Is "shale oil" the answer to "peak oil"?

Posted by Gail the Actuary on March 4, 2011 - 10:56am

Readers have been asking questions about a couple of shale oil articles recently. One is an AP article called New drilling method opens vast oil fields in US. A similar article is a CNBC article titled Massive New US Oil Supply – ‘Peak Oil’ Fears Overblown? Both of these articles talk about the extraction of shale oil in the Bakken and other locations, using horizontal wells and hydraulic fracturing.

According to the AP article:

Companies are investing billions of dollars to get at oil deposits scattered across North Dakota, Colorado, Texas and California. By 2015, oil executives and analysts say, the new fields could yield as much as 2 million barrels of oil a day — more than the entire Gulf of Mexico produces now.

This new drilling is expected to raise U.S. production by at least 20 percent over the next five years. And within 10 years, it could help reduce oil imports by more than half, advancing a goal that has long eluded policymakers.

There are several questions that might be asked:

1. Is this really a new drilling technique?

2. How likely is the 2 million barrels a day of new production, and the 20% increase in US production, by 2015?

3. Can this additional oil supply really reduce the US’s imports by over half?

4. How much of a difference will this oil make to “peak oil”?

Let’s take the questions in order.

1. Is this really a new drilling technique?

No., this is not really a new drilling technique. According to Wikipedia, hydraulic fracturing was first used in the United States for stimulating oil and gas wells in 1947. It was first used commercially in 1949. Directional drilling, including horizontal drilling is almost as old, but it was not widely used until down-hole motors and semicontinuous surveying became possible. The techniques have gradually been refined, as oil and gas companies have used them more and supporting technologies have been better developed.

A major reason we are using these techniques is because much of the easy-to-extract oil has already been extracted. Horizontal drilling and hydraulic fracturing are more expensive, but can be used to get out oil that would be inaccessible otherwise. The hope is that oil prices will be high enough to make these techniques profitable.

2. How likely is the 2 million barrels a day of new production, and the 20% increase in US production, by 2015?

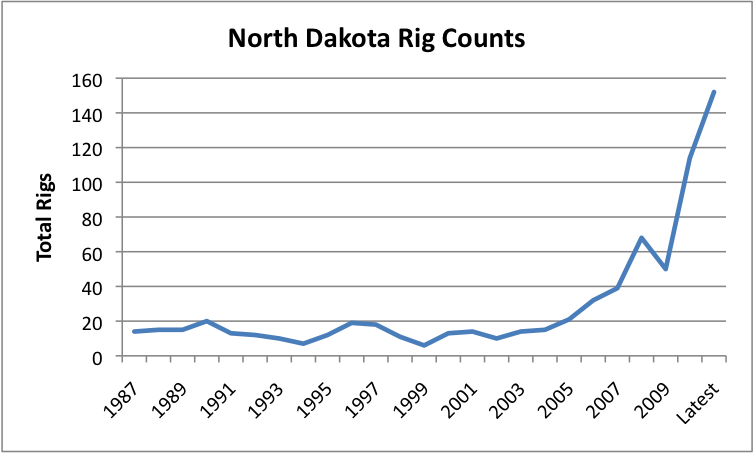

That is a good question. There is certainly a lot of drilling for oil being done now. According to Baker Hughes, 805 rigs are now involved in oil drilling. This is above the oil rig high point in 1987. (Natural gas rig counts are down recently, so much of this rig count increase seems to represent a re-purposing of rigs.)

Active rigs in North Dakota have also increased greatly. (These rigs are include both oil and natural gas, but with the Bakken and Three Forks-Sanish plays in North Dakota, it seems as though most would be oil rigs.)

There are several reasons why the hoped for increase might not be realized, however. These include:

Inadequate infrastructure. One question is whether inadequate infrastructure will prove to be a roadblock to meeting ambitious production goals in five to 10 years. The AP article quoted above mentions that currently oil is being transported to market by rail and truck, and drilling companies have erected camps for workers. If infrastructure problems are already being reached, before the ramp-up really takes place, a person wonders how much of an obstacle these considerations will be in the future.

Inadequate price. What tends to happen when there isn’t adequate transportation for the oil is the selling price of the oil tends to be depressed, relative to other types. As of February 8, the spot price for Brent was $99.25; the spot price for West Texas Intermediate (WTI) was $85.85, and the spot price for North Dakota Sweet was $65.61. The target discount rate relative to WTI is quoted as being 10% (because it is a light oil), but the actual price seems to be much lower.

It is easy for operators to assume that the price differential will get better, and also that the prices of other types of oil will continue to rise. But all of these things are by no means certain. High oil prices tend to send the economy into recession, so world prices may not rise as much as hoped–they may oscillate instead, rising, then putting the economy into recession and falling again. Also the differential of North Dakota types of crude to Brent may stay low for an extended period, if infrastructure issues cannot be worked out.

Optimism before drilling. There are many unknowns before drilling including how quickly oil production from individual wells will decline, how long wells will prove to be economic, what proportion of wells will have high production, and the level of oil and gas prices in the future. It is natural for those who are trying to get others to invest in these ventures to base their assumptions on an optimistic view of the future. If experience with shale gas in Texas is any clue, once realities start setting in, the level of drilling may decline, and overall production, after an initial run-up, may decline. If this happens, it will be very difficult to meet the ambitious goals presented.

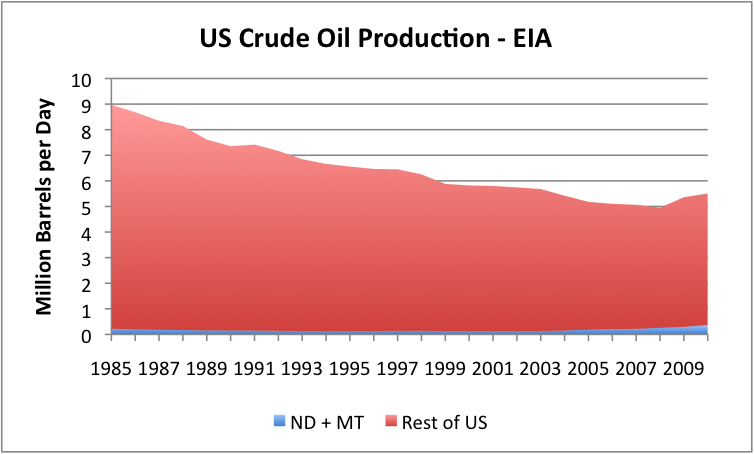

Large amount of increase required. If we look at a graph of countrywide US oil production, it has been decreasing prior to an uptick in 2009 and 2010. Bakken oil production (in ND +MT) is shown near the bottom of Figure 4. It appears as a thin blue line that was a bit thicker back in the late 1980s, became thinner for many years, and now is a bit thicker (reaching an average of about 370,000 barrels a day in 2010). Getting that line, or that line plus some other areas that are only starting up, to increase by 2 million barrels a day, to 2,370,000 per day by 2015, would be a tall order.

Likely other declines at same time. US crude oil production has been headed downward for a long time–actually since 1970, not just since 1985 shown on the graph Figure 4. If overall production is to be increases by 2 million barrels a day by 2015, it will be necessary to overcome these declines, as well as add 2 million barrels a day of new production. What happens is that each year, more and more oil fields and oil wells within oil fields become non-economic. These are closed. Also, what is extracted is an oil-water mix, and the proportion of oil tends to fall over time. This means that if a given volume of oil-water mix is processed from a well, each year the well will yield less oil and more water.

There has been discussion of raising taxes on oil companies. Raising taxes on oil companies tends to raise the number of wells that are non-economic.

According to Figure 5, about 85% of US wells are now producing less than 15 barrels a day, and about 15% of wells are moderate rate wells, producing 15 to 1,600 barrels of oil equivalent a day. Only a small percentage are high rate wells. If tax rates increase, some of them will be closed. New wells will also become less economic, and some wells will not be drilled that would otherwise be drilled. So a person would expect an increase in taxes on oil companies to result in a step down in existing production. Many of the oil companies affected will be small–their only business may be a few wells producing less than 15 barrels a day. The amount of oil produced by so-called stripper wells is about 900,000 barrels a day.

Another area where there is risk of decline is Alaska. The Trans-Alaska Pipeline System is suffering from issues related to low flow and corrosion. Major upgrades to the system may be needed, including heating the line, to keep it operational. At some point, the amount of “fixes” to the Alaska pipeline will exceed the value to be gained from shipping the oil, and the whole system may need to be closed because of low flow. The current flow through the pipeline is 640,000 barrels a day.

3. Can this additional oil supply really reduce the US’s imports by over half, in ten years?

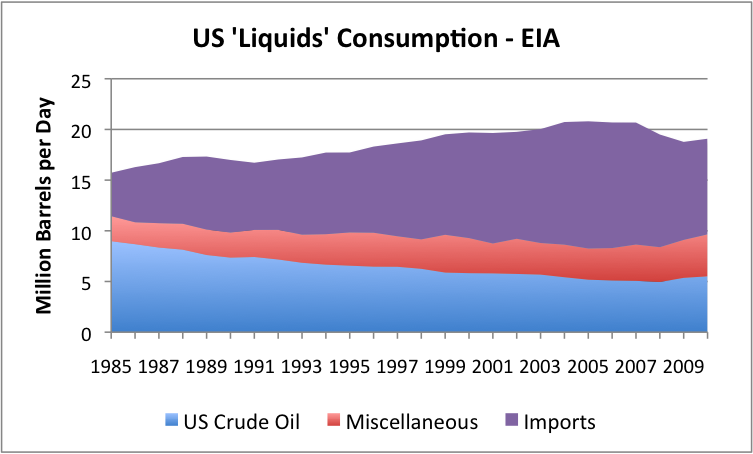

US oil consumption reached its maximum level in 2005. Figure 5 shows a breakdown into its major components.

The crude layer in blue is the same countrywide crude oil production as shown in Figure 4. The purple layer on the top is imports (minus exports), so net imports, based on EIA data. The layer I have called miscellaneous is everything else that goes into what is reported as “liquids.” Recently, the miscellaneous category has been about one-half natural gas liquids, one-quarter ethanol, and one-quarter “refinery gain”–that is the expansion that occurs when the US refines crude oil. The “miscellaneous” items are products that provide less energy per barrel than oil. Many people believe that these additional items have been included in “liquids” figures to make US oil production look like it is performing better than it really is.

Natural gas liquids. I am suspicious that quite a bit of the 2 million barrels a day of additional production by 2015 that is being forecast is not really oil. Instead, I expect it will be natural gas liquids. This currently represents about half of the “miscellaneous” layer in Figure 6. Natural gas liquids (NGLs) include propane, butane, and other gasses. It may very well that much of the recent increase in “oil” drilling rigs is, in fact, primarily for NGLs, since there has been a great deal of recent interest in liquids-rich gasses. In fact, some articles talk about the possibility of falling prices for NGLs, because of a possible supply-demand imbalance, if production of these ramps up.

An increase in NGLs would be of lesser benefit than oil, because it is not directly substitutable for oil, and is a cheaper product. Initially, it would mostly make home heating for those using propane cheaper, but then tend to drive NGL developers out of the market. Unless NGLs can cheaply be converted to higher priced oil products (and refinery capacity can be added quickly to accomplish this), it would seem like a drop in prices would quickly put an end to the NGL ramp-up.

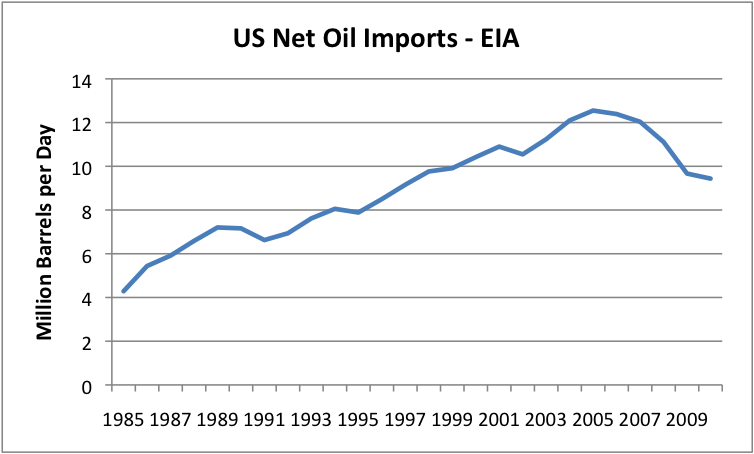

Imports. Figure 7 shows a graph of US net imports–that is the top layer on Figure 6–by themselves. (On all of these graphs, the data for 2010 is through November, but I have estimated December, to give an approximate 2010 value.)

It seems to me that oil imports really depend on what the US can afford for imports–how high the price is, how much oil for export is on the world market (which helps determine the price), and whether the US is in recession because of high oil prices. Oil imports were increasing up until 2005; now they are decreasing. This decrease in oil imports reflects the fact that oil in the world export market peaked in 2005, as much as anything else. High oil prices (and layoffs indirectly related to high oil prices) have made it difficult for people to afford goods and services that require oil in their production (vacation trips, new homes, new cars, many other types of goods). As a result, US demand for oil products has dropped to the point where our imports have dropped each year since 2005.

In my view, if additional US oil is produced, it actually helps increase US demand for oil products–in fact for all products. More people are employed, and this puts more money into the economy. It also helps keep world oil prices from escalating as fast as they would otherwise. The net effect is that I would expect higher US oil production to increase US imports (or maybe, keep imports from falling as fast), because they will help keep the US out of recession. I am sure some will disagree with me on this, however.

US oil imports have declined about 25% in the five years since 2005. In the next ten years, I would expect oil imports to continue to decline, regardless of what we do, because the amount of oil on the world market will continue to drop, and oil importers will tend more and more to be in recession. It is not clear how much US oil imports will drop, but a 50% drop in the next 10 years would not seem all that unlikely, regardless of what we what we produce, because of oil exporting countries will tend to consume more, and more countries will shift from being exporters to importers. We are currently importing 9.4 million barrels a day, so a reduction by half by 2020 would be a reduction of 4.7 million barrels a day.

Responding to the initial assertion that the oil ramp-up will permit a reduction by half of oil imports by 2020. If somehow over the next ten years, we could really produce 4.7 million barrels of oil to offset the decline in oil imports that we will likely be losing because of declines in the world export market, that would be wonderful. But at most, what it looks like the author of the AP article is looking for is a mixture of NGLs and crude oil that might ramp up to 2 million barrels a day by 2015, and 4.7 million barrels a day by 2020, in addition to compensating for whatever other declines we might be encountering.

If the mixture is heavily NGLs, it seems as though refineries will need to be reconfigured to adjust the NGLs to permit reformation into longer-length chains, to make the NGLs truly substitutable for oil. I do not know how feasible such a step would be, or what the “energy cost” would be. It would really be the net oil addition, after the conversion process, that would be of interest.

4. How much of a difference will this oil make to “peak oil”?

It seems to me that whatever additional oil and NGLs are produced will have a much bigger impact on the US economy than it will have on “peak oil.” Adding more energy, if it can be done at a price that is affordable, will be help keep the US out of recession, and thus keep employment up and demand for energy products up.

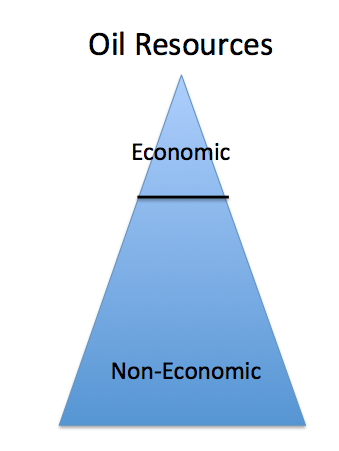

We have known for a long time that a huge amount of oil is available, in forms that are increasingly difficult to extract. The question, in my view, is how much of this huge amount of oil is economic to extract. This is closely related to Energy Return on Energy Invested (EROEI). At some point, oil becomes too expensive to extract; it just puts the economy into recession, or worse. A schematic diagram of what happens is shown in Figure 8:

We have known about the Bakken oil shale and the many other shales that have NGLs for a long time. There are also many other types of oil that we know about (such as ultra-deepwater, polar, oil-shale) that are quite expensive to extract, both in terms of price in dollars and in terms of resources required. The resources required are not just the direct resources of drilling–they also include pipelines that might not be used for very many years, and even local refineries, which again might not be used for many years, and training for workers. With respect to NGLs, if they are to be used as “regular” oil, they will need unification, perhaps with catalytic reforming, if they are to be used as longer-chain hydrocarbons, which are the higher-priced, more desirable, product. The big question is whether these processes can be made to be economic. If we ever get to the point where more energy is consumed in these processes than we get out at the end, the processes are clearly losers.

To me, each decision to drill a new well, or to start a new field, or even to continue pumping from an existing well, is based on the economics of the day. Some fields or potential wells or new wells drop below the “Non-economic” line on Figure 8, as tax rates rise. Others rise about the non-economic line, as technology improves. But by and large, the vast majority of oil resources that we know about will forever lie below the non-economic line. The assumption that oil prices will rise high enough to allow us to extract all of these oil sources is based on an incomplete understanding of the situation. At some point, the costs (and energy demands) of extraction and processing just become too high, relative to the benefits. Demand can never rise high enough to produce the high prices required for extraction. Ultimately, production will fall, not from a lack of resources, but from inadequate demand for high-priced oil from low quality resources.

The manner in which Figure 8 fits in with Hubbert’s Curve is not directly obvious. Most “liquid” oil will tend to be in the upper “economic” triangle. Most “solid” forms of oil will tend to be in the bottom portion of the triangle. (Hubbert’s Curve is usually applied only to the liquid portion of oil resources.)

But within this general breakdown, the edges will be determined by economics–does it make financial sense to use a particular tertiary recovery method on a particular liquid-oil field? Is it economic to extract something that is not quite liquid oil (like NGLs) and transform it to something that might operate vehicles?

One thing that is definitely different about Figure 8, compared to Hubbert’s Curve, is a different implication regarding how much is left, when the non-economic line is reached. Hubbert’s Curve discussion talks about half of the oil being gone, when decline starts. There is no such implication with Figure 8. Operators will continue to extract oil that can be extracted at low price (high EROI), even as more and more new types of extraction fall below the non-economic line. But it seems quite likely that much less than half of the low-priced (high EROEI) oil will be left, when we start running into difficulties with new oil types falling below the non-economic line.

To me, the big question is whether Bakken oil shale, other oil shales, and all of the additional NGLs can really be made economic. If they can, and the amount of oil extracted raised to the hoped-for 2+ million barrels a day by 2015 and 4.7+ million barrels a day by 2020, the new oil sources may help to keep recession away for a while longer. But if not, we are likely nearing the point where limited oil supply will push us more and more into recession. I am doubtful that the new oil shale sources can ramp up as quickly as hoped, but there is at least some glimmer of hope that these fuels will help keep the day of reckoning away a bit longer.

As "The Rock" and I have both noted, the Austin Chalk in Texas is a pretty good model for the various oil shale plays, and regarding claims being made by the oil shale promoters, at the peak of the Austin Chalk horizontal drilling boom a lot of similar claims were being made by Austin Chalk promoters.

And of course, the oil shales in Colorado, which are kerogen deposits in the Green River Formation (a substance that must be "cooked" to produce a liquid for refining), are not the same thing as the thermally mature oils in the Bakken and Eagle Ford, which can be shipped directly to refineries.

This isn't the stuff that needs to be "cooked" that I am talking about. I am talking about the stuff that needs to be "fracked", like the Bakken Shale. It looks like the Natural Gas Liquids are being dumped into this category too, but they too need to be fracked.

As a petroleum geologist, the distinction between thermally mature oil in the Bakken, et al, and kerogen deposits is clear to me, but the distinction is not apparent to a lot of people, e.g., talking heads on CNBC, so I would suggest that any articles on oil from shales* should have an explanation about thermally mature oils versus kerogen deposits.

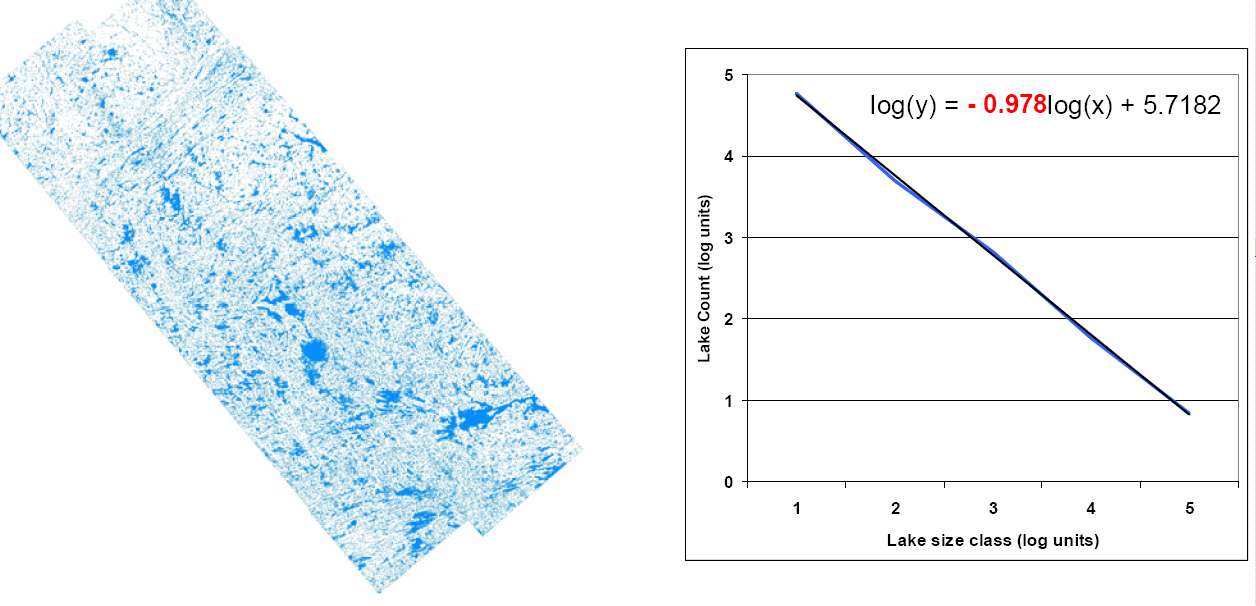

*Of course, the Green River formation in Colorado is really mostly an ancient lacustrine marl deposit

Mature v immature source rock?

Exactly. The marlstone is undercooked so the kerogen hasn't turned into oil. Just give it another 60 million years or so, maybe pile a few mountains on top to speed things up. Heavy oil (bitumen), like in Athabasca, is overcooked (the lighter fractions have escaped).

Ahhh..."Just give it another 60 million years or so, maybe pile a few mountains on top to speed things up."

Almost verbatim from the 1976 remake of "King Kong", where the oil geologist for Petrox Corp, Roy Bagley, (played by Rene Auberjonois) drunkenly tells Fred Wilson, (Charles Grodin) that the oil they've discovered on Skull Island (or whatever it is called) would, indeed, be a huge find...after ten thousand years! That was one of the more hilarious scenes of the film. And now it's being played out in real life.

-sTv

FWIW I agree. There is a lack of geology over here that could be addressed perhaps by "technical talks" or some such. There are lots of interesting socio-economic charts and graphs, but howabout some rocks, dirt and oil sometime? Thank you dearly, Westexas for being here. What happened to FF (FractionalFlow?)

~:)

Great article! Here are the quick and easy answers:

1. Is this really a new drilling technique? NO.

2. How likely is the 2 million barrels a day of new production, and the 20% increase in US production, by 2015? NO CHANCE. Production will decline by 20%.

3. Can this additional oil supply really reduce the US’s imports by over half? NO CHANCE.

4. How much of a difference will this oil make to “peak oil”? NONE Whatsoever. Declines will still outpace new production.

What to think about this ? A spokesman (on video, posted about 1 week ago on Drumbeat) who claimed that oil shale in the Green River formation is economical with $30 oil, said that the oil won from shale can be used directly, because it doesn't need refinery.

...claimed that oil shale in the Green River formation is economical with $30 oil, said that the oil won from shale can be used directly, because it doesn't need refinery.

That's very funny, considering that operating costs in established oil sands plants in the Athabasca Oil Sands run around $45 per barrel, and oil sands are a lot easier to produce than oil shale.

I think he's blowing smoke. More likely the costs would be 400-500% higher. We don't know, because nobody has a working pilot plant yet. I suppose ignorance is bliss, you can pick any number out of the air you want to.

Oil from shale can be used directly? What is he going to do, smear it all over his car?

Rocky, clearly he was suggesting that it will produce 'different kind of carbon chains'. So he is blowing smoke in many ways, probably one with THC.

Well, oil shale has been used "directly" in a few places by burning it like coal. However, the oil shale in places like Estonia is close to the surface, not buried 2000 feet under rock like it is in much of the Green River formation.

Any discussion of doing *anything* with the oil shale in Colorado/Utah has to start with the lack of water, and end with the lack of water, and in between you can talk about the lack of electrical resources. The area has a total population of maybe 200,000 spread over tens of thousands of square miles, so there is not a lot of electrical generation in the area currently. A nuclear plant has been whispered about in the town of Green River, Utah to supply power to shale projects, but of course, the water issue rears its ugly head again. The 50,000 acre feet per year of water is there in the Green River to build a plant, but every drop used upstream of Arizona, Nevada and California means less water for the megalopolises and farms of those states.

There is going to be one heck of a collision between the water needs of the Southwestern US and the energy needs of the rest of the US if there ever is a large scale attempt to produce oil from the rocks in Colorado and Utah.

@whomever, the word kerosene directly comes from the word kerogen. In ye olde days in Scotland they called it kerosene shale, not oil shale. 150 yrs ago, no one wanted that nasty olde gasoline, it was an unfortunate byproduct of the simplified oil refining done then. Everyone wanted that nice white kerosene (that came from kerosene shale/oil shale) to use in their lamps instead of that expensive whale oil. The Shell ICP process claimed semi-refined output including near-diesel, don't know about your quoted person. There was a long thread on this last week with some links but it all got removed after I'd skimmed it when I came back for a longer look-see. Or perhaps I imagined it?

It's hard to see how this can make much difference to us oileating minnows, considering the fact that we are trapped between the sharks of depletion and the bluefish of export land.

I frequently use the example of the North Sea, which had an absolute crude oil production peak of about six mbpd in 1999. Sam Foucher found that oil fields whose first full year of production was 1999 or later had their own peak in 2005, at about one mbpd, which was equivalent to about one-sixth of total regional production in 1999. However, these post-peak fields only served to slow the overall decline in the 1999 to 2009 time period to about 5%/year.

We have seen something similar globally, as global annual crude oil production (C+C) has so far failed to exceed the 2005 annual production rate--despite oil prices exceeding the 2005 annual level of $57 for going on six years now, with five of the six years apparently showing year over year increases in annual oil prices. The difference between the North Sea and global production is that we have a slowly increasing unconventional global component.

Note that based on the HL models, the world in 2005 was at about the same stage of conventional crude oil depletion as the North Sea in 1999 (approximately 50% depleted in both cases).

But as you noted, then there is the net export situation. . .

How much oil is in place in those shales, and how much can be recovered using current technology and prices? Does anybody know?

There is a big question as to how much "fracking" can release, and even how long existing wells will produce at economic levels. You see huge numbers and small ones.

I know that Douglas Westwood consulting firm is expecting that shale oils like Bakken and Natural Gas Liquids will grow greatly. I have a post giving my summary with my comments of a presentation by Steven Kopits up on Our Finite World now.

This is what his (probably optimistic) forecast of US production looks like going forward:

Gail,

These layered color coded graphs are useless. To understand this one I had to enlarge multiple times. I am not color blind. Being a pilot I am tested regularly. Gail, please do what you can to discourage this form of data presentation.

cheers Juan GA.

With those graphs it strikes me that always they manage to keep production rising. EIA, etc projects what the world will need, and with that data they draw the graphs.

I don't care how much oil is in oil shale. That's all I ever read about. One or two trillion barrels of oil, most of which is not economic..., I want to know production rates. That's what matters to me.

(correct me if I'm wrong -- I'm just a peak oil groupie)

The U.S. consumes about 20 million barrels of oil a day.

The world consumes about 80 million barrels of oil a day.

Current Canadian oil production is about 3 million barrels of oil per day. 40% of it comes from tar sands.

Royal Dutch Shell's Mahogany Ridge project (a demonstration project)

produced 1,400 barrels of oil from shale in Situ

Whatever oil we get from fracking oil shale

I do not know how much oil we get from Shale Oil in total but I know it's marginal.... (less than tar sands by far)

Plus, net energy will be lower for tar sands and oil shale (especially oil shale)

Canadian oil production is, in fact, running at about 3 million barrels of oil per day, but 55% of it is now from oil sands.

USGS 2008:

Cumulative Bakken production of 135 MMBO 1953-2008

~36 MMBO for 2008 alone

Mean Estimated ultimate recoverable of 3.65 Billion Bbls of 413 Billion Bbls in place (<1% recovery) with "current technology."

MRO 2011 press release:

MRO estimates that its average well will cost from $5.5 million to $6.5 million, and produce an average of 300 to 500 BOE per day during the first thirty days. The average well will have an estimated ultimate recovery of 350,000 BOE per well. That's about $17/bbl just for the drilling.

With MRO's numbers, you need over 10,000 wells to produce USGS 3.65 BBO at a drilling cost of $60 billion. Of course that's only 65 wells per active rig. I wonder what the peak rate will be? How fast can those wells be drilled? Will recovery efficiency improve or are current estimates optimistic?

For comparison, a good deepwater well might cum >20 mmbo with rates over 20,000 bopd. Of course the well cost is also x20, not to mention platform and pipeline costs.

Which tells me it may be worth to lay a pipeline from these shale areas to Wisconsin and Illionois, to move the crude out in large volumes. If the total resource is 3.65 to 7.3 billion (I doubled the estimate just in case), the peak rate would be about 1 million barrels per day. So it looks like a 40-42 inch pipeline could make money - it's actual capacity would set the plateau rate for the region.

I've worked planning mega developments for very large oil volumes from remote areas, and eventually one has to settle on a transport system to carry a decent amount of crude, but which also has a reasonable life span.

In this case, the pipelines will set the plateau, although some oil will leak out by train and truck, I imagine. But if the industry is rational, they'll get together and encourage construction of something able to carry about 1 million bpd, and that's as far as it'll go. And they will have to commit throughput or back it with equity. Which means if the wells don't pan out the pipeline(s) will be a white elephant.

Conclusion? This North Dakota oil shale play won't go above 1 million BPD, say by 2020.

Interesting calculation!

The sum of all of the optimistic statements being given to investors likely isn't true.

Currently there is less oil pipeline capacity moving out of the area than the oil that is shipped. Trains are being used to move oil out.

http://nextbigfuture.com/2011/02/north-dakota-oil-might-head-to-over-one...

(Harold Hamm/Continental Resources, CEO) "In total development in the Bakken we see about 48000 wells, of which 90-percent are yet to be drilled." Oil tycoon Harold Hamm says the formations in North Dakota and Montana hold about 20 billion barrels of recoverable crude. There are about 170 rigs drilling in North Dakota and oil tycoon Harold Hamm says that number is expected to rise. Hamm estimates those 48000 wells will produce as much as 1,000,000 barrels a day and it may be just a tad more than that.

http://nextbigfuture.com/2011/01/estimates-of-north-dakotas-oil.html

Gail does not address that there are potentially huge shale gas discoveries in Argentina, Quebec, Poland, India, the UK, off the coast of Israel, in China, British Columbia. There are potentially huge oil shale in Australia, China and France. There has not been any mention yet but I suspect large oil shale will be found in Russia as well.

The Arthur Creek shale formation in the Southern Georgina (Australia) is very similar to the Bakken but with about 5 times the thickness. All 18 exploratory wells drilled so far have shown oil. Australian geologists certainly seem to think they have found another Bakken. In another 15 to 18 months we will know if this is indeed true.

It is not Australia, however, but France-- where the greatest industry anticipation and activity is building in the search for the next Bakken; in the well known Paris basin.

The Paris basin (current production of less than 15,000 bpd of conventional oil) covers the northern half of France and extends into neighboring countries. It is a vintage oil and gas basin. Over 2 thousand wells have been drilled and 52 fields discovered. It has extensive oil and gas shale deposits. The 3 oil shale formations are the Lower Lias , Amaltheus and Schistes Carton. The current focus of excitement is the Lower Lias with estimated oil in place resource base of a few billion to tens of billions of barrels. The estimates (guesses) for the oil in place in the other 2 formations are much higher.

Torreador Resources asserts that an estimated 100 billion barrels of oil have been generated from source rocks in the Paris basin, of which 30 billion are in the Lower Lias.

In addition to the Paris Basin, Hess thinks it has found a basin analogous to the Bakken in China.

There are potentially huge shale gas discoveries in Argentina, Quebec, Poland, India, the UK, off the coast of Israel, in China, British Columbia.

Advancednano, I had the weekend to chew over this some more. If the shale play in North Dakota is for real, and the companies involved convince themselves it's not a flash in the pan, then pipelines should be built. I've spent most of my career overseas, so I'm a bit off when it comes to the hodge podge way things are done in the US, but evidently shipping by pipeline is much cheaper than shipping by train.

Let's say a shipper sees $15 per barrel higher tariff shipping by rail, then a pipeline is definitely viable. The question is, how large should it be? This depends on the commitments shippers are willing to make. And the shippers don't want to commit until they understand the way these rocks behave. So my guess is, since they're already moving a lot of oil by rail, somebody will build a smallish pipeline, then other lines will eventually be built to replace the trains - if the play pans out. Shipping by rail year after year just doesn't make economic sense.

The same thing will hapen in new areas, I think. They'll have to run pilot production for several years before they convince themselves to put in lines. I suggest those who work out the overall supply/demand balance for peak oil estimates take this into account, when the industry isn't sure about reservoir behavior, it tends to take it slow when it comes to transportation systems from remote areas.

If the shale play in North Dakota is for real, and the companies involved convince themselves it's not a flash in the pan, then pipelines should be built.

The Bakken play is for real and the pipelines are already under construction:

Bakken Pipeline Project

Mind you, this is a Canadian pipeline company pipelining North Dakota oil into Canada and putting it into the Canadian export pipeline system, which has seen massive expansions in recent years.

The Portal Link system used to take oil from Saskatchewan into North Dakota - they are just reactivating it and reversing it to run the other direction.

i know almost nothing about the local transport system. But if the proposed 1 million bpd is the target, then they need a lot more pipeline capacity. I would call a 125,000 b/d line a test or pilot system. A more significant investment would be say something to move 400,000 BPD. And those take time.

the pipeline companies wait until they have commitments from oil companies for about 80% of the capacity, then they build the pipeline. This is starting to happen. There is a lag in the construction of pipeline to the oil produced in a growing set of oil fields.

Transcanada pipeline is expanding pipeline capacity as well.

http://www.transcanada.com/5631.html

http://www.transcanada.com/bakken.html

In the fall of 2010, TransCanada went to the market with a proposal to move Bakken crude oil production by constructing a receipt facility at Baker, Montana. The open season was successful, allowing TransCanada to sign firm term contracts for 65,000 bpd of crude oil transportation from the Bakken to key U.S. refining markets.

The Bakken Marketlink project will provide receipt facilities to transport up to 100,000 bpd of crude oil from the Williston Basin producing region in North Dakota and Montana, to Cushing, Oklahoma and the U.S. Gulf Coast using facilities that make up part of the Keystone Gulf Coast Expansion Project. The project is expected to be in service in 2013.

Cushing Marketlink Project

In the fall of 2010, TransCanada went to the market with a proposal to move crude oil from the prolific Cushing crude oil storage hub in Oklahoma, to markets on the U.S. Gulf Coast. The open season was successful, allowing TransCanada to move forward with this important project.

The Cushing Marketlink project will provide receipt facilities to transport up to 150,000 bpd of crude oil from Cushing, Oklahoma to the U.S. Gulf Coast using facilities that make up part of the Keystone Gulf Coast Expansion Project. The project is expected to be in service in 2013.

Keystone Pipeline Project

The U.S. $12 billion Keystone pipeline system will play an important role in linking a secure and growing supply of Canadian crude oil with the largest refining markets in the United States, significantly improving North American security supply.

On June 30, 2010, TransCanada commenced commercial operation of the first phase of the Keystone Pipeline System. Keystone's first phase was highlighted by the conversion of natural gas pipeline to crude oil pipeline and construction of an innovative bullet line that brings the crude oil non-stop from Canada to market hubs in the U.S. Midwest.

Keystone Cushing (Phase II) is an extension of the Keystone Pipeline from Steele City, Nebraska to Cushing, Oklahoma. The 36-inch pipeline is currently under construction and will connect to storage and distribution facilities at Cushing, a major crude oil marketing/refining and pipeline hub.

The proposed Keystone Gulf Coast Expansion Project is an approximate 2,673-kilometre (1,661-mile), 36-inch crude oil pipeline that would begin at Hardisty, Alberta and extend southeast through Saskatchewan, Montana, South Dakota and Nebraska. It would incorporate a portion of the Keystone Pipeline (Phase II) through Nebraska and Kansas to serve markets at Cushing, Oklahoma before continuing through Oklahoma to a delivery point near existing terminals in Nederland, Texas to serve the Port Arthur, Texas marketplace.

Found this while looking for info on the Monterey formation: How Much Oil Does the U.S. Have in the Ground - What Does It Mean for Investors? - Seeking Alpha

Well, there's an alternate interpretation as well. I remember arguing about the Bakken a lot starting 4 years ago - all the companies and Price had these sky's-the-limit estimates, and the gung ho contingent were altogether crestfallen by the USGS figure, of course. They were also ready with plans for extreme EOR to wring every last barrel out of the thing, and the Seeking Alpha guy recounts more of these in his piece - CO2 and waterfloods to recover 16 bbo etc. Uh huh. The dead giveaway is the rig count in Gail's article; this is what's called a "brute force approach."

TX production is still flat, from tapping of Permian basin leftovers. Lots of dinky lenses to drill. This too is mopping up; Hirsch could have thrown this approach in as a wedge in his study; or perhaps it's part of EOR by his definition.

There doesn't seem to be much going on in CA and the Monterey oil rigs all are operating in the San Joaquin doing developmental drilling. Penn Energy is ready to redrill some 80s wildcat. It's an odd formation, acts as both source and reservoir, from Miocene sediments. Meanwhile CA just continues on its inexorable decline.

Heading Out had a blog post about the Eagle Ford, a play that's great if you think we'll achieve energy independence by commuting on forklifts burning C3H8. OGPSS-When oil isn’t crude and gas isn’t gas, the Eagle Ford Shale play.

And the USGS estimates are almost certainly wrong(too low). While Gail is correct in stating that directional drilling or fracking individually are not a new techniques, to say that there has not been a breakthrough in drilling technique in the last few years is also incorrect. It is the simultaneous employment of directional/horizontal drilling and multi-stage fracking that has been an innovation in drilling technique for oil E&P that has changed the EUR and economics of many different formations in just the last 5 years or so. Additionally, there has been considerable innovation in fracking methods (swell packers, Perf and Plug processes, ceramic proppants, etc) and 3D/4D seismic imaging and microseismic monitoring that have led to the impressive production growth rate (2000-2005 daily production average 87Mbbl/day vs 2010 average of 309Mbbl/day and current average north of 350Mbbl/day. Monthly production hit 4MMbbl at the end of 2007 and is now at about 10.7MMbbl and climbing rapidly).

Also, when you look at Bakken production in the last couple of years from individual companies, like BEXP for example, you'd see that the E&Ps also moved from short laterals and single stage fracking to long laterals and 475' spacing, to 400' spacing, on down to the current trend of 250' spacing with the number of frac stages generally in the range of 25-35. As the number of frac stages has increased and the spacing has decreased, recovery rates have consistently improved. Additionally, there seems to be considerable evidence to suggest that the Bakken and the Three Forks/Sanish formations are separate and do not communicate with each other. If true, this too means the USGS survey estimate is too low.

Why would the formations being separate affect the overall OOIP? I see Durgen asked USGS to reevaluate the formation(s) before leaving the Senate. And in any case I'm just questioning the companies' integrity; of course they would play up the riches of a resource, they're fishing for investment $$$$. Third parties should be the ones to do an on-the-level assessment of what's there.

All that extra fracking adds to the cost, of course. Looking at the Baker Hughes data I see that vert/horz wells as a % of the total achieved parity in 2009 and the majority by far are now horz. Perhaps the drillers will hit a sweet spot in terms of economics where the rates will plateau.

And in any case the Bakken doesn't have much impact on the world at large. Perhaps if the various theorized Bakkens around the world that advancednano posts about materialize into commercial production we'll see something. Right now ND mostly seems to be having an impact in distorting WTI badly.

Thanks for the article, Gail. Always a pleasure reading your insights.

As for the whole situation, I think we will increasingly see these magic bullet-esque attempts from the MSM as the situation gets worse and worse(and more obvious) to drum up, as you put it, 'the last glimmer of hope'.

All the experts, genuine experts, like Skrebowski, Hirsch, Aleklett, Robelius and others who are understanding the situation very well, point at the 2008-2015 range(depending how you count) on when we'll hit Peak(and how that's counted is a bit individual as well).

Hirch's 2012-2015 is still the best bet from this viewpoint.

There is one factor I think people forget though, and it's the "X-factor".

In the last 2-3 months we've seen what has happened when oil goes into the volatile area and general instability ensues, you get a Libyan revolution.

Ultimately what will decide Peak Oil is not geology but geopolitics, and often uncalculated and randomized, as we've seen. A sudden war, revolution or somekind of conflict. It can also be sparked by food prices which has fuelled the current unrest.

At this point it makes less and less sense of trying to pinpoint the Peak geologically, we can only point in a general direction, a windowed frame.

If will be 2011 or as late as 2015 will depend on things nobody can possibly forsee. Who could have forseen Libya at the start of this year?

From now on we're into the dark.

Given that Libya is increasingly looking to be entering a stalemated civil war, we can forget most of their production for the next few years. And it was easy, light sweet quality oil.

This I think will be typical of the reaction to peak oil - political instability as the oil rich monarchies and dictatorships fail to keep their young, restive and rapidly growing and increasingly hungry and religiously radicalised populations under control.

Decline from the peak will not be a smooth geological curve. It will not be an economic event. It will be violent and explosive.

A lot of people will die.

The esteemed (by us) geologists and economists posting here will have all their predictions rapidly overtaken by events.

I agree with you RalphW -- human history already tells us that doesn't it?--Great article Gail--maybe it's time a simliar report is done on uranium?

You should probably do that report yourself. I think Gail's too honest.

I did do a report on uranium a couple of years ago, and also a more recent update, which includes this graph:

I think one of the issues is that it is hard to get the price of uranium up high enough, long enough, to really go after additional supply. Also, the recent historical pattern is toward less electricity generated using uranium, rather than more. Many of the old reactors are nearing the ends of their lives, and countries are not taking steps to replace them.

There are long lag times in all of this as well. I would have to look at it some more, but even then I am not sure I would have all the answers.

What is missing is the real resource triangle for Uranium, which puts the one for oil to shame.

Uranium disperses a huge amount, by concentration levels you get the following:

Very high-grade ore (Canada) - 20% U 200,000 ppm U

High-grade ore - 2% U, 20,000 ppm U

Low-grade ore - 0.1% U, 1,000 ppm U

Very low-grade ore - 0.01% U 100 ppm U

Granite 4-5 ppm U

Sedimentary rock 2 ppm U

Earth's continental crust (av) 2.8 ppm U

Seawater 0.003 ppm U

The amount of uranium dispersed in the crust and ocean is much, much greater than that in the richest deposits.

So us going after shale oil or worse is a lot like us going after low-grade forms of uranium.

Time for another update.

Nuclear power generation was back up to the 2630-2650 TWH range in 2010.

http://nextbigfuture.com/2011/02/world-nuclear-generation-in-2010.html

This is back near the peak of nuclear generation as calculated by the World Nuclear Association (WNA).

The WNA reported 2008 world nuclear generation at 2601 TWH and 2009 at 2558 TWH.

2007 had world nuclear generation of 2608 TWH and 2006 had 2658 TWH per the World Nuclear Association.

The IEA is about 120 TWH more than the WNA numbers, and I would guess that they are including the nuclear generation from submarines and aircraft carriers and other non-commercial nuclear power.

The IEA reports 2008 world nuclear generation at 2731 TWH

The IEA reports 2007 world nuclear generation at 2719 TWH and World generation 2006 at 2793 TWH

http://nextbigfuture.com/2010/12/average-capacity-factor-for-nuclear.html

Spain not shutting down their reactors.

also new nuclear power coming online

Plus the list below does not include the surge of reactor orders when China starts exporting in 2013 at far lower prices. Those new reactor orders will have a big impact from 2019+ as those reactors start finishing

2011 Russia, Energoatom Kalinin 4 PWR 950 [probably 2012-2013]

2011 Taiwan Power Lungmen 1 ABWR 1300

2011 Canada, Bruce Pwr Bruce A1 PHWR 769 [probably 2012]

2011 Canada, Bruce Pwr Bruce A2 PHWR 769 [probably 2012]

2011 Pakistan, PAEC Chashma 2 PWR 300

2012 Finland, TVO Olkilouto 3 PWR 1600

2012 China, CNNC Qinshan phase II-4 PWR 650

2012 Taiwan Power Lungmen 2 ABWR 1300

2012 Korea, KHNP Shin Wolsong 1 PWR 1000

2012 Canada, NB Power Point Lepreau 1 PHWR 635

2012 France, EdF Flamanville 3 PWR 1630 [probably 2014]

2012 Russia, Energoatom Vilyuchinsk PWR x 2 70

2012 Russia, Energoatom Novovoronezh II-1 PWR 1070

2012 Slovakia, SE Mochovce 3 PWR 440

2012 China, CGNPC Hongyanhe 1 PWR 1080

2012 China, CGNPC Ningde 1 PWR 1080

2013 Korea, KHNP Shin Wolsong 2 PWR 1000

2013 USA, TVA Watts Bar 2 PWR 1180

2013 Russia, Energoatom Leningrad II-1 PWR 1070

2013 Korea, KHNP Shin-Kori 3 PWR 1350

2013 China, CNNC Sanmen 1 PWR 1250

2013 China, CGNPC Ningde 2 PWR 1080

2013 China, CGNPC Yangjiang 1 PWR 1080

2013 China, CGNPC Taishan 1 PWR 1700

2013 China, CNNC Fangjiashan 1 PWR 1080

2013 China, CNNC Fuqing 1 PWR 1080

2013 China, CGNPC Hongyanhe 2 PWR 1080

2013 Slovakia, SE Mochovce 4 PWR 440

2014 China, CNNC Sanmen 2 PWR 1250

2014 China, CPI Haiyang 1 PWR 1250

2014 China, CGNPC Ningde 3 PWR 1080

2014 China, CGNPC Hongyanhe 3 PWR 1080

2014 China, CGNPC Hongyanhe 4 PWR 1080

2015 China, CGNPC Yangjiang 2 PWR 1080

2014 China, CNNC Fangjiashan 2 PWR 1080

2014 China, CNNC Fuqing 2 PWR 1080

2014 China, CNNC Changiang 1 PWR 650

2014 China, China Huaneng Shidaowan HTR 200

2014 Korea, KHNP Shin-Kori 4 PWR 1350

2014 Japan, Tepco Fukishima I-7 ABWR 1380

2014 Japan, EPDC/J Power Ohma ABWR 1350

2014 Russia, Energoatom Rostov 3 PWR 1070

2014 Russia, Energoatom Beloyarsk 4 FNR 750

2015 Japan, Tepco Fukishima I-8 ABWR 1380

2015 China, CGNPC Yangjiang 3 PWR 1080

2015 China, CPI Haiyang 2 PWR 1250

2015 China, CGNPC Taishan 2 PWR 1700

2015 China, CGNPC Ningde 4 PWR 1080

2015 China, CGNPC Hongyanhe 5 PWR 1080

2015 China, CGNPC Fangchenggang 1 PWR 1080

2015 China, CNNC Changiang 2 PWR 650

2015 China, CNNC Hongshiding 1 PWR 1080

2015 China, CNNC Taohuajiang 1 PWR 1250

2015 China, CNNC Fuqing 3 PWR 1080

2015 Korea, KHNP Shin-Ulchin 1 PWR 1350

2015 Japan, Tepco Higashidori 1 ABWR 1385

2015 Japan, Chugoku Kaminoseki 1 ABWR 1373

2015 India, NPCIL Kakrapar 3 PHWR 640

2015 Bulgaria, NEK Belene 1 PWR 1000

2016 Korea, KHNP Shin-Ulchin 2 PWR 1350

2016 Romania, SNN Cernavoda 3 PHWR 655

2016 Russia, Energoatom Novovoronezh II-2 PWR 1070

2016 Russia, Energoatom Leningrad II-2 PWR 1200

2016 Russia, Energoatom Rostov 4 PWR 1200

2016 Russia, Energoatom Baltic 1 PWR 1200

2016 Russia, Energoatom Seversk 1 PWR 1200

2016 Ukraine, Energoatom Khmelnitsky 3 PWR 1000

2016 India, NPCIL Kakrapar 4 PHWR 640

2016 India, NPCIL Rajasthan 7 PHWR 640

2016 China, several

2017 Russia, Energoatom Leningrad II-3 PWR 1200

2017 Ukraine, Energoatom Khmelnitsky 4 PWR 1000

2017 India, NPCIL Rajasthan 8 PHWR 640

2017 Romania, SNN Cernavoda 4 PHWR 655

2017 China, several

The market is fully supplied; even lifting the embargo on India didn't budge prices much.

The USA has around 700,000 tons of depleted UF6 in inventory (over 470,000 tons of elemental U). That's not reserves, that's inventory left over from enrichment since the Manhattan project. There is also about 60,000 tons of uranium in spent fuel, mostly from LWRs. All uranium is feedstock for fast breeder reactors, and that inventory alone is sufficient to run the USA at ~100 quads/yr for several hundred years.

That's why the Integral Fast Reactor had to die: it would have killed fossil fuels and "green" energy with one stroke. It also requires about 1/10 the steel and concrete of sources like wind, making it more economical if political factors don't torpedo it.

That's politics. Uranium remains a bargain, energy-wise (and the major supply-side response to AGW).

You should know this, but you're in deep denial.

E- Poet, it's about the big picture. What does the tremendous increase of nuclear powerplants tell you ? That they are expecting that the strongly growing middle class in China and India will continue to grow this and the coming decades. That means growing oildemand. Now look at the export maths of westexas and you know how much oil will be left over then to export to Europe, the U.S., etc. In other words, that growth scenario is impossible.

Chindia are net importers, like the USA. The situations are similar.

Chindia do NOT have the nuclear-phobic lobbies which afflict the USA. They (esp. China) are building out nuclear capacity at a staggering rate; China is the major market for the new AP-1000 PWR. India, faced with a uranium embargo because of its development of nuclear weaponry (it has nuclear-armed China on its border), has been investigating thorium. Both have research programs pushing harder than our laggard efforts in the USA (forget England).

Nuclear power does not (now) compete directly with oil. Nuclear generates electricity, and the vast bulk of the USA's oil-fired electric generation shut down more than 2 decades ago. But ground transport is going electric, and some Gen IV nuclear technologies will be able to serve as process-heat sources for chemical reactions. It's certainly possible for nuclear power to bite further into oil's market share... if the liars who practice the politics of fear and barratry don't block it yet again.

What I see happening with these revolutions makes me seriously question the "religiously radicalised" part. It looks like a secular driven revolt. Desire for democracy, a better distribution of opportunity, and above a need to feel respected seems to be the driving force. Outside of a few areas -especially Pakistan, and Afghanistan (not in MENA) these folks seems only mildly religious to me. I think the radical Islam thing was mainly a desperate attempt to find a way out, as other methods had had no success freeing these people. Now, they have examples of seemingly successful secular revolutions. [I say seemingly, because chasing out the old regimes is the easy part, and as long as the current chaos continues the economies of these countries are slipping backwards.]

The International community is not going to let a civil war get in the way of Libyan oil field production. A no fly zone, ships to protect foreign oil company workers and arming the rebels to the teeth to take Gadaffi out of the equation will all come online to make the black gold flow again.

Add Saudi Arabia, Iran and Iraq to the category of 'Libyas in waiting'. The situation in Bahrain puts KSA in the crosshairs. Bahrain cannot afford to liberalize otherwise KSA's Shiites will demand the same treatment. A Bahraini crackdown triggers a Shia revolt in Saudia's oil producing region.

Twitter is buzzing with grassroots revolutionary defiance in Iran. It is fair to say that that country will boil over soon enough.

The non- OPEC oil producing regions are not stable, either. Success of revolution in Egypt lights the path for revolutionaries in Central Asia and Southern Africa. A people- power revolt in Nigeria gains what decades of militant activity could not at the cost to the West of lower net output.

As is seen in Libya, governments which decide to meet unrest with military force presses net output to zero.

OECD policy has been the flip side of net exports. 'Empty suit' dictators with Western support have constrained demand by monopolizing business activities and development. Elites benefit, the greater publics languish and surplus demand is exported to clients who provide military aid and access to Western finance.

The alternative to dictators are the jihadis and other religious autocrats who also constrain demand to the minimum and export the balance to the west. A bare minimum of domestic development is tolerated but demand is not permitted to flower. This leaves the bulk of producing nations' populations too poor to purchase western life- styles and fuel consumption.

When autocrats fail, factions are enabled and nations become 'failed states'. The end result is the destruction of domestic demand while energy producing infrastructure is maintained. The models are Iraq, Myanmar, Nigeria and to some degree Mexico. Failed states do not have to produce resources: Somalia, Afghanistan, Pakistan, Haiti, Yemen export their demand the same as do Iran and Syria. Failed states 'solve' the net export dilemma.

Next on the imperial agenda are Venezuela and Libya. The UK already has commandos on the ground in Libya training and arming the 'rebel' faction. Who will win the war between rebels and Qaddafi? Nobody, that is the intention. The commandos will secure the oil infrastructure and the citizens will be reduced to killing each other for scraps of food. Domestic demand will fall to zero and the 1.5 million barrels per day of Libyan crude will flow toward precious US SUVs and giant pickup trucks.

The danger is that infrastructure cannot be protected before anarchy makes oil business too hazardous to pursue as has been the case in parts of Iraq. A 'people- power' revolution in Iraq becomes another roadblock to the hoped- for 12 million barrel per day production advertised only a few short months ago.

The 'answer' to the US 'Peak Oil' is the overthrow of the Venezuelan government and installation of an American puppet or the creation of a failed state. Venezuela's vast reserves, second only to Saudia's, would replace imports from elsewhere faster than supplies can be had from Bakken. Creating a Haiti where Venezuela now stands would moot net export issues. US forces are already active in neighboring 'friendly' Colombia.

All that is needed is a people- power 'Twitter Revolution' in Caracas. Anyone out there paying attention?

???

Success of revolution in Egypt lights the path for revolutionaries in Central Asia and Southern Africa

So if the Libyan revolution drags on for months and maybe more-Gaddafi may really feel he has nothing to lose by sticking it out to the dire end--will the movement lose steam? I'm sure 'resources' around the globe are trying to fathom that as we type. If the Libya's oil infrastructure gets hammered but the regional movement stalls as the news Libyans' of increased suffering Twitters out around the globe for months on end will the heat begin to dissipate?

Will the movement lose steam?

I don't think so because it is 'do or die' for the revolutionaries. They lose to the Qaddafis and they get rounded up and shot.

It's the same for the dictators. They have one shot to 'get things right' then the failure -- of the brutal ones -- is met at the end of a rope.

It seems the revolutionaries are becoming more determined. Most places have been under the boot for decades, this following decades under brutal colonial regimes. Plus, so far the revolutions have all been successful. The powers- that- be have no clear winning strategy which is why the Saudis are paying off while the Iranians are mobilizing the Basij. Nobody knows what works except for the revolutionaries who know persistence and a shutdown of economies works.

War works too. This is the real problem. When people stop marching and occupying squares there will be more fighter jets, armor and naval operations. Commandos are already at work. Once the heavy stuff gets involved there will be no turning back.

steve

My point is that all remains fluid--persistence is a relative term. Tunisia' dictator fell in a Twitter second, Mubarak went out a little slower more like a blog thread hour. Gaddafi...not sure yet, it hangs in the balance.

from Aljazeera today

She also said there was no optimism there following news of the ultimatum from the rebels.

"There is no more euphoria of a revolution," she said.

"People are worried it will move towards civil war which will continue for months on end. There is a realisation that there is no institution in this country - that you have to avoid chaos.

The Libyan revolution is only three weeks old--but it's the average Joe and Josephine that have bare cupboards, no work income and losses in their family. Persistence may have to go beyond how the word is defined in a cell phone/internet time frame.

Then you have the outcomes. Yes, Mubarak is out but the army is back in control--not a situation many westerners would consider optimum in their own countries.

Libya...the longer the battle drags on the more likely heavy vendetta in the future. Even the smoothest of transitions could border on chaos--there really isn't a national government or military that is organized beyond what Gaddafi kept under tight personal control. There may well be substantial regional and tribal power struggles in the hierarchy vaccuum Gaddafi's family's departure will leave. Not pretty.

What happens it Libya could cool the Twitter fires some--we will see. If it does the powers in place may get just a bit of breathing room to try and improve their countries situations, though I am certainly not holding my breath on their managing that trick even if they get the chance.

I agree with you, that geopolitics is going to play a big role. Our whole system is so tightly networked, that a spike in prices could cause huge disruption (rising inflation, loan defaults, rising food prices) and these in turn could cause the overthrow of governments. In a way, what we are seeing is really the kind of complex interactions foreseen by Limits to Growth analysts years ago. I don't think we can expect a nice downward slope that can easily be fixed by being more efficient in our oil use. It is hard to predict precisely what will happen, expect that the general direction looks to be "down".

Yair...if any good can come out of the present Middle East situation I reckon it would be a few temporory fuel shortages (particularly in Australia and the US) that may help to clarify the thinking...if you like, a portent of things to come a few years down the track.

As I have mentioned before I post on heavy equipment boards and, for a sector that depends on diesel fuel for its existance, the ignorance of the world oil situation is alarming.

Given that the US is the "swing consumer," it could single handedly ameliorate peak oil by setting a national policy to reduce per capita oil consumption down to European levels. The first thing that needs to be done is to make our transportation system as efficient as possible, eg: I think it's criminal that gasoline taxes are as low as they are.

Unfortunately we are outnumbered 1000 (at least) to 1 by people who think it's criminal that gasoline taxes (prices etc.) are as high as they are.

Agreed. And they also seem to think that teachers are overpaid at $50,000 / yr, but have no problem with traders on Wall street getting million $ bonuses in the year after their company declares bankrupcy. Mystifying.

Maddening in the extreme...

Best explanation may simply be the following, courtesy of George Carlin (heard on the radio tonight):

When you're born you get a ticket to the freak show.

When you're born in America you get a front row seat.

Obviously those traders are our new cultural heros. Teachers and especially other public employees who aren't in the official Pantheon (police, fire, soldiers) are the new heels. If you doubt my first sentence, just watch any business or investment show on the telly. Stock pickers are who we lionize.

I'm not so sure about the "outnumbered 1000 (at least) to 1" presumption.

If I surveyed all the family/friends/neighbours I'm in regular contact with - many of whom I have personally raised to some degree the subject of peak oil - I would say the number is definitely closer to 50 (or less) to 1. Which isn't hopeless.

Then again, your 1 in a 1000(+) is more accurate if we're talking about those trying to kick the BAU habit. Even 100,000(+) to 1 might be quite likely. :-[

How I wish I was a "1".

Cheers.

Me thinks you exaggerate. Its probably more like 10 to 1.

It's not surprising that many North Americans are badly informed. Much of the news coverage has been dreadful.

In today's edition of the Ottawa Citizen, David Warren has a prominent article on the editorial page under the title "Dig, baby, dig". It is breathtaking how complex problems are framed in simplistic terms. A few examples:

"would you rather have your oil at the expense of a few slow-witted dead ducks, or with the blood of a million Arabs?"

"Under Obama, they [the US] now demand it [regime change] for a broad selection of their friends."

"proven reserves of shale oil vastly exceed the reserves of liquid crude ... its amazing what an enormous supply of hydrocarbons was laid in on this planet."

"[on environmental issues] Most of the world now grasps that anthropogenic "global warming" is a sham. Pollution is the real question, and happily the question to which there are more and better technical solutions."

"I cannot help, but think that there are two morals to this story. One is, "Drill, baby drill." And the other is "dig, baby, dig."

"swing consumer"

That's an insightful view of the US position in the global oil market. And our future consumption WILL be lower in any case. So your idea of fixing our transport system is spot on. But most Americans would rather just suddenly run out of gas before they will accept anything that radically changes their lifestyle, IMHO.

Interesting idea but here in the UK, where we like to tax anything and everything to the max, more than half the cost of a gallon of gasoline is tax. Despite that people seem to be driving more than ever.

Currently there's been huge controversy around raising this even further by just a tiny amount - 1p or 2 cents per litre (approx 10 cents a gallon). So any major tax hike would be met with fierce criticism and loss of the next election plus a probable dropping of the tax.

Even if the US did get past those problems surely a swift hike in the cost of gas would have severe economic consequences for the US - perhaps a national recession?

Rationing private car use might be a better solution or for a very quick fix putting the speed limits back down to 55 mph.

Great analysis, as always.

But look for a second at the last sentence: "I am doubtful that the new oil shale sources can ramp up as quickly as hoped, but there is at least some glimmer of hope that these fuels will help keep the day of reckoning away a bit longer."

Glimmer of hope for who? Those who can squeeze an extra few years of easy livin' before the crash? -- a crash that will only be worsened by the delay? Isn't this a rather delusional, psychopathic form of hope? Is this the best we can do -- delusional hope?

I make a plea here for OPENING OUR DAMN EYES. The paradigm shift in fossil energy is upon us. The decisions we need to make are uncomfortable but obvious. MAKE THEM. (www.postpeakliving.com)

I hear what you are saying and don't disagree. But I would appreciate the extra "time" if we can get it. Not for any illusion of "preparing". The more I have thought about that it is a fool's chase. But time to live and play and watch my children grow up, even if we just get a few extra years.

I don't understand people who want this way of live to end sooner than it has to. We all know this is finite. I realize how ugly things will get. But I have found peace from living in the moment.

I get where you're coming from -- I too try to appreciate the good things in my life at present, which are many -- but I find no peace from living off the destruction of the future, which we surely are.

This 'eating of the future' is the terrible, unavoidable truth of our civilization and it gives me only pain -- a pain overlayed with the good, but a horrible, ever-present pain nonetheless.

To not experience such pain along with the joy of life is to be either dangerously ignorant or to be a monster. And to not address it with action is morally criminal.

Here's what I do: http://www.energybulletin.net/stories/2010-12-13/agriculture-stands-chan...

As Catton wisely observed in 1980, the best way to avoid a worst-case crash scenario is to act as if that's the most likely outcome.

"Extra time" is good or not depending on what is done with it. "Extra time" will most likely be spent growing the GPD, the population, and our vehicle fleet, and every oil-dependent bit of infrastructure we can...I hate to sound like a pessimist, but more oil tends to make people think and behave like there's more oil, and the consequences of overshoot are worse the farther out there we get.

degar7 opined:

More time to keep the CO2 PPM climbing in the atmosphere? Good thinking, Degar.

I am afraid we don't have too much to say about the nature of the crash. I am not sure we can even do much about the timing.

But to the extent we can put a crash (of the type foreseen in "Limits to Growth") off, I see that as beneficial. Moving it forward doesn't provide any benefit in my view at all. It doesn't make the crash any less severe, or the world able to sustain any more people after the crash, as far as I can see. If we had taken action in 1972, perhaps some longer term changes could have happened to make the crash less severe, but given where we are now, I don't see any positive benefit at all.

Moving the crash forward does make people feel like they are "doing something." My question would be, "For whom?"

I agree we cannot do much about the timing. BUT...by actively creating shadow structures NOW, to take over essential functions when the crash arrives, we can likely lessen some not-insignificant amount of pain.

But shifting our time/material resources to these 'shadow structures' (i.e. creating local food, energy, transportation, manufacturing systems, etc) requires that we give up trying to pathetically prop up this destructive behemoth of a a civilization for one second longer than it would otherwise last.

Every bit of effort working on the boondoggle of shale oil is effort wasted -- it is effort that COULD'VE been spent on creating these necessary shadow structures. Shale oil/etc is thus a 'part of the problem' -- not part of the solution.

And c'mon Gail -- you do such wonderful energy analyses, but have you no comparably rich knowledge of carrying capacity, overshoot, and other such fundamental ecological concepts?! If you do, I cannot see how you can say, "Moving it up doesn't provide any benefit in my view at all. It doesn't make the crash any better, or the world able to sustain any more people after the crash, as far as I can see." That's a comment unworthy of your intelligence.

To the extent we are building shadow structures, to be helpful for the long term, they need to be built with locally available materials, in a low tech way (depending on biological processes for renewal). This can go on at the same time as whatever else we are doing. It doesn't involve anything that is very costly in today's terms.

You wrote, "[Building shadow structures] can go on at the same time as whatever else we are doing."

No, no, no, no, and no!! You cannot build up local communities, resilience, and biological health with local efforts while at the same time actively undermining those same things with a monstrously destructive, resource-sapping, and childishly-futile efforts to sustain the unsustainable.

You cannot painstakingly build a livable future while at the same time systematically destroying it with 85 million raging barrels a day of industrial energy.

The death-dealing industrial economy and all it's biocidal insanity is NOT compatible with efforts to 'choose life so that we may live.' We CANNOT have both.

+ Good work Dan, you truly get it.

I see a worldwide decline in oil supply as likely leading to collapse, very quickly, because of problems with the financial system. We can't get ready for anything during collapse.

So if we are going to do preparation, it really needs to be while we still have oil supply--at the same time it is in place.

We don't have the luxury of being able to turn off oil, get ready, and then have downslope, in my opinion.

Just so many stone heads Gail.

The heads will be standing but the people left won't have any use for them.

Really the way we are behaving is quite natural and it's called self preservation.....FYJ I'm Okay.

I don't think we'll be thanked for stripping everything. While we "prepare" the biosphere continues to be degraded by relentless population growth. More species will become extinct, the oceans, seas, lakes and rivers mined for food and clean air will be just a memory.

You are right though, we don't have the luxury (any more), it's too late by sixty years. Now all we have left is to make it easy on ourselves. Don't you find that to be sickening?

I'm with Gail on this. We must get ready now while the current system is in place. Once this system falls apart the capacity to prepare will plummet, in my view.

Oh prepare you mean, Disneyland, Las Vegas, Ipads, big screen TV's, McMansions, cruise ships, SUV's........all good preparations. In the meantime to support these energy sapping pursuits, we mine tar sands, drill in deep water, burn billions and billions of tons of coal, explore the Arctic and frac everything in sight.

But who is "preparing"? Is it governments and big business or is it the poor peons so the elite can continue their BAU edicts and also be the ones to get through the bottleneck.

Unfortunatly Bandits is right. No one is going to prepare except a few people in small groups or on the individual level. I'm increasingly comming across people eg tutors and students studying the environment, systems and energy issues, that should understand the problem of resource depletion but dont (although they all seem to think they have climate change in the bag). If these people dont get it then what chance do polititians or the public at large have?

So? Start with where you are with who you've got. What's the alternative? Becoming bitter and resigned? You can choose to do that but I'm not.

Right! I've been aware of oncoming problems for years but still have been making the changes in my life even though I know I'm not having an effect on the big picture. I find that I'm enjoying life a lot more than if I was just going with the flow and doing something that I knew was a major contribution to the mess.

I, myself and me................

Bargaining stage, that psychopathic response hides fear.

You see the enemy. You just don't "know" the enemy. You should though, because it is us.

Read again "The Tragedy Of The Commons".

http://dieoff.org/page95.htm

"I would like to focus your attention not on the subject of the article (national security in a nuclear world) but on the kind of conclusion they reached, namely that there is no technical solution to the problem".

I'm resigned but not bitter. I do try to explain the situation to people close to me but find although they are often nodding their heads yes its not going in. After a two hour chat with my partner explaining the importance of oil in our global economy and its innevitable decline he still later mentioned he thinks its going to be a double dip resession. Must learn some new meothods of re-education.

How are you getting on with the people you know aangel?

Pretty much the same as everyone else...not well. I have accepted that most people will not start changing until the physical world changes around them. Right now the physical world is "locking in" everyone's world view.

So I work with people who get it and are ready to get started.

The key is small amounts of info, over time.

People learn really new things more slowly than we think.

What's wrong with "industrial energy"? The 85 million barrels isn't livable, certainly, but the sun delivers 85 million barrel's worth of energy to the top of the atmosphere in about 3 seconds. We can use it, we just can't expect it from oil.

From the AP article: "And within 10 years, it could help reduce oil imports by more than half..."

Yeah, I could win the big lotto tonight, all of the folks in the ME including Israel and Iran could all get together and sing Kumbaya, folks around the world will decide that a one child policy is their new religion, and the AP could suddenly decide to print only factual information, avoiding couldisms. That would help.

Oil imports will be down by more than half in ten years. The question is whether anything at all will be available to fill the void.

I'm the writer of the AP story referenced above. Great analysis here. A couple of points to clarify: In the story we report that shale/tight/horizontal oil could HELP reduce imports by half. But in order for that to happen US gasoline demand needs to continue to fall, as projected (see related story: http://news.yahoo.com/s/ap/us_guzzling_less_gas and graphic: http://hosted.ap.org/specials/interactives/_business/us-gas-consumption/....) And GOM production needs to get back on the upward trajectory it was on pre-Macondo. As for it being a "new technique" well, that's a question of semantics (and a pretty irrelevant one, I'd argue). Sure, hydraulic fracturing and directional drilling have been tried long before, but the refinements referenced in this analysis that allowed this technique to economically tap tight oil matter and can very credibly called new--not just by me but by the people in the industry I spoke to for the story. Galileo's telescope used lenses. So does the Hubble Telescope. One final thing that I'd love to explore more: While reporting this story one analyst said something along the lines of: 'We've already pulled out 160 billion barrels of oil that happened to have seeped out of the source rock into reservoirs. Now we can go right to the source rock, and there may be another 160 billion barrels there...or some multiple of that.' Wow. Thoughts?

-Jonathan Fahey

If the source rocks had the same recovery factor as the conventional reservoirs, the 160 billion barrel analogy (from numerous US basins) might be approximately correct, but there is a huge difference in permeabilities and recovery factors*. I think that the last upper end estimate by the USGS (which is traditionally wildly optimistic) is for about 4 GB (billion barrels) for recoverable reserves from the US side of the Bakken Play.

*We'll see what the other Oil Patch types say, but in my opinion, whoever made the 160 Gb statement about conventional reservoirs and source beds should be sentenced to 20 years hard labor in Siberia.

On a different topic, you might want to research the difference between Peak Oil and Peak Exports. Some articles to ponder:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Peak Oil Versus Peak Exports

Excerpt:

http://www.energybulletin.net/stories/2011-02-21/egypt-classic-case-rapi...

Egypt, a classic case history of a rapid net export decline, and a look at global net epxorts

And my standard comment on the Saudi's "Excess Productive Capacity"

http://www.theoildrum.com/node/7554#comment-770186

Jeffrey Brown