Efficiency and Resilience: After Jevons Paradox, the Piggy Principle

Posted by Gail the Actuary on February 26, 2010 - 10:52am

This is a guest post by Marco Bertoli. Mr. Bertoli has an economics degree from Bocconi University in Milano and a master degree in renewable energy from the Milano Politechnical University.

Energy efficiency is one of the themes most discussed by those who are interested in issues regarding energy and the environment. The key question is how effective these proposed solutions will be. Will these technological solutions labeled as ‘energy efficiency’ (i.e. an increase in power plants generation efficiency, cogeneration, home insulation, more efficient electric motors, cars, light bulbs, etc.) really lead to a decrease in the global demand for energy?

First of all, we should distinguish between two different economic spheres: production and consumption.

With respect to production, the proposed solutions (increases in power plants efficiency, changes to EFF1 electric motors, inverters applied to pumps and motors, improvements in the efficiency of compressed air systems, etc.) will inevitably get caught in the trap of Jevons paradox. We should also remember that industrial development comes from a long history of efficiency increases in the use of productive resources, those being either energy or labor or credit or raw materials. (‘More with less!’ is the claim.)

Resource consumption has continued to increase in the long term, in spite of acknowledged gains in efficiency and productivity. Considering that, the myth of entrepreneurs reluctant to adopt available methods to increase efficiency should be abandoned: in fact, investment in energy efficiency should be considered business as usual.

On the other side, we should also remember that Jevons paradox applies exclusively to the production sphere: the world of the so-called ‘consumer’ behaves very differently. In this regard, the economic literature is still pegged to the Consumer theory developed by economists such as Walras, Pareto and other Marginalists between the late 19th and the early 20th century. This is exactly the same theory studied in Basic Economics courses.

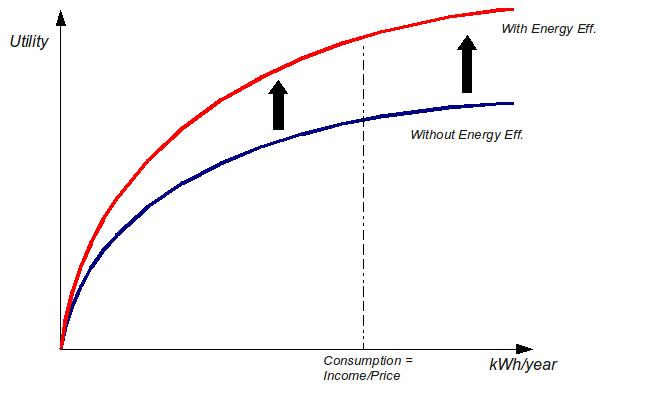

According to Consumer theory, individuals choose the level of commodity consumption which, considering their own income and the price requested, maximizes their own Utility. The key point regarding this theory is that one of the theory's unproven principles - the axioms - predicts that, for each individual, utility always increases as the consumption of any commodity increases. Ironically, economists call it the Piggy Principle.

In an energy context, let's consider what happens when an individual buys a more efficient car—the same can be said for light bulbs, home insulation, and so forth. What happens is that, in order to achieve the same level of utility, the individual can consume less energy. However, if the individual is a cute piggy, he/she will not be satisfied with the same utility he/she reached earlier if he/she is able to reach a higher utility for the same expense!

In the figure below, this reasoning is made clear.

For example, this effect is perfectly exemplified when we consider that with a more efficient car, with the same expense, you can take a job further away from home or, with more efficient bulbs, you can get a better illumination by installing multiple lighting spots (the so called ‘Ikea effect‘), or by insulating your house or installing a more efficient boiler, you can increase your indoor winter temperature, going for example from 18 ° C to 22 ° C. This kind of change has really occurred, if we consider that the winter set-point temperature in Italian schools was around 10 C ° in the early 20th century!

To sum up, it is clear that, due to the Piggy Principle, energy consumption is not affected by efficiency improvements in products for families. Furthermore, as a consequence, if energy consumption does not change, neither does pollution from energy-related emissions.

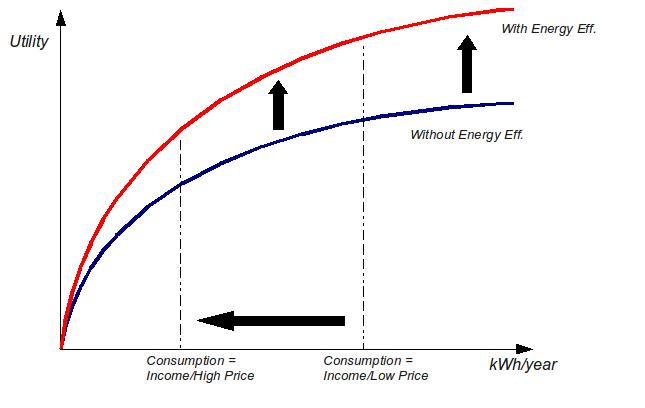

However, this lack of change does not mean that efficiency improvements in consumer products should not be pursued or encouraged. The opposite is to be said!

Efficiency improvements in consumer products in fact have the great advantage of increasing the Resilience level of society. We are referring to Resilience in its engineering sense, i.e. in terms of resistance to rupture forces. Once again, the figure below clarifies this concept: in case of a substantial rise in energy prices, those who invested in efficiency measures are better off in comparison with those who did not. This can be helpful when facing the dilemma of taking part in riots or supporting the next war for resources.

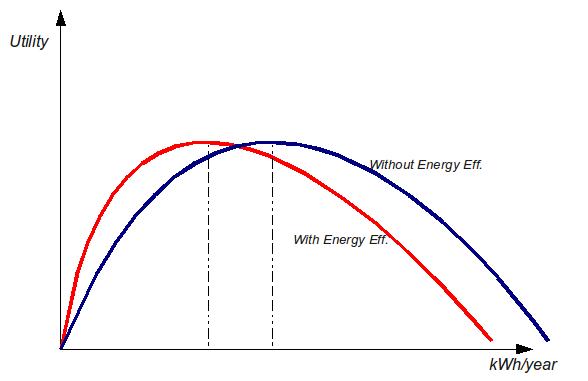

Now let’s focus on another question: are we really piggies? Is it really possible that, in a given period of time, the more we consume the better off we are? The answer is obviously NO! How can you accept as an axiom that individuals, if they could, would drive cars 24/7 the whole year round? Also, how could anyone assume that people, if they could, would be better off with 120 kg of meat per day than if they ate only 1 pound per day? It is pretty clear that the Piggy Principle is a long way from reality.

What we need to admit is that beyond some level of consumption, Utility peaks and then begins to decrease.

This concept is only sketched in some economic texts (Hoffman, Binger). The point beyond which utility decreases is called the ‘bliss point’.

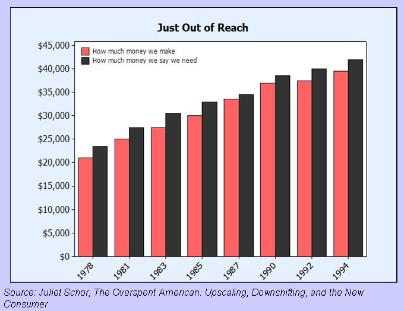

If a bliss point for each individual exists, why do figures show that this is never reached?

As a matter of fact, the consumption rate per individual has kept increasing in Western countries since the beginning of the Industrial Revolution. Moreover, some studies show that the need for money by individuals is never fulfilled.

Finally, if the bliss point exists, but figures show that individuals never achieve it, the correct question would be: how does it happen that the bliss point for individuals keeps moving further, becoming more and more unattainable? Why did we condemn ourselves to this constant Sisyphean challenge?

Several studies have provided answers to this question—beginning with V. Packard and other critics of E. Bernays (this is a nice video to start with). Bernays was Freud's nephew and is considered the inventor of propaganda and advertising modern techniques. Other studies reveal that some products themselves are designed to be ‘addictive’. One example is this research on fast-food conducted by Yale University. Yet another area of study relates to the proliferation of the so-called positional goods; in simple terms, these good are intended to stimulate consumption by leveraging social envy. Nate Hagens has made other studies of interest on the subject.

Going back to the problem of energy demand, we can now consider some of the policies that are proposed by different groups.

Some environmental organizations and movements support ‘halting economic growth.’ These organizations act in a beneficial way by informing the public about the benefits of a more sober life-style and the devastating effects of excessive energy consumption. We could argue that these campaigns help to avoid the constant displacement of individuals' bliss points.

We know, however, that it is extremely difficult to persuade a critical mass of a population with messages related to sobriety. We also know that the most effective persuader in determining the consumption level of a commodity is the price. Just by relying on price, it is possible to prevent the Piggy Principle from undermining the benefits of efficiency investments.

In regard to that, in recent days, the Dutch government has approved a very interesting proposal: it would replace the current ownership and sales taxes with a road tax by the kilometre (about 3€ cents/km, which, for a 15.000 km/year usage sums up to a total of 450 €!).

This policy focuses on the bulk of the matter: the road tax offsets the kilometric price decline preceived by those buying a more efficient car. So the Piggy Principle can't take effect and the final outcome is:

- Same mileage covered, so same 'Utility' reached by drivers

- Same total expenses for drivers

- Less liters of fuel sold, so less polluting emissions

But the more perverse side effects of this proposal need to be balanced in some way. Since mileage is a good on which the poor spend a higher percentage of their income than the rich, this is a regressive tax that might contribute to increase inequality. In addition, as with every carbon tax, it would be exposed to carbon leakage phenomena becasue of neighboring countries which do not apply it.

Thus, the findings regarding the Piggy Principle and the Jevons paradox lead us to the conclusion that energy efficiency issues are extremely sensitive. The simplistic solutions based on technology changes ALONE can prove to be a real boomerang.

I don't think we can isolate this behaviour from the consumerist culture we are all immersed in. Social status being equated with consumption leads all but the most self-contained to maximise consumption within the constraint of their income. Some people will work all the hours they can to maximise income, and then take credit beyond what they can afford, to maximise their consumption. Others are more 'balanced' and manage their finances to maximise their consumption in the medium term future. Few will instinctively constrain consumption at purely utilitarian levels, regardless of income. I can only think of one, a mathematics graduate verging on the autistic.

I myself have always managed by consumption for the long term, which has stood me and my family well in the current recession, but the end result is still that my level of consumption (apart from energy and efficiency savings) is outwardly inseparable from that of my peers. My gross income is lower than average for my demographic, I have substantial savings, zero debts and low overheads. I am happy with the cast-offs of my peers, many of whom would rather give away goods that they cannot be bothered to sell when they buy their unneeded replacement. I do not spend all my income, but without even thinking about it I retain a similar level of consumption. I do this largely for peace with my family. Status in our neighbourhood is more important to my spouse, and even more important to her is that our children should not feel they are part of an underclass. They are at an impressionable age.

I find myself drawn to the latest flashy website for the hi tech high embedded energy latest gizmo, even if it is only a bicycle. I try to convince myself that my trusty steed that I have ridden these passed six years will outlast this flashy replacement, but why not buy it? it only costs 0.5% of my cash savings...

Ralph, your fisrt remark is refferring to competitive consumption, an argoument I disscussed in the post.

I think that getting rid of that inclination starts from aknowledging that our well-being is higly correlated to income only below a certain level.

In a Maslow-pyramid approach, the needs fulfilled by material goods are the first ones, then come social relations, love, and so forth. And this is why there's a bliss point in utility curves related to material goods.

The paradox is that to get material goods, we spend 40% of our day-time (Hypotizing a 9 hours long work-day) neglecting things that really make us happy.

Sometime I wonder why in the face of such productivity boost, no-one says: 'Ok, let's work less!'...

I do work less. I cut my hours to 30 a week, but I cannot go further. Any less and my employment status changes, I lose tax benefits and employment rights. Also, the short hours makes my employers fixed overheads higher for the amount of work I produce. I could not start a new job on a 30 hour week, because the fixed overhead of training me in a new role would make me unemployable. I am only in this position now because of long experience and sunk costs for my employer, and as a cost cutting exercise.

I have received de facto promotion as my superiors have been made redundant or resigned. However my income is static and progression prospects zero. (Not that I mind!) My work load and responsibilities are growing exponentially...

Yet to quit this 'career' for a sustainable way of life is still almost unthinkable even now. Things will have to go a long way towards collapse before I can justify the next leap into the unknown.

Remember when Bush praised that woman for working 3 jobs? He said it was "uniquely Amurican". Yep. It sure is. But I digress. When I had a much higher income than I have now,i.e., when I was employed not retired, I had no problem spending all my money by searching out stuff to buy. Now, I have much less money but actually save more than when I was employed. Part of the reason I spent so much money was that was about all I was getting out of my job, certainly not job satisfaction.

Your case is a bit unusual because you are able to work 30 hours a week without, apparently, pressure to work more. You didn't say whether you had job satisfaction.

But I digress. One of the problems we have is that people are forced into working 40, 50, 60, or even 70 hours a week or more. Clearly, these people do not have the time to savor the joys of voluntary simplicity. We need firm mandates that allow people to work half time and even quarter time. And, if we had a good national health care system not the responsibility of the employer, this would be more feasible. Something must be done to minimize the fixed costs issues.

More flexibility would also occur if our employment pictures wasn't so dominated by corporations. A society with a much greater proportion of owner run businesses would be one where there would be more flexibility regarding hours worked, time off, and vacations. We may have a more efficient society but it it is not a society that permits us to cut back and lay back.

Best hopes for less work and less consumption. Let us slow it down.

Nicely put -I could not agree more.

At the rate things are going, if we "slow it down" any more, there soon won't be enough in the entire economy to pay just for the soon-to-be-enacted government mandates in health "care" alone, never mind the rest of the government, never mind food or shelter which are also considerably inflated by government.

Assuming you are from the US (what is implied by the comment), you'll soon need to work some more than 24 hours a day for keeping the governemnt mandates.

I guess your time to start to slow down is now. Or you speed really up, and cover debit before it gets too big, but I don't think that is viable.

Of cause he would.

He was paid to.

What we have here folks, is a natural consequence of exponential growth.

The worst time is at the peak, when everyone is being run ragged to support a system that was growing exponentially.

I suspect that USA and Europe are over the hill. Soon you will have the monkey off your back.

In contrast Australia is tied to the growth in China. We still have to reach a climax.

But we will get there. It is in the Maths.

"Hypotizing a 9 hours long work-day..."

For a split second I read that as hypnotizing (rather than hypothesizing), and that reading just seemed, well, so completely fitting. Thanks, that was the best mis-spelling I've seen in some time...

I read hypotizing the same way and agree completely

From your earlier comments I can see you are fully enamored of the U.S. health care system. It serves my family well enough, sometimes we are triple covered. I get to watch inflated bills bounce back and forth between carriers for a year, 18 months and, once, over two years. Every time those invoices are handled costs money. The initial provider has to charge an extra 20% or more to cover the cost of the money they have to borrow to run their business for that year or two that will elapse before they are paid. Oh it is a grand system. I am hardly fond of the bills that appear to be emerging from Washington but possibly, just possibly, they will be a starting point that can and will allow our health care morass to be modified into a more workable, sustainable and even more efficient system than the one we have now. This should have been addressed under Nixon. At this point in the game any solution will be very painful and letting the current system run its course with no additional government interference/inputs will likely be the most painful course of all.

There are 2 other points to consider when looking at energy efficiency.

Promote energy efficiency by allowing negawatts to count towards renewable sources. But in order to address the issue of potential increase in consumption as money is freed up, have the negawatts value decrease over 10 years. For example after 2 years the negawatts are worth 80% of renewable energy KW. After 4 years it is worth 60% and so on. This will drive continual improvements in energy per capita.

Secondly, given where we are at the moment, I think any additional money that is freed up will not go into greater consumption but rather into paying down various debts. The actual resources freed for additional consumption now has debt payments to soak them up. Generally, people have been using cash to pay down debt rather than increasing spending which is one reason why the recovery is anemic at the moment.

I grew up with stories of how my folks lived during the Depression. For my Dad, the family situation was overcome with ingenuity and frugality; almost a pioneer approach. For my mother the experience was painful and she did not want to talk about it. However, the values they imparted to their children was to always live within your means, and that 'stuff' does not make the person. We never wasted food and designer type stuff was not even looked at.

We have lived in a time of unbelievable opportunity and wealth. It has only been a couple of years since the myth started to evaporate in mortgage defaults and long term unemployment. For most, the idea of energy restraint is not even on the radar. Given time, people's values will change to fit circumstance. It will be pretty hard for mass media to propagate the 'you can have it all' myth when the reality falls far short.

Modern life is hollow, short on values, too hectic, and not very pleasant. Sure, the Corona commercials create some bookings at the all-inclusives when the sky is grey. However, those days are numbered. When it evaporates, the piggy aspect will be the pork in the freezer or hung up in the smokehouse, like it was in my Dad's backyard, another world ago. (At least for those who prepare and attempt to meet the challenges).

My personal guess is that declining ncomes will render the piggie concept irrevelant for the majority of us-we will be glad of all the efficiency we can purchase in terms of high mileage cars and low wattage lights. We will still drive less and turn the lights off quicker as a matter of necessity unless there is a positive energy Black Swan.

But in the short term, the article makes excellent sense.I suppose the arguments will hold right up to the point of insolvency for most people.

I have certainly seen it conclusively demonstrated on the individual level that energy efficiency can result in incresing consumption even in the face of very limited income.My Dad, who is uncommonly frugal , wastes some electricity pumping garden irrigation water( our gravity feed water doesn't cover the whole place) since he has noticed that leaving a half horse power pump running all day cost almost nothing-less than a coca cola.

When we were using a gasoline pump he cut it off the very minute he was satisfied with the amount of water delivered.

I could come up with dozens of other examples directly observed.

Wouldn't the Piggy Principle have a cap on it? I mean, you can only drive one car at a time and go so many miles in a day. I can only buy so many things, or occupy so many square feet, or eat so much food in a day. While all this may be well outside our world's ability to sustain such consumption, it seems to me that there's a limit on how much one individual can realistically consume and, if the data suggesting that as standards of living increase, population growth drops and levels out, then a realistic limit on how much humanity as a whole can really consume.

Does that make sense?

??? I think the cap is what's meant by "What we need to admit is that beyond some level of consumption, Utility peaks and then begins to decrease." However, the inflection point or limit for humanity as a whole is surely far higher than current world economic product. Most people on this planet are quite poor and definitely want more (for example, consult the sales statistics for cars in China and India.) And then there's the issue of positional consumption, e.g. for status display; I see no evidence that we've run into any serious limit on that.

with humanity as a whole we must consider income redistribution: even in industrialized country there's people whose income is not enough to get any bliss point.

But, if income is redistributed, that become possible. Last year I went visiting Schonbrunn palace in Wien. A huge place to live in, but Franz Joseph I of Austria spent most of his life and working days in no more than 100 m².

Today world gdp per capita is 10.348 $ (http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita). It means that a family of 3 would have 31.000 $ per year: that can be enough!

You are obviously not an American. Anyone with the temerity to even *suggest* such a concept is immediately branded a Lenin-loving Commie pinko traitor. No politician, journalist/commentator or media personality would even dare bring the subject up, for (justified) fear of being stripped of their position and pilloried by the Teabaggers and Faux News.

For example, we have this right-of-center President who is fairly new to the job. He's been labelled a "socialist" and "left-wing" by every media talking head out there (and those are the polite "mainstream" ones) simply becuase he's publicly objected to 46 million people not having health insurance and people being screwed by insurance companies over pre-existing conditions and rescissions. Oh, and he's raised the posibility of rolling back some taxes on inheritance and passive income that mainly benefit idle plutocrats.

Never mind that he is: (a) pro-war, (b) pro-Wall Street (in actions not words), (c) has appointed as many Goldman Sachs executives to his cabinet as his predecessor, (d) has still not shut down Guantanamo Bay or other CIA "enhanced interrogation" torture sites, (e) has not reinstated Habeas corpus, (f) is still funding unconstitutional "faith-based" initiatives, (g) has not renounced warrant-free spying on American citizens.

This guy could run as a hard-right Conservative in most other countries, but he's considered a "lefty" here in Teabagger Amerikkka. The right-wing demagogues who aren't so polite also accuse him other of things, including being secret Muslim, not having a valid U.S. birth certificate, and being Idi Amin & Jane Fonda's love child (ok, I made that last one up... I think).

I know you meant well, but there is only ONE acceptable form of "income redistribution" in the U.S.: from poor to rich. Reverse socialism is not only widely accepted, it's all the rage these days. Check back in a few decades and I'll let you know how it's working out.

Sure I'm not American ;). In Europe there's still a quite strong, in respect to US, labour movement.

In Sweeden 82% of Labour Force takes part in Trade Unions and the first national news paper is controlled by Unions. http://en.wikipedia.org/wiki/Swedish_Trade_Union_Confederation. As consequence the inequality index are the world's lowest, and democracy index are the highest. http://en.wikipedia.org/wiki/List_of_countries_by_income_equality

http://www.democracyranking.org/en/ranking.htm

Italy, my homeland, is different.. Income inequality is great, but here corruption (10% of State expenses) and tax evasion (1/6 of State tax revenues) are peculiar causes.

Ah the good old days of simple blackmail, bribery and graft siphoned off by political machines like old Richard Daily's. The lobbies have so convoluted our legal and tax structure that what is actually getting siphoned off here now is incalculable. Of course plain old graft and tax evasion have not been eradicated in the process.

Well put, and I am a bit surprised that other than the means of delivering the message, Obama is not implementing policies that Bush would have adopted or continued. People seem to have forgotten (or just overlooked) that Bush expanded the costs of Medicare far more than any President. Obama is only slightly more ambitious in this regard.

The main reasons that the average person does not realize he or she is losing ground to the rich are (1) the economic downturn makes it more difficult to see who the winners and losers really are and (2) at least for now the US has been very sucessful in issuing literally trillions in new money to transfer mostly to large finanicial entities but having all this new money accepted at face value.

The myth of the 'value' of the dollar is stronger than ever, stronger than the beliefs of those in most organized religions. It is beyond logic to think the dollar has any 'safe haven' value at all, but as memmel states below, before the collapse comes mass dillusion. At some point the value of US paper money will be seen for what it is, a paper promise than can never be repaid in the post peak world where stored wealth is declining.

You make perfect sense, however you clearly stopped reading the article before you got to where the author made exactly the same point as you, slightly more eloquently.

DanBrown: the Piggy Principle might have a cap on it for individuals in their own homes and lives, but this does not necessarily apply for companies, their executive management and their shareholders. These three categories of individuals benefit from the increasing growth and profitability of their companies. While each person as an individual might reach their own limit, the organisations they work for, and the overall market economy that they exist within may not actually have a limit.

Keeping up with the Jonses expressed as capitalism.

Correct there is no limit as long as someone is in front of you or you wish to maintain your lead.

In other words the system is capable of bootstrapping consumption via its competitive design.

If someone slows down then besting them still counts does not matter.

A jonesing pig is not pretty. In fact the drug slang explains it well.

Good one!

Thanks, Marco, for an excellent review of the limits of efficiency.

Being a big believer in technical solutions for reducing consumption, I think it is very important for the engineers among us to be reminded that technical solutions will never be the full solution at the societal level-- changing human behavior is at least as important.

One of the things we know about human behavior is that peer pressure is staggeringly effective at motivating large numbers of people to do things. The multi-trillion dollar (109) advertising industry works first to arouse expectations of happiness and secondarily to evoke peer pressure. Peer pressure is really seen in effect when particular brands of otherwise identical products suddenly rocket into the public awareness. One example: Living in Seattle I know the utility and reliability of North Face jackets in the mountains. But that doesn't explain their unbelievable popularity in East Coast cities where they are no more functional than many jackets that retail for half the cost.

Given that producers of products only make money when their products sell, it is no wonder that they hire advertising agencies to foment consumption far beyond what is needed to sustain life, often through peer pressure campaigns. However, this same human energy can be used in creative ways to reduce consumption as well. There is currently a wave of interest in using utility information and peer pressure to encourage efficiency. A few recent articles:

We have already seen this kind of pressure in my admittedly eco-kook Seattle neighborhood with folks first buying those carbon offset decals for their vehicles and, more recently, in the rush to replace older cars with a Toyota Prius or Smart Car. As the owner of a 1989 full sized Dodge Ram van I can tell you there is definitely some peer pressure going on. (NOTE: Our van is seldom driven and is used primarily as a personal bus, I'd put its people miles per gallon up against any of my neighbors' cars.)

Folks in the US used to leave showroom info in car windows to strut about all the features they had purchased. Now they leave it in to show off the fuel efficiency. How long before we get an annual decal as part of our emissions testing that brags about our car's fuel efficiency? As people become more aware that excessive energy consumption is part of our national and global problem I believe we will start seeing a lot more peer pressure being applied to do the right thing.

The efforts of electric utilities to use peer pressure to reduce consumption are already showing some results. Personally, I'd love to see a much better use of utility customer data to set up something like the US TV show The Biggest Loser. People on that show gain fame (and a better body) by -- you guessed it -- reducing their consumption. With more open access to utility data it wouldn't be that hard to set up a similarly themed web site that allowed people to self-identify with a group of peers from neighborhood, work, school or church and then have a competition to see who could be the most energy efficient. For publicly owned utilities like Seattle City Light this could greatly improve their conservation efforts.

In my opinion it is this ground up, community based peer pressure that will ultimately have the largest effect on our how our society will evolve through the coming energy crunch.

Best hopes for positive peer pressure.

-- Jon

I thought of Jon's point too - that in some social groups a Prius is much more of a status symbol than a Hummer. I don't believe this is due to Toyota's advertising.

I wonder how this fits with recycling too. In my area there is no deposit on bottles of any kind. Yet everyone, and I do mean everyone, pays for and participates in curbside recycling. In the beginning of widespread recycling I'm sure economists explained how an incentive was needed for widespread participation. Yet in my midwestern area, in face of a disincentive, recycling participation is near 100%.

Another altruistic behavior that doesn't fit well with economists models of behavior: Over one million Americans have traveled to the gulf coast at their own expense to volunteer for Katrina recovery. I find that remarkable.

I don't really have a point to make, other than it's really hard to model and predict future behavior.

Actually, you have made a good comment. What we need to find out is why do certain people or groups of people not conform to the supposed norms of economically so called rational behavior. Peer pressure is one factor but how does that pressure arise in the first place. Someone has to start the ball rolling.

I'd argue these are examples of clarity of vision.

http://www.theoildrum.com/node/6245#comment-594265

They happen but are currently rare enough to be considered freak events.

However I think you can see the power when they do happen. Think of a civilization focused on such clarity where the truth prevailed even

if it means bringing a fringe idea mainstream. One has to think this has happened consistently in the past in some civilizations thus forming the core of the civilization itself however I don't know of any examples.

and I am guessing you will not find any--clarity and truth are only useful in limited dosages when trying to organize people into something as large as what we call a civilization. Even on a small tribal scale the world must be simplified at least at the boundaries. For humans clear, simplified boundaries are often defined by divine decrees the truth of which are of course unquestionable.

The enlightened benevolent ruler :)

Historically yes. The proxy of democracy to create such a ruler fails eventually as it can be gamed.

Suggests that we don't understand how to create a system seems to me that the right answer

is probably a gaming proof algorithm of some sort.

Perhaps a market concept for running your society ?

Entrails of sheep might work or casting chicken bones.

Whats interesting is that by throwing in a purely random event

and simply going with it aka a coin toss I suspect you actually

come out better on average as it allows anti-consensus approaches.

Of course the shaman can always choose to game the system but

also he can just go with the random result. Something we have lost.

Makes you really wonder just how stupid are ancestors where after all.

From what I can tell from my reading pretty damned smart.

Sure they lacked a bit in the fundamental physics and chemistry but other than

that my realization that or "advances" are high questionable continues to grow.

One can see ignorance i.e lack of knowledge in some areas of course however I

see no sign of lack of intelligence indeed given they did not know they where

not meant to think in certain ways a clear superiority over us as isolation

allowed a richer environment of thought. Think about the cultural variation

during Roman times vs today or even earlier does not matter much. Obviously

a wide range of modes of thought and associated cultures existed and where

more diverse despite the fact that in general the core technologies did not

differ all that much. Stone then Bronze/Steel pottery grain thats about it.

Sort of looking forward into or future assuming we fragment but retain or

rapidly recover our core knowledge base what happens ?

The possibilities are immense of course many take the route of abuse war

and death at least at first but none of these are long term viable and

they don't put the genie of knowledge back into a bottle or close Pandoras box.

Eventually of course we have a knew world form where you have both basic knowledge

and this rich cultural mix as the period of troubles eventually ensured isolation.

Perhaps not complete who knows. Japan is and example perhaps.

Personally I wish I could somehow duck out on the next decades if not centuries

and come back during the next time we again begin to move forward as a species.

I'd have to imagine that quite a few Romans would have also wanted to do the same.

Skip he middle ages and come back when civilization finally returned :)

They could not and we cannot.

Good to see you have that same deep down core of optimism under layers of 'damn that don't look promising' as I do.

Having spent some village time I will tell you that some currently scientifically inexplicable things happen there. No our ancestors were plenty bright and the differences between us if our situations were transposed might be surprisingly small--but the sheer mass of population we have, the way in which modern medicine has skewed survival traits, and many other factors throw such imaginings far into the sci-fi realm.

Seems like a good spot to throw out my mantra---our socio-politico systems are part of and shaped by the big market system, the dice are always rolling. Glimpsing how incredible the big market that rules the universe must be is one of the great benefits of living in this time--most certainly it has come at the cost of great trade offs. About everything does..

Thanks for the comeback. Catch you next time--I've have to go and burn a bunch of oil visiting family points south now. Glad it is still possible--when it ain't we'll deal with it in some fashion I'm sure...I hope

China is forecast to grow as much as 11% in 2010 (1.4 billion people) and India just came in with a forecast of 8.75% (up from 7.5%)(for 1.1 billion people).

Albert Einstein was rumored to have said compounding is the most powerful force in the universe and he definitely called it the eighth wonder of the world. It will take a real technological game changer to offset those countries and other developing markets use such as Middle East and offset the supply issues.

wallstreetexpress reminds us of the elephant in the room -- consumption growth in the developing world.

Here's the story told with a couple of charts from the Energy Export Databrowser:

We have heard a lot lately about 'peak demand' which applies primarily to the G7 nations (Canada, France, Germany, Italy, Japan, United Kingdom, United States) where energy use has leveled off among the largest consumers:

Among the G7 nations it appears that consumption of fossil fuels, oil in particular, has maxed out.

But what about up-and-coming industrial nations like China, India, Mexico, Brazil and South Africa, sometimes known as the Outreach Five?

They currently use about 3/4 as much total energy as the G7 nations and their growth rate is huge.

And what about those Persian Gulf nations we think of as energy suppliers? Here is the chart for all the nations bordering the Persian Gulf:

Energy consumption in the Persian Gulf has been growing by leaps and bounds and they are entirely reliant on the oil and gas that they also ship out as their main export. (Standard westexas ELM comments apply.) Yes, these nations only use one eighth as much total energy as the G7 nations but their population structure means that the rate of increase we see in this chart is pretty much guaranteed to continue.

There is no doubt that we will reduce our consumption of fossil fuels in the year's ahead. We'll be forced to.

Yes, but the real problem was all those speculators.

:)

Couple your post with current account imbalances and debt and its rather obvious that on a global scale efficiency gains are no where to be found.

If there is no sign of efficiency gains perhaps they don't exist. Its just and accounting game.

I'm an optimist but not so optimistic here. We can hope for breakthoughs in technology but time is running. If not, there will be adjustment...people will learn to live with smaller cars...smaller homes...shorter distance vacations. It might even enhance some somewhat lost values. Transformation can be painful yet sometimes ultimately beneficial.

With an average wage of $1/hour I don't get how vast numbers of Chinese will pay for scarce energy.

China alone has a middle class (I believe defined as $10,000 per annum) that is already larger than the entire population of the United States. They are a vibrant growing economy and have for 20 years when they moved to a modified form of capitalism. Their government is using our deficits and interest payments to go buy resources around the world.

The U.S. has unfathomable future and current debt inside social programs, government spending, medicare and social security, etc. The developing world has little of this. The billions of people are in the "developing world" while we are in the "developed" (past tense).

We have unfathomable debt because most people in this country want to have their cake and eat it too.

They want LOW TAXES and at the same time, they want to keep all their social safety nets. Retiring boomers don't help.

Thus, crushing debt and increasing amounts of money spent on interest on our debt means eventually, something has to give.

Immigration is the same way, we want to both use illegals as a source of cheap labor when necessary, plus complain about them at will.

Somehow the country thinks we can have it both ways as long as we want.

AND...,

we have a right to our SUVs, HUMMERS, and CHEAP GAS. What does it matter if most the energy going into these massive hunks of metal, and plastic is used to move the vehicle not the person..., it's the rest of the worlds problem, not ours.

Good points.

But why the obsession with social safety nets, as though it is somehow superior to organize society without social safety nets. Countries which have generous social safety nets also have the most social mobility. Countries, like the US, which have poor social safety nets have less social mobility. Social mobility is an indicator of the value a society really places on merit.

Except for those in denial about a degrading environment (incl. climate change and resource degradation/depletion), there is an obvious problem with the waste generated by billions of poor individual decisions. There is also an obvious problem with the most wasteful of government programs, especially expenditures on the national (in)security apparatus and on unsustainable transportation and low-density living arrangements.

It is quite ironical that those who claim to be conservatives in US land (includes Canada, Australia etc.) are identifiable by their support for unfettered individual waste and their support for unlimited public expenditure on insecurity, even as they promote fear and insecurity at every opportunity. Interestingly, many, many of these people are mentally callused from bible thumping, to the point that they don't recognize their leaders as the Spawn of Satan. Others simply haven't read, or understood, the thinkers on which they usually rest their case. Poor Adam Smith comes to mind.

On a less important point, interest spent on debt is not in itself wasteful. Who is receiving the interest? Who benefits from the use of debt and the expenditure of the interest? There may well be a transfer of opportunity, which may not be in the best interests (no pun intended) of those making the interest payments, but do you know this for sure? Money is a multi-purpose tool and debt is one of its configurations. Money, like markets, is a social construct.

It matters who our leaders are and how we select them.

So many points to refute but I'll start with the 100% one. A great deal of the interest on U.S. government debt is going to foreign countries which are using it to increase their internal growth and consumption and to buy up natural resources.

Other than that it will either compound and continue to increase debt or it will have to be paid back in the form of either higher taxes (which will impede growth by draining capital from the private sector to the government) or inflation (in the form of a weaker dollar and higher prices particularly for commodities)...(I predict/pick all of the above).

One thing I do agree with is that it does matter who our leaders are. Oh,...

A "great deal" sounds very much like...well, some unspecified amount.

So how much of the interest on US government debt which is going to foreign countries is not being recirculated in a way which benefits the US?

Tax levels in many countries are higher than those in the US. How have high taxes affected the international competitiveness of German industry, for example. High taxes enable the Germans, and others, to have efficient and effective health care regimes at a much lower cost to the economy, and thus to national competitiveness, than the inefficient US health care regime. In this respect, and in others, the US is handicapped by the ideology you espouse.

How would the US economy be hurt if tax policy shrunk the financial services sector?

Would it hurt the US economy if the government took a larger share of disposable income, money that is going on Asian made gadgets or Aegean sea cruises, for example, and invested it in modernising US rail infrastructure? It would certainly hurt the feelings of those who put ideology ahead of national interest.

In answer to your above by paragraph,

1. you can look it up on the internet. Wouldn't you think the interest on 16 trillion deficit (and rapidly growing) largely funded by China, Japan, etc. would be a "great deal" of money.

2. The interest on debt can go anywhere but it is likely not being returned to the U.S. which has a huge negative trade imbalances. Think about a family with inordinate debt, debt is generally not a productive mechanism for enhanced success unless it is being used to increase productivity or income.

3. The 2008 Tax Reform Bill was enacted on August 18, 2007. The bill seeks to spur investment in German businesses by reducing the country’s corporate tax rates, currently among the highest in Europe. The tax cuts are to be paid for partly by reducing certain tax deductions and establishing incentives for businesses to file their taxes

in Germany rather than abroad.

Among the most noteworthy measures in the bill are the reduction of corporate tax rates, a new interest-capping rule, an amended change-of-control rule and new transfer-pricing legislation.

The following is a summary of key elements that are particularly important to businesses operating or investing in Germany.

Reduction of tax rates

The corporation tax rate will be reduced from 25 percent to 15 percent.

The U.S. now has some of the highest corporate tax rates in the world. 7 major comapanies recently (within 1 year I believe) left the U.S. for countries like Ireland (one was Accenture).

Germany also has huge trade surpluses unlike the U.S. which has monumental deficits.

Germany also has a "German deficit bomb" search

Economy | 21.12.2009

Germany to tighten purse strings from 2011

Großansicht des Bildes mit der Bildunterschrift: The German finance minister is performing a monetary balancing actThe German finance minister says the country must shave 10 billion euros off its national debt each year, starting in 2011. However, Wolfgang Schaeuble has not yet explained how.

The German finance minister says he will come up with a plan to start reducing Germany's national debt in the course of 2010. Wolfgang Schaeuble told the mass-circulation tabloid Bild that Germany must reduce its deficit considerably, even if it's a challenge.

"We must reduce the structural deficit, starting in 2011, by around 10 billion euros ($14 billion) per year," he said. "That will be tough, but we have to do it."

Schaeuble promised to draw up a plan to achieve his goal for six consecutive years by July of next year; however, last week he admitted that he wasn't sure where to begin making the cuts.

Germany's national debt is currently 1,725 billion euros ($2,470 billion), and it's rising by 4,439 Euros per second. That total figure equates to just over 21,000 euros of debt for every German citizen.

To make matters worse, ongoing government spending in a bid to fend off the recent recession means Germany is set to dig deeper than ever before in 2010. Last week, Chancellor Angela Merkel's cabinet gave the green light to a 2010 budget proposal that foresees borrowing a record 85.8 billion euros over the course of the year.

4. The financial service sector is one of the few successful industries left in the U.S. We have grown into a largely service based economy.

5. I have no problem with limited intelligent government decisions and it may be wise to subsidize rail. However, the problem is government is rarely limited and rarely intelligent. They are already taking a good deal of peoples disposable incomes and they often use it for unproductive or even with negative results. Also, if a person wants to buy an Asian gadget or take a cruise and they earned it, that is their right in a free society.

On healthcare, Government has caused a National crisis for the under 65 year old market in 7 ways...underreimbursing doctors for medicare....underreimbursing doctors for medicaid...forcing hospitals to give full care with no consequenses to 20 million illegal immigrants...allowing our lawyers (more per capita than any other country) to push malpractice claims to the edge...prohibiting state competition...6 states that overregulate the insurance industry such as NY (a rich state with fifth lowest participation in insurance in country - in 1993 when they passed "reform" 500,000 fell off insurance that year-- teenagers cost $300-600 a month to insure)...state mandates for what needs to be covered (ie. Ct. mandates chiopractic, mental care and invitro fertizization - good or bad, I don't know but they certainly cost a lot)...defensive medicine due to malpractice fear (could be 1/3 of tests)...

News this week...80% of U.S. heart patients with stents receive drug coated stents which have a significant impact on survival...30% of Canadians recieve drug coated stents. One of my Canadian clients told me how her grandmother spent 6 months in absolute pain before she could even get to see a doctor for the first time. Her grandfather was housed in a single hospital room for weeks with 7 other patients. My friend who has a summer place in Vancouver just told me his his gardener went for therapy for two years in the public system. Finally, he paid for a private doctor himself who immediatly told him he had a tear and immediately needed surgery and therapy was useless. Many people in Canada who have money do not use the public system, they use private Canadian doctors or come to the U.S. This includes search Yahoo news Danny Williams, the Premier of Newfoundland and Labrador who just had heart surgery in Florida despite the same procedure being offered in Canada.).

I would highly suggest you search all my other entries for lots of information you may not be aware of. This may be Very time consuming homework but I think you might learn many valuable things you didn't consider. I will not respond again unless you tell me you have read all my other insights.

Taxes aren't low in the U.S., but 47% of people do not pay FICA. Gut the welfare state before it eats the young.

To save yourself and your progeny, why don't you load up your boat and move to a place with minimal taxes and none of the programs of a welfare state. Haiti might fit the bill.

Trouble is, if you gut FICA (Social Security), then, as I said the other day, the only remaining practical arrangement for people's very old age becomes the traditional one: large families. The results of a generation or three of that will be very ugly indeed (no matter the price of oil.)

Larger families are perfectly acceptable, the U.S. and Europe are net food exporters. Negative fertility doesn't work well either. They are inevitable because Social Security will not last.

ROFLMAO ... no ... wait a minute, it's not funny at all. No more than one generation of large families will take care of that net export status for good. From then on it will be an exciting ride down until the population bomb goes nuclear. I can just see it now, the population tripling every 25 or 30 years. 10 billion people in the USA alone by 2100, one gigantic gigacity. Whee!

No, if you want to end up with anything even remotely resembling a decent civilized arrangement, large families can no longer be the answer. They're a Ponzi scheme whose era has run out.

2.1 fertility is not a disaster.

No, 2.1 is not a short term disaster - but so what? - nor is it what we were discussing, namely "large families." Large families, on the order of 4.0 or more, as in the good old days that people like to romanticize, would become disastrous in a hurry.

When Roosevelt passed SSec the average life expectancy was 65. The system was not designed to support people with both adequate income and complete health insurance for 20-30 years...and it won't.

"...and it won't..." Perhaps, perhaps not. But the traditional alternative, large families, is guaranteed to come to a bad end, since it implies rapid population growth. Remember, if you abandon Social Security and the like, you're going to be wanting to have enough children to guarantee your old-age care, enough to have a large margin of 'safety'. Since you and they will both be older and frailer than in the old days, you'll need even more than back then, just to guarantee that you have enough who are still fit enough to provide the heavy 24/7/365 labor you'll be needing. Remember too, that in the old days, the only people who needed that much care and remained alive were royalty; the rest were simply dead.

A fertility rate of 2.1 (cited elsewhere) simply won't begin to provide the guarantee, and it never did until the 20th century when social arrangements became widespread at least in the developed world. So either you keep Social Security and Medicare and Medicaid in some useful form, or else you begin rapid population growth the moment people realize those things are gone, or else you engage in forced sterilization to prevent people from doing what they know they must do for their old age.

Therein lies the predicament. With modern medicine, we have inadvertently created a monster, and we simply haven't the foggiest idea how to cope with it.

But Social Security and Medicare are ticking time bombs, they are gargantuan unfunded liabilities. They will implode eventually. Their costs makes the recent wars look like rounding errors. It is a matter of when, not if. If you made SS solvent by raising the retirement age too high, that's the same thing as getting rid of it but angering people at the same time. They cannot be fixed because they require so many workers paying into the system to support the retirees.

I agree with all of your points (except the "perhaps, perhaps not - we would/will pay for this in one way of another- big time) except they argue exactly for what needs to be done. I do not advocate the elimination of social sec. and medicare but rather the raising of the age limit. So far all age changes have never effected anyone over 55. It will not be popular to tell people the Government can not support them for 30% their adult life because one you give something to someone it is hard to take away.

Sudan. Small government and no taxes (that need to be paid, anyway).

wallstreetexpress - Chinastruck syndrome.

When that scam falls flat on it's face you are going to have to find some other mirage to be in awe of -- sad.

I don't know what scam you are talking about and I don't personally have a dollar invested in China. Is the scam that you don't believe another countries citizens can thrive like we have in the past? Read Jim Rogers book on how China has been developing for 20 years. Boy are they good at keeping the facade up.

Stop worrying about endless exponential growth..., on a finite planet. Eventually, it must all come to an end, one way or another.

Ironically I believe it is a Chinese curse "may you live in interesting times"...

And to borrow from the box currently at left,

To be thrown upon one's own resources, is to be cast into the very lap of fortune; for our faculties then undergo a development and display an energy of which they were previously unsusceptible.”

—Benjamin Franklin

Sure are interesting times.

I grew up in a barn. Well it meant as well been a barn. No running water, I could see the ground in the cracks in the floor, rats, not even an outside toilet, we all had our very own special tree. My mama would buy fuel oil in a five gallon can. She would heat one little room where we would take a bath in a wash tub and the children would reuse the water. When I was a teenager my uncle helped my mother build a house with a bathroom. I thought I was rich. Mama was able to buy fuel in a 150 gallon drum and we would heat the den, kitchen, and bathroom. I know what hard times are. My very first memory was working in my uncle’s cotton field. My mama taught her five children the value of money. I have work well over a half century sometimes digging holes in the highway with a pick ax. I’ve bought and sold seven houses. My sweet wife of forty-three years live a simple life but I keep the heat at 74 degrees, take a hot bath at least once a day, walk away and leave the TV on for hours, and remember the days when my family had nothing but each other with fondness. Strange. I love the picture of the pig. Nothing better than N.C. eastern style BBQ.

hotrod

Hi hot rod, You just might be one of he few here who really knows jxxxxxxt about poverty- you must have been there, personally, to really know about it.

Just like the male doc who delivers babies.He is never really going to know the story of child birth because he is never going to experience it personally.

Someday I am going to put up a long comment detailing the difference in thw world view of those who are trapped, and know it, versus all the stories of those who were a little hard up but knew they had a real shot at getting ahead.

There is one huge difference between the outlok of a person smart enough to work thier way thru engineering school or med school, and thier cousin who knows he can barely read and write well enough to get on at a factory and keep a checkbook.

I often hear such a person as the self made engineer admit that he could not have gotten into the most elite schools, perhaps that he probably could not have succeeded in a tougher and more competitive field-possibly pure math or theoritical physics.

What such people almost always forget is that the majority of the people who don't become successes by today's material standards simply don't have what it takes-either they weren't born with it, or they are so far behind educationally and so trapped by circumstances that they have no realistic chance of success.

They have learned the truth that nearly every young athlete soon learns-it takes more than they've got, intellectually and emotionally, to move up to the next level.Positions become geometrically fewer as you move up.

This insight is nothing new, but it is seldom mentioned among materially successful people and only rarely followed up to it's logical conclusions.

And in most 'normal' circumstances, this sort of truth is so Politically Incorrect that it has become socially and sometimes legally forbidden even to hint at it, at least in the USA and Britain. Any teacher who dared mention it, however obliquely, would be fired in short order for a "discriminatory attitude".

However, for some bizarre reason, it can still be learned in one last place, youth athletics, though there's a growing tendency to hide from it by prohibiting score-keeping. And as long as it can still be learned there, I'll probably remain a bit more forgiving of the vast overemphasis on youth league spectator sports than I might otherwise be.

One reason that I can't bring myself to become a "liberal" in despite of the many positions I hold that are consistent with modern liberalism is a deeply rooted unwillingness on the part of the liberal establishment to deal with the truth in so many ways.

If handling the truth is a prerequisite, I don't see how one can be a liberal or a conservative. Neither party can handle the truth, tell the truth, or know the truth. Having said that, regardless of one's initial circumstances or innate ability, a lot can be accomplished by hard work. I think that was the takeaway. At least for me.

Another message is that those who busted their ass finally getting a decent level of income are not going to take kindly to people now telling them they need to cut back. And, politically, it is not going to happen as we will soldier on in the belief that a miracle will occur. Senator Inhofe believes that America has more energy reserves than any country in the world. No doubt this belief system will make it so and negate any tendencies we may have towards peak oil or peak anywhere else.

If ability to deal with reality is the measure of being what passes for "conservative" in the U.S., then I need to go register with the Communist Party. I have never seen a more reality-averse, facts-immune bunch of willfully ignorant clods as those who constitute the American right wing today.

I'm not saying self-described "liberals" (a basically meaningless term these days as there is 'left-wing' party anymore) are always wonderful, rational people. But --on average-- it's far easier to have a rational, facts-based conversation with them.

Hi Harm , Tstreet,

I'm niether a liberal nor a conservative in the sense in which these words are generally used today.Certainly I must agree that modern "republican " style conservatives are just as deluded as any left leaning people in the US- indeed, even more so in many cases.

I do tend to remark occasionally that a conservative is not the same thing as a republican.

There really isn't a good word for my belief system other than "realist", politically speaking.

What I believe in is looking the truth as squarely in the face as possible, and dealing with it as wisely as possible with the long term in mind.Classical conservatism, in principle, if not dogma, fits the bill as closely as anything, so that's what I call myself.

As a classical conservative and a realist, if I had the power to make policy, we would be doing everything in our power to look after our long term security by promoting energy conservation and a renewables buildout,and we wouldn't be fighting anybody, unless they attacked us.My friegn policy would be very much tilted towards isolation.

We wouldn't have the banking crisis we now have because we would have a much smaller govt.Our welfare nets would be smaller, but there would be MUCH less need for them because we would not be on a path making them more and more important.

No body with any sense and the long term health of thier country in mind would endorse globalization in anything like it's current form, because it weakens the country-and the first principle is always to look out for the best interests of the country, as that is the best way to look after the CITIZENS of the country, over the long haul.

It would take me a good long while to really gather and organize my thoughts concerning this matter and write them up-and it would be a record length comment when finished.

A good place to start for anyone interested in this pov would be Eisennhower's famous speech about the military industrial complex.Sorry I don't have a link handy.

Here's a place to look for the really noteworthy speeches including Eisenhower's Farewell Address. The money quote is:

Please observe that this speech includes large numbers of polysyllablic words. Back before basic education got dumbed down to the lowest common denominator, in order to salve the egos of shiftless morons in the interest of left-wing Political Correctness, politicians could still use such words when they felt them to be necessary.

Obviously many of the words in the excerpt are no longer widely understood, particularly the ones about "endangering liberties". After all, of what possible value is a priceless liberty, when compared to a hundredth of a penny's worth of "elf'n'safety" or "security"?

Personally I think education got dumbed down so that corporations could have an uncritical audience to brainwash with advertising, but otherwise, very well said.

Perhaps, but I have no evidence to suggest that the professors in the education schools, who set the tone and seem to be 100% behind the dumbing-down, are lackeys of the corporations; quite the opposite. The usual argument seems to be that any standard that's not dumbed down to the lowest common denominator - i.e. any standard that someone, somewhere will not be able to meet - is "unfair".

"There really isn't a good word for my belief system other than "realist", politically speaking."

I'm not saying you're wrong, but the problem is, that's what everybody thinks.

Any "ism" by definition is a distortion of the truth. It is a world viewed with tinted glasses - blue or red, in the US - lot many variations in more open polities. With any ism - truth, fact and common sense are the casualities.

But as I see it the conservatism is almost completely divorced from reality in US - or as Colbert put it - facts have a liberal bias. So if I have to choose a side I need to go with the lesser of the two evils. And despite what some say - it makes a big difference who is in the whitehouse. I don't think a Gore presidency would have been similar to Bush's in many ways.

Lineman, interesting story. IIRC, we did have running water when I was a child (though probably only for a short period every day) - but we didn't have electricity. Even now I make sure I switch off every bulb when not needed ....

Jevon's paradox applies in a world of expanding, cheap energy supply, not in a world of dwindling supplies with ever-increasing costs. It seems to me the question is not whether energy efficiency will reduce the global demand for energy, but rather, in the face of a dwindling global supply, is efficiency an effective adaptation strategy for the human race? Even more critical, in the face of carbon emissions that are likely to create an untenable for future for all species on the planet for thousands of years, should continuing grossly inefficient use of energy even be an option?

I don't know if people in the US are energy pigs so much as they are completely unconscious of their energy usage. Energy has been so cheap and plentiful the last half century, most Americans are not even aware of how they waste it with extravagant profligacy, and they are not even curious about other options. With modest investment and a few behavioral changes, most Americans could cut their energy usage in half without diminishing their quality of life whatsoever, but they won't do it as long as energy is so cheap. Better to give low income folks subsidies for their electricity than to continue underprice it as we do by not including the environmental costs. The irony is that higher energy prices can result in Americans spending less on energy overall because the efficiency measures we can take are so easy and inexpensive, if only we would bother to do them.

Give up incandescent light bulbs? That's asking a lot. :)

Maybe we should all just live it up until we end up like Wile E. Coyote over the edge ofg the cliff.

I agree with this. There are some who revel in consumption, but the vast majority behave as they do because they perceive no compelling reason to think about what they do, let alone change their behavior. Even for some people who live near poverty, energy bill savings would be small compared to the consequences of other decisions in their lives.

These utility curves are too easy as a 'demonstration' of why people buy more.

From the theory of operant conditioning we know that cummulative response to inputs depends upon the 'schedule of reinforcement'. Behavior which is not reinforced becomes extinct.

Where there is uncertainity(variability) of reward animals respond more, when they are incentivized they respond more and in a situation where they rewarded for waiting they respond less.

In using energy we demand high reliability(low variability)

and no waiting which is continuous positive reinforcement.

In Jevons paradox energy efficiency increases the frequency of response by reducing a negative condition, price. So consumers end up using more.

If you ration reward(interval scheduling) animals respond less but tend to keep on responding longer in the absence of reward.

What does this possibly indicate about human responses to PO?

In a market based approach humans will respond quickly to reward but will stop responding without them(boom-bust).

In a ration based system humans will be produce fewer responses but will respond longer.

In a ration based system, Jevons paradox won't occur.

Interesting.... could you give us more links about that?

Thanks

http://en.wikipedia.org/wiki/Reinforcement

I wonder whether this isn't too important to gloss over - or to oversimplify by attributing it just to the wickedness of producers ("intended to stimulate consumption by leveraging social envy".) Status display seems to be much deeper and more ancient than any industrial arrangement, even manifested in cartoonish form as an evolved behavior among some animals. That is more than enough to suggest that moralizing scolding may prove woefully inadequate as a measure to suppress it. (And as usual, laying the trip entirely on the producers while pretending that the consumers are mere helpless and infinitely malleable beasts may also prove futile, since, as with Prohibition or the "War On Drugs" in the USA, it seems to lead simply to the replacement of regulated legal arrangements by unregulated illegal arrangements.)

Positional goods may be even more difficult since it's almost impossible to avoid them. For example, the sort of Transit Oriented Development advocated around here from time to time will certainly always be a positional good, i.e. there will be a strong zero-sum aspect. It will never become possible for everyone to be located at an equally convenient walk from the nearest transit station, nor at an equally convenient spot on the overall route map; so there will always be opportunities for rentiers to enrich themselves.

These two difficulties make one wonder whether we could ever see the practical aggregate "utility" curve actually bend downwards as in the second line-diagram. Perhaps it bends downwards for some of today's multibillionaires, but the thought of raising the world's population as a whole to such a level seems so outlandish (even if oil went back to $5) as to not merit serious consideration in any time-frame that could possibly be of interest to us.

Jevon's isn't just a macro effect, I've said for years it is one of the best friends of those trying to wean themselves from today's energy thirsty ways as well as dependence on the fossil-fueled economy.

The first benefit is that lower energy costs assist the person willing to go against the grain and actively strive to need less energy by leaving more "after-energy" income to invest in an even lower energy life.

The second part is mass production increases the affordability of energy efficiency products.

Of course the key to using the paradox to your advantage is to have a goal of needing not only less energy but less income as well -

both will be in shorter and shorter supply.

A point could be made that, as society becomes much poorer, technology-based efficiency improvements might slow to a crawl or stop altogether because of the lack of funding. This would leave us at a given point on the 'piggy' curve, very unwilling to back down to a lesser consuming level, but forced to by the deteriorating economic situation.

Actually, as infrastructure deteriorates efficiency gains could be lost and we could really go back down the curve we came up on.

That's not what the data indicates.There's certainly a rebound w/ most efficiency improvements, but none of those rebounds approach and exceed 100%, which is what Jevons paradox/the Khazzoom-Brookes Postulate describes. The vast majority of the time, efficiency improvements reduce energy consumption. They tend not to do so in an optimal fashion, but they still reduce energy consumption. The last time Jevons paradox was seen in the U.S. was in the electricity market of the early 1900s, so every efficiency improvement sinc that time has cut energy consumption all other things being equal.

http://www.ncseonline.org/nle/crsreports/energy/eng-80.cfm?&CFID=1126214...

Thanks for this.

What remains to be see is which, if any, explanatory concepts born of the era of expanding net energy, will be appropriate for an era of declining net energy, or even of declining net energy from a single, strategic source such as oil.

That depends on how someone defines net energy. Most of the EROEI posts on this forum tend to stop at oil discovery or extraction, and compare that to the EROEI of a finished product such as electricity from renewables, ignoring that the oil still needs to be transported, refined, transported again before it's a finished product. On top of that, when it's used, since we're looking at chemical energy here, it has poor efficiency compared to eletricity for just about everything outside of resistive heating.

This paper is meaningless unless it includes the expansion of the economy via globalization.

My opinion is its simply a feel good accounting gimmick.

Problems with false efficiency gains cause by the difficulty of correctly accounting for imports are well know and well understood if difficult to solve.

At the macro economic level its blatantly obvious looking at trade imbalances and debt levels that claims of gains in efficiency are false since if they where true then we would be running positive account balances not negative.

Show me the money in the end it does not lie.

Money and efficiency aren't connected in that sense. Efficiency improvements can't prevent people from racking up massive debt per say. All they do is reduce the amount of energy they use to complete a particular task. Someone can ride a bicycle to work and still run up tens of thousands in credit card debt.

In terms of the entire world, economic activity in general has become less energy intensive over the years.

http://www.biocrawler.com/w/images/5/55/World_energy_intensity_by_region...

I'm happy to consider not using money as a measure of efficiency gains. Perhaps we could use the number of species going extinct each year.

Or perhaps the rate at which fertile soils are destroyed or forests cleared. Are the rate we pump ground water that won't be replaced in a span of time that covers our entire civilization. Or perhaps in deaths by starvation and war ?

There are many ways to measure what our society has accomplished and its efficiency if you want to pick some why can't I ?

Plenty of of approaches that don't use money exist however the results are the same. I'm not claiming we have not become more efficient just the question is efficient at what exactly ?

Am I supposed to be excited that someone can now drive a Prius to their job flying remote Predator drones able to kill desperately poor people with multi million dollar missiles and be home in time to have a vegetarian meal with their kids ?

Yes I'm being extreme but if you want to measure our society with different methods lets look at all the ways to measure. Even your own measure leaves open and obvious question given that energy costs are rising. Is energy intensity decreasing because we have less or because we want less ? Given what we have done to this world I think its fairly obvious that we don't lack in the desire for more our appetite is insatiable, its just that our planet has no more to give.

Because we're talking about efficiency in the context of the OP, not whatever other measures you want to create. If you're really interested in whatever you're going on about then submit a write-up to this site.

Anyway, in terms of the one portion of your post that's on topic, energy intensity is decreasing because we're using less energy for the same amount of economic activity, that's energy intensity measures.

No absolutely not you don't brush off the truth easily.

Your example of someone riding a bicycle and going into debt. Well everything he bought is attributed to the current gdp.

You want to ignore money and use our GDP measures does not work that way. Because he has yet to do the work to actually earn the money to pay for the goods he has purchased. Only after the debt is paid is the energy balance for goods and services correct.

Now lets assume he defaults well the GDP drops of course and to some extent the efficiency drops along with it less goods are going to be produced since this person has no credit. However he never paid for the stuff he bought and the energy used to make the stuff.

The problem is your not back correcting your beautiful chart when debt defaults blow up your claims of efficiency based on debt.

Now the energy was burned for nothing. No money was actually created.

Zero

Division by zero has a well known mathematical form i.e it goes to infinity.

Now why is this important well guess what its the linkage between EROEI and money. As EROEI falls the probability of being able to pay back debts in the future falls because obviously the net energy available for goods and services falls.

This can be masked of course by simply expanding the debt levels and rolling the loans till it cannot.

When the loans start defaulting en masse then its obvious that you never could actually pay for the energy you used because the EROEI was no longer high enough.

The problem is since your unwilling to throw the debt curve on top of that curve and deduce the true meaning of the situation your unable to reach the right conclusions or more correctly unwilling.

This is not a hard problem its easy and obvious just people don't want to accept the truth. We have already gone over the edge.

Its well in the past.

Now to go beyond this there is more.

One of my key theorems if you will about complex systems is they lie about there state before they collapse.

I.e they always present either a rosy view or cloudy picture while the real system is in serious trouble.

Turns out there is a fascinating follow on to this no complex system can signal its own death or demise.

As it approaches the point of collapse it current state becomes increasingly opaque thus the uncertainty as to the time

of its collapse using measures of the state of the system goes to infinity.

Complex system thus exhibit an uncertainty principle as the fail.

The beauty is of course people that doubt the system is at the point of collapse actually have plenty

of data to back their assertions a lot of it simply wrong but your assured by the nature of the system that it exists.

Sifting fact from fiction becomes and unprovable process which is exactly the point as if the true state of affairs

was unmasked the system would collapse i.e the unmasking event whose timing is itself unpredictable would be the trigger

for the collapse. However the second rule states that the system cannot predict its own collapse therefore it must lie

about its true state to prevent such and unmasking otherwise its collapse would be trivially predictable.