll try tomorrow.

Just a rough guess but very few strippers operated by the major. IMHO EOR projects like Chevron’s are more PR driven than profit driven. There are tens of thousands of strippers along the Texas/La coastal trends and I know of not one operated by a major. I’ll run the data base for that stat too.

The dispersive aggregation result for production PDF is p(R)= r/(r+R)^2 where r = median rate = 1.6 bpd and maximum production is 15,000 bpd

This gives a mean of 13 bpd and it matches the 10 bpd, 100 bpd, and 800 bpd cumulatives accurately.

All the models in The Oil Conundrum work all the time.

I’m pretty sure we weren’t producing 20+ million bopd

You were just reading a bit too fast ROCK, crude oil supply of course includes all of our imports. Don't know if the writer was intending to obfuscate or just doing what I too often do-over distilling to the point were the fewness of words actually contributed to a loss of clarity.

.

I really think this statement should be repeated whenever the 'Drill, Baby, Drill" mantra is heard. Yes, it is possible to increase rate of production (here I like the soda straws in a glass analogy), but when you consider that overall production will decline, why would anyone want to do that? Like the song says, sometimes it's better to be a "slow hand."

Anyhow, I sort of enjoy the rhythm of the slow pumping jacks used at the South Texas stripper wells. Slow and easy does it.

Craig

Good point zap. And it's not just how fast you produce the well sometimes but how quickly you try to bring it up to that rate. One of my engineers just told me about a world class screw up: a private company drilled two super NG wells. They were completed and the owner instructed his engineer to flow them at 20 million cuft/day each. The engineer said he would take about 3 weeks to slowly bring them to that rate. Nope...owner wanted them flowing at those rates right now so he could announce it at the company's celebration party. Engineer followed orders and within days both completions failed. Couldn't repair the damage so had to redrill both wells: costs $16 million total to do so. Heck of a price to pay for just the sake of impatience.

Why would a well fail that way? What causes it to shut in while a slow ramp up would not?

NAOM

NAOM - Many reservoirs, especially in the Gulf Coast, are not hard well consolidated rocks but rather just sand grains often held together but a small amount of natural cement material. Pull a well too hard and you can actually pull the sand thru the perforations and load the production tubing up. The sand can also cut the steel pipe just like a sand blaster. Also you can cause undue pressure against the casing ("point loading") and actually crush the steel casing. That's what they did: casing collpase. Nothing to do but redrill. That's why you like the bring the well on slow so you can see potential problems coming before they bite you inthe butt.

Thanks, makes sense now.

NAOM

I am a stripper well operator and have 50 of the little darlin's. Fourty years ago I decided to hang on to every 3-5 BOPD well I had like my life depended on it and managed my reservoirs very conservatively, at very reduced production rates; even when the price of oil was below 15 dollars a barrel and my incremental lift costs per barrel was 11 dollars I believed that my oil in the ground was going to be worth a lot of money some day. I imagined 100 dollars a barrel or more. I was right and it happened long before check out time. I am a lucky man. With increases in total fluid production to incrementally increase OWR I do not believe my rates of decline over the years has execeed 2% annually.

Now I'll hang on to the my stipper wells and wait for 250 dollars a barrel. I don't think it will be too long.

So, I am with you. Slow and easy in South Texas. No elephants, no home runs, no 8 million dollar, 5000 foot lateral, 30 stage frac jobs for this 'ol hand. I'll take base hits above 3000 feet any time at bat, yes sir.

Keep a bind on it, Craig.

Outstanding Craig. It was really difficult trying to buy stripper production like yours. Using normal net present value your reserves past 7 or 8 years out were worth little...on paper. And thus often couldn't reach an agreeable price. Sounds like gravity drainage like I was trying to buy. Such wells will keep producing until the casing rots away. That's exactly the point I keep beating to death about URR. Fields like yours have an URR of X millions bbls of oil. But it will take many decades to get it out.

Always a bit jealous of guys like you: just make a quick run in the morning and pump some lube and sit back and listen to the sound of money: chug...chug...chug... LOL

Back in the day, I'd stop on the road alongside the stripper wells... spaced out to the horizon, just to listen to them. It is strangely calming, for some reason. Maybe it is just the slow, steady sound. And, I knew that this was the way most wells should end their days, at least in these fields. Just outside Odem there was one field that I passed often, and could notice that on a given day, only a percent of them were pumping. Gradually, by asking questions and getting to know the field workers (had some friends who had a workover rig, and saw them often, working those wells), I learned enough to be dangerous. Then I stumbled onto TOD, and y'all just blew me away. Now I don't know anything, again, but at least I know I don't. Thanks.

Craig

In the USA, the median well is about 1.6 barrels per day. So half of the wells makes less than $200 dollars per day.

Actually after typical royalty deductions, severance and property tax reductions and incremental lift costs of about 20 bucks per barrel, it is more like 90 dollars a day for a 1.6 BOPD well. That is good stuff compared to the 9 dollars a day I would make from the same well back in the mid 1990's and beats the snot out of 4.25 an hour I used to make working on floors when I was a kid.

I am a proud oilman. 3rd generation. All my units groan, they each have their own little destinctive voice. Squeaky motor belts, the squeal of dry stuffing box rubbers, a tail bearing going out or a busted tooth in a bull wheel; they clap, slap, squeal, jump, hitch, limp, moan and sometimes fall completely apart, their walking beams sticking straight up in the sky in shear anquish. We patch em up, put heavier oil in the gear boxes, grease them to the point it looks like their bleeding, then put em back to work. 24/7, around the clock.

I hear them, watch them nod up and down at 8 SPM and I am reminded of...patience.

Thank you fellas.

Mikey... you are the 'real deal.' I made about a dime an hour when I first started earning my own money. De-tasseled corn for Pfister's. Late made something like $72 a month in the service, and when I got out started at $1.10. I remember when I got a raise to $2.20. I was in tall cotton!!! that's why I went to College! (Paid for it as I went... no debt when I got out!)

Anyway, with a stable of those groanin', squealin', moanin' beauties, that $90 a day per at 7 days a week can add up to some pretty good revenue. Even after you pay some hands, and hire someone to haul the crude out by truck.

Craig

How many total wells in the USA?

Craig

363,459 according to this link:

http://www.eia.doe.gov/pub/oil_gas/petrosystem/us_table.html

and see this discussion:

http://www.theoildrum.com/node/7866#comment-799647

Thanks, WHT. I haven't had time to read Drumbeat the past few days... this thread caught my eye, and numbers of comments was low (don't know why... it is interesting stuff), so I started reading, and now have a bit more knowledge (and feel a bit less knowledgeable - how does that work?) than I started with this morning. But then, that is no surprise, since I have so much to learn.

Thanks for the help.

Craig

Sometimes the discussion turns south based on subtle details in the analysis. At least it keeps you on your toes.

In fall 09 I spent a few months in Bakersfield (doing a water efficiency project). On my first weekend there I went for a drive through the oilfield to the NE of town. Having been through a few of the oil areas in Alberta, with pumpjacks dotted here and there, I thought it would be similar - but it was the weirdest drive I have ever done. An amazing concentration of pumpjacks, pipes, pieces of disused rusting equipment, etc over thousands of acres - and no people - not even a lonely PU to be seen.

I thought I was in a an episode of "life after people", and the all the pumpjacks are still pumping because that's just what they do - a bit like walking through a field of cattle that are just ignoring you.

But there was a certain mechanical beauty to the whole thing. I did see, on the other side of town, a solitary pumpjack in the middle of nowhere that was powered by an old style slow running horizontal engine - an old Arrow or Ajax - now that was mechanical beauty! And it ran off a line coming back from the crude tank, heated by the engine cooling water - a pretty neat self powered oil system- and it looked like it had been doing this for decades, if not longer.

I'm sure the concept of NPV is pointless when you have something like that that can be passed on down the family.

Wv: oil, gas, and coal, oh my! Geology was good to us, yet we are one of the poorest states.