Drumbeat: June 4, 2010

Posted by Gail the Actuary on June 4, 2010 - 7:25am

Obama Arrives in Gulf Region as Well Cap Effort Proceeds

President Obama arrived here Friday for his third trip to Gulf coast since oil began gushing into the water nearly seven weeks ago, as officials said that a cap placed over the leaking well showed tentative signs of progress.

Adm. Thad W. Allen of the Coast Guard, who is commanding the federal response to the disaster, said some oil had been collected in the cap and was beginning to funnel up to the surface. But he noted that a great deal of oil was still escaping, by design, through vents in the cap that were intended to let oil out in order to keep cold Gulf water from rushing in and forming icy hydrates that could block the flow of oil to the surface.

So it will not be clear if the cap is sealed tightly enough to prevent large amounts of oil from continuing to pour into the Gulf until those vents are closed, Admiral Allen said. He said that current plans call for closing those vents on Friday.

“Progress is being made,” he said during a morning telephone briefing with reporters. But, given the up and down nature of past efforts to contain the disaster, he hastened to add, “I think we have to caution against over-optimism here.”

He said that a rough estimate of the amount collected earlier was at the rate of about 1,000 barrels a day, a small fraction of the estimated 12,000 to 19,000 barrels of oil spilling into the Gulf each day. But he said that as the valves closed, more oil should be collected, if the seal continues to hold.

Tar Balls Wash Ashore in Florida

PENSACOLA BEACH, Fla.—Brown tar balls were washing ashore on this popular Panhandle beach Friday as the Deepwater Horizon oil spill neared Florida's northwestern coastline on the Gulf of Mexico.

Cleanup teams have been deployed to scour 18 miles of beach in Escambia County, which borders Alabama, said a county spokesman. He confirmed the presence of the tar balls, adding that authorities will carry out tests to determine if they are tied to the spill that has been spreading across the Gulf since April.

Insurers Dodge Hefty Ash, Oil Claims And May Hike Premiums

The insurance industry could be among the few winners from the Gulf of Mexico oil spill and the volcanic ash disaster, which have the dual benefit of being relatively light in claims costs but may still give insurers an excuse to raise premiums for some types of cover.

The insurance industry "got lucky," because only around 20% of the losses incurred so far in connection with spill are being carried by the industry, said Stephen Catlin, chief executive officer of London-based reinsurance company Catlin Group Ltd. (CGL.LN), speaking at Euroforum's annual reinsurance summit in Zurich this week.

Wind Turbine Gearbox Reliability: The impact of rotor support

. . . the main problem of conventional rotor support structures is that the gearbox is performing structural and mechanical functions at the same time, which makes it challenging to simulate loads properly at the design stage. This is especially critical in a component as complex as a gearbox, which is basically designed to withstand mechanical loads. This challenge is illustrated by the recent debate in the US about whether gearbox failures are due to the gearbox ability to withstand the specified loads, or to the fact that real loads experienced by the gearbox are higher than those specified by the wind turbine manufacturers.

An efficient way to solve this problem is to use a rotor support concept that separates structural behaviour from mechanical behaviour. This allows designers to simplify the way the loads are transmitted in the drive train, and therefore specify the drive train components with figures that are much closer to the real loads.

The company's trademarked Alstom Pure Torque system is a unique rotor support concept protecting the gearbox and other drive train components from deflection loads. It was introduced by Alstom's wind business, formerly Ecotecnia, back in 1984, and has since been installed in more than 1600 wind turbines.

History of ‘peak coal’ is guide for our oil quandary

Mr. Jevons provides the modern reader will an eerie sense of déjà vu. In the mere dawn of the Age of Coal, he writes of the debate in Britain over the next principal source of cheap energy. The alternatives are mostly the same now as they were a century and a half ago (with the single significant exception of nuclear power): water power, wind power, tidal power, solar power – “all the supposed substitutes,” as Mr. Jevons expressed it, “for coal.”

Mr. Jevons, however, was not persuaded. Coal itself, he said, “possesses all the characteristics that entitle it to be considered the best natural supply of motive power.” Coal, he said, was like a spring – “wounded up through the geological ages for us to wind down.”

Under Pressure to Block Oil, A Rush To Dubious Projects

Under pressure from Louisiana Gov. Bobby Jindal and other state and local officials, the U.S. Army Corps of Engineers issued an emergency permit on May 27 authorizing the state of Louisiana to construct 45 miles of artificial berm — 300 feet wide at its base and rising six feet out of the gulf — in an attempt to protect delta wetlands and barrier islands from the encroaching oil. . .

While mitigating the environmental damage of this spill is critical, it must be done in a way that wisely utilizes the resources at hand, effectively deals with the problem (e.g., keeping oil out of wetlands), and doesn’t do more harm than good. But the emergency projects currently being proposed by various entities and permitted by the Corps of Engineers — including a plan to build a seawall in front of Dauphin Island, Alabama — have not had sufficient review and design to guarantee that any of the above goals will be met. Indeed, since the Louisiana berm will not be continuous, there is a strong likelihood that oil will flow in through the gaps, then possibly become trapped in wetlands.

In addition to its questionable prospects for success, the Louisiana berm project would be extremely expensive.

BP PLC on Friday said some oil was flowing up a pipe from a cap it placed on its broken Gulf of Mexico well, but crude still spewed and it was unclear how much could be captured.

"Even if successful, this is only a temporary and partial fix, and we must continue our aggressive response operations at the source, on the surface and along the Gulf's precious coastline,'' Mr. Allen said in a statement.

BP Chief Operating Officer Doug Suttles said it will be later in the day before they know how much is being captured. "There is flow coming up the pipe. Just now, I don't know the exact rate," Mr. Suttles said on NBC's "Today" show.

BP working to settle cap over oil well

Gushing oil makes success of effort unclear

After successfully hacking through the leaking pipe a mile deep in the Gulf of Mexico, BP worked to place a cap on the newly shorn pipe Thursday night.

Live video showed that an inverted funnel-like cap slightly wider than a severed pipe was being maneuvered into place over the spewing oil. However, the gushing oil made it difficult to tell if the cap was fitting well. BP spokesman Toby Odone said he had no immediate information on whether the cap was successfully attached.

UPDATE 1-BP aims to stop 90 pct of oil spill flow with cap

BP Plc (BP.L) (BP.N) aims for the containment cap placed over the gushing well pipe in the Gulf of Mexico to stop at least 90 percent of the flow of oil spilling into the ocean, a senior official with the British energy giant said on Friday.

"I'd like to see us capture 90 plus percent of this flow. I think that's possible with this design," BP Chief Operating Officer Doug Suttles told the CBS "Early Show."

"Of course what we have to do is work through the next 24 or 48 hours to optimize that. But that would be the goal. ... We want to stop this oil from spilling to the sea," Suttles added.

Suttles told CNN of the containment cap: "It should work."

'79 Gulf Oil Spill Leaves Sobering Lessons for BP

Three decades later, the 1979 Ixtoc disaster remains the Gulf's — and the world's — worst peacetime oil spill.

The parallels between that disaster and the current BP oil spill offer sobering lessons. There were no quick fixes for Ixtoc: It took 10 months to stop the leak, with Mexico's state-owned oil company, Pemex, trying methods similar to those that BP has attempted at its Deepwater Horizon rig.

Pemex managed to slow the spill a little using several methods including forcing metal spheres into the well. But it couldn't stop the leak until two relief wells were drilled — and even that didn't work right away: the oil kept gushing for another three months after the first well was completed.

Model Suggests Slick Could Zoom Up East Coast

New supercomputer studies suggest it is "very likely" ocean currents will carry oil from the Deepwater Horizon spill in the Gulf of Mexico around the tip of Florida and thousands of miles up the U.S. East Coast this summer, researchers announced Thursday.

"It is truly a simulation, not a prediction," said Terry Wallace, principal associate director for science, technology and engineering at the Los Alamos National Laboratory in New Mexico, which collaborated on the project. "But it shows that when you inject something into the Gulf, it is likely to have much larger consequences."

Oil Market Takes Long View on Spill; Prices May Rise

NEW YORK (Dow Jones)--An oil slick spreading from a leaking well beneath the Gulf of Mexico isn't having much of an effect on the cost of crude Wednesday. But tough new restrictions on offshore drilling may lead to higher prices further down the line, long after the spill is contained.

The spill becomes harder to ignore further into the decade. By 2015, Wood Mackenzie predicts stiffer federal offshore permitting and safety regulations will delay over 350,000 barrels a day of production.

What production does come out of the deepwater Gulf is almost certain to be more expensive as well, at a time when there are few alternative sources of new supplies. Companies already need oil prices of at least $60 a barrel to break even on a new project in the Gulf, according to Eurasia Group. The industry would need much higher oil prices to justify investing in new production, a reality that would be seen first in sparsely traded contracts for oil delivered in the next few years when those projects are scheduled to begin.

BP CEO Says Cap’s Success to Be Clear in 12-24 Hours (Update2)

BP Plc will know in 12 to 24 hours if its effort to capture most of the oil leaking from a Gulf of Mexico well is a success, Chief Executive Officer Tony Hayward said.

“There’s always a risk as to whether it will be a success,” Hayward told reporters in Houston today. Attaching the cap to the leak would be an “important milestone,” Hayward said. Like the other efforts to fight the leak, this latest device has never been used in such deep waters, he said.

Tony Hayward: What BP Is Doing About the Gulf Gusher

Here are a few of the lessons as I see them.

First, we need better safety technology. We in the industry have long had great confidence in the blow-out preventer as the ultimate failsafe piece of safety equipment. Yet on this occasion it failed, with disastrous consequences. . .

Second, we need to be better prepared for a subsea disaster. It is clear that our industry should be better prepared to address deep sea accidents of this type and magnitude. . .

Third, the industry should carefully evaluate its business model. For decades, exploration and production companies have relied on outsourcing work to specialized contractors. There's much that makes sense about this kind of structure, and lots of talented people and well-run companies are a part of it. But the question after the Deepwater Horizon accident is how all involved parties—including exploration and production companies and drilling contractors—can work even more closely together to better understand and significantly reduce the various risks associated with drilling operations.

Gulf oil spill: Coast Guard's early flow estimates are released

The day after the April 20 explosion of the Deepwater Horizon rig, the U.S. Coast Guard evaluated the "potential environmental threat" of a spill and concluded that, in addition to 700,000 gallons of diesel from the vessel, there was an "estimated potential of 8,000 barrels per day of crude oil, if the well were to completely blow out," according to Coast Guard documents.

Two days later, Coast Guard logs included a new estimate that a full blowout could result in a spill of 64,000 to 110,000 barrels per day. (A barrel equals 42 gallons.) That's far more than current estimates of 12,000 to 19,000 barrels daily.

The Coast Guard's early appraisals were not made public, however, as BP and the Obama administration pegged the initial spill at 1,000 barrels, and then revised it to 5,000 barrels daily.

Gulf Oil Spill Workers Report Health Problems

More than a dozen workers have been treated at local medical centers for flu-like symptoms ranging from chest pain to dizziness, nausea and headaches, presumably due to exposure to different chemicals emanating from the slick, according to news reports.

The Unified Command in Louisiana -- a coalition of government agencies that includes the U.S. Coast Guard, the Department of the Interior and the National Parks Service -- last week called back to shore 125 boats helping with the clean-up after medical complaints from crew members.

BP debt rating is cut as gulf oil leak costs mount

Fitch cut the oil giant to AA from AA-plus, citing the potential for civil and criminal charges and saying "risks to both BP's business and financial profile continue to increase."

Fitch estimated that the company could spend as much as $3 billion on cleanup and containment this year. The federal government Thursday sent BP its first bill covering oil-spill response costs so far, totaling $69 million.

Moody's lowered BP to AA2 from AA1 and put it on review, which might lead to another downgrade. Moody's said costs related to the protracted oil leak will "weigh significantly" on BP's cash and "constrain its ability to focus on other key areas of the company's business."

Who could gobble up a hobbled BP?

LONDON (MarketWatch) -- For sale (maybe) -- oil giant with world-class assets, unquantified liabilities and a reputation for major mishaps.

The obvious partner for BP would be Anglo-Dutch rival Royal Dutch Shell, though Total or Exxon Mobil can't be entirely ruled out either.

Gulf oil spill: BP to go ahead with $10bn shareholder payout

Tony Hayward, BP's embattled chief executive, will risk incurring further wrath in the US over the Gulf oil spill tomorrow by defying calls from politicians to halt more than $10bn (£6.8bn) worth of payouts due to shareholders this year.

He will hope to appease City investors by promising in a conference call with analysts to stick with BP's dividend policy amid mounting concern about a plunging share price.

BP declined to comment on its strategy tonight but it is understood that Hayward will say he is confident the company can pay for liabilities resulting from the Deepwater Horizon rig explosion – now estimated by analysts at $20bn to $60bn – as well as rewarding investors.

Another Torrent BP Works to Stem: Its C.E.O.

Among his memorable lines: The spill is not going to cause big problems because the gulf “is a very big ocean” and “the environmental impact of this disaster is likely to have been very, very modest.” And this week, he apologized to the families of 11 men who died on the rig for having said, “You know, I’d like my life back.”

From the start, BP promised to be transparent about the spill. But the company has wavered between providing information to the public and strictly limiting it. For example, it resisted for weeks putting up a live video feed of the underwater spill, agreeing to it only after intense pressure from Congress. The company has consistently refused to use widely used scientific techniques to measure the spill, saying it was focused on shutting down the well.

Everyone Missed It, But the EIA Just Totally Confirmed Peak Oil

We covered the EIA's release of its annual energy outlook, and noted the fact that the organizations' demand estimate had been lowered.

But Steven Kopits of Douglas-Westwood writing a guest post at EconBrowser notes something that everyone's missed, and argues that EIA has gone "hardcore" peak oil.

As BP severs riser, false report sends oil prices higher

On a day when BP took a successful step in its most recent effort to cap a runaway Gulf of Mexico oil well, an apparently false rumor about new restrictions on offshore drilling in shallow water drove the price of oil up $1.75 to more than $74 a barrel.

The false report that the Obama administration would extend its six-month moratorium on deepwater drilling to water less than 500 feet deep was carried by a variety of news outlets, including the Washington Post, the Associated Press and the Wall Street Journal.

That reporting was based on an e-mail obtained by the Associated Press and several other news outlets. In the e-mail, Michael Saucier, the regional supervisor of field operations for the Minerals Management Service's Gulf of Mexico region, told one company seeking a permit that "until further notice we have been informed not to approve or allow any drilling no matter the water depth."

Climate Bill Rebranded as BP Spill Bill?

Looking to use the Gulf oil spill as an impetus to act on climate and energy legislation, the Senate expects next week to start work on a revamped "BP spill bill" —one that includes both tougher regulation of the industry and the climate and energy provisions outlined last month by Sens. John Kerry (D-Mass.) and Joe Lieberman (I-Conn.).

Mike Allen teased this out in this morning's email, noting that the new plan to combine the two issues operates "on the theory the bill will be hard to oppose." A Democratic Senate aide confirmed to Mother Jones that this is the anticipated plan: combine the standing legislation with the energy bill passed last summer and a new spill-specific package.

Reid pushes to move energy bill in July

Reid asked the chairmen to recommend legislation to deal with the Gulf oil spill before July 4 so that leaders can include those ideas in the comprehensive energy package.

“Among the actions I think we need to explore are ensuring that the oil companies are held accountable for their actions and the damages caused by their operations,” Reid wrote.

Reid suggested changing the law to “ensure swift and fair compensation of people and communities for their oil pollution-related losses.”

The law now limits oil companies’ liability for spills to $75 million.

TNK-BP gas unit files for bankruptcy

Russian-British oil venture TNK-BP says a subsidiary that holds the license to a huge Siberian gas field has filed for bankruptcy.

The oil company said in a statement Thursday that RUSIA Petroleum was unable to repay debts to its parent company.

Xstrata halts Australian projects over new taxes

Anglo-Swiss mining company Xstrata, in a move being closely watched in Canada, has raised the stakes in the industry’s protest over plans by the Australian government to glean more taxes from the resource sector.

Xstrata PLC announced Thursday it will axe investments worth US$496 million in two projects in Australia in a move that puts the creation of 3,250 jobs at risk.

It also ratchets up pressure on Australian Prime Minister Kevin Rudd’s government over the proposed 40 per cent tax on profits generated from resources projects in the country.

Faith leaders push senators on climate legislation

"As religious leaders from across the Commonwealth, we are writing to express our alarm at the state of environmental stewardship here in Virginia, and nationwide," the letter states. "For us as people of faith, this is an issue of basic fairness and justice; not only because we are called to care for creation, but because of who will be harmed most by inaction: the poor and voiceless."

The clergy who joined this effort hail from all over Virginia and represent five religious traditions -- Hinduism, Islam, Judaism, Unitarian Universalism and seven denominations of Christianity.

Nigeria: Confronting Country’s Energy Crisis

The war against the energy crisis in Nigeria is, perhaps, one that all generations in recent memory have witnessed. The shrill battle cries and bogus rhetoric that announce the campaigns are all too familiar, but the results always fail to match the rigour and optimism. With victory ever so elusive, energy reforms in Nigeria have taken the format of a recurrent combat, the reason why any new talk of consummate triumph is met with justifiable reservations. This does not mean, at all, that Nigerians have stopped hoping.

The prostrate energy sector stands as a perennial indictment against all that ever ruled Nigeria.

Viscount Monckton, another fallen idol of climate denial

Now another fallen idol of climate change denial must be added to the list: Viscount Monckton's assertions have been comprehensively discredited by professor of mechanical engineering John Abraham, at the University of St Thomas in Minnesota.

Abraham, like the other brave souls who have taken on this thankless task, has plainly spent a very long time on it. He investigates a single lecture Monckton delivered in October last year. He was struck by the amazing claims that Monckton made: that climate science is catalogue of lies and conspiracies. If they were true, it would be a matter of the utmost seriousness: human-caused climate change would, as Monckton is fond of saying, be the greatest fraud in scientific history. If they were untrue, it was important to show why.

User fee for water even in agri sector?

NEW DELHI: Water may no longer be a free commodity even for the agriculture sector. In order to deal with an imminent water crisis that could haunt the country in the next few decades, the Centre has commissioned the Planning Commission to formulate a policy on integrated water management.

He said that a need for an integrated policy had been felt considering that diverse sectors which cater to irrigation, rural and urban drinking manage their affairs behaving as if god has given them an infinite authority over water.

Sony Feels Heat, GE Sees Opportunity as Lights Dim in Pakistan

Power plants commissioned in the 1960s and 1970s have deteriorated for lack of maintenance and spare parts, while transmission grids lose a third of their electricity to aged equipment and theft, said a fact sheet from the U.S. Agency for International Development. The agency is to spend $146 million over five years, in part to upgrade those systems.

Inefficiencies, unpaid consumer bills and price controls on power have led state-owned utilities to stop payments to private generating companies and fuel suppliers, which have cut service. Protests over the blackouts have turned violent, with rioters burning tires, attacking government buildings and stoning police.

Govt report shows decline in crude oil

Oil prices wavered and wholesale gasoline prices climbed yesterday, after a Government report showed that inventories of crude fell more than forecast last week and supplies of gasoline dropped unexpectedly.

Natural gas prices also rose after a separate report indicated supplies increased less than expected last week.

US Stocks Struggle to Stay Positive; Materials Slide

"Everything is pointing in the sustainable-economic-recovery camp, but I think people are just not buying it yet," said Jamie Cox, managing partner at Harris Financial Group. "We need the data to get back to normal before people are going to believe it."

"If this catastrophe had happened two years ago, oil prices would've been $200 a barrel," Cox said. Instead, the shifting strength of currencies is wielding more influence over prices. "The commodity itself is denominated in dollars and the dollar has become stronger because Europe is a train wreck. It won't be too long before that trend reverses," Cox predicted.

Mapping Out an Electric-Car Future

Anton Klima is a self-described electric car fanatic. The Los Angeles television cameraman is already on his second electric vehicle, a battery-powered BMW Mini E. To make sure he's carbon-free, he charges the car from solar panels on the roof of his Hollywood Hills home. But when he's out and about, Klima has to make do with a patchy network of public chargers left over from California's original electric-car campaign a decade ago. Though he can now track down chargers with an iPhone app, the shape of the plugs has changed, so Klima has to carry three adapters to be sure he can power up. "After a while you get used to [the hassles]," Klima says.

U.S. policymakers can't count on that kind of dedication as they map out the electric-car future. President Barack Obama aims to get a million electric cars and plug-in hybrids on U.S. roads by 2015 to ease U.S. reliance on imported oil and cut carbon emissions.

"Two chargers are needed for each car—one where you live and one where you work," says Richard Lowenthal, chief executive officer of Coulomb Technologies, a California-based maker of electric car charging stations. Building that infrastructure, he estimates, "may be a $12 billion industry."

Some experts caution against moving too fast. Mark Duvall, director of electric transportation for the Electric Power Research Institute, an industry group, believes it may be hard for the U.S. to reach Obama's target. He predicts sales are unlikely to top 15,000 electric cars annually before 2013. "If you build some solid gold-plated infrastructure before you understand what the public wants or needs," he says, "you're going to squander a lot of resources."

Suncor Energy Reports Oil Sands Production Numbers for May 2010

Suncor Energy Inc. reported today that the company's oil sands production during May averaged approximately 304,000 barrels per day (bpd). Planned maintenance on one of the company's two upgraders began on May 17 and is proceeding as planned. Year-to-date oil sands production at the end of May averaged approximately 250,000 bpd. Suncor is targeting average oil sands production of 280,000 bpd (+/- 5%) in 2010.

Way up north, another kind of oil controversy

However, in June, a Paris-based monthly journal described the area as “an immense toxic cesspool.”

The report in Le Monde Diplomatique echoed a 2007 report by Kevin P. Timoney, an ecologist with Treeline Environmental Research, who concluded that the town’s treated drinking water was safe, but high levels of arsenic, mercury and polycyclic aromatic hydrocarbons were found in fish, which many people in Fort Chipewyan, especially members of its native community, rely on for a substantial portion of their diet.

The newest report, from Le Monde Diplomatique, charged that around the Athabasca lake region the cancer rate is becoming alarming: 30 percent above the Albertan provincial average. The culprit, said the report, is suspected to be the toxic reservoirs where the effluence from the oil industry’s operations is collected.

N.J. orders Oyster Creek nuclear plant to beef up water monitoring after leak

The state Department of Environmental Protection invoked the state’s "Spill Act" today, ordering the Oyster Creek Nuclear Generating Station to drill new test wells, increase monitoring on existing wells and review its data on tritium contamination around the Lacey Township plant.

Tritium is a by-product of nuclear generation, and the groundwater contamination at Oyster Creek was first detected on April 9, 2009. At least 180,000 gallons of tainted water were released through two small holes in separate, underground pipes, and some of contamination is 50 times higher than permitted under federal health standards.

Inspectors Fault Beryllium Safety at Hanford Nuclear Reservation

No one said cleaning up a Cold War-era bomb factory was without its hazards. But weaknesses in a program to protect workers from a toxic metal may have exposed them to avoidable risk, according to a newly released report by the Department of Energy.

These findings confirm prior reporting done by ProPublica, which pointed out lapses or gaps in beryllium testing at the site and beryllium training for workers at the Hanford Nuclear Reservation in Washington state. At Hanford and at other nuclear cleanup sites around the country, thousands of additional workers have been hired, thanks to billions in federal stimulus funds.

Nokia announces bicycle charger for mobile phones

There is one obvious challenge to offering mobile phones in emerging markets: the availability of electricity to charge a mobile phone. You can’t expect people to be driving around cars with chargers when most in the market might be riding bicycles.

That’s one reason that Nokia has announced the Nokia Bicycle Charger Kit. The kit not only allows a bicycle to charge a phone while they ride it also could create a micro-business for individuals who could offer mobile phone charging services for a fee using a bicycle.

China’s Fast Track to Development

As incomes rise, China's passenger railroads will become by far the world's busiest. Moving passenger traffic off clogged conventional rail lines will free up room for an explosion of freight traffic, so increased freight revenue will pay the capital cost of building the new lines. And by reducing the need for airplanes, cars and trucks to carry passengers and freight, the system will yield big savings in energy intensity and carbon emissions.

China's rail system is already the most intensively used in the world. China carries a quarter of the world's rail freight and passenger traffic on only 6% of the world's track. China's intensity of rail use (passenger and freight combined) is double India's, triple that of the United States, and a dozen times Europe's. Over the next decade, China's Ministry of Railways expects freight carriage to rise 55%, while passenger-miles will double. More miles of track are not a luxury, but a necessity. In addition to the high-speed lines, the ministry plans to lay another 18,000 kilometers of new conventional freight and passenger track by 2020.

California Teachers Fund to Use Commodities to Hedge Inflation

June 3 (Bloomberg) -- The California State Teachers’ Retirement System, the second-biggest U.S. public pension fund, agreed to begin investing in commodities as a hedge against inflation and to buffer losses in equities.

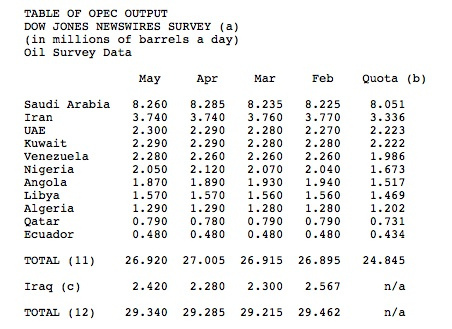

Total OPEC May Output Up 0.19% From April—Dow Jones Survey

However, oil production from OPEC's 11 quota-bound members that exclude Iraq fell for the first time this year, decreasing 0.32%, or 85,000 barrels a day, in May compared with April to a daily 26.92 million barrels, largely to due to lower output in Nigeria, the survey shows.

"If oil prices go below $65, OPEC will call an emergency meeting, but at $70 it is still comfortable," Al Harami said.

Severe drought causes hunger for 10 million in west Africa

A severe drought is causing increasing hunger across the Eastern Sahel in west Africa, affecting 10 million people in four countries, aid agencies warned today. In Niger, the worst-affected country, 7.1 million are hungry, with nearly half considered highly food insecure because of the loss of livestock and crops coupled with a surge in prices. In Chad, 2 million require food aid. The eastern parts of Mali and northern Cameroon have also been badly affected by the failed rains, says the UN World Food Programme, which described the situation as critical. The Sahel, a largely arid belt of land that stretches across Senegal to Sudan and separates the Sahara desert in the north from the savannah regions further south, is one of the poorest regions in the world. The WFP, which plans to assist 3.6 million people in the coming months, has described the humanitarian situation in the four affected countries as "critical", and says the hunger season is expected to last at least until the next harvest in September.

Since the link up top to the article about: "Viscount Monckton, another fallen idol of climate denial" is broken, in case anyone would like to see John Abraham's presentation it can be found here. It's about as good a take down of a denialist as any I've seen.

http://www.stthomas.edu/engineering/jpabraham/

NASA: The 12-month running mean global temperature has reached a new record in 2010 — despite recent minimum of solar irradiance

"We conclude that global temperature continued to rise rapidly in the past decade" and "there has been no reduction in the global warming trend of 0.15-0.20°C/decade that began in the late 1970s."

http://climateprogress.org/2010/06/03/nasa-giss-james-hansen-study-globa...

These comments improperly omit the influence of the thermal mass of the global climate system.

By thermal mass I assume you mean a kind of inertia?

CO2 by itself shows a huge inertia, having a fat-tail residence time that goes beyond a hundred years. What the skeptics claim to see and always reference is this fast sequestering rate of just a few years. This is a bit of a dilemma unless you consider that the atmosphere is a disordered system.

Solving the Fokker-Planck dispersion/convection equation for disordered systems can generate just such a fat-tail, with both a fast component and a slow long tail.

http://mobjectivist.blogspot.com/2010/05/word-on-dispersion.html

This is critically important and if I can see it just by doing the analysis, I don't know why other climate scientists don't refer to this property.

BTW, I just heard one of these deniers, the retired geologist Layton Stewart, and he attacks the use of supercomputers to do climate change simulations. Well Clayton you would be surprised how much you can do with some thought.

Mike,

Based upon your increased posting recently, it appears to me that you have too much time on your hands since you retired. I, on the other hand, am overwhelmed with projects. Therefore, I will expect you to come up here (I'll even pay your gas one way) to pick up the slack. You can have your choice of weed-eating, mowing a couple of acres of grass for fire protection. splitting a cord or so of wood or pulling some fence. When you get done with these, you can determine why my old Subaru isn't getting a spark to the plugs.

Please reply ASAP so I can have your tools ready.

Regards - Todd

PS...if only the darn rain would stop! We're up to 1 1/2" since this storm started.

LMAO.

Sure, as soon as I do all that here. Could there be a connection between more posts and more rain? I dunno.

Isn't there an article about your place around here somewhere? You should link it for the newbies.

Seriously, if this year was for real, I'd starve. I can't get anything going, and I'm so tired of wet jeans, and pulling off ticks B4 they latch on to me. Gonna be a year when the first tomatoes are in late Aug.

This ain't EZ, folks, even with lots of practice. Some things are just not under your control.

Oh...I don't need to mow; my neighbor will turn his horses loose on my place. Works out well for both of us.

Ok, for the newbies: "A Trip To Todd's" http://www.theoildrum.com/node/4979

Well, on the garden front I have some stuff going. The strawberries will have ripe fruit in a few weeks, the cane berries are going great guns, I transplanted the first sweet corn and beets, seeded a trial planting of hulless oats and a new variety of sorghum and got all the raised and three of the terraced beds prepared. I still have three terraced beds to do but I'm waiting for the vetch in the cover crop to set seed.

What kills me is that I have a ton of things* to transplant that I started at the "regular" time but are now legged things taking up most of the living room. They are going in next week hell or high water (and with the rain that might not be a joke).

Todd

*One new crop I'm trying this year is tobacco.

Hungry stuff, that 'baccy- manure, manure, manure

Us too. It has been miserably cold and wet all last month. After an unusually warm and dry winter because there was an El Nino. I try to look at it as good practice- after all, El Nino will come again, and again...

Where are you located? PA?. The Subaru zeroes you into the northern 1/2. It has been raining a lot here in SW PA as well.

One has to appreciate how hard growing something you want is, with all the weather. No wonder people just want to grow everything in a greenhouse or hydroponics.

Norcal...Mendocino Co.

...both of us. And, FWIW, if people haven't guessed, Rat I have known each other for, what Mike, 30+ years?

Greenhouses actually don't work well in our area because we get so much winter rain and snow that you have to use supplemental heating to have any chance. I used to have a 14x18' greenhouse and a 20x44' grow-out area but gave them up because it wasn't worth it. Then in spring they get too hot; forget it in summer.

Lots of people who think they're going to grow a lot of their food when it hits the fan are going to be in a world of hurt.

Todd

"Lots of people who think they're going to grow a lot of their food when it hits the fan are going to be in a world of hurt"

That's what bothers me most about the blowout. BP's fault, or Bush/Cheney's or Obama's; endless "end drilling" rants by reports who burn barrels of oil flying to NO to report in person; endless "We will sue BP" rants by folks who blocked the Cape Wind Offshore project cuz it spoiled the view; endless "uninspired lunacy", to quote Greer http://www.energybulletin.net/52987 .

We're not gonna make it; totally blindsided cuz not one talking head has ask, "Why are they drilling in the Gulf instead of West Texas or Bakersfield?" (Cuz they know it is BP's greed, of course).

I have yet to hear "peak oil". I have yet to hear "they drill so I can fly to NO to report this."

It's just "damn the pusher man, BAU". Have any told us how long it will take to replace 225M vehicles with EV, NG, compressed air? Any idea that we may not be able to make the batteries because of lack of resources? Wave that wand, Obama sign that bill, we are saved...just like that.

Coverage has been disgraceful.

I'm depressed. Gonna forget about CO2 for a day and light a fire and bring a little sunshine into the house. Too bad the creek isn't plugged in; I'd be making a lot of juice this year.

I did some ballpark number crunching...at 20K bpd, 50 days of oil will be 1M bbls (maybe this weekend?); 1000 days (+/- 3 years) = 20M bbls, about our peak daily consumption. Maybe 13 years to equal the world's daily consumption. Has anybody told us that?

We're screwed.

Instead of? No, they are drilling in West Texas and Bakersfield. And they have been drilling there for almost a century now. And they found a lot of oil there but they are now sucking on the dredges from both these areas. More drilling will not yield any more oil because they are already pumping those tired old fields dry.

They are drilling in the deep GOM because that's where the oil is. At $70 a barrel they will pump every barrel they possibly can from the GOM, from West Texas, from Bakersfield and anywhere they can produce a barrel of oil for less than $70 per.

Ron Patterson

Yeah, we all know that. It's never even occurred to those people to ask the question.

God forbid any of them trip over ELM.

Too bad I'm not allowed to plug into the creek. Salmon first, salmon only. Surely there must be a way to do microhydro without hurting the salmon :(

Despite the fact that salmon are the life blood of the Hupa and Yurok and Karuk people of The Hoopa Valley Tribe, they seem to think that is the only way to go. Check out their feasibility study to do exactly that...

http://apps1.eere.energy.gov/tribalenergy/pdfs/course_tcd0801_ca19x.pdf

There are small electric generators for streams which are basically small tethered catamaran rafts with a largish water wheel mounted so the bottom portion is turned by the flowing stream. Not high output, but cheap and steady...

"Lots of people who think they're going to grow a lot of their food when it hits the fan are going to be in a world of hurt.

2.5 acres/adult for a 2000-2500 calorie diet...

assuming good soil - adequate water and growing climate - minimal fossil fuel input - no animals.

More needed if you do not have these conditions

OldfarmerJmy

We have just moved into a small place ( 3 acres), I would like to buy the place next door but it is too expensive.

The greenhouse needs to be remade, we call it the greenhouse of death. I have just planted the first peas and it is now in the middle of a deluge. My mother grew up potato farming in Scotland. She says don't do it, it is too hard. Maybe because the school children were taken out of school to spend weeks pulling them up.

Yes good luck trying to feed yourself on what you grow.

Got to get you and jmygann into a permaculture course.

6,000 lb on 1/10 acre. Need not be back-breaking effort either.

Cheers

Wisconsin. Will Allen of Growing Power was speaking here in Detroit tonight. They stack up compost piles around the greenhouses and manage to grow year round. Use covers when it gets below 3o, I think he said. Winter hardy varieties.

Of course, can compost in the greenhouse.

Or use a rocket stove and run the flue pipe under the beds.

Also, spring too hot? Design issue? Korea is covered with greenhouses/hoop houses. Very hot, very damp.

Cheers

Leslie and I visited his greenhouses this Christmastime. Great Operation!

(But the compost seemed to all be standing separate. I've been stewing over Compost Hoppers built up against North Walls of Greenhouses, and piped for heat to boot!)

jokuhl,

you should check out www.mb-soft.com/public3/globalzl.html, for a look at a very unique composter, which it is claimed will even heat a fair sized house. He says it's ideal for greenhouses.

Some great ideas on his website....

very cool!

thx!

This is the correct link from the Guardian I think:

http://www.guardian.co.uk/environment/georgemonbiot/2010/jun/03/monckton...

Haven't posted here for a while so I thought I'd bring the new folks up to speed on one line of thinking discussed here often.

More and more people (and organizations, including the near-term forecasters of the EIA; see the story above) are discovering that a confluence of factors is leading to a near-term decline in oil production: the remaining oil is in much smaller reservoirs, it's deep offshore or in remote places, it's in politically unstable countries or it's locked up in unconventional sources, like tar sands. All told, we are at the peak of oil production. The oil model that I use in public presentations is ASPO's (the Association for the Study of Peak Oil and Gas):

Notice the white line. That represents two possible scenarios that depart from the simple bell curve production model.

The first is that it is a possible oil production curve (I would say likely) that occurs because, as the capital system continues to fail, the money will not be available to extract the remaining oil. As the Limits to Growth team pointed out, increasingly scarce capital makes obtaining the earth's remaining resources increasingly difficult then impossible to obtain for our use. In the case of oil, much of the remaining oil stays underground forever. The short form: we have far fewer than 100 years to get completely off oil. The situation is much worse than most people think (if they think of it at all — most people are not studying this topic).

The second scenario is how the oil production curve looks to an oil-importing country. As the oil producers themselves use more oil because their populations are increasing, there is less oil remaining for oil importers.

Jeffrey Brown and Samual Foucher have done the math to produce this graph:

Reality will probably mean a combination of both scenarios...so get ready for much less oil much sooner than almost anyone is predicting.

Since economic activity is directly correlated with oil use:

the world economy is going to shrink dramatically starting in this decade.

There will be one or two big steps down as stock markets, banking systems and/or fiat currencies crash due to systemic instability:

So how does our future look? Greer's model I think does the best job of describing humanity's future:

We are entering what Greer calls Scarcity Industrialism and I call the Scarcity Economy. Resources will be expensive in real terms, especially as we get poorer. What won't be scarce is human labor. We will have so much of it available we will struggle to keep social cohesion as we reorganize into a system that — somehow — favors using more workers instead of less workers. Right now, at the height of the machine age, our economies replace people as quickly as possible with machines. This model worked (more or less) during the ascent of oil but fails completely on the descent.

Communities around the world are beginning to prepare as we look at how to redesign our societies to account for the end of the Age of Oil. Please see www.transitionus.org for more information on this initiative.

-André, PostPeakLiving.com

Another way of looking at this is the trade off between the investments needed for the increasingly expensive and ultimately hopeless last-gasp effort to keep the FF production going a little longer versus the investments needed to ramp up renewables before the FF runs down to the point where the economy can no longer come up with the money to make ANY investments. I would rather we bite the bullet now and move on to the latter ASAP. Unfortunately, most of TPTB are so tied to the FF and growth paradigm that they will stick with the former for way too long, until way too late.

Hi, WNC.

Recently I came across the idea that moving completely off oil and onto renewables was never actually a real possibility while keeping the economy at the same size. (Gail, was it you who pointed that out?)

The math seemed to show that diverting capital to collecting renewable energy at anything but a token rate would have stopped growth and likely shrunk the economy. This is simply a consequence of the incredible amount of energy we were able to extract in the form of fossil fuels.

I'd like to see that math again. The conclusion was striking: moving to renewables was never really a possibility without also collectively accepting a contracting economy. It simply would have taken all the capital and more that had gone into growth the last century or so.

Gail's post below discusses capital but doesn't address the precise point above (i.e. that it was impossible to move to renewables and have growth) Does anyone remember who was putting forth that line of thinking?

I don't believe that a 1:1 replacement is feasible, or affordable, or necessary. When I say "renewables" above, this should also be understood to include investments in major energy efficiency things like electrified freight and passenger rail, a smart grid, district heating systems, and considerable residential and commercial building retrofits. If such major energy efficiency investments are pursued, then I am thinking that something more like a 1:2 replacement ratio is feasible - 1 quad of new renewable energy capacity replacing 2 quads of FF energy capacity. That will get us most of the way there, but I am afraid that we are also going to have to end up just being poorer and doing without a lot of things that we used to be able to do in an abundant FF energy economy. The thing is, you don't want to get to that point BEFORE the renewable and energy efficiency buildout is largely done, or you won't be able to afford those at all, and then you just keep going down, down, down.

This FF, renewables and finance question(s) only addresses a couple factors of the future perfect storm. What about all the rest, 'peak NPK', 'peak water', 'peak population', 'peak employment', etc. etc. etc.

It is like batting flies away from your eyes while the alligators have their way with your posterior.

Andre',

One part (in particular) of this economic prediction confuses me.. While the economics of INVESTING in renewables is indeed tough, when you have an increasing collection of renewable generators, aren't these actually providing value INTO the economy with minimal additional operating inputs?

I am not inclined to learn economics enough to perform such calcs, but at an elemental level, it seems to me that Renewable Energy is like planting a crop of perennials, as you buy the seeds once, but get a harvest for years and years.. (expensive seeds, but they do get paid off, generally well before the equipment is retired) I would expect that to have a stabilizing long-term effect on an economy.

As long as a use for that energy is there.. and I purposely didn't say a 'market', since the mode of exchange might be forced to change, then this harvest would seem to have a buoying effect, to what degree it is in place.

Bob

The point about continuously supplying energy is valid but often it comes down to a matter of scale, as it often does when discussing the global energy system.

Here is how I look at it. We are like a household that has been living with $1 million coming in every month. That amount will decline each and every month by $10,000.

Adding renewables is like taking $100 and creating a lemonade stand that reliably produces $10 each and every month.

Moving from $1 million a month to a bunch of lemonade stands that might in total bring in $10,000 of recurring revenue eventually is a big, big change, even if the revenue is steady and reliable.

I honestly don't think I've gotten the scale incorrect (by much). I've read many studies on grand renewable energy schemes and I think they are all fatally flawed.

They all assume there will be sufficient capital and oil to build out their plan and thus think we can get somewhat close to replacing the energy that comes from fossil fuels.

This I believe is a grossly incorrect assumption. We saw how quickly even renewable energy projects were cancelled during the 2008 liquidity crisis. That's why we should think of a flipping switch instead of a gradually closing spigot when considering capital.

Addendum: see Gail's point about the wind turbine gear boxes elsewhere on the DB. The assumption that renewables will continuously supply energy once the initial investment is made may not hold.

Faulty engineering has occurred in all technologies as Massey Energy and BP have recently shown us. That the same practices will continue is nonsense. Improvements in durability of equipment especially when talking about megabuck investments is inevitable because it is more profitable overt the lifetime of the equipment. New turbines are better designed and well built than previous turbines and will provide a valuable service for decades to come.

Yes indeed. I once saw used solar panels for sale. My first stop before any over-50-bucks purchase is the library. Here's what I found out:

People see a solar panel and see all those round cells. They think, 'oh, look at all those solar cells'. But what matters is how they're wired together in the back. There might be 40 cells, but they are wired into only two circuits. Two. Then all it takes is one...tiny...leak...and poof! half your solar panel is dead. Water and electricity don't mix.

I used to drive past the wind tubines in the Altamont Pass area east of San Francisco on a fairly regular basis years ago. Even on a nice windy day, three quarters of those suckers were never running.

(I told my kids, "See those giant fans up there? That's where they make the wind.")heh.

Well, the solar cells wouldn't generally be killed by that. Many Polysilicon cells are able to take a direct Short-Circuit and remain functional.. it would be a connection that had fried or was oxidized over time, more likely. The actual semiconductors (the crystals themselves) have been shown again and again to be very robust and durable. (EDIT: ..and while mending and self-repair have largely fallen out of favor in the Industrialized world, it is very possible to reattach broken strings of PV and continue to get power from them again. As I said above, we have a lot of recently added assumptions that HAVE to get revised. Part of this would include designing products so that they are able to be repaired and worked on..)

Windpower is fussier, since it relies on moving parts in a wearing environment.. but we've made them to last before. The old Aermotors and Winchargers from the Dustbowl days have been kept running for decades, or resurrected from pure scrap into working machines again.

Altamont was, of course one of our earliest big installations, and notable for several poor choices.

Each year, you can look at energy that goes into renewables (in terms of investment) and energy out (in terms of energy produced).

While the system is ramping up quickly, the net of those two numbers is always negative --the tough investment going in, exceeds what comes out. In fact, this could happen for a very long time. This net energy loss tends to push the economy toward recession.

The point I made down below that Andre refers to is that because of the high level of maintenance required on wind turbines, and the difficulty of doing this maintenance (as will as maintenance of transmission lines, and back up generation), there is a significant chance that wind turbines will not be operable for very long. For example, the life expectancy of today's gearboxes is only 7 to 11 years. So the huge investment we are making may really not ever have a positive pay back.

Gail,

The larger turbines are said to recoup their embedded energy in under a year.

Of course the yearly net is negative while you're ramping up. It's all 'investment heavy' technology. Take an individual farm and look at it at year 5, 10, 15.

From your article at RE World,

"Some manufacturers have chosen to move to direct drive to reduce the number of moving parts in the wind turbine more exposed to wear. But this has led to wind turbine specific generator designs that are usually more expensive and often come together with a long-term maintenance contract with the Original Equipment Manufacturer (OEM), which does not necessarily meet the operations and maintenance (O&M) concept of flexibility expected by customers."

It's important to remember that we're going to be forced to question any number of expectations and assumptions that have been forged in the days of fast, cheap energy, and a business environment accustomed to building with short-term expectations and 'planned obsolescence'.. As the above section reminds us, there is a strong disincentive to 'overbuild', even if we know it will improve the maintenance requirements and replacement schedules.. since Companies have been instilled with the deep belief that building this way will put them out of business. (While a few outliers try out the variants that let the field evolve)

Just looking at the Bearing Debate in that article tells me plenty about what is killing their gearboxes. I'm astounded at how little support they seem to design into that hub. And then the resistance to having long-term O&M contracts? Starts looking like they're on the JIT model as much as Wall-mart.

A lot of different layers need to change here.. and yes, it means it'll take more time and more money.. but it doesn't mean the technology of windpower is dead in the water. It's currently a victim of the age it's being born into.

EDIT: And now having reached the end of that Article, I would highly recommend anyone to have a look. Alstom has used a different approach which seems to be getting better results, even if the industry hasn't apparently followed them out of conventional designs..

(and of course, your comment merely said 'Keeping the economy at the same size', with which I agree, as I feel it is an obvious constraint of falling oil production in any scenario we might come up with, as well as my expectation that population will have a similarly parallel track with energy production.)

I would agree that it is certainly true that we can't move to renewables and have economic growth.

I think if we stay with the current fuel mix (mostly fossil fuels), there is definitely a tendency to economic decline, because oil can no longer be produced cheaply. Contracting oil supply leads to higher prices, followed by debt defaults and credit contraction. The result is recession and what looks like reduced demand. In a while, demand may build up again, but eventually this cycle can be expected to repeat, with endless economic contraction.

Adding large wind and solar PV to the mix as far as I can tell makes the economic decline situation worse, rather than better, because of the huge upfront investment involved. When calculations are done on a year by year basis with respect to the amount of investment for renewables versus energy payback, the result is that we are behind (investment exceeds payback) for many, many years before there is any net payback. This net outflow of energy means that economic contraction is made worse by the investment in these resources. It certainly does not lead to economic growth. I think Nate is the one who has done these calculations.

There is a "piggy bank" effect by investing in renewables that many people like. The people who have solar PV panels feel that they, themselves, will have electricity (mostly paid for by someone else) when others do not. I would be more sympathetic, if the benefit were going to society as a whole, rather than a relatively small number of well-educated individuals, but paid for by those who are less-fortunate.

Some people believe that wind turbines will continue to produce electricity, when fossil fuels fail us. I personally am very doubtful of that. Wind turbines are only useful (with a few exceptions, such as for making ammonia) as part of an electric grid. If the electric grid cannot be maintained, wind turbines will not be helpful either. Also, wind turbines need a lot of maintenance. I was just reading today:

If wind turbines do not last very long without high-tech maintenance (and this high-tech maintenance cannot be kept up), then the energy payback calculations that have been made are bogus. We may find that by the time there really should be a net payback, wind turbines are beginning to fail in large numbers, so even then the payback may not be there.

"a relatively small number of well-educated individuals, but paid for by those who are less-fortunate."

That was a bit skewed, Gail. If someone is getting subsidies for a solar installation, the public funds are coming from everybody's taxes.. your statement makes it sound like simply a poverty tax. There are also growing numbers of municipal buildings and schools are using these subsidies to install Alt Energy systems, and they are being sold at Home Depot and Wall Mart.. it's not an easy investment, but it's not as exclusive as it used to be, either. I know people who have Solar who are EAGER to share it with their neighbors during outages.. they are well aware that this kind of resilience is only better when more and more of us have access to it.

As far as windpower maintenance and payback goes, we've had them up for enough years to know that we're getting payback. We're leveraging some of those gearboxes awfully heavily.. but that's also HOW you get a new turbine paying for itself in months, not decades. I'm yet to be convinced that we'll soon become unable to maintain these, in any case.

OBLIG. DISCLAIMER: I don't say all this to imply that PV and WIND will offer us BAU.. but that they are one of the investments that need to be made (and are being made) to help us have a more resilient power supply post Peak.

And what does "economic payback" even mean anymore?

We can enter into an era of "sanity payback". That may be enough of a pay-off for many people.

Given all the excellent high EROEI ways we invest public money (Cash for Clunkers, fraudulent loans made by Fannie and Freddie, banker bonuses, blowing up Pakistani and Afghani villages) it is unthinkable we would use any of our funds to encourage investment in renewable energy. Subsidizing the home mortgages of wealthy families is far preferable to reducing their carbon footprint, and anyone who installs solar panels surely pays no taxes themselves, is a blood-sucker on the less-fortunate and only wants to gloat when their neighbor's power goes down.

After all, any energy-intensive good our society cares to produce, from SUVs to recalled Shrek glasses, is more important than a future source of energy. Manufacturing solar panels or windmills could divert resources from important items like RVs, iPads, and George Foreman BBQs. Jet skis and weekends in Vegas promote economic growth, but renewable energy will cause the decline of civilization. Since Americans are born to consume triple the energy of anyone else on the planet, they are genetically incapable of bicycling, installing ceiling fans or insulating their houses. Therefore, if we can't have all the energy we use today in the future, we should make sure we have none at all.

Bravo!

+10

Here, here! ( or is it Hear, Hear! )??

Hear, hear is an expression used as a short repeated form of "hear him, hear him". It represents a listener's agreement with the point being made by a speaker.

http://en.wikipedia.org/wiki/Hear,_hear

So glad to hear someone singing my song- To hear people say "costs too much" to solar and wind when they are tooling their fat selves around in a big fat car doing nothing but burn up the world is just sickening to me.

Or another one- too many of my otherwise frugal friends going on 2thousand mile daisy dances to see their grandkids, said dances guaranteeing those kids will inherit a ruined paradise- and then they say " Oh no problem, we got a cheap ticket" And they get furious when I say the reason it's cheap is because they are not paying its true cost and besides it's against their professed religion.

I know, I know, Don't bother to gimme a lecture. Not an effective strategy. Depends. If the effect aimed at is to cause apoplexy, it's effective.

And on the gearbox problem. I am in the business of innovation, people like me think up a thousand ways a day to get rid of known problems in machines- and we do get rid of them. The gearbox design today is pretty stupid. The suggestion made about diverting loads directly to tower should have been done from day one, not as an afterthought.

But the point is, things don't just sit there with their bad back, or whatever, they evolve, and after a while, they get good at what they do, like a cockroach.

"Hasn't been done therefor can't be done" is a logical fallacy heard far too frequently here.

The one I like is to get rid of not only the turbine gearbox but also that poor unhappy alternator sitting up there waving around in the breeze. Just put a humongus big crank water pump on that fan and connect all of them into a really big ground based turbine-alternator, and you got something that has some real life.

So wimbi,

What are you pitching here, a hydraulic loop? With flow restricting pipes running up and down a tall tower?

But keep talking here. This might lead to something interesting.

That tower has room for some pretty roomy pipes, it must be said. I would even think about devising the pumping and generator(s) to be inside the tower, to cut the distances of travel, and still drop the CG/Top-loading of the tower. An efficiency hit is hard to bear, but as maintenance and replacement of gearboxes becomes a more predictable number, it's just weighing one cost against another.. I think that the sticker-shock on the direct-drive units will probably fade as their advantages in simplicity start becoming clearer.

I don't know if those are the answer or not, but I'm with Wimbi. We've got many other angles to explore with designing Turbines and Windfarms.

Well, folks, I'm just twanging on an old string here. When I tried to think up a solar system that would work, I looked at the insolation map, found a couple of places with high solar intensity that were also near a body of water, - the gulf of california and the red sea. So then I think of solar farms there cranking out all the energy for the whole planet, manufacturing goodies and shipping them cheap (sail, of course) to everywhere. And the other great advantage of the seacoast is that it is "easy" to impound water and use pumped storage.

so then i got on hydro storage, and find that

it's VERY efficient if done right

and proven, over and over.

So if followeth as the night the day that I think of the same thing for wind. Use the turbines to pump water, by any way you like, to one central water turbine/alternator, and you;re in business. My first thought was a simple very robust crankshaft with the longest con rods in history going down to the tower base and pumping water. Pretty funny when the wind swings the turbine. OK, put the pump up top, or use a hydro con rod, And so on. plenty of games to play here.

And not to forget the kite windmill, which makes things ever so much better.

Truth is, Parker-Hannifin has already explored hydro tech on windmills and tested it against the standard gear-alternator arrangement and came out ahead. I lost the address.

Which is why the only future energy source worth pursuing is nuclear power. The focus should be on building MSRs and/or IFRs.

Ok, brother. Put your money up, then. Or ask the business community why they are demurring on laying their own shekels on the line for new reactors.

Some businesses are investing in nuclear power, but the research to build better reactors will mostly have to be done by the government. I pay taxes, so I am putting some money into this.

Again (see my response to your post below), isn't it already way to late?

What is a reasonable tact for an individual to take in helping to preserve some of the more valuable adjuncts to our present age? Medical gains, efficiencies in enegy use, and the like, for example. Also, what is the best way to either deflect what seems to be a likelihood of widespread civil unrest and insurgency, the emergence of gangs and dictators in place of elected governments, and military juntas? Reading recent US materials, it seems that the Military at least recognizes that things will go South (in 2012?) as oil availability diminishes. FEMA seems to have been prepared as a peace keeping agency for some time now. What are the limiting factors that would prevent these agencies from exceeding constitutional bounds?

Who is studying these scenaria? (scenarios?) Are there any published results? So far, TOD is about the only site that seems to be interested in dealing direction with the converging crises of civilization.

Isaac Asimov wrote, many times, asking, "Is anybody interested? Does anybody care?" The questions are valid today, and the imperative much greater.

Craig

Many many years ago, when I was a kid in elementary school, it was called the Library of Man. It goes like this: Imagine that every computer in the world has been destroyed; and every book in the world has been destroyed except the books in YOUR house. All of civilization has to start over again with only the books in your bookcase as a starting point and reference.

What books would you want those to be?

At one point I had my Library of Man complete. Then a health disaster followed by bankruptcy and a brief bout of homelessness caused me to suffer the loss of my entire library. So, I'm starting over.

But the books will be different this time. Last time, I was not Peak Oil aware. Yes, I had all the books from my ag degree, but they were all modern/fossil fuel/chemical type agriculture. And I don't think calculus or advanced chemistry are going to mean much fifty, or maybe even twenty, years from now, either.

This time, herbal medicine. This time, the old style farming, the 1830's Improver method. This time, basic self-teaching for musical instuments. And some basic background texts on genetics, ecology, meteorology. And if I can ever find one, a good basic book about mechanical engineering. So far all I have been able to find is either preschool level or advanced graduate level- neither fits the bill.

I would agree that the amount of oil that will be available to importers is likely to fall much more quickly than anyone assumes possible.

One of the issues is how well the international trade system holds up. If the system begins to fail (probably because of debt problems), many potential buyers may find themselves locked out of the market.

Another issue is taxes on companies extracting resources of various kinds, including oil. Companies make their decision to drill, based on the expected after-tax profit. We are now reading about Autralia's proposed 40% tax on mining profits, and the uproar that is causing, presumably affecting uranium and coal, but could affect other resources as well. Also, when US needs to find a place to fund its huge deficit, it seems likely that one part of funding will come from more taxes on oil and gas. This could lead to a cutback in profitability.

I think too that the big issue is how much oil people will be able to afford. People's net incomes are artificially high now, because taxes are too low relative to government spending. This is a graph I showed earlier comparing US government expenditures and receipts to disposable income:

Clearly, the government needs a huge increase in taxes, coming from somewhere. Even if it isn't from individual income taxes, individuals will end up paying the vast majority of it, one way or another--higher prices for products, or lower wages, as businesses attempt to make ends meet, one way or another.

I expect that there will be big tax increases (and other austerity measures) adopted in many countries, over the next few months to year or two, because other governments are have huge problems with deficit spending, plus rising debt. These tax increases will cause increased debt defaults and greater recession, leading to declining prices for oil and other resources. Governments will also find that their higher taxes didn't work, and try again on higher taxes. This too will cut back on the amount of oil that consumers are able to buy.

People may think this is all unrelated to peak oil, but I see it differently. All of the financial issues are related to declining energy return on energy invested (EROI). If EROI were very high, businesses would be making big profits from energy investments, and this would flow through to society through higher wages, and governments would find it easier to balance their budgets. But with inadequate EROI, the whole system falls apart. The result looks like inadequate demand, though--not the inadequate supply that many peak oil folks were hoping for.

Gail, any interest in pursuing the question I pose above? I've long been convinced that moving wholesale to renewables is no longer possible due to the scale of the task and how little time is left in which to accomplish it. Subsequently, you (and others) have educated me that there won't be the capital to do it either.

But the (admittedly academic) question I'm curious about is: was it ever possible and under what circumstances?

Renewables only reduce our use of fossil fuel, they don't eliminate it. Getting totally off oil or coal (for the next 50 years) is nonsense.

Energy efficiency under the right conditions/current technology can allow us to maintain our standard of living we can assume maybe 20%. Conservation as in voluntarily abstaining from consumption can help too maybe 10%. Renewables replace fossil fuels maybe 20%.

So we reduce maybe 50% realistically but we will have to continue to

mine coal, drill oil, etc. If we want to do that responsibly we will need to control CO2 by burying it. The economics of CCS is no more expensive than renewables. Europeans have shown that they can bear triple US oil and electricity costs.

http://en.wikipedia.org/wiki/Levelised_energy_cost

The obvious answer is that we will not maintain our standard of living.

The American way of life is, has been, and for quite a while yet will be negotiable with cold hard cash. Those without the cash will do without, as always.

A lot of uncertainties in how everything might all pan out. Were we to get seriously started today, could we build out quite a few renewables? Probably. Enough to replace all FF on a 1:1 basis? I very much doubt that, and doubt that would have ever been a realistic possibility, no matter how early we had started. We might quite possibly, though, be able to navigate a more moderate decline down to a point where we can level off into something sustainable.

How late can we leave things while we are distracted by our vain hopes of sustaining the unsustainable? I don't know. I don't know if there is a "point of no return" either - a point at which decline happens at such a steep rate that no more investments in anything are possible - or when that would be. Such probably does exist. I hope we haven't passed it already. I'll keep hoping we haven't until I see clear and unmistakable evidence to the contrary.

I think there is something to this graph if one assumes that the size of the economy is directly correlated to oil and other fossil fuel use:

One of Hirsch's papers estimates a 1:1 contraction of the economy as oil declines. I don't see it that way. I don't see a gradual decline but instead it will be like the Staircase Model.

Also, my intuition is that the shift from a growing economy to a contracting economy basically means "no more significant renewable energy projects get rolled out."

In other words, I'm expecting that we will experience more of a switch flipping states than a gradual decline in capital availability. The capital simply won't be available for the giant renewable installations that have any hope of matching the fossil fuel energy we currently use. (Instead I foresee much of the increasingly scarce capital being allocated to keep our failing infrastructure in some form of workability. The municipal governments are already entering this phase in the United States.)

Individuals, families and some communities might be able to muster enough capital for highly decentralized, lower-cost renewable energy generation, though.

Just to be clear: in my view, countries will occasionally produce big renewable energy projects but nothing close to the 1:2 ratio majorian describes above. I'm expecting more like 1:20 (i.e. we lose 20 units of fossil energy for every unit of renewable energy that comes online).

Another way of saying this, if my "capital switching off" theory is correct, is that we really blew it.

Dupe - deleted

Rgds

WeekendPeak

As mentioned above, this is only a part of the story. How do renewables provide plastics, paint, asphalt, medicines, propane, etc. etc.? Transportation is just a part of the problem. The total problem is TEOTWAWKI.

I really doubt it was ever possible to go to all renewables. One issue is that they are way too limited in what they can do. Even now, we don't have good storage for intermittent electricity, and that tends to be the main output. Wood and biomass are viewed as source for more liquid fuel and for more electricity, but as a practical matter, we really can't ramp these up by much, without reaching limits (fertilizer, land, irrigation).

It was fossil fuels that allowed world population to ramp up. There is no way that the renewables we are working on now would keep the current agricultural system going, no matter when we started.

We are going to have to go back to a much simpler set of renewables (renewable with local materials only--for example, small wind mills and water mills). With these renewables, the population that can be supported will be lower.

This author sees Americans choosing predatory militarism as filling the gap between oil/renewables and energy demand as the Post Peak Oil scenario unfolds.

http://gas2.org/2010/06/04/societal-collapse-due-to-peak-oil-inevitable-...

This fits in well with American culture and politics. We have already seen 8 years of it under Bush II. Obama seems unable to bring Wars for Oil Security to a close and should Republicans regain the Presidency in 2012, more perpetual war appears likely.

Terrorism is the cover story to justify the wars, but maintaining a dollar backed by oil is the real reason. Even now the policy is working as the dollar rises against its main competitor, the Euro.

With a rising dollar backed by domination of the Middle East oil supply, Americans will simple buy the remaining oil from OPEC at the going rate, whatever it is. The Chinese will be able to do the same thing with their yuan pegged to the dollar.

As the dollar rises so does remimbi. Thus the superpowers of the Post Peak Oil Era will be the United States and China.

American predatory militarism forces oil to be priced in dollars and China's economic might, based on cheap abundant labor, supplies goods to Americans to gain dollars to buy oil for China.

The Euro falls into oblivion because the European countries with oil, the United Kingdom and Norway, are not in the Euro Zone. The main Euro zone countries, France and Germany, do not produce much oil.

They are now stuck to the tar babies of southern Europe, the PIIGS, Portugal, Ireland, Italy, Greece and Spain through the Euro common currency and will be bled to death through these debtors.

The only other potential currency that can challenge the dollar/yuan peg is the yen. But it burdened with more debt than the Euro or the dollar. And Japan produces no oil so it also needs dollars to buy oil.