Does Peak Oil Even Matter?

Posted by David Murphy on December 17, 2010 - 12:52pm

It is easy to become befuddled by the current discourse on peak oil. Peak oil is defined generally as the point at which the flow rate of oil to society has reached a maximum. But this simple definition has issues too, such as what should be considered "oil." Take, for example, the following sentences from the executive summary of the International Energy Agency’s recent publication of the World Energy Outlook (WEO) 2010[1]:

…[In 2035] Global oil production reaches 96 mb/d, the balance of 3 mb/d coming from processing gains. Crude oil output reaches an undulating plateau of around 68-69 mb/d by 2020, but never regains its all-time peak of 70 mb/d reached in 2006, while production of natural gas liquids (NGLs) and unconventional oil grows strongly.

According to this data, a peak in the production of conventional crude oil occurred in 2006, but a peak in total “oil” production (including unconventional resources such as tar sands, natural gas liquids, etc.) may not occur for some time. So, should we consider this a confirmation of peak oil or not?

Radetzki, the author of a recent paper condemning the prophets of peak oil as “chimeras without substance,” would argue no.[2] He asked in his paper: “…but are there any technical or economic reasons to distinguish between conventional and non-conventional resources in an analysis of what is ultimately recoverable?” Radetzki notes in his article that the production of conventional crude may begin to decline soon but total oil production could increase (given proper economic investments, etc.) as unconventional resources are brought on-line, and the WEO seems to confirm this.

Radetzki’s argument is based on the conventional economic idea of resource depletion, put forth by numerous authors but maybe most famously by Barnett and Morse in 1963.[3] They wrote: “as resources become scarce and relative costs change, substitutions will occur to ameliorate effects of diminishing returns.” With respect to oil, this statement is understood to mean that technology will offset depletion by either helping to discover new resources, by bringing other known resources into production that were previously too expensive, or by developing a suitable substitute.

And indeed the evolution of oil production seems to verify these sentiments, as technology now exists to exploit oil from tar sand resources or to convert coal and gas to various oil derivatives. Considering that all of these resources can produce oil, and that there are decades (according to the WEO) of these resources remaining, does peak conventional oil even matter?

In short, yes.

Peak oil is important because it marks the peak of production of “cheap” oil, generally considered to be conventional crude oil. Do not be confused; transitioning from conventional crude oil to NGLs or oil derived from other unconventional resources should be thought of as an indication of peak oil, not the opposite—that technology has enabled the production of oil from NGLs and other unconventional resources, thus disproving peak oil theory.

If we are to consider NGLs and other unconventional resources of oil as substitutes for oil, than we should also consider conventional oil a substitute for whale oil. After all, whale oil and the oil sands are both chemically similar to crude oil, and crude oil production offset the decline in whale oil production due to depletion of whales just like NGLs and unconventional oil may offset the decline in crude oil production due to the depletion of conventional crude. Thus, by this transitive property of economics, we are really still waiting for a peak in whale oil production!

The economists’ argument—that resource constraints will be abated by technology and substitution—confuses substitution for increasing supply. The usual way that substitution occurs in a market is that the substitute has some sort of competitive advantage (i.e. better product, cheaper, etc.) compared to the item that it is replacing; think supplanting human labor with robots in the construction of cars, or replacing vacuum tubes with integrated circuits. It is difficult to think if there are any advantages in producing oil from oil sands in northern Alberta when compared to production of oil from either East Texas or Ghawar. For example, the cost of production in Saudi Arabia is roughly $20 per barrel while it is over $80 per barrel in the tar sands (Figure 1). But prices are set at the margin for oil (at least in theory), so that if demand for oil increases enough, the price may increase to a point at which unconventional oil production becomes profitable. If this occurs, then oil will be produced from unconventional resources because they are profitable too, not because they are a “substitute,” in the economic sense, for conventional oil.

Figure 1. Estimates of the cost of production for oil production form various locations. Data from Cera.[4]

Arguing that unconventional oil will be a good substitute for the depletion of conventional crude is like saying that human labor will serve as a good substitute for robotics, or that a depletion of MacBooks will be offset by an increase in UNIVAC production.” Though these are both technically feasible, they do not provide any competitive advantage, ceteris paribus. The point is that oil production from the tar sands and other unconventional resources occurred in response to increasing demand which in turn elevated prices, not because they offer some competitive advantage when compared to conventional crude oil.

What does this mean?

It means that to grow the economy for the next few decades on an oil energy base would require very high prices. But if the recessions of 1973, 1980, and 2008 have taught us anything, it is that high energy prices cause problems for the economy. Noting the inevitable transition to unconventional resources, the IEA reports that: “the average IEA crude oil price reaches $113 per barrel (in year-2009 dollars) in 2035 — up from just over $60 in 2009. In practice, short-term price volatility is likely to remain high.” Other data from the BP statistical review support this upward trajectory in prices: the average price of a barrel of oil from 1861-1969 was $23, $40 from 1970 – 1999, and $53 from 2000 – 2008 (all in real 2008 dollars).[5]

Clearly demand destruction (and a financial crisis) has the ability to lower oil prices, as prices plummeted from 140 to 30 dollars per barrel during the fall of 2008 and winter of 2009. But now, two years later, oil price is again back in the range of $90 per barrel. In a society like ours, where economic growth is touted as the solution to almost every societal problem (see more or less any op-ed on how to fund the U.S. deficit), peak oil presents a paradox: the growth of the economy requires an increasing oil supply, but increasing the oil supply, due mainly to a peak in conventional crude oil production, will require high prices which tend to undermine that growth. The billion dollar question is: at what price of oil does the economy stop growing?

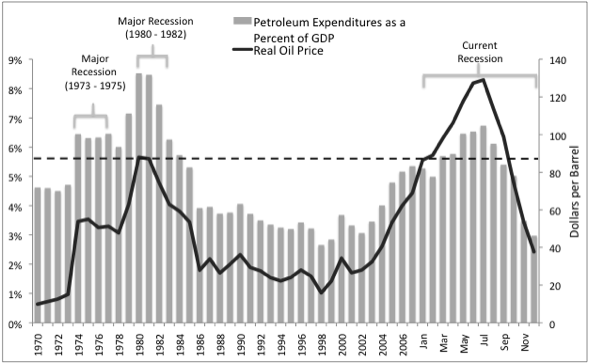

Over the past 40 years, when petroleum expenditures as a percent of GDP increased much beyond 5.5%, the economy tended towards recessions (Figure 2). This tendency is due mainly to the fact that oil infiltrates almost every facet of an industrial economy, from personal disposable income, to manufacturing, to service sectors. Therefore higher oil prices restrain growth via declining discretionary consumption as individuals allocate more money towards gasoline and home heating, or as the cost of producing a good increases, etc.[6] Chris Nelder of getREALlisthas described this situation succinctly, writing: “The true import of peak oil, therefore, may not be sustained high prices, but economic shrinkage. Demand will be destroyed long before oil gets to $200 a barrel…”

Figure 2. Petroleum expenditures as a percent of GDP. Figure created by Steve Balogh and published here.

In sum, although it is technically feasible to increase the production of “oil,” peak conventional oil, as it was first envisioned by Hubbert in 1956, has manifested itself almost exactly as predicted.[7] As Campbell described, peak oil will bring about short bouts of economic growth and contraction as oil demand and prices play tug-of-war, creating what has been referred to as an undulating plateau.[8] We seem to be experiencing these economic conditions right now. So the question is no longer "when will peak oil occur," but "how long will the effects of peak oil last?"

References

1. IEA. 2010. World Energy Outlook 2010. International Energy Agency.

2. Radetzki, M. 2010. Peak Oil and other threatening peaks - Chimeras without substance. Energy Policy, 38:6566-6569.

3. Barnett, H. and C. Morse. 1963. Scarcity and Growth: The Economics of Natural Resource Availability. Johns Hopkins University Press.

4. CERA. 2008. Ratcheting Down: Oil and the Global Credit Crisis. Cambridge Energy Research Associates.

5. Hayward, T. 2010. BP Statistical Review of World Energy. British Petroleum.

6. Hall, C. A. S., R. Powers and W. Schoenberg. 2008. Peak Oil, EROI, Investments and the Economy in an Uncertain Future. In Biofuels, Solar and Wind as Renewable Energy Systems: Benefits and Risks. Pimentel, Ed. Netherlands, Springer Netherlands.

7. Hubbert, M. K. 1956. Nuclear Energy and the Fossil Fuels. Spring Meeting of the Southern District Division of Production, San Antonio, Texas. 1956.

8. Campbell, C. 2009. Why dawn may be breaking for the second half of the age of oil. First Break, 27:53-62.

I've taken the liberty of superimposing oil prices in red onto this graph of US GDP.

http://www.tradingeconomics.com/Economics/GDP-Growth.aspx?Symbol=USD

complexity of demand and its feedbacks is the problem

the correlation has lags

..hard to see any simplistic matching. The econ 101 guys can argue there is no connection.

until the lags and feedbacks are understood this argument is pretty fruitless from the POV of perception management. Even something as simple as regulating the temperature of the water in your shower is often too complex to understand even by the end user fiddling with the taps.

You turn on the shower.. its too cold so you up the hot water but nothing happens.. the hot water is on its way but you are not receiving the benefit of it so you up it some more... BAMM the shower is suddenly too hot so you back adjust with less hot more cold... nothing then too cold..and so on.

Economics. someone comes up with an explanation of history and then tries to project that into the future as a "plan".

then it all goes wrong.

Precisely!

Funny thing you should mention that. I had a similar problem in a 100-year-old Victorian house I owned in Calgary. The water heater was in the basement, and it took forever to get hot water to the shower on the top floor at the far end of the house.

The solution was simple. I just snaked a PEX (cross-linked polyethylene) recirculation line through the walls from the hot-water tap on the shower to the drain on the water heater. It created a convection loop, and hot water continuously circulated from the water heater to the tap and back to the water heater, driven by the temperature differential between the water heater and the tap. It reduce the temperature differential between the water heater and the tap to near-zero, and the result was instantaneous hot water at the shower tap all the time.

So, when you have trouble with a feedback loop, don't keep fiddling with the taps, just fix the underlying problem. Otherwise it will be like British plumbing, it will never work right.

Of course there's some kind of law in Britain against having plumbing that works right. But that's their problem.

Sounds good to me. The only question I have is where do you stick the PEX (cross-linked polyethylene) recirculation line so that the cheap crude keeps bubbling up to the surface?

http://www.youtube.com/watch?v=0_XAPku7SgE&feature=related

The Ballad Of Jed Clampett - Lester Flatt ,Earl Scruggs (1962)

It seems to me that world economy is slowly but surely decoupling form US/OECD economy, so I´m not sure up to which point this kind of analysis (correlating oil price with the US economy only) is still valid.

For example, an article referenced in today's Drumbeat claims that Bahrain is subsidizing gasoline because of the low price at the pump in that country.

However, the graph in the OP shows Bahrain's cost of producing oil is about 1/4 of the world price of oil.

Therefore, the low price of gasoline in Bahrain may not be due to a subsidy, but is simply a result of Bahrain's natural competitive advantage due to the low cost of producing oil in that country. What it is foregoing is the opportunity to make a profit on the difference between the cost in Bahrain and the world price of the oil, but such "opportunity costs" are different from subsidies.

Thats the sort of sophistry that those recieving the subsidy use to justify it. As you admit the country (or national oil company) is paying a very substantial opportunity cost for every barrel of oil consumed.

It's not sophistry at all. There is a big difference between a country being able to produce something cheaply by itself and having to import it and pay the difference between the world price and the national price out of taxation, e.g. as India does.

OTOH, it would be wiser for Bahrain to use the cheap oil as feedstock to industries which sell value added petrochemical and manufactured products. This best exploits their comparative advantage.

Cheap FF might provide a comparative advantage, but it won't be the best comparative advantage. Far better to charge the world market price, and find the best thing.

It would be far wiser for Bahrain to charge their domestic industries the market price, and use the money in other ways to invest in their future. I'm not sure what that might be: it might be as simple as a Norway-style investment fund. Perhaps it would be investments in CSP in the desert, to free up oil & gas now used to generate very expensive electricity.

It's the usual self-centered tunnel vision you have every similar situation. XXX comes from near where I live, I should get XXX for much much less than the world price! Whether you call it a subsidy, or just a very poor economic decision, it still causes significant net harm (which I don't think anyone is disputing). Its best to use the word subsidy precisely bacause it makes the practice less defendable.

With 3,851 km of roads (3,121 km paved) they could probably set the price of gas to zero without the "harm" becoming "significant".

Bahrain is a country with 800 K population and a $30 billion GDP.

Underinflated SUV tires in a country with 300 M population and a $14 trillion GDP probably do more harm.

I bought a load of oranges yesterday, 4 pesos a kilo because they are relatively local. Are you suggesting that I should have paid 40 - 80 pesos to match world prices? If all commodities followed your reasoning there would be mass starvation as many would not be able to afford the profit centric, what can the market stand, over priced goods on the shelves of Walmart and their ilk world wide.

NAOM

OTOH, one can hardly argue that Bahrainis on the whole are among the world's poor. And one might argue that even for the poor, oranges are more of a luxury than a staple food. One might also observe that oranges, being perishable, are somewhat expensive to transport intact over long distances, which is not as true for crude oil. So the analogy seems weak; it seems likely that Bahrain would be better off not to incur the opportunity cost of giving away gasoline.

Bahrain is relatively small, less than 300 sq. miles (~750 sq km) and last I was there (mid 80s) it was pretty much built out. Not a lot of room for additional industry there. Expanded infrastucture would likely replace or convert that which already exists. Also, the island is skirted by sub-ocean freshwater springs that limit expansion in some areas. The Suk (markets) are great places to shop, especially for gold and pearls, though there is not much else to see there. Quite an energetic place (NPI).

Today economists would call a nations oil as "natural capital" which accounting aystems do not take into consideration. Because the U.S. consumed almost all of its naural capital the trade deficit is half or more for oil imports and the UK will also be in that situation soon.

I'm sure it will eventually. Though not this week!

http://finance.yahoo.com/news/Stores-push-gimmicks-for-apf-103114055.htm...

On your mark, get ready, set, shop til you F'n drop!

With the help of the credit card companies we want you to buy, buy, buy, all those extremely valuable, (to China at least) consumer goods.

Me, I think I'm going to the liquor store so I can drown my sorrows. At least I don't think they're selling malt from China yet, though they might be bottling Chinese ethylene glycol in scotch bottles...

Decoupling implies that the U.S. economy becomes even more vulnerable to oil prices. When U.S. demand is no longer the primary force driving oil prices up, then U.S. economic contraction will no longer be a guarantee of lower oil prices. Sluggish U.S. growth, yet oil prices being driven higher by demand elsewhere, high enough to cause another recessionary dip for the U.S. without actually bringing down oil prices, this is all part of our relative decline and becoming only the world's second biggest economy.

And from our perspective China's number one job as the world's number one economy will be to help the U.S. achieve energy independence by pricing us out of the market for imported oil.

That's correct, although I wouldn't say it changes our vulnerability to the price, rather (as you state) it reduces our abilty to reduce the price via using less ourselves. To the extent that the overall level of the world economy is governed by a finite supply of one or more critical resources the world economy starts to resemble a zerosum game.

IEA estimated that each $10 per barrel in the increase of oil prices reduces OECD GDP by 0.4%. Thus, the increase of crude oil prices from $25/bbl to $85 per barrel is about $60/bbl increase in crude oil prices which would translate into a 2.4% decrease in GDP. Clearly this is a huge impact.

It is not hard to understand how this impact is estimated. US imports around 12MMbbl/day of crude oil. Multiplying $60/bbl times 12 MMbbl/day and times 365 days per year results in a transfer payment of $260 billion dollars, which represents 2.4% of a 11 trillion per year economy. Thus, we need blistering growth in our economy to counter the very large transfer payments which is occuring when crude oil prices are high.

This calculation, however, does not consider the retransfer of wealth of those oil exporting countries back to the US if the people there purchase US goods. It seems that at least some of their wealth would be returned back to the US if they are taking in such a large winfall. This calculation also does not consider the short term improvements in efficiency that occur when crude oil prices are higher. However, because our use of crude oil is very inelastic, this impact is pretty small. This impact is much higher when crude oil prices remain high for a while and it can affect the purchases of motor vehicle types and driving behavior in the longer term.

Some petrodollars are recycled back to the US in the form of purchases of US exports. Some are deposited in banks in London and elsewhere to add to the volume of offshore currency. Some come back to the US in the form of purchases of US securities, formerly such things as mortgage backed securities, commercial asset backed securities, etc., but now not so much unless they are guaranteed by the US taxpayer via Fannie, Freddie and the US Treasury.

Thanks Dave

I think the issue of ethanol, NGL, CTL etc being included as 'oil' is a relevant (and problematic) one. The BTU content of 'non-oils' is considerably less. Analysis of oil depletion becomes confusing, especially to those unaware of energy quality differences. (I know Rune Likvern is working on a post dealing with the different components and heat values in NGLs)

Too true Nate

Not inly are there qualitative differences, but price conflates much else besides. Economists do not accept the relevance of EROEI or Net Energy. However all energy sources are only important because of their contribution of Net Energy to Scoiety/The Economy. Tar Sands, Biofuels etc contribute significantly less energy and this fact is represented in their price (subsidies notwithstanding). Economics as a discipline is missing a foundation - Energy is a key input along with capital and labour; and until mainstream economists accept this; and reevaluate their theories they will continue to not understand their chosen field.

One way I try to illustrate this concept for folks is to ask them to imagine they've been commissioned to build some large infrastructure project - say Hoover Dam. They have at their disposal an infinte supply of labor, an infinite supply of material, an infinite supply of money, and an infinite supply of energy. Without which could they still complete the project? It ain't energy...

Here in the US, perhaps the hardest thing to impart to folks is that developing countries will be able to afford oil and they (in the US) won't. It doesn't compute that India, China, et. al. will be able to grow their economies on $100+ oil while most developed countries will suffer decline. Peak affordability will vary, providing huge advantages to some (at least for a while). It's easier to adapt on the way up.

The OP mixes together both global and national numbers and arguments. The analysis would be clearer if it dealt either with global aggregates only (a top-down analysis) or in terms of national numbers only (a bottom-up analysis).

In the latter case, the impact of Peak Oil is determined by global price in dollars, but also by exchange rates, international trade and finance positions, the extent and purpose of oil usage in the national economy, etc., which are different for differently situated national economies.

Don't forget that more than half of the population in developing countries still live in villages. In india, pakistan and bengladesh its 67%, in china its 75% and so on. These countries can literally very well have working economies in absence of all fossil fuels. There have to be changes in food crops, rice requires 5 times more water per kg as compare to wheat for example while both have the same amount of calories per kg. Without fossil fuels what suffers in farming is basically water supply and little other than that. Labor is extremely cheap, machinization (tractors etc) are almost non-existent, wastes can be recycled (especially when majority of wastes is from farm animals and in the rest majority of people live at farm) etc. Climate change can contribute in increased water supply as we are observing here in Pakistan a general rise in annual water fall. The dams can last for some more time (30 to 50 years) in which time population is expected to decline anyway (due to decline in medical facilities).

Its just the industrial sector that lives on fossil fuels. More than half of the industrial labor in china hasn't been in cities since more than 20 years and know where to go back to. Usa in comparsion was fully industralized (only 25% in farming) even in 1930 and japan and europe were industralized even before. Today in all developed countries less than 2% of population is involved in agriculture. Without agriculture providing majority of employment the economy is inherently very unstable, very receptive to cycles and very volatile.

Most of the industrial output of developing countries are consumed by developed countries anyways, in return of paper. Massive decline in industralization is not much a loss from the point of view of an average citizen in any developing country.

I think this is a very astute assessment and one that I whole-heartedly agree with.

The only thing that worries me about the complete loss of industrialisation is the realisation that there may never be another industrial age if a 'critical mass' of energy is unobtainable by pre-industrial methods, i.e. if the oil is deep underground/water.

My fundamental fear would be that humanity would be trapped on earth forever - I hope it's not the case, but this era could be our best shot at leaving the planet for good.

So, from that point of view peak-oil can be viewed as critical for both developing and developed nations. Although it may be true that not everyone shares my desire to vacate the planet.

Exactly the point I have made from time to time. While some may wonder why anyone would want to leave their planet, it is not the individuals but the species that should aim so high.

The other point I make is that, perhaps the reason we do not hear from ET is that ET did what we are doing and ended up trapped until their sun ended all life on their planet. Or are in the process of that today.

Also, once all that nice easy energy is gone, we are back to natural sources; how will that impact our evolution? Not that any species, including the hubristic homo sapiens, is able to determine how they will look, act, etc., in 1 million or so years. For our species to truly survive, it will need to leave home, however, Of course, this is all a bit academic since the Earth is probably good for about 250 million years before it is simply too hot for life.

Craig

I loved star wars too; but , alas, a light year is a really, really, really big distance--an unimaginably big distance that we can only represent to ourselves with numbers. And people would have to traverse a lot of light years in order to get anywhere that didn't make our hottest, most inhospitable deserts seem like paradise.

I have a solution, though: stop thinking of the earth as a trap and start thinking of it as a home!

Kind of a global version of Jared Diamond's Easter Island description ... (Collapse:How Society's Choose to Fail or Succeed)

"Not that any species, including the hubristic homo sapiens, is able to determine how they will look, act, etc., in 1 million or so years."

we have been trying to do just that by taking our destiny out of the hands of chance(god) into are own hands bit by bit, tools, medicine, agriculture, science. yea hubristic but its too late we're all in now we will succeed or die . . . probably die

I've seen our species, and it is better for the wider galaxy, if we DON'T leave our planet. Perhaps the difficulty of interplanetary/interstellar travel is the universe's way of limiting the damage any particular rogue species can cause.

I'm not convinced there's enough water in usable form or any food whatsoever "out there" in the solar system to enable us to colonize other planets.

Why are you fearful that humanity would be trapped on earth forever? Existential angst much?

Or are you allowing our brief, fossil fuel powered sojourn to the moon to let your imagination run wild?

Limits are hard to understand, whether in oil, money, population, or even sci-fi fantasy.

It just seems that the natural next step is to expand out into space. I know it would probably only delay the inevitable, but perhaps it's just the unfulfilled explorer in me :-)

Anyway, best stop here as don't want to go too off topic..

No, it would not delay anything but it might speed up the collapse a bit. There is no place in space we could go that we would not have to take everything with us. We would have to take all the food we might eat, all the water we would need for everything, and even the air we breathe would have to be exported with us from earth. And if we needed more we would have to send back to earth to get it. How in heavens name would this delay anything?

No planet in our solar system, or satellite of a planet, has any of the things that are absolutely necessary for the support of human life. Therefore we would have to take everything with us.

But if you are talking about migrating to another another solar system around another star... then I am wasting my time in even responding to your post because you haven't a clue as to anything you are talking about.

Ron P.

The question is can humanity achieve stasis with its environment or must we grow or die? the latter is the rational for space. just need to warm mars up a little get some global warming going on over there.

Really? And how would we warm Mars up? Mars has virtually no atmosphere. The atmosphere there is about 2 percent of what it is here and it's all carbon dioxide. No oxygen or anything else. You would have as much luck warming up the Moon.

There is not rationality for trying to inhabit Mars or the Moon. Antarctica is thousands of times more hospitable than Mars. At least there is plenty of air there, and it is far warmer in Antarctica than on Mars. than Mars.

Ron P.

Of course this is precisely what I am suggesting. I think it is a tad short-sighted to rule out interstellar travel altogether. Given sufficient energy / benevolent circumstances then I can not see why technology would not progress to the point that would allow us to do this. It's the bottleneck in energy occurring at this point in time that frightens me.

If you consider the, admittedly still very hypothetical, situation in which fusion becomes a reality can you truly claim to be able to predict the ensuing fate of mankind? The abundance of energy would fundamentally alter our way of life. Things that seem science fiction could become commonplace. With enough research into genetic engineering, perhaps humans would eventually transplant themselves into metal shells that no longer require oxygen?

Consider even 50-odd years ago, the internet would have seemed straight out of science fiction! I don't see why you should consider this conversation a waste of time.

"I don't see why you should consider this conversation a waste of time."

I think recipes for rat would be more useful.

Don in Maine

I think I saw that squirrel is being touted as the new dish of the day...

But in all seriousness now, the last few posts have highlighted the two basic attitudes with which one can approach Peak Oil:

1) Firstly, the view that the energy bottleneck can be weathered, albeit perhaps uncomfortably, and that post-PO society will again begin rapid growth in the sense of utilising energy sources / technological advances.

2) The contrasting view is that Peak Oil will necessitate a complete regression to pre-Industrial times and that we should be concentrating on basic survival techniques.

Both views have their merits IMHO. If we were successful in converting the entire population into investing all their efforts towards survival / low-level sustainability then I'm sure that a semblance of a feudal-type society could quite happily exist for many thousands of years. Which is all fine and dandy, and call me cynical but I think that would also likely occur even if we went all out bust trying to use up fossil fuels as fast as we could and crashed with an almighty bump.

I'm not as literally able as I would like to be and am struggling to find words to describe my dissatisfaction at the utterly dismissive attitude some present to possible future scenarios, especially when no-one can lay claim to truly know what's around the corner.

I grew up on that fantasy as well. I'm not sure if you ever totally get over it.

Heavens to Murgatroyd!

Is the Oil Drum still alive? I thought they were commiting sepuku.

I have been out in the wilderness talking to economists.

I have even paid economists to explain things to me. (Hint: Take Quantum Physics, it is a harmonious doddle compared to economics. Economics is all about assertion and presumption, smoke and mirrors.)

Why do we have to leave the Planet? Because of the exponential function.

When I first expressed my displeasure at the way things were turning out there were 3.2 billion something souls on this planet. Now there are double that amount.

My guess is that the planet is capable of supporting 1 Billion souls on starvation rations, given that the soils are virgin and that the climate catastrophe is all hooey.

Humorous I know. How about a few breeding pairs in the high Arctic? Prof James Lovelock.

I clearly remember people asking "What use is the Sputnic? It just goes around the globe going beep beep beep."

Once we are building our homes in space and harvesting the infinite bounty of God's creation it will be blindingly obvious why we had to get into the third dimension.

But why am I arguing? Start Here

Please people, don't see the world as it is, see it as it will be in 100 years.

Aww forgdaboudit.

Humans will have to replaced, if Gaia is to have a brain.

Arthur,

For some reason when I click on any of the links you have in your post nothing happens.

I clicked on links in other posts in this thread and they do work.

You mention the exponential function, yet either you think the Universe is infinite in extent or you do not understand the issue.

Even if humanity could expand into space at will (no technological barriers, let's hand-wave those away for this discussion), Issac Asimov, in his article 'Fecundity Unlimited', demonstrated with some easy math that, given some more hand-waving technology capabilities, Humanity would convert all the Carbon in the known Universe to human flesh by the year 11,000 CE, given a rather low rate of population increase.

(I forget what rate he used and I lost track of the book with this article)

Issac Asimov purposefully ignored P as the true rate-limiting element and went with Carbon, and assumed that humanity could conquer all of known space as fast as they wanted.

If you assumed that humanity could transmute every atom of matter into human flesh, the time by which humanity would have exhausted the known Universe's resources would be a little later.

But, I do see that you said:

It is hard to have a serious discussion given this extreme amount of hand-waving.

I used to believe in techno-fairy tales, and if that is what floats your boat, peace be with you.

I no longer believe population growth is an issue. I used to think that, similar to Professor Bartlett, our population would follow an exponential path and experience the inevitable unwanted consequences.

However, I now realise that the situation is far more complicated than I previously thought. I tend to agree with the UN's prediction that, even if Peak Oil were not to occur, population will peak at around 9 billion around 2040 and stabilise or decline. You can easily see the strong societal / psychological influences that we have on our population when you realise that nowadays nearly all of the developed countries (plus China) have a sub-replacement fertility rate. Africa is the last major challenge when it comes to population control.

However, this does not mean that we will never have a reason to expand into space. After all, the planet does only have finite resources and there is a lot of matter out there. Never say never!

Thanks Nickagreer.

I do hope that the United Nations projections are correct.

One hopes for the best and plans for the worst.

People who insist that this old pioneer has to stay at the bottom of this gravity well are fascists.

Sorry about the broken links.

Try again. Although there is a lot of information about the consequences of the exponential function.

http://www.chrismartenson.com/crashcourse/chapter-3-exponential-growth

I have read most of Asimov's work. I do remember the expanding ball of humanity whose rate of expansion reached the speed of light.

My comment. "We are not there yet."

Let us not hand wave anything away.

O'Neill and a lot of others have done the hard work for you.

http://en.wikipedia.org/wiki/National_Space_Society

These things are feasible.

Let us not hand wave anything away.

Especially the consequence of the exponential function on the population. How are you going to keep all these people alive without cheap energy. Perhaps we should just hand wave them away?

I agree.

Let us base our discussion on facts. God's creation is infinite.

From

http://www.physorg.com/news/2010-12-scientists-evidence-universes.html

But I know what the real problem is.

The Left (logical) hemisphere of the brain has a dirty little secret.

It cannot handle information that it does not know are "facts" therefore it is hermetically sealed in circular logic.

From The Master and His Emissary

Arthur,

If you wish to make plans for you and others to escape our gravity well and build O'Neil habitats and then equip them with some kind of high sub-light or FTL drives, I won't stand in your way, as long as you use private capital.

A couple of points, though:

The technological challenges to colonizing the known Universe (let alone multiple Universes) are utterly out of our reach. This is not equivalent to the challenge Columbus et al faced wrt sailing across the uncharted seas to the 'New World'.

If we (humanity) cannot get our sustainability act together here on Earth, including a slow population decrease to some sustainable level (~1B?), then zero population growth, also including greatly reduced resource use, greatly increased resource re-use and recycling, and greatly increased use of renewable energy production, then the odds of us colonizing the Universe (let alone multiple Universes) are nil.

However (here is the hand waving), if we could develop the magic to colonize all of the Multi-Verse, and we had not yet learned and implemented sustainable living, then humanity would expand like a speed-of-light malignancy and fill all of known space...Universe-wide slums if you will.

I surmise that you think that the Universe is infinite, so, therefore, humanity's spread at the speed-of-light (or any non-infinite speed) can continue indefinitely, and this is your vision of utopia or heaven. This is from the mindset that humanity is the best thing ever, and that the greatest amount of humanity over time and space is the acme of perfection.

Meanwhile, back on Earth, we have a civilization to make sustainable and a planetary ecosystem to keep from being ruined.

Lookit, I personally would support increased robotic exploration of the Solar System...rovers on Venus, a new set of very-hi-res radar mappers orbiting Venus, cryostat-submarine melting through Europa's ice to see what if anything is in that ocean, balloon/glider probes in Titan's atmosphere...all that and much more is do-able with conceivable extensions of current technology.

As are advanced, very large space telescopes capable of imaging exoplanets within ~ 20 LY radius (my guess) of earth (at ~ a 25-pixel resolution)...

http://en.wikipedia.org/wiki/New_Worlds_Mission

We might even be able to send probes to Alpha Centauri at up to 10% C if we put a huge amount of resources into the project...but that is on the edge of possibly attainable.

However, there is a gargantuan leap between what I just described and your vision of thousands (millions? more?) of O'Neil-type space colonies/habitats wheeling around the Sun, let alone the Universe.

I would be supportive of Space=based solar power sats beaming power down to Earth, with a robust Earth-orbital and near-asteroid mining operation to support that, but that is likely a bridge too far.

How about we demonstrate that we have the brains and resolve to put solar PV on top of most of our roofs and over most of our parking lots (and a considerable amount of our desert scrub land) first...and increase our wind generation capacity to ~ 20% of our needs, and increase our energy efficiency, and institute a smart grid...

If we can't do that, we can't pull off Space-Based Power systems either.

or colonizing the Multi-verse.

Gosh, I thought your first post was satire. Apparently it wasn't! It seems that you actually believe us leaving the planet is a) feasible b) going to help matters.

I'm really impressed how shortsighted and allready apathetic you guys here on the OilDrum are.

Of course the ultimate coal of any higer form of life is to figh agains the overall trend towards more an more entropy - that's all (i know we produce entropy, but we build nice stuff wich doesen't show up naturally on a rock). And if we are smart enough we will need even no more water one day, because all we need is:

a) Artificial Intelligence, AI

b) abundant energy + stuff (Fe,...)

Than we have really fullfield our coal. I guess i will never happen but it's our ultimative goal!

Off course this means that some (maybe we, but the possibility is of course not very likely) higher form of life (or something which evolved from it - real AI/smart robots) has to leave there homeplanet and spread over the universe(s) some day, and it will happen somewhere i'm shure.

Like i sayed allready before - around 200 million years and Earth is finished anway. That's not so long - isen't it.

I am very pesimistic about aur one species now:

-Peak Resources

-Dysgenetics worldwide

-FIAT-Money system

-uncontrolled Global Warming

But this

is really nonsense. "The universe" is burning stuff fast - lock at the Sun, what shes's doing? Burning around 564 million tons of hydrogen per second to 560 million tons of helium (4 million tons is mass difference = energy). That i call a entropy gain and stuff burning for shure. Mankind is a joke against this.

Survive our home planete or go extinct very soon - i guess b) happens!

"Although it may be true that not everyone shares my desire to vacate the planet."

BTW, shut the door on your way out. Thanks.

I wasn't born in a barn ;-)

I don't believe this is true. According to Earthtrends Database China has about double the consumption of agricultural fertilizers as the US and India is fast catching up the the US. These are synthetic fertilizers that take Natural Gas for their production. I believe that almost all developing countries have adapted 'modern' agricultural methods to feed their growing populations and these methods are heavily dependent on fossil fuels.

Quite so. So called "developing" countries are going to have mass famines when the price of natural gas and diesel oil go to double or triple current levels. Not only fertilizer, but also pesticides are based on fossil fuel. The outlook for overpopulated countries such as China and India is bleak to catestrophic. They just do not have enough arable land to feed their populations in the absence of cheap fossil fuels.

By way of contrast, the U.S. has plenty of arable land to feed its current population using organic farming methods and manure fertilizer. As the Green Revolution goes into reverse, the "developing" countries are going to be hit hardest, due to their inadequate amounts of arable land.

Absolutely agree with that. But unfortunately the situation in Western Europe and Japan is not better than developing countries and possible is even worse in terms of population density and arable lands:

http://en.wikipedia.org/wiki/File:Countries_by_population_density.svg

http://en.wikipedia.org/wiki/List_of_sovereign_states_and_dependent_terr...

http://en.wikipedia.org/wiki/Land_use_statistics_by_country

For example in Italy the situation is quite tough in perspective, due to real estate speculation (legal and not legal). During fascism, they even cultivated wheat close to the Vatican with mixed success in what is known as the Battle of Grain:

http://en.wikipedia.org/wiki/Battle_for_Grain

Today, if a crisis takes place, Italy and all western Europe would be in a much worse conditions given the lower arable lands and the reduced number of fertilizer and pesticides and a much higehr population to feed

That might make an interesting TOD future article: "Modern Farming methods - fertilizer consumption, and fossil fuels required to create the fertilizer."

I tried a quick sketch of some basics in How Might We Be Fed, Parts I & II, TOD, March 2009.

Yes, Asian agriculture now uses large and increasing amounts of N fertilizer, but globally 'only' about 5% of present production of Natural Gas is used in N production. In China the majority of N fertilizer has been manufactured as urea from coal. Wisdom from Pakistan is correct though that significant re-cycling of soil nutrients continues in the villages, and that mechanization is mostly not a big issue. Most of the food produced is still consumed in the villages, but, as has been noted, rapid urbanization changes the equation considerably. Countries like China and India still have vast rural hinterlands that are often still densely populated. But while they have the very significant imperative of feeding the growing urban populations that now live wholly in a cash economy, they must not destroy the livelihoods of the populations remaining in the villages. There seems no way to urbanize these countries wholesale on the western model, and it seems to me that they must retain the buffer (as W from P might describe it) of an in situ agricultural population living on land that has supported them for 2000 years at rural population densities we could not contemplate in the West, past, present or future.

How the above plays in the future alongside industrialization is a very big question. Most of the world lives in these places, and the future seems to be happening very fast.

I wonder how it is, for the rural Chinese - surely they yearn to be urbanized, see for themselves what this internet thing is all about, etc. Or are they so much in the dark they're completely unaware of what great things exist just over the hill yonder? Sort of like the Afghanis, many of whom haven't yet learned of 9/11 (according to some recent report) - as eye-opening as the stories of the fall of the WTC would seem, it's still just something that happened in what might as well be another world.

Regardless Phil, it's an interesting comment.

Matt, thanks for your comment.

India and Pakistan, and Indonesia, are not the same as China, though especially India and China share very rapid industrial growth as well as a rural hinterland. Something like half a billion in rural India have no access to electricity. In China a lot of rural youngsters become remittance workers along usual lines; the more gentle souls by some report weep in their barrack cots for their mothers and from the loneliness of endless work. The drive for education is enormous and I read an estimate that China must grow the economy at 8% just to keep smart educated engineers etc. in work, and that is after a successful 'one-child' enforced birth rate reduction policy. (In UK we even see illegal sweatshops that rely on a very small fraction of these young Chinese and etc., etc. getting as far as here.)

Big migrations associated with industrialization were commonplace in the West, but 150 to 200 millions over a decade or so?

Seems there is a lot of stick involved rather than so much carrot. Recent factory downturns in China last year, or year before, saw the enforced return of youngsters to villages. Then look at unemployment even in UK, Ireland etc. A lot, by our standards, of unemployed graduates living with their parents.

The USA provides, IMHO, a distorted fantasy model, but the billions will live elsewhere.

best

phil

For those interested in this topic, I highly recommend Vaclav Smil's book:

Enriching the Earth: Fritz Haber, Carl Bosch, and the Transformation of World Food Production

Don't forget that more than half of the population in developing countries still live in villages. In india, pakistan and bengladesh its 67%, in china its 75% and so on.

China is one of the most rapidly urbanizing countries in the world. As of 2010, the population of China is 46% urban, 54% rural. By 2015 the urban population will exceed the rural population, and by 2030 China is expected to be 65% urban.

China's urban population is already twice the total population of the United States. There are over 160 cities in China with populations of more than one million.

Note that Chinese birth rates in rural areas are much higher than Chinese urban birth rates. The great problem of China is that they have way too many rural people in grinding poverty trying to farm way too little arable land. Except for some river water, coal, and rare earths, China is relatively poor in resources and depends ever more on imports of resources and food. China is not in a good position when it comes to declining production of fossil fuels. Also, China may well be the most polluted country in the world, and so long as coal is their main source of energy it will continue to have very high levels of toxic pollutants.

Two questions on your comparison. Firstly, can rice and wheat thrive in the same climate zones? I have always thought of rice as needing a warm climate while wheat requires a cooler climate. I am willing to be corrected and learn. Second does the need for water with rice depend on variety and are there varieties being developed that require much less water?

NAOM

wild rice is not directly related to the Asian rice http://en.wikipedia.org/wiki/Wild_rice

Yes wild rice can grow in cold weather as it does in the US and I have been wondering if it could be grown in Northern Europe. However, it would then probably be used in the few remaining wetlands present in Europe, so it is better not to do it.

Asian rice do need quite warm weather and is grown in California and southern Europe.

Also, much Asian rice is grown in Texas, which also produces a great deal of wheat.

The U.S. is uniquely blessed with agricultural resources.

Nothing like link farming. Beats farming the government.

Comparing these two plants is like comparing fescue and wheat. They are not near related. Taste is not close, consumer substitution nonexistent. Much less protein and chemical composition. Even priced as a boutique product, it hardly gets near $2.50 wheat. It requires 3-4 harvests over 6 wks+ to get adequate yields, prefers an acid soil. Also shatters from the pannicle when ripening, further decreasing yields.

My apologies Christo, Don and Doug. I saw NOAM's question, "can rice and wheat thrive in the same climate zones" and just responded with our regions native plants in mind.

I really didn't mean to compare the wild rice to wheat, or asian rice. I just posted the growing season for our region's wild rice, and an anecdote showing its historic importance to the "local" economy.

I personally am interested in wild rice, mostly for local production and consumption, not for commercial production and consumption.

Again, my apologies for the tangent.

This originally came from the point about how much more water is used by rice than wheat. Now, I have always thought of wheat as a temperate crop and rice as a tropical or sub tropical crop.It is all very well replacing rice with wheat to save water but if the wheat does not thrive in the climate that saving does not help. Likewise, would growing rice in cooler climes where there is adequate water produce a sufficient yield. Also rice growing regions are often fed by monsoon rains. The rice paddies are an excellent method for catching that rain. If wheat is substituted would the land be drained to support it causing run-off that will create floods and reduce the amount of water entering the aquifers. I am trying to get a feel if just comparing water needs of the two crops is an over simplification of the issues.

NAOM

Wheat is not particularly a temperate crop since it originated in the Middle East, and rice is not particularly a tropical crop since wild rice is also known as Canada rice.

I think it is true that wheat does grow better in dry climates and rice grows better in wet climates, although their ranges overlap. Wheat has a much better tolerance for drought than rice does (in fact it reaches the best quality under dry conditions), while rice will grow in flooded fields whereas wheat will not.

Wheat production is complementary to rice production because weather conditions that cause an increase in wheat production cause a decrease in rice production, and vice versa.

In many countries they grow wheat and rice on the same land at different times of year. They grow wheat during the dry season and rice during the wet season. This gives them two crops a year, whereas with a monoculture they would only have one.

However, if they can fit legumes such as peas, beans, or lentils into the rotation it helps considerably because they get a full set of proteins. Many grains are low in lysine, but beans are high in lysine. On the other hand, beans are low in the sulfur-containing amino acids, while grains like wheat contain much of these. Also, legumes recharge the nitrogen in the soil, which wheat and rice need to grow.

SA,

It seems that many are confused by the common name rice. Wild rice, sometimes called Canada rice, is of the genus Zizania, usually aquatica. Cultivated rice is of the genus Oryza. Originally, US Zizania was mostly in Minnesota and the Great Lakes, but since WW2, it has been transplanted through much of the northern part of the country, mostly by waterfowl groups. It is VASTLY different from cultivated Oryza spp, as I stated above. In the US, Gibbs took over much of the Minnesota production and have some production in CA. Other small time, regional growers have tried to make a go of it, but it is dicey. In the PNW, St Maries Wild Rice combined with a Oregon outfit, but I'm not sure if they still are operational. I have messed around with it for many decades.

The grain itself is usually roasted, then eaten whole. It is fairly astringent, quite nutty in texture. One of the difficulties is the nature of the seed production. Each grain is produced at the end of a long stem, which itself is part of the larger pannicle. That pannicle may grow to 18 inches or more in length. As each grain on the pannicle matures separately from the others, it makes harvesting difficult and spreads it over a large time interval. This nature does ensure self seeding in a regular lake or "paddy", but is frowned upon in most commercial cultivation. The fact that it is in an aquatic environment makes traditional combine harvest hard. Gibbs has modified some machinery for Minnesota, but now the push is drain the growing area dry so conventional machinery can harvest. As imagined, this loses much of the crop yield potential, and many are looking at breeding varieties that mature at once. With smaller outfits, harvest is performed via airboats with just the header portion of older combines afixed to the bow. This "basket" collects the grain as it shatters off the pannicle, and as a relatively nondestructive harvest, leaves the plant intact for later harvest when other grains have matured. Still, yields per acre are quite low, esp compared with other grains.

Comparinng to wheat is a misnomer. Though some land in CA is doubled cropped for Oryza and wheat, wheat itself has the moniker "Desert Rose". It is a dryland crop, flourishing in 10 to 15 inches ppt. Irrigating wheat rockets the yield, if other inputs are sufficient. But still, it's not "normal". It's claim to fame as a grain revolves on its parsimonious use of water. And nothing gets a dryland grower going faster than folks doing wheat with Federal water.

Since we have several definitions of "oil" and all different definitions will peak at different times, we need to settle on one and say this is the definition of "oil" that carries the most impact. I think that should be anything that you can just run through a refinery and turn it into gasoline, diesel or jet fuel. Or transportation fuel in general.

That would be crude oil, tar sands oil, deep water oil and condensate. Luckily we already have such a measure. It is what the EIA calls Crude + Condensate. And it can be priced in barrels, unlike NGLs and some other oil substitutes.

So peak oil will be when Crude + Condensate peaks. That is the measure that Hubbert used, and Deffeyes used and what many others use... but not everyone. But that is the closest definition of oil that I think most people will agree with.

And yes, it definitely matters when C+C peaks. In my opinion we are at that peak right now and have been for almost six years now. Everything since 2005 has been noise well within the margin of error. Of course world C+C production could turn up and leave the 2005 to 2101 plateau in the dust. But I think that is highly unlikely. In my opinion it is far more likely that it will turn down within the next two or three years and never look back. But we shall see.

Ron P.

I agree with Nate's take above. Barrel counts are subordinate to the net energy that those "barrels" provide. If 85 million barrels today provide only 80% of the net energy benefit they did 20 years ago, then the peak moves (backwards). Calculating the net energy available to economies is problematic, though IMO critical.

I heat with wood. I filled my shed with nice oak this year. If next year I fill my shed with soft maple and pine, I'll need to burn more next year to get the same heat output, though it took me the same time and energy to fill my shed. Simplistic, I know, though oil works the same way. If I have to drive farther up the mountain to fill my shed with nice oak, same result.

Why go to all that trouble, just burn your shed >;^)

It's all pressure treated; illegal to burn :-(

Hi Ghung,

You are THE MAN today-gross production doesn't really matter, it's NET after all internal usage within the industry is subtracted that counts.

Of course defining the limits of the industry is a tough nut;do we stop with the steel and machinery and diesel used to lay pipelines and build refineries, or only after adding in the oil component of the smaller industries that support the larger parts of the industry?

Unfortunately while the average Oil Drummer can understand this concept, it adds one more layer of complexity to the problem insofar as the public is concerned.

Even within this forum , we will find many regulars, probably, who for reasons of historical consistency, will argue that the focus should be on gross barrels, rather than net barrels, so far as the debate is concerned.

Incidentally, my personal opinion is that Darwinian is right-we should begin defining oil as crude plus condensate, and hope this catches on within the peak oil community.

Now you have given me a thought. The ME concentrates on exporting oil. I wonder how much per barrel equivalent they would get if they exported oil products, plastics, chemicals etc, even diesel and gasoline. Barrel equivalent being the amount of oil product produced per barrel of oil.

NAOM

There is a problem with condensate. In Australia, for example, only 5% of condensate can be used in local refineries. Therefore, most of it is exported. That really matters because when the global crunch arrives I expect the oil markets to become more or less dysfunctional, possibly transitioning to some sort of bartering with different types of oil. What real value condensate then has, we don't know. Similar problems exist with heavy, sour crude which has to go to special refineries.

There is a problem with condensate. In Australia, for example, only 5% of condensate can be used in local refineries. Therefore, most of it is exported.

That seems unlikely. The chemical composition of condensate is nearly identical to that of gasoline, and in the old days of low-compression, fuel quality insensitive engines some people used to fill their cars with condensate, and drive around on it.

More likely they get a better price for it on the export market than in Australia. There are a lot of offshore refineries that will pay a better price for condensate than for crude oil.

I agree with you Ron. What really matters is what the world can burn, no matter where it comes from. The plateau already includes - and hides - several peaks: Conventional peak in 2005, I think - though the EIA claims 2006 - and the peak of exports in the same year. All the added unconventional oil since then only sirved to satisfy the growing consumption of the producers. In fact the available amount of oil on the market shrunk since then and shrunk dramatically discounting the consumtion of Chindia. (If memory serves from about 40mb to 35mb) So for importers Peak Oil is a reality for quite a while already.

Though it's tecnically feasible to produce more "oil" if the price goes up it is feasible in the same way as a mission to mars would be if NASA would receive enough funding. It's jutst hypotetically possible but in reality it will never happen IMO.

Agreed the only thing that matters is what can be turned into fuel our current fleet of vehicles... and how much it costs. In this economic sense a cheap way of making oil from coal or gas would have more in common with conventional crude oil than tar sands or hard to reach deepwater oil, for instance.

The only issue is that this would create a potential shortage in coal or gas, which could in turn be replaced by nuclear energy.

In some ways the most important fuel is diesel. This is required for all the equipment that makes the world go round. You need diesel to eat food basically.

I think keeping tabs on diesel stocks will be key when shortages occur.

I bet the industry is already thinking about how to keep diesel stocks relatively higher than typical in the past in case of a serious production disruption.

Will it be harder to make diesel from coal or gas, than petrol?

20/9/2010

IEA corrects oil statistics containing bio fuels

http://www.crudeoilpeak.com/?p=1876

13/4/2010

Natural gas liquids and other liquids mitigate crude oil peak

http://www.crudeoilpeak.com/?p=1352

Does peak oil matter: it already matters when sub systems peak. The oil price went out of the 20-30 dollar band after the North Sea peaked. Oil importing countries then took on more debt to finance those higher oil prices, thus accelerating the underlying problem of accumulated debt, which finally triggered the GFC.

An earlier example was:

4/10/2010

Russia's oil peak and the German reunification

http://www.crudeoilpeak.com/?p=1912

The Iranian revolution was preceded by the peaking of Iran's oil production. There are always several feed back factors coming together to make the peaking a dramatic process.

The 1973 OPEC oil embargo was only successful because the US peaked 3 years earlier.

David asks the question "at what price of oil does the economy stop growing?"

A couple of weeks ago I put together an analysis of peak oil-induced demand destruction and found that the key "tipping point" seems to be when the S&P/Oil ratio goes below 12:1

Complete analysis here: http://www.peakoilproof.com/2010/11/demand-destruction-from-peak-oil.html

Nice analysis....I positioning some shorts now. We are now in the saw-tooth phase of world growth

The paper from Radetzki is quite bad. It has little facts, although he accuses peak-oilers of that himself. It is written a little like an opinion-piece, less so then an peer-reviewd article.

I have followed Radetzki for 2-3 years and he is consistently repeating his core beliefs. One scientist analyzed a piece by him, saying he is stuck in his topic of economics will find a solution through price since 40 years. And cant get out of the box. The guy should be around 75 years old.

He has written in sweden against climate change science. Got heavily criticized.

Currently he: "Work on a book manuscript of essays, to be published in December 2010 in Swedish. The lead theme of the book is that human creativity makes natural and environmental resources inexhaustible for all practical purposes, and that the threat of depletion is a chimera." fom his webpage: http://www.radetzki.biz/academic_history.html.

My judgement is that he must have great stories to tell, but he is shaped by what he has observed the last decades, and cant imagine that the next decade might change.

A couple of points:

As each recession forces economies of consumption (efficiency and conservation), the tipping point as % of GDP moves up. Similarly, if price ratchets up in small steps, with pauses for adjustment, the economically affordable price moves up. Expect the next oil price induced economic downturn at petroleum use maybe 10% of GDP.

As oil price causes Americans to make choices of how they spend their money, the prices will disproportionately hit China's economy, because a great deal of what we import from China is the first things that can and will be foregone.

Regardless of the technical or economic substitutability of non-conventional "oils", we still have the issue of stocks and flows. Tar sand/NGL production will not be cranked up as fast as conventional oil declines, so we still have a peak, aggravated, as noted above, by the net energy/b decline.

Maybe peak oil should be redefined as peak liquid hydrocarbon net energy.

Murray

I recommend peak fossil liquid hydrocarbon net energy.

What is important to society is the end product. That is liquid, easy to transport, burn and store, high energy density fuel.

Not the hole in the ground it came out of. It is reasonable to include coal to liquids and other technologies, provided that the

coal used is additional production, and not coal diverted from other end uses.

However, biofuels are a completely different. They result in double counting as fossil fuels are used in their production, they use agricultural land which definitely has other end uses, they are lower energy content, and they are not a finite energy source.

Including them in a calculation for the peak of fossil fuels is to inevitably skew the result.

What is the difference between ethanol and oil sands?

They both use a lot of land area and a lot of natural gas to make liquid fuels.

Not sure how easy it is to not count the biofuels in the mix.

I personally think peak conventional crude is still a very important graph.

I think that peak light sweet crude is equally important.

I think peak oil per capita is also important.

Laying these graphs on top of one another would show the transition from say conventional to higher tech refining gains to heavier/sourer crude to biobuels and to shale and sands oil and coal to liquids and so on.

Light sweet crude, conventional crude etc. is only a valuable graph from the point of view that its cheap to extract.

There is not significant difference in spending vast ammounts of money to mine deepwater conventional oil reserves, and spending less money mining heavy sour crudes and then spending extra money refining them into conventional petroleum products.

This is a good view for World Peak. There are a couple of reasons for a region to peak:

1. The region can import lower cost fossil energy than it can locally produce. This moves up the peak date as the inexpensive imported oil blocks expensive new developments.

2. The region cannot increase net energy no matter how high costs go or how much effort is put into drilling. I think this is likely to first appear in the natural gas markets (because imports/exports are much more limited and expensive compared to oil).

Case 2 is how the world will peak in oil. Essentially the oil industry will need so much energy (in the form of labor, steel, fuel, electronics, etc) per barrel of oil that net energy delivered to society will start to fall.

Society has 2 options at that point:

A. Get efficient faster than net energy is falling. (Very unlikely as I have seen energy usage for drilling rise from 1% of gross to 7% of gross in less than 10 years. That is a very huge efficiency change to make in society as a whole for reasons explained below.)

B. Curtail in usage via demand destruction, rationing, etc. This is how world peak oil is most likely to appear.

This has some interesting implications. First, if the fossil fuel industry does not want to contract rapidly as net energy declines, it must promote more efficiency usage in society. It *needs* an economy that can pay higher and higher prices for the same amount of energy. And only a society getting more efficient can do that. Secondly, the wider economy needs to understand that the recession that follows a price spike is the signal to be investing more heavily in efficiency not less. Any society that misses this signal will be out competed by a society that does not miss the signal.

Efficiency gains have a limited reach. It costs energy to replace cars, build trains, etc. So that cuts into the savings. The faster society tries to change, the higher the cost (because the cost is paid at the time of construction, but the efficiency pays back slowly over usage) and that puts a limit on how fast change can be made.

Everything outside of that limit must be made up by curtailment. And so it is very likely that once a peak in net energy is reached, the economy as a whole will peak very soon. Thus "peak oil" will appear as peak demand. Net energy will be falling and so society will not be able to invest enough to keep production up. The IEA will claim the problem is "lack of investment", while instead it is that energy production is competing for so much steel, labor and energy that society as a whole has been driven into contraction.

A study of fossil energy sources in regions without good trade connections is likely to give us the clearest view of what a peak in world energy will bring.

Is the net energy of various resources constant?

For example the energy input for tar sands I guess would be building the lorries, running the lorries, boiling the sands, etc., but surely if more efficient lorries were purchased with longer lifespans, or if the boiling water where the oil is stripped from the sands, is better insulated so that it loses energy more slowly to its environment or if the pipes are manufactured with more corrosion resistant material, surely all these things would act to increase the net energy available from tar sands over time?

Its not peak energy or net peak exergy even! But peak utility.. if we have half the exergy but twice the functioning efficiency in using that exergy the economy is static.... IMO

its the net amount of things you can do irrespective of their energy cost.

Its as if the GDP is the total amount of things going on if you like?

Trouble is that the beancounters work with the costs NOW NOW NOW. they are not looking at amortising the costs over many years. (okay, bit of license with that. They only look at recovering cost ASAP rather than take a long range view).

NAOM

JonFriese -

+10

This is the most lucid reasoning I've come across on this topic in some time. You've made a compelling case how analysts can discuss a peak in net energy and a peak in demand and be talking about the SAME THING.

You have also squared the role of energy efficiency against declining net energy with Jeavons Paradox. The bottom line there being: we don't become more efficient to preserve resources, we become more efficient to accommodate as many people (users/consumers) as we can. There is no special reason efficiency will reduce prices, and if net energy is declining prices will often rise.

A region with a self-contained fossil energy rise and fall? There has to be one but nothing comes to mind...

Yes, if net energy is declining then prices rise, even in a down economy. Natural gas is $4.00 Mcf right now. The NG industry is suffering but that is 100% higher than prices 10 years back. And this despite the worst recession since the 30's.

Efficiency can cause temporary low prices, but it really allows high prices. Another interesting thought is that the most efficient wins the bidding war for fuel, but the most efficient is not protected from the bidding war. Meaning that cutting your use 50% is great, but as others do the same prices will still rise to take the same % of your wealth. Efficiency is necessary, but not sufficient.

The only thing that protects against economic decline is a domestic energy source of high EROeI. So in the US, we have to develop renewable energy supplies with high EROeI, such as wind. Or as a homeowner, install some form of energy collection / generation. Save the fuel for backup. Buy during the price slumps and skimp during the spikes (a slump will always follow).

Very interesting, this.

As for your question, "how long will the effects of peak oil last?" my husband recently said 100 years until people will no longer feel the effects. He is such an optimist!

Coal started to be seriously used about 500 years ago, so I think we could even say 500 years until fossil fuel effects wear off, if we want to make a nice even slope up and slope down. Making a perfect 1000 year slice of fossil fuel-mankind partnership....or bondage, or servitude or enslavement or addiction.....or whatever you want to call it.

Don't post that correlation-is-causation chart of oil against the economy without also posting THIS chart, a much more significant factor in our recession than oil briefly touching $147/bbl (largely speculator-driven).

One of things I think your graph shows (in conjunction with oil prices, whether speculative or not) is that people or a large segment of the economy simply "ran out of money" against a 40-year real flat income. All the tricks to extract money from assets to continue consumption simply ran out.

wait, the reason the loans failed was that people could not pay their bills as oil costs in all things in the economy including their gas tanks went up preventing the monthly payment toward the house from being made, thus leading to the crisis which occurred some months following the extended period of high oil prices.

Sure we are handwaving, but money is money. Why couldnt people pay the bills?

The coincident trend for oil price was just a coincidence then? OK.

Despite being devils advocate on the oil price vs growth thing earlier in the thread I think there is a connection between PEAK oil and the sub prime crash.

The question is why did they run out of money then? .. they were always borrowing money they never had or realistically any hope of paying back.

Was the ability to expand levels of consumer debt and cyclically expanding the economy[service sector ] constrained because industry could not expand production due to resource constraints? As long as well all kept borrowing what's the problem?

The overall levels of consumption could not drive credit because the ability to make things and services in the organizational patterns of that day couldn't keep up with the debt demanded new wealth creation (2008, seems like a million yrs ago now). The price of oil indicated a desire for the oil ..it was not in itself a the reason the economy tanked it was just a CONTEXTUALLY meaningful indicator for that specific moment in time. $147 dollar oil now would not mean the same thing as it did then or perhaps it would but thats not my point if you get my drift. The notion of the price or any other indicator being a historically contextual marker rather than some generic "fits all of history indicator" is an important concept.

the problem of economic metrics is they tend to be viewed a simple isolated variables with fixed meanings based on scale rather than properties with changing meaning. That is my big thought for this thread

I think what your looking at there is exponential rates of interest VS resource utilization.. sure there were additional issues like the resetting of mortgage rates but if you stop for a second and thunk about it that actually supports the argument.

I think you've got some valid points in there but your grammar is so bad its hard to follow. Please try proof reading before posting.

its a common complaint

Despite being devils advocate on the oil price vs growth thing earlier in the thread I think there is a connection between PEAK oil and the sub prime crash.

The question is why did they run out of money then? .. they were always borrowing money they never had and/or realistically any hope of paying back.

Was the ability to expand levels of consumer debt and cyclically expanding the economy, the service sector in the main, foiled because of resource constraints? As long as we all kept borrowing what's the problem? The problem is the rate of new wealth production vs rate of debt repayment. which is function of exergy consumption.

The overall levels of consumption could not drive new credit because the ability to make things and provide new services in the organizational patterns of that day couldn't keep up with the debt demands (2008, seems like a million yrs ago now). The price of oil indicated a desire for the oil ..it was not in itself a the reason the economy tanked it was just a CONTEXTUALLY meaningful indicator for that specific moment in time. $147 oil today would not mean the same thing as it did then. The notion of the price or any other indicator being a historically contextual marker rather than some generic "fits all of history indicator" is an important concept.

One problem of economic metrics is they tend to be viewed as simple isolated variables with fixed meanings based on scale rather than properties with changing meaning. That is my big thought for this thread

I think what your looking at there is exponential rates of interest VS resource utilization.. sure there were additional issues like the resetting of mortgage rates but if you stop for a second and thunk about it that actually supports the argument.