Nothing New in Obama Plan for Offshore Drilling

Posted by aeberman on April 13, 2010 - 10:26am

In early April, the Obama Administration announced that it will expand offshore exploration and development to reduce dependence on foreign oil. The plan that was announced is, in fact, more restrictive than what was already in place, and will have no near- or mid-term impact on our need to import oil. It maintains the status quo by allowing leasing in the eastern Gulf of Mexico and offshore Virginia, and by allowing drilling in certain areas offshore Northern Alaska, but it closes the Bristol Bay area offshore southern Alaska. All areas in the Pacific Ocean off the coasts of California, Oregon and Washington remain closed.

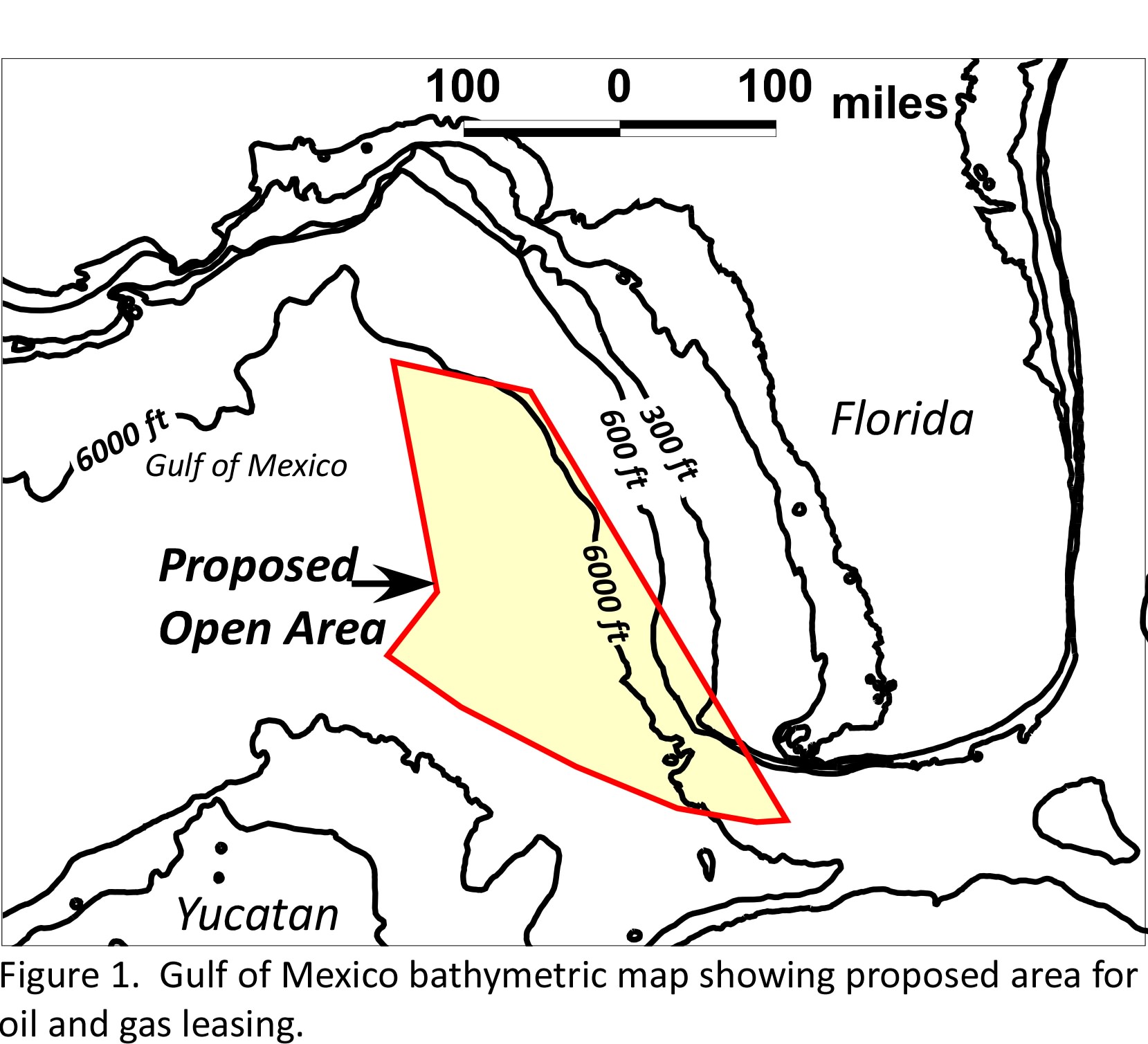

The portion of the eastern Gulf of Mexico that is offered for leasing in the government’s plan is limited to areas more than 125 miles offshore that are mostly in water depths of 6,000 feet or greater (Figure 1). While the administration describes this as a development area, it is a high-risk, ultra deep-water wildcat province. Sixty-two wells were drilled in shallower areas of the eastern Gulf before the drilling moratorium, and the only prospective area found so far is the shallow-water Destin Dome region off the Alabama coast where reserves are estimated to be 2.7 trillion cubic feet of gas (equal to about 1.5 months of US natural gas consumption). The geology of the eastern Gulf of Mexico is different from the traditional producing area of the central and western Gulf. While it contains legitimate petroleum systems, it is a relatively high-cost, high-risk area.

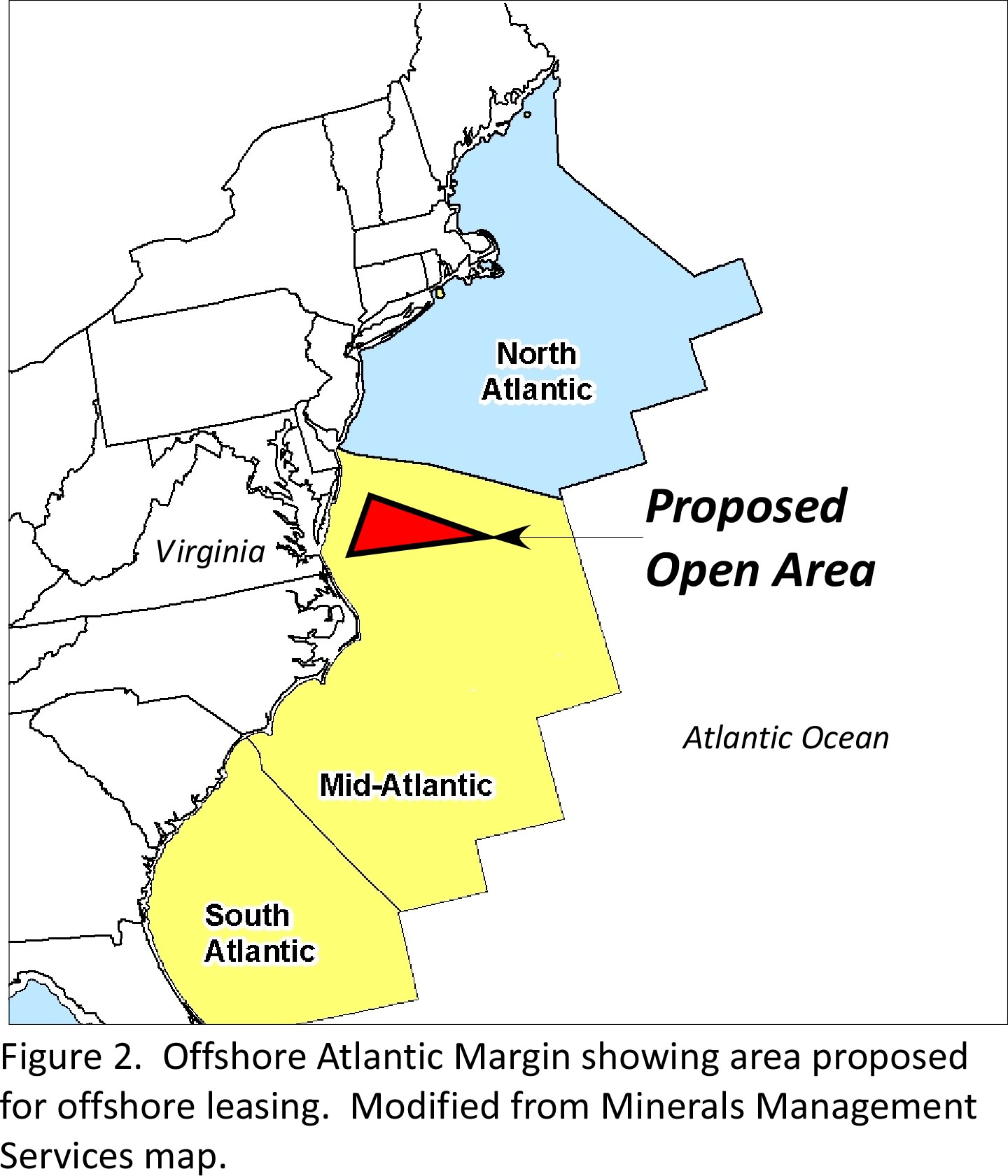

The area of the Atlantic coast that is included in the government plan is offshore Virginia (Figure 2). The Atlantic margin of the U.S. was drilled and evaluated before the area was closed to exploration in the 1980s, and the results were dismal. More than 50 wells were drilled, and only a few wells in the Baltimore Canyon area off the coasts of New Jersey, Maryland and Virginia had any indications of petroleum. A few wells tested showed that natural gas could be produced at rates that would probably be commercial onshore today, but not 100 miles offshore.

In frontier areas like the Atlantic Margin and Eastern Gulf of Mexico, big fields are commonly discovered early in the exploration cycle because industry identifies and drills the largest, most obvious features first. The fact that approximately 50 largely unsuccessful wells have been drilled in each of these areas is discouraging. The Atlantic Margin seems to be an area where any hydrocarbons that are found will be natural gas rather than crude oil, based on geochemical analysis to date. While that is not a completely negative factor, further exploration there does little to change our dependence on foreign crude oil, and we currently have abundant supplies of onshore natural gas that can be found and developed at considerably lower cost.

On the positive side, the Atlantic Margin and eastern Gulf of Mexico are huge areas where important discoveries may have eluded early exploration efforts. Neither of these regions has been evaluated using modern seismic methods that could yield a different view of its potential for producing natural gas or oil.

As someone who works in the exploration and production business, I am in favor of opening these areas and letting industry decide if they have merit. At the same time, it is important to be objective. Under the most favorable scenario, it will take many years to acquire and interpret the necessary seismic and geochemical surveys that precede drilling. If discoveries are made, appraisal drilling, economic analysis, and development planning will require more time. Infrastructure adds yet another layer of time and complexity. Evaluation of large oil and gas projects worldwide commonly takes at least six years from discovery to first production. High-risk, capital intensive oil and gas exploration cannot be expected to produce quick results.

Thanks, Art. I know I have seen and heard some comments to this effect before--basically that there had been a plan in place before for opening up the Outer Continental Shelf, and the new announcement did nothing, or actually took away a little. Also the places that are now being opened up don't appear to have outstanding prospects. With new techniques, they may yield a little more than with older techniques, but we shouldn't expect too much.

It sounds a lot like politics--an announcement that sounds good to one group of voters, and will get votes, either on new legislation, or on the next group of candidates being elected.

Business as usual, trying to drill your way out of a hole...it can't be done! Maybe a little less offshore drilling and a little more offshore wind power?

I cringe whenever I hear a politician say the the U.S. can become energy independent. The U.S. is the most mature petroleum province on the planet, and it is unlikely that giant new fields will be found offshore or onshore.

Trade is about the fact that you need something that I have, and I need something that you have. We get into trouble when we don't get along with or talk to countries that we need something from. I never hear anyone complaining about being dependent on foreign coffee.

We love to hate oil companies but also depend on them to supply our energy needs. A bit of understanding might be helpful.

We can't drill ourselves out of a hole, but it does not make sense to not try to find more domestic energy.

AEB

AEB, I agree with you, "energy independence" is one of those concepts kind of like "zero waste," it makes sense as a general principle and as a goal, but it shouldn't justify the kind of quasi-religious zealotry or unrealistic expectations and shrill demands you find in either area. It sounds from the discussion here though, like the offshore drilling that was proposed recently won't do very much at all to make a meaningful dent in imports or prices surging.

Of course, if one country is able to produce vastly more oil than it can consume, it makes perfectly good economic sense to sell some of it to the U.S., Europe, Japan, and others who are unable to supply their own demand - that is just economics 101. Same as if a European manufacturer of a wind turbine component, or trains or buses, can produce a higher quality product at a lower cost than a domestic manufacturer; it makes plenty good sense to buy from the Europeans in that case ("Buy American" rules have particularly gotten us into trouble on the bus and train front).

In any case, I certainly don't know of anyone reasonable who proposes and end to oil today, just wedges and phaseouts over time. So it would be one thing if it looked like there were actually a meaningful amount of oil there, but it seems like using seismic techniques in the eastern Gulf, for instance, will likely just reveal small pockets missed by the earlier exploratory wells, which will be expensive to develop and produce low yields, and whose development is likely to have considerable environmental impacts (like drilling in the Arctic National Wildlife Refuge, except in a possibly even more sensitive area, and for less oil). Just not enough bang (or EROI) for your buck...

I mentioned offshore wind power specifically, not because it is a wedge against oil shortages directly, of course, but as a technology that might just be a little more profitable in this region over the long term. Resolving future liquid fuel shortages will obviously be more complicated than just investing in renewable energy, but commissioning more and more wells with lower and lower EROI is not a very forward-thinking solution either.

I believe that Boone Pickens estimated that the best case scenario from completely unrestricted drilling in Alaska and the offshore Lower 48 would be one to two mbpd at least 10 years from now, but like you I agree that the areas should be opened up for drilling, if for no other reason than to get the delusional Drill Baby Drill faction to keep quiet.

BTW, I heard (last year), from a reliable industry source, that the Thunder Horse Field was having production problems--due to rapidly rising water cuts, because of high vertical permeability in the reservoir. The following story is interesting. I wonder if the well shut-down is totally related to equipment problems.

http://www.ft.com/cms/s/0/19eea8dc-435d-11df-833f-00144feab49a.html

BP to reduce Thunder Horse production

If that's true then I think the EIA just plugs in 250,000 barrels per day (or whatever) of production for Thunder Horse regardless of what it is producing.

I've added the 2009 data point below using preliminary data for the first 11 months of 2009.

GOM Fed Offshore production has jumped from 1.152 million barrels per day in 2008 to 1.523 in 2009. Production in November (latest month listed) was 1.665 million barrels per day (and on an increasing trend) just short of the record 1.693 set in June 2002.

If (and it's a big IF) BP and the EIA are telling the truth, even with the temporary shutdown of some Thunderhorse production then 2010 could be a record year for Fed Offshore GOM production (barring major hurricanes).

In February 2009, ace wrote USA Gulf of Mexico Oil Production Forecast Update which contained this forecast

Ace stated categorically that he did not believe the EIA forecasts. Well here we are just over a year later and ace looks a complete idiot (as do many others). Or else the EIA is lying. Could ace possibly comment?

1. Ace's projection covers 20 years; we've seen data for almost 1 year. Your comment reminds us of "Ready, Fire, Aim"...

2. Yes, many people here do not believe EIA projections of oil production. Why? We have a much longer track record of seeing the wide disparity between what was projected and what actually happened. As one little snippet of said evidence, you don't have to look very far.

http://www.theoildrum.com/node/5521

So where does the EIA say we should be in terms of global production right now?

Bleedin' 'eck. Have you never read any of my prior posts!! ;-)

By the way ace did explicitly state:

When according to the EIA it skyrocketed back up to almost the 2002 "peak" and might even have by now set a new monthly PEAK for GOM production surpassing the fake peak of 2002. That's worthy of discussion is it not?

And according to the EIA 2009 was actually 5.310 mbd and so far in 2010 the latest 4 week running average is 5.510 mbd (through to 2nd April).

These are huge differences (even noting the relative lack of hurricanes) and deserve comment by the author in my opinion.

What makes you think I believe the EIA?

First of all, there is something wrong with the EIA's PADD 3 number for November 2009. They give a GOM value of 1665 thousand BPD but then have to apply an "adjustment factor" of 586,000 bpd to the entirety of the PADD 3 value?

That is more than 17 million barrels.

Where did that go? (Notice the impact on the reported US production, the original number released just a couple of months ago was much higher).

Besides after years of data, in June 2009 all of a sudden the daily production numbers are multiples of 5 in the EIA dataset. That caught my eye.

Maybe some numbers are just being made up until the real data shows up?

Maybe?

Here is what MMS reports for GOMR

For 2009 and January 2010(Million BPD crude plus condensates, though tabulated and avaialble as separate values)

1/2009, 1.273

2/2009, 1.315

3/2009, 1.347

4/2009, 1.451

5/2009, 1.544

6/2009, 1.541

7/2009, 1.707

8/2009, 1.708

9/2009, 1.731

10/2009, 1.674

11/2009, 1.51

12/2009, 1.483

1/2010, 1.551

February 2010 to present is incomplete at this time.

Maybe the adjustment factor has to be included because the oil that is being reported in the most recent months for the GOM by the EIA really is not being produced.

Let's focus on these four numbers (and the decline of about 250,000 bpd from September to December):

9/2009, 1.731

10/2009, 1.674

11/2009, 1.51

12/2009, 1.483

My source told me, in early October, that Thunder Horse was having production problems due to rising water cuts. And just recently we learned that BP has shut in about half of the producing wells (supposedly because of equipment problems).

The Neptune Field is reportedly having the same trouble:

http://www.upstreamonline.com/hardcopy/news/article185261.ece

Marathon feeling heat at Neptune August, 2009

Marathon of the US has written down the value of its share of the BHP Billiton-operated Neptune field in the deep-water Gulf of Mexico in the wake of flagging production one year after coming on stream.

Edit: Can anyone pinpoint the fields that had declining production that caused the 250,000 bpd decline from 9/09 to 12/09?

That can be seen at http://tonto.eia.doe.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

And EIA US reported production continues to increase slightly through February (MER). Is it possible the EIA is consistently hallucinating badly when it comes to US oil production and actual production might be under 5 million barrels per day rather than 5.5 mb/day reported in February 2010 (PDF)? The last time production was reported to be this high was back in early 2005.

How many other countries are hallucinating oil as if that magically solves the problem?

The EIA data (until recently) has tracked remarkably closely with to the MMS GOMR data. And yes, I know that the EIA periodically revises its data from it's preliminary value to something that reflects bettter and more complete information.

In this case and compared to previously data published by the EIA, the nature of this difference just appears to be more glaring. Anyone can go look at what Thunderhorse is reporting to the MMS and, even if you take that with a grain of GOM salt, it is difficult to see where and how the two values between the EIA and MMS have diverged. This has certainly NOT been the case in the past.

Simply stated, the "adjustment" in the November value did cause the US total production to fall to less than 5.0 MMBPD for the month.

I note this huge drop in reported November production was not in the last released publication from the IEA - the IPM released on the 9th April. The IPM has 5.466 mb/day listed for November even though it is now reported as 4.938 in the production data. That's bizarre downgrading production by more than 0.5 mbd 5 months after the fact.

Is there an easy way to do this or do you have to import the text data from the OGORA file? Is there a lease number or field name code or something I need for Thunderhorse?

I think he's using those areas as leverage for the pending energy legislation. Yes, offshore oil production will be disappointing to many in the DBD crowd, but can be used as a carrot to further real progress in our energy roadmap.

At the risk of sounding like I agree with some politicians, all of the above is probably not a bad idea. Wind may be part of the solution, but it will be a small part. I get my electricity from wind so I'm in favor of it, but people need to get realistic about technologies that will take 25 years to have an impact.

I once did a calculation of how much land area it would take to replace just the natural gas used in electrical power generation. It would require an area almost the size of Texas that was completely dedicated to wind turbines. I don't think that any self-respecting environmentalist would think that was good land use. It would also cost more than $ 1 trillion.

Wind turbines have problems too. They kill birds and get a lot of insects inside them. There is no perfect solution. Everything is part of the solution.

Alternatives to oil and gas have all been thought of and tried a long time ago, and discarded in favor of what was most efficient. We need alternatives now but also need to understand that we need energy between now and whenever these new technologies are commercialized.

AEB

Don't confuse the area of a wind farm with the actual land utilization of the wind farm. Most wind farms only take up 2-5% of the actual land area itself. Farmers love wind farms, because they still work almost all of their land, but get much more money from wind 'royalties' than they do crops. The turbines are normally set up on the farmer's access roads, so very little land is actually used.

I have also heard the the Thunder Horse field is having vertical water breakthrough problems. That is very bad for BP and for U.S. energy supply.

I am not sure that Boone Pickens is someone we should rely on for good estimates of energy supply. He is a smart man but also a promoter. He brought the energy industry the extreme short-term results focus that kills balanced decision making.

I had a call from one of his associates many months ago saying that he wanted to talk to me about my views on natural gas supply. He never followed up and did not return calls or e-mails. I don't have the answer to natural gas supply but, obviously, Pickens' interest in hearing the other side (not talked about by his buddies in the speculative public companies that promote 100 years of natural gas) was quite limited and, perhaps, a bit insincere.

AEB

The number that I was given for actual crude production for Thunder Horse was that it was down to about 60,000 bpd of crude oil production in the September/October 2009 time frame, down about 75% from the reported peak (of course BP tends to report BOE). In any case, if this number is approximately accurate, I am astonished that this decline has not been publicly reported. Note that the acknowledged production decline at Neptune was about 70% from peak, as of late last year.

As I said up the thread, BP's decision to shut-in half the wells certainly looks suspicious, and if I am reading the article correctly, BP did not report the decision to shut-in half the wells (I believe that it was leaked by a former subcontractor).

I wonder if that was a "staged" leak. Nothing much to see here - just maintenance work. Will only lose 10,000 bpd over the year. etc...

for data hound sustenance, mms has posted this on georges bank and baltimore canyon areas:

http://www.gomr.mms.gov/homepg/atlantic/georges_bank.html

Last night I attended a community group meeting and attempted to engage some folks on the issue of Peak Oil. They were very polite but the immediate response was "The environmentalists are preventing us from drilling for oil. No one wants to pollute, but we need to become more energy independent."

I didn't have time to present a lengthy description of the challenges surrounding PO, but I sure could have used a concise response at that moment. Does anyone here have any suggestions? I suspect that this will come up a lot.

Peaks Happen, even in the best of circumstances, e.g., Texas & the North Sea, which were developed by private companies, using the best available technology, with virtually no restriction on drilling. These two regions accounted for about 9% of total world cumulative oil production through 2005, and Texas is down by close to 75% since peaking in 1972, and the North Sea is down by about one-third since peaking in 1999. In both cases, the initial production declines corresponded to increasing oil prices.

And then when Peaks Happen in oil exporting countries, we get to Net Export Math, e.g., the combined net oil exports from Canada, Mexico & Venezuela (CMV) fell from 5.0 mbpd in 2004 to 4.0 mbpd in 2008 (EIA) and to an estimated 3.6 mbpd in 2009 (assuming flat combined consumption).

Thanks WT - This is very useful but might go a bit wide of the mark in this case. I think I know where these folks are coming from: It's "There's all this oil just SITTING out there, and if THEY would just let us, we could go and get it." Rather akin to the "Drill baby, drill" argument. What's the snappy but polite repartee to that?

Ask them if it is their contention that we can have an infinite rate of increase in our consumption of a finite fossil fuel resource base, and incidentally the fossil fuel resource base consists of the sum of the output of discrete regions like Texas & the North Sea.

The 1972 Texas peak (blue) lined up with the 1999 North Sea peak (black):

Interesting little dogleg the last few years, courtesy of EOR in the Permian they say. That would be the EOR wedge from the Hirsch Report, a way to make declines more gentle. In all likelihood widespread application of this (renewed drilling of old plays, I'm not sure if "infill drilling" is the correct term for what they're doing) would be much more productive for the US energy balance than poking around in the Atlantic OCS.

For snappy but polite repartee, you could try "Why not just produce more oil out of the wells we already have?"

I recall seeing on television, during the past Presidential election, a rally at which thousands of people were pumping their fists in the air while chanting, "Drill Baby Drill! Drill Baby Drill!"

I try to imagine what I would say if someone handed me the microphone at that point...

"Where, where, where, would you like us to drill, drill, drill?"

Answer from the crowd: "In America! Land of the free, free, free!"

Me: "We drilled already, but we used most of it up! Don't you think that if the oil companies knew where any new oil was we'd be drilling it already?"

Crowd: "Drill Baby, Drill! Drill Baby, Drill!"

Hard to counter an emotional chant like that with reason, facts and figures. I imagine it just feels good to chant and think that will bring about a solution.

Hmm, how about Steve Martin's little speech in The Simpsons episode "Trash of the Titans":

"You know, I'm not much on speeches, but it's so gratifying to... leave you wallowing in the mess you've made. You're screwed, thank you, bye."

LOL!

I think drilling should be allowed, but not to have a significant impact on peak oil production or price. Rather it enables people to produce wealth in this country that displaces what would otherwise be imported.

Who will pay for (fruitless) 'Drill, Baby, Drill'?

That's your witty repartee! "Who will pay, baby, pay?"

Most people are clueless when it comes to our total and overall oil consumption. They only see (and feel the cost) of what they put into their tank(s). Even among fairly astute environmental types, the "hidden in plain-sight" (or is that, by reversing two letters, hidden in "Palin-sight") nature of the numbers, the disconnect between what we use, what we produce domestically and what it would take in terms of discovery to become "even more energy independent" (whatever that means) seems elusive.

In simple terms, I give then the average daily consumption (now back over 19 million bpd, what we produce (~5.3 million bpd plus ~2.1 million bpd is natural gas liquids) and then the total amount we have to import.

Then I point out that the maximum monthly average ever produced in the US occurred in November of 1970 (~10.1 million bpd) and the amount of imports exceeds that by a significant amount.

"All we have to do is find somewhere between 3 and 5 times all the oil we have ever found in the last 150 years in this country. Since all the "easy oil" has been found and pumped, this is now all the difficult and expensive oil that is left. All you have to do is sign on and be willing to pay, sight unseen, $5-20/gallon for the gasoline and the oil products from this oil."

"Are you willing to sign a binding agreement committing you, your children, and possibly your grandchildren to that?"

You can guess what the answer is.

Yeah! *YOU'RE LYING AND YOU ARE UNPATRIOTIC AND YOU'RE NUTS*! ;-)

hi FMaygar,,

I must say that I basically agree with every comment posted above this one up until the time I post this, in broad outline at least, including yours.

I simply want to point out that the usual Washingtoin level of political hypocrisy is running a little above normal, and the enviro /left is doing it's very best as usual to milk the Obama proposals for all they are worth. The administration has cynically grabbed the middle ground in such a fashion that the great American electorate is now convinced that administration is centrist in this respect , where as the so called new drilling plan is actually a defacto poison pill for the right wing of American politics.When nothing or very little is found that can be produced,as the odds strongly indicate, this will be trotted out aas evidence that there is nothing to be produced.

The media for the most part a few years down the road will simply never even mention the fact that ALL THE BEST PROSPECTS WERE KEPT OFF LIMITS, AND ALL THE WORST ONES OPENED UP.

Keep in mind that the average American gets his news and commentary in sound bite fashion.

I have already read many short pieces in the three papers I follow regularly, and lots more on the net posted by various news sites.

None of the short ones more than obliquely mention the facts in respects to the reversed cherry picking of the sites opened.

no siree!

Obama is one very capable politician, with a very capable staff.

If something is found, he and his administration are heros;if nothing is found , he has not pxxxed off his base (on the shaky California side especially) any more than absolutely necessary to put on the appearance of doing something.

Of course the whole story is out there in the MSM, but only if you read the long pieces in the better publications.

The denizens of such forums as this one will have the facts; and the folks who tune into Rush limbaugh and glen Beck will have the facts.The readers of the National Review will have the facts-because these forums will and have given these particular facts serious up front coverage.

But Joe and Susie won't have a clue.

And we all wonder why we are so incapable of forming a consensus and getting things done!

I dunno, are there any good prospects in the offshore areas that are still closed off?

Is there anyone who should know a good prospect lobbying for particular regions to be opened?

If so, which ones?

Not my area of specialty r4 but offshore CA certainly has significant potential. BUT....see my reply to george

Thanks, that was pretty much what I was looking for.

Perhaps some of those fields are accessible enough to tap into further down the line.

Hi OFM,

I think that observation pretty much nails it! It is a well calculated political strategy designed to inflict serious damage on the right wing's momentum and I think to some extent it has succeeded.

I have come to deduce from your posts that you consider yourself an old school rational conservative and have little philosophically in common with those who currently pretend to be "Conservative", we all know who they are. While I would probably characterize myself as an independent liberal, I feel that I have more in common with people like yourself than with the poseurs on either the right or the left wing of the two major political parties. I get the feeling that I am far from being the exception.

Think about that for a moment and let it sink in...

Agreed entirely. Twenty years ago in Canada the Conservative party was called the "Progressive Conservative" party, and I was a firm supporter, on the progressive side. (Interestingly, having almost no relationship to the Progressive party of Canada, whose support was entirely sent to the Liberal or NDP federal parties, eg Wikipedia - Progressive Party of Canada

"Some radical Progressives, who were followers of Henry Wise Wood of the UFA, supported a very different strategy[citation needed]. They wished to remain a decentralized party with each member simply representing his constituents."

At the provincial level here in Ontario, the Progressive Conservatives from the 1950's to the 1980's a) built large new consolidated highschools with every sort of facility imaginable, available to every student in the province. b) constructed a large number of community colleges. c) radically upgraded apprenticeship training. d) constructed twenty new nuclear reactors which still provide the baseload >50% of electricity. e) balanced the books. f) did a lot of infrastructure upgrades, eg. TO subway, GO G(overnment of) O(ntario) commuter train system g) stayed in power provincially for over 40 years (Frost and Davis governments)

More recently, the "Conservatives" (I call them neo-Cons) of Harris pretty much sole accomplishment was to privatize the electrical system in a really haphazard fashion which (I think) provides all the net gains of the taxpayer's 100 yrs of investment to the private sector, leaving the taxpayer holding all the debt. Dumb, dumb, dumb.

Smart, actually. The basic idea of "Conservatives" is to help a small elite enjoy the natural resources disproportionately.

Actually, no.

That is not the response.

?

I would point out to them that to my knowledge, the most successful east coast oil platform to date, the Hibernia platform off NewFoundland, Hibernia monthly production 2008 only produces about 135,000 bbl / day, has cost a huge amount of money, is in very shallow water (450 to 500 ft), it is the only oil producer on the Cdn east coast, and the remaining offshore east coast of Canada has been fairly well explored with only Natural Gas being found further south.

It would need 150 such platforms to supply US daily oil consumption if the oil could be found, and likely 7 or 8 new ones per year to compensate for depletion. At present rates of production, 1.2 billion bbl will be produced over a 24 year lifespan, half of which is already done. That's IF they can extract 100% of OIP!

Japan had a plan for becoming more energy independent back in 1941. It was called "Pearl Harbor."

The US plan to fuel economic growth through the next decade was the Iraq war. So far, it hasn't worked much better.

George -- I doubt this will help much but tell them you chatted with a petroleum geologist who has been drilling in Texas and La. for oil/NG for the 35 years. And not once in that time has an environmental issue prevented me from drilling a well. Not once with over 100 wells to my credit. Nor have I seen any other geologist not get a well drilled out of thousands for similar reasons. There certainly are areas that have been off limits for environmental/political reasons like offshore CA. And there certainly are commercial fields out there that could be developed if the Feds opened it up. Thus the question isn’t whether there are areas that could be drilled if all environmental/political issues were ignored. The question is whether it would make any significant difference with respect to PO. IMHO the answer is no. And this is from a guy who feels drilling where ever and when ever in responsible stewardship is a good thing for our country. A very good thing with minimal risks or downside. Thus I could be a the poster child for “Drill, baby, drill”. It’s how I make my living. But to offer such an effort as a way to avoid PO is, at best, horrible misguided and, a worse, a travesty.

Rockman, that's true. If the companies thought there was a major oil field out there which they could not exploit because of environmental laws, they would have already have taken steps to have the laws changed. Money talks in politics.

The areas that are off-limits to oil exploration are still off-limits because the oil companies don't think there's anything important there. They've already done preliminary work on them, and they don't look that good, so they don't care.

People who think there are good prospects which have not been drilled because of environmental rules are naive. There are probably minor oil deposits in areas protected from oil company activity, but nothing major. Nothing that will help the goal of American energy self-sufficiency, or put off Peak Oil for more than a week.

Thank you Rockman.

You're welcome George. And if it helps you can tell them I'm one of the smartest petgeologist around. You can just ask westexas to confirm.

What are the odds of several new Hibernia oilfields? 1.2 billion bbl oil in place, 135,000 bbl/day, 200 miles off NewFoundland, Canada? I do realize that all other east coast offshore Canada fields have been gas wells only ....

Approximately zero. You have to realize the oil companies have shot seismic all over the offshore east coast area, and will have identified the largest structures. They've already drilled into the most likely prospects to evaluate them. If there's anything undrilled, it's much smaller than Hibernia.

No, that's not true. In addition to Hiberia, there's Terra Nova (400 Mbbl) and White Rose (230 Mbbl), considerably smaller fields which are already on production, and Ben Nevis (400 to 700 Mbbl), a heavy oil field which was discovered in 1981 and will go on production around 2017. But after that, there's diddly squat. Any thing else must be minuscule in size or it would have already been found.

It's true that there's a lot of gas out there, and in fact Hibernia contains more gas than oil, but there's more than enough cheaper onshore gas to satisfy demand in the immediate future.

The Department of the Interior/BLM says US has 25 Gb of proven reserves, 43 Gb of reserve growth and 46 Gb of undiscovered resource, total 113 Gb.

Of that 4.7 Gb is in the Eastern half of the US and 1.3 Gb is in Alaska.

http://www.blm.gov/pgdata/etc/medialib/blm/wo/MINERALS__REALTY__AND_RESO...

For the GOP, this is just drilling for the votes of the yahoos.

For Obama, it's 'give the baby his bottle'.

"...where reserves are estimated to be 2.7 trillion cubic feet of gas (equal to about 1.5 months of US natural gas consumption)."

I didn't realise the large volume of NG consumed over there, approaching 2Tpm (must be all those "other" trillions bandied about these days). Strewth! In Australia, I hear a lot of chat about the huge reserves that may eventually be a kind of life line. I'm suddenly doubtful.

We're back to around 85mbpd of liquid fuels, but is there a figure for daily global consumption of gas? (natural and otherwise).

Regards, Matt Blain, Average Joe

And STILL a concerned dad of three great kids

Yep, courtesy of Jonathan's Energy Export Data Browser

Thanks for that! Again, I can't believe the numbers!

The 2009 EIA NG outlook. US site, so Tfc

http://www.eia.doe.gov/oiaf/ieo/nat_gas.html

There's an easy LNG calculator at http://www.lngpedia.com/lng-calculator/ (Energy Conversion tab)

Australia's huge LNG potential may mitigate PO for us (Australia). But looking at the world-wide picture there's still issues like:

-How much money and how long on to convert to LNG?

-How much LNG can actualy be produced? I note there seems to be little discussion on TOD regarding this (although Rockman posted when I asked previously). I recall one of the PO Doomers wrote a book a while back stating we where about to run out of NG, obviously hasn't done the PO debate any favors (the US is largely self-sufficent in NG). Maybe a difficult issue at the moment given the recent increase in unconvential NG production.

-And what do we do after NG anyway? (it's only a transitional fuel after all - are we going to be back asking the same questions on a "The LNG Bottle" site in 20 or 30 years?)

Thanks for the links, metal.

Just to be clear for next time I'm in discussion with my father-in-law (ex environmental scientist to Shell Australia, 40yrs), speaking in general terms...

Global reserves of around 6000 trillion cubic feet; world burns 100 trillion cubic feet or so each year (I'm a peak-growth kind of guy); that's about sixty years tops.

Near enough?

Regards, Matt from Melbourne

I get that it will vary all over the shop, transportation difficulties, hoarding and all that; just speaking generally. Cheers.

Well yes, the plus side being global reserves may be affected by unconventional reserves

But the problem is that the burn rate is going to have to increase dramatically as LNG replaces liquid fossil fuel in importing countries.

(love to see a TOD article discussing this, and get some expert opinion ... )

.. And regards from Melbourne too

I understand the gas to liquid probability (perhaps coal to liquid also). Damn, I thought I might be feeling a bit better about things after 30 months visiting here. Damn.

Any likelihood of a TOD get-together in Melbourne some time, so we can all bitch and grumble in person? I'm sure there's more than two of us in this city worried about the long term future.

Cheers.

The report you point to is for onshore resources under federal lands. Unsurprisingly, the vast majority of the resources are in the western continental states and Alaska -- that's where the vast majority of federal lands are. This skews the results. For example, much of the shale gas that exists in the West shows up in such a census; but almost none of the shale gas in Pennsylvania and New York does. Also unsurprisingly, that large federal ownership -- from 30-85% for Alaska and the 11 western continental states -- has been an ongoing source of irritation in those states for over a century.

See pg 110 Table 2.8, 113 Gb is for all US offshore oil.

http://www.blm.gov/pgdata/etc/medialib/blm/wo/MINERALS__REALTY__AND_RESO...

The idea we can allow offshore drilling shut up the drill baby drill idiots is Wrong. Also, why allow offshore drilling in the most environmentally sensitive part of the US continental shelf, which is home to dozens of endangered species including coral a, manatees and sea turtles? With the hurricanes Florida is the worse place for it. It would be better to open some place less sensitive such as the pacific. Offshore oil drilling is actually a dangerous and deadly delusion as all it will do is suck scarce resources away from permanent solutions to the energy problem and the costs of this could be very high for human health and welfare. Each of these rigs cost hundreds of millions, every dollar of that is money that could have been better spent on conservation measures, bike and pedestrian friendly upgrades to cities, near work affordable housing, public transit and wind and solar installations that provide real, permenant solutions. These rigs are also not safe, the offshore australian spill is a prime example of that, which has poisoned fisherman as a result of contaminated seafood as far away as Indonesian. If you believe offshore drilling is safe, i have a deal on the brooklyn bridge you might be interested in. The rigs have so many points of failure, miles of pipe and so on, chances are will be some sort of failure at some point. Catastrophic spills happen, but not every day, but when they do there is a devastating price to pay, and I place the health of the environment as a higher value than just a few more years of a dirty, messy energy source. You also have the day to day leaks, the drilling fluids, the produced water, smaller spills and leaks, etc.

We should not allow lies to trump the truth of this matter. The joe sixpacks and palin types need to be whacked over the head and put in a place where their idiocy can no longer dominate energy policy. The idea of offshore drilling feeds a dangerous delusion that we can solve the energy problems with "drill baby drill", and the environmental consequences of this are severe, from polluted contaminated seas and seafood and damaged coastal systems and so on. We need to make structural changes to society, moving from a consumption based model where jobs are tied to consumption to one based on conservation and meeting human needs, even if it means throwing away the market-based laissez faire ideologies. We need to throw out market based valuation of housing and instead place people near where they work to save energy. We need to make sure that people can survive without trying to sell massively wasteful products and services that are not needed. People can use clotheslines more and we need to encourage more gardening activity. We need to end subsidising car travel and massively expensive road projects when this money should be spent on things like public transportation using electrically powered trains for instance. Even a bus can get 100 mpg. Much of Obamas recovery act was frittered away on road projects that will be useless when gas hits $10 per gallon. All of it should have been spent on non fossil fuel conversion efforts. Just a few miles from me there is a $200 million dollar freeway project. Its too bad that by the time its done gas could be too high priced for many to use it. We have a society that is stuck in a behaviour pattern it cannot break out of, weve only had this paradigm for 100 years but people act as though it is their god-given right to fill up their gas guzzler SUV and drive 40 miles round trip from their McMansion with a pesticide drenched yard and screen boxed swim pool in a distant suburb sitting on top of a mowed down rainforest. We need tougher regulation on oil companies and maybe a tax on gas and oil as an energy source to drive energy investments away from oil and towards renewables and conservation, perhaps requiring oil company profits to be invested in renewables and conservation. We need to begin implementation of renewables and restructure to live within the limits of these technologies.

I don't have any hard numbers, but I suspect that the amount of environmental damage from transporting mostly imported oil (because of oil spills) vastly exceeds the environmental damage from drilling in US waters.

In any case, if I could dictate policy, I would abolish the highly regressive Payroll (Social Security & Medicare) Tax and replace it with a tax on all forms of energy consumption, at the retail level, with the tax proceeds used to fund Social Security & Medicare, with some allocation for electrified rail projects. Regarding energy consumption, this is basically a carrot and stick approach. Reduce your energy consumption and you will probably see a tax cut. Maintain or increase your energy consumption and you will probably see a tax increase. And since this is a consumption tax, it would have the side benefit of taxing a good deal of the underground economy.

That sounds like Oil company rhetoric to me. The offshore drilling is something that is not needed at all, so it basically adds risks. We know it will not decrease gas prices. So it doesnt matter really how it compares to tankers, its still an unnecessary risk. As well, there are great risks from rigs, that they are less or more than tankers does not change that. I also think the whole idea is doubtful that the rigs are safer. Just last year there was a massive spill of Australia.

One spill could poison or fish and ruin our beaches. When instead we could use the millions of dollars instead of on oil spilling rigs that solve nothing, we could instead spend it on clean wind generators that will keep generating energy basically forever. This would also create jobs maintaining the wind generators, in fact more permenant jobs, than oil drilling would. So the calculus for oil drilling does not add up, no benefits for gas prices, quickly depleted, risks of toxic pollution, pulls money away from clean source depletion, will perhaps ruin the environment for thousands of years to come for 2 years worth of oil, etc.

I say we forget the offshore drilling and implement a gas tax to pay for renewable energy deployments such as and offshore wind generators instead.

As for the medicare and so on. Ive always thought that all of these taxes should be progressive income taxes based on a bracketed schedule. All of your taxes come from income, lets be honest, its just a question of how the rate is set. It is fairest to make it ability to pay and progressive with brackets, obviously you dont want to hit people who make $20,000 with the same rate as those who make $100 million.

As presently structured, the Social Security tax is capped (I believe at about $107K for 2009), and is largely paid by lower and middle class taxpayers (and it is levied on the first dollar of income, unlike the income tax). The great tax scam of recent decades has been the huge increase in the highly regressive Payroll Tax, with the excess revenue put in in the mythical trust fund, and which was of course used for general purposes, allowing the income tax rates to be cut.

The Congressional Budget Office calculates that over a full lifetime, the Social Security system is mildly progressive. Lifetime low-income earners get a much larger pension relative to their contributions than high-income earners. Certainly the tax is regressive, but the benefits are sufficiently progressive to more than offset that. Anecdotally, comparing my and my wife's most recent statements from the SSA show that her total taxed earnings are less than a third of mine, but her benefit will be about two-thirds.

If the working- and middle-classes let the rich renege on the obligation to repay the Social Security trust fund out of general fund revenues, it's our own damned fault -- we control the vast majority of the votes. But it's certainly possible; as Paul Krugman puts it, "80% of voters are better off under Democratic economic policy than under Republican policy; how do the Republicans get so many to vote against their own economic self-interest?"

Exactly, exactly, exactly. That needs to be repeated again and again everywhere. Proof is easy. Short-term, long-term, historically, in proposed future, any way you want to looks at it.

Ponzicare and Ponzicurity would have worked if the population continued growing at a geometric rate with full employment. This cannot happen though, they are doomed to failure. Krugman is just another Keynesian economist.

As economist go I think Keynes has proven over and over again to be the best of the lot.

To fix that quote... "As economists go, I think Keynes has been proven wrong over and over again and has proven to be the worst of the lot."

The Keynesian theory of increasing government spending during hard times is the very heart of what is wrong with the finances of so many countries. Governments can not "stimulate" the economy through spending, as they first either have to "confiscate" the revenues of their citizens in order to pay for that spending, or, go deeper into debt to try to make up for the pullbacks of the private sector.

Great Keynesisan ideas include: "In 1999, Time magazine included Keynes in their list of the 100 most important and influential people of the 20th century, commenting that; "His radical idea that governments should spend money they don't have may have saved capitalism". (quote from Wikipedia)

My personal favorite Keynesian idea however is "John Maynard Keynes argued that it may make economic sense to build totally useless pyramids in order to stimulate the economy" (quoted from Wikipedia)

The flip side of Keynes is that during good times, the government is supposedly supposed to cut back on spending to flatten the inevitable peak. This government spending cutback never occurs however, and what we are left with is continually rising deficits and national debts.

If you like the huge national debt of your country (Almost 13 trillion in the US now), then you can thank Keynes for it, because its under the influence of his disproven and harmful theory that it was created. Keynes is the Sigmund Freud of Economics... his ideas should be an embarrassment to all economists (you too Kruegman) If you are interested in real Economics and economists, you might check out the Austrian school economists. Henry Hazlitt, who wrote "Economics in One Lesson", in which he singlehanded destroys Keynesian ideas would be a much better economic compass and a good place to start... but I'll leave it up to you to decide between the two...

"The long run is a misleading guide to current affairs. In the long run, we are all dead." John Maynard Keynes

OR

"But the tragedy is that, on the contrary, we are already suffering the long-run consequences of the policies of the remote or recent past. Today is already the tomorrow which the bad economist yesterday urged us to ignore." Henry Hazlitt

Well, I'm not an economist as such and know little of Keynes per se, but this guy makes a lot of sense to me and I believe his school of thinking is "post-Keynesian": A simple business card economy (Bill Mitchell)

Please show me the errors in his thinking -- I have failed to find them.

Another guy who makes a lot of sense to me is Richard Koo, see for instance this interview:

The Austrian viewpoint that you recommend, however, does not make sense to me. One reason it doesn't is their insistence that governments are bad, unions are bad, etc. Well I have news for you: People band together. Whether it be tribe, polis, nation, sect, union, commune, company, team or what have you, most people find they are stronger in a band than they are on their own. So the Austrian/libertarian vision of the lone entrepreneur as the backbone of society is, while emotionally compelling, completely useless as an assumption in an economical theory.

(edit: oops, OT. sorry)

...cult, organized crime, mob, gang, militia, terrorist organization, ah yes, all people banding together and finding they are stronger in a band then they are on their own.

The Austrian school of Economics does not argue that governments are bad... merely that excessive and especially unneeded government SPENDING is bad, because the money spent by the government first has to be taken from its citizens through taxation, and since the programs cost money to operate, in the end, less goods and services are created by that money.

Note my earlier Keynesian quote... Keynes argued that WASTEFUL government spending "building totally useless pyrimids" was a POSITIVE thing, as it would "stimulate the economy." In other words, the more useless the government project, the more Keynes would like it, as it would "create the most jobs". Over and over again, Keynes falls for the fallacy of the broken window. He forgets that the government has to take in the money it spends from taxes, and if that money hadn't been taken from the taxpayer, that taxpayer would have spent it in some other way to stimulate the economy.

In terms of Unions, the Austrian school is merely against "Make work" or "Spread the work" schemes. Over the years, and especially early on, unions contributed greatly to improving safety in many occupations. Where the Austrian school disagrees with unions, is when a union argues that 3 specialists are required to do a job that really only requires 1 generalist. "Sorry, its against Union rules for you to clean up that spill on the floor, union rules certify that only a maintanace specialist is allowed to conduct cleaning operations." Or union "Job banking" where union members get paid almost their entire salary to sit in a room and do nothing when there isn't work for them.

The Austrian school idolizes small government, low taxes, balnaced budgets (sorry Republicans... low taxes with increasing government debt and increasing spending is only for Keynesians/hypocrites/neo-conservatives) and low inflation. In other words, the Austrian school believes in responsible Government finances. I'm missing the bad part about not-overspending, paying off your debts, not forcing the next generation to pay for the government spending of this generation, etc.

Um. I have not read Keynes, and neither have you. Your quotes are interpretations of Keynes from Wikipedia. Now I expect Wikipedia to be reasonably accurate on matters of fact that are not politically or otherwise contentious; on contentious matters it's often quite horrible. A recent example I stumbled across: go check out the english article on Heinz Guderian, and compare it with the german article on same (run it through google translate if you don't read german).

But I have read some of the work of somebody who sort of took over where Keynes left off; I take this as representative of modern "Keynesian" thinking, rather than your (rather silly) strawman.

The point of this "proper Keynesian" pow is: if there are unutilized resources in the economy, such as unemployed people who are unemployed through no fault of their own, then the government can pay them to do Whatever (W).

Now of course the more valuable W is, the better; but here's the point: Even if the value of W is zero, the economy will be better off. GDP will increase. The govt. employed people will increase their consumption, which will strengthen the non-govt sector. Etc.

Not in a fiat money system, as Bill Mitchells business-card-economy example makes abundantly clear. I challenged you to find the errors in it; you have not even glanced at it. Taxes are what gives a fiat currency its initial value; the issuer does not need taxes as a source of revenue.

Money doesn't create goods and services; they're created by application of capital, work and physical resources. Money is an instrument for directing that application. And sometimes, as when the economy is stuck in a Kooian balance-sheet recession, private-sector money does that job rather poorly. Because of dysfunctional money flows, real assets get stranded.

Unemployed people that are unemployed through no fault of their own are real assets that have gotten stranded. They are NOT liabilities! Though they may turn into liabilites if left stranded.

For a government running a fiat money system, money is in principle free. So it costs the government -- and by extension the taxpayers -- nothing to put those stranded assets into productive work again.

And no, it will not be inflationary, not so long as the spending is directed toward freeing up stranded assets.

That's nonsense. Austrian and Chicago school economics are entirely discredited. The greatest accomplishment of the Chicago School economists and the "Chicago boys" they trained in Chile was to test the theory that colonies can be disciplined into line by severe application of Austrian school economics mixed with a health dose of illegal terrorism. See Chile and their support (and more) of the brutal dictator Pinochet to replace the populist social democracy which preceded him, with its subsequent death squads, elimination of any land reforms, education reforms, etc. etc. etc. Of course Chile and the criminal Pinochet is merely one extreme example of USA's "assistance" to many many governments throughout central and south america. Chicago / Austrian schools are completely discredited for their direct and explicit assistance in the Pinochet project. Read an accurate history. Try Valdez

Pinochets Economists - Authoritarians Without a Project

"Valdés, who is deeply critical of the Chicago School for its lack of social content and its influence in Chilean public life, has written an important history of an elite group of economists and their allies among Chile's conservative business elite." American Historical Review

Pinochet's politics and abuses of power have nothing to do with its Economic policies. I do not and have not advocated for military dictatorship, as the idea repulses me. Since you choose to focus on the economics of Chile however, I will accept your choice.

From Wikipedia: "When Allende took office in November 1970, his UP government faced a stagnant economy weakened by inflation, which hit a rate of 35 percent in 1970. Between 1967 and 1970, real GDP per capita had grown only 1.2 percent per annum, a rate significantly below the Latin American average"

"During 1972 the macroeconomic problems continued to mount. Inflation surpassed 200 percent, and the fiscal deficit surpassed 13 percent of GDP. Domestic credit to the public sector grew at almost 300 percent, and international reserves dipped below US$77 million. Real wages fell 25 percent in 1972[1]

"The underground economy grew as more and more activities moved out of the official economy. As a result, more and more sources of tax revenues disappeared. A vicious cycle began: repressed inflation encouraged the informal economy, thus reducing tax revenues and leading to higher deficits and even higher inflation. In 1972 two stabilization programs were implemented, both unsuccessfully."

"During the first quarter of 1973, Chile's economic problems became extremely serious. Inflation reached an annual rate of more than 120 percent, industrial output declined by almost 6 percent, and foreign-exchange reserves held by the Central Bank were barely above US$40 million. The black market by then covered a widening range of transactions in foreign exchange. The fiscal deficit continued to climb as a result of spiraling expenditures and of rapidly disappearing sources of taxation. For that year, the fiscal deficit ended up exceeding 23% of GDP"

"The depth of the economic crisis seriously affected the middle class, and relations between the UP government and the political opposition became increasingly confrontational. On September 11, 1973, the UP regime came to a sudden and shocking end with a violent military coup and President Allende's suicide.

"When the military took over, the country was divided politically, and the economy was a shambles. Inflation was galloping, and relative price distortions, stemming mainly from massive price controls, were endemic. In addition, black-market activities were rampant, real wages had dropped drastically, the economic prospects of the middle class had darkened, the external sector was facing a serious crisis, production and investment were falling steeply, and government finances were completely out of hand."

"After the military took over the government in September 1973, there was a year and a half of benign neglect of the economy as the regime consolidated its power. When in April 1975, the so called "Chicago Boys" took control of economic policy, a period of dramatic economic changes began. Chile was transformed gradually from an economy isolated from the rest of the world, with strong government intervention, into a liberalized, world integrated economy, where market forces were left free to guide most of the economy's decisions. This period was characterized by several important economic achievements, bolstered by increased support from the US administration: inflation was reduced greatly, the government deficit was virtually eliminated, the economy went through a dramatic liberalization of its foreign sector, and a strong market system was established."

"On March 11, 1990, General Pinochet handed the presidency of Chile to Patricio Aylwin. When Aylwin's Coalition of Parties for Democracy (Concertación de Partidos por la Democracia--CPD) government took over, Chile had the best performing economy in Latin America" (end wikipedia quotes)

So in other words, Chile went from a backwater with inflation over 100% per year, to one of the strongest and most stable economys in South America (and in reality, in the world) and this disproves Chicago/Austrian economics. Heck, if we look at their total debt to GDP ratio as of 2009, I'd trade it for the US's debt to GDP in a heartbeat.

Public debt of Chile: 9% of GDP (2009 est)

Public debt of US: 56.6% of GDP (end first Q 2010)

I fail to see how your choice of example discredits the Austrian/Chicago school of Economics. In fact, I think that the fact that these accomplishments happened IN SPITE OF a brutal military dictatorship is evidence of how good the Austrian school is. It shouild be noted that Pinochet is gone and Chile today is a strong democracy.

See also: The Miracle of Chile

http://en.wikipedia.org/wiki/Miracle_of_Chile

Part (and sure, it's only part) of the answer is that one major economic class willfully ignored when indulging in such rhetoric is the would-be affluent (call them wishful thinkers if you like but name-calling will more likely reinforce the behavior than alter it.) For example, college students tend to show up statistically as low earners, but few expect or desire to live their whole lives that way (hence, as I've said before, the large number of bicycles abandoned - with a cheaper one ceremonially pounded to bits now and then to emphasize the point - at the end of each semester in the area where I live.) Many people working starter jobs, or what they currently think are their starter jobs, will feel much the same way.

It is only half capped, up to the limit the employee pays it (somewhere around 6%), and the employer pays the same amount. After the limit the employer still has to pay. So the inflation in the cost of employing someone still continues, and that has got to affect how much he is willing to pay.

I'm still agreed about the regressive nature of payroll taxes. Its just that I think we need honesty and accuracy in our pronoucements. Of course if given the decsion making power, I'd do something similar to WT tax wise.......

This is not accurate. Both employee and employer pay their share up to the wage base cap (see IRS Publication 15). Medicaid taxes are paid by both employee and employer on all earned income, with some small exceptions.

For purposes of its various calculations, the Congressional Budget Office treats the employer's share as a tax on employees, under the assumption that the effect of the employer's share is to lower the gross wages that the employee would otherwise earn.

In the northwest Pueget Sound area, the worst environmental problem we have is because of all the oil run off from cars.

I would go for that, if *ALL* forms of energy consumption could be measured and included in the overall consumption amount. Humans vary more than one would think in how they go about accomplishing goals. For me, I could cut my air conditioning use completely, but it would be more difficult to cut my gasoline consumption. With an incentive, though, I might move to a much smaller vehicle than I own now. Etc. If we have flexibility, we feel more of a sense of control.

WT, I will second your tax plan (and if I lived in the US, I'd vote for you on that too).

The current system essentially taxes labour, and not energy, so companies have moved to replace labour with energy wherever possible.

To reverse this situation would be a great improvement. Not only does a consumption tax pick up the cash economy, it is, to all intents and purposes, unavoidable - unlike income tax, there are (or should be) no loopholes or exemptions.

We have such a tax in Canada, as do many other countries, it's just that the level is too low (5%). In British Columbia we also have a carbon tax, but at $30/ton CO2, works out t all of $0.30/gal gasoline, not enough to make a difference..

A key element with a carbon/energy tax, is to tax it on the energy content of imported goods, as explained by Jeff Rubin in his book. This is harder to do, but quite important, as otherwise there is a big tax loophole, and a disadvantage for local mfrs.

But, none of this will come to pass, anytime soon, as it seems the priority is to keep gasoline prices down, anytime that there will be an election in the next four years or so.

My inner-Adolf agrees with your objections--these offshore lower 48 areas that are opening up are all extremely hurricane prone, however this is a democracy and that system is fundamentally based on compromises.

In this case, the Paloon talking points are laughably wrong and very few if any wells will be drilled(as it costs a lot of real money to do so).

Somebody asked Boone Pickens about drilling off Virginia and he asked where the onshore Virginia oil fields were. I gather he was thinking 'geologically' rather than politically.

Well why not open up some areas which are less environmentally and hurricane sensitive, such as the Pacific Northwest and New England instead of an especially sensitive area like Florida (environmentally and economically). Florida has the most endangered species anywhere in the US, The manatee, plus the only coral reefs in the lower 48. Its a terrible place for it, the worst and most dangerous place, due to the Hurricanes. Why not play the compromise game with a less sensitive area such as New England or the Pacific? if it should go anywhere its on the pacific coasts.

You wouldn't happen to live in Florida would you?

Oil and Gas Resources for the state of Washington.

I do! And I happen to love *MY* reefs, I visit them regularly!

I also happen to have worked on oil rigs as a commercial diver. I have even seen a few spills.

I'm reasonably confident that the oil companies have learned a lot about not causing too many of them at this point.

However as you yourself mentioned up thread the typical run off from our storm drains contains every thing from oil to toxic pesticides, herbicides fertilizer etc... all of which probably have more of an impact on our marine ecosystem than will ever be caused by any offshore drilling.

If you don't want any damage to the reefs then lets start by changing our lifestyles and by cleaning up our streets and yards and beaches. Then we will need less oil as well...

Cheers!

And the reason you think Pacific Northwest is less environmentally sensitive is ?

You've obviously never lived on the West Coast. First off, the majority of people who live in Washington, Oregon and California do not want Oil drilling off the coasts. Why would Obama want to go against the wishes of the majority of people in states that actually support him? To my knowledge, all 3 West Coast states specifically prohibit offshore oil drilling in state law. Any politician who proposed such drilling would likely be handed their walking papers very quickly, this isn't Texas or Lousiania in terms of politics. There just aren't any votes to gain with such a policy, even the Republicans wouldn't touch it.

Also, although you mention the fact that the Pacific NW does not experience Hurricanes, you missed the alternate fact that the west coast does get earthquakes. Earthquakes have an unfortunate tendancy to break pipelines, which can result in huge leaks, potential explosions and uncontrolled fires. I have no personal idea what an earthquake might do to an offshore oil platform, but there certain is at least the potential for a lot of bad things to happen on one.

If Obama opens the Pacific coast to anything, it should be to large offshore wind development. There would still be a big fight over the decision, but one with a much more likely chance of energy development prevailing over potential political sentiment. Drill, Baby, Drill is a nonstater on the west coast, but Wind, Baby, Wind! is a chant that might actually get some traction.

You make valid points about earthquakes & hurricanes. The truth is that there have never been any oil spills in the Gulf of Mexico because of hurricanes and, while concerns are valid, it should not be assumed that earthquakes would result in environmental problems offshore West Coast. There are a million reasons not to do things, and consequences of this.

The oil and gas industry does a very bad job of communicating its risk and contributions. If there were shortages of petroleum, people would be very upset.

The truth is that the oil and gas companies in the U.S. have an excellent record on the environment. It is mostly shoddy, foreign crews of oil tankers who have the bad record.

I am not an apologist for the oil and gas business, but fair is fair.

AEB

Curious, here is a chart of a good chunk of the waters south of Alaska. As you can see as you get farther southwest the Aleutian Trench at 18,000 ft (3000 fathoms) isn't very far off shore, and the Gulf of Alaska is a heck of a lot stormier place than the Gulf of Mexico. Do you really think the oil companies are very interested in the waters south of Alaska at this time? Bristol Bay of course is shallow and full of fish from time to time so it is more of an environmental football. Right now the Pebble Mine play, right in headwater heart of the world's last large wild salmon fishery, is putting as much pressure on Bristol Bay as it can take. So declaring the Beaufort, the only place there really is a current oil play, open and everything else closed would hardly be a dumb way to go in the Alaskan waters. But are the waters north of the Alaska Penninsula and the Aleutians closed? How about west of the Seward Penninsula? Bristol Bay only covers a fairly small part of the waters to west of the state. Remember Alaska has more coastline than total coastline of all the rest of the US states combined. How much is going to get explored at once?

It’s all a song and dance. Expand exploration for oil. Become energy independent. Michelle plant a vegetable garden in the Rose Garden. Smoke and mirrors. People are sheep, they will follow. A good politician can screw you and make you smile at the same time. People will not be concerned about energy until their local BP station doesn’t have gasoline in their pumps. I’m too old to worry about it myself. I’m going to crank up the old Cutlass Cruiser station wagon, go to Dairy Queen with my grandson, and OD on a Blizzard. I hope you people are wrong about energy depletion.

hotrod

It is important to understand the real purpose for the off-shore drilling plan. This administration is not stupid enough to believe that this is going to make a significant contribution to domestic energy supplies. Indeed that is the point. The drill baby drill crowd and the Republicans believe that they have laid a trap for anyone who would propose a sane energy policy in this country because anyone who studies the situations knows that we are in for shortages or at least price spikes in the relative near future. And the sad fact is that the public is only too willing to believe that the reason that we are resource constrained is that 'those whacky environmentalists have put all of our assets off limits'. This is a ridiculous notion that unfortunately has gotten purchase among the general population. One way to disspell this notion is to essentially call their bluff. Open up some of the least environmentally sensitive areas and show that the real reason that the oil companies aren't drilling in these areas is because there simply isn't enough economically recoverable oil in these areas to make it worth the effort. If he doesn't do something like this, these unprincipled hacks are poised to use the coming crunch to attack any sort of sane energy policy as the source of the shortages. A pretty slick but disgusting move that could set back the cause of clean energy for a generation.

A presidential address some 33 years ago (snippet, 4mins, relevant to this discussion)...

http://www.youtube.com/watch?v=-tPePpMxJaA

"Debbie Downer" (Mike Moore, "Capitalism: A Love Story", 2009).

Could Obama deliver such a message? Doubtful; not many want to hear it. BAU to the cliff, I say, but what the hell would I know?

SW, for the "drill baby drill" perspective, did you read Oldfarmermac's posting at 10:56, above. He accepts your hypothesis and takes it to an opposite conclusion: that Obama devilishly has allowed "some" drilling, but has kept the best areas off limits, just so the "drill baby drill" club would be silenced. Myself, I think the first whiff of escalating oil prices will overwhelm any limits at all - but will not conjure up vast pools of oil that the "drill baby drill" crowd believes are being kept from them by evil environmentalists. The pools don't exist. But such is human nature that if even one spot is behind a curtain labelled "Off-limits" all dreams and fantasies will be projected on that one spot, "Oh, we know THAT ONE SPOT is the key, and we are being kept from it."

Isn't that part of the fable of the Garden of Eden?

He isn't playing to the lunatics. He is playing to the low information public. You can call it devilish if you want. Or clever. But since we agree that he is correct, I would characterize it as clever. You will never please the lunatics. There is no point in even trying. What you want to do is neutralize their message, which we agree is bogus.

That is just some tin foil hatting. It is fairly clear that the areas he opened were because of purely political considerations (basically red state, rather than blue).

Of course it is political. Red state populations are more likely to embrace the Drill Baby Drill bullshit. They are in more need of a demonstration of its futility.

If that was the idea - it could have happenned with drilling anywhere.

The basic idea here is letting some offshore drilling open to

- muffle shrill DBD cries

- near red states where the opposition would be less

- near states where the senators/congressmen needed to be appeased (remember drilling gets money to states)

Nothing whatsover to do with good/bad places in terms of geology.

Exactly

OK, there's been a few comments now that he didn't open the "good areas".

I still want to know, are there any such good areas out there?

There was exploration done on a lot of the offshore before the bans went into place, what is the biggest field that could be hiding out there?

Open it all up. Let's find out what we have as a nation. It will shut up those who are calling for drilling. Maybe open some eyes. If that happens this nation will be better off. Playing political games in a time of energy crisis is not the act of a true patriot but a clever politician. I'm sick of clever politicians. Even if it means I have to park my car and drive a scooter. The last politician I voted for was Tricky Dick. I still have a bad taste in my mouth. Come on Obama, be transparent and honest. Hell I may even register to vote again. But things being as they are I get better results at Diary Queen.

hotrod

It started open. People looked. Any really promising and accessible areas were held open (the big GoM fields).

Is there really likely to be anything significant in any of the rest?

If so, where?

I don't have a horse in this race, I'll adapt to whatever happens to the best of my ability, but I find this "debate" tiring. This isn't a political site, and I'd like to get past the political dimension of this to the practical.

I ask the same question again, for the third time:

Is there a region that is currently closed to exploration that is at all promising?

I'll add: are there areas where the geography can't be measured sufficiently to determine if they might be interesting due to the drilling ban?

Agreed that a complete inventory is essential to an informed debate. I want to see a cogent argument as to why the drilling ban prevents a reasonable estimate of the resource. Otherwise the whole issue is politics and nothing more because it will do nothing RE our energy position.

Define "at all promising" lol. My impression is that, no, there is no area that will "make a difference" (I'll define that as giving us 5 years of new supply). There are areas - close to Florida - where there is likely some little bit of oil that could be profitable because it's not too deep. The companies would like to snap up some profits thusly.

There is interest in exploring off California, but nothing huge is imagined there, plus it would be expensive to extract, plus the earthquake danger is real.

Mostly, the companies want to demonstrate that they can swoop in and collect natural resources any time, any place. And environmentalist-haters want to demonstrate to environmentalists how how powerless the environmentalists are.

It couldn't be very big, otherwise the oil companies would have identified it and drilled it. If they didn't drill it before the bans went into place, it wasn't a very likely prospect.

My wife and I were chatting about this today. I was talking about marine seismic - looking for oil by running a ship across the ocean floor towing an air gun and a string of hydrophones. I have worked for companies that did this as a major part of their business. You fire the gun every few seconds, and the hydrophones pick up an image of the undersea geology. I mentioned that this would be tough in the Arctic because of the ice pack. She said, "why doesn't the US use submarines"?

Good question. US nuclear submarines could tow air guns and hydrophones everywhere under the Arctic ice pack and do a really high resolution 3D survey of the entire Arctic Ocean. Then they could sell the data to the oil companies for a nominal price, and the oil companies could make their own decisions about where to drill. The Canadian sector has been explored to death, and the Russian sector is probably off limits, but the rest of it could be pretty interesting.

The fact they haven't already done it suggests to me that they aren't really serious about exploring the Arctic for oil. They prefer to indulge in wishful thinking.

People can decry politics all they want but energy policy has been entwined with politics since the dawn of the Republic. Nothing is done in the field of energy without navigating the political minefield. As such it should be clear by now that there are certain powerful political factions who value issues much more than solutions and will actively thwart solutions in order to keep what look like winning issues alive.

And then there are certain powerful political factions who are just plain stupid. I was thinking of "W" in that context.

Never underestimate the power of human stupidity. Robert A. Heinlein.

These are excellent questions. Ask a geologist (I am one), and the answer will usually be "it depends".

I agree with many of the comments that suggest that it is unlikely that there is anything big in the offshore that hasn't already been identified or tested. While that is statistically reasonable, there are always surprises especially since oil and gas prices are dynamic, and technology has advanced since the 1980s.

The history of petroleum exploration is that the largest fields are generally found early in the drilling cycle, but that is not universally true especially if the thinking was about a particular type of trap or a particular formation.

There are also many comments that suggest that if what remains is not huge, it should not be pursued. I disagree with this position on all energy counts. This argument would immediately shut down most alternative energy research, and would suggest that we should only import oil from the Middle East. Increments of a few percent of supply add up.