Renewable and fossil electricity generation costs compared

Posted by Rembrandt on December 27, 2010 - 3:02pm

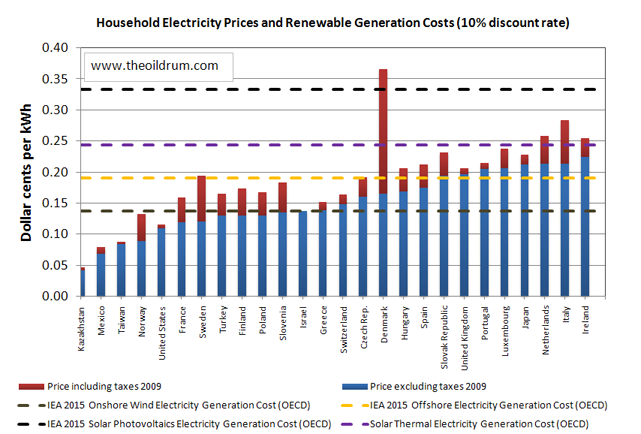

To reduce fossil fuel use in electricity generation, the implementation of renewable energy is supported via subsidies or market mechanisms in many countries. These are required because the costs of renewable electricity are substantially higher than fossil fuel based power generation. In this article, the difference in cost structure is made clear by looking at the 2009 industrial and household electricity price in comparison with short-term cost forecasts for 2015 for nuclear, fossil, and renewable electricity generation.

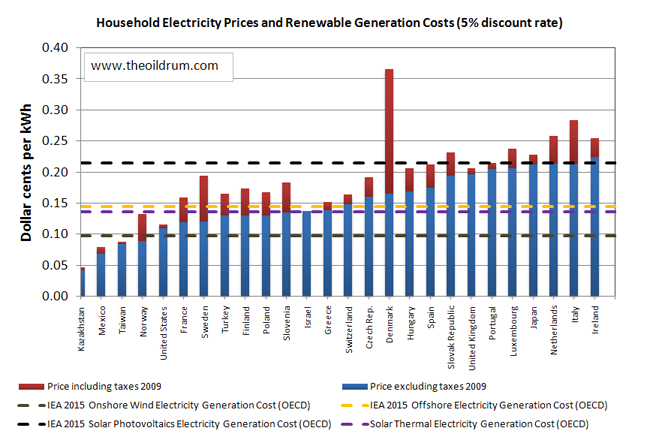

Special attention is paid to the difference in interest rates of borrowed capital for energy projects. This has a large influence on nuclear and renewable energy costs as these require larger upfront capital investments. For example, nuclear electricity becomes cheaper than natural gas generation at low discount rates, but more expensive at high discount rates. In case of renewables at higher discount rates only onshore wind costs fall below household electricity prices in most countries, while in case of lower discount rates this is also the case for offshore wind and solar thermal electricity.

Introduction

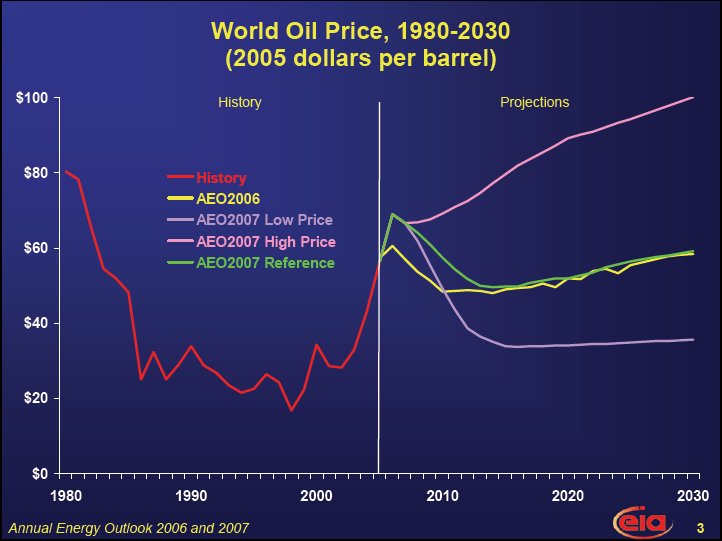

The future electricity supply of countries is highly dependent upon making choices under uncertainty. The lifetime of a power plant is at least 20 years and can range up to 60 years, so the selection of power plant types has a long lasting effect. The costs of fossil fuel or nuclear power plant inputs is difficult to forecast as events in recent years show, and similarly is it difficult to forecast the decline in costs of renewable energy.

One of the choices that politicians have to make in the present is how to support renewable energy sources. Many OECD countries have put in place feed-in tariffs, which provide a fixed tariff on top of electricity prices to pay for renewable electricity. The idea is to stimulate renewable electricity to the extent that prices drop sufficiently over a long time period, so that it will be able to compete with fossil fuel power sources. Opposition to this system comes from those who think that costs will not drop sufficiently, at least not in the foreseeable future, leading to a lasting cost burden for society to create access to sufficient electricity supply.

To make an informed decision we, therefore, need to know a lot about different aspects of electricity generation. Including the technical potential of different electricity sources, how base-load and intermittent electricity sources can be combined, the requirements and costs of the electricity grid, and how the costs of electricity generation will develop over time depending upon technological change and input costs.

In this article a part of the data is provided for such an analysis by outlining the anticipated costs of electricity generation in OECD countries in 2015, and comparing this with 2009 price levels. This gives a perspective on how big the gap is between the costs of fossil/nuclear and renewable electricity generation in the near- to midterm future, as well as an idea about what society can afford to pay. The costs of electricity storage are not incorporated here, as these are not that relevant at the renewable electricity shares we are talking about in the near term future.

The costs of electricity generation at different discount rates

The generation costs of electricity sources for OECD countries are documented in detail by the International Energy Agency (IEA). Every few years they publish a report on the Projected Costs of Generating Electricity. The report documents the costs of electricity generation five years ahead by looking into expected costs of power plants built, as well as some are planned for construction in the near-term future in the OECD. For the 2010 report data of 187 power plants have been taken, including 72 renewable electricity power plants, 20 nuclear light water reactors, 27 natural gas fired power plants, 48 coal power plants, and 20 CHP power plants of which most are natural gas fired.

The calculations take total costs of the power plant during its lifetime including decomissioning in case of nuclear energy. These are divided by electricity generated during the same lifetime to get costs per kWh generated. The main financial factor of influence is the interest that needs to be paid on the capital borrowed for the power plant investment, also called the discount rate. The IEA includes two interest rates for their cost calculations, 5% and 10%, which provide a lower and upper bound. Jerome a Paris of the Oil Drum, who works in energy project investment for the wind sector, informed me that for private sector investments in energy projects 7-8% is a reasonable interest rate in today's market. Utilities on the other hand are closer to a 5% rate for long term investments as they are able to borrow very cheaply. A second factor of major importance are assumed fossil fuel prices. As I do not have access to the full report I unfortunately do not know what the IEA assumed in this respect.

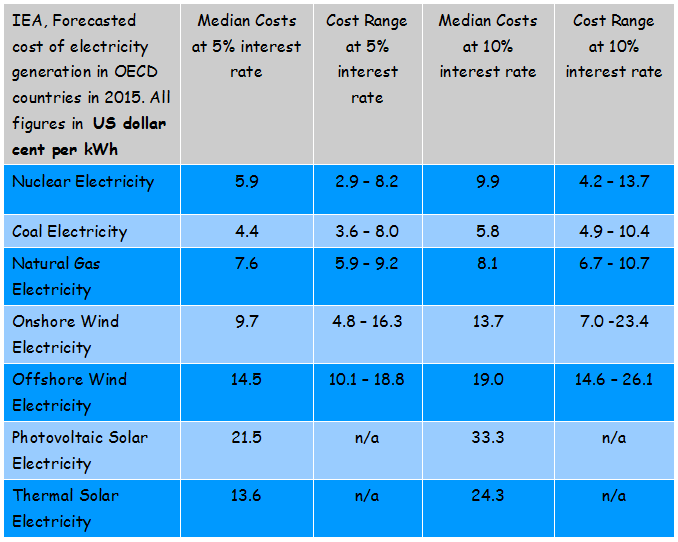

The data from the IEA report is given in table 1. There median costs and the cost range in dollar cents per kWh for seven different electricity sources is tabulated. The costs in general vary widely per source, for example at a 5% interest rate the levelised costs for Nuclear electricity generation were found to range between 2.9 and 8.2 dollar cents per kWh (in respectively Korea and Hungary).

The price of electricity

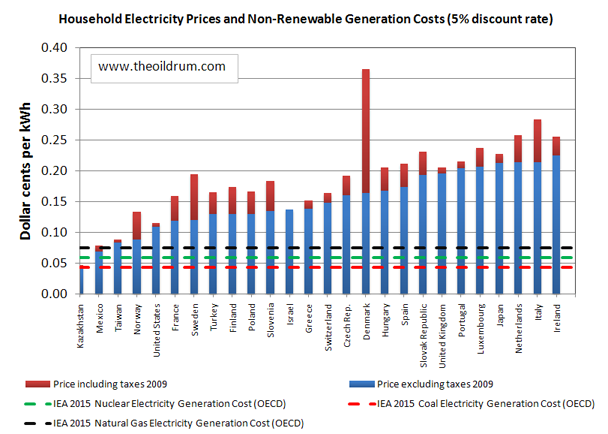

Electricity prices for household and industry in the OECD are documented in detail in the Energy Prices & Taxes report of the International Energy Agency. The differences between industry and households price levels of this data set were described in detail in a previous post. The importance of making this distinction in choosing for the type of electricity supply is that there is a large difference in cost patterns. In nearly all countries industrial users of electricity use the most electricity and have to pay the lowest electricity price, as the tax burden mainly goes to household electricity users. The most extreme example is Denmark where electricity prices including taxes for Industry users are 12 US dollar cents per kWh, while household electricity prices are 36.5 US dollar cents per kWh. In discussing about the affordability of electricity sources for society it makes sense to look at both industrial and household electricity prices, and compare these with electricity generation costs. Often comparisons are only made on the household level which paints a distorted picture.

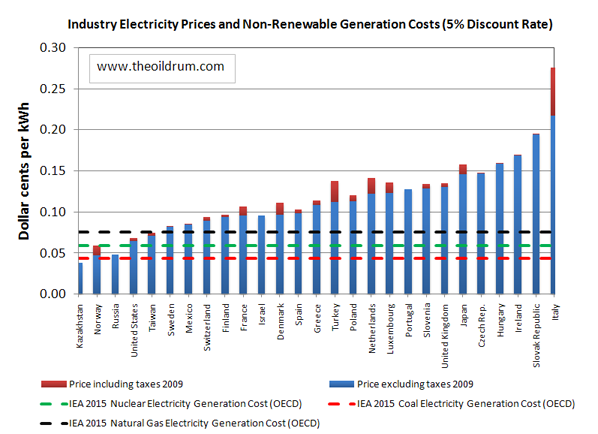

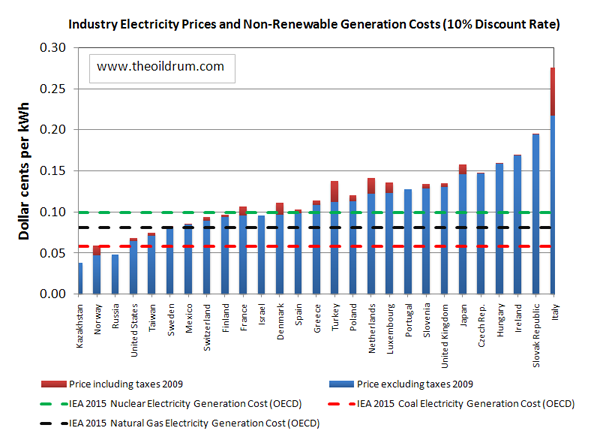

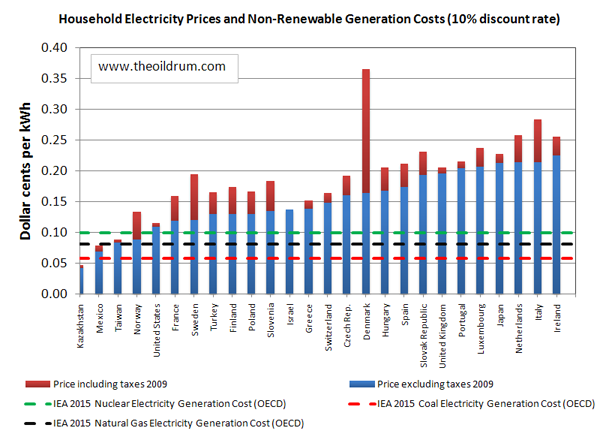

The electricity price and costs of nuclear and fossil electricity compared

Figures 1 to 4 give an overview of median OECD electricity generation costs for coal, natural gas, and nuclear electricity at 5% and 10% discount rates. The numbers used are from the IEA can be found in table 1. These are compared with the price of electricity in 2009 for 27 selected countries at a household and a industry price level. Households and small companies usually pay higher prices due a different tax structure. Sometimes, such as in my home country the Netherlands, there are also price agreements between public utilities and large industrial energy users to keep them more competitive. The industry price level, therefore serves as the lower bound, and the household price level as the upper bound of the electricity price.

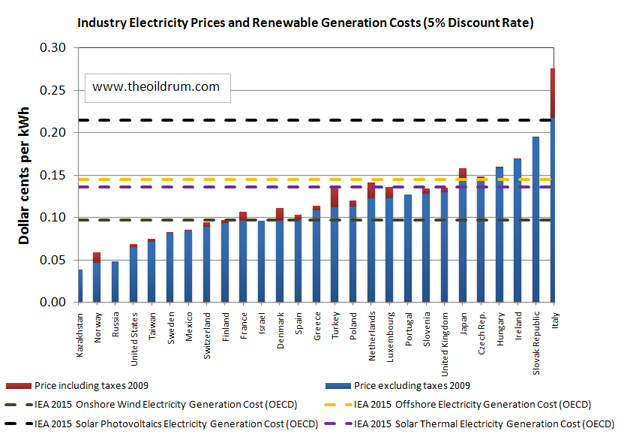

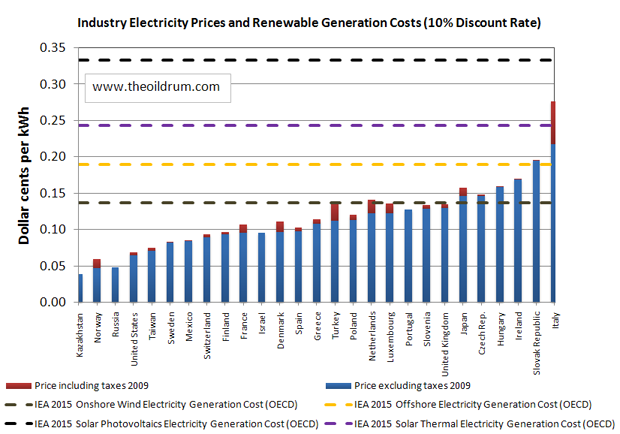

The electricity price and costs of renewable electricity compared

Figures 5 to 8 give an overview of median OECD electricity generation costs for onshore wind, offshore wind, photovoltaic solar, and solar thermal electricity at 5% and 10% discount rates. The numbers used are from the IEA and can be found in table 1. These are compared with the price of electricity in 2009 for 27 selected countries at a household and a industry price level.

Observations

These observations pertain to a comparison between 2009 electricity prices, and the IEA 2015 expected median costs of electricity generation. These should be seen as best available indicators, not as absolute realities for the short-term future. They do not incorporate fully all factors such as storage costs, intermittency requirements, and flexibility of electricity generation. For a fully meaningful comparison incorporating such issues is required which will be the goal of future posts in this series.

- The costs of nuclear, coal, and natural gas are expected to remain cheaper than all renewable energy sources in the short-term future.

- The cost of nuclear electricity generation is strongly influenced by the chosen discount rate. At the 5% interest rate, nuclear energy is less expensive than natural gas while at a 10% interest rate it is more expensive.

- At a 5% interest rate, the costs of onshore wind electricity are significantly below electricity prices exluding taxes for households as well as industry in most countries, but this changes for a 10% interest rates where costs rise above industry electricity prices in 22 out of 27 countries.

- The costs of offshore wind electricity and solar thermal electricity at a 5% interest rate are below electricity prices excluding taxes for households in 14 out of 27 countries, but above prices for industry. At a 10% interest rate the costs rise above the electricity price for both household and industry in the majority to all of 27 countries.

- The costs of photovoltaic solar will remain above electricity prices in the short-term future regarding what interest rate used or whether household or industry electricity prices are taken as a reference.

- The costs of renewable energy are in general highly affected by a higher interes rate on borrowed capital, but this is even more so for solar energy technologies.

End notes

The author is aware that this is only a partial analysis and that it would have been better to:

- Compare electricity costs of different technologies for respective countries, but the author does not have the data to make such a comparison.

- To also include merit order effects for wind-electricity on the power market in this overview. Detailed information can be found in this report.

- Include data on the costs of electricity storage and how this affects the price of electricity.

If someone wants to provide specific information on these in the comments that would be helpful.

Some early thoughts as I'll need to re-read the article

1) capacity adjustment; if an intermittent source has 25% capacity factor it is not really comparable with coal or nuclear. Fix it to make the capacity say 85% either through overbuilding or gas fired backup.

2) discounting; just work out costs to 20 years from now. Forget decommissioning costs of retired plant as they are unknowable and too far into the future.

3) CO2 penalties; either cap and trade or carbon tax. At a minimum I'd assume a carbon tax of $20 per tonne of CO2 or 2c per kilogram. That could make a big difference to coal's cost advantage which is the whole point.

4) location dependence; presumably solar thermal won't be practical at 60 degrees north nor offshore wind mid-continent. Perhaps a compatibility map should be added.

My mistake if any of these points have already been incorporated. More later.

Regarding capacity ~ since the cost given is for generated electricity, not for production capacity, that already adjusts for different relationships between average production and capacity ~ an additional capacity adjustment would be double counting.

That is correct, however a quality adjust would be merited. Note the quality adjustment isn't necessarily negative, if it is solar PV or solar thermal, and it comes during peak demand, the quality multiplier could be well above one.

1. Discounting all cash flows, including decommissioning, is the technically correct way of doing this analysis. You are correct that the difficulty in estimating costs is a problem, but that is mitigated, to some degree, by the long duration as this reduces their impact significantly. Using a 20 year period and ignoring everything after that has too much risk of favoring technologies that produce most of their value over a period of not much more than 20 years and have significant decommissioning costs.

2. The discount rate should be based on cost of capital, not just cost of debt. This is typically done using a weighted average cost of capital (WACC) (http://en.wikipedia.org/wiki/Weighted_average_cost_of_capital). Aswath Damodaran of NYU has done estimates of cost of capital by sector and estimates power generation WACC in the US at 8.23% (http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/wacc.htm).

3. It is not technically correct to use the same cost of debt for all technology types or to view utility borrowing rates as a proxy, although for purposes of this analysis, it is probably the best first pass. Cost of capital is defined by the riskiness of the project not the borrower. Utilities have a low cost of debt because they are borrowing for low risk projects (proven technologies, safe off take agreements, etc). If a utility borrowed to invest in an internet start up, they would either borrow at the same rate as you or me if it was done as non-recourse finance, or it would increase their overall borrowing cost of it were done on their balance sheet. Again, for purposes of this analysis, I don't think it is worth creating different costs of capital for each technology type, but we should be aware that this would be the technically correct method.

4. Several factors, such as fuel costs, technology cost curves, decommissioning, subsidies, etc. would make good sensitivity analysis topics.

Overall, this is a great analysis and I will look forward to reviewing it and the comments more carefully. Thanks.

Given the finite and depleting nature of our fossil fuel resources, a good case can be made for using a "Social Discount Rate" for evaluating these tradeoffs as opposed to the traditional market based WACC approach. This is what Sir. Nicholas Stern did in his Stern Review on the Economics of Climate Change as discussed here. http://www.nytimes.com/2006/12/14/business/14scene.html

Having a too high of a discount rate often leads society into Social Traps http://faculty.babson.edu/krollag/org_site/soc_psych/platt_soc_trap.html that are difficult, if not impossible to get out of.

True. Stern has done excellent work in this area and I will follow your links. However, a social discount rate is easier to use when the cost of the problem can be clearly defined, as it can be in climate change. In the current analysis, climate impacts and other pollution related problems could easily be incorporated, either as part of the core analysis or as a set of scenarios. Future energy costs could be as well, but forecasts can be highly subjective. But I do agree that you point is an important one.

Jack - Thanks for your response. I value the the WACC approach in capital budgeting and have depended upon it for decades....and still do for my business. However, lately, the more I have been thinking about the social implications of peak fossil fuels and climate change, the more it causes me to reconsider using "market" discount rates built up using the CAPM in these areas. I am of the belief that we too often use too high of a discount rate to make important long term decisions and it has lead to many social traps that we now have to deal with. While it is difficult to forecast our fossil fuel situation, there is strong case to be made that we are at or near peak fossil fuels. Given that we have a finite FF energy bank account, we need to make important decisions on the rate at which we should begin investing these FF assets into creating a renewable energy stream that will operate well into the future with little fossil fuel energy support. IMO using traditional discount rates gives too much weight to the present and causes us to continue to burn up our remaining fossil fuels without due consideration for the future.

Jim,

I think it's a mistake to focus too much on discounting. The real problem we face in kicking the FF habit is the resistance of a minority that will be be injured - those whose careers and investments depend on legacy industries.

A realistic discount rate, combined with the appropriate public policy (e.g., carbon and fuel taxes, efficiency regulations, etc) will work just fine.

"A dark ideology is driving those who deny climate change. Funded by corporations and conservative foundations, these outfits exist to fight any form of state intervention or regulation of US citizens. Thus they fought, and delayed, smoking curbs in the '70s even though medical science had made it clear the habit was a major cancer risk. And they have been battling ever since, blocking or holding back laws aimed at curbing acid rain, ozone-layer depletion, and – mostly recently – global warming.

In each case the tactics are identical: discredit the science, disseminate false information, spread confusion, and promote doubt. As the authors state: "Small numbers of people can have large, negative impacts, especially if they are organised, determined and have access to power."

http://www.guardian.co.uk/commentisfree/2010/aug/01/climate-change-robin...

and

"The billionaire brothers Charles and David Koch are waging a war against Obama. He and his brother are lifelong libertarians and have quietly given more than a hundred million dollars to right-wing causes."

http://www.newyorker.com/reporting/2010/08/30/100830fa_fact_mayer?curren...

Good comments Nick. As you point out, there are lots of good tools available in the toolbox....including creating more transparency relating to FF subsidies and externality costs.

And there are a heck of a lot of external costs that need to be charged back to the consumers of oil/FF: direct pollution, CO2, $3T in war costs...

A dark ideology is driving those who deny climate change.

And what about the people who see proposed solutions as nothing more than a way to enrich the "Monied class"?

http://www.environmentalleader.com/2009/12/08/uk-report-just-30-of-carbo...

Carbon reduction spending is only 30% effective. For every unit of cash spent on the Carbon reduction - a unit goes to investment bankers like Goldman Sachs.

I agree that it is becoming increasingly important to incorporate social costs in energy project investment analysis, but haven't seen many methodologies that are robust enough. I have seen projects that forecast pollution control cost offsets (often in biogas projects in livestock or agricultural process sectors), but this is driven by actual or expected impacts of the regulations on industry cash flows, so the external costs are already internalized by the government. Thailand created a very powerful and successful regulatory framework that was driven largely by energy security concerns. Their methodology was something like setting rough targets for new generation by sector, then creating incentives to help developers meet these. The incemtives consisted of feed in tariffs that varied by technology and project size, as well as a broad supporting environment that improved project economics. In some cases, government incentives reduced cost of debt to near zero.

As I mentioned above, incorporating the social costs of climate change are relatively straight forward as we have a huge amount of data on impacts and some premise for future carbon costs.

While I agree that we face a future of resource constraints, it is going to be near impossible to incorporate these at a large scale in public sector projects until the government formally acknowledges the issue. I think the private sector may well invest in projects that have exposure to energy prices as part of an investment strategy in the case that their own internal price forecasts are higher than the market's.

I do think many countries and investors are starting to incorporate energy security in energy policy, investment startegy and target setting, but have not yet seen a formal methodology. I do think we need one.

As well as a doubling in the discount rate it would be really useful to know the sensitivity to fuel cost (or to see the split between capital, non fuel operating cost and fuel costs for each mode). Gas in particular would be expected to be very fuel cost sensitive.

So . . . to some degree this says we should invest a lot in renewables now while interest rates are low.

But that said, it is really hard to get much buy in considering that natural gas is real cheap right now, is domestic, and is relatively clean.

Renewables, or nuclear.

Yes, I know that those who favor one usually consider the other anathema. I suggest these people read James Lovelock and see if enlightenment follows.

Howard Odum would have also agreed.

Once man can show that man can be responsible with fission power man should then proceed.

Replacing the bones of corpses of people who work in the fission industry with broomhandles in order to attempt to cover up how dangerous fission is shows how far Man has to go. Along with successful attacks on fission plants can create a 30 mile no-go zone per the Chernobyl example - Man's war like nature

On the renewable side you have people who advocated taking every scrap of plant matter, charring it, and mixing the char with Zinc to make batteries who ignored the strip mining of soil fertility in that vision of a solution.

You all might wish to look at changing the money system (money acts as a proxy for energy) so it is no longer based on interest thus requiring "growth" and move to a powerdown model.

For a good study, someone really needs to determine a link between commodity prices and interest rates. This only seems to be looking at the CapEx costs which are obviously heavily tied to interest rates. Renewables will have bigger CapEx but zero fuel costs for solar & wind. The non-renewables will have a lower CapEx cost but they have to pay for fuel. Obviously, higher interest rates will hit the renewables harder since they have larger up-front CapEx that must be financed with loans that become more expensive at higher interest rates . . . . but what about the fuel costs? Do they also natural rise along with interest rates? Interest rates are often pushed up by central bankers when they sense inflation. And inflation hits fuel costs (often very hard). So perhaps one has to assume rising fuel costs at the same time as rising interest rates since those interest rates may have been pushed up by bankers in direct response to inflation (which is rising fuel costs).

Perhaps the changes between the two are not very big? . . . although rising interest rates hit renewables harder, the non-renewables will be hit by higher fuel costs thus making it a wash?

This is obviously just off-the-cuff rambling . . . serious analysis would be interesting.

> serious analysis would be interesting.

Makes me remember a statement by a German politician, Horst Seehofer I think it was, which went about like: I always thought dealing with costs in the health system was complicated. That was before I had seen it in the energy sector. He's a former health minister.

That said, for renewable electricity sources in the US, the publications from the Berkeley Lab's Environment Energy Technologies Division look pretty solid (e.g. this one).

Mind you, other places can yield widely different quantities. Wind in Switzerland was said to cost around 20 cent not so long ago. In Spain, it seems to be priced at 4.5 now, in Portugal at almost ten. I remember it being 6 to 7 cents in Spain a couple years ago. UK onshore wind was usually rather expensive, even though they have a far better resource base. It seems safe to say that all generation price is local, and nothing will get built on OECD average.

Turbine prices at the factory gate may vary too. Went up recently even as delivered quantity increased hugely, now on the way down again even as raw materials are becoming more pricey. Learning curves will get you only so far, other factors have their say. Financing, other commenters have spoken about it probably better than I could.

I also understand the fossil side less well, but can't stop wondering if the IEA'd be prepared to offer hedging against the above coal generation price in 2015. Nuclear fission is military tech and thereby priceless indeed.

Then there is the cost versus price theme. Observation skills have lead me to the conclusion that there is no agreement on the costs of the various options, let alone in monetary terms. Good for forum debates.

Final note that the Berkely Lab also have some data on geothermal in Exploration of Resource and Transmission Expansion Decisions in the Western Renewable Energy Zone Initiative and that I couldn't find anything recent on biomass from them. The latter by the way is an entire topic of its own, as you may have guessed. Somebody?

Wind in Spain, it seems to be priced at 4.5 now

Spain is home to Gamesa - a firm that has had 'issues' in China.

http://www.nytimes.com/2010/12/15/business/global/15chinawind.html

If the cost of wind depends on local development and then worldwide sales China may see low wind costs also.

Three points, for now.

These costs do not, of course, include the many external costs, such as effects of climate change, expense of long term storage if nuclear waste, even the much more minor problems of birds and wind towers. And of course, the likelihood that carbon will eventually taxed and even rationed should also be figured in.

Another notable feature of the graph is the apparently high cost of solar. But in most areas, solar will be performing at its peak just as peak energy use is occurring--the hottest, sunniest times corresponding as they usually do to the highest AC usage. And around here, at least, an institutions use of electricity at the years peak electricity use sets the charges for the electricity that the utility will charge for the whole year.

It would be hard to figure this in precisely, but it is safe to say that future high temperatures/high electricity usage in the future will on average exceed those of the past, due to GW.

The other huge factor left out was the comparative expense of nega-watts. A watt saved is a watt earned, after all. I am betting that conservation measures of various sorts are going to be far, far lower than any of these production-oriented approaches.

Has anyone tried to incorporate these factors into a fuller calculation of the relative costs of these modes of electricity generation?

I totally agree with the comment about "negawatts" (while admitting my conflict of interest since I work in energy efficiency). While EE is always the "red-headed stepchild" in any energy discussion, I have no doubt that energy efficiency will be by far the most economic approach as compared to ANY new generation option that is fairly burdened with externalities, transmission/distribution costs,etc.

Although the EU has much lower energy intensity per unit of GNP than the US, there is tremendous opportunity for energy conservation in Europe. Single-glazed windows, uninsulated attics/walls, and and ancient inefficient furnaces/boilers abound. While these low-hanging fruit of EE are not addressed, investing in new generation seems like an obvious mis-allocation of funds. While Northern Europe has reasonably good building codes for new construction, the vast majority of the existing building stock has not been addressed. Also electric resistance heating is very common in Europe, allowing energy consumption reductions of 50% or better by using heat pumps instead, etc., etc.

Much better said than I could have. Sometimes even some environmentalists sound a bit like Dick Cheney to me with their near exclusive focus on production. It's like focusing on adding more logs to the fire while all the doors and windows are just standing open.

Is this just some kind of inherent myopia, or is it that there is much more money to be made (and lost) in production than in conservation?

FWIW, we're replacing 400-watt metal halide steelers in a municipal garage that operates 24/7 with 6-lamp T8 high bay fluorescents. The installed cost of these replacement high bays is approximately $150.00 (fixture, labour, permit, man lift, lamp recycling, etc.) and the demand reduction is 0.233 kW. This translates to be just under $650.00 per kW saved and the corresponding cost per kWh is less than $0.01 when amortized over ten years. For a facility that operates 60 hours per week, the ten-year cost per kWh saved is $0.02 and virtually nil after that.

In an office environment, we can replace a 4-lamp T12 troffer with a new 3-lamp T8 lay-in, reducing fixture load from 160 to 63-watts, often with a notable bump in light levels. At an installed cost of $75.00 per fixture, the cost per kW saved is less than $800.00, and at 60 hours per week, the ten-year cost per kWh saved is $0.025, or less when you factor in the related a/c savings.

We've trimmed our labour charges for 2011 and negotiated some very aggressive pricing with our material vendors so that our DSM services will be even more cost-competitive going forward.

Cheers,

Paul

Our college is about to replace the program that controls temperature in most buildings on campus for the first time since it went in the 70s (or early 80s). This will not only save millions, paying for itself in two to three years, it will make all the buildings much more comfortable, rather than the over heating and over cooling (and sometimes both at the same time!) that seems to have been the norm.

Even so, it wouldn't have happened if it weren't for a particularly persistent facilities guy, and a grant from the stimulus package.

Count yourself amongst the lucky ones. We've been working with the facilities manager for a major New Brunswick university for several years now trying to convince the Board of Regents to fund various efficiency upgrades and no matter how compelling business case they don't budge. The university is fairly well-endowed, but they're unwilling to finance these kinds of initiatives even though the risk is low and the returns far exceeds their traditional investments. It's beyond comprehension.

Cheers,

Paul

What reasons do they give? Assuming they're willing to give some kind of feedback...

Hi Nick,

No official explanation offered, at least none has been passed on to us. Anything beyond that would be speculation and hearsay so I should probably leave it at that.

Cheers,

Paul

Note that 95%+ of today's nuclear "waste" is either unburnt uranium (U-235 or U-238) or isotopes of Pu, Am and Cm which are themselves fuel for reactors we know how to build.

Essentially all uranium is either fissionable with fast neutrons or fertile material (or both). That means none of it is "waste" until it is either fissioned or transmuted (by accident) into americium or curium which doesn't make energy in the reactor it's in. Fast-spectrum reactors have a much greater probability of fission than neutron capture. If you want to get rid of this "waste", argue for fast-spectrum reactors which will turn it into heat and fission products before it becomes a problem!

Another solution is LFTR, (Liquid Fluoride Thorium Reactor). It can be run on Thorium, and/or SNF, (Spent Nuclear Fuel). Waste from todays reactors gets burned up in LFTRs with a reduction of nuclear waste over time.

LFTR uses a thermal spectrum, so it has many of the same issues regarding actinide burning that LWRs do (they tend to capture slow neutrons and get heavier rather than fissioning). But actinides can be used to start LFTRs which then go on using U-233 they breed from Th-232, and the remaining actinides (and any bred by chance in a LFTR) finished off in fast-spectrum reactors. The two types are complementary.

The largest input into costs, particularly for the nuclear option, is the time involved for permitting and construction. I did not find the assumptions used for schedule with resulting impacts on materials inflation and interest during construction.

That is an excellent point. Large solar plants can come on line very quickly and can be returning capital within a year or so. This would change the equation substantially compared to a much longer period for other systems.

I am not an advocate for solar in developing countries generally as the higher costs lead to significantly higher rates at even low percentages of generation. However, I spoke with some policy makers in the Philippines recently who may need to make a trade off of a higher cost installed capacity base for increased power now. Solar looks better in this context.

A distinction needs to be made between grid-connected and off-grid solar in developing countries. While I agree that grid connected solar is usually too expensive a central generation option for developing countries, off-grid solar lighting systems are rapidly penetrating developing country markets with and without subsidy, since off-grid solar PV competes with expensive, inconvenient, and dangerous kerosene and car batteries.

Between cell-phones and local power, some regions in developing countries may not bother to connect to national grids for a long time, if ever. In remote regions, local generation and storage may be cheaper than transmission and distribution costs, and even if they are not, funds to extend the grid are just not available anyway.

good point. There was a good NYT article a few days ago on that:

http://www.nytimes.com/2010/12/25/science/earth/25fossil.html?_r=2&pagew...

We have many locales that are off grid and served by diesel generators. A restaurant on the hill, houses along the bay etc. With the cost of grid connect the cost of solar needs to be compared with cost of running a genset, not just the fuel but the transport of it with many places around the bay accessible only by boat. Comparing the cost of solar vs electric units,in those situations, makes no sense at all.

NAOM

Solar installations can be built progressively more easily than FF. The first stage can be producing while the second is in construction and the 3rd in preparation etc. How does this affect the costings on a project?

NAOM

Implementing the project in stages would shorten cash flow tenor and provide value in terms of real options, the ability to decide later whether and how to proceed. This would significantly reduce cost of capital in the latter case and the NPV of the cash flows in the first.

Energy, not money is the real economic wealth. Money can be printed or created with the stroke of pen and is only a marker for economic wealth.

Given the critical nature of energy to humanity, a case can be made for using a very low discount rate (ie 0%-1.5%) in evaluating energy alternatives....even if the "market" discount rate for money is much higher. Sir Nicholas Stern used a similar approach in valuing the future impacts of climate change.

Using this very low discount approach makes it more apparent that we need to invest some of our remaining FF energy bank account into renewable energy supplies that will last (at least a while) beyond cheap oil. That is, convert finite and depleting energy assets into an annuity stream of future energy flows. Of course, this also makes nuclear power a lot more cost competitive.

Money is merely a medium of exchange. The thing that is being exchanged is energy.

I think you just about said that money represents energy, which is correct. I presented some details on that a while back.

http://www.theoildrum.com/node/7048/735318

"I think you just about said that money represents energy, which is correct."

Dechert, I'd go further than that and argue that money represents BIOLOGICAL, or ecological energy, not just plain old energy. This is because all money is a claim on human labour and human labour is powered solely by ecological energy sequestered from sunshine by plants (of course there is more to human consciousness than just energy but this is the thing which drives our bodies to do work).

I think I have managed to bridge together thermodynamics, ecology, and economics. I have written a long winded treatise which summarizes my thoughts if you are up for some late night reading. You seem like the kind of person that would be interested in that kind of thing. It would be interesting to hear your thoughts. I still would like to expand a few areas more, like the current banker fraud that is destroying the world's financial system.

http://markbc.wordpress.com/thermodynamics-for-economists/

Well, I don't agree with that. I noticed in your essay that you distinguish between "technical" energy and "biological" energy. The cold hard fact: energy is energy. It's all energy. Strictly speaking, we are only machines through which energy flows. It's always the energy that does the work, whether it's a person carrying a bucket of water or a pump pushing water through a pipe.

"The cold hard fact: energy is energy. It's all energy. Strictly speaking, we are only machines through which energy flows."

Ahh, but that is where you are simplifying it based on a mechanical kW-hr definition. As I explained, it is easy to convert biological energy to technical energy by burning biomass and then doing what have you with the liberated energy, be it heat, kinetic, or elecrical. But you cannot go the other way and make biological energy out of technical energy because all food is made by plants. You simply cannot eat gasoline or anything that can be made from it, unless you burn it to make electricity and power artificial lights to grow plants. And then we are back at "biological" energy because that food had to be made by plants! So "biological" and "technical" energy are indeed very different from the perspective of economics and ecology.

You can take exception to the arbitrary names I have assigned to "technical" and "biological" energy, but my logic is sound.

And many scientists would disagree with your strictly mechanical "machines through which energy flows" description of biological organisms. While this is undoubtedly a part of what makes biological organisms what they are, it is definitely not all. It is incomplete. But just because it is incomplete does not make it invalid, so I agree with your statement only to a degree.

Your distinction may or may not have value. I am not sure.

My version of biophysical economics starts with EA=EP-EC where EA is the Energy Available to do things other than produce energy. EP is the Energy Produced, and EC is the Energy Cost of producing EP. I think, roughly speaking, others sometimes say "net energy," which would correspond to what I call EA... and "gross energy" is EP.

This equation, EA=EP-EC would never distinguish between technical and biological energy. It always holds no matter what. As some have pointed out, in a modern economy, almost all (like 99 percent) of the energy in the equation is what you'd call technical energy. If you go through the link I gave earlier, you'll see I walk through a scenario where it's all biological energy. If I extend that scenario to include, say, fire, I can show how the equation still holds and is applicable to economics. It's a different sort of economics, though.

"in a modern economy, almost all (like 99 percent) of the energy in the equation is what you'd call technical energy. "

I don't know if I agree with that 99% figure, but overall it's very high. Brazil uses a lot of ethanol to drive its cars. And the other energy, the one that I am focussing on, is food energy which drives our bodies and by extension all human labour and our economy.

"This equation, EA=EP-EC would never distinguish between technical and biological energy."

That's ture, thermodynamics is thermodynamics regardless of what type of energy you are dealing with. But my point is that when it comes to food and the energy which it provides for our bodies, all of it comes from plants (like 100%), so right there by definition we are dealing only with biological energy. Technical energy is excluded fromthe table.

I am going to guess 2500 calories (really kilocalories) per day per person. There are about 4 BTUs per kilocalorie, so that's about 10,000 BTUs per day per person. Figure we have around 300 million people. That makes 3 trillion BTUs per day. So for a year, it would amount to about 1 quadrillion BTUs (or one "quad"). The US is averaging a little less than 100 quads of energy consumed per year, according to Dept of Energy. So, this energy -- food energy -- makes up about one percent. Food energy is probably not included in the Dept of Energy statistics.

It might be a little more than a quad, but not much. The US population is a little more than 300 million and average daily caloric intake might be over 2500.

Considering stats like 50% of 'food' gets 'wasted' from farm to table and the amount of 'human food' (say oats/corn...ignoring starlink corn) which is fed to animals that are then made into 'food' - tracking the 'food' will be harder than the above.

Any scientist that passed high school physics knows that energy means the ability to do work. Work is done with energy. No energy, no work.

The economy is about work. The economy is about energy. Frederick Soddy, a pretty good scientist, nailed that one about 90 years ago.

Not all energy is equal as outlined by Howard Odum in his discussion on Transfomity and Emergy. http://dieoff.org/page170.htm

I appreciate Odum's work. He was one of the first authors I read on this subject when I first started thinking about this in the 1970s.

However, I never saw the need to coin new words for different types of energy. I always found terms like "emergy" and "emdollars" a bit daffy.

Documenting the flow of energy is like accounting processes with money. I think we'd introduce a lot of confusion if we invent a lot of different words for "dollars" depending on how the dollars were moving, or being stored, or carried, or where they come from. It's complicated enough that we have Euros, Pesos, Pounds, etc.

I mean, in our biophysical economics text books, if we want to talk about the embodied energy of a product meaning the energy that went into making the thing, we can do that. We don't need a new word to do that. We can talk about entropy and depreciation in the same textbook.

Documenting various differences in qualities is also a major challenge. Understanding heat rates is useful.

I disagree. The "dollar" of investment bankers is not as valuable as the "dollar" of a farmers resulting food product.

Picking a different value to discuss different things is well known - as you note Pesos, Pounds et la.

That's a nice essay. I enjoyed reading it through. I've only had a chance to go through once so far, but just a couple of points/questions:

- I'm not sure I fully understand the value of distinguishing between your 'technical' and 'biological' energies. Surely the 'biological' is just equivalent to current 'Food Production' sustainability quotas? Those quotas take into account energy that could potentially be made available to sustaining / increasing food production. Why the need to complicate such an issue? Just clarification needed on my part.

- There is also one point I think you could perhaps have a rethink about:

I agree that there is potentially an abundance of energy waiting to be tapped into but the key issue here is that, presuming you would like to sustain a similar complexity of civilisation to the current one and continue to improve life qualities, the ability to capture that energy in the future is not guaranteed. To give you a very hypothetical situation, imagine if the worst of the worst happened and following stresses from Peak Oil we did collapse to a pre-Industrial feudal-type society. You can see that although potentially the energy is still there to be captured in, say, nuclear fission plants and oil deep under the oceans, society would lack the ability to access it via pre-Industrial methods (i.e. by hand or crude tools). I'm struggling to make my point succinct just now, but I would try to compare it to a 'critical mass' reaction - without reaching that critical mass, nothing happens. It doesn't matter if you can come within 1% or 99.9%, you'll still not reach the end goal. So, to summarise it shouldn't be assumed that just because the energy is out there that it's a given that we'll be able to harness it. The situation needs very careful management in my opinion.

Cheers,

N.

Edit: Perhaps a better analogy would be quantum energy states. At the moment we could be said to be in a higher energy state than pre-Industrial. If we were to drop to a lower state, i.e. pre-Industrial, then it may be that we would no longer have access to enough easy energy to make the jump back up to a higher state. And, unfortunately, there's no in-between.

Hi iagreewithnick,

Thanks for your thoughts. Do you have any more info on Food Prodution sustainability quotas? I don't know much about them. I make the distinction between biological and technical energy because as far as I can see, and based on everything I have learned about biochemistry (and by observing the worldwide health epidemic as a result of our addiction to processed food -- in other words, the more artificial the food is and the farther it is away from the original plant form, the worse it is for our health), food cannot be made by anything other than plants. You can't make it from oil, electricity, or any other energy source besides sunshine. So food energy is in a special class of energy, as I said because all food must be produced by plants sitting happily out in the sunshine somewhere. No other energy source has this limitation. The one exception is to use conventional energy to power lights to grow plants, but I don't think that's viable on a large scale. The Sahara has an almost limitless amount of energy available, but in terms of being able to convert that into food, it's not available to us, because no plant is going to be happy sitting out in the midle of a parched sand dune, until we can find a way to economically and sustainably provide water to that sand dune.

"I agree that there is potentially an abundance of energy waiting to be tapped into but the key issue here is that, presuming you would like to sustain a similar complexity of civilisation to the current one and continue to improve life qualities, the ability to capture that energy in the future is not guaranteed. To give you a very hypothetical situation, imagine if the worst of the worst happened and following stresses from Peak Oil we did collapse to a pre-Industrial feudal-type society. You can see that although potentially the energy is still there to be captured in, say, nuclear fission plants and oil deep under the oceans, society would lack the ability to access it via pre-Industrial methods (i.e. by hand or crude tools). I'm struggling to make my point succinct just now, but I would try to compare it to a 'critical mass' reaction - without reaching that critical mass, nothing happens. It doesn't matter if you can come within 1% or 99.9%, you'll still not reach the end goal. So, to summarise it shouldn't be assumed that just because the energy is out there that it's a given that we'll be able to harness it. The situation needs very careful management in my opinion."

That's a very good point and I made the assumption that society would remain organized enough to be pumping out competitively priced solar panels, wind turbines, electric cars, and heat pumps if things go really bad, which may not be the case. I remember reading on this site several months ago an article talking about the relationship between complex social organization (invoking entropy into the analysis) and the amount of easily accessible energy available to that society. Unfortunately I didn't bookmark it, does anyone remember this?

Actually, you can. Electricity and CO2 is sufficient for at least some archaea to make methane (at 80% efficiency, no less). Methanotrophic bacteria consume the methane, and a few steps up the food chain you have something edible. Life is amazingly flexible.

The idea of a system which can convert electricity to food at double-digit efficiencies is interesting, and I don't think we're all that far from it. It probably just needs all the pieces put together. We'd first see it done for space missions.

If the same low discount rate is applied to pollutants and other things which cut future returns on natural capital, ash dumps from coal and topsoil loss would weigh far more heavily in our calculations.

Even more so if the fuel is not just free, but yields a "tipping fee" for taking it.

This is what the Integral Fast Reactor should have been doing for us already. GE-Hitachi's S-PRISM concept is claimed to be buildable in volume for $1300/kW. The initial fuel supply would be reclaimed plutonium and actinides from spent LWR fuel, and it would run until end of life (40-60 years, perhaps longer) on reclaimed LWR uranium or depleted uranium from existing stores. This would dispose of the existing spent LWR fuel and convert most long-lived radwaste to isotopes with half-lives of 30 years or less. This waste would leave the plant already encapsulated in glass for long-term disposal, but it would only need isolation for a few hundred years. We could build a pyramid out of it in a desert and let the Cerenkov radiation at night turn it into a tourist attraction. Long before it got as old as Giza, it would be inert.

The USA has enough DU in stock (some 470,000 tons of elemental U) to supply all electricity for about 1500 years or all US energy requirements for around 300 years. If you apply a 1.5% discount rate to this, the value of recovering the energy in the spent LWR fuel and eliminating the future costs of Pu/Am/Cm disposal would make it highly attractive. The eliminated costs of coal ash and sulfur emissions would make coal un-competitive even if CO2 is priced at 0.

Even more good reasons for using a social discount rate. That was quite the cite on the S- PRISM concept. Remember when we used to build things like this!!

I'll be impressed when the builders of said things go to Congress and demand the repeal of Price-Anderson because they are just that safe.

Well, everything else gets its subsidies...why should nuclear be excluded?

This is true only as long as externalities and the scarcity value of fossil fuels (non-renewable premium) remain uncosted. In addition fossil fuel generation is often subsidised, or receives some other special consideration. The playing field is definitely not level; and as long as the FF lobbyists have their way it will never be.

SD - Good points on FF subsidies and the costs of externalities.

See:

Estimating US Government Subsidies to Energy Sources 2002 – 2008, Environmental Law Institute, 2009. http://www.elistore.org/Data/products/d19_07.pdf

and

The Toll from Coal, Clean Air Task force, September 2010. http://www.catf.us/resources/publications/files/The_Toll_from_Coal.pdf

These subsidies and externality costs can amount up to an additional 11 cents per kwh according to this report. "Hidden Costs of Energy: Unpriced Consequences of Energy Production and Use," National Academy of Sciences, National Academy of engineering, Institute of Medicine, National Research Council, October, 2009. http://www8.nationalacademies.org/onpinews/newsitem.aspx?RecordID=12794

As far as I know, we have yet to go to war to insure our access to another regions rich resources of wind and sun (or tide and geothermal, for that matter).

Nice job Rembrandt.

[They do not incorporate fully all factors such as storage costs, intermittency requirements, and flexibility of electricity generation. For a fully meaningful comparison incorporating such issues is required which will be the goal of future posts in this series.]

I look forward to that. Intermittent, unreliable, non dispatchable kWh's are not worth much. Imagine a world in which the grid simply delivers kWh's from a seller to a buyer for a small fee, like the post office.

Consumers could buy long term contracts from reliable producers at an agreed cost or take their chances on a real time spot market where prices could be high, low or not available at any cost.

Owners of intermittent sources would have to build their own backup plants to acquire long term contracts and consumers using the spot market would have to acquire their own backup generator, most likely using oil based fuel.

We are still firmly locked in the age of fossil fuel because we have not done the R&D required to produce the technology required to make the transition to something better. A good summary on R&D is here.

http://theenergycollective.com/david-lewis/48960/us-energy-rd-can-it-bea...

Wrong. Grid-connected solar kWhs have a premium value because they are produced exactly when they are needed.

"Dispatachable" peaker kWhs are VERY EXPENSIVE because of very low capacity factors. For example, gas-fired peakers here in California only run a few afternoons in July and August, if at all. Gas fired peakers have to be maintained and cost $/sq ft even while not running, which is almost all the time. For the next 6 months, most of the fossil fuel power plants in CA will not run at all.

[Wrong. Grid-connected solar kWhs have a premium value because they are produced exactly when they are needed.]

WRONG.

Germany leads the world with 15 GW of solar cells. You can get a daily graph of solar output here.

http://www.sma.de/en/news-information/pv-electricity-produced-in-germany...

You have to go back to Dec 23 to find any significant output. The peak that day was 0.7 GW out of 15 GW, and occurred about 1PM. Average solar output in December is negligible.

In the summertime production often peaks in late morning or early afternoon due to cloud formation in the afternoon, while demand peaks in late afternoon and extends well into dark hours.

This has nothing to do with the point. Peak capacity for grids in the Northern Hemisphere are sized for the summer peak. For example, today, the peak load in California was maybe 33 GW. It might be double that at 4pm in JUL or AUG.

It is no surprise that direct solar is not going to contribute a high percentage in Dec. You can only discount the value of solar or wind if they produced at times (like 4am) when baseload plants have everything covered. Of course, we never have solar at those times. Sometimes we have wind at those times. Even then, we have 4 GW pumped hydro in CA that can be used if necessary, for storage. Pumped hydro can be greatly increased as needed.

In short, intermittency is not an issue right now with renewables, and won't be until we reach 40 GW or so installed. BTW, all the new big plants going in are solar thermal. Check out the one from Rice Solar LLC. It will store heat and continue generation into the evening. http://www.energy.ca.gov/siting/solar/index.html

Keep in mind that solar panels on a user roof not only onload the generation of electricity, they also unload the distribution of electricity.

Blackouts in America usually happen because of power line failures. There are other failure modes, like explosions, politics, corruption, inability to continue to afford subsidies, etc.

"Peak capacity for grids in the Northern Hemisphere are sized for the summer peak."

Minor edit;

Peak capacity for grids in California and other southern states are sized for the summer peak.

I have 12 kw of electric heat in this house (Eastern Washington), and one through-the wall AC unit that pulls 3 kw. It's used about 15 evenings a year. The electric heat is used for about 7 months a year, although obviously all the baseboards are not on at once (At least I hope it's not that cold.)

At work the draw is usually about 55 MW, and there is a slightly higher draw in winter than summer, but only a percent or two.

Where that is a real problem for this time of the year with solar and wind power is that this area has about 8 hours of daylight, and usually heavy cloud cover, and no wind. About 85% of the local power is hydro, and rest is split between a coal plant and the local nuclear plant. There are windmills in the area, but this time of the year they don't do much. March is a different matter.

Yeah, I knew that as soon as I hit save. I have a California-centric world view for some reason.

It's probably true for northern climates in Europe and elsewhere. Availability of cheap hydro electricity will also be a factor.

Thanks for reading.

[This has nothing to do with the point. Peak capacity for grids in the Northern Hemisphere are sized for the summer peak. For example, today, the peak load in California was maybe 33 GW. It might be double that at 4pm in JUL or AUG.]

By 4 pm in august solar power in California is near zero. Click the link under graph for more data.

http://www.tep.com/Green/GreenWatts/SolarHistorical.php?p=1280728800

[Pumped hydro can be greatly increased as needed.]

Pumped hydro is mature technology. Why aren’t people building it en mass now? Where are all the great locations just waiting to be developed? How long is the permitting process? How many people want an ugly pumped hydro plant in their backyard, what does it cost?

More importantly a nuclear plant could use pumped hydro much more effectively by running it through a full charge discharge cycle every day taking full advantage of peak pricing every day, while a large solar or wind pumped hydro plant might see a full load cycle 4-10 times per month.

[In short, intermittency is not an issue right now with renewables, and won't be until we reach 40 GW or so installed.]

Only true for developed countries that have a massive conventional grid to provide free backup and power conditioning for renewables. We need a global solution.

U.S. coal plants were designed for 40 year lifetime and average age is 42 years. Fossil backup plants will have to be rebuilt if we go with intermittent sources, and that should be included in their cost estimates.

[Check out the one from Rice Solar LLC. It will store heat and continue generation into the evening.]

OK, I looked it up, here are the only relevant facts I could find.

[The proposed project will be capable of producing approximately 450,000 megawatt hours (MWh) of renewable energy annually (only 51.4 MW average output)

Estimated $750-850 million capital cost]

So, construction cost is $15.56 per watt, several times higher than nuclear. No information on how much energy is stored, how long it will last, life expectancy of the plant,(the demo plant only ran 3 years).

Bad weather could shut it down for several days at a time, so fossil backup power will still be required if California goes heavily into solar.

The German feed in tariff is 56 euro cents per kWh. If nuclear got the same deal they could build a 1.5GW plant with an annual capacity factor of 0.9 that would earn $7.4 billion the first year. It could pay for itself in less than two years and become a huge cash cow for its owners for the next 50+ years.

California is going to order utilities to buy solar power regardless of price. That could be more expensive than Germany.

http://www.cleanenergyauthority.com/solar-energy-news/california-feed-in...

You pick one single day in August in Arizona and then say that in CA power is near zero by 4 PM. Looks to me that they had a storm system move in at that time. This nonsense drives me crazy. I'm all for good data making a point, but this is again completely wrong. We have a panel system, live in Northern CA and we still have a lot of solar output at 4 PM.

[You pick one single day in August in Arizona]

Peakearl, I will repeat, Click the link under the graph (VIEW DATA FOR...) for more data.

http://www.tep.com/Green/GreenWatts/SolarHistorical.php?p=1280728800

I reviewed a months worth of data and found few days without substantial interruptions, and very little energy produced after 4pm.

Here is a link to today’s California demand curve.

http://www.caiso.com/outlook/outlook.html

Notice that at 4PM, just when solar is dying, the demand curve turns sharply up, the exact opposite of dechert’s claim that “Grid-connected solar kWhs have a premium value because they are produced exactly when they are needed.”

The peak is at 6pm and remains above the 4pm level until 930pm.

[I'm all for good data making a point, but this is again completely wrong.]

Great, provide a link to the right data.

Today is meaningless in terms of peak demand, that comes in the summer with AC use. Demand increases in the winter for lighting and heat as the sun drops but is vastly below summer demand. At the moment, our panels are producing nothing due to the clouds, but it doesn't matter. Our PV panels provide all our net need over the year, mostly at peak need times.

Note that the peak for today is supposed to be about 30,000, while in the summer it can get up to 50,000. Winter doesn't matter. We have hydro and abundant other sources in winter with low demand.

I did check your link before and again it was for individual days in Arizona, not average in California. The link below shows that in July, PV production in California at 4 PM is about half of noon peak, consistent with our real world experience. It is going down fairly rapidly at that time, but the peak demand in summer is also generally decreasing around that time. The curves don't match ideally, but they do overlap to a very meaningful degree.

http://www.stanford.edu/group/efmh/jacobson/Articles/I/HosteFinalDraft.pdf

[At the moment, our panels are producing nothing due to the clouds, but it doesn't matter. Our PV panels provide all our net need over the year, mostly at peak need times.]

Well that is wonderful; the grid provides free backup power and power conditioning. That works great as long as it is a tiny fraction of well to do people who can take advantage of net metering. The middle class who cannot afford an expensive solar system can pay higher rates to subsidize your free backup power.

What happens when all the customers net zero? How does the utility stay afloat?

[[I did check your link before and again it was for individual days in Arizona, not average in California.]

My point exactly; the link you provided is a fairy tale, where every day is an average day. Where is the real data? If California goes big into solar and wind what happens on the days when the whole state is cloud covered with very little wind?

What happens when there is a hundred year heat wave with no wind and the sun goes down?

I'm not sure your point beyond hyperbole. Cloudy days in August are extremely rare, and if it is cloudy there is no problem with electricity because temperatures will be relatively temperate. I never proposed powering the entire state with PV. I only am suggesting it helps. I am talking real world, you are not. I gave the expected solar production, which is consistent with my experience. I am middle class. I drive a small car. My neighbors who you seem worried about paid enough more for their large cars (not even counting annual gas costs) to pay for a system for themselves if they want it. The difference is my money pays back, albeit slowly, while theirs is gone in 2 years. Don't accuse me of some kind of elitism.

By the way, we pay a monthly fee to be grid connected - it isn't free, and in the summer when we are generating more than we use it reduces the amount of expensive peak electricity that PG&E has to purchase from out of state. If we end the year with a surplus, they get it. If we end up behind, we have to pay.

When there is a hundred year heat wave and no wind we are all in trouble anyway. There will be shortages, brownouts, blackouts, etc, just like there have been before renewables were much of the scene. We can't afford enough fossil fuel or other plants to supply the extremely rare episodes in any case. That would require carrying a huge amount of excess capacity that we can't afford anyway. The biggest disaster is when we have droughts and not enough water in reservoirs to generate hydro. We have no provision to cover that either. What is your point, though? Are you thinking that fossil fuels will be available forever in inexhaustible quantities. Are you suggesting we go 100% nuclear and cover the state with them? What is your recommendation?

[What is your recommendation?]

There are over 3 billion people around the world who want to join the middle class soon. If the U.S. could reduce its emissions to zero instantly, the savings would be gobbled up by the developing world.

The most important goal for the U.S. is to use our technical capacity to develop low emission energy sources that are less expensive than fossil fuel. People across the world will switch to the new less expensive sources quickly and voluntarily, not kicking and screaming.

Energy is so important to the human race that we must implement a plan that does not have failure as an option.

SHORT TERM STRATEGY

1 Drill, drill, drill. Drill in Alaska, drill offshore, drill wherever we have oil and gas. Each $10 per barrel that oil goes up costs Americans another $80 billion per year. Each 1 cent per kWh that electricity goes up costs Americans another $40 billion per year.

We need fuel to keep our economy going so that we can afford to develop the new technologies that the world needs.

2 Level the playing field so that we are forced to pay the true cost of energy from each source. Eliminate all energy subsidies.

When you take a load of trash to the city landfill you pay a fee per pound of trash. Humans have been using the atmosphere as a free waste dump since we gained control of fire. Atmospheric dumping of hazardous material is producing severe adverse effects on human health and global climate. We should charge an atmospheric dumping fee equal to the best estimate of the cost of damage done by the toxic waste being injected into our atmosphere. Low emission technologies will become more competitive on a level playing field.

3 Conservation is a strategy that is being implemented already due to rising energy costs, and it will increase. Improving insulation and using more efficient appliances make good sense.

Conservation sometimes comes at a high cost. For example sales of motorcycles and mopeds are exploding. The motorcycle fatality rate per mile is seven times higher than for cars. The fatality rate for bicycles is seven times higher than motorcycles. Econobox cars are less survivable in accidents than large cars built with the same level of technology.

Higher electricity prices mean less security lighting. There’ll be more muggings and rapes on college campuses and parking lots. Homes will be colder in winter and hotter in summer. More people on limited income will have to choose between paying for food, medicine or utility bills.

The cost of conservation includes increased human suffering and death. The sooner we develop clean safe abundant sources of inexpensive energy, the sooner we can minimize these costs.

INTERMEDIATE TERM STRATEGY

Use proven technology to reduce our dependence on foreign oil.

1 Accelerate the mainstreaming of emerging technologies including hybrid, all electric and fuel cell vehicles.

2 Mass produce floating nuclear power plants to increase our supply of clean emissions free energy electricity. A company called Offshore Power Systems built a facility to do that in Florida during the seventies, but it was never put into production due to a downturn in the economy that stalled growth and canceled orders.

http://www.atomicinsights.com/aug96/Offshore.html

3 Convert most stationary application of natural gas to electricity. Use our natural gas supply to displace imported oil. Automakers can convert from gasoline to natural gas quickly and cheaply.

LONG TERM STRATEGY

1 Increase R&D for energy by more than a factor of ten to $100 billion per year, 90 cents per day for each of us. Push every technology as hard as possible, build prototypes of everything as it becomes possible and publish the performance data.

When someone says R&D most people only hear “Research”. In truth Development is the really expensive part, and the U.S. has done very little of that in recent decades.

Build intermediate scale plants of all promising technologies, nuclear, cellulosic biofuel, solar power, geothermal, coal with full sequestration. For those technologies that are successful in medium scale we should built at least one full scale commercial size plant.

We have yet to build a fully sequestered coal plant after years of talk. We need to try even if the first plant is a failure.

There are dozens of ways to split a uranium atom. What are the odds that a steroidal submarine reactor is the best? There are huge improvements to be made in nuclear power plant design and construction, yet we have not built a new experimental reactor since 1973. We should be building experimental models of at least two molten salt reactors, the simple uranium MSR and the thorium breeder MSR. We should be building Integral Fast Breeder demo plants, sodium cooled and lead cooled. We should be working on small modular reactors.

2 Spaceship earth is less than 8,000 miles in diameter and covered largely by water. With the appropriate use of technology it could be a near paradise for 500 million to 1 billion people, without putting too much stress on the other species that share this planet, but we are over 6 billion, headed for 10 billion, with two thirds living in poverty.

Earth can never be paradise for 10 billion people, unless your idea of paradise is sitting in an air conditioned high rise apartment building, surfing the internet, eating insect pate. It will take a massive infusion of technology to provide a comfortable life for all those people while preserving whatever is left of the environment.

Population has to be on the table in any serious discussion of the future. The U.S. population has more than doubled since WW II. Had we stabilized it at that level we would have abundant inexpensive energy, water and food supplies.

Curtail immigration and give each person who graduates from high school the right to contribute one half of the DNA for two children. People who want more than two children would have to buy the rights from someone who has not used theirs. The price would be set by the balance of supply and demand.

CONCLUSION

The road of progress is paved with stones of failure. By spending 90 cents per person per day to push every technology as fast as possible, the best technologies and breakthroughs, whatever they are, will emerge as leaders in the shortest possible time. 95% of that money will probably be wasted on unsuccessful technology, but that is cheap insurance to assure that we get the best solution. Relying on a bunch of gray haired law school graduates in Washington to cherry pick technology is a formula for disaster.

The new technologies will tend to suppress rising energy costs. I believe the savings could surpass the annual R&D cost within 15 – 20 years, and save over $2,000 per year per person within 30 years, not to mention a large improvement in the environment and quality of life with this approach. 100 years from now energy will be cheap, clean and abundant.

A big R&D push will provide the U.S. with new products that are highly desirable all over the world, providing Americans with high paying manufacturing jobs and products to sell overseas to eliminate our trade deficit and strengthen the dollar.

We have wasted the last 30 years, it’s time for a change.

THank you, I understand where you are coming from now. I am not sure I share your optimism about the results of drilling, nuclear, R&D, etc, but it is an interesting proposal.

Okay, I like it so far.

Fail! Fail! Fail!!!

That was Nixon's response to the initial oil shock in 1973. We drilled drilled drilled and production went down down down.

Recently,exploration costs have jumped to $90 billion ... more than triple what it was just a few years ago (see aer). How much more do you want to spend on drill drill drill? Do you really think it production will not just go down down down? Are you aware that US oil production peaked in 1970? And that it is about half what it was despite Alaska oil and off-shore oil.

So far, your strategy fails.

Fail. This cannot be done. The reason: energy production and consumption is intimately woven with many societal-scale issues involving health, safety, freedom, environment, economy and so on. Energy is necessarily a centerpiece in public policy. No policy decisions taken will ever be completely neutral with respect to whether it favors one source of energy or another. Subsidies don't necessarily involve tax credits or other cash incentives. For example, if we decide a certain level of mercury spewed into the air is okay, then we subsidize coal by sacrificing health of citizens who get sick as a result of the policy. If we don't allow mercury vapor at all, then other energy technologies will be favored over coal burning.

In other words, we have always subsidized one form of energy or another to a certain degree. That will continue because the public policy issues tied to energy are very inevitably important.

Fine, but conservation does not solve the production problem. I'm not sure how you plan to "accelerate the mainstreaming...." With subsidies? With cheerleading? For example, when you say "fuel cell vehicles" we run into some very heavy issues. You need fueling stations with hydrogen. This means you need a hydrogen pipeline grid. It will probably not be economic to have a hydrogen generating plant at the fueling station. I already posted a link studying that issue. To get to a reasonable cost per kg of H, you need a pretty big plant. If we're really going to have fuel cell vehicles, then we're really going to need a hydrogen pipeline grid feeding the fueling stations. So, who is going to build the pipeline? Do we pour money into fuel cell R&D?

This is a non-starter. Maybe you see someone opening a check book to underwrite this? I don't see anyone ready to do that. Are you opening your check book for this? Just how many 10s of billions are you ready to risk of your own money? Let me give you a reality check: no one would touch this project unless the government provided massive subsidies, guarantees, and so on. And they would need to blow away massive public opposition to the project. I'm not sure how you deal with that one. Basically, the only way we get nuclear is with totalitarian leadership, command economy, and vastly more intrusive security to thwart attempts to sabotage the nuclear floaters.

Reminder: this is not a command economy. You can't just say, "do this." I think you should pull out a calculator and figure out just how quick and cheap it would be to convert cars to natural gas. If it is naturally a good deal, you should probably figure out why more people aren't doing it right now. There really is nothing to stop anyone from doing that absent your exhortation. Clue: it is expensive to convert your car. If we say have the car maker stop making gasoline vehicles and just make natural gas vehicles, there is the small problem of the 130,000 fueling stations that would have to be converted. Given that the average cost of a new car is running close to $30 grand, Americans will have to spend $6 trillion to replace the 200 million + cars on the road. This doesn't sound quick or cheap. Again, you'll have to exercise your totalitarian powers to get people to put out a lot of money for cars with less power and less driving range. Short of becoming an absolute dictator, you can't do this.

NO. The biggest problem the US faces is unemployment. The US gov and practically every state faces massive deficits. If people aren't working, they can't buy things that bring revenue. They also aren't paying income taxes if they aren't making any money. Unemployment is getting worse every day, and spending a bunch of money on R&D will not employ very many people.

Every technology we need to have an economy powered by 100% renewable energy is already ready commercially available or ready to be commercialized. Cost reductions are seen as these technologies are deployed in larger scales. We don't really need much more government sponsored R&D. We need legislation and incentives that will cause greater and greater deployment of renewable technologies. This will take a lot of investment and a lot of work: exactly what's needed to put people to work so they have money to spend and can pay their taxes.

We've blown many billions on this type of stuff over the past 60 years with little to show for it. There is not a single breeder in commercial operation in the US and not a single kWh of power has have been marketed from a fusion power plant. I say no more subsidies for nuclear!.

Not really. People need decent jobs. Your recommendations would not lead to any job growth.

If you only had the power! And what if someone has a child without proper rights granted to them by you? BTW, is that you granting the right, or the government?

Nevermind. Your vision is certainly futuristic and forward-looking. Absolutely bizarre, though.

What is your solution that does not have failure as an option?

Nuclear has been subsidized far less per kWh than solar or even wind, and it pays taxes for "waste disposal" which go into a black hole created by special interests devoted to its destruction.

Those same special interests have prevented breeders from going into operation. The problem with breeders has never been the reactors (which work just fine), it's the rest of the fuel cycle outside the reactor. Separation of materials from oxide fuels requires wet chemistry which is very expensive and messy. Metallic fuel can be processed in a bath of molten salts, which gets enough "hot" fission products into the reclaimed fuel that it is self-protecting against diversion (the bogeyman of the anti-proliferation crowd). The process is so simple that it can be done at the reactor site, so fuel never has to leave the hot cell (another protection against diversion).