Drumbeat: December 13, 2010

Posted by Leanan on December 13, 2010 - 9:57am

Fears of hacked eagles halts key wind projects

APPLE VALLEY, California — Fears that whirling wind turbines could slaughter protected golden eagles have halted progress on a key piece of the federal government's push to increase renewable energy on public lands, stalling plans for billions of dollars in wind farm developments.The U.S. Bureau of Land Management suspended issuing wind permits on public land indefinitely this summer after wildlife officials invoked a decades-old law for protecting eagles, according to interviews and documents obtained by The Associated Press.

The restriction has stymied efforts to "fast-track" approvals for four of the seven most promising wind energy proposals in the nation, including all three in California.

Stable LNG supply behind Russia deal

Japan's latest move to join hands with Russia in building a liquefied natural gas plant in the Russian Far Eastern port of Vladivostok is aimed at ensuring a stable supply of LNG from that country.A planned agreement between Japan and Russia to carry out such a joint project is greatly significant in that the deal would enable this country to secure a multitude of LNG suppliers, instead of its current heavy reliance on the Asian and Oceanian regions for LNG supplies. The move would shore up the nation's energy security, according to observers.

Brazil's Petrobras To Tap Credit Markets In 2011 - CFO

RIO DE JANEIRO -(Dow Jones)- Brazilian state-run energy giant Petroleo Brasileiro, or Petrobras, plans to tap global credit markets next year, adding to the cash horde the company raised in the world's largest share offer earlier this year."We are going to raise money from the market," Chief Financial Officer Almir Barbassa said.

Canadian oil sands firms team up on tailings study

CALGARY, Alberta Dec 13 (Reuters) - Canada's oil sands developers, stung by controversy over the environmental impact of their toxic waste ponds, said on Monday they agreed to collaborate on research into speeding up reclamation of the northern Alberta land they cover.The move comes after Syncrude Canada, one of the largest developers, was found guilty in the 2008 deaths of 1,600 ducks in a tailings pond, an incident that brought the issue into the international spotlight.

The oil industry, its lobbyists and its Congressional allies are predictably furious at the Obama administration’s decision not to allow exploratory oil drilling in the eastern Gulf of Mexico and off the Atlantic coast. The decision was unquestionably the right one.

Someone is killing Iran’s nuclear scientists. But a computer worm may be the scarier threat.

Ukraine to open Chernobyl area to tourists in 2011

KIEV, Ukraine – Want a better understanding of the world's worst nuclear disaster? Come tour the Chernobyl nuclear power plant.Beginning next year, Ukraine plans to open up the sealed zone around the Chernobyl reactor to visitors who wish to learn more about the tragedy that occurred nearly a quarter of a century ago, the Emergency Situations Ministry said Monday.

Silver lining in dark economic times: Recycling rates soar

For the past three years, Mark Schwede has been coming to Ranch Town Recycling in San Jose's Willow Glen neighborhood, dropping off cans and bottles every couple of months to make a few extra bucks.As the economy worsened, he began to notice a change.

"Before, it was mostly people with shopping carts," he said. "Now you're seeing nicer cars here."

Exxon CEO says global oil markets well supplied

RAS LAFFAN, Qatar, (Reuters) - Exxon Mobil Corp Chief Executive Rex Tillerson said on Monday global oil markets are well-supplied."Inventory levels are still very healthy in the U.S. and other OECD (Organisation for Economic Co-operation and Development) countries," Tillerson told reporters at an event in Qatar's industrial city of Ras Laffan.

"You still have OPEC (Organization of the Petroleum Exporting Countries) with spare capacity of something like 6 million barrels per day. I would say there's plenty of supply," he said.

UK Looks To Qatar To Meet Rising Gas Demand - UK Energy Min

DOHA (Zawya Dow Jones)--The U.K. will import more Qatari gas over the coming years as domestic supplies of the fuel dwindle and it looks to boost energy security amid fears about relying too heavily on Russia, the country's energy minister said Monday.In an interview with Zawya Dow Jones Monday U.K. energy minister Charles Hendry said the U.K. currently imports 12% of its gas from the Gulf Arab state of Qatar and this figure would rise in the coming years.

Enbridge's Line 6A resumes oil shipments

CALGARY, Alberta (Reuters) - Enbridge Inc said it resumed oil shipments on its 670,000 barrel per day Line 6A pipeline late on Sunday, five days after shutting the conduit for safety testing.

Shell Rejected by High Court on $54 Million Award in Oklahoma Lease Case

The U.S. Supreme Court rejected a Royal Dutch Shell Plc unit’s appeal of a $54 million punitive damage award in a decades-old Oklahoma dispute over oil and gas profits.Declining to consider putting tighter restrictions on damages, the justices today left intact an Oklahoma state court decision that said the award was within constitutional bounds.

Feinberg Said to Offer Oil-Spill Victims Fast-Track Compensation Process

Kenneth Feinberg, administrator of the $20 billion BP Plc oil-spill claims fund who has been faulted for slow payments to victims, will offer a quicker process to final compensation.

Russia should make offshore operations laws stricter says deputy PM

Russia needs to strengthen its legislation on development of the coastal shelf by oil companies, Deputy Prime Minister Igor Sechin said on Monday."In most countries, legislation covering shelf operations is much stricter (than in Russia). We need to modernize and alter the legislation," Sechin said.

The new hungry: College-educated, middle-class cope with food insecurity

Feeding America said 36 percent of the people who get food from its soup kitchens and pantries have at least one employed person in their household. While rural and urban areas continue to require the most assistance, several food bank workers say the need in suburban areas has risen more quickly.

Has OPEC built enough capacity during the lean years?

(Reuters) - With oil prices near $90 a barrel for the first time in two years, one of the biggest questions for analysts is has the Organization of the Petroleum Exporting Countries assembled enough spare capacity to quench over-heated markets this time?At least five major banks including Goldman Sachs, Societe Generale and JP Morgan raised their mid or long-term oil price forecasts last week, betting on faster than expected oil demand growth slashing the world's buffer supplies within two to three years.

The most bullish forecast came from Goldman Sachs, the largest investment bank in commodities. The bank's energy analysts warned that if their projections for global oil demand growth of over 2 million barrels per day (bpd) in both 2011 and 2012 prove correct, OPEC spare capacity could quickly be exhausted.

The Myth of Peak Oil Demand and the Example of Loma Prieta

The demand-shift response to the Quake of ’89 is actually a helpful narrative to understand larger demand-shifts now taking place in the global oil markets. And, the story also helps to clarify the primacy of supply, and how demand is only inelastic up to certain barriers. Yes, it’s true that Bay area drivers used many highways and roadways that were affected in the quake: right up until the time they collapsed.

OPEC Cheating Most Since 2004 as $100 Oil Heralds More Supply

OPEC is breaching its production limits the most in six years, signaling the world’s biggest suppliers are ready to pump more crude next year as oil rallies toward $100 a barrel.

Crude Rises as China Imports More Oil, Increases Refining Rates to Record

Crude advanced after a government report showed Chinese refineries ran at record rates last month, signaling oil demand will continue to increase in the world’s largest energy user.Futures gained as much as 1.5 percent, rising with global equity markets. China’s refiners increased crude processing to a record in November, according to the China Mainland Marketing Research Co., which compiles data for the National Bureau of Statistics. The Organization of Petroleum Exporting Countries maintained production quotas at a Dec. 11 meeting.

“We could be heading for a year-end rally, as the general outlook is good,” said Roland Stenzel, a crude-oil trader at E&T Energie Handelsgesellschaft mbH in Vienna. “Fundamentals from Asia are much better than the U.S.”

A Secretive Banking Elite Rules Trading in Derivatives

Banks’ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small, like Dan Singer’s home heating-oil company in Westchester County, north of New York City.This fall, many of Mr. Singer’s customers purchased fixed-rate plans to lock in winter heating oil at around $3 a gallon. While that price was above the prevailing $2.80 a gallon then, the contracts will protect homeowners if bitterly cold weather pushes the price higher.

But Mr. Singer wonders if his company, Robison Oil, should be getting a better deal. He uses derivatives like swaps and options to create his fixed plans. But he has no idea how much lower his prices — and his customers’ prices — could be, he says, because banks don’t disclose fees associated with the derivatives.

Contango Reverses as Oil Producers Sell Near $90 a Barrel

Oil producers increased sales for the first time in four weeks to lock in profits near $90 a barrel, reversing a two-year contango and raising speculation that stockpiles will decline.

Saudi Arabia Said to Cut Naphtha Exports to Asia on Refinery Maintenance

Saudi Arabian Oil Co., the world’s biggest state-owned oil company, may reduce naphtha exports to Asia next year because of refinery maintenance, said buyers who were notified of the company’s plans during supply talks.

U.K. Natural Gas for First Quarter Falls as More LNG Tankers Are Expected

U.K. natural gas for delivery next quarter declined as more liquefied gas carriers headed to the U.K. and Belgium. Power for delivery tomorrow rose on forecast increased demand.The port of Milford Haven in south Wales will receive two additional LNG deliveries this month, according to its website. Belgium’s Zeebrugge terminal, linked to the U.K. by pipeline, will also get a shipment, shipping data show.

South African Coal Prices May Extend Rally Two-Year High on European Cold

Prices for coal shipped from South Africa’s Richards Bay, the continent’s biggest export facility for the fuel, may extend gains from a two-year high as cold weather in Europe boosts demand for the fuel.

Factbox: OPEC ministerial comments at Quito meeting

QUITO (Reuters) – OPEC agreed to maintain current oil production levels at its meeting on Saturday while Saudi Arabia reiterated that $70-$80 a barrel was its favored price for crude.The group scheduled its next meeting for June 2 to discuss production policy.

Below are comments from OPEC ministers and officials at the Saturday meeting:

New York governor halts gas "fracking" until July

NEW YORK (Reuters) – New York Governor David Paterson on Saturday halted a controversial form of natural gas drilling in the state until July and ruled no such drilling take place until environmental regulators deem it safe.The industry and environmentalists -- normally rivals on the issue -- both applauded Paterson's executive order, which stops all horizontal, high-volume hydraulic fracturing, or "fracking," while calling for further study of that method's impact on drinking water.

Detroit’s Monsters Thrive on a Diet of Cheap Gas

CARACAS, Venezuela — Ascending the narrow streets that wind through this city’s hillside slums, the graffiti steadily gets more radical and anti-American, repeatedly proclaiming “Yankees go home!” amid murals denouncing President Obama and Secretary of State Hillary Rodham Clinton.But at the same time, the cars get bigger — as in ’70s-style, gas-guzzling, Starsky-and-Hutch, Ford-Gran-Torino big — and American.

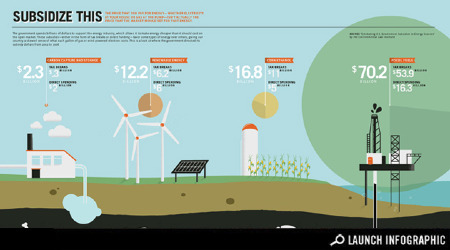

Transparency: How Much Does the United States Subsidize Energy

The government spends billions of dollars to support the energy industry, which allows it to make energy cheaper than it should cost on the open market. These subsidies—either in the form of tax breaks or direct funding—favor some types of energy over others, giving our country a skewed sense of what each gallon of gas or wind-powered electron costs. This is a look at where the government directed its subsidy dollars from 2002 to 2008.

Robert Bryce: Lame-Duck Bailouts for Ethanol and Wind?

Ethanol is the Frankenfuel of the energy business, a subsidy-devouring monster that cannot be killed, no matter how great the political opposition. Farm-state senators have apparently succeeded in adding an extension of the ethanol tax credit, which is scheduled to expire at the end of the year, to the tax bill now working its way through Congress.While that news is disheartening enough, the wind-energy business — the electricity sector’s equivalent of the ethanol scam — may also be winning in its effort to garner more federal subsidies. It is pushing lame-duck legislators to extend a part of the stimulus package known as the Section 1603 tax credit, which gives cash directly to wind-project developers. But what the wind boosters really need to keep their struggling business afloat is a mandate requiring the production of renewable electricity — at least 15 percent by 2020. And some Democratic senators are pushing a bill that would do just that.

Indonesia may import more fuel following subsidy ban

Indonesia's state oil and gas firm PT Pertamina said that the government's plan to cut oil subsidies next year would force the firm to import massive quantities of high-octane fuel in the year to meet rising demand, local media reported Monday.Starting from January first, subsidized Premium fuel would be off limits to private car owners in Jakarta and the whole of Java and Bali from July 1. Drivers would have to buy higher-octane Pertamax fuel at 6,500 rupiah (some 0.72 U.S. dollar) a litter, almost 50 percent more expensive than Premium, the Jakarta Globe said.

Philippines to be hit by power cuts in 2011 - Energy chief

MANILA, Philippines - The main island of Luzon could face power cuts next year, with supply possibly hitting critical levels before around 2,700 megawatts from new coal plants come on stream from 2013, the energy secretary said on Monday.The capital Manila -- home to at least 10 million Filipinos and where many foreign outsourcing companies operate -- will be hit hard by the outages, with peak demand projected to hit 7,900 MW next year in the whole island, 300 MW higher than this year's peak demand.

Abu Dhabi signs oil and gas deal with Yemen

DOHA // Mubadala Oil and Gas and the Yemen Company for Investments in Oil and Minerals (YICOM) have signed an agreement to co-operate on oil and gas exploration and production in Yemen.The two state-owned companies signed the agreement yesterday in Sana'a, the capital of Yemen, in the presence of Amir al Aydarus, the country's oil and minerals minister. It covers information sharing and a plan to assess potential joint projects including the redevelopment and expansion of Yemeni fields plagued by declining oil and gas output.

Turkmens Open New Gas Export Market After Agreement on Trans-Afghan Pipe

Turkmenistan has moved closer to opening another market for its natural gas reserves after signing an agreement for a pipeline to India via Afghanistan.

GE to buy UK oil pipemaker Wellstream for $1.3 billion

LONDON (Reuters) – General Electric Co has agreed to buy British oil drilling pipe-maker Wellstream Holdings Plc for 800 million pounds ($1.3 billion), as GE continues its push into the offshore oil services industry.The deal is the latest in a series of GE buys in the oil services sector in recent years and shows that, despite the BP oil spill in the Gulf of Mexico this summer, the industry expects deep water drilling to continue apace.

RWE Guarantees German Power Supplies This Week Following Strike Threat

RWE AG said there won’t be any power disruptions this week related to planned strike action at Germany’s second-largest utility.“We can guarantee electricity supply for our customers,” RWE spokesman Juergen Frech said in an interview, declining to comment on wage negotiations between the two sides.

Egypt, ADFD sign $50m loan deal for power plant

Egypt's Energy and Electricity Ministry said the Abu Dhabi Fund for Development (ADFD) has granted the Egyptian government a $50m loan for constructing and developing a power station in Banha, Arabianbusiness reported.

Pike River Appoints Receivers After 29 Die in New Zealand Coal Mine Blast

Pike River Coal Co., owner of a New Zealand coal mine where 29 miners died after blasts last month, had receivers appointed after telling major creditors it’s unlikely to be able to repay loans.

Uranium Spot Market Trading Volume Climbs to Record on Rising Asian Demand

The volume of uranium sold in the spot market, used by utilities to have material delivered within a year and by investors to speculate on the price of the fuel, hit a record this year on Asian demand.

Nigeria takes over ex-militant camps in oil delta

PORT HARCOURT, Nigeria (Reuters) - A former Nigerian militant leader handed eight camps in the Niger Delta to the military over the weekend, part of efforts to prevent new gangs emerging in the oil region after last year's amnesty.Ateke Tom is the latest former militant leader to surrender his camps after accepting the amnesty, which was partly brokered by President Goodluck Jonathan last August and brought more than a year of relative peace in Africa's biggest oil and gas industry.

Iraqi Kurd leader says Kirkuk belongs to Kurdistan

ARBIL, Iraq, Dec 11 (Reuter) – Iraqi Kurdish leader Masoud Barzani said Saturday that his semi-autonomous region has the right to self-determination and to the disputed city of Kirkuk, which is located above some of Iraq's largest oil reserves.The fate of Kirkuk is one of the main issues of contention between the Kurdish region and the central government in Baghdad, which are locked in disputes over land and some of the world's richest oilfields.

India woos Russian oil and gas investors

MOSCOW (Reuters) - India has invited Russia to explore its hydrocarbon reserves as Asia's third-largest oil consumer seeks less dependence on oil and gas imports and looks to attract more investment in its energy sector.India is also interested in increasing its participation in the development of Russia's vast oil and gas reserves.

Russian spy gets job with oil company Rosneft - report

(Reuters) - One of the Russian spies deported from the United States in a Cold-War style spy swap in July has been named an advisor at Russia's largest oil company, state-owned Rosneft, Kommersant reported on Monday.

$7.6bn TAPI gas pipeline project comes back to life

ASHGABAT: Pakistan on Saturday joined Turkmenistan, Afghanistan and India in signing the long-awaited over $7.6 billion gas pipeline project to help it meet its sharply rising industrial and domestic demands.

China elbows its way into discussions over Arctic future

There was little fanfare at the end of last month when the China National Petroleum Corp. (CNPC) signed a long-term cooperation agreement with Russia's most experienced company on shipping oil and gas through the Arctic, Sovcomflot (SCF).However, this deal is but the latest in accumulating indications of a Chinese strategy to elbow its way into the opportunities for both shipping and resource development afforded by expectations of the melting Arctic ice cap.

Clearing the air on electric cars

NEW YORK (CNNMoney.com) -- Ever since electric cars began commanding headlines a few years back, some have questioned whether the vehicles are really better for the environment.

Kazakhs Say Germany's Pure Nature May Invest $1.3 Billion in Hydropower

Germany’s Pure Nature Energy GmbH may invest 1 billion euros ($1.32 billion) to construct small hydropower plants in Kazakhstan, central Asia’s biggest oil producer, the Industry and New Technologies Ministry said.

Along with its hydrogen-powered NH2 electric tractor, New Holland has delivered a promise of the “energy independent farm”—a concept that may be reality sooner than you think.The NH2 is an early wavelet in a tsunami of electric-powered vehicles rolling off drawing boards around the world.

Kurt Cobb: Why you should read The Biochar Solution

First, you should know that I have an allergy to anything that smacks of geoengineering. And the use of biochar--charred organic matter that can improve soil fertility--to address climate change by interring carbon in farmland on a mass scale strikes me as one of the largest geoengineering projects ever conceived. I always ask, "What will the unintended consequences be? Can we be sure that those consequences won't simply present a new set of problems, possibly catastrophic ones?"Fortunately, Albert Bates, author of The Biochar Solution, takes these questions seriously and offers a measured endorsement of biochar as one of an array of strategies for responding to climate change. Even in the forward Vandana Shiva warns that "[b]y shifting our concern from growing the green mantle of the earth to making charcoal, biochar solutions risk repeating the mistakes of industrial agriculture."

UN boost for UAE carbon capture bid

A new UN agreement could pave the way for multibillion-dollar plans to build a carbon capture network in the UAE.But energy companies still have to wait to learn the exact shape of the UN carbon credit programme, including how much credit could ultimately be available.

Cancún Agreement Signals a New Pragmatism in Global Climate Policy

In the end, it came down to Bolivia. The South American country — whose President Evo Morales was one of the few world leaders to attend this meeting — had raised angry objections throughout the two-week-long U.N. climate-change summit in Cancún, Mexico. On Friday night, with the draft texts of an agreement prepared and every other nation ready for a deal, Bolivia wouldn't budge. "We reject this document," Bolivia's U.N. Ambassador Pablo Solon told the assembled representatives of more than 190 nations at the final plenary session, "and therefore there is no consensus for its adoption."

Climate deal does little but prep for future talks

Lowered expectations to the rescue.Global climate negotiators put the best face on the modest agreements they reached at the just-concluded talks in Cancun, Mexico, to tackle the problem of worldwide carbon emissions.

Climate Deal Decades Away as `Dysfunctional' U.S. Delays Cap

With President Barack Obama struggling to salvage his energy agenda and richer and poorer nations in conflict over extending Kyoto’s emission limits, a new worldwide climate treaty may be 20 years away, said Tim Wirth, who in 1997 led the U.S. delegation in Kyoto, Japan. Such a delay endangers the future of $2.7 billion a year in pollution credits sold under a UN program based on the Kyoto agreement.“We have a dysfunctional Congress and an administration without policy,” Wirth, a former Democratic senator from Colorado, said in an interview during two weeks of UN climate talks in Cancun, Mexico. “The U.S. doesn’t have an energy strategy. You can’t sign up to an international treaty unless you know what you are going to do at home.”

Climate Talks Might Need a Profit Motive

More business engagement is the key to unlocking real progress, said Yvo de Boer, who stepped down this year as executive secretary of the U.N. Framework Convention on Climate Change.Clean-technology profits could illustrate the opportunities from a global climate deal and persuade negotiators from China and the United States, the world’s top two emitters of heat-trapping gases, to cooperate.

“We’re trying to get away from a zero-sum logic,” Robert B. Zoellick, president of the World Bank, said in an interview. “From my own experience in trade negotiations, if you see it as one guy wins, the other guy loses, you’re going to have a hard time getting a deal, frankly, because nobody wants to go home the loser.”

Why We Might Fight, 2011 Edition

Countries thirst for oil, compete for minerals and confront climate change. The American military, with surprising allies, worries that these issues represent a new source of conflict.

Russia pumped out half of it's oil and does not expect to find any large oil fields any time soon:

Google translation from Russian:

http://translate.google.com/translate?js=n&prev=_t&hl=en&ie=UTF-8&layout...

Original (in Russian):

http://lenta.ru/news/2010/12/13/reserve/

Thanks for that article and translation HiFi. There are different views of Russia's future oil production, here are just three of them from very recent news articles.

Russian Oil & Gas Sector Headed for Major Shakeup

Oil production in Russia to hit record high

OPEC Raises 2011 Forecast for Non-OPEC Supply on Russia, China

Okay, the first article says Russian oil production is about to collapse. The second article says production will hold at 500 million tons per year or almost 10 million bp/d for the next few years. And the last article says production will hold at 10 million bp/d for the next 40 years.

Take your pick. But 10 million bp/d for 40 years comes to 146 billion barrels. That over twice the proven reserves Russia claims to have and two and one half times what Oil & Gas Journal says they have. And it is absurd to say that any country could reach a plateau and remain on that plateau for forty years.

So we know that Energy Minister Sergei Shmatko is blowing smoke in that last article. But he is the same guy who in the second article says they will remain on that plateau for a few years. When is he telling the truth? I would suspect that the first article is way closer to the real truth. Russian production reached a new post Soviet high in October and November but has already started to decline in December. I expect their production to start to decline in 2011. But that is just my opinion.

But I find it interesting that even Russia's Energy Minister says that Russia cannot increase production above 2010 levels, only that they can hold what they have now. I mean if they have enough oil to hold at current levels for 40 years then one would think they could jack up production next year by at least 10 percent or about one million barrels per day.

Ron P.

Ron,

I greatly appreciate your contributions to this site, in particular your diligence in digging up pertinent data. And I have little doubt that Russia is approaching or at their peak. But it seems premature to say that they have 'started to decline' based on a single month to month data point.

I agree Clifman, and I make no such assumption. But their oil production for the first 12 days in December has declined significantly. That may be due to the export tax that went up December 1st, I don't know. But the point is they did hit a new record high in October and November but that record high will not continue through December.

That was my point. That was my only point. Well... my only point concerning near term Russian oil production anyway. However I believe, just my belief mind you, that Russian oil production will start to decline near the end of next year and continue to decline just as US oil production did after 1970.

Ron P.

Speaking of Russia: Our laboratory's client of this morning was a post-doc from the far east-side of Russia, near Vladivostok. I won't bore you with the geeky details of what our lab does, but my conversation with Anton was quite enlightening. He is the first person to come into our facility who knew what Peak Oil is. Not only that, he says, matter-of-factly, "we were taught about it in high school". I was so stunned I sat in silence for a second or two. "Taught Peak Oil? In high school?". "Yes". "You mean, Hubbert's Peak, global production and all that?" "Yes".

Anton likes being in the U.S., although he says his friends back home make a lot more money than he. There is no market for EVs in Russia, he says. And he says that more than 70% of Russia's economy depends upon oil.

I have friends who think that the USSR collapsed because the U.S. outspent them on our military (!). When presented with the facts (in this case, the collapse of Iranian oil production following their revolution in 1979, and Reagan's "request" to KSA to increase production in return for more military protection for the kingdom, and the subsequent collapse of the price of oil, leading to the collapse of the Soviet Union), I get a flat stare.

I know I've oversimplified "The Great Game" in this context, so please correct/edify me. I am still amazed that the Russians are teaching their students these topics that are so vital to an understanding of how our world works. Just Amazing.

-sTv

Wow. I wonder if that's typical of Russian education?

I'm blatantly teaching it this year and it is starting to become somewhat accepted in my circle. Some are uncomfortable, but it is more and more in the MSM these days. Parents do not complain.

All schools in BC were just sent the green film (FUEL) Josh Tikkel? the veggie van....and it contains an interview with Matt S and C Campbell. My students more than accept it, and even tease me with gifts of toy oil barrels, etc.

P

They're showing interviews with Matt Savinar in schools now? OMFG. "Rarely is the question asked: is our children learning?"

That would be Matthew Simmons. The other Matt. Schools frown on astrology and being told to f off if you don't like it. :-)

I thought that the reason that the USSR collapsed was that under Breshnev there had been very little renewal at the upper echelons of the political establishment -- the Politburo was characterized as being ossified and sclerotic, a group of old men, close-minded and set in doctrinaire ways. Besides political rigidity, this led to economic stagnation at home and military overreach abroad, particularly in Afghanistan. After the brief tenures of Andropov and Chernenko, Gorbachev attempted to retrieve the situation, but unwisely attempted political and economic reform at the same time, leading to the collapse (which the Chinese wisely avoided).

If you consider the leadership in Washington, the foregoing theory is not too comforting.

Gorbatjov introduced the concept of "freedom of speach". Then people could talk openly about how bad everything was in USSR compared to the west. Then they run out of money. After that, nothing can save an empire.

Which is why the Chinese approach of limiting political reform while first working or economic reorganization and reform worked a lot better. The Chinese have been open to foreign technology and business, but they have ignored foreign politicians and economists (and Nobel Prize committees). By not listening to the Jeffrey Sachs types, they've saved themselves at least a decade of economic chaos.

Good point. Maybe if we could all learn to stop listening to economists, we'd all be getting on much better.

Right:-) What do economists know? We should listen to plumbers for economic advice, because at least they can stop leaks.

If you are to listen to an economist, choose wisely.

Uh huh.. I can't help but see Wile Coyote, going farther and farther back in his slingshot saddle, because he knows he doesn't want to go that other way!

Clearly, contact with the west's cupcakes hasn't helped to erase the idea of democratic reforms in the minds of Chinese people. A black-swan event will be like an alarm clock over there.

There would probably be a period of chaos, out of which a democratically elected nationalist demagogue would emerge. After all, a democratically elected government needs to identify a scapegoat on which to blame its shortcomings in order to maintain the support of the people by deflecting their ire outward.

I suspect that Democratic and Socially centered societies are part of a swell of tides that come and go. We've gotten a range of them over the years, and they crumble into protectionism and dictatorship or imperial or colonial status (same thing, sort of- external dictator).. and back again.

The big breakers that crash dramatically on the rocks get all the good press.. but it's all just water and physics.

I suppose Socrates and Mossadeq are having a drink up there and watching the tides roll in and out.

Wait am I confused. Are we discussing local peak. The Soviets peaked Russia a while back, no?

Academically speaking Russia already peaked.

a) The argument now if whether Russia can increase production significantly.

From what I see the answer is "no."

b) The next questions are whether Russia is set to decline and when?

No. The former Soviet Union, way back in 1988, production for that year, an average of 12,053,000 barrels per day of C+C. That was the peak until this year. But the Soviet Union does not exist now. The Soviet Union included Kazakhstan and Azerbaijan as well as a few other small producers. Above I was discussing only Russia.

The question is, did Russia produce more in 1988 than they did this year? I have no idea because they did not separate FSR production into different states. But combined, Kazakhstan, Azerbaijan and Russia will produce more, on average this year than the FSU produced in 1988. So even if you are looking at the entire Former Soviet Union, the peak, so far, is 2010 not 1988! So technically speaking Russia has not already peaked. So far, this year, the three FSU main producers combined have averaged 12,217,000 barrels per day of C+C. That will increase slightly by the end of the year.

Hope you are not confused anymore.

Now to your argument, (a). The answer is no, even the Russian energy minister says that they cannot produce more oil than they are producing right now.

Your next question, (b), the EIA says Russia peaks this year. Their Short Term Energy outlook has Russia producing 10.11 mb/d in 2010 and 9.96 mb/d in 2011. That is all liquids, not C+C.

This is one time that I agree with the EIA.

Ron P.

Ha, you are right if the prior peak of the Soviet Union included the break aways. I see. How silly of me to assume that.

In any case, the near term is the key, since everything is relative and the past is the past.

Thus Russia is set to decline, and they were the last bright spot we had.

Russia is trying to produce in Siberia and the arctic, which seem hard and slow to develop -- ***a sign they are in decline or headed that way.

Who else (what other Nation) is big enough to extend the oil peak further out?

Are we left with Iraq then? What is their immediate term/longer term trajectory?

If Russia is producing more than ever before now, but November output is higher than December, then November is Peak Oil Russia. Should they manage to crank up the production above the November values, then that is the new date.

"Always in motion the future is".

Yoda.

Looks like these guys where right on spot:

http://www.btinternet.com/~nlpwessex/Documents/RussianPeak.htm

Has OPEC built enough capacity during the lean years?

On what basis is this statement made? Does Saudi Arabia actually claim to have 12.5 mbpd capacity? I thought that was stated as a goal at some point but I don't remember seeing it claimed as achieved.

Any clarification would be appreciated.

I thought that this article and the following, "OPEC Cheating Most Since 2004 as $100 Oil Heralds More Supply," were remarkable BAU summaries of MSM thinking about oil supplies. The possibility that various OPEC countries can't increase their production is not something that is considered to be possible--at least not in public anyway*. The only real question is to what degree various OPEC countries can increase their production.

*As I outlined in my "Iron Triangle" thesis, I think that the "Enron Effect" is a big factor, i.e., a lot of people know that we are in trouble, but their income is dependent on the conventional wisdom assumption that a virtually infinite rate of increase in our consumption of a finite fossil fuel resource base is no problem:

http://www.theoildrum.com/node/2767

"Iron Triangle" Essay

I believe this inability/unwillingness to accept limits is at the heart of the tea party movement. People are hankering of the good old days and will accept any prophet who says they can have them back. In the meantime, anything but the real cause is fair game for scapegoating. Question: what happens when reality ultimately sets in? I expect unprecedented social upheaval in its ugliest form.

ps, WT -- I wonder what happens when the auto, housing, finance sectors die and we are left with a "two sided" triangle -- just oil companies and media. I think we are halfway there now.

Well, our local paper had an article about a local dealership investing $20 million in improvements over in their Honda dealership, and the article noted that this a common occurrence elsewhere:

Read more: http://www.star-telegram.com/2010/12/12/2698862/fort-worth-dealership-ow...

I don't think that the the various parties in the "Iron Triangle" are getting together in a smoke filled room and deciding to move forward with a common "Party On Dude" message, but I do think that a lot of members in the "Iron Triangle" have decided that it is in their (short term) financial self-interest to promote the Infinite Energy Supply/Party On Dude message.

Update: ExxonMobil contributes to the "Party On Dude" message: Exxon CEO says global oil markets well supplied (uptop)

To answer that question read the NYT article linked above titled "Detroit’s Monsters Thrive on a Diet of Cheap Gas".

Venezuela is a microcosm of what I'm quite sure we will see happening in the USA, I think we can just watch what happens there when the price of gasoline doubles and reaches $0.20 per gallon. It will be a repeat of the riots that happened there in the late 1980s.

This quote to me suggests that Venezuelans are perhaps only slightly less delusional than American Tea Party members...

He is right of course, it will make a great chicken coup or flower planter in his front yard...

" ...it will make a great chicken coup or flower planter in his front yard..."

I saw some folks that were using an old AMC Pacer (with the huge windshield) as a food dehydrator. Worked great.

You forgot Greenhouse. Use the auto glass to make a greenhouse!

I almost died laughing at those muscle cars in S. America.

Good grief. Talk about chewing up oil supplies as fasta s possible $0.10 a gallon.

Fuel Economy is not the driving economic factor behind car choice in Venezuela.

1) Can it survive the roads? Potholes, bad patch jobs, unpaved "short cuts etc", fender-bender type collisions are frequent.

2) Can you get it fixed? Replacement parts sometimes take a long time to order in (months, a year, longer). Also, do you know enough about it to make sure the mechanic really did fix it?

3) What can you fit in it? A lot of big old cars are used as "por puestos" or by-the seat taxi/buses. And by seat they mean the space your rear-end occupies after being compressed by your fellow passengers.

4) Can you buy it? Gas is cheap, but cars are expensive and bank loans are more difficult to get. Lots of dealers have month long waiting lists and re-sale values often stay flat or increase with time.

5) Is it safe? That means will it attract the attention of police and thieves? Its not good to look too poor or too rich

If the Venezuelan government decided to raise fuel prices I am not certain it would affect car choice as much as in other countries. The rich who regularly pay large sums to frequent locales that exclude the poor will simply add a new grumble to their list and hand over the cash necessary to fuel their SUV. The poor might drive less, but they won't be rushing out to buy a new fuel efficient car any time soon.

I get it. Venezuelan is a socialist welfare state. The state is paying people to drive inefficient cars basically by subsidizing the price of fuel.

I just thought it was hilarious that these inefficient antiques were so popular there.

I mean any car from the 80-90s era would be far more efficient and cheaper to operate, but that incentive is thrown out the window with $0.10 gasoline. lol. These 80-90s models are not very new either.

My father is pretty much right wing, and he attends tea party rallies, however he became conscious that fossil fuels are finite resources before it was mainstream knowledge and hip. He's also pro legalization.

Enough with the stereotyping.

Oswaldo's Grand Prix will make some quality scrap to be melted down and made into components for a nuclear power plant ;)

The biggest and most common issue I have seen coming from tea party members is that we have to stop spending more than we have. What is delusional about that?

I'll believe it when I see it.

"spending" and what we "have"

--both of those are delusions

Money is printed out of thin air and given to those deemed "deserving" of it (i.e. hedge fund CEOs)

What "we" have includes what the top 2% have --and they ain't loosening their grip on it.

Tea partiers are delusioned into thinking they are or soon will be one of the top 2%

Good luck with that one

Ain't going to happen

Interview with Sadad al Husseini - “The Facts Are There”

http://www.aspousa.org/index.php/2009/09/interview-with-sadad-al-husseini/

I suspect that the new Saudi production coming on line will be analogous to the new production that came on line in the North Sea after 1999. Sam Foucher noted that the oil industry did a very good job of bringing new North Sea oil fields on line from 1999 on. North Sea fields whose first full year of production was in 1999 or later had a production peak in 2005 of about one mbpd, versus the 1999 total production rate of about six mbpd.

As I said, an outstanding job in the North Sea, for which the industry deserves credit. By adding new production that was equivalent to about one-sixth of the 1999 rate, the industry managed to keep the overall post-1999 production decline rate down to 4.8%/year (C+C, EIA).

Thanks, elwood. Appreciate the response.

I add up those numbers and get a total of 2.85 mpbd added. If the total then is 12.5 mbpd, that means their base capability is 9.86 mbpd as of 2009. So, in what appears to be a very short time, they increased their production capacity by 30% by my math. That sounds pretty amazing, if true. Of course, manifa isn't producing yet (am I right about that?) Take manifa out and the increase is 1.95 mbpd. Still an impressive 18% production increase, if true.

But as we have seen recently, SA has indicated a desire to keep oil in the $70 - $80 a barrel range, yet have also indicated they have no plans to increase production to protect that range. So if they went to the trouble and investment to create this huge cushion, why wouldn't they be using it?

But pretty much as soon as oil eclipsed $80, the Saudis began stating that the acceptable range was $80-$90, or even $100. Which, as Darwinian & WT frequently point out, indicates that they have little ability to influence price by tapping any significant spare capacity.

I've read in several places that some of the new "capacity" that SA has is of such a poor grade that it needs extra refining, but they have canceled the refinery to do it.

Hahahaha. Some decades ago they declared: "if the world needs 15 mbd from us we will deliver that." So elwoodelmore, if you so profoundly did your own investigation, you should mention that also.

do you have a reference for that ?

husseini was interviewed in '09, i thought that was clear.

investigation ? my research has been focused on saudi arabia's oil and gas reserves and the various claims that have been posted here on essentially a daily basis. most of these claims appear to have originated in the 'twilight' zone.

Well, I have learned, that it is not allowed for muslims to drink alcohol. But being abroad it seems to be a different story. In this story Al Naimi shocks his environment by claiming that KSA has now 1.2 trillion barrels of proven reserves.

I think the question regarding the 15 mbd claim is answered. And as always in life, there is immediately the next question.

Elwood, how can You anything this guy talks take for granted ?

WT - Never claim again that KSA reserves are not depleting. We are dealing with the fastest depleting reserves the world has ever seen. The approach is called reverse engeneering on abiotic oil.

i didn't quote al naimi and i have no more idea than you do where the alleged claim of 1.2 gb reserves comes from. saudi aramco has never claimed 1.2 gb reserves in their annual review.

maybe he was drunk, maybe the reporter was drunk, maybe al naimi misquoted or was misquoted. some separation of chaffe from straw is needed.

I don't save or print all the articles I read, but I'm sure I read that someone there claimed it a long time ago.

This year a spokesman (forgot his name) has admitted that they need all the possible efforts to keep declinepercentages from their long producing giants low. So if they lose yearly 500.000 from their old giants, the few mbd from recently started fieldproduction compensates only for a few years to come.

OPEC Cheating Most Since 2004 as $100 Oil Heralds More Supply

OK, how does this make sense? The fact that they are ignoring production limits now means that they will be able to produce even more in the future? The fact that they are cheating today says nothing about their ability to produce more tomorrow. How about a more realistic interpretation -- they are now cheating at the limits of their ability and couldn't cheat more no matter what the price. In fact, if the price goes higher, the incentive to produce at full capacity diminishes as they will be getting more income from what they are producing. If the price goes high enough, they may feel even more comfortable cutting back production. The presumed linkage between higher price always leading to higher production should be left in the Econ 101 classroom where it belongs.

Kingfish,

The people who write these stories believe that they are the center of (their) Universe... that being the case, OF COURSE EVERYONE ELSE WILL SPARE NO EFFORT TO EXTRACT more oil FOR THEM.

I think this shows that OPEC is half of a cartel. When global demand declined in 2008, they successfully reigned in production to maintain about $70-$80 a barrel, after a brief dip to $30 , about 3 times the previous stable price. Through a combination of media and market manipulation they have sustained this price range for about 2 years, as demand bottomed out and has now recovered. However, as the market begins to price in expected continued growth in Chindian demand, OPEC is unable to control the price on the upside, and is priming the media not to expect it. They hope that this will short circuit the price spike of 2007 enough to prevent such a sharp dip when failure to supply triggers the next global financial bubble to pop.

To be explicit: Most OPEC nations are pumping flat out: they are completely ignoring their quotas. Maybe three countries have measurable spare capacity, and only SA has enough to influence the market. They made up more than 50% of the production cut on the downside. They could increase production a little, but they are keeping their powder dry. If they try to hold a price as they did in 2003-2005, they will quickly max out production and the lie will be given to their spare capacity figures.

All true, but KSA is playing a dangerous game of saying they have huge spare capacity but showing no willingness to use it. As calls for OPEC to increase production grow in coming months, Washington will feel pressure from voters to get KSA to use the spare production they say they have. What then? If KSA doesn't increase production it will be viewed either as an admission that they don't have it or a direct assault on the US consumer. Either way they lose.

So, as you say, they seem to be floating incoherent messages about not producing because of insecurity of demand or such nonsense. But it won't work. The public view of KSA as the holder of unlimited oil is so firmly entrenched that I don't see people accepting any excuses.

My guess is that KSA will promise to increase production, but won't actually. They might skooch things up a tad, but not enough. That's what they did in early 2008. Fortunately for them, the world economy fell apart and KSA was spared having to confront their lack of follow through. I don't think it will happen so conveniently next time.

It is not if, but when, the world economy falls apart again. China is as dependant on 10% exponential growth as the US was, to stop its own property based bubble popping. The global financial economy left the physical economy in the dust decades ago. It will not take many months of $150 oil (or even less, next time) to pop the next bubble. As long as Joe Sixpack does not make the connection, it can be rinse and repeat until ELM overwhelms the rest of OPEC.

Recession Lasting Until 2018 Worth Exploring

I dunno. It does seem like the economy's picking up right now. Who knows if it will last, though.

In some ways it does seem like things are better. But I wonder if that isn't due to us getting used to the new normal. In reality, seems to me we are just doing the bottom bounce. Any slight uptick seems big when you are at the bottom of the well.

King - thaT's exactly the point we bounced around a few weeks ago: Since 2005-7 GDP appears to be on a plateau. So the quesion is whether the current uptick is a return to continued improvement or just one more mole hill on the plateau before we slide back into another shallow hole? Lots of opinions but I haven't seen anyone offer a solid story to support either interpretaTion. Just a matter of wait and see IMHO.

I'll stick my neck out and make a couple of predictions:

1. By July 4, 2011 the stock market, as measured by the Standard & Poors 500 stock index, will decline at least thirty percent from the current level, and

2. This major decline in the stock market will trigger a moderate, and possibly a severe recession, with unemployment going above the 10% level.

Real GDP per capita has been going nowhere for at least ten years. Real disposable income per capita for the bottom 90% of the income distribution has been declining for at least ten years.

The way I see the next five years is similar to the stagflation of the nineteen seventies--but worse. Monetizing the deficits, as the Fed is enthusiastically doing, will within a year lead to substantial increases in the rate of inflation--at the same time that real GDP stagnates or falls.

So, what do you do with your assets under this scenario?

I keep all my financial assets in TIPs, Treasury Inflation Protected securities.

Don, when you predict (even cautiously), I listen. Can you elaborate on the basis for your first prediction (30% drop in DJIA)?

The stock market is grossly overvalued; earnings projections are much too rosy. Also, I expect interest rates to rise over the next six months. Why? Because when the Fed eases money (QE1, QE2, QE3) there are two opposing effects. The immediate and short-term effect is the Keynes Effect: Supply a greater amount of money and the price of money (i.e. the interest rate) tends to fall, other things staying the same.

But other things do not stay the same. Quantitative easing causes expectations of inflation to increase, and when expectations of inflation increase, nominal interest rates also increase. This longer run effect is called the Fisher Effect (after the American economist, Irving Fisher), and over time it dominates the Keynes effect. Thus, over time a very easy monetary policy will substantially increase the rate of inflationary expectations and hence interest rates, especially long-term interest rates.

The one sure way to cause a market crash is to increase interest rates. The Fed does not want to increase interest rates, but it is already happening to some extent. If interest rates increase just a couple of percentage points, that will probably be enough to crash the stock market.

The Fed won't touch interest rates while growth is low. And, they will keep up the QE, perhaps adding a third round?

The book, Zombie Economics, touched on the Fisher Effect, and seemed negative on it. My copy seems to have found legs, and I cannot recall the exact reason he cited, but Prof. Quiggin discounts most theories. To him, neither fresh water nor salt water hold water, I guess.

My worry is what happens when China's bubble pops, and they sell our notes and stop buying more. Who is going to be purchasing Treasuries? The Fed, I guess.

I did some TIPS also, several years ago; my conservative friends said I was nuts.

Craig

I disagree with some things. Here is what I think will happen (is happening):

1. The bond market is imploding. I am surprised that this has received so little attention.

2. Commodities, gold, food, are the new currency (US $ is toast) and they will skyrocket.

3. Good quality stocks (Dow Jones) will skyrocket.

4. Real estate will crash completely. I think a new top is real estate is decades away.

5. Next to real estate or any asset bought with borrowed money, TIPs are probably the worst investment you can make since the government gets to decide what "inflation" is.

6. It will be much worse than the seventies; this time there will be no wage/cost spiral; just cost spiral.

Some very good points there.

Previously I have been making some market forecasts here, but I thought that the new focused Oil Drum we won't be doing much of that. But it seems to be allowed today, so I'll offer some thoughts.

Posters may remember about last August 10 that I said the market would start rising for at least three months, which was the total opposite prediction of a few well known posters here. Well I am still pretty much 'all in' the market now - especially energy and natural resource stocks, and I have been giving friends and family the same advice.

Of course the bond market collapse is worrying, however I think most of the damage in 2010 is finished and that won't be holding the market back for the remainder. Unfortunately at some point we will see probably what will be a combined dollar and more severe bond collapse, which may also happen at the same time as the coming oil price 'superspike'. Needless to say, those circumstances will make investing difficult.

I don't know when the next crisis will start, so I understand why some are very skeptical about investing. I suggest that at least for now, investors go into 'value' funds - usually these would large, quality Dow Jones type stocks paying higher than average dividends and having siginificant physical assets with a low amount of debt or debt with low interest rates locked in.

You can't be serious! There are over 40 million US citizens currently on food stamps. To keep that in perspective the population of Canada is only 34 million.

I'm serious. "Getting better" is not the same thing as "good."

AP analysis: Economic stress falls to 18-month low

I'm sorry but I just can't buy it. It's purely wishful thinking and MSM spin at best and outright lies at worst.

Getting a momentary pulse after suffering cardiac arrest doesn't rise to the level of 'better' in my book.

http://www.dailyyonder.com/u2-real-unemployment-rate/2010/12/03/3065

That article and chart only goes up to 2009. The improvement, such as it is, seems to have started recently, so would not be reflected in that data.

Here's a graph from ShadowStats which gives a similar result which is up to date. I think one must conclude that the economy isn't really improving, as far as employment is concerned. The US Government data showing an increase in employment appears to be too small to keep up with population growth. Then too, how many of the new jobs pay as much as the jobs which have been lost, including benefits.

I know only too well how hard it is to find work. When I was seriously trying to find work, there were often 15 or 20 applicants for the jobs I applied for and those were the jobs I thought I could fit into. Having 2 engineering degrees, I thought that I would be considered over qualified for many positions, such as computer programmer, truck driver or construction laborer. I eventually gave up trying...

E. Swanson

Still looks to me like there's been an improvement recently.

Should be interesting to see how retail sales shape up. Seems like people are spending more, if only from "frugality fatigue."

Nominal GDP is above pre-recession levels. Constant dollar GDP is almost back to pre-recession levels, and will likely be there in another quarter or two.

http://www.data360.org/dsg.aspx?Data_Set_Group_Id=353&page=3&count=100

How about real per capita disposable income? How is that doing compared to prerecessionary levels? Answer: It is down. If you look just at the bottom 90% of income earners, real per capita disposable income is down even more.

I think one must take the government employment figures with a proverbial grain of salt. Here's the BLS description of the way the employment data is collected. The

BLS picks some 60,000 households to survey. One big problem with this approach is that the households must exist for the periof of the survey, therefore, the people living there must have enough income or other source of money to keep the household going. Also, I think the households must also have a phone contact, since they might be called on occasion.

Households (and people) who are not able to maintain a fixed residence simply will not be counted as they wouldn't be selected for interview. This may skew the statistical data in some subtle ways, since the results of the household survey are presumed to apply to the entire country. How many people now rely on temporary living situations and use cell phones for communication? It's not 1940 any more...

E. Swanson

AT&T and other major phone companies are starting to stop the residental sections of their phonebooks, why? the internet can help you find people faster, and cost. Problem, if they don't have internet, or don't have a land line, it still does not matter, you can't find them online either.

I know of only a few people that have land lines, they are people who own their own homes, everyone else has a cell phone and the numbers change all the time.

This is the not the survey says, of the previous years, things are changing faster than the gov't is likely to keep up with. People hear the rosy numbers, and look at the bag of groceries they just got from the food bank, or paid more for from the store, and shake their heads at how out of touch DC is.

The media wants their to be a rosy future, as it is dependant on rosy futures just as much. No rosy future, no buying ad revenue.

I don't trust the figures I keep seeing of a rosy rainbow, I just do not see it.

Charles,

BioWebScape designs for a better fed and housed world.

I like to read http://dshort.com for overall economic trends. I do not understand all of the indicators, but am learning.

That site's graphs do show that the S&P500, for example, is approaching within 20% of the most recent big peak:

http://dshort.com/articles/current-market-snapshot.html

Ok! Here's the official unemployment figures for the period up to November 2010 and it is still rising not decreasing.

http://www.bls.gov/news.release/pdf/empsit.pdf

The number of unemployed persons was 15.1 million in November. The unemployment rate edged up

to 9.8 percent; it was 9.6 percent in each of the prior 3 months. (See table A-1.)

In November 08 the official unemployment rate was at 7%.

Outside of small pockets and specialized sectors there is no economic recovery in the US as a whole. Given what we know about the relationship to cheap energy as a driving force in the US economy that shouldn't come as a great surprise.

Unemployment is flat to slightly declining, despite the Novemer data.

For the 25 years 1949-1973, the unemployment rate was a low 4.8% on average.

For the 20 years 1974-1993. the unemployment rate averaged 7.0%, including the years 1982-3 when it averaged 9.65%.

For the 15 years 1994-2008, the unemployment rate averaged 5.1%.

I could see a decade or two of unemployment in the 9% range, given the US economy's relative position in global trade.

Data for 1948 to present is from http://data.bls.gov/PDQ/servlet/SurveyOutputServlet

So Mag says it's rising, Merril says its declining--I'll split the difference and say it is essentially flat for the last few months, the very slight fluctuations over that period probably being statistically insignificant.

The unemployment rate, paradoxically, often rises as the job market improves. That's because people who had given up on finding a job start looking again.

I'm not sure the unemployment rate, per say, matters as much as we think it does. After all...and this really is a key point...unemployment is, always, a political matter - if the state wanted, it could act as the "employer as last resort" and ensure full employment, at all times.

It doesn't do this for a variety of complicated reasons, many of which make sense. But, strictly speaking, unemployment really is political, just like everything else.

Even when unemployment was low before 2008, was this country on the right track? Were we on the upswing, creating a bright future, and things were getting better? Most definitely not. We were building houses in the middle of nowhere, letting the rich get away with murder, and basically setting ourselves up for a crash.

So unemployment is really just another piece of the puzzle. What we can be pretty confident of is that we now have structural unemployment, no political will to correct it, which will likely lead to further poverty/crime down the line, which will eat into budgets, with, again, no political will to cut into deficits, and then when the economy gets "better" oil prices will go higher which will crash the system again, leading to greater unemployment, etc. etc. ad infinitum.

We also can surmise, for example, that functioning industrialized societies invest their surpluses in the health and education of their children. This is no longer happening in the U.S. Instead, we keep our grannies on vents, let our kids get fat, and put them into debt slavery as the price for wanting to go to college or own a home.

The U.S. IMHO, cares about unemployment about as much as it does about any number of things of which nothing is being done: illegal immigration, chronic deficits, income inequality, rising healthcare costs, oil import dependency, financial corruption, endless war in the M.E.

It's sad to say, but we live in a country in which the priority is for bankers to be able to get bonuses, not for ordinary people to be employed in their area of expertise.

Witness our most recent political stunt: more handouts for the unemployed (as opposed to jobs), more tax breaks for the wealthy.

So putting together the puzzle you can really sense the decline. And it's a shame because America is such an amazing country.

fm, you are arguing that the economy is dead. you have decided that all statistics and information to the contrary represent some sort of globally-devised conspiratorial propaganda campaign. as such, you are shouting down positive news/views as lies and highlighting negative news/views. you are inside your own echo-chamber, and i suggest you get out asap.

if 1 in 5 is un- or under-employed, that means, 4 in 5 are fully employed. this does not suggest the economy is dead.

the economy will not recover "as a whole". in all likelihood, if there is a substantial recovery, specialized sectors will drive growth and investment and confidence, and others will then follow suit. at the very best, it will take several years for the country to crawl out of the crater the debt crisis left behind.

And how is a partial recovery a recovery then?

A recovery for a few is not sustainable if the government is required to feed and house and clothe the unemployed remainder which are increasing in numbers.

You cannot possibly call this growth if the means to growth is paying people for free to eat and drink and live in subsidized housing units.

Is the Federal deficit decreasing?

Then GDP rises with increasing deficits are kind of tricky accounting gimmicks which inevitably signal significant failure in the growth market paradigm.

just as different sectors of an economy grow, stagnate, or shrink over time, a recovery happens when one sector drives growth in another. for example, new auto sales decline but used sales and auto mechanic workloads rise spurring parts suppliers to manufacture more spare parts.

adaptation and economic change takes time. it's not as if a switch will be flipped and the economy entire will burst to life. in fact, the closest thing to that 'switch' is the federal funds rate, but bernanke already switched it to the 'on' position, and... nothing happened. corporations continue to hold their wads.

the story is not over, and of course, it's much easier to predict the past.

(sorry, sgage.)

Is your shift key broken? Capitalizing the first word of each sentence is a convention for a good reason. C'mon, give it a try, it's not that hard! Or are you trying to make some sort of a statement? Or are you just too cool? It really helps readability - I'm not trying to be a jerk.

Maybe Bert only has one hand :-0

email, blogs and the internet changed all sorts of communicative etiquette (think: wtshtf, omg, lmfao). i write professionally. i tend to use lower case when i'm just blabbing about this or that. it has nothing to do with coolness... it's informality, so readers know i am shooting the breeze and will excuse my haste and associated grammatical errors, bluntness, etc.

you are not being a jerk. when little things like this get under your skin though, perhaps you should check to see if your 'control' key is stuck.

I'm going to ask you all to use correct spelling and punctuation, if you're able. We don't want "textspeak" to take over here. Sgage is right, capitalizing the first letter of sentence makes it easier to read.

This isn't the place for "blabbing about this and that" anyway.

Below are some excerpts from this Drumbeat. You seem to be providing a bit of "blabbing about this and that" and along with a smidge of "textspeak". What gives, Leanan?

-- "Getting better" is not the same thing as "good."

-- Bad things can get better. It's a perfectly standard use of English.

-- OTOH...banks are sending out 10 times as many new credit card applications as they did last year.

-- Pro sports seem to be doing pretty well.

-- And "on the ground" - people just seem more optimistic.

But no matter. I'll pipe down. Happy hols, all!

If you would please capitalize the first letter of each sentence, your writing would be much more readable. Thanks!

I appreciate the suggestion, I'm not shouting down anything. I just think I'm a realist observing the big picture and yes I tend to be extremely skeptical of the so called positive

news/viewspropaganda coming out of Washington via the MSM. To be clear if 20% of Americans are unemployed to the other 80% everything still seems to be fine and dandy but for the 20% who are unemployed the economy is indeed dead for all practical purposes.Unfortunately I'm not seeing much improvement on the ground. At least in my corner of the world I still see more and more small local businesses being boarded up, I see the foreclosure signs and overgrown lawns down the street, I see more homeless people wandering the streets and granted this is anecdotal but it seems every time I'm at the checkout counter at the supermarket recently, the person in front of me is having a problem with their government issued food stamp card.

Maybe the economy isn't quite dead yet but I think we could safely say that as far as the average Joe is concerned, it is gravely ill to say the least. Wishful thinking notwithstanding. Then again, my echo-chamber doesn't include too many bankers or Wall Street types.

Reading this thread it is clear to me that some of you need to get out more.

My brother helps run a large food pantry for his Church, one of the largest in the area. He used to think I was an alarmist, especially about the economy, but he recently told me that I've been dead right all along. The good news is that donations are up at the pantry. The bad news is that they have been overwhelmed by need and have run short of basic items several times. Volunteers are spending their own money to replenish stocks of canned goods, flour, milk, etc. What scares my Brother is that many of the folks frequenting the food pantry are the elderly middle class folks he's known for years. He thought they were "set for life".

I drove to Atlanta Friday to pick up a free furnace from an aquaintance who upgraded to a higher efficiency system. The unit I got is only 4 years old. I had planned to install it in my home as a backup to our radiant floor. Methinks I'll donate it to someone who needs it more than we do.

I took the long way home north from Atlanta through some areas that I haven't been to for a while. The number of closed businesses, properties seemingly abandoned, developements boarded, clearly in forclosure, all a reminder of how far some have fallen. Several stores and gas stations that seemed to be thriving last year, gone. For Sale signs everywhere. Another sureal roadtrip.

Yet, folks still running around in their big cars as if they don't notice. Perhaps they can't afford to. After all, the system will work it out eventually. Most folks are still working (somewhere), and paying their bills (most of them). Yet there's something spooky about the cup-half-full mentality that seems to predominate.

When asked about the big picture, I'm inclined to agree with Kunstler:

[edited for TOD acceptability]

BTW, when did JHK start worrying about being "indelicate"?

I suggest that folks take a trip to rural Mississippi or West Virginia. Get off of the Interstates and just poke around a bit. Forget the official numbers; they are digital rationalisations of reality.

No one's set for life with 0% interest rates.

Save that text. You could post it twenty times a day. The irony is that there are mirror image echo chambers on both side of all of these issues calling the other side echo chambers.

Confirmation bias is very powerful.

Still, it can't get 'better' if it is not good. The progression is: "Good, Better, Best."

I maintain the Economy is bad. It may have become less bad. In our world, the real economy is "bad, worse, worst." Movement from these can only be called, improvement, as you said. The improvement is very selective... rich people are having it pretty damned good. For them, maybe it is better.

I keep hearing from my conservative friends that the workers are not important... but they cannot explain to me who is going to be buying stuff if the workers don't have money.

I am watching, and very concerned with what I see. Spin at the highest levels, while reality gets out of hand. I predict that the volume will increase in the near future... more frantic, wilder claims.

Craig

That's silly. Bad things can get better. It's a perfectly standard use of English.

I don't think the improvement is selective, so much as it's spotty. Some geographical areas are doing better than others, and jobs are more plentiful in some fields than others.

YAbut I don't think you will be able to/should count on that. A "sucker rally". Your mileage may vary.

I think I've made it clear that I'm not counting on it.

Some people will get "suckered" into thinking things are better, when they should be dis-investing themselves from the "squid" hahaha! Some will think they can "game it" for a while longer.... I still use a credit card occasionally and I use (dirty dirty) cash, so I play for a bit longer... AND I surf the interwebz for that dopamine kick when I should be doing something more ummm useful. BTW, What is your property worth? ~;)

This isn't about investments. (I've been out of the market for awhile now.)

Rather, it's about the economy, and the immediate effects it will have. If the economy really is rebounding, even if only temporarily, then we can expect oil prices to rise.

no one said or argued that things are good, fm, but there are signs that some indicators may have bottomed and are turning up a bit.

that said, the imminent reckoning for state and local budgets in 2011 worries me. it's very immediate, very nuts-and-bolts, and very big.

This is worth reading in that regard. http://www.zerohedge.com/article/cbo-recommendation-munis-%E2%80%93-default

The graphs on all economic charts would have been heding upwards for at least the last six months, had the oil prices been low, say below 50 USD, for the whole time. Now it takes longer time with a higher resistance from the higher oil prices. My speculation is that we never realy will see it turn, as any move upwards drags oil prices with it, so that we are pretty much stuck where we are now. Untill global production finally goes into decline.

If home prices decline next year another 10% or so, as projected, I don't see how the economy is getting better.

Which local government folks will be eliminated or discarded?

Sanitation.

Streets and transportation.

Public safety, medical, fire and police.

Schools.

All state budget problems stem from pensions for the above in any case. Getting rid of these jobs and paying the retired to live it up is dim witted of course. Unless you think the future is not worth it.

Cutting schools is like borrowing from the future so the past can live it up as well.

These are the choices. Either use the future to make the present prosperous or cut the pensions along with the services.

Selecting the youngest generations to pay for the oldest is the worst kind of theft and indicative of a much greater problem with our civilization.

Don't know if this has already been posted, but here is, IMO, a very good essay by Michael Cain, on the ongoing and upcoming state and local budget problems, using Texas as an example. This was posted on Gail's blog:

http://ourfiniteworld.com/2010/12/09/oil-limits-lead-to-state-budget-squ...

Oil limits lead to state budget squeezes

It won't be the bureaucracy or officers or officers' staff or trappings of luxury.

NAOM

Of course not. In fact, if you are part of the "in-crowd", you may just find a whole new group, department or even division created in order that you can move up. I observed this several times when I was employed by the State of Tennessee.

Also in TN, the bureau staff, which contributes nothing but (mis) management takes 17% off of each Division's budget, leaving less for inspections and compliance efforts.

I, for one, would love to hear what are people's favorite 'Canaries' for gauging the State of Things.

I think my 'addiction' to the Oil Drum is to have a place with some global eyeballs that can help me keep getting 'a sense of the room' .. and yet, it seems to me there might be easier metrics to base this on. I'm aware of the difficulty in GDP numbers and the official Unemployment counts..

There must be some good notions among all you smart TOD folks that can help keep our eyes on Metrics that Matter.. I think Fred points to one. What are some others that show us a few more parts of the 'Elephant'??

Credit Card Debt? Commercial Sports Ticket sales? A loaf of bread as a percentage of an hour's work? (for the First percentile, the fiftieth percentile and the 99th?) Homeless Families Stats? Utility customers in arrears or blacked out? (Big one up here in the NorthEast..)

Bob

Cost of energy is a key indicator. As energy rises faster and consumes more GDP then we can no long buy other goods and services.

Declines are obvious in Cable TV subscriptions and in DVD/video sales. That is not looking good for disposable income to me.

Food stamps is a key indicator.

Declines in schools and educational are becoming noticeable.

Lack of cooperation in our government implies a general problem -- money used to be able to solve our differences in government in the old days -- now we are guessing who is peter and who is paul so we can rob peter to pay paul -- and that leads to nasty gridlock in my view.

Lets examine the price of Gold. Not good. Holding gold means you have little faith in typical securities investments for example.

Economy is stagnating at best. Declining modestly probably.

Anyone saw the 60 minutes where an entire town in Iowa is vanishing. Anyone calling that positive Growth is nutter.

http://www.cbsnews.com/stories/2010/10/28/60minutes/main6999868.shtml

Vanishing small towns in America is just another metric that capital and investments are depreciating rapidly imho.

Finally, the reduction of consumer debt is not actually debt that is being paid down. That debt is being written off due to default. When debt is removed from a credit based economy is spells economic contraction as well.

Credit card debt has fallen, but mostly because of charge offs. OTOH...banks are sending out 10 times as many new credit card applications as they did last year.