Global Refining Capacity

Posted by JoulesBurn on March 30, 2011 - 6:59pm

This is a guest post by Stephen Bowers (TOD user carnot) who works for Evonik, a major chemical company based in Germany. Stephen is a petroleum chemist with over 30 years experience and started his career as a mud logger drilling oil wells.

Product Demand and Disposition

Global refining capacity is in a state of flux. In the main, the refining capacity in the OECD countries is in a mature state, with refineries aging and struggling to achieve the necessary returns for re-investment. This is particularly relevant for Europe and Japan where refining margins have been poor for decades. The same applies to an extent in the US, although there has been more investment in upgrading in the US than Europe. It would be not hard to reason that high taxation of fuels may have been partly to blame. Irrespective of your point of view, the fact that refining margins are so poor - typically $2-5 per barrel - it is no surprise that much rationalisation is taking place on the mature markets.

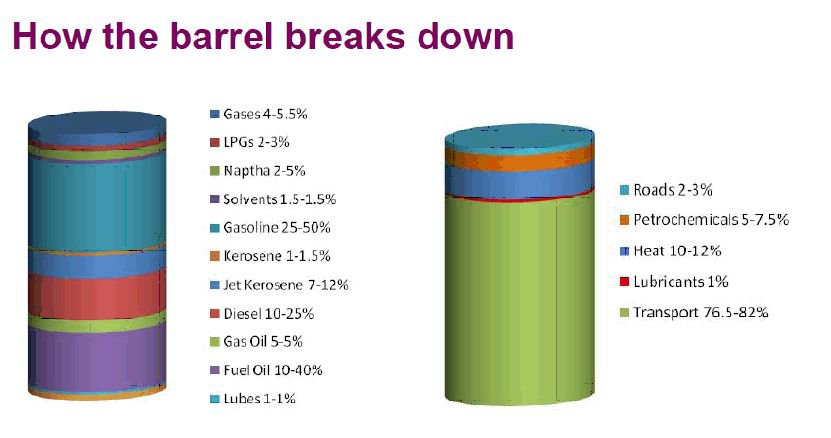

It is worth looking at the typical disposition of the products from a barrel of oil and Chris Skrebowski's (of Peak Oil Consulting) slide Fig. 1 does it well.

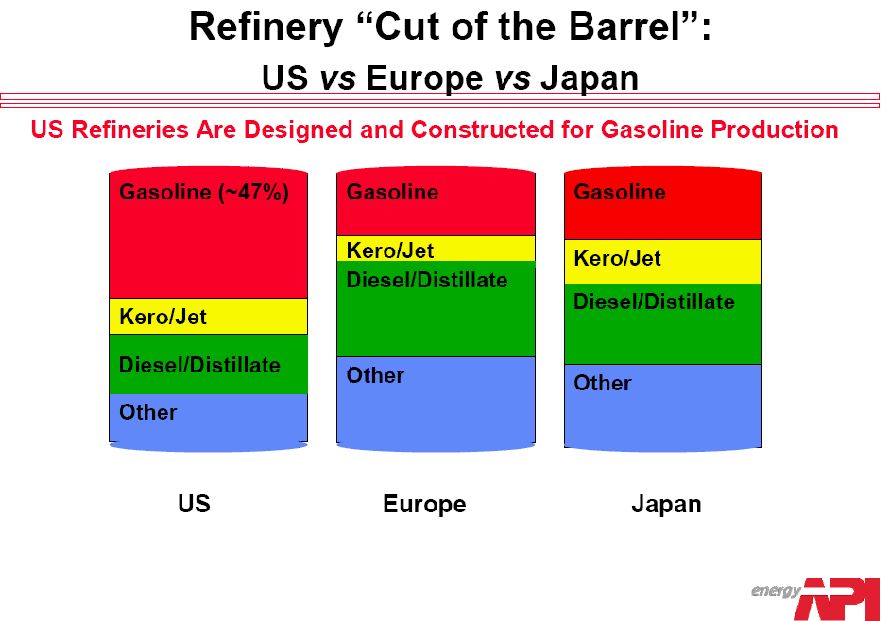

By far, the majority of crude oil is consumed in the production of transport fuels. On a regional basis there are significant differences with Europe emerging as a middle distillate market and the US remaining firmly in the gasoline mode. (See Fig. 2.)

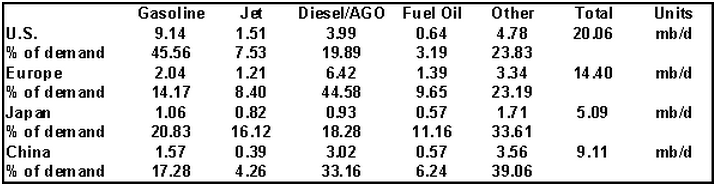

It is worth noting the difference in product demand because this significantly affects the configuration of a refinery. As can be seen, the US demand is focused on gasoline and in Europe the desired products are jet kerosene and diesel. In the US there is considerable capacity to convert middle distillate to gasoline. Converting light products to middle distillate is much harder and there are few processes available. In terms of fuels specifications it is apparent that the EU EN 228 and EN 590 fuel specifications for gasoline and diesel respectively are emerging as the dominant specifications as they are being widely adopted in the developing countries. Europe has been a leader in small diesel engine capability (Mercedes, BMW, Audi VW, Peugeot, Fiat), even ahead of the Japanese, and within Europe more than 50% of new cars sold are now diesel. Even the premium luxury brands now have diesel options. This is driven by the fuel economy as measured in volumetric terms and by taxation. Table 1 below is constructed from the Feb 2011 IEA Oil Market Report and gives the % of demand for each product group (note - 1 month's data should not be taken in isolation). Notice how the US has managed to reduce fuel oil production. The real point though is the sheer difference between gasoline and diesel consumption between Europe and the US. The other products include ethane, LPG and naphtha which are extensively used in petrochemical production. This will be discussed later in more detail. Note that the total demand may exceed the refinery capacity. This is not surprising as condensate and LPG may not be processed in refinery and with be counted as other demand. In addition there might be imports and exports of finished products (US gasoline and Europe middle distillate. Japan and China, naphtha and LPG.)

Refining Processes and Complexity

The refining process for crude oil can be described by 5 basic process steps as in Fig. 3 below. All modern refineries producing transport fuels will contain these 5 process steps, though not necessarily all of the units described in each process.

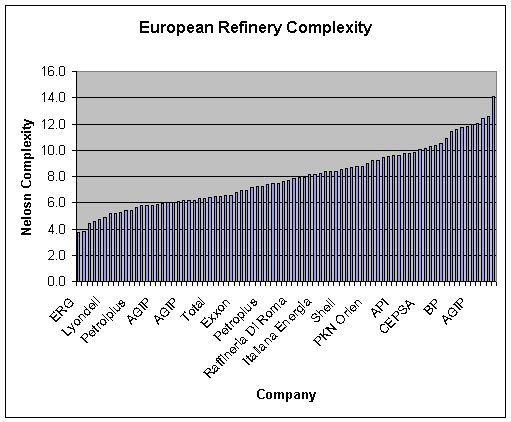

Europe has something of the order of 120 refineries but some of these are very small specialist operations. In the main there are about 79 decent sized refineries with a crude throughput of 13.8 million b/d. One measure of a refinery complexity is the Nelson Index, which assesses the refinery conversion capacity by relating each processing unit capacity against the crude distillation capacity and applying weighting factor. Table 2 gives a simplified list of complexities for individual units and the base line capacities from which they were derived.

Refinery Nelson Complexity = Sum of (Unit capacity/ CDU capacity x Nelson Factor) for all units on refinery.

In the above example, the unit Nelson Factors have been calculated from the baseline unit size. In the above example the refinery total is for illustrative purposes only. I have left out all the possible units for simplicity-i.e no hydrotreaters, oxygenates, isomerisation all of which carry a Nelson Factor.

For Europe, my computer model gave the following distribution in Fig. 4 (note this is the result for individual refineries). Many refiners report the Nelson complexity in their publications, particularly if they have a high score.

A Nelson complexity of 4 is a simple refinery whilst the refinery of complexity 14 would be regarded as amongst the best in the world, but extreme care should be exercised before concluding that complex refineries are naturally more profitable. In general that is true but very much depends on the product mix. A complex refinery making 40% gasoline at the expense of middle distillate in Europe would be a big mistake. The refinery model I developed is able to calculate a refining margin based on the refinery configuration and product mix, and makes a good estimation of the energy demand and CO2 emissions. This allows a better estimation of refining margin for a particular refinery and allows some modelling with different crude types. (This is not a sales plug - it is not for sale or hire.)

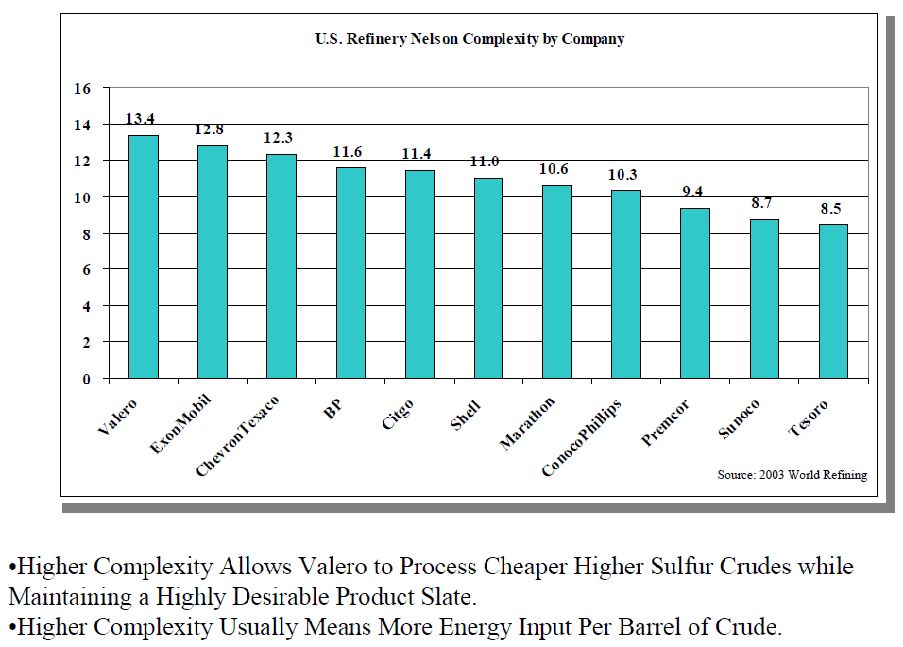

For the US, the situation is as follows (Fig. 5), noting that this is 2003 time-line (still reasonably accurate) and this is the aggregate score for all refineries operated by the owner. In general the US refining base is more complex than the European base:

A complex refinery might look like this (Fig. 6) (The actual Refinery is the Chevron El Segundo taken from the Chevron Diesel Fuels Technical Review.) - http://www.buschtaxi.org/downloadz/technik/diesel.pdf or here for later version www.chevron.com/products/prodserv/fuels/.../Diesel_Fuel_Tech_Review.pdf

In this refinery there is high conversion of the the crude to transport fuels with the aim to produce minimum fuel oil. Note that AGO is used to feed the hydrocracker and the FCC, which is not normal for Europe where middle distillates are in short supply. In the US gasoline is the desired product and therefore the AGO fraction is often cracked. Another point to note on this refinery is the use of both a hydrocracker and a FCCU. This is unusual as normally either a hydrocracker or a FCCU is used alone. The light cycle oil from the FCC is a diesel stream with very poor qualities, and is becoming increasingly difficult to blend into road diesel due to the high aromatic and sulphur content. This refinery has a Nelson Index of 10 calculated from the latest OGJ survey. As can be seen there are four main fuel products - gasoline, jet, diesel and fuel oil. In addition there will be coke, sulphur and lpg.

BPRP Geslenkirchen's refinery in Fig. 7 is an unusual refinery configuration for Europe and is one of a kind. I have chosen this refinery as it compares well with the Chevron El Segundo refinery in Fig. 6. Both have a Hydrocracker, FCCU and Coker. Gelsenckirchen goes further in that it also has a Visbreaker which is a mild thermal cracking process. You will also see that the coke is calcined which removes the remaining traces of hydrocarbons and produces nearly pure coke. This refinery uses the light distillates for petrochemicals and as a result there is no alkylation unit. The light naphtha and lpg is sent to a steam cracker for olefines production. Some gasoline is produced from the FCC and the reformer. The reformer also feeds the aromatics unit which is used for benzene and xylenes production. Another feature of this refinery is the partial oxidation of the vis breaker tar stream which is used for the production of ammonia and methanol. The Nelson complexity of this refinery is only 8.6 which indicates that this index should be considered very carefully when making comparisons. The production of high value petrochemicals is not reflected in the Nelson analysis. Olefines production is mentioned in more detail later, but note that the BPRP FCC produces propylene which is used for cumene production (propylene + benzene). Note CHD is catalytic hydrodesulphurisation.

The Strangland diagram in Fig. 8 illustrates the hydrogen content vs. molecular weight for various fuel types. As the molecular weight rises the retention of hydrogen in the molecules becomes more important. Cracking reactions tend to reduce the hydrogen to carbon ratio and to maintain the correct H:C ration in the finished product (either hydrogen has to be added or carbon removed). Motor gasoline is more tolerant of lower hydrogen to carbon ratios. Aromatic molecules such as toluene and xylene have H:C rations of just over 1:1. These species have high autoignition temperatures, high octane numbers and good combustion properties in spark ignition engines. Jet fuel and diesel require hydrogen to carbon ratios of close to 2:1. Carbon rejection and hydrogen addition processes are discussed later. Products lying outside of the envelopes will either need upgrading in some form to meet sales specifications. In some cases the cost of the upgrading may be higher than the value of the product. The only option for the peri-condensed aromatics is fuel oil or coking.

Refinery Crack Spread- refining margins

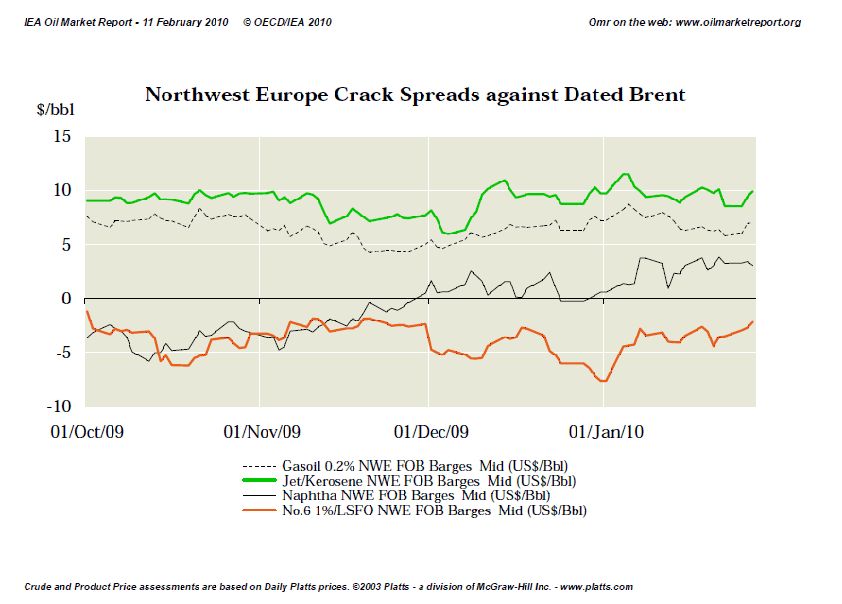

One of the key parameters for a refinery profitability is the crack spread. A selection of crack spreads for different refining centres can be found on the IEA web-site.

The crack spread is the margin over the crude price that refiners make. In this example for northwest Europe, the margin on jet kerosene is the highest at $5-10 per barrel. Naphtha is from $-5 to +5 per barrel and fuel oil is a consistent loss at around $-10 per barrel. For commercial reasons the gasoline crack spread is not shown on this graph. The gasoline price however can be obtained from this website as a graph of gasoline pricing. (This is due to Platts licence rules). To make a margin the value of the profitable products has to exceed the net loss of value of the loss making products.

Crude Oil Characterisation, Yields and Residue Upgrading

Crude oil (conventional) can be characterised into 4 main types as depicted in Fig 10. Naturally it is not quite that simple as there are medium grades that lie in between and then there is the ultra heavy which is outside the scope of this essay.

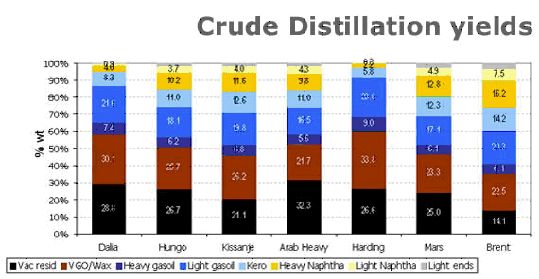

The yield pattern of the crude is important (see Fig. 11). Here is an example from BP (sorry, a bad name in the US).

Different crude types have different product yields. The difference between a sweet light crude - Brent and a sour heavy crude - Arab Heavy is dramatic. The main difference between these two types is in the yield of light products and the yield of vacuum residue. The Arab Heavy produces 3 x the mass of vacuum residue compared to Brent. For this reason Brent is seen as a premium crude and Arab Heavy will be sold at a discount to reflect the poorer yield and the higher cost of upgrading.

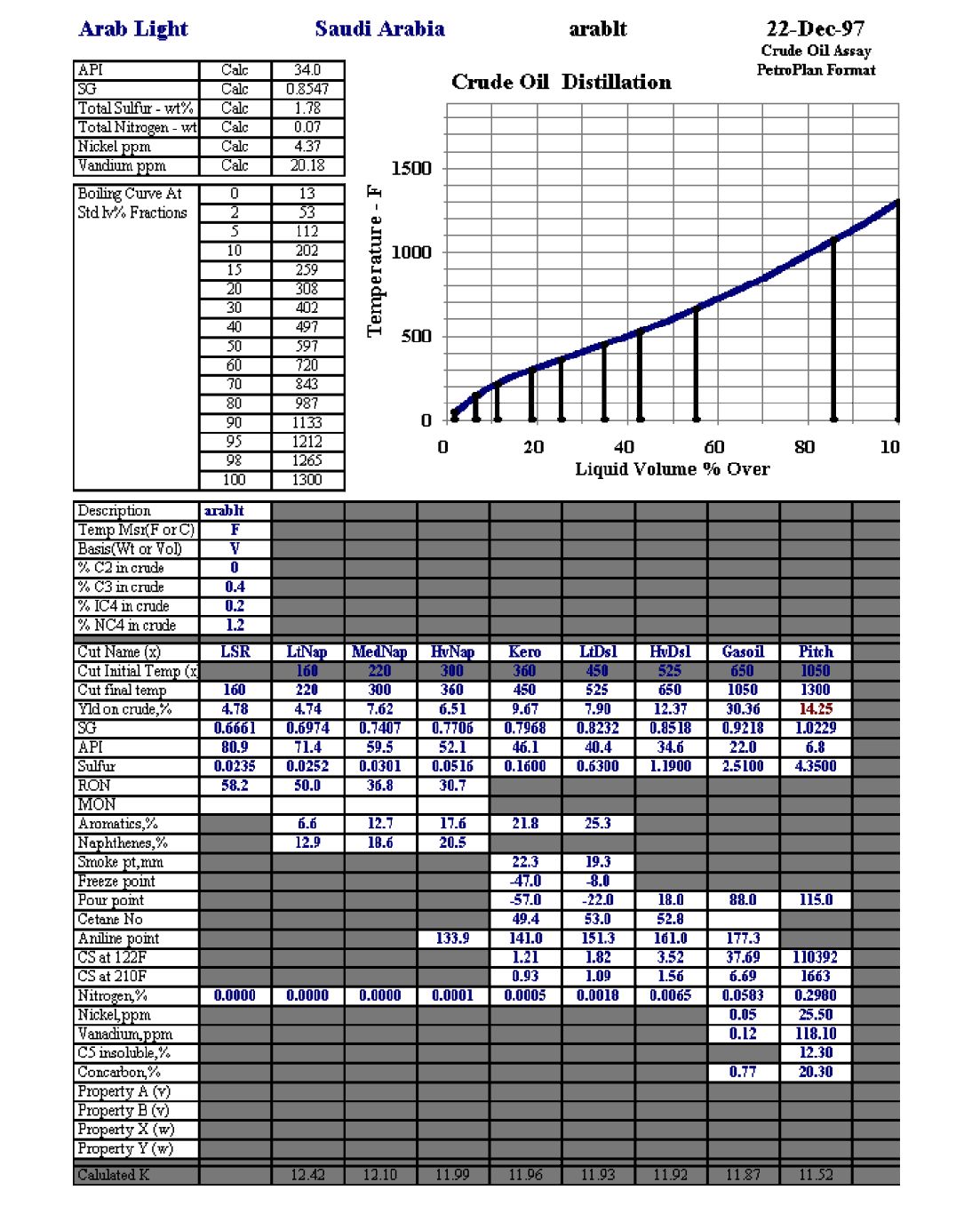

The yield pattern can also be found in the assay of the crude. The example in Fig. 12 is the assay for Arab Heavy, which is a Saudi crude. A source of assays can be found here.

There are several important properties worth considering in this assay. The aromatic content of the streams is important for the quality of certain types of fuel. In the middle distillate fractions this is towards the higher end of what would be desirable. Both jet kerosene and diesel properties are influenced by the aromatic content. In the vacuum gas oil and residue, the metals content is important along with the Calculated K (Watson K factor) and the C5 insolubles and Concarbon. The latter is a coke precursor and very much influences how these fractions can be upgraded. You will note how the sulphur concentrates in the heavy fractions, usually in quite complex ring structures which makes removal challenging. In all, this is moderately difficult crude to process. It is the sulphur which is the main issue. For those so inclined you might like to make comparisons with the other crude assays to see the difference. The sharp eyed among you might notice a difference between the BP and Petroplan yields. This is due to BP reporting Weight % and Petroplan Volume %. The Petroplan assay lists 3 naphtha fractions. Not all refineries will split the naphtha fraction in to 3. What I wish to draw to your attention is the RON (Research Octane Number) of the naphtha fractions. These are exceedingly low and would be very difficult to blend into the gasoline pool without upgrading either in a reformer or isomeriser. The kerosene and light distillate and heavy distillate fractions (middle distillates) have good cetane numbers (50 ish) which would be suitable for direct blending into the diesel pool. The pitch or vacuum residue has a high SG of greater than 1 which means it will sink rather than float in water.

Upgrading the vacuum residue

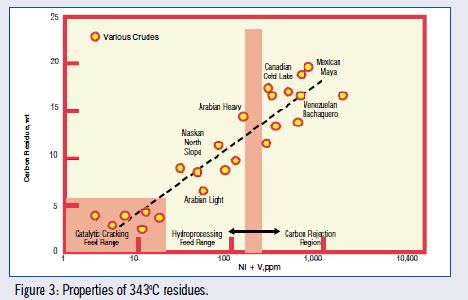

As noted from the simple BP yield data in Fig. 11 we can see a large difference between Brent and Arab Heavy. Processing Arab Heavy will produce 32% of Vacuum Residue, which really only has a use as fuel oil, unless it is upgraded. Several options are available. Coking is the most likely although the quality of the coke produced would not be too good and essentially fuel quality. Hydroprocessing would be costly in terms of hydrogen and catalyst. Below in Fig. 13 is a graphic representation from Foster Wheeler who produce Delayed Cokers. The carbon rejection range refers to coking, although strictly speaking an FCC is a carbon rejection process. Using Arab Heavy as an example processing of residue in a FCC would not be a good idea, as it fails on both metals and carbon residue. Using a Hydrocracker, though not impossible, would entail a large consumption of hydrogen and a shortened catalyst like due to the metals. There are some other possibilities but these are not very common, such as deasphalting followed by hydrocracking of the de-asphalted oil.

Refinery Capacities and the influence of Ethylene Production

It is now worth looking at Regional refining capacity for 2010.

The current US refining capacity is about 17.8 million b/d, and as earlier stated Europe has a refinery capacity of about 13.8 million barrels per day. The Asian capacity has been split into the relevant nations for clarity. I have not considered the exporting nations in this essay. The main exporting nations are the OPEC countries and these countries have different economic drivers to the consuming nations. Table 3 gives a breakdown of the pertinent refinery capacities in the US, Europe and Asia.

Sorry to mix units. Mb/d is million barrels per day and mta is million tonnes per year. For a refinery 100 kb/d = 5 million tonnes crude oil.

As can be seen in Table 3 the regional capacities show some remarkable differences. The large FCC capacity in the US is for the production of gasoline and should there be a switch to diesel cars, as in Europe, the US would have some serious issues with diesel capacity. Catalytic reforming units are similarly large and are for the production of gasoline. The US also has a high installed capacity of coking units which are used for minimising fuel oil production. For the US VDU capacity is 54 % of the CDU, which again points towards the ability to process heavy oils (care must be exercised with this comparison, especially in China). In Europe the same ratio is 41% which illustrates that Europe processes more medium and light crude and is not targeting high conversion to gasoline - go back to Table 1 to compare the demand differences. Both India and South Korea have a low VDU:CDU ratio.The truly scary fact is the scale of the demand growth for oil in China. If those refining capacity estimates are correct for the next 5-10 years then one has to ask where will all this oil come from, since it amounts to around 1 million b/d each year for the next next 10 years.

One of the major petrochemicals produced form refinery feedstocks is ethylene. If associated gases from oil production are available then these are frequently used as ethylene feedstocks and show up as demand but are not necessarily processed in refineries. In the US about 40% of the ethylene capacity is from refinery naphthas whereas in Europe the figure is closer to 75%. In Japan and South Korea the figure is close to 100% as there are no local sources of ethane or lpg. For several decades North Asia has imported feedstocks for ethylene production as the installed refinery base has not been able to satisfy local demand. China is massively expanding its ethylene capacity along with its refining base, which I have illustrated in the bottom half of Table 4. The Asian refinery capacity is not keeping up with the ethylene capacity growth and in 2010 China became a net importer of naphtha for ethylene production. In Europe much of the light naphtha is used for ethylene production, along with lesser amounts of LPG and ethane from local production. Some refiners have implemented heavy feedstocks such as hydrowax which is produced from hydrocrackers as an alternative feedstock to light naphtha. On a volumetric basis, Europe is sinking excess of 10% of the crude oil into petrochemicals if the other materials are also taken into account. Asian crude oil demand is, if anything, even higher for petrochemicals and in China petrochemical growth is outpacing refinery capacity. What I am trying to illustrate here is that a very substantial part of the crude oil barrel is being used for petrochemicals in Asia, which is being used to produce the plastics for the manufacturing base. On a global basis, plastics growth has been exceeding GDP growth for decades. As China industrialises and more Chinese become car owners, the demand for gasoline and naphtha in China is on a collision course. China will have to import increasing amounts of naphtha or the car drivers are going to have to drive less.

Table 4 illustrates the yield of ethylene from various feedstocks.

As can be seen, the yield of ethylene varies according to the feedstock. The co-products of ethylene production are in many cases as important as the ethylene itself. Both propylene and butadiene are important chemical feedstocks that are in short supply. Butadiene is widely used in car tyre production and for the production of nylon polymers. Propylene is used both in polypropylene and for the production of other chemical products such as methacrylates, phenol, and propylene oxide. Other routes to propylene are gaining capacity and a new type of FCC has been developed that is configured for the production of petrochemicals rather than fuels, that can produce 40-50% C3 and C4 fractions. Increasing amounts of petrochemicals are now obtained from refineries.

For those interested, Fig. 14 shows the process flow for a naphtha olefines cracker.

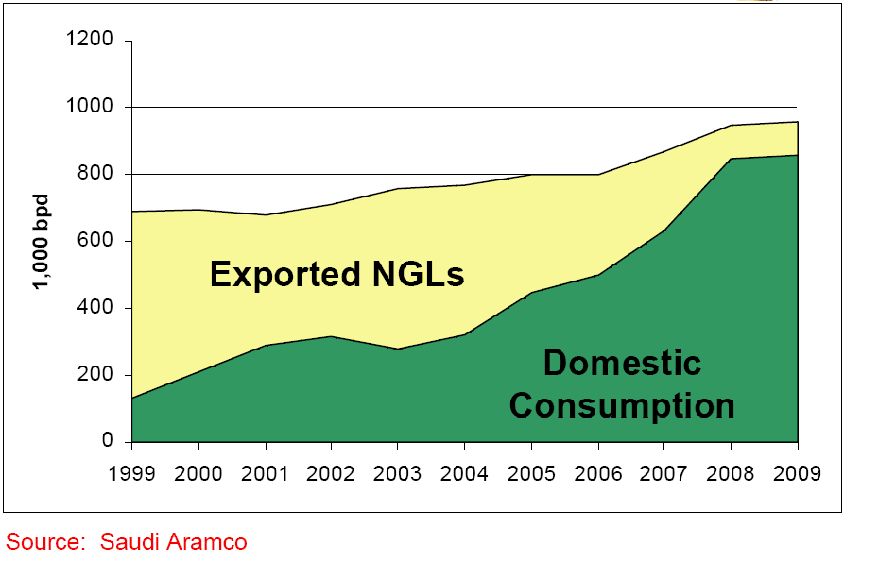

Western refiners are now represented in China, including BP, Exxon, Shell, Saudi Aramco and Kuwait Petroleum. Expect more to follow. In terms of ethylene capacity then use an approximation of 1 million tonnes of ethylene requiring 3.6 million tonnes of naphtha or naphtha equivalent. 5mt of refinery capacity is about 150 kb/d of crude oil. The situation in South Korea, Japan, and Taiwan is such that ethylene capacity exceeds the naphtha production capacity of the country's refineries and these countries have long been net importers of naphtha and lpg for ethylene production. They are about to find that they will be fighting head to head with the Chinese for naphtha supplies, and meanwhile Saudi NGL exports are declining rapidly as they are consumed at home.

From the Saudi Aramco 2009 annual report the production for sale of NGL's amounted to

Propane: 376 kbd

Butanes: 218 kbd

Natural Gasoline: 203 kbd

Gas Condensate: 226 kbd

At the moment, other ME countries exports NGL's including Kuwait, Qatar and the UAE. But plans are afoot for petrochemical plants to locally process these products into value added petrochemicals. The driver behind this is to provide jobs for a rapidly expanding population. Should these NGL's disappear from Asia then the demand for this type of product will have to be met from crude oil, which will mean a substantial increase in crude oil demand in the region, and necessary increases in refining capacity. Meanwhile if the fall in gasoline consumption in Europe continues as predicted, in some forecasts by as much as 30% by 2020, then there is the probability that further closures of European refineries are likely, and that Europe will be looking East and West for jet and diesel to fill the shortfall in production. By 2020 Europe has legislation in place to reduce the average CO2 emissions for new cars to 95 gms per kilometre - a tough target that few cars are capable of to date.

One thing for certain, the next few years are going to be challenging for refining. Many refiners struggle to make money currently as refining margins slide back to $2-5 per barrel. My own refinery model clearly demonstrates this phenomena and finished product prices will have to rise substantially.

This is a very brief round up of refining capacities and for those more experienced readers, I apologise for it lacking all the necessary detail. I will try and answer specific questions in the comments section but please be patient. I travel a lot and time is sometimes an issue.

Jules-

Read the post, awesome job. You showed a breakdown of percent of a barrel of crude. Accord to the DOE, U.S. refineries produce between 19 and 21 gallons of motor gasoline from one barrel (42 gallons) of crude oil. What percent would that represent in say light, sweet crude? What I am getting at is that I am under the impression you get more than 42 gallons of petroleum products from a barrel (42 gallons) of oil. If true, how much more in some different crude oils? I know it is not magic, but refining is close to PFM to me.

http://www.eia.doe.gov/tools/faqs/faq.cfm?id=24&t=7

The author of the post is not Jules [sic], Stephen Bowers wrote the post.

My bad, read the posted line when I typed. Steven, great article.

Edit: and I thought they were one in the same. I should have guessed from the guest label.

There are "refinery gains" when you crack larger hydrocarbons into smaller ones, or add hydrogen (sourced from natural gas) to make more saturated hydrocarbons. The product components are less dense than those you started with. Its a volumetric thing, as the energy density per kg doesn't change as much.

answered below.

THANKS I will read it again. Carnot, maybe you should try brain surgery, it might be easier.

Therefore my Hamburger Helper comment which was conveniently deleted.

I don't know why things get deleted here that amount to me saying that "perpetual motion machines are impossible". Is it because it is so obvious, or is it because I am offending sensitive constitutions? I think it makes sense to point this out otherwise you get the Fox News crowd believing that refinery gains are somehow important in our energy future.

Gratuitous mention of convenience food products. Triggers the spam filter.

Please structure your remarks in a way that avoids a personal attack.

Best regards,

Community Moderator

WHT

Pot calling kettle black, springs to mind here. Last time I asked you to produce a graph of Iraq production for the next ten years based on your calculations, my post was deleted.

Done it yet?

All the data and models and physics stand on their own. Personalities do not play into any of this. If you think any of your provocations have any impact you should probably think again. IOW, this is way too significant a topic to personally impact either you or me.

WHT

Over a number of years you have critised other models but you have not come up with anything better.

Your inability to produce a graph of Iraq production shows quite clearly that your theorizing does not translate into anything people can use to predict real production rate in complex situations.

The only graph of yours of any country I have seen is Norway showing it peaked in 2001, hardly ground breaking.

This is a list of models that exist, regardless of whether you or somebody else considers them ground-breaking, documented in The Oil ConunDrum:

The Oil Shock Model.

A data flow model of oil extraction and production which allows for perturbations.

The Dispersive Discovery Model.

A probabilistic model of resource discovery which accounts for technological advancement and a finite search volume.

The Reservoir Size Dispersive Aggregation Model.

A first-principles model that explains and describes the size distribution of oil reservoirs and fields around the world.

Solving the Reserve Growth "enigma".

An application of dispersive discovery on a localized level which models the hyperbolic reserve growth characteristics observed.

Shocklets.

A kernel approach to characterizing production from individual fields.

Reserve Growth, Creaming Curve, and Size Distribution Linearization.

An obvious linearization of this family of curves, related to HL but more useful since it stems from first principles.

The Hubbert Peak Logistic Curve explained.

The Logistic curve is trivially explained by dispersive discovery with exponential technology advancement.

Laplace Transform Analysis of Dispersive Discovery.

Dispersion curves are solved by looking up the Laplace transform of the spatial uncertainty profile.

The Maximum Entropy Principle and the Entropic Dispersion Framework.

The generalized math framework applied to many models of disorder, natural or man-made. Explains the origin of the entroplet.

Gompertz Decline Model.

Exponentially increasing extraction rates lead to steep production decline.

Anomalous Behavior in Dispersive Transport explained.

Photovoltaic (PV) material made from disordered and amorphous semiconductor material shows poor photoresponse characteristics. Solution to simple entropic dispersion relations or the more general Fokker-Planck leads to good agreement with the data over orders of magnitude in current and response times.

Framework for understanding Breakthrough Curves and Solute Transport in Porous Materials.

The same disordered Fokker-Planck construction explains the dispersive transport of solute in groundwater or liquids flowing in porous materials.

The Dynamics of Atmospheric CO2 buildup and extrapolation.

Used the oil shock model to convolve a fat-tailed CO2 residence time impulse response function with a fossil-fuel stimulus. This shows the long latency of CO2 buildup very straightforwardly.

Terrain Slope Distribution Analysis.

Explanation and derivation of the topographic slope distribution across the USA. This uses mean energy and maximum entropy principle.

Reliability Analysis and understanding the "bathtub curve".

Using a dispersion in failure rates to generate the characteristic bathtub curves of failure occurrences in parts and components.

Wind Energy Analysis.

Universality of wind energy probability distribution by applying maximum entropy to the mean energy observed. Data from Canada and Germany.

Dispersion Analysis of Human Transportation Statistics.

Alternate take on the empirical distribution of travel times between geographical points. This uses a maximum entropy approximation to the mean speed and mean distance across all the data points.

The Overshoot Point (TOP) and the Oil Production Plateau.

How increases in extraction rate can maintain production levels.

Analysis of Relative Species Abundance.

Dispersive evolution of species according to Maximum Entropy Principle leads to characteristic distribution of species abundance.

Lake Size Distribution.

Analogous to explaining reservoir size distribution, uses similar arguments to derive the distribution of freshwater lake sizes. This provides a good feel for how often super-giant reservoirs and Great Lakes occur (by comparison)

Labor Productivity Learning Curve Model.

A simple relative productivity model based on uncertainty of a diminishing return learning curve gradient over a large labor pool (in this case Japan).

Project Scheduling and Bottlenecking.

Explanation of how uncertainty in meeting project deadlines or task durations caused by a spread of productivity rates leads to probabilistic schedule slips with fat-tails. Answers why projects don't complete on time.

The Stochastic Model of Popcorn Popping.

The novel explanation of why popcorn popping follows the same bell-shaped curve of the Hubbert Peak in oil production.

The Quandary of Infinite Reserves due to Fat-Tail Statistics.

Demonstrated that even infinite reserves can lead to limited resource production in the face of maximum extraction constraints.

Oil Recovery Factor Model.

A model of oil recovery which takes into account reservoir size.

Network Transit Time Statistics.

Dispersion in TCP/IP transport rates leads to the measured fat-tails in round-trip time statistics on loaded networks.

Language Evolution Model.

Model for relative language adoption which depends on critical mass of acceptance.

Web Link Growth Model.

Model for relative popularity of web sites which follows a diminishing return learning curve model.

Scientific Citation Growth Model.

Same model used for explaining scientific citation indexing growth.

Particle and Crystal Growth Statistics.

Detailed model of ice crystal size distribution in high-altitude cirrus clouds.

Rainfall Amount Dispersion.

Explanation of rainfall variation based on dispersion in rate of cloud build-up along with dispersion in critical size.

Earthquake Magnitude Distribution.

Distribution of earthquake magnitudes based on dispersion of energy buildup and critical threshold.

Income Disparity Distribution.

Relative income distribution which includes inflection point to to compounding interest growth on investments.

Insurance Payout Analysis, and Hyperbolic Discounting.

Fat-tail analysis of risk and estimation.

Thermal Entropic Dispersion Analysis.

Solving the Fokker-Planck equation or Fourier's Law for thermal diffusion in a disordered environment. A subtle effect.

In other words; No you have no idea what so ever what Iraq will produce over the next ten years.

You should be a little more careful about highlighting the shortcomings of M King Hubbert's calculations when you can do no better.

The derivation reveals exactly how one can arrive at the Logistic curve that Hubbert used in his calculations. This is a universal behavior of resource depletion

"The Hubbert Peak Logistic Curve explained.

The Logistic curve is trivially explained by dispersive discovery with exponential technology advancement."

This needs to be added to all earth sciences curriculum immediately. It puts Hubbert's original thoughts on a firm theoretical foundation.

That is truly scary. The only OPEC producer which theoretically has spare productive capacity is Saudi Arabia, but they do not seem to meeting current demand, and recently called on oil service companies to provide 30% more drilling rigs just to drill enough wells to maintain production.

Mexican, Venezuelan, North Sea, and Alaskan production are all in steep decline. Canada is in the process of increasing production from its vast oil sands, but only by 1 million bpd total over the next ten years, not 1 million bpd per year.

I don't see where all the new oil the Chinese are going to want is going to come from. Most likely they're going to have to outbid other countries to get a larger share of the available supply, which means much higher oil prices in the next 10 years.

Some numbers:

http://www.energybulletin.net/stories/2011-02-21/egypt-classic-case-rapi...

Egypt, a classic case of rapid net-export decline and a look at global net exports

*ANE = GNE less Chindia’s Net Imports

Neither do I. The point I did not mention is the YOY growth in demand in the OPEC countries. In 3 months the new Saudi Aramco Review will be released for 2010. It will make some interesting reading. All of the ME countries have out of control oil demand growth. The export land model will be realised sooner than we think.

Something that we haven't paid much attention to is the prequel to the ELM, to-wit, what happens to net oil exports given a production increase in an oil exporting country?

Let's look at 20 years of data for "Export Land," from 1990 to 2010. The peak for our hypothetical country would be 2000, when production was 2.0 mbpd, consumption was 1.0 mbpd and net exports were 1.0 mbpd. Let's assume a steady 2.5% rate of increase in consumption from 1990 to 2010, with production increasing at 5%/year from 1990 to 2000, and then declining at 5%/year from 2000 to 2010.

I have talked endlessly about the post-peak ELM net export decline (net export decline rate exceeds the production decline, and the net export decline rate accelerates with time), but from 1990 to 2000, the rate of increase in net oil exports exceeded the rate of increase in production (8.4%/year for net exports, versus 5%/year for production).

We saw something similar in Russia. Their 1999 to 2009 rate of increase in total liquids production was 4.5%/year, but their rate of increase in net exports over the same time frame was 6.4%/year (EIA).

Consider the supply signals reaching the market. Until net exports peak (which they appear to have done globally in 2005/2006), it appears that the rate of increase in net exports tends to exceed the rate of increase in production*, signaling ample supplies, but then the peak hits, and everything changes--the net export decline rate exceeds the production decline rate, and the net export decline rate tends to accelerate with time, with all of this of course being compounded by the "Chindia" factor.

*Unless the rate of increase in consumption is very high, with a high consumption to production ratio, e.g., China and the US, when they were still net oil exporters.

Westexas, you might be interested to note that the EIA % increases you quoted for Russia are also representative of the real world % changes for the entire set of countries which are in the growth phase of their net exports:

Note the last bar in the chart: a 4.1% annualized growth rate in production led to a 6.3% annualized growth rate in net exports over a decade. (click on chart to read source post here on TOD)

Saudi to boost crude burn for power generation in 2011

Up 33%.

The spin is astonishing.

It is astonishing to think the Saudi's will be burning over half a million barrels of oil a day just to generate electricity for themselves. That's over 50 million dollars a day worth of crude oil that could be held in the ground against the day when their production is lower and the price is higher.

The more prudent thing to do would be to price electricity at market value to encourage conservation, and to burn their large natural gas supplies instead of oil. However, the most prudent measure they could take is to reduce their ridiculously high birth rate to more manageable levels.

I keep thinking that by the time they exhaust their oil reserves, they will have more people than Canada does, and no way to feed them all because they well have no oil left to sell to buy food. They certainly can't grow enough food for them in the desert.

You missed the fact that they are already burning 1 million barrels per day of crude due to gas shortages. That might reduce when the Karan field gets going but not for long.

Prudence is not part of the thinking sadly. The Arab mentality is that "they are owed".

Look at the Kuwaiti example of free food. What will it achieve - fat Kuwaitis.

The Arab mentality is that God will provide. They are astonishingly fatalistic and particularly in puritanical SA, which by comparison makes hardcore Calvinism look like a lifetime membership to the Bunny Club . I fear the Saudis will maintain their burgeoning birthrate in order to provide 'work' for their otherwise unemployed womenfolk. Saudi women need something to do and since they cannot work having babies and shopping just about fills their endless pointless days.

When we hope for excess Saudi capacity of 2 million barrels - and we question their wisdom of burning oil for domestic electricity in case we suffer shortage - in a world where every producing nation is pumping like billio just to satisfy current depression moderated levels of international demand, we are truly on the edge of a precipice.

Sounds like what they really need (other than to face up to their population/food problem) is some coal fired electricity - I am sure Australia (or the US) would be happy to swap boatloads of coal for the same of oil.

Presumably the oil they are burning for electricity is the most sour/heavy stuff, but even so, someone else will always buy it.

Fat people are to food as the Strategic Reserve is to oil.

DD

Thanks for this very informative report--well done !

Thank you for a very thorough job

Having just skimmed through it(at school right now, just done an exam and waiting for my friends so no time for more), but even by just skimming I can claim that this is one of the main reasons I and many others come here. So intelligent, and articulate. And it's all free.

All I can do is bow my head and gently tip my hat(metaphorically ofc) in respect to the author.

I'll re-read more thoroughly later on and will post an (hopefully) informed question to the author.

Very comprehensive post.

Here is a question. We know that light sweet crudes are likely to become a smaller percentage of available oil as these have been depleted faster than heavy sour for obvious reasons.

We also know that diesel engines are more efficient in terms of power output for chemical energy input - they use less fuel. This makes them cheaper to run, and increasingly popular given the current relative fuel costs and tax levels.

So - is it more efficient in energy terms, to increase the cut of diesel fuel relative to petrol, using advanced refining techniques, than to keep a higher petrol cut which will be burnt less efficiently in the car?

In other words, if we want to make the best use of the available oil, should we focus on getting every last drop of diesel out of a barrel, or maintain a mixture of petrol and diesel cars on the road?

How will this calculation be affected by the increasingly heavy oils available?

My question as well, and I'll add;

1. "How much more energy is required to produce low sulphur diesel from heavy, sour crude?" which leads to EROEI deltas in contaminant removal and product improvement, noted briefly in the article.

2. "How much refining capacity exists for heavy sour crude?" which is partially addressed with the complexity discussion, though rather indirectly.

I realize there are many different shades of heavy and sour, though offering this to spark the discussion.

Excellent article, Stephen. Thanks Joules.

Surprisingly light crudes are still readily available in rlative terms. A lot of the very new capacity that has been built has focused on the heavy crudes which has increased the demand for these crudes. If you look at the Saudi production the heavy crude is produced from Safaniyah. Estimats put this at about 1 million b/d out of a total of around 9 million b/d. Zuluf, Marjan and Abu Safah produce Arab Medium with a production of around 1.5 million b/d. The rest is Arab Light and Arab Super Light.

Yes diesels are more energy efficient but some care is needed. Most comparisons are done on a volumetric basis wghcih is technically incorrect. Gasoline has a typical density of 0.75 and diesel 0.84. For thermodynamic comparisons the use of mass should be used, and then the advantage is not quite so great. It all comes down to the compression ratio of 10:1 vs 18:1 for gasoline and diesel respectively. A hybrid engine running on pure ethanol with a compression ration of 18:1 and spark ignition will nearly match the thermodynamic efficiency of a diesel.

The trouble with squeezing more out of the barrel in terms of middle distillates is that it has already been done. The refining industry has developed good techniques for cracking heavy molecules to the gasoline range but putting them back together to make more diesel is not so easy. Somehow an oefine has to be dimerised or trimerised into a heavier molecule ideally in the C12-C20 range. The company I work for can do this but it is expensive and it is not easy to produce perfect diesel. GTL will make excellent diesel but the process turns a lot of the feedstock in CO2; more than one third is burned in the process.

I am a firm believer in energy efficiency as the best way forward. That is why I drive a Prius. Boring I know but it uses little fuel.

I also believe in energy efficiency. My car is smaller than a prius, has a diesel engine, and uses even less fuel, although it is not a hybrid.

It does have some regenerative braking and it shuts the engine down instead of running at idle at the lights.

My question was really aimed at the European market. If diesel continues to become more popular, will it be possible for European refineries to further increase the diesel cut, albeit at a price, or will we face real shortages of diesel before we see real shortages of petrol as the supply of oil declines.

Ralph, Europe is already squeezing the barrel dry for jet and diesel and there is nothing left to get. A refinery I visited late last year was runningat about 94% CDU cpacity because it was limited by the diesel hydrotreater. TheULSD specification has put a lot of pressure on the refiners. For some yearsEurope has been a net importer of jet and diesel with most of the diesel being

imported from Russia, and I for one would not bet on a Russian supply contract.Russia also supplies a large chunk of the European crude oil demand, especially in the East.The UK may not be as exposed as some countries as Russia is only a

minor suppier to the UK. But when the excrement hits the rorating oscillator thenthere will be real trouble. Europe might be slightly better off than say the USas the emission limits are much tougher and sooner.It could get rough, and noimporting country will be immune. It will be a classic sellers market.

Actually, Russia is #2 after Norway. Full statistics are here:

http://www.crudeoilpeak.com/?page_id=2820

Matt,

You are indeed correct. However, there is a little more to the story. The UK demand is about 1.5 million b/d and the oil production for the last 3 months about 1.3 million b/d from the last OMR. On a net basis the UK is importing about 200 -300 kbd. What is actually happening is that a lot of the UK production is being exported and imports are off-setting the exports. Russia is the second biggest supplier to the UK after Norway at about 140 kbd or just about 10% of the demand. Contrast that with the EU demand and the quantity supplied by Russia. The UK is in a far better position that some of the EU countries. But if Russia did pull the plug the UK would still be out of luck, as pressure would mount for it to help out the rest of the EU.

You have left out one important factor: diesel engines use the full compression ratio at all power settings, but gasoline engines only use the full compression ratio at high power settings because they govern power by adjusting the volume of air-fuel mixture admitted to the cylinders. Diesels govern power by adjusting the amount of fuel only.

For a hybrid vehicle such as your Prius this is less important because the engine can run at high power or not at all. Of course, that's simplifying it too.

But the VW Golf TDI, one of few small diesel cars sold in the U.S., can go about as far on a highway with a gallon of diesel as the Prius can with a gallon of gasoline. And it does that with a load capacity of 1100 pounds. According to the manual, the Prius has a load capacity of 825 pounds.

Of course, the hybrid does better in stop-start traffic conditions, but it still has a 25% smaller load capacity, no doubt because it has to carry around the dead weight of the battery.

Good point on the speed control. The diesel also has no pumping losses. My Prius has an Atkinson cycle engine which over expands the exhaust stroke by some clever valve timing.

I do not mind how the engine works as long as it is energy efficient. My wife car is a diesel Yaris which is also very frugal and is quicker than the Prius.

I'm not sure why increasing the capacity would increase the demand of something, but in any case, it is not true that new Saudi capacity additions have been heavy crudes. The most recent additions (in thousand barrels per day):

2001 Ghawar Haradh II (300)

2004 Abu Safah (150 more)

2004 Qatif (500)

2006 Ghawar Haradh III (300)

2007 Nuayyim (100)

2008 Abu Hadriyah, Fadhili and Khursaniyah (500)

2009 Khurais (1200)

2013 Manifa (900)

Of those that have happened, only Abu Safah produces anything heavier than Arab Light.

If it is the case that their "spare capacity" is heavy, it is because their recent additions have replaced declines elsewhere (although they have done some maintenance on the offshore fields)

Jouls

Freudian slip. I was referring to the rapid increase in refining cpacity in India and China. The Reliance reinery in India +600 kbd was designed around Arab Heavy. That wolud swallow half the production of Safaniyah. The new Total Jubail Refinery 400 kbd is also designed around Arab Heavy and is due on line in a couple of years. Manifa will probably come on stream in time for Jubail. The two other Saudi refinery additions will probably also run on Arab Heavy. I also suspect that the AH might also be the oil being burnt for power - cheapest option.

I think this is a very important, and little appreciated, fact. A diesel engine can, with appropriate fuel delivery systems, run on any combination of diesel with ethanol, methanol, mixed alcohols (C1-C8), propane, butane, CNG/LNG, biodiesel, straight vegetable oil, heavy fuel oil, lubricating oil, and woodgas - all at around 40% peak thermodynamic efficiency. (one test of a Jetta engine on methanol actually achieved higher efficiency than diesel!)

My father is restoring a 1930's "diesel" engine where the fuel specified is "Balikpapan Crude" (from somewhere in Indonesia)

It is the ultimate multi fuel vehicle engine - the only thing it won't run on is - gasoline.

As we are forced to use more alternative fuels, diesel engines are clearly the way to go - they can use almost anything and will use less of it. Engine life is much longer too...

I would agree with you, but I do not think the gasoline engine is dead quite yet. Maybe direct injection will help as it will allow lean burn and the clever Atkinson cycle is another option. But overall the diesel offers more flexibility on fuel type.

If the refiners were to put the lighter distillates into the diesel then there would have to be a few spec changes. Firstly the flash point would be lowered, not a problem. but running on high light distillate might be a problem with lubricity. The old rotary type fuel pump was very susceptible to wear but I am not sure on the common rail fuel injection equipment. This might better tolerate low lubricity fuels.

You might be interested in a book called Modern Tansport Fuel Technology by Eric Goodger. I think this is a very good book with a lot of data on engine technologies. ISBN 0 9520186 2 4

In this book there is a lot of discussion on alternatives. With your Jetta example was the ingition initiated by a spark? To my knowledge both methanol and ethanol need either spark ignition or a pilot fuel of diesel to initiate igniton. The autoignition temperature of these alcohol fuels is very high making pure compression ignition difficult. I think the same applies for NG and LPG as both have high RON/MON which makes the cetane number low. I checked Goodger's book and he lists the cetane of methanol as 3.

Great work Jules!

One question I have is do we have an idea of global refining capacity? As the primary purchasers of crude, I see the refineries bidding against each other on the spot market and driving the price up. Especially when a refiner's regular contracted supply gets interrupted. So if there is 100 MBD of refinery capacity available and only 75 MBD of crude supply I see the refiners driving the price up until some plants are closed.

I new I would be asked this question and it is not that simple to answer. The OGJ figure is 88.229 million barrles per day but it masks the NGLS which are counted in the crude figures but are not always refined in a refinery. The same goes for condensates, though many condensates splitters in the ME in particular are located on refineries.You should also consider the operating rate which will never be 100%. The OGJ also includes some small specialist refineries which can take already refined material. This might be for lubes or specialist solvent type products; the capacities are very small.

New refining capacity is being built in the ME and Asia. The Saudis had planned to build 4 new refineries between 2010 and 2015. This now looks to be 3 (Juabil, Yanbu and Jizan) with a capacity of 400 kbd each. The UAE is building a 400 kbd refinery in Ruwais due about 2012-2013, and Kuwait had a plan for a 600 kbd refinery but this is on hold. India ia also expanding its refining capacity, but post the Reliance +600 kbd expansion, things are a little slower. 5 new refineries planned in 5 industrial centres.

So where are they going to get all the oil for those shiny new refineries?

Very informative article! I wonder how the energy input per energy unit of fuel produced compares for gasoline, diesel, jet fuel, and fuel oil? In an energy-constrained world it seems this would be important, or are the energy input differences small enough that it doesn't much matter. How much energy is required on average to produce an energy unit of fuel?

Curiostom, Will Stewart and RalphW

I should have expected this question and I do not have a ready answer.

My model uses an energy input per barrel of feed. To get the energy

for say gasoline will require a bit of number crunching, but I can

probably make a reasoned estimate. Off the top of my head I would saythat the order of EROEI would be jet, diesel, fuel oil, and gasoline.

That might sould strange but most jet is cut fromthe CDU along with

diesel. Both jet and diesel are then hydrotreated and thats about it.(Note this is the simple version). Gasoline is a bit different. It willhave to have gone through several other steps. Reformer, FCC, isomerisation,

alkylation all of which are very energy intensive. These days it will also be hydrotreated. Here are a few energy inputs for various processes:

Min Max

CDU 90 200

VDU 50 120

FCC 50 180

Hydrotreating 60 180

Cat Reformer 220 360

Alkylation HF 430 430

Isomerisation 100 250

Unit are GJ/b and source is Szklo and Schaefer Fuel Specificaion,energyconsumption and CO2 emissions is oil refineries 2006.

For the Total Antwerp refnery we have the following

CDU cap 360 kbd 49.33 ktd

Products 362.93 kbd 49.19 ktd

Energy consummed 2.98 GJ/mt

Gasoline 123.9 kbd ~14.1 ktd

1 mt of gasoline is about 45 GJ which makes the EROEI and 14.6:1.

However this is basd on the entire refinery energy balance. I would

go through each individual process and work out the energy required

for each process stepand then look at the yield. It will take a few days.

Sorry for the poor formatting. I am in a hotel and the wifi keeps dropping. I used notepad to past in the text. Please excuse my typos as well. I am not the best.

A good article showing the not-so-fungible nature of the oil refining industry.

Sadly Europe and Japan are least able to adapt to a Peak Oil situation.(They are DOOMED, relatively). Diesel fuel is truly a blind alley. Their best bet is more ethanol or electric cars.

The Chinese are building coal-to-methanol plants like crazy.

Officially the is no mixing but Chinese automakers are selling M85 cars.

Cheaper M15 gasoline is sold at private gas stations for taxis.

Illegal mixing of methanol and gasoline is epidemic.

http://www.chemweekly.com/release/2010/2010MeOH.pdf

International oil markets based on lighter crude unfairly hurt US consumers who can operate fine on heavy crude but must pay prices based on light oil.

All this adds up to much higher gas prices with enormous profits for US Big Oil. Demand destruction won't help because of Chindia.

Some oil products like polyethylene can be produced from natural gas instead.

Japan is pretty doomed.

Europe's a mix bag.

Southern Europe is. Northern Europe, Scandinavia specifically, not so much.

You're not that informed.

Same with people talking about the 'EU Crisis'. If people actually look at the data the worst hit countries are the southern ones plus the UK. France and Belgium is somewhere in-between. The rest are doing pretty okay.

I'm talking about the EU, EU-27.

85% of its energy is imported,

83% of its crude oil. It's highly dependent on nuclear(14% of energy). The bright spot is coal where it produces slightly more than half of the coal it uses.

http://www.iea.org/stats/balancetable.asp?COUNTRY_CODE=30

By contrast North America(the NAFTA unit)imports 35% of its energy.

http://www.iea.org/stats/balancetable.asp?COUNTRY_CODE=19

All Scandanavia only represents 26 million to 500 million in the EU-27. It's like saying if Florida is okay the US as a whole is doing fine.

The reason I am bashing Europe is because if the US is poorly prepared for Peak Oil, Europe is a flipping basket case.

They are doing a tiny bit more than the US on energy and beat the US on talk but just looking at the numbers their situation is dire.

I don't think I'm being unfair at all.

I lived in Europe (Germany) for a little while. Like the US in the fifties, our neighbors would call us or come by when they were going to town or the store. We reciprocated.

Maj, good to see that you are being controversial which is good. As you know I am not convinced by ethanol. I certainly do not like it in gasoline but a purpose designed engine might help - see a post further up. Turning photons to fuel will never be viable as far as I can see. Only Brazil can really show a success story and even that is debatable.

I think that you might have gotten confused with natural gas. In the US natural gas is often loosely used to describe ethane, which has been extracted from either associated or non-associated gas. Normally natural gas is used to describe a methane rich gas, usually in excess of 90% ethane. I am sure that you are aware that cracking methane to ethylene is not possible, at least to my knowledge. Methane is a C1 gas and ethylene a C2 gas.

You can make ethylene directly from natural gas.

http://www1.eere.energy.gov/industry/chemicals/pdfs/ng_ethylene.pdf

We're so worried about fuel for our cars that we overlook a really

frightening danger--the end of the Age of Plastics, which are incredibly useful.

Ethylene rubber tires for bicycles for example.

The human race is almost insane.

The good thing about ethanol is it is not toxic so it can be shipped. Coskata has an bacterial ethanol process what turns CO into ethanol, so theoretically you could turn coal into

ethanol for shipment to Europe. Brazil could provide a lot of ethanol to Europe and maybe Russia's forests could help. If algae biofuel works, then once the biodiesel is squeezed out the remaining biomass 'waste' could be converted to ethanol. At least Europe have enough for some jets.

The USDA says the US can sustainably harvest 1 billion barrels of oil equivalent in cellulosic ethanol which is a lot less than the 7 billion barrels of oil we use now. So where are the 100 mpg cars we need?

The level of panic is not where it needs to be, IMO.

Ethanol in concentrations much above 40% w/v is very much toxic. Apart from direct poisening it causes cancer.

Ethanol harms more people in the UK than Tobacco.

My car does 93 mpg highway. (imperial)

Maj,

Did you read the paper in your link

http://www1.eere.energy.gov/industry/chemicals/pdfs/ng_ethylene.pdf

The paper refers to the oxidative dehydration of ethane contained in natural gas streams, and is a project that aims to identify catalysts. This is nothing new. The methane homologue step is the most difficult and the most cost (it is the same step as GTL).This is not even mentioned in the text.

When there is a working plant then I will be convinced. The most promising new technology for ethylene production is the KBR ACO process.

www.kbr.com/.../A-Catalytic-Cracking-Process-for-Ethylene-and-Propylene- from-Paraffin-Streams.pdf

A world without plastics will be a very diffrent world than today.

FYI Brazil alrady supplies Europe with ethanol. Brazil has also seen that it makes sense to produce sugar when the price is high, which it currently is. There is no way that Brazil can produce enough ethanol fro the entire world. It will be lucky to provide for itself in the longer term.

Why turn coal into ethanol? The alcohol group consists of 34.7% weight of the molecule. Currently, it is still possible to obtain the oxygen from the atmosphere for free. A hydrocarbon will be far more energy dense and less costly to transport, aside from all the other benefits.

The USDA might claim there is 1 billion tonnes of waste biomass but think of the environmental damage to the soil structure. Then there is the logistics. Where are all these cellulosic ethanol plants? As always - nearly there. The same was said for fusion power 50 years ago - nearly there. The same excuse will be for algae- nearly there. Nearly will not be good enough. Energy efficiency is a lot more realistic than a collection of nearly theres.

Want I absolutely do agree on is the level of concern is nowhere near enough.

Your skepticism on methane based ethylene is unjustified.

They've done it in the lab so it is feasible. It is important to get out ahead of problems rather than stick one's head in the sand--you're in the industry and Peak Oil aware so you really should be pushing this.

Coal to ethanol would be a way to boost ethanol, the ultimate renewable, low CO2 source of liquid fuel, part of a power down strategy. The energy density of ethanol is greater than LNG. methanol and other liquid fuel replacements. It's possible that butenol would work but that is only 20% more dense than ethanol and the extra processing is probably not worth it.

The other fuel is hydrogen from renewable electricity but people seem scared by it.

Your response of 'show me' skepticism is typical of bottle fed oil industry types. For all the money that gets thrown at them

oil men are incredibly uncreative when it comes to new energy(why bother we're making a FORTUNE).

What little innovation actually occurs always comes from the detested US Federal government.

You guys can sit on your hands or you can lead the way.

James Hansen is right.

There needs to be Nuremberg trials for Big Fossil execs.

Your paper was about ethen to ethylene, not methane to ethylene. It might even be technically feasable but that does not make it economically feasable, and in this business that is what counts, like it or not.

I think you need to look at the energy density of ethanol and gasoline, or any hydrocarbon. There is a big difference. Gasoline is about 44 MJ/Kg and ethanol 29 MJ/Kg.

I do not see ethano as the ultimate renewable at all. Apart from the handling drawbacks which are many, the damage to the environment needs to be considered. Mining the soil of nutrients is not sustainable, and fields of monocultures will only lead us down a slippery slope.

Have a look at Net Primary Production and Gross Primary Production. That will give you an insight of what I am talking about. On average NPP = 0. Think about it - it has to.

Have a think about hydrogen and then look up hydrogen blistering. How are you going to store the stuff. Its difficult and it is dangerous, and then you have to come up with a sustainable method of production, and moreover distribution. Most is currently produced from SMR-steam methane reforming or from refinery or steam cracker off gases.

By the way I am a petroleum chemist. I am not an oil exec but I know when a project will fly or not. Most biofuel projects are based on fantasy. If they could fly there would be no need for fossil fuels, but they cannot. Cellulosic ethanol is a good example. Where is it?- even with subsidies it has not flown. As for algae go and look at the thermodynamics - and not the rubbish that the algae IPO hawks push.

Read it again, professor.

"From Natural Gas to Ethylene via Methane Homologation"

I look at volumetric energy density which relates to the amount of

liquid fuel you can put in the tank.

But you're back harping about gasoline. The only renewable fuel that equals gasoline is hydrogen which if it doesn't come from renewable electricity comes from fossil fuels. Aside from fear, there is nothing more inherently dangerous in flammable hydrogen than in gasoline or methane. The problem is our cars run on liquid fuel.

Your reasoning on ethanol/renewables is silly. Of course you can

produce more fuel by simply digging it up. What happens if you run out? Maybe will dig up something else and turn it into fuel?

When digging yourself deeper into a hole, the advice given is to 'stop digging'.

Maj,

Are you capable of reasoned argument without being personal. Read what I have written and read your reference. The methane homologue in the paper was not even mentioned. Trying to stop the chemical reaction at C2 would indeed be a challenge. If this process is so brilliant perhps you could enlighten us all where the plant is located.

Did you look up the energy desnity of gasoline on both a mass and volumetric basis? Had you done so you would have realised that gasoline has a greater heating value than ethanol on both a volumetric and a mass basis. I did not mention that point deliberately.

You were the one to bring up hydrogen. I said you should do your homework: it is far from easy.

You appear to think that there is some big conspiracy by Big Oil to kill off every renewable project. Well Big Oil is not so big these days as their control of oil reserves becomes worse almost by the day. Again do your homework on what the major produce. It is not much in relation to the total.

As for renewables then show me the numbers. What you have demonstrated to me is that you have an armchair knowledge of the subject. Have you ever been to a refinery, let alone worked on one, and have you any experience on renewables other than reading what is written by the likes of Solazyme and Range Fuels ( sorry another one that has gone bust). Big Oil does not have to kill renewables. It will kill itself with its crackpot claims.

Have you any experience at all on crop production and soil fertility? I think not somehow.

OMG, you're as prickly as r^2, a fellow petroleum engineer.

Methane homologue is mentioned, first thing in the article.

Or did you think I made it up?

Now you're back to extolling the energy density of gasoline of which the only renewable energy of comparable density is hydrogen at 300 bar. You claim it is far from easy but producing hydrogen and compressing it is in fact child's play. The difficulty is in getting people off much cheaper gasoline.

Is it news to you that Big Oil hates renewables?

http://www.nytimes.com/2009/04/08/business/energy-environment/08greenoil...

Actually I have worked at an oil refinery and a few chemical plants. The cheap ass management was atrocious and the site was very dangerous.

Natural gas normally consists of methane + ethane. I worked for a company that had a very profitable sideline in stripping the ethane off natural gas streams and selling it to the petrochemical industry. They called the facilities "straddle plants" because they "straddled" the natural gas pipelines.

The source of their profits was that they bought the ethane at natural gas prices (based on heating value) and sold it at petrochemical feedstock prices. It was a very cozy sideline and much more profitable than producing oil or gas.

Here's a description of the largest of the facilities, which processes 5.6 billion cubic feet of natural gas per day and produces 75,000 bpd of ethane (plus 55,000 bpd of other NGLs).

Empress Straddle Plants

That is a big plant and a lot of gas. The Saudi's are up to about 9 billion scuf/d of raw gas. I make the ethane about 180 million out of the 5.6 billion scuf. That is about 3% of the raw gas by my reckoning. I guess this was processing non-associated gas?

I goofed with my earlier post. It shoud have read methane instead of ethane.

For Maj. I remembered there is an indirect route of methane to ethylene. The route is methane to methanol and then the UOP MTO process. Lousy EROEI though and I do not know if there are many units outside of China.

"There are many things that you can do with chemistry. Not all of them make sense".

A figure is cited of 76% to 82% for transport fuels. What is the maximum number it is economically feasible to go for this? (I am thinking along the lines of switching the other uses of petroleum to natural gas and coal...)

In theory the process energy and some of the petchems could be replaced but it is not that easy. BTX were once derived from coal tar but this is a minor source these days. Most BTX comes from the refineries and would be difficult to replace completely. Lubes are small and although synthetic lubes could be used there would have a much worse EROEI. NGL's are pretty well used as far ass possible for petchems and therefore these would not be an option. Natural gas (methane) also has limited applications for susbstitution. Methane to ethylene has yet to be done. Methane to transport fuels can be done as GTL, but again the EROEI is not too good. However we like we are going to need asphalt and that would be difficult to substitute, though coal tar bottoms is a possible option. The short answer is it would not be easy to make a big impact.

I'd guess the end use percentage breakdown can only change so much even when crude oil is a lot less, say 50 mbpd globally. The killer is transport at ~80%. The time must come when there are fewer planes in the sky and the roads are dominated by EVs and NGVs, more buses not so many cars and trucks. A lot of distance travel will be by rail. I presume that even with oil production way down refining methods still mean that 10-15% must go to non-fuel products. Gas-to-liquids even though wasteful of energy may be needed for jet fuel and PHEV range extender fuel.

It seems the future means less mobility-at-will, less plastic packaging, more local food and more stay at home entertainment. You hear talk of synthetic fuels like dimethyl ether but I doubt that ordinary folks will be able to afford them.

I think you nailed it in one. I still want know how all the electricity is going to be generated though. The base load supply is the issue.

There is always that stuff--all over the north, not just under Alaska--lets hope we can do better.

A little more on point--just how much of a barrel of oil could go to producing petchems if we tried to maximize petchem output, with no other considerations?

Luke,

I looked over project a few months ago based on zero fuels production, although it did produce fuel oil. In principle this could be done with the lpg, light distillate naphthas, middle distillates and the VGO (vacuum gasoil). The reformer could produce aromatics and a steam cracker and petchem FCC could produce olefines and aromatic rich naphtha. Another option, dependenet on the crude could be a residue FCC. For fuel oil reduction a coker could be used, but there are other options such as a deasphalter and feed the DA oil to the FCC. If you look at the BP refinery flowsheet this could be an all petchem refinery, if the fuel streams were used as feedstock. Coke is sold on and fuel oil is used for the production of methanol and ammonia.

The overall conversion of crude to petchems might be around 60-70% dependent on the crude. The further you go into petchems the more the energy input increases so a lot of the conversion steps will consume the fuel oil and off-gases. It much depends on where you stop. For naphtha cracker about one third of the naphtha ends up as fuel products most of which is burned for power.

I am not sure about the coal reserves. Oil reserve data is bad enough and coal is many times worse. The good coal is gone and we are left with lignite and sub-bituminous coals which are not so good in many applications.

Thanks Carnot

I figured the more petchem you tried to get the more energy it would require in stair step type fashion--I was just looking for a ballpark limit.

Yes coal data is weak and the huge, virtually unmapped, deposts are of 'weaker' coal--but a person has to get around the subarctic and arctic in a small plane some to readily grasp the immensity of the mostly frozen regions under which huge quantities of coal lie. Lots of data on coal under the Cook Inlet, just to mention one very unlikely to be developed lump in a slightly warmer though highly inaccessible environment. Producing gas and oil wells and grids of exploration wells through big swaths of the Inlet region have given more than a passing indication of its existence.

Whether or not it will ever be profitable (just in the company balance sheet understanding of the word not in the total cost sense) to go after that far north coal is an entirely different debate. Obviously the sci-fi writers of Avatar projected a scenerio where it will be and the corporate balance sheet trying to maintain a high consumption BAU was all that would be considered. Gail the Actuary and many others envisioning an instant derailment of all BAU as finances implode and oil dries up of course paint an entirely different picture of the future.

If we don't blow ourselves to hell or come up with a far better energy consumption/production matrix than when are currently weaving I tend to go with those sci-fi boys. They understand what we are made of better than the instant collapse crowd. That of course is my opinion, but I'm not going to lie and say I consider it a humble one ?- )

Here is a charts showing US consumption to production ratios for oil (barrels), natural gas (MCF) and coal (tons) based on EIA data. The US is of course the world's largest net oil importer, and we are one of the world's largest net natural gas importers. Regarding coal, we are just barely self-sufficient. In fact, on a tonnage basis, a few years ago we briefly slipped into net importer status.

wt - remind me where the bulk of our imported NG comes from. Thanks

Hi Rock --

That would be our good friends to the North. We take our commerce w/Canada so much for granted, it hardly feels like imports/exports. They are just like another couple of states (ahem, I mean, we are just like another couple of provinces...)

Luckily, the Canadian's have bountiful supply with very little demand ... or perhaps not.

Assuming that Canada will be an ongoing exporter of natural gas is about as smart as assuming that Mexico will be an ongoing exporter of crude oil.

(Chart from the Gas Trends databrowser based on EIA. BP data is also available for comparison.)

Jon

Thanks guys...that's what I suspected.

The current methods of oilsands production use large amounts of NG. As oilsands production goes up, NG net exports go down (in the absence of some big gas finds). So the US can effectively have lots of oil, or gas, from Canada, but not both.

Building the Arctic gas pipeline from the Mackenzie River delta would change this picture, but this project has been on again-off again for 30+ yrs now - I wouldn't bet on it happening.

Well, there are large amounts of natural gas in the Canadian Arctic, and there are large amounts of shale gas in Northeastern BC, but it all requires higher natural gas prices to make it economic.

At this point in time, with US natural gas prices depressed by its own shale gas reserves, and Canadian supply adequate to meet Canadian demand for the foreseeable future, there's no real incentive to develop these resources on a major scale.

The Chinese, though, are showing interest in the NE BC shale gas deposits and an LNG terminal on the West Coast.

WT - the coal situation has been more of a business/geography choice than any real resource constraint. PRB coal was considered too far from the western seaboard to be worth exporting, (and other coal exports (e.g.e Alaska) are small in the scheme of things) but with recent runups in coal prices, this has changed, and there are numerous companies looking at exporting US coal to Asia

Commentary by and between carnot and majorian mentioned hydrogen - and then they go back to yammin' about methane and ethanol.... can someone give me some background on whether hydrogen is a reasonably good future (car) fuel alternative that we should be investing more effort into - infrastructure, production/storage/engine technology... PLEASE?

Many thanks,

Hydrogen acts solely as an energy storage mechanism, largely equivalent to a battery. With that as a start, you can get all the info you need by searching around the web.

SteelyDan,

I have closed that chapter because its flogging a dead horse.

A good place to start on hydrogen is the book

The Hype About Hydrogen Joseph Romm ISBN 1-55963-703-X

In some repsects hydrogen is the perfect fuel. In other respects its not so simple to produce and distribute. Make it liquid and it is so cold you would not believe it and it constanlty boils off. Pressurise it into a cylinder and you need some special metals and some really good seals, and I mean good.Hydrogen will leak from the smallest leak. It has a very low minimum ignition energy, meaning that a very weak spark, a tenth of the energy for gasoline will set it off. Other forms of hydrogen storage has included metal hydrides that are decomposed.

Making it is not so easy. Most is made from methane or refinery off gases. It can also be produced from heavy oils but the CO2 emissions are colossal. The other option is electrolysis but this is not done on an industrial scale due to cost. Burning fossil fuels to make electricity to make hydrogen is worse than making hydrogen from methane. Like anything the electrolyisis route uses more electricity or energy than is contained in the hydrogen that is produced.

Fuel cells are the obvious best option for hydrogen, but is could be used in a spark ignition engine, gas turbine or steam boiler. Conoco has a gasification process that gasisfies coal in an oxygen stream. The produced CO2 is removed and sequesteered and the hydrogen is burned in a gas turbine. I do not think many have been sold though, if any.

The other point to note about hydrogen is the flame speed. It is about 7-10 times faster than simple hydrocarbons so in a spark ignition engine the timing would need to be adjusted.: you would not need so much advance. Flame speeds for hydrogen are around 3.5 m/s and 0.5 m/s under the test conditions (Rose and Cooper)

That is the short version to avoid yammin'. No doubt there are others who are better informed than I and can add to my version.

Thanks gents - the energy.gov sites don't give the raw intellectual vibes that come from TOD'rs.

Re hydrogen fueled vehicles: Honda seems to be making progress with its fuel cell-powered vehicle, the Clarity. Honda has developed a home hydrogen generating fuel cell that can provide hydrogen for the Clarity or for home heating, electricity, etc. These items are being test marketed in southern California (http://automobiles.honda.com/fcx-clarity/). I think also that Iceland has come some way in making hydrogen powered vehicles practical.

Looks interesting but as ever the source of hydrogen is the issue. In this case it uses NG and then there are all the costs of compression. You will need a fairly chunky and expensive compressor. For some the range is a little limiting but for me it would be fine.