Drumbeat: May 27, 2010

Posted by Gail the Actuary on May 27, 2010 - 9:22am

Setback Delays ‘Top Kill’ Effort to Seal Leaking Oil Well in Gulf

BP had to halt its ambitious effort to plug its stricken oil well in the Gulf of Mexico on Thursday afternoon when engineers saw that too much of the drilling fluid they were injecting into the well was escaping along with the leaking crude oil.

A technician at the BP command center said that pumping of the fluid had to be stopped temporarily while engineers were revising their plans, and that the company hoped to resume pumping by midnight, if federal officials approved.

The technician, who spoke on condition of anonymity because he was not authorized to brief reporters, said the problem was not seen as serious. “We’re still quite optimistic,” he said, but cautioned: “It is not assured and its not a done deal yet. All of this will require some time.”

Obama Pushes for More Regulation, Extends Oil Drilling Moratorium

President Barack Obama, under pressure to step up response to the Gulf of Mexico oil disaster, on Thursday vowed tougher regulations for the oil industry and said he is suspending action on 33 exploratory drilling operations in the Gulf and canceling or temporarily suspending pending lease sales and drilling in Virginia and the Arctic.

API: The Impact of Delaying Offshore Development

"We understand the concerns many people have about offshore drilling in the wake of this incident, and the frustration many feel toward oil companies. But this issue is much larger than the oil industry, since access to affordable energy impacts every sector of our economy, every state in our nation and every American family. Further, thousands of products - from toothpaste to iPods, cell phones to computers, and vitamins to vegetables - use oil and natural gas as a feedstock in the manufacturing process.

An extended moratorium on safely producing our oil and natural gas resources from the Gulf of Mexico would create a moratorium on economic growth and job creation--especially in the Gulf States whose people and economies have already been most affected by the oil spill--by undercutting our nation's access to affordable, reliable, domestic sources of oil and natural gas.

Scientists find evidence of large underwater oil plume in gulf

The scientists, aboard a University of South Florida research vessel, found an area of dissolved oil that is about six miles wide, and extends from the surface down to a depth of about 3,200 feet, said Professor David Hollander.

The plume is clear, with the oil entirely dissolved.

"Here is a situation where, unless you're looking at the chemical fingerprints, [the oil] is absolutely not visible," Hollander said. "It's not some Italian vinaigrette or anything like that. It's absolutely, perfectly clear.

USF researchers confirm massive underwater plume from gulf oil spill

A news release from USF's College of Marine Sciences refers to it as "a wide area with elevated levels of dissolved hydrocarbons throughout the water column."

The thickest concentration, they found, was more than 2 miles beneath the surface — deeper than where the Deepwater Horizon well has been spewing oil for the past month — and about 20 miles northeast of the collapsed rig.

Gulf Spill Bigger Than Valdez, Estimate Shows

A team of U.S. scientists on Thursday significantly raised the estimate of how much oil has been leaking from a damaged well into the Gulf of Mexico. The figures signal that the disaster is at least as big as the Exxon Valdez spill two decades ago, and could perhaps double it in size.

Between 12,000 and 19,000 barrels a day are estimated to be spilling into the waters of the Gulf, said U.S. Geological Survey director Marcia McNutt, the leader of an inter-agency team created to measure the size and rate of the spill following criticism that a previous estimate of 5,000 barrels a day was inaccurate.

The announcement comes as Coast Guard Admiral Thad Allen said Thursday that BP PLC's effort to stop the flow of oil from a broken well in the Gulf of Mexico has so far "stabilized the wellhead" and stopped the oil and gas from coming up.

But Adm. Allen and a BP executive, in separate appearances Thursday, cautioned that the so-called top kill operation to seal the well, and stop a gusher of crude fouling the Louisiana coast, isn't complete.

Gulf oil spill now largest in U.S. history as BP continues plug effort

Scientists at the U.S. Geological Survey said the well has gushed 500,000 to 1 million gallons a day — greater than the original estimate of 210,000 gallons a day offered by the National Oceanic and Atmospheric Administration several weeks ago.

At that pace, at least 17 million gallons and possibly as much as 39 million gallons have spilled into the Gulf in the five weeks since the Deepwater Horizon rig exploded and sank 50 miles off Louisiana's coast, killing 11 crew workers and unleashing an ecological emergency. Exxon Valdez spilled about 11 million gallons into Alaska's Prince William Sound.

Admiral Allen Approves One Section of Louisiana Barrier Island Project Proposal as Part of Federal Oil Spill Response

The National Incident Commander for the BP oil spill, Admiral Thad Allen, today approved the implementation of a section of Louisiana’s barrier island project proposal that could help stop oil from coming ashore and where work could be completed the fastest—as an integrated part of the federal response to the BP oil spill.

This step will save Louisiana the cost of construction for this section by integrating it with the federal government’s ongoing oil spill response—thus paving the road for payment by BP, as a responsible party, or the federal Oil Spill Liability Trust Fund.

It will also allow assessment of the effectiveness and environmental impacts of this strategy in one of the areas most at risk of long-term impact by BP's leaking oil.

Obama Suspends Arctic Oil Drilling Until 2011

The Obama administration, under pressure to act over the Gulf of Mexico oil disaster, announced Thursday that it will suspend consideration of any applications for exploratory drilling for oil in the Arctic until 2011 and said that a moratorium on permits to drill new deepwater wells will continue for six months.

President Barack Obama, in a news conference, vowed tougher regulations for the oil industry.

Mr. Obama said the "oil industry's cozy and sometimes corrupt relationship" with federal regulators underscores the need for more oversight.

Gulf oil spill: Head of Minerals Management Service quits [Updated]

Elizabeth Birnbaum has resigned her post as head of the U.S. Minerals Management Service, the beleaguered federal agency that oversees offshore oil drilling.

Interior Secretary Ken Salazar announced the resignation Thursday morning at a House subcommittee hearing on the oil leak in the Gulf of Mexico.

Salazar said Birnbaum resigned on her own terms, and he praised her as a good public servant.

US oil spill clean-up boats recalled after crews fall ill

All 125 commercial fishing boats helping oil recovery efforts off Louisiana's Breton Sound area have been recalled after four workers reported health problems, officials said.

The crew members aboard three separate vessels "reported experiencing nausea, dizziness, headaches and chest pains" mid-afternoon Wednesday, the US Coast Guard said in a statement.

"No other personnel are reporting symptoms, but we are taking this (recall) action as an extreme safeguard," said Coast Guard Chief Petty Officer Robinson Cox.

7 Gulf oil spill cleanup workers hospitalized

Seven workers helping to clean up the Gulf oil spill remain hospitalized after they reported dizziness, headaches and nausea while working on boats off the Louisiana coast.

West Jefferson Medical Center spokeswoman Taslin Alfonso said Thursday that doctors believe the likely cause is chemical irritation and dehydration from long hours working in the heat.

US wind energy market facing constraints in 2010: IHS study

The recession-induced drop in power demand and lower electricity and natural gas prices have "had a profound effect on utility willingness to ink power purchase agreements," IHS said.

In addition, the study said that increased transmission congestion and reduced utility demand have reduced growth in traditional "wind hot spots"such as Texas, Minnesota and California, forcing developers to look to states with less ideal wind resources and more difficult development conditions.

"Transmission remains one of the greatest barriers to the development of US wind projects," the study said, adding that "[c]oordinated national policies will be necessary to more efficiently link the US' vast wind resources to high-demand regions." But even if those policies are in place, IHS said there "will be a lag of several years" before those projects begin operating. "A national renewable energy standard or federal energy policy legislation along with a streamlined transmission siting and cost allocation process are the essential ingredients to building a robust future US wind market."

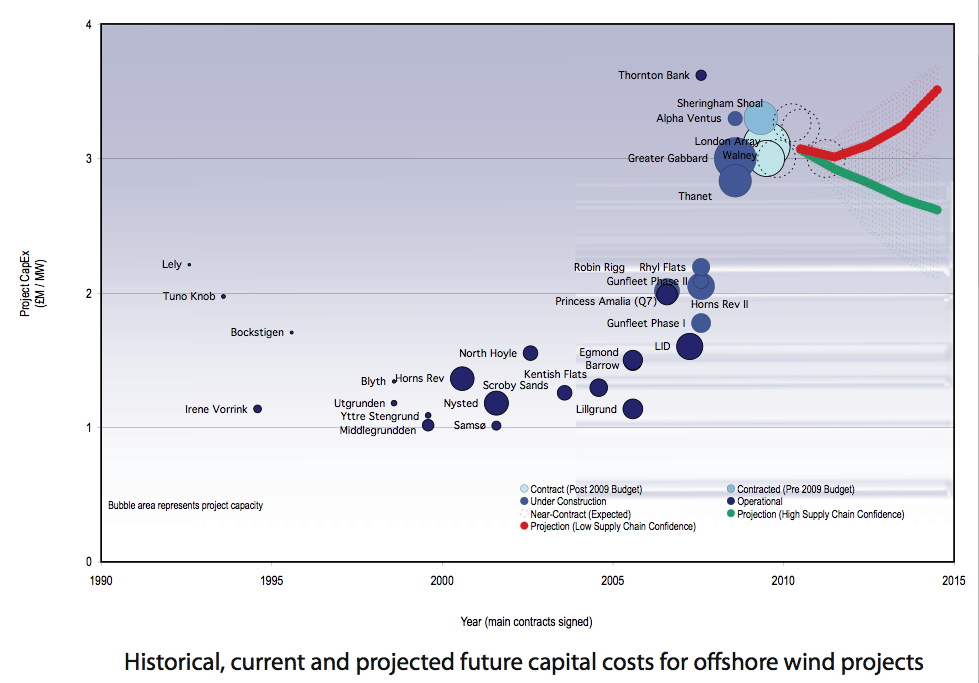

Mixed messages on offshore wind’s future

While capital costs would usually fall as an industry grows, offshore wind is seeing the reverse. The UK wind energy trade association, RenewableUK, in a paper of its own, attributes this to supply chain issues. More specifically, they list:

-Reduced competition within the wind energy supply chain combined with an increase in demand for supplies, particularly from onshore wind.

-Contracts drawn up between suppliers and customers during the sector’s early years caused losses to suppliers, as high early competition amongst suppliers set low future price projections, before costs later rose once the true costs and technology challenges were realised.

-With over 80% of UK offshore wind capital value being imported, the fall of the pound against the euro and fluctuating commodity prices have forced prices up.

Accounting for increasing energy use by the US food system

Energy used by the US food system accounted for 80% of the increase in American energy use between 1997 and 2002, according to a recent report from the USDA’s Economic Research Service. Other remarkable conclusions of the analysis include:

-Food system energy use increased by 22.4% while total energy use rose by just 3.3%.

-On a per capita basis, total energy use actually fell by 1.8%, but food system energy use was still up by 16.4%.

JM Greer: The World After Abundance

What’s going on here is precisely what The Limits to Growth warned about in 1973: the costs of continued growth have risen faster than growth itself, and are reaching a level that is forcing the economy to its knees. By “costs,” of course, the authors of The Limits to Growth weren’t talking about money, and neither am I. The costs that matter are energy, resources, and labor; it takes a great deal more of all of these to extract oil from deepwater wells in the Gulf of Mexico or oil sands in Alberta, say, than it used to take to get it from Pennsylvania or Texas, and since offshore drilling and oil sands make up an increasingly large share of what we’ve got left – those wells in Pennsylvania and Texas have been pumped dry, or nearly so – these real, nonmonetary costs have climbed steadily.

The Peak OIl Crisis: After the Spill (Tom Whipple)

It is not yet clear whether the drilling industry, or the government for that matter, wants government inspectors aboard every drilling rig participating in critical operational decisions that could result in a blowout. With a million dollars a day at stake, it is unlikely that the industry wants relatively low level inspectors deciding that the cement needs another day or so to dry properly. The upside of course is that should the unthinkable happen, the industry is in a good position to pass the liability on to the government if it signed off on the procedure.

There are obviously billions of dollars and the fate of nations involved in this question, for if offshore drilling takes substantially longer and becomes substantially more expensive, then so does our oil.

BP decisions Set Stage for Disaster

A Wall Street Journal investigation provides the most complete account so far of the fateful decisions that preceded the blast. BP made choices over the course of the project that rendered this well more vulnerable to the blowout, which unleashed a spew of crude oil that engineers are struggling to stanch.

BP, for instance, cut short a procedure involving drilling fluid that is designed to detect gas in the well and remove it before it becomes a problem, according to documents belonging to BP and to the drilling rig's owner and operator, Transocean Ltd.

BP also skipped a quality test of the cement around the pipe—another buffer against gas—despite what BP now says were signs of problems with the cement job and despite a warning from cement contractor Halliburton Co.

Once gas was rising, the design and procedures BP had chosen for the well likely gave this perilous gas an easier path up and out, say well-control experts. . .

Finally, a BP manager overseeing final well tests apparently had scant experience in deep-water drilling. He told investigators he was on the rig to "learn about deep water," according to notes of an interview with him seen by the Journal.

BP Used Riskier Method to Seal Oil Well Before Blast

Several days before the explosion on the Deepwater Horizon oil rig, BP officials chose, partly for financial reasons, to use a type of casing for the well that the company knew was the riskier of two options, according to a BP document.

If the cement around the casing pipe — used to line the well — did not seal properly, gases could leak all the way to the wellhead, where only a single seal would serve as a barrier.

Using a different type of casing would provide two barriers, according to the document, which was provided to The New York Times by a Congressional investigator.

BP worker takes 5th, making prosecution a possibility

A top BP worker who was aboard the Deepwater Horizon in the hours leading up to the explosion declined to testify in front of a federal panel investigating the deadly oil rig blowout, telling the U.S Coast Guard he was invoking his constitutional right to avoid self-incrimination.

The move Wednesday by BP's Robert Kaluza raises the possibility of criminal liability in the April 20 explosion that killed 11 and five weeks later continues to spew hundreds of thousands of gallons of oil into the Gulf of Mexico each day.

Gulf oil spill: Governor calls for permission to dredge

Louisiana Gov. Bobby Jindal took another boat tour of the oil spill area Wednesday and later repeated his call to get federal permission to dredge sand and create barrier islands to protect inland estuaries.

The Army Corps of Engineers is fast-tracking the application but must allow other agencies to comment, according to federal environmental law.

A timeline of the disastrous BP oil spill in the Gulf of Mexico (photos)

Since the Deepwater Horizon rig sank into the Gulf of Mexico on April 22, more than 200,000 gallons of oil a day have been pouring into the sea from the well it was drilling. Response teams have been working day in and day out to contain and clean up the floating oil, while experts have attemptedcso far unsuccessfully—to shut off the flow of oil from the wellhead. The leaked oil has already washed up on the delicate Louisiana shoreline, and may soon reach the coasts of other gulf states as well, closing down fisheries and threatening the region’s fragile ecosystems.

Gulf oil spill: Results of 'top kill' operation won't be known for 24 hours

It will be at least 24 hours before BP officials will know whether their high-risk effort to plug the wellhead spewing crude into the gulf has succeeded, the Chief Executive Tony Hayward said Wednesday afternoon.

He said the effort is proceeding as planned and cautioned that the televised images of the oil plume do not give an indication of how the operation is going or whether the oil flow is increasing or decreasing.

White House leak reveals Barack Obama's reaction to news of oil spill

The administration has repeatedly put responsibility for the cleanup on the oil firm. "We will keep our boot on their neck until the job is done," the interior secretary, Ken Salazar, said this week.

But a CNN poll suggests the focus on BP has distracted from the administration's own efforts, showing for the first time that the majority of Americans, 51%, disapprove of Obama's handling of the crisis.

Commentators are also increasingly complaining about lax oversight by his administration before the spill, and a hands-off approach to the cleanup.

Obama warns on “risky” fossil fuels

President Barack Obama said the US would not be able to sustain the kind of “risky” exploitation of fossil fuels that caused the Gulf of Mexico oil spill, as he prepared to announce sweeping new regulations for offshore drilling.

On Thursday the White House will release the results of a 30-day review that it asked the Department of Interior to conduct about the safety and regulatory regime that was in place before the Deepwater Horizon rig exploded. Previous reports have suggested numerous regulatory and technical failings.

The review could have wide-reaching implications for other energy companies involved in offshore drilling, such as Royal Dutch Shell, which has invested $3bn looking for oil in Alaska.

Oil Spill Response: New Ad Demands Leadership on Climate Legislation from Senate Democrats (Video)

A leading environmental group is upping the ante in the climate change debate, making a major ad buy targeting predominantly Democratic senators to get them to push for more progressive energy legislation in the wake of the oil spill in the Gulf.

Repackaging an ad that has already aired nationally, the Natural Resources Defense Council is now taking its effort local. The group is airing the same spot in key strategic states in an effort to compel more legislative leadership on the climate front.

Poll: Majority give Obama, feds failing grade on oil spill response

Nearly three-fourths of those surveyed Monday and Tuesday say BP is doing a "poor" or "very poor" job in handling the calamity. Six of 10 say that of the federal government. And a 53% majority give Obama a poor rating.

The catastrophe has boosted concern about the environment over development of new energy supplies -- a long-time balancing act in American politics.

Now, a majority say protection of the environment should be given priority, "even at the risk of limiting energy supplies."

The 55%-39% divide on that question was a reversal of American views in March, before the April 20 explosion sent crude oil spewing into the gulf.

Rig mechanic says BP was in a rush despite problems

Hours before the fatal accident that sank the Deepwater Horizon oil rig in the Gulf of Mexico, workers for the rig's owner quarreled with BP officials who wanted to finish the drilling job despite problems, a mechanic told a Coast Guard committee in Louisiana on Wednesday.

Douglas Brown, the rig's chief mechanic, testified that three officials for rig owner Transocean Ltd. balked at the desire of a BP "company man" to remove drilling mud from the pipe connecting the rig with the well.

"There was a slight argument [that] took place.… The [BP] company man was saying, 'This is how it's going to be,' " said Brown, who could not identify the BP official.

After the midmorning meeting, Brown said, Transocean worker Jimmy Harrell grumbled, "Well, I guess that's what we have those 'pinchers' for" — apparently referring to the shear rams on the blowout preventer on the seafloor.

Gulf oil spill: Is MMS so corrupt it must be abolished?

On Wednesday, Sen. Ben Nelson (D) of Nebraska introduced legislation to mandate a two-year waiting period between government and industry jobs in order to reduce industry influence on regulators. The legislation, called the Stop Cozy Relationships with Big Oil Act, would also make gift-acceptance, a key focus of the most recent MMS investigation, a felony with a possible 15-year prison sentence.

The reality, however, is that the MMS needs industry expertise to properly manage America's oil riches, says Inspector General Kendall.

BP Deepwater Horizon operations were six weeks behind schedule, documents say

BP's drilling operations were about six weeks behind schedule when the Deepwater Horizon rig exploded April 20, according to documents cited Wednesday at a hearing examining the cause of the Gulf of Mexico oil spill.

Reading from BP documents that have not been made public, BP safety leader Steve Tink said his company had applied to use the Deepwater Horizon in another oilfield on March 8, 43 days before the accident.

BP was paying Transocean, the company that leased the rig to BP and ran it on BP's behalf, $533,000 a day, Transocean safety official Adrian Rose testified.

Exploratory oil drilling in Arctic halted until 2011

The Obama administration Thursday will suspend planned exploratory oil drilling in the Arctic Ocean off Alaska until at least 2011, a casualty of the Gulf of Mexico oil spill.

The suspension will be part of a report that Interior Secretary Ken Salazar will give to President Obama, who's likely to address the suspension as well as other proposals stemming from Salazar's report, at a White House news conference Thursday.

The move will stop Shell from drilling five wells in the Chukchi and Beaufort seas off northern Alaska weeks before it had hoped to start work, an administration official said.

American faith in technological magic exacerbates frustration with Gulf of Mexico oil leak

"Americans believe that there must be a technological fix. If a problem is not solved, they tend to assume incompetence," said David Nye, the author of "Technology Matters: Questions to Live By."

"This is not about logic, it is about being a victim of forces beyond the control of local politics, so people bump it up to the next level," said Nye, a professor of the Center for American Studies at the University of Southern Denmark.

And the last next level is the Oval Office where, as everyone knows, the buck stops.

Project delays threaten oil supply: Technip

PARIS/LONDON (Reuters) - The world will face an energy shortage in two years if oil and gas companies delay investment decisions in new projects due to the economic crisis, the head of oil contractor Technip (TECF.PA: Quote, Profile, Research) said on Wednesday.

Oil prices have plunged 20 percent from the 19-month peak of $87.15 hit in early May, on concern about the euro zone debt crisis and austerity steps that may hurt economic growth.

"If the price of oil was to collapse again to around $50 to $55 a barrel, then we would probably see customers rethinking their plans," Thierry Pilenko, the head of Technip, which builds refineries, oil rigs and gas plants, told the Reuters Energy Summit.

But any more delays in approving new production projects would lead to a global energy crunch, he said.

Oil prices jump as market panic recedes

New York's main contract, light sweet crude for delivery in July, jumped 2.76 dollars to 71.65 dollars a barrel at the end of Wednesday trade.

London's Brent North Sea crude for July soared 2.19 dollars to 71.74 dollars.

Oil had plunged on Tuesday on fears that the eurozone financial crisis could turn toxic for the global economic recovery.

Flannery: I’ve changed my mind on carbon capture

THE environmentalist Tim Flannery has withdrawn his support for carbon capture and storage as an answer to combating climate change, saying he now believes it would be economically unachievable.

The former Australian of the Year, who has championed CCS and projects such as Santos' $700 million Moomba storage project in South Australia, said he had changed his view on the idea of capturing carbon and storing it underground during a trip to Germany last week.

Nissan’s Ghosn gambles big on electric cars

Nissan Motor Co. CEO Carlos Ghosn made the rounds in the U.S. the last two days pumping up his electric-car plans. He said the automaker and its global partner, French carmaker Renault SA, will be able to build 500,000 electric cars a year by 2014. To back up his bold plan, he announced a $1.7 billion investment in a lithium-ion battery plant in Smyrna, Tenn. All told, Nissan is dropping $5 billion from 2007 to 2012 for its ambitious play to be the leader in electric cars. The U.S. government loaned Nissan $1.4 billion of the cash for the battery plant. So in essence, we all have a piece of his gamble.

Honda may develop electric car batteries in China

May 27, 2010 (China Knowledge) - Japanese auto maker Honda Motor Co is looking to China to develop electric car batteries, as it aims to tap the country's technology and vast resources, CEO Takanobu Ito said yesterday, Reuters reported.

"If there is a suitable chance, we hope to work with China to (develop) batteries," Ito said, adding that a major breakthrough is needed in battery technology and it would take 10 to 20 years before battery-run electric cars became common patterns.

GM set to develop electric car for south Asia on its own

General Motors looks set to go it alone in developing a battery-powered car for south Asia based on its best-selling mini-car, the Spark, after its partner, Reva Electric Car, sold a controlling stake to an Indian competitor.

Mahindra & Mahindra, India's biggest sport utility vehicle maker, said yesterday that it had bought a 55 per cent controlling stake in Bangalore company Reva, one of the biggest producers of commercial electric cars in the world.

GM, based in Detroit, said in a statement: "We may not continue with the Spark [electric vehicle] programme with Reva in the light of this development and will pursue our own electric vehicle programme." Under its alliance with Reva, announced last year, GM was to provide the vehicle platform and manufacturing facilities for the car, which was to begin production this year. Reva was to provide technology for the battery, electric motor and power management.

Record Production from Bakken oil Wells

Initial flow results showed a peak rate of 3,171 and 5,035 barrels of oil equivalent a day (BOEPD). With these results, this company now has the two top producing wells in the entire Bakken play.

For the Second Quarter, this company will be producing as much as 6,800 boepd. By the end of the year, it is expected to be 10,000 boepd.

Alaska Oil Pipeline Shut Second Day After Power Outage

The Trans-Alaska Pipeline, owned by BP Plc (BP) and other oil majors, remained shut a second day Wednesday, cutting most supply out of Alaska oilfields, following an oil spill triggered by a power outage.

Pipeline operator Alyeska Pipeline Service Co., owned by BP, ExxonMobil Corp. (XOM), ConocoPhillips (COP) and other oil companies, said North Slope oil producers have been asked to cut oil sent to the pipeline to 16%. That's roughly 107,000 barrels a day, down from an average of 670,000 barrels a day, said Alyeska spokeswoman Michelle Egan.

UK gov’t discloses size of its nuclear stockpile

Britain offered its first public accounting of its nuclear arsenal Wednesday, disclosing that it has a stockpile of 225 warheads in a move that offers transparency to non-nuclear states in hope of winning stricter global controls on the spread of atomic weapons.

Britain had earlier disclosed that it possessed 160 operational warheads, but Hague's comments that the country's "overall stockpile of nuclear warheads will not exceed 225 warheads" was the first time the maximum size of the total stockpile was revealed. The Foreign Office later said the 225 figure was the number of warheads the country now holds.

Quote of the day:

Peak Oil + Lemon Socialism = Oilpocolypses>

This is a great article. The author argues that Stuart Staniford's arguments here: Singularity > Climate Change > Peak Oil > Financial Crisis are totally wrong. I agree.

Stuart argues: "I think the arguments for a very near-term peak in oil supply have started to look quite weak." I think Stuart's arguments are very weak in this article.

Ron P.

Shouldn't that quote of the day be:

I agree with you about Stuart's arguments. They are weak.

Stuart says he can't get excited about the financial crisis as being a massive long-term threat to humanity.

The problem is that the financial system has been the enabler of our current massive international trade system. The financial system as we know it cannot continue without economic growth, because there will be too many debt defaults. (Debt must be repaid with interest, and growth helps provide this interest increment.) Lack of economic growth because oil supplies are now flat to declining will make all of the inter-country debt balances huge problems. (These is the case whether flat oil supplies are due to lack of supply or lack of demand--both are equivalent. Lack of demand reflects a real problem--the benefit is not great enough to justify the higher cost, given total funds potential purchasers have available.)

It is easy to think of a substitute for our current international trade system that would work--bilateral trade--essentially barter -- I'll trade you this, if you trade me that. But this would require a massive drop in trade. With this approach, we couldn't make all of our high tech things--computers, electric cars, even replacement transformers for the electric grid.

It is Liebig's Law of the Minimum that is important. If there is one needed thing that we don't have, the system won't work. It may be a financial system that enables our current way of life, or it could be parts to repair our electrical transmission system, that we can't get because of trade problems (really debt problems).

a substitute for our current international trade system that would work--bilateral trade--essentially barter -- I'll trade you this, if you trade me that. But this would require a massive drop in trade. With this approach, we couldn't make all of our high tech things--computers, electric cars, even replacement transformers for the electric grid.

Gail, you wrote yesterday about "not assuming the worst till it happens".

And a strictly barter international economy is simply *NOT* going to happen !

The unit of trade may well chance from the US Dollar to:

1) Gold

2) Swiss franc

3) Brazilian real

4) Russian ruble

5) Norwegian krona

6) A standardized barrel of oil

7) A bushel of wheat

8) Gold

9) Cigarettes and nylon stockings (these worked in occupied Germany)

or some combination of the above.

Economic history (for THOUSANDS of years and HUNDREDS of societies) shows that a unit of currency will be created to allow multi-lateral trade.

Yes, barter will exist (it exists today) but so will multi-lateral trade.

And, BTW, several nations can produce an electrical transformer within their national borders.

You are simply wrong.

Alan

PS: And just why can we not have international trade based on gold ? Increase the nominal value (say $20,000/ounce) and the physical volume available is more than enough.

I suggest a combination of 1) and 8) ;-)

Alan, just a couple of points.

1. Gold is a form of currency, it has been for centuries.

2. A bushel of wheat, gold, cigarettes and nylon stockings are all consumable commodities and using them for trade would be strictly a barter system.

3. Using oil would be marginal, semi barter if you will. It would be extremely difficult to swap oil from nation to nation.

Gail states: "With this approach, we couldn't make all of our high tech things--computers, electric cars, even replacement transformers for the electric grid."

This statement is absolutely correct. The fact that several countries make electrical transformers has nothing to do with it because most do not. The point is that most of the countries that do make transformers must import copper or other metals in order to make them.

I really don't understand what your complaint is with Gail's post.

Ron P.

Gail -

I'm very curious as to how you arrived at the conclusion that the US would be incapable of manufacturing replacement transformers for the electrical grid without our current international trade system.

Correct me if I'm wrong, but wasn't there a time not all that long ago, when the US manufactured all of its own large transformers? If so, then what would stop us from resuming to do just that?

I suspect you might be making the mistake of confusing financial interdependence with technological interdependence. The US imports a great deal of stuff not because it is technically incapable of manufacturing those things itself, but rather because there has been a strong financial incentive to off-shore such manufacturing in order to bypass the higher-paid American workers. Sure, if we revert to more domestic manufacturing, many things will cost more, but in most cases there are few if any technological barriers to doing so.

Please also keep in mind that in terms of both volume and value of shipments, key raw material imports into the US (such as chromium and certain other metals/mineral resources) represents a very small percentage of total imports. It is the finished manufactured goods that currently comprises most of these imports.

The USA still produces the specialty steel used for transformer cores (as does Iceland BTW).

The rest is fabrication of common materials.

Alan

Wow, seeing the debate go back and forth about manufacturing electrical transformers... Just a guess, but I would estimate most don't know which are the critical components in a transformer's construction. It's not where you think.

Regardless, one of the significant economical factors in power transformer supply, (>50 MVA, and I'll be condescending, they are measured in Volt-Amperes and not Watts), is shipping. County X might be able to manufacture a transformer at less expense, but when it reaches the site at Country Y the competitive advantage is negated. Just been through this exercise.

To throw one out there for those south of the 49th, a lot of the components are U.S. manufactured anyway, like Basler tap changer controllers and explosion relief diaphragms.

And when you get into the large category of +200-300 MVA, well just the logistics of transport is a specialty unto itself. But I digress...

Joule, sure we could manufacture electrical transformers but we could not manufacture nearly as many as we need. This is because we import just over half copper we use.

Annual Data 2009 Copper, Brass and Bronze PDF

In 2005 we mined 1.15 million tons of copper while we imported 1.2 million tons.

Many metals and minerals we do have within our borders but we also import far more than we mine here, especially in the high tech sector. Life as we know it today would be impossible without international trade.

Ron P.

Darwinian -

But does that mean that we had to, or that there were some economic advantages to do so?

We also now import a good deal of the steel and steel products we use, but that's not because we have a shortage of iron ore in the US. It is because other countries manufacture steel at very competitive prices and thus can export it at a profit. During the 1980s when Lee Iacoca was vigorously preaching 'buy American', I was visiting a Chrysler body panel stamping plant and noticed huge rolls of sheet steel stamped with Nippon Steel. I'm sure the reason Chrysler was buying Japanese steel was not because US steel wasn't available but rather that they got a better deal on it.

Again, we must distinguish between economic and purely technical reasons why there are imports of certain items. And to amplify what I previously said, most of the stuff we import has nothing to do with a shortage of raw materials in the US. It's mostly about price.

Joule, iron ore is not a scarce resource, copper ore really is. Also steel is a far more labor intensive process than copper production. China, for instance, imports iron oar then exports the finished steel into the US cheaper than we can manufacture it ourselves. That is not the case when the price of oil gets very high as Jeff Rubin has pointed out.

Also Jean Laherrère says Copper Peaks in 2020. So to answer your question I would say the US situation with copper is similar to our situation with oil. We produce every barrel of oil and ton of copper we can and import the rest.

But I state emphatically that the US could not manufacture computers and other electronic parts without international trade. The reason is Coltan. (Columbite-tantalite). That is a metallic ore found in Australia, Canada, Brazil, and central Africa. After refinement, coltan yields metallic tantalum (Ta), a heat-resistant powder capable of holding high electrical charge. Tantalum is used in the manufacture of numerous electronics including cell phones, pagers, and computers.

By a huge margin the lion’s share of coltan comes from the Central African nation of The Congo. That is because they have so much more of it than anyone else.

Cell phones fuel Congo conflict

We import Coltan or Tantalum because we have to. We have exactly none here in the US. And without it all those tiny memory storage devices is impossible.

Without international trade there would be no cell phones, computers, digital cameras, and a host of other things. Without international trade life as we know it in the US would be impossible.

Ron P.

Tantalum is used for capacitors like here http://www.kemet.com/kemet/web/homepage/kechome.nsf/weben/products#sur-tan and there are alternatives but tantalum capacitors is simply the best choice for some purposes.

As they say in computing, Garbage In, Garbage Out. People have been trading valuable materials, including even bulky foodstuffs, over long distances for millennia. While central direction is convenient for this, it's never been required, the notion that it's required is just egotistical commissar-talk. Think hawala, and it's not the only method.

We're talking tiny specks of tantalum or niobium in those capacitors. A year's supply for the US would take up very little space. The problem lies in the assumption of NO international trade. Highly unlikely even in Mad Max scenarios; trade has remained around despite yet worse scenarios in the past.

Oh, and in many cases there are substitutes for those capacitors. Newer power supplies don't necessarily need 'em any more.

At the end of the day, if you need something to satisfy a compulsion to worry, this isn't the biggest worry by a long shot.

In my view, I think you're minimizing the kind of credit freeze up that could occur. We actually saw a lot of trade stop when the letters of credit weren't being written by the banks and thus container shipping plummeted in 2008.

No, trade wasn't brought to complete standstill but it's easy to see a big dip that disrupts production lines long enough that the manufacturer can't get products out the door. That sets in motion a series of cascading effects in which the manufacturer — also cut off from credit right when it's needed most — is forced to close their doors.

Will trade eventually recover to some degree after that event? Sure it will. But that process could take years.

Aangel,

You are right on it. The credit freeze up in 2008 caused a lot of ripples.

The word from the street now is that electronic component factories in China are backordered eight weeks to six months. Some aren't taking new orders.

There is some upheaval going on. We have outsourced so much manufacturing that we are utterly dependent on Chinese parts. For about everything.

For electronics, we are dependent on China for a dozen rare earths, directly and embedded in the parts.

Darwinian -

The main point of my original comment was that the US is perfectly capable of manufacturing its own large electrical transformers and is not inherently dependent upon international trade to do so. I think that is still true regardless of whether copper is getting increasingly scarce. By the way, the single largest use of copper in the US today is in home construction, and these days that does not look like a very bullish area to me. My secondary point, and really probably the more important one, was that the driving force for the vast bulk of the stuff the US currently imports is cost rather than resource scarcity. And I will stick by that. Probably over 90% of the stuff carried on these monstrous container ships from China could be manufactured in the US if need be.

Sure, certain rare metals like tantalum will have to be imported, but the amount used in things like cell phones and computers is in the gram quantity range per unit, and our total coltan imports is only several thousand tons per year, not even enough to fill a small bulk carrier ship for one single voyage a year. Hell, we could continue to import such small quantities by clipper ship if we had to. So, I still think that this vast edifice of international trade we've erected is not critical to our well-being or survival, and that some radically scaled-back level of trade, solely having to with things we can't do without and can't supply ourselves, can continue at a several orders of magnitude lower level. Hell, there was brisk international trade during Roman times, so I don't see oil depletion putting a total end to such. In the hierarchy of important fossil fuel usage the import of small quantities of high-value critical materials is pretty high up on the list, even if we have to revert to coal-burning steamships.

By the way, the single largest use of copper in the US today is in home construction

The last time I checked the 'if you have more than 100 lbs of copper you are a horder' rules from WWII are still law - thus most homes today are in violation of the old hording rules.

Buildings with copper waste stacks even more so.

Ron, I agree on the international trade part, but you write only half of the story about Tantalum.

There are promising new identified resources for Tantalum ore, for example in Egypt,Chile and China. Besides, there are alternatives such as Niobium.

Your comments are one of my favorites, because they are absolutely free from cornucopianism and have sometimes a healthy dose of sarcasm, but occasionally seem to be too pessimistic.

He he, yeah I do don't I. I dearly wish I could be optimistic. But in my lifetime I have seen the world population TRIPLE! And, I have seen the devestating result of that massive population explosion. So I should be optimistic ans say: "Not to worry, we will be saved by technology, or God, or providence, or whatever your popular savior happens to be." No, massive amounts of very cheap energy and technology got us into this mess. Should we expect the cause to also be the cure?

Ron P.

Ron, that is not my point. In general I also am not optimistic. That is why I wrote: occasionally. In this case there are new significant discoveries and 'the elements of hope' like Niobium. How it all will play out during an economic downturn is another story. The optimists always say: look at what happened during for example WW II, something like that could be done again.

US could not manufacture computers and other electronic parts without international trade. The reason is Coltan.

Well there is always the sea and sea-water extraction (plus recycling)

Niobium and tantalum were measured in North Pacific seawater. The concentration of Nb shows a slight depletion in surface water and that of Ta shows a slight increase near the bottom. The mean concentrations of Nb in surface and deep Pacific water are 3.0 and 3.8 pmol/kg, respectively, and for Ta, 0.08 and 0.20 pmol/kg. Their relatively uniform distribution suggests that Nb and Ta are less reactive with particles in seawater than Zr and Hf. In analogy with V, the species of Nb and Ta may be oxyacids rather than hydroxides.

By comparison in ppm

Uranium U 0.0033

Copper Cu 0.0009

Niobium Nb 0.000015

Gold Au 0.000011

Tantalum Ta <0.0000025

So the technofix might be harvest Uranium to make fission power to power the extraction.

Thus not a 'not possible' situation. Just not really likely to happen.

Ron,

Your PDF file is an excellent source of data but it's largely tables of numbers. For us visually oriented people another source of information on minerals is the US Minerals Databrowser which allows folks to peruse the century long time series of US production, consumption, imports etc. for copper and 85 other minerals tracked in the USGS Historical Statistics for Mineral and Material Commodities dataseries.

For example, here are a couple of plots available for copper that show how our production/consumption balance has evolved and what we currently (2003 is the latest data) use copper for:

Happy Exploring!

Jon

This debate about the manufacture of transformers is really interesting. I know Wikipedia isn’t exactly a peer reviewed academic paper, but here’s what it said about iron ore mining (iron ore, of course, being a main component in the manufacture of the specialty steel used in transformers):

“The major constraint to economics for iron ore deposits is not necessarily the grade or size of the deposits, because it is not particularly hard to geologically prove enough tonnage of the rocks exist. The main constraint is the position of the iron ore relative to market, the cost of rail infrastructure to get it to market and the energy cost required to do so. [Emphasis mine]

Mining iron ore is a high volume low margin business, as the value of iron is significantly lower than base metals.[6] It is highly capital intensive, and requires significant investment in infrastructure such as rail in order to transport the ore from the mine to a freight ship.[6] For these reasons, iron ore production is concentrated in the hands a few major players.”

Two observations:

1) I think it’s important to remember the role energy plays in all of this. If we’re talking about manufacturing transformers, we’re starting from mining. Mining requires a lot of energy. In the hypothetical situation where international trade collapses, but the U.S. still produces the same amount of oil they produce today, they will be working with 1/3 of the supply of petroleum. To assume continued production of iron ore and specialty steel at levels sufficient enough to maintain the current grid as well as other critical steel needs would be to assume that a combination of coal, natural gas, nuclear, and alternative energies can step in and replace the energy lost to petroleum brought in through international trade. It also assumes that infrastructure at mines will be changed to accommodate these new energy sources. Technically, granted a slow enough rate of change, this is all very feasible. Technical feasibility is not the ultimate judge of whether something will or will not happen, however, and when you factor in #2…

2) From Wikipedia, again: “Mining iron ore is a high volume low margin business, as the value of iron is significantly lower than base metals.[6]It is highly capital intensive, and requires significant investment…” These few major players do not produce iron ore to make steel. They produce iron ore to make profits. If there is a financial collapse resulting in either deflationary or inflationary economic collapse, it is safe to say there will be much less profit for these major players, and so there will be much less iron ore to manufacture steel to manufacture transistors.

An example of combining numbers 1 and 2:

In my career, I have spent some time observing the operations at an underground limestone quarry. The whole operation right now is highly dependent on diesel fuel for many things, including huge “Euc” trucks for transport, and ANFO explosives for rock fracturing. There is little doubt that engineers could technically re-design the entire operation to use much less liquid fuel, if not eliminate it all together. If we are talking about, say, a well planned 5-10 year long shift taking place in a market climate where the economy is expanding (contingent on expanding energy supplies) with growing demand for limestone, and the credit and the technology required to change the infrastructure are both widely available, the company running the quarry may be able to pull off the transition, albeit probably while still going into a ton of debt. However, if there is less than 5-10 years to make the changes, the economy is stagnant or contracting with shrinking demand for limestone, and credit and the requisite technology are not widely available, then the company is probably not going to be able to profitably mine limestone.

I think the same would go for iron ore, chromium, manganese, and any other metals used in electrical transformers.

Lorax, mine this...

FMag, good suggestion, and I totally agree that it makes sense to recycle metals we've already mined.

I wonder, are there any really good comprehensive studies out there that have attempted to compare the energy costs of mining vs. recycling metals? I know that a good percentage of steel manufactured today uses scrap as a feedstock, so recycling must be less energy intensive.

One of the more energy intensive aspects of recycling I can think of is that it's probably even more transportation intensive than mining. You've got all these different locations with bits of scrap metal, and you have to gather them all up and take them to the mill to be melted down and processed into new ingots or sheet or coil or whatever, then redistribute it again. Mining is similar, but all of the feedstock comes from a single location.

None of this is to say that we shouldn't be recycling to the full extent of our ability, just that recycling has some energy cost too.

There is no doubt the recycling is orders of magnitude less energy intensive than mining most metals. Perhaps local scrapyard recycling centers already exist in large enough numbers near rail and harbors so that shipping to and from these centers could take advantage of more efficient transportation options of barges, ships and trains. It might be possible to do the smelting near wind, hydro or even areas that could take advantage of solar furnaces.

http://www.scientificamerican.com/article.cfm?id=recycling-could-replace-m

Further to your comment, Fred: a factoid from http://macorship.blogspot.com/2010/05/metal-recycling-may-ease-steel-mak...

Of course, a lot of China's steel production is being "locked up" in permanent structures like buildings and bridges, and in increasing the size of its vehicle fleet, so it will be a long time before China reaches "developed" country levels of recycling as a percentage of current production.

Recycled steel goes into arc furnaces which use electricity [say 20MW to 100MW - about the same as a small town]. It takes about 1 hr of cooking to make approx 100 tonnes of liquid steel. It's then cast into 10 ton lolipops and remelted at a later date, or poured straight into a continuous casting plant to make long bars which are again remelted later.

Iron ore is smelted with coal/coke in blast furnaces. I don't know if they throw scrap in as well.

I do have a question about that graph, but I might be reading too much into it. Do you have any idea why near the end of the data there is a sharp drop in US consumption and then a steady decline after that? Is it just noise in the data or did something else drive down the demand?

aph5,

No, it's not noise at all. And your question is an example of how one starts to see things and ask questions when the data are presented graphically like this.

The main culprits for declining consumption since 2001 are a combination of deindustrialization (offshoring) and substitution of plastic pipe for copper in housing construction.

The USGS 2007 Minerals Yearbook section on copper describes:

People with an interest in minerals and materials really should try reading some of the information put out by the USGS. It's of the highest caliber. (Yes, I know that they take the OPEC reserve numbers at face value and we all know they cannot be right. I'm talking here about the group that reports on non-fuel minerals.)

Jon

EXCELLENT points Gail.

Just like Argentine Trade Tango after their 2001 financial collapse.

Financial collapse, or even an extended global depression will make any mitigation efforts that much harder to fund and implement.

I agree 100%! What that means though, is that current system won't continue because it can't. So I think its time to start moving beyond the current paradigm. No use whipping a dead horse. It's time for mature economies to stop with their own growth paradigm.

I think there will still be plenty of growth in the underdeveloped world for quite some time to come. I believe there are going to be huge markets in medium tech such as water purification, low cost small photovoltaic systems, electric bikes, ubiquitous portable telecommunications, etc.

There can be growth in educational services, preventive medicine, aquaculture and hydroponics systems, recycling of resources including humanure and so on.

My guess is that someone is still going to finance all of this and that there will be plenty of global trade. Will a lot of the old debt be defaulted on? Probably! Will our current financial system collapse? Again, probably.

Will there be growth in SUV sales and credit default swap derivatives? I doubt it.

I grew up and lived in Brazil during number of currency devaluations and lived through 1000% a month inflation there. I got to see the underside of the underground economy up close and personal. I have reason to believe your worst fears are fully justified.

But guess what? life went on, some people jumped out of their office windows in tall buildings, there was a military coup followed by dictatorship and people did what they had to do, they survived.

So at the end of the day I don't have a whole lot of sympathy for those in the rich fat countries who will now have to do with a bit less. They need to go on a diet and stop growing anyway!

So let me leave you with these words:

So either you're with the new program or you are part of the problem that needs to be fixed and I guarantee you it will be fixed one way or the other...

Now this got me going to post my own take - a summary...long, apologies,

..

Will the world financial system crash ? I think it will.

Today:

1) Too much debt. - OECD countries. Hedged with derivatives and insurance, which only makes the situation worse, and contributed directly to the staggering amounts. To what degree is not visible to me. Without them, horse-trading could, in principle, take place, leading to a sort of re-setting, with hair cuts apportioned, I suppose. One of the problems is that ‘wealth’ (assets) has evaporated by who knows how much, trillions and trillions of dollars, some alarming % of OECD wealth. But the debts due are of course still hanging around.

It would be nice to see some worked-out accounting, just as a *hypothetical* exercise, to get ppl thinking. Because the essential characteristic of money, since the dawn of time, is just that, the clearing of debt _ credit. Perhaps it can’t even be done.

That nothing of the kind is openly discussed by Gvmt heads, Pols, MSM, bankers spokesmen, etc. shows either that all elected leaders are stupid and/or out of the loop, or just hanging on with da cronies on da block; or that they realize the problems are insurmountable, and they are playing pretend-and-extend, hoping for a miracle. Or some combination of these.

Mama Mia! What a mess.

Everybody owes money to everyone else and no-one can pay. As debt, or money creation, is a bet on the future:

2) Not enough ‘growth.’ This has been masked by depressing, squeezing, lower rungs - employees, middle class, weak countries, etc.-, by bubbles, by mal-investment, (e.g. US, Spain housing bubble, US invasions), by labor arbitrage, by ‘profits’ in the financial sector, and by hype, false numbers, grandstanding.

The debt should be put in relation to ‘growth’, and ostensibly ‘growth’ has nevertheless taken place, see some ‘emerging’ countries, etc. (e.g. Vietnam, Poland, Brasil.) Yet, the ‘growth’ is hard to judge as it is not, on the whole, counterbalanced with ‘shrinking’, with loss of living standards (measures doubtful, difficult), such as in the Congo or Iraq. Moreover, its cost in debt is not figured in!

Peak oil per capita passed by in (??) the 70’s. Ever since then, we in the OECD have been consuming more or about the same, to the detriment of everyone else in the world. A staggering example not of income gaps, but the energy gap, a bit of the same story.

3) We humans on Earth are bumping up onto limits: cheap hydrocarbons- soil - the ravages of over-population and agri - biodiversity, forests, etc. Cultural transmission - the ‘knowledge’ economy, remember that? is bogus. It is no longer effective, it only lifts a few small boats here and there, in conjunction with Corporations, e.g. Big Pharma, Munitions.

4) The economic system has been taken over by a small set of ‘banksters, speculators’, in cahoots with Gvmts, who squeeze out profit from transactions, leverage, computer trading, etc. skimming off the top; by coercion and intimidation (bail outs.) By running a casino where essentially they bet against all the rest of us with a tremendous house advantage. But mostly through fraud, which flies as they operate in a legal limbo, unexamined, unchecked, free as the birds. (Relative of course.)

5) An ethos of competition that pervades every nook and cranny. (aka Capitalism sometimes.) Europe, for ex. How can one have one currency without ‘federal’ oversight and collaboration, but instead treaties and agreements that ensure competition between nations? Nonsensical, and perceived by voters, whose votes were circumvented or re-iterated to conform or plain prevented or denied. The peripheral countries and ‘late joiners’ were scammed. Ersatz prosperity, anyone?

6) Gvmts (OECD) have become privatized, that is, they are there to defend private interests, not the common good, or the ppl of their country. Private debt (banks, insurance, hedge funds, some big biz, mortgages in the US, and more) was turned into public debt. That is, the clearing house is history, dust, and debts are assigned willy-nilly to any passer-by. Called moral hazard now, in the past, extortion, fraud, a crime. Admittedly, politicians believed that the merry go round could continue, that private interests melded with the interests of the ‘public’, or they just turned a blind eye.

The utter hypocrisy and conceptual emptiness of the ‘free market’ mantra is evident. Those who bet on future ‘growth’ and revenues should be scalped - e.g. if Greek bonds are worth zero or only 33% of previous, as certified by the corrupt rating agencies or ‘market values’, well then, after all, the fool who bought is left with penny paper, junk bonds, eyes to cry as the French say.

An end-run looms, all these boondoggles interacting at once. A run to zero, a destruction of the system, jiggered by relentless positive feedback loops. The most important is the financial system, as that is what regulates what is actually carried out in the real world .. It used to be the other way round, finance adapted to real-world possibilities, constraints, judged ‘facts’, etc. Medieval kings used to devalue by decree, ha ha, ppl just carried on and paid no attention. Sumerians knew how much effort (energy) it took to raise sheep or produce cloth.

The Romans, the ‘Goths’, the Moors, invaded Spain, for trade, resources, territory, produce, transport routes, possibilities for expansion, blond Galician ladies, booty of all kinds, but also cultural renewal, innovative scenes. It costs all of them massive investment, armies, lakes of blood.

Today: just sit behind your computer screen and have some confidential chats in the corridor. Halls, I mean, of power.

Remember the massive demos against the invasion of Iraq?

What happened? Nothing.

Enough for now...

light relief, Brit humour: ;)

http://www.youtube.com/watch?v=5D0VhS8qXT0&feature=player_embedded

Ah, hate to say so, but they're clearly Australians/New Zealanders, not British. Still, rest of the post was spot on.

I think Stuart has lost completely his grip on reality.

I suspect he is projecting his deepest desires to mate with computers and become a BORG himself.

I have to say I agree with some significant part:

This seems to restate peak oil as a two-pronged dilemma: There is a supply peak, and there is a demand peak. If we hit the supply peak, it creates immediate economic contraction, thus producing a reduction of demand, and hence we re-visualize the problem as a demand peak.

The real flaw in the article is the assumption that we can, somehow, produce and transport all of the many faceted replacement technologies with the remaining fossil fuels before they become unavailable. This is magnified by the capital problem and liquidity problem associated with that. If you follow all of the arrows, you find that the combination of difficulties could well, and in my mind will most likely result in a sudden collpase, with much of the remaining oil remaining in the ground. An ironic and ignominious finale.

Craig

Well, of course. This is what we did with the banks, and with the auto industry . Why not include the oil moguls as well? And, the holding company at risk does not hold the assets here, as I have pointed out many times already. BP PLC is on the hook, and while I am not privy to their inner finances, my bet is that they only own the lease at this single field. In the end, the US and the impacted states will be the big losers here.

It is time we tax the bejesus out of oil! Let the oil companies and users pay all of the costs of their insanity (including me, to the extent that I purchase oil products). Not that I believe for one minute that will happen. Instead, conventional wisdom says the rich will get the inheritance tax eliminated or negated significantly, and their tax cuts will be extended. And, business taxes will remain the same, or decrease (to stimulate employment, of course). After all, Business and the wealthy few own the politicians who pass all of those legislative measures, and they will get what they pay for.

Craig

Failure is not an option. The American lifestyle is not negotiable.

Boy o boy, the U.S. is in for one hell of a surprise.

The government is the captive of the oil industry. As long as there is a revolving door, the good old boys will take care of each other. If the gov is going to regulate it must develop its own expertise. Having said that has anyone in mms been fired or prosecuted?

Beyond that, l think that Obama is incapable of feeling passionate or compassion about what is going on in the gulf. Where is the outrage? Where is the bully pulpit?

Bush set up the conditions for this but Obama seems to have done nothing to reverse W's legacy

And where is the clean up? Although, much of this area may be beyond hope.

And now to recoup some costs of the BP disaster....oil almost to $75 today...coincidence that oil is shooting up after leak has been plugged?

China has made it very clear that investment will continue to flow into Europe. This is likely the best explanation of the trend at the casino today.

There is also a growing expectation that China will allow its currency to rise more quickly than has recently been anticipated.

What the moves in China demonstrate is that the financial system, which is one of civilization's most successful technologies, will continue to be adapted. International trade will continue. The world will go on. Good people will continue to work for social justice. Greedy people will continue to rationalize their behaviour. Doomers will continue to look for the dark cloud.

Hey...quit raining on my dark cloud.

fly -- Given that it might be 5 or 6 years at least before the first bbl of oil is sold from the BP discover, logic would say no. But that would assume oil traders are logical.

We were promised the taxpayers would not be hit up for this cleanup. So the BP was given the green light to increase the cost of crude after they plugged the well...that's all I'm saying here. They will come out flush after a month or two with crude over $80.

Given the green light by whom? How does BP get to unilaterally increase the cost of crude? I'm pretty sure that's not how it works...

sgage...not really being serious. Just thought timing of the rise in crude was pretty closely tied to the plugging of the leak. Crude price has been hanging pretty hard at $70 for awhile now. Why did it go up today?

Because clearly BP got the green light to raise crude prices. :-)

I wonder if the leak really is plugged - I sure hope so...

Well..it wouldn't be BP proper. It would be the shadow commodity hedge funds that work with the oil companies and central bankers of the world actually pulling the levers.

Evidently the leak is NOT plugged. Top kill is suspended 'til midnight. Old man Murphy is lurking about.

All those oil stocks that went up on the news that the topkill was successful today... well, look out for tomorrow.

LOL not even I believe this one.

No just the stock market was up today and perhaps a lot of people felt oil was undervalued.

Assuming this is a pump and dump situation for stocks lets see what happens when this rally fades.

However earlier oil was up to steady while stocks where still down so perhaps a bit of decoupling perhaps not.

The acid test will be when we start seeing this set up.

Treasuries down ( interest rates up ) Dollar down, Oil up, stocks down.

That in my opinion is the signal for TEOTWAWKI.

Until we see some decoupling from the stock market for oil and esp some moves in treasuries then its BAU.

It'll be sooner than you want, Memmel!

Craig

No telling really I think once its starts it will move fast.

Basically what I'm saying is at some point the finanical world which is already divorced from reality will begin to realize that its money might just not have any value. I.e the fiat currencies are worthless and worse debt is worthless.

If debt is worthless then real estate companies etc have little value right now. Government promises to pay have little value. Basically we have the immense some of money that can only be lost.

The only thing with a little bit of value would be stuff consumed right now for daily life. People will begin to realize that a few billion people in the world have intrinsic demand for food and oil thats not going away.

The paradox is we literally cannot destroy money fast enough to prevent people from attempting to convert it to positions in commodities. And the commodities markets simply are not big enough for all the money trying to keep from being destroyed.

Thats the problem in my opinion with deflation while you have immense amounts of fiat money that literally can only be lost. This is whats different this time from the first Great Depression. We are having deflation occuring on top of a massively over inflated money supply.

Be glad for the moment that its being soaked up in US treasuries and other liquidity games. Once its clear that these are losers watch out. A slowly contracting daily economy simply cannot absorb the money that will be thrown at it.

Gold will get some but its also not big enough of a market.

Its a mad rush to find liquid stores of value and there simply is not enough real wealth in the world that can be purchased with our current money supply no matter how fast it deflates its orders of magnitude greater than our "real economy".

So I'm basically asserting that eventually debt deflation does not matter if the amount of notational capitol is significantly greater than the economic system. Right now it does but the turning point when only real wealth holds value.

Indeed if you read about housing you see that cash investors are making up a big part of the market. I suspect that behind these cash investors is a significant amount of borrowed money not just cash. So for the moment its acting as a drain of money. However once prices start falling again many of these so called cash investors will be forced out of their positions and forced to sell to stave off losses. This of course will start a stampede out of real estate once its clear the bottom is not even close to being in. Sure it will slosh around a bit into stock and treasuries but eventually as I said it will become increasingly clear that no financial instrument is safe.

Some of this money might land in land but taxes on raw land and volatile pricing makes me think this won't happen also raw land is illiquid and with housing crashing and if I'm right about oil rising who needs it ?

We shall see if I'm right right now I did not see enough to convince me that the big one has happened yet.

memmel...way too long a theory. I think mine is much more parsimonious.

Where is the outrage? Well lets have some perspective and look at soem of the rank hypocrisy going on right now.

IMHO if Obama had proposed to have in place a huge federal response for such a disaster beforehand, talk radio and the tea partiers would have screamed bloody murder about federal overreach, too much regulation, deficit etc. The people as a whole probably would be ambivalent at best. The democrats in congress would have given at best lukewarm support.

I remember my working visit to the LA coast 12 years ago where you took your life in your hands if you said anything negative about the offshore oil industry, now the people on the Red state gulf coast now want to see outrage and massive federal help. As for the Clintonistas saying that the response would be better under Bill or Hillary I call BS. Although corruption at MMS appears to be W's legacy, the dismantling and underfunding of the USGS, NOAA and Coast Guard began under Bill.

The truth is that most people and their elected reps wanted that oil and didn't want to hear about any consequences. That's where my outrage is today.

Said it before and I'll say it again, Entropy always wins.

This is what maximum entropy rate looks like. And, I still like my Lord of Rings analogy, this may well be our Balrog.

Moore’s Law is no longer valid.

That is not to say that computing power will not continue to increase… but not very much. From here on out it will certainly not double every 18 months. Moore himself predicted, in 1997, that Moore's Law to hit wall

Then just last year IBM researcher says Moore's Law at end.

That is the point: Exponential growth in every industry eventually has to come to an end! Whether it is GDP, the national debt or whatever, no exponential growth can continue forever.

Yet many people continue to quote Moore's Law as if it will hold forever. And even when they admit that eventually it must come to an end, they put that end in the far distant future. In fact Stuart Staniford, in the link I quote in my first post today, states:

Though he does admit that Moore's Law will eventually yield less certain results, he obviously does not see a problem with it right now. But according to Moore himself, and the IBM researcher quoted above, this is just flat out wrong.

Ron P.

Ah, but technocopians believe that someone will figure out how to use quantum particles, or even black holes, as computers, thus extending Moore's law indefinitely. Just add water! (Or a few googleplex-joules of energy)

;>)

Craig

Well the quantum computer could invalidate Moore's Law, but in the other direction. It could evaluate all possible alternatives simultaneously and come to a solution in one step.

However, I don't believe we're at the limits of Moore's Law with regard to conventional computers, yet. We're still not down to the atomic level in component size.

So you disagree with Moore himself and IMB. Okay, fair enough but what on earth makes you think we could ever get chips down to the atomic level? Just how would we ever get down that far?

I know the silly little story about a robot making a smaller robot and that robot making another one until everything is at the atomic level. That whole story is silly because making the first robot takes a huge factory. Chips are made with lazers in huge clean rooms requiring many engineers and a massive amount of machinery. The first robot could never make a second smaller robot without all that!

In my humble opinion chips will never be made on the atomic level. Hell, we cannot make anything on the atomic level except bombs. Making chips at that level would come decades after we made a simple motor or even a hinge at that level. That is a pipe dream. Forget about it.

Ron P.

Many things have been made at scales measured in ångströms, from tiny basic mechanical devices to sculptures. The problem is mass production more than making such things. This is where using biotech and nanotech together with computing brings about a decent compromise, since cells have been making molecular machinery for, ooh, several billion years. The first experimental synthetic organism being made this month lends credence to the idea that we are advancing on the front of controlling these processes more accurately.]

Of course, one shouldn't believe the wanked out fantasies that one can find in Kurzweil's more technocopian pieces, where nanomachines can be used to do things we do today with more primitive production technologies. Grey goo is no more a saviour of civilisation than it is the imaginary bogeyman of sci-fi (and Prince Charles).

Let us see if they can get spin probability to work.

Personally, I don't think there will be anyone available to answer the phone, let alone deal with quantum predictions in the very near future.

Computer parts may make sharp arrowheads.

"Computer parts may make sharp arrowheads."

kinda puts a new spin on me knapping at my desk all day.

Nicely played, nucleargraffiti!

Important post. If microchips keep on getting smaller they will be grey goo. Prince Charles is probably right in warning the world about the risks of "grey goo" spreading "like carbuncles of buildings" over the land.

If you actually consider the physics and the chemistry (rather than portrayals in science fiction), it's very unclear at the moment whether a wide enough range of energy-extraction reactions can exist in one set of atoms to make genuine "grey goo" (ie, able to spread almost anywhere). This doesn't mean it might not be possible to have very, very dense computing elements (as in my post below, I'd give odds for their feasibility of existance several orders of magnitude higher than whether they could actually be used for anything practical).

Unfortunately, it's easy for people like Prince Charles to "warn" about things they haven't actually spent any time analysing and asking actual experts questions about. I hereby warn of a massive wave of dementia in women 40 years from now from toxins from repeated Botox migrating to the brain. Is that realistic? Who cares, I haven't spent any time investigating it, but can't you see what a valuable service I'm doing warning people?

I'm going to talk about the generalised Moore's law of double "computing power" in around 18 months; no-one needs to remind me of the definition of the original law. Some techincal points:

(1) I don't think anyone except maybe Kurzeil in his most hyper moments say exponential growth will go on forever. The key question about any exponentially observed increase is will it continue into the future long enough to dramatically change things. There's a significant difference about the possibilities between if it continues for 6 more years or 24 years. For example, it still mildly shocks me that "spare" datacenter power now makes it possible for an Android phone to send speech for filling text fields off and decoded for "free".

(2) The EE Times link no-longer works, so I can't see the reasoning why Anderson thinks the end is now-ish. Various researchers have lots of ideas, most of which are not clearly infesible yet, eg, the physics of a transistor appears to work with 7 atoms

http://news.bbc.co.uk/1/hi/10146704.stm

Can you make enough of these connected together to make a supercomputer economically? Don't know, but it's not clear that you definitely can't. So the issue is IMO open.

(3) For me, the most important point: 2 years ago I sat in a seminar where some HPC software researchers talked aobut how they were acheiving 100s of peta-flops and their "we can absolutely guarantee being able to do this" roadmap was acheiving 10s of exa-flops in 5 years (ie 3 from now). However, this was exaflops ONLY doing some chemical fluid-state interactions modelling where they've spent intense effort understaniding the patterns of coupling between elements of the simulation to actually access the theoretical computing power of the device. Most of the architectures I see proposed for the next couple of steps of generalised Moore's law appear to again give theoretical power that may not be economically accessible (hardcore programming costs money) for the kinds of AI processing that's required to make the computer power have an effect on the physical world problems (rather than niche massively parallisable physics simulations). Even with stuff like OpenMP, CUDA, OpenCL and other language paradigms, it's not clear we're going to make a dent in the problem.

[Edit: wikipedia suggest my memory is a factor of 10 too high both times.]

So my opinion, for all my thinking on this subject, is that it's not clear which way it will go.

How about the new memristor technology? It's a 4th passive element(along with the resistor, capacitor, inductor) making it possible to make 4 nm transistors.