Tech Talk - Thoughts on oil production from the MENA countries in turmoil

Posted by Heading Out on April 3, 2011 - 4:20am

The popular protests among the countries of the Middle East and North Africa (MENA) are continuing to roil, and so, rather than the review of the countries that I have been discussing in the posts of the last few Sundays, I thought I would just briefly review the status of the countries that are now in various stages of unrest, and include their relative production and exports of oil. I am not going to discuss the natural gas situation since, in relative terms, there is currently a significant excess of natural gas available to the world market. As a result, should the MENA production falter (providing it does not spread to countries such as Qatar), any default can be made up from elsewhere.

I am going to take a quick look at Libya, Yemen, Syria, Algeria, Morocco, Bahrain and Jordan, as countries that are looking less than stable. The list is my estimate of the order in which they will fall, or not, in the sequence shown (my unapologetic dominoes). I am not going to talk about Tunisia and Egypt since, optimistically, they are now in transition with little impact, in the short term, for their hydrocarbon statistics. (And Schlumberger would add Ivory Coast to the list.)

Let me start with Libya, since I was struck by a comment by a Guardian reporter on the current situation there.

Everywhere, there are long queues at petrol stations, sometimes with hundreds of vehicles stretching down the road as they wait. At one queue, drivers were relieved when a tanker finally delivered a load of fuel, but then reacted with frustration when there was no electricity to operate the pumps.

If there is no fuel within the country, then the time it will take to bring the oil refining and distribution system back into operation will get longer as the crisis continues. And since domestic demand will be met before exports restart, the length of time that Libyan oil will be off the world market continues to grow.

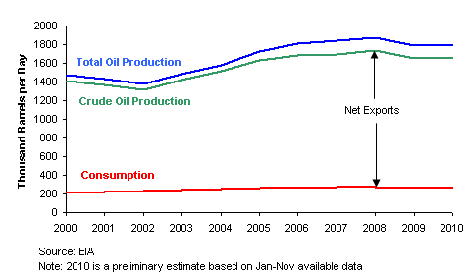

Just as a reminder of the balance between exports and domestic use, here is the EIA plot of that balance.

The impacts of the protests in Libya were almost immediate and the world market has lost 1.4 mbd of oil. The impacts in other countries will be more or less drawn out, depending on the nature of the change.

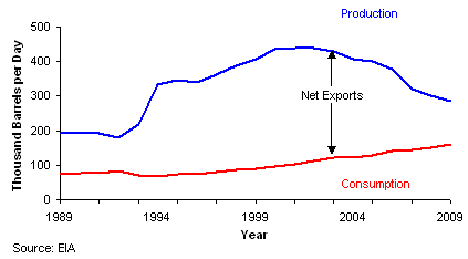

Yemen appears to be the next shakiest country in my rather murky crystal ball. With Yemen, although the President there just withdrew his promise to resign, the protests are beginning to follow the Libyan model in that the protesters have taken over part of the country, and fighting has started. Yemen produces some 260 kbd of oil, but exemplifies the Export Land model in that production is now declining and domestic consumption rising, and the volume available for export is rapidly diminishing. The EIA report that it was 125 kbd in 2009, and mostly went to Asia.

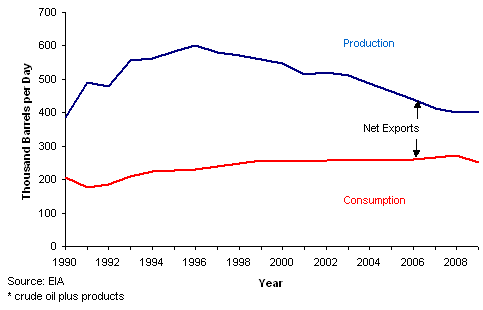

It is beginning to look as though Syria might collapse along the same path. The precursors are starting to happen, in the same way as for Libya, and if it goes there is another 368 kbd of production that may be lost. Of this some 148 kbd is exported, mainly to Germany, Italy and France. Internal consumption, on the order of 200 kbd, may decline, which will, in itself, likely foment unrest.

While the protests in Algeria have died down, for now, should more governments topple (as seems increasingly likely, vide the above) then protests may return to more public visibility, since the causes of the unrest largely remain. However, we are now moving from the countries where significant change is beginning to seem probable, to those where it is increasing unlikely. Algeria is, I suspect, right in the balance on this. There is less motivation to get back into the troubles that preceded the French leaving the country back in 1962, when a million people died, and then there was a civil war that ended in 1999 that killed another 150,000. As a result there is more of a chance for the current President to make enough changes to survive.

I wrote about Algeria, which produces more than 2 mbd, earlier in the series and for now will presume that the production of both oil and natural gas will continue.

Morocco, which produces only around 4 kbd of crude, needs to import around 191 kbd to meet domestic needs. It is also a country where, after some initial unrest, the king took some actions and has promised reforms. Whether these will come to pass and will be sufficient remains in question, but for the present it moves the country over more toward stability, and I will accept that for now.

Bahrain, produces around 40 kbd of oil, with recent investments of $15 billion being projected able to increase that to 100 kbd by 2017. This is expected to require an additional 3,500 wells be drilled.

Bahrain has seen more turmoil than some adjacent countries and had seemed to be heading along the Egyptian path. However it lies close to Saudi Arabia, and there has been sufficient intervention from tanks and troops from there that the unrest seems to have been quashed. Unfortunately the economy has nose-dived, but this is unlikely to affect the oil production.

Jordan follows along the same lines as Morocco, in that the king remains relatively popular, and the unrest is more directed at the government. The recent protests demonstrated the conventional use of the police water cannons for riot suppression, as opposed to cooling spent nuclear fuel piles (as in Japan recently). In terms of oil production, Jordan sensibly stopped producing oil around 1992, and has imported around 100 kbd since then. Thus with a low probability of the monarchy falling, and no oil production, there is likely to be little impact from Jordan, at the present.

Given the concern by Schlumberger let me end with a quick glance at the Ivory Coast. The EIA page for the country is currently down, and to remind you of the problem there – there was an election and the incumbent President was defeated. He has, however, refused to step down, and so unrest is growing as the winner would like his job. The more immediate impact may come in the price of cocoa, since this is the major export, but there is an oil component. The concern comes because the Ivory Coast is along the off-shore trend from Nigeria, through Ghana, that is now being followed by international exploration. Results haven’t been particularly promising, but the ongoing violence is reducing exploration drilling to validate potential.

To summarize the situation therefore it would seem that, for just the MENA countries, the developing unrest could take Libyan (1.4 mbd); Yemeni (125 kbd); and maybe Syrian (148 kbd) oil from the export market. The domino that is starting to look a little unstable is Algeria at 2 mbd, but at the moment I doubt that it will go.

The rolling blackouts in Japan are a warning of what will happen in other countries that start to come up short in energy production. It makes industrial production difficult, and thus plans for load shedding will become more important. Wonder which companies are working on them? Because the numbers are beginning to look worrisome in terms, not just of price, but also of availability of oil at the time that it is needed in the non-too-distant future.

I'm glad you focus on the smaller countries like Syria. Taking away Syria's and Yemen's combined exports is not an insignificant blow to an oil market which already operates on a wafer-thin 'spare capacity' (Goldman Sachs belives it is under 2 mb/d as it stands now).

I also share your sentiments about Algeria. I think it's a bit harder for a revolution now that the Libyan stalemate is for all to see and how the West essentially let Bahrain be occupied by Saudi Arabia, in exchange for Arab league support of the Libyan intervention.

A lot of rulers, and I think they are correct, believe that the West will simly not go further than a few tepid denunciations of 'excessive violence' that is 'disturbing' as well as a few 'calls for reform' added into the mix for good PR's sake at this point.

One also has to remember that we are at the doorstep of a new election in Nigeria, which is a very, very important supplier for America. Historically, that has always meant lower production due to unrest and violence which usually occurs when the election's due and at times even in the aftermath.

It's quite hard to believe that the combined exports of Yemen and Syria would matter in a 'normal' situation but with the superthin margins that we've currently got, that speaks volumes in of itself, this is indeed 'the new normal'.

Thanks for an intestering post, Heading Out.

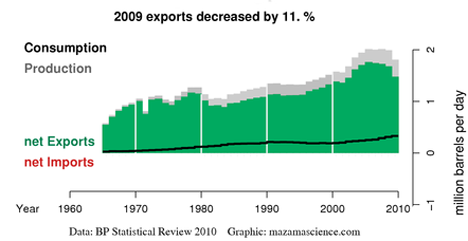

Crude Oil Production (blue), Consumption (red) and Net Exports (green) for Egypt, Tunisia, Yemen and Bahrain (total for all four) from 1980 - 2009 (click graph for source post)

Egypt, Tunisia and Bahrain are smalltime players (even among the dwarfs).

Yemen, Syria, Oman are much more interesting.

So is the recent fallout from Gabon.

It would be interesting to see how much worldwide refining capacity has been lost or offline in past few months

It seems incredible (and alarming) that we are having to even assess the impact of what are, in the scheme of things, relatively minor oil producers, going 'offline'. The failure of OPEC to cover the loss of Libyan oil must be ringing some sort of alarm bells in the corridors of power - and then throw in 200,000bpd offline here, and another 300,000bpd offline there, and all of a sudden youve got yourself one hell of a problem.

Well in the ones with incredibly poor "intelligence" perhaps. I'm sure the rest worked that out long ago.

And this is the greatest mystery of them all, surely these people should know what is going and must've known it for quite some time. Bill Clinton has spoken about Peak Oil way back. So, why has nothing been done? I mean, one can look at climate change and just sigh at the ineffectiveness, but at least it's a phrase out there. People pretend to care. But you can't even use the phrase 'peak oil' in politics at the top level if you want to be taken seriously.

It's beyond bizarre and there's not a single good explanation for it which I can come up for. It's like these people have a death wish.

Peak oil cannot be talked about directly at the top for the same reasons a Dr. does not talk to patients about changing their diet. The most they will say is lose some weight, then its up to the patient to fail at every attempt. That's because people cannot be expected to change their habits. The only thing that can be done is to let post peak oil shake things up to the point where people draw their own conclusions. For example, hybrid sales are up. So feedback from reality does force some change, but planning for the need to change from forseeable feedback is for the most part absent. Who knows, maybe a future improved version of ourselves might actually be able to plan ahead instead of adjusting to crisis.

Egypt is in a state of suppressed unrest. The suppression is growing, but so is the unrest. Mubarak was removed from power but his military cronies that gave him the boot are continuing and expanding similar policies while the underlying economic factors are not improving.

Iraq and Iran both have significant unrest which could significantly impact future oil production. A large percentage of the population in Saudi Arabia wants change.

The US just announced plans to double the size of its Iraq "embassy", already the world's largest. And the embassy's budget is currently larger than Iraq's.

But unrest isn't limited to MENA. It appears to be on the increase worldwide. And the interaction with energy systems will not be limited to oil. The Fukushima power fiasco leads me to question the wisdom of using nuclear power to transition from fossil fuels. Civil unrest, political instability and warfare all seem incompatible with nuclear power which apparently needs a stable environment even in shutdown.

I recently looked at a map of nuclear power plants and many are in places that are unstable. North & South Korea, Pakistan & India, Eastern Europe, and China.

Russia, Europe, England and the Eastern United States are rich in nuclear power plants and ripe for disaster should things unwind badly.

Gabon with 200 kbpd....

http://www.reuters.com/article/2011/04/02/us-gabon-oil-idUSTRE7312CE2011...

Thanks for the report. The most chilling info is detailed in the ELM graphs. It's almost surprising gas has not rocketed much higher this spring.

Some thoughts on pre-peak net export numbers in oil exporting countries, AKA "ELM, The Prequel."

http://www.theoildrum.com/node/7641#comment-785575

Also interesting is the long article in Times Magazine on-line about the large supply of natural gas available in the US. And a long article in the Saturday Essay of the WSJ on the same topic. The WSJ article especially glossed over environmental concerns involved with shale gas production.

Seems to me that Ameicans are being shown, loud and clear, the rosy future with domestic energy supplies. Maybe this picture will keep us from worrying too much about the dwindling amount of available oil world wide.

Regarding the WSJ article, the author is the same Daniel Yergin who, in 2004, asserted that by the end of 2005 oil prices would be back down to $38 for the foreseeable future. I therefore proposed that oil prices should be denominated in terms of "Yergins," with One Yergin = $38 per barrel. Global oil prices are currently at about three Yergins. (Incidentally, I suggest a Google Search for: Daniel Yergin Day.)

Mr. Yergin asserted in 2004 that rising oil production would force oil prices down. In fact, EIA data show that annual global crude oil production (crude + condensate) has been at or below the 2005 annual rate for five straight years, as annual oil prices ranged from $62 to to $100 for 2006 to 2010.

So, contrary to Mr. Yergin's repeated predictions, oil prices rose in order to balance demand against flat to declining supply.

Regarding shale gas, Art Berman has researched the topic at length, and following are some excerpts of his comments (from an introduction to an upcoming lecture):

I suggested that Daniel Yergin's prediction are so frequently wrong, that one could profitably use the "Yergin Indicator" to bet against Yergin's latest prediction. This has generally worked quite well for oil prices, with oil prices generally trading at about twice Yergin's predicted price level within one to two years of his prediction. Consider the following discussion of oil prices from about two years ago:

http://paul.kedrosky.com/archives/2009/04/daniel_yergin_o.html

So, if Yergin is bullish on US natural gas production, then the "Yergin Indicator" suggests that natural gas prices will at least double in the next one to two years, with US natural gas production falling. Time will tell.

Thanks Westtexas for the background. Seems more of these "positive" articles are being floated lately, possibly to distract from the increasing shortages of oil supply and to ease concern about the USA's ability for infinite economic expansion. I am on the Eagle Ford shale with one rig (not pooled in) 600 yards from my house. While I would love wealth from royalty checks, it's depressing to see how many resources are put into extracting energy from this one well. I doubt that all the energy produced from one well will take longer to consume than the time it took to build the road, drill and extract. Our energy consumption must change.

Could you give us a URL for Berman's complete lecture?

Here is the info that I received in an email:

Libya is a small country, with a population of only about 6 million. The center, the coast of the Gulf of Sidra, is populated thinly along the coast. So there is no question that the east and west can be maintained as separate spheres of influence indefinitely.

There are reports that Egypt is now a conduit for arming the opposition in the east. The Turks have been supplying humanitarian aid for some time. Egypt is very well armed and could roll over all of Libya in a week or two, but will be restrained by the US, UK and France. On the other hand, eastern Libya (and the oil fields) could well become part of an Egyptian protectorate established to solve Egypt's refugee problem in a spirit of Islamic brotherliness.

Syria is an interesting case. Asad has no choice but to hang onto power. If he goes, his Alawite minority as well as other minorities would likely be slaughtered as infidels. On the other hand, to stay in power, Asad has to make some reforms and accommodations. I'd expect him to go the Chinese route of economic reform under strong single-party rule. Furthermore, I don't think that the Turks want to see a jasmine revolution on their southern border and a destabilization of the Kurdish issue. Syria can also play an important role as an export conduit for Iraqi oil to the Mediterranean. I don't think any of Syria's neighbors want to see a change in the status quo.

Very true, the Turks want stability. But then so does everyone else.

I read in the Sunday Times (UK) today that Saudi Arabia needs oil at $85 to make exploration viable, so we can assume that oil won't ever go below that again, unless there is a very serious economic collapse.

As for concentrating on the smaller oil produces, this certainly concentrates the mind on their compound importance; but since none of these revolutionary movements was really expected - at least on this scale - and the whole area is extremely volatile, I truly believe that anything might happen at any moment and we should not be surprised at events and nor should we exclude serious trouble from the big players.

The longer the chaos reigns in Libya the more the infrastructure will collapse, and I too am assuming Libya to stay out of the energy loop for a while. Fuel prices worldwide are rising and this is already influencing consumption. If commodity prices rise too much more I wouldn't be at all surprised if the riots we are viewing on our screens now don't begin to spread to western countries too.

And as for the current world glut in gas supplies, I wish somebody would tell the companies selling same in Britain, since today we were promised price hikes of up to 15% this summer. I know we are at the end of the European pipeline form Russia and that our own supplies are reducing, but we do have LPG terminals. I guess that Japan's LPG consumption is already having an effect, on Britain at least, as I suppose must our falling currency. And our economic future?

Intersting times.

Perhaps someone could help me sharpen my thoughts here (Heading Out?).

I was thinking back to old discussions on TOD about spare capacity. When I first discovered TOD there was a topic about the Ghawar field. It had all kinds of graphics showing how the water horizon was seriously closing in. (Would love to see an update on that)

The general impression I got, on later discussions involving SA also, was that the true figure for spare capacity was around 2 million.

But now, the impression I get is this:

Libya -1.4

Yemen -0.2

Syria -0.5

That adds up to -2.1 right there. Then possibly add in the near future, because of political problems:

Nigeria -2.3

Gabon -0.2

Sudan -0.5

That would be -5.1 million. Eek.

So was my original impression that true spare capacity was 2 million incorrect? Or have we indeed already lost (or about to) more than what true spare capacity was?

My standard Saudi comment:

http://www.theoildrum.com/node/7554#comment-770186

Excerpt:

My memory from a few weeks ago, when Libya first blew up, is that the government in Saudi Arabia announced that they would increase production to make up the shortfall. I believed that, but what wasn't mentioned was that Libya's oil is light & sweet, while the production that Saudi Arabia would replace it with is heavy & sour (thus driving up the price of light crudes like Brent & WTI). And that would pretty much exhaust their ability to boost production, so other countries going off line would come straight off global production.

My other assessment is that Libya is the only substantial OPEC member susceptible to a popular revolution at this stage, because countries with large oil exports have the wherewithal to buy off opposition - if not all the opposition, then enough to keep up a power base and hang on. Libya is a special case because Gaddafi has been inefficient in using oil revenues to buy the people off. Later on, when production starts trending more strongly down & the ELM scenario reduces the funds for buying off dissent, the petro-monarchies might start falling, too.

Much as I dislike the House of Saud, I can't see it falling before Ghawar collapses. And nobody outside the House of Saud would have enough info to merit being confident of when that will be. And they, for obvious reasons, aren't telling.

One could also argue that a short period of "instability" (which in most cases means sadly simply people having the spine to strive for basic rights) could lead in short order to wiser production from less corrupt governments.

In the case of the Libyan uprising - which I strongly suspect might be manufactured in part by the West - there are already public plans for Qatar to bring eastern Libyan oil to market. That is in fact one of the only things about that situation for which anyone seems to have made a concrete plan around.

With all the upheaval in the MENA countries, you have to ask why oil prices are not higher, the answer is found by looking at those countries that have been able to increase production over the last 5 years. Countries such as the United States and Brazil, who have been able to increase production and therefore allowed exports to go to other countries. In total these countries have increased production by over 5 million barrel per day.

Country Increase

Canada 363,408

United States 330,435

Brazil 421,446

Colombia 259,561

Turkey 4,920

Azerbaijan 611,170

Kazakhstan 232,573

Russia 632,325

Iraq 521,639

Oman 90,230

Qatar 291,066

Angola 689,927

Congo (Brazzaville) 67,507

Libya 17,041

Sudan 161,332

Tunisia 5,175

China 467,101

India 87,138

Thailand 58,553

World 5,312,547

Jaz, Thank you. Otherwise reading this series of posts you might come to the very false conclusion that world crude oil and lease condensate production was falling. Quite the contrary: It is rising at quite a rate. The latest figures from the EIA have recently been released and show a all-time high for December 2010 and also for Q4 of 2010.

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=50&pid=57&aid=1&...

December 2010: 74.796 million bbls/day

Q4 2010: 74.298 million bbls/day

Peak Oilers on TOD, such as ACE, have of course predicted that production should have fallen to about 67 million bbls/day by now.... http://www.theoildrum.com/node/5177... My other favourite post is of course: http://www.theoildrum.com/node/3720 where Webhubbletelescope so confidently stated: "Conventional oil sources have peaked". (Of course WHT will now argue that Brazilian oil is not conventional because it speaks portuguese and so on..... :-))

A link to my 3/21/11 comment, along with an excerpt:

http://www.theoildrum.com/node/7686#comment-780640

Of course the North Sea, which peaked in 1999, is a prime example of a post-peak region with new oil fields coming on line. North Sea oil fields whose first full year of production was 1999 or later had a peak of about one mbpd in 2005, versus a regional peak of about six mbpd in 1999, but these post-peak oil fields only served to slow the overall decline rate to about 5%/year. Two differences between the North Sea in 1999 and global crude production in 2005: (1) Globally we have a rising unconventional component and (2) The North Sea is of course exclusively offshore, versus onshore and offshore globally.

westexas

Let us say oil production does not grow any further, does that prove peak oil due resource constraint is right?

If you consider how many countries have been effected by above ground factors over the last few years it looks to me that peak oil is as much a result of politics, economics and war as lack of oil.

Just a small sample of the things I am referring to.

Angola civil war

http://news.bbc.co.uk/1/hi/world/africa/country_profiles/1839740.stm

Libya sanctions

http://www.time.com/time/world/article/0,8599,1967079,00.html

Iran sanctions

http://www.reuters.com/article/2011/03/18/us-israel-iran-idUSTRE72H0M520...

Iraq civil war

http://www.iraqbodycount.org/

corruption in Russia

http://goliath.ecnext.com/coms2/gi_0199-10121351/BP-Russian-venture-exec...

Civil war In Nigeria

http://www.independent.co.uk/news/world/africa/nigerias-civil-war-into-t...

It is hard to argue that above ground factors play an overriding role in the timing of peak oil.

There is always something going on that adversely affects production somewhere. For example, in 2005 we had two hurricanes that severely impacted US Gulf of Mexico production. But the fact remains that we saw a rapid increase in crude production from 2002 to 2005, in response to rising oil prices, and since then annual crude oil production has been at or below the 2005 rate for five straight years, despite a rising contribution from unconventional sources.

And as I noted several times before, the real story is the post-2005 decline in global net oil exports, especially the decline in Available Net Exports, which I define as global net exports less Chindia's combined net oil imports.

People will have to judge for themselves the validity of the following analogy:

http://www.energybulletin.net/stories/2011-02-21/egypt-classic-case-rapi...

http://www.youtube.com/watch?v=nFmcZYIlHA8

Nordic

Ace claimed:

World oil production peaked in 2008 at 81.73 million barrels/day (mbd) shown in the chart below.

http://www.theoildrum.com/node/5177

oops

It was actually around 90 million barrels/day in January.

The Oil shock model is looking more shocking by the month, ha ha.

Here we go again:

1. C+C is generally revised downwards. It's certainly possible that the previous peak might be beaten by 0.2 or 0.4 mb/d. It doesn't matter in the grand scheme of things.

Come back if C+C exceeds the 2005/6 peak by at least 2 or 4 mb/d instead.

2. 'All liquids' contains much more than C+C, many of those liquids give less energy for the same volume, meaning you need to produce, export and burn more to get the same amount of energy from normal crude.

If adjusted, the 'All liquids' production is essentially flat since 2005. A fluctuation of 0.5 up or down does not change anything.

3. We've invested loads and loads of cash since 2005-2010 and crude production has essentially been flat. We actually increased the spending per year from 2005 onwards compared to 1995-2004, and gotten nothing in return more than staying in the same place.

In other words: the world has been investing far more to just stay in place.

4. We've still below peak exports.

5. Unconvential needs a very high oil price to even break-even, over $90 dollars, which is hurtful for the economy to begin with.

After Saudi Arabias spending binge, they need the price of oil to be at least $85 for their national budget to even break-even, according to Arabian business press. And the Kingdom wants a profit at that, which means we're looking at least $100 prices for the overseeing future.

6. Unconvential will not save us. Canada is merely exporting 1 mb/d, this might increase to 2 mb/d in ten years in a realistic scenario. If they go all-out, perhaps 3 mb/d. But again, we're unlikely to have a stable situation since the prices required from places in the Artic etc will need so high prices that we'll either have constant recessions or stagnation. Probably both.

7. All peaks have an undualting plateau. We're on our sixth year. If you're focusing on the minor fluctuations, you've not understood the (rather simple) concept. Also, what a single individual forecasts cannot change the underlying reality. Peak Oil does not rise or fall with a single person.

After the plateau, there is a fall. IEA themselves forecast a 10 mb/d shortfall in 2015. So does the U.S. Joint Operations Environment report from 2010. So does the German military.

And so on.

8. And finally, ask yourself that if we're so loaded with oil, why can't Saudi Arabia even cover the Libyan losses? They are supposed to have 4-5 mb/d in spare capacity?

I could go on, of course, but I think I'll save this post for future reference if jaz thinks it's high time to deny reality, which seems to be an occurance with a certain predictability.

Jaz takes a few potshots at the Oil Shock Model but doesn't realize the model that is suffering right now is Hubbert Linearization. The problem is that HL cannot account for an extended plateau. That's why we aren't seeing much mention of HL on TOD recently. By definition, HL assumes that an inverted parabola occurs at the peak, as I show in The Oil ConunDrum. When the parabola flattens out into a plateau it essentially screws up the linearization.

OTOH, the shock model is perfectly capable of handling an extended plateau. That's partly why I came up with the model, as I knew HL had severe limitations.

Of course, Deffeyes' (HL based) estimate of 2,000 Gb for global C+C URR really only consisted only of conventional reserves. But so far, slowly rising unconventional production has not been sufficient to increase the global annual crude oil production rate beyond the 2005 annual rate.

I agree with that but the problem is that skeptics will see HL being applied to the current data and criticize the nonsense results that come out of it. They miss the fact that HL is simply a heuristic that only works in a narrow set of cases.

Unfortunately the PO skeptics are usually so knuckle-headed(Lynch, Yergin, et al) that they might not figure this out on their own, and I am spilling the beans by mentioning this issue with HL. Oh well, it is better to keep knowledge out in the open.

WHT

He said as much himself, I think Hubbert was cleaver enough to see where political moves would change his culculated peak. If he was alive today I do not think he would be calling you for help.

http://www.youtube.com/watch?v=ImV1voi41YY

"OPEC countries are tampering with this curve by restricting production, delaying peak by ten years or so"

So what's your point?

Now you are admitting to the fact that peak oil was 10 years ago, just delayed due to political perturbation that you can understand with the oil shock model.

I have a feeling you just want to be a contrarian.

BTW, If Hubbert were alive today and doing this stuff he would be a marvel of modern medicine.

I am not admitting that peak oil was 10 years ago, since I have been making the point that we have still not reached peak production.

Hubbert graph showed peak oil for around 1995 at 110 million barrels per day, with a rapid decline rate after. It does not take a genius to work out that if oil production was held down by OPEC than you will get a lower peak and an extended plataux.

You seem not to understand that production in many oil producing countries have never been allowed to rise in an unrestricted way. Global oil production is more subject to quotas, embargos, wars and corruption than to any graph you may come up with.

Hubbert gave us an understanding of limits but many of the things above are not predictable, if they were than a graph of Iraqi production would be produced by you.

Since one is not forthcoming it just proves my point, better than any words can say.

The oil shock model handles perturbations well. The problem was that Hubbert understood intuitively what was happening but he wasn't trained or had no knowledge of applied stochastic math so he wasn't able to properly model the phenomenon. We will never know but something must have prevented him from using a compartment model approach (i.e. the oil shock model) as it perfectly describes what is actually happening.

Math can actually describe physical behaviors, who would have thunk it?

Here is an excerpt from my standard global C+C versus oil price analysis, linked up the thread:

IMO, Deffeyes* was the most accurate of the analysts who made predictions about future volumes of global production. Just look at the exponential rate of change for annual global crude oil production from 2002 to 2005 (+3.1%/year) versus 2005 to 2010. The calculated rate of change for each year from 2006 to 2010 inclusive, relative to 2005, was either negative or zero.

*His prediction was for a crude oil peak between 2004 and 2008, most likely in 2005. He made an erroneous observation about a peak in 2000, but he never backed away from from what his model predicted, a conventional peak between 2004 and 2008. He didn't think that slowly increasing unconventional would be sufficient to keep total global crude oil production on an upward slope, and so far he has been right.

Leiten

I am not denying reality, I believe peak conventional oil will happen within the next few years, as I have stated before several times.

However this peak is due to TWO factors and not just ONE.

The two factors are.

1: Resource contraint in many free and stable countries, nobody can deny oil production decline in the Northsea, Australia, Indonesia, US lower 48 since 1970, Alaska, Mexico etc.

2: Above ground factors in many countries comes in several forms.

A: Such as expelling the best oil companies from a country eg Venezuela, Russia, Iran etc.

B: War and civil war, Iran/Iraq conflict, Iraq war, Libya civil war, it is difficult to drill and produce oil when people are dropping bombs on you.

C: Corruption in many African, South American and former soviet countries where contracts are given to the company that pays off the most policitians.

D: Large fluctuations in oil price, falling to $10 in 1999 for example, this price made investments in new fields a waste of time.

T Boone Pickens said the world counld produce 100 million barrels a day(total liquids I think) if it were run like Shell.

You have to admit that if every country was free from corruption tyrany and war, oil discovery and production could proceed unhindered and reach a higher level than now.

Perhaps 85-90 million barrels a day c&c in 2020.

The lower level we will experience is due to 40 years of war, violence and corruption in many oil producing countries. Look at Libya, civil war= no oil, you cannot argue with that, can you?

I can't help noticing that a lot of of the above ground factors are actually caused partly by a lack of oil production forcing a lot of stuff out into the open.

You can argue that above ground factors are predominant, but underlying a lot of those is a constant need for fuel that is getting harder to find as the population of each country increases and oil availability dwindles.

If America had not had dwindling oil resources in it's own country, would it have been so keen to get into it's last set of wars for instance?

In other words, Jaz may have a hard time distinguishing between cause and effect.

Richard

I agree with you entirely, the US has used most of it's oil and has been in decline for years.

As a result it has manipulated elections and removed governments in other countries to suit it's own ends. Just like the UK and many other powerful countries have done in the past.

If you look at the causes of the First World War, it was because Germany was building a railway to Iraq, which would enable it to control the regions oil. The UK and Russia could not allow that to happen, the assassination of the Arch Duke was a good opportunity to stop German ambition.

http://video.google.com/videoplay?docid=-8957268309327954402#

As Robert Newman says nobody is that popular, very funny.

Before the First World War, there was plenty of oil for everyone, guess it is easier to kill those who want a piece of the pie than to share it with them.

http://en.wikipedia.org/wiki/Baghdad_Railway

During 1901 a German report announced the region had a veritable "lake of petroleum" of almost inexhaustible supply.[8]

Peak oil is not as some hear portray, only resource constrained, to highlight the point, if you moved the oilfields of Iraq to Texas, what would Texan oilmen be able to produce from it in say 5 or 6 years.

Most oilmen would say between 8 and 12 million barrels per day, that is just one country where oil production is far below what it could be given the right above ground factors.

Most oilmen would say between 8 and 12 million barrels per day, that is just one country where oil production is far below what it could be given the right above ground factors.

Well I don't know that most oilmen would come to consensus all that easily about any solid number production prediction but ignoring your hyperbole--we can be damned thankful that Iraqi oil isn't in Texas getting pumped as fast as possible and overheating the economy into even more unsustainable exburban growth.

Always thought this country had a fair bit of dumb luck. Now if the fast food joints and snack food aisles were as hard to get to as today's oil is America might be able to beat its obesity problem before too long?- )

Part of the problem in convincing people about peak oil is that there are many areas of the world where the oil is still very easy to get to. Most of the oil in the Middle east is easy and plentiful.

http://www.bp.com/liveassets/bp_internet/globalbp/globalbp_uk_english/re...

Russia proved reserves are 74 billion barrels and they produce 10 mbd, Norway reserves are 7.1billion barrels and they produce 2.3 mbd. Iraq has 115 billion barrels so a production rate of 10 mbd would give them a lower depletion rate than either Russia or Norway. About 3%.

Trouble is global consumption requires finding very expensive oil because countries like Iraq, Iran, Libya, are not the safest places to go drilling.

If peak oil is now it is a consequence of wars, corruption and stupid dictatorships. many of which we have created ourselves.

And yet Peaks Happen, even in the best of circumstances, e.g., Texas & the North Sea, which accounted for about 9% of total cumulative global crude oil production through 2005 (C+C in both cases):

It's interesting that, based on the HL models, Saudi Arabia in 2005 was at about the same stage of depletion at which the prior swing producer, Texas, peaked in 1972 and globally conventional crude oil reserves in 2005 were at about the same stage of depletion at which the North Sea peaked in 1999.

Globally, we have seen close to a billion barrel shortfall for 2006 to 2010 inclusive--between what we would have produced at the 2005 annual rate (C+C) versus what we actually produced--versus the very rapid increase in production that we saw from 2002 to 2005.

The following chart, lining up Texas (in black) in 1972 with Saudi Arabia in 2005, was prepared in early 2006, using Saudi production data through 2005 (C+C in both cases). The 2006 through 2010 data points for Saudi Arabia have been added.

Original 2006 paper: http://www.energybulletin.net/node/16459

Westexas

I have no argument with those graphs, but will say again, if all the oil producing countries of the world were peaceful and stable then oil production could rise for a few more years.

The list of countries where oil exploration has not been hindered by corrupt governments, wars, terrorists or expultion is quite small.

This is why Hubbert's production peak of 40 billion barrels per year was never attained.

Hmmm, odd that everything was "peaceful and stable" until 2005, but not afterwards. . .

As noted up the thread, the alternative view is that there is always something adversely affecting production somewhere.

That is my point exactly, what has changed in the last few years is the big producers in stable countries have gone into decline. UK, Norway, Denmark, Mexico, Australia.

OPEC at the moment is limited by instability, not by resource constraint.

Other examples Angola coming out of decades of civil war is seeing quite large increase in oil production.

http://www.companiesandmarkets.com/Market-Report/angola-oil-and-gas-repo...

Nigeria is production is again determined by war or peace in the reagion.

http://www.bloomberg.com/news/2011-04-05/nigerian-election-violence-coul...

The simple message that PEAK Oil is purely resource constrained is wrong and easily demolished.

Things are a little more complicated than that and the correct balance needs to be struck.

It is actually resource constrained as average extraction rates throughout history have never gone down below 3%/year and never gone much beyond 7%/year. Every year, year after year, the world has extracted from reserves a fairly consistent amount. This means that we use oil at a relentless pace, extracting at a rate that draws down the reserve supply very efficiently. You cannot argue with this because you haven't done the modeling.

Wrong Again

Page 6 of BP Statistical Review,

http://www.bp.com/liveassets/bp_internet/globalbp/globalbp_uk_english/re...

The variation between countries is vast from less than 1% depletion to more than 10% again in Iraq the figure is high at the moment(over hundred years of reserves at current porduction). This is nothing to do with the geology of the fields in Iraq and everything to do with 30 years of wars, sanctions and the lack of investment.

The next few years will prove me right and you wrong.

I said world of course. Everything I write about takes into account dispersion and variance while the average works out to what I wrote. It is all documented so no use arguing this point.

I don't see how you can be proved of anything. I don't see any model that you are referring to, only assertions.

1. Where is your model for Iraq, if you cannot model Iraq you cannot model the world.

2. Did your Model predict loss of Libyan oil overnight?

3. Which country will be next?

That is three questions, but as per your usual when you cannot answer a question you skulk off to another thread or have the question deleated.

Of course modeling is more difficult when one doesn't have all the pieces but modeling is also very useful when you have to deal with the occasional missing piece. It's known as extrapolation. Don't mistake my not working Iraq out for some inadequacy. I refuse to be bullied by some hack.

Ha. The Shock Model is perfect for situations like Libya. Libya is a perturbation on the oil flow and that is what the model allows.

Google perturbation and oil shock model

http://www.google.com/search?q=perturbation+"oil shock model'

I guess my model (based on a URR of 2.8 trillion barrels) does show a broad peak around that date. Thanks.