EIA Annual Energy Outlook 2011: Don’t Worry, Be Happy.

Posted by aeberman on December 29, 2010 - 10:46am

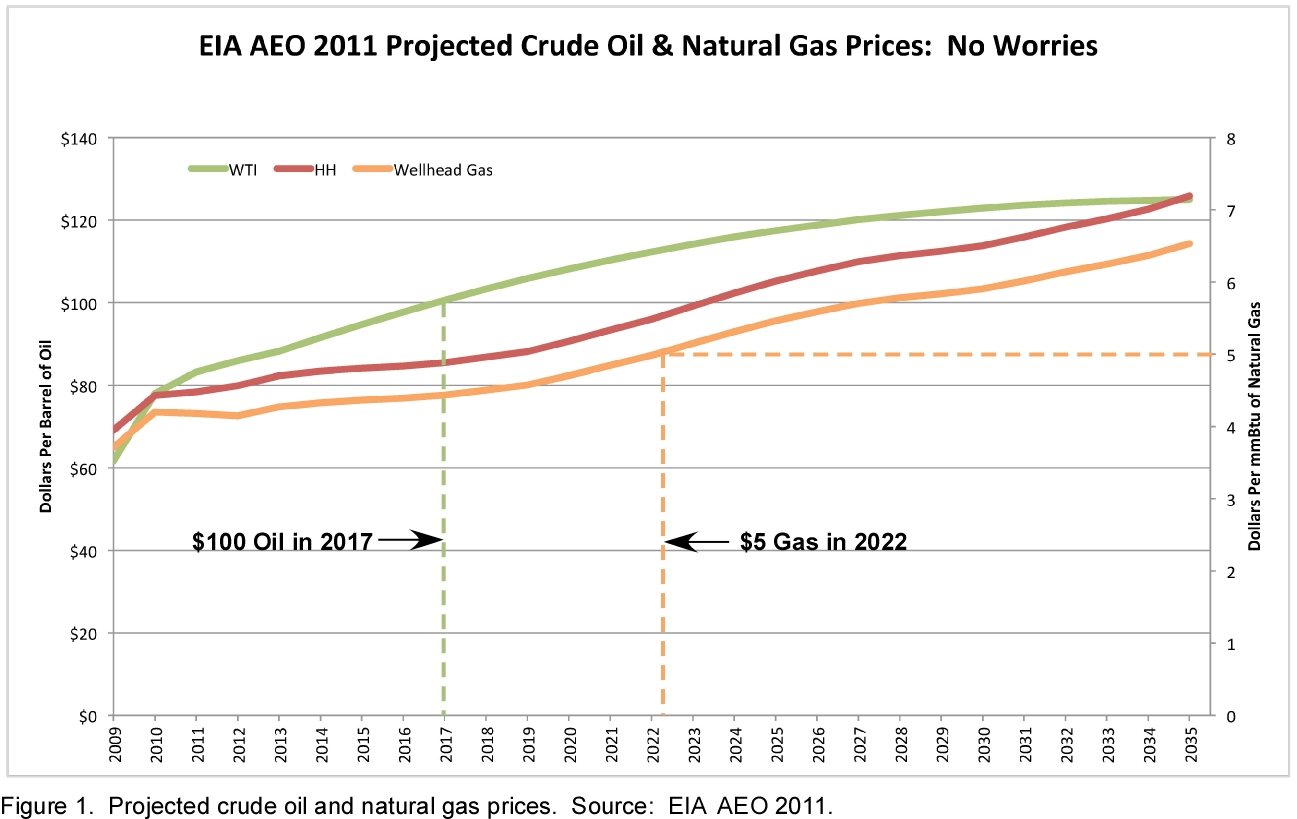

We no longer have to worry about energy supply or prices. That is the message from the U.S. Energy Information Administration’s (EIA) Annual Energy Outlook (AEO) 2011. Cheap energy will characterize the world for most of the next decade, according to the report. Oil will not reach $100 per barrel until 2017 and natural gas will remain below $5 per thousand cubic feet (mcf) until 2022 (Figure 1).

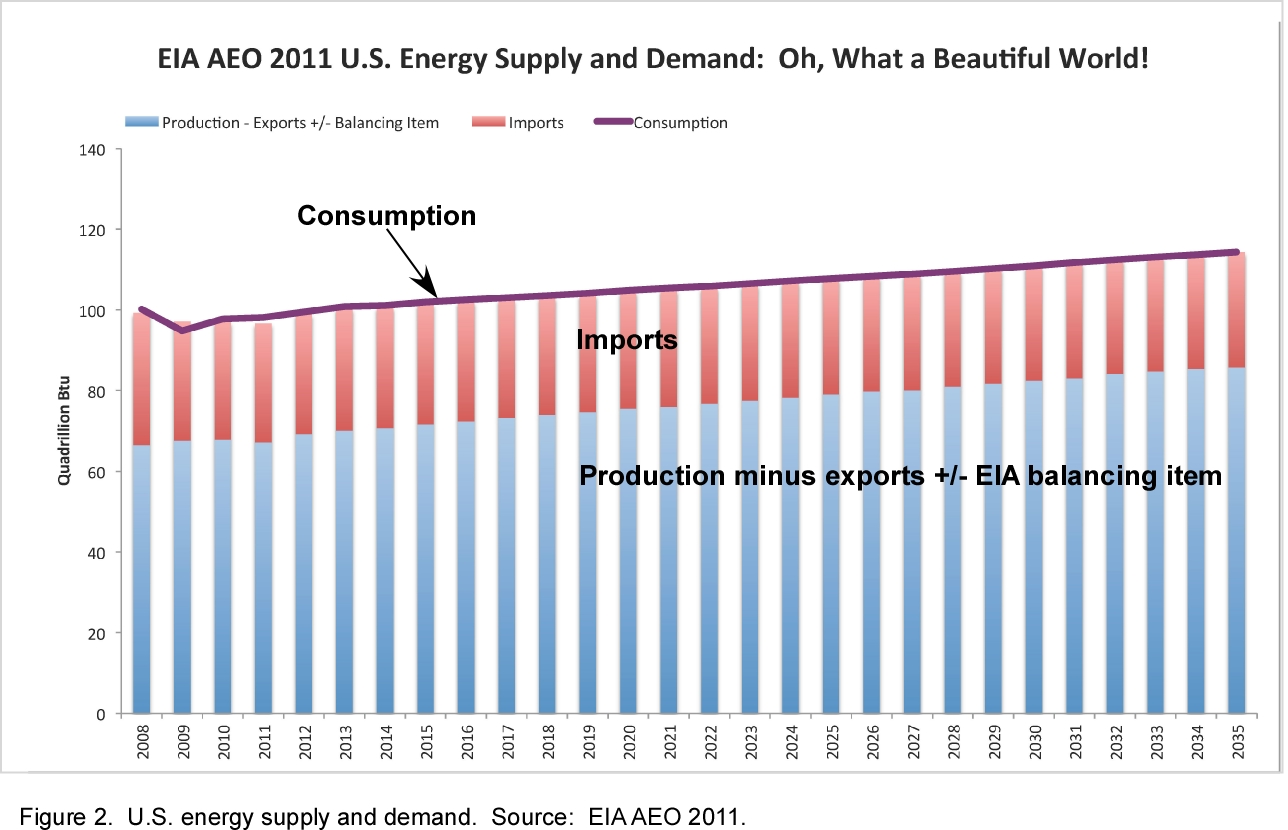

Despite four decades of oil shocks and natural gas price spikes, the future looks stable with supply and demand comfortably balanced (Figure 2). Wasn’t it just two-and-a-half years ago that $147 per barrel oil helped push the world into the current global recession? The EIA forecast is as troubling for the smooth and gradual progression of oil and gas prices as it is for the improbably low values of those prices. The history of oil and gas price, supply and demand is characterized above all by volatility but the EIA projection does not reflect this characteristic. Don’t worry, be happy.

Natural Gas

The headline of the AEO 2011 Early Release Overview (http://www.eia.gov/forecasts/aeo/) published December 16, 2010 is that shale gas resources in the U.S. have more than doubled since last year’s report. The current estimate is 827 trillion cubic feet (tcf) of gas, up 474 tcf from last year’s assessment of 353 tcf. The new figure is 25% higher than the Potential Gas Committee’s (PGC) 661 tcf from shale in its June 2009 report (http://www.mines.edu/Potential-Gas-Committee-reports-unprecedented-incre...). Notably, the PGC also presented a “probable” case of total gas resources of 441 tcf. Shale gas represents approximately one third of this estimate and is 17% of the EIA estimate (147 tcf). We hope to get more detail on how the EIA determined total and shale gas resources, along with other aspects of the EIA Outlook when the full AEO 2011 is released in March.

Technically recoverable resources should never be confused with reserves because resources do not take commercial considerations into account. These may be in accumulations so small or so deep that the gas may never be drilled or produced at any price, or may be in areas that are off limits or impractical to drill. It includes plays and basins that are, as yet, untested.

A resource assessment begins by estimating a total resource in place based on assumptions about gas richness, shale thickness, thermal maturity and areal distribution. A technically recoverable resource is a sub-set of the total resource that is determined by eliminating areas where one or more of these factors are marginal. There is great uncertainty involved in both of these estimated volumes. The expectation of future production based on as yet uncertain current production decline models is a key factor. For North America, The Baker Institute estimates 583 tcf of technically recoverable shale gas resources. Other estimates include Navigant Consulting (900 tcf), the Potential Gas Committee (661 tcf), and ARI (1000 tcf).

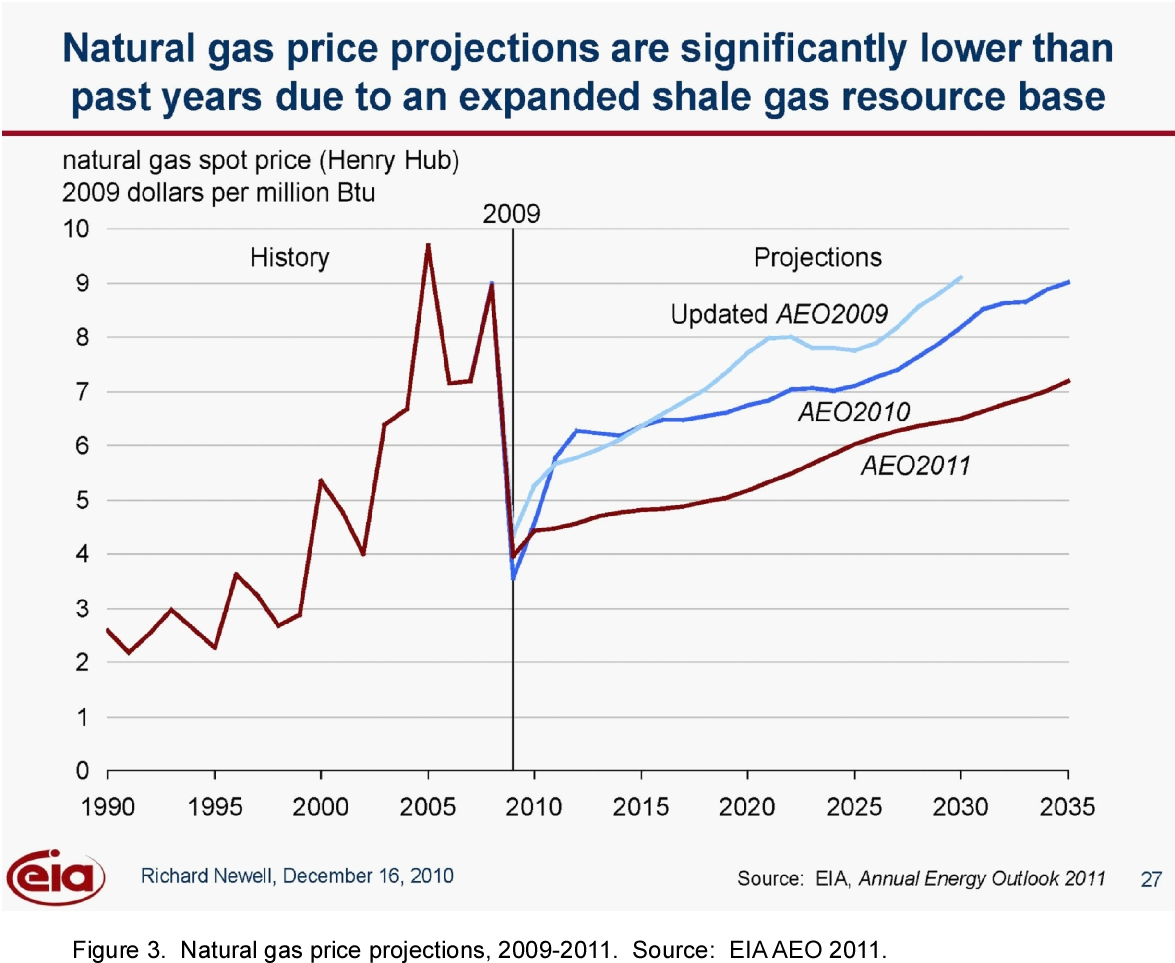

Given the variations in these recent evaluations (2008-2010) by credible organizations, resource estimates should not have much bearing on future production volume or price forecasts. The EIA, however, takes a different view. Slide 27 in Richard Newell’s December 26 unveiling of the AEO 2011 states, “Natural gas price projections are significantly lower than past years due to an expanded shale gas resource base” (Figure 3).

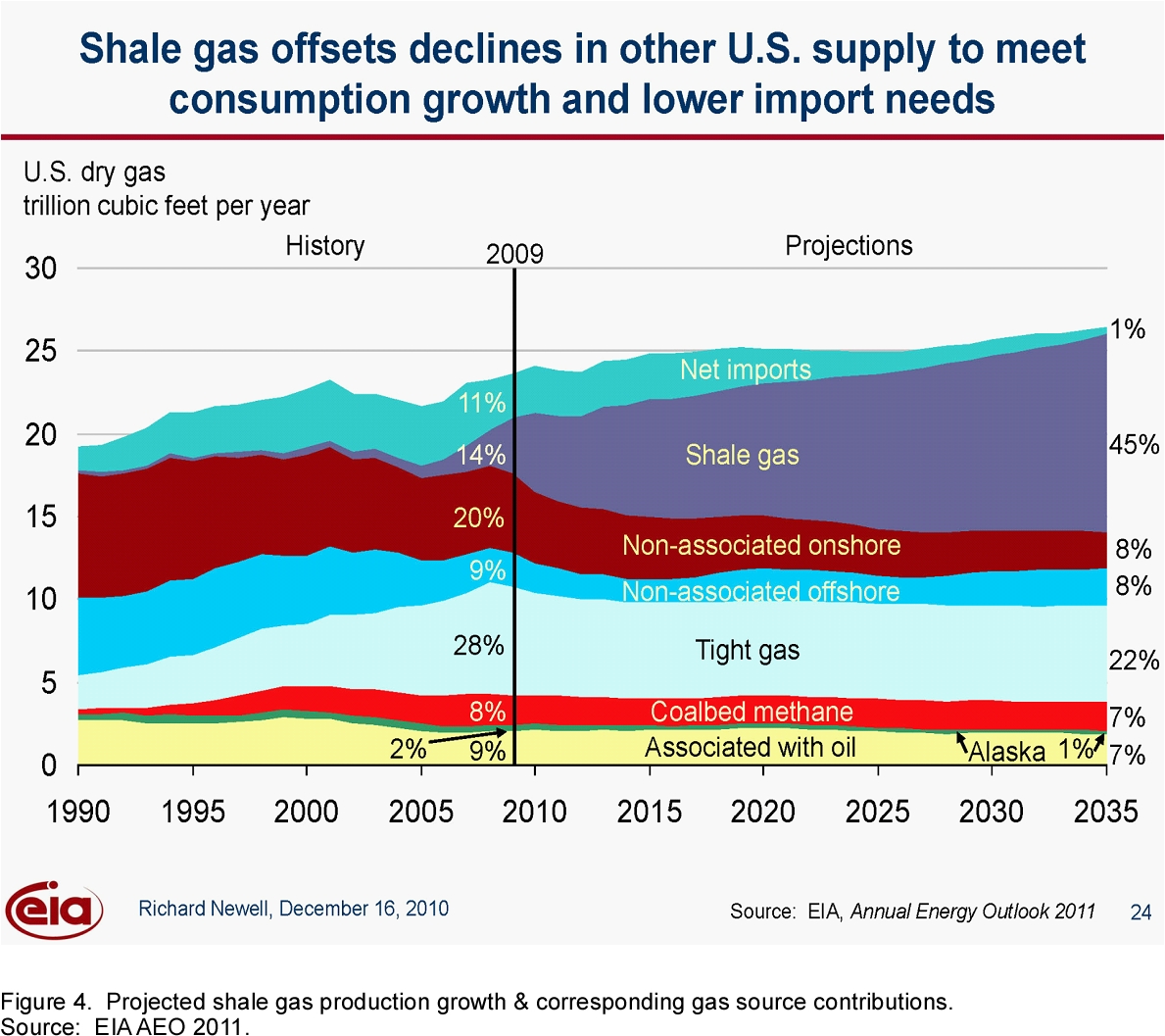

For the EIA, increased estimates for U.S. shale gas resources equate to higher production volumes, lower prices, and decreased imports of natural gas with shale gas accounting for 45% of total supply by 2035 (Figure 4). Average annual gas prices are 20-25% lower than predictions made a year ago in AEO 2010.

The only volume that really matters is proved developed reserves. While the EIA’s estimate of resources has doubled since last year, proved reserves only increased 2.5% in 2010 (EIA AEO 2011). Much of this increase will likely be proved undeveloped reserves (PUD) thanks to revisions in Securities and Exchange Commission definitions for 2009. Clearly, the commerciality of undeveloped reserves is more questionable than proved developed reserves.

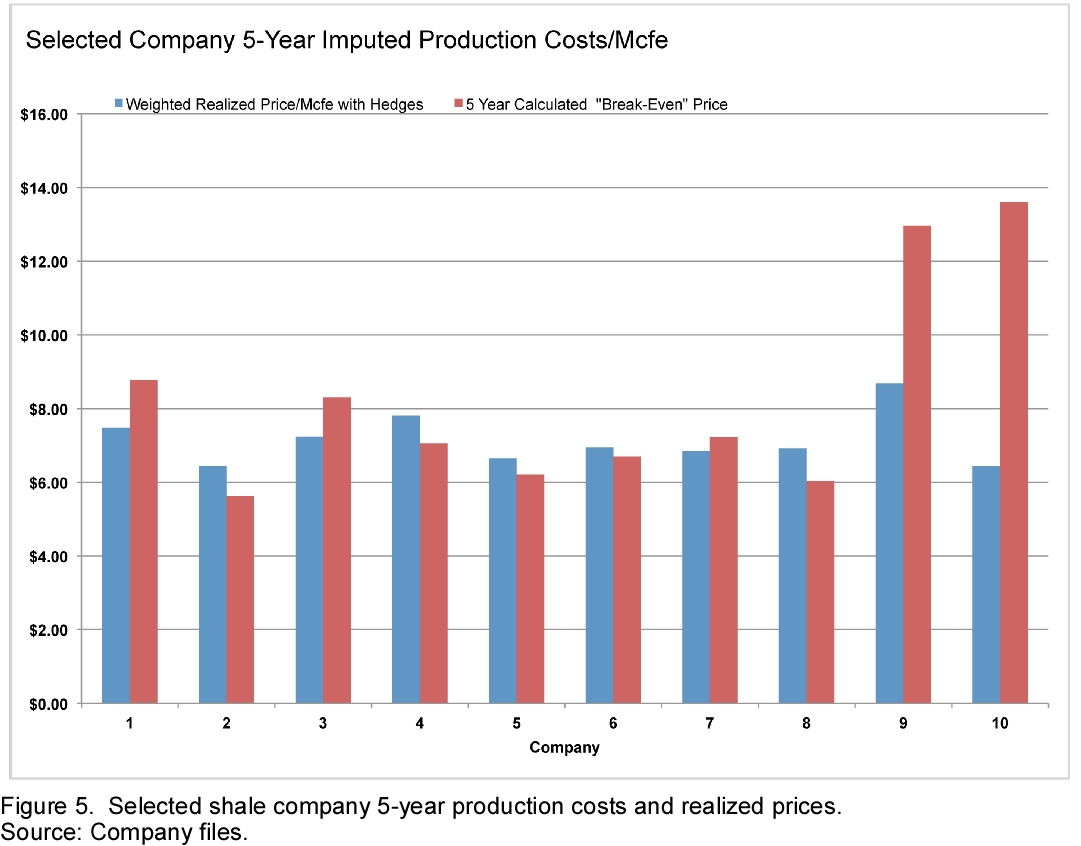

The EIA fails to grasp that the exploration and production business succeeds or fails based on earnings and profit, and not on production growth, resource or even reserve additions. Natural gas operators require at least $7.00 per mcf on average to break even in the shale plays (Figure 5).

Favorable hedge positions over the past five years have carried companies through fluctuating and, more recently, low product prices. With futures strips now below $5.00/mcf for the next twelve months, hedges fail to guarantee the marginal cost of production.

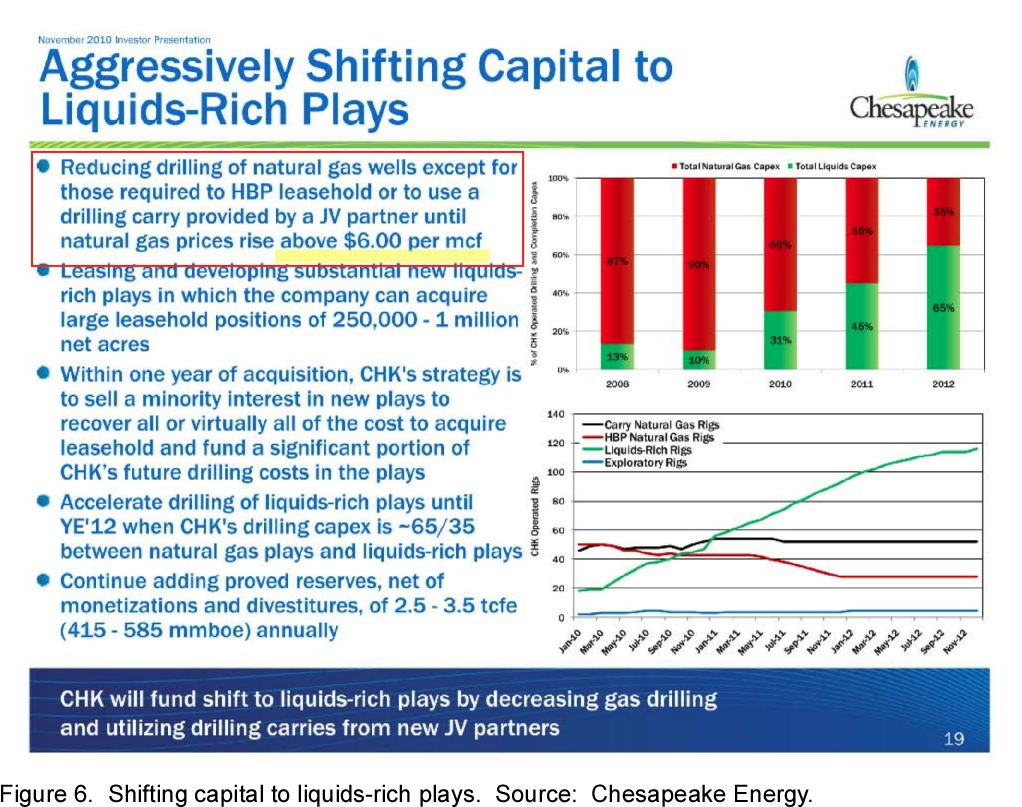

While shale play enthusiasts have claimed profitability at gas prices below $5/mcf in recent years, these half-cycle economics do not include significant “fixed” and “sunk” costs such as debt service and overhead. With the flight to liquids-rich plays in recent months, the truth about true cost is being revealed. Chesapeake Energy, the paragon of shale operators, states in their most recent investor presentation that they do not intend to drill anything other than obligation wells in gas plays “until natural gas prices rise above $6.00 per mcf” (Figure 6). This reveals their commercial threshold despite past claims of profit at lower gas prices.

The EIA gas price forecast, therefore, implies that operating companies will continue to drill and produce gas at a loss for the next decade. This cannot happen. Because of the high decline rates of shale gas wells, drilling must continue at current rates just to maintain production rates.

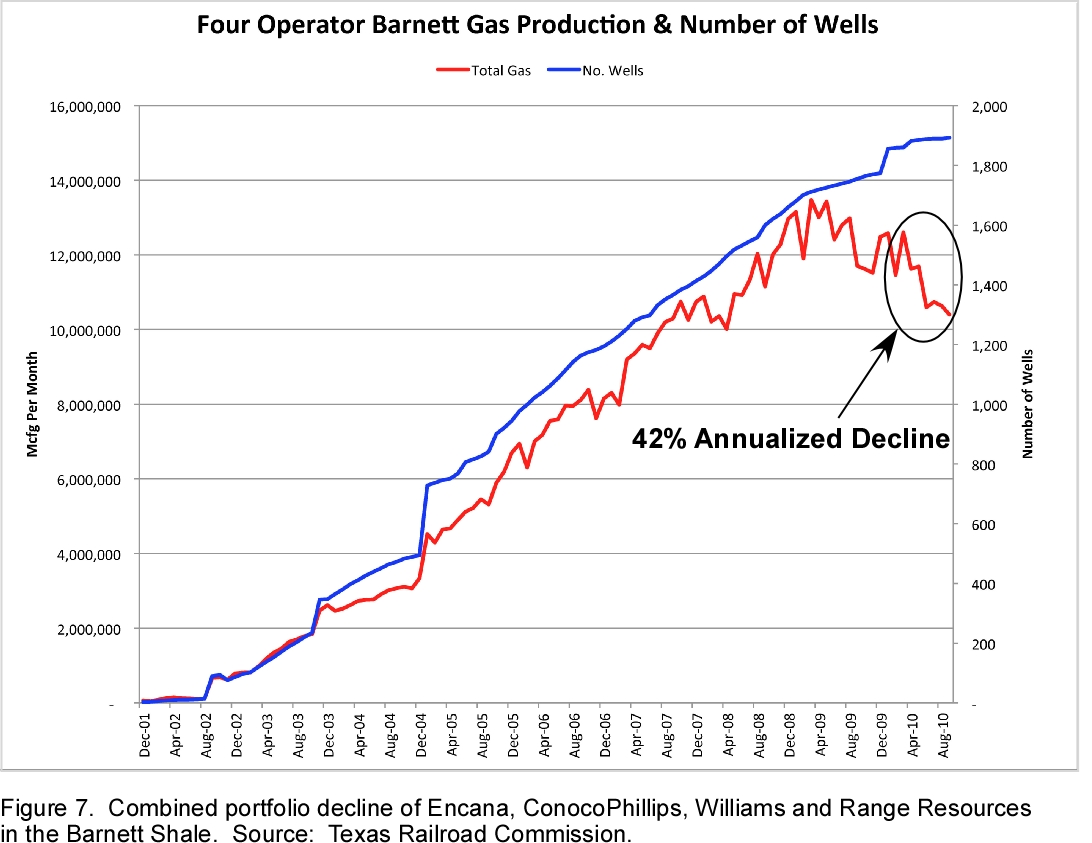

Because some large operators in the Barnett Shale stopped drilling new wells in 2010, we can determine true portfolio decline rates, and they are substantially greater than predicted hyperbolic decline models. Figure 7 shows that the portfolio production decline rate is more than 40% for Barnett Shale wells operated by Encana, ConocoPhillips, Range Resources and Williams.

For shale gas production to double and reach 45% of total U.S. supply as the EIA predicts by 2035 (Figure 4), rig counts will have to more than double. This cannot happen unless gas prices rise substantially beyond EIA predictions regardless of improvements in drilling efficiency and economies of scale.

The most likely average natural gas spot price for 2011 will be $4.10/mcf (J. M. Bodell, personal communication). Toward the end of the year, it is possible that gas prices will strengthen toward $5.00 as drilling to hold land by production decreases.

Crude Oil

The EIA’s assessment of crude oil supply, demand and price is similarly puzzling by its departure from current data and considerable informed opinion that oil price will rise in the near term. The projection that oil prices will remain below $100 per barrel until 2017 conflicts with every credible source on the topic. The U.S. military, the world's largest single consumer of oil, has publicly stated its belief that there may be a liquid fuel shortage by 2012 (Joint Operating Environment (JOE) Report, 2010: http://www.jfcom.mil/newslink/storyarchive/2010/JOE_2010_o.pdf).

Oil closed at $91.51 on Friday, December 24, 2010 and will probably end 2010 at an average price of about $79.50 per barrel, yet the EIA estimate for the year is $78.03. Many experts predict that oil prices will exceed $100 per barrel in 2010, but my sources indicate that West Texas Intermediate crude oil prices will average $88 per barrel (J. M. Bodell, personal communication) but will increase to $95 or $100 per barrel later in the year.

The main factor that will control crude oil prices in 2011 is demand from the developing economies of countries outside of the OECD (Organization for Economic Cooperation and Development). Demand is expected to increase 3.6% (IEA) among developing nations and this should challenge OPEC (Organization of the Petroleum Exporting Countries) spare capacity. Because of subsidized oil and motor fuel prices in all OPEC countries, crude oil demand is largely insensitive to price. In contrast, the IEA predicts that oil demand in OECD countries will decrease 0.5% in 2011.

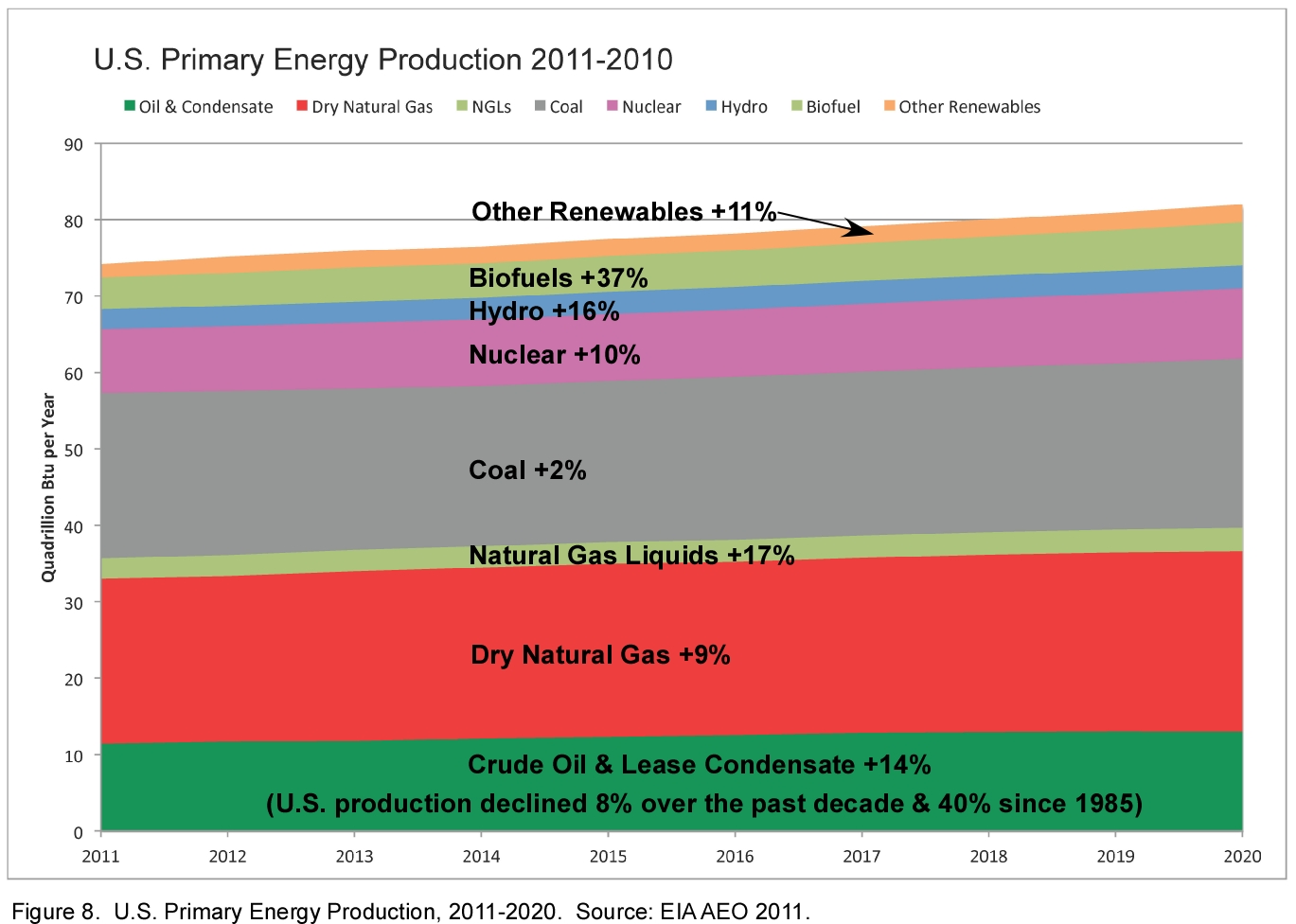

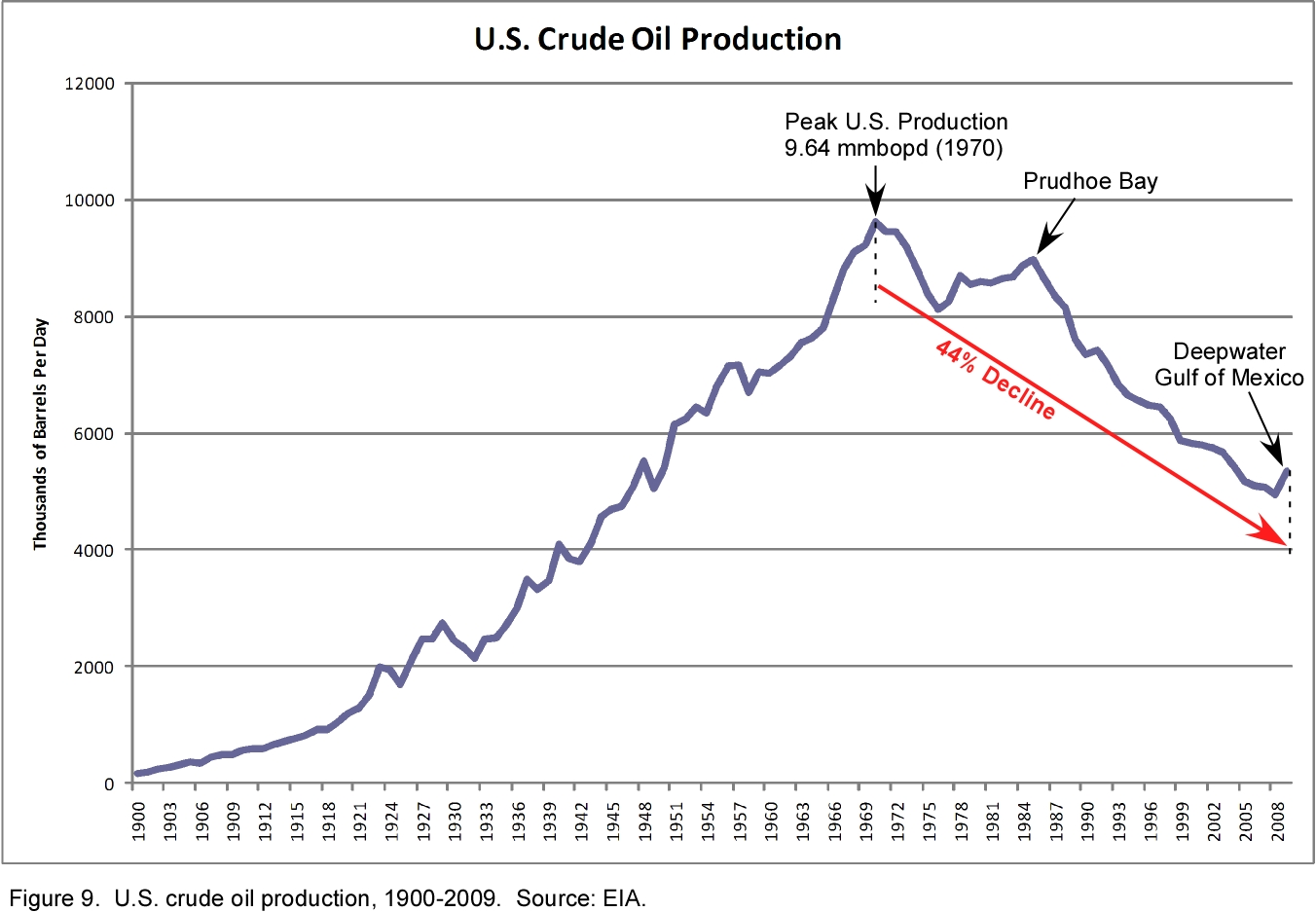

The EIA AEO 2011 report features a 14% increase in U.S. crude oil and lease condensate production from 2011 to 2020 (Figure 8) despite an 8 percent decline in production over the past decade and a 44% decrease since the 1970 U.S. production peak (Figure 9).

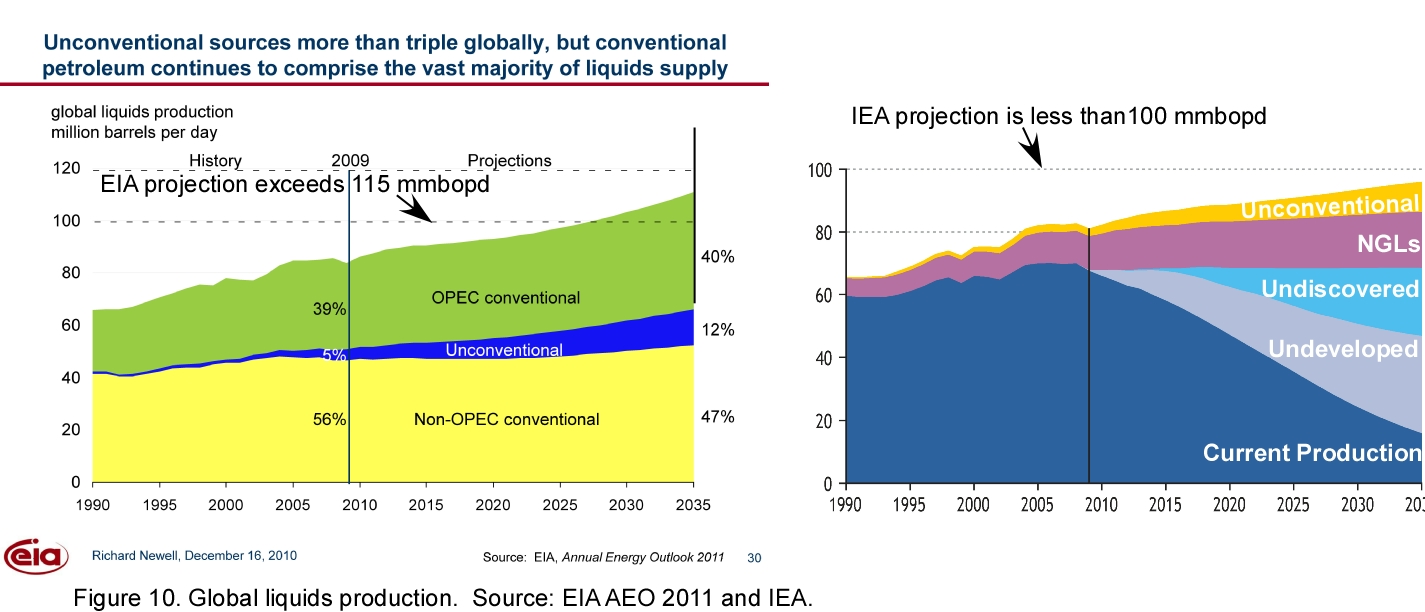

It further implies that unprecedented increases in nuclear, hydroelectric, biofuels and renewable energy sources will magically materialize to meet growing U.S. energy demand. EIA forecasts also imply that global liquids production will reach 115 mmbopd before 2035 while other estimates, including those by the IEA (International Energy Agency), do not anticipate that production can exceed 100 mmbopd (Figure 10), and many doubt that it can even reach that level. In any case, the price of oil would have to be substantially higher than EIA estimates to reach the production levels that it predicts.

Conclusions

It is understandable that the EIA, as a branch of government, must produce an annual report that is politically expedient and that supports a view that meets public policy expectations. The EIA approach takes a long-term economic view and is, therefore, not concerned with the fluctuations that characterize the real world of petroleum supply, demand and price. At the same time, it is not useful that this report is in conflict with industry best practices and opinion as well as trend data available to the public.

The EIA’s resource estimate of technically recoverable gas from shale is interesting but not relevant to future price or production volume forecasts. The Potential Gas Committee’s 2009 report is the benchmark of credibility, and we hope that the full EIA report in March will explain why we should accept unwarranted and insupportable upward revisions to PGC resource estimates and how these might translate to energy reserves and price. The EIA treats shale gas just like conventional gas in its forecasting and does not acknowledge the much higher decline rates and, therefore, great number of wells required to maintain supply.

Exploration and production companies involved in shale gas production have presented a position that emphasizes production and reserve growth over earnings or profit. It is confusing that the EIA has assumed that market forces and improving efficiencies will save the day for oil and gas prices. It would be more appropriate to frame the problem in the context of reasonable expectations that would be useful to public understanding of the shale gas phenomenon and its potential contribution to natural gas volumes and price. It is unsettling that the EIA has not acknowledged the belief by the U.S. military and other credible sources of an impending liquid fuel shortage that confronts the United States and the world (e.g. Hirsch, Benzdek and Wendling, 2010; JOE Report) . Instead, the EIA has provided an unrealistic view of future oil and gas supply and price that will inevitably not serve public understanding or promote reasonable planning for resource availability or price.

Thanks for posting the lyrics!

Art

Youtube: http://www.youtube.com/watch?v=5bNE-5TVAmg

Thanks, Art. Great synopsis. I guess the big question I have is how quickly NG prices can possibly rise to the point that investment starts again? Your chart of Barnett production shows a leveling off to my eye. I wonder if the obligation drilling will be sufficient to postpone or at least ameliorate a near-term production decline.

And if the economy tanks further in 2011, as I expect, will there even be the financial will to invest more? My guess is that a lot of investors are feeling badly burned by the crash of NG prices. To get them to pony up again, they will have to be confident about a long-term increase in prices, not just a spike. Even though Chesapeake says they won't drill until prices get to $6, my guess is that we won't see a big move back to drilling until prices get above $7-$8 and stay there long enough for investors to feel confident.

Your thoughts?

Kingfish,

Thanks for your comments.

It is surprising how capital keeps flowing to the natural gas drillers despite everyone's concern about current and long-term prices. Part of it is the appeal of commodities in hard times, although natural gas has to be one of the worst values in that basket--maybe some see it as undervalued as a result, but not me.

If, as you believe, the economy gets worse in 2011 and if gas prices stay low or go lower--all of which is likely--I expect that there will be capital constraints on some of the more highly leveraged companies. There will be some distress cases that, like in the subprime case, will not be seen as very important...initially. Bubbles end badly and this is no exception. We never know when or why they end is the problem.

The shale operators are pushing the "land grab" strategy which has higher gas price at the end of the rainbow. This may have persuaded some capital providers that it is worth losing money in the short term for the optionality that it buys later when prices are higher.

The flaw in the model is decline rates. I don't think that the EIA or most investors have comprehended that the number of wells that must be drilled can never decrease and must, in fact, increase as the fields are developed. It's just not a retail model where, once all the stores are built, it's all earnings for 20 years until new stores are needed. It's a constant treadmill and a constant capital draw.

Art

Hi Art,

Confused: it seems the general thrust here is that $3-$5 NG is unrealistic as it costs more than this to produce in most cases. If $6-$8 is more realistic in terms of actual production costs, then why is NG not undervalued at today's $4.30?

How long can producers/investors operate at a loss just to stay in the game?

dave - the story of NG prices has gone astray a bit. While it's true that the current low price for NG has cut back activity in all the SG plays it hasn't damaged all NG exploration to the same degree. We've spent $100 million in the last 12 months with the primary targets being conventional NG and NG/condensate. Do it right and there is a profit to be made at NG around $4/mcf. Naturally there won't be as many conventional NG prospects drilled at such low prices but the incentive is still there. Also one might ask if we've justified our drilling based upon expectations of higher future prices. NO: we use the current NG prices with a very slight escalation to run our economics. But we also recognize that if we can make an acceptible profit at $4/mcf than if prices double in the next few years we'll be able to gouge the public and make a killing. Opps...did I type that out loud.

Also I just noticed you mentioned "production costs". For most NG production the actual cost to produce a NG is typically much lower than $4/mcf. In many cases less than 10% of the cash flow. I suspect you meant development costs: monies spent to lease, drill, complete and tie NG reserves into a pipeline. Those efforts obviously costs a great deal more than "lifting costs".

To be fair to the EIA regarding the smoothness of the graph, you can't realistically expect them to predict and depict shocks to the system with any degree of accuracy. The graphs represent an average, not a Nostradamus prediction.

However, regarding the overall picture and the absolute values of the predictions, I'm not qualified to comment.

The obvious way to cover such uncertainty is with error bars and low-case/high-case/average-case curves, capturing volatility and estimated error.

Personally, I think any estimate that doesn't include price AND production is questionable. I think prices will be mitigated by demand decline, and so the price curve might not be all that bad while the reality sucks.

Shale gas should help to put a cap on energy prices, though with a multi-year lag. I fully expect to see the historical cyclical trend (boom and bust) continue. It's probably getting close to time to get into NG investments -- they can't go down much further.

Yes, of course you're right re: the error bars etc. I guess that graph is intended more for executives than for serious analysts and would probably look too confusing with low-case / high-case for each of the 3 lines.

That is a scary thought - that everything has to be dumbed-down for the executives, who make the big decisions.

How can we expect our neighbors to ever understand this stuff if we can't expect our leaders to be able to understand this stuff?

No wonder Sarah Palin is taken seriously as contender for president in 2012.

nick,

I agree about the smoothness of the projections and understand that the EIA is taking a long, high-level view. The problem is that their low gas and oil prices will not justify the amount of drilling necessary to support the volumes they project. Smoothness aside, it is economically unreasonable to expect market forces to continue to support capital expenditures without price support.

Art

Thanks Art.

I do concur that the data in the graphs do look suspect. I can't imagine how they'd manage to keep oil to $100 over 7 years from now. Certainly doesn't seem likely.

Edit: btw there's a small typo in the text:

My observation about oil prices from 1997 to 2010:

BTW, I wonder what the EIA projected, in 2005, for global crude oil production and for oil prices, in the 2006 to 2010 time frame?

FYI, a summary of our ASPO presentation:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Peak Oil Versus Peak Exports

West Texas,

I completely agree with your y-o-y observations and your net export model.

I chose to keep this analysis at a high level since EIA did not release much detail. I, therefore, chose not to get into the important topic of increased oil consumption by big exporting countries. I also did not get into the increased non-OECD consumption except by comparing the projected increases vs OECD decreases. Just because I didn't include them in the text of this post in the interest of focus and brevity, does not imply that I don't consider them or believe in their significance--I do!

Thanks,

Art

At least the EIA forecast is increasing. For years they kept looking at rising prices and forecasting a drop for the next year. Then when it went up again they would start at a higher number and forecast down again. This literally went on for 6 or 7 years from 1999 to 2006. A chart of this activity looked like a slanting ladder. Humorous if it wasn't so serious.

Aaaah the staircase model.

the aspect of the eia forecast i find least credible is the ratio of gas to oil price on an energy equivalent basis. $29/boe for gas in 2017 -vs- $100 oil.

imo, mr. market won't like this - long term.

If the EIA ratio of gas to oil cost/BTU or KJ is correct, then some countries that are burning oil for electrical power may shift to natural gas, thus slowly driving up the price. Would China use natural gas (imported LNG) for running generators instead of using diesel fuel when coal supplies are tight? I believe so.

In short, the fact that energy cost for nat. gas is projected to be less than 1/3 of cost for oil means some substitution will take place. Gas pipelines may be built to take gas to places where users were burning fuel oil for heat, thus increasing demand and price for gas. EIA does not seem to consider this.

Some time ago I sent a disc with some introductory Peak Oil stuff to my country's Minister of Energy and Mining. I don't know if he looked at it but, my guess is that he breezed through it, talked to a couple of experts and came to the conclusion that, it would be a good idea to shift some of the nation's energy consumption in the direction of NG. This is exactly as you describe it.

That's what you get when you send market intelligence people who are not by nature cautious and diligent. Such people often are too impulsive and throw caution to the wind instead of taking a second look. It is precisely the type of situation you describe that is likely to make a mad rush to NG a mistake. What happens when more school districts start to acquire CNG fueled buses? The sad part is that, once the deed is done, the Minister will not suffer as much, if at all, as will some of his poorest constituents.

Alan from the islands

Edited: to remove speculation.

yeah, increased utilization. cng, gtl or methanol may step in at the behest of mr. market. gtl makes sense at this price differential, even if the eroi is 0.6 as some have calculated. maybe methanol will advance as a motor fuel(if the world gets hungry enough).

and as you point out, islandboy, risky business.

Great information, Art, and it puts the economics of unconventional resource drilling and development into perspective.

The only way I can make sense of their projections is if EIA thinks that costs of "technologies" will reduce costs to a point where they will reduce the costs associated with drilling and development of unconventional resources. This has happened somewhat, in part because of the use of techniques and chemicals in both processes which are causing problems with fresh water. Due to these unintended consequences, these will have to be changed, and thus, cost reductions which have been achieved will have to come from new materials. If better materials were available, they would already be in use, IMHO, and they are not, so they will likely cost more, involve more processes, and change the way resources such as shale gas are developed. If completion costs were reduced 15% over the last ten years due to "improved" techniques, mostly from new drilling and frac fluids which are likely being mass produced, that advantage will be lost, and instead of further cost reduction becoming available, the new materials will have to be developed, increasing R & D, which will have to be recovered by the service companies. Net effect: increase in drilling and completion costs.

Without lower costs, their newest work should have begun with "Once upon a time..." and taken the fairy tale on from there. (Of course, if it was done in Texas, for adults, it would need to start with "You ain't gonna believe this $%^#....")

Postscript: I do not think frac chemicals and processes are what is causing problems with gas in fresh water wells - I think it is the drilling and previously unplugged or improperly plugged well bores. No data to support my belief, but the problems are being reported in areas where there are old oil and gas operations.

Chuck,

Technology has not succeeded in reversing the decline of oil production in the world, and I don't expect that it will be any more helpful once the big shale plays are developed. As you point out, technology comes at a price. I am enthusiastic about gains in early productivity in the shale plays but I am unconvinced that the unit cost for gas produced has decreased. Longer laterals, more stages to fracs, more materials and equipment add to cost as well as higher rates. The gorilla in the room is decline rates. We do not and cannot yet know what effect, if any, the technology will have on decline rates.

I am inclined to agree with you on the causes of drinking water contamination. In addition to improperly plugged wells, there is now evidence that the Cabot incident in Dimock, PA was the result of a poor surface conductor cement job.

Art

Indeed, it's not hard to predict that unanswered questions will likely increase production costs:

woody - Let me offer an insider view of the "great advances" in technology that has brought about the shale gas plays: there has been little change in the drilling, frac'ing and completion technology in the last 15 years. A few small changes in the drilling equipment and chemicals but nothing that would come close to being a breakthrough. What did change dramatically was the expectations of what the shale gas reservoirs will yield. Even today it's not easy to explain how good some of the recoveries have been. Over the last 15 years the industry has taken the same drilling and frac'ing technology I was utilizing in the early 90's and have applied to more of the geologic section with increasing aggression. About 10 years ago an operator might drill a 500' long horizontal well and pump a 500,000 lb frac. Today SG wells are drilled several thousand feet laterally and longer and have as many as 12 to 15 separate fracs (totaling several million lbs) pumped into the same well bore. This expansion accounts for much of the amazing high initial rates that have been seen: a current well bore being equivalent to half a dozen of the earlier designs. But note that this is just the application of more of the same technology over greater distances. It hasn't happened because of any new magic bullets...just the shooting more of the same bullets we had 15 years.

I think this is an important point for folks to grasp: IMHO don't sit there and wait for some new magic to expand the SG plays. I don't see anything coming down the line that would qualify as such. New trends for sure...maybe some even better than we seen so far. Certainly sustained higher NG prices will push SG development much further down the road. But IMHO the technology that will be applied to future SG plays will look very similar to what we've seen the last 5 years or so.

Rocky - I am pretty familiar with what is happening out there. The slick chemicals, ceramic bb's (and other unknown frac media) vs sand which will screen off unpredictably, the use of downhole monitoring and steerable bits, etc. The electronics have helped more than all of the other stuff, but the service companies are still trying to do as much R and D as they can, and then life will be even more expensive.

I think that the cost per btu is probably rising for completed wells and will rise even more over the next ten years - just a feel for what it took to get us here, in part from my time w/ Western Co back in the 60's. Their research facilities turned out a lot of what they were able to put into action using some extremely well designed pumps they built. I was in the office but got to see the facility, and it was probably crude by today's standards.

The completion materials of the future will come at a pretty steep cost, especially post-Macondo. Now that lay people understand that, in too many instances, pressure is in control, I think our business is going to get a lot more expensive. Testing and bond logs on the upper casing strings is probably where we will start, and it is probably not unreasonable to do so, but in many instances in the past, was not done.

Also, I don't like drilling - it is too much like Darrell Royal's three things can happen when you throw a pass, and two are bad - interceptions or incompletions - and it is only good when the pass is complete.

woody -- I agree: most active SG players were public companies and for a good reason: their primary goal was boosting share price and not profits. Granted reality will (a did) bite them in the ass but they made Wall Street very happy...for a while.

"....If better materials were available, they would already be in use, IMHO, and they are not, so they will likely cost more, involve more processes, and change the way resources such as shale gas are developed...."

The fact is that commodity prices have driven up the cost of steel, concrete, and chemicals that are used in developing shale gas. For example, the cost of alloys in steel are up over 50% from a year ago (like Ni), while costs for raw steel are up 10 to 20%. And high strength steel is used on not just the casing of shale gas wells but in the feeder and trunk lines to get the gas to market. With the EPA looking into disposal of frac water, the cost for disposing of that is very likely rising too. All around shale gas development cost are mostly rising, not falling, IMO.

I am painfully aware of the alloy costs - 18% (If memory serves) chrome tubing for 2 wells, 1 and 1/2 years ago - 1600+ feet, $22,000 each string. That tubing will withstand the corrosive nature of Mississippi formation water where I have those wells. Supposed to last 2 years. All OK so far. We'll see in 6 months. Oh yeah - with brass below that tubing and brass pump, etc. $4,500 each well. It cut pulling costs dramatically and keeps wells going, so it has been worth it so far, but not sure about next time, if it is in 6 months.

And, again, all of that is likely to keep going up, in this case because the cost is pretty much pegged to energy cost - both production and transportation. And, afaik, there is no steel production in Oklahoma.

So, how much of those alloys and metals stay in the ground, and how much are pulled back out when the play eases to nil?

Craig

I am not in the oil production business, but based on the design of most gas and oil wells (see previous posts by Heading Out on well design), most of the materials stay in the ground. With the well casing being cemented in place it could not be pulled out. Perhaps the upper portion of the well liner could be removed after production ceases, but that would require the drill rig to come back to the well site and that would be costly, IIRC.

mb- You're correct for the most part. Every now and then it's worth cutting and pulling csg. But the net worth isn't that great. You still have to pay the rig to pull the csg at the same rate they charge for drilling. Also the csg threads can be damaged to some degree and that can cost a good bit to repair. If you use the csg for another well you can save some bucks but if you're going to sell it you'll get get a good bit less than the price of new csg. We don't every run used csg...the savings to risk ratio isn't typically worth it.

Thanks to both you and mb. I don't know how near peak we are in those metals; they are finite also. Seems to me that this will become a big part of increasing problems with peak oil. As recovery costs increase, whether from technology, depth of drilling and techniques, or from cost of parts, decreasing metals and diminished capital available will have a growing impact.

Craig

mb - Drilling and completion costs may be rising now/in the future. I don't track those costs too closely. But compared to 2 or 3 years ago costs are way down due to drop off in rig utilization. During the peak some rig rates got up to $60,000/day but have dropped to half that cost these days. OTOH, in Texas thanks to the Eagleford Shale boom, frac'ing costs have shot up. But that how it always has worked in the past: as NG prices rise so will demand for rigs and materials rise...as will costs follow upwards shortly there after.

Dry NG production in the U.S. for the first 9 months of 2010 compared to the same period of 2009 is up by 405 billion cu ft.

Total consumption for the same period 2009 vs 2010 is up by 908 billion cu ft.

NG for production of Elect in this period alone is up by 392 billion cu ft.

The 10 month numbers are in per EIA: Dry NG production for the first 10 months is up 658 B Cu Ft.

Total consumption for the same period 2009 vs 2010 is up by 844 billion cu ft.

NG for production of Elect in this period is up by 428 billion cu ft.

If this trend continues thru 2011 we will see lower build in storage, or more inports, or both, and higher NG prices.

Chip,

There is a more recent report from EIA that compares first 10 months of 2010 with previous 10-month periods--different numbers, same general trend with production up and consumption up a bit more.

A couple of points to consider. Comparing 2010 to 2009 skews things a bit on the consumption side because of the more highly depressed economy in 2009 (not that it's great now but industrial demand has improved). Y-O-Y 2010/2009 is 4.5% but Y-O-Y 2010/2008 is 2.2%.

Also, where is the demand growth coming from? Some is industrial use recovery but much is from coal-to-gas switching. This is happening because low natural gas prices favor it. If gas prices increase above about $5.25/mcf, the switching goes the other way to coal. I suspect that EPA will regulate a certain amount of coal out of use in favor on natural gas over the next 5 years, as threatened and this will increase gas demand. Really, though, I don't see a lot of demand-side growth until the U.S. gets more serious about electric transport and that will be for awhile.

There can be little optimism about supply-side declines for the near term until the capital dries up for ongoing shale gas drilling. When the true costs are learned along with true decline rates, then there will be an interesting discussion about supply and marginal cost of production. That is when to look for gas prices to move up, but that will destroy some demand.

Art

Thanks for your perspective.

I'm just not very optimistic about SG. Costs, new regulation, depletion rates, and available sources of money are all negatives. I just don't see SG keeping up with the depletion of all other NG production. The decline of production we saw in the earlier and greater part of the last decade is continuing and will have to be replaced with SG. Can it succeed?

Edit: I should point out that both total NG consumtion and NG delivered to customers were both greater this year than in the first 10 months of any other year this decade by nearly 500 B Cu Ft.

I view the depletion rates as the most vexing problem. I am reminded of the problem the KSA had during 2007-08 runup of oil, when they kept promising greater production, and were adding wells and not increasing MBDs.

Craig.

Very interesting Arthur. My feeling is that US based TOD staff need to spend more time exposing EIA fantasies. One place to start would be to extract data from Figure 4 for shale gas (and other gas types) and run a cumulative production on that, including HL, to get a feel for what URR is implied - and the number of wells etc that would be required to access this resource.

The forward view on prices etc combined with the forward view on high volumes of expensive to produce resource is quite astonishing.

It would also be interesting to go back and look at the EIA (and CERA) projections for global crude oil production and oil prices, in 2005, versus the actual data in the 2006 to 2010 time frame. One way to portray it would be 2000 to 2010 (est. for 2010) crude oil production (on horizontal axis) versus annual US crude oil prices on the vertical axis, showing the actual data and then EIA/CERA volume/price projections for 2006-2010.

This chart shows (2005) top five combined net oil exports versus annual US oil prices through 2008:

http://www.theoildrum.com/files/slide1.png

I agree Jeffrey - a bit of history matching goes a long way to revealing competence of the forecasters.

Here was Yergin’s prognostication from November, 2004:

http://www.forbes.com/forbes/2004/1101/041.html

*This led to my proposal for a new unit of measurement for oil prices: One "Yergin" = $38

I see 3 Yergins sometime before the 4th of July provided the bond market holds, it was under some stress yesterday. I also don't expect the economy to be sustained for long at 3 Yergins.

This is wonderful, I love it! The world is going down the sink, but we have something to laugh about at the way down. I might actually use Yergin units at a peak oil presentation I'm planning to hold some day...

My forecast for oil this Christmas made last Christmas was $Yergin+2 - I got that very wrong, wrong footed by the magical soothing powers of QE. I think we will see $40 again - very hard to predict when. The main point of course is that $40 oil means a crushed economy - not an abundance of cheap oil.

At some point government bonds will be sold off and interest rates rise - unless the FED plans to just keep buying.

Inflation beginning to gather pace in the UK combined with public sector workers being asked to accept pay cuts or redundancy. Its still very hard to see a happy ending.

... maybe you meant 'x' rather than '+'? If not I'm amazed that someone as knowledgeable as your good self could be so far out given that I, as a complete amateur POist, thought it would be somewhere in the region of $100pb - economy allowing.

Many "knowledgeable" people considered $40 a reasonable guess if they were expecting a double-dip recession.

Many of those people will likely be just a year off in their guess. We've got failing states and municipals to deal with this year and the next, and residential and commercial real estate are still deflating... then of course there is the duct-tape-and-pray European Union with the P,I,S of the PIIGS remaining to be bailed out... and China is raising rates at home to slow down their megabubble...

Maybe we could see $40/bbl in spring 2011?

With Bakken oil and deep water GOM oil requiring about $50 and $60 per barrel to break even for new production, I don't think $40 per barrel would last long. In early 2009 oil went to $37/barrel from $140 in mid 2008 and many commodities fell, like copper from $4.00/pound to $1.60/pound. These then bounced back within a few months to regain half or more of the loss. Based on past performance if oil did go to $40, it would likely rebound back to $60 - $70 within nine months, IMO.

A large part of the drop in commodities was due to the financial panic in late 2008 and early 2009 as banks and investment firms had to bail out of a declining market. Unless another financial panic happens I don't see how oil could drop so much so fast, especially if the dollar loses value compared to currency of our biggest oil suppliers like Canada and Mexico. With the US federal deficit in 2011 probably setting another record of nearly $1.6 trillion (thanks to congress giving away the store in tax breaks) and the fed maybe doing QE3, anything can happen on the financial front.

Isn't the issue here the swing between prices and not the prices themselves? Isn't the news the degree of oscillation - as predicted - and how different that is from only the recent past? Whether or not the price drops or not it's this volatility that will screw things up in the longer term.

I agree, its the volatility that can keep some FF energy projects from being funded, unless you are talking about shale gas, apparently.

But if the investor looks at yearly average prices for fuels, then a much better case can be made for developing oil such as in the Bakken, now producing over 310,000 bpd (projected 2010 average in North Dakota) where four years ago was less than 110,000 bpd. My point was that short term price fluxuations cause some decrease in developing oil and NG plays, but if long term (over a four year period) the prices can average a good margin above break even (meaning some annual increase), then projects move forward and new oil and gas comes on the market. See www.dmr.nd.gov/oilgas/stats/statisticsvw.asp for more info on Bakken oil production.

"maybe you meant 'x' rather than '+'?"

I thought the same thing at first. But read his next sentence more carefully.

He expected that there would be a huge smack down as we saw the last time prices spiked.

This may yet happen, but whether it will get as low as the Yergin neighborhood is yet to be seen. I think even the minimum price will rise, even as the smack downs get rougher. There are lots of folks in developing countries just figuring out how much value they can get out of a gallon of gas. Delivering goods on a scooter to under-served areas is ultimately likely to win out over driving to the gym in an SUV. That this isn't already the case speaks to the irrationality of the market.

Ultimately, all these may become irrelevant as oil and gas get rationed by some means more rational than the 'market.'

Current Oil price= 2*Y + F - 5

where Y is a Yergin (equals $38/bbl)

where F is a Forbes (equals $20/bbl)

Perhaps the grand unification theory can be summed as:

P= a*Y + b*F + c

where a, b and c are appropriate coefficients

....we will see $40 again. Please could you name those companies that can supply the whole world with $40 crude oil without getting broke in short time? I think, long before that, companies will stop producing and the oil price will stabilize, higher than you think.

This is old news. It is exactly what we saw post-aug-2008, prices plunging down towards 40 USD, then bouncing up again some, in shiot time. So by learning from history and accepting the fact that nothing realy has changed, when the next crisis hit, oil will fall down to someting low, maybe in the range of 30 to 60 dollars, before going up like 20 dollars or so again.

Not according to the logic of westexas. Just upthread he describes a pattern where successive year over year price declines end up at roughly twice the level after the previous decline. If this were to continue, sometime between 2011-2012 we'll see the price run up and then fall back to leave us with an annual average price of $100-$130, probably in 2012. Of course, past performance is no guarantee of future results.

Frankly, considering the fragile state of the recovery and the bubble that is the Chinese economy, that seems a bit of a stretch to me. However when QE is thrown into the mix, anything's possible.

Alan from the islands

My main worry is this: Last time we saw oil at 147 USD a barrel, world economy hit the ground at record breaking speed. That was in times of good global economy, and before we borrowed money from mostly everyone to bail out everyone else. This time economy is weaker (lower economic activity, higher unemployment etc) and more burdened (more dept, higher deficits, lower reserve funds etc). Will oil prices realy climb to 147 again before the economy break its neck? I don't know, but I do not believe so.

As Alan noted, the average annual price of oil in 2009 was $62, which was higher than all annual oil prices prior to 2006. In other words, only 2006, 2007 and 2008 had higher annual oil prices. The average price for 2010 is going to be the second highest in history.

Although I like your work what you just stated above can be viewed differently.

I'd argue that as time goes forward we will see fundamental shifts in our economy. It will never go back to the form it previously had. If you look at the way you put things the economy is now fundamentally different from 2006 back.

It will never return to anything resembling that economy.

If so then it makes sense that oil demand itself has changed dramatically from 2006. The economy supporting 90 dollar oil today is intrinsically different from that of 2006.

I'd argue that perhaps its more likely now that we would see say oil rising to 200 then falling to 150-100 then say 300 and falling to 150 etc.

And I think we went through a basic fundamental economic change through 2010 economic concepts from 2008 back will increasingly fail to apply. What was considered normal during the post WWII era through 2008 simply don't apply anymore.

Indeed we had our last post WWII recession it probably ended sometime in early 2010.

What replaced and to some extent overlapped with the end of the last recession was a new economic order running on a different set of rules. The underlying economic drivers for consumption have changed.

Overall one can view it as a sort of puppet economy with infusions of printed money flogging the economy forward.

The fact its really a farce can be easily seen if you choose to look.

But people have to live and they will and they will adjust. However I think you will find that people will do so by focusing increasingly on the near term. J6pck either by desire or force will increasingly focus his aspirations on the short term as the future becomes ever more uncertain. He won't take on long term debt except for a car. Cash is king. Spending on consumables and cheap goods will be the norm. Committing to a mortgage and exception. Some of course will save to offset loss of credit.

In short the daily economy will continue and so will its demand for oil. The debt based economy esp mortgages and the commitment to pay them will fail.

This fundamental shift in the nature of the economy has I think happened. People no longer worry about the future not because the expect things to get better but because they are certain that it will be worse than today.

Unlike the Depression price inflation from rising commodity prices will dampen savings. Not that people won't save but they will expect that saved money will eventually be used used to buy gasoline or food not say a house.

Obviously at times consumers will be forced to pull back and the resulting contraction probably will send prices down for a bit but not for long and I think never back to previous lows.

Overall its simply more and more people defaulting on debt and living basically pay check to pay check with no future expectations except for things to get worse if they think about it too long.

On the flip side its not all bad many will choose to enjoy life today buy that game console take a drive or even a trip if they have the money. So on the surface things won't look as bad as they really are. Meanwhile demand for debt continues to plummet and housing prices fall.

Sorry for the long diatribe but somehow I think social shifts need to be considered. And if I'm right then over the next year the fact that things have fundamentally changed esp about long term debt will become increasingly clear.

Indeed I think whats really happened is that the masses have simply decided to create their own Debt Jubilee they have given up on their leaders. And many will fill that they deserve as they are simply con artists themselves.

As always time will tell but I really think that as the year unfolds and you watch how things change it will become clear that a fundamental economic shift towards living for the moment has occurred. Although I think it will play out differently from the last depression I think the intrinsic shift towards focusing on living the next day has happened just like then.

Unfortunately overlapping this shift is I fear a return of hatred for anyone considered different or having perks however at least for now thats still out in our future although I expect it to be the next big shift. You can already see it building for example against public employees and their benefits and also immigrants. People will by force live day by day but many won't be happy about it and they will eventually take their anger out on others.

You have certainly bracketed me twixt waterline and keel. I have ceased to worry about the future. I am spending cash as quickly as possible to perfect my boat. New everything that isn't absolutely bulletproof.

Why accumulate cash? If things start to unravel, how long will we be able to purchase quality equipment. In case nobody has noticed, a lot of high quality equipment manufacturers are failing. Just try to buy a milling machine or lathe that isn't made in China. I suspect that soon our choices will be Chinese or nothing.

So I spend the dollars and keep the heavy metal. Can anyone suggest a better plan ?

Dave in Thailand

I spent my income on paying of my student loan, and am now debt free. Feels VERY good. Now I plan to save up for a house. While money can still buy you stuff. Spends cash on quality tools and various durable goods while I wait for that.

Childhood dream was to buy and live on a sail boat. I envy you. Good luck with your plan.

$40 for a short period of time will not kill off the IOCs. But it does make them shy of making risky investments. And those that find low price too hot to handle will get taken over. This brings us back to the "oil accordion" with prices bouncing around between the price global society can afford to pay and the price it costs to develop marginal barrels. Volatility in oil price has dropped this year.

Part of the rationale is that high prices will kill demand in the OECD. We try to learn from history, and the one thing that history tells us is that oil prices are impossible to predict. The UK economy at least is now in a rather sureal state, much of the unaffordable debt still exists as the bond market gets edgy, public spending is being slashed, Sterling has tipped over to commence decline following small recovery after Tory election "win", taxes are to rise hard in 2011, the fiscal and trade deficits continue to expand. Gold is at an all time high in £, our infrastructure is being destroyed by snow and ice. But we smile and be happy man:-)

Euan,

I would like to put some meat on your prediction:

In the US, QE2 will expire in Q3 2011. We should see interest rates rising and few $$ to buy oil, resulting in a rise in WTI. There are two reasons this may not happen:

1) Congress massively cuts the budget and confidence in the US $ returns

2) QE3

The first option is unlikely and the second just postpones the problem to 2012.

So I'm predicting that we will break $120 in Q3 2011 or 2012 depending if the Fed implements QE3.

Doomers would say that the wheels will come off the US economy resulting in $40 oil. I don't think the story is so simple. The US is still sleeping, but the dragon is starting to stir. How will the US react once it realizes it has no clothes? Let the witch hunt begin!

Now that it has happened, its easier to understand how QE has worked. In the UK at least, the government, via the Bank of England, now owns most of its own debt. The government has essentially hijacked the bond market, as buyers of last resort, buying debt at par, interest rates remain stuck on 0.5% as inflation takes off. In monetary terms, inflation is the only way out of the hole.

You tell me. US will soon realise that E$ = EJ and latter is required to sustain / create wealth. Don't disagree with your prognosis for oil - this is a slow motion train wreck.

My hope was that Wall St would add energy use as a reporting requirement for every public company. The market would force people to think about energy. You can't control what you can't measure.

I spent some time working with Google on a project they funded at NASA on renewable energy. They treat there data centers power systems as a company secret. They do not want Microsoft copying their ideas. Most people do not realize that they have an army of engineers designing their data centers to have low energy use. It is a competitive advantage.

Anyone at Microsoft reading this?

Background: About 50% of the power used at a data center is for cooling. If you can cool your data center with river water or other heat pump techniques, you can cut your power use by 40% at least.

Do you know any data centers that are in heated buildings? Do you know any grocery stores with refrigerators and freezers that dump their heat into air conditioned rooms? Argh!

In Germany, recently an data center provider found out that all this cooling effort is completely unnecessary (in a moderate climate zone): Data servers simply don't need such low temperatures, if you run them at 35°C they are absolutely fine! This is what he does and he uses the heat also for heating the building in winter :-)

Some of these big data centers use as much electric power as a small steel mill, so getting rid of the heat is an absolute necessity. Also, many are located in the southwestern desert states, where the outside air temperature can be higher than 45°C during the day, and then fall by 15°C overnight. The change in temperature can be a bigger problem for computer reliability than the actual temperature itself.

Euan. While we are talking about predictions; what about an "energy predictions for 2011" thread for all those wild and/or educated guessings out there? It's that time of the year after all...

Yergin either is not so bright or he is paid to lie. LOL. See I thought Peak Oil was just not recognized -- now I realize it is actively denied in the press daily to perpetuate a myth abut infinite oil surplus.

Daniel Yergin today (2011) is not the same person as he was 6 years ago (2004).

We have not heard much from Yergin and CERA recently.

Apparently they are trying to recast themselves into other energy sectors:

source: http://www.google.com/hostednews/ap/article/ALeqM5i2YitVQIJRBssIHu2s0xjA...

Here is another one:

According to a Bloomberg article, at the World Energy Congress in September, Pulitzer prize-winning author Daniel Yergin was quoted as saying, “Global energy demand will climb 30 to 40 percent in the next 20 years, spurred by rising incomes in emerging markets and global economic growth”. Yergin wrote the book The Prize which is a history of the oil industry and is called “The Oil Bible” by industry experts. Yergin was also quoted as saying, “The shale-gas ‘revolution’ counts as the biggest in the energy industry since the beginning of the 21st Century.”

source: http://sdsmtaurum.com/2011/01/oil-and-gas-conference-draws-wealth-of-kno...

Euan,

I concur and I will be critically following EIA pronouncements. I agree with your suggestion on Figure 4. I haven't done the exercise yet, but my sense is that it will require an enormous number of wells (and capital cost) to accomplish the growth EIA projects for shale gas.

Art

This flies in the face of the EIA's mission as stated in the Mission and Overview page on it's web site.

Reading on from the same page one would surmise that the EIA was NOT set up to produce reports along the the line of koolade and happy pills but, sound market intelligence "to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy." If this is the kind of garbage that informs public policymaking and, God forbid, the plans of private industry (think the auto and airline industries for example), the resulting policies and plans will be just as clueless.

I am not a US resident or a citizen but, if I were I would be mobilizing a campaign to have the EIA disbanded to stop the waste of $100+ million per year of taxpayer money.

Alan from the islands

And there Yardie, you've hit on the head:

Our publicly owned, near monopoly electric utility BC Hydro is required to produce a Long Term Acquisition Plan (LTAP) for the planning of generation resources to meet demand. I picked through the latest submission to the Utilities Commission and what did I find as the very bedrock of their pricing forecast? EIA natural gas prices and CERA production forecasts.

I believe there are enough TOODers here to see the impending catastrophe in that foundation data set. When you have a group of people ensconced in a highly bureaucratic institution that can, at best, perform with the same acuity of twenty blind men trying to describe an elephant, they are going to resort to the same group think and go with the "credible" sources.

To put it in the vernacular, they are hooped! Never mind there are billion dollar decisions being made on this premise.

Dare I call down the false gods before the acolytes? Not bloody likely! Instead I move ahead with resource plans as we know them and look to capitalize when their plans fail.

Island Boy,

I admit that I was trying to be a bit generous with the folks at EIA, not because I am satisfied with their report, but because I know that there are many analysts there who probably understand that the report has been massaged to meet political expectations. I am not saying this is correct or within the charter of the EIA but that's the way it is.

Art

In case you are worried about rising prices, I attached one of my videos to help people powerdown at home and save money.....

http://www.youtube.com/watch?v=PUCl1TruUfo

MrEnergyCzar

These guys are criminals, and so is the US as a whole, by still consuming as much oil as China, Japan, Russia, Germany and India COMBINED (as of 2009 figures).

As to TOD making fun of everything (or adopting the "witty cynism" line), it is fine, not asking for a serious gas tax raise in the US is another thing, although any way out of this complete mess must include a serious gas tax raise in the US (from a pure US selfish point of view as well as other ones).

Y - You must be new in these here parts. Most of TODers have long suppored increased consumption taxes on all fuel. Especially if they had begun the ramp up back in the days of President Carter.

About 25 years ago a guy name Lee Iacocca suggested that the US gas tax be raised $0.50 per gallon, mainly for the purpose of deficit reduction. Back then the annual deficit was about $100 to $200 billion and the tax would nave raised about $40 billion.

Well, Mr. Iacocca was not a nobody, he was chairman of Chrysler Corporation, the third or fourth largest auto maker in the world back then. Mr Iacocca was ridiculed and generaly discounted. So here we are in 2010 and Obama's deficit commission recomends a $0.20 rise in the gas tax (equal to $0.10 in 1980's dollars) and the suggestion gets a no go from every leader in US Congress. So forget about the gas tax being raised inthe US in the next four to six years. If it ever does get raised it will only be after many US politicians and a majority of the driving public have their cold dead fingers pryed from the streering wheels of their out of gas cars & trucks.

mb - Unfortunately I fully agree with you mb. Especially now that most politicians have lost all fear of creating money out of thin air. They probably figure when those chickens come home to rooste they'll be out of office anyway. But try to stick the public with just an insignificant gasoline tax increase and they know they are probably gone after the next election.

I've known a few leaders who would literally have been willing to throw themselves on a live grenade. I see no one like that in D.C.

So does this mean we'd need leaders that would be willing to radically defy the will of the people, then? Hmm. I guess "democracy" isn't the best after all.

mike - Not defy the will of the people but present to them a clear picture of the problems we face along with potential solutions. Solutions that might so displease the general public that they attack the messenger instead of the problem. OTOH there are times when the govt is very justified in defying the will of the public. The best example I can think of was the civil rights movement. Growing up in La. in the 50's I can promise you that racism was not going to be pushed aside without forceful govt actions against the vast majority of the "right" citizens in the south. IMHO true representative democracies don't allow the rights of any minority to be abused simply because a majority thinks it's OK.

Well said. Our leaders have to be straight with us about our prospects and how to deal. It's the only way to develop political support for necessary policies that may bring short-term pain for longer-term gain.

Extend and pretend gets us nowhere.

Why is the USA so Gasoline Tax phobic ?

They are now almost unique globally, and looking rather out of step, and disconnected ?

One example :

jg - I suspect it goes to our love affair with autos. Though I live in one of the largest US cities (Houston) public transportation here is fairly insignificant compared to NYC. Perhaps it comes from some sense of controlling you life: with a car with a full tank of gas "I'm free to come and go as I choose." So taxing ones "neccesity of life" is not looked upon well. Restricting our abaility to drive around Texas is viewed in the same light as restricinting our access to firearms. IOW don't mess with Texas, my gun or my car. Don't even talk about the possibility: we'll make you pay a dear price.

Although it makes sense to to do so, a gasoline tax would be problematic in the U.S.

A whole range of formerly prosperous industrial cities: Milwaukee, Detroit, St. Louis, Baltimore, I could probably go on, have long been abandoned by the middle classes due to urban crime, race issues, lack of union power, a preference for suburban living, etc.

But, of course, the foundation that allowed that process was cheap oil. Take away cheap oil (or tax it), and that process can no longer continue, and at the very least imposes a huge burden on the already beleaguered middle classes.

But yet, any form of "New Urbanism" or some such nonsense is futile. These places are wastelands! You can't magically have nice, well maintained apartments and homes, robust public transportation including subways and rail, good paying, stable jobs, lack of crime, etc. This isn't possible anymore, there's nobody left to do it.

So we are screwed, folks. Hipsters and yuppies "gentrifying" the cities isn't going to solve anything, because the moment they have kids, they are out of there. We've abandoned the cities for expensive suburban living, and we are paying the price.

When Dick Cheney says the American way of life is nonnegotiable, what he means is that we will never again have prosperous cities with middle classes who use public transportation. And he's right!

"....that we will never again have prosperous cities with middle classes who use public transportation..."

This statement has some truth in it, but not for the reasons you think. I live in the City of Saint Louis and can see some changes that are occuring because of more expensive energy, namely transportation fuel. The middle class folks that live in the far suburbs have less expendable income and many are not so middle class any more. Some have lost incomes, while others have less money to spend on discresionary things because too much goes for gas and food (which is rising two or three times more than the official government figures). So those suburban middle class people may become poor folks that cannot afford to move back to a city because their home equity has declined along with their disposable income.

Except for those people employed in the medical and defense business, many people in this metro area have seen a drop in their real incomes. However, for the people that don't live near their jobs and have close by places to shop, they are seeing a reduction in their money that is not committed to housing, food and transport. I often ride my bike to the bank, store, post office, doctors office, Home Depot, Metrolink, all between 1/2 to 1-1/2 miles away. I have had my income reduced, but my other costs have not increased much since I live in a four family building (very enegy efficient) that is 3 miles from the downtown and I grow a garden that supplies nearly all my vegtables in the summer.

So my impression is that during the further decline of the economy and increase in FF costs, many folks living in the "old core cities" have less to worry about, except for crime. But, the best defense against crime is neighborhood cohesiveness that I see in this city, which I did not see when I lived in the suburbs over ten years ago. The folks in the suburban areas are seeing a larger decline in their real estate values and have more at risk as fossil fuels increase in cost, IMO.

You probably haven't seen serious gentrification in action. When I was a young computer programmer, I moved into a older inner-city neighborhood in Calgary where most of the houses were small, 80-year-old one-story two-bedroom houses. I bought the only two-story three-bedroom Victorian house on the block, on a 25x95 foot lot. I bought it because the city was going to put in a light-rail transit station nearby which would zip me straight to work, and there was a nice park nearby.

By the time I left, most of the houses on the street looked like my two-story Victorian. The Yuppies discovered the neighborhood, tore down all the little old bungalows and built two-story Victorians to match mine, only bigger. Then they started having kids and, guess what, they didn't leave, they just made their housed bigger. The fact that the local school had closed didn't bother them, they just bussed their kids to the same public schools as the richer people in the nearby communities, or paid 20,000 a year to send them to private schools.

Last time I was through the neighborhood, I just about got nosebleeds looking at the Yuppie Mansions that were sprouting like mushrooms. The latest newcomers had taken advantage of the liberal zoning regulations in the area (zoned for multi-unit houses) to build their houses out to the maximum allowed: Three-story 3000+ square foot single family houses with underground parking on 25x95 foot lots. The architects were using the area as kind of a billboard to advertise their talents, so every new house was some kind of architectural extravaganza.

Now that was serious gentrification.

The same thing is likely to happen in the inner areas of American cities - if the cities are lucky and smart enough to get the parameters right. If not, they'll probably turn into another Detroit.

@ Oilman Sachs

What you say still is in a very "manicheist" state of mind : it will not work completely, so let's forget about it.

You should also consider the following : it's quite easy to consider today a US fleet of fossile fuel based vehicles consuming at least 20% less than today's fleet for the exact (more or less) same function. However moving to this fleet takes some time. There are also still some functioning cities centers in the US, and housing densities has many angles.

From an economic point of view, the point is not to define the solution, but it is if there is one (somehow), accelerate the transition towards it. And for sure a tax on fossile fuel acts in this way, and is much better than subsidies on predefined "good solution". Not to forget that the government still has a budget, to my knowledge ....

And a tax doesn't need to be at 2$ a gallon from the beginning, although it's where it should be aimed, at least, clearly..

But also clearly, obviously the US and its people prefer to go to WAR (provided it's not really them it's ok, or something like that)

They probably figure when those chickens come home to rooste they'll be out of office anyway.

Perhaps rather than planning on being out of office they should plan on being out of the country. They might find life uncomfortable for them here after the peak.

Perhaps bc but remember: members of Congress earn their retirement package almost immediately for all who get reelected. immediately and it provides their current salaries and insurance benefits for life. Also remember this is a group where most memebers leave office as millionares. The future is less bleak in you have the cash. Again, all the more reason they don't make the public mad enough to run them out of office. Rather ironic that making bad choices for the counry has significant better outcomes for the politicians in D.C. making those same decisions. What a system, eh.

R I've been here for quite a while, and frankly I've not seen it (increasing gas tax) mentioned a lot if at all. And it is one thing to say "it won't happen anyway", and not saying that it has to be a key aspect of the US energy strategy : lowering consumption, improving the fleet of vehicules, favorizing alternatives without subsidies, and lowering fiscal and trade deficits, the more the wait, the more stupid vehicules are bought.

And again, do you realize the level of US gas tax compared to other OECD countries ?

And if you look at what Turkey went through for instance from 1998 to 2009, it's quite amazing

10 weeks is a blink of an eye:-)

I came here over 4 years ago, after emailing Westexas, suggesting that higher gas taxes was the only way out for USA.

Where u get your 2nd chart? Turkey is amazing!

E

Euan, it's from the blog of Stephanie Flanders (BBC economics editor) :

http://www.bbc.co.uk/blogs/thereporters/stephanieflanders/

But could not find a link to the original blog post yet

edit : below the (or one of the ones) post where it appears :

http://www.bbc.co.uk/blogs/thereporters/stephanieflanders/2009/09/the_en...

Looked a bit but didn't find much on the web about how the raise was managed or perceived in Turkey, but that was fast !

I have a post that should go up today called "Chart of the Year" - its going to be charts only - good if you can post these 2 charts.

Finding out how Turkey responded would be an interesting exercise - I imagine dramatic reduction in oil consumption and improvement in trade balance and national budget.

--------

A quick check at BP stat review shows oil consumption rising till around 1998, then stabilisation thereafter at around 640,000 bbls / day. Need to look at this on a per capita basis.

Put me down for $10 per gallon to be phased in at $1 per year. Having said that, there is no way out of this mess, loosely paraphrasing Bob Dylan.

Why bother debating or advocating a gasoline tax in the US?

Piss into the wind all you want, you'll just get your britches wet. There are more productive ways to use time.

So the US has completely given up, right ? That's what you are saying ? They just want to remain the filthy pigs they are for the short while they can ?

The US is obviously the Enemy then, it's quite clear, the prime objective should be to give the mercy shot to this disgusting wounded animal (as wounded animals can be dangerous, they might want to try something in their last minutes, better get rid of them)

Yves, I think you're missing the point, and obnoxiously so at that. The US has not in any way given up -- by and large the public hasn't even noticed there is an issue. Change here is driven by price and profits - with risk and reward - and there is absolutely no viable way to increase fuel taxes anytime soon.

The best you can hope for is for dollar collapse to add the "US import tax" you might like to see. After all a tax is just a highly regressive rationing system, so if you're going to get all holier-than-thou maybe you should suggest a more fair approach to energy allocation and rationing?

And yes, I do expect we'll demonstrate our ability to break things like a bull in a china shop before the US quietly takes their place in the long list of has-been empires.

Yes the US has completely given up, don't see how to say the contrary, whether the public is aware of the issue or not doesn't matter much compared to the facts that : 1) the government is very aware of the issue and has been for a long time (having even pushed some cover ups on the issue, see for instance what happened further to the 1998 IEA report, or current EIA report) 2) people well aware of the issue, such as yourself for instance, are still waiting for some magical solution (or preparing their doomsteads), and don't see a tax on gas as politically feasible.

And why a tax on gas would be "a highly regressive rationing system", it is just something that modifies the cost curves for everybody, therefore favorizing more efficient solutions in every investment decision, or "way of life" decisions in general. That is exactly what is needed, not even going towards trade and fiscal deficits. It is also something very easy to implement, without all the bureaucracy and associated cheats that any "subsidies on good solutions" or "cap and trade system" requires.

As to "And yes, I do expect we'll demonstrate our ability to break things like a bull in a china shop before the US quietly takes their place in the long list of has-been empires." I'm not going to say that "cynical fatalism" is bad on principles, but it for sure isn't a sign either of the US not having given up ...

The EIA report is merely propaganda to support their political agenda.

The real outcome will be different, but no one will care about the EIA in 2020.

Oil is at $92 today. It was less than $80 a year ago. So my guess is $100 oil by 2012.

The oil sands in Canada may help the US, but what about Europe?

Costs of production for oil sands will raise the price of oil much higher in the US.

I do not believe that the US will be able to maintain current levels of consumption.

If the dollar collapses as many predictions indicate, the price of oil will be expressed in the new world currency before 2015. Natural Gas and the Boone Pickens plan may end up saving the US from total downfall.

Cool,

I agree with what you said until the part about Boone Pickens. I think that there are some major problems with converting the U.S. vehicle fleet to natural gas, not the least of which is what if the resource is overstated the cost is understated as I have contended for some time? Now we've spend 25 years and billions of dollars to make a long, painful conversion only to learn that the gas is not cheap and we only had 20 years of supply 25 years ago. The idea that we all get to continue with unfettered personal transport through the magic of technology that doesn't yet exist is comforting but wrong in the end. I also think that reliance on any single fuel for transport is another mistake.

Art

Natural gas would only be an interim solution on the way to total electric/nuclear.

If 1/3 of cars could run on it, it would get us through the shortage period.

So oil that's currently wobbling between 91 and 93 dollars can't possibly rise to $100 in anything less than 5 years, even though it has gone way above that already once? What fantastic planets these people must be visiting because they sure aren't talking about Earth here.

$100 oil within a year and natural gas will continue in glut until we start turning into liquid motor fuel as M-85. The it will gather some good price steam and get over $7 a mcf. This will take a few years as the oil industry is in solid opposition. First in China I suspect, although they plan to make it out of coal at a higher price.

Sasol will do it in Canada to be the first in NA I would guess. That is what their plan is in the Horn River region of BC.

pete - I'm not sure what oil industry you're refering to but everyone I work with would be thrilled to see as much NG converted to liquid fuel as possible. Anything that eats up the surplus NG would be very welcomed.

bindlepete,

Yes, the Talisman joint venture with Sasol up in the Montney shale is sitting on an awful lot of gas and wants to build a 36,000 bpd GTL plant. At the current gas to oil price ratio, that could make alot of sense.

It seems that we as a society are moving onto a new form of "crack" --more notably referred to as NG frac crack.

But "crack" it is because it deludes us into thinking that we can just keep going and going this way without ever facing up to the realities of our finite and non-automatic Earth.

______________________________

[ i.mage.+] for frac crack

[ i.mage.+] for further background info

____________________________

[i]= image, [+]= more info

What would happen if we did decide to "face up"? How would things be, say, 150 years from now?

Figure 7 is stunning! Thank you for posting it. 2009 drilling rates were not enough to offset declines.

MIT did a study "The Future of Natural Gas". http://web.mit.edu/mitei/research/studies/report-natural-gas.pdf

Figure 2.6 which shows Barnette production increasing if drilling continued at the 2010 rate. If the four major players you have listed are an indication, then the study is likely wrong. I think they radically underestimate the decline rates (as you have often commented).

Figure 2.4a and 2.4b attempts to attach a price to each increment of supply. So they estimate the first 500 Tcf can be produced for < $5 per MMbtu and the next 500 Tcf can be produced for < $9, and the next 500 Tcf can be produced for less than $16 per MMbtu. 500 Tcf would last about 20 years at 25 Tcf per year. So perhaps that is what they are using to build these cost forecasts.

Last year the world IEA did a cost analysis for US shale gas. They had some figures for Barnette and they showed that only the 2 core counties could get enough production per well to reach $4 per MMbtu, the near core counties had breakeven prices twice as high, and the outlying counties has prices as high as $12 per MMbtu. This is from memory so I will have to go look at the charts again. If I remember correctly they assume a 12.5% royalty rate and $3 million drilling cost.

Jon,

Thanks for your comments. The MIT study is a good example of how to write a report to please its funding providers. This is straight from Thomas Kuhn for anyone who doesn't understand that most science research has nothing to do with learning something new. It's all about finding evidence to support what you already believe to be true so someone will give you money to prove what they also believe, or hope, is true.

The two-county core area of the Barnett Shale is as heterogeneous as any geology in the world. Being in the core only means that some wells (vs. no wells) have the potential to break even or make a little money. This is providing that you don't drill very many wells because the bad ones will eat up the profit from the good ones and, on balance, you will be lucky to break even on the project. The way to go in the core is to drill a single well or maybe two and sell the project to someone who cannot live another day without owning a little piece of heaven in the Fort Worth basin.

The idea of decades of natural gas supply in the U.S. is absurd. If you take the Potential Gas Committee's estimate of 441 tcf of "probable" technically recoverable total gas resources, and make the optimistic assumption that half of that resource will become reserves (221 tcf), you have roughly 10 years of gas. Add the 240 tcf of proved reserves, and you have another 10 years for a total of 20 years. Now, where did 100 years of gas come from exactly?

Art

Jon - A little thing - royalties: a 12.5% royalty is almost unheard of in Texas today. A 20 - 25% royalty is more the norm. Also drilling costs: I'm not up on current activity in the Barnette or other SG plays but $3 million will only get you a rather shallow well with a rather short lateral with a rather limited number of frac stages. For instance even with rig rates being down a deep Haynesville well in E Texas with 10 frac stages will easily run twice that cost assumption.