Drumbeat: February 2, 2010

Posted by Leanan on February 2, 2010 - 10:21am

Open Letter to President Obama

Dear President Obama,Your State of the Union speech last week laudably referenced clean tech and renewable energy several times. We ask that you follow your words with action, by leading the transition to a post-carbon economy and a healthier world.

You also spoke of our need to face hard truths.

Hard truth: Our continued, willful reliance on fossil fuels is making our planet uninhabitable. We are evicting ourselves from the only paradise we’ve ever known.

Hard truth: No combination of current and anticipated renewable sources can maintain our profligate energy usage as the global supply of fossil fuels heads for terminal decline.

MOSCOW (UPI) -- For most of the past decade, Russian leaders and their top officials and businessmen have believed that their huge reserves of oil and gas would guarantee them prosperity and global influence for decades to come. But suddenly some cracks are emerging in that confidence.As often happens, technology is changing the conventional wisdom. Over the past five years the combination of two technologies has transformed the energy market in the United States and now threatens to do the same elsewhere in the world.

Foreign Firms Angle for Uganda's Oil Reserves

A skirmish over an oil field on the shores of Africa's Lake Albert highlights Big Oil's intense interest in Uganda -- a rising star of African energy.

The International Energy Agency (IEA) expects total natural gas output in the EU to decrease from 216 billion cubic meters per year (bcm/year) in 2006 to 90 bcm/year in 2030. For the same period, EU demand for natural gas is forecast to increase rapidly. In 2006 demand for natural gas in the EU amounted to 532 bcm/year. By 2030, it is expected to reach 680 bcm/year. As a consequence, the widening gap between EU production and consumption requires a 90% increase of import volumes between 2006 and 2030. The main sources of imported gas for the EU are Russia and Norway. Between them they accounted for 62% of the EU’s gas imports in 2006. The objective of this thesis is to assess the potential future levels of gas supplies to the EU from its two main suppliers, Norway and Russia.

Without action, Texas' power supply will run out

Having an adequate supply of available electric power at reasonable prices is vital to existing business activity, as well as future economic development. However, studies (by my firm as well as other entities analyzing the issue) consistently show a potential shortage of electric power in Texas without significant capacity additions to the electric grid in the coming years.

Nigeria: Banks Behind Oil Marketers Demand For Promissory Notes From FG

Lagos — Strong indications emerged at the weekend that the new demand by oil marketers for issuance of promisory notes before they could access banks loans was actually sponsored by bank executives.Oil Marketers, under the aegis of the Major Oil Marketers Association of Nigeria (MOMAN), have listed issuance of promissory notes by the Federal Government as a part of new requirement before they would resume full importation.

Pakistan: Over 9% rise in petroleum prices a major blow to industry

LAHORE: The business community has strongly criticised the decision of the government for increasing petroleum prices and said it would result in price hike and play havoc with every sector.

Pakistan: Worst gas shortage in the offing

Karachi—To overcome energy crisis Pakistan is currently working on gas import options including LNG imports of 300-600mmcfd of gas in the next three years besides the much talked about piped gas from Iran with total imported quantity quoted at 2100mmcfd.However the energy experts feel that since both projects will come on stream with substantial time lag, it is feared that the gas shortage will worsen substantially till the time the much delayed Iran gas pipeline project materialized.

The Philippines: Investors urged to put up nuclear plant in Cebu

CEBU — The Provincial Government of Cebu is encouraging investors in the power industry to consider putting up a nuclear plant in Cebu to provide a lasting solution to the power crisis in the Visayas grid.

Russia to supply about 3 bln Kw/h of electricity to Baltics via Belarus in 2010

MOSCOW, February 1 (Itar-Tass) -- Russia’s electricity transit to the Baltic states via Belarus will amount to about 3 billion kilowatt-hours in 2010, an official at the Russian electricity export-import operator Inter RAO UES said on Monday.“The transit agreement with Belenergo envisions planned capacities and quantitative indicators for Inter RAO UES’s electricity transit through the Belarusian national power grid,” the official said.

BP Expects to Lose $1.6 Billion on Shipping, Solar

(Bloomberg) -- BP Plc, Europe’s biggest oil company, expects to lose about $1.6 billion in its solar and shipping businesses this year, said Chief Financial Officer Byron Grote.In 2010, BP expects the quarterly loss, excluding non- operating items, for alternative energy and shipping and some other businesses to average around $400 million.

In winter's chill, cold batteries mean trouble for plug-in cars

Nobody worried about cold-weather performance of electric vehicle battery packs when it was warm outside, but now that Old Man Winter has descended, the problem is beginning to surface. When cars have a range of no more than 100 miles, the loss of 20 to 30 percent of that is a very big issue indeed.

Climate change: 'Berkeley has a special obligation'

The relationship between income and energy use is no coincidence, and recognizing that simple fact is an essential part of getting past the current stalemate and finding answers to climate change, Roland-Holst, an adjunct professor in Berkeley's Department of Agricultural and Resource Economics, told the 100 or so climate-change experts gathered at Berkeley Thursday for "Beyond Copenhagen: Forging a Global Response to Climate Change." The conference reviewed what happened at Copenhagen and looked at the future of ongoing negotiations over global warming.

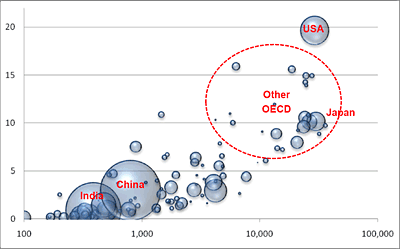

ARE economist David Roland-Holst's chart — which one of his graduate students calls his 'demonic bubble bath' — shows the tight relationship between energy use and prosperity, a key climate change issue. Based on World Bank and International Energy Agency data, the vertical axis plots per capita energy use in terajoules/year; the horizontal is per capita income as measured by the GDP. Bubble sizes represent population.

Oil near $75 in Asia amid improved economic data

BANGKOK – Oil prices headed toward $75 a barrel Tuesday in Asia as regional stock markets snapped a losing streak and economic data suggested U.S. crude demand could improve.Benchmark crude for March delivery was up 27 cents at $74.70 a barrel at early afternoon Bangkok time in electronic trading on the New York Mercantile Exchange. The contract rose $1.54 to settle at $74.43 on Monday.

As 2009 ended, a report issued by the International Energy Agency (IEA) received scant media attention, but it has huge implications for future U.S. economic growth and national security.Faith Birol, chief economist for the IEA, announced that unless there are major new oil discoveries, something his agency does not expect, the output of conventional oil production will peak in 2020. The agency's official conclusion is that production will reach a plateau sometime before 2030.

The news was startling from an agency that had previously refused to predict when oil supplies might stop growing. In fact, the IEA, closely watched by the world energy markets as an objective analytical source, had previously downplayed the prospects that oil production was reaching a peak.

20 reasons Global Debt Time Bomb explodes soon: Which trigger will ignite the Great Depression II, wipe out your retirement?

6. Peak Oil and the Population Bomb. China and India each need 500 new cities. The United Nations estimates world population exploding 50% from 6 billion to 9 billion by 2050: Three billion more humans demanding more automobiles, exhausting more resources to feed their version of the gas-guzzling "America Dream."

Total to Halt Refining Operations at Flanders Plant

(Bloomberg) -- Total SA, Europe’s largest refiner, plans to halt refining operations at its idle Flanders plant permanently after the recession eroded demand for oil products.“I don’t see the possibility that the refinery will restart,” Total’s head of refining, Michel Benezit, said yesterday in a telephone interview. “It makes no sense to continue refining when there are no clients.”

Israeli Gas Importer Maiman Says Tshuva Find to Increase Demand

(Bloomberg) -- Yosef Maiman, who holds 22 percent of Israel’s only importer of gas from Egypt, said the country’s record gas discovery off the coast of Haifa will increase demand for the fuel and help grow his business.“Eventually the market will make room for the both of us,” Maiman, 63, said in an interview at the Herzliya Conference, referring to billionaire Yitzhak Tshuva, whose Delek Group Ltd. is part of a partnership that made the gas discovery last year. “Converting an economy from fossil fuels to gas isn’t a quick process, but the more gas we get, the more usages we will find for it. I hope it will benefit our company as well.”

BP Sees ‘Slow’ Recovery as Profit Misses Estimates

(Bloomberg) -- BP Plc, Europe’s biggest oil company, expects the recovery from last year’s recession to be “slow and gradual” as fourth-quarter earnings missed analyst estimates.

Italy Oil Bill May Rise 36 Percent, Trade Group Says

(Bloomberg) -- Italy will spend as much as 36 percent more on oil this year, the equivalent of about 1.8 percent of gross domestic product, according to industry group Unione Petrolifera.

India steps up scramble with China for African energy

LUANDA (AFP) – India has stepped up its efforts to gain an economic foothold in Africa in a new scramble with China for the continent's resources, signing energy deals with top oil producers Angola and Nigeria.

PetroChina to Sell $1.6 Billion Notes for Expansion

(Bloomberg) -- PetroChina Co., the country’s biggest oil and gas producer, plans to sell 11 billion yuan ($1.6 billion) of notes in its first domestic debt offering this year to help finance domestic and overseas expansion.Cash requirements for the company’s exploration, refining and pipeline divisions will continue to rise “significantly” this year, PetroChina said in a statement yesterday on the Web site of Chinabond, the nation’s largest debt-clearing house. The sale of the seven-year, medium-term debt will be on Feb. 5.

CEZ Trading Director Sees Power Demand Rising Further

(Bloomberg) -- CEZ AS Trading Director Alan Svoboda said the Czech Republic’s largest utility anticipates continued recovery in power usage.“Demand should continue to improve” in the first quarter, Svoboda said today in an interview at a conference in Prague, adding that future growth in electricity consumption will be linked to economic recovery.

Nigeria to Auction 2 Billion Barrels of Oil Reserves, FT Says

(Bloomberg) -- Nigeria plans to auction some 2 billion barrels of oil reserves by the end of the year, the Financial Times reported, citing comments from Emmanuel Egbogah, special adviser to the president on petroleum matters.

Baylor Researcher Finds Methane Hydrate in Gulf Using New Search Method

A Baylor University researcher has used a new search method that he adapted for use on the seafloor to find a potentially massive source of hydrocarbon energy called methane hydrate, a frozen form of natural gas, in a portion of the Gulf of Mexico.Dr. John Dunbar, associate professor of geology at Baylor, and his team used an electrical resistivity method to acquire geophysical data at the site, located roughly 50 miles off the Louisiana coast. The Baylor researchers were able to provide a detailed map of where the methane hydrate is located and how deep it extends underneath the seafloor.

Panel Suggests 100 Ways Buildings Can Be Greener

A panel of experts convened by the mayor and City Council issued more than 100 recommendations Monday on how to make New York City’s building codes more environmentally sound by imposing energy-saving requirements on construction and renovation work.

White Roofs May Successfully Cool Cities, Computer Model Demonstrates

ScienceDaily — Painting the roofs of buildings white has the potential to significantly cool cities and mitigate some impacts of global warming, a new study indicates. The new NCAR-led research suggests there may be merit to an idea advanced by U.S. Energy Secretary Steven Chu that white roofs can be an important tool to help society adjust to climate change.

China’s Smart Grid Investments Growing

China’s overall federal stimulus investments in smart grid projects will surpass the United States’ in 2010, according to a forthcoming market research report — though not on a per capita basis.

Japan leads the race for a hydrogen fuel-cell car

Japanese carmakers, such as Toyota, are developing an affordable hydrogen car using fuel cells. Meanwhile, the government and energy companies are funding hydrogen refueling stations needed for the cars' widespread use.

Converting Coal Plants to Biomass

Coal-powered generating stations retrofitted to run on a mixture of coal and dried wood pellets can produce cost-competitive, emission-reduced electricity even without the advent of a cap-and-trade system, according to a new biomass life cycle analysis published in the Journal of Environmental Science and Technology.For utilities under pressure to meet renewable portfolio standards, biomass should be considered along with wind, solar and small-scale hydro, says Heather MacLean, the lead researcher and an associate professor of civil engineering at the University of Toronto.

Shell Pushes Brazilian Ethanol After Scaling Back Wind, Solar

(Bloomberg) -- Royal Dutch Shell Plc, the oil company that started an ethanol venture with Cosan SA Industria & Comercio in Brazil, is pushing biofuels as an alternative energy investment over wind and solar.

Solar Brokering Firm Assesses First Year

A co-founder of the San Francisco solar-purchasing brokerage One Block Off the Grid, or 1BOG, as it is more commonly known, says his business model is proving effective.

"Strong risk" of 2010 famine in Africa's Sahel: EU

DAKAR (Reuters) - Millions in West Africa's arid Sahel belt could face famine this year unless the world acts quickly to help, the European Union's humanitarian aid arm said on Thursday.The warning came as Niger confirmed the veracity of a leaked government forecast that half its population will face food shortages this year after a dive in grain production, but said it had enough food stocks to care for the most needy.

Study: 1 in 8 get help at food banks

One in eight Americans — 37 million — received emergency food help last year, up 46% from 2005, the nation's largest hunger-relief group reports today.Children are hit particularly hard, according to the report by Feeding America, a network of 203 food banks nationwide. One in five children, 14 million, received food from soup kitchens, food pantries and other agencies, up from 9 million in 2005, the year of the group's last major survey.

Of Dr. Seuss and Coal Gasification

The company that protects the copyrights on the works of Theodore Geisel, better known as the children’s book author Dr. Seuss, has sent a cease-and-desist letter to a Massachusetts company looking to get into the coal business under the name Lorax — the title character of a story published in 1971.“There’s no reason for them to use the term,” said Karl ZoBell, the long-time lawyer for Dr. Seuss Enterprises, “except to purloin the good will attached to the book and use it for a company that appears to be the opposite of everything the book is about.”

US firm kicked out of Peru mining group for pollution

LIMA (AFP) – Peru's mining, oil and energy association (SNMPE) said Saturday it has expelled US mining company Doe Run from its roster for not cleaning up its pollution problems, which environmentalists say are among the worst in the world.

Is There an Ecological Unconscious?

In Albrecht’s view, the residents of the Upper Hunter were suffering not just from the strain of living in difficult conditions but also from something more fundamental: a hitherto unrecognized psychological condition. In a 2004 essay, he coined a term to describe it: “solastalgia,” a combination of the Latin word solacium (comfort) and the Greek root –algia (pain), which he defined as “the pain experienced when there is recognition that the place where one resides and that one loves is under immediate assault . . . a form of homesickness one gets when one is still at ‘home.’ ” A neologism wasn’t destined to stop the mines; they continued to spread. But so did Albrecht’s idea. In the past five years, the word “solastalgia” has appeared in media outlets as disparate as Wired, The Daily News in Sri Lanka and Andrew Sullivan’s popular political blog, The Daily Dish. In September, the British trip-hop duo Zero 7 released an instrumental track titled “Solastalgia,” and in 2008 Jukeen, a Slovenian recording artist, used the word as an album title. “Solastalgia” has been used to describe the experiences of Canadian Inuit communities coping with the effects of rising temperatures; Ghanaian subsistence farmers faced with changes in rainfall patterns; and refugees returning to New Orleans after Katrina.

Rock Icon Andy Fraser Champions Global Warming Issue with Powerful Song “This is the Big One”

Nashville, TN (Billboard Publicity Wire/PRWEB ) -- Andy Fraser, founding member of the influential 1970’s rock group, ‘Free,’ and writer of their mega-hit “All Right Now,” continues to spread the message about global warming and resulting catastrophic climate change through his powerful song and video, “This is the Big One.”

NEW YORK (CNNMoney.com) -- The Copenhagen climate talks went nowhere. The Senate's attempt to pass a global warming bill appears stuck. But that's doesn't mean greenhouse gas laws aren't coming.The Environmental Protection Agency, spurred by a Supreme Court ruling, is racing to fill the void. As early as March, the EPA could be required to cap greenhouse gases from things like power plants and large factories, essentially doing what Senate Democrats want, without a messy vote.

UK emissions drop by nearly 2 per cent in 2008

The UK’s greenhouse gas emissions reduced by nearly 2 per cent during 2008, compared with 2007, the latest statistics from the Department of Energy and Climate Change (DECC) show.Publishing its final estimates for 2008 today, the Department says that the drop show that the UK is ‘on target’ to meet it’s our Kyoto-set target of 12.5 per cent below 1990 levels by 2012. It total the drop of 1.9 per cent in emissions brings the UK emission-levels to 19.4 per cent below 1990 levels.

Japan Aims to Get Bulk of Emissions Cuts in Japan, Nikkei Says

(Bloomberg) -- Japan wants to achieve 60 percent or more of its target for reducing carbon-dioxide emissions through efforts within the country, Nikkei English News reported, without saying how it obtained the information.

U.S., China, others join Copenhagen Accord on climate

Reporting from Washington - The United States, China and dozens of other countries accounting for nearly 80% of the world's greenhouse gas emissions have signed onto a voluntary agreement to curb climate change.If the countries make good on their pledges, they will dramatically reduce the emissions scientists link to global warming, but not enough to hold temperatures to levels scientists say are needed to minimize risks of drought, flooding and other catastrophic effects.

Study Finds a Tree Growth Spurt

Forests in the eastern United States appear to be growing faster in response to rising levels of carbon dioxide in the atmosphere, a new study has found.The study centered on trees in mixed hardwood stands on the western edge of the Chesapeake Bay in Maryland that are representative of much of the those on the Eastern Seaboard.

All are growing two to four times as fast as normal, according to a study published in Tuesday’s issue of The Proceedings of the National Academy of Sciences.

After controlling for other variables, scientists concluded that the change resulted largely from the increase in carbon dioxide, a major factor in climate change.

The Californication of ethanol continues.

http://www.farmersca.com/index.cfm?show=4&id=0702BF52

It is nice to know that Wars for Oil Security do not emit pollutants. And that natural gas is never flared nor does it ever contaminate ground water. It is very good that coal fired electrical plants are pollution free. And when we use American coal other countries do not have to open up new coal mines to replace our reduced exports.

Welcome to the Hotel California:

http://www.youtube.com/watch?v=WLIMg6VztI8

Mirrors on the ceiling,

The pink champagne on ice

And she said “We are all just prisoners here, of our own device.“

And in the master’s chambers,

They gathered for the feast

They stab it with their steely knives,

But they just can’t kill the beast.

Last thing I remember, I was

Running for the door

I had to find the passage back

To the place I was before.

“Relax” said the night man,

“We are programmed to receive.

You can checkout any time you like,

But you can never leave!”

I guess they are a little upset over losing a billion dollar market.

Maybe a new Enron Style solution would work?

From my rant in yesterday's DB on vested interests at work:

See what I mean? Move along, nothing to see here!

Alan from the islands

The music link is a nice addition. I've got it playing while I read TOD postings. Sets the mood in a macalb, world on a race to increase oil & gas flow as much as tech will allow in an upward growth at any cost, India and China going after the American way of life, debt headed for cataclysm, just find a way baby to get those hydrates and burn them, cut the forests, watch the ice melt and deserts encroach sort of way. Really adds something - thanks.

X, nice to know CA is still irritating to you. California leads the US in energy efficiency and innovation. Check it out any time you like.

From above: PetroChina Co., the country’s biggest oil and gas producer, plans to sell 11 billion yuan ($1.6 billion) of notes in its first domestic debt offering this year to help finance domestic and overseas expansion.

No doubt some of these notes will be bought buy U.S. institutions. And some of those may be using funds they borrowed from the Fed at lower rates and thus securing a nice risk-free profit. Of course, those monies might have been loaned to U.S. companies, but hey, profit is where you find it.

And there I was thinking the U.S. gov't wasn't doing anything to secure future foreign oil production. They are...but in this case for China. Maybe this isn't how it will play out but the potential irony was just to rich to pass up.

What am I missing ?

What you noted is an example of why I knew our current recession would be really bad as energy prices wouldn't stay at bottom long enough to fuel the sort of recoveries seen in the past--China is now able to fuel its economic expansion by tapping its internal market alone, that it would be immune to a large degree from Wall Street's greed-induced economic crisis, a situation that's true amongst mature developing economies elsewhere, resulting in the quick rebound in energy prices dispite the prevailing dogma that when the West gets an economic cold, the remaining world gets the flu, a dogma no longer true. The signal it sends to investors is unmistakable--China is able to pay its bonds, which makes them more attractive than US government bonds, impacting the US's abilty to sell its debt at low prices.

I'm sure LoraxAG actually believes that they're helping by making coal 'better'.. but yeah, the mismatch is astounding! You can't make this stuff up. Well Ok, Seuss could.. and did.

The company, LoraxAG, would probably win the lawsuit if they chose to take it to court. Titles are not copyrightable. So unless Dr. Seuss Enterprises has registered "Lorax" as a trademark they are very likely out of luck.

Ron P.

The way it was explained to me in B Law, you can't trademark the word "Gulf" or a circle or the color orange, but you can trademark the word "Gulf" inside of an orange circle.

So we live in "Logo World"?

But you can trademark company names. Apple (the Beatle's record company) and Apple (the computer company) have gotten into repeated court battles over the name. If your company is completely different, and people could not possibly mistake them, then you can have the same name. But if you're in the same business, trademark applies. Apple Records was okay with Apple Computer when all they made was computers, but when they started selling music, they went to court.

Not sure how this applies to Lorax. I'm sure they had lawyers look into it before choosing the name. The name may be trademarked, because there has been a play based on the book, and a movie is being made. Typically, studios will trademark names like that.

Maybe not. I have been trying to find some expert legal opinion on this subject. I am aware that lawyers from the Seuss estates have in the past not looked kindly on anyone using just about anything from Dr. Suess's works. It seems they have successfully served cease and desist orders on people for just reading a Suess story on the air without their permission.

I found this on the Daily Kos:

Sounds like there might be some action to prevent the name being used. Perhaps the coal company is deliberately trying to become an ecological martyr just to get their name out in the public venue?

Anyways should be interesting to see how this develops.

If, as seems to be the case, the Lorax coal folks have publically admitted lifting the name specifically due to the association with the Suess Lorax character, they will probably be forced to either pay some $$ for the rights or give it up.

Had they not admitted it, the Suess folks wouldn't really have a winnable claim.

Trademark (and copyright of words) are very much about what you can prove you're actually using them for in commerce; and what you're willing to vigorously defend in court. There's a fair bit of bluffing, since it's cheaper to pay a small fee to someone than to take it to court. Basically, if you have a lot of lawyers and are willing to p*ss away a lot of money, your marks are very solid. If not, less so.

(disclaimer: not a lawyer, just my opinion, but have had to deal with such stuff for years.)

A little along the lines of the lawsuit thread: been waiting to share this odd tale. This fellow has created a full time money making job for himself - he sues debt collectors. Apparently he got behind and the DC's started hounding him. He researched the laws and found some of those DC's actions were illegal. So he sued the folks hounding him and made some amount of $'s. He discovered that many of the DC's didn't know the laws and/or didn't care. So he started to intentionally run up debts, not pay and then sue when the DC's broke the law. As the story was told he now makes more than he did at his previous job.

Is this a great country or what!

This guy?

that does it, i'm gonna trademark gobblygook !

Sounds like it Leanan...thanks. You are true a Well of Knowledge. Just heard the radio version...short on details.

No, you cannot trademark the word "Gulf" but you can trademark the word "Exxon". Gulf is a common term used everywhere, Exxon is not. However the debate over whether the firm LoraxAG can or cannot trademark the word Lorax or LoraxAG. The fact that it is a title of a book makes no difference since titles, in most cases*, cannot be copyrighted. Therefore if Dr. Seuss Enterpirses had never trademarked the word, which is extremely unlikely that that they have, then LoraxAG is free to use it and free to trademark the term Lorax or LoraxAG.

Some may remember the case Miller Brewing brought to court. They tried to stop Budwiser from using the term "Light" in the title of their beer. They failed. The court ruled that the word "Light" was just too common use to be trademarked. But Miller did trademark the word "Lite". Bud can sell Light Beer but they cannot sell Lite Beer.

*Titles that have a colon, or some other method of seperation, the part after the colon is copyrightable. That is a title like "The Great Enterprise: or how you can make a million dollars in three weeks." Another person could write a book and title it "The Great Enterprise" but they could not include the rest of the title. That is if the title contains some intelligence, or nonsense in this case, then that part is copyrightable.

But a copyright and a trademark are two entirely different things. A tilte of a book is not a trademark and a trademark is not (usually) a book, though in some cases it might be.

Ron P.

However, Exxon did their best to cover all bases when they were changing their name. I was living in Nebraska at the time, and it made the papers when they asked then-Governor J. James Exon, owner of "Exon Office Supplies", to sign paperwork stating that their name wasn't infringing. IIRC, the newspaper story indicated that Standard Oil of NJ had purchased rights from several other small businesses with Exon or Exxon in their name. "Exon" is now a common noun for a particular type of nucleic acid sequence found in RNA, but that usage post-dates Exxon's name change.

As I recall, Jersey Standard also went to considerable effort and expense to find a word that was not a real word in any language in any country where they operate (essentially, all of them), just so it could be trademarked.

My impression is that big pharma pretty much does the same thing with each of the brand names coined for their new drugs. One more thing driving up the price of prescription meds.

My favorite is Aciphex

http://www.youtube.com/watch?v=TId5izj6cHQ

(Is this the new "social marketing" at work? - They have this commercial reposted all over because of it's humorous(?) name.)

You may well be right. I just think it's almost going to amount to more trouble for them than it's worth.

I remember being in a hospital with my mom (when I'd smooshed her pinky finger with a log-splitter.. right as she was starting to play Cello.. Filial guilt abounds..) and there was a poster on the Doctor's office wall for 'Soma', the name of the drug in 'Brave New World' that kept everyone 'asleep'.. there's no shame.

http://www.youtube.com/watch?v=0JLIFZFvRmw - (A glimpse of the 'Other' SOMA)

I think Huxley borrowed the name himself. Soma is an ancient term.

http://en.wikipedia.org/wiki/Soma

Sure.. I know it is the root word (Greek?) for Sleep.. I just thought it was laughably heinous for a drug company to market a drug under the name, when Huxley had made it such a recognized metaphor as a 'Keep the People Cowed' product.

Continually astonished, but not surprised..

It looks like the Latin root 'somn-' meaning 'sleep,' but it is actually from Sanskrit, originally meaning 'pressed,' presumably referring to a stage in the process of producing it. It is much debated what the original substance was.

Sanskrit may have been the source of the name of another popular treatment: 'viagra' means 'tiger' in Sanskrit.

But I agree with your point about the irony here.

I agree, but the negative publicity could be overwhelming. Imagine a letter writing campaign against LoraxAG by a bunch of school children.

Yes - the bad PR may be worse than any lawsuit.

LOL. Todd and I have been down that road.

Bailey's request signaled a new skirmish in a battle for the minds of Laytonville's young. The townspeople (most draw their living from logging) began to buy ads in the Laytonville Observer to protest Seuss. Said one: "To teach our children that harvesting redwood trees is bad is not the education we need." With the second ad, says School Superintendent Brian Buckley, "we knew we had a problem." Last week a school-district committee voted 6 to 1 to resist censorship and keep The Lorax on the required list. Next week the school board gets a whack at the problem.

http://www.time.com/time/magazine/article/0,9171,958654,00.html

Re: Climate change: 'Berkeley has a special obligation'

I saw the graph with this story and then read memmel's comments about Golden Swans, etc in yesterday's DrumBeat. That prompted a bit of twisted logic.

We frequently use the acronym BAU around here for "Business-As-Usual". Maybe we should re-define BAU to mean "Bubbles-As-Usual".

Pop!!!

E. Swanson

It is true than GNP is strongly correlated with energy consumption. However, wellbeeing, developpement index, sature pretty fast passed some point. By the way, this is predicted by the economic theory. We could easily cut our consumption by a facor 4, without affecting much these variable.

That depends upon who you mean by "we".

Sure, the US does use about twice the amount of energy per unit of GDP as Europe or Japan. The problem is, even cutting back to half our present level would mean massive shifts in the way things are done because the US has already built a society based on cheap energy. Cheap energy made suburban sprawl possible and we bought the dream. In Europe, things have evolved over many centuries and the result is much higher densities on average compared with the US. It will be exceedingly difficult in the short term for the US to cut energy use by half and cutting by a factor of 4 would require emergency measures not seen since WW II. I don't see this happening without some major disruption.

Worse, if our discussions of Peak Oil and the Export Land Model problem are impending, the US may not have enough time to effect the necessary change, again, absent some major changes in the way things are done. Even worse, there's almost no way for the usual financial system to pay for the needed changes, given the fact that large changes in asset values will accompany the shift. Something like martial law and the government assuming total control of all economic activity will be needed, i.e., a revolution, IMHO. May we (not) live in interesting times and attract the attention of people in high places...

E. Swanson

"The problem is, even cutting back to half our present level would mean massive shifts in the way things are done because the US has already built a society based on cheap energy. Cheap energy made suburban sprawl possible and we bought the dream."

Well put. In other words, our sunk costs are sinking us.

Even things that would rapidly reduce energy use and arguably improve our well-being will, at first at least, be seen as a big reduction in life-style--putting four+ people in all those cars and SUVs that now have one driver in them could quickly reduce gasoline use, and it would reduce isolation and increase social contact, things that are generally good for feelings of well-being. But carpooling is generally seen as something poor people have to do, so most people will likely see it mostly as an inconvenience and a lowering of their status.

But an effective advertising campaign to frame carpooling, downsizing, biking, walking...as high-status activities could perhaps change some of these attitudes. Note that none of these requires energy or other resource inputs.

A massive effort at insulating houses and other buildings may still be doable and would provide the best payback for money and energy invested. But settlement patterns, lack of public transport systems...will haunt us for a long time.

I took public transportation home from work yesterday, Pasadena to San Gabriel. Started home at 5pm.

I noticed that most of the busses did not seem to have much ridership maybe 75% full at most. MTA 780, MTA 762, to MTA 378.

When gasoline spiked around US$4, I remember the busses were almost standing room only.

We accompanied a friend today who had business at the U.S. Immigration Center in Garden City, Long Island, NY. About 20 miles from our neighborhood in Jackson Heights.

We took the 7 train to Roosevelt Avenue/74th St, caught the F train to 169th Street, and an N24 bus to Garden City, across the street from the Immigration Center. All one fare: $1.10 for me (senior), $2.25 each for them. Same for the return trip.

And you get an informative tour of storefront businesses and strip malls almost unbroken along the route.

Japan, of course, has reached their present position after more than 60 years of effort. Their attack on the US that pulled us into WWII was made after the US refusal to continue shipments of crude oil to Japan, which the Japanese government considered an act of war. Given that they import more than 85% of their energy (and it would be much higher, but they get credit for many tons of plutonium "manufactured" in their nuclear reactors), they've had to be efficient, since that imported energy must provide not only the goods and services for their domestic economy, but enough exports to pay for the energy supplies.

Even today, outside of petroleum, the US is largely self-sufficient in energy. As others have indicated, the real question for the US is whether the country can get its petroleum consumption down quickly enough.

The "20 Reasons.." article above contains nothing that surprises me, but it is staggering to see it all presented together in such a nice, concise manner. Man, are we ever screwed!!

The only thing missing is a prediction of how it all goes down, which I think is just as obvious: somebody blows something up in the Middle East which ignites the whole she-BANG. Probably (another) False Flag Operation, but it won't matter who is really responsible, it will be the trigger that brings down this whole house of cards. And we won't learn a thing, we'll just blame it all on those Ay-Rabs. We've been trained for over a decade now to do just that. And it may be soon - anybody else notice the increasing military buildup in the Gulf??

Yeah, I'm wondering whether Farrel is a lurker (or even contributor??) on this forum. He was a pretty middle-of-the-road type for years, but now seems to be seeing the depth of our multiple predicaments more clearly than many. I'm planning on picking up his newest book, "The New Frugality."

Fifty years ago the price of gasoline was $0.31 (USA) for a gallon of regular. The price of oil was $3.00 a barrel.

I'm old enough to remember when competing service stations (they provided "service" back then) had "gas wars", and you would occasionally see gasoline prices as low as $0.10 - $0.15/gal.

The lowest I ever saw it was 9.9 cents... I filled 'er up! Was running a '48 Pontiac straight eight at the time.

Today I drive a Toyota, 4 Cyl. Gas is $2.41.9 last fill up, and oil at $75. Based on the ration above, $3 oil and .35 gas, I suppose gas is cheap today... it should be about $9.299??? What are they waiting for?

Craig

I remember taking drivers ed. They had a slide of something that was "wrong". We in the class were asked "what is wrong here" for the 10th time with only one of the slides having something so glaringly an issue that students were able to answer.

Then the 11th one comes up. It had gas at $0.10 a gallon. The question was asked "whats wrong" and I raised my hand. Pointed out the $0.10 a gallon gas. Turns out that answer is funny, but wrong.

Has anyone ever tried to do a Hubbert Linearization for an oil field including ERoEI or net energy?

I was rereading Does the Hubbert Linearization Ever Work? Where Robert Rapier evaluates HL and it occurred to me that I had never seen a net energy HL. I looked through the comments and Totoneila asked the same question but was never answered.

Robert's post concluded the HL doesn't have a great deal of predictive power, but I'm wondering if HL plus ERoEI can tell us anything. Does anyone have the data to plot this? Perhaps the production data for some domestic fields and the dates when enhanced oil recovery technologies where used?

Thanks in advance, Tim

I don't know about net energy, but Deffeyes predicted--based on HL--a global crude production peak from 2004 to 2008, mostly likely in 2005. He erroneously observed that production actually peaked in 2000, in contrast to what his model showed, but he never backed away from his 2004-2008 prediction. Here is a look at recent global production data versus price.

Global Cumulative Crude Oil Production Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, crude + condensate)

Here are the average total global crude oil production numbers per day by year, versus average annual US spot crude oil prices:

2002: 67.16 mbpd & $26

2003: 69.43 mbpd & $31

2004: 72.48 mbpd & $42

2005: 73.72 mbpd & $57

2006: 73.46 mbpd & $66

2007: 73.00 mbpd & $72

2008: 73.71 mbpd & $100

Relative to the 2002 production level of 67.16 mbpd, in the following three period, 2003-2005 inclusive, the cumulative three year increase in production was 5,164 mb, versus a three year increase in oil prices of $31. So, for every dollar increase in oil prices, three year cumulative global crude oil production increased at 167 mb per dollar, again relative to the 2002 rate.

But then we have the 2006-2008 data.

Relative to the 2005 production rate of 73.72 mbpd, in the following three year period, 2006-2008 inclusive, the cumulative three year decline in production was 632 mb, versus a three increase in oil prices of $43. So, for every dollar increase in oil prices, three year cumulative global crude oil production fell at 15 mb per dollar, again relative to the 2005 rate.

Thanks Westexas, but I'm not looking for Peak Oil info that I can process. I'm looking for stats that I can show to economists and policy makers. It's a fundamentally different standard.

I drank the koolaid a long time ago, so accepting Deffeyes projections isn't much of a stretch for me. But the infinite growth crowd needs a much more rigorous proof. HL + ERoEI might be just the ticket.

To me it looks like peak in 2005, followed by an undulating plateau.

Anyone see anything else there?

Craig

I've been playing around with numbers for whole regions; North America peaked in 1985, at 13187

kb/d. In a sense you could compare that to the FSU or KSA, is that an exact analogy? Anyway the decline pattern in subsequent years was as follows:

As can be seen, they did rebound for one year, but decline has been fairly inexorable since. The average change for NA 1980-2008 is 0.44%, too. I mean to play around with these regional numbers more, the world itself is a region, after all. Certainly you don't get anything accurate plugging the US decline pattern into the world, or not at the initial point of peak production, anyway, which was quite sharp; if the world followed a pattern like that we'd have hit ca. 76 mb/d in July 2009. JD had a post about regional decline, too.

I've been trying to get an answer to a similar question for a long time.How much does the utilization of wind and solar depress the price of coal and natural gas?

I'm reasonably sure that the price reduction is very small as yet but when you multiply that out over millions of cubic meters and millions of tons over years of time .......

I am generally rather wary of subsidies as they are seldom fairly distributed and waste a lot of resources simply in the application and record keeping process.The current appliance program strikes me a a perfect example opf a hell of a lot of bookkeeping for a very small return since it will just advance appliance sales now at the expense of sales later.

But it may be that money spent subsidizing wind and maybe even solar SAVES us money collectively even wihout considering the environmental,economic, and security consequences of our current runaway ff consumption.

Personally I am dead certain that wind will save a lot of money in the long haul as I expect coal and ng prices to climb steadily with occasional dips as the years go by.So far as I can see anybody who thinks otherwise is drinking altogether too much koolaid.

There are many factors that affect price when supply is not constrained. I'm not sure one could come up with a reasonable model of that. However once supply is constrained then there is a good rule of thumb that can apply, but I don't know what it is called. It works out to a 1% rise in demand creates a 20% rise in price.

There will always be complicating factors such as demand elasticity, but that ratio was mentioned here during 2008's oil price run up and I took it to be a fairly reliable model.

I agree that there is an good argument that sustainable energy subsidies now will provide a net gain in the future as fossil fuel limits come into play.

And what's with the Israeli Gas Importer Maiman (above) implying that offshore gas deposits were not fossil fuel?

Hey hey Mac,

I'm certain that you are right, building wind and solar will save us money in the long run. But at the present moment wind and solar are subject to the receding horizon problem.

They aren't cost effective at the current electricity price but they will be competitive at some higher price. Except that the cost increases as the energy price increases keeping them perpetually just out of range.

In my ridiculously over simplified world view the receding horizon problem is due to ERoEI. Since energy is a significant fraction of the cost for renewables ERoEI can be used as a reasonable proxy for competitiveness. FF have a fantastic ERoEI and renewables won't be competitive until their ERoEI improves or, more likely, the ERoEI of FF falls.

Since we can't count on the ERoEI of renewables increasing substantially (it's possible, but not certain) but we can count on the ERoEI of FF falling it makes sense to plan for future energy production at the price for renewables.

The subsidy regime I like is to impose a tax and transfer system. Tax coal at some very low initial level and transfer the revenues to renewable production so that after the subsidy renewables produce slightly cheaper electricity. At the start you have predominantly coal fired plants so a small tax provides a lot of subsidy per renewable plant. As the number of renewables grows the tax increases to keep renewables profitable. The process gradually transitions us to a world of more expensive energy provided by renewables. Since we are headed for a world of more expensive energy it seems like a sensible way to get there.

On subsidies, please note that no nuclear plants would ever have been built anywhere without massive subsidies, including huge government-funded research outlays and in the US government insurance.

Many subsidies for oil are not recognized as such much less priced into the final product. What if all the costs of Iraq Wars has been added to the price of oil? And of course some uses of oil-based fuels go untaxed entirely--jet fuel.

Tim -- if I understand your question correctly this is one of the problems with projecting Hubbert on a global scale. I can provide you with detailed production curves of many large oil fields in Texas. But here's the trick part of the answer: what do you want that decline to look like? I can show you one where production starts out at X thousands of bopd and then declines at around 1 or 2% and then suddenly drops at 20%. Or one that starts out at X thousands of bopd and then declines at a constant 15% until it becomes uneconomical to produce. Or produces with no decline for Y years, suddenly starts declining at 10% and then slows to a 1 or 2% decline after Y+ 8 years and then production increases 8X in the next several years (thanks to the advent of a new production technology developed in the early 1970's) and then begins a 10% decline rate that eventually turns into a 2% decline rate until a new operator takes over the field, drills a series of horizontal wells that increase production 5X with a very low decline rate until suddenly, in a year or less, the oil production ceases completely and the field is abandoned.

I think you get my point. There is no such thing as a "typical" oil field. Some have a URR of 8%...some 60%. Some recover more oil during secondary recovery efforts then during the primary recovery phase. Some fields recover no additional oil from secondary recovery efforts. The wide variety of production profiles I just offered doesn't even cover the full scope. Even within the same trend of oil reservoirs there's a good bit of variations due to technology developments over time as well as how different operators produce a field. Even two fields with identical reservoirs developed at the same time can look a little dissimilar: ExxonMobil doesn't do it the same way as a small privately owned company would. Nor would they do it similar to a national oil company encumbered by all the various political factors (i.e. Venezuela).

There's the problem in a nut shell: If one tries to make a generalization of future production based upon past production profiles then you assume those future fields are very similar to the historic fields. But the historic data doesn't average to give you an accurate picture of the old fields. During the time of Hubbert, after we recovered more tthan 50% of the URR of all Texas oil fields, no one was even day dreaming about producing oil in 5,000' of water from reservoirs twice as deep as anyone thought oil might even exist. In fact, any such "typical" field profile wouldn't likely match many of the old fields. But a reasonable answer could be calculated for any of the major producing fields we have out there today. All the KSA et als have to do is release the data. As we all know that won't happen so we're left with guestimating. And we have some of the best guestimators on TOD that I've ever run across in the oil patch over the last 34 years. But in the end an answer can't be more accurate then the data used to calculate it. A simple and undeniable law of statistics.

ROCKMAN,

Thanks for the detailed reply. And yes, I am looking for applicability on a global scale. While I know that you can only coax so much out of an incomplete dataset, I think it's important to keep plugging away at it because KSA et al aren't going to divulge their secrets anytime soon and our governing structure clearly aren't convinced yet.

Here is more accumulating evidence that offshore oil tanker inventories are being drawn down:

Unfortunately, I haven’t been able to find a link yet, although there may be one later.

Some posters continually respond to me posting such articles as they ‘don’t believe’ inventories are coming down, or that they ‘don’t expect’ oil prices to rise because of the ‘peak demand’ concept. However I agree with what memmel said yesterday - in that those that want to dispute the apparent fall in US oil imports and world oil inventories should come up with some workable theory to explain why what appears to be happening is not so.

BP: Declining contango makes storing oil less profitable

"In winter's chill, cold batteries mean trouble for plug-in cars "

I drive a Honda Civic Hybrid. Gets around 45 - 60 mpg city driving in summer, and around 25 - 35 mpg in winter. Definitely due to cold batteries.

The car has an "auto-stop" feature which switches the engine off while idling, but this only kicks in after a couple of miles of driving in winter, so the lack of auto-stop is most apparent on short trips.

Regenerative braking also takes while to get going in cold weather.

Some people tell me they warm up the car before going out, or heat the garage. I've never tried that, since idling uses up gas, any way, and I don't have garage heat.

It does mean I tend to use transit more in winter, ironically, since my gasoline bills go up.

I don't know anything about the batteries used in hybrds but every battery I know of heats up while being charged or discharged, and COOLING BATTERIES is a serious design problem in most applications.

It seems to me that keeping one warm overnight would be very easily accomplished by enclosing the battery box in insulation with movable flaps to expose it to the air flow of the moving vehicle when it is to warm or hot.

There are plug-in heating pads that one can buy and place underneath their car battery. These, plus engine block heaters, are often used up north, where it really gets cold all winter. I suppose that some sort of battery heating system could be built in around the battery pack, powered during re-charge, maybe with some sort of temperature sensor to turn it on/off. Of course, that is just one more thing to drive up the price, too.

Lead Acid Bat Capacity is only

half at 0C vs 25C. Most Lithium Battery chemistry is fairly consistent in this range , but life is reduced by oxidation much like Lead Acid at higher temperatures > 40C.

I have a non-hybrid, and I get my mileage goes down from about 65mpg in summer to about 55 in winter, so your batteries are only partly to blame. My hypothesis is that engine performance is worse in the winter because it takes a long time to warm up. The more efficient the car, the more pronounced this effect because there is less heat generated. Unless I need to melt ice on the windshield, I don't turn on the heater until the motor is fully warmed, otherwise the engine never fully warms up in city driving. Cold air is also denser, so more resistance. Snow tires also have higher rolling resistance.

If your engine is not warming up fully your cooling system is not performing correctly unless maybe you are living someplace it gets REALLY COLD, like thirty below zero F.In this case a radiator shroud is needed to reduce the flow of super cold air thru the radiator and engine compartment. A lightly loaded engine may lose so much heat thru the engine's outer surfaces at such temperatures that it cannot get up to normal operating temp.

If it the engine does not warm fully up, the computer will keep it in warm up mode , which wastes gas.

The car has a warm up mode, but it you can practically see the fuel gage drop on cold days if you use it. It is a small engine, 1.4 liters, 3 cylinders, so it has a large surface/volume ratio. It is a great car and I could keep it warm inside if I were willing to drop to 50mpg in winter.

One small effect is air density, wind drag should be proportional to density. Colder air is denser. Roughly every 2.85C resitance should go down by one percent.

Since warmup time is longer, for short trips I would think that a lot of fuel is wasted during warmup. If you are pushing water, or snow around on the road that would dissapate a lot of energy. I once remember driving through 18 to 20 inches of heavy windpacked snow, using compound low in the 4WD PU petal to the metal (i.e. most of 200HP to maintain less than 10mph). But I did make it to the main road, when all other drivers couldn't.

The main issue with cold weather driving of hybrids is the engine and exhaust system temperature and not the batteries. The smaller more efficient engines do not create as much waste heat.

There are instructions online on how to block the front grills of the Prius to increase the efficiency. There are probably similar ones for the Civic. I have done this and it works to improve my mileage on the Prius. Just don't forget to take them out when it gets warmer in the spring.

Basically, US hybrids are optimized for emissions, not mileage. The engine must run at first to get the catalytic converter up to the ideal operating temperature as fast as possible. Also the engine will run if the heater is on and creating too much demand.

Good point about electric heat being a major energy draw.

For all-electric cars, it is cold batteries that reduce efficiencies in the winter, in my experience significantly.

We have have ICE's for now, so nothing to add to discussion regarding plug ins in winter vs. summer, but did think this article was interesting.

http://www.businessweek.com/globalbiz/content/feb2010/gb2010022_730397.htm

China is telling Obama point blank he cannot meet with the Dalai Lama or the U.S. will face repercussions. Wow, it sure didn't take long after they started lending us money to begin dictating terms for who our President can meet with or sell arms to, like Taiwan.

In years to come as we borrow ever more from the chinese, the political clout they have over us will undoubtedly intensify. Wonder what will happen once world oil production descends from peak plateau.

No different than US telling Pakistan not to get any gas from Iran.

Scratch that - this is extremely mild compared to what US tells other countries.

Looks like the price of oil is on an upward binge. It's up about $5 a bbl since last week. Going for $80, or is it the beginning of the next run for triple digits? The peak demand for summer driving is a long way off yet...

E. Swanson

The year over year comparisons are interesting: About $79 for January, 2010 versus $42 for January, 2009, and the current price of oil exceeds all prior (nominal) annual prices, except for 2008.

Per Coffeyville Refining, the avg POSTED WTI for Jan is $74.56.

https://www.coffeyvillecrude.com/CVRCrude/showPriceBulletins.do;jsession...

That roughly $4.50 is what the spread between actual purchaser's pricing and near month futures have grown to.

Animated map of unemployment over time in the USA. Startling, indeed.

LINK

Extremely cool gog. Mucho thanks

Glad you found it interesting, rock. Tax revenues are really in trouble and I expect cutbacks in the public sector to increase rapidly over this year and the next.

Unemployment rises in most metro areas

Odd how it seems to spread out from the southern Mississippi. Is it just that there are chronically high uemployment rates in Mississippi and Arkansas?

In the end (Nov 09) the Great Plains, areas that have lower population density, have the lowest unemployment. Is this because they aren't eligible for unemployment? Based on this, I know what part of the country to go to to find a job these days.

The delta of arkansas and mississippi just have high chronic unemployment, due to agriculture being the main industry.

Leanan, Used to manage the rice commodity area for Quaker Oats in the 80's-90's (Rice a Roni, rice cakes, snacks, and cereals) the annual rice trip was a flight into Memphis and a trip down the Delta to Jackson Ms.. First time it was quite a shocker seemed as if I had entered a third world country at times. Several towns of near 100% blacks with no visible tax or employment base and therefore decrepit and inferior public schools. Private schools for those few that could afford them. I have spent limited time in the Appalachia area but I can't remember it looking any more destitute. I remember asking one of the Plant Mgrs. in Jackson about the population and he indicated that a very high percentage had never been out of the county.

Also odd how State border counties are higher than interior counties. But only East of the Mississippi.

stone knives and bearskins are the only items to save mankind.

hard scrabble hunting gathering. yup. have you reduced your lifestyle today? happy motoring is dead. the military industrial complex will either kill us quick in an atomic conflagration or slowly by using up all the oil in the biggest misallocation of resources EVAR! more so than suburbia.

what we need is a massive die off. i am thinking of 99% of present earth human population wiped out. total collapse of civilization and a loss of all knowledge. no gold man sacks, no frozen pizza, no stealth jet fighters, no ipads, no gold plated tungsten bars, no black ops, no world made by hand, no comment posting on the oil conundrum, no soc sec, no carry trade, no toilet paper, no indoor plumbing, no agriculture, no big box shopping, no fast food, no spiffy charts of inane information, no evil gubbermint, no past, no future just the crummy now. short and brutal, at the whims of the cosmos.

i'm talking some serious doomer porn.

but first uhmerkians must live as chinese peasants. and the chinese peasants must live as uhmerikan tin horn capitalist exploiters. it's karma or maybe ying-yang.

i think all you oil conundrummers go first and try it out. if it looks like fun or way cool, i'll join in later and after all the banksters give up their massive bonuses. yeah, that'll do it.

i seen posts on this site about how water will be the new oil.

i submit to you all:

have we reached peak water?

yes we have.

why? because of fracking. in our unlimited greed and folly we will

pollute ground water over a large area of the continental USA. it's happening right now.

http://hosted.ap.org/dynamic/stories/U/US_GAS_DRILLING_RISKS?SITE=FLTAM&...

"

HARRISBURG, Pa. (AP) -- A drilling technique that is beginning to unlock staggering quantities of natural gas underneath Appalachia also yields a troubling byproduct: powerfully briny wastewater that can kill fish and give tap water a foul taste and odor."

only stone knives and bearskins can save us. have you reduced your lifestyle today? you will when you cant drink well water. i bet that will cause a huge die off. IT'S DOOMER PORN!!!!

"it's all good"