What happens when energy resources deplete? - Copy 2

Posted by Gail the Actuary on June 19, 2010 - 11:05am

Because of the large number of comments, this is a second copy of this post.

What happens when energy resources, such as oil, deplete? Many people believe that oil prices will just go up--but I don't see that to be the case. A more likely result is a future dominated by recession and debt defaults--similar to what we have been seeing recently, but trending over time to be worse. In the midst of this recession, the view may be that there is plenty of oil, if only the price were higher.

Views of Oil Prices

One view is that energy prices will rise, substitutes will be found, and prices will come back down again, perhaps settling at a somewhat higher equilibrium reflecting the cost of producing the substitute energy source. The economy will continue to function pretty much as before. The catch is that we aren't finding reasonably-priced, scalable substitutes, so this isn't happening. Oil prices are down, but not because of substitutes.

Another view, popular among those concerned about peak-oil, is that oil and energy prices will just keep rising. If scalable substitutes aren't found, some expect that oil prices will rise from their current price of $75 barrel, to $100 barrel, to $200 barrel, to $300 barrel, and eventually to $1,000 barrel or more.

The problem with this view is that it doesn't take into account the amount of money people actually have available to spend. Just because oil or energy prices rise doesn't mean that people will get additional income to cover these higher expenditures. In real life, prices can't keep going up.

I expect that what really will happen is oil prices may bounce up, but they will soon come back down again, because of recessionary impacts and credit crunches caused by high oil prices. Most of the time, oil prices will end up in the uncomfortable middle--too high for the economy to buzz along, but too low to encourage much new oil production, or much new renewable production. The result is likely to be continuing recession, getting worse over time, because of what will be generally viewed as inadequate demand for oil.

What really happens when energy prices go up

Energy expenditures are not a big share of income for high income people, but they are for the many people getting along on minimum wage, or close to minimum wage. If oil prices go up, these folks find the price of food and gasoline going up, and perhaps the price of home heating and electricity (because the prices of the various types of energy tend to move together). They find their budgets stretched, and they either

1. Cut back on discretionary spending, or

2. Default on loan repayments.

A similar situation happens to the many people who earn more than minimum wage, but live paycheck to paycheck, and pretty much spend all the money they earn. As the prices of energy-related goods rise, these people too find a need to cutback. Some will cut back on discretionary goods; others will default on loan repayments; some will do both.

Thus, when oil prices rise (or energy prices in general rise), we end up with two main effects:

1. Banks find themselves in worse condition because of many loan defaults.

2. The economy starts feeling recessionary impact, because so many people cut back on buying discretionary goods.

These impacts are likely to lead to others as well:

1. Banks become less willing to make loans, because of the problem with defaults.

2. Many people are laid off from work, because of reduced demand for discretionary goods (restaurant meals, vacations, new homes, new cars, new home furnishings, for example.)

The cutback in the purchase of new homes, new cars, new home furnishings and the like leads to yet more impacts:

1. The price of homes drops (because fewer are upgrading to more expensive homes, and because loans are harder to get).

2. There is less demand for oil (because oil is used in making cars, new homes, and many other things. Also, if fewer people take vacations, and fewer people drive to work, this reduces oil usage).

3. There is also less demand for natural gas, coal, and electricity, because all of these are used in manufacturing discretionary goods.

The next round of effects then becomes:

1. Even more people default on their loans, because with the decline in home values, they owe more on their homes than their homes are worth. This may also happen if people have lost their jobs, and can no longer afford their homes.

2. The prices of all energy products drop (oil, natural gas, coal, uranium, ethanol) because of reduced demand. Many fewer solar panels are sold as well.

About this time, governments come in with stimulus funds, bails out for banks, and the problem appears to mostly solved. It isn't really solved though--it is mostly transferred from private citizens and from corporations to governments. But governments find expenditures vastly exceed revenues, and debt is rapidly rising. Something needs to be done--either raise taxes and cut services, or default on debt.

Before we talk about these options, let's talk about timing.

When does all this happen?

The popular myth among people concerned about peak oil is that difficulties do not really start until oil production begins its down-slope. In my view, the difficulties start much sooner--as soon as oil supply cannot be provided at close to a constant price.

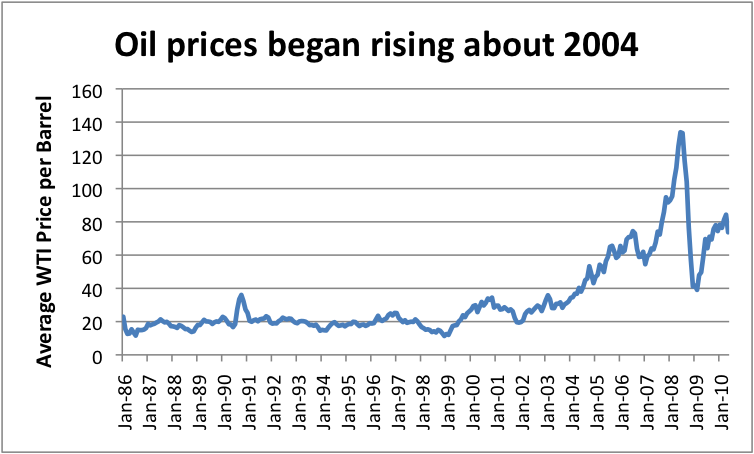

Oil prices were in the $20 a barrel range for many years, but then started rising about 2004, as Chinese demand began rising. So this was really the first sign of problems.

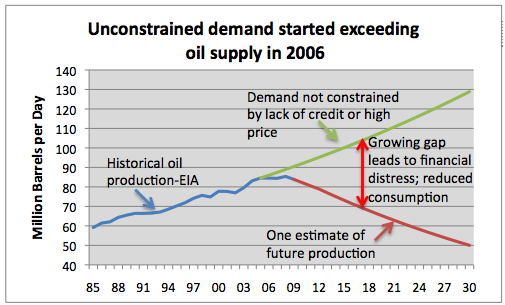

A second measure of when this happens is when the growth in oil supplies starts to falter. The world had been accustomed to a close to 2% a year rise in world oil production, but slipped onto a production plateau starting in 2005. This production plateau has lasted until the present time (2010).

So if we compare what production we might have expected in the absence of higher price or credit problems (green line), to the actual production (blue line), a gap started to appear about 2006. This is another measure of when we would expect symptoms of energy shortages to start affecting economies.

I know many will say, "Oh, but while we had problems with sub-prime mortgages about then, and housing price drops, it couldn't have had anything to do with oil prices." I would point out:

1. Recessionary effects happened around the world, not just where there were subprime mortgages. Japan was affected even before the US, and didn't have subprime mortgages.

2. The effects that we would expect from higher oil prices had to be manifested somewhere. It turns out the greatest manifestation was with lower income people, living in distant suburbs where the commutes were longest. These are precisely the folks one would expect to be most affected by higher oil prices.

3. The impacts of recession and credit problems have gradually spread more broadly than subprime loans, as we would expect, based on the foregoing discussion of the expected impacts.

I should point out that saying that higher oil prices being instrumental in causing in recession doesn't mean that there couldn't be underlying weaknesses, that would allow the manifestations to be in particular parts of the economy.

Also, we know that higher world oil usage is closely linked with world economic growth. One would expect relatively lower oil use to therefore lead to recession--and that is precisely what seems to be happening in the real world.

What is ahead?

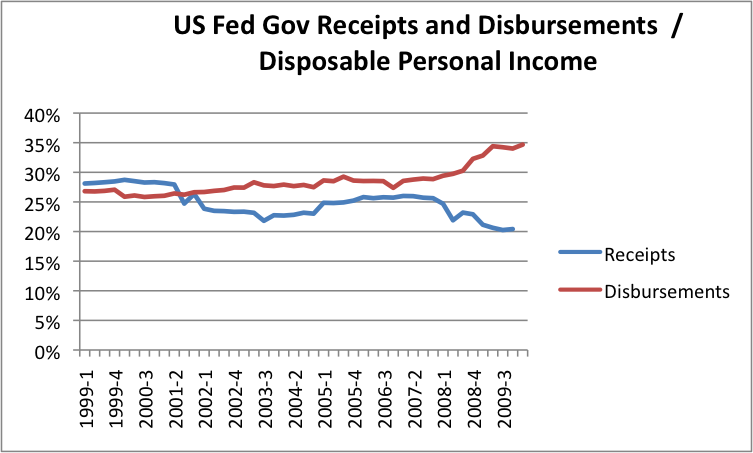

We are now at the point where the recession seems to be better, because governments have bailed out private citizens and companies (particularly banks). But this leaves the governments with a huge amount of debt, and with a big gap between revenues and expenditures.

Figure 3 shows what a huge shortfall the US government now has in revenues. There are many other governments around the world with similar issues. In addition, state and local governments have serious revenue shortfalls.

If recession continues, it is difficult for governments to continue to borrow more, as expenditures outpace income. Eventually, governments are left with two options:

1. Raise taxes and reduce services, so as to get revenue and expenses back in line.

2. Default on debt.

Either one of these things will make the situation worse:

1. If governments raise taxes, the effect on citizens is pretty much like higher oil (or energy) prices. Citizens react by cutting back on discretionary spending or defaulting on loans, and we are back to more of the problems recessionary problems, plus loan defaults we had before. If governments also layoff workers, this increases the recessionary effect.

2. If only one or two small governments default on debt, the world can probably accommodate the defaults pretty easily. But if problems spread to a large number of big countries (UK, United States, and Japan, for example), then international trade is likely to be disrupted, because many sellers of goods will find themselves without payment. To prevent this happening again, the sellers of goods are likely to set stricter terms--I will sell you so much oil if you will sell me so much wheat in return, for example. The amount of trade is likely to drop precipitously, because of the cumbersome nature of such trading.

If governments mainly raise taxes and reduce services, I would expect the result to be more recession, more debt defaults, and lower prices for all energy products. Everyone will say, there is plenty of oil (natural gas, coal, uranium) in the ground. If prices were only higher, we would extract it.

If there are major international debt defaults, the situation is likely to be somewhat the same (recessionary impacts and lack of credit), but some goods may cease to be available for import. If these goods are critical goods (computers, replacement parts for the electrical grid, replacement parts for automobiles), the economy could spiral downhill rapidly.

A variation on defaulting on debt is attempting to inflate it away. This still leaves owners of bonds very unhappy, and can cause many of the same problems as regular default.

What would it take to ramp up oil production (or a substitute) so production is again on a trajectory where it is growing at, say, 2% per year?

I can see several ways such a ramp-up theoretically could be accomplished. (Some of these are more ways of circumventing the problem. Note that these are all temporary solutions. In a finite world, it is not possible to continue exponential growth forever.)

1. If conventional oil production is flat to declining, one could ramp up unconventional oil production (oil sands, oil shale, ultra-deep, and arctic for example).

2. If conventional oil production is flat to declining, ramp up production of other liquids--ethanol, biodiesel from algae, and coal to liquids, for example.

3. If conventional oil production is flat to declining, one can try to convert a large share of the auto fleet to electric, and ramp up electrical production.

4. If conventional oil production is declining, one can theoretically engineer cars to be much more efficient, and ramp up production of these new cars.

Regardless of which approach one uses, one needs:

1. A lot of time. In 2005, Robert Hirsch was the lead author or a report for the department of defense called Peaking of World Oil Production: Impacts, Mitigation, & Risk Management. This report showed that mitigation would take 20 years. If one stops and works through the details of any of the three solutions proposed above, one can see that each of these require long lead times. For example, scaling up oil shale would likely require new coal fired power plants in the area, new coal mines, new train tracks from the coal mines to the oil shale area, and new water supplies piped into the arid US West, not to mention building the facilities themselves. Perfecting the technology for electric cars, and building a whole fleet of these, would be a similarly slow undertaking, as would replacing the current auto fleet with more efficient cars.

2. A lot of capital. Unless oil prices are higher--a lot higher--it is hard to justify large capital expenditures, in ventures such as this. We have just seen that consumers cannot afford high oil prices, without recession.

3. Long term subsidies. If the prices of the new fuels are too high for consumers to really afford, one needs long-term subsidies. We have just seen that high oil prices seem to hurt the economy badly. High prices for substitutes can be expected to have a similar effect.

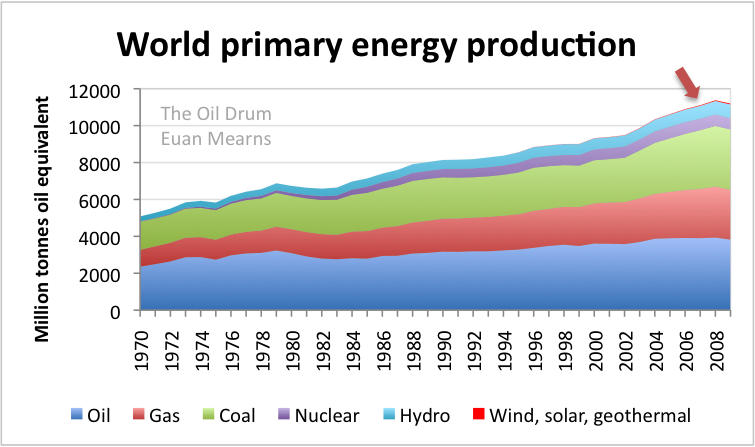

It seems like any one of these issues is likely to be a deal-killer. Since we are already at a point where conventional oil is falling short of demand, the time requirement will mean that scaling up will be very difficult. Progress to date on renewables has been very small, as shown on Figure 4.

Wind, solar, and geothermal are combined in the tiny red line at the top of the chart. Since these all produce electricity, not a liquid fuel, they are not good substitutes for oil. Biofuels are not shown, but are also a very thin line.

What is "Peak Oil"?

"Peak oil" is sometimes described as the time when conventional oil production begins to fall. There is still a lot of oil in the ground, though, but what is left is

1. Very slow to extract. It is necessary to ramp up huge amounts of production capability to mitigate the downslope of conventional production.

2. Expensive to produce. The easy to produce oil is gone.

So what peak oil really is, is a turning point. One can theoretically continue to produce the same amount of oil or more, if one makes huge investment well in advance. The problem is that it is really too late now. By the time new production finally gets started, conventional oil production will be down very substantially from its peak level. The fact that no one ramped up unconventional production (or alternatives production) before it was too late leaves us with precisely the problem that the peak oil community has been warning about--oil production capacity that can be expected to decrease over time, as individual fields deplete.

Peak Oil and Exponential Growth

Oil supplies are expected not just to level off, but to actually decline. Part of this happens because of the natural decline rate of conventional oil fields, as the finite amount of oil that is in the field is extracted.

The decline is likely to be more severe than historical decline rates (2% to 8% per year) would suggest, for two reasons mentioned earlier:

1. Declining credit availability, as high default rates continue among buyers. Lack of credit will tend to keep oil prices low, and discourage investment.

2. Higher tax rates on fossil fuels. Governments are short of funds and oil companies are temping targets. If tax rates are raised, this will likely cut back production, since oil companies base investment decisions on expected after-tax profit, and this will be lower for many projects.

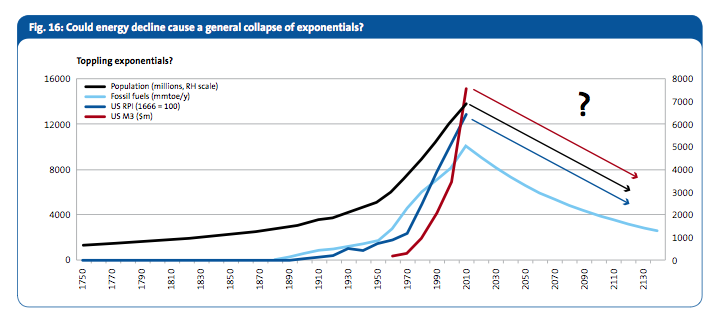

Meanwhile, we have a huge number of variables growing exponentially:

• Economic growth

• Money supply

• Stock market prices (hopefully)

• Population

These variables are not independent of energy supplies. If nothing else, people need food to eat, and oil is used very extensively for food production. It is questionable whether these variables can continue their exponential growth if oil and other energy supplies are declining in quantity.

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist”. Kenneth Boulding

Related posts and resources:

Delusions of Finance: Where We are Headed February 8, 2010

Gulf Oil Spill: With so Many Resources, Can't we Just Drill Somewhere Else? May 29, 2010

Peak Oil and the Financial Crisis: Where we are Headed March 25, 2009

Casualty Actuarial Society Climate Change Committee presentation - June 16, 2010

Gail,

I think we should have yet another debate on the timing of Peak Oil. We used to do this all the time but I have seen little recent discussion of the topic. Robert Rapier was always skeptical of the 2005 date for Peak and cautioned that we should not call Peak too early so as not to lose credibility on TOD by crying "Wolf!" Skrebowski now puts Peak at 2014. Stuart Staniford sees only weak evidence for a Peak now or an imminent Peak.

I'm impressed by Skrebowski's approach using megaprojects. Also I take Stuart with the greatest seriousness; I think he is one of the most intelligent people ever to post on TOD. I have the greatest respect for Robert Rapier.

Hence, I think we should call into question whether or not the current plateau is a Peak Plateau.

By the way, oil has been depleting since the first oil well was drilled. What we want to know is when production starts DECLINING.

One thing to note is that of keeping track of peak varieties, crude vs. crude plus condensate vs. all liquids. That turns it into a shifting sand, making it hard to pin down and confusing to a lot of people.

The point it is making is there are economic consequences to the plateau of oil production that began in 05. That Descent from peak is not necessary for there to be negative impacts.

From the text is this:

I think what matters is

1. The timing of when oil supply can no longer keep up with demand, at essentially the same price. After that you get all kinds of effects.

2. When there is a serious break in the financial system, caused by debt defaults. After that, I expect production to drop quite precipitously-much faster than the Hubbert Curve would suggest --much more akin to overshoot and collapse.

I think the Hubbert Curve tends to lull people into thinking the downslope will be something nice and manageable. We won't have the funds to invest even to keep the downslope at the level it has been in the past, and after a few years, greatly reduced international trade will affect the ability of E&P companies to do what they have done in the past. It will be Liebig's Law of the Minimum that ultimately stops much economic activity we have today.

Your two points about what happens when oil prices go up misses a significant fact. The money went somewhere and wasn't burnt or buried in a landfill or evaporated as so many economic incompetents seem to assume. If you live in an oil exporting region, a rise in oil prices is cause for relief at banks and results in a rise in discretionary spending and so on.

An increase in oil prices signifies two things. First, more of the economy's deployment of capital and labor and wages and such will go to that sector. Second, those who counted upon the price falling will be disappointed. Until such price rises to a level such that there are constraints upon other sectors due the oil industry taking production capacity away from other areas, or there is an actual shortage of energy limiting prudent consumption, the effect is merely one rearranging the deployment of human initiative.

Because the USA is no longer an oil exporting country, a rise in oil prices means the money spent has to be retrieved somehow, or the effects you cite will occur. But the US case isn't the whole world. Spending 400 billion on oil imports - where did it go? - is still accepted practice but spending a fraction of that amount on domestic alternative energy, money which could stay in the economy and recirculate, is considered dodgy.

So in a place like Alberta or Venezuela, a return to the good old days of low oil prices means all the ills you describe fall on the producer rather than the consumer. One man's debt is another man's asset. What's so hard to understand about that?

I know what you say is true, for quite a while. This is the explanation we heard, as oil prices increased from 2004 to July 2008, when suddenly something snapped.

I think the "debt unwind" was critical in bringing a change about. As I mentioned in the post, there are more and more defaults on loans, as this process occurs. The effect of these loan defaults work through the system, quite slowly--especially since the government is trying to prop up banks and otherwise hide the effects.

But we know US consumer lending peaked the same time oil prices peaked. Once US lending starts going down (and is propped up by government lending) we are starting a slippery path--we can't keep up economic growth the way it has been, if we have a combinations of

1. Lower world oil availability

2. Less and less credit, resulting in lower demand for oil and other energy products

The credit system plays a big part in this, as well as the higher investment required for new energy products, and lower availability of funds (both for consumers and for investors).

As I mentioned in the post, too, the ability of governments to hide the problems is not going to continue forever. At some point, it looks like there will be a "snap" in that part of the system.

Gail,

With all due respect to your opinions--which I greatly value--on this issue of what caused the credit collapse I agree with Ilargi and Stoneleigh over at theautomaticearth.blogspot.com: The rise in oil prices had little or nothing to due with the financial troubles of the past few years. Instead, it was the enormous leverage in real estate that went along with a bubble of rapidly increasing debt that caused the crashdown in real-estate prices and hence the rest of the debt deflationary problems. Derivatives made a bad situation much much worse, as did easy money during the bubble and "innovative" mortgages.

Thus, IMHO, the rise in oil prices did not trigger one of the worst recessions we've had since the Great Depression. IMO, our current economic situation is less bad now than it was in the early nineteen eighties with inflation plus prime interest rates going as high as 16% and mortgage financing at 18% plus inventory financing for business over 20%.

I am sure you have read what James Hamilton had to say about high oil prices and the recession. Steven Chu seems to quote James Hamilton. Jeff Rubin is an other one who talks about oil prices causing the recession.

I was one who predicted the downturn in 2008, at the beginning of 2008. Later, I was asked to give a talk at the Biophysical economics conference on the reasons I made my predictions, described in this post called Delusions of Finance.

Our current situation may not be as bad right now as the 1980s, but our real problems are credit problems that cannot possibly go away, and huge shortfalls in government revenue, that will get worse, as energy problems worsen. I think it is sometimes a liability to be trained in traditional economics. There is too much belief in all the mechanisms that have been put in place, and too little understanding of the principles allowing the system to work as it does:

1. A debt based system (in which one has to repay debt with interest) only works well in a growing economy. We have had a growing economy forever and ever--first with coal, then with oil, but now it is stopping. Now the music is stopping, and is even going backward. There is no way the system can stay together, no matter how robust it looks currently.

2. You need growing energy to keep the system expanding and the debt system healthy. That energy growth is now faltering. Oil was keeping the system growing until 2004. Since then, coal has also helped keep at least some expansion going in the developing world. But going forward, it is hard to keep the system expanding, and a lack of petroleum, by itself exerts a limiting effect. There are other limits on the system--like fresh water--that will also limit expansion.

You have good company in not understanding what is going on. In their paper, This Time is Different: A Panoramic View of Eight Centuries of Financial Crises by Carmen Reinhart and Kenneth Rogoff, they say on Page 15,

By their statement, Reinhart and Rogoff clearly don't understand. It is the high growth rates that prevent default. It is a whole lot easier to borrow from the future when the future when there is growth than when there is decline. That is common sense (and also the result when one sums up the expected values across many types of borrowers).

And we know high growth rates come from energy resources --historically at home, but now leveraged from use by lesser developed countries. When economists look at OECD separately, or individual countries separately, they can claim there is little connection between growth and energy supplies, but on a world basis, the connection with energy supplies is unmistakable.

Our current situation may not be as bad right now as the 1980s, but our real problems are credit problems that cannot possibly go away, and huge shortfalls in government revenue, that will get worse, as energy problems worsen.

Your underlying assumption is that oil cannot be replaced. This is unrealistic.

Electricity replaced kerosene for illumination (oil's main application in the 1870's).

Coal, natural gas and nuclear replaced fuel oil for electrical generation (oil was 20% of US generation 40 years ago, now it's less than 1%).

Natural gas and electricity are replacing home heating oil.

Extended range EVs like the Volt, EVs like the Leaf, and plug-in hybrids like the plugin Prius are here.

Intermodal rail is replacing long-haul trucking.

For more info see: http://energyfaq.blogspot.com/2008/09/can-shipping-survive-peak-oil.html and http://energyfaq.blogspot.com/2008/09/can-shipping-survive-peak-oil.html .

We don't need oil for prosperity.

Agree that the Hirsch rapport makes a mistake in not mentioning hybrids, but maybe they are considered only as efficiency gains. Let's say within 10 years 20% of all cars worldwide are hybrids, but that in 2020 there are 200 million more cars on the road, what is the gain ? And regarding EV's: if within 10 years 5% of all cars are EV's, but in 2020 there are 200 million more cars, what is the gain ?

Hybrids and EV's will not prevent the following oilprice spikes and the resulting economic downturns. People will not learn from the past, oilprice will not stay high for sufficient long time and governments are powerless in the way that they cannot make choices for the people.

maybe they are considered only as efficiency gains.

Yes, that's how the Hirsch report deals with that.

if within 10 years 5% of all cars are EV's

Let's say that within 10 years 50% of all new cars are EVs. It's simply a choice, both public and personal.

Hybrids and EV's will not prevent the following oilprice spikes and the resulting economic downturns.

They'll reduce the height of the spike, and any resulting economic damage.

People will not learn from the past

Sure they will. The US CAFE is rising sharply; the Chinese CAFE is much higher than the US; both the US and China are pushing EVs very hard.

governments are powerless

No, they're really not. See the latest "Piggy" article, and look at how the gasoline per person plateaued: that was the result of government action.

Let's say that within 10 years 50% of all new cars are EVs. It's simply a choice, both public and personal.

The product design cycle (5 years from OK to showroom for an ICE) and bottlenecks in suppliers will simply NOT allow that !

10% in ten years would be truly remarkable. And EVs are hardly the optimum solution.

Not the Volt has 40K production the first year and a slow ramp-up the second year.

OTOH, we could have 100 million eBikes by 2021.

Alan

The product design cycle (5 years from OK to showroom for an ICE)

The Volt is ready right now.

bottlenecks in suppliers

Given that we'd be starting right now, not 5 years from now, that requires selling 50K in 2 years, and growing by 80% per year after that. That's faster than Commercial Best Speed, perhaps, but certainly doable.

10% in ten years would be truly remarkable.

Yes, I'm afraid I agree that EVs and EREVs probably won't grow nearly as fast as we would like. See my discussion: http://energyfaq.blogspot.com/2010/06/how-quickly-will-we-move-to-electr...

But....they could. It's a choice, public and personal.

And EVs are hardly the optimum solution.

In the short term, they certainly are. In the long run, a large component of rail would be an extremely good idea, I agree.

Not the Volt has 40K production the first year and a slow ramp-up the second year.

Yes, GM is being a bit timid. Again, choices...

we could have 100 million eBikes by 2021.

Yes, we have a lot of good choices. I hope we make some of them.

I wrote about cars on the road. If within 10 years 50% of new cars are EV's then it will take another 5-10 years before 50% of all cars on the road are EV's.

For now, in most countries a lack of infrastrucure is hampering selling of EV's and the lack of selling many EV's is hampering the development of infrastructure. Both 'groups' are waiting who starts first.

Americans are buying big SUV's again, after a drop in 2008. In China is nothing to gain, because they are just taking off.

IMO until now in the US it is mainly the result of rising unemployment. A gain for whatever reason will be offset by countries like China and India. Rising CAFE is only a drop more than carrying water to the sea.

I wrote about cars on the road.

You were writing about the mix of EVs vs ICE produced in the near future.

in most countries a lack of infrastrucure is hampering selling of EV's

Yes, I think EREVs are the best solution for quite a while: 10% of the fuel consumption, with no compromises.

IMO until now in the US it is mainly the result of rising unemployment.

I'm talking about the period of 1980 to 2010. The US grew by 150% in that period, while gasoline (and oil) consumption was flat.

At least 'little'. The things Gail writes are sounding familiar after having read the book 'the next economy' from Paul Hawken, about the effects of rising oilprices in the 1973-1981 period.

Oil had a significant indirect effect, by raising trade deficits and total debt, and a modest direct effect on incomes.

OTOH, the economy responded very differently to the oil shock of 04-08: petrodollars were recycled better, and markets responded much more efficiently due to better communications and much more agressive substitutions for oil and much more aggressive cost cutting.

Gail, don't you think the snap is already being felt? Seems like investors reacted badly to the recent EU trillion dollar bailout, and here in the US Congress seems to be resistant to anymore bailouts even for the unemployed. It would seem the willingness to borrow to stimulate the economy is at the end of its tether.

If so, is that the "snap" you are referring to, or is there some other view you have of what will occur?

Seems like the direction things are headed per this guest piece is towards greater disenfranchisement of lower income people and those over burdened with debt.

From there, it would seem like this growing segment will remain on the sidelines, that is until a threshold of the population is clamoring for assistance from the Fed, State and Local govt's which will be struggling to pay the interest on their loans. When it reaches a point where the hungry mouths are no longer satiated by relief programs, food riots will begin and collapse quickly follows.

The graphical seperation of lines will be a dropping food supply vs. a flat or slightly rising population. Population will then quickly follow the food supply line down to whatever level it will sustain that population. Oh my!

First rule of the Peak Oiler (or may be two): Get out of debt and stay out of debt.

Absolutely impossible for huge swathes of the western population without a massive 'walk away from it' I know.

I was in a fortunate set of circumstances that allowed me to do exactly that some little while after I found out about Peak Oil. It involved a huge lifestyle change and an equally daunting change of location. I fear that as dwindling oil supplies begin to bite many, many people will face similar options. At least I made my choices whilst the going was good.

Financially I am not well off anyway. I have a very small pension and some ever-dwindling savings. I have three more pensions that will kick in in a couple of years time. I am not banking on any of them either happening or continuing to happen. The only indebtedness that I could not walk away from in my present circumstances is a small communal charge (about 6GBP p.a.) for living where I do.

It would grieve me to be without Internet - it is my lifeline to friends and family elsewhere. To be without electricity would be a minor inconvenience. I was eight or nine years old before we had electricity in the house when I was growing up. To be without mains water would be a greater inconvenience, but I have a well and in my youth knew people that only had a pump in the yard. It's all stuff based on the modern age and cheap and readily available energy. Can't do without? If you had to then you simply would have to.

I can say that I wouldn't like it - I would find it hard and my current lifestyle would undoubtedly suffer. But put in context, I would not starve. Only yesterday evening I bartered a couple of barrow loads of sand for a litre of red wine. That's what life is like here!

I am not sure what role getting and staying out of debt will play. If everyone is in debt --especially governments --then it seems like some kind of major changes will take place, but it is not clear how they will work out. It could be disputes over who has rights to assets. (I personally have stayed out of debt--but that is something a family with two professional incomes can manage quite easily -- not everyone can.)

It seems like the place that debt might make a difference is with a home mortgage, since this might have an impact on who has the right to the home. But here, governments don't want people on the street, and empty houses are of limited value to banks. I expect many people will need to move anyhow, and having an unsalable home without a mortgage will be of limited value.

What happens when oil is depleted ? We will necessarily transition to natural gas and nuclear, and do a retro-transition back to coal and hydro-electric. Alternates such as wind, solar will also become more attractive and feasible, but will never be a majority of our power supply. (what do you do at night, or when there's no wind?).

So think of the late-1800's on steroids, that's the type of energy system we'll have. Coal is not "bad"- I've been heating my home with it for 16 years, and it's much less expensive than oil, electricity, or natural gas. I heat my modest home with only 2 tons of coal/year, at last year's cost that was only $370 or $185/ton. I burn one 40 lb. bucket a day, and the stove runs constantly from November to April nonstop. It is a modern high efficiency hand-fired coal stove.

Transportation- we will have to convert our cars to propane, like the fork lifts are today- or we will have to sythesize fuel from coal, like Hitler and the Nazis did during WWII.

The dumbest, worst thing you can think and do, is "go green". It is an oxymoron, by going green you kill more trees than by just changing sources of fuel to coal, natural gas, alternates.

Our food supply depends on huge harvesters that run on engines, without it, we all starve- imagine going to the store, and the shelves are empty- get the picture ?

Imagine no electricity, and so no way to keep food from spoiling in the frig- do you get it ?

Imagine no electricity to pump water to your spigot in your kitchen- are you seeing the danger ?

We're talking life and death here.

Screw "going green"- POUR THE COAL ON !!

If we had started a while ago, hadn't depleted our resources so much, and didn't have a problem with global warming, I would agree with you.

I have not been a fan of big wind and of solar PV either. To me, they are just a distraction. They will never scale. The PV panels will benefit their current owners, but not too much anyone else after the grid becomes unusable. They are not renewables; they are fossil fuel extenders. They go down in the same timeframe that fossil fuels go down.

We really need to be planning for the longer scale transition, which will not really allow huge wind and solar PV. We know it will allow things made strictly from local resources--say small scale wind, and small hydro, but that isn't a whole lot compared to what we have now.

The crucial difference the peak makes is that "supply" (actually flow) of liquid fuels becomes inelastic in the face of increasing demand. Pre-peak, elastic supply could be ramped up by more rapidly depleting oil stock. At peak and post-peak, inelastic supply makes price the pressure relief value when demand rises. (Economist's unfortunate use of the imprecise word "supply" in the name of the supply and demand model has sowed endless confusion about what is actully happening.) High prices impoverish the economically vulnerable segment of every oil-dependant society, and nasty consequences ensue.

WRT electric power, I disagree strongly with your dismissal of solar and wind energy. If we want/need to harness energy to do work, it's exactly THE point that post-peak we'll need to shift from depleting fixed stocks of oil and uranium to tapping flows of renewable energy from the ongoing forces of the solar system (sun, wind, currents, tides). (Ditto for geothermal, except that the ongoing force is planetary.)

Optimism on the scalability or storage questions is warranted after serious investigation of the existing technology and deployment opportunities. Cloudy Denmark and parts of Germany already produce more than 20% of their electric power from wind and/or solar. China is well on its way to produce 37% of its electric power from wind by 2020. Why should they be able to do things we can't?

Here are two in-depth reports outlining just some of the prospects:

http://www.iea.org/papers/2010/csp_roadmap.pdf

http://www.energywatchgroup.org/fileadmin/global/pdf/2009-01_Wind_Power_...

I also recommend reading this website once or twice a week to catch up & stay current on renewable-energy technology and deployment:

http://www.altenergystocks.com/comm/content/cleantech/

WRT liquid fuels for motive power, I am less confident that we can replace oil at scale. If fact current thinking is that this is not physically possible:

http://www.renewableenergyworld.com/rea/news/article/2010/06/biofuels-pu...

But it's obvious that we're going to push this envelope; as we speak, for example, the US Air Force is subsidizing start-ups to commercialize and create a successful industy in aviation biofuels. Because of the huge scale at issue, increased efficiency plus electrification of surface transport are the most likely solutions to the motive-power problem.

Concentrated Solar Heat (CSH) can be made with 1880 (or earlier) technology using mirrors or lenses. It can rather easily be scaled up rapidly. I agree that solar panels are a stopgap at best, as are wind turbines made with 21st century technology. But the Dutch had some pretty good windmills as far back as the thirteenth century, and by the eighteenth century they were a lot better. Early twentieth century windmills and generators could be made with the materials available in 1900.

We ran a post on the Dutch windmills, and I have no problems with these.

Concentrating solar heat certainly works for small cooking ovens, and for other local uses. I am not certain how well it would work for something like an electrical system, where one normally would heat water in a boiler, and operate long distance transmission lines. It depends on the extent we could build and maintain such a system. I am doubtful it could really be done.

You seem to talk about concentrating solar electrical generation as if it were a mere proposal. I'm sure you know that it already does exist.

In spain we do have a couple of Thermoelectric solar electric stations.

They are named PS10 and PS20, and are, of 10MW and 20MW power, and can operate some full pore hours into the dark and store energy when not needed (as heated molted salts inside vacuum chambers)

http://es.wikipedia.org/wiki/PS20

The are both solar tower concentrator plants.

They are both integrated into a combined thermo and pv station, of 300MW peak ssutained power, that can work nearly as a "traditional" power plant, and as that part of spain is nearly a desert, no clouds most of the year.

Platform:

http://www.solucar.es/corp/web/es/nuestros_proyectos/plataforma_solucar/...

Right now solnova1 is entering commercial production and solnova3 is almost ready to produce.

They are both cilinder concentration, vacuum molten-salt thermoelectric.

Both have about 50MW.

Solnova4 is under construction (50MW).

Solnova2 & 5 are going to be built this year if possible (50MW each) as will AZ20 (20MW, solar tower).

There are some 4GWp of PV installed in Spain, and in this site:

https://demanda.ree.es/generacion_acumulada.html

you can see the structure of power generation (sorry, spanish and flash).

As you can see, more tha 50% of the power generation is renewable, and we regulary have more than 20% of wind energy production.. something some electric grid operators claim as "imposible".

https://demanda.ree.es/demanda.html

So yes, thermoelectric is possible, PV also is possible (just a bad business for the society), and certainly you can go "green" without much travel.

¿Cost? Well.. we pay 0,15€ (about 0,18$) per KWH.. really expensive (domestic tariff), and it could get as high as 0,25 or so if we had 100% renewable. But most of that money would rever to the country, and not get away like oil does, so we would "recover" most of it.

Of course, now that we are officially debt ridden (funny, as our more debt ladden countries are out of the storm eye..) the cuts are coming to the energy generation "advances"

Cut & paste of REE data:

Day Month %incr.Month Year %incrYear 365 days %incrementoMóvil

Hidráulica 112.162 2.117.248 57,80 24.201.267 81,45 34.724.910 45,23

Nuclear 161.035 3.358.140 34,92 27.698.182 11,52 55.622.506 1,76

Hulla + Antracita 11.604 254.489 -52,51 1.953.805 -75,52 7.327.999 -65,29

Lignito pardo 6.172 277.807 -52,16 2.094.134 -28,31 6.606.672 -11,62

Lignito negro 5.869 52.529 -40,70 394.525 -79,29 2.016.543 -58,84

Hulla de importación 14.690 362.734 -39,36 2.281.624 -50,36 7.230.758 -21,64

Carbón 38.335 947.559 -47,46 6.724.088 -61,36 23.181.972 -45,73

Fuel + Gas 6.948 131.920 14,93 795.718 -11,07 1.983.253 -16,57

Ciclo combinado 156.204

Lignito pardo is a kind of coal.. bad quality.

Ciclo combinado refers to combined cicle, and it usually is natural gas fired.

Hulla refers to gas coal, fat coal, etc.

Note: why do I get to be "new" when I registered nearly 2 years ago?

Your electricity is cheap compared to mine :( I've just been checking the price of glass to set up my first solar panel that will provide evening lighting for me. The 'new' you refer to is the comment not the author.

Suerte

NAOM

The thing is, a 5MW eolic tower costs (everything included) from 7,5 to 10M$, and you have something like 50% continous rated power (not true, you have usable wind like 80% of the time, but not full power).

So you have to pay 4 million bucks for each MW.

A supercritical pulverized coal power station, gets around 2-3 million per MW.

http://www.consumersenergy.com/content.aspx?id=1964

The difference, of course, is that we get a 50% "average" with wind, and with coal you get security.

And I guess my numbers for eolic are not correct.

As for PV.. it is 3-5$ per Wp.. and then you don't get energy in the night unless you have batteries, you need a transformer and inverter, the installation.. it quickly gets to 15$ per effective W.. not a good investment unless you don't need the batteries, you have a huge installation with three axis solar follower and you are just complementing the network.

I prefer a slightly different take on solar although I will be charging a battery on this one.

1/ Moving energy. It may be sunny outside but you may need light/power inside. Solar cells can run indoor lights/fans/freezers etc during the daylight hours and eliminate mains use during them. No battery needed.

2/ DC supply. Adapt electricity use to DC. Lighting is a good example, it is easy to switch light fittings to LEDS which can run straight off the cells. DC motors can replace AC ones. No inverters needed.

3/ Energy storage. Look on the whole issue as energy storage rather than electricity storage. Cold water, hot water, kinetic energy (that has just given me an interesting thought). Just like the molten salt in your towers. Again, no battery.

4/ Grid link. Don't store but feed it back to the grid to supply those who cannot install their own. Use that to offset nightime use.

Solar cells are dropping in price and set to drop further. It may well be cheaper to add more panels than followers though adjusting the tilt a few times a year may be an idea. I think people need to start moving away from some of the old concepts of solar and start with a clean slate.

NAOM

The longer that we can extend fossil fuels, the more time we have to further scale up more renewables! Every step we make towards renewables makes the "long decline" a little bit longer, the slope of the downward curve a little less steep. The longer we can preserve whatever supply of fossil fuels we have left, the better off we will be in the long run.

Gail, in place of investing in renewables now, what would you recommend? There may not be a lot of time, but there is at least some time left. In my view, there is NO other option, why wouldn't we want to extend our fossils as long as possible? We are still building power plants right now, so why not have all those plants be renewable instead of fossil fuel burning? The goal does not have to be replacing 100% of fossil fuels with renewables, it can be replacing as much as possible as quickly as possible. Every little bit will help. I don't know about you, but I'd much rather live in a world with 25% of todays energy production, than one with 1% or less.

We can all lay our heads in our hands and give up, or we can stand up and fight the fight. If we lose the fight, so be it. At least history can judge that as we approach this critical time in the history of civilization, we met it standing up with our eyes wide open and weapons in hand, not sleeping in our beds, or hiding under them wetting our pants.

Here's a real-time action along Rune's line of thought: FPL Group utility is grafting what will be the world’s second-largest solar plant onto the back of the largest fossil-fuel power plant in the United States. FPL "expects to cut costs by about 20 percent compared with a stand-alone solar facility, since it does not have to build a new steam turbine or new high-power transmission lines."... "FPL estimates it will cut its natural gas use by 1.3 billion cubic feet each year, the consumption of 18,000 American homes. It will also cut carbon emissions by 2.75 million tons over 30 years, the equivalent of taking 19,000 cars off the road. The solar panels concentrate the sun’s rays into a vacuum-sealed tube that contains a synthetic oil, which heats up to 748 degrees Fahrenheit. The oil is then used to produce steam that is fed into an existing turbine to produce electricity. Using small sensors, the mirrors will be able to rotate during the day to track the sun’s movement. In case of a hurricane, they will flip upside down for protection."

http://www.nytimes.com/2010/03/05/business/05solar.html

I am not convinced that big wind and solar PV give us anything at all over the long term. I expect their systems will pretty much go down with fossil fuels, so the huge front-end costs will not get much payback, except for the homeowners who happen to have them on the tops of their houses, and have appliances that can use them in daylight hours. What they do do is distract us from our real long-term problems, and make us feel like we are doing something.

I think there is a real possibility that the additional variability they add to the grid may bring it down sooner than otherwise. At a minimum, solar PV and big wind do absolutely nothing for our liquid fuels problem.

It takes a very long time for major energy transitions--minimum 40- to 50 years, but more like 100 years for very big transitions like we are dealing with now. We need to be focusing on how we can make it from where we are now, to that end point, using technologies that do not rely on fossil fuels, because we are not going to have them for the long term.

Even though we always hear there will always be a little oil available, I don't think the "fact" is really true. In order to keep any oil flowing. we need to maintain a lot of major systems, like refineries and roads, and the financial system, and the electrical system. At some point, this is not going to happen, and we will pretty much lose all the fossil fuels. We need to start planning for it now, because it will be a very long, hard transition.

People lived for years without fossil fuels, so it can be done again. As bad as that situation is, it seems to me to be the one we have to plan for.

It takes a very long time for major energy transitions--minimum 40- to 50 years, but more like 100 years for very big transitions like we are dealing with now.

Hardly !

It took about a dozen years (not including prototypes) to switch the bulk of locomotives from coal to diesel.

Mules to Model T and other trucks for local & farm to market, etc. deliveries took less than 20 years. The bulk within ten years.

The transfer of higher value long haul freight from rail to truck took as long as it took to build a majority of the interstate system, 15 to 20 years.

The bulk of Urban Rail in the USA was built in just 20 years; 1897 till 1916.

It took just 20 years (roughly 1950 to 1970) to trash virtually every bit of prime commercial property (called "downtowns") and well built, superbly located, well established neighborhoods (called "inner cities").

I have demonstrated how all 35,000 miles of rail main lines could be electrified in just 7 years (Ok, 8, maybe 9 years for all 35k if Murphy shows up). This helps solve the connection between renewables and transportation.

Adding back double tracks (torn up in 1950s and 1960s), adding rail over rail bridges (E-W over N-S), better signals and operations# can be done concurrently with electrification. These steps would massively increase both capacity and speed of rail (no waiting for a single track to clear from trains in opposite direction, E-W traffic not held up by N-S, etc. In a decade (or less), the bulk of truck freight could be transferred to electrified rail. In two decades, the vast majority could be transferred.

Rushed for time ATM, more tomorrow.

Best Hopes for Seeing the Possible,

Alan

# Only CN offers regularly scheduled freight service (trains move with 25 or 200 cars at set times). All RRs need to offer this service to attract more truck traffic.

Alan,

You are not alone in that belief that we should be able to make the switch away from fossil fuel more quickly. China is aim at adding 61 GW in a decade according to a report by Barry Brook in his Brave New Climate web site.

China plans to expand its nuclear generation capacity to 70 GW (up from 8.6 GW in 2010), South Korea to 27.3 GW (up from 17.7 GW), and Russia from 43.3 GW (up from 23.2 GW). Looking further ahead, India’s stated goal is 63 GW by 2032 and 500 GW by 2060, whilst China’s 2030 target is 200 GW, with at least 750 GW by 2050.

Our projection for new nuclear is not a robust as China’s, but much higher than previous projections. According to EPA’s core policy analysis of Senators Kerry and Lieberman’s proposed legislation released June 16th. Nuclear energy is projected to generate 44.2% of the US’ electricity in 2050, more than any other source. Total nuclear capacity is projected to more than double from 101 gigawatts in 2010 to 256 gigawatts in 2050 (assuming 90% capacity factor).

Alan, in a previous post you accused me of BS in stating that our immune system evolved a tolerance for radiation. It is not BS, but I apologize for using a loose definition of species. Our immune system is critical for survival and evolve long before Homo sapiens appeared. The early earth had high background radiation which drove selection for radiation resistance. Some key proteins evolved even before plant and animal kingdoms appeared. The immune system was well developed when Homo sapiens arrived. Major recent selection pressure occurred when hunter-gatherers started agriculture and began to live in large groups. Urbanization brought a whole new group of diseases. Selection pressure for the fittest made for accommodation to the new epidemics. When explores brought their diseases to the New World, natives suffered great mortality which shows that recent evolution of the immune system continues.

Of human additions to radiation medical radiation is the big one. Recent concern of over use of CT scans is in my opinion a problem that needs attention because the accumulation of repeated scans amounts to unsafe levels of exposure. Replicating DNA is at risk, so the need for CT scans in growing children should be carefully evaluated.

For the USA, new nuclear can only be a secondary and second stage response to getting off FF. A "gap filling" exercise after a Rush to Wind, Geothermal, Solar, etc.

44.3% in 2050 is a secondary and second stage response. We cannot wait that long and still burn 55.7% FF.

New Nuke building in the USA killed themselves. Zimmer did almost as much damage as Three Mile Island in the eyes of utilities. Too many new nukes, too fast, resulted in lengthy delays and MASSIVE cost overruns.

Lets finish Watts Bar 2, build two nukes in Georgia and three more elsewhere in the USA by 2020. Create some experience and restart the supply chain. Finish another 8 or 10 new nukes by 2026, on time and on budget (all 3rd generation designs) and then start building more at a somewhat faster pace after 2025. Perhaps a prototype 4th Gen as well in 2025, slowly building up experience.

----

The increase in C14 from atomic bombs raises the background radiation for every living creature, and every strand of DNA worldwide, for thousands of years. A non-trivial and irreversible "side effect". We should avoid duplicating a similar effect with other isotopes from nuclear waste.

BTW, You have created a wrong view of the opposition to nuclear power.

Alan

Alan, I think that your summary of the near future for the USA is about the same as I see it. We have yet to start a generation III reactor construction project, and the pace is too slow. We need all the non-emitting sources that we can find and we need to reduce the waste of energy. Even so FF is going to be a significant part of our energy picture for at least a half century.

SCANA is a fortune 500 company with a variety of energy holdings in southeastern USA. For future planning they did a study with a 40 year service outlook. Here is a comparison of projected costs for new power generation provided by SCANA’s CEO, Bill Timmerman, December 2009. The per megawatt hour (MWh) cost of electricity with nuclear fuel is $76, compared with $114 for coal, $132 for wind, and $614 for solar. He concluded, “Building more nuclear power plants promises to hold down future electric costs.”

Building comparable generating capacity from diffuse and intermittent energy sources takes a toll on our mineral resources. Wind needs 7 times more concrete and 90 times more steel than nuclear. Thermal solar requires 14 times more concrete and 140 times more steel than nuclear. From a resources and space perspective nuclear looks pretty good. Uranium is still cheap enough to make once through more economical than breeder with reprocessing. In time the LWR spent fuel will be fuel for breeders but not in my lifetime.

I have used C14 in research, especially while working on algal cell cycle studies, in Bergen Norway in 1975. One strives to do extremely careful cleaning in a C14 Lab with lots of swabs to document a clean environment. I recall finding high levels of Sr90 following USSR atmospheric testing in silt build-up along mountain stream in Wash St. in 1963. I have no recollection of significant C14 associated with the fall-out. I was studying the biological effects of radiation at the U of Wash at the time.

We can move to 10% (or so) FF by 2040-2050 with a sustained effort, focusing on wind, HV DC and pumped storage, with secondary efforts on solar PV (and solar hot water and solar thermal generation is desert SW), geothermal in the West, more Canadian hydro and small hydro in the USA and new nukes.

We cannot build nuclear reactors safely and economically much faster than what I proposed.

Your resource numbers are meaningless.

Example: Aluminum is not just aluminum. One grade (cheap) can be used to make beer cans. Another grade (VERY expensive) can be used to make airplanes.

Wind turbines can be made out of average commercial carbon steel (the gears require a somewhat higher grade). "Beer can" steel if you will.

Nuclear power plants (other than the Administration building, fences and parking lot) require Boeing grade steel EVERYWHERE. And concrete, and everything else safety related.

Nuke materials cost more per MWh than WT materials becasue of the specifications.

And WT steel is very readily and easily recycled. It is not lost like irradiated steel from old nukes (although the French are taking some of the less irradiated steel and recycling it into nuke waste containers and limited new nuke parts).

I also know that new nukes get the wind subsidy plus MUCH MUCH MUCH more subsidies. And the only new nuke announced is in a state where the ratepayers will pay for it as it is built (regardless if it is completed, or how long it takes). Any claims that new nukes today in the USA are cheaper than wind is in conflict with observed reality.

------------

Environmental radiation must be a minor emphasis if you do not know about C14 pollution. Northern hemisphere spiked at double natural levels of C14 in atmospheric CO2 and then it began to spread into the entire biosphere. Trend appears to be a permanent 1/8th increase in every strand of DNA in every living creature, with sea creatures getting a time delay. People's age can be estimated by their concentration of C14.

http://en.wikipedia.org/wiki/Carbon-14

So if "radiation is good for you" we have over 1 mrem/year extra in place already :-((

Alan

Once again, the sweeping, over-certain, unsupported, obstructionist dig at renewables. I guess the principle at work here is that if you tell a lie enough times, people will believe it.

Jaggedben,

Perhaps you are just a tad rough on Gail-she can't repeat her arguments everytime she makes a comment but they are available, scattered all thru the site archives.

What she is saying is that after studying the subject of energy intensively for years she concludes that the economics of renewables simply won't work out; that there is a fast and inevitable economic decline baked in already which will prevent the renewables industries from ramping up fast enough or to the size necessary to shoulder the load as the ff deplete.The return on investment is simply not high enough ( as she sees it ) for the renewables ambulance to get the patient to the hospital before the patient dies of energy starvation.

This is HER opinion of course, but if you understand the arguments she makes concerning credit, trade, and so forth, it is as well supported as the contrary argument.

We need to keep Rockman's lectures about models firmly in mind when we discuss such questions;he is absolutely correct that you can model just about anything and make the MODEL logically airtight and internally consistent and MAKE THE MODEL PREDICT WHATEVER YOU LIKE.

The results predicted by the model will depend on the assumptions you put into it as much or more so as on any hard data.

One of my old teachers took me aside once and showed me on paper that " assume" spells ass-u (and )me back in the days when teachers could NEVER say a "dirty" word.

I never forgot this lesson and it has stood the test of time.

Now you can ASSUME that the necessary huge , huge, HUGE investments necessary to make the renewables dream fly prior to the depletion driven crash of ff will occur IF YOU LIKE, helped along by ASSUMED economies of scale and ASSUMED cost cutting technical progress, and ASSUMED invention of new storage methods etc.

Or you can look at the likely but ASSUMED (by Gail) time frames involved, the ASSUMED ( by Gail)expected availability of capital in a worlds staggering under an unpayable debt load,the ASSUMED incredibly expensive capital sucking revenue destroying interventions necessary to prevent irreversible collapse in the short term by supporting a huge portion of the unemployed on welfare, and various other ASSUMPTIONS (all made by Gail in her personal model of course!), and run the model based on the well established principles of her profession, which IS incidentally a numbers crunching profession..

And you will get the opposite result of course.

Actually you don't even need to plug in numbers;you can easily convince yourself that renewables can't get the job done-just as you have convinced yourself otherwise.

I find her arguments quite persauvive (I could be partially in error of course) because I happen to agree for the most part with her assumptions, or at least what I ASSUME are her ASSUMPTIONS.

So after trying to do my dead level best to look impartially at the facts(Maybe the FACTS in FACT are ASSUMPTIONS?) my personal estimate of the matter is this:

Based on my own seat of the pants but reasonably well informed understanding of the realities of renewables,I believe it is PROBABLY technically POSSIBLE to make the switch to renewables if we were to be willing to COLLECTIVELY change our way of life to such a degree that we could hardly recognize ourselves as the same civilization.

After studying politics and human nature for many years, I believe that it is utterly absurd to think such a change in our lifestyle WILL take place, barring the occurence an incredibly lucky sequence of wake up calls which I refer to as Pearl Harbor events.These events would have to be frequent enough and dramatic enough to hit us upside the head like bricks,one after another, but not so injurious to our will power or the economy as to destroy our ability to respond appropriately.

Of course it could be that the depletion of the ff comes about slowly enough to allow us time to make the necessary adjustments while allowing us to continue to live quite well if not so extravagently as in the recent past.

Alan Big Easy makes a persausive case that this can indeed happen and some days when I am feeling less than usually cynical about the human race I believe he could be right.His suggestions are WELL within the sphere of current engineering practice and do not require any drastic sacrifices on anybody's part.

But getting the public to voluntarily accept ANY sacrifice is a near impossible job.

An absolutely horrible piece of advice, BTW.

Rewording it: Models allow us to build machines that we can direct to do ANYTHING WE WANT THEM TO DO.

They can only do that if we use similar models to UNDERSTAND EXACTLY WHAT IS GOING ON.

Welcome to the world of statistical mechanics and what has dtiven the computer age. And what is statistical mechanics but the study of entropy. The problem with renewables is that they are all highly entropic, not having the benefit of concentrating their energy for millions of years. Yet we can use the same models to try to reason about the system and how best to go forward.

Oil depletion is about the decline of using a concentrated form of energy.

What we have next is the study of renewal, and specifically coming up with ideas in how best to use entropic forms of energy.

WHT,

I'm not talking about building a machine in any physical sense of the word at all-

if you weren't so besotted of your beloved statistics you might be able to get your head around this argument at another level altogether-the level of fools counting chickens when they have mistaken stones for eggs.Chickens are notably lacking in intelligence and will happily incubate stones,if you substitute them for eggs.

The models I refer to are also known by other names such as houses of cards or delusions and prejudices.;)

The stones are possibilites in this case.

You will truly go down in history as a great scientist when you manage to successfully model the ability of humanity to delude its collective self. ;-)

PS-If I weren't so old I would go take a few statistics courses just so I could jerk your chain once in a while. ;)

Yet you can take what ROCKMAN says at face value? Never too late to start.

What Rockman is telling us -and what I am repeating-is that if you control the terms of the debate, you can win the argument.

This isn't about physical science and engineering except at the limits or boundaries;thye question will be decided by what we as a bunch of fickle and easily diustracted naked apes will do.

Although I am a long way from fully qualified as either a biologist or psychologist, I can easily follow the arguments of the leading authorities in thse fields in regard to our behavior;and we are living machines more or less "programmed" to function in the short term and in competition cooperation with an "in " group and competition with an "out" group.

At another level(and this thing has more layers than your average onion) Rovkman is telling us that while (rhetorically speaking, not you personally of course) folks such as yourself may have your professional ducks in a row,you may also may have ulterior motives of your own, and define the terms of the debate to rig the outcome to suit your own ends; or the people using your methods may have such ulterior methods.

At some point evberybody has to rely on somebody else's expertise.

For me to put my faith blindly into a theoritical system of thought which I admittedly do not understand is utterly foolish-on the same level as believing in the BIble because it is the only book I might have read.

Given the choice of putting my faith with Rockman or with you in this instance, I will go with Rockman as what he is saying jibes VERY WELL with everything else I know.

Someday you will have to rely on the advice of a doctor or lawyer without really understanding the technicalities of the problem at hand.If you know that one of them is a a very intelligent individual who says a lot of things that you yourself know to be true, and another goes around lecturing everybody in terms they cannot understand and seems to espouse to a lot of opinions/theories outside the mainstream of his profession, I expect you yourself would go with the former individual;unless of course you can locate a database and statistically analyze the records of both of them!

Your commentary is so full to overflowing with technicalities understood by only those trained in your field that so far as most of the audience is concerned you might as well be speaking Greek.

Please-try to explain why my original ADVICE is in error in ordinary non mathematical langauge so I can at least understand where the error lies. ;)

So far as I can see Rockman is entirely on the money in this case.The tools are only useful to the extent that the workman using them is competent and honest.

If this is indeed Rockmans position, count me in with him. We've already seen the examples at TOD where the exercise of matching a historical trend is confused with its predictive ability, or worse yet, its ability to instill knowledge on a topic.

Jaggedben

In support of what OFM has said, last year Aeldric and myself undertook a rough assessment of the economic effort required to replace the FF economy with alternative energy sources over a period that would match the extinction of FFs. We published this on TOD under the heading "The trouble with energy". We concluded that the exercise was simply impossible. At least it was impossible in any scenario approaching BAU. There simply must be a curtailment of energy usage by the world economy and corollary to this is a curtailment of world GDP.

The big question is, can a world already in turmoil over a breakdown in the economic paradigm of continual growth muster enough capacity to deliver even a small portion of the renewable energy systems that are theoretically possible.

Yes, "enough" renewables can be built to sustain an industrialized economy.

Opposition such as Gail's to building as much renewables, and as much efficiency and conservation as possible now, ASAP, only increases the use of oil & gas and coal and makes things significantly, perhaps dramatically worse.

In the largest sense, the distant future is unknowable. But we should add to our supply of what will mitigate as fast as possible.

Instead, Gail supports more consumption today and less investment. A sure recipe for collapse.

Alan

Alan

I hope you are right. I am personally working very hard to this end. However, I am continually dismayed by the propensity for immediate self interest to win out over long term strategy in almost every aspect of human endeavour.

I suspect the outcome with respect to this question will be quite patchy. Those countries with an overendowment of energy resources or that are clever in positioning themselves for the future may retain a substantial industrial capacity. Many others however will slip back several hundred years.

In 1998 the Swiss voted, in a national plebiscite, to spend 31 billion Swiss francs# over 20 years to improve their already excellent rail system. Several goals, but #1 was to shift freight from trucks to renewable electrified rail.

Some people can plan ahead.

Looking forward, I would rank the following areas as likely to continue as industrial centers, selling (among other things) energy producing capital goods to other areas that have something they want to buy. Also computer chips (perhaps lower spec than today), medical equipment, farm machinery, etc. Eyeglasses will certainly be useful trade goods with almost everyone.

In rough order of probability.

Nordic Block - Norway, Sweden, Denmark, Finland, optional Iceland, Greenland (mining), Baltic states

Brazil - 80% hydro electricity, sugar cane ethanol with decent EROEI, #2 agricultural exporter, growing industrial base, offshore oil (seeking to source needed oilfield equipment domestically)

Germany-France axis (associated Switzerland) with neighboring nations added in whole or part (Northern Italy, Austria, Poland, Czech, Belgium, Netherlands, England are all optional).

Note: Good rail and electrical connections with Nordic Block, so a complementary trade.

Parts of European Russia (Urals and/or St. Petersburg area perhaps). Some access to Siberian resources and enough farmland to feed a shrinking population.

Japan - Shrinking population, immense capital infrastructure (much designed for post-Peak Oil world), established "high end" production makes them good candidates to trade for food and raw materials they need. Combine lower living standards with smaller population and they be able to trade for what the basics that they need. Social cohesion will allow them to strive for a goal (survival in this case) with enormous intelligence, discipline and drive.

Taiwan and pockets of coastal China - Dieoff seems possible in much of China, but social cohesion has seen that many times before. A handful of surviving pockets of industry on the mainland connected with Taiwan may be able to reach a critical mass.

Canada ? - BIG problem is that neighbor to the South. Otherwise a lot of positives. Perhaps like Taiwan, pick pockets that are useful to merge with.

USA ? - We could join the groups of surviving industrial centers by *NOT* doing what Gail suggests but instead diverting a few % of GDP from consumption to investment in long lived energy producing and energy efficient infrastructure (see Swiss example below) while bringing more manufacturing "back home" and partnering with Canada.

Best Hopes for a Few Industrial Centers no matter what,

Alan

# 31 billion CHf = to over $1 trillion for USA if adjusted for population & currency.

And why does it have to approach BAU? What does that have to do with whether renewables can continue to exist in a post fossil fuel world? (It ought to be obvious that a society powered solely by renewables will be different in important ways from BAU. Indeed it's to be hoped for.)

The question really is, if we invest in renewables now, will that allow us to build out renewables at all in the future? Gail doesn't think so, but I've never been able to figure out her reason for thinking so. She just repeats over and over and over again that renewables need fossil fuels.

@ oldfarmermac...

You wrote:

With all respect, I disagree with you. I've read quite a lot of what Gail has written on this website. On the particular point of whether or not modern renewables (such as solar PV) must be dependent on fossil fuels in the future, I submit that she has never made an argument supporting her view. She has simply put it forward as an assertion over and over again. Your repeated use of "ASSUME" in the rest of your post exactly illustrates my disagreement with her on this point. She asserts the inevitability of a particular scenario and gives no credence to other possible, and perhaps even plausible, scenarios. Thus my criticism that she makes "over-certain" statements.

I think that all we'd really have to change is commuting by car and probably the 24/7 use of electricity, but I basically agree with you. (That is, aside from issues peripheral to energy, such as soil depletion and climate change.)

Gail disagrees with you. It is clear from what she has written repeatedly that she believes it is not technically possible to manufacture renewables without fossil fuels. See the previous conversation...

http://www.theoildrum.com/node/6287/599391

(Don't miss my reply, and barret's, at the very bottom.)

Thus my criticism that her statements on renewables are "sweeping."

This boggles my mind. You want to celebrate and encourage a transition from a dirty fuel (oil) to an even dirtier fuel (coal)? This reminds me of an imprisoned person in solatary confinement who begins to revel in their own feces... painting the wall with them, throwing them at the guards, even eating them. Step back from the situation and reevalutate, coal is part of the problem, not the solution.

Your very glory in reveling in the cheap price of coal is a great example of why the US NEEDS a carbon tax, with the revenue going towards the creation of cleaner power infrastructure. You emphasize the variability of wind and solar power generation, but neglect the equally clean, less variable sources like Hydro, Geothermal and Tidal. You also ignore the possibility of electricity storage, using pumped hydro, molten salt or other potential solutions. Tax the heck out of the dirty and use the money to make clean power super-cheap!

Reveling in cheap coal is similar to celebrating lead paint on children's toys, MTBE in gasoline, DDT as a general pesticide or PCBs in industrial equipment. Do you really feel good about leaving your grandkids with major lifelong problems like severe climate change (both CO2 and methane generated), groundwater contamination, acid rain and acid mine damage, radiation (yes, from burning coal), loss of life from mining disasters, coal fly ash storage ponds (see: Kingston Fly Ash Slurry Spill), and mercury emissions? Is it really worth all of that potential damage to save a couple bucks on your heating bill?

Do us all a favor... read through this ONE link I'm going to give you, from wikipedia. Wrap your mind around all of the damage that coal can cause, and then think about if you want your dollars to be supporting and encouraging this kind of resource.

Environmental Effects of Coal

After reading, you might considering going to the website for your utility and seeing if you can sign up for some of that "green power" that you scoff at. With my personal household power use, it costs my family a measily extra $5 per month to support/offset 100% of my electricity use from wind/solar generation. Thats the equivilent of giving up 1 freaking latte, or 1 drink at the bar, once a month. Even if you are offgrid, you could at least swtich to a pellet stove for heat. Some things are worth paying a little extra for, unless you really like to play with your feces I guess...

Wow Runeshade, your diatribe is smug. I think the coal poster stated he used two tons to heat his house. That's a generous 50MM BTUs for about $400. If he lives in the NE, thats about 30MM BTUs below average. You might not know it, but for large numbers of your citizen comrades, the alternatives to be evaluated do not include, "Shall I sacrifice a latte once a month and pretend I'm doing good?"

BTW, I'm curious, how many BTUs of energy do you consume? If you are partially self sufficient in the supply of your personal energy needs, please elaborate on the capital costs and any special tax incentives you might have enjoyed.

Next time you sneer upon another human driving a mid-nineties gas hog SUV, consider that the driver may be on his/her way to a nurses aid job to wipe up after your next of kin, for $20K/yr, and this comrade would be driving spanking new Prius, but for the fact that he/she couldn't possibly qualify for the "Cash for Clunkers" subsidy that you probably tout as good public policy.