Saudi Aramco Loses Count, Drills Too Many Wells In Ghawar

Posted by JoulesBurn on March 4, 2010 - 10:26am

The Haradh III development at the southern tip of the Ghawar oil field in Saudi Arabia, completed in 2006, has been portrayed by the national oil company Saudi Aramco as the turning point in the battle between geological adversity and engineering prowess. The poorest reservoir rock in Ghawar has succumbed to the latest in well and drilling technology. Aided by 3D Seismic images showing fracture locations, well sites were optimized and drills were guided by remote control from Dhahran. Smart completions were standard (did they ever call them "dumb" completions?), and something called an "iField" was set up. Maximum-reservoir-connectivity wells (MRCs) were fitted with monitoring electronics and valves on individual laterals such that they could be throttled back as needed to minimize water encroachment. Testing was done, adjustments were made as needed, and everything rolled out ahead of schedule. Goals for individual well productivity of 10,000 barrels/day were met, and projections indicated smooth sailing for ten years or more. Lots of glowing articles were published, and the man in charge eventually rode off in glory to solve the rest of the world's oil production problems.

The Haradh III development at the southern tip of the Ghawar oil field in Saudi Arabia, completed in 2006, has been portrayed by the national oil company Saudi Aramco as the turning point in the battle between geological adversity and engineering prowess. The poorest reservoir rock in Ghawar has succumbed to the latest in well and drilling technology. Aided by 3D Seismic images showing fracture locations, well sites were optimized and drills were guided by remote control from Dhahran. Smart completions were standard (did they ever call them "dumb" completions?), and something called an "iField" was set up. Maximum-reservoir-connectivity wells (MRCs) were fitted with monitoring electronics and valves on individual laterals such that they could be throttled back as needed to minimize water encroachment. Testing was done, adjustments were made as needed, and everything rolled out ahead of schedule. Goals for individual well productivity of 10,000 barrels/day were met, and projections indicated smooth sailing for ten years or more. Lots of glowing articles were published, and the man in charge eventually rode off in glory to solve the rest of the world's oil production problems.

Funny thing, though. When you look at a satellite photo and count the number of producer wells they ended up drilling, it adds up to quite a few more than they have been claiming -- about 60% more.

There must be a reasonable explanation. Perhaps they simply miscounted.

Faux Pas in the Desert

OK, so what's the big deal? After all, what are a few extra wells? But Saudi Aramco has been rather consistent, as well as thorough, about the development details:

The Haradh III project came on stream in February 2006, adding 300,000 B/D of Arabian light crude production capacity to Ghawar, the world’s largest oil field. The project’s main significance, however, derives from the fact that it sets a milestone for smart technologies at a scale and complexity unprecedented for Saudi Aramco and, arguably, for the industry. Haradh III might be regarded as the entry point to a new era in upstream projects and specifically into the domain of real-time reservoir management. The project spanned a period of 21 months. It entailed construction of a grassroots surface-facility network, integrated with a complex subsurface development program. Maximum-reservoir-contact (MRC) wells, smart completions, geosteering, and i-field features provided the four main technology components.

From the table at below left, taken from the above paper, it seems that the new era features a lot more acronyms:

|

|

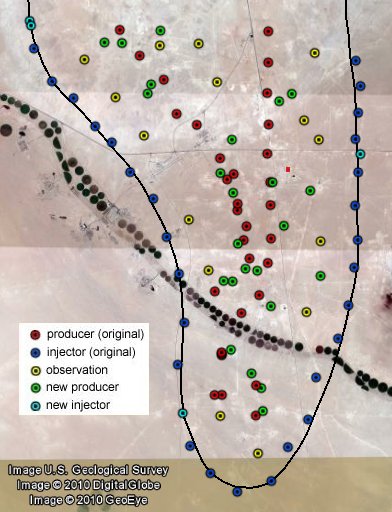

Figure 1. Project specification and well layout for Haradh-III from Saudi Aramco | |

A key figure is the number of producers (32). Also interesting is that the figures of 300,000 barrel/day flow and 2% depletion of reserves implies 5.475 billion barrels reserves in Haradh III(of course, this oil is not really physically separate from the rest of Haradh oil).

The well placement map (above right) from the same paper shows how these wells were positioned to drain the field, aided by water injection from the periphery. The map also indicates 32 producers and 28 injectors, but with 15 instead of the 12 observation wells (EV/OBS) enumerated in the table.

The above article was written by Nansen Saleri, the former Reservoir Manager for Saudi Aramco. He leveraged the success of this project to kick-start his new career as a reservoir engineering consultant. He later authored another article on Haradh-III, with a title invoking Matt Simmons' book "Twilight in the Desert" (egad!): Dawn in the DesertAgainst a backdrop of many international upstream projects straining to achieve their target production levels and intended plateaus, Haradh III reached its planned production capacity of 300,000 barrels per day well ahead of schedule, and the field’s performance more than 18 months since its start-up exceeds virtually all pre-project goals.

Sounds great, and he even provided some production data:

|

Figure 2. Early production data for Haradh-III from Saudi Aramco |

So, how are the wells doing?

Haradh III became the first Saudi Aramco project to be developed exclusively with MRC wells, with down-hole ICVs for flow control. Average well-production rates were targeted to be 10,000 bpd (which was achieved), compared with 3,000 bpd for Haradh I and 6,000 bpd for Haradh II. ... The principal sub-surface challenges and their pre-project risks (premature water breakthrough, loss of oil production, high-decline rates) were for the most part managed. Eighteen months after initial production on January 31, 2006, the field is maintaining its production capacity at 300,000 bpd, at virtually no water production, and with 100 percent active status for all its initial producers.

While we can't double check the flow measurements, we can count wells. I took a look at the Haradh-III development project a couple years back to determine if the field was laid out they claim. Satellite imagery from Google Earth was used to identify and count wells to check against those reported. Unfortunately, most of the southern end of Ghawar was covered by high resolution imagery only as recent as 2004 (i.e. prior to the Haradh III project). Some 2006 low resolution imagery was available, and this plus the fortuitous location of a few wells on the eastern fringe (where there were 2006 hi-res pictures) gave a reasonable indication that the project was as advertised. Another complication is the large number of gas wells present in that region, and gas and oil wells can be distinguished only at high resolution. So a definitive assessment would have to wait.

See Satellite o'er the Desert and selected stories on The Oil Drum for more background on this and subsequent work on visually characterizing the oil fields of Saudi Arabia.

Fast Forward to 2009

Over the last two years, Google had updated the imagery for the rest of Ghawar such that everything was covered by mid-2006 imagery or later. The southern tip, however, was still stuck in 2004. But late in 2009, a handful of restricted locations across Saudi Arabia were updated with imagery only a couple months old, including pictures covering the lower two thirds of the Haradh and the northern half of the Hawiyah operational areas of Ghawar. These pictures were taken with the new GeoEye satellite. This imagery update was greatly appreciated, as 2006 is fading quickly into the ancient past. Also new in Google Earth is a timeline feature which makes available the archived imagery for easy comparison with the current view.

The new imagery shows that the locations for the producer, injector, and observation wells given in the well layout map from Saudi Aramco roughly match those found in the satellite image, as shown below (more your cursor over the image to overlay the well map). The trio of closely-spaced wells towards the southern end of the well diagram correspond to three actual wells spaced about 100 meters apart north to south. One producer is slightly displaced, as are some of the observation wells; but overall, the rendering is fairly accurate -- after one corrects for the "squishing" of the map, something that Saudi Aramco seems to do with many of their maps (perhaps to confuse us).

Figure 3. Haradh-III wells which Saudi Aramco admits to. Mouseover overlays Saudi Aramco well placement diagram. Click reveals additional wells seen in Aug-Sept 2009 imagery. |

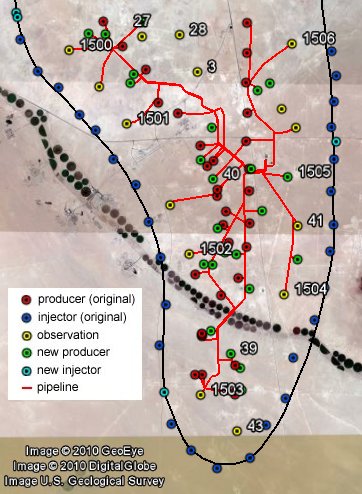

However, there are many other new (non-gas) wells visible in the satellite images than those claimed. Shown in the figure below (or by clicking on the figure above) are locations of 28 additional wells. Based on their location, four of these are identified as injectors (light blue placemarks). Of those remaining (green placemarks), two are most likely observation wells, leaving 22 possible new producers. Two of the indicated sites do not yet have wells drilled, even though they most likely will, so a very conservative estimate is that 20 more producers have been drilled than reported by Saudi Aramco.

|

Figure 4. All visible wells which are part of the Haradh-III project (September 2009) |

Using a variety of Ghawar well maps, I have determined the numerical identities for many of the wells. These are indicated in the figure below. Five of the observation wells (nos. 3, 27, 28, 41, and 43) were originally vertical wells drilled prior to 1990. Seven additional observation wells (1500-1506) were drilled at the start of the Haradh-III project. Interestingly, two of the "new" wells are actually old vertical well sites, shown as abandoned in 2004 imagery, and now presumably redrilled with horizontal sidetracks. Further confirmation of the identity of these wells as oil producers is the observation that they are connected to the same pipeline network with feeds into the Haradh-III Gas Oil Separation Plant, as shown below with the red traces.

|

Figure 5. Haradh-III oil pipeline network and identities of several wells |

Note that most of the observation wells are also connected to the pipeline network, and wells 3, 27, and 28 are connected to the pipeline network for the Haradh-II GOSP further north.

One detail remaining to be answered is the timing; when, since early 2006, were the additional wells drilled? DigitalGlobe, one of the imagery providers for Google Earth, has mid-2006-2007 images covering most of Haradh, but GE has not made them available at high resolution. However, using the low-resolution previews as overlays indicates that at least five of the new wells were present during that time. One of these, the northernmost new (green) well in the above figures, was seemingly on fire.

Well Done

Shown in the interactive graphic below is the region around a new well seemingly on fire in June of 2006. It was probably in production, as the pipeline to the rest of the Haradh-III network is in place. Move your cursor across the image and left click to view changes in the area from 2004-2009. All of the three producers visible were drilled or flowing at the time of the fire. The 2004 and 2009 images are from high-resolution selections in Google Earth, while the 2006 image is a lower resolution DigitalGlobe image. However, it is still relatively easy to identify changes between the high and low-res cases. Most notable in 2009 is the large number of new gas wells as compared to earlier. This is typical of all of Haradh, as drilling for gas has exceeded that for oil.

Figure 6. One of the added oil producer wells, spewing smoke in June 2006. Mouseover the dates to show 2004 and 2009 views. Click to highlight details. |

Mission Accomplished?

With a flurry of rather glowing articles in the press as well as in technical journals, Saudi Aramco has crowned the Haradh-III project a resounding success. These articles are so consistent in their assessment of the project that it was rather surprising to find that it has required 52 producer wells instead of the claimed 32 and also required 3 additional injectors. A couple extra might be expected, but that so many more were needed and that this has not leaked out is somewhat shocking. What are we to infer from this? Lower production from each well (vs. the claim of 10k b/d)? More total production (i.e. over 300k b/d)? My bet is on the former. This certainly doesn't mean that Haradh-III isn't a significant achievement, but this does suggest that the geological complexity still hasn't been overwhelmed by technology. Saudi Aramco has been scrambling since opening day in early 2006 to meet the 300,000 barrels per day production target, and as of last fall, had at least a couple more wells planned.

Finally, I will note that the latest grand achievement by Saudi Aramco, the Khurais field redevelopment, also suffers from well inflation. When first announced, there were to be a total of 310 wells. When finally started up, there were 420 wells. At least they admitted it this time, although no explanation has been offered (perhaps they haven't been asked nicely). Hopefully, Google (GeoEye) will point its new camera at Khurais sometime soon so we may help them count wells.

To browse the well locations using Google Earth, go here.

Busted! Pwnd!

Grand stuff Joules. Your posts are always the greatest.

"iField"? You just know that their reservoir engineers are watching things like "Light Saber Kid" while on break.

Google Maps Link to the Haradh area. Those circles and half moons are more center pivot agriculture, if anyone's puzzled. I see that the Google Maps database is improving, I used to have no luck entering in field names, but it knows where Ghawar is now. KSA highway symbols show up as well.

I recall some study of industry averages for completion of projects/budget overruns/need for additional workover and infrastructure/etc. It was all thoroughly in the "red," i.e., your average project was coming in late/overbudget/overworked. I'm visualizing some slide from a .ppt that Gail (I think) posted quite a while ago; anybody remember this?

In that light, how typical would you say that Armaco's woes are?

This is another example of their neverending obfuscation, too.

Im interested in the center pivot agriculture. I wonder if thats an underground aquifer or a river of some kind. Or if they just built them along a road. It seems to follow a line - presumably a water source.

Is that the same water they use for res injection?

I wonder how KSA balances its water needs for agriculture and its growing population against its need to maintain production. I think Matt Simmons' book mentioned using seawater for injection too?

They seem to be importing food, exporting oil. but what happens when they need more oil themselves or production falls?... Food prices will be inextricably linked to oil prices and this is one more of the complex interconnections (in addition to fertilizer prices and the cost of running a diesel tractor).

Great write up though. Love the interactive graphics.

They announced a couple years back that, due to the impact on groundwater resources, they were abandoning the domestic wheat project, and were going to rely fully on imports by 2016: Saudi Arabia scraps wheat growing to save water | Reuters

They do use seawater, yes. The new and improved (?) Khurais pipes it all the way from the coast.

Haradh wheat - Google Search

It's an ancient riverbed of sorts called the Wadi As Sah'ba. Wells drilled tap the Umm Er Radhuma aquifer, which covers most of Eastern Saudi Arabia. Artesian springs from this aquifer have produced the oases at Al Hasa (just east of the Uthmaniyah part of Ghawar) and Al Qatif (north of Dhahran).

There is a curious occurrence along the Wadi As Sah'ba near Ghawar, and I will have a post on it one of these days.

JB

Joules, the Wadi is the source of water for the many oases in Saudi. However it is not, or was not, the source of the water used to irrigate the wheat fields. That water came from non-renewable fossil aquifer water. The Wadi is replenished from rains falling on the mountains in Western Saudi. However most of the water for agriculture in Saudi comes from non renewable fossil aquifers.

Water, energy, and limits to growth

And: As Countries Over-Pump Aquifers, Falling Water Tables Mean Falling Harvests

And from Ugo Bardi and The Oil Drum: Peak water in Saudi Arabia

Ron P.

Ron,

I didn't say the wadi was the source of the water. But, there is a correlation between where the wadi is and where the fields are, no? I believe that is because the aquifer is somewhat closer to the surface there, or less saline there, or whatever.

JB

iField ? I didn't know Steve Jobs got into the oil business.

Steve Jobs dabbles in everything from Ipods, Iphones, to iFields.

Steve Jobs is definitely not an iDiot(!)

I wonder if we have any readers from Saudi Arabia who could offer their insights on what is going on--under a pseudonym if appropriate.

It certainly looks like Saudi Arabia is looking under every sand dune and offshore to try to find oil, and pumping in areas that are expensive or yield low-quality oil. These actions would seem to suggest that most of the "easy oil" sources have been found, and more and more iffy, high priced sources are being worked on to try to keep production up.

Probably because at $70 + per barrel they can afford to do it and make a profit.

If you look at a chart of KSA production, it seems to have distinct phases:

Up to ~1980 this looks to me like a classic 'vertical drilling' bell shaped peak - peak year for vertical wells 1980.

From 1980-1990 production was deliberately held back to meet OPEC quota.

From 1990 to 2003 production was boosted by horizontal drilling but even using this production peaked about 1998.

From ~2002 they moved on to max vertical contact and this peaked very quickly around 2005.

That is a neat chart, Thanks!

It makes one wonder how much spare capacity there really is.

True Gail especially when you consider the somewhat inverse relationship between horizontal/max contact wells and production rates.

That's what I would say may be the carry-away lesson of the article, as an example of a cutting edge field development. It looks like they may have gone very rapidly into a declining production rate and had to add wells and injectors to make their projections. In particular, it makes their 2% annual depletion rate look pretty optimistic.

Exactly. The "phase diagram" reveals what we cannot see from looking only at the barrel produced as we use to do using the Hubbert method. I still think that KSA is chiefly a swing producer and the production amount is still due to the OPEC limits and price policy. But the effort and methods for maintaining the same production level tells a different story.

So KSA is like a person who is quietly lying in his bed and his doctor assures that he is all right - but nobody notices that he is clandestinely being transferred to the intensive care unit of a hospital. Now Ghawar is under intensive care.

Here's my entry into this sweepstakes:

This is a stacked graph, nb. Exports = Prod-Cons. No doubt a bit gets scrambled up into stocks. The percentages are of the total volume. KSA's energy consumption is 60/40 oil/NG. EIA said demand was to grow (from whence I'm not sure) 8-10% by 2010, mostly for power generation + petrochemicals. 2008 showed 7.14% growth. Growth in power generation is sure and steady; a linear trend through their electrical generation history has an R2 of 0.98.

KSA could do a lot with solar or solar thermal. This sector is due to go through the roof; doing so would free up a lot of oil for export. Heavily subsidized prices prevent it from doing so, also perhaps wishing to save face in some fashion. Saudi Arabia deigning to burn fossil fuels - crazy talk!

Global Concentrated Solar Power Industry to Reach 25 GW by 2020 - Renewable Energy World

Very interesting figures. ELM is apparently alive and doing well in Saudi Arabia.

Since 1982, stated internal use as a precentage of stated production looks to have doubled through 2007, though I would add that absolute use has gone up every year.

Using the assumption that internal use will increase i.a.w. the present annual increase, and production has peaked, can anyone project the date that exports will equal zero?

Craig

That is an artifact of the simple metric that went into this graph; since production was voluntarily cut back in the 80s consumption shows up as an inordinately larger percentage of the total. The actuality is worse, actually ;), go with the 1981 number of 7%, where they were producing at full, and consumption has trebled.

At the 2007-2008 growth rate KSA consumption will exceed production in far off 2058. Why do you ask, Mr Huber? ;)

That's assuming production stays flat, no massive alien invasions, stuff like that. 2007-2008 = 170.26 kb/d; 2000-2008 average diff was 102.47 kb/d, so that 2058 number is high case. I think this is why no one except bloggers cares much about consumption in producing nations, not that it isn't important, but...

Might as well say this following that graph. If you look at consumption numbers for a number of countries. And I urge you to find it on your own and do a bit of research as everyone should bone up on consumption/demand etc its important. What you find is that consumption tends to follow population growth which in general follows a linear pattern. Non-linear increase in consumption of oil are rare and as even rarer in oil importing nations.

http://www.indexmundi.com/india/oil_consumption.html

Its a big topic in and of itself and its one I disagree on as far as ELM goes not that ELM is not real but that real consumption growth is seldom non-linear.

However if you suspicious about a oil producing countries actual production levels then non-linear increases in internal consumption are a bit of a red flag that all is not as it seems.

In any case one can readily take the linear trend and extrapolate it through the present and wonder why the sudden increase in internal consumption coincided with a rapid increase in the price of oil. Or one can accept the official argument that rising oil prices caused higher cash flows and the population of the oil producing nations then decided they needed to do donuts in the desert for four hours a day burning up the gasoline that still only cost them 25 cents a gallon regardless.

Of course no one else is going to explain how a lot more money is going to induce people to use a lot more gasoline that was already dirt cheap in the first place and not even and issue with per capita consumption already higher than the US in its heyday.

More likely oil consumption continues to rise in proportion to population in these countries which is roughly linear but as I said a topic worth of discussion. In any case there is a compelling case that some real declines are hidden in elevated internal consumption claims. So finally the assumption of a constant production rate with ELM is probably not correct. Better to assume that we are seeing and accelerated real decline rate and linear increases in consumption resulting in and ELM thats probably has a higher net export decline rate then what WT gets.

I'll play with those numbers someday, but right now I'm content messing about with examining historical demand, mostly just in the US, both for selfish reasons and since the EIA data is a magnitude more accessible than that of other countries. Population is interwined with GDP, with overall economic structure, and a host of other factors, plus oil consumption data itself is largely restricted to annual numbers in most nations, and then only back to 1980 with the EIA, precisely after when things became very interesting - peak demand really kicked in.

Have you played with Morgan Downey's Oil Demand Motion Chart? No setting for population but you can feed in per capita GDP.

We cannot forget that as extraction becomes more complex, the energy used in exploiting the oil fields increases. Hence, the horizontal drilling is more expensive and energy intensive than vertical shafts were. Likewise, injection of water and co2 is more energy intensive than natural pressure and simple jacks. This is, according to my understanding, a part of ELM. Plus, of course, increasing population, higher living standards, military defense of oil fields (probably the most overlooked, though seemingly obvious), and in some cases aid to Palistine, perhaps to the Taliban, or other governments and religious groups, and so forth.

A strictly linear growth would not seem possible. In fact, even as a function of population growth, in a young population with a high birth rate, nonlinear growth of oil use within the nations would be more likely than any other scenario.

As far as doughnuts in the desert... well, maybe some of the wilder princes? I dunno. Interesting thought though. :>)

Craig

There is a lot to it and your not considering expansion of NG usage use of residual fuel from refining instead of buring oil directly etc etc. Certainly in the US the aging of the baby boomer generation did not lead to substantial growth in oil consumption. Indeed it generally declined over the same period.

I've read enough to question this claim of exponential growth in consumption esp given as I said gasoline is dirt cheap and consumption is if you will saturated. Consumption changes in the US where very much and issue of price and it took significant increases to stall consumption increases.

I've been waiting to some extent till WT publishes his paper. And overall I agree with it just that its important to decide if its consumption increases or real declines being passed off as a sharp increase in consumption above the "norm". I've come to the latter conclusion. With that said it does not change the ELM conclusion except that actual export declines may be significantly higher as obviously geologic decline is not limited by the population and the decline rate can easily exceed what would happen with simple increased internal consumption. However obviously some of this is accounted for to some extent in the "official" numbers thus the results of the ELM calculation regardless of if the missing oil is from decline are internal consumption is basically the same.

To a point.

If I'm correct then Saudi production has been in decline for some time with peak somewhere in 1998-2003 you can read that off the original graph. If so then they are now well past peak and experiencing a gut wrenching accelerating in the decline rate. And this event is already also in the past.

Saudi Arabia is not long exporting much oil to the US less than 1mbd if I recall correctly from the EIA data correct me if I'm wrong.

The claim to be focusing on the Asian market however.

http://in.reuters.com/article/domesticNews/idINLDE6201XS20100301

Seems as if Asia is buying from Africa.

So the Saudi's are not shipping oil to the US and not shipping it to Asia perhaps just perhaps they are not shipping it at all.

If so then its not just ELM since it matches well with a real underlying decline that was foisted for a while as explosive growth in consumption and we are now at indeed past the divergence point where ELM coupled with intrinsic declines work out to some nasty net export numbers. You think WT ELM is bad if you include estimates of accelerated decline rates from advanced technology anywhere close to what we saw in Mexico the numbers are horrendous 20-30% net export decline rates.

Can I be wrong sure but the problem is if I'm even close to being right things get ugly fast. Its not prudent to blithely dismiss such and outcome and it does not require anything extraordinary for it to be true. What I'm saying is not far fetched and if it was really happening and the Saudi's admitted it then the reasons are not intrinsically shocking their fields are old and have been aggressively extracted. The only thing that makes such people even consider such assertions as questionable are simply unsubstantiated claims made by and about Saudi Arabia. For that matter in my opinion Iran is also playing the same game and so as Indonesia. Until recently Mexico seemed to be truthful and with in reason Russia. Norway and Canada probably telling the truth and so is Vietnam.

In fact if you want to take a model country of what I'm suggesting simply take a hard look at Vietnam as far as I can tell all there numbers are pretty legit, also they have steadily increasing internal consumption and falling oil production. I think they will no longer be a net exporter this year. And because of the war they also have a very extreme boomer cohort passing through so if any country is going to show explosive increases in per capita consumption its Vietnam. Next you can compare them with neighors such as Malaysia and Thailand and even the Philippians that have different demographics and GDP changes. And you have Indonesia and Malaysia as significant oil producers thus models for importers exporters and former exporters all with very similar economies exist in the region. My point is that you can readily use southeast Asia as a sort of model for the various factors effecting ELM to consider if a given country is hiding declines via elevated consumption claims. Obviously I've looked and my conclusion was the Saudi's are lying.

memmel,

Good post, your points are well taken. Of course it seems like we should be using the advice from the movie "The President's Men" and "follow the money".

Oil consumption in the most developed nations (i.e, U.S., Europe and Japan) has been relatively flat. If China, India and the other Asian product exporting nations are buying from Africa and not Saudi Arabia, then Saudi Arabia should have what every seller hates...a shortage of customers, especially big customers.

So sooner or later (one would guess sooner) they would begin to experience what everyone hates, a real money shortage.

Have we seen any signs of this yet in KSA? Any Texan here (and I know there are plenty here!) should be able to verify that pain in the oilfields, either in price or production levels does not take long to be felt in the larger economy.

And speaking of money...some of you folks surely have a dollar price on what all of this oilfield development must have cost...did the Saudi's bear the bulk of this expense themselves? It seems important at this point to have some big customers waiting for that oil and willing to pay a pretty fair price for it. Are they out there?

It is easy to call the Saudi's liars (I have unwisely insinuated as much myself in years gone by), but they have had a history of delivering the goods...it may be more correct to view them as suffering from hubris or cockiness...because they have delivered the goods in such a big way for so long, they honestly believe there is no end..."the road goes on forever and the party never ends", hey, we've always done it...

your point memmel, "Can I be wrong sure but the problem is if I'm even close to being right things get ugly fast."

Once again, this is to me is the great fear about peak oil...no one knows when the floor may fall out from under us, and one day is as good as the next...why not tomorrow? Why not 4 years from now, or 10 or 22 years from now? Our reliance on oil as our primary, almost monopoly transportation fuel makes us vulnerable to potential catastrophe. In the interest of risk management alone we should find such a situation intolerable. But for now, let's look at the Saudi economy and see if they are suffering any worse than the rest of us from a real cash shortage in their economy. That would be a major clue to duck and cover your ass FAST.

RC

LOL we probably can get the well logs for every single well in KSA before we know about the money.

Its not Saudi Arabia but obviously Dubai was thrown to the wolves.

And the Saudi stock market crashed a while back. Don (observer1) is a money guy and knows more.

But Shari banking is a strange world and of course your dealing with a Monarchy so state money is a fluid thing.

Very old post but it might be helpful to see what they did last time oil was dirt cheap and they needed money.

http://www.nytimes.com/1988/07/12/business/saudi-arabia-bond-offering.ht...

http://goliath.ecnext.com/coms2/gi_0199-4988714/Middle-East-Africa-Saudi...

I will admit that I've avoided to a large extent diving into what money trail exists in the ME.

http://www.reuters.com/article/idUSTRE61G1D320100217

That in my opinion is not good news. I have read a bit about this but obviously if they are having problems with oil production and suddenly willing to enter into the money markets then its not a good sign.

But you would have to be very knowledge about Islamic financing the ME and KSA to know. And of course look at their buy side treasuries bonds etc etc whats their Sovereign wealth fund doing can you even really know ?

And of course although they have claimed little damage from the financial crisis one has to imagine whatever is going on in the murky world of high finance also has a big effect on the money trail.

Excellent idea but also I wish you well if you choose to chase it. I'll watch it a bit closer for sure but but I'm not sure what really possible or knowable. By definition the Saudi royal family is a conspiracy of some very wealthy and powerful people no tin foil hats required.

memmel, don't you ever sleep?

Very impressive analysis and deduction, though.

Wow, impressive sleuthing and analysis. If you're ever looking for work, I'm sure the CIA would love to have you on-board ;)

Tom Whipple (writes for ASPO-USA and Falls Church News Press) is a former CIA analyst. Sounds like a good work area for peak oil analysts--especially "Joules Burn."

Now starring in "Oilfinger"... "My name is Burn, Joules Burn."

So many wells, so little time

It comports with figures I have seen that S.A. added some 500 wells in 2006-2008, with zero increase in production [or, importantly, in exports].

Craig

Fantastic facts and analysis. Thank you for sharing it.

This is a nice piece of work. If I'm reading this correctly, it boils down to 'Better Superstraws Through Technology.'

/sarc on/

But don't you think real-time reservoir management will be critical when all the excess abiotic oil starts bubbling up to the surface?

/sarc off/

Simple, indisputable exposition of a complex topic - much appreciated.

Sweet interactive graphics - unless one is even a wee bit color-blind.

Wish I could resolve a "new producer" from a "new injector" on the maps - maybe try X's and O's?

Sorry about that, Chief.

The injectors are only on the periphery, so the four new ones are those that look blue/greenish.

JB

Good article.

Now considering the well count. First if anyone has any knowledge of some other large project that suffered wellitis with a large increase in the number of wells it would be nice to know about it.

Next I've not read about this happening and given the technology employed to site the wells in the first place it seems doubtful that the new wells where added because of a major blunder.

I tend to seriously doubt that these new wells are blunders or and issue with the project. That does not mean that the real production levels either per well or in total are the same as whats claimed. They are what they are and we will probably never know for sure however what ever they are obviously production is high enough to make the investment.

Now although we don't have individual field data that matches this sort of activity we do have a very good fit if one considers regions.

When the US peaked there was a massive drilling campaign often resulting in marginal and or unprofitable wells being drilled.

I assume other parts of the world should show a distinctive and real increase in drilling as fields and regions decline.

Thus the additional wells here and in Khurais are probably not being drilled because of serious issues with the fields themselves but in a vain attempt to offset a major and serious decline in production elsewhere.

Now with that said the obvious culprit is the rest of Ghawar. So I'd suggest that not only is this good evidence that Ghawar is in decline but also that its decline rate is "surprising" some people.

Next one can speculate that these project where originally designed to offset declines in Ghawar's production i.e back when they where conceived for development the decline of the producing regions was either a concern or already starting. Given that it seems additional work was done to probably offset unexpected declines it makes sense that the original development was done to offset a lower expected decline rate.

http://www.saudiaramco.com/irj/portal/anonymous?favlnk=%2FSaudiAramcoPub...

Thus going with the assumption that Haradh was developed to offset declining production in the other producing regions of Gahwar the knowledge of real declines or pending declines obviously existed before 1996 !

http://www.hydrocarbons-technology.com/projects/haradh/

This has GOSP-2 comming online in 2000 a few years here and there don't seem to matter much :)

The exact dates are not super critical just that it seems reasonable to assume that the underlying goal was to offset declines in other producing regions in particular the rest of Ghawar. The basic time table coupled with this flurry of drilling suggests that not only has Ghawar probably been in decline for some time but that its decline increased unexpectedly later on. This could well have even been before 2006 even if decline rates are increasing you would still need to execute the original project as planned and then some.

The fact the project seems to have been expanded effectively at the same time as its original schedule suggests that the condition that was causing concern was pre-existing not something that came on as the project progressed.

And next given this speculation we can guess a timeline for the decline of Ghawar starting sometime in the late 1990's early 2000's and becoming increasingly serious by the late 2000's. This sort of time line fits well with assumptions about the underling reasons behind these projects.

Do we have any supporting evidence to suggest such a timeline is not just idle speculation ?

Well first and foremost the huge increase in price of crude over exactly the same period suggest that indeed a major source of crude could have readily declined substantially. This alone in my opinion is sufficient to support the strong possibility that Ghawar has already declined substantially in production.

On top of this on my blog I back calculated oil production from atmospheric C02 data and determined a real substantial decline in production over exactly the same period.

This paper along with the series preceding it in my opinion supports concern about the situation at the very least.

And last but not least given the nature of Ghawar and its position esp in global exports at the most basic level it makes sense that a emergency if you will in global oil production not tied to some war or other event would probably be related to problems in Ghawar problems in any other region simply cannot occur on a scale to dramatically influence world oil prices. No other single field produces enough to have its decline have such and impact. And combination of fields results in fairly large spread and much slower average decline. And last but not least given the size of this project if it was declines elsewhere in the world then this and other Saudi projects would have gone a long way to offsetting the declines unless Ghawar was in steep decline :)

And last but not least this casts some serious doubt on the validity of peak oil theory as if its true then most of them blew it.

Obviously I don't have a lot of faith in traditional peak oil theory as it uses industry data to predict peak oil. Given the above obviously industry data is not worth anything. Some reasonable sleuthing paints and entirely different picture and peak oil theorists dependent on industry data during and after the real peak oil event when the quality of the data is highly questionable cannot generate any realistic projections. GIGO.

Whats really interesting is this faith in the industry data comes even though most peak oil theories reject the obviously political bump in reserve figures by OPEC. The most blatant and questionable figures are rejected yet beyond that nothing is done.

Thus these series of papers on Ghawar are probably the most important one published concerning peak oil as they suggest using raw data that things are not as they seem the peak oil community has been way to complacent in its acceptance of industry data without fact checking.

Certainly its not easy to figure out ways to double check and cross check claims made by the industry but with some creative thinking as shown by this series its possible.

And obviously my conclusion is that most people have seriously missed the true situation. Small wonder that peak oil theory is not taken seriously as its relatively easy to mislead the theorists as they simply don't have the desire to check their data.

This work as I said based on raw data stands beyond the crowd and its importance and implications should not be underestimated.

Hopefully my suggestions at least cast a reasonable doubt on official numbers at least enough to suggest that and aggressive effort needs to be made to audit the industry data using creative approaches such as this. As long as the peak oil community is happy to accept GIGO then it will never be taken seriously.

Memmel,

There are other pieces of the puzzle which come to light when considering the import of Haradh to what is going on further north. All three phases of development have had major issues, and continue to be areas of activity. I decided not to do a comprehensive tell-all about Haradh in this post because it was better left as a simple premise with irrefutable evidence. Suffice it to say that a lot of new wells have been put in Haradh-II in the last few years, and Haradh-I had five rigs drilling new oil wells when last photographed in 2006. But, as is the case for Haradh-III, the nice Saudi Aramco story of technological progression from north to south has been cleaned up for prime-time television.

I do not believe that they are trying to get more out of Haradh than intended. There are scattered reports of them having to shut off MRC well laterals rather early to keep the water cut down, and when you do that, you have cut your capacity by one fourth to one third. After awhile, you're talking serious barrels, and the only way to get more is to drill more. Plus, the new well locations (even though we don't know where the laterals go) don't make sense from the perspective of their original plan. That is, the next step would be to put wells in the middle of the "V" rather than just put them where they already have drainage.

JB

Hopefully I was clear that the additional wells where probably not according to plan. If not I was suggesting that they where added under duress. Now the key is interpreting why. As far as the Saudi claims on specific number from per well production levels to overall field production levels I take those with a big grain of salt. However these are big projects and in this case into a effectively virgin and well known field. Sure it has some problems yes like all projects but I don't agree with your conclusion that the new wells are because of problems in the field. Especially given the new wells you mention in other older projects and other fields.

On the technical side I've never had any reason to question the Saudi's ability to plan and execute large projects and hit their design objectives questioning what the real numbers are is quite different from questioning the execution. In general they do what they plan to do and achieve it. Certainly they have to deal with problems like everyone else but I don't have any reason to believe that serious miscalculations have occurred in the planning and execution phase of their projects.

I don't agree with the conclusion that the new wells are because of intrinsic problems with the projects and that serious technical issues are the reason behind the extra wells. Thus assuming they are technically competent and I have no reason to assume otherwise then the new wells are a desperate attempt to offset serious decline elsewhere.

Certainly there are technical issues but I don't agree that thats the correct explanation not to mention almost impossible to prove :)

Sure technical issues can certainly explain part of the situation but I'd suggest its probably a fairly small part.

So I think they executed the projects and basically met original design goals however those turned out to not be nearly enough to meet their overall need because of issues elsewhere. Thats what I see in your data not a large number of serious technical problems in the field itself. As far as real production levels go given the design its certainly 100kbd plus but I'm no expert and can't say more than that. Was it every really designed to produce 300kbd ? Dunno perhaps someone with more expertise can comment on the possible production range for the configuration.

Obviously if I'm correct and the additions are to offset decline elsewhere then a range of possible real estimates on the original production levels and new production levels with the extra wells plus whats been done in other fields will give you some idea about the amount of excess decline they are trying to overcome.

I can tell you now there is only one field in the world that can decline at a rate sufficient to cause what your seeing.

The rest of Ghawar.

There is one facet of my observations that clearly points to shortcomings in the original 32 productions wells as opposed to adding new wells to produce even more oil from Haradh-III. Specifically, there were only 4 new injectors added. One of those seems to fit where there should have been one anyway, and the two at the northwest corner were probably put there because of issues they discovered when pressurizing the field in the last months of 2005.

If the new wells were to represent added production, one would expect a proportional increase in the number of injectors (16 or more), and more evenly distributed.

Why do you suggest this ?

If the field has pressure it has pressure you noted they only add four more then thats what they needed.

Perhaps as production progresses and the field is much older you would get that sort of relationship but at this stage those

injectors are primarily for pressure and most of the field is still oil.

I don't understand your logic can you explain a bit more ?

Lurking experts perhaps may want to chime in ?

i think this is a "we just don't know" case.

additional injection wells may or may not be necessary to support additional production, it depends on the injectivity and location of the injection wells.

this presents a paradox: if aramco's modelling was correct a priori, then additional injection wells would probably be needed but if there modelling was a bust,well, it was a bust. they may not have gotten the injection right either. who knows ?.

i suspect aramco had a pretty good idea of what water injectivity would be.

Injectors provide more than static pressure; they provide flow. If you take 300,000 barrels per day of oil out, you have to put that much water in (more if water is coming out too). So, if they are taking (say) 450,000 b/day oil, that means an extra 150k b/d water has to make its way toward the center of the field. You are not going to do this unless you have a sufficient number of injectors, distributed appropriately to maintain sufficient pressure at where the new wells are.

Well no.

Consider a field that produced under natural pressure i.e no water injection at all you get what 20% recovery sometimes better.

Later on in the fields life I agree what your saying is important but early on depending on the nature of the field you don't even need water injection. And this is a very tight field so the initial role of water injection in such a situation should be fairly minor.

Note this is from simply reading about modern wells in other tight formations I've never even read about about secondary recovery being used at all as far as I can tell its all primary.

Where is FractionalFlow when you need him :)

petroleum.berkeley.edu/papers/patzek/spe35721.pdf

This suggest that injection rates in tight formations are low and that water injection is primarily to prevent reservoir damage.

I'm not saying your wrong about the need to sweep eventually but its secondary. Also of course one has to imagine that you have a lot of leeway into the actual injection rate for a particular injector well. I don't see any intrinsic reason why the rate of injection cannot vary over a fairly large range. ( Expert help needed)

Given the way Ghawars been developed in general the initial infrastructure is almost certainly designed to handle how the field will change over many decades what ever was put in now was probably put in place in anticipation of conditions at least say ten years from now.

As I've said I think you have jumped to the wrong conclusion that the excess wells are related to problems within the project itself.

Again I don't know for sure but I disagree that your assumption of the need of significantly more injectors to ramp production.

Its not that simple.

the south end of ghawar is "tight" ?, relative to what ?

Well yes.

This is Ghawar without water injection:

With natural pressure from the aquifer, the water still has to come from the periphery. It doesn't just magically appear near the bottomhole of the well to replace what you have taken out. And the only way it gets from the periphery is to flow there, just like the water you inject from the edge of the field. Without water injection, fluid (oil or water) cannot flow from the periphery fast enough, the pressure drops below the bubble point, and you shut down your well. Even now in central Uthmaniyah, there are wells which are dead because the pressure is too low, and the oil pressure at the surface isn't enough to get it to the GOSPs.

So when water is injected, you create a band of high pressure which can cause water to flow uniformly towards the center to replace the oil that flows out. But if you just put in a few injectors, they are not going to be doing much to maintain the pressure on the other side of the field.

Bottom line: water injection maintains pressure by injecting water, and if you don't replace what has been taken out in oil (and produced water), you are not maintaining pressure. And if there isn't low enough resistance to flow of fluid (water or oil) between where you inject and where the well is, your pressure will continue to drop.

As far as the reason why they are putting in more wells, we are both speculating. You have your mind made up about what is going on in Ghawar, and I believe that colors your speculation. But the main purpose of this post was just to point out that they are adding them in difference to what they say, so let's just leave it at that.

Naive oil-patch question. What keeps water or any other substance injected into a field from back-flowing or seeping out from where you want to add the pressure to increase your flow rates? How do you keep the pressure going forward, continuous pumping in?

Well you can't some water will always escape and go a different direction. However you must remember it is an anticline, with a cap rock not only on the top but on the sides as well. The same cap rock that caps the oil also caps the water.

Also, there is always pressure at great depths. When you allow the oil to escape the pressure naturally drops but only in the area where the oil is pumped from. When you inject water you are only restoring the pressure to what it was before. The area all around, and below, the reservoir is already at a very high pressure. The injected water will simply re-pressurize the area where the pressure has dropped.

Ron P.

Here is one example of what happens:

http://www.theoildrum.com/node/3754

Water from the Ghawar injectors was pushing towards the Harmaliyah field to the east, so Saudi Aramco decided they had better put in some wells to suck the oil up before it got pushed further east and out of reach.

Ah...good review in the link. I had seen that previously but forgot...thanks. It would be nice to keep this current thread going in updated form, perhaps TOD editors can do a new thread as "Updated". I have a feeling we will want to refer back to all this as things progress in spring/summer 2010.

I think your understating my position :) I'd argue that its extreme to highly radical "colored" simply does not do it justice.

I'm 100% confident I am beyond a shadow of a doubt and have no problem being extreme and perhaps "colored" if you really want to tone it done however I'd prefer a stronger term as I think I've moved well past that point. Often rude in some posts and I really don't care if people agree with me or not as given my position peoples opinions really don't matter. At best depending on how they think they can make changes in their personal life but thats their problem and I don't care either way. They can take or leave what I have to say.

In fact one of the hardest things to get across is the fact that what I think and what you think does not matter one bit if I'm right.

Nor does the opinions and position of anyone on this planet. We can no longer avert the whats going to happen at best we can make decisions now that may or may not help us later. The only thing that really bothers me is if I am right then the fraud committed by our leaders has played a huge role in putting us into a certain catastrophe. The way people thought in acted in the past is very much a part of whats got us into deep doodoo if I'm right. And if so well then simply out of vengeance I'd really really like to see the liars and crooks exposed for what they really are even though it does not change anything. I don't know about you but I'm not particularly happy about potentially living through the end of a civilization simply because what people think became far more important than reality and truth and the manipulation of how people think eventually resulted in a very ugly truth.

The fact I have a "colored" position does not matter its worse than that however ..

Am I right ?

Self-understanding is a good thing. But given your diagnosis of the situation, why do you comment on TOD?

Just asking...

Ultraistic Altruism.

Lets assume I'm correct.

1.) If so then our current system is based on a pack of lies at all levels to some extent this is becoming clear.

If so and if its exposed and documented and the full extent of what we have done is made public the future historians

should have a excellent written record of this time period. I'd believe this will help others avoid the trap we fell into.

2.) On a personal level obviously there is little reason to rise up in revolt or become violent the system will collapse soon enough on its own accord shaking it will do nothing. Thus your left with personal action. Well in general thats fairly benign and focused on becoming self sufficient how ever you feel is the best way. The advice is in general WT ELP ( Economize Localize Produce) I don't see that this is harmful to anyone. Even if later on things turn out for the better taking some time to try and take control of your life is simply a generically good thing. So any action is really pretty harmless to society and helpful to the individual if not society.

At worst your consumption levels fall and you don't help us spend our way out but Jevon's paradox assures us others will take advantage and consume what you voluntarily forfeited. This does not change the outcome really either collapse or we are better off and we return to growth. So overall pretty mellow.

3.) Karma, Its a small world perhaps someone actually listens to what I'm saying makes whatever personal moves they want to make and it works out for them. Maybe one day I'm a refugee fleeing some conflict and trudge up to a farmhouse begging for food. Perhaps this person finds out who I am and feeds me to thank me. The point is that individual decisions are themselves of no concern but life has this way of sometimes every now and then allowing a good deed to result in a benefit. Not all the time but if you don't try then you never know.

4.) Following on with Karma is the reverse in that if I am right and I chose to say nothing that act is wrong. Far better to do my best to state my position and take the scorn ridicule and disdain certain to be heaped on me by those far more intelligent and smarter than myself than to say nothing even if in the end I'm wrong and they are right.

So in the end because it is the right thing to do regardless of if I'm right or wrong.

Perhaps thats why I moved to doing open source development exclusively many years ago because in the end it was something that I felt was the right thing to do. The same underlying outlook that drives me to do that also makes me comfortable in taking this extreme position in both cases I believe I'm right and part of being right is to do the right thing and share your position with others.

Not doing so would be like writing a bunch of programs claiming they where open source then never giving them to the community.

Thus If I was unwilling to publicly state my position it would be exactly the same as doing open source development and never releasing why ?

So for me all that really matters in the end is that perhaps a few people read what I write and begin to doubt the situation and start searching for the truth until you can doubt you will never ever have a chance if the truth is as extreme as I claim. You have to take and ever more skeptical position to even hope to pull all the pieces together. At least thats how I did it at first I believed the EIA data for example then over time I simply hand no choice but to except that they where lies but then of course your left trying to guage the depth of the lie. Well turns out its a chasm, but you can only see it if you start doubting. Or at least its the only way I know as thats the path I took. Thus ultraistic altruism forces me to shout hey things are not as they seem but to see you must doubt and find the truth for yourself.

Of course as things unwind this becomes easier and easier everyday I suspect that a fair number of people have already realized what I have. Many of course did so long ago the intrinsic lies have been in place for decades simply festered. But you have to first doubt.

For the sake of argument assume the Saudi's are lying and already in steep decline the rest follows if you can't even make such and assumption and test it then why ridicule me ? Its standard logic to assume something is true then prove it false. I don't understand why people are so unwilling to take such a position and work through it. Perhaps because if they do they know damned well that its impossible to prove its false. In fact all reasonably independent faces point to the fact its true only believing the pronouncements of Saudi Arabia and the EIA as true can be used to discount the hypothesis. Not one single real verifiable independent fact supports the Saudi's not being in decline. And if thats true then what else is true ? You can be sure theres more. Thus if you can't prove that the Saudi's are not in decline then the entire house of cards comes tumbling down. And as I said it cannot be done with independent facts you have to trust the Saudi's and other agencies with vested interests to tell the truth to prove they are telling the truth. Thus only by believing a fallacy can you contradict what I'm saying.

I'm not convinced I'm the crazy one :)

I fear we have no way to predict the detail of this EOWAWKI. All past End of Your Civilisation events have revolved around the comparatively gradual unravelling of food supplies due to changing climates or politics or wars, a bit of localised rape and pillage and the odd bad case of the flu.

But this time we are confronted with the boolean event of either having oil (and sulphur, and food etc etc). Or not. In my country we have no internal resilience at all to the non-arrival of our twice-weekly tanker load. There is no national strategic reserve of crude, no local oil-for-fuel production, and no neighbours for 2000km in any direction we can scrounge some off.

Either the trucks will keep shipping 1000km food to our supermarkets, or within 5 days of the tanker not arriving (within say 2 weeks of our oil supplier coming second in the bidding war for some crude) our shop's shelves will be empty and it will be Instant Dark Ages by Sunday.

I just read a quote from a local artist that fits this situation..."Sanity is the ability to identify Insanity".

Thanks Mike for all of your work. I admire the narrative and the rational for the "hunting" of Saudi. Pattern Recognition from disparate data is hard to explain to those that have not trod "the same path".

Now where is Fractional_Flow? This is the kind of post that he/she would pop in for a comment. Does the smiley indicate that you are in contact or know the whereabouts?

Memmel, I think you're being a bit harsh on the peak oil researchers. There's been a lot of discussion all along -- certainly since I started taking part in the discussion in the late 90s -- of the dubious quality of reserve and production data, and various efforts have been made to work around it; there have also been plenty of analyses that took the official figures and said, "Okay, even if this is correct -- and it's probably way on the optimistic side -- we are in deep fertilizer."

That being said, of course you're right that these very close analyses of specific fields give us another set of data points that are of huge value, and Joules' work in particular is a must-read. I don't think there's any doubt at this point that Saudi production capacity isn't anything like as stable as the Saudis claim, and may decline a lot sooner and a lot more steeply than the more sanguine analyses have tended to suggest.

I don't think I'm being harsh I'm sorry one of the basic tenets in science is to validate your experimental data.

This fundamental step has not been met by peak oil theorist. I'm sorry its simply not been met. Until you have some way

to validate the data then the theories are worthless as predictive tools and are at best qualitative.

Not only can they be off by a mile I'm convinced they are. They blew it completely. There are a number of ways to check the data produced by the oil companies and I'd argue that all of them suggest that the current predictions of peak oil based on industry data are simply wrong. Sure I'm being harsh but the price movement alone should have been enough to cause people to seriously question whats really going on.

And I'm being harsh for a reason. If my conclusion is correct and peak oil is not and event that occurred recently but well in the past then I think its obvious that our society is going to have some serious problems in the near future. Timing becomes important.

Sure I could be wrong however if peak oil was well in the past and we are well down the backside depletion curve and nothing has been done to address the issue then our options right now are very limited if they exist at all. My opinion is that the general peak oil community thats taken up the issue of peak oil yet has completely utterly missed its occurrence and the implications is worse than simply dismissing the situation. Its like someone becoming concerned about the housing bubble in 2003 then deciding based on data from the housing industry that any real bubble would peak in 2010 followed by a slow decline in housing prices.

You may laugh at that example but thats exactly how peak oil is proposed to happen by its supposed proponents for all intents and purposes its the same problem as one would have using the housing industries data at face value. If its stupid to do it with that industry which is huge why on earth do we do it with the oil industry ?

Both are critical core industries sized in trillions of dollars one obviously was a complete shame how about the other ?

If you willing to believe the oil industry to the same level you believe the housing industry then your at least off to a good start.

If I'm right then both are equally rotten and its important to expose them.

Look at the damage that has resulted from the housing industries pack of lies if I'm even close to right about the oil industry then harsh is the correct way to act. If you think the collapse of the housing ponzi scheme was bad then consider oil.

After years of studying peak oil and researching it I've found my conclusions compelling enough to cry wolf and mean it.

You can of course dismiss me fine but what if I'm right ? What if the data from the oil industry is so bad that the real situation is significantly different from what the public is presented with ?

Heck the situation in banking show another huge industry full of deceit given the depths of the problems there one would have to think that the suggestion that similar serious issues exist in the oil industry should at least be considered ?

If you choose to look I'm confident that you will find the depths of the lies and deceit in the oil industry rival those in the banking industry with similar dire consequences. Again the price of oil alone should at least suggest we are in a oil crisis

of the same scope as our financial crisis it should have been sufficient to spur the community to question the truth yet it has not.

So I'm sorry this possibility has simply not been addressed by the peak oil community thus harsh is the correct response.

You ARE wrong...but I forgive you

Interesting article.

I agree with memmel in general, but I don't think there's anything that remotely resembles a "peak oil community." At best there's the IEA, and they have dropped the ball, as is evidenced by the continued downward yearly revisions to production estimates.

Even if there were a peak oil Greenpeace or equivalent...what exactly are we supposed to do? Take to the high seas like pirates and board tankers from Saudi Arabia?

Same approach people took with the housing bubble ignore the industry and focus on the data that matters.

For the housing bubble the key metric was rents incomes and mortgages ratios. Thats all that mattered the fundamentals.

I for example took the route of looking at atmospheric C02 levels if we burned it then its gonna be in our atmosphere.

Its not.

This example start counting wells.

The claims of a ghost fleet full of oil well a lot of the tracking data is on the web see you you can find this ghost fleet.

And I call it a ghost fleet because it does not seem to be there.

I've looked at VMT also.

Look at the Baltic Dirty Tanker indexes and clean tanker indexes. Fleet additions and scrapping.

These millions of cars that China bought well they had to be built somewhere that was a massive purchase I see nothing that indicates that they where ever built. The auto industry should have been running like gangbusters with a new auto industry the size of the US emerging yet GM went bankrupt.

Right a post on the oildrum not even a key post just something in the drumbeat perhaps start getting people aware of any and all data that pertains to oil production and consumption that might not be tainted.

I've suggested looking at asphalt and bunker fuel as canaries in the coal mine if you will.

Be creative think about it. Another one I've brought up for example is sulfur production its dirt cheap but its become increasingly expensive dirt and went through its own major price spike. This was roundly dismissed because the world is not "running out" of sulfur however that not the point the point is pricing pressure at all on sulfur is a HUGE red flag and most of the worlds sulfur is produced from oil and natural gas. For there to be any pricing pressure on sulfur you would have had to have a serious decline in one of its major sources. Well NG is not yet in steep decline that leaves oil. I posted and people did not really get it perhaps since I was more concerned about a future world with low oil NG production and its implication on sulfur. No oil no sulfur no industry period. No EV's nada nothing.

But back on track my point is plenty of secondary indicators exist find them post them and watch them.

I've looked at a bunch and sulfur and CO2 are fundamental enough and both say we are well past peak that I'm comfortable in suggesting that the true does not match what we have been told. Find your own pet indicators and debate and follow others.

Follow the money as posted above.

Validate reserve claims vs actual production for fields were this is available and they are well past peak.

Count wells !!!

Almost every single one points towards as I said the truth not matching what we are told. Its not as easy a problem as the housing bubble but its also not impossible.

I suspect that if you try these types of approaches eventually you will turn into a raving lunatic claiming the oil industry is lying its ass off.

Then I'll have a club :)

Brilliant Memmel! I'm off to plant some more beans!

Memmel's theories are interesting, but I find it difficult to follow the logic when he throws statements about data from disparate sources and then extrapolates five steps beyond what he's actually proven. To take just one example, it would be good if he could back up his claims about sulphur with some graphs of price & production, and links to source data. And then see what happens in discussion, to see if reasonable alternative explanations of known facts appear.

Of course, I would be absolutely delighted if Saudi oil production was about to fall off a cliff - provided the rest of the world follows the sort of decline path predicted by more knowledgeable peak oilers than I'll ever be. I've said before, and will say again, that the House of Saud is the most evil regime on Earth (can you tell me any other country named after its ruling family?). Having these monsters in charge of a treasury stuffed with so much money, and its custodianship of the Islamic holy sites of Mecca as well, has had incalculable effects on societies around the world.

If Memmel & a couple of other commentators are right and Ghawar collapses in the near future, this will have two very positive effects. Firstly and most immediately, it will be the end of the House of Saud. Their subjects will be livid and their overseas sponsors (both the old ones of Britain & the US, and the ones they're now courting in China & India) will be "very disappointed". We'll then see exactly how thin the base of an absolute monarchy is. And once they're gone (to be replaced, no doubt, by an "Islamic Republic of Arabia", with a lot less oil to play with), some fundamental changes will start filtering through the Islamic world.

Secondly, the world will wake up to the reality of Peak Oil. The collapse of Ghawar will totally explode the credibility of all Cornucopians, who rely on the popular assumption that Saudi Arabia is floating on an inexhaustible supply of oil. Once the truth is out in public and not being covered up by the media & the oil industry, the human race might start turning its abundant energies and intelligence to solving the real problem that it can at last see.

So, while I remain sceptical, I'd love it if Memmel could actually prove his hypothesis.

The collapse of Gawhar will explode a lot more than cornucopian credibilty. The human race will never widely accept the truth about peak oil. The truth is that the peak oil problem has NO SOLUTION, therefore the "abundant energies and intelligence" of which you speak can have no effect whatsoever on the ultimate outcome. Sorry.

I tried...

You would have to dig out my original postings on the subject.

More to the point I urge you to do it yourself. You can read about the history of sulfur production its critical role in our economy our current sources of sulfur (oil,ng) and the implications of these sources going away.

Your not going to figure it out by me spoon feeding you how things work you have to do it on your own. Only after you grok that our society has two basic supports oil/ng and sulfur and the oil and sulfur come from the same place can you appreciate the implications

of a world without large quantities of cheap sulfur.

http://www.theoildrum.com/node/5851#comment-549470

http://www.theoildrum.com/node/5521#comment-517322

It was not that hard to find these links in the google search on the left.

I've brought the issue up several times.

My degree is in chemistry so when I groked the implications I freaked as the implications of the end of cheap sulfur are even more chilling then the end of oil. Our current civilization has and absolute death sentence hanging over it. No cheap abundant sulfur no large scale economy. And there is no such thing as substitution for and element. Even if we managed to offset the decline in oil we will still be wiped out by this situation. Their simply is no replacement source for sulfur that matches the scale achieved by extracting it from oil no other sulfur source exists that can provide massive quantities of sulfur literally cheaper than dirt.

Of course the ironic part if you read about the history of sulfur and understand its position is the willingness of the governments of the world to first deal with acid rain and then later push through ULSD. I assure you I'm not the only one that understands the role that cheap sulfur plays in the economy. I find that the fact that one of the few "white knight" noble moves by the worlds government to combat pollutions serves to offset declining sulfur production as oil declines very very ironic.

I always kind of wondered why the government was so tough on sulfur yet let so many other issues slide well I can now answer that question. The mixing of localized Nitrogen oxides into the problem clouds the issue however I now consider that secondary.

This is a very good place to start understanding the role and issues surrounding sulfur in the modern world.

http://www.time.com/time/magazine/article/0,9171,805879,00.html

Certainly you need the history before this point but the role of extraction of sulfur from NG and oil in "saving" modern industrial society begins here. Without the influx of large quantities of cheap sulfur we would have never made it to where we are today.

Memmel, the EIA data for oilproduction are generally considered as reliable. How could Peakoil be well in the past ?

Well yes they are very reliable but in the sense that oil industry sponsored research into AGW always shows its not a problem.

Or tobacco sponsored research can never link smoking with cancer.

Subprimed is contained.

Our banking system is sound.

Housing is not in a bubble.

BLS adjustments to unemployment.

Depending on what you mean then yes EIA data is 100% reliable.

Never pass and opportunity to quote Upton Sinclair

"It is difficult to get a man to understand something, when his salary depends upon his not understanding it!"

The probability that the EIA will fail to announce the existence of peak oil until well after the fact is close to 100%.

Its safe to take this assumption as a fact.

If so then the fact they have steadily changed their tune over the last several years and esp moved to the "peak demand" bandwagon

is very telling. Just the move from a story of infinite growth alone is a big move.

If I'm right then one would expect the EIA to be the least reliable source for the truth and the most reliable at continuing to try and claim nothing has changed. Thats simply the way these things work and any understanding of history supports this.

Thats why its important to understand the implications behind when these institutions are forced to back down and start becoming more truthful. They only do it under extreme duress after all hope of kicking the can down the road and allowing time to resolve the problem before it needs to be addressed honestly fail.

What the EIA says is almost compeltely useless garbage outside of this bending if you will under the conditions I'm claiming.

Only a truly independent audit could hope to uncover the real situation and yes these happen but only after the truth is obvious.

They are no more relevant to oil than the official US unemployment rate is to the real unemployment rate both can be dismissed for the most part outside of watching the directions or vector of their announcements. Both sets of numbers are flawed in the same way as both organizations will detach their announcements from the underlying truth to make sure they remain reliable.

Thank you for taking the time to write such long, well researched comments.

To say nothing, JM, of the ultimate impact of extending high production rates. It may provide a few years of 'higher' production, and then the depletion rate will be seriously raised as well. Much as the Mexican fields have shown of late.

And, that 2% rate depends on those proven reserves that are "probably way on the optimistic side." Deep doo doo may prove to be a pleasant interlude before the serious fertilizer strikes that rapidly approaching oscillating atmospheric accelarator!

;>)

Craig

John,