Social Security and Medicare Funding Issues: Even Worse when One Considers Resource Constraints

Posted by Gail the Actuary on April 15, 2010 - 10:35am

Today is "Tax Day" in the US--the day that income taxes are due for 2009. Another on-line group asked for submission of tax related articles for Tax Day. The audience there is not particularly peak oil aware, so I put together this post.

When we think about the taxes and the federal deficit, we don't usually think of Social Security and Medicare, because in government lingo, the payments we make for these programs aren't taxes, they are contributions, and the funding deficit for these programs is not taken into account in determining the federal deficit.

If we think about the situation, though, the difference is really academic. The payments we (and our employers) make to Social Security and Medicare are very close to taxes, and the fact that the programs are underfunded is not taken into account in determining the federal deficit doesn't make the problem any less real. If the programs are to be maintained at current levels, young people will have to pay much higher contributions--doesn't this sound a lot like debt?

I think, though, that the funding situation for these programs is likely to be even worse than the actuarial forecasts project. The actuarial forecasts assume that the economy can continue to grow as it has in the past, and that wages will continue to rise. The forecasts also assume that population will continue to grow. With these assumptions, the plans tend to stay fairly close to in balance, with contributions, as percentages of wages, remaining unchanged.

The problem is that we live in a finite world, and our resource use cannot continue to grow forever. In fact, we likely will need to reduce the use of some resources because we are reaching limits, such as depleted fresh-water aquifers and less available oil supply (higher prices compared to pre-2004 norms). We may also decide to limit fossil fuel use because of climate change concerns. If we are reaching limits such as these, there is a substantial chance that incomes will no longer grow as they have in the past, making the funding of future promised benefits even more problematic than actuarial forecasts would suggest.

Typical View of Funding

Many people believe that somehow the contributions they and their employers make to Social Security and Medicare are set aside for them, earn interest, and when the time comes, will be there for them.

This is quite far from the truth (although this impression is fostered by calling the programs insurance programs). When Social Security was first begun, it was simply a pay-as-you-go system.

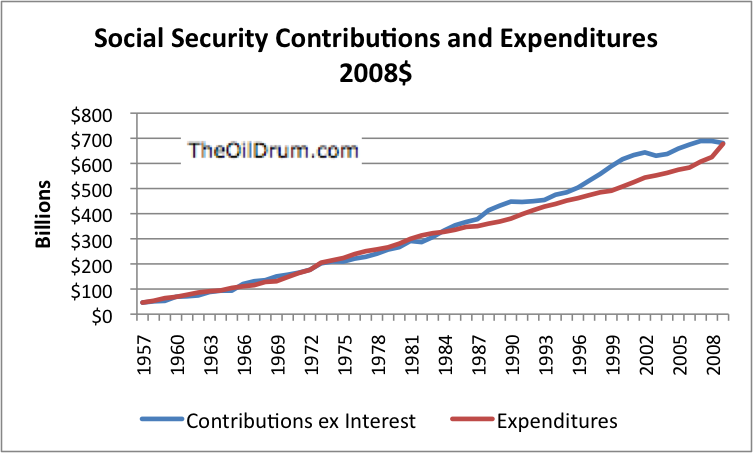

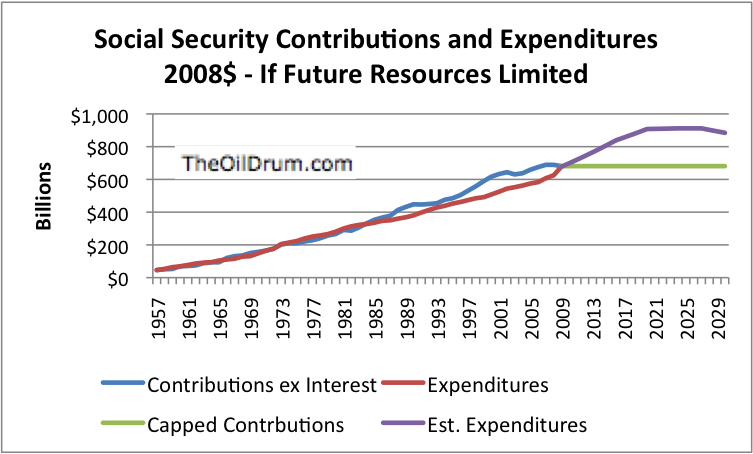

One can see from Figure 2 that up until about 1986, differences between contributions and expenditures were very small. It was as if the cost of benefit payments in a given year was divided among the current working population. After about 1986, there is a greater difference between contributions and expenditures, but the amounts are still fairly close because the funding assumptions assume a fair amount of real growth in wages will occur in the future, limiting the need for advance funding.

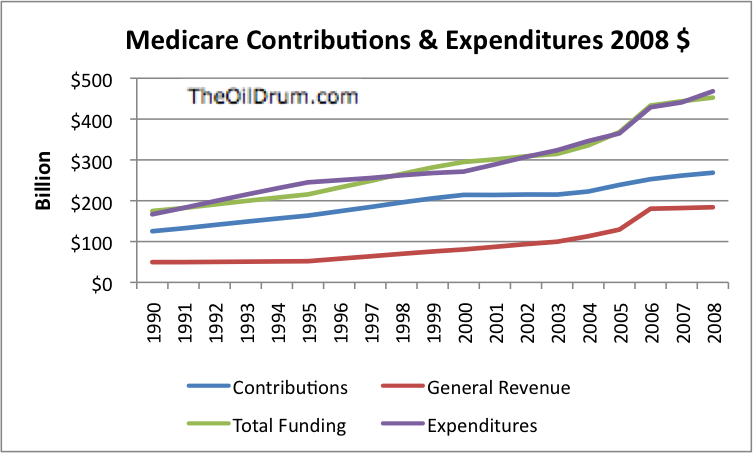

If one looks at the spreadsheet of Medicare contributions, one finds that expenditures match up fairly closely with the sum of "Contributions" plus "General Revenue," implying little advance funding. Detail data indicates while the "Hospital Insurance" portion of the program is funded by contributions, the other portions (Supplementary Medical Insurance and Drug coverage) rely to a significant extent on general revenue.

What Happens to Excess Funding

The amount of excess funding for Medicare is pretty minimal, but for Social Security, at least up until to 2009, there were several years when substantial extra funds (the difference between Contributions and Expenditures) were being collected.

What happens to these excess funds? There are different accounts with different names, but when one looks beyond the rhetoric, what, in fact, happens is the government takes the contributions that exceed needs on a pay-as-you go basis and spends them on whatever else it might need tax revenue for--salaries, roads, the war in Iraq or Afghanistan, or whatever. In its place, it leaves IOUs in the form of special issue bonds and certificates of indebtedness. As of the end of 2009, the amount of these bonds amounted to $2.5 trillion dollars, and the average interest rate was 4.688%. These bonds are held in trust funds. For more information, see Social Security and Medicare Trust Funds: An Expanded Exposition.

Because of the availability of these funds, the US government has less need for borrowing from "outside"--for example China or Japan. For example, at the end of 2009 Wikipedia shows the US having gross debt of $12.3 trillion dollars, and "Debt held by the public of $7.8 trillion dollars. By subtraction, $4.5 trillion dollars of debt is held by government agencies. Social Security Trust Fund debt is $2.5 trillion out of this $4.5 trillion dollars. The other $2 trillion dollars relate to other government programs where the expenditures were lower than cash flow (perhaps because of premiums collected in advance). The advance funding in these programs were treated similarly to Social Security and Medicare--that is, the excess funding was spent, and US government debt substituted for it, allowing the US government to borrow less from outsiders.

From the point of view of those putting together the financial statements for Social Security and Medicare, the US government bonds are assets paying interest, and thus reduce the need for Social Security contributions. But let's think about this. Where is the money going to come from, both to repay the government debt, and to pay interest? It can only come from higher taxes. So while Social Security contributions may be a bit lower, essentially the same individuals will likely have to pay higher income taxes (or other taxes) in the future to repay this debt plus interest, so the benefit of this whole arrangement is much less than it might otherwise would be.

The actuarial reports for Social Security and Medicare talk about when the trust funds for these organizations (containing US government debt) will have exhausted their balances, because outflow will exceed income for enough years that all of the US government debt will need to be redeemed. While this is one date of interest if you are running the trust funds, it seems to me that at least an equally important issue is when it is no longer possible to use Social Security and Medicare as an easy place to get funding for government programs (war in Iraq, or whatever), without having to sell bonds to outsiders. Once expenditures start exceeding contributions on an annual basis, the US government loses a place to conveniently fund its debt, and is forced to borrow more from other sources. Based on Figure 2, we seem to be reaching the point now where expenditures exceed contributions for Social Security. If trends continue, and expenditures start to materially exceed outflow, it may be necessary to further ramp up external governmental debt because of the loss of internal debt financing provided by Social Security.

The Role of Limited Resources

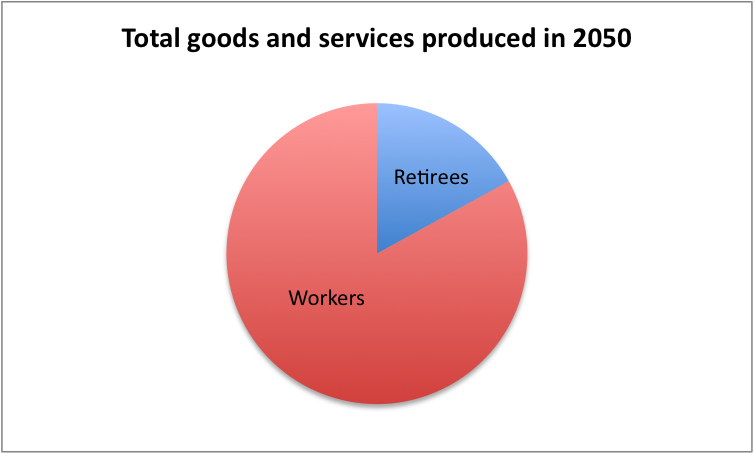

If a person stops to think about it, paying for Social Security and Medicare benefits on a pay-as-you-go basis isn't quite as dumb as it sounds. In some real sense, all beneficiaries can receive in a given year is goods and services that the economy can produce in that year. These goods and services are a subset of the total of the total goods and services produced by the economy, since the workers who produce the goods and services will also have to have shares as well.

Each worker or benefits recipient receives a tiny sliver of the total "pie" of goods and services available. While there is some variability in the size of this "pie" because a service giver or manufacturer can choose to produce more output, this output is limited by necessary inputs. For example, if gasoline or diesel is in short supply, fewer goods may be manufactured, and food may be in shorter supply, because diesel is used in cultivation, transportation, and refrigeration. If fresh water pumped from the Ogallala Aquifer is in short supply, less corn may be grown in the Plains States, leading to less ethanol and less food for animals.

Where We are Now with Respect to Resource Limits

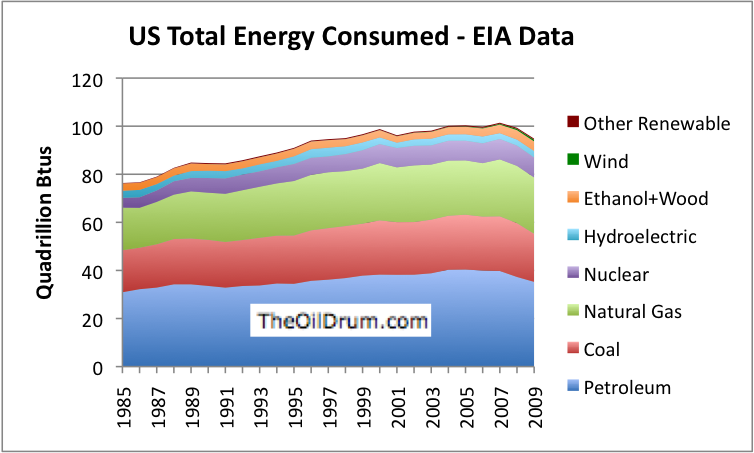

Unfortunately, we are already getting to the point where resource limits are affecting economies. Figure 5 shows that world oil production hit a plateau, starting about 2004. Figure 5 shows data only through 2008, but production for 2009 still is on the same flat plateau. Since world population is growing, this means on average, less and less oil products are being produced for each person. The limiting effect of reduced oil supply ripples through world financial markets, either as higher prices or (something which is less recognized) reduced credit availability.

Oil is used for a lot of things--food production, manufacturing new cars, and in building new homes. The constricted supply of oil has no doubt played a role in the recent economic contraction--for example, with higher oil prices after 2004, homes in distant suburbs no longer were as desirable, leading to loss of demand and lower prices for these homes.

To offset the failure of oil production to expand, Figure 5 shows that there has been a huge ramp up of coal production, and a smaller ramp up of natural gas production. But coal and gas are not very good substitutes for oil--they can be used to produce electricity, but electricity doesn't fuel our long haul trucks, or supply asphalt to pave our highways, or fill many other roles now handled by oil products.

The ramp-up of coal has been mostly in lesser-developed countries, but the US and other developed countries received the benefit of this ramp up, through cheap goods imported from abroad. Long term, the ramp up of coal is not a very good strategy from a climate change point of view--coal is the worst fossil fuel from a point of view of CO2 emissions, and carbon capture and storage is a long way away from a feasibility point of view.

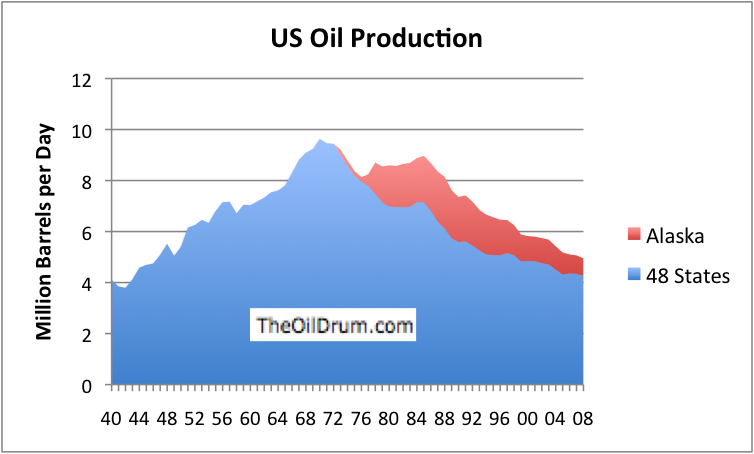

Going forward, there are differing views on whether world oil production can again be ramped up, or if it will soon begin to decline. We know that in individual locations, oil production seems to reach a maximum level, and then start declining.

As an example, oil production for the US 48 states (excluding Alaska and Hawaii) reached a maximum in 1970. Drilling was then started in Alaska, and production reached a peak there a few years later. The same pattern has occurred in many areas around the world where liquid oil is produced - the North Sea, Mexico, and in something over half of the oil producing countries in the world, lead most observers to believe that eventually liquid oil production for the world will begin to decline. At this point, world oil production is approximately flat, as shown in Figure 5.

There are various solid forms of oil, which theoretically have longer, flatter production patterns, which might possibly be ramped up to offset declining liquid oil production. For example, a huge amount of oil is theoretically available from the oil sands in Canada, but extraction is very slow and expensive. . Oil can also be produced by heating kerogen (found in oil shale) for long periods, but this procedure is also expensive and slow to ramp up. It remains to be seen whether sources such as these will have provide more than a very minor impact.

There are many estimates as to when world oil production will decline. This recent US military report says (page 29):

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD [million barrels per day].

The National Petroleum Council put out a report called Facing Hard Truths about Energy Supply, in response to a request by Samuel Bodman, who was at that time Secretary of Energy. The report talks about the need to ramp up energy resources of all types, in response to growing demand and uncertain future supply.

An estimate by Tony Eriksen ("ace") of The Oil Drum shows world oil production beginning to decline in 2011.

Even without a significant decline in world oil production, Figure 8 shows that the US has seen its oil consumption decline in the last couple of years, as China and the oil exporting countries take more of the available oil. While some would argue that this decline is the result of the recession, a good case can be made that the causality is as more the other way around--high oil prices, starting as early as 2004, had an adverse impact on the US economy. James Hamilton is one economist who has shown a connection between high oil prices and the current recession. The adverse impact of oil on the economy is also frequently mentioned by Energy Secretary Steven Chu. Figure 8 shows that renewables have played a very minor role, and do not come close to offsetting the decline in available oil supply.

If oil is in short supply going forward, there is a significant chance that what we have seen as the recent recession will continue or will reappear, after a short intermission. In fact, the recession may well get worse. A cutback on other energy sources, such as coal, would likely cause further recessionary impacts, as would a widespread shortage of fresh water.

What is this Likely to Mean for Social Security and Medicare Funding?

Social Security and Medicare funding are done through contributions that are computed as percentages of wages. If wages do not rise, because of recession, neither will contributions to these programs, and this lack of contributions is likely to be a problem. If a person looks at Figure 2 (shown above), one can see that there has been a very distinct flattening of Social Security funding in the last three years, as wages have plateaued.

At the same time, expenditures have tended to continue to increase. A big part of this arises from the fact that many people are now reaching retirement age, because the oldest baby boomers are now 64 years old. With layoffs more frequent, and jobs less available, some may choose to take benefits early, rather than look for another job. Figure 2 seems to show a larger uptick in expenditures recently, as if more are taking retirement benefits when other options are not available.

If, in fact, we are now hitting resource limits, the patterns of the past couple years may repeat themselves. In Figure 9, I show a very rough idea of what kind of impact this might be expected to have on the Social Security program. Trends toward high expenditures and flat contributions would continue. Eventually, high unemployment rates and lower wages would have an impact on benefits received, but before this happens, contributions (based on wages) would likely fall far below expenditures.

I have not tried to make any forecasts for the Medicare program, but note that even with the current actuarial estimates, expenditures are shown as rising much more rapidly than Social Security expenditures. Medicare expenditures are now about 75% of Social Security expenditures, but by the late 2020s, Medicare expenditures are expected to exceed Social Security expenditures. If contributions are based on flat, or possibly even falling salaries, this would cause a real funding problem. (Of course, plan administrators would have the option of raising contributions or reducing benefits to fix this problem.)

Solutions

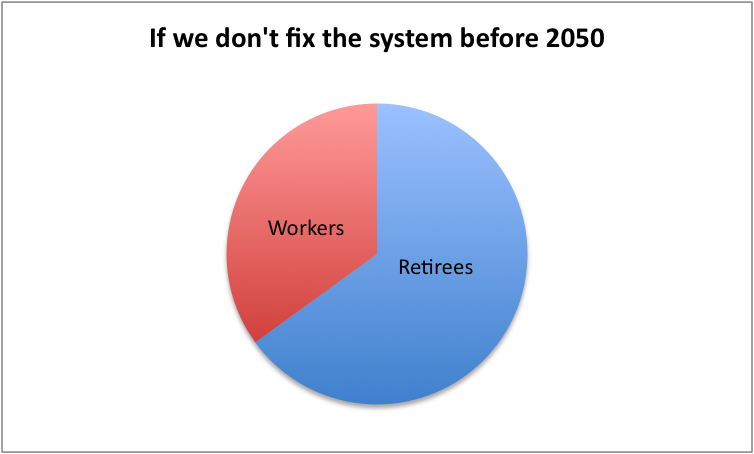

There are no easy solutions. Population growth has always been encouraged, because such growth makes it easier to fund benefits for a rising population of seniors. It also gives spreads the US debt over a broader base.

But if resources are limited, the last thing we need is a growing population. We would be better off with a smaller population, so that earth's limited resources can be shared among a smaller number of people, providing more for each person. If families start having only one child each, this would be helpful from a resources point of view, but it would make it even more difficult to pay off out all of the outstanding debt, in addition to paying for Social Security and Medicare benefits for all the seniors.

I think we need to assume that eventually Social Security and Medicare benefits will need to be cut back--otherwise the retirees' share of the resource pie will just become too large. This will especially be an issue, if resources in total are declining, so everyone is poorer. Social Security and Medicare will not be an easy issue to fix, because all of us are affected, and no one will welcome the changes. Politicians are likely to continue to find the issue very difficult to deal with.

The problem is all bonds public and private. The obsession of focusing on public debt which is dwarfed by private debt is an ideological hobby horse. I would submit that the balance between public and private is the issue and in the case of the U.S. would be better if it were balanced more toward public than private than it is now.

The statistical metric that seems to drive all policy is labor productivity.

I was able to model the distribution from a huge Japanese database on labor productivity and the results are startling. I have begun to see the statistical mechanics of capitalism more clearly than ever before. The overriding trend in the data is a square power-law that either derives from (1) competition or (2) a growing debt.or debt leveraged as cheap energy. It might be possible to separate these two if we can look at how the statistics change with time. Competition might turn into a more nearly zero-sum game while debt can continue to grow if it is backed by cheap energy. Whatever the significance of the model is, I've gotten a deeper appreciation of how the analytical tools of econophysics allow us to make sense of the broader macroeconomics picture.

http://mobjectivist.blogspot.com/2010/04/business-as-entropic-warfare.html

From the end of your post on the mobjectivist blog--

I honestly can't follow all the math, but the general trend is clear enough: in a resource constrained world the strong get stronger and the weak pass away or scuttle around in the shadows. "Resources" can be real things, like oil and water and coal and sunshine, or they can be debt proxies -- promises to pay for future delivery of resources. However, a debt-based economy requires at least the illusion that the debt will be retired, and requires a powerful enough enforcement mechanism to ensure collection.

Based on what I read on TOD, I believe that we have reached "peak oil", and probably peak many other resources. The illusion of retiring debt with future resource production is evaporating, and the ability of the government and banks and other enforcement agencies to collect appears to be waning -- attempting collection of all debt would really send the economy into a tailspin --so in effect, we have truly reached "peak debt" as well.

The Internet has made some forms of information-gathering easier, and accordingly, the number of "rubes" may also be declining -- how many Norwegian city councils are likely to buy Goldman-Sachs CDO's for their pension funds in the future? -- and so we may have reached "peak rubes" as well.

How does this fit with your zero sum model? Pretty well, I would guess. The strong will grow like the mighty Douglas Fir, and the rest of us had better become shade tolerant.

That is a pretty good summary of what I was getting at.

The math is only difficult because you need "entropy eyeglasses" to follow it. The variables are not single-point values but encompass a range in values that follow from the Maximum Entropy Principle.

The same entropy applies in resource depletion, just as in we have a range of productivity rates, we also have a range in discovery rates.

The ultimate for oil depletion is a URR and that for productivity is some sort of debt ceiling.

We know that a finite URR exists for resource depletion, and one might exist for the debt ceiling.

What happens if the debt ceiling is somehow tied to a URR? We hit that and ... kablooey.

If not that, we enter into a brief Ponzi scheme that can only end badly.

In that context, the only hope is to be rescued by alternative energy forms that allow the debt-based economy to continue.

The other interesting thing about entropic distributions is that they show the "haves" and "have nots" of society. A higher effective productivity URR keeps pushing the number toward more "haves".

I have to admit that the concept is not completely intuitive, but that is why the analysis has remained buried for so long. People don't intuitively think in these terms.

It might eventually come down to a case of "monkey" see "monkey" don't do...

http://www2.gsu.edu/~wwwcbs/pdf/Senseoffairness.pdf

Who knows we might yet get to see ex bankers chained to plows tilling the fields while the rest of us monkeys hurl feces at them...

I suppose that that these strategies exist on an individual level and amongst closely interacting groups. Yet, senses of fairness probably do not extend outside some "compassion range". At the largest scale, the aggregation of individuals continues to disperse with a range of rates so that they effectively fill out all available niches, and any sense of equitability gets lost. Perhaps governments can change this through "equitability" regulations but that is not the natural progression unless energy is added to the mix. To stem the tide of entropy we need to add order in the form of law, and people of course have their own personal opinions on that approach. That is in essence the idea behind Social Security and why it raises arguments on both sides. We are essentially trying to reduce disparity via laws.

This brings up an intersting point. Species diversity is more entropic (inverse power law) than human productivity (inverse square power law). This implies that our own set of rules on how we perform capitalism does in fact add enough order to at least reduce the entropic dispersion. This order is in the form of energy and rules on how to work capitalism. Are we compassionate enough to reduce this further ... while dealing with resource depletion at the same time. What an incredible double challenge.

"fair" isn't the same thing as "equal" or even "compassionate".

I would guess that in many societies a large number of people regard unequal distribution of resources and income as "fair" for any number of reasons.

The usual ones are 1) God wants it that way (some animals are more equal than others because they were born that way) -- most settled aristocratic societies

2) The "pre-rich" phenomenon -- I can be rich if I work hard enough, and maybe with a little luck (the U.S.A mentality)

1) works as long as "God" (or his priesthood) is strong enough to keep the peons down.

2) works as long as there is the illusion of limitless resources which are available to everyone.

Both seem to be failing. We need a new standard of "fairness"

Fairness to reward effort vs fairness to even out misfortune.

Your are right, perhaps the latter is more like compassion.

So we have the fair tax. Who decides what is fair in that case?

That's why we need a new standard of "fairness." A whole new way of thinking about it.

Actually, it's already been done -- but largely in metaphysical and theological frames. As long as we insist on technical fixes, we will fail. The Faust legend comes to mind, or for that matter, Adam and Eve in the Garden of Eden. Our ancestors thought knowledge would bring damnation. We threw that all over in the Enlightenment, but I'm not so sure "we" aren't on the short side of a Faustian bargain.

The USA has PLENTY of money for Medicare/ Social Security, public transit, windmills,

solar energy and pretty much all we need to move into the 21st Century Green Economy

if we quit wasting over $1 Trillion every year, about 53% of federal income taxes,

on Wars. See http://www.commondreams.org/view/2010/04/13-4 for details.

The total bill including interest on War Dept comes to $1.6 Trillion.

War spending is not just in the War Department but hidden away in various places like

the Dept of Energy nuclear weapons spending, CIA black box spending, National Security Agency, as well of course as the continuing hundreds of billions for the Iraq/ Afghan wars.

Social Security taxes have been overpaid for decades and placed into the "Social Security Trust Fund" owning US Treasury Bonds to pay for future retirees.

That is in trouble because since LBJ raided the Social Security Trust Fund and included it as part of the General Budget to pay for the Vietnam War.

For the trillions the US has wasted on War since the Arab Oil Embargo we could have

built a totally Green Infrastructure.

Even as Obama negotiates a laudatory agreement to reduce nuclear weapons, Hillary Clinton is insisting on wasting $5 Billion a year to "test" existing weapons and for the nuclear arms labs.

I agree that would have been possible up to peak oil. Declining oil production changes the whole game.

And of course the whole system was eventually going to break down anyway because the economy can't grow forever on a finite planet. It was always only going to grow until a limiting resource stopped it. It just happens to be oil. A little bit longer and it might have been fresh water or any number of other resources.

The world economic system is designed to fail.

it won't fail my congress critter told me they could make hot air(CO2) our next money system, instead of all those worthless paper bills I was laying down as mulch.

See endless growth.

Smiles

charles.

And of course the whole system was eventually going to break down anyway because the economy can't grow forever on a finite planet.

That assumes economic growth requires more commodities. The US now uses less oil than it did in 1979, while GDP is more than twice as large, and domestic manufacturing is 50% greater than it was then (I know, hard to believe...but true). Similarly, the US appliance and vehicle sales per capita leveled off decades ago.

I am pretty sure US oil usage surpassed the 1979 peak in the mid 90s... if it has dipped below that peak (I don't think so, but couldn't quickly find the answer) it is only because of recession.

That said, I tend to agree that oil isn't absolutely required for growth, though I do think any decoupling is going to require a period of economic pain, which I think is what we are seeing now. Oil is required for our current infrastructure. But I could easily imagine an all-electric economy based around bike-able cities with public transport hubs to mitigate historic sprawl and syn-fuel powered construction/maintenance.

In fact, there are very few problems I can't see being impossible to overcome if one had plentiful electrical power. (Assuming you don't consider giving up unlimited motorized personal transport a problem.)

Yes, economic growth requires more commodities. This is a rock-solid correlation.

Add another human to the planet and that human will consume more than just services. As that person attempts to raise their standard of living, they will use more commodities. Even if they were to magically use only more services (never buy a new car, or bike or anything) their use of services will requires that the entity providing the services buys commodities.

The ratios might shift a bit here and there, one country may take over first place from another, etc. but that's all just noise. Living requires consuming and there is no way around that.

economic growth requires more commodities. This is a rock-solid correlation.

Andre, here are some examples showing that's not the case:

1)The US now uses less oil than it did in 1979, while GDP is more than twice as large, and domestic manufacturing is 50% greater than it was then.

2)US vehicle, appliance and vehicle sales per capita leveled off decades ago. Home sales did too, except for the recent bubble (which wasn't driven by actual demand, but by a speculative bubble).

There are many more examples.

Add another human to the planet and that human will consume more than just services.

Sure. OTOH, the Demographic Transition is a really good example of what I'm talking about here: population growth doesn't go on forever.

Living requires consuming and there is no way around that.

Well, sure, but that's not what we're talking about here: we're talking about whether growth in consumption of commodities is needed.

Can you explain the obsession with debt? Debt exists in virtually all societies.

Your paper doesn't provide much intuition and what is the relevance of entropic dispersion?

On TOD the idea is that debt acts like the apple leading the horse. Future payoffs expected from variable risks. Same genral idea as a Ponzi scheme. What makes this work is that low-cost energy will lead to innovation, thus mitigating the risk.

Dispersion is simply a wide spread in some measured value. As the metric increases in size, the relative variance does not change so it looks like the statistics get more and more spread out. Entropic dispersion is a specifi dispersion which follows maximum entropy arguments, which allows one to reason from a minimum of known iformation. So we only know things like the mean, and finite constraints.

Trust me that there is little room for intuition in the posting. The majority of people have not understood this concept for years, and it will take a while before it gets accepted. I did place in a snippet of code describing how you would simulate the effect. I thougt that might give some people a hands on feel for what is happening.

Most people are used to solving a problem where one behavior occurs and it roles out as expected, the so-called deterministic solution. Next, imagine that all possible solutions with various initial conditions were solved for simultaneously, a multi-tasking solution basically. That is what you need to solve these kinds of problems.

Of course people can't get their head around this with respect to oil depletion either. The same issue occurs; oil exploration is a multitasking solution of many individual workers exploring all areas of the world at different rates. The math ain't intuitive but fortunately the results are simple.

What makes this work is that low-cost energy will lead to innovation, thus mitigating the risk.

Why low-cost? Why not medium-cost? German and Japanese manufacturing seems to do quite well with electricity that is twice as expensive as in the US (and, of course, manufacturing uses electricity more than oil).

Splitting hairs. I deal with actual numbers, and you can split up a range into low and high. By my specifying low, you can see the half I am suggesting.

Splitting hairs

No, I'm trying to get at something important.

It's often said that 20th century economic growth depended on cheap energy. Well, there's no question that energy is going to get a little more expensive, but is that a problem?

Wholesale power generation used to cost well below the current $.05/KWH. Combined with transmission, distribution & other overhead, it costs now around $.10. It's very likely that the cost of wholesale generation rise by, say, 50%, and T&D will rise by 10-20%, so the grid will be a bit more expensive.

But, German and Japanese manufacturers would laugh at the idea that these costs, lower than they face now, would cause serious harm to an economy.

One reason is because energy productivity is not measured properly.

Energy productivity is assumed the way all inputs are assumed as interchangeable with other forms of capital, such as credit. Your final remark in your article suggests a divergence between the various forms of capital that does not exist in current economics. Free substitution is one of the ways in which current established economics is able to square the circle on depletion as energy inputs are conveniently switched from the denominator to the numerator.

Labor productivity is improperly analysed because energy productivity components of labor productivity aren't separated from the human components.

Highly automated Japanese businesses embed a large energy component into labor productivity. As energy productivity declines (an arithmatic inverse relationship to energy cost -- NO, due to marginal utility decisions made within productivity process as part of that process) there is distortion on human component of labor productivity.

There are too many institutional biases in economics - ass covering is part and parcel of the job along with prejudices that are set in stone. (Watch this video.) One prejudice is that marginal utility is the exclusive province of the buyer whose set of preferences sets the final, top line price irrespective of cost. Rather, there is tension between the different participants' marginal utility effects - participants' proxies' aggregate MU which determines price and thence returns.

.

How that works is top line profit and growth are functions of marketing. The inverse relationship in productivity is between the marginal utility decsion on the part of the purchaser as determined by the marginal utility factors put into play by the producers' marketing campaign. Production productivity becomes largely irrelevant as low productivity output can be hugely profitable due to smart advertising decisions that amplify the advertiser's MU, while another highly efficient producer fails because of marketing shortcomings that leave him vulnerable to credit constraints or other factors outside his control.

The counterweight is purchaser productivity; the unit purchases per customer or purchases per currency/credit unit. This is the heart of Keynes' "lack of aggregate demand" and why not-so-dense economists like James Galbraith and Michael Hudson are beating themselves to bloody pulps in frustration with the 'Reaganomics/Gingrich Self- Defeating' economic model which exports customers to low- wage China where energy, etc. productivity is irrelevant.

Needless to say, US purchaser NET productivity is declining. Why do I say that?

Right now marginal utility is warped into something unrecognizable as marketing goes viral and the product is anti- business anarchy. Whatever MU has become, it's smashing the sh)t out of expectations of 'rational marketplace participants' (From Yves Smith):

Where debt repudiation on a grand scale is financing top line growth in China is does not suggest (a) any sort of utility return regardless of any sort of productivity ... or (b) rational behavior.

None of the foregoing is a critique of your obsrvations as these exist within the envelope of (distorted) marginal utility, ignored fundamentals, institutional bias and moral hazard running amok.

Man, oh man, if we can put our heads together we just might have all this figured out in no time.

That's why I comment here. We get people like Steve to contribute and we gain incredible insight.

I don't know if you intended this but where the information goes, numerator or denominator, changes the power-law behavior significantly. As it stands, productivity goes in the denominator and we get the fat-tail in labor productivity.

And from what I know of Steve, this is just his hobby!

Same thing here, its all a hobby, but a rather serious one at that.

Steve,

Thanks for your insights. Your video link doesn't seem to work. Could you give it again?

Let's see if this link works.

It worked. Thanks!

Your final remark in your article suggests a divergence between the various forms of capital that does not exist in current economics. Free substitution is one of the ways in which current established economics is able to square the circle on depletion as energy inputs are conveniently switched from the denominator to the numerator.

Could you expand on that? It's not quite making sense to me.

I think I get it. Behavior that looks like compound growth can come from any number of factors, such as energy, debt, or innovation.

Steve is saying that substituting energy between its various forms is not at odds with this notion.

Behavior that looks like compound growth can come from any number of factors, such as energy, debt, or innovation.

hmm. That doesn't sound right. For instance, some people seem to be saying that the recent US bubble was created with debt. On the contrary, it was a construction bubble - the GDP growth largely came from solid, real construction. The Finance, Insurance and Real Estate sector was only a small part of GDP growth over that period.

What is house flipping but a form of compound growth?

This isn't very hard to reason about.

Capital gains income from house flipping wasn't the big contributor to GDP, it was the actual construction.

There was quite a lot of unrealized capital gains, but that was a paper gain that was never turned into real income.

You know what? The analysis I did was on disparities. In part, disparities come about because someone extracts the wealth from someone else. They leverage their own wealth as a compounding effect at the expense of someone else. This is no paper effect.

The actual construction also has a compounding effect. The higher productivity firms leverage their wealth into more automation and efficiencies.

Nice try, Nick. I know you have a habit of hanging around the comment area long after most people have stopped reading, so I admire your tenacity.

The analysis I did was on disparities.

Well, I'm not talking about your analysis of the distribution of Japanese labor productivity - your findings seem perfectly reasonable to me. Instead, our conversation started when I asked a question about Steve's analysis.

Steve seemed to be suggesting something about labor vs energy that I couldn't make sense of (perhaps that energy and debt were not fungible, but that they were treated that way by traditional economic statistics). I think you answered that GDP growth could come from, in part, expansion of debt, and I replied that I thought that the recent US bubble was mostly composed of tangible economic activity (construction), not services like the FIRE sector.

Fair enough. What is quasi-stable and what is bubble-like behavior is still up in the air in my mind.

It all depends on what you mean by "growth". One can have sustainable growth that feeds on itself. One can have growth that is not producing the foundations for further growth. The growth caused by the construction boom did not lay foundations for further growth. But the construction boom really did result in much more physical activity of making the houses and office buildings. It was not just assets becoming worth more on paper.

During the construction boom GDP rose. That rise in GDP included a misallocation of capital due to poor regulation of the banks. But the economy really did grow. It just did not grow in a way that was sustainable.

I agree.

As I'm sure you gathered, it goes back to the question: can GDP grow without oil? - the answer: yes. Of course, infinitely better to build things that are needed, investments in alt energy and electrification, etc, etc.

Thank you for this post, Gail. The phenomenon you describe is well known as "Debt Service Mentality".

For years the Government borrowed Social Security and Medicare money AT BELOW-MARKET RATES. In other words, the Government would have had to pay a higher rate if it tried to borrow this money on the open market. But instead the Government had access to a large pool of money with no ability to negotiate borrowing terms - your Social Security and Medicare and withholding.

When financing is cheap, it is very tempting to think in terms of "What payment can I afford?" rather than "How much principal obligation can I safely assume?" To date, the Government has systematically avoided the latter view by systematically REDUCING RATES. Every time rates fall, the Government's current payment falls and it can "afford" more payment.

There comes a day of reckoning, however, when the payment concern is superceded by the principal concern. This shift occurs when you are forced into a pattern of spiraling borrowing to satisfy your obligations (including debt-service obligations in your last death throes). There are a number of possible triggers:

1. Your revenue is reduced by economic phenomena such as systemic unemployment.

2. Your expense is increased by physical phenomena such as a boom in retirees.

3. Your expense is increased by fiscal phenomena such as "target inflation" that increases benefit payouts.

4. Your expense is increased by liquidity phenomena such as rolling short-term debt structure or extraordinary funding draws that force renegotiation of borrowing less favorable terms.

Right now we are seeing ALL of these triggers and ALL of these triggers are worsened by critical resource constraints. This pattern is exactly what Greece is going through right now - soon to be followed by many other sovereign entities.

The question is whether these obligations are ultimately payable, or are they are of such a scale that than they can only be defaulted. (Some countries interest payments are such an astonishly large percentage of GDP that it seem unlikely such debt can ever be repaid.)

These are not new issues, the problem is huge. The retirees have been repeatedly beat up by the phony CPI inflation that is skewed to allow government indebtedness at the expense of benefit holders. The government abuses the payers of the SS by questionable IOUs, and reduces the payees payment with undeterred inflation in energy, food and health care. It is no picnic to live on SS as a significant portion of retirement income.

I can assure the writer that the solution to cut benefits has already been implemented by the Government by not recognizing inflation at the retiree's level for more than 20 years.

Not true. It is an urban legend that the CPI figures are rigged. The ShadowStats stuff is not credible. It's handwaving.

CPI may not be rigged, but I would counter that at best it is an indirect measurement of inflation that is constructed and altered (retroactively) by the same group of people who stand to gain if it happens to come in on the low side (conflict of interest) and that it's components may not reflect what many people experience in their own lives as an increased cost of living.

A lot of pretty loaded words, Mr. Beck.

The average poor person is better able to afford color TV and cell phones and such now than in the past -- but gasoline, housing, utilities, insurance and taxes have all gone up significantly. Just depends on what's in the CPI. I don't personally experience ShadowStats as "handwaving."

Great points Shunyata. I would argue that it ends in inflation and printing money rather than default, but other than that minor quibble I think your analysis is spot on.

It can't end in inflation because the obligation itself is inflation indexed!!!

I would add to your (accurate) comment that the obligation itself is inflation indexed - AT THE CURRENT TIME... I fully expect that provision to change, or the inflation indexing to be capped at a set percentage, with real inflation far outpacing whatever cap is set. Also, although Social Security is indexed to inflation, I don't believe that Medicare payments are.

In fact, Medicare payments to providers were planned to be decreased before being overrode by Congress. Physician payments in 2006 were held to 2005 levels (they were orignially slated to decrease by 4.4%), in 2007 they were held to 2006 levels, in 2008 they were held to 2007 levels and in 2009 they were slated to increase by 1.1%. Without further intervention by Congress, Medicare payments to providers are scheduled to decrease between 25% and 35% over the next several years.

Runeshade,

There is virtually no inflation today. Core inflation is 1%.

Medicare payments are to the providers, not the consumers of services.

You're confusing the two.

Gasoline is up over $1.00 a gallon over the last year and there is no inflation? I would beg to differ. John

Really no inflation? I think that statement is virtually inaccurate - with the exception of certain goods that are hedonically adjusted by our guv already.

What do you call the asset market behavior over the last 12 months? (stocks, bonds, commodities?) They don't say we are reflating for nuthin' - or at least attempting too.

Cost of utilities - phone tv/cable, property taxes, gasoline, food - (bag of chips is about 1/3 less volume than 5- 10 years ago).

How about foreign currencies vs the dollar over the last 1, 5, 10 year timeframes? Can we buy more for our dollar than we could 1, 5, 10 years ago? For a few goods and fewer services yes, but not in healthcare, education, transportation, taxes, food, energy or similar virtualities.

http://inflationdata.com/inflation/inflation_Rate/historicalinflation.aspx

Looks like its running in the low to mid 2's. At 3% over 24 years your purchasing power is cut in half. That seems to be my experience in my 40 odd years living on this once and future blue planet.

If you believe the government numbers, you will be like my old aunt (before Cola) who sent me 3 dollars for my birthday back in the 70s and my mom told me to write her a nice thank you card because for her living on social security that was a significant sacrifice for her. I'm afraid that this will become more common for more people in the future, and I'm afraid the government numbers will only show 1-3 % official inflation all the while.

Here's to official inflation numbers accurately reflecting reality,

-Cloudy with a chance of rain

Since core inflation ignores energy and food, its use is intended to under report inflation especially for the poor whose main expenses are shelter, food and energy.

As of this moment, Medicare payments to physicians are cut by 22%. Congress does not seem to be able to change that, even if they want to, which is debatable.

This cut hits different physicians disproportionately -- those of us in "primary care" with heavy Medicare loads are pretty badly affected, because it is illegal to collect anything from patients that isn't "approved" by Medicare -- even if a patient is rich as Croesus.

Of course, in the end, it is all part of a plan to discredit, and eventually eliminate Medicare in favor of some private insurance scheme.

While I once was in favor of private insurance rather than a government program,the private insurance companies have become even more powerful and less accountable than the government, and since insurance is apparently mandatory in the new "healthcare" plan, things are looking somewhat bleak.

The Mafia and its protection rackets have finally triumphed -- and the Tea Party plays right into their hands.

Hi, Lng,

Of course I know nothing about you personally-perhaps you work in a poor people's clinic for a pittance.

But except for the fact that when doctors aren't paid they quit working, I find it quite amusing that they are now on the other end of the govt hand out stick;after all, the profession came to be one of the very best paid "sure thing" professions in this country because the govt , in collusion with the profession, made it so.

Beware the handout, as the hand that brings it can turn into a fist pdq.

It's indexed to an arbitrary number calculated by the same government who has to write the checks and that has already shown a willingness to change the way it calculates that number as it pleases. If that sounds like a good deal then I have some 30 year TIPS to sell you.

Yes, it can because the cost-of-living adjustment is based on last year's undersized CPI-W. For example:

In 2010 Fed prints $1 trillion which is used to purchase U.S. treasuries increasing the money supply by 1.5 times causing an inflation of 50%.

The COLA for 2010 is 0% based on 3rd quarter 2008 to 3rd quarter 2009 data.

In 2011 Fed prints $1.5 trillion which is used to purchase U.S. treasuries maintaining inflation of 50% per year.

COLA is 32%.

In 2012 Fed prints $4.0 trillion which is used to purchase U.S. treasuries increasing inflation to 89%.

COLA is 44%.

For 3 years, SSI purchases less than half what it did at the start of 2010.

The pattern of inflation rising faster than COLA continues for years deflating the purchasing power of Social Security income until recipients die from starvation or exposure after losing their homes. That's hyperinflation. After enough Social Security recipients are eliminated, the government issues a new currency worth 2 times the original which, after conversion, immediately devalues to 1/2 while the government insists, using ineffective price controls, the value remains unchanged (CPI-W = COLA = 0). Welcome to hyperinflation.

Thanks, Shunyata!

I would agree about the day of reckoning coming. I would add to your list of four possible shocks a fifth one, of shocks based on natural phenomena, that in our overstretched condition we can no longer handle adequately.

We already saw that with Hurricane Katrina. We don't know yet about how serious the volcano in Iceland will be. Right now, it is disrupting airplane traffic between the US and Europe. The WSJ reports

Ash From Iceland Volcano Disrupts Air Traffic

We don't know what will happen yet, but if this continues and the fallout is "only" a few bankrupt air carriers plus loss of tourism revenue, it could send some teetering world economies over the edge.

After becoming slightly worried by the way this was setting up, I have begun to do some fact checking and the first appreciation seems to be rather reassuring.

Judging by the pictures, and according to Wikipedia, up to now the eruptions have actually been relatively small, and the air traffic disruption is a consequence of the very peculiar climatic environment of the place and its significance for the making of european weather (see for instance Icelandic Low & Northern Atlantic Oscillation).

As long as the eruptions don't become larger, it won't be a big deal beyond Iceland and air traffic.

There seems to be a risk of secondary activity at nearby Katla, which is a larger volcano with an eruption listed at more than 6 to 7 cubic kilometers (1.4 to 1.7 cu mi) dated to 10,600 years BP, again according to Wikipedia. To put that into context, Mount Tambora came up with an estimated 160 cubic kilometers in 1815.

I couldn't find any really large volcanic event for Iceland, maybe because they originate from an oceanic fault where the plates pull apart. On the other hand, there's a hotspot below Iceland, and therefore there may be a remote possibility of the planet coming up with something new...

Disclaimer: I'm not a volcanologist.

That simply not true. Federal debt is sold through auctions. So by definition it is a market rate.

I am amazed at the lack of economic sophistication ...

I get it now. You are kidding us.

As I understood it the Federal debt that Social Security owns is specifically not marketable and not sold at auction. I could be wrong, but it seems to me some debt is sold at auction and some isn't.

This is correct. The IOUs to SS are a special type of treasury bond that are not marketable.

Social Security and Medicare get their own special version of government debt, which cannot be sold elsewhere. I don't know how the rate is set, but I suspect Shunyata may be correct. He works in a financial area, and may have direct knowledge of this.

2. Your expense is increased by physical phenomena such as a boom in retirees.

This is an important mistake, made by many people. Retirement is a social phenomenon.

Further, people are living longer, and disability rates in the aged are falling sharply: the retirement age should be dramatically raised.

The End of Retirement

Well, that's different from what I'm saying.

I'm saying that our current "pension/social security crisis" is a perverse flip side of a very good thing: we're all getting healthier.

Retirement was really a form of disability insurance: people were expected to not be able to work after a certain point, and pensions and SS helped support them.

Now, we're getting much healthier, and we don't need retirement, at least not until much later.

--------------------------

I have to say, I'm puzzled: if you feel that Energy Descent is a very long-term phenomenon, then I really can't understand why you are so pessimistic. It's perfectly clear that wind, solar etc can provide all the energy we need in the long-term.

Thank you for shedding light on a difficult and politically sensitive subject. The fact is, the spending of the US Government is completely unsubstainable in the long run. As we stand right now, spending on just 3 programs, Social Security, Medicare and Medicaid will shortly consume the entire revenues of the federal government. When you add the interest we are paying on the national debt to the mix, the day of reckoning becomes closer and closer, and as Gail said, this is independant of any setbacks that might appear to economic growth, like peak oil. This means that there will be NO money left over for ANYTHING else. No national defense, no social programs, no Dept of Education, no homeland security, no basic science research. Without some fundimental changes in both our government spending and our taxation policies, the US is on the road to bankruptcy.

So, how many of you believe that our politicians see this incoming train wreck arriving and are going to raise taxes in order to balance the budget and push back this impending disaster? Anyone? Likewise, how many believe that the government is going to cut back on military spending by about 3/4, and all other domestic spending by about half? Any takers on that one? Without huge reductions in our government spending now, this country is in a lot of trouble.

Since neither the Democrats nor the Republicans can be counted on to actually act on this unfolding crisis and balance the budget, where does that leave us? Unfortunately, it leaves us borrowing more and more money to balance our budget until the inevitable occurs and the borrowing well runs dry. So... what happens when you hold an auction for government bonds (this is how we finance our deficit/debt) and no one shows up to buy? This moment, which is fast approaching, will be the moment of truth. The sad answer is, when we can't borrow the money, we are left with one option... print more money.

So, when we are forced by our out of control deficit spending to start printing money, you can expect inflation to kick into high gear. Basic economics tells us that printing more money increases the overall money supply. An increase in money supply is a textbook cause of inflation, and the longer the imbalance of spending and revenues continues on, the worse that the inflation will get, until it becomes hyperinflation.

This is the future for the US without drastic changes in BAU, and as Gail astutely pointed out, this is even BEFORE we factor in reductions of economic growth due to PO. If you think the picture looks bleak, its because the picture is bleak. Without an IMMEDIATE move to totally elimiating the budget deficit, the picture just gets worse and worse. GW Bush really screwed us economically by turning the small surpluses he inherited into massive deficits. Obama has not improved the situation any, and in fact, if you look at his proposed deficits in the years going forward, will in fact make the debt/deficits much worse by the end of both his first, and proposed 2nd term. In other words, don't expect the politicians to bail us out, because unless they are proposing increasing taxes and/or DRASTIC reductions in benefits, they won't solve these problems. Don't kid yourself about the Republicans either, they talk about reducing the size of government, but they have failed to do so every single time they have had control of the government. In fact, the Republicans tend to make the problem worse through dishonesty. The party of "Borrow and Spend" tends to lower tax rates while simultaneously increasing spending, on national defense, conservative programs, etc.

In summary, we should prepare for a period of rising and unrelenting inflation, and/or hyperinflation. Some people will respond by putting assets into gold as a defense, and that is one potential solution, at least until the government decides to tax this potential revenue. The best answer to a almost impossible situation however, is to use extra money that you have now to 1) Pay off your own personal debts and 2) Use that money to make preparations for the future. The time is now to plan and start your garden, purchase and store supplies and make general preparations. Read up on Zimbabwe if you want a current example of how bad inflation (hyperinflation) can be to an ecomony.

Thanks for this great article Gail.

Runeshade,

The best analogy for the current US situation is Japan's Lost Decade. Japan had massive deficits, rising money supply as measured by the Japanese equivalent of M1, and deflation.

Inflation expectations as measured by the interest rate differential between ten year Treasury bonds and inflation indexed ten year Treasury bonds is 2.4%.

Oh, and Zimbabwe had rising money supply velocity ...

One huge difference.....Japan was and is a net exporter and the US?

Gail exaggerates the economic impact of peak oil. There is plenty of room for energy substitutes and improvements in energy efficiency and plain old fashioned reductions in energy use to mitigate the slide down the fall side of oil production mountain.

"Gail exaggerates the economic impact of peak oil."

Yes and no. If you ignore for the most part the interconnectedness of the current system, "yes". But we don't really have a way of measuring that interconnectedness. Looks like we're going for an experimental evaluation. Gail seems to think that a critical aspect of that interconnectedness is the global trade system. I doubt that will the major one. "Our system" has self-adjusted for many decades to a certain rate of growth/energy availability. To ask for a smooth readjustment in the likely time frames is optimistic. Current degree of globalization is so recent that I don't think system dependencies are that deeply embedded.

Since this is all an experiment, how do I get a transfer to the control group?

I really think peak oil is likely to cause debt defaults, because without economic growth many people's incomes are not rising, (and some are falling) making more than the expected number of people default on their debts. From debt defaults, we move to problems with the financial system and also to major problems with international trade.

We started seeing debt defaults, starting first with subprime mortgages, and moving on to regular mortgages. Defaults will likely get worse and worse if the economy cannot grow because of peak oil (except perhaps temporarily, before it crashes again). Commercial real estate is one area with more defaults coming, but so is mortgage debt and municipal bonds.

If there were no financial system connecting everything together, I think we could get along quite well, in spite of peak oil. There is room for some economizing in oil use. But this doesn't fix the financial problems that the oil shortage causes.

The US, for many years, has bought close to twice as much imports as it sold as exports. This was sort of OK, as long as the US was growing, and the view would be that there would be enough to pay later for purchases, even if there isn't now. Problems will arise if someone says, "I really don't want to sell to you. You can't really pay for it." Today the problems are with Greece, but in not too long, it may be Britain and the United States.

Exactly. The unwinding financial system is going to be make everything else more difficult then impossible.

Nomura calls it a "balance sheet recession." Perhaps it's a term of art but I've never heard the term before.

See the Business Insider post and see the comparison between Japan when their deflationary period started in 1990 and the current U.S. one. Amazing parallels (h/t Mish):

Richard Koo's Awesome Presentation On The Real Reason Why This Recession Is Completely Different

http://www.businessinsider.com/richard-koo-recession-2010-4#-1

Well I am going to agree with you on this.

Americans in particular could reduce energy consumption by 50% and not feel deprived at all.

That is just conservation but we have to do it.

If we wait until the "market" does it through price and substitution it might get pretty tight.

A general 50% reduction in waste spending is a 50% reduction in the jobs which rely on said waste spending. Thus causing a positive feedback loop.

Not at all - it would mainly be a reduction in income for oil exporters. This is what economists call "rent" (unearned income), not labor income.

Not in agriculture. Its common, though a bit disingenuous, to say in the future we'll just waste less, so things will be ok. Perhaps it touches on psychology, but I think everything we've seen suggests that we'll bear a very large cost before we give up discretionary consumption, and by bearing the cost of non-essentials we more or less wreck the fundamentals.

I welcome the discussion of demographics and its effect on the economy and society. It's a discussion that is still in its infancy and is as important as peak oil.

On the negative side, the analysis is marred by the total omission of military spending in the US, a HUGE portion of the national budget. As the price of fuel goes upward, overseas bases and military adventures will only become more expensive.

Why did you leave this out, Gail?

By the choice of subjects, one determines the direction of the debate - framing. Selecting some aspects of the problem to analyze and not others is a political choice.

Social security and medical care are critical to the well being of society as a whole. They are currently under attack by right wing elements. Military spending, OTOH, gets a free pass.

Bart / EB

Bart -

Now that you mention it, while Gail has been relentless in criticizing alternative power, such as wind and solar, as being a mal-investment of capital, I don't recall a single peep out of her as to whether the upwards of $1 trillion the US spends annually on its defense budget, various wars, and overall security apparatus just might also be a 'mal-investment'. Apparently, some things are up for discussion, while other things are not.

I recently read somewhere that the total cost of delivering fuel to a point of use for our forces in Afghanistan is something like $100 per gallon (yes, per GALLON - that is not a typo). A $70-million Osprey tilt-rotor plane crashes in Afghanistan, and it's ho hum. Money no object. PV panels and wind turbines are a waste of money, but nothing is said about the Pentagon throwing away billions like they're nickels. Military spending does not seem to be considered unsustainable, perhaps because the government believes it will be sustained as long as there are taxpayers to be squeezed.

I fully agree with you that at TOD we seem to have just a bit of a disconnect in this regard.

Hi Joule,

I do understand your point, but we are after all discussing this issue at this very instant, are we not? ;)

I don't see Gail's comments and posts as being anti renewable myself.

I do see her as being honest and realistic , in the face of what might turn out to be excessive optimism on the part of the readership in general in respect to the speed at which renewables can be ramped up.

Think of her as a sort of Hubbert , if you will, warning us that our proposed solutions are going to be too little, too late.

I hope she is wrong, but I have a gradually growing sinking feeling in my gut that she is right.

Today I will begin the installation of a solar domestic hot water system for our home-partly because I think it will save some money.I have cribbed the design from the net, salvaged most of the materials, and will construct it my self with a helper as needed.

But the current savings will not really justify the effort and expense..It's the future cost of energy, combined with a possible future loss of income, that has me convinced that this is a worthwhile project.

Unfortunately the vast majority of the public,probably including most of the people who read TOD, will not change thier ways until it is too late and a trully crippling crash takes place-one so bad that recovery might not be possible.

If things work out this way, the renewables industry will crash with everything else.

A somewhat more pessimistic pov is that even without such a crash and the maximum likely rate of expansion of the renewables industries,including subsidies, renewables will not be able to shoulder the load as fast as ff are depleting.

I can't speak for Gail, or anybody else of course, but as a regular reader I believe this last scenario is a reasonable,condensed interpretation of her overall position.

As I see it,she's not antirenewable at all, but simply more pessimistic, or , in my estimation, more realistic, than the average renewables fan.

I share her position if indeed I have correctly interpreted it.

I won't speak for Gail either but that's my impression of her position.

It's a position I share with her, also.

The number of financial systemic events that could take down the whole system is large and one of the more recent ones added to the list are derivatives. Granted, they are just another form of debt so the fundamental problem lies beneath them: declining energy means the debt won't ever get paid back. No way, no how.

We will watch the not-so-slow self destruction of the financial system and it has already begun.

-----

Derivatives are Economic Time Bombs (Buffet)

Credit Default Swaps Are STILL Dangerous

http://www.washingtonsblog.com/2009/09/credit-default-swaps-are-still.html

"Energy and debt are the primary drivers of economic growth, but of course debt doesn't contain BTUs."

Abstract Energy Gain and the Permanent Recession (Nate Hagens onASPO.TV; behind paywall)

Military spending is left out (even though it is going to HAVE to be reduced), because it is not a current legally mandated expenditure. The benefits of Social Security, Medicare and Medicaid are known as mandatory spending, and by current law are funded before anything else. The road we are on shortly leads to a time where we won't have to worry about military spending, because there won't be any left over money after financing those three programs plus interest on the national debt.

These massive unfunded liabilities make Military spending look like a rounding error. Everything will be cut.

The US tax burden is much lower than in Europe. It will be quite easy to raise the money to cover American's stingy social programs by implementing a VAT tax or raising taxes.

How about a little less fear mongering?

US social taxes are only 15% of the first $100K in income. In Germany, the world's largest exporter, it's 25% of all income ...

And the US does need to spend a half trillion dollars on defense ...

And the US does need to spend a half trillion dollars on defense

But, was the Iraq war defense?

Also, we're spending far more than $500B on total direct military spending.

The benefits of Social Security, Medicare and Medicaid are known as mandatory spending

The benefit levels are not mandated. They could be cut overnight by a simple act of congress.

The likeliest target: retirement age, which is far too low.

This post is one I had serious issues with both length of article (getting too long already, focused on what I was attempting to focus on) and time to research and write the article (less than two days). One picks a focus, and goes with it.

I purposely stayed away from writing an article about general spending issues (including military spending) and the published debt levels, because it is hard to write an article that is not so bleak that no mainstream organization would consider printing it.

I did mention the possible use of Social Security and Medicare cash flow for both the war in Iraq and Afghanistan where I could in the article.

I understand the need to focus.

Nevertheless, Gail, this is a serious error in the analysis. Not only does it miss the big picture, but it calls into question your fairness.

It would only take a paragraph or two to put the issue into perspective. And if you wanted to cover the issue fairly, you would continue the analysis with other parts of the budget, perhaps in later columns.

And if you are to focus, why did you choose these subjects to focus on? You seem to be saying that you avoided subjects that are taboo in the mainstream press. If so, this diminishes your credibility as an analyst, since you are tailoring your message.

You are a crack analyst and I depend on you! Please maintain the fairness and objectivity that you've shown in previous analyses.

Runeshade points out that military spending is not legally mandated. In this case, it would be the relevant sector to focus on, since it could more easily be changed.

I don't think Runeshade is correct when he says that military spending will automatically decline. The history of declining imperial powers shows that they spend an increasing portion of their income on military/police. The cost/benefit of imperialism declines, the home population becomes restive, and the society's thinking becomes militaristic rather than problem-solving.

I think that is the dilemma that faces us: do we spend dwindling resources on imperialism and illusion, or do take a more productive path?

best, Bart / EB

Forgive me for intruding but I'm going to anyway.

Can people please make an effort to stop impugning other people's character?

Gail explained why she did what she did. She puts in gobs of hours into the site as it is. She has a preference for the topics she chooses to cover and that's entirely her prerogative. It is perfectly fine to allow other people to handle other topics or what you would consider the "big picture."

Here. It's easy to be generous with other people.

Just say, "Gail, this is really good, especially in just two days! Have you thought of incorporating military spending? Personally I think that without discussing military spending we just won't see the whole picture. Let me know if you want a collaborator, I'd be happy to help."

Notice that bit at the end. It's really easy to ask other people to do all the work. Now, I know you have put in gobs of hours yourself into this topic (EnergyBulletin), but the point still stands for this case. The reality for people involved in social change is that the (few) people who are committed and involved are almost all overworked, which often leads to burnout.

Also, anything one ever wants to say is "wrong" can be alternately expressed as "what's missing." It makes conversations work much better and respects the other person, making them likely to want to stay in the conversation with you.

In this case, what's missing is generosity.

Thanks for reading to the end.

Good on yer aangel.

If you need some muscle to back you up, I'm right here.

Thanks for your comment, aangel. I appreciate your trying to keep communication going.

If there were a better way to make this point, I'm sorry I didn't do it.

There are two separate issues here.

One is whether one respects the volunteer work that other people do. In a volunteer movement, that's very important. Agree with you totally here and Gail deserves kudos.

Second, there are questions of fairness and framing. I take Gail's work seriously, as well as her ability to deal with legitimate criticism. In this case, significant perspectives were left out of a piece of analysis. As joule points out, "at TOD we seem to have just a bit of a disconnect" [regarding defense spending].

So this is an ongoing problem.

It is not easy to take exception to the writing of someone you like personally, whose work you respect. But if we want to get outside the TOD ghetto, we've got to have good analysis and be fair.

Please note that I gave a suggestion for an easy way to correct the problem in this article -- a paragraph or two to give the overall budget picture, and an explanation of why only two factors were being looked at.

best to all, Bart / EB

I read through the (many) comments, and I think I'm better able to verbalize the problem.

The problem is not whether Gail, I or anyone has political beliefs. The problem is mixing them up with objective analysis. It is fine to express one's opinions, but it is important to label them as such, and keep them separate from the analysis.

It is probably possible for us at TOD to agree on a general analysis of how resource constraints will probably emerge.

We could also probably agree that society will make choices, and we can also agree on a list of what the questions might be. For example, military, highway intrastructure, education, health, senior benefits, agriculture subsidies etc.

Despite our differences, we could also examine the size of each sector, and what the implications of cuts would be. We could also examine ways that spending could be made more efficient.

Where we would disagree is in assigning priorities.

This is where politics comes in. There will be a debate and struggle.

Even here, we could agree on the need to define different viewpoints clearly, and listen to the most articulate and intelligent.

The problem with this essay is that it skips several steps, and instead of allowing the problem to be seen as a whole, it jumps in with an implicit set of priorities. As can be seen from the discussion, we don't all agree on the unspoken assumptions.

I would like to see more emphasis on the problem itself, seen as objectively as possible. And THEN it would be interesting to hear Gail's opinions, as well as those of other people.

Bart / EB

It is probably possible for us at TOD to agree on a general analysis of how resource constraints will probably emerge.

I think we still need to do a lot of work at that stage. We still haven't come anywhere near a consensus on the limits for things like coal, wind, solar, and EVs.

Thanks Nick. I dunno, I think we're a lot closer to agreement than it seems. Especially if we allow for an uncertainty factor.

I'm surprised at how much agreement there is among a wide swathe of the population, once they become aware of the basic concepts and data. (Omitting outliers and those with a special interest).

The reaction seems to be a consistent "Very Concerned" to "Urgent."

As Sharon Astyk said in one of her columns, one doesn't have to know the date and time of peak oil in order to start preparing.

One of the encouraging things is that people from across the political spectrum can agree on resource constraints.

Even more surprising is that among those who are informed, there is the widespread conviction that we must cut back ... somehow. The disagreement is in the details. But even then there is a lot we can agree upon.

That sounds right to me.

Sorry ... one more thought.

From the point of view of analysis, there is a critical logical fallacy here. To be schematic:

1. Assumption: Peak oil and resource constraints. (Heartily agreed upon, at least by most TODers)

2. Missing Step: There are multiple ways that society's resources are currently expended. At the level of the US budget, here are the major expenses and their % of the whole.

3. The Leap: One portion of society's expenditures - Social Security and healthcare - is unsustainable at current levels.

Logically, Step 3 has not been proven and cannot be proven without considering Step 2.

Skipping Step 2 also means that assumptions about the relative value of expenditures are not articulated.

Mainstream organizations would not publish your article because it is so one-sided. There is plenty of room for energy substitution, reduced energy consumption, and improved energy efficiency in mitigating peak oil.

Similarly, the US had comparable debt levels during the WWII and suffered no downside.

Pessimism needs to be meticulously back up by facts ...

You want pessimism? Look out your window at Europe and look at all the unemployed youths. Simply saying "There is plenty of room for energy substitution, reduced energy consumption, and improved energy efficiency in mitigating peak oil." does not make it true. There is not necessarily a way to mitigate everything and keep things going as they have been. However, this does not mean going back to the 18th century.

"...Things fall apart; the center cannot hold;

Mere anarchy is loosed upon the world.

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity" — WB Yeats

Roderick Beck -

The US WW II debt did not become an irreversible drag on the US economy simply because of the incredible post-war economic boom that set in during the Eisenhower years. Growth was everywhere, globally the US was numero uno, and optimism was rampant (though you did have to worry about those Ruskies and The Bomb).

Things are just a bit different today.

I think you may be missing optimism as well, eh?

I will even venture to say that all policy initiatives, general discussion and debate are bolstered with evidence.

Nod to Alan, ... Here's to evidence based reasoning,

-Partly cloudly and a chance of sun

Even though I disagree with Gail I think mainstream organizations should not try so hard to maintain a narrow range of acceptable positions. The beauty of the internet is it allows fringe positions (e.g. that Peak Oil is near) to get a hearing.