Drumbeat: March 9, 2010

Posted by Leanan on March 9, 2010 - 9:59am

Shell's discounted bid for Arrow reflects the present world oversupply of gas

The bid and Arrow's decision to take it seriously despite the price discount reflect the much more complicated outlook for gas in the wake of the global financial crisis, and after the development of technology that is capable of doubling the world's gas reserves.There is an awful lot of gas in the ground, enough perhaps to break the nexus between gas prices and oil prices. The peak oil argument that oil prices will rise inexorably as producers fail to bring new production on stream fast enough and cheaply enough to replace diminishing reserves simply does not apply. That knowledge both impels the $3.2 billion offer Shell and PetroChina have launched, and dictates that Arrow take it seriously.

Saudi Aramco chief warns of 'green bubbles'

Saudi Aramco chief Khalid Al-Falih warned today of "green bubbles" and expressed worry about "assumptions" in the political realm that alternative energy sources could "transform the face of energy overnight".

Gazprom Neft Says Russian Taxes Tripping Up Deals, Expansion

(Bloomberg) -- OAO Gazprom Neft, the oil arm of Russia’s gas export monopoly, said Russian taxes are hindering ventures with international oil companies and are the main obstacle for its expansion at home and abroad.“The main problem is the tax regime,” Alexander Pankratov, head of business development at the St. Petersburg- based company, said yesterday in an interview at the CERAWeek conference organized by IHS Cambridge Energy Research Associates in Houston.

US Crude Outlook - Improving crack spreads give lift

HOUSTON (Reuters) - Improving refinery crack spreads could boost feedstock demand and lift cash crude differentials, especially if oil futures back away from the $81 level as many analysts expect,

Chevron Drives Upstream Growth with LNG Projects

Chevron enters the decade with an upstream portfolio of major capital projects that uniquely positions the company for future growth, executives said today at a meeting with financial analysts in New York. In the downstream business, executives highlighted plans to improve returns by aggressively lowering costs, exiting markets and streamlining the organization.

Gabrielli: pre-salt supply chain tight

While operating in Brazil's pre-salt region does require an array of technologies, Petrobras CEO Jose Gabrielli told a Houston lunch that a bigger challenge lies in meeting logistical demands for operating in deep waters offshore. During the Brazil-Texas Chamber of Commerce event on 9 March 2010, Gabrielli said it is important to focus on 'the hubs that we must develop for our people and goods 300km from our coastline.' For the pre-salt, he elaborated, 'the main challenge that we have is much more on logistics, on the optimization of the knowledge we have.'The opportunities in pre-salt, he said, are big, but they also require a new hub for suppliers. 'We believe the most important constraint that we may have is in the supply chain,' Gabrielli said.

Nigeria May Push for Higher OPEC Oil Quota, NNPC Says

(Bloomberg) -- Nigeria may seek to increase its OPEC oil production quota if output remains free from militant disruption, an official from state-owned Nigeria National Petroleum Corp. said today.

Chevron cutting 2,000 jobs in refining restructuring

NEW YORK (MarketWatch) -- Chevron Corp. said Tuesday it plans to cut 2,000 jobs this year as part of an effort to realize savings in its refining operations, as the oil major signals that recent woes in the business of making gasoline and diesel fuel will persist well beyond 2010.

Sinopec Shanghai Says China Should Raise Fuel Prices

(Bloomberg) -- China should increase fuel prices to prevent domestic refiners from incurring losses in March and April, said a unit of China Petroleum & Chemical Corp., the country’s biggest refiner.

Egypt: Petroleum ministry denies diesel shortage

Sufficient amounts of diesel are available on the local market as planned, said the Ministry of Petroleum, despite recent overcrowding at gas stations and reports of shortages.

Clashes at gas stations as diesel crisis escalates

Diesel fuel shortages continued in Cairo and the governorates on Monday, leading to clashes between frustrated drivers lining up outside gas stations. The Petroleum Ministry, however, has denied the existence of any shortfalls in the quantities of diesel fuel supplied to gas stations.Shortages of both 80-octane and 90-octane gasoline have also been reported in a number of governorates.

U.S. Sitting on Mother Lode of Rare Tech-Crucial Minerals

China supplies most of the rare earth minerals found in technologies such as hybrid cars, wind turbines, computer hard drives and cell phones, but the U.S. has its own largely untapped reserves that could safeguard future tech innovation.Those reserves include deposits of both "light" and "heavy" rare earths — families of minerals that help make everything from TV displays to magnets in hybrid electric motors. A company called U.S. Rare Earths holds the only known U.S. deposit of heavy rare earths with a concentration worth mining, according to a recent report by the U.S. Geological Survey (USGS).

S.Korea unveils 'recharging road' for eco-friendly buses

South Korean researchers Tuesday launched an environmentally friendly public transport system using a "recharging road" -- with a vehicle sucking power magnetically from buried electric strips.The Online Electric Vehicle (OLEV), towing three buses, went into service at an amusement park in southern Seoul. If the prototype proves successful, there are plans to try it out on a bus route in the capital.

Short-staffed agency overseeing high-speed-rail effort draws fire

WASHINGTON — The federal agency in charge of $8 billion in economic stimulus spending on high-speed-rail projects doesn't have the staff or expertise to properly oversee the money, government investigators and congressional critics say.The Federal Railroad Administration (FRA), whose main job until now had been keeping freight and passenger railroads safe, awarded the high-speed-rail grants in January — months later than planned.

Even more useful than the books or activities, though, is the principle behind libraries, that we and our neighbours can pool our resources and hold things in common that all of us occasionally need. Most of the Western World, however, adopted this principle for books and then stopped, never extending it to other obvious areas of life.In fact, the trend of the last few decades has been the opposite – people bought more and more of their own private stocks of anything, no matter how expensive or little-used: a row of ten family homes might have ten rakes, ten chainsaws, ten barbecue pits and ten Dora the Explorer videos, each of which is used for only a few hours a year.

More urbanites have their pick of fresh fruit

Last fall, Eric Alperin, a San Francisco artist, heard about blackberries, plums and loquats growing on public property in his city and free for the picking.Armed with bags and a pole device for picking fruit from tall branches, Alperin and his wife went foraging.

"It was great," he said. "We picked as much as we could carry and had beautiful, fresh, free city fruit," Alperin said. "I'll definitely go (picking) again." Fruit-picking opportunities like that are becoming more common, as volunteers in cities including Boston, Detroit, Philadelphia and Madison, Wis., mobilize behind a goal of planting fruit trees on public land in city parks and neighborhoods.

Agritourism helps Tennessee farms stay in business

NASHVILLE — In a tough year for Tennessee's state budget, the departments of tourism and agriculture have found a mutual silver lining: a boomlet in agricultural tourism.Milking cows (sort of), wandering through corn and cotton mazes, watching chicks hatch, having a country wedding and picking melons are among the activities drawing city folks and their pocketbooks to farms around Tennessee.

CERAWeek panel: Developing nations key to future

A shifting center of gravity from the developed to the developing world will redefine the energy landscape over the next two decades.That's the theme that emerged from the first panel discussion of this year's IHS Cambridge Energy Research Associates' IHS CERAWeek conference in downtown Houston. The discussion kicked off five days of panels and lectures featuring top energy executives, policy makers and analysts.

Growing economies in Asia, particularly China, and the Middle East, will shape the supply and demand dynamic of everything from oil and gas demand to electricity to the development of renewable energy sources.

“What will fill the demand?” asked Xizhou Zhou, a China expert with IHS CERA.

“The answer to that question is, really, everything.”

Energy takes stage: CERAWeek offers wealth of information

If you’re into energy, this week is Christmas in March in Houston. It’s CERAWeek, the five-day confab covering all things energy-related. For the cognoscenti, it’s brimful of gifts of information and informed opinion.CERAWeek is the brainchild of Daniel Yergin, Pulitzer Prize-winning author of The Prize: The Epic Quest for Oil, Money & Power and chairman of IHS-Cambridge Energy Research Associates (CERA), a leading think tank/consultant on energy topics.

CERAWeek offers something for everyone interested in energy — oil, alternatives, the environment, coal, utilities and on and on for a full five days. But this year our attention will be focused on Wednesday’s daylong session on natural gas. And T. Boone Pickens is why.

CERAWEEK - FACTBOX: What are the big issues for CERAWeek?

(Reuters) - The symbiotic link between oil and the economy will dominate CERAWeek, the CERA consultancy's annual go-to gathering of elite energy and economic figures and thinkers that begins on Monday in Houston.

CFTC official wants more energy market transparency

Energy commodities regulators worldwide will need to move carefully and cooperatively if they expect to make global oil markets more transparent, US Commodity Futures Trading Commission member Scott D. O'Malia said in Tokyo on Feb. 26."We have to acknowledge that we've witnessed a paradigm shift in the global oil market over the past decade," he said in remarks to the International Energy Agency and Institute of Energy Economics Japan's Forum on Global Oil Market Challenges. "The paradigm has shifted in two significant ways…. First, oil is now a financial asset and its price movements are correlated to economic growth. Second, the growth in oil demand is being led by developing nations."

2010 energy prospects promising, U.K. firm says

Oil and gas services company Petrofac said it was confident for 2010 as it expects further investment in oil and gas projects, after it doubled its order backlog and posted net profit above forecasts in 2009.

Pakistan: Power tariff-hike to destroy economy

FAISALABAD - Proposed increase of Rs1.2 per unit in electricity tariff would push the cost of exportable items, making Pakistani textiles costly and inflicting loss of millions of dollars. It will also cause closure of more industries as industrial sector will not be able to absorb this shock; leading to more unemployment & poverty in the country.

Plans to increase consumption of fuel by 31 percent due to electricity crisis

The Venezuelan government plans to increase its fuel consumption by a third in 2010 to fuel thermoelectric plants with which President Hugo Chávez hopes to overcome energy crisis.Officials expect a total consumption of 104 million barrels in 2010, about 285,000 barrels of oil equivalent per day (bpd) of fuel oil, diesel and gas, which will be used to increase thermoelectric capacity by 4,000 megawatts (Mw).

'Energy crisis just artificial'

MANILA, Philippines - Sen. Richard Gordon said the power crisis in Mindanao is artificial and may be part of a sinister plot, and demanded an explanation from the Arroyo administration.“They should explain why there is a power shortage. From what I have heard – and I have just been to Mindanao – the water level in Lanao lake is normal. They just opened up a power plant in Cebu and they will open up a couple more. I don’t know what they are talking about,” Gordon, Bagumbayan party presidential candidate, told editors and reporters of The STAR yesterday.

“They have a lot of explaining to do.”

East Kalimantan Demand Higher Coal and Gas Supply

TEMPO Interactive, Jakarta: East Kalimantan administration pleaded to the central government for more allocation of gas and coal for to meet regional demand for energy. Governor Awang Faroek said on Tuesday (9/3) the province accounts for 54 percent of total national gas production and produces 50 million metric tonnes of coal every year, and “Its not funny if East Kalimantan should experience energy crisis.”

Green energy revolution expected in Kingdom

JEDDAH: Saudi Arabia and the Gulf signalled their intention to kick-start a renewable energy revolution in the region on Monday.A panel of experts at the ongoing Gulf Environment Forum in Jeddah, chaired by Assistant Minister for Petroleum Affairs Prince Abdul Aziz bin Salman, said measures were in place to improve the energy mix and finally reduce Middle East dependence on oil.

Sarkozy: ‘Help poor countries go nuclear in energy crisis’

POOR countries should be helped to build their own nuclear power stations to help fight climate change, French President Nicolas Sarkozy said yesterday.His vision won over international energy officials from India to Brussels, and French executives eager to market their expertise abroad, at a Paris conference. But some experts said Mr Sarkozy’s push was opening the door to risks of deadly technology getting into the wrong hands, and warned consumers to pay attention to the staggering price tag of potential nuclear energy growth – up to £2.6 trillion worldwide by 2050.

"We need nuclear energy" to meet international goals set for slowing global warming, Mr Sarkozy said.

A reactor to make nuclear affordable

One of nuclear's biggest drawbacks, though, is the multi-billion-dollar price tag for all those new reactors. From the Marketplace Sustainability Desk, Sarah Gardner reports now on a way to make nuclear affordable.

Schools' New Math: the Four-Day Week

Four-day weeks have been in place for decades in states like New Mexico, Idaho and Wyoming and initially came about as states were looking to combat growing energy prices. Last week, Pueblo School District 70 in Colorado said it would adopt the schedule next school year for its roughly 8,000 students.The shift has drawn scrutiny from some education and parents groups who say the shorter week hurts students academically and complicates child-care efforts.

Mexico Oil Politics Keeps Riches Just Out of Reach

VENUSTIANO CARRANZA, Mexico — To the Mexican people, one of the great achievements in their history was the day their president kicked out foreign oil companies in 1938. Thus, they celebrate March 18 as a civic holiday.Yet today, that 72-year-old act has put Mexico in a straitjacket, one that threatens both the welfare of the country and the oil supply of the United States.

The national oil company created after the 1938 seizure, Pemex, is entering a period of turmoil. Oil production in its aging fields is sagging so rapidly that Mexico, long one of the world’s top oil-exporting countries, could begin importing oil within the decade.

Mexico is among the three leading foreign suppliers of oil to the United States, along with Canada and Saudi Arabia. Mexican barrels can be replaced, but at a cost. It means greater American dependence on unfriendly countries like Venezuela, unstable countries like Nigeria and Iraq, and on the oil sands of Canada, an environmentally destructive form of oil production.

“As you lose Mexican oil, you lose a critical supply,” said Jeremy M. Martin, director of the energy program at the Institute of the Americas at the University of California, San Diego. “It’s not just about energy security but national security, because our neighbor’s economic and political well-being is largely linked to its capacity to produce and export oil.”

Oil drops below $81 after monthlong rally

Oil prices dropped sharply to below $81 a barrel Tuesday, due to a stronger dollar and profit taking on a monthlong run fueled by growing investor optimism about global economic growth.

Gasoline prices at high for the year

Motorists are well down the road to higher pump prices as warmer weather and the driving season approach.Average retail gasoline prices, continuing a surge that started last month, have now matched their 2010 high on the way to prices that many analysts believe will top $3 per gallon this spring.

Exxon Lowers Bar, Buys Assets Previously Deemed Unattractive

(Bloomberg) -- Exxon Mobil Corp., BP Plc and Total SA are investing in assets that previously weren’t worth their time or money after oil-rich nations reduced access to reserves and exploration drilling faltered.Efforts to find new sources of crude and natural gas are failing more often, with San Ramon, California-based Chevron Corp.’s exploration failure rate jumping to 35 percent last year from 10 percent in 2008. Countries such as Venezuela are making it more expensive for companies to develop their resources, if they’re allowed in at all. And previously developed fields are drying up, reducing oil companies’ future supplies, or reserves.

Samsung Heavy Wins Order From Shell for Floating LNG

(Bloomberg) -- Samsung Heavy Industries Co. won an order to build a floating natural-gas facility for Royal Dutch Shell Plc, the first deal between the two under a 15-year supply contract signed last year.

INTERVIEW - Algeria sees global LNG recovery in 2-3 years

ALGIERS (Reuters) - The global slump in demand for liquefied natural gas (LNG) is temporary and demand will recover within the next two to three years, Algerian Energy Minister Chakib Khelil said in an interview on Monday."If we look at the long term, definitely from the environmental point of view and from the point of view of satisfying global demand, there is going to be a big need for natural gas," Khelil told Reuters.

A conventional fuel, an unconventional future

The recent announcement that Korea Gas Corp. would invest $1.1-billion to participate in the development of EnCana's huge gas shale holdings in northeastern British Columbia is another signal that Canada's natural gas industry has entered a profoundly important new stage that, at earlier times, government policies made impossible.

Shell’s Arrow Bid May Spur Coal-Bed Gas Takeovers

(Bloomberg) -- Royal Dutch Shell Plc and PetroChina Co.’s A$3.3 billion ($3 billion) bid for Arrow Energy Ltd. may spur more takeovers of Australian producers of coal-bed gas, a growing source of supply for Asian energy importers.

Sasol may abandon fuel liquids plant if no govt funding - paper

JOHANNESBURG (Reuters) - Petrochemical group Sasol (SOLJ.J) may abandon its planned 80,000 barrel-a-day South African coal-to-liquid Mafutha plant if the government does not help finance it, the Business Day newspaper reported on Tuesday.The paper quoted Sasol Chief Executive Officer Pat Davies as saying the world's top maker of motor fuel from coal would let the government determine its funding component for the project, while the company proceeds with its preparatory works currently in feasibility stage.

Mitsui Said to Consider Returning to Singapore Oil Trading

(Bloomberg) -- Mitsui & Co., the Japanese trading group that earns half its profit from energy, may restart oil product trading in Singapore after withdrawing from the city- state in 2007, according to two people familiar with the matter.The Tokyo-based company pulled out from Asia’s biggest oil- trading center when it shut its Singapore unit Mitsui Oil (Asia) Pte in 2007 after losing $81 million from naphtha transactions hidden by a trader. The cover-up resulted in the imprisonment of three former employees by Singapore courts last year.

Time for ‘bold action’ to reduce oil use in Greater Sudbury

Canada’s economy is highly dependent on oil. Many Canadians believe western Canada’s oil sands deposits will be our salvation. The oil sands, however, are a major atmospheric carbon emitter, which will exacerbate global climate change significantly, while also fouling the region’s water supply.Should we all be driving hybrids to prepare for the impending high oil prices and volatility? Perhaps, but the report asserts, “There is real danger that the focus on technological advances in cars is making consumers and governments complacent.”

EPA probes whether shale gas drilling contaminates water supplies

The top U.S. environmental regulator said she was "very concerned" about fluids blamed by some for polluting water supplies near sites where drillers use them to extract natural gas from shale deposits. U.S. Environmental Protection Agency chief Lisa Jackson said she hopes her agency will launch a study this year into the nature of fluids used in the hydraulic fracturing process of natural gas drilling.

Fracking Fluids Part I: A controversy coming to an energy investment near you

The controversy surrounding fracking fluids is getting louder. Websites and media savvy organizations are getting more press on this issue, using a very simple and powerful pitch – are the chemicals used in fracking fluids in oil and gas wells contaminating our drinking water?North American investors have not been directly hit by this issue yet, meaning that a company’s stock hasn’t plummeted because they had to stop drilling over these concerns – yet.

Challenging conventional wisdom on renewable energy's limits

In making the case for a rapid conversion away from heavily polluting energy sources like coal and nuclear power to cleaner generation, renewable energy advocates often confront the argument that their scheme is impossible due to the intermittent nature of sun and wind.But a groundbreaking study out of North Carolina challenges that conventional wisdom: It suggests that backup generation requirements would be modest for a system based largely on solar and wind power, combined with efficiency, hydroelectric power, and other renewable sources like landfill gas.

Tuning the energy innovation engine at MIT

BOSTON--The MIT Energy Conference here on Saturday covered a little bit of everything--"China speed," climate change, financing gaps, government policy, nuclear and natural gas, and, of course, science experiments--as entrepreneurs, business people, and academics tried to get their arms around big-picture energy challenges.The Massachusetts Institute of Technology has become a hotbed for clean-energy innovation over the past four years, attracting students and faculty to the field, some of whom have spun out promising companies.

I.B.M. Opens Energy Lab in Beijing

In another sign of China’s emergence as an epicenter of green technology, I.B.M. has opened a lab in Beijing to develop smart grid software for the global market.

IEA: safety, non-proliferation key premises for nuclear development

Safety and non-proliferation are two key premises for global expansion of nuclear power and countries seeking nuclear use must adhere to these principles, Executive Director of the International Energy Agency (IEA) Nobuo Tanaka stressed here Monday.

UAE believes in responsible use of nuclear power

The United Arab Emirates’ interest in developing nuclear energy is motivated by the need to develop additional sources of electricity.This is to meet future demand projections and to ensure the continued rapid development of the country's economy, UAE Foreign Minister H.H. Sheikh Abdullah bin Zayed Al Nahyan affirmed here today.

Israel 'to unveil plans to build nuclear power plant'

Israel is expected to unveil plans this week to build a nuclear power plant, reports say.They say an announcement will be made by Israeli Infrastructure Minister Uzi Landau at an energy forum in Paris.

Israel is facing a crisis over electricity supplies, but environmental objections have blocked efforts to build a new coal-fired plant.

Don't buy Obama's greenwashing of nuclear power

Last month, inspectors found dangerous chemicals in the groundwater near the Vermont Yankee nuclear reactor. The situation demonstrates that from the mining of uranium ore to the storage of radioactive waste, nuclear reactors remain as dirty, risky, and as costly as they ever were. If President Obama's recent enthusiasm for nuclear reactors has led you to believe otherwise, you've bought in to the administration's greenwashing of nuclear.

Solar Industry Learns Lessons in Spanish Sun

Farmers sold land for solar plants. Boutiques opened. And people from all over the world, seeing business opportunities, moved to the city, which had suffered from 20 percent unemployment and a population exodus.But as low-quality, poorly designed solar plants sprang up on Spain’s plateaus, Spanish officials came to realize that they would have to subsidize many of them indefinitely, and that the industry they had created might never produce efficient green energy on its own.

Lending Scheme to Bring Solar to Cambodia’s Poor

With access to solar-powered energy products for Cambodia’s rural poor extremely limited, the solar energy company Kamworks and the Cambodia Mutual Savings and Credit Network are partnering to provide low-interest loans to customers hoping to outfit their homes with solar panels, while Kamworks will provide and install the equipment.

Ethanol Making Comeback as Valero Sees Profit Where Gates Lost

(Bloomberg) -- Ethanol, the commodity that cost Bill Gates more than $44 million the last time prices collapsed, is poised to rally as much as 20 percent as the fastest drop since 2008 spurs demand.Falling corn prices and record ethanol supplies have driven the price down 17 percent in three months to $1.634 a gallon, its worst run since 2008’s fourth quarter. It will average $1.96 a gallon at the peak of the U.S. summer driving season as refiners from Valero Energy Corp. to Sunoco Inc. mix more into gasoline made from increasingly pricey oil, according to the median of 10 analyst estimates compiled by Bloomberg.

European Activists Sue Over Biofuels Studies

Environmental lawyers and activists on Monday sued the European Commission for failing to release studies investigating the impact of biofuels on the environment.

Whetting Singapore's thirst for rice

"To produce one bowl of rice it takes about 500 liters of water," said Dr. Bouman."For a city like Singapore, the question is whether the 688 billion liters of water needed to produce the country's rice will remain available."

Worldwide, water for agriculture is becoming increasingly scarce as groundwater reserves drop, water quality declines because of pollution, irrigation systems malfunction, and competition from urban and industrial users increases.

Climate change will also reduce water availability in large parts of the world. And, by 2025, 15-20 million hectares of irrigated rice will suffer some degree of water scarcity.

Cool it on efforts against new rules, EPA chief asks

WASHINGTON — The head of the Environmental Protection Agency on Monday pushed back against lawmakers' attempts to halt the EPA's regulation of greenhouse gases from power plants, refiners and other industrial facilities.EPA Administrator Lisa Jackson said the agency's proposed new rules, which would take effect next year, could help ignite new demand for clean energy technology.

Instead of trying to block new rules, lawmakers should spend their energy focusing on “new legislation to do something” about climate change, Jackson told reporters after a speech at the National Press Club.

Asking “what would nature do?” leads to a way to break down a greenhouse gas

ANN ARBOR, Mich. – A recent discovery in understanding how to chemically break down the greenhouse gas carbon dioxide into a useful form opens the doors for scientists to wonder what organism is out there – or could be created – to accomplish the task.University of Michigan biological chemist Steve Ragsdale, along with research assistant Elizabeth Pierce and scientists led by Fraser Armstrong from the University of Oxford in the U.K., have figured out a way to efficiently turn carbon dioxide into carbon monoxide using visible light, like sunlight.

California to amend 'cool cars' rule

The state, which gave initial approval of the new rules in June, aims to sharply reduce solar energy in vehicles to reduce greenhouse gas emissions. The California Air Resources Board is working to finalize the regulations in the coming weeks. The final rules must be in place by May 7.But the California Police Chiefs Association, California State Sheriffs Association, Crime Victims United of California and other groups warn that the new standards, requiring window glazing to keep car interiors cool, could degrade signals from cell phones, and from ankle monitoring bracelets worn by felons.

Fidel Castro warns of dangers threatening humanity

Former Cuban leader Fidel Castro warned of many dangers currently threatening the planet and the humanity such as mass destructive weapons and climate change."For the first time, the human species, in a globalized world full of contradictions, have created the ability to destroy themselves," Castro said in an article released on Monday.

How does America end up with such terrible national security strategies?

Last month I wrote a blog post on the appallingly, monumentally bad Quadrennial Defence Review (QDR) of 2010 — the document the US Defence Department is required to produce as a basis for developing the military force structure and strategic requirements for the next four years. This document, meant to analyse the threats to the United States, failed to mention radical Islam as a threat in its over 100 pages. It also passed over the threat of Iranian nuclear weapons with only a one-sentence mention. Yet the top officials of the Defence Department did not fail to notice the REAL threat facing the United States. The QDR devoted several pages to the serious threat inherent in… climate change.

Monbiot: The trouble with trusting complex science

There is no simple way to battle public hostility to climate research. As the psychologists show, facts barely sway us anyway.

Wild relatives of crops seen aiding climate fight

(Reuters) - Farm experts plan to track down wild relatives of crops such as rice or wheat with traits that make them able to resist global warming in a project costing perhaps $50 million, a leading expert said on Tuesday."The wild relatives of cultivated crops ... are largely uncollected or conserved in gene banks," said Cary Fowler, head of the Rome-based Global Crop Diversity Trust which co-manages a "doomsday" seed vault on an Arctic island north of Norway.

Move to train truckers to be greener

The UK government has launched a new proposal to encourage more lorry drivers to take eco-driver training in a move to save up to 3m tonnes of carbon emissions.Over five years, a saving of around £300m in fuel costs could be achieved, according to transport minister Paul Clark.

India backs Copenhagen climate deal: minister

NEW DELHI (AFP) – India has decided to formally back a climate change accord struck in Copenhagen last year that includes non-binding limits on global warming, Environment Minister Jairam Ramesh said Tuesday.

Climate forest deal in sight: Indonesia

WASHINGTON (AFP) – Wealthy and developing nations should be able to seal an agreement this year on deforestation, unlocking a key part of the next treaty on global warming, Indonesian negotiators said Monday.

Should Scientists Fight Heat or Stick to Data?

You want to know why Al Gore and his movie have proven to be such an abject failure? (And yes, failure is the right word — polling shows no net increase in public concern about global warming in the years following the movie — for two decades its been roughly a third of the public who are seriously worried about global warming.) It’s for this very reason. A very dull and dispassionate voice was chosen to deliver a supposedly dire and passionate message. It was one of the worst cases of bad casting in history. Gore is ultimately “a scientist” when it comes to communication instincts. You can see it played out in his movie and two books as he’s slowly come to the realization that you need something more than information to reach the masses. Duh.

Contrary to popular belief, young people are not more politically engaged on the issue of climate change than older Americans, according to a new climate poll conducted by researchers at American, Yale and George Mason universities.The researchers found "adults under the age of 35 are significantly less likely than their elders to say that they had thought about global warming before today, with nearly a quarter (22 percent) of under-35s saying they had never thought about the issue previously. Only 38 percent of those between the ages of 18 and 34 say that they had previously thought about global warming either 'a lot' (10 percent) or 'some' (28 percent), compared to 51 percent of those 35-59 and 44 percent of those 60 and older.

It’s easy to imagine an apocalyptically soggy future for New York—high waves soaking the hem of Lady Liberty’s robes, flash floods roaring through subway tunnels, kayakers paddling down Wall Street—and just as easy to dismiss it all as another end-of-days Hollywood fantasy. Global warming may be powerful and real, but so is denial, and the urge to postpone thinking about that particular item on the world’s to-do list is almost irresistible. Coastal cities, however, don’t have that luxury. For centuries, New York has been steadily expanding into its harbor; when the steroidal storms of the not-too-distant future start pummeling our shores, the waters will push back.So Barry Bergdoll, the head of the Museum of Modern Art’s architecture and design department, divvied New York Harbor among five teams of designers and challenged them to figure out how a low-lying metropolis might deal with rising sea levels and violent storm surges. Their answers will appear (starting March 24) in the MoMA exhibit “Rising Currents: Projects for New York’s Waterfront,” and they vary from spongy streets to reefs made of glass or oysters to apartment buildings dangling above the brine.

Developed countries outsource emissions: study

Developed countries are "outsourcing" more than a third of their carbon emissions associated with products and services to other countries, researchers say.A study of trade data found that some countries in Western Europe have more than half of their total carbon dioxide emissions occurring elsewhere, especially in developing countries such as China.

Peak Oil Demand Is Coming, But Here's Why It's Not Good News" by Chris Nelder (bold his)

Chris Nelder is a man after my own heart. He is saying the same thing that I have been saying for over a year. This is one of the best articles I have read in some time.

Chris Nelder had a guest post on TOD on June 26, 2009.

Have We Reached an Inflection Point in Economics History?: “Indeflation” and Energy

Ron P.

That article was posted in the March 6 Drumbeat. Chris himself posted a comment or two in the resulting discussion.

Sorry Leanan, the date on the article fooled me, (March 8th), I searched yesterday's Drumbeats and did not find it so I assumed it had not been posted. I will do an advanced search next time instead of assuming that the date on the article indicates its first publication.

Ron P.

I agree Ron - that article is an outstanding summary of our predicament.

Interestingly - I have been having a long running discussion with a group of friends about this subject with little success in getting them interested but one of them came across Nelder's article and has circulated it this week and the interest has picked up dramatically. All of a sudden they are all talking about the implications of peak oil and I am just sitting back and enjoying the interaction. Probably just shows that I am not as good a communicator as I thought.

Thanks Tex. My point was the part that Nelder put in bold text. (But only in the March 8th posting.) I have been arguing for months, particular with Memmel, that oil prices cannot spike to the heights we expected them to before the 2008 crash. I am very pleased to find that Chris Nelder agrees with me. Nelder says: Demand will be destroyed long before oil gets to $200 a barrel,... As he says, economic shrinkage will destroy demand long before oil gets to $200 a barrel.

I think prices right now, at $80 a barrel, are just about as high as they can go without causing further economic shrinkage. I think that the high oil prices we have today, and of course lack of oil supply growth, are keeping the economy from any meaningful recovery. It is like a negative feedback loop. Economic recovery drives up oil prices which kills the recovery in its tracks.

Ron P.

My guess is that the damage and instability since the crash has had a couple of effects:

1. The economy is running much leaner, and will be much quicker to react. I can't see any industries where the plan will be to tough it out through a protracted energy price spike.

2. The economy is more energy efficient -- not that we're using that much less in any particular application, but we're simply not doing some of the stupid things that used energy to no great purpose.

I'm thinking that over time the $80 [inflation adjusted] point will slowly shift upwards -- roughly at the same rate as energy efficiency gains.

Oh well. I was kind of hoping that we'd be able to digest the real estate bubble before the next downturn.

Rather optimistic is Matt Simmons. Listen here:

http://www.netcastdaily.com/broadcast/fsn2010-0306-2.mp3

Second interview (starts at 10:15). Talks about the possibility of saving the world with making liquid ammonia (and water) from seawater.

Can someone shed some light on exactly what Mr Simmons project is all about?

Is it really a game changer? Or is he just shilling for his business venture?

HAC,

"Game Changer" starts to sound a little too close to 'Silver Bullet' .. and many here have generally agreed that this is not really a reasonable goal.

It might be good enough to determine if it's simply a good idea, net-positive, clean, durable, etc..

Our old buddy, Sacred Cow Tipper has this review of an '08 talk by Simmons on it..

http://strandedwind.org/node/210

and Rapier Offers a debunking..

http://i-r-squared.blogspot.com/2008/01/debunking-matt-simmons.html

It includes this line, which doesn't give Simmons any new brownie points in my book..

.. so much for a broad-view of what keeps us alive on this planet..

so Rapier summarizes (in the comments section..) without much on the Ammonia plan itself, but instead a look at the messenger;

"I have heard him say that heavy sour oil isn't worth much on a number of occasions, and others have repeated it. People are lead to believe that it's not very useful. That's garbage.

So what does he do? He goes on and on about how algae or ammonia are going to save us, and he is taken seriously. Why? Then, when he says "We have peaked", then that's good enough many people. Because after all, he's Matt Simmons."

Simmons is an intelligent and enterprising guy but he was wrong about the great crash of 2008 - he was calling for $200 oil - so I am a skeptic.

Nevertheless, if algae are at least going to allow some people to run their ICEs, then it could be a winner, at least in the short term. And who cares about the world at large. It can't be saved. Have any of you volunteered to feed children in Somalia?

You don't have to be faster than the bear. If 90% of people don't have any money and are taking buses, then you are a winner if you are among the 10% that still have money and drive a car.

site:i-r-squared.blogspot.com ammonia - Google Search Works better than the built in blogspot.com search.

Here's a good one: R-Squared Energy Blog: Ammonia and Biofuels A guest post, actually. Only 4 comments; Engineer-Poet dissuades, as per norm. I was just perusing some old TOD story on PHEVs and there was a lot of good back-and-forth between E-P and others about NH3's utility. One commenter was "NH3," he used to post here a good deal.

The R2 piece brings up Stranded Wind too, what Matt is proposing but sited in the Great Plains.

Robert's just taking Matt to task for some of his scientific shortfalls, he still has respect for the work the man has done, and I doubt Robert is top to bottom dismissive of ammonia's potential.

Simmons' attempt at a solution just shows how far up the creek we are. How much ammonia from sea water is being produced right now? How fast could it be ramped up to substitute for even a small fraction of our oil consumption? How many cars currently run on ammonia? How much would it cost to convert the entire US car fleet to ammonia? What is the EROEI of this scheme?

Our monkey brains can only conceive of some kind of grand techno-fix. In reality we only have two options:

1. Dismantle the suicidal growth economy (no more advertising, no tourism, fast food, etc.), start rationing energy, and impose a strict one child per family limit.

2. Prepare to engage in a fight to the death over declining resources, especially oil.

We evolved to select option 2 and that is what I expect we will do.

SolarDude,I think a combination of your options is more likely.

The key question is the rate of change in demand in developing countries versus developed countries, and therefore what happens to the net total demand (versus, IMO, a long term accelerating rate of decline in net oil exports).

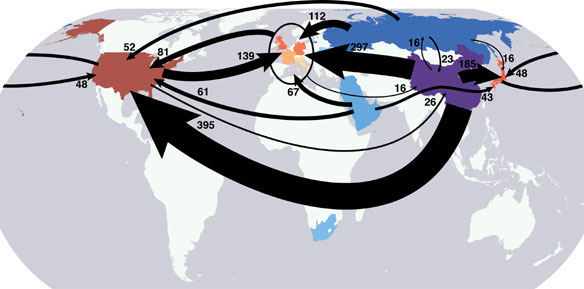

What we can say, from 2005 to 2008, for Chindia is the following (EIA):

Over the same time frame, the annual US net import rate of change was -4.3%/year.

Developing countries are a lot more demand sensitive to price increase. $150 to $200 oil has a much bigger impact to China than the U.S.

Even if there is a large middle class in China as defined as $10,000 a year family income, they still need to compete with the first world for energy, including poor families making $30,000/year.

Hopefully we will go to that price of $150-$200 over the next 5-10 years. This will produce jobs in the U.S. by spending dollars here for alternate energy.

????

Total Chinese oil consumption almost doubled from 1998 to 2008 as annual oil prices went up more than sevenfold, from $14 to $100, while US consumption in 2008 had fallen back to its 1999 rate, and has fallen further since then.

IMO, developed countries like the US are going to have to make do with what is left over after the developing countries take what they want. My forecast for the US is that we are going to be forced to make do with a declining share of a falling volume of global net oil exports; this is ELM 2.0.

Furthermore, many developed countries--because of vast debts and huge unfunded government obligations--are effectively bankrupt, especially in light of the ELM 2.0 math.

I'll repeat my canard that demand can be tempered - indeed it was tempered sharply 30 years ago. Fuel oil as a % of total 1977

consumption:

Now for 2008:

Demand isn't being tempered in these countries as sharply as it was last time, indeed I have doubts it can, barring our wholesale deindustrialization/impoverishment, or a real command economy approach to conservation, or implementation of a very cheap and practical means to improve efficiency.

If China's growth comes primarily from exports to the "developed" world, how do they not decline when their customers decline? If they decline how do the buy gas? Dependencies and price work to balance the worldwide economy.

By building up domestic markets.

China's growth is not coming primarily from exports to developed countries any more. It is mostly coming from growth in internal Chinese demand and exports to other developing countries.

They've hit the "sweet spot" in economic development where they no longer have to count on the rich countries to drive their growth any more. So the American economy could go down the toilet (which it has), and the Chinese could continue to grow.

Not such a good situation if you're American. Much better if you're Chinese.

If you're Canadian, which I am, it's okay too - China is a great market for raw materials. For Australians, it's even better.

I don't think that's true at all. They are very far away from that point.

Doesn't China (and India and lots of other countries besides the US, Europe, etc.) subsidize the price of oil and gasoline for their citizens? China can just take all their treasuries and pay for $200 a barrel oil while their citizens can get away with paying $1/gallon for gasoline.

1 gallon of $10/gal. gasoline in Chindia will get you a lot further on your little motor scooter that gets 60 mpg and you've never been 50 miles from home in your whole life than that same $10/gal. gasoline in the USA in your Suburban. $10 gas in a little Chindian scooter/car, will get you back and forth from work for a month, $10 in the Suburban will get you to the corner. Figure it out, 2.5 billion Chindians, 350 million Mericuns. Who is going to get what part of the export pie? Best from the Fremont

Make that $11.67/gal for the Chinese driver and $13.52 for the

Indian. So the scooter owners get 3.5x the mpg - they're making

a tenth and a fortieth of the income, respectively.

Well, in my world, filling a Suburban thrice monthly at $10/gal = $900 in gas bills for about 1,600 driven miles. Say I take home $3,000 per month...average wage, or close. $900 is a pretty good hit. I couldn't do it for long. The Chindian, on the other hand, spends $20 monthly for fuel (1,200 driven miles) and splits that with his two buddies that climb on for the ride besides. So, while I think "average Americans" will be priced out of the gasoline market for personal vehicle use, the rising middle class Chindians will not and there are a bunch of them who'll be happy to dubs what we can no longer afford. In other words, what oil exports remain will more likely go to India/China. Because of their considerably greater populations they'll simply out bid us. 1.5 billion Chindian drivers can spend a lot more money for fuel than can 125 million American drivers, because their baseline to begin with is generally very fuel efficient vehicles...scooters, and small automobiles vs. our much larger and less efficient vehicles. Best from the Fremont

One thing that people ten to overlook with India/China is that they already have a very functioning and dependable public transportation system. All the growth in personal automobiles is luxury to a large extent. This can be relatively easily curtailed when the SHTF. That situation is quite opposed developed countries like US where a large portion of population *has* to commute to get to work (avg i think being 30 miles per day).

This is the reason I keep arguing in my friend circles that development of public transportation infrastructure should be at top of the energy expenditure list (besides installing high EROEI renewable energy sources). If not a full blown investment at least there should be heavy incentives towards public transportation usage. I honestly don't believe that this particular problem is solvable simply by leaving it to the 'market forces'. This is for a simple reason that the reaction time required to setup the new infrastructure in a declining net energy system will be quite high.

One such mass transportation project has come online in Delhi (India's major metropolitan) called Delhi Metro Railways. (Link: http://en.wikipedia.org/wiki/Delhi_Metro ). I hear Anecdotal evidence that this has led to significant easing of traffic congestion in Delhi. Another benefit of mass transportation is that it can be designed to use a non-petroleum energy (via electricity). Hence it will be somewhat immune to peak oil.

Dunno where the BRICs fit in but dug this up:

Must read CIBC report: $7 gas by 2010, 10 million cars off the road, 1970s style GDP growth « Climate Progress, June 26, 2008

Is it 2010 yet? Hmmm.

An awful lot of Chindians just use bicycles. Many are buying electrified versions. Part of the monster Chinese stimulus went into some 500k km of freshly laid track, too.

"Must read CIBC report: $7 gas by 2010, 10 million cars off the road, 1970s style GDP growth « Climate Progress, June 26, 2008"

We could call this Y2.1K

So it is self evident that oil will not go much above $80 for the rest of the year?

These quibbles are the same CERA "we did not leave the stone age because we ran out of rocks" BS. There are solid indications that there will be oil shortages by 2013 (which are due to delayed oil field development projects). The CIBC report was being too optimistic about a rational price signal.

Hello Ron. I suppose the game goes like this. The administration does everything to get the economy back on track and the trader at the Nymex do the fine tuning to arrange for it not to work. When the Bush administration gave each taxpayer a 600 Dollar check the record high of 147 dollar a barrel was the answer. So no recovery and a rise in demand triggers a rise in oil prices, but some kind of greenshoot and a pure expected rise in demand alone will do very well. The traders are some kind of self-destroying-prophecie speculants, which is realy a hard job.

P.s. Im new on this side. Up to now I have read and learned a lot. So thanks a lot everybody.

Lothar Keck ( nothing to hide) Cologne

Will this loop be indefinite? When will the "market" figure this out?

And will there be a point along the downward curve of oil production that oil shortages will be able to overcome the recession effect and rise significantly over 80 dollars a barrel.

When the market figures it out, may be, that there will be a massiv demand destruction and the economic collapse.Nobody will invest in an ever declining market.

If supply declines sharply it will truly rise significantly over inflation adjusted 80 dollars. But then demand destruction will also be massiv. I think a period of high volatiliy will be the result.

Probably it just takes multiple workers crossing their path and reinforcing the concept while eroding barriers. This is a pretty well trodden path by evangelists. Keep up the Good Work!

Seeking Alpha has an interesting post today, found at:

http://seekingalpha.com/article/192519-why-i-m-now-less-optimistic-about...

Mr. Harrison understands the economics part fairly well. He has not yet made the connection with Peak Oil... Without cheap oil to fuel a recovery, we wind up with recessionary and depressionary pressures. As economies drift downward (is this the "Long Decline" or the "Long Emergency"?), the point at which oil price further depresses GDP also declines, as stated. Several months ago, TOD was showing this point at about $80 per bbl. Prices are above $80, real data shows decline, e.g.: housing starts at the lowest level in history, continued job loss, personal consumption falling (the wierded out data says a small increase... actually resulting from increasing spending on fuel as those prices rise), etc.

Oil prices cannot drop much, since any significant decline puts price below cost of production (including severance, depletion, maintenance, captial costs, and all). When that happens, new drilling and production ceases, propelling depletion at a higher level, and creating supply/demand imbalance that must drive prices again higher. We are very close to the point where the cost of production is equal to or higher than the highest price without creating more economic havoc... if we are not already there. And, the excuses are being floated, like "it's really peak demand," some version of economic theory that it is just the financial markets, or there is a new bubble in "x," and so forth.

Nor, with a deflationary recession, will the true nature and extent of peak oil be recognized until it is far too late [assuming that is not already the case]. The falling value of currencies (not just the dollar) will disguise the real rise in oil cost, as a precentage of GWP. Here, in America, the relationary increase of the greenback vis-a-vis the Euro, and maybe the Yen, will encourage the markets to believe what they desire. Stock markets will remain level, or even rise slightly, but far less than the real deflation of the dollar against the Barrel, which has become the real world currency valuation.

Those who were wondering why oil did not drop, given the "increasing value" of the US Dollar need to wake up. Oil did not drop because the dollar did. In our truly global economy, how are we able to truly measure values, other than in necessaries? Water, food, shelter, medical care, transportation... compare the costs of these with personal income, and determine relative share of the cost of each with oil, gas, coal, electric (including nuclear, water, geo-thermal, wind and solar), including the unit cost of production in energy, and you might be able to come up with some abstract figure to use as a present gauge for specific currency or commodity. I am having trouble getting my head around a way to do this, and I am working on it. If anyone has an idea, or better yet a solution, please let me know.

Craig

Excellent summary, and based upon capex budgets put forth for 2010, the incremental, all-in cost of developing oil reserves and related infrastructure is probably higher than most believe. But no I haven't quite figured out myself how to price things in terms of energy. I am not even sure that the 'oil' price quoted on the commodity exchange is the best grade to use as a reference point for oil.

Anyway, probably later on this year, I expect the same concerns about the Euro, Pound, and Yen, to develop about the dollar. Except that when most 'investors' finally get around to worrying about the US dollar, the drop in the dollar will be steeper and faster than anything we have experienced in recent years.

I assumed based on the title of this story that it would be stupid but I was wrong. Love it.

The Bush solution..., Invade Iraq to try to control the flow of thier oil.

The Obama solution..., Try to print our way out of this mess. Green cornucopian

The "peak demand" crowed can't be that stupid..., they must know the supply curve hasn't moved much in the last few years. It was the demand curve that caused the spike, crash, and then stabilization at around $80.00 a barrel.

It must be deliberate propaganda

Expressed graphically, it looks something like below. The big step down is when some sort of domino effect takes hold and several governments default or the stock market plummets or there is a run on the banks or....

It will be interesting to see if this model actually unfolds. A staircase decline rather then a slow decline or crash.

when will the next shoe drop?

Always hard to know exactly, of course. The future tends to be that way, unfortunately.

But I think a good case can be made that:

1. the shape will be stair step-ish

2. the overall direction will be down even if there are some steps that trend up for a while

3. there will be one or more big steps somewhere along the way

Beyond that, who knows? Will a pipeline be blown up? Will a major city sewer pipe break and contaminate the fresh water? Will we reach 25% unemployment in 2013 or 2015? Impossible to tell but not entirely necessary to know if one figures out that we are entering a whole new world and is committed to preparing for it.

I tend to distrust smooth-curve projections/predictions. Reality seems to have a way of being more complicated and messy than that.

I am fairly certain that ELM 2.0 will mean that by around 2020, most of the imported oil that the US has been counting upon will no longer be available (which is not necessarilly the same thing as saying that it no longer exists). This means a reduction in US oil use of approximately 2/3 in about ten years. That's going to imply quite a bit more than mere "efficiency gains", and indeed, I see no way that we could achieve that magnitude of reduction just through efficiency gains in that short a time frame in any case.

We are talking here of an average annual reduction rate in oil demand of a little over 10%. Given my scepticism toward smooth projection curves, I'm inclined to think it more likely that we'll bump along for a few years with declines in the modest single-digit percentages, then something (and the scenarios are multitudinous) will happen to hit us with a fairly substantial double-digit percentage reduction in short order - something on the order of 20-40% almost overnight. Further annual declines in the range of 5-15% might follow for a year or two after that until we begin to level off. What I have just described would therefore be a prime candidate for being one of the triggers for that doozey of a drop modeled above. Of course, it is quite likely that other things will be going on that will be either causes or consequences of the sudden reduction.

There could be other things that cause such a sudden drop. A cascade of defaults, especially of sovereign debt, and most especially of US Treasury obligations, would be another prime candidate. And, of course, there are always the usual suspects riding on those four horses.

First I want to say I am inclined to agree with your future expectations.

Having said that, I am still looking for a mild economic recovery in the first half of 2010. Available information on oil use seems to confirm that. The EIA says the latest four weeks, 3% more oil has been processed, and this from a Platts headline just a few hours ago:

I expect that the supply/demand situation, in the face of ELM 2.0, is being resolved by a rundown of existing inventories. Mostly the inventories run down so far have been the mostly invisible oil stored in offshore tankers, which will be followed in our summer 'driving season' by drops in EIA measured inventories.

After that, it's every man (and woman) for himself (herself) as hard adjustments are going to be made - somehow. I expect one of those adjustments will likely result from a US dollar and/or US bond market crash, or mini crash. Those events probably will get the blame for the next round of 'demand destruction' - but in reality it is the lack of cheap oil that leads to economic downturns and mis-planning.

I am inclined to think that the real economy is presently on one of the flat parts of the stair step. Whatever fluctuations from zero we are seeing I tend to chalk up to a combination of inventory changes, government fiscal tricks and gimmicks, and random noise. Real, solid, sustainable growth it most assuredly is not.

All plausible scenarios except one question. Why it that a) retail price of gasoline and diesel in Canada is "in the range of" what you consider absolutely catastrophic for the US, eg. $4.00 / gal yet b) the average Canadian uses more fuels than the average American, yet c) Canadian economy isn't crashed or "stair-stepped-down", as you propose?

Inquiring minds and all that.

That is thought provoking. As a guess I might suggest that results depend a lot more on expectations than on the preceeding reality. We know that the Europeans are accustomed to higher fuel prices than the US and their economies perform similar to the US. Perhaps if Canadians are already used to spending a higher percentage of their incomes on fuel (longer, colder winters and all that)they haven't experienced the kind of shock that would precipitate a major economic crisis in the US.

People react proportional to how different events are from expectations, not how different they are from some objective reality.

You need to take a harder look at that statistic. The "average Canadian" includes two Class I railroads, and a lot of 400-ton mining trucks.

What are they using the fuel for? In many cases, not driving to work. They're using it after they get there.

I am truly concerned about the end of the world production plateau which might be just around the corner (2012) or who knows, could be several years later. At that point, there would be no stopping the depression, rationing, and draconian police state measures that would affect us all. However, I hold out some hope that birth rates start plummeting and death rates start rising, ala Russia. If that's the case, we can be miserable, but at least not crowded and miserable. And by we I mean the U.S.

Would we rather be Russia, or India? That's the question that more or less faces us.

Great article link Ron P. The above blockquote sizes it up pretty clearly.

"He is saying the same thing that I have been saying for over a year." - Darwinian

------

"As the psychologists show, facts barely sway us anyway." - Monbiot

------

"So of course worldviews can change. Maybe the problem is that we don't understand how it happens. (Hint: read "Influence: Science and Practice", by Robert Cialdini.)

"I'd also suggest, before we all go arguing about how static and unchanging human nature is, that some of us investigate neuroplasticity, or how the brain actually changes and re-wires itself throughout life. They are now figuring out how to amputate phantom limbs, improve autism, getting some blind to see, some deaf to hear, and some stroke victims to regain nearly full function again. (Hint: "The Brain That Changes Itself", by Dr. Norman Doidge, book and audiobook available on Amazon, your local library, torrents, ED2K, and other filesharing.)" - me, here

------

I clearly agree with the psychologists and perhaps Monbiot. After a year of saying the same thing over and over again, Darwinian, maybe you should try using elements of influence instead of beating people over the head with the facts that don't sway them.

Failing to do so will mean huge amounts of wasted personal energy and resources.

I can see why people, and even psychologists have developed notions about people who don't change. We've been living deep within the 'comfort zone' .. who'd want to change that? (Insert picture of happy tubby folks on the spaceship in Wall-E)

I look at studies that are based on the people around us in the west, and wonder how many of their conclusions are just ridiculously skewed since these people are living in a way that is a gross anomaly compared to so much of human history, no less natural history.

People can change, but it often takes external forces to get that free-will moving.

I pointed out the other day that Iowa not Texas is now the leader in installed wind electricity generating capacity. I took this view based on installed wind generating capacity per capita and per square mile of land area. There were some who disagreed and took the standard view that the absolute total of installed capacity was the correct measure of leadership.

Here is case where the absolute total number doesn’t mean very much:

http://news.bbc.co.uk/2/hi/technology/8552410.stm

It is a chart showing the spread of the internet 1998-2009. We can see that Sweden had the highest percentage of internet use in 1998 and other countries increased their use over time. There is no question that Sweden was the leader in internet use in 1998 even though the United States no doubt had a higher absolute number of internet users.

In the last window if one mouse overs the United States and then China, it is clear that China has about 60 million more internet users in 2009 than the United States. Does that mean that China with its censorship and other restrictions is now the leader in internet use because the absolute numbers show it? I don’t think so.

Suppose for sake of argument that a small country achieved 100% wind electricity production by hard work, investment, use of public policy and tax disincentives/incentives. Let’s call this country Denmark.

And lets suppose another country which is very large but which has a much weaker wind power policy and system in general still managed to install quite a lot of wind generating capacity such that it generated 20% of its electrical needs. Let’s call this country the United States. In absolute terms the installed wind capacity of the United States exceeds that of Denmark by several orders of magnitude.

Which country is the leader in installed wind generating capacity? To my mind it is Denmark.

Those who disagree with this should now acknowledge that China is the leader in internet use since the absolute number of internet users is higher than any other country at nearly 300 million.

Sorry x but Texas is still the best. We have enough guns and red necks to take Iowa's capacity away anytime we want.

Just a friendly tease. It would be nice to imagine a publicly framed competition amongst states to race towards such a title. Sometimes pride is a stronger motivator then common sense. At least in Texas.

chivington kicked the texans' a$$es back to texas at glorieta pass:

http://en.wikipedia.org/wiki/Battle_of_Glorieta_Pass

(texans,oilfield types,also insist on pronouncing it glor-ee-etta and cement is see-ment)

OK, "YO! TEXANS ARE TOO YELLER TO GO GREEN!", says the guy ducking quickly out of sight behind the sandbags in the Sunshine State... ;-)

Not yella FM...stubborn. Kinda like why we wear cowboy boots: it feels so good when we take them off. Why not go green? Because it will feel so good when we're forced to later.

I pretty sure you're not but I figured it was a direct assault on your (generic your) pride to be called that. Perhaps I shoulda said something like "You guys couldn't go green if you tried, and if you did try you'd come in dead last!"

Cheers!

We do have to give Texas credit for what they have achieved. Given the vast amount of FF we have and its relative cheapness you have to wonder why we've made any move towards the green.

Doesn't Texas import something close to 90% of the Energy consumed within the state?

Timber -- Not sure where your number comes from. Texas "exports" much more energy from the state then we consume. Not sure that really means anything though. Our costs of energy is marginally lower due to no cross country transport. Texas and La. are also big pass-through portals for much of the offshore production. Again, other then a good bit of jobs not a big deal IMHO. But the state of Texas actually owns a good bit of oil/NG from state mineral leases. As I offered before it will be interesting to see what the state gov't does with that oil WTSHTF. It physically belongs to the state and if Texas wants to keep it inside its borders no one can stop it. That's going to lead to some rather dicey politics I suspect.

Perhaps some bumper stickers [ SUV-bumper sized, of course :) ] with the state shape in the background, the inside of the state filled with the stars-and-stripes pattern, and wind and solar in the foreground, with the caption of either:

-or-

Or here is another thought: Federal funds awards (stimulus funds, or whatever to call them) with bonus amounts given to top states that adopt said solar and wind (and renewable) power and are the top tier(s) in the country?

The button I made says

"Your House is Cold. The Sun is Hot. 100% Maine Sunshine."

Doesn't have to be taken all that literally, but it does get the State-Pride thing in there.. I guess.

It takes talent to use common sense and Texas in the same sentence normally trying to do so results in and explosion with either your paper bursting into flames or your computer blowing up. Something about a multiverse collision and minor big bang. Its and open secret that the super collider was going to be placed in Texas because its in an different universe from the rest of the planet. Kudo's only a Texan can pull off such and achievement.

memmel -- sorta like the old line why God created wiskey: so the Irish wouldn't rule the world. Why did God create ego...so Texans wouldn't rule the world. But he did try to make up for it by giving us so much feaking oil/NG.

Well since I'm from Arkansas I'll let you in on a little secret the only people we despise more than Texan's are the wannabe Texan's in Oklahoma. Nothing warps you more than going through life with a five gallon hat.

I know what you mean memmel. When folks in Texas talk about building that fence to stop the wet backs sometimes they're talking about building it along the Red River.

The improper sentence structure with a superfluous period actually resulted in a sentence and a sentence fragment, which inhibited the incipient singularity thus preserving the stability of the multiverse.

Note my comprehensive solution to unemployment, Texas, Kansas, railroad manufacturing, water, and regional property values: hire the unemployed to excavate Texas, incinerate the resulting high-quality BS, and then transport via rail the ash to Mexico (they always wanted Texas back) and the tailings to a pile in Kansas. Over time the Gulf would extend to the Red River, and Kansas would be known for being mountainous, with skiing as a recreational attraction and rainy windward slopes to replenish the Ogallala Aquifer.

With a nearby deepwater port and coastline, existing locks and rivers, new railways, adjacent mountains, ample freshwater, and ample employment the regional property values would stabilize and grow. As for unfortunate Texans, they could apply to be excavation laborers or rail hands. The remainder would be settled on a reservation island around Austin, which could continue to view itself as the rotational center of the universe without the unpleasant intrusion of differing views.

X; (Whenever I write to you I feel like I'm in a James Bond film!)

My wife's from Iowa. I love Iowa. and You really want to win this one, I can see that.

I'm just waiting for Simmons to put those floaties out into the Gulf of Maine.. with our paltry population, we win, with the millions of acres of Great North Woods, we lose.. but we'll at least have enough Ammonia around to clean Iowa's and Texas' windows, if not their clocks. (And we do need the work..)

Now, about this 'Comparing' of Internet Winners to Wind Production Winners, China and US, Iowa and Texas .. are you coming around, or are you just a very complicated fella?

"That's a Horse of a Different Color!"

By the way, this conversation is going to be censored on the Chinese internet.. sore winners!

Mexico Oil Politics Keeps Riches Just Out of Reach (uptop)

The coauthor of this article, Clifford Krauss, is pretty sharp, and I spent an hour or so with him on the phone a couple of years ago reviewing "New Export Math." The concluding portion of the linked article follows.

In any case, as I constantly point out, Peaks Happen, even in regions developed by private companies, using the best available technology, with virtually no restrictions on drilling, e.g., Texas & the North Sea. So, then the question becomes whether unrestricted access by private companies will make an incremental or a material difference. However, given the Texas/North Sea case histories, of course it's really always incremental, since non-depleting oil fields--so far at least--exist only on Fantasy Island, where Yergin & Lynch live.

And this is an absolutely key point is that is widely overlooked: The premise underlying the Private Company/High Tech argument is that we can save ourselves by increasing the rate at which we deplete a finite fossil fuel resource base. But of course, the basic assumption seems to be that we all live on Fantasy Island.

While not specifically mentioned in the article, it appears that PEMEX is facing a very severe cash flow problem if it wants to expand Chicontepec. While I haven't worked out all the numbers, it appears that PEMEX will experience a negative cash flow in the development of Chicontepec over the next few years. This is a bit of problem since PEMEX has already wipedout shareholders equity on its books (note that does not mean it is bankrupt, just that it is not making any money).

http://www.bnamericas.com/news/oilandgas/Pemex_2010_rig_needs_to_be_comp...

Going forward I expect Mexico, Brazil, and others to increasingly demand foreign energy investment, in the form of 'partnerships' to make up for a lack of capital. But will the investors be asking - what is the energy returned on the energy invested? If they asked that question, they might not like the answer.

May I also add this from Brazil - to which Platts Oil says "Now that's what I call a capex budget - Petrobras says it will spend up to $45 billion in 2010."

http://www.upstreamonline.com/live/article208274.ece?WT.mc_id=rechargene...

keith schaefer:

"last year i couldn't even spell fracking(frac'ing) and now i still can't."

A very important sentence. Everyone should stop and think a bit about the potential meaning of that statement.

Actually you could look at the idea of KSA dabbling in CSS the same way as the Chinese with wind power - building up a market for export, pioneering technologies, and increasing production capacity. Their stated goal is to achieve export capacity for solar power, if they can free up some oil exports into the bargain all the better - the latter would pay for the former, no doubt. KSA use of oil for power generation is about 415 kb/d - I believe this figure spikes in the summer when they resort to burning oil directly for peak AC demand, but aren't sure, as my source is 2nd hand from the IEA and I don't know what went into its formulation.

You needn't read a tacit admission of peak KSA oil production into this.

"Barring a sudden spike back to the 2007 highs of $147 per barrel, Holmes believes the global economy can handle higher crude prices, and predicts oil is likely to move toward $90 in the near term."

http://finance.yahoo.com/tech-ticker/it%27s-the-most-wonderful-time-of-t...

Peak oil mentioned along with Peak Gold .....

http://finance.yahoo.com/tech-ticker

good videos ..... IMHO

Runaway Toyota Prius stopped by US highway patrol

As John Stewart pointed out on the Daily Show, this was a major design flaw with the Prius and Toyota's in general - if you're going to have gas pedals that stick don't have them in cars that get such good gas mileage - try to confine it to gas guzzling SUVs and trucks so you'll run out of fuel sooner...

Why didn't the driver turn the thing off? This problem has been hugely publicized over the last weeks, including reminders on how to turn the thing off. 20 minutes?

Maybe Toyota should just put a big red button on the dash that just TURNS IT OFF.

It's a perfectly sound idea, IMHO. Race cars have kill switches as a matter of course.

With the Lexus that crashed, the problem was that it was keyless. There was a way to turn it off, but it wasn't obvious to someone who hadn't read and memorized the manual.

It is still possible for one to buy a Model T on ebay for $10-15K. That's starting to look better and better all the time. . .

When I worked at the Royal Aerospace Establishment in the UK, I few with the team in an old civil airliner. The co-pilot had the original electro mechanical controls and instruments. The pilot had the experimental autopilot , gps nagivigation and flight control computer. In the middle was a large red button - it got used.

What was that Tainter said about collapse being a reduction in complexity?

As an engineer designing products for some 23 years I have strong dislike for un-needed complexity. My old Accent does very little automatically, which is perfect for me as I do not want a car doing anything I have not told it to do. The doors do not lock themselves, the A/C does not turn on if I put it to defrost (I have to push a little button myself - the horror!). All of the major systems are independent.

The idea of a drive-by-wire throttle makes my skin crawl. Now if you want maximum efficiency you must accept a much, much higher level of complexity - variable valve timing, cylinder deactivation, all the systems on a hybrid, etc. However, the opportunities for failure (of design or manufacturing) grow exponentially, and the likelihood of maintaining it without specialized tools, knowledge, and a supply of replacement subsystems goes way down. Look at the Airbus crash that appears to have been caused by a computer crash in response to a failed airspeed indicator.

Second, people have developed a ridiculous idea of what represents too much effort. Everything must be automatic - lifting a finger to push a button or move a lever is unacceptable. Compare it to what would have been normal just a few decades ago. Somehow I get the feel that's gonna change soon........

Last, the level of technology people use every day has moved well past their understanding and into the realm of magic. They may as well be waving a wooden stick and uttering words - that's just another form of interface at this point. What you do to make things happen is mostly just a matter of memorizing things that have no obvious relevance to the actions that occur, and therefore the actions you should take when things go wrong are equally un-obvious. Basically, they failed to memorize the proper spell to make the car stop.

I've said for some time that we are surrounded by so much energy from birth to death that we cannot see it all around us, and have zero intuition as to how much energy it takes to do any given thing. Combine that with a similar effect in regards to technology and the proliferation of techno gadgets all around us - the combination makes it all so much like Harry Potter, just with slightly different Human Interface Devices. It would be pretty easy to make a wand that can detect gestures and a voice recognition system.....

"Technology" is merely the modern day replacement for the word "magic".

When Joe 5.5Pack says "Technology will save us", he is really saying 'Magic will save me'.