How limited global oil supply may affect climate change policies

Posted by Gail the Actuary on August 28, 2010 - 10:45am

On Wednesday, August 25, I gave a presentation called How limited global oil supply may affect climate change policies at the MIT-NESCAUM Endicott House Symposium on climate change. This is a link to the presentations given there.

The audience included leaders from governmental, industrial, academic, and non-governmental (NGO) sectors. They were very concerned about climate change, but not very aware of, or concerned about, the issue of resource limits.

In my talk, I pointed out where the "standard" view of the economic response to peak oil goes wrong. People expect that if there is an oil shortage, prices will rise and then substitutes, or additional supply, or technological solutions will be found. But what if these solutions take decades or even generations to implement? Oil from new fields is not instantly available; new biofuels do not scale up quickly; and technological innovations take decades to make a meaningful difference in the overall picture.

In the absence of a quick response of substitute supply or technical innovation, it seems to me that other responses come into play--ones that explain the recent financial distress we have been seeing. When oil prices rise but are not met with immediate solutions leading back to lower prices, consumers respond by reducing discretionary spending, or by defaulting on debt. Either of these responses tends to lead to recession, reduced oil demand, and a reduction in oil price. Eventually growth in demand (perhaps from China and India) can be expected to raise prices again, but again, new oil supply /new technology /new substitutes are likely to be delayed, so that higher prices are likely to give rise to reduced discretionary spending and debt defaults, and more recession.

Because of these impacts, the expectation for the future should be for oscillating prices, but not necessarily very oil high prices. Recession can be expected to improve, and then get worse again. If the expectation for the future is this type of economic situation, perhaps views regarding needed climate change policy should be revised to match the new economic reality.

Furthermore, because the world is a closed system, with limits, there is the possibility that world oil supplies will actually decline in not too many years. The likelihood of this decline gives rise to a greater sense of urgency of the need to reduce oil use--one cannot just wait and hope that future technological innovation will fix the situation. It may be that lifestyle changes will also be needed, reflecting a lower standard of living. Climate policies may need to be rethought to match the way a world with limits can really be expected to act.

Dr. Richard Gibbs, one of the symposium co-chairs, kicked off the symposium by talking about the fact that the world is a closed system, and we are now dealing with pollution and excess greenhouse gases as symptoms of the limits inherent in a closed system. My job was to try to extend this idea--to explain that oil is subject to limits as well, and to point out that, in fact, we seem to be reaching some of these limits.

My name is Gail Tverberg. I am an editor for The Oil Drum website--a website that talks about "Energy and Our Future". My background is as an actuary.

Dick Gibbs started the symposium talking about the world being a closed system, because it reaches limits in many ways. I would like to talk to you today about one of the limits we are now reaching--namely oil supply limits.

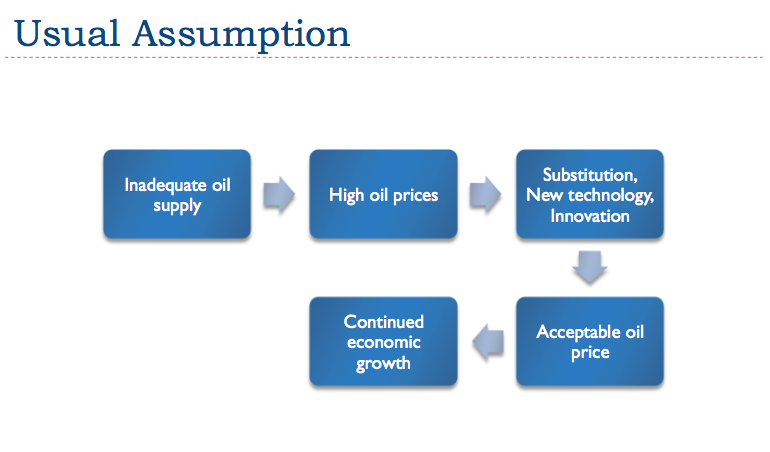

When most people think about oil supply, it seems to me that they expect a scenario, pretty much like what I show on Slide 2. Inadequate oil supply will lead to high oil prices. High oil prices will lead to various kinds of remedies, including more oil extraction, new substitutes, new technology, and other innovation. One might expect that pretty quickly, an acceptable oil price would return, and the economy would return to economic growth.

The problem with this scenario, as I will show in the next few charts, is that there is a fairly long time lag between high oil prices and new supply or substitutes.

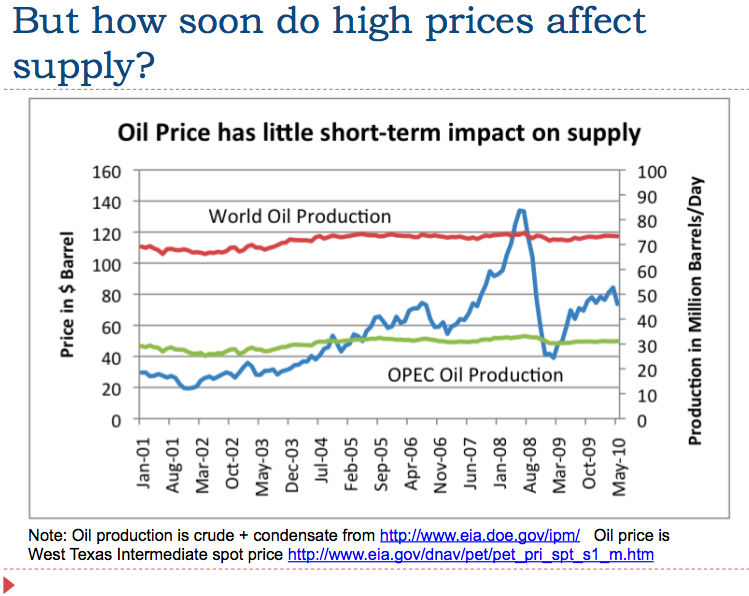

Let's look at crude oil supplies, and oil prices. In this slide I show world oil production and OPEC oil production, along with world oil prices. It is pretty clear from this chart that as oil prices rose between 2004 and mid-2008, there was very little increase in world crude oil supply. In fact, it was pretty much flat.

OPEC doesn't seem to have raised its supply very much in response to the higher oil prices either, except a million barrels a day or so at the end. One might suspect that their statements about high spare capacity overstates the extent that they can really ramp up supplies, when oil prices are tight. But they are willing to drop production when oil prices decline, and the portion of their oil supply that is most expensive to produce becomes less profitable.

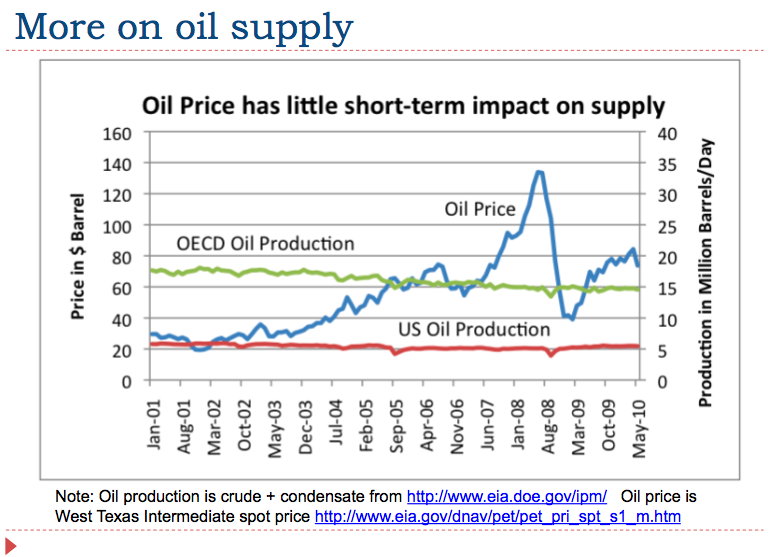

This is a similar slide, showing crude oil production of OECD (that is, developed countries in total) and the US.

OECD crude oil production, in spite of the rising prices, is trending down over the period, with some leveling in the last year.

US oil production is fairly flat (except for when hurricanes hit) but if you look closely, you can see that US production has increased a bit in 2009 and 2010. This is at least, in part, in response to higher oil prices several years earlier, because it takes several years to add sufficient wells to create an increase in oil supply. The recent increase in US crude oil production reflects increased oil production in the deepwater Gulf of Mexico and in the Bakken shale oil (North Dakota).

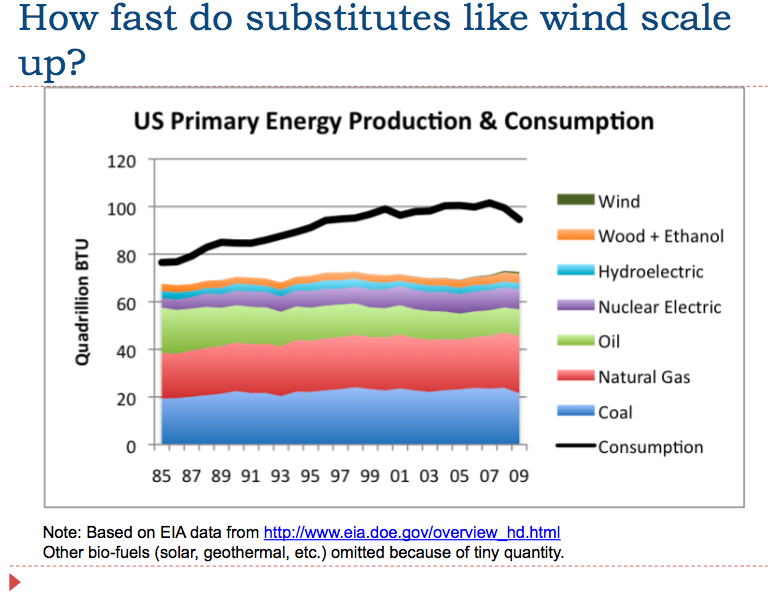

Wind energy is the tiny dark green line that is visible only in recent years, just above the line I call "wood and ethanol" on the chart. (It is called "biomass" in the EIA report it comes from.) The "wood and ethanol" line does not rise very quickly either.

Other ways of measuring the rise in wind energy would give a little more favorable picture. For example, the percentage would be a little higher, if we looked only at electricity, or the amount of energy were measured differently from the way the EIA does it. But no matter how one measures it, it is not coming close to replacing fossil fuels.

The thick black line at the top is US energy consumption, and the difference between US consumption and US production is imports. One can see from the chart that imports were dropping in 2008 and 2009, during the recession. Oil represents the US's major type of energy imports, so the decline in imports to a significant extent reflects a decline in oil imports. During this period, world crude oil production was flat, and demand from developing nations was increasing, so a decline in oil imports should not be a surprise.

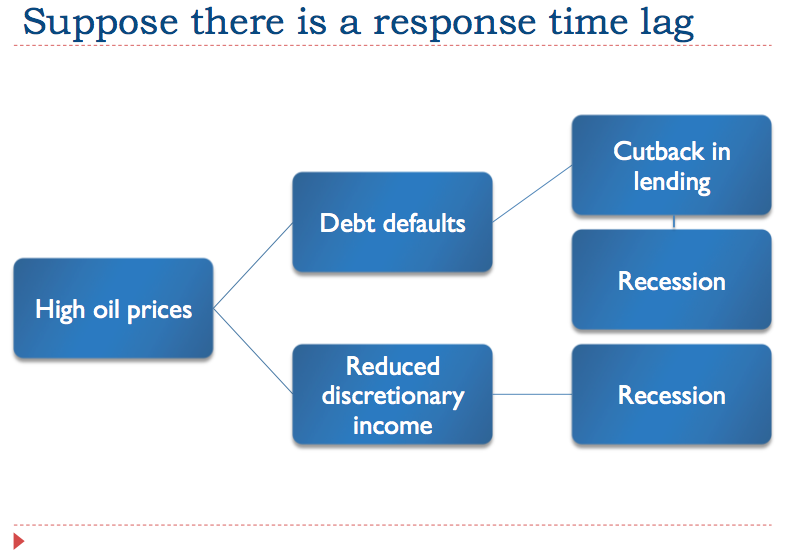

This slide shows my view of two different responses to high oil prices, if high oil prices are not immediately remedied by substitutes, or more oil production, or new technology. One outcome is debt defaults, as people and businesses find it more difficult to pay back loans, when they are faced with paying higher oil and other energy costs (since costs tend to rise together). This leads to a cutback in lending, as banks' capital is eroded, and banks realize it is not prudent to make loans to marginal buyers. With less loans available for buying new cars, and financing new business opportunities, businesses lay off workers, and recession ensues.

Another common response to high oil prices is reduced discretionary spending. If oil prices (and thus food prices, and perhaps home heating prices) are also higher, people respond by cutting back where they can. They may go out to restaurants less, or go on fewer vacations. This reduced spending on discretionary items also has a recessionary impact.

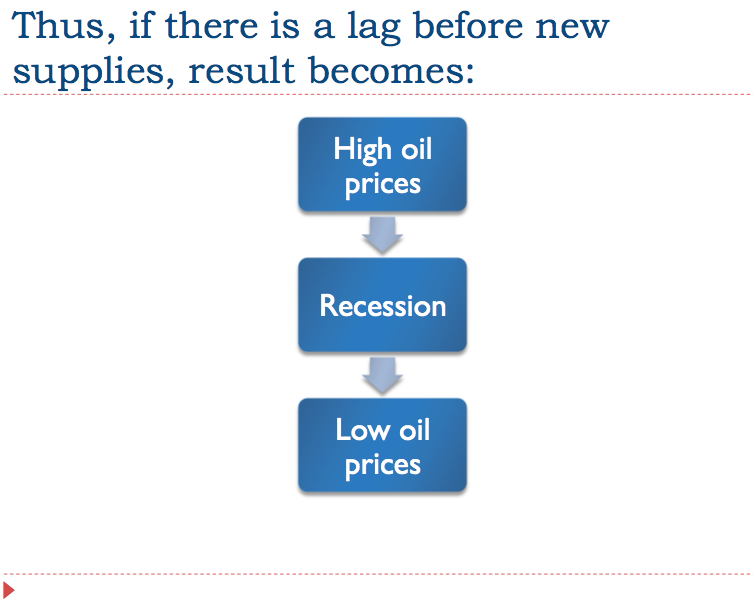

If we step back and look at the situation, we have high oil prices, leading to recession and to low oil prices.

Eventually, one might expect that demand will rise, perhaps from the developing world, and put upward pressure on prices again. Again, there is little immediate response in terms of additional supply or alternatives, so one sees a pattern of oscillating prices developing.

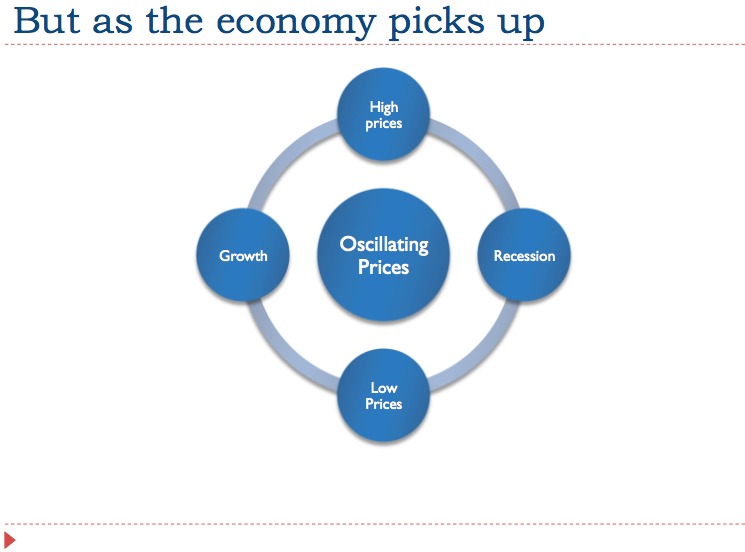

Oscillating prices are a problem, because they do not give clear price signals. They aren't high enough to encourage substitutes on a large scale.

One thing that is particularly confusing to consumers is that looking at inventories and other conventional measures of oil, the situation appears to be an over-supply of oil. That is in fact true--there is an over-supply of expensive oil, oil that many customers cannot really afford. What is really needed is a bigger supply of inexpensive oil.

There are really two problems.

One is that the world is a closed system--what some of us would call a finite system. There is still considerable oil left, but the oil that is left is more and more expensive (in $$ and resources) to extract, because we remove the "easy oil" first. At this point, and price threshold where recession occurs seems to be about $85 a barrel. This limit is related to low Energy Return on Energy Invested (EROEI). While it would be nice if prices could keep rising indefinitely, we know that at some point, it will take more than a barrel of oil to produce a barrel of oil, and at that point, it will not make sense to continue to extract oil, even if there still seems to be plenty available.

The amount of energy needed to produce a barrel of oil includes the energy of the infrastructure that needs to be in place (transportation for example) as well as the direct energy used in production. This need for infrastructure brings the EROEI requirement up to something like 3:1 or 5:1, rather than just 1:1. And it looks as though we are getting close to limits on both an EROEI and dollar basis--close enough that high prices cause recession rather than a quick shift to increased production; close enough that EROEI for oil from the tar sands seems to be in the 3:1 to 5:1 EROEI range already.

A likely outcome is that production of oil will at some point in the not too distant future, start to decline, rather than just stay flat, as it becomes more and more difficult to find oil that can be extracted at affordable prices and an adequate energy return.

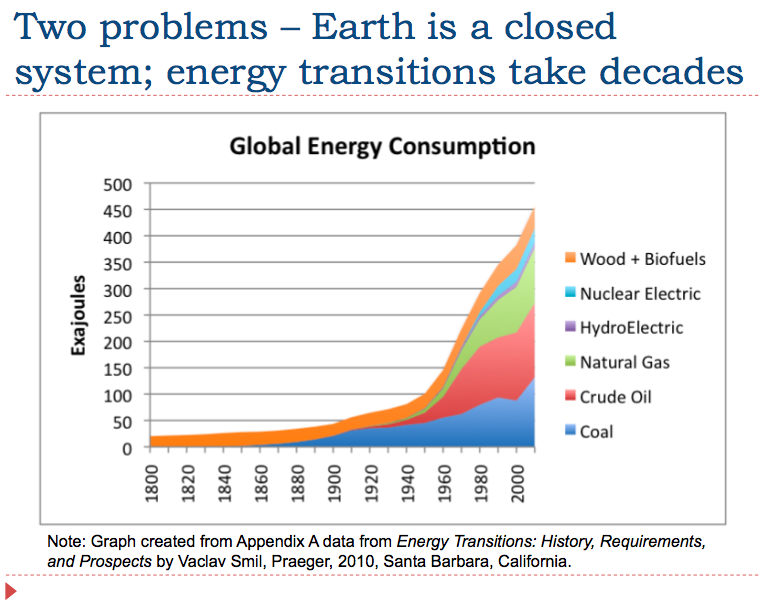

The second problem is that energy transitions take decades, or longer. We first started using coal before 1800, but use did not scale up to a high level until 1910, over 100 years later. Natural gas use began by 1890, but it was not until 1970 that it reached 2.2% of world energy supply. Vaclav Smil, who has written over 50 science books, has written a recent book on this problem, called Energy Transitions: History, Requirements, and Prospects.

As oil production remains flat, and the amount of oil that the developed world is able to buy declines, it seems to me that we are likely to see more and more of the economic problems that we have experienced in the recent past. We can expect more and more business closures, more layoffs, and probably lower home prices.

Governments can be expected to act fairly differently, as their sources of revenue dry up. For example, road maintenance is likely to suffer, with more and more roads returning to gravel, and funding for higher education and research is likely to decline.

If there really is a significant reduction in oil supply, it is quite possible that new greenhouse gasses emitted may decline significantly, without any particular government action.

I don't claim to be an expert in climate change policies, but it seems to me that policies will need to be rethought, in the light of a very different future economic scenario than most have considered, and also in light of the possibility of declining oil supplies available to the US. If the decline in oil availability is a current, and near future concern, then the need for change takes on a much greater sense of urgency, than if one is simply trying to meet a 2050 climate goal.

It seems to me that the usual approaches may not work as well, and more pragmatic approaches may be needed. It is not at all clear than we will be able to maintain our current standard of living, as oil supplies decline.

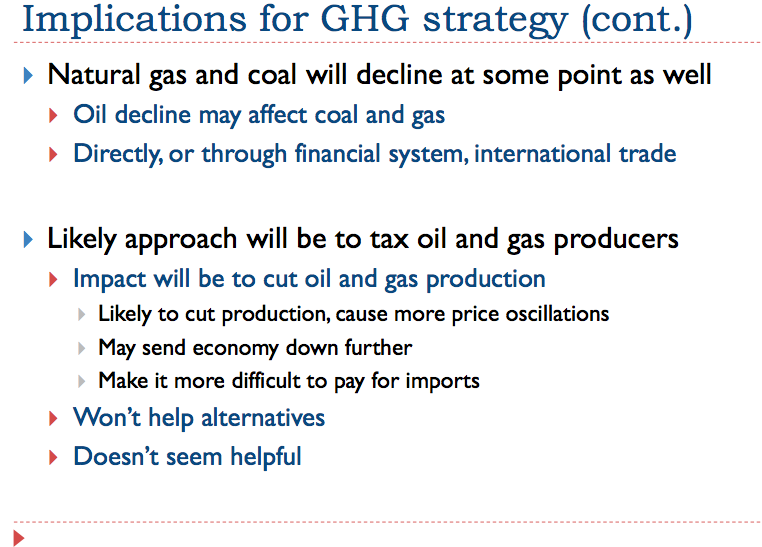

Natural gas and coal supplies can be expected to decline at some point as well. There are a great many connections between different types of fossil fuel uses, so a decline in oil production may bring about a decline in natural gas and coal production as well, although we cannot know this for certain at this time. There are a number of interconnections that may cause extraction of various fuel types to move together. For example, if the credit system is impaired because of debt defaults caused by indirect impacts of declining oil supply, this could lead to less demand for all kinds of fuels, as occurred during the recent recession. There are other connections as well. For example, oil is used to transport coal to its destination, and to mine metals used in making coal and natural gas extraction equipment.

Almost everyone agrees that comprehensive energy legislation, including cap and trade, is not likely to be passed this year in the US. Instead, we see the US, like many other countries, is badly in need of additional tax revenue, and the oil and gas industry appears to be a likely candidate for more taxes (since it is easier to tax large, unpopular businesses, than to tax voters). So a likely outcome seems to be higher taxes on the oil and gas industry. But we need to think about this. The connection that everyone hopes for--lower production leading to higher prices--doesn't seem to be a very robust one. Instead, by raising taxes, we may produce more price oscillation, and more recession. This outcome is not likely to help alternatives at all, and will likely make our balance of payments situation worse.

So we really need to think through climate change policy approaches carefully, in light of the closed system of that we are working in.

The disconnect between oil production and AGW is that all of the oil ever available simple wouldn't move the meter on atmospheric carbon anyway. The real heavy hitter is and will be coal. The effects to pay attention to are the increase of coal use with the lessening availability of oil.

The question is the extent to which this increase in coal use will take place, with a shortage of oil supply. We know China and India have ramped up use recently, but it is not clear how much this ramp up can be extended. Once China becomes more dependent on imports for coal, the cost will escalate greatly, and the availability for rapid ramp-up may not be there.

Furthermore, going forward, a cut back in oil production can be expected to have a big effect on financial markets--credit is likely to become much less available, and there may even be a reduction in international trade, as weaker countries default on their debts. These credit impacts and international trade effects may have an impact on coal and natural gas production as well, perhaps in the availability of replacement parts for machinery. More importantly, demand will be cut back, if buyers of fossil fuels cannot get credit to buy new goods that use energy in their production, and businesses cannot get credit to expand. So coal production may follow oil production down.

With oil I often assert that a sizable amount of what is left will stay in the ground forever. The technical difficulty of getting it out and amazing cost will become too much for a contracting world economy to handle.

However, with coal, I don't yet have a sense of whether we might just mine all the stuff out even if we are paying laborers just "a cup of rice a day" to do it.

An interesting analysis would be to examine the cost per BTU of coal over time to see if it is as sensitive to the same sort of cost escalation that oil is experiencing. And even if the cost does go up commensurately, might the technology for mining be one that we can rather easily maintain during contraction?

As I read Heading Out's tech talks on coal, it becomes clear to me that we have to maintain a very high tech society to extract anywhere nearly as much coal as we extract today. A few people with picks cannot walk miles into a mine, and extract a very large amount of coal. Without huge earthmoving equipment (and the diesel to run that equipments), we will not do the strip mining of coal that is done today.

We could theoretically make coal-to-liquid to substitute for oil, but even this requires considerable investment at the front end, and resources such as water, which are not very available in the arid west where much of the coal is located. So I would not count on this either, as investment capital becomes more and more scarce.

Gail,

I tend to lean toward this view ("Without huge earthmoving equipment (and the diesel to run that equipments), we will not do the strip mining of coal that is done today.") and yet I still can't shake the feeling that we will have so many extra people with no gainful employment that we could literally have (say) 25,000 people working at each open coal mine, easily.

We are, after all, going to have a lot of unemployed people. With that many available hands, we might be able to get fairly close to today's production numbers.

Aangel,Gail,

Modeling economic trends is quite beyond my area of expertise, but it seems as if eitherof you could be closer to the ten ring, depending on the way the cards fall-on how fast things go down hill, and how fast the various economies of different countries can make the obviously wrenching switch from high oil, high coal consumption to very high coal , very low oil consumption.

I gather that building a coal to liquids plant is a four of five year job, although something tells me that in an emergency, we could do it in three or less. Other adjustments involving heavy infrastructure,such as converting a large percentage of over the road trucks to run on natural gas, will probably take as long or longer.

If the expected next oil crunch arrives soon, my own wag is that it will knock the various advanced economies of the world as well as the fast growing economies of China and India, for a loop that will be close to a knockout punch.

We may get down so low that it takes many years to recover to a state of more or less steady if modest growth-maybe as long as a couple of decades.We might not recover, and if we do, the population might be substantially lower than it is today.

This would mean that while coal usage might eventually rise dramatically, it won't happen for a long time, and that coal use might dip substantially during the interim period.

Do either of you have any figures on expected CO2 levels based on intermediate scenarios similar to the one I propose?

Another thought that occurs to me is that existing coal reserves close to the surface and mineable by low tech, high labor methods might come to be considered as strategic materials and nationalized or at least embargied against export by the countries that possess such reserves.

I don't have any problem at all envisioning a world scared of a super power China doing things to make it harder for the Chinese to grow even more powerful ;and both Chinese and Indian coal reserves are not supposed to be adequate for more than a few more decades at most.

It seems reasonable that if they feel the need to do so, either or both countries will take strong arm actions well before the coal reserve issue becomes critical.This means such moves might occur within a decade to two decades at most.

They would only be following our example after all,excepting of course that our own recent and current overseas adventures have involved oil rather than coal.

Hi, OFM.

I ran some back-of-the-envelope calculations a few years ago when I was putting together the post below, however, I didn't end up putting them in the post in the end:

http://www.postpeakliving.com/content/peak-oil-and-climate-change-faq

At one point I thought ASPO was going to look at that but I haven't followed up to see. Perhaps the folks at the Uppsala Global Energy Systems Group have something on it. I would check with them first.

I was asked offline about that picture with the thousands of Chinese workers and their wheelbarrows.

It comes from this page:

http://spot.colorado.edu/~richtea/prints.html

It's "Fig 12. Application of wheelbarrows during flood control projects, Shandong, before 1973."

The Chinese have in the past tended to throw people at a problem because they had so many of them. We'll end up doing the same at some point, probably next decade (2020's) but maybe toward the end of this one when the large work programs begin.

Also, note that within a decade or so, it's very possible that big machinery will get vandalized by workers once it becomes clear how many jobs, say, a single backhoe replaces.

Right now, workers are still too expensive and oil too cheap so the machinery will continue to "get the job." By 2030 it should be completely reversed, is my guess.

I find it interesting that the typical construction wheelbarrow holds about 6 cubic feet. This translates into a bit more than a 42 gal. barrel of oil.

At todays wages and todays energy prices here in Australia, if you put a shovel in a mans hand you are paying $260 per kW/hr. The same amount of Electrical energy is $0.06. (6 cents.)

You are suggesting that human energy must decrease in cost by an order of magnitude to become competitive.

I must acknowledge the powerful force of culture, which miss-understands the economics.

This happens where I work. Manual labour is seen as a virtue. The more the sweat, the more virtuous the man.

It would be more logical for out of work people to vandalize the machinery to create jobs, than for those who use the machinery to make their jobs more difficult and share their pay with more people.

There may be a similar pic for the Snowy Mountain Scheme in Australia, but I can't imagine another like it (in Oz) any time soon.

But again, what the heck would I know.

It will always be cheaper to invest in fuel efficiency than to develop oil shale or more tar sands or heaven forbid coal-to-liquids (A COMPLETE NON-STARTER BECAUSE PEAK COAL IS JUST AROUND THE CORNER AS WELL). Let me inform you restless souls in the USA that we here in Europe can choose from no fewer than 15 production cars that get 55 MPG (US gallons, not imperial), they have 4 doors and 4-5 seats, albeit compact by US standards. We will soon have about 5 production models that get better than 60 MPG, although these are sub-compacts. Only one of these is currently a hybrid, the Prius. All the others are clean diesels. I own two clean diesels, but they are not the latest and best models. They only get 35-46 MPG. You yanks don´t have these because of a regulatory bias and a consumer bias against diesels based on a number of sh:tty models from the 1970´s. Diesel tech. has improved vastly, and is very cost effective. We pay about $7/gallon and have done this for about 4 years now. It really works to make you choose the right transport for every task. For many, this means public transport or bicycles.

http://www.greencarcongress.com/2004/11/average_fuel_co.html

http://www.newscientist.com/article/dn17506-us-vehicle-efficiency-hardly...

Keep in mind that President Obama hails from Illinois. As a Senator and as a candidate for President he stood for 'clean coal' as the 'deus ex machina' from our oil import problems, and for our energy future.

With that in mind, look for the administration to press forward with greater coal use in order to limit imports of oil. Maybe all those jobs we need are going to be in the mines? Of course, Illinois; coal is extracted by strip mining, so no big help in the home state, at least.

With the further consideration that Bernanke, Geithner and company are running the show, look for BAU decisions, ramping up of coal production, probable loosening of environmental restrictions on coal, and a host of other bad decisions to try to pump up the economy, or at least keep it from going totally flat.

Farther on down the line, it will be flat-lined. But that is a whole 'nuther story.

/rantoff

Craig

deus ex machina is what I see proposed most everywhere .. in total seriousness -- must make me a doomer ;-)

Since I'm in Illinois I have to jump in here.

I exchanged email, briefly, with my senator on the topic of "clean coal". Recall that, in 2007/8 there was much talk of the "FutureGen" carbon sequestration project.

http://www.futuregenalliance.org/

Progress has been two steps forward, three steps back, but I really believe they thought they had the answer at the time.

The reason they were so seriously considering carbon sequestration for Illinois is that natural gas is currently stored in certain rock formations in the Kankakee area, and it would be a similar exercise to store carbon dioxide the same way.

It's not a solution that can work everywhere, mainly due to geology.

Depending on where in Illinois one is, one's energy (excluding transportation) may come from Coal, Natural Gas, Nuclear or Wind, or a mix of all the above. Some Solar, but mainly for domestic hot water. The coal lobby is largely downstate. Although there are a couple of really dirty coal-fired power plants in Chicago that people have been trying to get rid of for a long time, but the jobs...

The current propensity for using hydraulic fracturing for retrieval of natural gas effectively eliminates those areas from consideration for use for carbon storage afterwards.

The problem with FutureGen is essentially political - there are many who don't want to see Federal dollars spent on a project that is perceived to benefit Illinois more than other states.

More crazy scare-mongering.

CO2 is stored in designated old oil and gas fields, unmineable coal seams or saline aquifers. Shale gas is mined from shale strata not coal gas or saline aquifers. Your assumption that they are going to happen in the same place as shale gas is nonsense.

For example in northern Illinois you have a large strata of sandstone with saline aquifers in it and no natural gas. It's perfect for CO2 storage.

CO2 sequestration seems to be the least sexy of all the

ways of going green and the one most likely to successful at drastically reducing CO2 emissions, which is so why many people hate it.

I think a lot of people hate it because they think it is just talk, and won't result in anything other than delay. Some hate it because the energy consumption of the more developed methods (if yoy worry about peak coal, then CCS means we get fewer KWhr per ton of whats left). Then there are those who buy into the "it will leak, and silently kill" scaremongering. Then there are the people who are horrified by mountain top removal, and think CCS, will mean more MTR happens in the future.

I consider myself mildly in favor. But, with a heavy emphasis on research for more energy efficient methods of capture. I don't think we are going to do it if it increases fuel consumption by 30-50%. I would like us to do CCS in conjunction with biomass, as a way to draw dowm atmospheric CO2. If we do get reasonably affordable capture methods developed, the scaremongering will become a problem.

Another disconnect is the difference between 'climate change policies' and actually doing anything materially which actually reduces carbon emissions.

It seems that the rate of coal burning increases in direct proportion to the number of 'climate change policies' produced.

The sad truth is that the issue of AGW is now politically dead as a dodo.

We saw this recently in the Oz national election. In 2007 AGW was rated by the winning leader as " The most important moral challenge of our times". In the August 2010 election it was barely mentioned by either side ( except the Greens of course).

As we continue to slide further into economic crisis,

( http://www.abc.net.au/4corners/content/2010/s2987864.htm )

AGW will be further marginalized as a political issue.

AGW due to oil will be "self-limiting" at current level of CO2 production and decline in future decades.

The big source of multi-decadal CO2 generation is coal. The world's major coal reserves are in China and the United States. China and the US will be locked in severe economic competition. Neither will stop burning coal so long as coal is the cheapest domestic source of electrical generation. They simply cannot afford to.

Therefore, the only possibility is to develop other sources of electrical generation that are cheaper than coal. Whichever succeeds at this becomes the winner in the competition.

If either artificially raises the price of coal in order to discourage coal burning, it artificially handicaps its economy, and it becomes the loser in the economic competition.

Other issues that are unrecognized by this analysis will make this author and his anaylsis forgotten very soon. He has analyzed why his car won't start by constantly checking the air pressure in the tires.

I would like to argue that this gives the false impression that a lower standard of living is automatically a bad thing. It is possible to have a higher quality of life despite having a lower standard of living.

http://en.wikipedia.org/wiki/Standard_of_living

I propose that 'Quality of life' should be should be the goal of civilized societies and by that measure life in the US, which is still considered to have one of the highest 'standards' of living, has a 'Quality of life' that is poor and getting worse.

I don't think that framers of climate change policies have even considered the possibility of living standards declining.

For example, electric cars are viewed as the way of the future by some. If electric cars are too expensive for many, or cannot be scaled up quickly, the question is what alternatives should be considered. I expect that most policy planners have never considered bicycles.

I mentioned during the symposium the possibility of some roads going back to gravel, as states found it too expensive to keep paving all of their roads. This idea seemed to come as a shock to some participants.

That's probably a very good point. I would imagine it is even less likely then, that they would associate the possibility of a declining standard of living, actually leading to a higher quality of life.

For the record, the fact that so many people seem to think that in the future we will all be driving around in electric versions of our current ICE cars and that this is actually the solution to our current predicament, makes me very despondent indeed.

BTW, Gail, in case you have ever wondered, I do agree with most of what you have to say >;^)

It's just that at times, it seems to me, that all of us, (and I include myself) are so deeply wedded to the current paradigm of BAU, that we are hardly able to imagine any other reality.

I'm willing to bet that the framers of climate change policies have certainly understood that lifestyles would change (much fewer large vehicles, less VMT, smaller houses, less heavy manufacturing), which would reduce output and hence incomes. Of course, this does not necessarily affect education, basic health care, and other Quality of Life considerations.

Given the state of the economy at the present time, I have no doubt that our currently lowered 'standard of living' will continue to decline regardless as PO becomes more apparent, so what the 'framers' above envisioned will likely take place in a roughly similar fashion, though use of coal (CTL, space heating) could be a wildcard.

"Of course, this does not necessarily affect education, basic health care, and other Quality of Life considerations."

Emphasis on "necessarily". I think that in fact in today's American culture education, health care and more will be traded by policy makers for deficit reduction, military spending and such without so much as a whimper from the majority of the voting public.

I was careful to put in 'basic' before health care. Heart and bone marrow transplants, for example, would be far more rare in such a scenario. Much of the population currently does not receive basic health care in the US.

I don't think any solution can be made to work in a short period of time - without a large scale effort like the WWII effort. There is a great deal of oil that can be saved by using electric bikes, for eg. Same with plug-in hybrids.

What is lacking is political will - not inherent engineering problems.

Before WWII, there were a lot of unused factories that could be put to use, and plenty of fuel and other inputs for manufacturing tanks and other things needed for war.

I don't think we are in the same position now. Most of the high tech manufacturing is now overseas. We lose control and understanding of what is involved, if processes are scaled up elsewhere.

Also, our electric system is so unreliable (outages, etc.) that few with high tech controls would want to build here, if there is another option elsewhere, at least based on what one of the people at the symposium was saying. You almost need your own electric supply to get high enough quality electricity in this country.

Take a look at the rest of the world, especially the developing world. Unreliable power, is like what Pakistan, Iraq, and even Soth Africa have. Losing several hours per day almost every day. We worry about an occasional regional blackout that happens every few years. We can be much mech much less reliable than currently, and still seem to be a paragon of stability to anyon from those parts of the world.

The problem is small "blips" (as well as small outages) that can take sensitive equipment like a refinery down. If this happens, it may take days to bring the refinery back up again. As homeowners and shop owners, we would hardly notice these small problems with electricity production, but they are a huge problem for industrial users, I understand.

http://www.powermag.com/issues/cover_stories/In-Search-of-Perfect-Power_...

$80M out of a $13T economy is about half a percent of GDP. Not a small cost, but not an end of the world scenario either.

http://www.powermag.com/issues/cover_stories/In-Search-of-Perfect-Power_...

It could be twice as high or more than 1%.

http://osu.okstate.edu/index.php?option=com_content&task=view&id=340&Ite...

http://beforeitsnews.com/story/131/318/CNN:_U.S._electricity_blackouts_s...

It is going to take more than money to fix the problem, as I see it. Somehow, things will need to be reorganized in such a way that agreement can be reached on uniform standards within the system. There also need to be changes so that it is easy to get agreement on what needs to be done to upgrade the grid, and who will pay for it. I think that organizational issues and responsibility issues may be more of a problem than the money involved.

Data centers typically have battery backup and motor-generator sets that are able to carry all critical systems through an indefinite power outage. Important data centers also have dual power feeds from grids on different substations.

Financial systems are implemented in two data centers more than 200 miles apart on different power company grids. The 200 mile rule by the Federal Reserve is intended to reduce outages due to common faults.

Some systems are backed up on other continents.

I doubt that any country has power from the electrical grid that is so good that "uninterruptible power systems" and geographic redundancy are not needed, both due to power outages and other disaster planning contingencies.

I suspect they have thought about it. But public relations wise it is very dangerous to allow your agenda to get connected to "doing with less". The reaction to decline (even if is good for us), is to put off anything else that seems to make the decline greater (or sooner). Look at Califonia prop 23 (a fossil fuel funded attempt to overturn greenhouse gas caps). It doesn't say NO CAPS, it says delay CAPS until state unemployment reaches some unontainable value. This is a pretty common reaction to a request to use less. And you can bet well funded reactionary forces are waiting to capitalize politically on it.

They cannot consider it.

And here is why.

Deflation.

As Aaron Wissner argues in The Automatic Earth any sane person who sees the situation for what it is will get out of debt. This will cause money to evaporate, and the economy to stall leading inexorably to deflation.

Economists treat Deflation with more dread than inflation as they cannot force people to borrow money and spend.

Deflation and Depression: Is There an Empirical Llink? January 2004,

Andrew Atkeson, University of California, Los Angeles and Federal Reserve Bank of Minneapolis

Patrick J. Kehoe, Federal Reserve Bank of Minneapolis

My understanding of this piece is that they have discovered empirically that the opposite of inflation is not deflation.

Further they argue that the slowdown in the Japanese economy was not the result of lack of liquidity or stimulus but that the economy had matured.

I interpret that to mean that the economy had achieved it's objectives and incentive to acquire were suppressed.

To the authors, as I understand them, Japans economy is an Ideal. The ideal of everyone's needs being met.

The horror of it all.

Still, how would Muggins in the street react if he thought that the inflation rate was going to go negative? He would do as I am doing.

He would pay down his debts and ensure he had as much cash in his pocket for the inevitable buyers market that will come as over-leveraged entities are forced into fire sales.

It is this liquidation of debt(money) that is the font of the economists nightmares. It is what is forefront in his mind.

Therefore he would relegate considerations of Peak Oil, Climate Catastrophe and their consequences into "to be dealt with later categories"

Is this how you audience reacted Gail the Actuary?

Perhaps this is true regarding state or national level climate change policy, although I somewhat doubt it. (Depends who is meant by

'policy planners'). At a local level, in cases where policy planners are thinking about climate change at all (admittedly still not 'most' places), it is far from true. Making roads more bike friendly is something local policymakers can actually implement. In San Francisco (and the wider Bay Area) it has become a noticeable feature of both politics and physical change in the city.

And in Portland (OR).

I agree with the basic sense of actual quality of life being only loosely connected with resource consumption, which is unfortunately how the masses perceive it now.

I think we will get nowhere with substitutions for carbon fuels until the masses have a clear and understandable explanation of what quality of life means.

Medical care can be much more at home. That's a good thing, considering the number of diseases one can catch at a hospital, among them depression at being treated like cattle.

Education can be rapidly shifted away from sending bodies at great cost to second homes at universities, and using MIT-style courses and non-attending grad students to personally tutor the online students.

City transportation can be by taxi-bus, which works very well and no one knows about it, including so-called transportation experts who live in the past, and are not aware of the penetration of cellphones, the existence of the necessary software, and the hydraulic hybrids already in use by UPS, FEDEX and the military.

Commodity transportation can be shifted largely to electrified rail carrying HVDC on their rights of way from central windfarms. I see double tracks running under transmission towers. NIMBY be damned. Cities can use smaller modular nuke plants, already for sale. Hot sulfur batteries are tested, and ready for installation.

Loss of subsidies on commodity crops will greatly redistribute the cost balance between meats and vegetables, and no doubt major newspapers will follow the NYTimes in pushing new status symbols like being skinny, socializing on the internet instead of flying back and forth for family birthdays, wedding, anniversaries and even deaths. I'd buy stock in videoconferencing software.

Nothing can be done without the people, and some way to negate the megaphone of Veblen consumptions advertising.

Work on that. The technology is relatively simple. Cognitive behavioral mass therapy isn't that expensive, but legislators need the masses behind them.

I agree with you on education, but would include secondary education, i've seen "cyber charter school" growth numbers of 30%+ for the dozen or so currently licensed in PA. My son participates in one that is about 5000 kids, about the size of a school district around here, the bus/car commute to school is zero, and while yes it requires a PC, in comparison to the brick and mortar investment for a whole school district vs 5000 pcs (which would probably be in the home, and in the school) - It seems like a lot less energy. The use of Moodle and open source education platform also has some implications including courses without books, courses "taught" to 90 kids instead of 30 (I remember introductory engineering classes at RPI of 300, and I definitely mastered them).

I would tell you that the educational subject choices are much broader than the traditional schools here, and I'd guess it is only going to get wider. So it is possible that drive by less energy some people will experience better outcomes in education.

Higher education is just before a major crash in funding and attendance.

Some schools may move to these high-tech systems but there will be very many less students to use them. Soon it will become clear to most students that spending $100,000 on an education when unemployment is 20% or 30% is not smart.

I have a post in mid-edit about this topic I hope to submit when I return from vacation. Higher education is a bad place to be right now and I recommend that college level professors start reskilling even more quickly than the rest of us.

I think the product will continue to have value. But, using online resources for learning and certification is much cheaper. I suspect within a few years, cheap online classes will start to take a dent out of the brick and mortar schools. And this is not too soon, too many are already priced out of higher education, and the trend is worsening.

Not for the middle class and lower. It really doesn't matter how cheaply the school can deliver its message if the market doesn't need it. There is already too much of their "product" on the market — educated people. This will continue to get worse as each year sees more graduates entering a contracting economy. How much longer do you think this trend can continue before people get smart and stop attending schools of higher education?

Higher education is going to go back to the privilege of the wealthy, and before this decade is out. This happens suddently, not gradually, which is the premise of the article I'm writing, that certain elements of our society "switch off" quickly.

My guess is that we'll be graduating 1/25th or less of the people we do now by 2020. Many, many schools will close, especially the private colleges.

The four-year Liberal Arts degree was mainly useful for the high socioeconomic status son who would enter business with the family or friends of the family, e.g. a G H W Bush. Alternatively, from one of the Seven Sisters was useful for the daughter who was expected to marry well.

However, higher education is alive and well. Apollo Group had an enrollment of 443,000 in 4Q'09. They and their competitors will do for brick and mortar colleges and universities what Amazon and Barnes and Noble did for your neighborhood book store.

Yes, but my thesis is that this situation is going to change dramatically and soon.

However you want to look at it the impoverishment of people in OECD nations will come from loss of income. The problem for individuals and families is the decline in their quality of life will not be a gradual process they can adjust to but a single drop from employment into unemployment. This will be devestating for people who are not financially or psychologically prepared.

Also, the government now has unemployment programs to protect the unemployed, but at some point the number of unemployed (and lack of tax revenue) may make it very difficult to maintain the programs.

Gail,

You have several hypotheses here which you've never tested. These include " consumers respond by reducing discretionary spending, or by defaulting on debt." and " other energy costs...tend to rise together".

You need to quantify both of these, and provide some evidence. Take a look at Professor Hamilton's work, for instance. I think you'll find that neither of these is as important as you're suggesting.

Nick

I am trying to understand your question. It would seem to me that when consumers have less money (due to higher energy prices)that they either reduce discretionary spending or default on debts because they have to. Are you suggesting that they have other options?

Sure.

First, they can go to substitutes: join a carpool (10% of US commuters carpool); buy a more fuel efficient car (e.g., a Prius, which costs less than the average US car);, take the train, etc. Heck, most households own more than one car: they can just switch their driving miles to the more efficient vehicle (dad takes the Corolla away from the teenager, stops driving the Escalade to work). Car-switching and car-pooling can be done literally overnight.

2nd, Gail seems to assume that an increase in consumer spending on fuel will significantly increase debt default, and that this would be an important factor in the economy. This appears doubtful: fuel spending is a small % of most consumer spending. The poorest quintile of income tends to not own cars, and most fuel is bought by the more affluent.

The existence of good substitutes also reduces the likelihood of debt default: why wouldn't someone about to be foreclosed on sell their SUV and buy a used Civic?

Hi Nick,

Even if debts could continue to be serviced, new loans would be almost impossible to obtain. Why, becausing borrowing into a declining economy would mean on average principal and interest would be very hard to repay-interest rates would be huge. In addition, people would be likely to hold onto cash-because in a declining economy and in an uncertain environment tomorrows paycheck is uncertain. For these reasons we would see a deflationary spiral with effectively no bottom. There'd be less and less money in the economy, and food and other essentials would I suspect crowd out everything else. And with less and less money in circulation-debts absolutely could not be paid off-only default or hyper-inflation would suffice.

As to why someone would not sell their SUV for a Civic-Who'd have the money to buy all those gas guzzling SUV's?

Agree on your earlier point-oil prices may decouple from other sources on the upside, but not on the down.

Regards,

david

Hi David,

That's assuming a declining economy. I'm questioning that assumption and the assumptions leading to it.

In order to prove that the economy will not decline, you need to show not that some people will avoid the impacts of declining oil supply, but that pretty much everyone will. I think that you are way off base in assuming nearly everyone can avoid the impacts. Look at all the folks out of work.

Yes, we're in a recession, and some are out of work.

But, that argument assumes that the current recession was primarily caused by the oil shock, and that a continuing decline in oil consumption would necessarily cause economic decline. First, you have to show that oil's impact on individuals was as you assume, and then show that their behavior will be the same in the long-term.

Otherwise, the argument assumes the premise.

Nick & Gail, I see you are both right, but arguing from opposite ends.

The Price spike does not need to be a PRIMARY cause of the recession, in order for consumer spending to change. It merely needs to be identifiable.

Note that it only takes a small change in discretionary spending, to have an effect, as much of the base-load consumer spending is locked-in (at least until they down-size). ie Power/Water/Taxes/Rates/Mortgage/Transport/Education

Here are some numbers, from outside USA, showing exactly how consumer spending moved, in response to the price spike.

30 June 2009 :360,303 vehicles registered in Auckland city

(84 per cent were private cars and vans)

= 13 per cent fewer vehicles than in 2005,

= 17 per cent fewer than in 2007.

= Motorcycle registrations were up 10 per cent

= motor scooters up a staggering 123 per cent.

= in the five years to June 2009, public transport patronage increased by 16 per cent

Note that registration number is total, not just new sales - the first recession response is to delay buying a newer car, the second response is to make do with less cars in the household. (Still well above 1.0)

This shows a very clear move to reduce the total household car count, and also a move toward the bicycle end of the transport option.

It is easy to find data showing the effects of changes in discretionary spending.

1.4 million people, 1000 km^2, 45F low in winter, 75F high in winter, yes fair amount of rain.

Atlanta

6 million people, 6000 km^2, 33F low in winter, 90F high in summer,same amount of rain.

You can walk and cycle 12 months a year in Auckland, but cycling at freezing point or at 90F with humidity is not for everyone. Auckland is paradise on Earth. Atlanta without AC would be...Weather arguments disqualify bike as a continuous solution in any large North American city. Too hot or too cold.

In North America bike is for pleasure.

You can walk and cycle 12 months a year in Auckland, but cycling at freezing point or at 90F with humidity is not for everyone.

In saying the "move toward the bicycle end of the transport option.", I was meaning mainly Scooters.

Cycles remain the domain of the truly (fool) hardy, with an accident rate much above scooters.

I see in USA the scooter trend is also very strong:

2008 ["Nationwide, the Irvine, Calif.-based Motorcycle Industry Council reports a boom in scooter sales from 12,000 in 1997 to 25,000 in 1999, 50,000 in 2001, 96,000 in 2004 and an estimated 131,000 in 2007, which MIC spokesman Mike Mount said could reflect demand outstripping supply.

“Through the first two quarters, scooter sales are up 66 percent over what they were the first two quarters of 2007,” Mount said."]

["The owners of the Vespa, Piaggio and Aprilia scooter brands saw a 100.5% increase in scooter sales in May compared to the same month a year ago. In June, sales were 147% higher in a year-over-year comparison and in July, sales were 173% higher."]

However, it does not look like those increases were sustained, but it does show how a price spike, strongly drives consumer buying decisions.

There is also now a strong drive to Electric Scooters, and Electric Bikes.

http://www.motorcycle-usa.com/363/5297/Motorcycle-Article/Peugeot-Return...

http://future-motorcycles.com/2010-ultra-electric-scooters/

http://www.gizmag.com/466-million-electric-motorcycles-by-2016/14306/

Says:

["Current annual global motorcycle sales: ~80M/yr (mostly ICE)

Forecasting that more than 466 million electric bicycles and motorcycles will be sold worldwide during the period from 2010 to 2016. (78M/yr)"]

Graph is here :

http://bioage.typepad.com/.a/6a00d8341c4fbe53ef0120a89778cd970b-popup

China dominates Electric 2 wheelers, with ~22M/yr,

driven by this :

["According to ETRA “the high sales in China can be ascribed to the large number of cities which have legally banned petrol engine mopeds and scooters, leaving consumers with no other choice but to opt for electric bicycles”.]

The EU is forecast to increase 33% in 2010, and break 1M.yr

Scooter...Part of a year in most of North America at best.

But,

http://video.google.ca/videoplay?docid=-2063667852598904740#

;-)

"Scooter...Part of a year in most of North America at best."

It still helps though. My 750 cc motorcycle (not a scooter) burned 56 gallons of gas less then my Aveo (economy car) for the 5000 miles or so I can use it from May to October.

Don't get me wrong, I used to own motorcycles myself but I'm mostly afraid to ride on public roads these days-I simply can't afford to take the chance of getting laid up as the result of an accident.

I still borrow a bike and ride occasionally where there is very little traffic.

I learned a LONG time ago that as far as actual per mile operating costs go,you can't really hope to save much if anything by riding a motorcycle compared to driving a compact car.

Your Aveo will probably go 40,000 miles on a 400 dollar set of tires, and it will probably last from 150,000 to 300,000 miles.

Your bike will probaby go 8,000 to 10,000 miles on a 200 plus dollar set of tires-if you ride conservatively.It probably will not last mich over 30,000 miles if it is a sporty perfomance model,unless you really baby it, but I will admit that the later model cruisers look as if they are good for at least 50,000 to 100,000 miles or MORE of reasonably trouble free riding.Some of them appear to be at least as reliable as a typical car.

When your Aveo is five years old and out of warranty and you need an alternator, you will be able to get one with an "as long as you own it" warranty for 150 dollars, in 2010 money;an alternator for your bike will probably cost from two to three times as much due to dealer only pricing; and it will be warranted for a year at best.

I probably shouldn't admit it, but I once tied my 450 Honda to the back bumper of a truck with a quarter inch piece of nylon rope at a traffic light one dark night;I knew the truck would be going my way,down a lonesome country highway, and the temptation was to much to resist.

I got simply extraordinary mileage for the next twenty miles or so before the novelty wore off and I dropped the loose end of the rope.

That's a rather modern couch-potatoeish perspective. Keep in mind that people have lived here for thousands of years, and thrived without motor vehicles. Not everyone requires a paradisaical setting to enjoy going outside, and the softness (to put it gently) of the present generation is far from the norm historically.

360,303 vehicles registered in Auckland city

= 17 per cent fewer than in 2007.

The number of vehicles dropped by 73,000 in 2 years?? That would be difficult to do even if new car sales were zero. Check your stats?

Why do you say that? The U.S. car fleet is shrinking, too. More cars are being retired than are being bought.

I wouldn't be surprised, but the difference would be very small.

I've seen speculation about this, but not data. Do you have a data source?

It did seem quite a claimed decline, but the info is here

http://www.aucklandcity.govt.nz/council/documents/stateofcity/docs/chapt...

To me, it meant many were not renewing their registrations, (as well as a decline in New car sales, but not to 0 ). [More may be driving unregistered ? ;)]

They also claim employment moved from 339,980 @ 2004, to 356,680 @ 2009 (+16,700)

so that's quite close to 1 car / city job (some jobs will be outside the city limits)

So that indicator is largely flat/positive.

More comment is here

http://www.aucklandcity.govt.nz/auckland/economy/analysis/july09.asp

and another site has this

Fuel use per capita in Auckland has declined from 1,191 litres in 2004/05 to 1,058 litres in 2009/10. (-11.1%)

which is negative, but not by as much (Suggests the lapsed registration/sold outside region declines, were used for less miles, than the 'main car' ?

Or, in USA units, 6.65 Barrels/year I think.

Relates to ~New York state, on this yardstick

http://www.infrastructurist.com/2010/04/26/how-much-gas-does-your-state-...

Recession was not caused by the oil shock. If high oil price is responsible, how come India, China and some developing countries are booming? Recession was caused by bursting of the bubble caused by too much easy credit. The amount of money people spend on gasoline is a small fraction of their mortgage payments. Are you saying that if gasoline was $1.50 a gallon people would not have defaulted when their ARM reset from 2% to 6%?

They are beginning to outbid us for oil. EG China and India have about 7 times our population and are able to devote much more labor towards obtaining a gallon of gas - a person may work eg 80 hours and need 1 gallon a week for his scooter. In our hubris, I think we in America never counted on this happening. They are demographically much younger too.

Their demand continues to increase while ours stagnates or falls. If fuel was cheaper, our demand for motor fuel would go up.

Think about it for a minute.

It doesn't matter how much world demand there is for oil, beyond a certain point it's more expensive than the substitutes.

The price of oil has risen, and now hybrids are competitive. EVs like the Leaf, and EREVs like the Volt will get cheaper. If market prices for oil rise, or if we get smart enough to internalize the steep external costs of oil (security, pollution, etc), we'll switch faster.

Most of the substitutes use fossil fuels as inputs. It is hard to have their costs not increase, which fossil fuel costs increase. This is the "receding horizons" problem sometimes referred to.

I am doubtful that the cost of EVs will drop. Subsidies are going to become more and more a thing of the past, as the recession gets worse, and governments are shorter on funds. Also, businesses will need to cover their own costs and make a profit too.

Most of the substitutes use fossil fuels as inputs.

The main substitute for oil is electrification. Electrical equipment requires very little oil to manufacture.

Wind has a very high E-ROI, and little of that small imput is oil, so it's costs won't be affected much by PO.

This is the "receding horizons" problem sometimes referred to.

This applies mostly to very low E-ROI things like ethanol. Even there, low coal and nat gas prices mean that E-ROI has less importance than one might think.

I am doubtful that the cost of EVs will drop.

They're already low enough to be useable, and their costs will fall with rising volume, and economies of scale.

Subsidies are going to become more and more a thing of the past, as the recession gets worse, and governments are shorter on funds.

Again, this is circular reasoning: you haven't shown that PO will cause the economy to decline.

Nuclear could substitute all gas and coal generated electricity as well as all heat generated with gas. It does scale. Not easily but does. Gas and coal diverted to transport. A bit like Pickens :-). Wind and PV do not scale "at this scale"

Yes, EV/hybrid is a dead end. EV freeze a lot of important metals in batteries and have fuel economy comparable with small turbo diesels. If you put a small turbodiesel in a Prius, it would have same fuel economy as Hybrid, but using somewhat lesser quality fraction of oil. For fully EV electricity must obviously be non-carbon which means...What scales. Wind, PV or nuclear?

China knows. They build coal plants but start building nukes like crazy, too. IMHO we should, too.

When things get really tough, we could see the sale of very cheap electric cars take off-and such cars can be built and marketed.

All that is necessary for this to happen is that the customer accept a very small slow car with a limited range -say thirty miles.

This can be accomplished with cheap , easily recycled lead acid batteries, and building the rest of an electric car is a piece of cake.

Lead is plentiful.So is sulphur.

I think that given the choice-no car, or small slow car with very limited range- millions of people will opt for the simple cheap short range electric.

If this comes to pass, thousands of people will find jobs installing coin operated charging stations just about every where a car can be parked legally.

Let us keep in mind that when and if things get really tight, gasoline will be one of the first things to be tightly rationed.Even a fairly well off consumer may find it much to his or her advantage to buy a cheap, slow, short range electric so as to extend his gasoline ration and therefore be able to drive an existing otherwise useless sport ute to Grandma's house once a month, or take the boat to the lake, or mow the lawn with the five thousand dollar lawn mower......

Such cars could actually be cheaper than a conventional compact car-and far cheaper to operate on a per mile basis, so long as electricity prices don't get out of hand.

But I believe the future is a not so cheap subcompact built out of very light wieght materials, superbly streamlined, powered by a VERY small diesel, and legally limited to a top speed of maybe thirty five to forty five mph.

Such a car would accelerate like a heavily loaded truck, but it would also get close to a hundred miles per gallon at 45 mph, and might beat that at 35.

If battery costs come down , it could morph into a plug in hybrid, and get an effective two hundred mpg in the hands of many commuters who drive less than fifty miles a day;such a car would only need a battery less than half the size of a Chevy Volt battery to go forty miles, and a quarter of that size to go the first twenty miles.

We have a simply mindboggling amount of money sunk into suburban autocentric infrastructure;we aren't going to give it up if there is any way at all to avoid doing so-even if it means teachers and lawyers commuting in micro minis not much faster than bicycles-but warm and dry in cold weather, and possibly even air conditioned in hot weather.

Such a very small car could be effectively cooled with a really small ac unit if it were insulated with a few pounds of foam and made relatively airtight.

It could also have an ac unit capable of running on grid ac while charging and freezing a couple of gallons of water in a built in cold pack;that might suffice for a twenty to thirty minute ride.

Do you mean like almost any of these ?

http://www.progressiveautoxprize.org/team-central

Whilst this segment makes great energy-sense, the problem lurking here, is crash testing.

There is a large no-mans-land, between small cars, and motorbikes, which is amplified by the crash requirements.

That will need a change in rules/approvals, and maybe even an impost on the '3 tonne SUV', which would simply obliterate one of the subcompacts.

i used to see a lot of 3ton suv's and full size pickup trucks with one person in them commuting to work and otherwise. I see probably 90% less over the last three years. I've wondered what the difference would be between my EV colliding with an Accord and my motorbike from time to time....

Something along the lines of the x prize cars ,yes;but with fuel prices and practical engineetring comsiderations determining what is built, rather than the somewhat arbitrary rules of the contest.

The three ton suvs will be seen only occasionally on the road if minidiesel or mini electric car becomes very popular;and my guess is that the drivers of such vehicles will learn to be very careful, as by then public sentiment will be against them, and laws inflicting draconian punishment (in terms of current punishments) on the driver of one who causes an accident will be passed.

That is an interesting point farmermac, differential punishment/fines, based on mass, imagine what you would get for an 18 wheeler! I'll bet that the first move here would be the insurance company, cars of equal cost, with the 1ton being a $3000/yr insurance and the 3ton being $10000/yr.

I didn't buy an air conditioned car until '81. In most of the country there may be a "want" for an air conditioned car, but there is no "need" for an air conditioned car.

I'm with you farmermac, lead batteries can do the trick, and recycling them makes it better. I have a polaris EV which seems to do about 30mph and supposedly goes 50miles, i haven't tried the that yet. If they made it into a NEV i could haul 500lbs of vegetables on a small trailer to a 2nd spot in the 45,000 person town i'm near and have another satellite market spot. The charging is 1kw and nicely charges from my solar panels. I'll keep an eye out for their next generation EV, and continue to watch the NEV's, by my way of thinking a lot of people could be satisfied in the 35 mph range in and around many cities and towns, i don't think the town of 45,000 has a road above 35mph.

India, China, and some of the developing countries use a lot less oil per capita than we do, so the impact there is smaller.

Also, they saw what was coming, and really ramped up coal use at the same time that oil supply was becoming less available. This very much helped give an offsetting increase in cheap energy, that helped make up for the increase in oil cost.

OECD countries were trying to get coal use down, and wanted to substitute higher cost energy--both of these factors could also be expected to contribute to recessionary impacts.

India, China, and some of the developing countries use a lot less oil per capita than we do, so the impact there is smaller.

Bingo! So if we could reduce our per capita oil consumption (which is very high compared to Chindia) we could easily cope with increasing oil price and grow our economy in spite of it. Isn't that what Nick has been arguing?

Also, they saw what was coming, and really ramped up coal use at the same time that oil supply was becoming less available.

But the crux of the matter is that their oil consumption has been increasing for several years. They didn't substitute oil with coal. They have increased both oil & coal consumption. As the oil consumption in OECD countries dropped, Chindia and some other developing countries picked up the slack.

OECD countries were trying to get coal use down, and wanted to substitute higher cost energy--both of these factors could also be expected to contribute to recessionary impacts.

Obviously the recession is made worse by higher energy costs. But I thought the debate was about whether high energy price was the root cause of recession.

Wow suyog - your bending my mind on that one. We can't easily cope.

The title of this piece is

The connection between Peak Oil and the recession is an aside.

I think that the fear of Deflation will trump any decisions about the Climate Catastrophe.

The deflation threat is more immanent although the CC is more lethal.

I seem to detect a false and non-productive thread disputing whether or not high oil prices caused the recession.

Most of the time recessions are caused by inappropriate and unproductive investments. The investments then have to be written down to their actual value which causes severe dislocations in the economy and a recession.

In addition, recessions are often exacerbated by borrowing large amounts of money to make these investments. I think there is no question that this factor made things worse.

I don't think that this recession is any different there were massively unproductive investments made. They were made in facilities that require cheap fuel prices to make sense. Some examples of these inappropriate investments that come to mind are:

-- large amounts of housing built in areas that can only be serviced by private vehicle

-- large amounts of roads built to service these areas

-- large amounts of commercial development built in areas that can only be serviced by private vehicle

-- facilities built to produce non-fuel efficient vehicles

-- the non-fuel efficient vehicles themselves

-- non-economic low EROEI energy developments

I am sure that could be much longer, but they all have a common thread in that they assume that fuel will be cheap for a long time to come. If investment had been made in a series of measures to realign the North American economy to massively reduce energy, and, in particular oil, use over the past 10 years then things might have turned out differently.

There seems to me to be little point in this dispute.

If wishes were horses .....

Hi Nick,

do you recognise that the economy is dependent on the environment for energy and material inputs as well as output sinks to absorb wastes?

Absolutely.

I'm simply arguing that in the long-run that the economy is not dependent on fossil fuels in general, and fossil fuels in particular.

Eliminating our current dependence on oil & FFs would also eliminate our biggest waste problem, CO2.

Even our current dependence on oil & FFs is overstated by the minority whose investments or careers are directly dependent on them.

Separating this kind of "substitution" from what people call "cutting back" seems almost like drawing a distinction without (much of) a difference, at least in terms of economic impact. If oil/energy issues become bad enough to drive people onto hugely time-consuming trains or buses (e.g. almost every day Chicago RTA invents some new lame excuse for the day's execrable service), or into hugely time-consuming carpools (the 1920s model of everyone marching in lockstep from an inner suburb to a huge nearby plant and back again at precisely the same time is pretty well kaput, so most end up taking the Grand Tour every morning and night, and end up waiting around for at least one laggard every night), then I would submit they'd be unlikely to get more than a pittance for the SUV, and that (reliable) used Civics would be too precious to be available at a "reasonable" (i.e. current business-as-usual) low price.

So they'll suck it up and spend more on gas, leaving less money for other things. Or they'll buy an enormously expensive new fuel-efficient car, leaving less money for other things. Or else ... they'll piddle away hours and hours, either waiting for municipal buses and trains whose lazy overpaid tenured drivers can't even be bothered to show up on time, or else riding all over town in a carpool twice a day - leaving no time for other things. (Plus, those buses and trains cost just about the same per mile as driving alone in a car, and seem cheap only because governments that still think they're flush with money give the "service" away practically for free. In a pinch that will become unaffordable, and the rider will pay or else stay home.)

As to debt, there may be some exaggeration in Gail's view of things, but it does seem as though the bubble economy lured so many people so close to the edge that a feather can push them over. And while I reject the silly notion that debt can't work without growth (after all, religious authorities have always inveighed against it precisely because it is often an effective tool), rapid growth makes it far, far easier to pay off, almost to the point of making it look like a freebie. That strongly encourages taking it on recklessly - which has already been done in spades so that now we're deep into the hangover. I suppose we'll have to wait and see how that turns out.

One way or another, there's never been a free lunch.

Very good points - in a short space it's hard to make clear distinctions.

Yes, most people don't like carpooling or mass transit, so it's not a perfectly interchangeable substitute. The point: both of them work to get people to their jobs. Carpooling in particular can be implemented overnight, costs nothing, and saves 50% to 80% of fuel consumption. So, if people are really in pain, they can still do the basics, like getting to work, without having to skip the mortgage payment.

By the way, Metra and CTA bus services aren't great (though CTA's BusTracker helps), but their electric rail service really is very good for commuting, and we have plenty of electricity.

they'll buy an enormously expensive new fuel-efficient car, leaving less money for other things.

A Prius is less expensive than the average US car. Ten year old Corollas and Civics are very cheap and reliable, and get pretty good mileage.

I reject the silly notion that debt can't work without growth (after all, religious authorities have always inveighed against it precisely because it is often an effective tool)

Would you like to expand on that? I'd be curious for your thinking.

we're deep into the hangover

True. It may take a long time to recover.

Debt: has been used for ages to time-shift the use of resources. By the time you could save up for a house, you hardly needed it any more. Or by the time you could save up for tools-of-the-trade, you'd hardly be capable of using them any more. So some form either of debt or of debt-called-something-else (often servitude) took care of such problems (e.g. apprenticeship, working for practically nothing for seven years; in the good old days, with life so short, many would never even have outlived that term of servitude.) OTOH as we've been seeing, debt can be badly overdone (even in times of rapid growth.) Hence the tradition of inveighing against it, reinforced of course by the bucket-of-crabs mentality that pervades at least some branches of many religious traditions.

And let's not forget all the other things that function almost exactly like debt but aren't called debt. For example, "free" and universal education at public expense. That's another form of time-shifting the use of resources from late in life to earlier. So, for that matter, is childhood itself. And yet somehow people managed, irrespective of the rate of economic growth, which was usually essentially zero.

Old Corollas: may be cheap now (almost by definition: nobody wants them) but if these issues start to bite really hard, they won't be so cheap or available any longer. This is simply not a door everyone can walk through at the same time.

Carpools: "Carpooling in particular can be implemented overnight, costs nothing..." Simply not true. Costs are often payable in currency other than cash. For many people carpooling (or transit) will carry a heavy cost in time, because most of us North Americans long ago ceased to conform to that ancient 1920s lockstep commute model. (Of course there are a few for whom it works fine; no problem with that.)

Debt: yes, if the material resources exist, we'll find social institutions to use them.

Old Corollas: Everyone doesn't have to walk through the same door at the same time.

Carpooling doesn't have to carry a heavy cost in time. Online matching systems, either ahead of time or in real-time, can make all the difference. Traditional carpooling was employer-based and clumsy because of communications and info processing limitations. Those problems don't exist now.

I must suppose that Nick is rather well off and doesn't know anybody who lives from paycheck to paycheck.

I personally know many people who do, and while they have cut back somewhat on energy purchases as prices have gone up, they have necessarily cut back MORE on other things.

And many people I know who do have "a little money", meaning they are moderately well off, buy a lot less gasoline and other fuels than they did formerly, but they have cut back thier fuel purchases LESS than spending on other things.

Gasoline is seen as necessarily having more utility than other goods or services to most people-especially the huge number who must drive to work and nearly everywhere else.

Science and the scientific method are fine things; but they need not be carried to ridiculous extremes.

Mac,

Sure, there a lot of people who live from paycheck to paycheck, but a lot of people don't. Gail is talking about the whole economy, not just the rural poor. We shouldn't do economic analysis assuming that everyone is poor.

Also, see my comment above.

You don't need everyone to be poor for the effects I am talking about to happen.

What is necessary is that some of the population be living from paycheck to paycheck. These folks aren't necessarily going to be thinking through the possibility of trading in their SUV for a smaller older car, and looking poorer in the eyes of their neighbors. The SUV will be depreciated in value (as it drives off the lot), so its trade in value on a new smaller car will be considerably less, in terms of what it will really buy.

You don't need everyone to be poor for the effects I am talking about to happen. What is necessary is that some of the population be living from paycheck to paycheck.

But how many is "some"? How big will the effect be? You need to quantify that. Otherwise, it's just a handwaving argument.

Again: the poorest quintile of the population tends not to own cars. The richest 40% of the population tends to pay cash, or have the cashflow to deal easily with such problems. We're talking about perhaps 20% of the population, and even most of them will be able to carpool, switch to the teenager's small car, take the train, etc.

These folks aren't necessarily going to be thinking through the possibility of trading in their SUV for a smaller older car, and looking poorer in the eyes of their neighbors.

They'll be thinking about it. Most will be reluctant to look poorer, but will they be willing to lose their house to keep their SUV?

The SUV will be depreciated in value (as it drives off the lot), so its trade in value on a new smaller car will be considerably less, in terms of what it will really buy.

They may have to buy a used car. Perhaps a 5 year old Corrolla, Civic, or Yaris.