What is “our” oil doing in their economy? — Saudi oil consumption trends

Posted by nate hagens on April 8, 2011 - 9:39am

Oil importing nations have long treated Saudi Arabia as an infinitely deep well of crude oil supplies. In 2005, Matt Simmon’s book Twilight in the Desert did much to call attention to the possibility of diminishing production from the desert kingdom’s aging wells. More recently, cables released by Wikileaks highlight the possible overstatement of Saudi oil reserves. Excellent commentary and links to detailed information covering these issues can be found in a recent post on The Oil Drum.

What much of this discussion ignores, however, is that oil exports from Saudi Arabia depend on more than just production — they are a function of both production and internal consumption. This post will focus on the existing trends of energy consumption within Saudi Arabia and how they will impact future exports, whatever future production levels may be.

Long Term Trends

Consumption of energy within a nation is dependent upon the interplay of population, standard of living and energy efficiency of the economy. Of the three, only population can be measured and reported in simple, uncontroversial units: “# of persons”. It seems obvious but it bears stating explicitly that “In an industrial society, more people implies more energy.” This growth paradigm is of course the fundamental axiom of our current financial and economic systems.

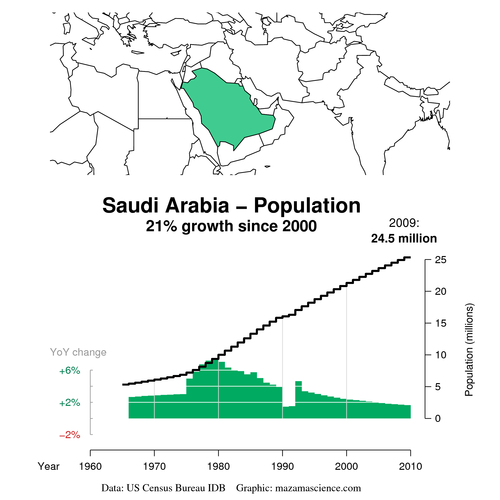

Figure 1) from the Gas Trends databrowser shows Saudi Arabia’s rapid growth from a population of 5 million in 1965 to 25 million in 2010. The large influx of foreign workers seen in the late 70′s has been trending downward since 1980 with a large exodus seen in 1990-91 during the first Gulf War. Natural growth has slowed somewhat with total fertility rates dropping from 5.0 births per woman in 1995 to 2.9 births in 2005. Yet the population is still projected to reach 27 million in 2015 and 32 million in 2025.[1] At that point the Saudi population will be larger than the combined populations of Australia and New Zealand.

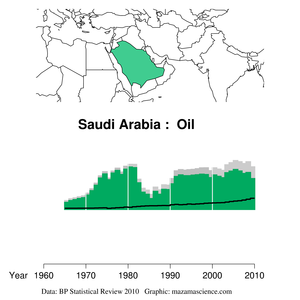

The effect this growing population is having on energy consumption is seen in the next two figures which come from the Energy Export databrowser. In Figure 2) we see long term development of Saudi oil production (gray), internal consumption (black line) and net exports (green). While production levels over the last decade have seen some large year-to-year variations, production in recent years has been near the all time highs. By contrast, net exports in 2009 were at their lowest level since the first Gulf War. This is easily explained by looking at the steadily rising level of internal use which in 2009 consumed 27% of total oil production.

The Energy Information Association (EIA) Country Analysis Brief on Saudi Arabia has the following to say about internal oil consumption trends:

Saudi Arabia is the largest oil consuming nation in the Middle East. In 2009, Saudi Arabia consumed approximately 2.4 million bbl/d of oil, up 50 percent since 2000, due to strong economic and industrial growth and subsidized prices. Contributing to this growth is rising direct burn of crude oil for power generation, which reaches 1 million bbl/d during summer months, and the use of natural gas liquids (NGLs) for petrochemical production. Khalid al-Falih, CEO of Saudi Aramco, warned that domestic liquids demand was on a pace to reach over 8 million bbl/d (oil equivalent) by 2030 if there were no improvements in energy efficiency and current trends continued.

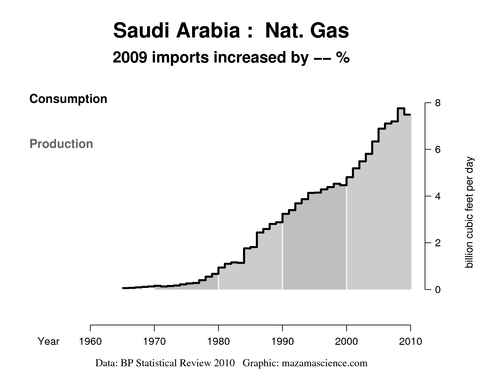

Figure 3) shows the long term trend of Saudi Arabia’s only other source of energy — natural gas. With no infrastructure for import/export of natural gas, the Kingdom consumes 100% of its own production. In 2008, natural gas accounted for 44% of total energy consumption with oil making up the rest.[2]

The rising level of consumption seen in figure 3) is expected to continue as explained in the same EIA Country Analysis Brief:

Rapid reserve development [of natural gas] is necessary for Saudi Arabia’s plans to fuel the growth of the petrochemical sector, as well as for power generation and for water desalination. Saudi Arabia had set a goal of meeting 10 percent of global petrochemical demand by 2015, with natural gas a primary feedstock. According to Saudi Aramco forecasts, natural gas demand in the kingdom is expected to more than double to 14.5 billion cubic feet per day (Bcf/d) by 2030, up from an estimated 7.1 Bcf/d in 2007. In order to free up petroleum for export, all current and future gas supplies (except natural gas liquids) reportedly remain earmarked for use in domestic industrial consumption and desalination.

As figures 2) and 3) make clear, overall energy consumption trends are up significantly in recent decades and reflect the needs of a growing population and a growing economy. Even if we make the bold assumption that the current unrest in the Arab world leaves the Saudi political establishment unchanged for the next decade, rising energy consumption levels will greatly impact Saudi Arabia’s ability to export at the level to which oil consuming nations have grown accustomed.

Recent Oil Consumption Trends

This section will review some of the more recent trends and projections in an attempt to identify more specifically how different segments of Saudi Arabia’s industrializing society contribute to increased oil consumption.

Refineries

The Joint Oil Data Initiative (JODI) is an international effort to address the need for “transparency in oil market data”. Collecting data from producing and consuming nations, the JODI database attempts to provide “timely, comprehensive, and sustainable energy data” on a monthly basis. Although data reported by many nations are still unreliable, the data for Saudi Arabia are quite good. (JODI is headquartered in Riyadh.)

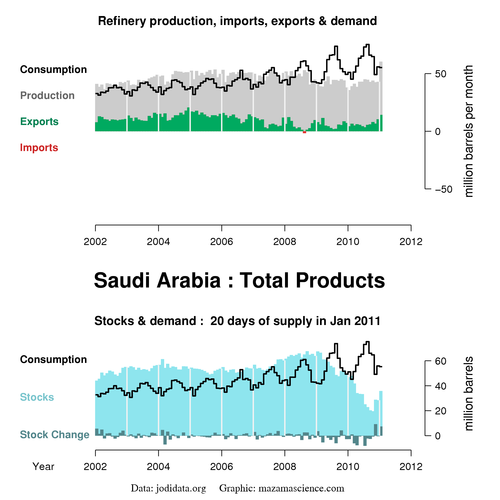

Figure 4) uses a chart from the JODI databrowser to show recent trends in refinery output (gray), local consumption (black line), exports (green) and imports (red) of refined products. (Similar charts are available for individual refinery products.) Looking at total refinery output, we can see a steady increase in demand of refined products along with an increasingly pronounced seasonal cycle. In the bottom half of the chart we see that what had been a comfortable cushion held in stocks has dwindled in the last two years to a two week buffer as demand begins to regularly exceed supply. Increased refinery output in January has temporarily allowed for a slight stock build.

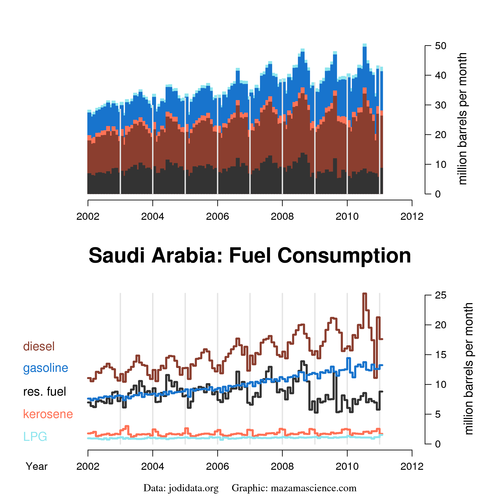

The consumption trends for individual components of refinery output is seen in figure 5). The most important liquid fuels in the Saudi economy are diesel and gasoline. Diesel (brown) is used primarily to provide electrical power[3] with highest use during demand peaks in the summer cooling season. Fuel oil, crude and diesel run about half of Saudi Electricity Company’s plants, the rest being fueled by natural gas.[4] Gasoline consumption (blue) shows a steady increase, driven by the growing Saudi automotive market.

These trends reflect in large part the rapid development of a broad Saudi consumer culture. It probably doesn’t require a huge marketing campaign to encourage the average Saudi to install an air conditioner but it does seem ironic that the US government, through their buyusa.gov site, seems to be encouraging the sale of gas guzzlers to the Saudis. Here is a quote from their Saudi auto market brief [pdf].

The strength of the Saudi economy, reflected in a higher per capita income, led to the increasing popularity of luxury cars and premium automobiles. In addition, Saudis have always opted for large SUVs that can accommodate large families. The market for GMC Suburbans and similar sized SUVs has remained relatively unaffected by the fluctuations in the economy.

Desalination

Providing fresh water to Saudi’s millions is a very high priority in their desert environment. To date, 27 desalination plants operate throughout the country, which provide 70% of the nation’s potable water along with 28 thousand megawatts of electricity from Integrated Water and Power Plants (IWPP). Unfortunately, this currently requires burning approximately 1.5 million barrels per day of crude oil.[5] The largest desalination plant in the world, Shoaiba, currently runs on fuel oil. Despite encouraging news a year ago that Saudis launch national solar desalination initiative, initial efforts to produce 11 million m3/yr of water by 2013 pale in comparison to Shoaiba’s output of 150 million m3/yr. And no one is waiting to see how well solar desalination works. The huge Ras Azzour IWPP is currently under construction and will provide 375 million m3/yr of fresh water along with 2400 MW of power — all fueled by crude oil.

Economy

Even before the current unrest in the Arab world, the Saudi government knew that it had to increase economic development to address the needs of their burgeoning population. The Ministry of Economy and Planning summarizes the basic road map in its Brief on the Ninth Development Plan [pdf], released in 2010, which identifies five major themes:

- “enhancing and intensifying efforts to improve citizens’ standard of living and promote their quality of life”

- “development of national manpower and increasing their employment”

- “balanced development among regions of the Kingdom”

- “structural development”

- “raising the competitiveness of the national economy and national products”

The report goes into much more detail as to what each theme implies. Suffice it to say that achieving any of the goals will entail using more oil within the Saudi economy.

The other aspect of Saudi Arabia to be aware of is that rising oil prices, in contrast to their effect on importing nations, act as a boost to the Saudi economy. Despite the sensationalist title, the article As the Middle East Burns, Saudi Economy Glows accurately identifies what is currently going on:

Bahrain and Yemen aside, the turmoil in the Middle East has turned into a boon for Saudi Arabia, as the country’s coffers swell with the proceeds of climbing oil prices and production. And, a series of subsidies and other measures worth as much as $xx billion will help ensure the bounty reaches ordinary Saudis.

National Commercial Bank, a Saudi lender, raised its outlook this week to 5.1% from a previous 4%. Barclays Capital is planning to revise its forecasts shortly as is Bank of America. A Reuters poll of economists taken last week before the second of two government spending plans was unveiled showed the Saudi economy growing by 4.5% this year, slightly faster than previous expected.

As supplies from Libya have fallen and worries that other exporters may cut output as well, oil prices have risen about 20% this year. Benchmark Brent crude for May delivery traded at about $115 for a barrel on Thursday. Economists estimate that for every $10 increase in the price, Saudi Arabia can increase its budget by 6% of gross domestic product.

Conclusion

A few simple facts summarize the details explored above:

- Saudi Arabia has a rapidly growing population.

- The Saudis wish to grow their economy. (Who doesn’t?)

- Growing the Saudi economy will require a lot of energy.

- Increasing oil prices stimulate the Saudi economy.

- Oil is the only conventional energy supply Saudi Arabia has in surplus.

This article makes the case that the Saudi economy will consume ever increasing quantities of the oil they are currently exporting. The argument will be made that they could meet much of their power needs with either nuclear or solar power in order to continue earning oil export revenues. While enticing in theory, the real world of existing infrastructure, existing know-how, existing finance and existing technology will trump in the near term.

As for nuclear power, the current disaster in Japan will act as a drag on proposals to build nuclear reactors in the region. Even after any decision is made to proceed it will still take a decade for any nuclear power to come on-line as outlined in the article Gulf presses ahead with nuclear energy:

Saudi Arabia has signed nuclear co-operation agreements with the US and France, creating a ministry-level centre for the development of nuclear and renewable power.

“It’s at an early stage,” said Saleh Alawaji, the Saudi Arabian deputy minister for electricity and chairman of Saudi Electricity said at a utilities conference in Abu Dhabi yesterday. “I think the option of using nuclear energy … is a must.”

Kuwait is considering up to six nuclear reactors, with the first two planned to come online in 2021 or 2022. Despite the widespread misgivings, Kuwait is likely to proceed with those plans, Ms Marafi said.

Solar power is a much more viable option and there are promising signs such as the Saudi- SrR1.43bn deal for solar cell manufacturing plant. Unfortunately, the pace of adoption of solar does not meet Saudi Arabia’s immediate needs for power. That’s why we still see headlines like Saudi to boost crude burn for power generation in 2011.

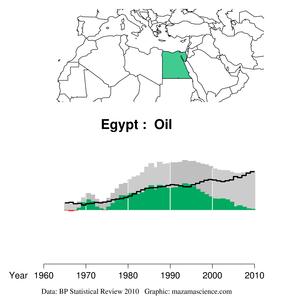

We should expect Saudi use of their oil patrimony to evolve very similarly to that of other growing, industrializing, oil endowed, Islamic nations as seen in figure 6):

|

|

|

|

Both Indonesia and Egypt have seen relatively moderate declines in their ability to produce oil. Yet they have been eliminated from the ranks of oil exporting nations because of rising internal consumption. Indonesia’s net exports of oil have fallen steadily since their secondary peak production year in 1992. Egyptian net exports of oil have fallen steadily since their peak production year in 1993. So far, Saudi annual net exports of oil have fallen steadily since their peak production year in 2005.

Reviewing the population growth in figure 1) and all the evidence presented above it seems safe to predict that Saudi net exports of crude oil have entered terminal decline.

Let’s repeat that just to make sure it doesn’t get missed:

Saudi net-exports of crude oil have entered terminal decline.

Related Links

- Saudi Arabia Looks to Solar, Nuclear Power to Reduce Its Oil Use by Half (Bloomberg, Apr 3, 2011)

- US Census Bureau International Data Base [↩]

- EIA Country Analysis Brief on Saudi Arabia [↩]

- Saudi Power Sector Needs SAR300B Investment over 10 Years, Zawya, Mar 28, 2011 [↩]

- Saudi Regulator May Hike Electricity Rates to Encourage Thriftier Usage, Bloomberg, Oct 04, 2010 [↩]

- Saudi Arabia to Replace Oil with Sun Power for Desalination Plants, GLG news, Nov 15, 2010 [↩]

A brilliant summary on Net Exports Theory(or also known as the ELM model).

If the Saudis cannot step up to the plate, which we've seen in 2008 and again this year, who else will come? Saudi Arabia is supposed to be the trump card.

It still amazes me how so much of the established commentary on energy issues can be so enormously wrong, and how easy it is to actually see through the spin if you take a look at the actual data and compare it with history, as you've done.

It is always good for you or others at this site to remind (or educate) us on the actual state of the world energy situation, since it's so easy to be drowned out by irrelevant noise such as that somehow the Fed is responsible for a whopping $50 dollar premium on the oil price, or that our salvation lies in unused tankers dotted around the seas.

This article is a useful antidote to such uninformed ignorance.

Something that we haven't paid much attention to is the prequel to the ELM, to-wit, what happens to net oil exports given a production increase in an oil exporting country?

Let's look at 20 years of data for "Export Land," from 1990 to 2010. The peak for our hypothetical country would be 2000, when production was 2.0 mbpd, consumption was 1.0 mbpd and net exports were 1.0 mbpd. Let's assume a steady 2.5% rate of increase in consumption from 1990 to 2010, with production increasing at 5%/year from 1990 to 2000, and then declining at 5%/year from 2000 to 2010.

I have talked endlessly about the post-peak ELM net export decline (net export decline rate exceeds the production decline, and the net export decline rate accelerates with time), but from 1990 to 2000, the rate of increase in net oil exports exceeded the rate of increase in production (8.4%/year for net exports, versus 5%/year for production).

We saw something similar in Russia. Their 1999 to 2009 rate of increase in total liquids production was 4.5%/year, but their rate of increase in net exports over the same time frame was 6.4%/year (EIA).

Consider the supply signals reaching the market. Until net exports peak (which they appear to have done globally in 2005/2006), it appears that the rate of increase in net exports tends to exceed the rate of increase in production*, signaling ample supplies, but then the peak hits, and everything changes--the net export decline rate exceeds the production decline rate, and the net export decline rate tends to accelerate with time, with all of this of course being compounded by the "Chindia" factor.

*Unless the rate of increase in consumption is very high, with a high consumption to production ratio, e.g., China and the US.

And in India car sales rose by 30% to 1.98 million units in the fiscal year to March 2011.

Awesome analysis, I'm a long time admirer of your work Jonathan. Anyone wanting to take an educated guess on when zero net exports is reached? If I eyeball a trendline on the bottom chart, it looks like 2020 to me. Not that the actual date is critically important, as I think the effects of decline will be felt well before that. It is just useful if you can go to the public and point out that "Saudi Arabia will not have any oil available for export by 20xx, based on current trends."

In actual fact the KSA will cease to exist sometime before the year 20xx of zero net export.

The ME is probably the world's least sustainable region. The KSA needs its oil wealth income to continue importing food and providing desalinated water to its bloated population.

Once oil income begins to decline the legitimacy of the ruling House of Saud will evaporate. Kind of a positive reinforced feedback loop cutting oil from the world even before zero net exports are reached.

Therefore the decline of net exports from KSA will have critical implications for the Saudis as well as us

Well, yes, something has got to give!

Water (and food) and income inequalities and (impossibly?) slow build renewables and nuclear don't bode well for increasing populations.

As a sub-American Brit (that's most of us in UK) I have been wondering which of the advanced economies would be first to fall into terminal decline, us in UK or perhaps the Japanese might beat us to it? But when I look at the precarious forward march of KSA and draw parallels with USA, I wonder.

Jonathan (great data) says

USA starts with super-high per capita fuel and energy consumption, has growing population (10M every 5 years?). One percent of Americans account for 24% of US income. Can 'the rest of the world' afford the USA or its model of a way of life?

USA does have food, though, and should not need much de-salination of water. KSA theoretically might achieve the American per capita level of consumption and 'wealth model', perhaps the only sizable country except for Canada, Australia (?) to do so, but it does not look likely. Can the 'rest of the world' afford Saudi Arabia? Can we not? Adjustments will happen.

Sorry about rhetorical questions - but ...

The Saudi Regime will probably survive the current round of popular uprisings. However, their customers are becoming increasingly jumpy. With a second oil shock in 3 years now well under way (Tapis spot over $131) , something is going to snap and I strongly suspect it will be the next US administration.

Obama is playing Libya very low key, getting out as quick as he can. Unfortunately, it looks like stalemate at best, with Gadaffi sabotaging the eastern oil fields to stop the rebels getting the oil money. Major economic dislocation is now inevitable in the OECD, the Japanese quake just accelerating the decline. It seems inevitable that the Republicans will be re-elected, but with strong influence from the Palin end of the spectrum.

Will the urge to liberate 'our' oil be resisted?

I may have missed something, but previous efforts to "liberate" our oil seem to have missed the mark to some degree. Current efforts seem born more of desperation than efforts to replicate prior success.

Can anyone point to a good source for "daily life in KSA"? What do all those people do? I can only imagine driving around, shopping, and playing video games, but maybe there really are factories for people to work in. I see that there is some farming, but that seems fairly unsustainable in the absence of water.

My impression is that the locals do not work. They live off government dole. We all know how well that works out in the end. It is the guest workers that do the work.

It seems that many (most) jobs for indigenous men are indeed Govt. related and many younger men (some women) are professional students (free education). I couldn't find any reliable statistics on employment.

Over 20% non-nationals.

I also think the Repubs will take back the White House in 2012. From now until that election will be another economic step down thanks to the rise in commodity prices, in particular oil. In that giant step for humankind downward will be discontentment across a wide swath of demographics. Sure, Obama isn't responsible for peak oil, but the voters don't care, they just want it back the way it was.

What we will get after tax cuts for the super wealthy and privatization of all entitlements is a coupon book in the mail. The first coupon will be a 50% off voucher for healthcare for those over 65. Forget that they have major pre-existing medical conditions and their premiums will exceed 2000 a month, so 50% off won't mean much as they wretch up their guts in the gutter. The 2nd coupon will be 50% off for your kids to enroll in private schools, which will take care of half of 22500 a yr per offspring, so you won't be able to afford it and they will remain illiterate. The 3rd coupon will simply say, "Remember to enroll in and pay into a 401k for your retirement, because there is no longer any social security." And you better too, because all that will happen in retirement otherwise will be a minimum wage job, if you can get it, and living in your vehicle.

But what does it matter anyway, because peak oil will level the playing field as everyone goes berzerk criss-crossing the country in search of that last scrap of food. Have a nice weekend!

Here are the Saudi charts that I presented at the 2007 ASPO-USA conference in Houston, showing actual Saudi production, consumption and net oil exports through 2006, along with Sam Foucher's modeling of future Saudi production, consumption and net oil exports. The dashed lines represent Sam's 95% probability boundaries (calculated 95% probability that Saudi production, consumption and net exports would fall between the dashed lines). The dashed lines could also be viewed as the low case and high case, with the solid line being the middle case. The actual data points for 2007, 2008 and 2009 have been shown.

Note that given a production decline in an oil exporting country, unless consumption falls at the same rate as, or at a rate faster than, the rate of decline in production, then net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time. Furthermore, net export declines are front-end loaded, with the bulk of post-peak CNE (Cumulative Net Exports) being shipped early in the decline phase. Sam's most optimistic forecast is that the (2005) top five net exporters (Saudi Arabia, Russia, Norway, Iran and the UAE) will have shipped about half of their post-2005 combined CNE by the end of 2014.

Links to four of the articles that Sam and I collaborated on:

http://www.energybulletin.net/node/16459

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

(May, 2006)

http://www.energybulletin.net/node/38948

A quantitative assessment of future net oil exports by the top five net oil exporters*

(January, 2008)

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Peak oil versus peak exports**

(October , 2010)

http://www.energybulletin.net/stories/2011-02-21/egypt-classic-case-rapi...

Egypt, a classic case of rapid net-export decline and a look at global net exports***

(February, 2011)

*Summary of 2007 ASPO presentation

**Summary of 2010 ASPO presentation

***A "What If" Scenario for global net exports

To me it appears that the rate of net export declines are faster than anticipated. That last point downward looks very steep. What else is affecting net exports that was not in the modeling? Could it be a steeper than expected decline in production?

I think that there was some voluntary reduction in Saudi net oil exports in 2009, but there is "voluntary" and there is "voluntary." I suspect that the Saudis were more than happy to reduce production from some of their very high water cut oil fields (what Matt Simmons called "Oil stained brine"). And it looks like they didn't show much of an increase in 2010, versus what was (so far) the second highest annual oil price in history (only 2008 was higher). In any case, here are recent Saudi net export numbers:

2002 to 2010 Saudi net oil exports versus US annual spot crude oil prices (EIA):

From 2002 to 2005, the Saudis responded to rising oil prices with sharp increases in net oil exports:

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

But then we have post-2005 Saudi Arabia, when the Saudis responded to generally rising oil prices with declining net oil exports:

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

2009: 7.3 mbpd & $62

2010: 7.4* mbpd & $79

*Estimated

Very impressive post, in its content, analysis and use of graphics.

Bravo!!!!!!!!

But alas, I must nitpick on one particular stated fact:

"To date, 27 desalination plants operate throughout the country, which provide 70% of the nation’s potable water along with 28 million megawatts of electricity from Integrated Water and Power Plants (IWPP)." The 28 million megawatts is 28000 Gigawatts. This is too big by a factor of 1000.

If I may add my 2 cents. Everyone knows that KSA has fantastic solar energy possibilities. Not many people know that KSA also has fantastic geothermal resources in the west in an area of relatively dormant vulcanic activity. These could easily generate many GW of BASELOAD capacity that could displace current use of oil for power generation and desalinization. This is a great way to re-use existing drilling, reservoir and "oilfield" capacity and knowledge that KSA has developed.

Sources:Rehman S. "Saudi Arabian Geothermal Energy Resources - an Update" Proceedings World Geothermal Congress 2010 Bali, Indonesia, 25-29 April 2010

Thank you Todd.

And thanks for the correction on power output from the IWPPs. I copied the 28 million megawatts number from the fifth reference without thinking carefully about how much power that really is. (Part of why I like pictures of trends instead of absolute numbers.)

Brian or Nate, can we correct this in the post?

Jon

Jonathan, thanks also for the title. I understand why you name the model ELM, but of course no one has automatic rights to the oil under another country's sand or soil. So the real problem is with countries making their economies absolutely dependent on a fuel that is not available (at least at the levels required) from their own territory.

But whether it is food or fuel, many (most?) countries now depend on international trade for many of the fundamentals of their economy and existence. All presidents since Nixon have acknowledged that this is an untenable situation for the US, and now Obama too has raised the same concern (however weakly, given the inadequate policies proposed to address the situation).

So, as the title implies, it is at least as much a problem of importing as exporting--if nations weren't dependent on imported oil, ELM would only be really then only be an existential threat for the exporters.

Can we look forward to an update of the graphs so we might have a clearer idea of when Saudi consumption may match their production/extraction? (Of course, it should be remembered that things look very bad for the world long before we reach that ultimate point.)

dohboi,

I should be clear that Jeffrey Brown (aka westexas) is the originator and insistent promoter of the Export Land Model (ELM). An early post of his sparked my own interest in the topic I sometimes refer to as 'net export analysis'.

My own twist on the analysis is to avoid using any modeling as the data tell a pretty compelling story on their own when presented in the right manner. (I admit it, I'm a data visualization junkie.) But it is clear that Jeffrey and I both agree on the critical importance of looking at net exports when trying to understand what is happening in the international oil markets.

As for updates to the graphs:

The annual data in the BP Statistical Review is updated each June and the Energy Export databrowser will be updated within a week of the release of the BP data.

Jon

That is so true ... but only when it goes over the hump and it starts the downslope. So you will invariably find that the data-centric empirical approach never helps when the data is on the upslope. Without careful modeling and understanding of the mechanisms in place, the extrapolation is usually way off. It's somewhat analogous to spending money with or without a balanced budget in mind (with ledgers and all that). If your budget is the model, you have some idea of what is happening with your funds. However without a budget, you would never know how much you have overspent until the bounced checks start coming back and you begin to throttle back. Hey, that is just using a data-driven approach, what can possibly go wrong with that?

We won't hit this particular set of circumstances again so I can imagine that it sounds like some 20/20 hindsight. Yet there will always be a next time with some other resource taking the place of oil.

Nothing more compelling than a data visual laying across a model prediction.

Thanks, Jon.

Excellent piece. In effect when oil prices are moving up the Saudi economy gets itself into a loop whereby burgeoning cash inflows lead to more rapid domestic demand which means less exports.

Why oh why are we not seeing high quality reasoned analysis of this type in organs such as the Economist and the FT? Oh wait.........

Until a certain threshold augmenting oil prices increase demand. As you pointed out increasing prices do increase consumption in oil exporting nations. But increasing prices also increase the search for oil, the buildup of alternatives which all consume a lot of energy in the short term. Even saving energy most times requires an upfront energy investment.

When the threshold is reached that the rest of the economy feels the pain, the oil demand is shrinking. At that point recessionist trends of the overall economy combine with cutbacks of exploration projects and cancelled alternative energy investments. The result is an accalerated shrinking of oil price and demand.

I do not know where the threshold will be this time, but I guess it will be a bit higher than in 2008. Then we will have the next slump of oil prices coupled with the next recession. This will be followed by the next even higher spike.

Don't worry, the US will soon export democracy to Saudi Arabia as well. That will result in some demand destruction.

I am guessing that is sarcastic, but please explain the mechanism of demand destruction under democracy.

Seems like in USA, as democracy increasingly gives way to oligarchy and stratification, concentration and winnowing of the extremely wealthy there is demand destruction.

Demand is higher when more of the people have more of the money -- the current trends are just reversing the historical gold rush as "gold" is converted back into ore and concentrated in the rocks of the supremely wealthy.

It's not democracy that causes demand destruction, it's the way we in the west "bring democracy". Historically, that has reduced demand by violently reducing the population. I suppose that there's also a demand increase when it comes to rebuilding all those schools and factories and hospitals and roads and...

The way democracy has been brought to e.g. Russia in early 1990s... we've seen a real bit of demand (and population) destruction effect, BTW.

That's what I said, I think -- it is not democracy that is spreading in Russia, or Egypt or the USA, it is a strengthening of the oligarchy.

I am beginning to question whether "democracy" is even technically possible except in pioneer populations in an uninhabited land. The moment the society begins to mature and increase in population density, it begins to stratify its power and wealth.

"Revolutions" always seem to eventually favor the entrenched power structure, even though individuals will of course be eliminated.

Interesting that this article, questioning the long term economics of oil, should come at a same time that one HuffPo writer wonders:

Add to this, China PPP was $1.5 billion in 2001, about the same as Italy, ten years later it is third. Give it 5 years and it will be Number One and the US will be number Three.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)

Jaz: As this is an US centric website I am presuming you are using US billions (1,000,000,000). Perhaps you mean 1.5 Trillion?

yes indeed $1.5 trillion. Thanks. The PPP metric, helps explain how more cars are bought by Chinese people than US citizens. Even though wages there are still much lower.

Thanks for the link to HuffPo.

It is mostly about market signals giving a false prognosis of where you end up?

(Medical analogy here)

This is what WTexas tells us about false positive market signals when production, and typically exports, USA and China excepted, are on the way up (thread above)?

Here I go again with the iconoclasm.

While there is no doubt that Saudi Arabia's production will one day go the way of Indonesia and Egypt -- and probably fairly soon -- I don't see evidence that Saudi Arabia has actually entered the export decline phase. Figure 2 show that SA's exports have remained quite stable for twenty years. There's maybe a bit of a dip at the end, and there's no doubt that terminal decline is eventually inevitable, but I'd need to see maybe two more years of declining exports to be convinced that free-fall has begun.

Let's meet back up here in 2013.

It seems likely that 2011 will be the sixth year in a row that Saudi net oil exports will be below their 2005 annual rate of 9.1 mbpd, despite the fact that it appears that annual US spot crude oil prices will have exceeded the $57 level that we saw in 2005 for six straight years, with five of the six years showing year over year increases in annual oil prices. (Soon, the Saudis will have been showing declining net oil exports, relative to 2005, longer than the Second World War, 1939 to 1945).

My standard Saudi comment:

http://www.theoildrum.com/node/7554#comment-770186

And the concluding paragraph from the Egypt/Global Net Exports article linked up the thread:

westexas

What happened to those megaprojects? they far exceeded internal consumption in three years.

http://en.wikipedia.org/wiki/Oil_megaprojects

An excerpt from my standard Saudi comment, linked above:

And here is our assessment of global net oil exports for 2005 to 2009. As soon as the 2010 data come out, we will update the table, and we are working on adding the 2002 to 2004 data.

If we assume that top 33 production falls by 5% from 2005 to 2015, and if we assume that Top 33 consumption increases at the 2005 to 2009 rate out to 2015, and if we assume that Chindia's combined net oil imports keep increasing at their 2005 to 2009 rate of increase (out to 2015), then Available Net Exports (ANE, i.e., Global Net Exports not consumed by Chindia) would fall from 41 mbpd in 2005 to about 27 mbpd in 2015.

We are presently halfway to 2015, and I suspect that what we are seeing in the oil markets is a fierce bidding war for the declining supply of Available Net Exports.

WT: Of course I agree with your data and the assumptions you make (assume, the ass of you and me) but they assume no "Black Swans". It has been my experience that black swans, "We could never have anticipated that!" is more the normal than truely the unusual. Also, IMHO, Black Swans will become more prevalent as we start down the slope since humanity has never experienced this type of down turn with this many people living this high.

BTW: Looks like WTI just went over $112.

sarc/ Who would have ever thought that high this quick? /sarc

Absolutely true Lynford. It's very doubtful that the downslope will be predictable, but rather it will be marked by sudden events that will hasten the downslope. Each time one of those events takes place, like what's currently happening in Libya, we will say to ourselves, no - not right now while oil prices are so high! But that's the way downslopes occur. I actually think things will fall apart at some threshold quite quickly.

The oil price rise in USD is in part due to the decline in the USD. The USD is buying less and less of anything. Look at how many USDs are needed to buy a ton of grain, coal, copper etc or the record prices this week for Au and Ag (excluding a few weeks at the time of the Hunt bros fiasco the price of silver is at record highs). In other currencies the rise in oil hasn't been so dramatic.

Whatever USDs the Saudis are getting are causing inflation problems there (Dollar pegging will do that).

I wonder what happens when your global lead currency ends up being practically worthless compared to real items and other currencies?

Given the state of America, and the magical abilities of fiat money it may be quite interesting...From a distance.

DAVID HALE: For the time being the market is right, but everything in Saudi Arabia is uncertain simply because the regime is so decrepit. The king is 86 years old, he is in bad health. His successor the Crown Prince is in worse health. Behind them is the defence minister, Mr Naif, he’s ultra conservative, he’s incapable of any reforms.

So if we lose the king, lose the Crown Prince we get somebody who might be even more difficult to make changes. So Saudi Arabia is a very, very difficult situation to call, I think it will be very complex and very difficult for quite some time. Some day in the next 10 years there will be a new generation, a new leadership which may be able to transform things but still right now is at least five, six years in the future.

ALI MOORE: So if something was to happen, what would happen to oil prices?

DAVID HALE: The price of oil could double. If you’re going to lose Saudi Arabia, the price of oil could easily double to $200 a barrel, easily.

http://www.abc.net.au/lateline/content/2011/s3177190.htm

I had put this in my post:

4/4/2011

Sydney's RTA builds M2 exit lanes for $200 oil

http://www.crudeoilpeak.com/?p=2872

Right now women aren't allowed to drive in KSA.

Now imagine what 'liberalization' of THAT will do to Exportland?

World oil production per capita in litres per month. Population data by US and UN.

World oil exports per capita in litres per month. Population data by US and UN.

Ultimately, as for all commodities, the price of oil is a question of incentives and substitutes: "if you're long commodities, you're short human ingenuity".

http://silberzahnjones.wordpress.com

It might pay to do a little research before asserting blind faith in the power of the market.

Try googling "history of technological diffusion" and "capital asset lifetime", and thinking about the implications for the maximum possible rate of substitution. Compare that rate to expected oil availability over the next few decades. (This post of Jon's hints where that's going.)

Then try googling "Los Angeles tram system and General Motors" and "Exxon and Climate Change" and pondering likely political developments. Hint: those in power now will not go easily.

Finally, there are a lot of good posts here on TheOilDrum on the merits and demerits of "substitutes" for oil. Try searching the site and reading a few of them. I recommend reading all of Stuart Staniford's and Robert Rapier's posts for a start.

Why haven't I given you links? Well, two reasons. Your link indicates that you're a researcher: you'll find stuff easily. And you'll give more credence to what you find for yourself than to anything someone else steers you to.

You got that one right.

I am short on human intelligence and reality-type ingenuity.

On the other hand, I'm long on delusion-based human ingenuity.

Rather than speaking for myself, I'll let Professor Neil deGrasse Tyson do the explanation

Check this video out:

http://www.youtube.com/watch?v=w-uZZ7RdL5E

+10!

BTW, I talk to worms and birds all the time, they often seem a lot more intelligent than quite a few of our fellow humans... e.g. the morons in congress who believe that we don't need to worry about anthropogenic caused climate change and sea level rise because some bronze age mythological deity promised he would never destroy the world by flooding again >:-(

Funny I used to talk to my sons pet rabbit all the time. Very intelliget rabbit never once made a comment about all the irrelevant drivel I must have been talking.

All the civilizations that came before ours had "human ingenuity".

And yet they all collapsed.

The Neanderthals went extinct.

(A recent Scientific American issue argued that they were almost as smart as our ancestral line was, tools and culture. Something else killed them off. Probably "us".)

So if you are betting that "this time" it will be different, you're betting against history.

With that said, I'm not ready to go gently into the night and will fight for continuance of our way of life just like everybody else.

Need I make out a list for you?

♣ ___Belief in a deity that, despite the vastness of the cosmos let alone the astronomical number of other critters that inhabit this 3rd pebble from the Sun, spends all "His" time and unlimited energies focusing on the "prayers" of individual ones of us lightly haired monkeys

♣ ___Belief in an "Invisible Hand" and a "Market" with anthropological attributes (i.e. The Market is feeling strong today)

♣ ___Belief in supernatural forces (ghosts, goblins and fortune tellers)

♣ ___Belief that "ME" is the special one, the exceptionalist one, the chosen one, the Neo in the Matrix, the one poor family that makes it out alive in the movie "2012", etc.

♣ ___Belief that there is a "them/ they" and they will figure something out on a just-in-time fairy godmother basis

greg

You blame those in power, but would the average US citizen vote for this level of annual vehicle tax.

A Ford Fusion would cost $330 per year and F150 would be $730 a year, this money could be used to build tram and rail and bus networks.

http://www.direct.gov.uk/en/Motoring/OwningAVehicle/HowToTaxYourVehicle/...

or $4.50 tax per US gallon?

Hell yes. I'd sprint to the voting booth to vote for anyone who proposed the taxes you mention. But if I were the average American, I wouldn't be here on TOD.

>would the average US citizen vote for this level of annual vehicle tax. ... or $4.50 tax per US gallon?

No doubt of it, if they were advocated for long enough in the main-stream media by most authority figures. Most people go along with what they're told. Even when their kids are going hungry.

The sad irony in all this is the Saudi's will use our money to build their more sustainabile energy infrastructure so they can sell us additional oil (at ever higher prices) that we will eventually use up. That leaves them with a strong renewable energy structure and us with few energy supply alternatives and no money left to pay to rebuild our energy supply. How could we be so stupid?

"Are people smarter than yeast? Hug your bag of NPK" I miss that guy and his wheelbarrow.

As far as I can see SA is as slow as the US in building out a solar energy system.

As oil supply dwindles, Saudis turn to renewable energy

(MSNBC, previously titled Saudis prepare for an oil-depleted future)

Well, the last sentence is wrong. But WT would agree that KSA exports little oil by 2028 (although at a lower production level)

Saudi Arabia consumes 2.4 million barrels a day, and is expected to need at least 8.3 million barrels by 2028 if no action is taken. But the U.S. consumes a staggering 18.8 million barrels daily, making it the most oil-hungry nation in the world.

Now, the interesting thing about this is that SA has about 26 million people, and the US has 300 million people. The SA oil consumption is 0.092 barrels of oil per person per day; the US oil consumption is 0.063 barrels per person per day - or about 2/3 as much.

If the US consumed oil at the same rate as SA, it would be consuming 28 million bpd, or about 10 million bpd more than it actually does. That's a ridiculously high consumption rate, but if oil consumption was subsidized as heavily as in SA, American consumption probably would be that high.

True. And, of course, they are using oil for desalination and power generation which we are no longer doing. That must add a lot to their heavy consumption rate.

RMtGuy

Thanks for that reminder/calculation.

Though the two populations grow at different rates - USA at the lower rate - both results might be significant. (USA 20M in last 10 years; KSA at proportionally higher rate but smaller absolute numbers, 5M in 10 years).

It is disturbing to see 2 top per capita consumers in obligatory competition for the same resource. The Livermore Laboratory's energy chart link (above thread) suggests demand in the US for petroleum is structural not discretionary, and it looks like the same in KSA for even more obligatory reasons (food, water, proportionally greater growing numbers of people).

Presumably, however, US demand for petroleum has flattened out despite growing population? Could we realistically expect the same to happen in KSA over the next decade or two?

What is the rest of the world going to do about both of them (rhetorical) while we watch what happens?

The Livermore Laboratory's energy chart link (above thread) suggests demand in the US for petroleum is structural not discretionary,

I don't quite agree with this. The need for [petroleum fuelled transport] is structural, since the cities have largely been built without affective rail transit systems. But the vehicles people use for their transport, and thus their petroleum consumption, is absolutely discretionary.

If most commuters were driving Euro style commuter cars instead of SUV's, minivans and PU's, there would be a dramatic decrease in oil consumption.

Until recently,the choice to own and drive a big vehicle, and have a long commute, was not that expensive, so many, many people took it. That choice is now becoming very expensive, but it was always a choice.

They just chose poorly, that's all

Paul

Good point, but do we have any figures?

There must be 'discretionary' motoring that has been or could be cut-back. Recently the US was at the zenith of pseudo-prosperity, but do we have numbers for 2-car families (mom, pop, 2 kids) where both are used for work, plus the extra mileage delivery to child-care?

I have not checked whether the numbers have already been discussed on TOD.

The proportion of US auto fleet that still is highly visible SUV, presumably was going up until 2008. Given the replacement life of the fleet (nearly 20 years?), that is part of the 'infrastructure' now, no? Some proportion of these people must still be paying off their purchase loan?

Another part of American life is the extraordinary inequality of income where, as Joseph Stiglitz reminds us in Vanity Fair recently, one percent uses 24% of total income. What that does for fuel/energy use (a totally unconstrained use of 24% of total US income?) I have no idea, but it is certainly a built-in part of 'infrastructure'.

best

phil

Source #3 in the article is subscription only. This link says Al-Falih forecasts 8.3 mboe/d in 2030, not 8.0: Saudi Arabia to Target Solar Power in $100 Billion Energy Plan - Bloomberg. Paddy Padmanathan, CEO of ACWA Power International, quoted in that article, stated last fall that KSA consumption for power is 1.2 mb/d.

Thanks for that well documented post.

I think KSA cannot be compared with Indonesia and Egypt. They are still the swing producer (even if what happened in Lybia must have significantly decreased their spare capacity).

Their export declined in 2009 because they want to keep the prices at high level, and that differs pretty much from much smaller producers as Egypt and Indonesia, which do not have any power on the market.

Because they can still modify their supply by something like 1 mpd from a year to the other, I think we should wait few years before concluding KSA export are defintely on the decining slope. 2011 exports could be higher than 2010 ones. But anyway we all share the conclusion that their export has no chance to increase significantly in the future.

From 2002 to 2008 we saw six straight years of year over year increases in annual oil prices. It's interesting to compare the difference between Saudi (total liquids) net oil exports from 2002 to 2005 versus 2005 to 2008:

The Saudi post-2005 net export versus pattern is somewhat similar to the post-1997 Texas crude production versus price pattern and to the post-1999 North Sea crude production versus price pattern:

Here is the 1972 Texas production peak (black) lined up with 2005 Saudi production (C+C in both cases):