Don’t count on natural gas to solve US energy problems

Posted by Gail the Actuary on February 18, 2011 - 11:26am

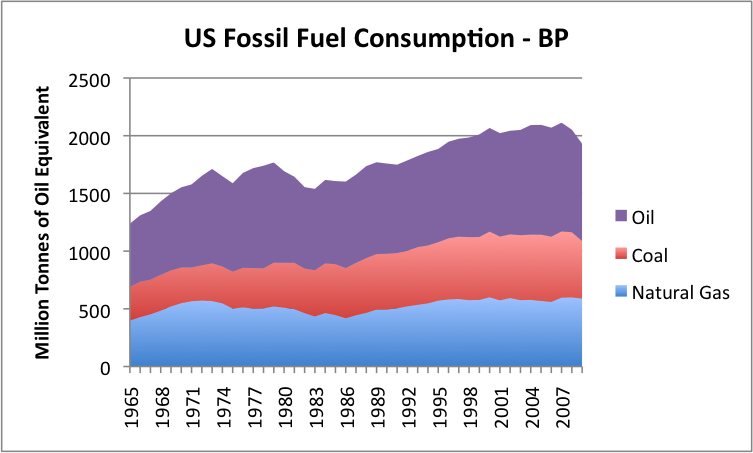

We often hear statements suggesting that by ramping up shale gas production, the US can raise total natural gas production and solve many of its energy problems, including adding quite a number of natural gas vehicles, and replacing a large share of coal fired electricity generation. While there is the possibility that shale gas will allow US natural gas supplies to increase for a few years (or even 10 or 15 years), natural gas is only about one-fourth of US fossil fuel use, so it would be very difficult to ramp it up enough to meet all of these needs.

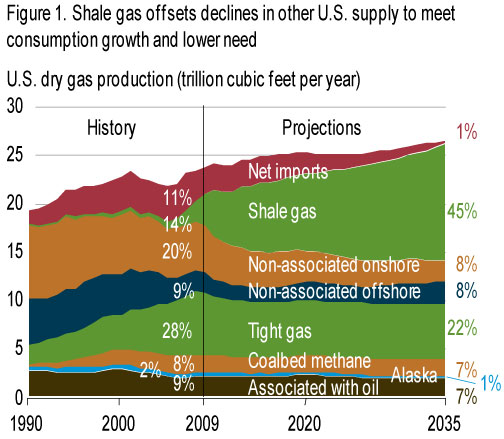

One issue is whether a rise in shale gas will mostly offset other reductions in natural gas supply. In Annual Energy Outlook 2011, EIA forecasts that shale gas production will increase from 23% of US natural gas production in 2010 to 46% of US natural gas production by 2035, but that these increases will mostly offset decreases elsewhere. Even with this huge increase in shale gas production, the EIA only sees US natural gas production increasing by an average of 0.8% per year between 2011 and 2035, and US natural gas consumption increasing by an average of 0.6% per year per year to 2035--not enough to make a very big dent in our overall energy needs.

I don't know that the EIA forecast is correct, but below the fold are some related issues I see. While we may see some increase in natural gas supplies, there is significant downside risk, if shale gas cannot continue to ramp up considerably, because of cost, or fracking issues, or CO2 issues, or any number of other problems. Even if shale gas does continue to ramp up as planned, the EIA forecast suggests that the impact on total US natural gas production is likely to be modest at best. It seems to me that steps we make to use this new supply should be made cautiously, being aware that the increased supply may not be all that much, or last all that long.

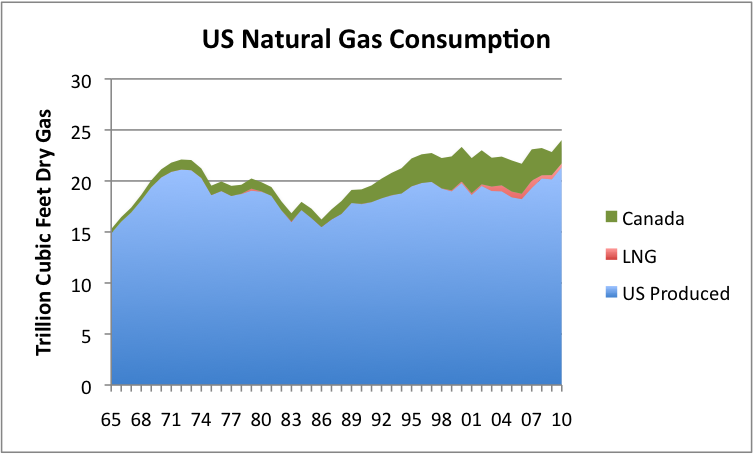

1. The US is a natural gas importer. It does not produce as much natural gas as it consumes.

Figure 2 shows the US has been a natural gas importer for many years, with Canada being the major source of imports. LNG has played a more minor role. The amounts imported have not been a large percentage of the total, but even now they are essential for keeping the prices down. The import amounts shown are on “net of exports” basis. In other words, LNG imports have been reduced by LNG exports (from Alaska to Japan), and Canadian imports have been reduced by exports of natural gas to Canada.

2. The US supply pattern for natural gas has been quite irregular over the years.

A person can see how irregular the natural gas supply pattern has been in Figure 2. Figure 3, below, shows US natural gas production by itself. The irregularity of production over the years and the fact that current production is not much above 1970, makes a person wonder if the optimistic forecasts are really accurate. One factor that may have may have depressed production was price controls from 1954 until 1978, but even without price controls, there has not been much of an upward trend in production until recently.

3. In the absence of shale gas, EIA’s forecast for US natural gas production would be a decline over the next 25 years.

This is clear from Figure 1, at the top of the post. EIA is forecasting an increase in shale gas, but to a significant extent it would act to offset a decline in other production. Note that historical shale gas production on Figure 1 is very small, but the EIA is forecasting a very large increase for this sector. If declines in other production have been optimistically estimated, then it is possible that there may be a decline in total production, even if the shale gas estimate is correct.

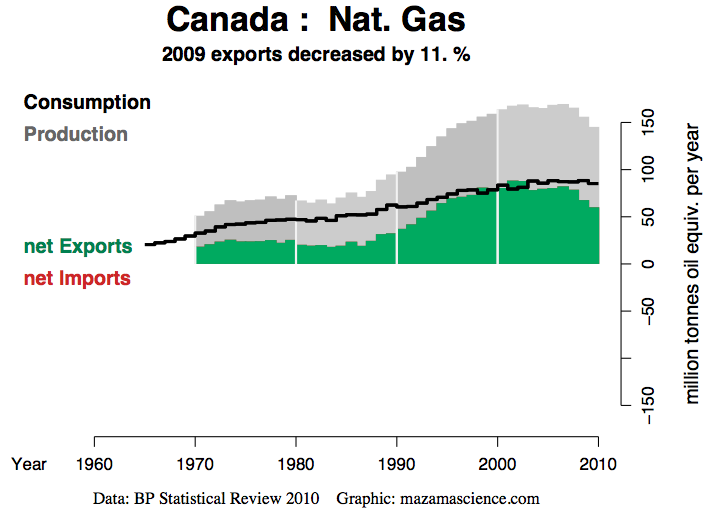

4. The production of Canada, the US’s largest source of imports, is declining as its own use is rising.

Figure 4 suggests that at least part of the need for additional shale gas production is simply to offset declines in Canadian production. If Canada uses more natural gas in its oil operations, this could exert additional downward pressure on exports in future years.

5. The much publicized report from the Potential Gas Committee relates to “resources”. Much of these resources may prove to be too expensive, or not technically feasible, to extract.

Figure 5 is the summary exhibit from the report, showing proved reserves and resources.

US current consumption is about 24 trillion cubic feet a year. If we divide the “U. S. Future Supply” of 2,074.1 TCF by 24, we get 86 years, which is the source of the statement that 100 years of natural gas supply is available. But it is not at all clear how much of this is economically extractable with technology that we have now, or will be able to develop in the future. If we exclude speculative resources, we are down to 61 years, assuming no growth in natural gas consumption. If natural gas use rises, we would exhaust those resources much sooner.

If we exclude both “Speculative Resources” and “Possible Resources,” then the number of years at current consumption falls to 29 (but much shorter, if production ramps up sharply). The shale gas portion of this is about a third of the total, or approximately 10 years, at current consumption levels.

The EIA had access to the Potential Gas Committee report when they put out the “early release overview” version of Annual Energy Outlook 2011. They show an average annual growth rate of US dry gas production to 2035 of 0.8%, and an annual growth rate of US dry gas consumption to 2035 of 0.6%. (The latter would reflect lower expected imports over the time period.) So evidently, their expectations are quite modest overall.

6. If Texas experience serves as an example, shale production starts dropping fairly quickly after it starts.

Texas is the home of Barnett Shale, the first of the big shale resource plays. Data for the state of Texas indicates that 2009 production was down from the 2008 level, and an estimate I made for 2010 using data through November suggests it will be down even further in 2010.

Based on Figure 6, It appears that Barnett Shale production reached a peak (of approximately 2 trillion cubic feet per year) in 2008, and has been declining since. According to Art Berman, initial plans were based on the assumption that the quality of reserves was uniformly excellent throughout the area, but as drilling proceeded, it became increasingly clear that there were only two sweet spots, and drilling contracted into those areas.

7. Shale gas drillers appear to need higher prices than are currently available to make production of shale gas profitable.

A big reason why natural gas looks so attractive now is its low price, but it is doubtful these low prices can last. Art Berman has shown that a well head price of over $7 per thousand cubic feet is needed for shale gas drillers to make a profit. He has also pointed out that estimates of well profitability are based on optimistic views of how long individual wells will be economic. If wells are taken offline more quickly than assumed, this will further raise the needed price. (I came to a similar conclusion using a different approach here also).

In the recent past, prices have been more in the $4 per thousand cubic price range, but over the long term, prices have been very volatile.

Many who are expecting that natural gas use to grow are assuming that prices will stay low. It is doubtful this can happen. Prices will need to be much higher for shale gas production to grow greatly.

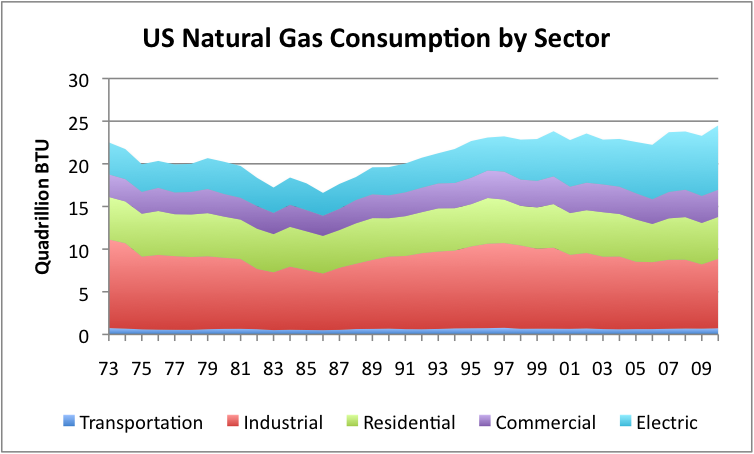

8. High (and volatile) prices tend to depress natural gas consumption for industrial use and for heating buildings.

Industrial use of natural gas has not been rising over the long term; it was higher in 1973 than it is currently. Industrial use rose to a peak in 1997, but when prices started becoming volatile, it dropped again. Natural gas for residential and commercial use is primarily for heating, hot water, and cooking. Its use has remained quite level over the years, reflecting increased efficiency of furnaces, better insulation, and growth in electrical substitutes (such as heat pumps). The only area of natural gas consumption showing real growth has been electrical use of natural gas.

Much of the enthusiasm for new uses for natural gas seems to be driven by its current low price. When this price starts rising again, past history suggests that enthusiasm may wane. Higher use for electrical consumption may continue regardless of price, but a low price makes it more attractive for this use too.

At some point, even electrical use may decline with high price. There is considerable evidence that high oil prices send the economy into recession. There is good reason to believe that very high natural gas prices might have a similar effect.

9. The amount of oil and coal consumption that needs to be replaced is huge in relationship to natural gas consumption.

Figure 9 shows that natural gas amounts to only a little more than a quarter of total US fossil fuel consumption. Trying to ramp its production up to replace coal, and to offset declines in oil availability would seem to be an extra-ordinarily difficult task. Natural gas production would need to be more than doubled–something no one is expecting.

10. There are a number of outstanding environmental questions.

With traditional gas drilling, most drilling seems to be in relatively unpopulated areas. Shale gas operations include more populated areas, leading to more chance of water pollution. Many people are concerned about the possibility of harmful environmental effects from fracking, especially if it is done close to the source of New York City water supplies. At this point, there is a six month ban on fracking of horizontal wells in New York. The EPA is also doing an analysis of the safety of fracking. It is not expected to be completed until 2012, however.

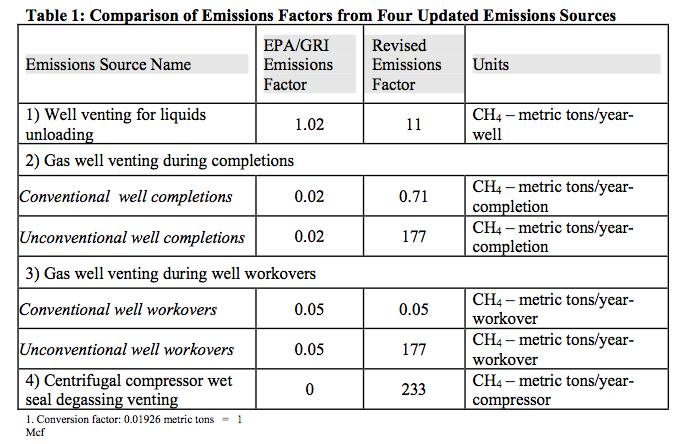

There is also an issue of whether fracking permits significant fugitive emissions of methane that could result in shale gas’s overall global warming potential being far higher than that of natural gas from conventional sources. The EPA has a technical support document on its website, suggesting that this might be the case. This is a summary graphic from that paper:

According to David Lewis’s calculations, these high emissions would bring the global warming gas potential of shale gas at least to that of coal. Professor Robert Howarth of Cornell University has come to a similar conclusion, analyzing data directly. His article has been submitted for publication in a peer-reviewed journal, but has not yet been published.

These findings are obviously preliminary. It may also be that even if the findings are true, there are changes to production techniques that can bring emissions down to an acceptable level, but these are things we don’t know. If this issue starts receiving much attention, it would seem to have the potential to reduce interest in shale gas production.

Summary

In summary, a review of information related to US natural gas production (and in particular shale gas production) does not give much confidence that it can ramp up by more than a small percentage over the next 25 years before it runs into some obstacle. The most likely obstacle is affordability, but there are others obstacles including the need to keep drilling (at high cost) to keep shale gas production up, or production will decline as it has done in Texas. Even if production can ramp up more, there is a chance that global warming gases associated with shale gas will suddenly become an EPA concern, and production will need to be scaled back.

There is little evidence that shale gas producers can make money at current low prices. At higher price levels, coal becomes a cheaper alternative, and substitution becomes more difficult. Coal and petroleum consumption are so large in relationship to natural gas consumption that trying to ramp up natural gas to replace more than a very small percentage of these fuels would seem to be impossible.

Shale gas is needed to offset declines in conventional production and a drop in Canadian imports, so one cannot assume that an increase in shale gas production corresponds to an increase in the amount of natural gas available for consumption.

I have not tried to look at LNG imports. To date, they have played a minor role. Based on EIA data, in 2008, LNG exports corresponded to about 7.5% of world consumption, and from Figure 2, it is clear they have only played a small role in US consumption. I would not expect this situation to change greatly. LNG terminals are expensive, and have to be financed whether they are actively used or not.

Excellent report -- NG has reached some mythical beliefs due to alot of hype from certain sources--the reality is much different !

Agree with Big Bear Gail - excellent overview. I had not seen Figure 1 before. It is very telling on several fronts. You have convinced me that the Pickens plan is a non-starter. Converting vehicles to NG may be a sound short term decision for some individuals, or even some fleets, but in the big picture it is not going to address our predicament.

Thanks.

I like this statement.

"NG has reached some mythical beliefs due to alot of hype from certain sources..."

It's no wonder that the API has hired Brooke Alexander to spin oil and gas:

IIRC, she began her career selling ice cream.

I believe Pickens has an interest in the infrastructure aspect of natural gas. This is how the Haliburton and the Rockefellers made their fortunes. I first became aware of peak oil in 2003 and it was at this time that a quick calculation ( not including shale) gave us about 6yrs before a major decline in natural gas. I think it odd that the 56tcf in proven reserves has not changed since 2003. At current consumption I would like to know how many of these shale fracturing sits are required to maintain BAU operating pressures in the pipelines?

Great article!!

Of course, it will be ignored by the corporate-controlled mainstream media, and have no influence on our corporate-controlled energy policy. Same as any good piece of climate-change analysis (ex: http://climateprogress.org/2011/02/17/nsidc-thawing-permafrost-will-turn...).

...onward to the cliff!

Nicely done Gail! Thank you for putting this all together.

The Canadian Govt did a report on the cost of natural gas production by geological region. The cost is about $7.00 per mmBTU, so not that different than US shale gas.

http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/ntrlgs/ntrlgsspplcs...

I think it is a wonderful testimony to the effectiveness of the shale gas hype. Investors are rushing to put money into shale gas (driving down prices and destroying the investment) while the conventional industry starves.

The leases are often of the"use it or lose it" variety, so companies end up drilling when they see no sense in drilling. Also, some are drilling to get the liquids, but they get unwanted gas in addition, and are willing to sell it for a loss. So all of this tends to hold the price down.

Companies like Exxon end up buying gas assets, when they can't find oil. But what good is an investment you can't make money on?

In this case, it's the Chinese who are moving in and buying up large amounts of that cheap BC gas (see map above).

China pays $5.4-billion for B.C. gas play

The Chinese, as usual, are playing this investment for the long term. There is a proposed LNG terminal at the Northern BC deepwater port of Kitimat, and from there it's a straight sail across the Pacific to China.

The Northern BC shale gas deposits are probably as big or bigger than the US ones, and there's no local market for the gas. At the moment the US market is saturated with shale gas, so Asia is the obvious place for it to go.

There are few political problems with it - the BC government reaction is, "Yeah, sure, let's sent the gas to China, create more jobs in BC, and use the Chinese money to build more hydro dams." Keep in mind that the BC government owns the mineral rights to all this land and would get all the royalties on the gas.

The Canadian government is happy that it is a 50/50 joint venture with a Canadian company, with China supplying the money and Canada the workers - it doesn't care whether the gas goes to China or the US because the NG isn't needed in Canada.

As I say, the Chinese are long-term investors. The fact that North American NG prices are depressed in the short term is of little concern to them.

Oil and gas leases are on a "use it or lose it" basis whereas land for solar hasn't. The buyers are just hanging on to it and trying to figure how to turn a profit on trading rather than being forced to do something with it. A poor inequality.

NAOM

There were some other comments at her Our Finite World post:

http://ourfiniteworld.com/2011/02/07/dont-count-on-natural-gas-to-solve-...

Historical data for North America and other regions dating back to 1970

http://chartsbin.com/view/u57

How does natural gas production today compare to 1973?

http://allcountries.org/uscensus/1181_natural_gas_supply_consumption_res...

I did this analysis and tried to send it to be posted on TOD. It is pertinent to Gail's analysis. the figures I have in my paper don't copy, but the text is clear without them. Murray

Projecting the Near Future of USA Natural Gas Availability Feb 11, 2011

1) A look at conventional production

Let’s start with Jean Laherrere’s curve from 2006, which suggests that conventional NG production was about to “fall off a cliff”, which as we all know, didn’t happen. Was Jean simply wrong, or is there something more at play? A second look at discoveries vs conventional (marketed minus unconventional) shows that the area under the discovery curve is quite larger than under the conventional curve, so that there was still more to produce before the fall off as of 2006. However, conventional production in the USA declined 4% from end 2002 to end 2006, so if the decline were to be arrested, it clearly would have required an increase in drilling. Web Hubble Telescope, in his magnum opus entitled The Oil Conundrum, has noted that oil producers will increase annual production as a % of reserves in order to keep production on a plateau when faced with a decline. It seems likely that NG producers would do the same. In fact vertical rigs for drilling conventional plays increased rapidly from 653 working rigs at mid 2002 to 1173 rigs at mid 2007.

Some of the results of that effort can be seen in Texas with a large increase in producing wells after 2002, simply keeping production flat. Vertical operating rigs dropped off sharply after the economic crisis in 2008 down to 275-330 rigs from Q2 2009 to end 2010 (a 74% decline), and at least some of these rigs were used for shale gas development, suggesting that there is little more economic potential for increasing conventional production. We may be at the edge of the cliff.

Indeed, scaling the discovery/production curve with graph paper and eyeball, (or shifting the discovery curve 27 years instead of 23 years) it looks like all of the area under the discovery curve has been produced by the end of 2010. In fact, conventional production has decreased by about 2 Tcf from 2006 through 2010, if the EIA numbers are right. There is a strong possibility that EIA has overestimated shale gas production for 2009/10 (see below), in which case conventional production has remained on a plateau, increasing the probability that the production rate can no longer be maintained. If conventional production does now drop off parallel with the discovery curve, it will drop by >10 Tcf/yr by 2015, or by > 2 Tcf/yr per year going forward.

Now the big question is, can increases in shale gas production offset such a rapid decline in conventional production, or is the famous NG glut about to turn into scarcity? To address that question we have to get into an analysis of shale gas production potential.

2) What about shale gas?

There is considerable variability among sources and plays. Berman provides a curve that implies an average EUR of about 1.25 Bcf/well for the Barnett, but says he calculates an EUR of .84 Bcf. The USGS assessment of 14 “units”, ignoring the 4 lowest, would average closer to Berman’s lower EUR, but their curve of decline implies an EUR of about 1.0 Bcf. However they provide a forecast with a 50% probability of 2.1 Bcf, which seems very high, perhaps based on the Woodward (see below).

At 1.0 Bcf EUR, and using Berman’s decline rates the first year production would average 520 kcf/d, for the Barnett. (Bermann uses M for 1000 and MM for 1 million, but as an electronic engineer, I will us k for 1000 and M for 1 million). Pennsylvania has reported production of 180 Bcf from 632 operating wells between end June 2009 and end June 2010, giving 285 mcf/well/yr or 780kcf/well/day for the Marcellus shale, which is at least in the same ballpark. The USGS data gives a first year average well production of 930 kcf/d for the Fayatteville, and 1100 kcf/d for the Woodford. The big outlier is the Haynesville, which is twice as deep as the average for the above, is under correspondingly more pressure, and has denser gas pack. First year production averages about 4400 Kcf/d/well, roughly 5 times the average of the shallower plays.

Berman concludes that the EUR is proportional to the first years production rate. Using the above numbers, and an EUR of 1.0 Bcf for the Barnett, we get EURs for the other plays as 1.5 Bcf for the Marcellus, 1.8 for the Fayatteville and 2.1 for the Woodward. Production falls off to about 50% of the first year in the second year, 67% of the second year in the third year and 88 % of the third year in the fourth year. The first 5 years produce about 70% of EUR. Using these results we get an unweighted average EUR of about 1.6 Bcf per well across these 4 plays, better than Berman’s estimate, but much worse than operators’ claims. The Haynesville might have an EUR of near 5 Bcf/well.

I have estimated wells used for drilling for gas from Baker-Hughes data, with realistic SWAGs of % of total horizontal rigs and total gas rigs. On average there were about 440 horizontal NG rigs operating in 2008, with a peak at mid-year and then a decline to about 420 at year end. Rigs dropped off sharply in 2009 to a bottom near 350, and then picked back up again to 480 by year end, giving a time weighted average of near 400. Growth continued through 2010, to average about 565, with a probable start for 2011 of 670. It is assumed that the 2300 uncompleted wells at end 2010 were drilled using vertical rigs, in order to avoid losing leases.

Pennsylvania numbers give 7 operating wells/rig/year. Other data suggest 9 or 10 wells/rig/yr. USGS has unproductive wells at 10 percent of total, in early years declining to about 3% in 2009. I have done a piece-wise linear estimate (see below) of rigs, wells/year, and production/well using 10 wells/rig/yr as a base case with the above first year production figures mix weighted to the higher producers after 2006, with declining production year to year as described above, and added a generous increment for vertical wells, and it simply isn’t possible to get to the EIA numbers for 2009/10. Other years are pretty close. 2011 completions of the 2300 carryover wells have been assumed at 14/rig/yr for the horizontal rigs.

I have to conclude that the EIA numbers are wrong, and that shale gas production has been like 2005-0.18Tcf, 2006-0.4 Tcf, 2007-1.0 Tcf, 2008-2.1 Tcf, 2009-2.3 Tcf, 2010-3.5 Tcf. The EIA has 2006/7/8/9 as 0.3/1.0/2.3/3.4 Tcf. We are close for 2006/7/8, but then my estimate drops to 68% of the EIA number for 2009. It should be noted that the EIA had 2009 total consumption at the same level as 2008, when in fact it should have dropped by at least 5% due to the economy.

Estimates for wells/rig/yr and first year average production rates are probably optimistic and no allowance has been made for rigs moved to drilling for NGL. Wells/rig may drop if a lot of new rigs are deployed. First month average productivity may not be maintained as drilling moves away from the best of the sweet spots. The 2011 estimate could easily be 20% high.

If conventional gas drops off by 2 Tcf in 2011, shale gas might optimistically replace 70%. We are likely to finish the 2010/11 withdrawal season with about 1.5 Tcf in storage, and if summer of 2011 is not as hot as 2010 we could reduce summer consumption by 300 Bcf, or maybe 200 Bcf after allowing for growing demand from the recovering economy. If we can draw down ending withdrawal season storage by 400-500 Bcf without causing any problems we can just offset the 2 Tcf decline in conventional production, and squeak through without disruption. If the drop off is just a little more than 2Tcf, we might still squeak through if we can increase imports. Are the variables too optimistic? Can cash strapped producers increase working rigs fast enough?

Prices will go back up, and drilling will pick up again. With no more shut in wells to bring on in 2012, no more room to draw down storage, little room for increased exports, if we have another 2 Tcf decline in conventional production, we will be in severe difficulty by mid 2012. Shale gas cannot make up the difference.

References

http://gswindell.com/spe70018.htm Texas NG production info to 2005 - basis for modeling conventional prod’n?

http://oilshalegas.com/shalefields.html Lots of info, quality hard to assess.

http://geology.com/ several shale gas articles

http://www.aspousa.org/index.php/2009/06/a-long-recovery-for-natural-gas... NG data 2 June 2009

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzQwNTk3fENoa... Chesapeake Energy View of their NG production decline

http://www.eclipsenow.org/archives/5218 Interesting analysis, but I have no hot-links to the figures mentioned.

http://www.aspousa.org/index.php/2009/08/lessons-from-the-barnett-shale-... Arthur Berman 2009

http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_NaturalGa... Bad news on shale gas!!

http://info.drillinginfo.com/wireline/2009/09/how-arthur-berman-could-be... Suggests Berman is wrong, then confirms his numbers

http://mazamascience.com/OilExport/ Interesting data source

http://www.eia.doe.gov/oil_gas/natural_gas/info_glance/natural_gas.html

http://oilprice.com/Energy/Natural-Gas/Dont-Count-on-Natural-Gas-to-Solv...

http://pubs.usgs.gov/of/2010/1138 and http://pubs.usgs.gov/of/2010/1151 Some helpful USGS analysis, quite conservative for a change.

Piece-wise Linear Shale Gas Production Estimate - Feb 11 2011

• Base case 100 rigs @ 10 wells/rig/yr, all produced on first day of year. First year average well productivity = 100 kcf/d.

o Annual production = 1000X365X100 = 36.5 x10e6 kcf/yr

• Real first year case – each rig drills 1 well in each of 10 equally spaced periods through the year. The first well produces at the the first year average rate for 365 days. In between wells produce at consecutively higher rate for shorter time. The last well produces at the first month peak rate (140% 0f first year average) for 36 days. Total first year production rate multiplier “m” is 62% of base case.

• Successive years for a single well produce at reduced rates relative to first year average as 2nd year – 50%, 3rd year – 33%, 4th year – 29%, 5th year – 26%, 6th year – 24%, 7th year – 23%. Graphing these average rates one can determine start and end rates for each year. The first and last period wells’ start and end average rates can then be determined and the averages averaged to get the decline rate for the ensemble of wells drilled through the year. Relative to the base case the ensemble successive year production rate multipliers “m” are 2nd year – 75%, 3rd year 42%, 4th year 31%, 5th year – 27%, 6th year – 25%.

• For each year we can now identify multipliers n and p, where n100 is the average number of rigs drilling 10 wells each, and p100 is the average production rate for the year in kcf/d/well.

• Using the constant K = 365x10e9 we can then calculate any year’s production for any beginning year as mxnxpxK for that year.

• We can then sum the productions from each prior year and the current year to get total production for the current year.

• Further adjustments must be made for fewer wells/rig/year in early years, and for production in any given year from vertical wells. A learning curve wells/rig was assumed for 2005/6/7 as 5, 7, and 9 wells, with successive years at 10. Vertical well production is a reasonable fudge factor that gets close to EIA totals for 2007/8.

• 2009/10 production has been adjusted down by 1000 and 1300 producing wells respectively to account for the 2300 non-producing wells at the end of 2010, and 2011 has been adjusted up by the full 2300.

• “p” has been determined using the above mentioned average first year production for rates for the 5 plays where figures are available. A mix has been SWAG’d between Barnett and Other. Other is the simple average of The Marcellus, Fayateville and Woodford rates for 2007/8/9, with 5% Haynesville added for 2010/11.2005/6 are assumed to be Barnett only. The mix weighted average rate is then calculated for each year.

• “n” for 2005 through 2007 has been taken from a study I did in 2009, and 2008/9/10/11 has been SWAG’d from several sources but based mainly on Baker-Hughes rig counts.

UPDATE – 2/14/11

• After thought, added 2/14/11. - The 2300 well carryover could come from using vertical rigs to drill wells in 2010 to avoid losing leases. In this case all of the horizontal wells drilled in 2009/10 could be produced in 2009/10, which would raise production in 2009 through 2012.

• Also a more detailed analysis of Baker-Hughes data has led to a revision of the 2010 rig count from 500 to 565.

• Assuming completions of the 2300 wells could be done in 2011 by horizontal rigs at the rate of 14 wells/rig/yr that would raise the average wells/rig to 11 for 2011.

• The end result table has been updated accordingly

End result:

2005 2006 2007 2008 2009 2010 2011 2012

n (100 producing rigs) 1.6 2.4 3.1 4.4 4.0 5.65 6.5 7.5

p (production rate 100 kcf/d) 5.2 5.2 5.8 6.3 7.6 8.8 10.0 10.0

Wells drilled 1600 2400 3100 4400 4000 5000 6500 7500

New wells produced 1600 2400 3100 4400 4000 5000 8700 7500

Vertical well multiplier 1.5 1.4 1.2 1.5 1.3 1.4 1.1 1.1

Wells/rig adjustment 0.5 0.7 0.9 1.0 1.0 1.0 1.1 1.0

Shale gas produced (Tcf/yr) .18 .42 1.0 2.1 2.3 3.5 5.0 5.4

EIA 0.3 1.0 2.3 3.4 ?-4.1

E-mail your figures to me at GailTverberg at comcast dot net, and perhaps I can add them to your comment.

OK. Have sent the e-mail. Hope that works. I would really like to get feedback on the analysis, especially better numbers, or reasons why Laherrere's idea of falling off a cliff could be wrong, or better estimates of timing if it looks valid. Thanks, Gail.

Oops - noticed 3 errors- in one place I said wells when it should have been rigs, and in 2 places the Woodford became the Woodward. Apologies. Murray

Why would conventional production crash like that? It keeled over from 1981-1983 too, owing to the recession I'd assume; doesn't the current sharp decline largely have its origin in lack of demand, too? Associated just looks like it's following the slope of the decline in oil production, with a peak in 1995.

Using 2010 as your end point for calculating an expected decline rate is misleading, if the economic demand factor is the key element here. Have other nations experienced catastrophic decline rates like you foresee? Perhaps the UK? But they have a more limited set of sources, it would seem to me. US Conventional gas production hasn't been subjected to the same rush to capitalize as with North Sea offshore.

U.S. Natural Gas Gross Withdrawals and Production

Laherrere's assumption is that you can't produce what you haven't discovered. The figure missing shows a discovery curve that grows rapidly, plateaus briefly and falls sharply to a more or less steady state level about 80% less than the plateau. The production rate grows similarly to a plateau like the discovery plateau with a delay of about 25 years. Laherrere used a 23 year delay back in 2005. I think a 27 year delay better nmatches the 2 curves. The area under the produced curve about matches the area under the discovery curve by 2010, with production still on the plateau. It seems like production was kept on the plateau by a very large increase in drilling the conventional plays, thus exhausting them more quickly. Other factors being equal, the producrion must fall off at about the rate of discovery.

Like this?

From 2007: The Oil Drum: Europe | Interview with Jean Laherrère. I've gone over the ASPO 2004 pdf this graph comes from and his projections just haven't panned out. Europe looks to be ca. 5 tcf now, instead of 10.5 tcf in 2009.

2003 and 2009 were 150.44 and 150.87 respectively.

Jean didn't even bring up shale. This notion needs a rigorous going over, otherwise it is fit only for the circular filing cabinet. It makes sense prima facie but isn't doing much so far for actual projections of conventional. BTW UK decline 2003-2009 was 7.60% average, that would equate to more like 1.5 tcf for the US. UK and Canada are about the only major gas producers going through much of any visible decline far as I can see. Also I'm just looking at EIA numbers for Dry Natural Gas.

The explanation of conventional natural gas extraction increase has always been that it was rate-limited by the pipeline infrastructure. You could have all sorts of "queued" discovery areas ready to go but if the local pipelines weren't there they would sit fallow. Then as one area would get used up, the operators would just go down the line, constructing new pipeline segments as needed. The result was that you can draw figures like the following in which Murray and before him Westexas have explained:

This same characteristic does not occur for oil anywhere near the same degree because oil is a more greed-inducing resource and is more mobile at the point of extraction. That is why you rarely see figures like that shown above for oil -- the segments are much, much more dispersed over time as the extraction is much more proportional to amount remaining (i.e. longer tails), and so the figure would not show as uniformly vertical a set of yearly extraction stripes.

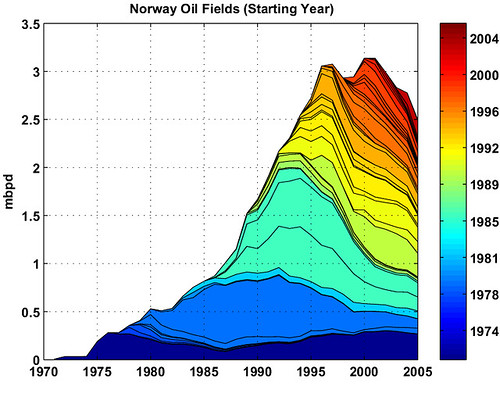

Theoretically, oil looks more like this due to dispersive discovery followed by proportional drawdown:

And for Norway, you can see the reality check (with arguably fewer long tails because of the difficulties in sustaining long-term offshore extraction)

That essentially explains the plateau-like nature for NG. Obviously if we run out of extraction points, you can imagine the dynamics changing quickly. Shale deposits of NG provides many more of these continuation points so that we can potentially defer the collapse for some time.

WHT - it seems likely that those "new areas" were under the discovery curve, and just look at the rate at which they drop off. If the discovery curve plummet means no "new areas", then for sure we will be at a cliff edge. so - are we out of "new areas"? The huge drop in vertical rigs suggests very strongly to me that the answer is yes. Comments?

Murray, If we don't see the dispersion in discoveries and there is not much dispersion in the extraction rate then you will see a faster fall-off.

I couldn't tell which specific set of data (re: the vertical rigs observation) your question was related to.

the decline in vertical rigs was quantified in my analysis. That is what I referred to.

I guess "Non-associated" onshore and offshore is the conventional production and they may not have fallen of a cliff but they declined steep. It is not the shale that have compensated for this fast decline it is mostly tight gas that have been produced, look at the graph at the top. Shale have a large share for one or two years and it is a very short time period.

I wouldn't get overly concerned with the difference between "shale gas" and "tight gas". For the most part, shale gas IS tight gas.

KLR - do you know the rate at which the UK discovery curve declined? Giving the notion a "going-over" is exactly what I am trying to do. Just because the fall-off hasn't happened yet, doesn't say it won't happen. All of the numbers have sufficient uncertainty that the cliff edge could easily be misjudged by a couple of years. More quantified critique is what I am hoping for. Murray

Murry - Monumental effort...much appreciated. A little off topic but touches on your projections of decline rates. I just finished reviewing a proprietary report on one of the major players in the Eagleford Shale trend. Though not a typical shale gas play per se it does offer a little insight into the time span required to recover URR of a fractured shale reservoir. Their current profile indicates 30% of the URR produced during the first year. The next 45% of URR requires 9 additional years. They don't project the time required to produce the final 25% of URR but eyeballing it I would guess about an additional 15 to 20 years.

The URR values offered do look impressive along with the impact of the first year's "flush" production. But the reality is that it will take on the order of perhaps as long as 25+ years to recover the URR. OTOH this does establish a stable relatively low decline rate beyond Year 1 which explains why we haven't fallen of the "cliff" as the shale gas boom collapsed a couple of years ago. But it also emphasizes why much higher NG are required than we have today to continue the growth in SG development. The hottest play in Texas right now is the Eagleford Shale. But no one is playing it for the NG yield. It is being driven by its high oil/NGL yield and $85+ oil prices. As long as oil prices remain high we'll likely see another ramp up in NG production similar to that generated during the shale gas boom several years ago. Oddly this could generate trouble for the other shale gas plays. Give the glut in the NG market today the EF development may keep downward pressure on NG prices. The EF players will be forced to flood the market with NG that they'll sell no matter how low prices might go. Their profits are coming from the sale of liquids...not NG.

That seems quite consistent with Berman and USGS figures.

I agree 100% and by the winter of 2012-13 the news media will be harping on the same key as they were about the housing bubble; how did the experts not see this coming. The continuing saga Overshoot in Hype.

Many thanks to You and Ms. Gail.

Thanks Gail, this should be a useful resource to send people who have swalled the "shale gas in gonna save us" pill.

I wanted to question your statement that high NG prices will harm the economy however. The key difference between NG and oil, is that a large fraction of the later commodity is imported, and hence any increase in price leads to balance of payment issues (the benefits of the high sales price come largely overseas). At least for gas, with imports/exports being only a small part of the picture, is that the money consumers spend on NG should largely stay within the economy. So I would think the net economic effect of a change in price would be large.

While the import effect you mention is part of the problem, the bigger problem is that people's salaries don't rise, just because the price of oil or natural gas rises. One issue that oil and gas uses tend to be for things that are really basic--commuting to work, electricity, and heating a person's home. Faced with a constant salary and rising prices for necessities, people will tend to cut back somewhere. Some of this will be on oil or gas spending (fewer vacations or turning the heat down somewhat), and part of this will be on other things (fewer trips to restaurants, less contributions to charitable organizations, don't buy a new car or a new home). The net effect is the same whether it is gas or oil. Gas tends to be a smaller part of the budget, so isn't quite as sensitive, but if utility bills go up by $100 month, people will have to respond somehow, and the result is generally recessionary.

Arguably, the higher price you pay for the natural gas is going back into the US economy. To the extent that it is actually going back as wages, it is helpful to the economy. But if all it is doing is increasing the profit of the oil or gas drilling company (wages are the same, regardless), it is not clear it will have the same effect.

Part of the problem is that we are working with lower and lower EROI resources. We put in more and more inputs, but get less and less benefit to society back. That is the ultimate problem, and what leads to rising prices in the first place.

people's salaries don't rise, just because the price of oil or natural gas rises.

This really needs to be more specific. Which people? You're talking about consumers, but what about the people who are selling gas? Their income is rising.

Prices are set by small discrepancies in supply and demand, and by marginal cost. If NG prices rise by 50%, that doesn't mean the average cost of NG production rose by 50%. Probably the average only rose by 5-10%.

So, 80%-90% of the revenue is simply a tranfer of income and wealth. Some people get poorer, some get richer, but average income doesn't change much.

So, 80%-90% of the revenue is simply a tranfer of income and wealth. Some people get poorer, some get richer, but average income doesn't change much.

That is way too simple a way of looking at it. The effect of that income transfer on the economy has to be run by all the multipliers.

Income is distributed quite unequally in the US

taken from this article

The above chart would show an even greater percentage of income earned by the top quintile if sheltered offshore income could be added in. Simply put 80% of the country gets 40% of the pretax income and even worse 60% gets 22% of the pretax income.

If higher gas prices remove enough real dollars from the bulk of the population at the bottom of the economy eventually the phony growth numbers generated by those same dollars essentially playing with themselves at the top of the economy will evaporate. Multiply anything by zero and you get zero, multiply a number by a number less than one and the product shrinks--growth at the top of the heap all depends on some greater than one positive value of the base number at the bottom of the heap. Oversimplified but not near so much as your but average income doesn't change much statement.

Yes, the working class save less than the rich. Nevertheless, they still spend most of their income. And who said all of the additional expenditure would go to the rich? Some will, but much will go to employees of oil companies, etc.

I agree - detailed analysis would help. But, the point remains: we're mostly talking about redistribution of income and wealth. Gail's description made it look like all additional expenditure on NG was lost to the economy.

too bad I couldn't get that chart to stay up--essentially its shows income share each 1/5 of the population gets 3.5%, 7.1%, 11.6%, 18.9%, 59.1% respectively bottom to top income;then tax share 1.9%, 5%, 10.2%, 18.9%, 64.3% (same order)

I agree extra cost for natural gas might well not follow quite the ugly skew to the top we have been getting of late. New manufacturing jobs add a lot more to the economy than new barista, bartender, cook and server jobs centered around the financial centers do.

That said the way our economy dives when the average wage earner cuts spending has been most obvious of late. Higher energy costs taking a sizeable income chunk of that bottom 60% of the population will drag the economy down if things like even lower cost foreign goods and increased productivity don't keep their income from shrinking too fast.

Any idea of how big a chunk of US manufacturing the natural gas industry currently comprises?

Again, the rich may save more than the working class, but they still spend most of their income. And, what they don't spend on consumption, they invest - some of it on oil & gas deals.

the way our economy dives when the average wage earner cuts spending has been most obvious of late.

The great recession was caused by a credit crunch that interrupted the recycling of money into investments (much of that money was petrodollars being recycled into mortgages...). It wasn't started by the average wage earner cutting back on spending. I know that's often said here, but it's not so.

IIRC, mining isn't classified as manufacturing - I'd be curious if my memory is correct.

mining and manufacturing are often but not always lumped together.

The great recession was caused by a credit crunch that interrupted the recycling of money into investments

Investments in what another Target store--we really don't need more retail space. Investments in a Chinese factory. Investments in overbuilt office space. These investments were to service what part of the economy--oh yes the overheated consumer part fueled by mortgages lent on thin air. And I've saved the best investment for last--investments to cover thousands of square miles of very productive farmland with over sized houses that created millions of miles of oil sucking trips to everywhere and back.

The investment cycle was way out of wack, and it isn't much improved since the greater recession (I still call Ronnie's the great recession). The country's growth was on its the soundest footing (in my opinion) for a couple of decades plus after World War II (and yes we built on farmland then too, but it was closer in). That happens to coincide with the period of the most equal wealth distribution. We are pretty much back to the wealth skew we had in the 1920s--that didn't end well from what I've been told. Though eventually it did interrupt the cycling of an ever higher percentage of wealth to the wealthiest.

But this is starting to drift a bit from natural gas. I know more than a few Chicago area people working two and a half jobs to keep the mortgage paid, the fridge full and the house warm (natural gas). Heating price doubles and something's got to give--many many people are already working every hour they can. Why are they working so many jobs--just to keep a flat (not inflation adjusted) income. There isn't near the fudge space in the economy there used to be.

I think I pretty much agree with what you're saying.

Yes, some lower income folks are going to suffer. On the other hand, some higher income folks will have a little more money, so the overall impact on the economy is probably small.

The sensible thing is to provide some help to lower income folks: insulation, temporary heating bill subsidies, lower taxes.

Higher oil prices basically drive the inflation rate, but we are not getting automatic cost of living raises.

Try to think of one person who gets more money because the price of oil or gas rises. The owners of the oil or gas companies get more money, but it hard to find anyone else, unless they get automatic cost of living raises. Reinvestment is taking more and more of the total. Unless this is in local jobs, it doesn't really help the economy.

The owner of a gas filling station might get more revenue from the customer for gasoline, but he will have to pay more for his product, so he won't net any more. The customers will likely cut back on the purchases of coffee and doughnuts if the price of gasoline goes up, so he will be behind on a net basis. If he lays off one of his workers as a result, the worker will be even more behind.

If oil and gas weren't the force that makes our economy "go", I might agree with you about higher prices being only a transfer of wealth. What happens is that we put more and more money into the extraction and transportation process, and it leaves less and less for everything else. Oil and gas that costs a high price to extract is low EROI oil and gas. Our problem is that we are getting less and less benefit back for each dollar invested (it takes more dollars of investment to get one Mcf of gas or one barrel of oil). At some point, which we are quickly reaching, we reach a point where the cost of investment exceeds the benefit extracted.

In terms of Charlie Hall's cheese slicer models, our problem is the red discretionary income arrows keep getting thinner and thinner, even as we try to extract more and more. This is the real problem.

Gail, like I said to Nick too simple. Money into the transport and pipe manufacturing, additional gas field hands and management does multiply through the economy, and at a higher rate and more quickly than bonuses to hedge fund investors. Its coming in at a more fundamental level as working class wages, so it doesn't get spent on second houses in Bermuda, European high end cars. Rather it is spent on kids clothes, second cars (maybe an EV for extra middle managers), a bit more furniture and the like.

Because the extra money to extract the gas is spent in the US it does have some positive effects on the economy--unlike money we spend on oil imports which doesn't flow back through economy except as purchased debt--not nearly the same thing.

That said I do agree that because increased gas prices will take a bigger chunk of the flat at best income of a huge swath of workers, the higher gas prices will constitute a net drag and in the end will reduce that all important metric to the US economy, discretionary spending.

You have to take what earners aren't spending in the non-gas sector of the economy run it through multipliers and see how much income is lost and subtract it from how much the additional gas effort adds to the economy after it is run through all the multipliers. I'm betting it comes up a negative number, thus making higher gas prices a net drag. You also have to analyze where the investments have been channeled and what sections of the economy that grows and shrinks. Yes that is what the flow diagrams say but no numbers back up the widths of the flows. Nor is there any differentiating between money spent on domestic energy sources and money spent on imports.

Higher natural gas prices might not filter money to the top at quite the rate finance does but they will keep transferring more of the bottom sixty percent's money to the top 20%. Whether that second highest 20% gains or loses will make the big difference--they are the swing voters that put people into office.

Try to think of one person who gets more money because the price of oil or gas rises.

First, local taxes will take roughly 10%. 2nd, local utilities will take a chunk. 3rd, money will flow to gas producers and their investors. They'll recycle the money through consumption and investment.

Unless this is in local jobs, it doesn't really help the economy.

Yes, there will be some transfers between regions of the country: NE will lose money, Texas will gain.

we put more and more money into the extraction and transportation process, and it leaves less and less for everything else.

True. But, have you tried to put numbers to this?? There was an article on TOD that estimated that NG extraction E-ROI had dropped from 40:1 to 20:1. Well, that's reduction in net energy from 97.5% to 95%: that's not much.

At some point, which we are quickly reaching, we reach a point where the cost of investment exceeds the benefit extracted.

Perhaps if gas reached something like $75 - we're a long distance from that, and long before we reached it we'd substitute other things, like electricity from wind power.

There is a huge difference between the wellhead EROI of natural gas and the delivered EROI of natural gas. What you usually see is the wellhead EROI. This is one graph shown by Charlie Hall (but I think originally by Carey King from the University of Texas).

On a delivered basis it is in the single digits.

Low EROI is the major reason that the price needs to be quite a bit higher.

in the single digits.

That's not enough information. E-ROI of 8 would be more than good enough. E-ROI of 2 would be a big problem.

So, do we have more precision than that?

Charlie Hall, after showing this slide, made the observation that he wondered if coal was the only fuel with a high enough EROI.

- Enough time to perform the substitution, and

- Enough surplus energy to make the investment.

I don't think the USA, mired in next-quarter thinking, can be sure of that without firm policies in place to bring it about.You're assuming that there would be...Enough time to perform the substitution

Yes, I think it will take a very, very long time for NG prices to rise above $15. Don't you? Art Berman doesn't say that there aren't large quantities of NG, he says that $4 is too low. I think he'd say that there's quite a bit at $15.

Enough surplus energy to make the investment

We have enormous amounts of surplus energy. We spend 9Mbpd on personal transportation, when carpooling in efficient cars would require well below 3. We keep our homes at 72F, and pride ourselves on removing all of the walls in our homes (why did those foolish people put up all those walls??) to create one big open space.

We have a lot of surplus energy, compared to our core needs, and we could reduce our consumption dramatically in days, if necessary, while still getting everyone to work.

Nick et al - Just a little add on to the discussion. I haven't seen the two of the biggest cash transfers mentioned: royalty owners and production taxes. When I point out the benefits of increased domestic drilling inevitably someone points out that it won't change the course of PO to any significant degree. Of course, I've never propose that possibility.

Unlike almost every other country the vast majority of mineral rights here belong to citizens....often small farmers and ranchers. On the large end are minerals owned by the states and feds. At one time the entire Texas university system was funded by state owned oil/NG royalties. The feds typically collect 16% off the top of all OCS and onshore fed leases. Just a guess but average royalty to private mineral owners is around 20%. And that's off the top also. A rough estimate: total value ($80 oil...$4/NG) of U.S. oil/NG production = $820 billion. Estimating average royalty to govt + private citizens = $123 billion. State/county production taxes range from a couple of percent to 9%. Let's assume 4% so that's $33 billion in local taxes.

So that's over $150 billion/year in just production taxes and royalty. On top of that there's the state and federal income taxes on the companies...won't try to estimate that but obviously it's significant. Then add in an even bigger number: salaries paid to the workers of not just the operating companies but the thousands of oil field service companies. And those folks pay local and fed taxes. Would the economy be better off if those salaries were paid to overseas workers?

No, increased domestic drilling won't prevent PO. But domestic production does inject a big pile of bucks into the economy that would be sent to some foreign companies otherwise. And if we had to import all that domestic oil/NG? Add another $820 billion to our yearly trade imbalance. And that assumes oil/NG prices wouldn't be higher if our domestic production didn't exist.

Yes: monies spent for domestic fuel sources pull monies away from other projects. But the monies stay in the economy as well as allow other major section of the economy to function more efficiently then if we imported all our oil/NG. Just one example: what would our farmers be spending if we didn't have our domestic production? Easy to guess that our food costs would be significantly higher if every gallon of diesel a farmer burned originated from an foreign well.

Thanks for throwing a couple real numbers out there ROCK--do you know if most drill and pipeline pipe is made domestically, or is most of that just money off to China and the shippers? I've seen the wait for steel on military projects that require at least NAFTA made goods--so I do suspect a great deal of the steel used in the oil and gas industry comes from overseas. The more of the industry that is truly domestic the better for our economy.

By the way did you happen to see what direction that thread in the Egypt gas post headed before it disappeared? That little highly illegal (but rarely caught) securities scam I over simplified wasn't directed at you but as you had already used "I" in your response I just kept it going by using 'you.' The tone was really starting to deteriorate last time I glanced at the thread and that is one thing the editors know must be kept in check...they are generally pretty forgiving of our bird walks?- )

Luke - we do import some oil field tubulars but I won't try to guess the split with domestic sources. I'll call around tomorrow.

No about Egypt...been off the grid most of the day

I agree with you, that drilling adds a lot of funds that circulate through the economy. It is definitely a plus for the ecnomy

The point I made earlier was if the price went up (so that companies were making a better return) but there was no increase in drilling, the impact would be much less. Of course, with inadequate prices, we are facing a situation where in the near future, companies will likely pull out, if they can't make an adequate return, but that doesn't show up in the numbers yet.

I think we want to separate out two sorts of price changes. The first one is a change in the price level because of market conditions. In the immediate short term this changes the profits for the producers/sellers. The second one is the longterm trend which should be based upon a market equilibrium, higher prices mean more development of the resourse and less usage, and lower prices the reverse. If the price rises because of the first cause, the extra cost is transfered to the owners (company officers, and stock holders). In the second sense, that means more economic effort is being expended trying to produce the resource. This generally means more oil&gas jobs, but compared to a baseline gas with cheap to produce gas, the economy is actually producing fewer goods and services, so is actually less well off.

In the market case, the excess profits flow primarily to wealthy investors, whose propensity to spend the money differs from John Q Public's, so this transfer probably doesn't help the economy overall (but the investors making money they can spend) this at least patially mitigates the consumers loss.

In the case where we are spending more physical assets to produce the gas (and also spending more assets to consume less -for instance buying/installing insulation), the same number of employed people are producing fewer end consumer products, so we are getting poorer -even if GDP may not be changing.

See my other comment to Luke H.

I agree - if the labor required to produce a unit of gas goes up, that additional labor doesn't increase GDP. Of course, if we have unemployment and an output gap like we do now, that additional labor just means a slightly better distribution of income.

Thanks for the post Gail.

It seems to me that steps we make to use this new supply should be made cautiously, being aware that the increased supply may not be all that much, or last all that long.

Unfortunately that is kind of like expecting the birds at my feeders to conserve the sunflower seeds that magically keep replenishing themselves. No worries about alternatives till the feeders stay empty--certainly in our case no worries about what other important uses we have for the natural gas, say f e t i l i z e r, that would be of much greater long term benefit than burnig it.

Re: the Barnett decline - If you keep the same number of rigs drilling the same number of wells/yr for about 4 years you no longer keep up with the cumulative decline. You have to add rigs just to run in place.

Murry - That's a very critical point that isn't often brought into the discussion. I was on contract with one of the major SG players in 2008. That spring the geostaff was pushing the drilling dept to contract every drill rig they could for their E Texas SG play...they didn't care what the day rate or terms were. That depletion tread mill was beginning to show up in their projections and they needed so many more rigs just to stay static. But when NG fell below $6.50 that position swung 180 degrees. By January of '09 they cut 14 of the 18 rigs they had under contract and paid a $40 million cancellation penalty. Yes: paid $40 million for the right to NOT DRILL SG WELLS. In my 36 years I've never seen an operation fall apart so fast...and I've seen a number of major crashes.` I won't try to put a figure to it but a considerable portion of our current NG supply (which has now become rather stable due to the hyperbolic nature of the decline) is coming from wells that will never recover their initial invest. That fact is not lost on the oil patch as well as our capital sources.

Some RRC stats: http://www.rrc.state.tx.us/data/production/gaswellcounts.php

Note that there is a slight discrepancy between the EIA data and RRC data, but that is probably due to total gas production versus marketed dry natural gas production (EIA), but in any case, the RRC shows that 23,000 gas wells in Texas in 1972 produced 7.5 TCF, while 101,000 gas wells in 2009 in Texas produced 6.8 TCF. If my math is correct, in 1972 we averaged 900 MCF per day per well, while in 2009 we averaged 180 MCF per day per well.

And now we do horizontal drilling and use a lot of fracking, so the cost per well is a whole lot higher. The EROI is clearly way, way down.

westtexas - thanks muchly for that url. It shows producing wells in Texas up 17.9k 2006 through 2009. I had estimated shale gas wells developed 2006 through 2009 as 18.3k. Given that not all of the Texas wells were shale gas, and not all of the shale gas were Texas, that degree of agreement encourages me. They also have Texas production up about 1.5 tcf. If conventional was flat that is Texas shale gas up 1.5 tcf. That also makes my total 2009 shale gas of 2.3 tcf look pretty good.

OTOH that long gradual decline in mcf/day might argue against a cliff. What do you think?

Murry – WT likes to sleep in so I’ll chime in for now. Many on TOD understand the high INITIAL decline rates. But we don’t chat much about the out years. Once production drops below 90% or so the DR greatly decreases. It varies by trend but SG wells can continue to produce commercially for decades. There are New Albany SG wells in KY still producing after 40 years. At a small fraction of their initial rate, of course, but still producing. Many of the older SG wells show almost no decline beyond Year 15.

I don’t have a handle on exact numbers but here’s a model to give a sense of scale. Initial rate 3,000,000 cf/d (not all wells did as good as the headline grabbers doing 20,000,000 cf/d); a 95% decline after so many years (average 150,000 cf/d or about $600/d gross at current price); 18,000 SG wells. The simple model: 18,000 X 150,000 cf/d X 365 days = 0.99 tcf/year. Assume an out year DR of 10% and you’re still doing 0.9 tcf next year. Not too bad a fit given I just made some WAGs.

Having worked with pressure depletion drive SG reservoirs for the last 10 years I didn’t anticipate the “cliff” WRT production volume. If there were to be a cliff it would be seen more in the new well drill count and the rate of increase in NG production. The economic limit of any SG well will be the cost of compression. Not only do flow rates drop dramatically but so does the flowing pressure. Once pressure drops below 800 psi or so the NG has to be compressed to raise pressure to enter the pipeline. The primary fuel to run the compressors is almost always the produced NG itself. Compression can eat up 10% or more of the production stream. Fortunately this burned NG is not counted as produced volume in the statistics.

It’s also good to remember that much of this out year NG production represents a money losing proposition for many wells. The NG is still economic to produce as long as LOE (lease operating expense) is covered. But factoring the high drilling costs many of these commercially producing wells will never produce a net profit. Many SG wells drilled required a NG price above $6/mcf to just break even. But once a well is drilled/completed all costs are considered “sunk” at that point. A commercial well is one that generates at least $1 net cash flow per month. “Commercial” production doesn’t mean the well generates a profit on the initial investment.

One thing that impressed me when I saw tight gas wells in Wyoming is the fact that they depend on our current infrastructure to continue. There are complex controls, that report whether the wells are producing as planned. The wells I saw had solar panels and batteries nearby, to keep the controls operating. In another part of the country, I suppose, connections to the electric grid could be used. A maintenance person came around in a truck to service wells that seemed to have problems. There were computer programs to make certain that this was done as efficiently as possible--not driving all over, to get to a single well.

As long as this can all be kept up, and the cash flow is positive (and the taxes aren't too high), this will work. But if infrastructure (roads, trucks, battery manufacture, etc.) starts to go, then there will be a problem.

There are complex controls, that report whether the wells are producing as planned. The wells I saw had solar panels and batteries nearby, to keep the controls operating. In another part of the country, I suppose, connections to the electric grid could be used. A maintenance person came around in a truck to service wells that seemed to have problems. There were computer programs to make certain that this was done as efficiently as possible--not driving all over, to get to a single well.

Yeah, I used to design these things in my younger days. You put a remote terminal unit (RTU) with a bunch of sensors at each wellhead with a solar panel, antenna, and radio. It monitors everything and reports back to the central computer on everything that happens. The field personnel come in every morning and get a nice report of what is happening on all their wells. They go out and visit the ones that have problems. At the gas plants can they control the well production rates to match supply and demand, and back at head office the marketers get a daily report of deliverability on all the gas contracts. At the end of the month the production accountants get official-looking reports of who owes how much money to whom.

The fun parts were doing pipeline balances (pipeline leak, close block valves, notify management), safety monitoring (man down, no response, call out ambulance) and burglary detection (building door open, equipment removed, vehicle moving down road, notify police to be waiting at end of road.)

I think that the most interesting metric is a "cash flow equivalent" BOE calculation for the average production rate of 180 MCF of gas per day*. The WTI to NG wellhead price ratio is on the order of about 23 to one. So, in cash flow terms, the average gas well in Texas would equate, in cash flow terms, to an oil production rate of about 8 bpd.

*Probably wouldn't be a bad idea for someone to double check my numbers

It might be interesting to do this same cash flow equivalent calculation for total US production.

Sounds like lots of stripper wells.

Figure 9 shows that natural gas amounts to only a little more than a quarter of total US fossil fuel consumption. Trying to ramp its production up to replace coal, and to offset declines in oil availability would seem to be an extra-ordinarily difficult task. Natural gas production would need to be more than doubled–something no one is expecting.

The way that NG is likely to contribute to replacing oil is by backing up wind,nuclear and solar electric power used for electric vehicles. Replacing oil refining alone will save considerable NG. If NG backing up nuclear and renewable energy with NG peaking used at 10% capacity factor and EV transport is about 5 times more efficient in energy consumption than oil transport would need to use about 20million tonnes of oil equivalent NG( about 4% of present consumption) and of course a lot of nuclear, wind and solar electricity. Similar switching from NG hot water and space heating to heat pumps will give much larger savings than the additional NG used for electricity peaking.

If there is a rapid switch to gas as a transport fuel it will create a price shock for existing gas users. Truckers switching from diesel to CNG will happily pay much more than gas fired power stations or town gas users are used to. Hereabouts diesel and petrol work out around 3c per megajoule or $30 per gigajoule. Current gas users seem to like prices around $5 per GJ or mmbtu, the two units being almost identical. As a first guess how this will affect the gas price if transport and non-transport gas demand were each 50% of the market the average price might become (30 + 5)/2 = $17.50. Therefore absent special taxes truckers switching from diesel to gas pay a lot less for energy but gas fired power stations pay a lot more.

I would support a modified version of the Pickens Plan leaving out the major wind power element which I think is illusory. The trick will be to burn less gas in power stations thereby freeing up supplies for transport and non-power uses. The latter includes thermal (eg home heating) and chemical as in ammonia production. I believe gas supplies about 40% of electrical energy in the US and around 30% in the UK. Perhaps that should be 10% just for peaking plant. In my opinion most electricity should be generated by nuclear.

I could point out that the Honda Civic NGV has just won the greenest car award while sales of the GM Volt are slow. People want to drive for at least a couple of hours on a single 'fill up'. For trucks and pickups this is essential. What is the alternative when oil is $200?

If memory serves NG produces only about 10% of USA electricity.

Close to 20%. Used to be 18%, but has risen a bit.

Actually gas was almost 25% in 2010 according to the EIA.

http://www.eia.gov/cneaf/electricity/epm/epm_sum.html

Now imagine what that pie would look like if politics hadn't killed progress in nuclear power in the 1980's.

It's taken 30 years and some conversion experiences as some of the antis finally recognized the true cost of their positions, but we may (if we're lucky) resume the curve soon.

Now imagine what that pie would look like if politics hadn't killed progress in nuclear power in the 1980's.

Opposition to nuclear power was mainly generated by the practices of the nuclear industry partly due to the rapid build-up, poor management and training, massive cost overruns(WOOPS), and a few stupid expensive accidents( Browns ferry, 3 mile island). Lets hope these lessons will prevent a repeat of the 1970's mistakes by the nuclear industry.

If say 75% of electricity today was from nuclear it wouldnt greatly change todays problems of replacing oil, we would still need 10% power from NG peaking but we could retire a lot of very oil coal-fired power plants. We would still need to replace >200million ICE vehicles with EV over a 30 year period.

According to a rather interesting analysis at Depleted Cranium, the NRC is substantially responsible for the TMI Unit 2 meltdown. I have long been reading about the NRC's control room design standards being directly opposite to what's known to be good human-factors design (as understood and practiced by agencies like the FAA). TMI Unit 2 was one of the first reactors completed under NRC oversight. The excessively complicated controls and instrumentation (the information from which caused the controller errors) were put into Unit 2 by order of the NRC. TMI Unit 1 continues to operate to this day.

The NRC's new-reactor certification requirements are horrifically expensive and uncertain, as the company seeking certification essentially has to pay to train the NRC's personnel at $250/hr and the process can take 7-20 years. That wasn't the industry's mistake; Congress and the White House own that one.

Actually, it would; lots of out-of-the-way places still rely on oil for electric generation, and switching them to nuclear power frees that oil for use in transport. Reactors in the 10-100 MWe range are being aimed at those markets (outside the USA with its crazy regulatory system).

The other thing is that nuclear process heat can be used to do chemistry. If you can turn your garbage to syngas, you can make methanol cheaply. Methanol is a direct replacement for petroleum in flex-fuel vehicles.

Boof,

I could point out that the Honda Civic NGV has just won the greenest car award while sales of the GM Volt are slow. People want to drive for at least a couple of hours on a single 'fill up'. For trucks and pickups this is essential. What is the alternative when oil is $200?

GM Volt can be driven a couple of hours on a single fill up, and for city driving most of this would be using electricity(1-2h in city traffic). For long haul trucks I can see that 40 mile range on EV mode is a problem but most pick-ups and SUVs are used exactly as other cars, commuting small distances every day. Short haul trucks could use mainly electricity.I think you can make the case that for charging vehicles or mobile phones, plugging in daily is not going to be a big problem, and a lot easier than filling up with petrol.

The big advantage of EV transport over petrol or NG is the much higher efficiency(75%) compared with 15% ICE, while heat pumps are about 300% efficient for space and hot water heating. Makes more sense to use NG to supplement wind, solar and nuclear, and use the expanded electricity to replace oil and NG used for transport and heating.

Not sure what you are referring to " GM Volt sales are slow"??

Neil sure electric drive trains are efficient for around town but GM ended up installing a direct to engine transmission in the Volt for highway use. I don't have the figures handy but I think the Volt sold several hundred units in January 2011 when they seemed to be hoping for thousands. Some of my neighbours commute 70km each way then park in their employer's yard. Not only will PHEV range have to improve to do this trip with a bigger safety margin but workplace recharging will have to become commonplace. The employer might find it easier to hire staff who can make do.

Several commenters on other threads in TOD have said they need supplementary gas heating on cold nights since their air source heat pump struggles. Gas fired combined heat and power may help in cold weather but again the uptake is slow. I have free firewood so it's not a problem for me. With both cold weather heat pumps and long range PHEVs the problem is not so much efficiency as fitness for purpose. The pathway gas-electricity-battery has losses at each step which partially undoes the efficiency of the electric drive train. I'll try to get more precise data. Gas for transport is going to be big, how big depends on how businesses and households adapt to less oil.

Boof,

Some of my neighbours commute 70km each way then park in their employer's yard.

The 64km range of a GM volt was the average daily driving distance, but even for those who travel more than twice the average a GM volt would be able to use electric for 90% of the trip to work. If we assume the company pays 20cents/kWh its only going to cost $1.60/day to fully re-charge those long distance commuters, and a lot less for most. Compared with daycare, a coffee machine, bottled water in lunch room etc this is hardly a big cost for an employer.

Air source heat pumps will struggle in cold weather to maintain 25C in winter just as air conditioners struggle in hot weather to maintain 20C, but really would it be a disaster if the heat pump could only maintain 18C on the coldest winter nights? Perhaps a wool jumper could be used on those occasions or a larger unit installed. Its not the savings on the coldest night its the energy savings over the 3-5 months of winter, and the 12 months savings for heating water.

I see a PHEV as perfectly matched to the needs of most vehicle drivers who have access to grid electricity or off-grid PV. It still requires some oil or NG but dramatically less for most people, even those that have very long distance commutes. One solution for long distance commuters would be a larger capacity battery, a little more expensive, but not compared to the price of an optioned up SUV.

yes to the sales numbers, NO to the hoping for thousands... .

http://gm-volt.com/2011/02/02/as-volt-sales-outpace-the-leaf-gm-works-on...

(and other, non-Faux News stories).

GM and Nissan are slowly ramping up manufacturing (and in the case of the Nissan Leaf, the shipping to the US). They are being very careful.

They are selling EVERY SINGLE ONE of the cars they make, as fast as they ship to the dealers.

And they're not in nationwide availability yet.

Nissan has 20,000 people signed up for the Leaf.

GM has 50,000 on the (unofficial) Volt waiting list.

I have free firewood so it's not a problem for me.

Yes, that does change the economics of the decision-making process. At the moment, NG is cheap and it's not worth my while to get out the file and sharpen the chain on my chainsaw, but if it went up, I would get out the file, sharpen the chain, tune up the engine, and there would be a lot more standing deadwood from behind the house going into my fireplace. Most people don't have this kind of flexibility.

The last time I used the fireplace was when the electronic ignition went out on the gas furnace. The wood fireplace kept the house toasty warm until the furnace dude replaced the part, but my wife complained bitterly about all the insignificant bits of wood debris near the fireplace, and the light covering of ash dust from the fireplace in the absence of the electrostatic filter on the furnace to zap everything out of the air.