The Ethanol Rhetoric Ramps Up

Posted by Robert Rapier on November 23, 2010 - 10:56am

It has been interesting to watch the flurry of ethanol rhetoric since the recent elections. With the $0.45 per gallon subsidy (called the VEETC) and the ethanol tariffs both set to expire at the end of next month, both sides feel that there is a lot at stake, and they have really ramped up the rhetoric. One side will claim that ethanol is the greatest thing since sliced bread, then the other side claims it is an environmental disaster. Around and around the claims go. Misinformation abounds.

Mortgaging the Future

I am not going to argue in this essay that U.S. ethanol policy is good or bad, but I am going to argue that extending the VEETC is fiscally irresponsible. There are a couple of issues that influence my thinking on this: (1) I think governments need to be better stewards of taxpayer dollars; and (2) I hate waste.

Over the past decade, the U.S. has been on a spending binge, spending far more money than we have collected in tax revenues. That means that we are burdening our children with debt. I believe this is incredibly selfish and irresponsible. We are supposed to work to improve the future for our children, not sabotage it. So my view is that when we spend tax dollars, we need to have a very good reason for doing it.

I also hate waste. Wasted food, energy, money, time – I loathe them all. So any time I see wasteful government spending that mortgages the futures of the next generation, I am determined to fight it.

If, however, I thought that the VEETC was actually doing something to improve the prospects for future generations, I would suggest that it was money well spent. But I don’t think that’s what it does at all, for reasons I will get into below.

The Redundant Subsidy

To review, here is where things stand. There are two pieces of legislation set to expire at the end of this year. One is the $0.45 per gallon subsidy (called the VEETC) that is paid to oil companies to blend ethanol into gasoline. Because the oil companies are also mandated to blend ethanol, the subsidy is mostly redundant. That is, we are paying a subsidy for something that is already being compelled by law. As I have argued before, it is like paying people to obey speed limits. I don’t know too many people who would think it is a good idea to borrow money from our children so we can give it back to their parents for obeying traffic laws. (You can find a more detailed discussion on the VEETC here).

The second piece of legislation is an ethanol tariff that is applied to ethanol entering the U.S. market. Brazilian producers want to see that tariff removed to open up the U.S. market, and U.S. producers want to see it maintained to protect their market. For a more detailed look at the issues around the tariff, see Implications Of The U.S. Ethanol Tariff.

I believe that the ethanol lobby recognizes that they don’t really need the VEETC with the mandate in place. After all, we had subsidies for 30 years, but the explosive growth in the industry only happened once the Renewable Fuel Standard (RFS) was passed into law in 2005. The RFS meant that it was no longer optional for the oil companies to blend ethanol; they were compelled by law to do it.

Following the passage of the RFS, ethanol use exploded, tripling in 5 years following passage of the Energy Policy Act of 2005. In fact, growth was so fast that ethanol producers produced too much ethanol. So they went back and lobbied Congress to increase the amounts that oil companies were mandated to blend. Originally scheduled to blend 7.5 billion gallons of ethanol by 2012, the new schedule increased the blend amount to over 13 billion gallons of conventional (corn) ethanol by 2012 and 15 billion gallons of corn ethanol by 2015.

The Subsidy Protects the Tariff

So if the RFS accomplished what the VEETC was intended to accomplish, why is the ethanol lobby so concerned about seeing the VEETC extended? What I think they fear is that since a cited justification for the ethanol tariff is that it prevents foreign ethanol producers from benefiting from tax credits for U.S. producers, if the tax credit goes away then so does that cited justification of the tariff. Then, corn ethanol has to compete against imports. This is something that corn ethanol producers do not want, so they lobby to keep the VEETC, which then gives them cover to argue to keep the tariff.

Shifting Strategies

It has been interesting to watch the shifting strategies of the ethanol lobby. Initially, they distanced themselves from the VEETC, saying that it really benefited the oil companies. When it became pretty clear that the oil companies couldn’t care less, they started talking about jobs, foreign oil, etc. All of that was irrelevant with respect to the VEETC, because the mandates ensured that any benefits (e.g., displaced imports) would occur with or without the VEETC in place. Later there was some dissension in the ranks, when Growth Energy suggested (as I had long suggested) that perhaps the subsidy no longer serves the function it was designed for, and perhaps some thought should go into using some of that money for developing infrastructure for E85.

Lately, however, their argument goes like this:

Unlike most subsidies the ethanol blenders tax credit does not go upstream to ADM or stay with the blender. IT GOES TO THE CONSUMER @ the rate of 4.5 cents in savings for every gallon of e10 they buy. It’s simple, just follow the money.

One thing I wanted to comment on is that these are clearly talking points that one of the ethanol lobbying groups has sent out. How do I know? They once sent out talking points related to something I wrote, and they had the same characteristics. People suddenly start to show up parroting the same line of defense. I have now seen the above argument — in almost identical style and making the same claims — popping up in lots of places where people are critical of the ethanol subsidies. The idea is to simulate this big, grassroots movement in favor of continuing the subsidy. But the comments are so similar, it is clear that this was organized.

Subsidizing Consumption

So how about the claim, that the VEETC slightly lowers gasoline prices? Actually, I agree with it. One thing the subsidy does is subsidize the price of gasoline. So it can be argued that some or even all of the savings passes through to consumers. In fact, ExxonMobil recently said as much to me:

ROBERT RAPIER: What is your position on the expiration of the VEETC at the end of the year? Do you object to that expiring? Would you be happy to see that expire? What’s your view?

MR. SPELLINGS (XOM spokesman): I think we would be content for it to expire. We do not see ourselves as the beneficiary of that subsidy. We think in the marketplace today, that subsidy probably flows through to the consumer. We do not see how it’s a subsidy that benefits us or a subsidy that benefits ethanol refiners or farmers that produce the corn, although some folks continue to think that this is a subsidy that benefits either ethanol producers or corn producers.

So let’s agree that the subsidy, at a taxpayer cost next year of $6 billion, will flow through to consumers. Now I ask you, why on earth is it a good thing to hit all taxpayers with a $6 billion bill (again, borrowing money from our children) only to subsidize fuel consumption for motorists? Why is it fair for a person who doesn’t drive to subsidize the fuel of those who do? Or for those who are very fuel efficient to subsidize those who are not?

I believe with every fiber of my being that WE SHOULD NOT SUBSIDIZE CONSUMPTION OF A DEPLETING RESOURCE. If the subsidy lowers the price of gasoline, it encourages consumption. That is the exact opposite of what we should be doing, and therefore the worst possible reason for extending the subsidy. We are not only mortgaging the next generation’s future, but the money we are using to do so will cause us to consume resources that will put them at an additional disadvantage.

The Cost of Discretional Blending

So what about the argument that the subsidy encourages gasoline producers to blend more than they are legally required to blend? This is the essence of the argument that chief ethanol lobbyist Bob Dinneen used recently when he talked about extending the subsidies without having a debate:

Bob Dinneen: In the absence of the tax incentive discretionary blending evaporates. With more than 2 billion RINs through the RFS program that are out on the marketplace, they would quickly be bought up by refiners. So there’s no question that in the absence of the tax incentive demand for ethanol will fall.

So let’s take that one on. What this means is that ethanol producers have overproduced ethanol to the tune of 2 billion gallons. (Remember, the last time they overproduced, ethanol producers lobbied for and received a new RFS schedule that benefited them). It means in 2011, for instance, that gasoline producers could buy and blend 2 billion gallons less ethanol (actually it is more like 1.4 billion gallons since the mandate increases in 2011) than the mandate requires. So if removal of the subsidy caused ethanol to be more expensive per unit of energy than gasoline — almost a certainty since it is more expensive than gasoline today — then demand for ethanol would indeed fall.

So what? Is it the fault of the taxpayer that ethanol producers produced more than the legal requirement? Should we be in the business of encouraging overproduction, or protecting industries who overproduce from the consequences of doing so? Further, what is the price that we are being asked to pay? In 2011, it would amount to around $6 billion to protect 2 billion gallons of ethanol. Really? Someone can seriously suggest that we should pay a subsidy equivalent to $3 per gallon of ethanol (on top of the cost of the ethanol!) just to make sure ethanol demand doesn’t fall? Preposterous.

Too Late for Debate?

Incidentally, what about Dinneen’s argument that it is simply too late in the year to debate the issue, and therefore the default position should be to extend the credits?

Bob Dinneen: You can’t have that in the week or two that you’re going to have in a lame duck session. So they can extend this tax incentive with, you know, a stroke of the pen, a little bit of Whiteout, just change the date. That’s what they need to do this year and let’s have a robust discussion about future biofuels tax policy and make sure we’re thinking about it in terms of what’s the best policy to promote cellulosic ethanol?

The problem with that is that Dinneen wasn’t interested in debating that issue earlier this year either. He could have been proactive and said “Let’s have that discussion.” Instead, he has simply repeated the mantra all year that the tax credits should be extended. When Growth Energy tried to have that debate way back in July, Dinneen wasn’t interested. His response to their proposal was:

“Now is not the time to add uncertainty and complexity to the energy tax debate,” said Bob Dinneen of the Renewable Fuels Association. “Losing the tax incentive will shutter plants and cost tens of thousands of jobs.”

So it should be clear that Dinneen isn’t interested in having a debate. His strategy is to stall, delay, and then claim it is too late for debate. Top it off with a bit of fear-mongering on the horrible consequences of not extending the tax credits, and you have the stale, backward-looking strategy that he has used for years. I say enough. If it is too late to have a debate, then don’t ask taxpayers for $6 billion. We are broke.

In the next post, we will examine the possibility that part of the VEETC is going toward subsidizing exports.

http://theenergycollective.com/nathanaelbaker/47551/al-gore-says-support...

Al Gore Says Supporting Corn Ethanol Was a Mistake

Has Al Gore's persona dropped so far that a statement like this receives so little attention, press, etc. I was astounded when i saw this yesterday, but the silence following it has been deafening.

He has actually made several statements over the past couple of years that tipped off that he was thinking like this. So it wasn't a big surprise to me.

Robert, It was definitely a surprise to me although you follow the ethanol debate a lot closer than I do or even wish to.

Yeah, he is pretty much "over" in terms of the limited attention spans of people moving on to more compelling

shiny objectspublic-policy stories. Actually, he got quite a lot of attention, considering. Maybe he should try to get on Dancing With the Stars.Seriously, it isn't getting attention because of the powerful forces that don't want it to. All of the corn-state politicians, all of the sugar-state politicians, ADM, sugar producers, SecAg Vilsack, etc.

sugar-state politicians...sugar producers

I'm under the impression that it's mainly one very powerful family in Florida.

No, there are many other powerful special-interest groups who make campaign contributions to legislators of sugar beet and sugar cane states. For example, look at Louisiana. Or Colorado.

It's puzzling. I've personally seen candy makers go out of business or relocate out of the US due to the subsidies.

You would think that candy makers and other food processors would have made countervailing contributions to prevent or repeal these subsidies.

Vested interests will attempt to keep the current system going as long as they can — until the wheels fall off.

Also, fundamental to the issue is that ethanol isn't in any way going to keep the current system going:

In the upper-right corner are the EROEI's of ethanol for studies done prior to 1980. They are around 1 to 1. The red data points are the EROEI's of recent studies. Some are less than 1, some are slightly greater than one.

But whether old or new, no studies indicate that ethanol is anywhere near the EROEI of the fuels with which we have built this civilization.

Only in this energy-abundant environment — with enormous debt accumulation — can some people fool themselves into thinking ethanol is any sort of solution.

There are just SO MANY fundamental, insurmountable, and easily-grasped arguments against this sort of large-scale biofuel nonsense (energetic, agricultural, ecological, social, etc). Even its continued debate is a true sign of our mass-insanity as a civilization. So it goes.

There is a fundamental argument FOR this nonsense.. If you agree with the hypothesis that world population is directly related to available food supply, then taking food agriculture production and converting it to fuel is absolutely the only sane thing for a civilization approaching resource limits to do.

We seem to have two choices:

There is a fundamental argument FOR this nonsense.

For biofuels yes, for the subsidy in question, no.

But the concept that we actually have to produce the fuel we need, rather than just buy it from somewhere else, is great. The sooner this reality hits everyone in the face, the sooner all the really wasteful uses of energy will cease.

The fact that the EROEI of ethanol is low, misses the point about the form of energy going in. Most of it is natural gas, which is not a transport fuel, and is 1/6th price of transport fuel. You put in a gas that is hard to use as a transport fuel, mix with corn, and get out a safe, easy to use liquid fuel, and some corn leftovers. And you get twice the liquid fuel out of the gas you put in.

Take a look at RR's previous post about Shell's Bintulu GtL facility - it gets 0.5 EROEI, though it does not use any biomass.

Yes, corn ethanol is not the EROEI of fossil oil - that is why we use the fossil oil first. But that age is coming to an end - comparing to that is comparing to the "good old days", and they are fast coming to an end. We need to adjust our society to run on low EROEI liquid fuels, and use less of them, because at some point, that is all we will have.

BenjegerdesFarms wrote:

We seem to have two choices:

Your choices are based on false assumptions. Ethanol production in the US is not going to cause hunger. Quite the opposite.

Third-world countries, even those that are rapidly developing, are still largely rural economies based on agriculture. That means there are hundred of millions of farmers whose livilihood depends on the price of agricultural products and in particular the price of grains. The price of grain has been stagnant for many decades. That price stagnation is what causes poverty and bare sustenance economies in much of the 3rd world.

Ethanol production in the US has resulted in unprecedented agriculture commodity prices increases. That is a boon to rural 3rd world economies.

Getting US Ag surplus off the world markets is not a bad thing.

Producing less animal fat by feeding less corn to livestock is not a bad thing.

Producing less sweeteners from corn to feed to children is not a bad thing.

If you start with the correct assumptions you might see things differently.

I have to disagree with you, Aangel. Corn ethanol as it is currently manufactured currently sucks from an energy point of view. Simple changes dramatically change the energy balance for corn ethanol, and these are changes that should be underway for her reasons. By using not tilled farming practices reduces the amount of stover required to be left at the farm. This material is then available to power the ethanol production process rather than using oil or gas. This one change dramatically alters the energy balance as most of the production energy for corn ethanol is in the distillation part of the production cycle. If the US to ever be serious about energy conservation then these are changes that should be made.

This does not make ethanol a total solution. By far the largest reduction in fuel consumption for personal transport will come with the transition to electrically powered vehicles which are far more efficient even when the energy source is coal fueled electricity.

By far the biggest challenge for Americans and Australians alike will be shifting our thinking from huge vehicles down to smaller ones. We have been living an energy lie which will be difficult to give up.

I understand all that. And I still don't think ethanol will keep this form of civilization going — or electric cars. I further think that the day of the personal automobile in its current form is coming to an end.

If we don't fight like cats in a sack over the remaining resources and enter a period of extended war over said resources, the best I can see is that we switch wholesale to motorcycles, scooters and rickshaws and save whatever liquid fuel is produced for the farmers, bulldozers, busses and the occasional airplane. We'll have some form of four wheeled vehicle but most of them won't be highway capable.

I believe what most people fail to see is that there is a societal switch that is about to be flipped. When energy gets expensive all resources get expensive but not just a little, but possibly by an order of magnitude or more.

That's because the ore concentrations we are currently mining are so low that only cheap energy and capital are allowing us to process the enormous quantities of rock it takes to get the valuable minerals and metals out. When either or both of those necessary inputs (cheap energy and abundant capital) go, resource extraction is going to plummet.

Enjoy this lifestyle now because when the cheap energy/abundant capital switch is turned off we enter an entirely new world.

Does ethanol get a subsidy or is it taxed at a lower rate than gasoline from crude oil?

This is an important distinction and a strong case can be made for taxing ethanol at a lower rate than gasoline.

Further, we can have a farm run purely by actual horsepower producing ethanol. Wouldn't this farm clearly be a net energy producer?

Complete and utter BS! Federal spending was 18% of GDP in 1980, today it is still 18%. This is all about starve the beast, and nothing to do with reckless spending, it is out of control tax cutting. You've drunk the coolaid, that decades of rightwing propagandists have been spewing.

That doesn't mean we are spending that 18% wisely. The whole ethanol program is pork for ag interests, with just a bit of wishing for a magic pony thrown it.

It appears that federal spending in 2009 was about 25% of GDP:

http://www.politifact.com/truth-o-meter/statements/2010/nov/15/kent-conr...

The recent increase is due to recession, cutting both GDP and revenues, not because the government has become a drunken sailor on holiday. The meme of "government out of control" has been firmly implanted in the population by those who wish to destroy the mixed economic model, and replace it with oligarchy. They get a lot of inadvertent water carriers (anyone who repeats the various canards that have become accepted public memes). These beliefs can then be manipulated to elect tea party types who will further decimate government revenue. Then they will scream "government is out of control, look at the deficits", and the kneejerk reaction is to cut taxes even more. If we don't wake up and figure out what is happening, but simply emotionally respond to the propaganda, we are doomed.

In nominal terms, the 2000-2009 rate of increase in federal spending would cause spending to double about every 10 years.

http://politifact.com/oregon/statements/2010/sep/27/scott-bruun/scott-br...

But if you account for inflation, the spending total is $1.78 trillion in 2000 and goes to $2.29 trillion in 2009. That’s only a 29 percent increase.

And, GDP grew 16%, so the amount relative to GPD grew by only 11% (1.2865% / 1.1569).

You need to correct for cyclical factors. In 2000, we were near the top of the dotcom bubble, in 09, the peak recession from the GFC. During recession in addition to discretionary stimulus, you have increased government expenditures, for stuff like welfare and unemployment. Absent any policy changes the government/private ratio will vary through the business cycle, with a maximum ocurring during recession.

Absolutely.

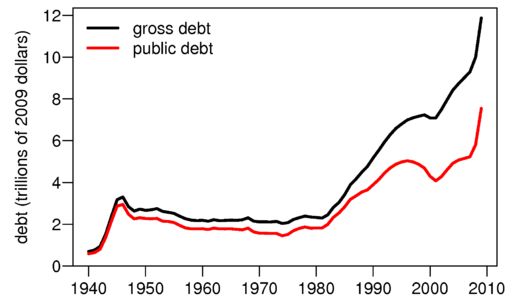

Here is another graph that may help you see what RR is pointing out:

Notice how as the private sector is deleveraging the public sector is picking up the difference. Combined, both forms of debt greatly exceed the country's GDP.

The U.S. has been on a spending binge by racking up debt. So has most of the rest of the world, btw.

Andre,

Of course debt far exceeds GDP. Debt is a stock concept; GDP is a flow concept--so much per year.

Look at the massive federal debt after World War II. We managed that debt largely by inflation to reduce its real burden by more than half during the thirty years after 1945.

IMO, most long-term U.S. debts will be wiped out by inflation rates of 5% or much more over the next fifteen years.

Except for a little cash, all my investment funds are in TIPs, Treasury Inflation Protected securities. I think TIPs are much safer than gold, for reasons I've discussed over the years in my TOD comments.

Yes, but the point I wasn't clearly making is that — unless inflation wipes everything out as you say — it is income that must pay back debt and that gets difficult when the debt and thus the interest gets very high, as it is now.

This is the thing traditional economists miss: debt matters. It's not just a transfer of spending power from one group (the lenders) to the another (the debtors).

"Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects.” (Bernanke 2000)

That's just crazy talk. Of course it has significant macroeconomic effects.

Bernanke is right. There is a ton of economic history that strongly supports BB's statement. For example, see one of the editions of the old textbook (never surpassed, IMHO) by Faulkner on U.S. economic history.

Note that economic history is a separate department from economics--different vocabulary, different concepts and conclusions from mainstream economics.

You might also Google "institutional economics" if you have the time.

Ah, Don, your traditional training (and blind spot) is showing through... ;-)

Andre,

Speaking of blind spots: How many courses have you taken in economics? How many in economic history.

Most engineers know little or nothing about economics or where the good data is on the question at issue. Economists, Economic Historians, and some Sociologists know how to find the data and how to interpret the numbers. Laymen generally do not know these essential things. That is just a fact of life.

Most engineers know little or nothing about economics

Actually, they usually know more about economics than most other professions know about engineering. A standard course in Engin school is called "engineering economics". Much engineering training and practice involves practical elements of economics.

The problem here isn't engineers. I think you'll find they're more sensible on average, because it's perfectly clear to any sensible engineer (who's put some attention to it) that there are lots of substitutes for oil in particular, and FFs in general.

The problem here is people who have neither engineering or economics training. They include journalists like Stoneleigh and Kunstler; lawyers like Simmons (though he was sensible most of the time) and LATOC; druids; biologists who misapply ecological concepts to human systems; etc, etc, etc.

Does Engineering Economics have much to do with macroeconomics? My understanding of Engineering Economics is that it is either all or almost all microeconomics. I've known more or less well about 100 engineers, including several with Ph.D.s (or whatever the engineering equivalent is for a full professor). Of the 100 engineers, one had majored in economics and then changed to engineering in grad school. Two more engineers were interested in and had studied more than the minimum in economics.

You seem to have a good knowledge of economics, so I'll list you as #4 on the list. But have you ever studied the economic history of the U.S.?

In general, it is good advice that the cobbler should stick to his last. There are, of course, exceptions.

Well the engineering economics of this issue are that the subsidy is not actually achieving anything much, compared to if it wasn't there. So it is a waste of money in the first place, and waste being financed by deficit makes it even more wasteful.

RR addressed this further downthread, but I'll quote him here;

Whether it was spending or borrowing isn't relevant to the point that it is deficit spending on a useless subsidy. So I don't want people to become distracted by whether or not the deficit increased from spending too much or taking in too little.

As an engineer myself, I would agree that we know more about economics than most economists know about engineering. We have to , as all engineering projects are driven, ultimately, by economics, but not all economics is driven by engineering.

And I would like to think we are pretty good on microeconomics, again mostly because we usually have to assess that in any project.

For macro, we are probably as knowledgeable, on average, as any other well educated people who don;t work in that field. But, because of our nature, we generally take a fairly pragmatic approach - we like to see government money actually "doing something", because if it isn't, we have plenty of things waiting to do something with it.

In the textbook I wrote, ECONOMICS: MAKING GOOD CHOICES, there is a full-page critical thinking exercise on the inefficiency and undesirability of quotas on sugar imports and other price support policies for domestic sugar beet and sugar beet producers.

To the best of my knowledge, all economists that are familiar with the subject argue vehemently against U.S. protectionist measures on sugar to keep out foreign-produced sugar. They do this because such government interference violates the principle of comparative advantage, which is a Big Deal in economics since the days of the great Ricardo.

For many decades the world price of sugar has been roughly half the U.S. price of sugar. When I can, I stock up on sugar in Canada, because it is so much cheaper than in the U.S. Also, if kept dry, sugar lasts indefinitely.

Sugar is great for making lab alcohol or other varieties of potable ethanol. Of course, I never do anything illegal! My first alcholic drink was lab alcohol (at age 14), and it is the same thing as 190 proof Everclear.

Glad you survived that first drink. When we made alcohol in science at that age , a class mate of mine made a homemade still and made himself very sick - not the alcohol itself, but some impurity in thus.

I have never understood the US sugar thing, but then, I really don't understand why there are a lot of agricultural related subsidies. I lived in New Zealand not long after they got rid of all their agricultural subsidies, and the ag industries that survived the bloodletting were just ramping up for real exports, and now they have world class stuff, that you can buy all over the world - a great Ricardo example.

I wish Canada would do the same they are still subsidising/quota controlling dairy, eggs, even grain, to some extent.

Ricardo had it right then, and still does now (as did and does Adam Smith, in my opinion). The attitude of governments that the economy will totally and utterly fail if they don't "do stuff" is baffling.

Actually its just special interest group politics. The benefit from (say) a sugar import restriction goes to a small but easily identified group, who will be willing to throw their weight and money behind or against a politician depending upon his support of sugar import issue. The losers, are the rest of the country, which is diffuse enough that they tune out the issue. A small but well

connected group will win almost every time. Only ocassionaly does a real analysis of the benefits and costs to the whole economy enter the picture.

Exactly.

Actually, government is often very competent to do the kind of Pigovian adjustments and counter-cyclical fiscal management that government ought to do. But, they're not often left alone to do it properly.

The story of the sugar tariff and its effect on ethanol manufacturing and corn syrup is a fascinating one. And yes, you're right that a small group of people (or a big corporation) can have huge effects on public policy. This isn't my favorite rendering of the story but I'm unable to find my favorite so this must suffice:

"Ethanol's revival is intimately linked to one company, the giant grain-trading firm Archer Daniels Midland, and one seemingly unrelated product, high-fructose corn syrup. The story centers on a man who arguably counts as corporate America's most generous and influential political donor of the second half of the 20th century, former ADM CEO Dwayne Andreas. To understand the weird and lucrative nexus between an industrial sweetener, a gas substitute, and a grain magnate, we need to go back to the days of disco."

http://www.grist.org/article/ADM1/

Catmint, the American politicians bitch like hell if any other country is in the least bit suspected of bribery while, at the same time, accepting the mordidas of campaign contributions.

NAOM

I'd agree with Paul N's comments. Engineering Economics is primarily an intro to financial analysis: present value, cash flow, etc. There is enormous diversity in engineering - branches of engineering deal with cost/other optimization, operations & systems analysis, forecasting, etc. Engineering, as a heavily quantitative field that deals fairly heavily with cost analysis, is a good background for learning economics.

You seem to have a good knowledge of economics, so I'll list you as #4 on the list.

Thanks!

But have you ever studied the economic history of the U.S.?

Sure. I've read several editions of Heilbroner's work, and a number of economic histories - US, world, industry, etc. I particularly liked Yergin's work on oil, Sloan's autobiography (which is mostly a history of GM), and Zinn's People's History (which is technically poli-sci, but has a heavy emphasis on economics).

In general, it is good advice that the cobbler should stick to his last. There are, of course, exceptions.

I think that the important thing is a sense of humility - knowing that there are few truly new ideas, that one has to fully research topics, etc. Also, that one has to specialize to be most effective. Nevertheless, some diversity of ideas and cross-specialty knowledge is essential to almost anything.

I find the lack of humility on TOD to be breathtaking. This lack of respect for other professions, especially economics, leaves TOD often irrelevant and sometimes ridiculous. For this reason, there are very few people to whom I recommend TOD. It's too bad. Perhaps the coming changes will help.

I heartily agree--and most especially with your last paragraph. You said it better than I could have.

Do try to get ahold of a cheap old copy of Faulkner for economic history of the U.S. It is a fascinating book and well-written. I do not like the more recent texts on U.S. economic history, because they tend to skimp on the Colonial period.

Thanks.

I'll add Faulkner to my list of things to read.

Sorry Nick, Don, but before you can make an appeal to authority to bolster your position, you need to ensure that authority is accepted.

Unfortunately economics has demonstrated time and again that it DOESN'T know what the hell is going on, and that by following its 'laws' you can make a right hash of things.

As it is, its an art wrapped in the clothes of science. You can't be surprised when various science/engineering types prod it, find that its not sound, and call it as such. Cold hard light would be the term. House of cards would be another.

I'd suggest that the 'lack of humility' is on the part of the economists - failing to accept the failures of their discipline and fix them. Respect is earnt, not demanded.

Now I won't be surprised to see this posting met with the usual bluster rather than considered acceptance of the truth; but I'll leave you with this thought. Real sciences type to simplify their subject; find essential truths; then build systemic representations of the real world that match. Economics persists in trying to turn rules of thumb into 'laws', ignore the cases that don't match, ignore evolution in the system, and confuse matters by layering complexity on top to hide the reality.

The evidence is that it's simply not fit for purpose.

Economics is a social science, just as sociology, cultural anthropology, and political science are social science. History is also often considered a social science.

I cannot think of one single economist who ever said or wrote that economics is a "science" in the sense that astronomy, biology, chemistry, and physics are sciences. And there are bogus parts of economics, just as bogus elements intrude into the other social sciences--no question about it. I twice failed my oral examinations for a Ph.D. because I explicitly identified some of these bogusities and suggested a radical transformation of the discipline to integrate it with other social sciences. I have never been a mainstream economist, though I admire immensely the work of men and women such as John Maynard Keynes and Joan Robinson.

Hence, I think you are committing the fallacy of attacking a straw man.

BTW, I do not consider economics to be the Queen of the social sciences; IMO that title belongs to anthropology.

Key question: Is economics fit for purpose?

I wouldn't be quite as vehemently down on economics if it actually, scientifically, said that it didn't really have a clue. Then maybe we could clear the decks and deal with the real problem (the system has been setup to be beyond control), and not chase actions based on decade old thesis that have already been shown not to be 'scientifically' right.

Instead we get literally countries being bet on economists' ideas. I had hoped after the massive and obvious failure of virtually all economists to predict the recent financial crash (despite all the evidence) that they would have the honour to slink away - but nope. Even when they were running around like headless chickens after the sky fell, they were confidently stating that we should do the opposite of what the Japanese did; because that didn't work. It's the global society version of the car mechanic 'hitting it with a hammer' because they've no idea what's wrong.

Economics isn't the Queen, and it isn't even the Joker. Nope, its the Ace; played high by the card sharks, but really only worth one.

Agreed. The economics profession as a whole is generally failing right now (this will become more clear over time as this form of economy disintegrates and fails to magically adjust to declining resources and increased pollution i.e. CO2) and, based on the responses of Nick, Don and Jeff Rubin at the ASPO conference when challenged, is also demonstrating an inability to even see the that they have a problem. Thankfully not all of them it seems. The paper from Krugman seems to be a positive step and the economist from the IMF I spoke to at ASPO was able to see that a change in thinking was required, too.

Queen Elizabeth had the right question:

The reason is that the current crop of economists are using a model with a conceptual flaw in it so large that the entire world economy could fall through it — and in fact did.

At least someone in that profession is being critical. Dirk Bezemer, Professor of Economics at the University of Groningen in the Netherlands, put out a paper in 2009 in which he counted how many people predicted what was going to happen in 2008. To be included the following criteria had to be met:

Source: http://www.debtdeflation.com/blogs/2009/07/15/no-one-saw-this-coming-bal...

At the time of writing, the count was a dozen. Since then others have surfaced and the count is now up to three dozen.

Out of a profession with 15,000 practitioners in the U.S. alone, 36 people seeing something as big as what just happened it pretty poor, I would say. If civil engineers had that bad of a failure rate you can trust that there would be some significant soul searching. Actually, because civil engineering math, being based on physics, is so mature that would just never happen in the first place. The occasional failure does occur but nothing like the repeated failures of the economics profession:

What was common in all the predictions that passed the criteria was that they explicitly modeled debt.

Is the small sample size of Nick, Don and Jeff Rubin enough to warrant saying that they economists are still not to be trusted?

It's probably still too early to make that call but it doesn't look good. I'm inclined to think that the current crop has to pass before some new thinking has room to make a difference.

Predictive power is an interesting problem. There are many areas of human endeavor which have difficulties with forecasting. Medicine has a hard time predicting who will have a heart attack. Geology has a hard time predicting earth quakes. Civil engineering has an easier time because they're not expected to make predictions for natural systems - a bridge, say, is a synthetic system, something entirely built by humans, and therefore it's behavior much easier to understand and predict.

Economics is trying to predict one facet of perhaps the most complex natural system in the world: human society. It shouldn't be surprising that this is difficult. Nevertheless, I think you'll find as much correlation in the chart you reproduce as we find in another chart you've occasionally reproduced: the correlation between oil consumption and GDP.

Now, a few people predicted this bank panic/recession. Of course, there are always people predicting recession - they can be described as predicting 20 of the last 5 recessions. Like a stopped clock, they'll occasionally be right.

On the other hand, we have to ask: can they predict other things? For instance, why has Stoneleigh done so badly? Here's a prediction from November 2008: "We appear to be beginning a market rally at the moment, which should lead to precisely this set of trend reversals. Such a rally is only temporary relief however. It may last for a couple of months, but then the decline should resume with a vengeance." http://theautomaticearth.blogspot.com/2008/11/debt-rattle-november-29-20...

That was 24 months ago...

And, finally, Andre, did you predict the current recovery? Yes, it's slow, but there's no question that there was a bottom, and that things have recovered from there, and that the US economy is currently growing. A year ago, did you predict that?

Civil engineering has an easier time because they're not expected to make predictions for natural systems - a bridge, say, is a synthetic system, something entirely built by humans, and therefore it's behavior much easier to understand and predict.

Nick, you are obviously not a civil engineer, and/or haven't worked with many, or you wouldn't say something like this.

We need to predict natural systems all the time - it is the elec eng's, and some branches of mech eng, that rarely have to do this.

The foundations for said bridge rest on a natural system, and no matter how strong the bridge, if you don't understand what it sits on, it may fail. There is a building in Italy in a town called Pisa that is a good example of this.

When we design a dam, be it for hydro-electric, irrigation storage or flood control, we not only have to understand the foundations, but also the weather/rainfall/runoff patterns, and predict what they may be for the next 100years. Same for designing an urban stormwater system, or a pipeline crossing a fault zone, a road over a swamp, the wind load on a tall building, the impact on river/beach sedimentation of bridge piers/breakwaters, seawater corrosion on dock pilings and on it goes. In fact, almost every civil project involves interaction with, and thus modelling of, the natural environment.

We have to model natural systems all the time - it's part of the job.

Fortunately, what we don't have to model (much) is human behaviour - we simply assume the worst, and work from there!

civil engineer...need to predict natural systems all the time

Of course. I just wasn't thinking - I've actually worked with many. Civil engineering deals with a mix of natural and synthetic systems. I was just thinking of the synthetic designed part, but of course it's embedded in the natural, and perhaps most of it's job is coping with ("taming", if you will) the natural part. That's a lesson in dashing things off too quickly, or perhaps just in the importance of peer review...

The point is simply that engineers design things, which means that they have a basic advantage in understanding how something works and how it will behave, while many other disciplines simply have to cope with natural systems over which humanity has relatively little control (including humanity...).

To most people aware of the issues we discuss here, it's pretty clear how poorly the economists are doing both in the short term (the graph from Société Générale) and the longterm (the imminent collapse of the world economy because of a fundamental error in their thinking):

The biophysical economists are doing their best to rectify the situation but they are so small in number that they aren't making much of a dent.

As for your specific questions about the near-term performance of the economy, the highest granularity I go to is 5 years i.e. if I anticipate something will happen by 2020, I make sure the audience knows that it could happen in 2015 or 2025. The point is to be ready for the event before it happens and that as time progresses the probability of it occurring increases.

Currently I am saying that the chance of a cascading stock market failure is 50/50 by 2015 and 99% by 2020. I base this on my anticipation that a contracting economy due to oil shortages will not support the current stock prices and people will at some point panic and run for the exits. The exact trigger isn't relevant; I believe the system to be in a very precarious state.

On January 1, 2020, if the stock markets of the world haven't crashed, I will gladly buy you a wonderful dinner with some fine wine.

Edit: If you'd like to hear how I typically phrase it, please listen to my interview on CBC Radio with Colin Campbell and Michael Lynch:

http://www.postpeakliving.com/content/cbc-radio-interview

To most people aware of the issues we discuss here, it's pretty clear

I don't know about relying on "common wisdom". For instance, it seems to be the same kind of common wisdom that the US has outsourced almost all of it's manufacturing, when in fact the US has 50% more than it did 30 years ago. The common mistake comes from the dramatic fall in manufacturing employment, due to rising labor productivity.

As for your specific questions about the near-term performance of the economy, the highest granularity I go to is 5 years

Really? You've refered often in the last year or two to the economy being in decline, vehicle sales falling, etc.

I base this on my anticipation that a contracting economy due to oil shortages

Yes, that's our basic point of difference. It still puzzles me. Given that the world has managed to grow strongly for 4 of the last 5 years with oil production flat, I can't imagine how anybody comes to that conclusion.

The world economy grew strongly in 2004-2008, declined only .6% in 2009, and grew by about 4.6% in 2010. http://www.reuters.com/article/idUSTRE6670UK20100708 . The US's economy is 2.5x larger than in 1979, while using no more oil than in 1979.

The world's liquid fuel output in 2020 is likely to be at least 90% of current levels. A 10% reduction would certainly reduce economic activity by a few percentage points (perhaps as much as 5%, total) compared to what it would have been otherwise, but a reduction of .5% per year vs the status quo isn't "that big of a deal", in the larger context.

In the long-run, we can and will eliminate our dependency on oil. I'm looking forward to it.

Yes, I know, and I'm tired of explaining myself to you. You clearly can't see the impact that declining oil is going to have on our civilization. You're like x with EROEI and how he continually misses the point because his foot is nailed to the floor.

Good luck with that.

I'm tired of explaining myself to you.

I understand.

It's too bad we can't get to the heart of why you believe that "the impact that declining oil is going to have on our civilization" is so strong. I've reviewed all of the evidence you've given, and none of it really supports it. I wonder what it was that convinced you, and how we can find that out, so that we can clarify for you why it doesn't make sense?

I just don't understand how one can look at the economic growth in the US and world, in the face of flat or declining oil consumption, and think that oil is this magical, irreplaceable ingredient to economic growth.

Heck, I've almost completely eliminated oil in my daily life, with electric trains. I could use my electric scooter to eliminate the rest, if it was safer. I could buy a Leaf, but the 2k miles I drive per year wouldn't justify a new car.

By the way, x is right about E-ROI: it's less important than liquid fuel returned on liquid fuel invested.

I hit the problem of slightly disagreeing with myself here.

I've said I'm not happy with Tainter's words because he says that complexity necessarily creates extra energy usage and therefore lower returns which eventually cannot be met > collapse.

I don't think the 'necessarily' holds true - that we could have more complexity (in the complexity science definition of the word) and lower energy usage at the same time.

However, I have to give him that generally, when humans increase complexity to deal with problems, they tend to increase energy usage. In short, we're usually quite dumb in what we do.

Roll that into a declining oil situation and you get less energy to deal with problems, at exactly the time those problems are increasing because you don't have the oil available to make the existing system work.

Now we could be super smart this time round, as I suggest is possible, and engineer our societal systems to use less energy to meet the problems created by less oil. Or we could massively ramp up other energy sources, whist re-engineering our society, such that we can use the energy to effect the transition. The possibility for that comes down to time and the steepness of the decline.

I'm not putting my money on us being super smart this time, or of the decline being shallow enough, or of us starting transition in time (that one's a given) - I think we are going to be as dumb as we've always been, and things are going to break.

I'd suggest if you want to understand this area, you need to get a whole system viewpoint - and be prepared to slaughter a few economics sacred cows.

PS we've had anaemic 'growth' whilst a plateau because we've been running up debt and using accounting tricks to paper over the cracks. In essence that 'growth' number you quote is based on poor metric of what's actually going on - and reality is intruding, or haven't you noticed?

> "Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects.” (Bernanke 2000)

Bernanke is right, in equilibrium.

Eggertsson and Krugman's new working paper provides a macroeconomic model for exactly what aangel is saying. When a large negative shock to debt limits happens, the marginal propensities to spend of borrowers and savers do diverge markedly.

It turns out that the distribution of debt does matter after all.

Now, we just have to wait 30 years for this result to make its way into the textbooks.

In the model, deficit-financed government spending can, at least in principle, allow the economy to avoid unemployment and deflation while highly indebted private-sector agents repair their balance sheets, and the government can pay down its debts once the deleveraging crisis is past.

This doesn't seem to support what aangel was saying.

Aangel: > Yes, but the point I wasn't clearly making is that — unless inflation wipes everything out as you say — it is income that must pay back debt and that gets difficult when the debt and thus the interest gets very high, as it is now.

The paper talks about "the paradox of flexibility" in which the rate at which incomes decline exceeds the rate of deleveraging. It seems to me that André has a worldview which assumes incomes are about to start, or have started, a secular decline, or at best have stopped growing, and his statements need to be interpreted with that in mind.

Of course debt-financed fiscal stimulation of the economy could short-circuit the paradox, ceteris paribus. If everyone's incomes are in a secular decline, that's a one-time delaying tactic.

Note the humongous difference between real (i.e., adjusted for inflation) income and nominal income. Over the next ten years I expect real income to fall substantially in the U.S. due to declining oil production. But I also expect nominal income to rise prodigeously due to accelerating inflation. Debt, of course, is written in nominal terms, except for Treasury Inflation Protected Securities (TIPS).

Keynes noted that inflation tends to exist and increase because of the "superior political influence of the debtor class." He is right. Politics says "No!" to any risk of deflation, but "all right" to QE2, which definitely has major inflationary risk attached to it. The history of the Fed is a history of mostly inflation, with the single exception of the Great Depression. Today the purchasing power of the 1913 dollar (date of Fed's founding) is worth more than twenty-five dollars of 2010. In other words, the currency has been debased and debauched. In this respect, I expect the future to resemble the past.

If we could just get rid of the quotas on sugar imports and other subsidies that raise the price of U.S. sugar, I think that cane ethanol would make sense for the U.S. Not as much sense as it does in Brazil, but still profitable and probably able to scale up to take the place of more than ten percent of our petroleum imports and gasoline imports.

If we could just get rid of the quotas on sugar imports and other subsidies that raise the price of U.S. sugar, I think that cane ethanol would make sense for the U.S.

If you consider sugar as a feedstock for ethanol, it makes little sense to have an import quota on "energy", there certainly isn't one for oil. A similar situation exists with tariffs on lumber imports. If you regard each board foot as solid fuel, or biomass to liquids feedstock, which it can be, then it makes little sense to tax renewable energy imports, and not oil - but that;s the way it is!

Eventually, the south will work out a way to grow more biofuels. It is odd that the warm weather states ideally suite for max biomass production don;t, while the northern states better suited for specialty food, do.

Today the purchasing power of the 1913 dollar (date of Fed's founding) is worth more than twenty-five dollars of 2010.

Don, that sounds a bit high. I would have expected something around 10 dollars. Where did that come from?

Check the endpapers of any major economics textbook (for the macro and micro courses). You will see a chart. What three and a half cents bought in 1913 is approximately equivalent to one U.S. dollar today.

I took economic statistics from a man named Kuznets. (You can Google him.) He said in regard to price level index changes over a hundred years: "We're lucky if the first digit is right."

The price-level index I most often use is the GDP deflator, because almost all economists agree that this is the best index to use. Unfortunately, we do not have solid GDP data before about 1940, so once you go back farther than 1940 you have only SWAGS for GDP data. So far as I know, all macroeconomists know about the great difficulty in constructing price-level indexes over long periods of time. I took a year long course (two graduate seminars) in constructing price-level indexes--one on theory, one on real-world problems.

The problem of constructing long-term price level indexes is hairy. But consider the following:

1. When I was a kid, movies cost 12 cents--10 cents for the ticket and 2 cents war tax.

2. When I went on my first date, in 1948, the price of a goodly portion of Coca Cola at the soda fountain was 5 cents--one cent more if you wanted a cherry coke, which both me and my date (a sexy second-grader) did.

3. For a long time the price of a stamp for first-class mail was 3 cents--5 cents for airmail. And the postal service used to be much better than it now is. You could get a special delivery stamp for 25 cents; I don't know if you can buy special delivery stamps anymore. Also we used to get two deliveries of mail per day, one in the morning and one in the afternoon. Local deliveries were made in 24 hours or less.

4. The price of a paper kite was 5 cents when I was a kid--then it rose to 10 cents. Shocking.

5. My father bought the house at 51 Lake Ave. in White Bear Lake, MN for $4,800 in 1943. It's current appraised value is well over a million dollars (lake frontage and two lots on a desirable corner).

6. An office call to the doctor was $4.00. A house call was $5. Do doctors even make house calls anymore?

7. Gasoline was 15 cents per gallon for a long time. Gradually it rose to 25 cents during the early 1970s.

8. Milk delivered to the door in quart bottles was cheap. Do milkmen still make deliveries?

I looked at the BEA, and they say that the deflator for 1940 was 7.7% of the 2010 figure. So, that suggests inflation of 120% from 1913 to 1940. Given the deflation of the Depression, that seems a bit high to me.

Oh, well. If it's on textbook endpapers, I suppose it's probably correct.

Greg - Your comment ("it is income that must pay back debt...") brings me back to the chat we had earlier. For the most part we aren't paying back debt...just paying the interest. The net presenty value of the debt payoff is reduced by the discount (inflation) factor. But we're not paying off these debts for the most part...we're refinancing them. And the NPV works against in this aspect, doesn't it? IOW when we refinance a $10 billion bond in Year 20 the NPV today of that future $10 billion note is significantly larger than when we issued the original bond in Year 1.

Does that make any sense. It gave me a raging headache as I typed it so I'm not sure if I have any idea what I'm talking about. Do you? Thank goodness I'm a geologist and not an economist...Don might take some mercy on me.

I think geology and economics are equally difficult. You can believe the numbers the economists publish just as much as you can rely on petroleum exploration geologists to give you accurate and valid numbers on oil reserves in a field.

Perhaps I'm doing an injustice to economists;-)

Err, I'd say your doing an injustice to geologists.

At least in the end, if the field doesn't deliver the oil they claimed, they will admit they were wrong.

gary - Not entirely. If we don't get the recovery projected geologists can always fall back on the last line of defense: damn production engineers screwed it up.

Or blame it on the damn exploration geologists. I'll repeat a tale that shows just how wrong they can be. My first assignment with Mobil Oil in 1975 was to begin development drilling on a new field discovery in the GOM. My job was to just shuffle the paper work while we drilled off the exploration groups maps. My first 5 wells off the platform were DRY HOLES. Field reserves dropped from 125 bcf to 25 bcf and 25 million bo to 1 million bo. I was dubbed the "undevelopment geologist" of the year. The 2 exploratory wells found x number of reservoirs. The exploration group assumed they would be productive in all the different fault blocks. Obviously a very BAD ASSUMPTION!

Thus began my career as a development geologist who never believed another damn thing any exploration geologist said. LOL. To be fair the explorationists often work with a minimum of data. More drilling = more data. And then when you get to the production phase the knowledge base really expands. That's why it's a shame the KSA et al won't share their data. We could very accurately predict future oil production rates from the known fields today...probably down to 5-10% accuracy. Production trend lines are always much more telling than any map set.

This is religion for GaryP and the engineerists. They're ranting not listening, so you will never convince them. Engineers perfect, economists devils.

Well, a few things.

1) I'm a scientist first and engineer second.

2) My view of economists is a learnt affair. I didn't always have such a downer on them, but the more I learnt, the more I couldn't believe the junk they took as 'laws'. If it were archaeology it wouldn't matter, but this is what societal decisions are based on - and its not even close to fit for purpose.

Frankly I think they are at about the level of water dowsers; and we need REAL science in there, its too important.

Don't bring up water dowsers. The last time I did that several people chimed in to say it was real.

But they weren't all economists

I know a lot about income distribution, both from my roughly 200 credits in sociology but also from classes in economics and economic history.

Your statement that the Bernanke quote is only true in equilibrium is highly misleading. The whole point of economics is that economic variables (such as MPC and MPS) tend to move toward their equilibrium point.

And yes, I have also studied economic dynamics in some detail.

> The whole point of economics is that economic variables (such as MPC and MPS) tend to move toward their equilibrium point.

Yes. Well, no. An equilibrium. After a shock, the system could move to a new one. E & K's paper discusses this for the situation that the US now finds itself in. They say that the key insight is that the distribution of debt does matter in this situation. Neither of them is an economic slouch, either, Don.

Thanks for joining the conversation, gregvp, I'm catching up to the comments as I eat my dinner.

I haven't looked at the paper to which you linked but it does sound from your description like what Keen has been demonstrating for some time now. His various presentations (including the recent one at the American Monetary Institute) point out why debt matters.

Don: as for your suggestion that people should "stick to their knitting," forgive me if I politely ignore that. I'm of the view that a reasonably inquisitive person who doesn't have their foot nailed to the floor (i.e. some agenda or ideology) can understand just about anything — including the very hardest math. Of course it can sometimes be real work but mostly people give up before they gain the understanding they seek.

Or they don't even start because they made some decision about themselves when they were eight years old, like "I'm not good at (math/science/art/whatever)", which they sentenced themselves to for the remainder of their lives. When people truly let go of these sentences they have issued to themselves they almost always are surprised by the results.

This seems to be a consistent theme of yours that people shouldn't ask tough questions if they happen to re-examine a popular belief (in this case, yours).

Sorry but no thanks. Those are the best kind of questions. So you might as well stop making those suggestions to me because I'll tell you now that the chance of me following your suggestion is just about nil.

I assert that the current understanding of economists has at least one fundamental flaw that I know about, which is why their predictive power is just so damn poor:

Since you are writing economic textbooks, I'm inclined to think that your world view shares this flaw and what you have written so far seems to confirm it.

I'd be glad to send you a copy of my textbook; it is very cheap on amazon.com

So you think I'm qualified to debunk engineering just because I'm good at math? I think not. I leave engineering to the engineers--even though they sometimes make huge errors such as on the I-35W bridge over the Mississippi that collapsed. In other words, engineers make faulty predictions (Remember that engineers signed off on the final and fatal launch of the space shuttle Challenger.) all the time--exactly as do economists.

I'm no more qualified to debunk engineering than you are to debunk economics.

A cobbler who sticks to his last generally can make excellent shoes. He isn't likely to be much good as a gunsmith.

Don, you are of course free to think whatever you like. In the meantime, I'm going to continue to point out the flaws of the economists and you are very welcome to point out the ones the engineers make. I have no problem with that.

The funniest (and possibly true to some extent) critique of engineers that I've heard came from a clinical psychologist (Ph.D. and about fifteen years of practice as a psychotherapist). Here is the essence of what she said: "All engineers are more or less autistic. Most seem to have Asperger's Syndrome."

Now I am not a psychologist, so I cannot offer an expert comment on this generalization. If the generalization is true (and she did use the words "All engineers . . .), that would explain a lot of the behavior I've seen among the roughly 100 engineers (mostly EE) I've known.

Umm....

From Wikipedia on Asperger's syndrome;

"Asperger's syndrome (pronounced /ˈæspərɡərz/) is an autism spectrum disorder that is characterized by significant difficulties in social interaction, along with restricted and repetitive patterns of behavior and interests. It differs from other autism spectrum disorders by its relative preservation of linguistic and cognitive development. "

So she is playing up the stereotype that engineers have poor communication and social skills - and there are certainly some that do, but engineers do not have monopoly on that. As for repetitive patterns of behaviour and interest, absolutely - that is why most of us engineers love doing engineering.

And it is a good thing that we have these repetitive patterns, because we want to get what we do, right. Like the saying goes, "doctors get to bury their mistakes, but engineers have to live with theirs for all to see" I would also add, that engineers, more than anyone else, have the potential for hundreds/thousands of people to die from their mistakes, so we take not making them very seriously. If that means we are portrayed as being obsessive/compulsive, verging on autistic, then so be it. You want the person who is charge of providing clean, safe drinking water to you, to be obsessive about the cleanliness of such.

A clinical psychologist makes a mistake - and what happens?

An economist makes a mistake and ...?

I'd suggest that says more about psychologists than it does about engineers.

Look at the massive federal debt after World War II. We managed that debt largely by inflation to reduce its real burden by more than half during the thirty years after 1945.

Agreed that debt has been much higher as a fraction of GDP, but after WWII prospects for the U.S. were very bright. I can't say that today.

IMO, most long-term U.S. debts will be wiped out by inflation rates of 5% or much more over the next fifteen years.

Whether you are wrong or whether you are right, it doesn't change the fact that we are needlessly going into more debt by spending money on foolish programs. So whether the debt is wiped out or not, this essay describes $6 billion a year that we should not spend.

Robert - a couple of points you might elaborate upon when you have a moment. I understand the inflation argument with respect to paying back a loan with $'s of reduced value. But isn't that the most valuable when you're making one balloon payment at the end of the loan? But we aren't doing that. We're making interest payments this month on money we borrowed last month. And those interest payments are coming out of this year's budget...not decades down the road. Also, doesn't the concept of reduced value of repayment due to inflation depend upon actually paying off the loan? In other words, aren't we essentially refinancing old loans every month? IOW we aren't paying off the loans with reduced value $'s because we aren't actually paying off the loans. We're just paying the interest on the loans. And know we're borrowing a portion of those interest payments by taking out new loans? We have X trillions in loans we're paying interest on with today's $'s...not reduced valued $'s decades down the road.

Isn't that the running joke with the credit card companies: they don't really care if you eventually don't pay the loan off as long as you keep making those high interest payments for the next few decades. IOW they may not get that $10,000 balance paid off but they collect $60,000 or so worth of interest over the life of the loan.

Rock - the other blade of the debt repayment scissors is growth. If you take out a loan when your income is $10,000, repaying it when your income has grown to $50,000 is much less of a burden.

Assuming the loan is nominal (not inflation adjusted) then, as your income grows, the interest payments become progressively less of a burden as well. $50 per month means a lot more to the person on $10,000 than to the person on $50,000.

If you assume you income is always going to grow, it doesn't really matter whether you pay off the debt, because you know you can pay it whenever that might be necessary. And governments always have something else to do with their income -- or, rather, pressure groups always find them something else to do with it.

But note that assumption. It's a biggie. I never really understood why Gail made such a big to-do about debt in some of her posts here on TOD, but I'm starting to get it now. Switch from inflation and growth to deflation and ... what's the antonym for growth? shrinking? ... and debt looks like a Very Bad Thing Indeed.

Hey! I've just turned into a Debt Bug! ;-)

...and yet one aspect of de-growth is very low interest rates, which leads to the Treasury borrowing more with less burden. I have read that the US government's payments on debt interest are much lower now than in many years.

Of course there's likely to be a catch there, such as if one's position becomes one where high interest rates cannot be survived.

Valid points Greg. But my point was that you don't pay the note off when you're making $50,000....you borrow the same money back again. And this time you're borrowing value reduced $'s thanks to inflation...so you have to borrow more to buy the same stuff you bought decades earlier. And while you were growing you were paying part of your increased earnings in interest. So you've given up part of your increase while at the same time didn't pay the balance off. So now you have to pay back the same loan all over again. And you're still just paying interest and not balance. Add to that the new loans you've taken out to pay for your budget short fall which is partly due to the interest payments you have to continue paying on loans you took out decades earlier.

I know what you mean about being a debt bug. What did it for me was to pay close attention to how much of the fed budget is going towards interest payments. One interesting metric of that aspect: the interest payments we're making to China today is more than they spend on importing oil by around 25%. So not only are we turning over a big chunk of the fed revenue but are also funding China's effort to buy up future oil reserves thatwe won't have access to. Framed like that I wonder how many would really see the inflation adjusted payback as a good thing.

the interest payments we're making to China today is more than they spend on importing oil by around 25%.

hmmm. IIRC, China is importing about 1.5T b per year of oil, or about $120B. China has about $2.2T in Treasuries, at perhaps 2%, on average, for about $44B in revenue.

That sugggests that US interest payments are only funding less than half of the Chinese oil bill.

Nick - I don't have the link nor can I confirm it's accuracy.

Just pulled this up from wikipedia (http://en.wikipedia.org/wiki/United_States_public_debt): as of 7 Nov our T note debt was $13.732 trillion. China owns $846.7 billion of the T bills (July 2010). Using your 2% that means we're delivering almost $17 billion/yr in interest payments to China.

EIA says China imported 1.57 billion bo in 2009. Or some where north of $100 billion/yr today. So the interest doesn't even cover 20%. I must be more careful who I reference. Thank goodness few pay attention to any economic statements coming from a geologist. Otherwise I would feel very embarassed

Well, heck, I just had a flaky mistake caught by Paul Nash.

That's part of the fun of TOD...

True Nick. One reason I don't mind tossing out questionable reports: almost always someone who has the facts straight.

Happy Gobble Gobble to the TOD mob.

Happy Thanksgiving to, and all!

As you can see, the really big issue, is private, not public debt. And countercyclical spending means the government has to increase its debt burden while the private sector unwinds its own. The government can't go broke, it creates/destroys money via the central bank. And it isn't vulnerable to hyperinflation either. With a constant velocity of money the inflation rate is the rate of increase of money minus the rate of increase of net production. So the government could fund an X% deficit indefinitly as long as

the sum of the inflation rate minus the GDP groth rate equals X. So if we take some reasonable numbers say X=5%, and the growth rate is 2%, the long term rate of inflation would be only 3%. This is in stark contrast to the way it works for families and businesses, where a builtup debt hole is a serious problem. Since people don't understand this, and the special status of government feels unfair, this meme is endlessly pounded in. The result is just more starve the beast politics. The result is to let the oligarchs take it all.

Philosophically, I'm closer to your thinking than my comment may first appear but it's still important to note what I think is an error in your thinking:

That is in a strict sense true but misses the point. Debt and the changes in the level of debt currently far outstrip the capacity of the government to flood the market with money for a variety of reasons. The biggest reason is that most of our money comes from the banks, not the government. The next big reason is that we are firmly in a liquidity trap.

Still, as you point I do believe the ideology of "starve the beast" is currently gaining traction. As for me, I have no trouble paying my taxes because I think I get value from them. But what has happened in the last few decades just doesn't work with excess expenditures, both private and public. Everyone has been spending beyond their means anticipating that future growth would just make it all work out.

Then, unless I'm misunderstanding what Don is saying, there are people who with all sincerity try to say that the current model being used by Bernanke et al is accurate. Redistributions in the form of debt are benign only in small amounts.

I was just a kid when Reagan the air traffic controllers that went on strike. Looking back, it marked the beginning of a new era of Reaganomics. Cut taxes, cut spending and then wealth will trickle down to the little people. We, the working class, have been trickle on, for sure. Oh yeah, if you have to fight a war, just borrow the money from the US tax payer. How are we going to tax cut our way to prosperity and fight two lost wars simultaneously?

I was just a kid when Reagan fired the air traffic controllers that went on strike. I apologise for my bad grammer.

I was just a kid when Reagan fired the air traffic controllers that went on strike. I apologise for my bad grammer.

Hi W. c. c. t.,

If no-one has yet replied to your post you can edit it - there should be the word 'Edit' before "Reply | Reply in a new window | ..." at the bottom of the post. ("Edit" only shows on your own posts, of course.)

Don't worry too much about grammar. Many commenters have English only as a second, third, or fourth language, and everyone makes typing mistakes or drops the occasional word, so we all tolerate mistakes.

If you'd like people to read what you say, though, keep the paragraphs short -- which you're already doing. Keep up the good work!

Federal spending was 18% of GDP in 1980, today it is still 18%. This is all about starve the beast, and nothing to do with reckless spending, it is out of control tax cutting. You've drunk the coolaid, that decades of rightwing propagandists have been spewing.

Sources please. As the graph in my essay shows, public debt grew very rapidly from 1980 (largely under Republican administrations), and of course in the past couple of years with all the bailouts we are spending more even as we are taking in less. And contrary to your claim, we have had a good deal of reckless spending.

To repeat, I loathe waste, and I loathe borrowing from my children for foolish spending today. I can give you a long list of items that fall into the "foolish spending" category, one of which is the topic of this essay.

Outlays and receipts as a percentage of GDP can be found in Table 1.2 from the OMB. While e.o.s. has the specifics wrong, he is right that federal spending during the 30 years has not changed significantly. Spending increased in 2009 in response to the recession, which is appropriate, while at the same time revenues fell. The combination of increased spending, decreased revenues, AND a smaller GDP is why the deficit for 2009 was the largest as a percentage of GDP since WW2. (The 2010 numbers are estimates in copy I downloaded.) e.o.s. is also right that the current outcry is largely driven by efforts to cut Social Security and other non-defense spending. The real problems in the long-term budget outlook are, in order, health care costs, military spending, and tax revenues. Social Security is solvent until the 2030s, and everything else is noise.

I'm a bit surprised you posted the graph of nominal debt in the first place. Because of inflation and substantial population growth, naturally nominal spending increased significantly since the 1930s. But the two factors also render the chart meaningless, bordering on deceptive. In macroeconomic discussions, only ratios relative to GDP matter.

I don't know how I missed that the graph was in 2009 dollars, but it is still meaningless due to population growth and general per capita economic growth. Only the percentage of GDP matters.

I'm a bit surprised you posted the graph of nominal debt in the first place. Because of inflation and substantial population growth, naturally nominal spending increased significantly since the 1930s. But the two factors also render the chart meaningless, bordering on deceptive.

Well, no, not deceptive, just poorly worded. All I intended to convey was that we are deficit spending to fund this ethanol subsidy. I am amazed at the digressions around my actual wording, but will be more careful in the future.

RR:

Sorry I took the discussion so far off topic. We have two separate discussions going on here. One is about macroeconomics, and debt in general, the other is about

ethanol subsidies. We are entirely on the same page about the later. Its just that

I see my country heading for some very bad times, and some memes you repeated are a big part of how we are being manipulated onto this path.

Early in the program ethanol subsidies might have made policy sense, i.e. we didn't