A Brief Nuclear Update

Posted by Gail the Actuary on July 11, 2010 - 10:45am

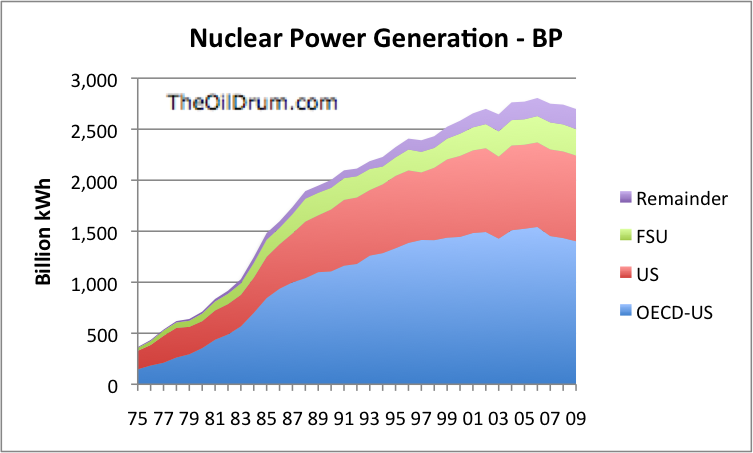

World nuclear power generation slipped again in 2009, continuing its slide since its peak in 2006. The data shown is from BP's compilation of statistical data, but data from the World Nuclear Association shows the same pattern--peak production in 2006, with declines each year since 2006.

The part of the world with what appears to be the clearest pattern of declining nuclear power generation is what I call OECD-US, the is, the countries in the Organization for Economic Development and Co-operation, minus the US. This group would include Europe, Japan, Australia, Canada, and Mexico.

It is possible that there are particular accidents and facilities being taken off line for upgrades or other reasons that are causing this pattern. But with aging facilities, it may very well be a pattern we can expect in the future, at least in the parts of the world with aging nuclear facilities.

Besides OECD-US, both the US and the Former Soviet Union (FSU) showed dips in nuclear power generation in 2009, at least partly related to declining electricity demand in general. The only group which showed an increase in nuclear power generation in 2009 was the group I call "Remainder", which includes China, India, and many "developing" nations.

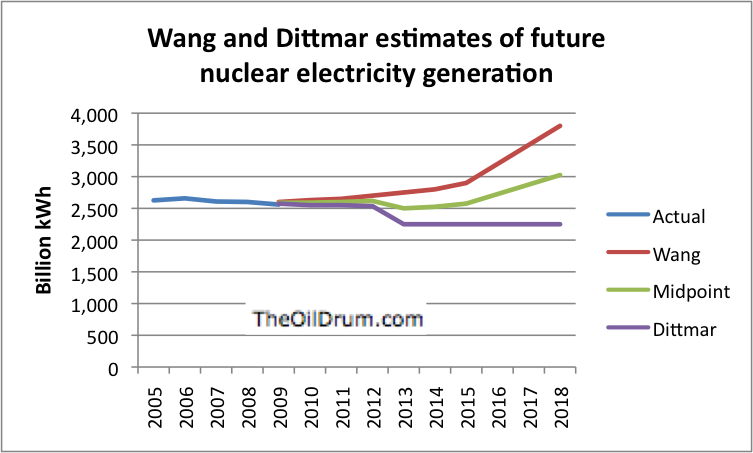

Last year, Michael Dittmar wrote a series of posts on the future of nuclear energy. Brian Wang, who writes at nextbigfuture.com, and under the name advancednano at The Oil Drum, took issue with the projections he made. Brian Wang made a bet with Michael Dittmar regarding the future of generation of nuclear electricity, using World Nuclear Association figures, which are slightly lower than BP amounts, but seem to follow the same pattern as BPs, where both are available.

Wang forecasts a 46% increase over 2008 power generation levels by 2018, while Dittmar foreacsts a small decrease in the same timeframe. For the 2009 year, Wang forecast production of 2,600 billion kWh while Dittmar forecast production of 2,575 billion kWh. The actual amount was 2,560 billion, which was lower than either of the estimates, so Dr. Dittmar won for this year.

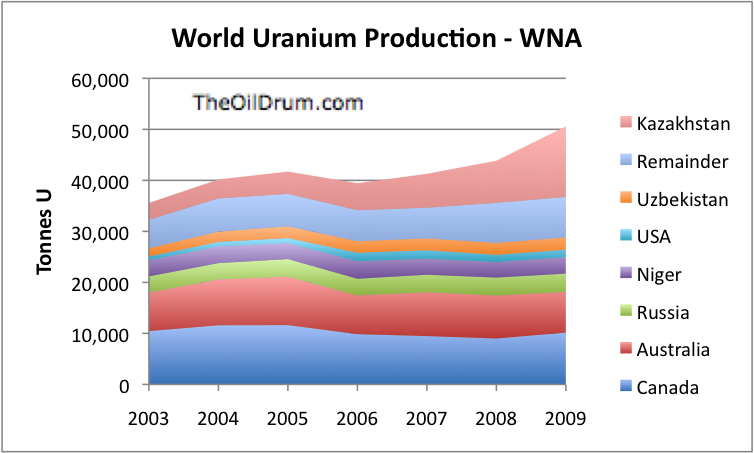

There was also a bet with respect to uranium production for 2009.

Wang estimated that for 2009, world uranium production would be 49,722 tonnes of uranium while Dittmar estimated that world uranium production would be 44,000 tonnes. The actual amount, based on figures of the World Nuclear Association was 50,272 tonnes, which is higher than either estimate. Therefore Brian Wang is winner on this part of the bet.

With one bet going each way, I would describe the situation as basically a tie.

Going forward, it is not entirely clear what will happen. The spot price of uranium is very low now, only a bit over $40 a pound. This low price is reportedly occurring because of the high production and low costs of Kazakhstan.

Another reason the price is low is because the US is because recycled US bombs are reaching the market. According to mineweb:

"Prices continue to be dampened by a low level of ‘uncovered utility requirements in the West, concern over further production gains in Kazakhstan and the barter of U.S. Department of Energy UF6 inventory to pay for an environmental cleanup at a closed Ohio uranium enrichment plant," Mohr advised.

The announcement of a DOE barter sale to USEC Inc., a leading supplier of enriched uranium fuel for commercial nuclear power plants, was blamed for the beginning of a uranium price decline a year ago. The sale will end in the third quarter of this year. However, Mohr said U.S. Energy Secretary Chu intends to sell additional federal uranium inventory under another program.

Long-term contract prices are down, but not as much.

The long-term contract uranium price is US$58.00/lb. It is down from US$61/lb January 2010, though has been relatively stable, compared with the more thinly traded spot market price, since peaking at US$95/lb from May 2007 to March 2008.

Australia has instituted a new tax on mining profits, and this is discouraging new production there. China has said it is planning a similar tax. Both higher taxes and lower prices would tend to discourage uranium production, although it is not certain by how much.

Current uranium consumption seems to be around 66,000 tonnes a year. The amount by which current production of 50,272 tonnes needs to be ramped up to meet consumption depends on whether nuclear generation is really increasing or decreasing. (Part of the demand is now being met by recycled bomb material from both US and Russia, but in not too many years, this will be exhausted.)

If nuclear generation is set to rapidly increase, as Brian Wang forecasts, then very large increases in uranium production will be needed over the next few years, so that production matches demand. But if nuclear electricity generation is really falling as a result of older facilities going off line, then annual uranium consumption can be expected to drop from the current 66,000 tonnes. If this happens, perhaps not too large an increase from current production levels is needed.

One thing that strikes me about nuclear electric generation is the limiting factor is likely capital availability. This is likely the same limiting factor for new oil production, new natural gas production, and new wind production. To the extent these are all tied together, future new production from all of these sources may move together more than most would expect.

A decline in debt availability (or the unwillingness of governments to guarantee more debt) could be a limiting factor in the production of all of these resources, since capital is now often made available through debt financing. With governments in increasingly poor financial condition, their ability and willingness to guarantee the additional nuclear debt required to refurbish old facilities and add new ones may be limited.

These considerations would suggest that growth in nuclear generation may be be limited to a few countries which are able to finance new reactors--perhaps China and some other Asian nations. To the extent that old reactors are taken off line elsewhere, total nuclear electric generation may continue to decline.

I also worry about capital limits, since we appear to be facing several very substantial needs for it in the next couple of decades: build-out of renewables, very large upgrades in the electric grid, etc.

And it always seem worth noting that the cumulative costs for operations in Iraq and Afghanistan have now passed $1T; at $5B per for a nuclear plant, we could have replaced the current US nuclear fleet twice over. The killer for that particular piece of misguided for policy is in the opportunity cost, what we could have done with the money instead of throwing it away.

Our local electric cooperative recently announced another rate increase. I noticed that the % increase diminishes with increased usage, rewarding consumption. They have produced a slideshow to explain why an increase in rates is necessary. They are essentially caught in a credit "Catch 22", and are slaves to growth like most of our essential services (as Gail explains above). Their presentation is simple and concise: http://www.brmemc.com/rateincrease/Rate_Increase_Explained.html

Members used to get an annual rebate if the (co-op) utility showed a profit. This hasn't happened for years (according to family members). I post this as a local example of why growth in nuclear power and most other energy sources has declined. These folks are trying to pay off the debts they have already incurred, anticipating ever-increasing demand. I see this as being a good example of the state of our overall economy. It occurs to me that these rate increases may cause a sort of feedback loop, encouraging cash-strapped customers to conserve even more, further reducing sales revenues (though I'm sure that our current heatwave is good for business).

Disclosure: We are not connected to the grid and are not an electricity customer of this co-op.

Thanks for the interesting comment. The negative feedback loop I would agree is the most likely outcome. The depression as a whole I think generates much of this same -feedback in most subsets of the economy. Your comment really does speak to the possibility of an economy that can exist without growth?

There are two kinds of capital: Financial capital and real capital. Real capital limits refer to an existing stock of buildings, machines, tools, trucks, computers, and the concept can be extended to human capital; we have only x number of nuclear engineers. Real capital does indeed create binding constraints for more investment in an industry.

Financial capital refers to various kinds of money, equity, or debt. Note that the Fed can create money without limit, and it will be under pressure to do so to finance increasing government deficits. Because of the Fed's unlimited ability to create new dollars, I do not think that financial constraints will limit the investment into nuclear power. However, for there to be investment there must also be profit. As the cost of coal-fired electricity increases, I expect the profitability of nuclear electrical power generating investments to increase.

Thus, I disagree with Gail on this one big issue as to whether or not there will be financial limits to investment in nuclear energy over the next twenty years.

Are you saying that in your view all new nuclear power plants will be built by governments rather than private capital?

Private capital certainly does have limits on availability and right now the U.S. government is willing only to provide loan guarantees.

I expect private capital to be massively subsidized by financial guarantees by government. This has been the history of the nuclear industry in the U.S., and I think it will be the future too.

At the current moment, capital is actually plentiful if there were any kind of guarantees by the government or strong companies. Bond rates are the lowest in many decades. This should be very favorable to nuclear power plant construction.

It would be interesting to see Greece or Portugal or Spain guarantee any nuclear debt.

In fact, as we go forward, I expect to see more and more of this issue. This is the point I am making. I don't expect Britain and the US will be able to go on indefinitely, just raising their debt and guaranteeing more debt.

Yes, but loan guarantees are not the same thing as money. The capital and appetite to spend it must still be there.

It seems a very big stretch to me to say that nuclear will be built in the environment I foresee with just loan guarantees. We are, in my view, entering a period of astonishing austerity driven by a massive multi-decade deleveraging like the Great Depression but bigger. In such an environment, private capital switches to wealth preservation and doesn't want to take risks.

That leaves just the governments willing to spend, if they can beyond attempting to keep the mess from falling apart. If the American Society of Civil Engineers says we need $2.2 trillion to bring the U.S. infrastructure up to a workable level, even if they are too high by half much of our money will go toward decaying bridges, rupturing sewer and water systems, etc.

I think you and I are seeing a very different future economic environment and that is impacting what we both see is and is not likely.

Let's think about the issue in terms of net energy. There is less and less net energy flowing into the system. In terms of Charlie Hall's cheeze slicer, there is less and less net energy coming back for society to use for reinvestment and for other purposes. See for example this post:

Are you saying this basically doesn't matter? Money is divorced from the actual output of the economy. The government just prints some more. No one will be the wiser, if it has to keep printing more and more. There may be inflation, and as resources deplete, more and more inflation, but so what? No one will catch on. We will be able to obtain a disproportionate share of the world's resources (since the total is going down, but what we want to spend for concrete and steel and other items for say, nuclear, is is not), just by spending more of these inflated dollars?

I think to some extent, we have been able to fool ourselves, and think that there is more net energy (or more true output from society) than there is, by financing everything with debt--but much of the recent financing is of the type that can never be paid back with interest. Our net energy is likely already decreasing--certainly in the countries that are not ramping up coal use. It is likely that it will get worse over time.

Gail,

Nuclear energy competes directly against coal. I think that coal's true costs will be recognized--and sooner rather than later. Thus I see that nuclear has a huge competitive advantage against coal: It does not emit vast quantities of CO2, mercury, soot and other pollutants. Over time I expect the nuclear industry to expand while the coal industry (eventually) contracts.

There is less and less net energy flowing into the system.

We have an enormous surplus of energy right now. We could reduce our energy consumption by 25%, and still have plenty left for essential functions such as building nuclear or wind generation.

Which 25% did you have in mind?

Start with the military.

We could do it pretty much across the board, or focus on personal transportation.

Personal transportation accounts for almost 50% of US oil consumption. The average US light vehicle carries only 1.15 people: increase that to 2.3 (perhaps with mandatory carpooling, enforced in part by 100% HOV highways), and you're there virtually overnight. OTOH, the average US light vehicle only gets 22 MPG: increase that to 44 over 10 years, and you're there.

If we reduced at least some across the board, that would be easier. Freight wouldn't be hard to reduce by 25%: move some long-haul trucking to rail, slow down truck and ships by 10%. Aviation could reduce speed and increase capacity factors to reduce consumption by 10% pretty easily.

There's still about 400K bpd of home heating oil in use in the US: it's time to get rid of that.

Sailorman

On financial vs. real capital, you could distinguish them as M1, M2, M3, as in cash, savings, bonds, etc, and as K1, K2, K3, as in kilograms, kilowatts, and most important of all, kilocalories.

M economics vs. K economics.

Economists work almost exclusively in the M economic sphere, where money can call forth endless supplies of drilling steel, nuclear pressure vessals, coal draglines, etc.

We live in the K world.

Wkwillis,

You are correct that we live in the K world of barrels of oil, tons of coal, cubic yards of concrete, and so forth. However, it is worth noting that financial constraints can at times bite harder than constraints on the resources of production--Land, Labor, (real) Capital, Entrepreneurship and management skills.

Gail the Actuary, for example, sees financial limits as the binding constraint on real output as we move into a post-Peak world. My own guess is that a command economy, as we had during World War II, can break through market-based financial constraints. Thus I do not think that financial limitations will work as a long-term cause of stable or declining real GDP.

GDP around the world is going to go down as oil becomes relatively scarcer and more expensive; real GDP will fall more or less in lockstep with falling global oil production.

Don,

The US produces 150% more GDP now than in 1979, with less oil.

Land freight can go by rail, and reduce fuel consumption by 70%, then go by electrified rail, and eliminate the rest. Water freight can reduce speed by 20%, and reduce fuel consumption by 50%, then install wind propulsion and batteries and eliminate the rest. Personal transportation can go hybrid, and reduce fuel consumption by 50%, install batteries and eliminate 40% of the remaining 50%, and use ethanol for the remaining 10%.

We don't need oil.

How much of that GDP is simply inflation and government spending? GDP is not a good metric to use.

How much of that GDP is simply inflation

Very little. It's not that hard to count things, especially over 30 years.

and government spending?

Government spending is real consumption. You may think other forms of consumption would be more useful, but that's different.

-------------------------------

In any case, it's beside the point: Don was talking about GDP.

$1T; at $5B per for a nuclear plant, we could have replaced the current US nuclear fleet twice over.

Besides that it is more like $10B per nuclear plant:

http://www.thestar.com/business/article/665644

http://www.npr.org/templates/story/story.php?storyId=89169837

With $1T; at $1.4B per 1GW of wind power, that leads to 714 GW of wind power producing more than double as much electricity than the current nuclear fleet without depending on uranium imports and high decommissioning costs:

http://www.webwire.com/ViewPressRel.asp?aId=55119

Needless to say that First Solar is already at: $0.81B per GW for photovoltaics:

http://www.reuters.com/article/idUSN2816328020100428

Some people keep on forgetting that people need energy for a hot shower and a coffee in the morning and don't necessarily need to save nuclear power at all costs...

Just curious - have you ever tried take a hot shower in the morning in a house with solar hot water heaters? I have - not a pleasant experience unless you are really lucky and the first one up.

I have also been becalmed for a couple of days on the open ocean on a sailboat - also not a pleasant experience because I knew that every extra day on the water was one less day on the beach in Bermuda because we had a fixed return date.

Your quoted prices for wind and solar are pretty impressive. I would bet that the people in New England whose electricity supplier has just signed a power purchase agreement with Cape Wind would love to have access to that kind of power. Instead, after collecting all available federal subsidies, the seller will be providing electricity at $207 per MW-hour starting in 2013 and escalating at 3.5% per year (perhaps the wind gets more expensive with inflation) for the next fifteen years.

http://atomicinsights.blogspot.com/2010/05/how-much-will-electricity-cus...

I also wonder about the solar numbers that you quoted. Abengoa Solar, the company that has been awarded a DOE loan guarantee of $1.45 billion, will be spending about $2 billion to build a solar thermal plant that will generate about 250 MWe at the peak of the day. It is not clear how much extra heat will be collected and put into storage.

That works out to about $8,000 per kilowatt of peak capacity for a system that will have a CF of about 25%.

http://theenergycollective.com/marcgunther/39495/solar’s-long-and-winding-road

That is pretty expensive considering NuScale is quote a bottom up price estimate of about $4,000-4,400 for a 270-540 MWe power plant that should be able to achieve a CF of 80-90%.

http://atomicinsights.blogspot.com/2010/02/post-meeting-report-platts-nu...

Rod Adams

Publisher, Atomic Insights

Host and producer, The Atomic Show Podcast

I believe that CSP plant will have a six hours of thermal storage built in to it which will significantly increase the capacity factor.

Good references on small nuclear reactors!

I hope some day that the renewable and nuclear people can be more supportive of each other as there is a place for both depending on the situation. All of the negative talk from each side only serves to slow down any development of both technologies. We will need it all.

Besides the fact that the nuclear industry in Europe is currently running a massive PR campaign against renewables and efficiency: We won't need it all. We will need what is most cost effective on a given location, since you can't spend the same Dollar twice.

And as far as the US and its energy needs are concerned: Most cost effective is an increase in US-efficiency as there is absolutely no reason for the US to use double as much energy, despite having a lower average living standard than some much more efficient European countries.

Agreed, efficiency is great and the US will be reducing its consumption, one way or another. However, given the laws of thermodynamics, we cannot do work with negawatts. We still need to find at least partial substitutes for the energy lost from depleting oil resources which will leave a huge BTU shortfall in the world's primary energy supplies.

I have not seen anything about such a campaign in Sweden. Could you give some sources to read?

I realy dont see how such a campaign against renewables and efficiency could succeed, it would get shreeded by any politician, journalis, engineer or home owner smarter then a pile of rocks.

Here in the UK the rocks tend to be smarter than any of those except maybe the engineers.

I mostly notice PR-efforts by the nuclear industry in Switzerland and Germany.

The Swiss nuclear power operators want to build 3 new nuclear power plants and the German nuclear power operators want to keep their nuclear power plants running as long as possible. In order to reach these goals they need to fight renewables and efficiency (they don't attack coal, because the same companies who own nuclear power plants typically also own coal power plants).

At least in Switzerland they do this by preventing efficiency and renewable efforts (apart from hydro) on a political level and scaring the public by telling them: If Switzerland won't build new nuclear power plants, the lights will go out, as there are apparently no alternatives to more nuclear power. Which is obviously absurd given the fact, that Switzerland sits on 55% flexible hydro power and trades (imports from France at night and exports to Italy during day time) about the same amount of electricity as the entire country consumes.

Besides having read articles (in local newspapers), which badmouth any renewable and efficiency efforts and are often written by a PR guy rather than an actual journalist. Here's an example of TV spot run by a Swiss nuclear power operator showing a dimwit with a photovoltaic-watch that doesn't run because it's been raining:

http://www.youtube.com/watch?v=h8VeugmAsx8 (Ironically the company which has been running ads like this, also had a nuclear power plant with 1.2 GW not running for almost 6 month - not just a rainy day.)

Or if you google for PV or solar energy in Switzerland you receive ad-links from the 3 Swiss nuclear power operators (axpo, alpiq and bkw) or their PR-sites (one domain has the ingenious name: alwaysenoughelectricity.com), telling you, that PV and solar energy is basically of no use:

http://www.scribd.com/doc/26470277/Google-PV-Links

Of course there are journalists, engineers and politicians which know and lay out the facts, but at the end of the day the power industry only needs to win the majority in the parliament or the public opinion (which is significantly easier, if they're the one sitting on the dough).

What a waste of PR and mental energy! In Sweden has the nuclear power companies gotten what they wanted such as an ok for upratings and life lenght extensions and now also an ok for replacing old plants with new ones. But this only makes money for them if they actually produce electricity.

Having fewer competitors gives higher prices but what have they to worry about with todays trends? Everybody knows that the Danes soon will start running out of natural gas, there is a wee bit of discomfort in being dependant on Russian politics to get energy, the global coal markets has sinkholes in China and soon India and peak oil will shift everything but the need for power.

Fighting renewables and efficiency is like breaking your neighbours shovel to monopolize snow shovelling before the blizzard hits and suffocates everything.

Even worse and more ironic is the Swiss Poeple's Party (SVP) which is constantly and apparently fighting for Switzerland's independence, but at the same time blocking any efficiency and renewable efforts.

The same party just convinced the majority of the public that minarets somehow threaten Switzerland and that they need to be banned (4 were built during the last 60 years). So I wouldn't be surprised if they also manage to convince the public that we need 3 new nuclear power plants.

And by the way they also say, that they just want to replace 3 old reactors with 3 new reactors but what they don't say and most people do not know, is that they want to replace 3 x 0.35 GW reactors with 3 x 1.6 GW reactors, which will produce almost 5 times as much electricity and is obviously only an option if the country is getting significantly more inefficient. (Besides the lifetime of the 3 old reactors is unlimited, so they don't have to shut them down, even if they build 3 new ones.)

Just curious - have you ever tried take a hot shower in the morning in a house with solar hot water heaters? I have - not a pleasant experience unless you are really lucky and the first one up.

People here don't have problems with these systems over here. But then again I live in central Europe where we can draw from dependable plumbers...

Regardless, better would be to use heat pumps in order to increase the grid flexibility - similar to France which runs electric water heaters at night when inflexible nuclear power plants generate a surplus of electricity. At the end of the day electric water heaters don't care whether they are powered by homegrown wind or imported uranium...

the seller will be providing electricity at $207 per MW-hour starting in 2013 and escalating at 3.5% per year (perhaps the wind gets more expensive with inflation) for the next fifteen years.

The feed in tariffs for wind in Germany are between 5.28 cents/kWh 8.36 cents/kWh and wind manufacturers are obviously still capable to generate a profit with these prices otherwise windfarms in Germany would simply not exist. Then as opposed to nuclear, wind does not get government loan guarantees....

http://www.wind-energie.de/de/themen/kosten/

And if you cared to read what I wrote, I didn't quote any solar thermal numbers - oh well, ignorance is bliss.

Two questions and a comment.

For various reasons, there is a significant % on this board who are disinclined to even consider nuclear, not even the Gen-IV designes that produce far less radioactive waste with much shorter half-life (some designs can even burn waste from older reactors). I like the eco-friendliness and simplicity of wind/solar myself, but also realize that it's foolish to take a perfectly good (and more easily scaled) energy source like nuclear off the table as we face the downslope of Hubbert's peak.

Gen IV exists only on paper!

A good definition of the advantages of Gen III and its advantages would be welcome.

(yes it is supposed to be a factor of 10 more safe (but recent EPR troubles indicate otherwise) and as such a factor of 2(?) more expensive per kwh)

michael

How is nuclear more scaleable than smaller, modular systems? It is a fallacious to assume that only large power plants are scaleable; many smaller plants accomplish the same purpose and carry less risk and shorter lead times, which gives them a considerable advantage, particularly in a risk-averse investment environment like the one we have now.

Here is an example that demonstrates the point: You could invest the same quantity of money in nuclear plants or wind farms for roughly the same amount of average capacity (i.e., accounting for the 25-40% capacity factor for wind) but your nuclear plant will take ten years to complete, while the wind farm will be done in perhaps two or three years depending on the site. Equity investors will not want to risk uncertain returns on their investment that do not even begin until ten years in the future. Plus nuclear, like wind, has major up-front costs, but unlike wind also major back-end costs associated with dismantling and waste disposal/long-term storage. We haven't even resolved this issue for the existing fleet of nuclear plants, let alone if nuclear energy were scaled up.

You get a much faster return on your investment (and faster energy payback) by redirecting the same funds spent on nuclear to smaller, modular renewable or micropower systems. The money/energy you get back faster can in turn be reinvested in expanding the buildout of said renewables, so ultimately the same amount of money invested in wind or other renewables, even for the same initial amount, can net you easily double the total energy return or even far more once you account for reinvesting the profits. By the time the first nuclear plant is done, you would already have several generations of wind farms in place and have generated a great many kilowatt-hours already, compared to zero for the nuclear option.

Renewables are far more scaleable. It's not even close.

but also realize that it's foolish to take a perfectly good (and more easily scaled)

The world added over 38 GW of wind power last year at a growth of over 40% compared to 2008:

http://www.gwec.net/fileadmin/documents/Publications/Global_Wind_2007_re...

And the world installed 7.5 GW of PV in 2009 and is expected to install 15.2 GW of PV this year:

http://www.solarbuzz.com/sbqdata.htm

On the other hand net nuclear power was actually reduced last year:

http://www.iaea.org/programmes/a2/

On the other hand net nuclear power was actually reduced last year

Yes, but is that because of the Chernobyl/3-Mile Island effect on public opinion, and the fact we haven't had a U.S. reactor built in some 30 years? It's certainly not because we *can't* expand capacity.

Re: the other comments about scalability and speed of building wind/solar, I agree renewables *could* be scaled up to a significant % of power generation, but 2-3 years seems a tad optimistic barring a massive Manhattan-style government project. Also, as advancednano pointed out, nuclear can generate power for 60+ years vs. wind for 15-25 years. That long tail significantly boosts the attractiveness of nuclear.

"Yes, but is that because of the Chernobyl/3-Mile Island effect on public opinion"

Ah, yes. If it weren't for that silly public who have the ridiculous notion that we should learn and be warned by past experience!

And, yes again--the Manhattan project was just a wonderful effort--it really helped out the good people of Hiroshima and Nagasaki. Maybe another one will work similar wonders for all of our beautiful cities.

Wind is at 300 TWH per year worldwide now and solar is at 20 TWH total.

Nuclear is 2559 TWH.

We have passed the initial restart phase with reactors in the development pipeline and will start seeing ten or more completions per year.

the world did complete 213 reactors during the 1980s

So adding 100-200 TWH per year with nuclear will be happening again.

Operational improvements doubled the nuclear power generated without new reactors. Operations can still be improved in France, Japan, Ukraine and other sub-90% capacity factor countries.

Nuclear plants can have extended uprates to allow existing plants to get up to 20% more power in project that can be done in 18-30 months of elapsed time and with just the regular refueling downtime.

When 2011, 2012 and 2013 numbers start rolling in, then as I indicated all the talk about the 2006-2009 period of nuclear generation stagnation will be shown as the temporary situation that it was.

You should also put up the generation additions for coal and natural gas and hydro. Those are higher than wind worldwide.

China's overall power consumption rose 24.2 percent year-on-year to 969.5 billion kWh in the first quarter of 2010. China's total power consumption is to hit about 4.10-4.17 trillion kWh in 2010, up 12-14 percent year on year. Based on the estimation on power consumption, the research body of State Grid further forecasted that the total power coal demand would reach between 1.74 billion tonnes and 1.76 billion tonnes during the same period, up about 10.8-12.1 percent year on year. the coal-fuel power generation will reach between 335 and 341 million kWh in 2010, a year-on-year growth of 12.0 to 13.9 percent could be expected, while the coal consumption for power generating will stand at around 1.56 billion tonnes to 1.58 billion tonnes, up 10.3 to 12.1 percent over a year earlier.

http://en.sxcoal.com/NewsDetail.aspx?cateID=182&id=34265

The numbers at http://www.iaea.org/programmes/a2/ show the dramatic ramp-up in construction:

# of reactors under construction at beginning of year:

2010: ****.****1****.**\*\**\*.*\**3****\****4****\****5****.*

2009: ****.****1****.****\*\**\***\3****.*\**4****.*

2008: ****.****1****.****\*\**\***\3****.*

2007: ****.****1****.****2**\*\**\*3*

2006: ****.****1****.****2****\*\**

2005: ****.****1****.****2****.***\3

2004: ****.****1****.****2****.****3***

# of GW under construction at beginning of year:

2010: ****.****1****.**\\2*\**\****3*\**.****4\***.****5**

2009: ****.****1****.***\\**\*.\***3**\*.****4*

2008: ****.****1****.***\\**\*.\***3**

2007: ****.****1****.****2\\**\**

2006: ****.****1****.****2*\\*.

2005: ****.****1****.****2****.\

2004: ****.****1****.****2****.****

# of GW in operation at beginning of year (− 350 GW):

2010: ~~> ****.***\6***\.**\\7\

2009: ~~> ****.****6\***.\***\\*

2008: ~~> ****.****6*\**.*\**7\\*

2007: ~~> ****.****6*\**.*\**7\

2006: ~~> ****.****6**\*.**\*7**

2005: ~~> ****.****6****\****

2004: ~~> ****.****6****.

And many reactors have been and more will be shut down.

And even if wind and PV additions will stop growing: 300 GW of wind and PV will be added in the next 6 years...

But I'm glad that you at least noticed one of the links I posted.

Is generation IV nuclear reactors the liguid fluorine thorium type or is one of these actually in existance producing electric energy?

The current nuke fleet is essentially all late-1950s or early-1960s designs.

That's why I only compare 2010 nuclear power with 2010 wind power - if you cared to read what I wrote.

...so as in the OP's explanation of the decrease in Russian nuclear production - reduced demand due to high cost - we may expect to see demand destruction due to high costs in general. I think even without problems in capital, this naturally then puts the focus on low cost production before all else, which certainly favors coal.

Nicely summarized, Gail. We used less of everything last year except hydro, according to BP:

This is consumption in mtoe, btw, from the Stat Review Consumption by fuel table.

Your link to the bet was from the comments section of one of Dittmar's articles, but Brian had a dedicated guest post as well: The Oil Drum | Uranium supplies are likely to be adequate until 2020. Brian also provided this handy table of the forecast, year by year:

Likely economics will dictate the winner for this year as well. What's the latest on electrical demand? STEO forecast is for US demand to be at slightly less than 2008 levels this year, up 3.6% from 2009.

IMO the main hurdle for nuclear power is cost and finance. Nuclear plants are so expensive and their costs have to be carried for so long without revenue, that not even the largest public utilities can afford to finance them. Why would a large utility company commit more than its market capitalization to a nuclear project?

It would be valuable to hear from proponents of nuclear why you favor deploying one of the most costly electricity-generating technologies instead of those that are less costly. Do you favor the massive government intervention in the economy the companies would seek? Do you favor a government-sponsored enterprise? Information on investment and return amounts and timelines would be particularly helpful. I'm looking forward to learning from you, thanks.

Source: page 11 of http://www.ferc.gov/legal/staff-reports/06-19-08-cost-electric.pdf

The comparison you show is for capacity, and different types of generation run at different capacity factors. When an adjustment is made for this, wind comes out to be roughly equivalent to nuclear, in cost of generation. (Offshore wind cost per kWh of electricity produced is likely higher than nuclear.) The quality of electricity produced from nuclear is better than the highly variable electricity produced by wind, and nuclear can be placed close to where it is needed. Wind can only be generated where it is located.

Just one question :

How much of the cost of nuclear is due to government regulation and mandated expenses ... and how much is due to actual cost of nuclear power ?

Same question for wind.

Imho, given the current tax climate and political winds I would easily "adjust" the graphs dividing the heavily taxed and regulated nuclear power by 2 and doubling the heavily subsidised wind & solar cost (obviously this in addition to the base-load problems solar and wind have).

The problem with such graphs as this is simply that government subsidies don't change the world : we pay the *real* cost, not the fake subsidized/taxed cost. Politics don't matter. Reality matters. When push comes to shove (and push *will* come to shove) nuclear will win out, and we will build lots of ill-designed quick-quick nuclear power plants instead of the very well designed ones that we could have built without all the anti-nuclear sentiment.

Here's why, a sneak preview of things to come

Am I reading your ideas correctly. You believe that nuclear power is not receiving government subsidies? Do you really believe that?

No-one really believes that it is receiving such subsidies. If we define an energy price scale such that the spot market price of uranium is 1, governments' take on natural gas comes out as at least 2. (The vendors' price of natural gas is of course ~20, but of that, royalties are one-eighth to one-sixth.)

So persons wishing to be in government's good books strategically misrepresent the way in which nuclear energy deprives it of income. They handwave subsidies, as if nuclear power plants were a public money sink, rather than acknowledging that their operation, by preventing the mining and sale of much more expensive natural gas, impedes a public money source.

Governments don't make much on coal, and this is reflected in many public money pandering commentators' tendency to refer to coal and uranium as if they were the same sort of thing, rather than poles apart safety- and sustainability-wise. They are similar only in how much fossil fuel income they deprive government of.

(How fire can be domesticated)

Nuclear not getting subsidies, tell that to people in Georgia.

heavily subsidised wind & solar

You mean like forcing taxpayer to pay for organizations such as EURATOM and IAEA to promote nuclear power?

In fact Austria without nuclear power pays almost double as much on EURATOM than on its 995 MW wind power:

http://www.igwindkraft.at/index.php?mdoc_id=1009697

Or having laws forcing consumers to pay for the capital costs of a new nuclear power plant in advance?

www.npr.org/templates/story/story.php?storyId=89169837

Or having taxpayer backed loan guarantees for nuclear power?

www.npr.org/templates/story/story.php?storyId=15545418

www.bloomberg.com/apps/news?pid=20601087&sid=aC7VY11v6aMw

Or having taxpayers to pay over $159 billions on nuclear R&D?

http://www.world-nuclear.org/sym/2001/fig-htm/frasf6-h.htm

Or having taxpayers to pay over $100 billions for decommissioning of nuclear power plants?

http://www.guardian.co.uk/world/2008/jul/10/nuclear.nuclearpower

Or having taxpayers to pay billions on ultimate repositories?

http://www.postandcourier.com/news/2008/aug/27/nuclear_surge_needs_waste...

Or having a federal law which in the event of an accident dramatically limits their liability?

http://www.progress.org/nuclear04.htm

Needless to say, that even the photovoltaic industry in Germany pay more in taxes than what they indirectly receive in feed-in tariffs (which btw are not paid by the tax payer) - not to mention that they reduced the German costly unemployment rate:

http://lohnsteuer-kompakt.de/redaktion/steuereinnahmen-der-solarindustri...

And the German wind power industry not only generated over 90,000 sustainable, tax-paying jobs and Germany exports 83% of its wind-turbines with a tax-paying PROFIT, wind power actually does lower electricity prices in Germany:

http://www.windfair.net/press/5604.html

http://www.tagesspiegel.de/wirtschaft/art271,2147183

When an adjustment is made for this, wind comes out to be roughly equivalent to nuclear, in cost of generation.

Besides that this statement is as far as new nuclear plants are concerned obviously false:

http://www.turkishweekly.net/news/67392/politics-key-to-russia-turkey-nu...

Interesting also:

Industrial electricity prices before tax (2007):

Denmark (20% wind power): 7.06 cents/kWh

Belgium (55% nuclear power): 9.69 cents/kWh

http://tinyurl.com/mfnvku

More importantly: Denmark still exports over 90% of its wind turbines with profit in a market with a double digit growth (as opposed to nuclear power which does neither).

http://uk.reuters.com/article/oilRpt/idUKLV55678920081231

and nuclear can be placed close to where it is needed.

So if there's no cooling water available, God will provide for it?

The EIA doesn't show Denmark's industrial electric costs. Their residential costs are amazingly high: 39.6 cents per kWh. They may be subsidizing industrial costs. Even at that, their residential rates seem to be nearly double the rest of Europe, and more than triple the US. See my comment elsewhere on this thread showing a rate comparison, with Denmark's rates on top.

The ocean can be used for nuclear cooling. I agree though, that water can be an issue. And if ocean levels rise, we probably don't want nuclear generating units on the coast.

Both nuclear plants in my state are on the coast to use the ready cooling water. One came within 3 inches of ocean flooding in a 1993 storm. If Jim Hansen is right, and sea level rise from global warming is 10 feet per century for several centuries, where should we site new plants to use sea water yet avoid premature decommissioning? (The 2013 IPCC report is going to be interesting, because for the first time all the self-reinforcing accelerators of warming will be included in the forecasts.)

Again you are ignoring the fact that Denmark taxes household electricity highly, because household electricity prices are irrelevant if you are not wasting electricity blindly - which is exactly the point of taxing electricity.

Denmark is definitely not subsidizing industry electricity prices.

The ocean can be used for nuclear cooling.

So you are saying that the US needs to build long electricity lines from the Ocean to the windy center in order to provide those states with nuclear electricity?

Ah so after your "proof" was shown to be off by ... oh ... a bit more than a factor of 4. Never mind that given this correction your point is an illustration that using 50% renewable energy (can) quadruple energy prices (which doesn't seem to be an unreasonable estimate actually, since Spain has similar figures).

And this is your reply ? "the price is irrelevant" ? This is beyond pathetic. Why not admit you're wrong and get on with your life ?

Or at least attempt to make a reasonable argument, like "they started too soon, but technology has matured" (which is true, even if it hasn't matured enough by far). "They're too far north to get much out of renewable energy" (which is true, except close to 1/3rd of the US is further north) ...

Why not admit you're wrong and get on with your life ?

Why not admit you're a blatant liar and get on with your life.

Again:

Industrial electricity prices before tax (2007):

Denmark (20% wind power): 7.06 cents/kWh

Belgium (55% nuclear power): 9.69 cents/kWh

http://tinyurl.com/mfnvku

More importantly: Denmark still exports over 90% of its wind turbines with profit in a market with a double digit growth (as opposed to nuclear power which does neither).

http://uk.reuters.com/article/oilRpt/idUKLV55678920081231

And the fact that Denmark decided to tax household electricity to pay for public services has absolutely nothing to do with the actual generation costs of electricity.

I'm sorry but facts are facts...

You might be interested in knowing that the largest nuclear station in the United States is at Palo Verde, AZ. Just in case you are not familiar with our geography, the plant is about 50 miles outside of Phoenix, AZ in what we call the desert southwest. The cooling water is provided by treated sewage effluent.

http://www.pnm.com/systems/pv.htm

All thermal power plants need some form of cooling - that is the way thermodynamics works since heat flows from hot to cold and it is the difference in temperature that enables power production.

If you remove thermal power from the US nuclear grid you are left with about 8% of our current supply - 6% from large scale hydroelectric plants and less than 2% from wind and solar.

There are some new nuclear plant designs - notably B&W's mPower - that are designed to use air cooled condensers.

Rod Adams

Publisher, Atomic Insights

The ocean is very often used for nuclear cooling. It should be easy to design around the ocean water level increase and continue to use oceans for cooling water for large thermal power plants.

'Anyone', before posting them for the umpteenth time, it might be worth your while to check whether your favorite anecdotes have passed their sell-by dates.

Which kind of suggests that Denmark is running out of places to install wind turbines. As does this project

US$1.6 billion / 400 MW / ~0.4 capacity factor = ~10 $/W(average)

US$20 billion / 4800 MW / ~0.9 capacity factor = ~5 $/W(average)

Which looks like the better deal?

My 'green' electric co. said in its 2009 annual report it was able to supply only 48% of demand via wind, and the reason why they can't increase it is the NIMBYs here in UK (Not In My Back Yard) - these are mostly the landed, well-organised "professional" types of course who get so hot under the collar about their beautiful views being spoiled (in the short term of course, never mind what might happen in the long term!)

Interesting to see the amount of NIMBYism that breaks out if/when nuclear starts to expand, and also the extent of authoritarianism the government uses to crush it.

AS I understand it the upfront cost of a nuclear power station includes monies escrowed for future decommissioning of the plant. In the UK nuclear decommissioning requires the site to be returned to a green-field condition presumably because it is unlikely to attract anyone wanting to use it as a brown-field site for future development. Coal-fired and gas-fired power stations do not have this capital preloading requirement and can exhaust their waste directly into the atmosphere with no financial burden to the operators. Any attempt to put a price on the waste gases from fossil-fuel thermal stations to pay for remediation of their effects is being fought tooth-and-nail by the fossil fuel lobbies, not suprisingly.

It is not all that clear that the escrowed money for nuclear plant decommissioning will be anywhere near what is needed. The amounts set aside are in the form of financial securities, which could fairly easily have very much reduced value, if we have other problems. The cost of the energy required to take care of the decommissioning is an unknown, if oil supplies are declining in availability due to peak oil.

I have not seen how the calculation of the amount that was needed to be set aside was made. My guess though is that the funding was made assuming that the securities purchased would gain in value over time. If they are stocks, the assumption has been made that they will continue to grow in value, perhaps by as much as 9% per year. Even with bonds, the assumption is likely made that the interest on the bond will be paid. How all these amounts will compare with the true cost of decommissioning is an unknown.

Not to mention eventually the last plant constructed will need to be decommissioned and at some point, even if it occurs at some indefinite point in the future, there will be no more nuclear electricity to be produced but the waste will still need to be managed, which means you'll have an industry with an energy debt and will have to come up with some new external source of energy to pay the debt. The nuclear option makes a rather large wager that we will be able to come up with this energy from somewhere - and we won't be able to compromise because the risks of botching it up are too great, so that energy may have to be diverted from what would otherwise be more worthwhile projects (like building more renewables).

Here is the website for SKB that handle the Swedish nuclear wastes.

http://www.skb.se/default____24417.aspx

They have unfortunately not translated the webpages about financing.

The prognosis for the total cost is in todays SEK 107 billion for handling

and storing all the waste from 12 nuclear powerplants. This is roughly a

cost equivalent to building three new nuclear reactors.

29 billion has so far been used for facilities and research.

The fund currently hold 42 billion SEK in Swedish government bonds.

It needs a future 36 billion from utilities and interest.

The current producer fee is about 0.01 SEK per kWh, about 0.13 cents,

it has been 0.02 too 0.01 SEK per kWh depending on the funding needs.

The cost prognosis is split in these parts:

4 % final repository for low and medium level waste, bulit and in use

but will be enlarged as needed.

19 % research and administration, good enough for final selection of method.

5 % transportation, the first high level waste ship, Sigyn, is soon to

be replaced due to age and wear.

18 % demolition of old nuclear powerplants, prognosis based on maintainance work and demolition of nuclear facilities in oter countries.

13 % building and runing of the wet storage for spent nuclear fuel, built,

enlarged and in use.

13 % encapsulation of the spent fuel and other high level waste, site is selected and it s planned to reach full production in 2023.

28 % building, running and closing the final repository for high level waste, site selected and it is planned to reach full production in 2023.

These plans will however change a litle since the nuclear power plants are being life lenght extended but that makes the financing easier. 2023 is a long time in the future and the schedule could slip but the political support for actually doing something with the waste is strong. All major political parties agree that we should do now and the site selection for the final repository were made in fierce competition about getting the facility.

All waste handling facilities will be built while nuclear electricity is being produced in volume. We also have political support for replacing old rectors with new ones wich makes it likely that the relay will be handed over withouth financial market woodoo. If nuclear power anyway peters out in Sweden it will have to be carried by the rest of the economy running on hydro, wind, biomass and wathever replaced the nuclear powerplants.

Gail already pointed out the need to convert to price per Kwh. Nuclear reactors can operate for 60+ years. Wind turbines and solar can wear out in 15-25 years.

75% of the new nuclear construction is outside the OECD. Look at the costs in China, India, Russia where most of the build is going. In those places the costs are $1400-2000 per KW. Russia uprated reactors for $200 per KW. (added 311 MWe). They will add another 300 MWe with another set of reactor uprates. Not the equivalent of a full large reactor from those uprates but the point is the cost without western style regulation was ten times less.

Note : all of the reactors. Even the ones in Russia, China etc... now all have containment domes and upgraded safety and other features. I am thus confident in their safety.

As for government sponsored ... All Energy has massive government sponsorship and support. Renewables have feed in tariffs. Oil and Gas have massive tax breaks.

http://www.iea.org/textbase/nppdf/free/1990/weo1999.pdf

International Energy Agency revealed that total global subsidies to fossil-fuel energy amounts to $550 billion a year.

the world will spend over $13 trillion on energy infrastructure over this decade. $6 trillion on fossil fuel subsidies which is not included in that $13 trillion.

Energy is a big money game.

Coal and oil have the biggest subsidy which is not included in those figures is that they do not have to pay to contain or clean up their pollution. Nuclear does pay to do that. But coal and oil dump billions of tons of CO2 and smog, and millions of tons of toxic metals. Mercury, Arsenic etc... this costs the world over a trillion in health costs and environmental damage and business damage.

http://nextbigfuture.com/2009/02/coal-power-and-waste-details.html

Acid rain reduces the years you can use a car and increases the frequency for repainting buildings. How long does an east coast car last versus a west coast car ?

Nuclear is at 2600 TWH. Wind is at 300 TWH. Solar at 20 TWH. Coal is at about 6200 TWH.

Why wouldn't you want nuclear to go to 4000 TWH by 2020 and offset coal going from 6200 TWH to 8000 TWH instead of 9400 TWH ? All of the non-fossile fuel combined from now to 2020 is just to try to stop the growth of coal. Through 2030 then we might look at using everything including nuclear to try to retire some coal plants.

Nuclear plants in the US are subsidized by the Price-Anderson act, which limits their liability to a fraction of their potential damage. Oil spills are also subsidized via liability caps. Privatize the profits, socialize the damages.

The WNA Nuclear Century Outlook Data shows a change from 2008 capacity of 367 GWe to a low estimate for 2030 capacity of 602 GWe, a 64% increase. Even if the gain shown for the US of 21 GWe does not materialize, (which it may not, due to the tenuous condition of the US financial situation,) there is still a 59% gain to 583 GWe.

I think that the most likely future for the US over the next decade is to try to reduce energy consumption per capita from the currently unaffordable levels by 40% or so to get back down to the average for developed countries, along with burning more natural gas and coal and adding some wind and solar. This may let us skip most of the next generation of nuclear plants and get to better nuclear fuel cycles in the future.

The last real price I saw for a large nuclear plant was $10,000 per kw. If you do a Levelized Cost of Electricity (LCOE) analysis on this I still think nuclear will be competitive with other newer technologies due to its long plant life, high capacity factor, and relatively low fuel costs. Of course, that is if you don't throw in a huge cost for decommissioning.....something which is very hard to estimate right now.

IIRC Great Britain with 12 or 13 nuclear reactors has had to allocate about 3 billion so far in decomissioning costs. I think they have scaped 2 so far. I hope that helps with the estimate.

@NatResDr - I favor nuclear for several reasons. First of all, compared to wind and solar, the system is far more reliable. During the recent heat wave in the eastern half of North America, the fleet as a whole was operating at about 97% capacity. There were a couple of units in a maintenance shut down, and a couple of units that were coasting down for fall refueling outages. Other than that, the daily reports filed with the US Nuclear Regulatory Commission indicated that the rest of the plants were producing 100% of their rated output for the full 24 hours per day for the whole week.

http://atomicinsights.blogspot.com/2010/07/when-heat-is-on-reactors-are-...

Quoting the cost of peak generating capacity without recognizing the difference in the ability to hit 100% and stay there for as long as 24 months without a rest demonstrates a real misunderstanding of the revenue generating potential and the ability to repay construction loans from that revenue. Last year, 13 nuclear plants in the US - more than 10% of the fleet - actually produced 100% of their full capacity for the entire year.

I do not favor massive government intervention, so if the renewables industry would be willing to forgo its 30% initial cost grants, renewable energy portfolio standards, and state level subsidies, I would be willing to bet that the nuclear industry would have no trouble attracting private capital. Actually, I suppose I should caveat that bet by saying there are plenty of reasons why established investors might want to shy away from financing nuclear power - those investors undoubtably have investment in fossil fuel related enterprises that would suffer dramatically from the recognition that energy is not scarce anymore.

One more thing - I am pretty certain that the cost of building nuclear power facilities will drop in a reasonably predictable fashion as we learn from the first of a kind projects and as we move towards factory manufacture of smaller plants that can take advantage of the same techniques as Eli Whitney once introduced.

Rod Adams

Publisher, Atomic Insights

Host and producer, The Atomic Show Podcast

This claim based on a double standard is just hard to accept. Given the risks it is unlikely that any nuclear power plant projects can attract the necessary capital without governmental support including liability limits and governmental loan guarantees....aka "massive government intervention." Removing support for renewables is not going to make this better.

However, I am all for "full cost accounting" http://summits.ncat.org/docs/EROI.pdf so we can go in with our eyes wide open on power supply investment decisions.

Here is some more thinking on this from Dr. Costanza's Solutions Journal. "The Perfect Spill: Solutions for Averting the Next Deepwater Horizon" http://www.thesolutionsjournal.com/node/629

I thought that I would be allowed to provide part or all of an oildrum article with my own view.

The decline since 2006.

Japan had an earthquake (2007) that caused the shutdown of 7 nuclear reactors aboue 40 TWH of reactors. Those reactors are being brought back. Most have been.

This last year France had labor problems and some maintenance problems 30-40 TWH

with the economic troubles and lower energy demand utilities had the incentive to perform more maintenance and shutdowns last year.

Japan has had some issues raising its capacity factors. But they have a program to get up to US and South Korean 90+% levels over the next 4 years.

France also has a program to raise capacity factors.

Germany is extending its 17 reactors for about 15 years past a previous political shutdown for 2021.

There will be over ten nuclear reactor completions in 2011. A few were delayed from 2010, but there have been completions in 2010.

2010 9 new reactors, 6.2 GWe (shifted the two Canadian Reactors to 2011)

2 reactors are scheduled for Dec, so a slip into next year is possible for the South Korean and Argentine reactors

2011 11 new reactors, 9.3 GWe

2010 and 2011 should see 15.5 GWe of new reactors or about 100-120 TWH. Plus there

will be 1GWe of uprates.

then 100-150 TWH of new reactors every year

2012 10 new reactors, 9.92 GWe

2013 12 new reactors, 13.08 GWe

2014 14 new reactors, 13.63 GWe

http://nucleus.iaea.org/sso/NUCLEUS.html?exturl=http://www.iaea.or.at/pr...

61 reactors are under construction now. Those are the reactors that are getting completed from now to 2014. some may take longer but the ones in Asia are getting completed by 2014-2015 at the latest for the ones already under way.

Of the 61 (58.8 Gwe) being built in the world now

China 24 (not OECD)

Russia 11 (not OECD)

S Korea 6

India 4 (not OECD)

Bulgaria 2 (not OECD)

Slovak 2

Ukraine 2 (not OECD)

8 other countries 1 reactor each

Also about 5 GWe of uprates are expected by 2014.

There is even bigger build up to 2020. Vietnam plans 13 reactors. China another 30-50 beyond the 24 already under way. By the end of the 2020s the world will be back to the 24 completions per year of the 1980s. During the 1980s over 210 completions. With double the world GDP getting to 50 completions per year in the 2020s-2030s is just getting to proportionally what was done in the 1980s. For 2020 and beyond the big impact will be factory mass produced reactors which will get proven prior to 2020.

There are very few shutdowns expected.

Dittmar said that uranium production would be the limiting factor from 2013-2018 and already in 2009-2012. He was 15% wrong from 2009-2018 already as he never increases uranium prediction above 45,000 tons/year

This is one of two point that I would emphasize about the bets. Uranium production is clearly heading up with a lot more from Kazakhstan, Niger, Namibia, Canada, Russia. (10,000+ tons per country over the next 5-10 years.) and some more a few thousand tons from other countries. Australia could ramp up a bunch but how much they do depends upon politics.

I had indicated that the nuclear generation differences predicted for 2009 and 2010 were small and a 2-3% variance is in the noise.

Operating capacity efficiency is the big kicker for the upside. Ukraine, Japan, France, Russia, India can get their operating factors up. Getting up to 90% is doable. India just had to have an embargo lifted for fuel and that happened last year. A 10% boost in capacity factor for those counties will add about 100 TWH/year.

Hi an,

Please forgive the awkward phrasing, but which two would these be?

Cheers,

Paul

Bruce power plants. Classified as new even though they are restarts from long term shutdown

http://www.brucepower.com/pagecontentU12.aspx?navuid=29

India's kundukalam 1 is now expected for end of Feb 2011.

Some of this can be looked at at the IAEA Pris database by country and status

http://nucleus.iaea.org/sso/NUCLEUS.html?exturl=http://www.iaea.or.at/pr...

and cross checked against

http://www.world-nuclear.org/info/inf17.html

Power reactors under construction, or almost so

Start Operation* REACTOR TYPE MWe (net) 2010 India, NPCIL Kaiga 4 PHWR 202 (operating) 2010 India, NPCIL Rawatbhata 6 PHWR 202 (operating) 2010 Iran, AEOI Bushehr 1 PWR 950 2010 Russia, Energoatom Rostov 2 PWR 950 2010 India, NPCIL Kudankulam 1 PWR 950 (move to 2011) 2010 Canada, Bruce Power Bruce A1 PHWR 769 (move to 2011) 2010 Canada, Bruce Power Bruce A2 PHWR 769 (move to 2011) 2010 Korea, KHNP Shin Kori 1 PWR 1000 (dec) 2010 China, CGNPC Lingao II-2 PWR 1080 (oct) 2010 Argentina, CNEA Atucha 2 PHWR 692 (dec) 2011 India, NPCIL Kudankulam 2 PWR 950 2011 India, NPCIL Kalpakkam FBR 470 2011 Taiwan Power Lungmen 1 ABWR 1300 2011 Russia, Energoatom Kalinin 4 PWR 950 2011 Korea, KHNP Shin Kori 2 PWR 1000 2011 China, CNNC Qinshan 4-1 PWR 650 2011 China, CGNPC Lingao 2-1 PWR 1080 2011 Pakistan, PAEC Chashma 2 PWR 300 2011 Japan, Chugoku Shimane 3 ABWR 1375 2012 Finland, TVO Olkiluoto 3 PWR 1600 2012 China, CNNC Qinshan 4-2 PWR 650 2012 Taiwan Power Lungmen 2 ABWR 1300 2012 Korea, KHNP Shin Wolsong 1 PWR 1000 2012 France, EdF Flamanville 3 PWR 1630 2012 Russia, Energoatom Vilyuchinsk PWRx2 70 2012 Russia, Energoatom Novovoronezh II-1 PWR 1070 2012 Slovakia, SE Mochovce 3 PWR 440 2012 China, CGNPC Hongyanhe 1 PWR 1080 2012 China, CGNPC Ningde 1 PWR 1080 2013 China, CNNC Sanmen 1 PWR 1100 2013 China, CGNPC Ningde 2 PWR 1080 2013 Korea, KHNP Shin Wolsong 2 PWR 1000 2013 USA, TVA Watts Bar 2 PWR 1180 2013 Russia, Energoatom Leningrad II-1 PWR 1070 2013 Korea, KHNP Shin Kori 3 PWR 1350 2013 China, CGNPC Yangjiang 1 PWR 1080 2013 China, CGNPC Taishan 1 PWR 1700 2013 China, CNNC Fangjiashan 1 PWR 1000 2013 China, CNNC Fuqing 1 PWR 1000 2013 China , CGNPC Hongyanhe 2 PWR 1080 2013 Slovakia, SE Mochovce 4 PWR 440 2014 China , CNNC Sanmen 2 PWR 1100 2014 China , CPI Haiyang 1 PWR 1100 2014 China , CGNPC Ningde 3 PWR 1080 2014 China , CGNPC Hongyanhe 3 PWR 1080 2014 China, CNNC Fangjiashan 2 PWR 1000 2014 China, CNNC Fuqing 2 PWR 1000 2014 China, China Huaneng Shidaowan HTR 200 2014 Korea, KHNP Shin-Kori 4 PWR 1350 2014 Japan, Tepco Fukishima I-7 ABWR 1350 2014 Japan, EPDC/J Power Ohma ABWR 1350 2014 Bulgaria, NEK Belene 1 PWR 1000 2014 Russia, Energoatom Rostov 3 PWR 1070 2014 Russia, Energoatom Beloyarsk 4 FNR 750 2015 Japan , Tepco Fukishima I-8 ABWR 1080 2015 China , CGNPC Yangjiang 2 PWR 1080 2015 China , CGNPC Taishan 2 PWR 1700 2015 China , CPI Haiyang 2 PWR 1100 2015 Korea, KHNP Shin-Ulchin 1 PWR 1350 2015 Russia, Energoatom Novovoronezh II-2 PWR 1070 2015 Japan , Tepco Higashidori 1 ABWR 1385 2015 Japan, Chugoku Kaminoseki 1 ABWR 1373 2016 Romania, SNN Cernavoda 3 PHWR 655 2016 Russia, Energoatom Leningrad II-2 PWR 1200 2016 Russia, Energoatom Rostov 4 PWR 1200 2016 Russia, Energoatom Baltic 1 PWR 1200 2016 Russia, Energoatom Seversk 1 PWR 1200Thanks, an. Applying the label new to a reactor built in the 1970s strikes me as somewhat peculiar. If I had stored a 1974 Valiant on blocks in my driveway, tinkered with the carburetor and installed a new set of tires, do I have at that point a "new" car or one that has been refurbished/restored to service?

[I don't mean to be an ass... just a little hung-up on the semantics.]

Cheers,

Paul

But don't you also have to estimate how many older power plants will be taken off line, because of unforeseen issues. As power plants get closer to the end of their lives, there are likely to be more and more problems that develop.

Refurbishment is possible, but is not necessarily cheap or quick. Just recently, the article was posted Canadian nuclear plant rehab goes awry Refit was supposed to show how to keep old plants operating.

Even new plants can have problems. Britains' Sizewell B plant has had two fires this year. It is currently shut down with no date for reopening yet set.

That is the 1-3% in the noise issues. maintenance, refueling etc... However, any plant with more extended shutdowns, still ends up to usually come back online. The downtime just means that it is wearing out the other parts. So it could be 50-70 years of operation with 5-10 years of shutdowns for refueling and maintenance. With an elapsed calendar time fo 60-80 years.

But adding 4-6% per year from new plants and uprates and then adding 1-4% from operating improvements, is why I see a net 4-7% annual gain.

But the larger phaseouts, like Germany are not happening. And those that expect the USA, Japan etc... to shutdown plants after 40 years are wrong. Any well operated plant will get extended. Germany's plants are getting 15 more years and we will see if they shut them down in 2030-2040. the remaining US plants are getting their 20 year extensions. Half already extended to 60 years. The rest will be too. Except for a very few. But I do not see more than 2-3 in the 2010-2020 timeframe. Uprates offset the shutdowns.

All of Britains plants are getting swapped out for new plants. Britain had a particular crappy set of plants. Although under french EDF management they are doing better.

Germany is extending its 17 reactors for about 15 years past a previous political shutdown for 2021.

Actually no decisions have been made as of yet.

But interesting is the fact, that Germany exported about the same amount of electricity this first quarter as its 6 oldest nuclear power plants produced - making an argument for an extension a hard-sell given the fact that renewable power production will continue to increase in the next 10 years:

http://www.taz.de/1/zukunft/umwelt/artikel/1/stromexportweltmeister-deut...

And I would predict that, absent a complete global economic collapse, that that sector will continue to grow. The developing countries all realize that if they want to build any sort of modern economy, they require reliable baseload generating capacity. Oil is too expensive to burn; everyone figured that out in the 1970s, although some developing countries still use it. Other fossil fuels have various availability and transport problems. A modest-sized country probably doesn't have the geographic diversity to overcome the intermittentcy problem of wind and solar.

Which leaves them with nuclear. I would expect that starting sometime in the next ten years, someone is going to be selling a fair number of small modular long-refueling interval reactors to the developing countries every year.

As noted in the list of reactors under construction now. the non-OECD - "remainder" is where 75% of the reactors will be.

There is no reason that grids should stop at national borders, and of course they do not and will not.

Currently Denmark deals with the intermittency of ~20% wind by modulating hydro generation in Norway. Similarly, Paraguay and Uruguay could deal with wind energy fluctuation by modulating Brazil's hydro. Every country that is not located in a desert far from the seacoast has the option of adding their own pumped storage facilities also.

After the first few "dirty bomb" terrorist events I would expect that market to dry up pretty quickly. Developing countries typically cannot operate a national security state required to secure the nuclear fuel cycle, plus corruption makes enforcement of laws about waste disposal and safe operation unlikely to be enforced. Consequences of all this are much worse for nuclear than wind or solar.

Denmark has extremely high electric rates, compared to most other countries. A few 2008 comparison rates for households (per kWh):

Denmark $ .396

Finland $ .172

France $ .169

Japan $ .206

Norway $ .164

Portugal $ .220

Spain $ .218

Switzerland $ .154

United Kingdom $ .231

United States $ .113

Part of the problem is that much of the wind electricity that is generated is cannot really be used in Denmark, so it gets sold at very low rates to neighboring counties. So Denmark gets stuck with a lot of costs, and not a huge amount of benefit. There is a paragraph in Wikipedia describing this problem:

58% of household electricity costs in Denmark were taxation, which has nothing to do with wind power. Denmark has a general 25% sales tax. In the US energy consumption is generally subsidized (income,sales, property taxes pay for roads instead of having drivers pay their own way via gas taxes, oil depletion allowances, etc.) while in Europe energy is taxed like any other good or more. Eventually the US will have to adopt similar policies if the planet is have any chance to slow climate change.

http://www.finfacts.ie/irelandbusinessnews/publish/article_10006575.shtml

"In absolute values, household electricity prices were highest in January 2006 in Denmark (23.62 euro per 100 kWh), followed by Italy (21.08), the Netherlands (20.87) and Germany (18.32). The lowest prices were observed in Greece (7.01), Lithuania (7.18), Estonia (7.31) and Latvia (8.29).

When adjusted for purchasing power, household electricity prices in Greece (8.01 PPS3 per 100 kWh) remained the cheapest, followed by the United Kingdom (9.05), Finland (9.38) and France (10.92), while the highest prices were recorded in Slovakia (24.48), Italy (20.23), Poland (20.05) and the Netherlands (19.15).

The share of taxation in household electricity prices varied greatly between Member States, ranging from around 5% in Malta, the United Kingdom and Portugal to more than 40% in Denmark (58%) and the Netherlands (42%)."

@tommyvee

Actually, most roads are paid for with gasoline taxes in the US. I will grant that the taxes on gasoline could be higher, but our roadway building funds often run surpluses that are used to fund other government expenditures.

Here is an example:

http://www.omaha.com/article/20100103/NEWS01/701039893

In Colorado, roads in cities and towns are completely paid for from property and sales taxes. There is no gas tax contribution to local roads and streets. Localities are prohibited from adding tazes to gas to pay for anything, roads included.

The situation is similar across the US, with almost no local roads and streets funded by gas taxes. I will grant that the Interstate Highways and other Federal roads were initially nearly funded by gas taxes, although there are constant efforts to divert general fund revenues to roads, since gas taxes are insufficient for maintenance and construction. See the article below or many others like it which prove how wrong the claim that gas taxes pay for roads is.

http://www.thetransportpolitic.com/2010/06/07/the-age-of-general-fund-fi...

"n fact, Congress has developed a solution to this fiscal hole — it’s just one that it claims to be unacceptable: the use of the general fund. As Ken Orski — an Associate Administrator of the Urban Mass Transportation Administration (now FTA) between 1974 and 1978 — pointed out to readers of his Innovation Briefs last week, Congress has allocated a total of $79.2 billion of income tax-sourced funds to pay for ground transportation projects over the past two years. That’s almost twice what the Highway Trust Fund is supposed to devote to highway and transit projects every year.

Orski notes that $43.2 billion went directly to make up for shortfalls in Trust Fund revenues. The rest of the money went to the Stimulus’ roughly $45 billion in one-time only project funds, including the Administration’s $8 billion commitment to high-speed rail."

Gas taxes pay only about 1/3rd of direct road costs in the U.S. Beyond that, it's exempt from sales tax in many states.

Gail's comment actually proves my earlier point, that national borders will not be a significant obstacle to coordinating renewables and storage across areas much bigger than small countries, since it is already happening on a large scale.

Denmark has extremely high electric rates,

No according to the FACTS, it does not:

Industrial electricity prices before tax (2007):

Denmark (20% wind power): 7.06 cents/kWh

Belgium (55% nuclear power): 9.69 cents/kWh

http://tinyurl.com/mfnvku

and household electricity prices are irrelevant compared to living, healthcare and income tax costs.

That cost is only there during the time when the wind blows which normally isn't in the morning when you are showering and needing that cup of coffee.

http://www.youtube.com/watch?v=qgUsun3hIT0

Besides that Denmark doesn't have weather dependent electricity prices,

most French showers are nuclear powered at night such that people can take warm showers during daytime. Since heat energy can be stored extremely cheaply, electricity can be consumed and stored as heat when power plants generate a surplus. And electric water heaters in fact never care, whether electricity is produced in a nuclear power plant or a wind farm.

More importantly: Denmark still exports over 90% of its wind turbines with a profit in a market with a double digit growth (as opposed to nuclear power which does neither):

http://uk.reuters.com/article/oilRpt/idUKLV55678920081231

If Denmark had decided to invest in nuclear power instead of wind power, it would not only have higher industrial electricity prices, but also have a much higher unemployed rate - possibly similar to France...

And your Institute of Energy Research is funded by Exxon, which has definitely no interest in a growing renewable market.

http://www.exxonsecrets.org/html/orgfactsheet.php?id=115

And their report on Denmark is unsurprisingly bogus:

http://www.awea.org/newsroom/pdf/IER_Denmark_Response.pdf

I don't know where they get the US rates in this table -- New York and California, about one quarter the U.S. population, were much higher during times I lived in those states. The rest of the country would need to be sub-0.10 to average that out, and I don't think it is. On the other hand, in two different cities in Finland we've paid closer to what it reports for the US, so I'm not sure I believe that number either.

It's an average. I know AG customers paying less than 1 cent per kwh in the U.S. Outside of CA, TX and the NE, most of the contiguous U.S. is still under 10cents. That's the folks who didn't deregulate.

This would seem to be more true of developed countries than developing ones. Developed neighbors have more extensive national grids already built, larger amounts of trade with their neighbors, etc. There is a considerable attraction for a country struggling to get a national grid built, let alone a sizable international capacity, to be able to drop nukes in increments of 100-300 MWe into regional networks, especially if a developed country is willing to let them pay it off over time.

Hydro has its own sort of intermittency problems: ask any of the Philippines, China, Vietnam, Kenya, Venezuela, Chile, as well as other places globally. Personally, I suspect that turning renewables into real baseload generating capacity is at least a somewhat harder problem than many people have thought. Not impossible, but there will be unexpected "gotchas" to deal with.

The world has already passed you by. Events you think will be difficult in the future are already implemented.

http://www.ahguatemala.com/general_information/energy