Egypt’s Natural Gas Trends and Potential Impacts

Posted by nate hagens on February 14, 2011 - 10:33am

The following guest post is from Jonathan Callahan, a PhD chemist currently working as a data management / information access consultant. Jonathan writes on energy issues and data management at Mazamascience.com

Current events in Egypt and throughout the Arab world have captivated world attention and with good reason — in 2009, Arab nations exported approximately 17 million barrels of oil and 18 billion cubic feet of natural gas every day.[1] Developed nations are extremely dependent upon this steady flow of energy into their economies.

North American audiences are very focused on the oil part of that equation. A recent article in The Oil Drum has analyzed the oil situation in Egypt, including its recent slide from oil exporter to oil importer. This post examines the other half of the equation — Egypt’s production, consumption and exports of natural gas and the impact existing trends will have on nations that import that gas.

Geologic Setting

To fully understand trends in fossil fuel production one must know something about the geological prospects within a region. Among the most concise and well written geologic summaries are those published by Colin Campbell in his ASPO Newsletters. The following excerpt comes from his 2009 Country Assessment for Egypt which is well worth reading in its entirety.

Geology and Prime Petroleum Systems

In geological terms, there are three main productive basins, of which by far the largest is the offshore Gulf of Suez, where oil is trapped beneath Miocene salt. [...] The third basin is the Nile Delta, which is a gas province. The Mediterranean shelf is narrow and steep. It might hold some deepwater potential, but the chances are slim.Exploration and Discovery

Exploration [for oil] commenced in the 1920’s [...] but overall exploration is at a mature stage, with the larger fields well into decline. Exploration drilling [for oil] is expected to decline and draw to a close around 2030 as fewer and fewer prospects remain to be tested.The Nile Delta holds substantial gas reserves of about 50 Tcf and offers some further potential. The country’s total reserves amount to about 65 Tcf.

Production and Consumption

Oil production commenced in 1914 but did not rise significantly until after the Second World War [...] Consumption has risen steeply in recently years to reach 241 Mb/a, meaning that the country is already a net importer.Gas production commenced in 1935 and reached an early plateau at around 1.5 Gcf a year from 1941 to 1953 before falling steeply. A second surge of production came with the opening of the offshore in the Nile Delta to climb steeply over the last few years to almost 2 Tcf a year. It is now expected to plateau at about 2.2 Tcf/a for the next two decades before declining steeply. Consumption has risen in parallel. Along with related Gas Liquids, it will be an increasingly important source of energy for the population centres of Cairo and Alexandria.

In summary, Egypt’s oil fields are all mature and in decline while natural gas is mostly limited to a single province — the Nile Delta. Campbell sees this province achieving a peak in natural gas production at 2.2 trillion cubic feet (Tcf) per year (6.0 billion cubic feet per day). This is very close to current production levels.

The Egyptian Natural Gas Holding Company (EGAS) is a little more optimistic than Campbell regarding total reserves:

Recoverable natural gas reserves reached 78.1 TSCF as of June 30th,2010 The Mediterranean area holds the largest amounts of total gas reserves of 76% followed by the western Desert 11%, Gulf of Suez 7% and the Nile Delta 6%.

Gas reserves yet to prove is estimated to be 120 TCF which still need further efforts maximizing utilization of latest technological advances in the field and increasing investments in exploration and production as well as attracting foreign international investors.

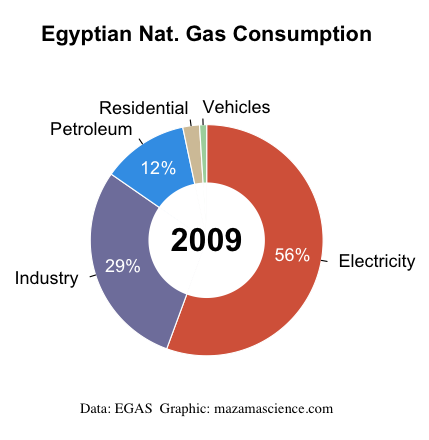

With oil in decline, Egypt is increasingly reliant upon natural gas to fuel power generation, as a source of export revenue and to fuel transportation. (In 2009, Egypt had 122 thousand vehicles running on Compressed Natural Gas (CNG) according to EGAS. The milestone for 2015 is 300 thousand vehicles.)

Production and Consumption Trends

To put Egypt’s overall situation in context, let’s first take a look at the trends in population and net oil exports.

Figure 1), from the Population Trends databrowser, shows Egypt’s rapidly rising numbers. Many have been aware of Egypt’s population problem for years but the inflationary summer of 2008 saw awareness spread to the main stream US media with the NY Times article: Egypt fights to stem rapid population growth.

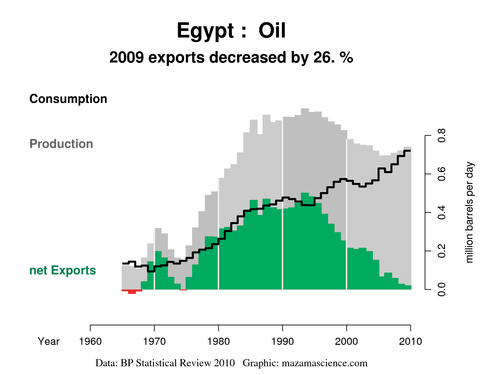

The recent political crisis has called attention to Egypt’s rapid fall from oil exporter status as seen in Figure 2) from the Energy Export databrowser.

Even though oil production has been up in recent years, consumption has increased so rapidly that it has overtaken production causing net exports (production minus consumption) to decline to zero. Egypt is now an oil importing nation. Like Indonesia before it, Egypt is a classic example of the Export Land Model as proposed by geologist Jeffrey Brown.

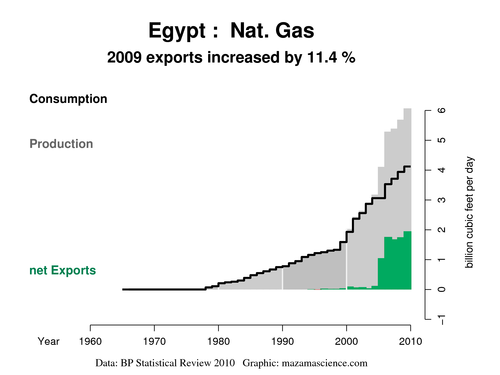

Unfortunately for Egypt, the proceeds from oil exports that helped to subsidize water, food and fuels for the impoverished masses have been replaced with an expense. On the positive side, exports of natural gas have been up in recent years as seen in Figure 3) from the Gas Trends databrowser.[2]

The breakdown of Egypt’s internal consumption of gas by sector is given in Figure 4) with power generation, industry and petroleum production consuming the lion’s share.[3]

If Campbell’s assessment of a maximum production rate of 6 Bcf per day is accurate, there is little room for growth on the production side. Given current trends, Egypt will soon face reduced exports of natural gas unless it can reign in consumption. This seems unlikely in the face of rapid population growth and the changing lifestyles of Egypt’s High-Energy suburbs.

It is clear, then, that Egypt’s ability to export natural gas will be reduced in the coming years unless it either 1) makes huge and unanticipated new discoveries or 2) radically reduces its own internal consumption. Neither of these is likely. Given that knowledge, nations that currently import Egyptian gas should be looking to replace those supplies within the next decade, regardless of what is written in any contracts.

Natural Gas Export Infrastructure

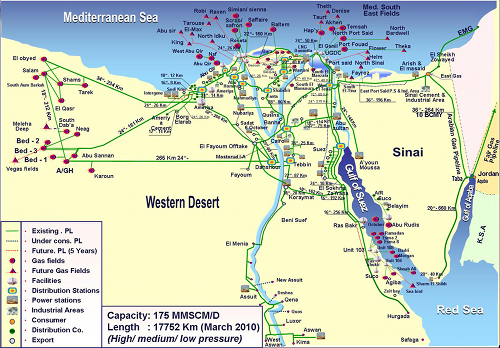

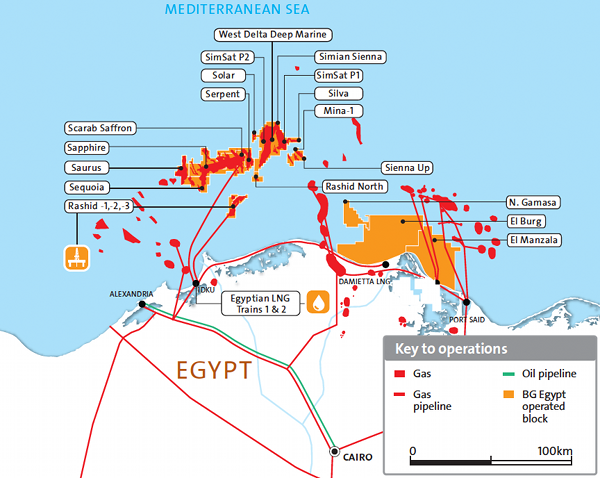

As seen in Figure 3), Egypt currently exports 2.5 Bcf/day of natural gas via pipeline and LNG which represents 38% of total production.[4] An overall view of the natural gas fields, pipelines and LNG trains is seen in Figure 5) from the Egyptian Natural Gas Holding Company.

Natural gas pipelines connect offshore fields with the major population centers of Alexandria and Cairo as well as the LNG trains in Idku and Damietta. A closeup of the Nile delta and offshore region, showing individual fields is given in Figure 6) from the BG Group country profile for Egypt.

A 36″ pipeline connects the Nile Delta producing region to the Sinai town of El Arish. From El Arish, the Arab Gas Pipeline carries Egyptian natural gas to Jordan, Syria and Lebanon while the Arish-Ashkelon undersea pipeline carries gas to Israel as seen in Figure 7) which comes from Stroytransgaz, the Russian firm contracted to build the Syrian segment of the Arab Gas Pipeline.

The EIA Country Analysis Brief section on natural gas succinctly summarizes Egyptian natural gas exports:

Exports

Egypt began exporting natural gas in the mid-2000s with the completion of the Arab Gas Pipeline (AGP) in 2004 and the startup of the first three LNG trains at Damietta in 2005. In 2009, Egypt exported close to 650 billion cubic feet (Bcf) of natural gas, around 70 percent of which was exported in the form of LNG and the remaining 30 percent via pipelines.Pipelines

Egyptian pipeline exports travel through the Arab Gas Pipeline (AGP) that provides gas to Lebanon, Jordan and Syria with further additions being planned. The Arish-Ashkelon pipeline addition, which branches away from the AGP in the Sinai Peninsula and connects to Ashkelon, Israel began operations in 2008. Domestic pressure over contracts, pricing for exports to Israel, and technical problems caused a few interruptions but exports resumed in 2009.Liquefied Natural Gas (LNG)

Egypt has three LNG trains: Segas LNG Train 1 in Damietta and Egypt LNG trains 1 and 2 in Idku. The combined LNG export capacity is close to 600 Bcf per year with plans to expand in the near future pending export policy changes and legislation. In 2009, LNG exports were approximately 450 Bcf. The largest recipient of Egyptian LNG for 2009 was the United States, which imported around 160 Bcf, representing 35 percent of Egyptian LNG exports for the year and also 35 percent of U.S. LNG imports. Other major destinations for Egyptian LNG include Spain (32 percent) and France (13 percent) with smaller volumes travelling to Canada, Mexico, Asia and other European countries.

Importers of Egyptian Gas via Pipeline

The recent attack on the Egyptian pipeline facilities in the Sinai has heightened concern in nations that receive pipeline imports from Egypt. Below, we summarize the natural gas situation in each nation that imports gas from Egypt. (A more thorough review of the total energy situation in the Levant is available in the 2008 Energy Profile of the Eastern Mediterranean.)

Jordan

Jordan has one producing natural gas field which provides 25 million cubic feet per day of gas to fuel a single power plant.[5] Egypt provides Jordan with over 232 million cubic feet per day at subsidized prices.[6] The Kingdom of Jordan thus relies on gas from Egypt for 80% of its electricity generation needs. A recent article in the Jordan Times covers what happens when Egyptian gas becomes unavailable:

“We have converted all our power plants to heavy fuel oil and diesel and all plants are in operation,” NEPCO Director Ghaleb Maabreh told The Jordan Times.

“We are on the safe side in sources of fuel and availability of power,” he said, stressing that there will be “no power cuts” as long as reserves last.

According to NEPCO, the Kingdom’s power plants have two weeks worth of diesel and over one month worth of heavy fuel in strategic reserves.

Maabreh noted that the switch to heavy oil and diesel for electricity generation will be “more expensive”, but declined to estimate the amount the disruption will cost the Kingdom, adding that the full financial impact will “be clearer” once individual power plants report later in the week.

“Right now our first priority is to have a secure supply of power rather than to think of costs,” he said.

When natural gas supplies from Egypt dropped to 70 per cent of their normal levels last summer, the Kingdom witnessed various brown-outs and blackouts affecting the water distribution.

Based on the impact of the previous drop in supply, it is believed that the current disruption will cost the Kingdom “millions” each day.

Syria

Until recently, Syria has been largely self-sufficient in terms of natural gas. Newly constructed, gas fired power plants are the main users of recent imports from Egypt which amount to 66 million cubic feet per day or about 8% of total consumption.[7]

Lebanon

Lebanon has no natural gas of its own and recently generated 87% of its electricity with oil products, mainly gas/diesel and residual fuel oil. The remaining 13% is produced with hydro.[8] With the arrival of the Arab Gas Pipeline in Tripoli in 2009, however, a previously defunct power plant has been converted to run on imported Egyptian gas, significantly reducing fuel costs.[9]

The recent discovery of the Leviathan gas field off the coast of Israel has Lebanese excited about the natural gas prospects off their own coast and determined to carefully demarcate their maritime boundary with Israel, with whom they are still technically at war. The regional dynamics associated with this discovery are explained in an article in Atlantic Council.

Israel

Israel has embraced natural gas in its attempt to diversify its sources of energy. According to the Israeli Ministry of National Infrastructures, major extensions are proposed to the existing pipeline infrastructure (see map) as part of a “national outline plan”. The recent pipeline blast in Egypt has heightened Israeli fears of their dependence on Egyptian natural gas. An article in Time magazine reports:

The explosion that ripped through a natural-gas pipeline in the northern Sinai Desert on Saturday, Feb. 5, did more than cut off the flow of Egyptian fuel to Israel and Jordan. It also deepened Israeli fears about the changes under way in a powerful neighbor rendered at least neutral over the past 30 years by a peace treaty that might not survive the change in government.

...

Egypt supplies Israel with some 40% of its natural gas, which Israel now uses to generate electricity, replacing dirtier coal and diesel. The two countries are barely three years into a 15-year contract for 1.7 billion cubic meters of Egyptian gas a year, provided via an undersea pipeline that branches off the line shattered by the blast.

Efforts to develop the recently discovered offshore gas fields, especially the large, deepwater Leviathan gas field have shifted into high gear. Once these offshore fields are brought on line, most likely beginning with the Tamar field in 2013, Israel can look forward to over a decade of energy independence.[10] (It is perhaps worth noting that Noble’s Leviathan-1 well is in 5400 ft of water. For comparison, the Deepwater Horizon was drilling in 5000 ft of water.)

Importers of Egyptian Gas as LNG

Unlike the nations that import Egyptian gas through pipelines, the main importers of Egyptian LNG are nowhere near as dependent upon Egypt as a main supplier of natural gas.

US imports of LNG equivalent to 160 Bcf represent less than 1% of annual gas consumption in a nation that is largely self-sufficient in natural gas. Spain’s imports of 145 Bcf represent approximately 10% of Spain’s annual consumption, all of which is imported. France is also completely dependent upon imports but only receives 78 Bcf from Egypt which amounts to 5% of annual consumption.[11]

Summary

The natural gas trends in place do not bode well for Egypt’s export capacity in the coming years. Increased internal consumption combined with a relatively mature natural gas province imply that exports of Egyptian gas will begin their inevitable decline sooner than anticipated. Indeed, Egypt may be scrambling to live within its own energy means before the end of the decade.

Of the two importing nations heavily dependent upon gas imports from Egypt, Israel is in the happy position of having significant recent discoveries within its maritime jurisdiction. For Israelis, energy independence is a distinct possibility if they can develop those fields before the decline in Egyptian exports. Jordan, by contrast, is in an extremely uncomfortable position with no reserves of its own and no immediate replacement for Egyptian gas. Their only hopes may be for a completion of the Arab Gas Pipeline, hoping that the flow may be reversed to deliver Iraqi or Kurdish gas to Jordan, or for such massive production in Israeli fields that they overcome political differences and begin imports from Israel.

“Gas for Peace” may be a phrase we hear before the decade is out.

- BP Statistical Review of World Energy 2010 [↩]

- It is worth noting that the BP data used in Figure 3) differ significantly from EIA data for Egypt which has recent production and consumption numbers almost 25% lower than those found in the BP dataset. [↩]

- Data used in Figure 4) are from the Egyptian Natural Gas Holding Company. [↩]

- Egyptian Natural Gas Holding Company [↩]

- Energy Profile of the Eastern Mediterranean [↩]

- Attack on Egypt gas line forces Kingdom to use fuel reserves (Jordan Times, Feb. 11, 2011) [↩]

- Egyptian Gas to Israel, Jordan May Halt for Two Weeks (Bloomberg, Feb. 06, 2011) [↩]

- State of the Energy in Lebanon [↩]

- Lebanon Receives Egypt Gas To Run Power Plant (Downstream Today, Oct 20, 2009) [↩]

- The Sinai Gas Blast: Another Reason for Israeli Anxiety over Egypt (Time, Feb. 07, 2011) [↩]

- All data from the EIA Country Analysis Brief and BP Statistical Review of World Energy 2010. [↩]

As usual, Jonathan's analyses drive right to the heart of the consumption/export trend, with a hat tip to those who brought us ExportLand awareness. Thanks Jonathan and Nate.

As so much gas is used for electricity, Egypt would do well to increase their participation within Desertec as both a generator and consumer.

Egyptian Solar Research Center

150 MW solar thermal pilot project in Egypt

Egypt: Desertec Project to be Linked to the Arab World

And there are also significant wind resources in Egypt as well;

Predicted wind climate of Egypt determined by mesoscale modeling | The map colors show the mean power density in [Wm-2] at a height of 50 m over the actual (model) land surface. (World Bank)

Thanks for this report. The question is for how long revenue from gas exports can pay for petroleum and other subsidies in terms of dollars.

It is interesting that Egyptian gas supplies to Jordan are subsidized. Once domestic gas supplies get tight, exports to Israel are likely to be reduced first. Next, subsidies will be cut. There are plenty of conflicts pre-programmed.

We should closely follow what kind of energy policy the Egyptian military are pursuing.

In case we see Parliaments in Arab countries being established and working, we can expect that oil and gas reserve issues will be discussed. This would inevitably lead to the public realizing that their easy oil was sold off by their former rulers and that there might not be all that remaining oil they thought there is.

Quote from a report on subsidies

More on subsidies:

31/1/2011

Egypt - the convergence of oil decline, political and socio-economic crisis

http://www.crudeoilpeak.com/?p=2525

Yes.Now that they have no oil export revenuse, they are going to have to burn their gas candle from three ends-domestic use, sale to purchase oil, and sale to purchase all other necessary imports including food.

They need a miracle- a candle with three ends.Methinks they are in deep doo doo.

Seriously, does anybody think the Egyptians can develop any sort of export industry to pay for their food imports in an ever more competitive world where the race is either to the bottom low wage producer, or else to the barricades behind import tariffs?

Tourism ain't gonna pay the Egyptian grocery bill no matter what.

With airfares following oil prices up and domestic disturbances likely on the ground, and a depressed economy just about everywhere, my first guess is that tourism can't even make a serious dent in the import bill.

Mexico is not too far behind, but the Mexicans have more options by a long shot-such as more arable land and much more rainfall.

Mac, we get early potatoes from Egypt here in holland so they are most likely in deeper doo doo.

It seems obvious that demand needs to be addressed, as they will not have the funds to maintain current consumption rates. So that suggests greater reliance on bicycles and buses for transportation, and tiered (and/or realtime) pricing for residential, commercial, and industrial electricity use (the former based on a set tiering structure, and the latter two based on the current consumption levels of each business customer, to incentivize efficiency). For example, a current commercial or industrial company could be given the same rate for 90% of the previous usage, and a surcharge of 25% for the next 15%, an additional 25% surcharge for everything else above that. This is all very much in practice today in other places;

http://www.pge.com/myhome/customerservice/financialassistance/medicalbas...

"Tourism ain't gonna pay the Egyptian grocery bill no matter what." You're right there are few tourists there now and in Northern Europe many people book their main summer holidays about now, obviously many will choose not to go to Egypt (and Tunisia). There are reports that a number of antiquities were looted. The Red Sea resorts of Sharm el Sheikh, Marsa Alam and Hurghada attract thousands for the sun, diving and the beaches and whilst they have been quiet my guess is there will be a big downturn this year. Back in 90/91 during the first Gulf War it was very quiet, the Muslim Brotherhood terror campaign that followed also didn't do much for tourism.

Tourism accounts for something like 10% of all emoployment and similar amount of the GDP.

Egypt needs to be added to my list of countries deep in Peak Oil fecal matter to keep a watchfull eye on.

Other areas/nations so far is:

Mexico

Yemen

Hawaii/Los Angeles/Las Vegas (seriously, what will they do in a PO world?)

Me thinks Pakistan would feature on the list to. This list is gonna grow...

The big island of Hawaii, (and Maui to a lesser extent) has huge geothermal potential, and there is methanol, wind and wave potential throughout the archipelago. The Islands hydro potentential is hardly trifling-the mountain top the center of Kauai is arguably the wettest place on the planet. But right now Hawaii gets virtually all its energy from imported oil--not to mention its tourism income from jet fuel. Yes they could be a bit of a coal mine canary.

I think Pakistan should be far ahead of Egypt on the worry-meter.

As the recent revolution has demonstrated, Egypt is relatively educated, peaceful and homogeneous. Egypt will have tough times ahead and needs to embrace birth control but I cannot see how it could become a 'failed state'. I am less sanguine about Pakistan.

"exports to Israel are likely to be reduced first" I wouldn't bet on this for both financial and geo-political reasons. Making less money per unit is probably not what the Egyptians "government" are thinking about right now

with approaching 10% of their GNP (through tourism) not going to show up for some number of double digit months (the six months of suspended constitution is not a big draw). Additionally Egypt cannot afford an

angry Israel, Lebanon thought they could and they are still running a 50% duty cycle on electricity in Beirut and 20% in the countryside. No one can afford to lose any of their infrastructure due to natural disaster, riot and war,

there simply isn't enough money (or energy) to replace it with very rare exceptions. This is a time to be very cautious and conservative if you own a bit of infrastructure.

Note my comments at the bottom of the thread. It appears to me that Israel (after the gas export agreements were re-negotiated in 2009 to $4-$5mmbtu) probably pays the most out of Egypt's major export markets (the exports to Jordan are "subsidized" and they sell LNG today at about $3mmbtu). However, for political reasons, it is always convenient in Arab countries to blame Israel for various woes, whether Israel is in any way responsible doesn't usually matter.

While Israel is a very small country (both in population and land-area) compared the the states around it, its per-capita production (and consumption) of Electricity is way higher than any of the surrounding countries. This, combined with it also having relatively speaking the most developed heavy industry in the region (particularly in the area of chemicals, pharmaceuticals and fertilizers) means that it has the potential of being one of the largest NG markets in Egypt's vicinity and it was foretasted that Israel would purchase 7BCM a year from Eygpt by the end of the decade.

The newborn political parties in Egypt are demanding that Egypt stop exports to Israel. What it means is on a long term basis Egypt might lose its most important export market and instead be relegated to selling LNG or "subsidized" gas to Jordan and Lebanon (whose markets as compared to Israel are much smaller anyway) or having to sell to Europe via very long pipelines, while competing with Iraqi and potentially Iranian gas.

Above "The recent attack on the Egyptian pipeline facilities in the Sinai" my contacts told me it was down to poor maintenance and the blame was shifted to those "foreigners" who were being blamed for inciting riots.

What a mess ...

And doesn't anyone else find the constant reference to twitter, twitter, facebook, facebook,regarding this "revolution" kind of obscene ?

(without even going to the current moves around facebook capital and Goldmann Sachs)

It is obscene, but I also find it a tad ironic that the enabling technology of facebook and twitter will enable the destabilisation of the economy that will help bring about the collapse.

It reminds me of Douglas Adams's Babel Fish. The cause of more wars and misery than anything else in the universe.

According to EIA Country Analysis Briefs - Egypt - Last Updated: February 2011 Egypt is in the position of importing oil and exporting gas. Clearly, to control balance of trade, Egypt will need to convert energy uses from oil to gas wherever possible and curtail gas exports.

The gas export pipeline network appears to be completely politically contrived, especially the exports to Israel, which no doubt reflect US dollars paid to the Mubarak regime. Same for the exports to Jordan. If Jordan can pay market prices, it should be able to get gas from Iraq and Iran via Syria.

I think it's probably fair to say that Jordan cannot pay market prices, at least not in the long term. Nevertheless, pipeline work to hook up all the nations of the region is well underway:

It looks like Syria is becoming a very important gas transit nation within the region. As is the case in Austria with their Baumgarten hub, this may mean that Syria will enjoy a high level of natural gas security going forward.

Jordan is yet another unstable, post-colonial contrivance, now a majority of which is actually Palestinians, yet ruled by a King descended from the Hejaz.

Excellent as always, Jon. The NGV Global (formerly know as The International Association for Natural Gas Vehicles - IANGV) says Egpyt sported 119,679 NGVs in 2009, a perhaps implausibly precise number. The data from NGV Global is very interesting but I wonder about how solid it is; they are an advocacy outfit, after all.

The NGV-G site has a handy chart you can pull up with size of NGV fleets for each year 2000-2009, plus total fleet size (in most instances) and # of fueling stations for 2009 - I saved the 2008 numbers, Egpyt added an extra lone station...for NGVs as % of total fleet they went from 2.92% in 2008 to 5.04% for 2009. The numbers provided for this % on the site are still using 2008 figures for some reason. The fleet size number is from, ack, 2005...fresher data will set you back €330 from the International Road Federation. Egypt are 13th in the world for NGVs as % of fleet. I mean to do a more comprehensive breakdown of how, if at all, NGVs are helping to curb fuel use.

Excellent post. I found it interesting that

Once these offshore fields are brought on line, most likely beginning with the Tamar field in 2013, Israel can look forward to over a decade of energy independence

gee whiz a whole decade--that may seem big to an election cycle but not to much else.

On a related note: A few years back (my, my on checking it's been over a decade) Bob Ballard was looking for wrecks off Gaza. He spotted some promising mounds on the sea floor. As he increased the size of the survey a huge field of mounds came into view. He realized these weren't wrecks but rather indicators of an undersea gas field. Haven't heard much about exploration off Gaza.

Regarding the electricity supply for the Gaza-strip, if memory serves me correct, it is 60% supplied by the israelis, 35% by the egyptians and 5% from a diesel fueled plant where the diesel comes from Israel. I guess it is all heavily subsidised. But what can they do other than import, there is no known energy source on the strip, untill/unless they find an offshore gas field?

Finding the field is one thing, Gaza getting the benefit of it is another. Lots of articles out there on the subject. The biggest number I saw was a mere trillion cubic feet though. Stop gap stuff.

edit: well lots more pages come right up on google now--too many--estimates from 3-35 trillion cu ft. with just a quick look. Anyone have reliable reserve numbers Gaza and Israel. Marco your 22 trillion cu feet number is ballpark for what I saw on Israel's northern offshore play, but the Gaza numbers I found are all over the map. Thats what happens on politically hot topics I guess.

Okay, I checked to get more accurate figures, there are two proven gas reserves off of Gaza, Gaza Marine-1 and Gaza Marine-2. Together BG estimates them at about 40-45BCM total. Anything outside of these estimates are just speculation.

BTW, Israel would gladly buy this gas from the Palestinians, but politically it is a difficult deal to consummate, at least these days.

Thanks that fits with I originally found, the trillion or trillion and a half cu ft range. Pretty much stopgap stuff. Still to a place with no resources its a significant find.

Is Gaza likely to sell off a large part of the resource? It would seem more to its advantage to use it to develop its own systems--except Gaza probably needs the currency gas sales could generate desparately.

Gaza has little to no infrastructure. They would need a lot of capital investments to able to do something with the gas. Everything there is stymied by the fact that Hamas rules Gaza and the PA the West Bank and those two aren't on good speaking terms so even getting some sort of agreement on what to do with the gas is difficult. Given the geographic location of Gaza's fields, besides selling it to Israel, there isn't much they can do with it either (unless maybe Egypt would want to share the Arab Gas Pipeline, which I doubt they would).

I don't know about exploration but here is an article from 2009 that attributes the 2008-2009 Gaza War to Israel's desire to control the offshore gas fields:

The Chossudovsky article is a good one. Reading

Geopolitical Time Line: War, Natural Gas and Gaza's Marine Zone

Fishermen's Rights versus the Development of Natural Gas as a companion piece is also worthwhile.

I had read about Ballard's accidental discovery in a little article (possibly from the online MSNBC Science section) back in either 1999 or early 2000 so when the 2nd Intafada exploded in fall of 2000 my ears were tuned in waiting to hear the Gaza offshore gas find mentioned. I never picked up on a peep in MSM.

Oh stupid me, here I thought that war started when Hamas refused to prolong the 6 month cease fire agreement, and instead launched 80+ rockets into Israel. But there you see, Israel was behind it all the time.

Israel effectively handed the rights to the gas fields off Gaza to the Palestinian Authority (with British Gas owning the development rights). This was done when Ehud Barak was in charge. To this day, right wing parties in Israel blame Barak for "giving away" those rights; however, politically, it was the only sane move to make.

At the end of the day though, those reserves don't matter as much. Even though they are easier to develop, they are much, much smaller that the more recent discoveries made in Israel's own waters, albeit, much further out from the coast.

An email I received from B.H. reminds us that Egypt is also a net exporter of electricity to its immediate neighbors:

Here's the contents of the article in naharnet:

Here is a comparison of key oil production, consumption and net export numbers for the ELM, Indonesia, UK and Egypt. Egypt's net oil exports are negligible now, but I assume that they became a net importer in 2010 (BP data). The EIA already shows them as a net importer. Note how rapidly post-peak CNE (Cumulative Net Exports) are depleted in all four cases.

The gross revenue per capita from net oil exports for Saudi Arabia, Kuwait and UAE together is approximately $13,500 per annum. These countries are widely expected to sidestep the wave of unrests, doubtless because they have been buying off their populations for a very long time.

The gross revenues per capita from net oil exports for Egypt, Tunisia, Yemen and Bahrain together is approximately $48 per annum - two hundred and eighty times less than the revenue of their rich Gulf cousins. The regime has already fallen in the first two and is under serious challenge in the second two, with angry people in the streets.

The math for this and the charts are here.

Note - the per capita figures in the comment above are based on mazama science's population data browser. I suspect these figures include the millions of Asian workers in Kuwait, Saudi and UAE who are not recipients of the benefits from oil sales? If so, the "appeasement effect" with respect to the citizens should be even stronger than the $13,500 per capita per annum.

good point to mention. On related note I found this article gave bit of a look at the road naturalized Saudi's travel. It ends:

"Getting a decent education for their children and setting up businesses for them or helping them land a job ... all demand huge resources," said Amin Mohammad, a Saudi of Syrian origin. "It's very, very tough. It is not as if once you become a Saudi you are given a tree that bears nothing but riyals."

Egyptian gas resource extremely notable and scrambling to live within it's own energy. In the interesting sources that Egyptian gas supplies to Jardan are subsidized. Egypt has several natural gas holding company & fuel reserve stock. Gas for peace is an awfully astounding column you've posted. Thanks a lot for that a fantastically amazing post!

Jonathon, Well put.

What a mess indeed, but only the tip of the iceberg. Egypt is heading into the soft and smelly and it will drag others down with it. Once the ME energy profligacy comes to an end the likelihood is that Europe will be dragged into the whirlpool as well.

Look at the current situation with refugees from Tunisia heading for Italy. How do you stop them. Once they get to Europe removal is all but impossible, especially with the liberal interpretation of the European Human Rights Act.

As energy prices balloon, which is already heappening, the debt obligations of all consuming nations will escalate. Take the EU, 16 million b/d . $50 barrel oil = $300 billion per annum for oil. $100 barrel oil = $600 billion. How are we going to pay this? What are we going to export and to who?

Meanwhile the global population continues to grow, especially in the ME and Africa. Homo Philoprogenitus continues his march across the world unchecked. Our politicians sit and "Watch this Happen", and in another decade will be "Wondering what Happend".

The efforts of many NGO's to help the world's poor and starving are noble efforts; but if they are not matched by sensible efforts to control population growth these efforts will be in vain beacuse all that will happen is that there will be a steady increase in the absolute number of the poor and starving. Witness Afghanistan.

Peak Oil, Population Growth and the Environment are linked at the hip. You have to treat all 3 and time is running out.

Otherwise I am afraid it will be the 4 horsemen.

I have given up waiting expecting people to see reason. It will be the four horsemen.

This is evolution in massive overdrive. Millions (billions?) will survive and billions will die. It is natural selection.

Edpell,

I fear you are correct. Obviously the blatantly obvious is not so obvious to most. Like you,I agree the numbers surviving will be in the millions rather than billions as the the world adjusts to living from the solar flux.

So much for man's supposed intelligence. The olduvai gap awaits.

Next tinderbox. Yemen - same problem. Population, religion, no water, no oil/gas, no hope.

One part of the gas resource equation not discussed is the potential resource sitting in the southern part of the Gulf of Suez and the NW part of the Red Sea. Conoco discovered a fairly large gas field offshore at Hareed back in the nineties and it was never developed simply because the economics would not warrant a subsea pipeline in relatively deep water. Given that domestic gas prices are low due to subsidy and there is zero gas infrastructure this far south the area has not recieved much in the way of exploration. There were some wells drilled by Exxon back in the eighties but the notion that heat flow is extreme and hence gas more likey than oil has kept exploration from proceeding at a normal pace. Given better economics one should expect to see some gas added into Egypt from this area.

Boo!

Id flag my own thread as inappropriate but I guess I cant delete it so....

The preoccupation with OTHER peoples RESOURCES is reprehensible. If it were true good will in intent, well that is one thing, but as was pointed out in the article above,

BY the way, American "audiences" are NOT very focused on the oil part of the equation at all, YOU are.

The preoccupation with OTHER peoples RESOURCES is reprehensible

Hmm, I thought that the way it very often works is that for a price other's resources become the buyer's resources. Showing that Egypt had quit selling oil resources certainly is of interest to potential buyers as is showing how long they will be selling natural gas.

BY the way, American "audiences" are NOT very focused on the oil part of the equation at all, YOU are

As a general rule I'd agree that the vast majority of people constituting North American audiences are not too focused on oil--that is I believe what you meant to say. The focus sharpens when the price at the pump jumps or heating costs suddenly suck up a much larger portion of the household budget. Since overseas oil and gas production have major impacts on those items, some preoccupation with OTHER peoples RESOURCES would seem more unavoidable than reprehensible.

Folks, a reminder of the TOD comment guidelines found here.

Off topic, personal attacks, and excessive thread-hogging type comments will be deleted. Why we care about Egypt and their energy situation is definitely a relevant question, but there are limits.

Lets try to keep this forum readable, civil and on topic please.

Well said Nate, by the way while reading the comment section, some questions come to my mind, but most of them are probably to complex to post them here on TOD, is there any way to reach you personally, or do you even have the time to answer?

Israel's reserves in the article are listed as lasting about a decade of consumption. The Tamar and Leviathan fields at last estimates together hold appx. 650BCM of natural gas. That should last Israel well over four decades of consumption, not one. Not to mention the fact that deepwater drilling in Israel is still in its infancy. These 2 finds were located within a year of each other and there are surely more large discoveries to be made.

Funny that it is often remarked how Egyptian gas is sold to Israel at what is supposedly a super-ultra-cheap rate (but is actually @ $4-$5mmbtu) through its short pipeline to Ashkelon and why due to that fact all Egyptians are enraged and the public there demands that it should stop selling the Israelis gas. At the same time, Egypt sells LNG at about $3mmbtu which makes no sense why they would be all up in arms against sales to Israel if their alternative is to sell the gas as LNG for substantially less. Currently the agreement between Israel and Egypt allows Israel to purchase up to 7BCM of gas per year (and the demand is there) and due to the political winds in Egypt, that agreement may be unilaterally canceled by Egypt. From what I can tell, that would be a significant loss to Egypt, not a gain as the former 'opposition' and soon to be main political parties in Egypt claim. Go figure.

BTW, it is often mentioned that Egypt sells Jordan gas at 'preferential' rates. Does anyone know what the actual $$ amount is?

How cheap can the deep water gas be produced?

Current estimates to develop Tamar is about US$3 billion. Rather high but when you consider the fact that probable reserves in that deposit are about 250BCM (proven 185BCM, estimated by NSAI), then it's not too bad. Also, the same consortium that will develop Tamar will also develop the nearby Leviathan so there will be some savings on shared costs there. Proven reserves have yet to be estimated for Leviathan but a test drill has confirmed GMR of about 450BCM. There's also a very low probability of several billion barrels of oil under the gas formation; the test drill should reach that depth by sometime in April. BTW, both fields contain very high quality gas, and at fairly high extraction pressure.

The field near Gaza I believe is somewhere in the 20-30BCM range, a bit smaller than the Mary-B field offshore Ashkelon which supplies Israel's needs today.

It's estimated that once Israeli industry really gets on the NG bandwagon and all of the planned CCNG powerplants are constructed, Israel would consume around 13-16BCM/year. At that rate, Tamar and Leviathan should last four to five decades. However, the plan was to import 7BCM/year from Egypt, which would have made the domestic supplies last even longer or be available for export. Politically (and as the article posits also perhaps due to Egyptian depletion) that looks uncertain now.

There have also been a few other fields discovered offshore (closer to the coast) but these are in the 10-20BCM range (Noa, Dalit) though given the huge finds in the past couple of years, these almost don't count ;-) Now that Egypt might stop the supply, there new interest in developing these since they're easier to drill.

To date, seismic surveys have also identified a 2-3 other fields in Israeli economic waters, each in the range of 100BCM each. Those should be test drilled sometime in the next 2-3 years. There are some leases which haven't been explored at all.

Well, Well Thanks.

Still Israel is in a bit of tough spot geographically and demographically. It would be interesting turnabout if Egypt ended up buying some of Israel's gas.

I'm guessing Israel might be making plans for electrical generation after the gas runs out--do you know what directions they are most actively pursuing?

Nowadays most base load electricity in Israel is generated using coal but the percentage of gas is slowly creeping up. As a total, gas now makes up about 40% of electric generation.

My "gut feel" tells me that in Israeli waters they'll eventually find about 850BCM proven reserves of gas and about 1TCM probable reserves. If so, we're talking about enough gas to power the planned NG electric plants until probably around 2070 (that's with no exports) and even longer if Egypt comes to its senses and resumes selling the Israelis gas as previously planned. Given this timeframe is so far out in the future, I doubt they have started thinking about what's next. Heck, by 2070 we should all be driving flying cars and getting our power from fusion reactors anyway :)

Thanks for all the info.

If so, we're talking about enough gas to power the planned NG electric plants until probably around 2070 (that's with no exports)

There always is that dollar now incentive to export, at least when price is up. I live in Alaska where an LNG export operation just shut down and the need to import LNG by 2013 just made the news. Yep we act just like the birds at my feeders, but I don't think the abiotic guy is going to come by and fill 'em up. Fly high ?- )

MarcoPolo,

Thanks for your informative contributions in this thread. At a certain point I had to call an end to my research for this article and I didn't end up digging into the details of gas fields off of Gaza. I'm sure there's enough material for an entire post on "Offshore Gas Fields of the Levant" if anyone has the time.

I'm probably going to move on to a different "declining net exports" story for my next post.

Regards,

Jon