Delusions of Finance: Where We are Headed

Posted by Gail the Actuary on February 8, 2010 - 10:51am

Back in October, I participated in the 2nd International Biophysical Economics Conference at SUNY-ESF in Syracuse, New York. Charlie Hall had written to me, inviting me to come and give a talk. Specifically, he wanted me to go back to my post from January 2008 called Peak Oil and the Financial Markets: A Forecast for 2008 and explain why my forecasts had turned out pretty close to correct, while many others widely missed the mark. The title he suggested for the talk was Delusions of Finance.

My financial forecast really has implications for beyond 2008, so I added some more forecasting thoughts as well. In this post, I would like to share this presentation with you. A download of the presentation, plus an audio recording, are available at the Biophysical Economics Conference Proceedings website under Gail Tverberg.

I am a casualty actuary by training and spent many years doing forecasting and modeling as an insurance company employee and later as a consultant to insurance companies. Many of these companies were small medical malpractice insurance companies that provided insurance for a group of hospitals or physicians. Medical malpractice claims are notoriously slow to be reported and to be paid, so we had to forecast many years of reporting and payments, (and corresponding investment income). These models were used both for determining appropriate insurance rates and for determining balance sheet reserves for these companies. Quite often I was involved in putting together models for proposed new companies in order to estimate likely capital requirements. I was also prepared a lot of estimates of the likely impacts of medical malpractice reforms.

All of this didn't really give me any special training for making financial forecasts relating to peak oil, but it did give me a lot of practice with making forecasts and trying to think outside the box. I needed to figure out what was unique to each situation, and figure out a way to model it. I hadn't gone through the standard MBA training, but I had bumped up against a fair amount of it along the way.

My background goes back far enough that I had a chance to see how badly insurance companies fared back in the 1974 period, when oil shocks affected insurance companies. One of my former employers went bankrupt, and another one nearly did. I could see that if a similar situation happened now, other financial companies would likely be affected as well.

Quite a bit of the rest of this presentation is fairly self-explanatory, especially if you have seen some of my other presentations, so I won't provide too much in the way of comments.

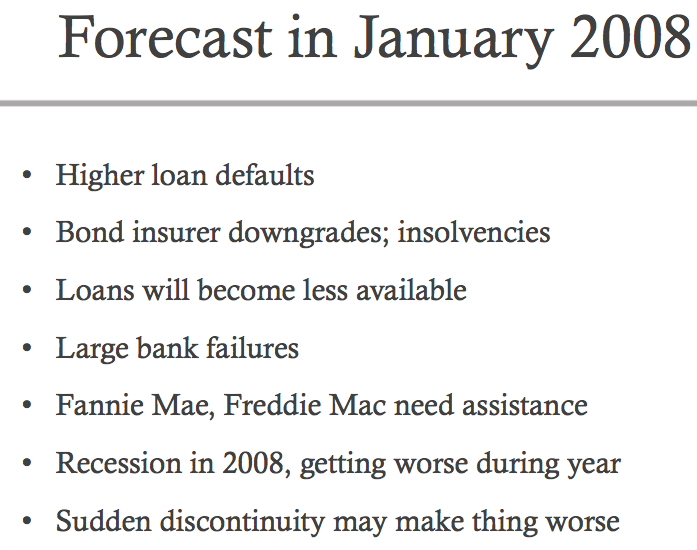

This is a link to the full post. You may want to read it, if you haven't previously.

My later slides explain these points more fully.

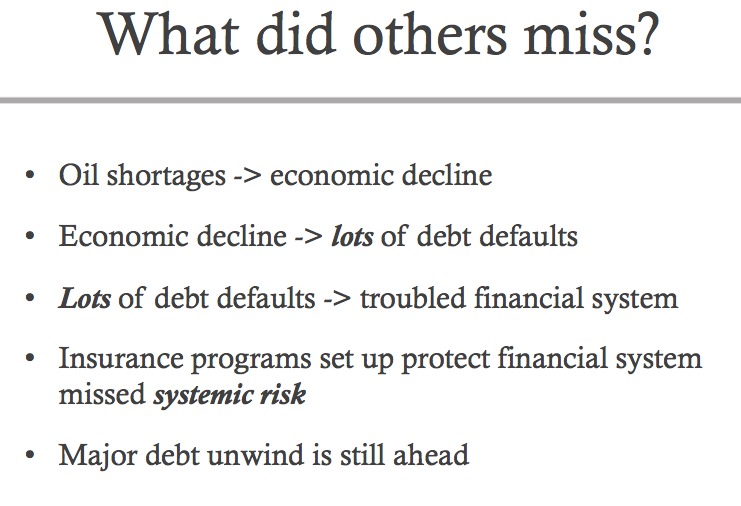

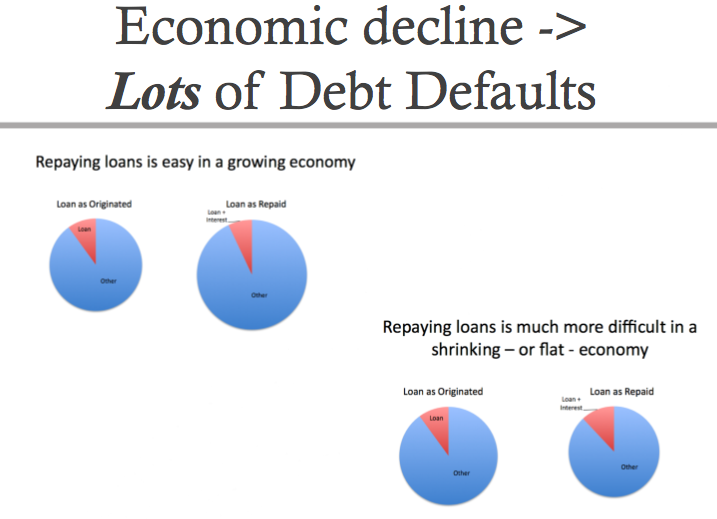

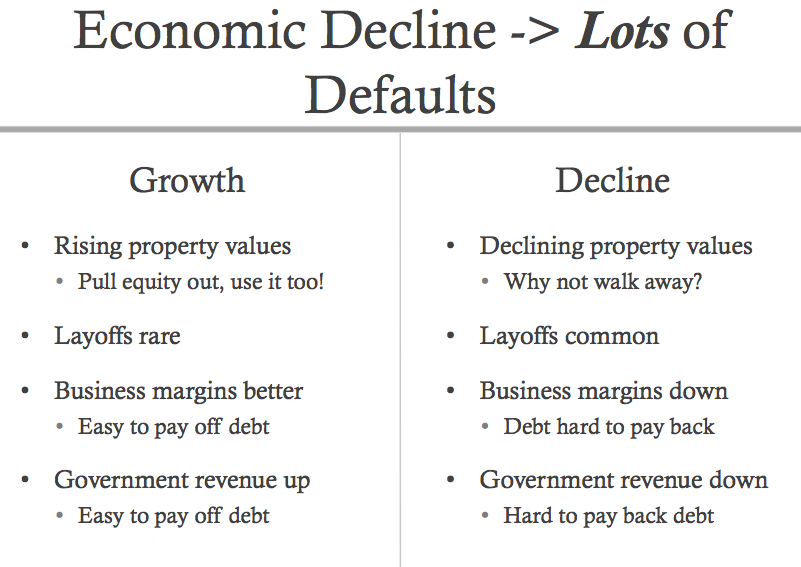

If you stop to think about it, there a quite a few differences in the way the economy functions in a period of economic growth and in a period of economic decline. The assumption of continued economic growth by traditional economists (who don't consider resources and their limits) has been so strong that most have not even considered what the economy would look like in a period of long-term decline.

Many have observed that there would have been defaults, even without peak oil, because of the reckless lending that had been done. I would contend that at least part of the reason the lending had been done was to give the illusion of growth, when there really wasn't much apart from that generated from very loose lending standards. Furthermore, even if loose lending standards were part of the problem, the problems related to peak oil made it worse (and can be expected to cause more problems in the future).

When there isn't a problem like peak oil (or limits to growth in general), debt defaults are in fact pretty much independent. That is why the system for determining insurance charges to be included in the interest rates charged for loans worked pretty well until peak oil came along. In the absence of peak oil, a homeowner or businessman defaults because of some particular problems he or she has. Past history is likely to be predictive of the future, because while there are different individuals defaulting, the average number of defaults will tend to be pretty stable from year to year.

It is possible that there will be some loans in a declining economy, but their use will be much less widespread than we see today. Their cost will also tend to be higher.

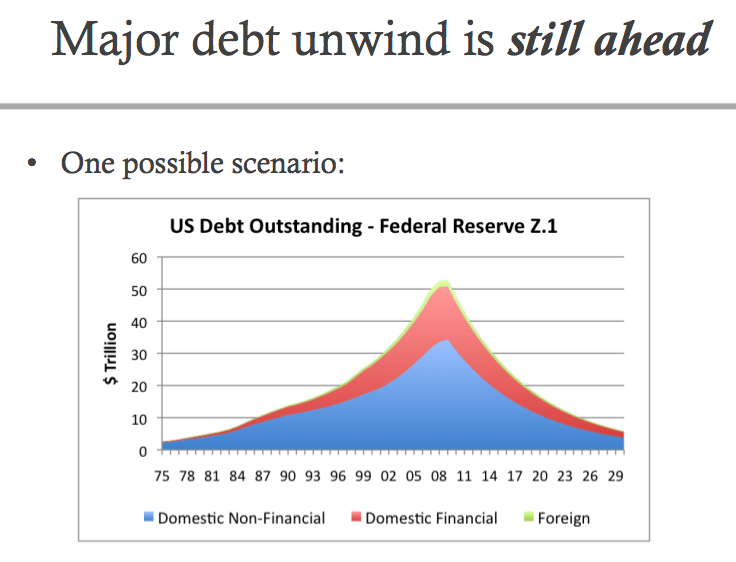

When lending is increasing, businesses have more money to invest in new plants and equipment and homeowners find it easy to get loans of new homes or for home improvements.

As countries cut back their stimulus funds, the decline in credit available may be especially severe. I noticed this article this morning:

Lenders warn of mortgage shortages

Britain’s banks and building societies have warned that they will have to slash mortgage lending and raise rates on home loans if the government insists on prompt and full repayment of the £300bn they have received in state support since 2008.

In the US, homeowners used their homes as a piggy-banks when home values were rising. They could refinance their homes, remove the built-up equity, and buy new cars, furniture, and other things. When there are fewer home buyers (because of less loan availability), and continually declining values, the effect is reversed.

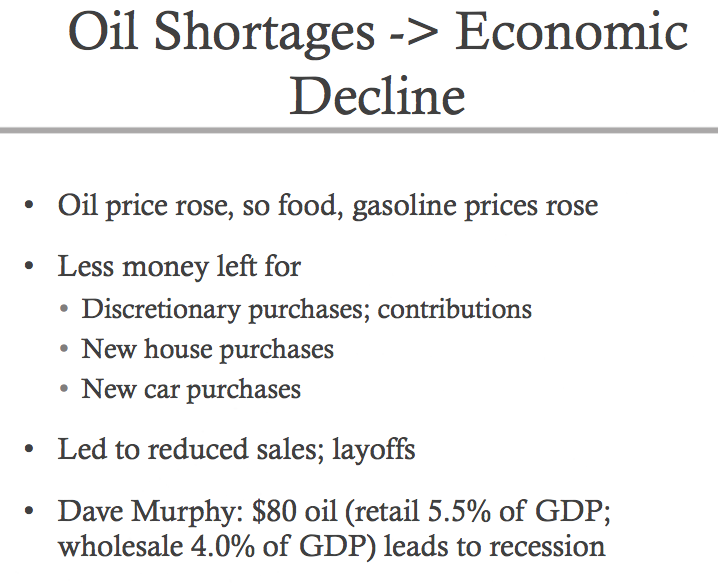

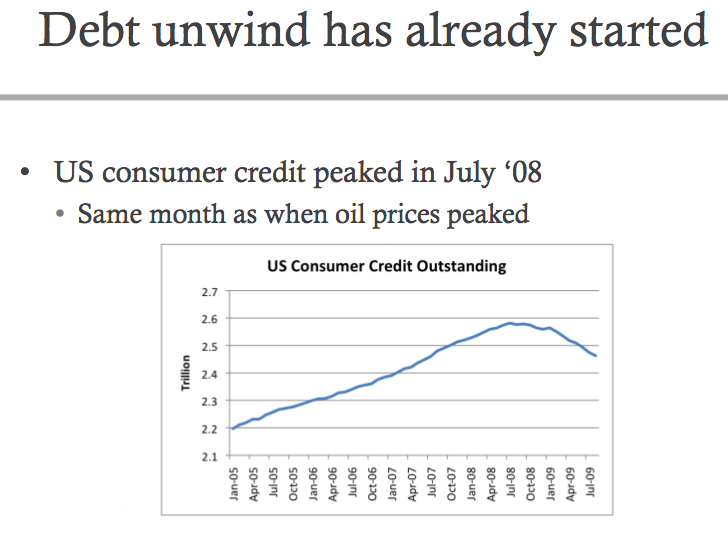

Credit problems are really what are likely to spread the lack of oil to a much broader reduction in fuel use, essentially through growing recession. This recession may affect OECD to a greater extent than non-OECD, but there are such great links between the two that I expect eventually all will be affected. This reduction in fuel use is likely to be described in the press as "reduced demand"--which it is, but because of recession induced by credit contraction (ultimately going back to lack of growth in oil supply).

I am sure that some trade will continue, even if countries have financial problems. But it seems to me that a very large amount of trade is needed to keep up our system at the current level. High tech equipment would seem to be hardest to create with local materials alone. We can make simple things, like wheelbarrows and shovels with recycled steel, but it is not clear that precision parts for things like computers and other high tech equipment can be made without exactly the right imports from around the world, and factories set up with the right controls.

These changes could start very soon. It is hard to know precisely how things will play out.

Thanks Gail. It's a great summary of our current predicament.

I think predicament is the right word if:

Problem = situation that can be fixed

while:

Predicament = situation that can not be fixed, only adapted to.

We've all read "The Long Decline," it would appear, and like me you would prefer that view... gradual, perhaps punctuated, with periods of "recovery" intervening.

Good luck with your adapting. I am trying to do my best likewise. Have a good week.

Craig

I think you mean "The Long Descent". I haven't read it yet...but it just arrived in the mail today!

Good presentation.

The sticky wicket that really needs a slide (or two) is the fact that when growth limiters become apparent, the political process deteriorates and becomes dysfunctional. The situation is worse than you depict.

It seems like that feedback loops that work off this all work to reduce output. As you say, when growth limiters become apparent, the political process deteriorates and becomes dysfunctional. I think that when countries default on their debt, there is a big chance of political disruption as well, and even changes of borders of countries.

There is also the issue that has been pointed out frequently on The Oil Drum of disruption in countries like Mexico if oil exports are dropping off rapidly, and the country needs these exports for tax revenue.

All of these things seem to work together, but not in a good way.

Gail, thanks for sharing your point of view which seems to be correct regarding what happened the last 2 years and is happening now in f.i. Greece.

Gail, if debt unwind is going to reduce the availability of all fossil fuels (less demand) then scaling up the THAI process and other new processes to extract heavy oil and bitumen seems to make little sense.

In this case many of those projects will never be built, at least not in the short run.

It seems like prices pretty much dictate what really gets built. If we had $150 barrel oil, I expect that both a lot of oil from the oil sands would be profitable (with THAI or another process) as would very deep water oil. If oil prices won't stay up, most of these won't be expanded. Despite all we hear about oil sands, production is not very high (about 1.3 million barrels a day), and hasn't been rising very rapidly.

Indeed Gail, but your post suggests that $ 150 oil won't last a long time.

OTOH, your mentioned http://www.petrobank.com/wp-content/uploads/2010/01/2010JanPBGPresentati... in the post about THAI from yesterday says: improved economics: lower capital costs; 1 horizontal well, no steam and water handling facilities. Lower operating costs.

Even then: if oil demand goes far down during an economic collapse, those cheaper planned projects won't be built soon.

On any of these, we will have to see. What works in the lab may need a lot of adaptation to work in the field, and capital costs aren't really known until all of the "kinks" get worked out of the system. Even with lower capital costs, it is not likely to scale up quickly. Any method that starts with bitumen is going to be slow. I know one of the links I posted talked about production of 350 bopd at one of the sites they are working on. That is 350, not 350,000, barrels of oil per day. It takes a lot of scaling to get that up to a reasonable amount.

Yes, but another one (Conklin THAI pilot project)targets 1500 bopd. The May River project is planning for 100.000 bopd. International potential is very big, but as you write: how will everything work in the field ? And when oil demand goes far down in a few years they don't start building more of those projects in the near future.

One of the surprising counter-intuitive outcomes of Peak Oil has been the adverse impact on investment in alternative energy.

I don't think many of us saw this coming, though in retrospect it makes sense. If oil is wealth, then lack of oil will naturally result in less wealth to invest in alternative energy projects- at least in the short term.

Perhaps a lot of the investment in alternative energy was driven by a desire to do something about Global Warming rather than earnest attempts to counter a decline in fossil fuel availability?

I think we all predicted that PO would result in a mad ( if belated) scramble to invest in every possible type of alternative energy going.

When people eventually realize that we are not returning to BAU, this may turn around- or perhaps not if the confidence of society is hit too hard.

Interesting thought Fingolin.

I believe you may be right.

If borrowed money perhaps with govt gaurantees cannot be had, utility scale systems in my opinion are not likely to be built.

I think that wind farms in particular are now at a point where some wind farms could be financed entirely by investors using thier own money, probably pooled, but I am afraid the potenial investors will look at the potential income stream as unreliable and or very limited for fear of having thier selling price capped by regulation if they want to distribute over the grid.

There might very well be a gold rush for small scale operators-those involved in home sized and business sized installations.

Unfortunately , the continued reduction in the purchase cost of the actual equipment , the panels or the turbines themselves, apparently depends as much on ever increasing large scale production as it does on innovation.Innovation itself may slow to a crawl, starved by a lack of research money.

Nasty feedback loops !

We haven't been seeing much in a way of cost reduction for wind. In fact, the new "in" thing is offshore wind, which is even more expensive than onshore wind, per kWh of generated electricity. Long term maintenance is likely to be a challenge as well, with salt spray constantly hitting the turbines, and the huge size of the turbines.

Small size turbines have been a disappointment, because when the turbines are not elevated to high levels above the ground, the amount of electricity generated is low.

In any reasonable sense, people are going to be poorer going forward. It is going to be difficult for them to afford high priced electrical power, in any quantity. So whether or not governments restrict rates, it is going to be hard to collect the funds for a large amount of high priced electric power.

I think that there is a substantial chance that operators for wind turbines won't be able to keep collecting the funds they need to pay off their debt. The reason could be anything from capped electrical rates, to problems with transmission lines that do not permit transmission of the electricity to the location where it is needed to unavailability of maintenance service for the turbines. So investors are right in being worried about taking on this kind of debt.

Old Farmer Mac,

Some time back you asked me to post an email address.

Here is one I use most of the time. It previously had been in my profile but it began attracting a lot of spam , IMO from being too obvious there for webbots to find.

In disguise then:

The Last CE at Yahoo dot Com

Note. Compress all words preceeding the AT sign.

I do have a spam filter on that email address and it works most of the time.

We have 5 inches of light fluffy snow on the ground here. The weather is more akin to what I remember on the farm back in the early 40s. Lots of snow but little icing over of the ponds(which they always froze over back then).

Airdale-A rural,southern,hickish,stupid,redneck of the vast flyover wastelands.I also play the banjer like the same type in "Deliverance" and ah eat grits a rat smart fer brekfest, some bileing on the 'far' wrat now.

fingolfin, I nominate this as quote of the day.

That is a good point. Alternative energy is to me someone's plan for hoarding a little of the energy we have now, for use later. As it becomes more difficult to do, the interest will go down.

(hi Gail & nice blog)

The interest (in Alt-E projects) may go up, but the means to accomplish anything are going down. Kind of like how almost no one would start up new industrial operations during GD1 ~ no Vulture Capital available regardless of the want for it.

That's a sign we'll just have to keep watching for :P

Great post, Gail!

But darn it, didya have to be so right?

Yeah, I had a similar thought. I mean when you go down the list from the January 2008 post and look back from the January 2010, you have to ask something other than "what were they thinking?" More like "were they thinking?"

Gail, I bet you got the Super Bowl right, too!

I went to a party and munched on food, but stayed away from betting. I think that was a good choice.

Gail, this is terrific and very thought provoking. You should send it to Bloomberg and see what they say? I totally understand and agree that feedbacks will possibly/probably exacerbate the changes and/or decline. It is interesting to note the decline in available refining etc. in anticipation of a decline in fossil fuel use.

I have a productivity question for you or other readers.

I am confused as to how the idea of productivity is really established? For example, is it simply the GDP divided by labour costs? My question/comment is in consideration of how unproductive Canada is supposed to be in comparison to US workers. In Canada, we are world class miners and smelters. We are top notch fisherman and fish the same waters and species as Alaskans. We are world class loggers and sawmillers. Our agri business is a world supplier of grains. We have a profitable aero-space industry as well as software developers. Yet we are supposed to be less productive than US workers? I don't get it, and I find it hard to believe. Our Parliamentary Govt seems to muddle through without the wild swings of the US, we have excellent universities and school systems, and our banks make profits and are not on life support. We are more unionized and our wages are higher, but that is always under attack by the same capitalists, everywhere.

If corporate profits are a function of off-loading workers to what is basically slave labour economies, then I can see how we cannot compete on paper. In reality, softwood tariffs product US forestry, and there are also limits on just about everything else.

I have had no economics courses beyond discussion groups, reading, and my own intuition. It seems to me truth and common sense is elusive.

Someone tell me, if the US economy is supposed to be so productive, why are there protective tariffs on Canadian goods, and other producers?

Paul

I think it might be better if readers sent an e-mail with a link to Bloomberg, especially if there is a reporter you have corresponded with before.

I am afraid productivity calculations is not something I have studied. It is not something that affects medical malpractice insurance companies much.

Labor productivity is GDP divided by man hours.

I have no concerns about the reliability of the productivity statistics. Most developed countries use similar methodologies.

Canada is a supplier of raw materials, much of which are processed in the Unites States. Since productivity tend to be the highest in manufacturing, that probably explains any purported productivity gap between the US and Canada.

However, I was not aware there was a big gap.

RB wrote...

"Labor productivity is GDP divided by man hours."

So how much of our "economy" was debt vrs canada?

How much of our economy was selling trinkets to one another. Some range around 70% of GDP is retail.

So we americans are better (and faster) at buying and selling things we don't need on credit than you are.....

Strong growth in US debt fueled a consumption binge during the first half of this decade. The Bush tax cuts increased disposible income and government debt. The personal savings rate fell to almost zero and total personal debt sharply increased, particularly as housing became a bubble. It was the surge in the value of homes and apartments that provided the collateral that households used to leverage themselves.

Debt per se is not necessarily bad. If the US government had run big deficits in this decade because they were building a first class public transport systems then that debt could be justified as a high payback investment.

Instead too much of the debt was just consumption by borrowing against future income and overpriced real estate.

Hope that helps.

"70% of GDP is retail."

it's usually phrased as "consumer spending" which is distinct from "retail" since it includes all healthcare. But even that is misleading because half of that is actually spent by the government.

I, too, have been suspicious for a long time about "productivity". I suspect that it has been rising in the US because we have off-shored so much work and the middle-men, sales force and management staying in the US have raked off a larger fraction of the profits of industry. This would make the remaining workforce seem to have created a larger portion of the value of goods and services sold.

Any real experts on this subject lurking out there?

Too much bubble GDP based on finance and debt would seem to explain it just fine.

The explanation that I read a couple of years ago was that inflation values were manipulated to an arbitrarily low level, and the excess then assigned to GDP, making everything look peachy.

The idea being: if you add up the value of all production for the year, you have a gross GDP value, but it also includes value increases due to inflation of course. To get a true value for GDP you have to subtract the amount from the gross value that you decide was due to inflation. If you think about it for a minute, its pretty easy to see the advantage of being able not just to claim a low inflation rate, but also claim a healthy increase in the GDP. The last ten years or so of economic "official story" vs "what it seemed like on the ground" makes more sense if they were doing that sort of manipulation.

Hi Daxr,

That's rubbish. This is nothing more a version of populist conspiracy theories. The BLS statistics are high quality and not influenced by political decision making.

When I was doing economic research, I worked with the BLS to understand their data, including its strengths and weaknesses.

As I noted in an early post, the real issue is not US economic data, but the very sharp redistribution of income and wealth to the top 20%.

More and more is going to fewer and fewer. The Census Bureau has published many articles on this phenomenon.

"That's rubbish. This is nothing more a version of populist conspiracy theories. The BLS statistics are high quality and not influenced by political decision making."

How about this then?

http://www.chrismartenson.com/crashcourse/chapter-16-fuzzy-numbers

It may well be rubbish, and I have nothing to go on myself but what seems plausible, from the outside.

John William's ShadowStats page suggests that real inflation in the last ten years in the USA has been around 7-10%. Meaning that the USA's real GDP has been falling by about 3% a year.

The market price of gold seems to agree with his assessment.

http://www.shadowstats.com/

Also, keep in mind that the way the CPI is measured was changed during the Clinton years. The CPI used to include the price of houses. If house prices were kept in the CPI then interest rates would have had to be a lot higher - and the housing bubble would never had happened.

I'm not an economist but I remember reading something about the way imports were treated was incorrect. In auto manufacturing assembly worker hours are trivial compared to making parts, which are now largely imported.

Basically correct. The problem is that things like cars assembled here do not have the labor in their parts correctly allocated. Thus a car could have 50% or more of its parts imported yet this is treated as a productivity gain.

http://www.dailyfinance.com/story/investing/how-misleading-economic-data...

The chances of this getting fixed are probably fairly slim.

Its rather obvious give the exploding debt levels that we have not seen and real productivity gains.

Probably the last increases occurred in the 1990's.

Memmel,

I hesititate to take this working paper as definitive. Same comment applies to the Daily Finance link.

This is an unpublished paper. They may have a point, but we don't know that yet.

The exploding debt levels in this decade were not due to surging investment in plant and equipment or public infrastructure. It was financing consumption.

Why you think that debt-financed consumption should lead to surging productivity growth?

Focus on the obvious - the redistribution of US income to the earners in the top 20% income bracket.

I am not sure what you mean by an expert. I was trained as an economist. I understand how the statistics are constructed.

First of all, what is produced outside of America is not included in domestic GDP. So if a company outsources software development to India, then the value of that software development is included in India's GDP.

Output refers what is produced on US territory regardless of where the company is headquartered. If Microsoft sells its software using servers in Ireland, that is not US output. It is Irish output.

American productivity is high for many reasons, including cheap access to raw materials, a very high strong university system, good roads and highway, a system encourages entrepreneurship, etc.

The real reason Americans express skepticism about economic statistics is that they assume a one-to-one correspondence between the economy's performance and their own private fortunes.

Unfortunately, that is not the case today.

The US economic pie has grown moderately over the last 30 years, but how the pie is sliced up has changed dramatically.

A much higher proportion of US income goes today to the top 20% of households.

The US Census has lots of data and it all points to the same phenomenon, increasing US income equality. Look at income of American senior management. Their incomes have been growing much faster than the average household. In the absence of strong US economic growth, that implies of redistribution from the less advantaged to the more advantaged.

Paulo, Gail, and all,

Another excellent subject! I invite you to go to www.normbook.homestead.com/Contents.html and read this online book. It explains in great and understandable detail what real productivity is. As the bankers teach their tellers, you learn to recognize counterfeit bills by constantly handling the real ones. The fake ones, then, feel funny. We have been so long without sound economic theory (and I tend to fall in with OFM and Airdale in being skeptical of TPTB as a source of useful truth) that it's as if all we have handled, economically speaking, is the counterfeit stuff.

I also invite you to read what Thomas Jefferson and Benjamin Franklin wrote concerning proper economies and how to gain wealth. For example, Franklin wrote in "Positions to be Examined" that there are three ways by which a nation may become wealthy:

1) By war, thus taking by force the wealth of other nations,

2) By trade, which to be profitable requires cheating. If we give and receive an equal amount of goods and services through fair trade, their's no profit other than that obtained in our own production cycle. It's just nicer to be able to eat oranges instead of only bread, trading Canadian wheat for Florida oranges,

3) By agriculture, through which we plant seeds and create new wealth as if by a miracle.

I also invite you to check out the National Organization for Raw Materials at www.normeconomics.com. These sources explain far better than I can in a short comment how an economy truly works, and how by bringing raw materials into the economic cycle at less than a parity price will always lead to a shortfall throughout the economy, causing people to either lower their standards of living accordingly or borrow money to make up the difference, which leads to greater imbalances and greater debt, coupled with greater gambling devices (the house loan scam, for example) until it all crashes under the weight of reality.

Gail, you are absolutely right--there is a lot of unwinding to happen yet. According to raw materials theory, things won't truly start upward again until all crashes down to the level at which the price that raw materials enter the economy creates enough money to pay for all the processing, handling, marketing and consumption of those raw materials, plus enough profit to do it all again next year.

Historically, centralized bankers have created a false economy through war. War involves the creation of materials that rather quickly get consumed, creating the need for more materials, paid for by war bonds, but the economy is bogus unless the winning nation goes ahead and kills off most of its opponents and takes their wealth to pay for the cost of the war. That just doesn't happen anymore. World War II happened because the Allies let the Germans live, while exacting tremendous economic punishment on them, leading them to react back powerfully and viciously under their new leader, Hitler.

Yes, we have squandered our fossil energy. We have not used it to better the use of our annual energy alotment from the sun. Unless there is a remarkable discovery soon of how to tap into other sources of energy (dark matter?), coupled with extreme efficiencies of using our metal resources and new uses of carbon-based and thus renewable products (carbon fiber), we simply won't climb back to this level again. But as I pointed out in another post, how much of what we do, as measured in the GDP is really production vs. fixing the mess caused by such production? Where's the true net gain in that?

It's been said that a culture goes mad en masse and comes to its senses one at a time. Perhaps when the dust settles, wiser people will prevail and we can rebuild a true economy that can endure. Otherwise, parity will happen for awhile until enough people can be persuaded to get high on borrowed money again.

Thanks for the links. The counterfeit economic theory that we have been handed has been so worthless that I have not worried much about delving into it further. It will be interesting to see what these links say.

I am told the audio link above doesn't work yet. I don't think the Biophysical Economics Conference website is really fully finished yet. I'll let you know if I find out something further.

There is a thought that I have had related to energy supplies. Some argue that we need to build more nuclear plants - others argue that this isn't needed as we can just build wind instead. Let us consider just the financial differences between building these two forms of electrical generation.

Nuclear is fantastically expensive to build. It requires billions, and you don't get any revenue at all until the reactor and generator is complete. Some utilities are reportedly able to self-finance new reactors - others will require outside financing, and here is where things get tough. I am inclined to speculate that banks are unlikely to finance new reactors, and that the only hope is for governments to become involved and offer financing.

Wind is quite a bit different. The large turbines are large enough and expensive enough that an individual is highly unlikely to be able to finance the construction of a turbine, but still one individual turbine is many orders of magnitude less expensive than a nuclear reactor (while individuals might not be able to afford these things, institutions can - both of our alma maters have installed wind turbines on or near their respective campuses, for example). It is also true of course that an individual turbine generates orders of magnitude less electricity, but in a way you can view a wind farm as modular in the sense that as soon as the first turbine is complete you can start collecting revenue.

Given the much lower costs of an individual turbine, financing is likely to be far easier, and a wind farm can be build piecemeal as quickly or slowly as financing is available.

Enough of these things (both nuclear and wind) have been built that the economics of each are fairly well understood, and predicting the revenue streams should now be relatively straightforward.

How many movies have we all seen where the jist of the plot is...."follow the money"? Take the winter Olympics in BC. It was advanced under the guise of 660 million and they will pay for themselves. We are now at 6 billion and there is no snow! at many of the venues. The people of the province will be stuck paying the bills for decades, while the builders....friends of our right-wing Premier, made the money on infrastructure construction, etc. It is our local version of Haliburton.

Nukes? it is all about finance, money, contracts, 400 dollar hammers.... And now that there are no limitations on campaign finances, it will only get worse. The new Green and energy crisis is just another way to suck out money for the connected. Maybe too cynical, but that is how it seems.

I'm sure Gail would agree that projects like the Olympics are a financial forcasting nightmare. The ability to project a decade into the future is risky in the best of times. I doubt the Olympics as we're used to seeing it will continue for long.

The only way that the Olympics can continue for very much longer is if they give up some sports, and thus some venues, allowing them to shrink considerably in size to more manageable proportions. Specialized venues used for only one or two events, and that are especially expensive to build, would seem to me to be at the top of the list of things to cut. Halfpipe would be a good example - sorry, Shawn!

In other words, we are probably also at Peak Olympics. Games in the future will be much smaller in scale and focused on a smaller set of events. There will probably be fewer athletes competing and fewer nations represented as well.

As I have said, the 21st century will be one long exercise in giving up things, and this is part of it.

Nah, not yet, ROFL. If local funds run low, just hallucinate more central-bank dollars (or Euros as the case may be) and throw them at it. You're forgetting the panem et circenses, bread and circuses, that anesthetized urban Rome's very own Great Shiftless Moron Mass during a good portion of the Empire's long catabolic trip downhill. In a long crunch, vacuous entertainment spectacle might once again be among the last things to go.

Great Recession or not, vast throngs still eagerly fork over obscene sums for ESPN, sports tickets, soccer-yob jet flights, and the like, with yesterday's Super Bowl as a fresh example. Even those who make a great histrionic show of strident fury at the "unfairness" of the richness of "the rich" scarcely ever blanch at shoveling money at - guess who - "the rich", if only it will save them from likely failure or embarrassment should they ever attempt to put their doltish little minds to finding something of their own to do on a spare Sunday evening.

Ha, ha, I'm really curious when the last Formula 1 race season will be run. I'm not too much into racing but I watch F1 like the way passers-by oggle car crashes and ambulances... will F1 be an early casualty of a long emergency, or as you mentioned, will the dictum of panem et circenses rule in this case?

The circuses that draw the most attendance will last the longest. I don't think that F1 is heavy favorite here.

The fly-away races have made F1 a rather guilty pleasure for me. There is no way that F1 can continue with BAU.

On the other hand, the lower boundary of F1 is 'Fastest lap time of any series on any paved road course' and the upper boundary is driver, crew and spectator safety. Just in the 12 or so years I've been following it there have been enormous changes in rules and the addition of many races have been moved or added in places where the money is.

I could see F1 lasting a long time, although it will probably contract to a series of rail travel destinations, on established courses, and renewable fuels.

Peak oil does not imply peak testosterone.

Most importantly, fewer spectators who can afford to do discretionary travel?

I keep wondering how much the Athens Olympics factored into Greece's current financial problems. (I know they had trouble filling the stadiums.) Anyone know?

I love watching the Olympics even though televised sports usually bore me silly. But they do seem like great way for a region to go into massive debt.

I wonder whether the massive debt needed to finance new venues will even be available for future Olympic events.

Or maybe another view is more suitable -- why must all the venues rotate every cycle? Track and field could rotate between 5 cities....skiing the same...ditto water sports. The assets from past events could be reused, and smaller venues would take corresponding lower lodging and transport logistics.

It wouldn't be as fabulous, but still offers the competitive value (you'd rather have contests in the games rather than via wars!).

I think the grandiose Olympics will continue for a very long time (long after other treasured events are killed by the money trail) ... the Olympics (summer, winter, and para) are about national, political, and individual athletic egos and pride - and not so much about market economics at all. If the major international cities of the world give up on competing for them (not that there are any real signs of that), then there are plenty of emerging / developing ones in "the South" who will jump at getting them - and just command the money into place. Same for the Soccer World Cup. They will all keep happening until they really can't. But I agree that major cities should recycle their venues ... but then it wouldn't be "the Olympics" any more, eh?

Seems a pity that Whistler can't provide any snow ... I just paid my cable surcharge to get the whole caboodle ...

There is tons of snow in Whistler. The only snow problems are at Cypress mountain, which hosts arials and moguls.

Completely agree with you about ego and pride. I don't see the Olympics going away any time soon, no matter what they cost.

As I said upthread, hallucinated central-bank funds. Panem et circenses have come first, or close to it, for millennia.

The scale of PV and wind also allows for mass production, as in assembly line manufacturing. Large scale projects are in large part custom built-to-order. However, if the financing isn't there the manufacturing facilities won't get built.

More GA banks failed in the last days of Jan. Many of them had high exposure to the realestate/building bubble. My former employer watched what remained of his highly leveraged empire evaporate on the 31st. This is getting brutal folks. Yet there are still many who insist things will return to normal "because they always do". It seems that there is no room in their little world view for the big picture.

The availability of all the Raw inputs needed aside people are willing to pay $2000 for a plasma TV -enough for about 2KWatts of PV if mass rolled-out. This is just enough to ensure a reasonable standard of living without the thrills and its probably the way the Chinese will go IMO.

I think there will have to be widespread financial collapse before we understand the need for long term thinking wrt energy. A few Kw of PV tucked away is going to be a Godsend in this environment.

Nick.

Four arrays tracking!

Better get yours while prices are down.

Boy, I'd love to, but that "major debt unwind" thing seems to have started cranking up in the waterplanner household. It's interesting to see Gail's macro analysis happening at the micro level, too. Not exactly fun, but interesting.

Understand, WP. We've been eating a lot of PBJ sandwiches and chicken this winter too. If we had an electric bill we would be struggling to pay it. This was in my mind when I began this project years ago. I've had a sense of things to come for a while and decided to pay some things forward. I wish our society had done more of this.

You need to set up as a bank. Then you can get money at the discount window at 0.5%, and lend it to the US Gov't at 3.59

% (it is going up now; I don't expect that to stop). Use the free interest for purchase of your own solar array. Or give yourself a big bonus! Pat yourself on the back, and send out a press release that you had record profits. Pretty good gig, if you ask me!

Sometimes, when I think about it, it drives me nuts! The banks get money to lend from the Federal Reserve (a private corporation, owned by - the banks). The get it at the discount rate, currently very very low, and loan it at higher rates. The Federal Reserve does NOT have any money to lend them, of course. That is what drives me nuts! They create it... and they don't even have to print it. They just issue - what? a check? to the bank. Then the bank can loan it to a business, a family, or to the US Government. Right now, no one is very credit worthy. Very little private lending is being done. The safe loan is to purchase Treasuries.

So... the US Government needs money. They borrow it from the bank at 3.6%, and the bank gets it from the Fed at 0.5%. Now THIS really drives me crazy!!!! Why doesn't the Government skip the middle man and just go to the discount window????? Gail!!! HELP ME!!! Someone!!!! PLEASE!!!! Am I the only one who absolutely cannot stand this?

Craig

This strange system has been thought up to pretend to the public that everything is fine, when it obviously is not.

As the banks are bankrupt, the alternative would be to nationalize all the banks. This would not look good, and all the people in power, who own and make money from the banks, would loose out.

The system is obviously a brilliant form of wealth redistribution, as 99% of the public has not worked it out.

It is organized crime run by criminals for the criminals to enslave the unsuspecting, trusting, fearful masses.

The bad guys won............now what do we do?

Oh, please pass the cheese doodles while I change channel surf..............

No matter how this shakes out it will take effort from a yet to be organized population of the duped, overweight and lazy.

The worthless psychopaths that hold the strings are not very many in number and can't do anything without the complicity of the sheep.

This is the paradox.......they have no power at all except through psychological manipulation.

At this point the rules are for fools and people keep following because they don't have the courage to break from the destructive system into the unknown.

Where are the genetics that led their ancestors to migrate here many years ago??

Glad to see you back Porge.I have entertained some interesting thoughts as to your wherabouts recently ,considering that you are quite our most outspoken firebrand here on TOD who actually knows what he is talking about.

If the average man on the street had even a GLIMMER OF THE REALITIES of our banking system, we would elect apopulist president and congress next election and the banks WOULD BE nationalized;that is if the citizenry didn't just go , en masse, local police included, into riot mode, too far ahead of the election.

We may yet live, some of us, to see an American home grown jihad, target the banking industry.

Understand that I am not actually predicting such a thing, but merely stating that it is POSSIBLE , especially if evolving circumstances favor it.

Circumstances seem to be evolving in that direction.

In the not so distant past, we have had people hot enough to torch fancy oversized cars for environmental reasons.

I can see a defacto coalition of redneck libertarian hillbillies and urban dwellers of all ethnicities stopping high end cars (such as new Cadillac) on the street and inviting the occupants to not only donate thier small valuables to the cause but also enjoy the bonfire of thier vanity-a large car with a full tank of gas will keep a good sized crowd warm and entertained for fifteen minutes or so.

Those who think such a thing cannot happen may have read some history , but if so they didn't COMPREHEND it.

Personally I would much rather enjoy my old age welfare check and continue to buy some out of season produce and burn some small amount of heating oil and gasoline than not.I'm too old to ENJOY a revolution.

Me thinks it is the disappearance (for most) or reduction (for the every poor) of said "old age welfare cheque" that could trigger the bonfire of the Cadillac vanities.

Lets just hope the children (or grandchildren) are young enough to ENJOY the revolution and sentimental enough to keep the fossils supplied.

What type (s) of tracking rack/solar panel do you use?

One of them seems to have a different orientation than the others. Is that a wind turbine in the background?

The panel on the right is in the process of returning to its proper orientation. She's my little "wild child" when there is intermittent cloud cover. The others patiently hold their position while she goes "in search of". I need to adjust the sensitivity pot on the controller. Just haven't done it yet. This doesn't happen often.

Three of the trackers are made from old C-band satellite dish mounts salvaged from the junk pile. I used "uni-strut" for the racks. The one second from the left is a "store bought" Wattsun tracker. My homebuilt trackers have worked just as well (for a third the cost), although in extreme winds they likely wouldn't fair as well (but they're insured). The gizmo in the background is a weather station. It has registered a wind gust of 78mph without damage to the panels/trackers. The panels are fairly well protected in their location. Panels are Kyocera, Siemens and BP. 3600 watts total rating. We also have another small (160 watt) array for water pumping.

Thanks for the info. I've been looking at the Wattsun, as well as a European polar-mount design called Traxle.

I've seen the Traxle in publications. They're supposed to be high quality. That said, be sure you consider parts availability. I've had a few problems with my Wattsun, so parts is an issue. My homebuilt trackers have parts that are readily available around here and the electronics are affordable/repairable, so I keep spares. Tracking can increase output significantly.

The comment I have made before (maybe to you, perhaps to someone else), solar PV on the ground doesn't look very secure. It seems like someone will walk off with it pretty quickly, if electricity is in short supply.

Just keep a couple of pet king cobras under the panels ;-)

I've set up a couple of ground mount systems, I don't think they are any more or less secure than most things on any private property. Normal precautions should suffice. Not everyone would know how to steal them safely anyways.

I know that when I visited Wamsutter's natural gas facility in Wyoming, they had panels on the ground, and mentioned that theft was a problem.

One of the advantages of PV is its usefulness in remote, often unattended locations. As awareness of their value goes up, so do thefts. Thefts from road signs has been a problem for years, but they still use them because these are acceptable losses. My first three panels had frame damage after someone tried to steal them from a "winkomatic" road sign. They still produce full power 18 years after their original installation. People steal cars, your valuables, I even had a friend who had all of the plants stolen from his yard shortly after spending thousands on landscaping. PV panels aren't any different.

David Holmgren talks about building wealth that cannot be stolen easily. Firewood, Community built wind-mills, etc., sound like wealth that will be difficult to steal. It can be "captured" and settled on, though :)

The harder you make it for someone to take the longer you will keep it.

While in general I find a world powered by mirco solar PV unlikely, for other reasons, I still think you are not thinking outside the box enough... you claim that you do this for macro issues, and you do, but for whatever reason you never extend this kind of thinking on the micro level.

Behavior is adapative.

Presented with that problem, theft of micro PV, the simple solution would be too take all the PV for a neighborhood and centralize it in the middle in a co-op. Put a fence around it. Find two or three unemployed twenty year olds. Give them shotguns, rifles, a little cover, an alarm, and a cut of the old electric juice. Problem solved.

Again, the scenario is unlikely, as I think people will adapt in other ways, but the only reason people in Cali put PV on their roofs now is because probably no one is going to steal it.

I had numerous reasons for considering PV in the beginning. The clincher was the cost of bringing in the grid, over $15k. Back then, PV was more expensive but the money was a good start, and considering PVs modular design I knew we could build up to a larger system over time, and it became a sort of money making hobby (not much, but enough to offset some costs and buy equipment in quantity with others).

I have long been a proponent of the smart micro-grid concept for a while. I used to design power grids and a few of us used to discuss the concept at happy hour (about 25 years ago). Neighborhoods cooperate on projects to create a system that all can benefit from and share costs/responsibilities. Largely automated, these micro-grids are then interconnected via the main grids but can operate independently at some level. Modularization (similar to computer networks). This is something I suggested for Haiti last week. Alas, we don't live in a "neighborhood" as such. We're rural and the nearest homes are @ 1/4 mile away (family).

As for thinking outside the box: there is no box, only clouds, and a few of us seeking clairity.

My point was that when predicting how mitigation efforts might work in the future, you can't just look at the situation today, you must consider llikely future conditions.

For exmaple, people said in the TREV article that you can't use a small car solution to personal transit to replace SUVs because there are too many big cars on the road going too fast... in the future, those conditions will probably recede, and in fact, those conditions are built into the predicament that you are looking for a solution to.

I see the same thing with the argument that reduced oil demand reduces electricity demand, so there is no way fuel growth with electricity. This is a circular argument. At some point, fuel use will be so low that it will not factor into the economy as much as possible growth of new electrical supply (even if that new level is lower than it is now). Once it starts growing again, we return to a growing economy scenario (albeit with a lot of past "wealth" written off), and all that that entails (new debt).

You can't look at mitigations to future scenarios and shoot them down based on current circumstances that are likely to change as part of the scenario.

Sorry I am so longwided. To quote Twain, I would have written a short letter, but I only have time for a long one.

I've thought exactly that so I'm keeping an eye on security systems. This one looks promising:

http://www.vitamindinc.com/

Come on... you're kidding, right? "Software"? When I was in "Bargain" mode I used to dream about crude electronics and low-powered PCs powering NASA style robots that do our mundane tasks.

But think about the kind of complexity in our society required to support it. The kind of energy and resources required to manufacture and bring to market the components required to maintain a PC that we so take for granted today.

Using computers, cameras and technology sounds unrealistic for the future. In the short run, sure this might work.

A very determined hacker will get what he wants, anyway. But most desperate theft attempts can be easily solved by using community solutions - a couple of dogs and some youth in a co-op setup sounds better.

In our case Gail, they would have to do alot of (steep) walking, get through several fences, get past the dogs, and then there's me. But I understand your concerns. Also, we're about 6 miles from a smallish TVA hydro dam, so I expect there to be some power for the area, though likely rationed WTSHTF.

Precisely why I haven't had the guts to throw away a lot of money into PVs. :)

I'm instead funding (while I can :) ) the research and implementation of an ox-powered water pump which can also double up as a generic shaft to which other stuff can be attached (I'd like to make a crude grain processor and a wood-processing lathe).

I don't think Electricity as an energy transport is the right choice to be made for a 30-years-from-now situation given its dependence on copper, rubber, etc., I don't see it functioning effectively 30 years down the lane. PVs seem even more hinged on "high tech" that I think it will fail splendidly very shortly.

Wind looks very promising and practical for a low discretionary energy future.

Hi Sunson,

I keep reading that aquifer depletion is becoming a big problem in India. Is this a factor in the development of your ox water pump?

I agree. There is an online store, name of Affordable Solar (I think), that sells a starter kit for US$999

It is a single solar panel, about 200watts, and an enphase grid-tie converter, to provide an output of about 175watts AC.

Doesn't sound like much power? Well, it is enough to offset a standard refrigerator during a sunny day :)

...just a thought on how to get started.

You can also get 1.5kW of Kanekas for $1800 ($1.20 a watt) from Sun Electronics. It was a litttle cheaper earlier but I bought a pallet and they are on the level.

PV does lend itself to mass production, but most of that is a high tech process and much of it is done overseas.

A more primitive, but equally reliable technology would be stirling engines. Not elegant, but easy to manufacture (i.e. low tech with recycled materials), and reasonably efficient. Moreover, since they work on temperature differentials, they can be used with heat sources (e.g. mirrors), or cool zones (e.g. oceans, rivers, lakes, the earth).

Agreed! I never could quite understand why this didn't fly.

http://www.ted.com/talks/bill_gross_on_new_energy.html

What if one of the petal controllers aimed wrong and started the roof ablaze?

I guess that might be workable but I would bet that insurance premiums would be pretty high.

That talked to a long time convert --- I wrote The Hot Engine Primer back in the 70s to some good reviews when nothing easily accessible was available. Spent a week ago Sunday dinner with a retired commander of a US nuclear sub --- wasn't aware of his background till later so never got his opinion on Sweden's sub fleet that are Stirling powered.

ericy -

I fully agree with the points you make re wind vs nuclear regarding financial obstacles.

Whereas nukes are entirely an all-or-nothing proposition (you can't build half a nuclear reactor), wind power lends itself quite nicely to modularization, as even large wind turbines only come in 3 to 5 MW units. So, if you want 60 MW, you install 20 3-MW turbine; if you want 120 MW, you install 40; etc. etc. And as such, the financing of wind power doesn't have to be in a single multi billion-dollar chunk, but rather can be applied in smaller increments as the wind project is completed in phases.

This says to me that in times of economic stress and decreasing availability of credit, wind power might be a far more doable thing than nuclear power. Of course, as long as natural gas is still cheap and abundant, in terms of capital cost per unit of generating capacity nothing can compete with a combined-cycle gas turbine power plant. How long natural gas will be cheap and abundant is the key question, isn't it? But for now the utilities don't seem to care all that much, because they can pass on most of the fuel price increases to the consumer.

As most home heating (in the US at least) is by natural gas, I think a strong argument could be made that we should conserve our natural gas reserves for that specific purpose and not get carried away with adding more gas-fired power plants, because once the natural gas becomes too expensive and/or in short supply, how are we going to heat our homes? Go back to coal furnaces? Now that would do wonders for urban air quality, wouldn't it.

"you can't build half a nuclear reactor"

I beg to differ with you. There are three half built reactors in Richland Washington. See the WPPS fiasco. They had three reactors half built and went broke. The AAA bonds went to near zero and thousands of people lost large shares of their retirements. The whole thing was mismanaged and the government kept changing the requirements. A friend worked in the same room for three years on one reactor as a pipefitter while the engineers changed the pipe plans six or seven times. When the whole thing came down due to cost overruns, there was no one to blame because no one was responsible. Designed and built by committee!

Lynford -

Indeed the WPPS (aka Whoops!) ranks right up there with some of the biggest and worst fiascos of all time. A perfect example of something so big and with so much inertia that once it got rolling, no one was willing or able to stop it ...... until it finally stopped itself by crashing.

It's a good example of why one should never make the assumption that there is someone in control and making sure things don't screw up. Very often no one is in control.

You have to allow for the intermittency of the wind. With that in mind, you need to install something like three times the "nameplate" capacity of the turbines to achieve an average given result. Thus, if you want 60 MW, you install 60 3-MW turbines, not 20. If you want to displace one (average-sized) 600 MW coal power plant, you install 1800 3-MW turbines.

P. Coyle -

I'm aware of that, and was speaking in terms or nameplate capacity, not average output. That factor is about three to one, as you pointed out. Maybe a little less if you're talking about a good offshore location.

But please keep in mind, as long as wind power remains only a relatively small fraction of the grid to which it is connected into, it doesn't have to be installed at three times the nameplate capacity, because the entire system is not relying solely on the wind power component and other portions of the grid can compensate when the wind is low.

Certainly today's nukes only come in very large individual chunks. OTOH, all of the national labs with nuclear reactor programs have done at least preliminary design for small modular reactors (generally in the range of 50-150 MWe output). Several operate at standard pressure, so can be considerably smaller and lighter. Most have passive fail-safe features. Some are small enough to be manufactured and tested in a factory setting, then moved to the final site. Some have higher burn-up rates and produce significantly less waste. Some run on thorium fuel cycles. Some can run on essentially any of the possible fuel cycles.

Most other countries have realized significant savings on nuke construction by standardizing on one or at least a small number of designs. It would be interesting to know what the costs are for a modular reactor designed to be inexpensive to produce and with a guaranteed market of at least 20-30 units/year.

Of course the reason that nukes are specified to be as large as they are is to take advantage of "scale". When you are building an extraordinarily complex pump, for exampe, it doesn't cost as much double its size as it does to make two pumps. Nuclear plants have always been on the large end of power plant sizing for just that reason. So making modular plants reverses that logic. It may take a lot of standardization and mass production to overcome that situation. Then the capital issue becomes one of building the manufactruing plants and commiting to large numbers of small plants to attain the benefit. Catch-22

Several things make nuclear power expensive. PWRs, (Pressurized Water Reactor), are derived from the designs Rickover developed in the 50s to power navel ships. Water for both the primary and steam side was picked to reduce development risk, a good choice at the time. Scaleability of these plants is not good on the down side. Another problem for reactors in the US is the fact that the government regulatory fees are about $4 million per year per reactor. This alone would more than double the operating cost for a 10 MWe reactor.

New reactor designs such as LFTRs, (Liquid Fluoride Thorium Reactor) can scale to about 10 MWe efficiently, and need far less in the way of “Safety” systems. Combined with reduced regulatory fees this would allow LFTRs to replace virtually all coal and gas fired power plants.

Absolutely true. But if starting from scratch, one of the first questions would undoubtedly be, how can I get rid of things like extraordinarily complex pumps? There are a large number of designs being looked at. Barring total global economic collapse, it seems likely to me that at least one of Japan, China, Russia, Korea, or India will commercialize such a design. At least some of them -- and China in particular -- can guarantee a sufficient domestic demand to justify construction of the first factory.

Personally, I think Japan will be the most interesting case to watch. They import >85% of their energy, and the figure would be higher except that they get credit for large amounts of plutonium "manufactured" in their existing reactors. IIRC, they have a total of over 50 tons of plutonium that has already been separated from spent fuel, and over 100 tons of plutonium in spent fuel that has not been processed yet. Some of the modular designs could burn that and produce large amounts of electricity. Most of the modular designs would seem to be much more earthquake-resistant than a conventional nuke plant (in the sense of greatly reduced chances of a release of radioactive material).

I think the problem is that wind, per kWh generated, is quite a bit more expensive than nuclear, and certainly than coal. Furthermore, the electricity you get is variable in output, and needs a lot of transmission upgrades to useful.

While the $ amount for each individual turbine is less, when you add all the costs, it is really a very expensive energy source. Dennis Meadows of Limits to Growth fame says that capital limits are what are likely to bring our current system to an end.

I am not convinced that we can afford either nuclear or wind at this time. With the recession, electricity demand is going down. I think there is a good possibility that electricity demand will continue decline further, as debt unwinds. Trying to pay for new capacity when we really are not in need of new capacity, is doubly difficult. Maybe we should be concentrating on other mitigations, and just let electrical output decline with recession.

If your big concern is CO2, I expect this will decline pretty quickly even if wind or nuclear are not added, because of continuing increasing recession. In fact, I could make a case that adding wind or nuclear will increase CO2 concentrations. Adding wind and nuclear will use fossil fuel in their construction, so the short run impact of building new wind or nuclear capacity is likely to be an increase in CO2.

Our knowledge about the long term savings of CO2 from wind and nuclear is not very great. All the calculations we see about hoped-for long term savings are based on assumptions of the new wind or nuclear capacity being useful for 40 or 50 years. But if other issues (such as decline in globalization) cause problems that prevent these from being used during their full productive life (for example, inability to maintain transmission lines), the future CO2 savings may be illusory.

and not just for the reason you cited. As this fellow, formerly of the Nuclear Regulatory Commission points out:

Gail -

We've been down this same road several times before. But I don't mind doing it again:

Yes, the capital cost of wind power is much more than the capital cost of a coal or gas-fired power plant. However, wind power consumes virtually zero fossil fuel, and that is the whole point. If we had an unlimited supply of fossil fuel, no one in his right mind would even consider wind power. But of course, we don't.

So, if one thinks we don't have an impending fossil fuel supply problem, then one would also automatically believe that we shouldn't bother with wind power. This appears to be your view. But if one believes that we do and that it could take well over a generation to mitigate, then one would want to start nibbling away at the problem, bite by bite. That is my view, and that's where I think things like wind power, solar, and nuclear need to come in.

You also appear to have this belief that the global recession will solve the fossil fuel problem by reducing demand. However, I would maintain that once most of the 'fat' is sweated out of the fossil fuel demand structure by economic hardship, then what remains is a largely irreducible fossil fuel demand for essential uses, such as home heating, travel to and from work (such as it is), manufacturing of essential goods, and essential public-sector services, i.e., police, fire departments, and (arguably) the military. There is some minimum level of energy consumption that a modern civilized society requires in order for it to remain a modern civilized society.

And once more, this notion that the manufacture and erection of wind turbines consumes huge amounts of fossil fuel is demonstrably incorrect. The energy payback period is quite short, regardless of how one measures it. Accordingly, the CO2 generated from putting wind power in place can also be quite easily shown to be but a tiny fraction of the CO2 that would have been burned over the operating life of an equivalent coal-fired power plant, even using worst-case assumptions. Go through the numbers. So, I think this CO2 issue you are attempting to raise is entirely bogus.

I don't want to put words in your mouth, but let me try to understand the subtext of what you are saying: 'electrical demand will continue to fall, so let us not invest in non-fossil fuel alternatives such as wind, solar, or nuclear. Therefore we should continue with fossil fuel generated power until the fossil fuel runs out and our entire civilization collapses, at which point we won't need to worry about either fossil fuel or alternative power.' Am I close?

I think we are reaching limits to growth because of peak oil and because of many other limits. It seems to me that building more nuclear and wind is an attempt to keep BAU a while longer, while justifying our efforts based on CO2 saved. I don't think the effort to keep BAU going is going to work--so the huge expenditures in this direction are pointless.

It is hard to see that anything we build now is going to have an operating life of 30, 40, or 50 years, so making calculations as it they are is more than a bit optimistic. It seems to me we would be better looking at models in 5 year increments--how much CO2 will be generated by a particular combination of construction and fuel use in 2011 to 2015; 2016 to 2020; 2021 to 2025; etc. We should apply a very high "discount rate" to any savings out in later periods, because they likely won't exist.

Gail -

For me, CO2 reduction is not the key issue, but rather I see it as an added bonus of non-fossil fuel power generation.

I don't understand why you find it 'hard to see that anything we build now is going to have an operating life of 30, 40, or 50 years'. Many coal-fired power plants that were built in the 1950s are still operating. With proper operation, diligent maintenance, and the scheduled replacement of key components, there is no reason why a nuke or wind farm cannot have an operating life of well over 30 years and perhaps a lot longer. That is, unless your view of the future is even more pessimistic than mine. Yes, if things are totally hopeless and there is a total collapse and we find ourselves in a Mad Max world, then it doesn't matter what you do (even bothering posting things with this web site). As for me, I think the future will be difficult and grim but not apocalyptic.

I don't view wind, solar, and nuclear as a delusional way of keeping BAU, but rather as a means to supply a significant fraction of the minimum amount of electrical energy that a society depends on when the fossil fuel starts running out and/or gets prohibitively expensive. If indeed there will be a trend toward plug-in hybrids and all-electric vehicles, then electrical demand might not drop as much as one might suppose. However, that is difficult to predict.

And even if we use your basis of 5-year increments, I would posit that regarding coal vs wind, you would be probably still be ahead with wind in both energy invested and CO2 generation well within the first 5-year increment. Of course, if you shut down a new wind farm after only 5 years, you would be killed financially, but that is also true of a new fossil fuel power plant. So that consideration appears largely to be a wash.

Speaking of which, many of the older coal-fired power plants have been given quite a bit of leeway and lengthy extensions with regard to air emission requirements. But these are running out. It can be enormously expensive to retrofit air pollution control systems for some of these old plants. As such, utilities sometimes decide to decommission the plant rather than waste good capital on upgrading something that is already quite old. A good example of this is NRG, which is shutting down an older coal-fired plant in southern Delaware and will be making up for the lost power from other sources on the grid, including an offshore wind farm to be built off the Delaware coast by Blue Water Wind, which was recently acquired by NRG.

As a nation the US habitually makes bad 'investments' of monstrous proportions. Diverting just a few months worth of Iraq/Afghanistan expenditures to wind/solar/nuclear would not cost us any more than it already is costing us, and would at least give us something useful to show for it. As long as there is a defense/national security budget upwards of one trillion dollars, I have a hard time swallowing the notion that the US cannot 'afford' to build out alternative energy at some modest but significant rate. It gets down to priorities.

Because of their simplicity relative to other mechanical sources of electrical generation, wind is robust and should have a long life. I've read about old Jacobs units that have been in use since the '30s. One in Kansas has been in continuous use for over 70 years with regular maintenance (brushes, lube, etc), with one major refurb in the '70s. Newer wind turbines, with modern materials and technology should last at least as long. They are no more complex than a hydro plant, and because of their modular/distributed nature, with regular maintenance, their lifespan could be indefinite. As I've posted before, when smaller units have a problem, they often just swap in a new unit and take the problem unit back to the shop. The larger units are maintained on site.

A lot of the old stuff used to be very durable because it was very overbuilt - think the Brooklyn Bridge, built in the horse-and-buggy days, carrying modern traffic. I don't know how much margin is built into the mechanicals of modern wind turbines - can we say they will be so durable?

Wind turbines have far fewer moving parts than other systems, even than older wind generators. I just don't think their durability is a big issue.

Maybe, but every now and then I drive past this wind farm in north-central Illinois and it seems like around a third of them are always out of service, in any season. At best that's a strange way to do business.

That's because they start and stop according to the needs of the grid, just like hydro, natgas, etc. The hydro damn I live near doesn't generate all of the time even when the reservoir is full. You don't know jack about power grids, do you Paul?

I think in Texas what they are doing now, instead of taking unneeded wind off-line, is the wind suppliers are paying a charge at times wind is not needed, instead of being paid for the electricity when it is not supplied.

My guess is that PaulS is right. Most of the wind turbines are in need of repairs, although some might be in locations where it is not particularly windy. Wind turbine downtime is a big problem. This is a recent article about it. This is a link to a presentation from Delft University about Wind turbine reliability, plus some slides I cut out of the presentation. (Click for larger images).

The thing that astounds me is that this analysis seems to be talking about more than one failure per year per turbine on recently-built turbines. Failures were much worse than this back in when a 1987 study was done--perhaps as many as 15 failures per year per turbine. I hope someone can tell me I am interpreting the scale wrong. But the conclusion is clearly written in terms of failures per turbine per year (not percentage of turbines failing in a year). The annual downtime percentage seems to be in the 2% to 3% range, so most of these failures would seem to get corrected pretty quickly.

As one might expect, early and late failures predominate.

There are a whole group of causes of wind turbine failure.

These are the sources that have caused the most downtime. Gearbox is #1. Grid or electrical system is close behind.

The above image seems to be at least one source of the familiar statement that turbine reliability is getting better over time. I would argue that the trend line fitted is bogus. Clearly, the one very old wind reliability study called EPRI, USA from August 1987 had horrible reliability--perhaps 15 failures per turbine per year. (Failures are on a log scale)

But fitting a linear trend line through that point going forward is silliness. Look at the trends for groups of individual dots by type, in more recent years. The trend is at most down a little; nothing like that suggested by the fitted trend line.

I find this graph more disconcerting. It shows (and some of the other slides comment) that reliability decreases with the size of the turbine. This is not a good sign. Hopefully, there were some distortions in the study--maybe a disproportionate share of the large ones were in their shakeout period.

The report concludes:

-Unreliability > 1 failure/year/turbine is common.

-Unreliability is higher for larger turbines

-Such unreliability will be unacceptable offshore. We need reliability <0.5 failure/year/ turbine.

-Unreliability concentrated mainly in the Drive Train

-Some unreliable subassemblies are surprising:

--For example gearboxes are not unreliable

--But gearbox failures do cause large downtime and costs

--But electrical parts are unreliable

--And cause relatively little downtime but large costs

Hi Gail,

Just spoke with a former employer who has been a consultant for AWEA and deeply involved in wind energy. He says we are both right. Reliability has been an issue as turbines have been scaled up, usually due to drive assembly issues (reduction gears have been redesigned to save weight). Also, generator components called "stacks" have been redesigned to provide more power over a greater range of wind speeds. Some have been deployed that weren't "ready for prime time yet". One explanation of "stacks" here:

http://www.dailytech.com/New%20Wind%20Turbine%20Generator%20Ditches%20Me...

He described these issues as very solvable "growing pains", often occuring after North American manufactureres have been sold overseas.

He says I'm right in that often a group of turbines will be idled due to "grid economics", off peak demand, etc. Just because a wind energy producer has power available doesn't mean utilities have to buy it. If they can't sell all of the power they are producing then they have no choice but to idle a percentage of their capacity. Some one else posted that wind farms are overbuilt to compensate for times of lower wind speeds. He said that in some areas this is true, that it depends on sighting factors, and design economics.

He wants to send me some data but needs to check if it is legal for it to be posted here. Maybe I can convince him to write a post, if his contracts will allow it (his primary concern).

Well, just anecdotal here, but a couple weeks ago my wife and I drove through a wind farm in Wyoming County, NY. There was a fairly steady wind, and all 20 or so large windmills we saw were spinning at approximately the same rate. A truly graceful, beautiful sight to behold. Somebody's doing something right.

"He says we are both right." So there was no need to be rude and snide, was there?

I would be interested in a guest post on this subject, from someone who really knows about the subject. He can do it anonymously if he would like. Have him write to me at GailTverberg at comcast dot net.

Link to the presentation seems to be missing?

I think I fixed the link. (It downloads from the link.)

I think the problem is that wind turbines are part of a networked electrical system. You do have the maintenance issue on the turbines, but you also have the issue of maintaining the transmission lines (including transformers) and the back-up gas fired system. The electric power company needs not to go bankrupt (or alternatively, to get bailed out by a government agency with adequate funds). The workers for the system all need to get to work, somehow. Replacement part (like transformers) have to be imported from their overseas manufacturers, and the manufacturers have to buy all of the raw materials from their suppliers from around the world.

Maybe this system will all work for the 40 or 50 years envisioned in the calculations of wind feasibility, but I would not count on it.

I think that renewable energy sources like wind and solar are best applied at the smaller end of the scale, with distributed generation and limited storage at the household or neighborhood level, serving only the most essential needs, independently of the grid power supply.

It's futile to insist that renewables be scaled up to feed the grid as a direct replacement for depleting fossil and nuclear fuels. In all but a very few locations, the energy density is just not there on a reliable and predictable daily basis, and high-level storage is generally impractical.

One of the realities we're eventually going to have to accept is that our present rate of energy consumption is not sustainable into the future. A some point we're going to have to scale back our use of electricity to whatever the renewables can sustain. If that means 5 or 10 percent of our present power consumption, then so be it.

We will have to concentrate on the old idea of "negawatts", not megawatts. Conservation, efficiency and low-tech alternatives. What you don't need , you don't have to generate.

Hi Joule.

This is a hot topic of conversation with my bike buddies in the coffee shop. Clearly, the war money could have addressed many of the problems identified by TOD folks. Arguably, these wars are misguided. Totally uncertain is how the US will use it's military power in the future. Why is there no rational national policy regarding these facts?

What is the underlying national psychology that allows our elected leaders to feed the "military industrial complex" at the expense of our true security issues (PO/GW/etc)?