World Oil Capacity to Peak in 2010 Says Petrobras CEO

Posted by ace on February 4, 2010 - 10:15am

Mr. Gabrielli, the CEO of Petrobras, gave a presentation in December 2009 in which he shows world oil capacity, including biofuels, peaking in 2010 due to oil capacity additions from new projects being unable to offset world oil decline rates.

Gabrielli states in his presentation that the world needs oil volumes the equivalent of one Saudi Arabia every two years to offset future world oil decline rates.

This is a stronger statement than the one he gave in January 2009 in an interview with Business Week when he said the following.

According to the company's projections, production from existing fields will fall from a little over 80 million barrels a day to maybe half of that even if new techniques are used to slow their rate of decline. So just keeping global production flat is going to require lots of new fields and requires the world to replace one Saudi Arabia per three years.

Gabrielli is clearly concerned about declining future world oil production. His statements are now in alignment with those of other oil company executives including Sadad al-Husseini, former Aramco executive, who states that world oil production is on a peak plateau, and Total's CEO, Christophe de Margerie who doesn't see global oil production ever exceeding 89 million barrels per day (mbd). World oil production in December 2009 was only slightly lower at 86 mbd.

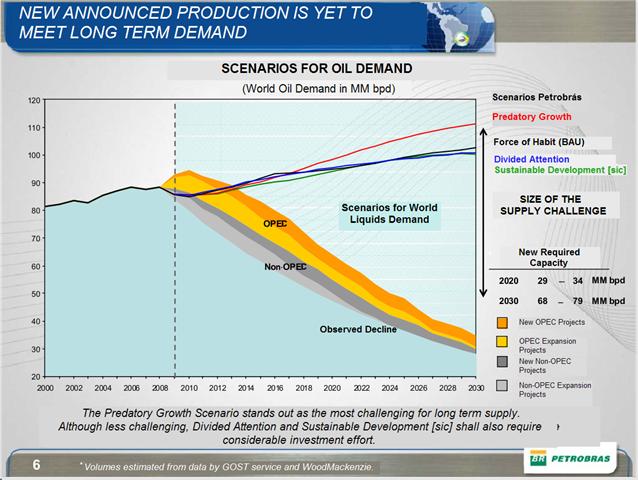

Gabrielli shows world oil capacity peaking in 2010 as shown in the translated version of his chart below. He shows historical world oil production to 2008. Next, he applies a decline rate of 5% per year to existing production represented by the lower light blue area. He then forecasts capacity additions from sanctioned projects estimated from Wood MacKenzie's Global Oil Supply Tool. These oil capacity additions are in four categories: OPEC new projects, OPEC expansion projects, non-OPEC new projects and non-OPEC expansion projects. In 2010 the biggest contributor is OPEC expansion projects which includes about 1.3 mbd from Khurais and 0.8 mbd from Khursaniyah. These additions include both crude oil and natural gas liquids and are sourced from Saudi Arabia's official statements which lack independent verification.

He also shows three demand scenarios ranging from low demand to high demand. For the BAU scenario, the required new capacity, in addition to sanctioned project capacities, is about 29 mbd in 2020. Unsanctioned projects from Brazil and Iraq should be able to provide some of this capacity but other capacity additions will be needed to meet demand. Biofuels can also help but there will probably not be enough new oil capacity additions to meet demand in 2020.

It is important to note that Gabrielli's capacity additions exclude additions from unsanctioned projects and from oil yet to be discovered. Thus many Iraq projects and Brazilian Santos basin projects would be excluded. Iraq might produce another 8 mbd by 2020 according to recent estimates by BP's CEO. Brazil's production is forecast by Petrobras to increase by about 2 mbd by 2020. Thus, additions from non sanctioned projects from Iraq and Brazil might add another 10 mbd capacity by 2020. However, this still leaves a required lower capacity addition of 19 to 24 mbd in 2020 to come from other sources. This capacity addition is equivalent to production from about two Saudi Arabias which is an enormous challenge.

Gabrielli's observed decline rate appears to be about 5% per year and he applies it to the entire liquids production in 2008. Part of the liquids production, such as ethanol and Canada oil sands, is increasing rather than declining. The use of separate decline rates for each component of liquids production would be better, but the peak oil capacity year of 2010 would probably not change. Instead, the forecast production curve decline profile would be slightly different.

On another slide, Gabrielli plots cumulative decline in existing fields against time. Consequently, the world needs one Saudi Arabia every two years just to keep production constant. Fortunately, new oil capacity from sanctioned projects can offset some of cumulative decline of 30 mbd in 2015. However, the chart above still shows a gap of over 5 mbd which needs to be filled by projects yet to be sanctioned or development of undiscovered oil. If this gap cannot be filled then demand cannot be met and prices will increase to reduce demand down to supply.

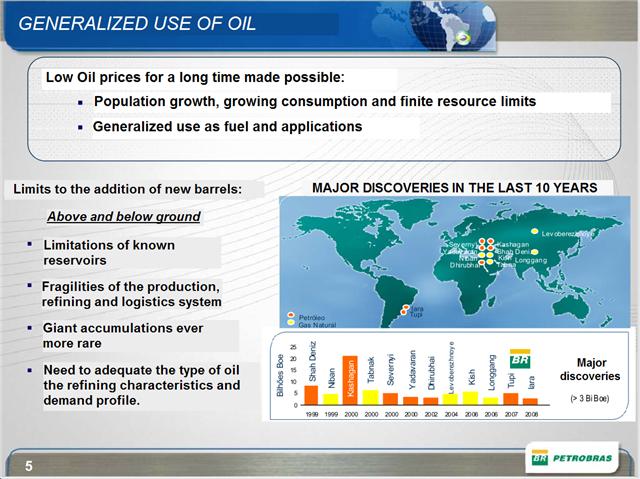

Gabrielli also shows few new large discoveries being made recently in the chart below. However, these discoveries can have significant lag periods before production reaches meaningful levels. Petrobras' recent discovery at Tupi may be about 5 billion barrels of oil and gas, but production is expected to grow slowly with capacity increasing to 100,000 barrels per day possibly by the end of this year. This capacity is planned to remain constant until 2012 as part of the Tupi pilot project. If full commerciality is declared, then Tupi might reach 1 mbd by 2022. Gabrielli also shows the large Kashagan discovery in 2000 which was supposed to start production in 2005, but the earliest start date is now 2013.

Additional constraints on world oil production are weaknesses in the production, refining and logistics systems. In addition, Gabrielli points out that refineries need to be matched to the type of oil being produced. Recently, world oil production is becoming heavier and more sour which requires suitable refineries. The construction of these refineries can take several years. Limitations of known reservoirs are an additional constraint as many existing fields are very old and cannot produce more oil easily. Mexico's Cantarell field is in decline and Kuwait's Burgan field has passed peak production.

In October 2009, Gabrielli gave a different presentation which showed a forecast of world oil demand based on the IEA WEO 2008 and the EIA IEO 2009 shown below. Note that the additional capacities required for 2020 and 2030 are larger than the ranges given in his December 2009 presentation. For example, in 2020, Fig 1 shows additional required capacity of 29 to 34 mbd while Fig 4 shows required capacity of 42 to 51 mbd. This difference is due to Fig 4 excluding sanctioned project additions, whereas Fig 1 includes sanctioned project additions as sourced from Wood MacKenzie. Gabrielli expresses concern about future oil supply as he states in the slide below that world oil production capacity will be challenged to meet projected demand growth.

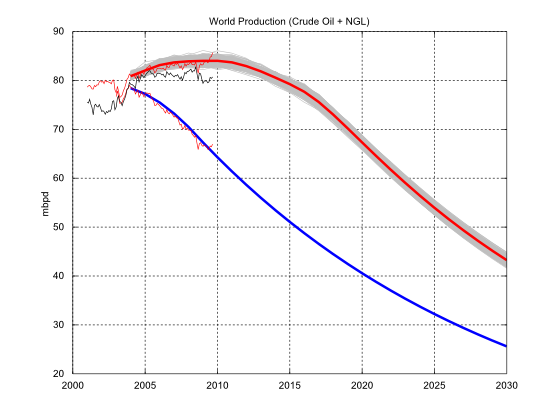

Another source of capacity addition data is Wikipedia Oil Megaprojects. If an annual decline rate of 4.5% is assumed for existing production then the chart below also shows 2010 as peak oil capacity, excluding biofuels and processing gains. The blue line represents the decline for existing production. The oil production in 2030 in the chart below is just over 40 mbd which is higher than Gabrielli's estimate from Fig 1 above. This is due mainly to Gabrielli using a higher annual decline rate of 5% and the Wikipedia Oil Megaprojects data including additional projects which are highly likely to be sanctioned.

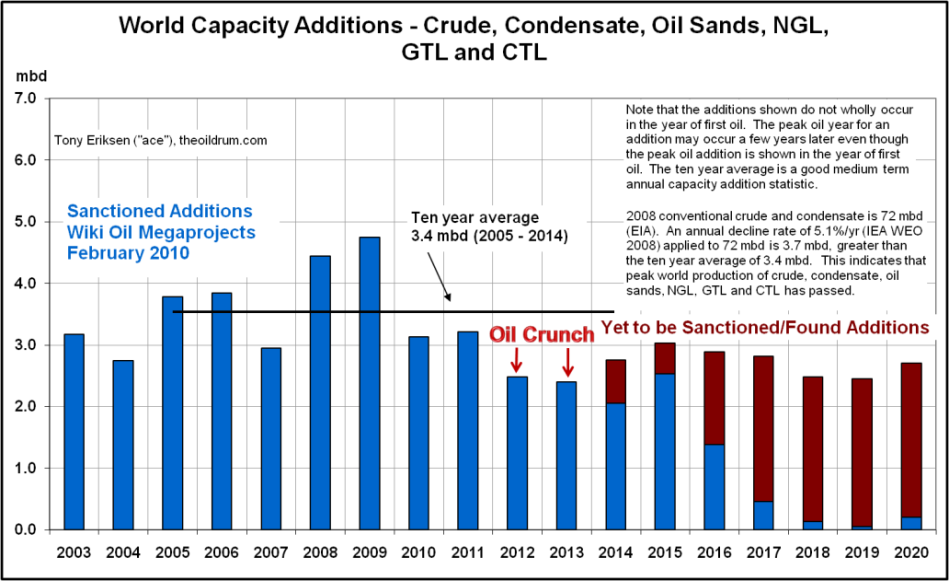

The capacity addition data from Wikipedia Oil Megaprojects can also be plotted from 2003 to 2020 as shown in the chart below. Additions from yet to be sanctioned projects and yet to be found oil have also been added. The bulk of these additions are estimated to come from Iraq, Brazil deepwater, Russia, Saudi Arabia, USA deepwater and some West African deepwater. The text in the chart indicates that world oil production has passed peak. In addition, capacity additions in 2010 and 2011 should be only slightly less than the decline of existing production. However, an oil supply crunch is shown for 2012/13 as new capacity additions in those years are less than natural global decline from existing fields. Fatih Birol, chief economist of the IEA has also stated that an oil supply crunch could occur by 2014. One of the reasons for this crunch is that many projects were delayed when oil prices fell to under $US40 per barrel in late 2008.

Gabrielli says that the world needs the equivalent of one Saudi Arabia every two years just to keep production constant by offsetting natural oil decline rates. In 2008, Saudi Arabia produced 9.3 mbd of crude oil which is also represented by Gabrielli's red line in Fig 2 above. For the two years 2008/09, the chart below shows capacity additions of 9.2 mbd which is just less than one Saudi Arabia. If biofuel additions are also included, then the equivalent of one Saudi Arabia of capacity was added in 2008/09. However, it will be a big challenge to keep on adding a Saudi Arabia equivalent capacity every two years. 2010/11 capacity additions, including biofuels, will be less than one Saudi Arabia and in 2012/13, additions will be only about one half of a Saudi Arabia. Furthermore, the IEA's World Energy Outlook has stated that decline rates are accelerating which means that in the future more than one Saudi Arabia equivalent capacity would be needed every two years to offset world oil decline rates.

Gabrielli's concerns about peak oil capacity in 2010 and future declining world oil capacity should be taken seriously. In Fig 1 above, he shows that by 2012/13 the world oil capacity will only just meet world demand, based on Wood MacKenzie's data, highlighting the risk of a potential oil supply crunch. If Wikipedia Oil Megaproject data are used then peak oil capacity is also indicated in 2010 as well as an an oil supply crunch in 2012/13. The IEA's Fatih Birol has also stated that an oil supply crunch is likely to occur by 2014. In other words, the world does not have enough future Saudi Arabia equivalent capacity additions to stop world oil production from declining, causing an inevitable supply crunch within the next few years.

A special thanks to Oil Drum contributors Luis de Sousa for translating Gabrielli's slides (Figs 1 to 3) from Portuguese to English and to Sam Foucher for updating the world oil supply forecast chart (Fig 5) based on the Wikipedia Oil Megaproject database.

Well, Duh, uh!

I would differ somewhat in the EXPRESSION of Dr Bartletts insights into humans and exponential functions and simply say that the VAST majority of humans,probably including between one quarter and one half of those with college educations, does not even know what an esponential function IS.

I am beginning to believe that my hopes for a gradual decline and reasonable stability over the next few years are perhaps somewhat overly optimistic.

Lots of things remain undone here, and it certainly would be nice to have a few more years to get them finished up-not to mention the old folks in the family checking out before thier checks quit arriving.The worry would finish them off.

You are overly optimistic Old. I would have guessed more than 75% don't. Even those who have studied enough math such that they should know are generally pretty sketchy on what it means. I teach a math-oriented subject in college and sometimes even my students don't quite grasp it even when they know the formula.

I would concur with George. In my experience in higher ed, even there most folks are innumerate.

It's horrifying.

In the early days of TOD we trumpeted Bartlett's video once every three or so months, perhaps it's time to bring it back out of the closet again.

Arithmetic, Population, and Energy. If you want a refresher or have not viewed Bartlett's presentation before, here is a link to a Zapata George page that has all 75 minutes of video neatly stacked together. http://www.zapatageorge.com/zapatag/nobull_report/nobull/68

A nice thing about Bartlett's presentation is the way he expresses the exponential function in terms of doubling intervals. Familiar enough, but rarely grasped, I think. Fred's cartoon would be better with the function written that way. (Who can really get the significance of the infinite series expansion?)

I've used Bartlett's best line a number of times, "In each interval, as much is added as has ever existed before". Now that's so blindingly obvious as to verge on tautology, yet it regularly draws a gasp. I like to add, "Constant percentage growth is exponential growth", and "There are no sustainable exponential growth processes in the universe". Valid, I think. Name one.

Points taken, I'll see if I can come up with a better cartoon, though the one I created was more for the TOD cognoscenti than the non initiated.

Blockquote> There are no sustainable exponential growth processes in the universe". Valid, I think. Name one.

Well, except for perhaps, the infinite expansion of the actual Universe itself ;-)

'A Universe From Nothing' by Lawrence Krauss, AAI 2009

http://www.youtube.com/watch?v=7ImvlS8PLIo

Maybe. Recent observational evidence says that the expansion is accelerating, but is the rate proportional to the current scale (definition of exponential)? Doubtful. If it were, the doubling time would have to be extremely long given that we've already had around 14Byr for the thing to utterly explode into nothingness. Since no-one currently has the faintest idea what the so-called dark energy causing the acceleration might be, I fear we must wait a little while to be sure...

Gergyl, my comment was indeed tongue in cheek. As far as we know our universe is expanding, not growing in any true sense of the word. The only way for the Universe to really grow would be if it started eating all the infinite parallel universes. Ok, now I'm really grasping at

dark matterstraws. Or is that strings? Now I think I'm getting groovy vibrations ;-)http://xxx.lanl.gov/abs/astro-ph/9902189

The separation of most matter in the universe is exponential in time.

I know of one, and only one: the expansion of the Universe since the Big Bang. But is that growth, or just inflation? A dark matter, indeed.

LOL!

My Father went about teaching me how the exponential function worked in his own twisted way.

At the age of 15 I asked him for some cash, 30 pounds, to go out for a friends birthday. He agreed but said I had to pay back 5% compound interest per week. He explained how it worked and I agreed to the loan. It only took a few weeks to realise I was heading into deep trouble and so paid him off as soon as I could.

Might use the same trick on my kids when they get older.

This should provide yet another clarion call from the oil industry itself that should be difficult for most "energy analysts" to avoid (unless that have put a hard stake in the ground against PO, which some certainly have). I'm not seeing this article on commonly accessed news sites yet, so it remains to be seen if the average person even hears about this. Or remembers it 15 minutes later...

As much as I dislike using the term "average person" I'm not that concerned about the oblivious masses. It's those that are in leadership positions at the helms of corporations and governments that I would really like to hit upside the head with a 2 x 4.

Having said that, I am aware that it isn't in their short term self interest to even understand or to speak openly about the implications.

There are days when my frustration level is off the charts. Today is one of those days!

Assualt and Battery.

I would be in favor, were it not for the carbon cost of the Battery!

;>)

Craig

Yes, but it's those people driving SUVs single occupant and all the other wasteful activities that need to understand as the politicians and corporate leaders are basically powerless otherwise.

Perhaps you've never watched one of these then?

http://www.youtube.com/watch?v=2uvbANB6oIY

I'm sure those poor powerless corporate leaders had no idea that the people would be so wanton in their disregard for the commons, despite their well intentioned message, that profligacy should be avoided at all costs. Who could have imagined that their plea to the common man would fall on such deaf ears.

Yes, advertising certainly plays a big role, and this plays into some of Nate's posts on discount rates and how people make choices. Ultimately, knowledge and action would have to trump image and innate consumption; we've done it before, though usually only in dire times.

Hopefully, that J-curve should actually be changed to an S-curve..., but the S-curve would still be at too high a level, especially when depletion is taken into account..., but either way..., we are no doubt in trouble.

Most people should know about the exponential function..., they're obsessed with compound interest, and investments.

The problem is..., they're greedy and they can't make the connection between the real world and exponential growth, or resources for that matter.

The planet seems so big, even if it's diameter is only just under 8,000 miles.

Most people aren't in tune with where food comes from. When it rains, it's an "ugly day." Even in California, a bread basket state that produces far more food then most people realize. People don't understand where resources come from. Minerals come from deposits in certain geologic locations on the earth. Oil can only be found in certain locations, with source rock, an oil cap, and within the oil window, near a reverse fault, an anticline or salt dome and the source rock must be below the oil window. People in the city don't know where things come from, they only know "drill here, drill now, and taxes are too high, and always will be (NO GAS TAX).

People just aren't in tune with where things come from.

Some people think there is no population problem because they say all people could fit within the state of "Texas," ignoring that Texas does n ot have enough fresh water nor could it possibly produce enough food to support that population.

Maybe it takes a special way of thinking to actually get it. To make the connection between over population and depletion and the connection between industrialism and cities most of us live in and the earth where most of our energy and resources to build our way of life comes from. Maybe it's all too abstract.

Either way..., people understand copound growth, they either don't care and are greedy, or they don't understand the consequences of exponential growth.

pressed the wrong reply...,this was supposed to respond to the "oldfarmer."

Perhaps but I think it also has a lot to do with a special kind of cognitive dissonance.

See my comment to OFM the other day about "Thinking"

People may be greed, but not well informed. Most people don't understand how compound interest work, and make very bad financial decisions because of that.

SO what happens when we have successfully pumped out every drop of oil out of the EARTH?

Does Anyone Know what effect it will have on the Planet?

It Only took several BILLION years for it to get there, and a couple hundred to get it out.

Why is EVERY OTHER PLANET that we can see DEAD?

Are we Going to just find out what it does to the planet when it runs completely out and is too late?

Are we such an INCOMPETENT SPECIES that we cannot figure out some other means of energy?

CAN GREED KILL THIS PLANET?

We see the sun doing fusion every day, there's no reason we cannot some day use fusion ourselves. In the meantime, there are alternatives, but BAU they will most likely not sustain.

Somewhere over the rainbow

Way up high,

There's a land that I heard of

Once in a lullaby.

Somewhere over the rainbow

Skies are blue,

And the dreams that you dare to dream

Really do come true.

Someday I'll wish upon a star

And wake up where the clouds are far

Behind me.

Where troubles melt like lemon drops

Away above the chimney tops

That's where you'll find me.

Somewhere over the rainbow

Bluebirds fly.

Birds fly over the rainbow.

Why then, oh why can't I?

If happy little bluebirds fly

Beyond the rainbow

Why, oh why can't I?

Perhaps you need some more of those little blue happy pills ;-)

" Perhaps you need some more of those little blue happy pills ;-) "

In recent issue of NewsWeek there is an article by Sharon Begley reporting that the little blue happiness pills only work because of the placebo effect. Your comment might be spoiling there efficacy. ;-)

I happen to believe that the world can support a human population of about 1 billion with fossil fuels, because that was the population at about the time the industrial revolution got started. That future population might be more comfortable than the billion living in 1800 because of newer knowledge leads to more healthy life styles. But that is problematic.

OTOH, recent article in WSJ claims that recent advances in NG production from shale might make USA a fossil fuel exporting nation again. But only for a hundred years.

Any claim that begins with "recent article in the WSJ" you can pretty much disregard. Pure unadulterated corporate cornucopianism. Very rarely anything worthwhile beyond the stock tickers.

No way. We cannot kill the planet. We may cause a great extension event (90% of species), but Earth will recover in a few ten million years. It has happened before.

When there is a great extinction event the species in the 10% that survive are not top carnivores or omnivores. No doubt if 90% go so will humans. After a great extinction event the next round is not the same as the last round. Likely since extended consciousness has proved to be self destructive and arose only once it will not arise again. The earth will recover but no one will be around to note it.

Look on the bright side.

The last great extinction event cleared the stage for the emergence of the higher mammals.

Perhaps the anthropogenic great extinction event will clear the stage for something higher than us.

Why would humans go extinct? Even with global warming, we probably would not be able to stop the eventual march of the glaciers back down south.

It always amazes me when people speak with certainty about things happening millions or tens of millions of years from now.

If (and it is looking ever more inevitable) we have the largest extinction event ever experienced on the planet, there is no guarantee that complex life will recover before the sun gets too hot for life to be viable on the planet.

Don't comfort yourself that the planet will be fine. We just can't say that for sure.

Note that we had already plunged the world into the sixth great extinction event before the effects of GW really started kicking in.

I dont think pumping every drop of oil out will be the problem. The transfer to EVs to keep transport infrastructure intact could be worse. Renewables are not being scaled up fast enough which means more nuclear and coal. Coal use, being much dirtier than oil, will polute our sinks much faster.

Yes, Teri, it can. And probably will.

Strange species, homo sapiens. Wonder if they'll be missed.

Craig

Strange species, homo sapiens. Wonder if they'll be missed.

Sara Teasdale says no:

There Will Come Soft Rains

Hi Teri,

Since you asked ;-)

1. We won't. The last bits are too hard to get.

2. Precisely nothing - the biosphere will be stressed a bit through greenhouse, it's the end for us

3. We can't see many other planets, and they're dead (as far as we know) because they have no liquid water

4. Yep, doing that now :-)

5. We can and have figured it out, we just lack the collective will to do it

6. Probably not, but it can certainly kill our species and a great many others

Cheers.

Meanwhile, I would argue that the production/price data show that world crude production (crude + condensate) appears to have effectively peaked in 2005, as Deffeyes predicted it would:

Global Cumulative Crude Oil Production Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, crude + condensate)

Here are the average total global crude oil production numbers per day by year, versus average annual US spot crude oil prices:

2002: 67.16 mbpd & $26

2003: 69.43 mbpd & $31

2004: 72.48 mbpd & $42

2005: 73.72 mbpd & $57

2006: 73.46 mbpd & $66

2007: 73.00 mbpd & $72

2008: 73.71 mbpd & $100

Relative to the 2002 production level of 67.16 mbpd, in the following three period, 2003-2005 inclusive, the cumulative three year increase in production was 5,164 mb, versus a three year increase in oil prices of $31. So, for every dollar increase in oil prices, three year cumulative global crude oil production increased at 167 mb per dollar, again relative to the 2002 rate.

But then we have the 2006-2008 data.

Relative to the 2005 production rate of 73.72 mbpd, in the following three year period, 2006-2008 inclusive, the cumulative three year decline in production was 632 mb, versus a three increase in oil prices of $43. So, for every dollar increase in oil prices, three year cumulative global crude oil production fell at 15 mb per dollar, again relative to the 2005 rate.

I love reading whatever westexas has to say..., but it's never a good way to start the day.

:(

There was a little news item recently about people being more depressed the more time they spent on the Internet. I suppose we could do a poll of TOD readers and rates of depression, but the results would probably be too depressing. . .

LOL

It's not just TOD today; here is an item from CNN Money:

Craig

Update at 4:03 pm CST: Dow is down 265 pts for the day.

Greece and Portugal in big trouble.

No wonder that fear guage is up. One of the few things, other than unemployment, that is today.

Good luck to us all.

cc

Don't even take me there, WT.

My wife says 'the other woman is a blog'..

Think happy thoughts.. come on, I can do it!

Probably not depressed from the Internet, but because they are more or less depressed they start spending more time on Internet and not for searching the 'bright sites', so reinforcing the depression.

It is obvious that the oil producers have found out that if they withhold the production and get the price high enough, they don't have to sell as much to get the same gross revenue, and quite possibly more net revenue. So, it is merely an indication that the producers don't need more money as much as the buyers need more oil. This can only be proven out by production going up to offset lower prices, like the $4.13 the near-month contract is down right now.

WT, I am surprised that you did not remind us how little of the decreased production will be available under the ELM parameters. I know everyone else is thinking in those terms.

It is a little odd that producers started "increasing their spare capacity" at the same point in time at which Deffeyes predicted that world crude oil production would peak, and it is quite a change for producers to shift from increasing their three year cumulative production at 167,000,000 BO for every dollar of increase in oil prices to cutting three year cumulative production at 15,000,000 BO for every dollar of increase in oil prices.

Since you asked, here is the same analysis for Saudi Arabia, but in terms of net oil exports:

Saudi Cumulative Net Oil Exports Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, Total Liquids)

One of the primary contributors to the 2002-2005 increase in production, followed by the 2006-2008 decline was Saudi Arabia, but let’s look at Saudi net oil exports, which are defined in terms of total liquids, inclusive of natural gas liquids and refined products.

Here are the average Saudi net oil export numbers per day by year, versus average annual US spot crude oil prices:

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

Relative to the 2002 net export rate of 7.1 mbpd, in the following three period, 2003-2005 inclusive, the cumulative three year increase in net exports was 1,716 mb, versus a three year increase in oil prices of $31. So, for every dollar increase in oil prices, three year Saudi cumulative net oil exports increased at 55 mb per dollar, again relative to the 2002 rate.

But then we have the 2006-2008 data.

Relative to the 2005 net export rate of 9.1 mbpd, in the following three year period, 2006-2008 inclusive, the cumulative three year decline in net oil exports was 841 mb, versus a three increase in oil prices of $43. So, for every dollar increase in oil prices, three year Saudi cumulative net oil exports fell at 20 mb per dollar, again relative to the 2005 rate.

Note that in early 2004, the Saudis reiterated their support for the stated OPEC policy of maintaining an oil price band of $22 to $28, and they made good on their promises to support lower prices as they significantly increased net oil exports in the 2003-2005 time frame, but then in early 2006, they started complaining about problems finding buyers for all of their oil, “Even their light/sweet oil,” even as oil prices continued to increase. Apparently no one thought to ask them in early 2006, as oil prices traded over $60 per barrel, why they didn’t offer to sell another two mbpd of oil for $28 per barrel.

Well, at least we have no reason to think those two projected New Saudi Arabias will act the same as the original.

If I can type this correctly, here is what happens if I add one more column to your data, which I have simplified by entering only the year and the gross revenue, It is a shame we do not have the net revenue, because it would probably grow at an even greater rate.

2002 184,6

2003 257.3

2004 361.2

2005 518.7

2006 554.4

2007 576.0

2008 840.0

Of course, 2009 will break this streak of increasing revenues, but the 2008 revenue increase would have the effect of mitigating the 2009 decrease. If Mattel could have the same results, I am sure they would. It is difficult to corner the toy market, however, but it does make for an interesting business model. This could be seen in the light of what Yamani projected in his years of strangling the importing nations, occasionally increasing their production to ward off alternatives by killing the apparent necessity to find alternatives. For now, however, Russia can fill the void, so it is a plausible argument that KSA is allowing them (Russia) to use up productive capability filling demand while KSA holds the line on their production and save it for continually higher prices.

Admittedly, we conspiracy theorists can be really creative finding new ones. This may just be a random coincidence, but Saudi Aramco has been so well operated (from a financial standpoint) that it just might be a well planned manuever.

Fortunately (?), the value of the dollar is dropping.

Well, then again, maybe not.

Craig

Along the same lines the US peaked in 1970, then hit 95.72% of its all time peak 18 months later. Would be instructive to analyze these head fakes or last gasps or whatever you please to call them.

My former CEO Jim Mulva has also said the same. Jerome did a story on this:

http://www.energybulletin.net/node/37000

RR (sitting in a hotel room in Germany, where the snow is piled high outside)

Thanks for reminding us. The story is from back in November 2007. It was also on The Oil Drum.

A bit out of date, but using data from Gibson Consulting CP+Total+Petrobras = 23.7% of the top 10 companies ranked by E+P in 2002 that have CEOs who have made affirmations concerning supply limitations.

This new revelation is quite striking considering how Brazil is the biggest bull in the herd in terms of supposed limitless supply gain. Good catch, Tony! And of course this story is the only mention of Gabrielli's statement you'll find searching Google News for oil Petrobras Gabrielli.

You're right there, KLR. The cornucopians have been milking Tupi for all it's worth over the last couple of years - "a game changer" heralding vast new resources, "technology" once again outsmarting the "doomers".

Is it just a coincidence that emission reduction targets are pretty much on par with future oil production declines?

Now why on earth would you ever think that are good leaders would choose to use natural declines to at like they where tough on global warming ?

Naw they would not do that would they ?

This is a little off subject, but has anyone on TOD been following the whole Haiti Super Giant field thing ?

How seriously can we take claims that it has more oil than Venezuela ? "Haiti is the New Saudi Arabia" sort of thing.

Its been lighting up the news feed lately:

http://www.voltairenet.org/article163808.html

Can anyone in the know comment on this ???

Very curious.

I stopped reading Engdahl years ago. He's a crackpot, and his writing is a jumble of obfuscation.

Mikeb writes:

The website he writes for (Voltaire.org) is certainly a prize-winning lunatic's paradise. Here's one of today's headlines:

Was the earthquake in Haiti caused by the United States?

Read on:

http://www.voltairenet.org/article163626.html

Hahahahahahahah!!

Szia Fred! You're on a roll today! Keep it up...

Craig

There was discussion and some links in Gail's post last week:

"Haiti's Energy Problems"

http://www.theoildrum.com/node/6168

I may not qualify as 'in the know' but I do know that, buried in the middle of the article, is the assertion that Cuba could have up to 8 billion barrels of oil deep offshore, and that Haiti may have up to 20 billion.

Of course that would be 'abiotic oil,' so there's that. Also, 28 billion barrels does not even come close (just over 10%) to replacing even one of the Saudi Arabias the Petrobras CEO identifies as needed to meet world demand. It could be a rough ride down after all.

OK verti. For your benefit I struggled thru the entire article...you owe me. I'll give you my very biased and harsh review. But first, yes, there may be commercial oil/NG deposits in the general area. But from what I gleamed there isn't enough info to be very definitive either way. And nothing to indicate any probability of a major oil plays. The article is a combination of conspiracy theory, abiotic oil and a complete lack of geologic perspective. Much of its logic rests with accepting the discovery of a super oil field off Cuba. Maybe they found a commercial deposit out there...maybe not. As no one has presented any substantial data to support the claim it just more worthless verbiage IMHO. Abiotic oil? Been discussed to death on TOD. Research and form your own opinion. Most here discount it entirely. Conspiracy theory: if Royal Dutch Shell et al thought there were huge commercial reserves there to develop they would have bought off the easily corruptible Haitian gov't many years ago and they would have drilled it up by now IMHO. It would be the Nigeria of the Caribbean today if it were there. Geology: the geology of Venezuela's oil producing regions are not related to Haiti. The big ME oil fields are there because the reservoir rocks and source rocks were deposited there and not because it where two plates meet.

Again, there may be some commercial oil/NG to exploit in Haiti. But IMHO this article is so far over the top that it's worse than useless...it's deceptive. And I feel intentionally so.

Dontcha just love it, Rockman? We will all be eating hypothetical food, grown using diesel fuel made from and fertilized by fertilizers concocted out of abiotic oil and gas, as we drive to our stockbrokers' in cars fueled by same. And, all of this will be paid for by imaginary money created by the Federal Reserve, given to the big banks and lent to us, even though we are all out of work.

Is this a great country, or what?

Craig

Yes indeed Craig. That's the problem with articles like that. They mix some facts with some hypotheticals flavored with a few conspiracy theories. That's why I had to allow some possibility: difficult to distinguish actual oil indications from any extrapolation without having the exact and varified details. The one thing I'm certain of is that if those Dutch boys with RDS knew there was a huge oil field there they would have bribed their way into ownership and would have been producing it long before now.

whoaaaaa! all that oil is there because of the confluence of the following elements: source rock, time(and timing), heat, a migration* path, reservoir rock and a trap, imo.

further, as i understand it, the heat for the mid east and north sea petroleum system was present because a rift developed that provided heat for the conversion of kerogen to hydrocarbons. so if haiti is located near or within a rift, at least one of these elements would probably be present.

not all rifts are associated with massive amounts of recoverable oil, such as the u.s. midcontinent rift.

the bakken of the williston basin is an example of a "continuous oil accumulation"(no migration* of oil). the williston basin is probably a "failed" rift, which provided a heat source for the conversion of kerogen to hydrocarbons.

http://www.nextgov.com/nextgov/ng_20100115_9940.php?oref=topstory

Well what a coincidence one day you do exercises to prepare to provide hurricane relief in Haiti and the next day you have an earthquake and you are ready.

Which brings up two questions - if you had done exercises and were ready why did it take so long to get going?

And which is more questionable - a coincidence theory or a conspiracy theory

What is rumbling around the web besides rumors of untapped oil (and gold etc) is rumors of HAARP being used to create an earthquake. I know I know sounds crazy BUT Secretary of Defense William S. Cohen in 1997 did say this

http://www.defense.gov/transcripts/transcript.aspx?transcriptid=674

It would seem that if a former secretary of defense could envision earthquakes being set off by electromagnetic waves this shouldn't be discarded as just another conspiracy theory. Actually when something is labeled a conspiracy theory they mean a crazy theory because humans conspire all the time.

As usual, you read the source and it doesn't say what the clipped version makes it seem to say. The context makes it clear his comments are hypothetical:

Frankly, he also sounds a bit loony.

Considering that Pentagon thought staring at goats was a great idea - I'm sure crazy schemes are afoot - just that they remain crazy, not practicle. Kind of new age voodoo.

I have been saying for a while now that it really doesn't matter all that much how much oil is still in the ground, what really matters is how much new capacity comes on line to offset depletion losses, and this in turn means that what really matters is funding for megaprojects, or rather, the lack thereof. It is the lack of megaprojects due to lack of money which really seals the deal when it comes to convincing people that really matter (like this Petrobras guy) that PO is real.

We "saved" the banks. Maybe we can help these guys more:

I probably shouldn't say this, but it's wrong to imagine that this information comes as a surprise to our leaders. After all that's why we have armies deployed across the globe, to secure the world's remaining oil supplies. Iraq is a prime example. Afghanistan has a crucial role to play. Iran is already in the cross-hairs. Venezuela is next in line. Apparently there are major oil-fields in the sea between Cuba and Haiti. Supposedly Afghanistan has substantial reserves of oil and gas, according to their president, an oil man himself.

A rule of thumb. "Everything" connected with the deployment of our military forces, when one strips aside the rhetoric about "freedom" and "terrorism", and all the variations on these two major narrative themes... is about oil.

But obvioulsy one can't tell "ordinary people" and "ordinary soldiers" that they are fighting and dying to secure our access to energy reources, that would never do, it tastes too much of blatant imperialism, which of course, is what it really is. But that is another story.

Our political leaders would rather have us believe that they are fools, rather than knaves, with a brutal and violent, hidden agenda, and who can blame them?

I know for a fact, from personal experience, that people in the ruling elite, the people who really count, the people with money and power; that they are not stupid at all, or ignorant about the challenges relating to Peak Oil. After all, running the world, and at the same time giving the impression that they not, isn't easy! The elite aren't stupid, but what's the solution, we've painted ourselves into a corner and the system is starting to collapse, with potentially disasterous consequences for everyone involved, but, of course, those consequences will hit "ordinary people" a lot harder and first.

I've always been surprised that the habitants of the Dominican Republic who share the island with Haiti always insisted so stubbornly that the island and its shores were full of oil that the Gringos were just guarding for the future. Now the Gringos are there - maybe that future has come? The theory that the US intentionally caused the Haitian earthquake was sent to me from there more than a week ago. It seemed it got a lot of resonance there. Your Gringos are such bad guys! ;)

Hmmm... this meme of ordinary guys as wholly non-responsible victims almost draws a few crocodile tears... but can you really tell ordinary guys instead that they will have to make do with less energy, perhaps much less, if the access is not secure? After all, one of the nicest things about democracy (even imperfect democracy) is that ordinary guys can have it both ways effortlessly, just by voting it to be so. As long as the Wile E Coyote moment fails to arrive in the immediate future, it's all good.

PaulS,

Well, I don't think we live in a democracy, or anywhere near one. In fact the system is biased against "excessive democracy" and pretty much always has been, and things are moving away from more democracy, not towards it.

One can't have a functioning democracy in a society where wealth, and therefore power, are so unevenly distributed. In a market society money speaks way louder than votes. In a sense, the powerful, are continually "voting" through their economic power, whilst the rest of the population have to be satisfied with periodic elections, for candidates chosen by powerful economic interests. Most modern states are oligharchies, in practice, with the powerful choosing to allow the ritual of democracy and the rhetoric to disguise fundamental power relationships. Alas, voting has on a marginal effect on how society is governed, as voting, unfortunately, rarely re-distributes wealth, which is the main source of power in a market controlled society.

And... suddenly deciding to ask people, grotesque, leading questions, relating to energy is rather a rather amusing concept, considering how little one normally cares about their opinions on a whole range of important issues, after all, the people aren't really citizens, but consumers, and subject to the same forces that motivate, steer, and control, consumers.

Hi Writerman,

Well said, the concentration of wealth in the hands of so few people is an extreme problem.

But, if voting is an effete action and violent protest is usually ineffective, what strategy might be useful - or is the situation totally hopeless (which I hope is not the case)?

Sorry. It's hopeless.

Very well put writerman. Essentially the ideal of our forefathers to have a country by the people, etc. died at the hands of greed. The top politicians in DC are almost all super wealthy and stay that way by continuing to gain wealth after public office by working as lobbyists.

I noticed when Obama was campaigning he claimed he wanted to end special interest in Washington, but once in office its a line he says sometimes but there's no teeth behind it. He either knows the system cannot be changed, or he's part of it now.

Or just maybe he was part of it all along. Chicago?

Sitting here looking at the copyright date (2005) of ole Matty Simmons Twilight and the Desert and the Disaster...blah blah blah.....book...

Assuming he worked on it for 2 years (or more)...here we are in 2010, the info is AT LEAST seven years old and it's BAU!!!!

Call me a cynic....or just someone who has lived long enough...but I suspect someday....when our Boys in Desert Camo get Iraq under control (enough control for the frantic drilling to begin)...I bet we find out an amazing fact...that the amount of oil under the sand was vastly under reported at 115bb.... After all, if we wanted that piddly sum...all we had to do was takeover Saudi Arabia...and we had a perfect excuse...since the majority of those guys were Saudis.....9/11, ya know...

Bet it turns out Iraq has something like 300 billion barrels...or not...or more....But I will never believe Uncle Sugar spent the treasure and blood for only 115bb...

Of course, now everyone will now shout me down...but there are no real statistics that PROVE how much oil is there...

And that gives the world plenty o' time to work out the bugs with methane hydrates, algae....and maybe even fusion...

Now hunch over the keyboards (don't spill your colas and cheese doodles) and do the thing OilDrum does best....SPEW THAT DOOM!!!!

LOLOL........Gad, I love nerds........

Just wait, aviator. We'll see what we see.

For the record, I hope you're right.

Dreamer!

Doomer!!!!!!!!!

My wife says I'm a hopeless optimist. Actually, I try to be rational about it, though.

I said that I hope you are correct. Some magic source will be found for oil; the techies will invent something; everything will be hunkey dorey.

Then I see no change... population going up and up. 6.8 Billion now, projected to go to 8 or so by 2050? On a planet that can sustain about 1 Billion, give or take 250,000,000. I wish I was just making up these numbers.

Global warming could be a concern... if I thought we would survive until the temp and co2 got high enough to finish us off. And, the science on that is fairly well settled. Still, we do nothing.

Years ago, Isaac Asimov used to write about the shear numbers of human population, "Isn't anybody listening? Doesn't anybody care?" The answer then was, "No." And so it goes today.

For the same reason the neither Communism nor Capitalism works in the real world, the real world is "doomed" to fail from its own predeliction. They don't listen. They don't care. Except about next week's balance sheet, getting something for nothing, passing it all on to their kids... it is all what I call the 'entitlement mentality,' and it goes for the far right and the far left.

If you can show me anything that contradicts what I have said, please do! I hate what I see happening. I have grandchildren, for God's sake, and I want them to have good, comfortable lives. We, meaning my generation, have screwed them royally. I hate us! Though, I have been talking, shouting, and even screaming about it for years to no avail! I have good friends who have told me straight up that they refused to do anything differently, because they like their SUVs and their energy expending, wasteful lives too much. Big screen TVs, motor boats (at least they could drop back to sail boats... they are more fun and don't use near as much fossil fuel).

But, no, I have good friends who drive race cars, power boats, and Hummers. I tell them, and they agree, that oil will run out (and, I explain that peak oil means running down, not out). But, they won't change. They refuse!

And, TOD is, actually, a waste of time if you expect to change anything. We are all preaching to the choir... and we all have the same tale to tell that I just ranted on about. Not doom. Reality. Preparation. Anticipation. Caution. I especially do not understand anyone who considers himself a conservative acting so recklessly with the planet!

So... I will be very happy to be wrong, but not surprised to be correct. And, Madam, I do not expect to change your mind. Not that I would not say, "I told you so" after TSHTF, should I meet up with you.

I know what I would say to you if you came up and told me, "See. You were wrong." I would say, "Yes, and it's great. And, nothing I did got in the way of you being correct." Would you be able to say the same? What do you tell your grandkids when they ask you, "What happened, Grandma?" "Well, I wanted to keep going when Zaphod told me it wasn't possible. Sorry, Timmy. Now, eat your bean."?

Have a nice year or so... and we will see what we will see, now. Won't we?

Craig

Craig,

that's exactly what I am experiencing and thinking. And you know what? As I see how much I put myself in disadvantage compared to my peers, I am about to just do as they do. Because being honest, caring, responsible and thrifty gets you nowhere. Everybody thinks you are kind of mad. Seldom some might think you are a saint. Which won't help you.

So it's Jevon's Paradox all over again. Example: I drive my bike and a Smart car and thus I make it possible for some chinese (random pick) guy to drive a Buick Regal. But my brain stem tells me that I'd better drive this Buick Regal. May be my brainstem's right.

I am firmly convinced that all that free energy is changing the gene pool as it devalues morale and values (NOT religious values but universal values (see Hans Küng)) and thus decreases the respective gene carrier's darwinian fitness. Which is kind of logical but also somewhat sad.

Best regards,

J. Daehn, Hannover Germany

Peak Oil is a geological phenomenon. It will come eventually, Iraq will not prevent it. Are methane hydrates even able to be commercially extracted profitably? Algae is able to be done, but it's too expensive. If you're driving an automobile in 25 years, what do you believe will power it?

I stopped commenting on these threads a few years ago because, well, it didn't seem to make any difference. This comment just caught my eye.

Mr. Aviator (Mr. 202?) Collapse is something that is happening right now, as we speak. It's more like musical chairs or a never ending advancing tide. It just keeps coming and isn't noticeably problematic until the crabs are nipping at your toes.

As Harry Truman said; A recessions is when your neighbor loses his job. A depression is when you lose yours. Can I assume that you, personally, haven’t suffered any ill effects in your life lately?

Jon.

Jon:

I seem to remember you were posting about the time I began reading TOD. I think you should keep it up, now. It may not "do any good" in the sense of changing anyone's mind, or advancing realistic - what, solutions? means to deal with the situation? survival techniques?. Whatever. What I would say, though, is that it helps to keep your mind clear, and to deal with change and circumstance. I really see TOD as more of a support group.

Plus, of course, there are some incredibly knowledgible individuals out there who supply real time data. A framework of reality to hang your hat on as we plod on into the unknowable future.

Craig

Thanks, Craig. It is nice to talk to people who understand what is going on. I tried having some of these conversations with family members, but I gave up when my brother (in other circumstances an intelligent guy. Really.) said that we could use hydrogen in fuel cells to generate electricity, which we could then use to crack water into hydrogen.

Sadly, yes. We share quite a few genes.....

Jon.

And he didn't realize that the only way that would be any use would be if we could violate the First Law of Thermodynamics.

Many people don't seem to realize that the laws of physics are non-negotiable. The only way to get around them is to be living in some kind of alternate universe, which apparently many people think they are.

It's all Obama's fault.

Yes, you're right. Obama really should have been elected 20 years ago to start the two decade mitigation recommended in the Hirsch report, which needed to be written 15 years earlier.

There is a little part of me that wonders if the administration sees the energy ceiling ahead, and is holding back on a bigger stimulus because it would only cause greater misery when the economy cracks its pointy little head on it.

Despite the best efforts of Reichsführer SS Cheney, the administration still requires budget approval from Congress, most of the members of which appear to be pawns of the American Plutocracy. It is likely, in my opinion, that many of the plutocrats will favour further stimulus spending if it seems that their position and personal fortunes are threatened by ongoing events, but will expect the funds to be extracted from the teeth of the lower ranks.

I note the despairing concern elsewhere on this thread with the level of public comprehension of the exponential function. I'm more concerned with the willingness of people to invest their hopes and disappointments in one man, albeit the titular head of state. Is this a legacy of our paleolithic experience? Or of the peculiar notion of a personal saviour/god figure in the sky, omnipotent and omniscient, a notion which seems to increase its grip on the modern American psyche with each passing year?

Does delusion ever peak?

"A point in every direction is the same as no point at all"... from The Point by Harry Nilsson. http://en.wikipedia.org/wiki/The_Point!

I'm a big fan of lists....

So of all of the Oil Majors listed here:

http://www.wikinvest.com/industry/Oil_&_Gas_Majors

Which have had their CEOs confirm a near term (before 2015) or already past peak in oil production

Exxon Mobil - ?

Total S.A. - Yes

Royal Dutch Shell -Yes

BP - ?

Chevron - Yes

ConocoPhillips - Yes

Saudi Aramco - Saudi Arabia - ?

Gazprom - Russia - ?

China National Petroleum Company - China - ?

National Iranian Oil Company - Iran - ?

Petroleos De Venezuela SA - Venezuela - ?

Petrobras - Brazil - Yes

Petronas - Malaysia - ?

Ah, see my post above - took a crack at quantifying that number. I think in days gone by there was a dedicated story about prominent figures on our side of the peak oil debate, too.

From the original post;

"Sadad al-Husseini, former Aramco executive, who states that world oil production is on a peak plateau"

so you can click Yes for SA. You know they are never going to admit to anything whilst working for the company.

Chief executive Tony Hayward from BP was on BBC radio this morning.

On global warming he thought wind makes sense in US. Offshore wind very expensive 3x. There is plenty of gas and the UK has plenty of facilities for importing gas - low carbon sensible way to bridge between where we are today and where we want to be in 30 years time. In mature markets of west the peak for gasoline consumption was in 2007. The oil companies will not sell more gasoline in the US or Europe than it did in 2007; ever period. Government will drive efficiency into the transport fleet.

Asked about peak oil said their view was that it would be a demand side phenomenon not supply side. Demand will peak before supply because there is plenty of oil in the world, there really is. There are geopolitic challenges getting it out. Demand side phenomena beyond 2020 somewhere between 95 and 110mbpd v the 85 now.

When asked about price he said. His rational explanation was the following though the world doesn't always work out that way. He said in the non OPEC world, the area of difficult oil, he said we need an oil price of 60$ or more to allow us to invest to make a return on our capital,in the OPEC world, the oil is a lot easier to get out and is less expensive but they have got the challenge of fixing their domestic budgets and they also need 60-70$ a barrel. On the demand side there was some interesting phenomena; we saw no change in consumer behaviour during the run up in oil price till the oil price went over 100$ a barrel. Then everyone stopped doing things; the Americans stopped driving ...the world changed. So you can sort of argues that on the supply side its 60$ and the demand side its 90$. Is the world going to turn out like that?

Asked about China' increasing use and resource conflicts he thought there was a self regulating valve: as oil goes through 100$ a barrel it acts as an inhibitor on global growth and development, this being particularly true of India and China which are much less energy efficient than the economies of the West are today.

When asked about the carbon footprint of oil, he said the global energy efficiency was in the region of 15% and that there was an enormous potential for improving this.

The following should work for UK people about 2hrs into the Today program

http://www.bbc.co.uk/iplayer/console/b00qb12j

I also heard that interview with Tony Haywood this morning and I almost choked on my cornflakes. His serene complacency took my breath away, especially his re-assurance that "there is plenty of oil in the world... there really is." It reminded me of a very bad financial adviser I used to have. But the interview reflected a wider problem. The interviewer (whose name escapes me) clearly did not have a clue about what the concept of peak oil means, so he was reduced to making trite comments about how oil was supposed to be running out when he was kid in the 70s. It was like listening to a moron interviewing an autocue - and this is supposed to be the high end of the news market. I really dont know why they bother with this nonsense. Who invented peak demand by the way? Was it CERA?

Citing "demand" is a wonderful way to muddy the waters in the peak oil debate. Demand is defined as a measure of how much people have the desire for and the ability to pay for something. Thus a fall in demand, or "demand destruction" as "peak demanders" like to call it can be either due to a loss of desire to pay - a good example being the decline in the demand for whale bones - or a loss in the ability to pay, as for instance when food prices go up so that people starve. The former is generally benign, and the latter malign. The likes of CERA and Mr Tony Hayward don't specify which variety of demand destruction they envisage will accompany "peak demand".

Well that is for the general public with a bit of an optimistic spin from a salesman. At Davos he more or less said the same as the current CEO Desmarest of Total. Oil fields declining on average by 5 % a year, peak will be at 100 Mbd, but does not want to argue with the 95Mbd quoted from Total (Current level + 10%). Demand in the OECD has peaked for good, will never ever reach the level of 2007 again in the OECD. Huge challenge, only doable with IRAQ, BP has a plan to take Rumailah form current production of 1 Mbd to 3 Mbd. Very polite and diplomatic, but doesn´t take the heavy boasting from the Saudi guy on the panel (Peak oil talk (hysteria ?) past us, reserve capacity ample, and expensive...) seriously, otherwise oil business would never invest in the really expensive stuff.

http://a9.g.akamai.net/f/9/6890/6h/weforum.download.akamai.com/6890/VOD/...

One of the stupidest things I've read in sometime. I guess he is talking about energy used per GNP - not per capita.

Let us say the airport in 40 miles away. In the US if I take a cab to the airport - it costs $50 and 2 gallons. So 1 gallon of gas generates $25. In China/India the cab, run on CNG, consumes the quivalent of of 1 gallon of gas. But it costs only $10. So 1 gallon of gas generates $10.

Which economy is more efficient ?

Obviously world oil production is struggling to keep up with demand.

What needs to be added to this analysis IMO is the different extration rates for heavy oil resources and light oil resources. I think something like 10% of world production is in heavy unconventional oil and 90% is non-heavy conventional oil.

If there are 1000 Gb of conventional oil which can be extracted at a maximum of 27 Gb/a and 1000 Gb of unconventional oil that can be extracted at most 9 Gb/a

then you can expect a huge contraction in world production as the world moves from conventional to unconventional oil.

Some people might think it is not even worth the effort but oil is too useful to be left in the ground.

How much of that potential is locked up in the Orinoco? And much as I'd like to root for Hugo, they are 68.35% off the 1970 peak and 73.74% off the 1998 peak. Applying the...Michael Klare function to this distribution, I forecast a curve containing next to diddly jack in the way of heavy oil anytime soon. And it isn't technically difficult to extract, either - comparable to what has been produced in California. It will require a political extreme makeover and a sustained regime of high crude prices to make it happen, from the looks of things.

500 Gb is in Orinoco but they pump it with progressive cavity pumps...the stuff comes out like peanut butter. So even 1 Gb/a is optimistic.

Alberta is better productionwise.

Chavez is too stupid to develop that oil and is deconstructing Venezuela. Better to turn the country over to Exxon, at least the oil-thirsty world would get a break...oops, now I'm thinking like Dick Cheney.

I've linked to this piece a few times: THE ORINOCO HEAVY OIL BELT IN VENEZUELA

(OR HEAVY OIL TO THE RESCUE?). Excellent doc.

Let's see, what's shaking down Venezuela way? Venezuela, Russia to exploit Orinoco oil strip

ENI? The same ENI that got kicked out of Kazakhstan for non-performance?

Why is it these quasi-state oil companies like Petrobras, Lukoil, Statoil now parade around the world masquerading as IOCs?

I loved it when Lula daSilva told Petrobras to concentrate on developing Tupi and to forget about shopping for overseas reserves.

Canada has over a trillion barrels of bitumen in place. SAGD recovery rates were as high as 60 percent. Orinoco ventures might switch to higher recovery rate lower EROIE recovery techniques as cold production becomes too costly. 60 percent of a trillion is 600 billion or about 20 years worth of oil at current burn rates. Canada will most likely increase production volumes going forward.

There was once an option to convert Alaskan North Slope natural gas to liquids and send it down the TransAlaskan pipeline. More recently nations have gone to burning compressed natural gas in their vehicles directly as CNG is cheaper than liquids.

Recovery "as high as 60%" for some of the current production does not imply in any way that all of the one trillion barrels of bitumen is recoverable to this extent.

Regardless, Canada will be one of the fossil fuel perpetrators that ensures the world has over 700 ppmv of CO2 by 2100. Eocene climate is on its way.

Extraction rates are an important factor. Many new offshore field development plans are often based on high annual extraction rates in contrast to onshore fields. Much of the new oil additions are from offshore fields.

For example, there have been many new offshore fields which have recently started production in the US Gulf of Mexico (GoM).

If Thunder Horse production is about 250 kbd then annual production from this field is 0.09 Gb. Recoverable reserves might be 1 Gb so the annual extraction rate is estimated to be 9%. These high extraction rates can give a short term boost to production rates but production decline rates can drop sharply afterwards. Cantarell is a good example of high decline rates occuring after high extraction rates.

High offshore extraction rates are helping the GoM (Federal) to increase production back up to 1.65 mbd in September 2009 which is just less than the peak of 1.69 mbd in June 2002.

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFP3FM...

The US GoM has some big additions this year which include Chinook/Cascade, Perdido Hub and Phoenix.

http://en.wikipedia.org/wiki/Oil_megaprojects_(2010)

However 2011 has few additions.

http://en.wikipedia.org/wiki/Oil_megaprojects_(2011)

I'm expecting GoM production to fall next year due to a lack of projects and an extraction rate shock.

Extraction rates of heavy unconventional are low and when combined with an extraction rate shock from many offshore fields could give high decline rates in the medium term.

ace, I was surprised when I read some time ago that onshore oilproduction peaked in 1985 meaning that added offshore production was able to increase production for 20 (or more) years. Knowing that offshore fields often have high extraction rates and high decline rates past peak, world oilproduction past plateau could decline more rapidly than most expect.

Han -- there's also another down side factor in the onshore vs. offshore profile. In addition to very different decline rates that you point out the minimum sustainable economic production rate for an offshore field (especially Deep Water) is much higher thana typical onshore field. As mentioned before one reason we still have a large portion of U.S. onshore oil production is due to small and very small operators that can make a decent living producing stripper wells (< 10 bopd/well). The average onshore well produces at just under 10 bopd. Thus not only will offshore oil fields reach MOL earlier, small independents cannot step in for the big companies when the wells reach so low rates. Those wells will be plugged and abandoned and that stranded oil will never be produced.

great article ACE - you have put a lot of work into it thanks (esp the megaprojects database updates)

I am still trying to connect supply and demand and price over the past few years.

I reject conspiracy theories, or speculators pumping up the price. Can we explain price with supply and demand, based on the data we have.

So, in the scenario that demand is constant:

If we take the "one SA per two years" to keep volume constant, then = approx 4.6MBD/year new capacity is required.

ACE indicates that average new capacity additions have been 3.4 MBD (10 year average)This explains the upward sloping price curve.

The exponential in the price curve could be explained by demand increasing by 1% per year.

Now what would cause the hockey stick in the price which began at end of 2007?

Well if we go to ACE's megaprojects chart, we see that 2007 additions were significantly lower than 2006.

And if we assume that new capacity does not come on stream like clockwork, but there are significant lags, perhaps as much as 9-12 months, then we could say that the effect of 2007 lower capacity was not felt till the end of 2007, and price started to march up.

By the same token, the 2008 large increase in capacity was not felt till later in 2008, hence the break in prices in August.

So can we verify this by earlier data?

The previous significant drop in new capacity that was similar to 2007 was 2004. And sure enough 2005 price increase was +31%/year compared to 2006 which was +15%/year.

So if we fast forward to 2010 and look at the megaprojects chart, the drop in new capacity, compared to previous year, is the biggest I can see. it is also significantly below the 4.6 benchmark.

So we do know that OECD demand has dropped by about 4 MBD, and we are coming off 2009 with the highest new production in a while. So it will take - I think - till 4Q 2010, or 1Q 2011, but we will see the same hockey stick and the same march upwards.

the question then is, where is the break point.

becuase 2011 megaprojects volume is the same as 2010. The sustained drop that starts in 2010 continues and in fact worsens.

Do we have another drop of 4 MBD in the OECD? can we handle that?

Thanks for those comments!

A minor point is that capacity additions from wiki oil megaprojects exclude bio-fuel additions.

There is a big drop in capacity additions from 2009 to 2010. 2011 is also low. Oil prices could be quite high by July 2011 as summer demand increases. Even July this year could see some high oil prices.

In Jan 2006 OECD demand was just over 50 mbd. In 4Q2009 OECD demand fell by 4 mbd to 46 mbd. By July 2011, if non OECD demand increases by 2 mbd then OECD demand may have to fall by 4 mbd if world oil supply falls by 2 mbd by July 2011.

Can the OECD handle another 4 mbd drop? That could be tough as the first 4 mbd drop would have been the easiest. There will be less air travel, smaller cars and more hybrids and more use of public transport.

As Tony relates, in the WEO2008 it is stated that the decline rate increases each year by .01%. To accompany this statement they included a graph which suggests decline will wobble all over the place somehow, but forget about that for the moment. Starting at 4.35% in 2009 the DR would evolve thus:

Applied to a constant figure of 85471 kb/d (average for 2008, wholly arbitrary) these are the amounts of all liquids needed each year to offset decline:

You start off needing to produce a China each year and end up needing almost a Europe. You start off needing 1/2 a Central & South America and end up needing 1/2 a Russia. Eh, you get the idea.

Here is a link to my spreadsheet for working out these numbers, if anyone's interested. I see spare capacity drying up in three years, it's all very much a horse race to see whether sufficient new projects can be sanctioned and online by then. This is barring another leg down in demand from economic woes, of course.

OECD demand drop. A graph of this is included in my latest post:

Which bank would now finance more road tunnels?

http://www.crudeoilpeak.com/?p=1097

On the decline rates in existing fields it is important to note that the higher natural decline in post peak fields increases the replacement job:

This graph is from:

18/10/2009

OPEC reserves revisited

http://www.crudeoilpeak.com/?p=355

Where ever there is a discontinuity, please correct me. Here is what I see, and the questions I have.

First of all, is 5% depletion reasonable to expect? With enhanced recoveries, depletion will be more, not less, than history teaches. I have been seeing 6.5% and higher in fields that are already past peak, and were recovered using these techniques. Is that wrong?

Second, and trying to look at the brightest side possible, rates of use will decline as supply diminishes to below demand. That will propel prices to new highs, with ensuing recession and depressions in the economies of the world. Each recession will reduce demand, to below supply. And, it will reduce supply further due to less available capital to extract the more expensive oil, leading to more cycles of the same sort. Each cycle will reduce demand to below supply, giving rise to an endless cycle of "recoveries."

So... the bright side is that we can look forward to many many recoveries, all of course brought on by the applied moronity of our government, alternating between Republican and Democrat. Until we wake up one morning with no industry left, no power, and a population of .750 Billion. At which time, those few left will be able to sustain themselves. Not that they could do anything else.

And, friends, that is the good news for today!

Craig

Small clarification, for the benefit of readers. Oil production can increase, maintain a stable rate or decrease. If production is falling, we talk about the decline rate.

Depletion is a one way street, except for some select ares such as Saudi Arabia and Fantasy Island, where Yergin & Lynch live. These two areas have magical non-depleting oil fields.

In any case, outside of Saudi Arabia and Fantasy Island, depletion continues regardless of whether production is increasing, stable or declining. So the depletion rate is the rate at which either total recoverable reserves or remaining recoverable reserves are being consumed.

I have frequently cited the example of Indonesia, UK and Egypt, which had a combined production peak in 1999. Their initial three year post-1996 net export decline rate was only about 3%/year, but the initial three year post-1996 CNOE (Cumulative Net Oil Exports) depletion rate was about 25%/year. In other words, they were depleting their post-1996 supply of net oil exports at eight times the rate at which the annual volume of net oil exports was declining.

My guesstimate is that we are currently depleting the post-2005 global supply of CNOE at about one percent every two months.

1% every two months! WT, say it isn't so!

The line I like from this article is;

Such a simple, easy to understand, well worded explantion, yet the implications are staggering, especially moving forward.

Something that also caught my eye this morning was this article:

http://www.washingtonpost.com/wp-dyn/content/article/2010/02/04/AR201002...

It was the 1.9 trillion increase of debt approval by the House. But get this,

So it didn't pass by much, and if it had not passed then money would not have been available for social security and medicare. The continuing recession and the high mountain of debt are starting to converge into its own bottleneck. We may not be far away from people fending for themselves. That's a daunting thought, because old people really suffered during the depression, and that's one reason why social security was started in the first place.

Of course this all pales in comparison to this article, which to me shows the realization of peak oil is finally starting to become understood by more than just the so called fringe, and when the masses finally come around to comprehending its implications, wow, there will be some real angst going on. I'd hate to be a high profile politician when the SHTF.

Two things that we can say with a fair degree of certainty: The post-2005 CNOE depletion rate is more than zero, probably in the single digit range, and the post-2005 CNOE depletion rate, based on our model and case histories, will exceed the annual net export decline rate.

In the case of Indonesia, UK and Egypt (IUKE), they were depleting their post-1996 CNOE at the rate of one percent every two weeks, from 1996-1999, and at the rate of one percent every 10 days, from 1996-2002.

Dear Perk Earl,

Time's passing... and I think one either has democracy or one doesn't. It's a simple enough concept. Either the people rule, or they don't. Whilst democracy, in theory, could exist and function in a Greek city-state, where only a quarter of the population even had a vote, I'm very sceptical about democracy in nations with millions of inhabitants. Democracy is possible, but unlikely. So call the system what it really is, an oligarchy, rule by the rich, but save me from all this rhetoric about democracy, please!

The "masses" won't find out, because the problem won't be framed in terms of "Peak Oil" and the responsibility won't be alloted correctly, and no one will be held to account. For example, the current economic slump in the United States isn't the responsibility of ordinary Americans, because they don't count, or have real power. Power is in the hands of those who own the country. It's their political system, their politicians are in charge, their mass media, their colleges, their army, their banks...their system. Democracy is, and has always been recognized, as a potential threat, when carried too far, to the power of the few who control the wealth of society; that's why only neutered democracy is allowed.

How will the established political caste deal with Peak Oil and the slump? Well, certainly not by recognizing it for what it it. War appears to be their answer for almost everything.

Hi writerman,

As part of a bicycle tour in Provence, we visited Cannes. We walked around the yachts in the harbor and visited the residential area. It was during the off season after most of the tourists were long gone. The level of wealth was obscene. It is hard to imagine how the average hard working, working class, "conservative" in the US can support the free market ideology that supports this very elite few. The idea that the average working person will ever achieve this level of wealth is probably less than the odds of winning the lottery.

I doubt that these people understand that their exteme wealth will make them juicy targets when TSHTF. It'll be fun to watch.

Unless I'm badly mistaken, Provence and Cannes are still part of France, which is definitely not part of the USA. Were all the yachts and residences occupied solely by Americans? Perhaps not. What, then, causes French people to support their "very elite few"?

What I'm getting at is that you've probably just provided evidence that the existence of moneyed elites is at least somewhat cross-cultural. If so, then it's going to take a deeper sort of inquiry than just snide self-flagellation to arrive at any sort of useful conclusion about why people tolerate and even support them.

Hi PaulS,

Yes, it did not seem to me that Cannes was inhabited primarily by French elite - it seems to be a pretty international crowd. It also seems to me that the really wealthy folks don't bother much about borders - they move about the globe at will.

OK, I get the idea that you like to be insulting but I'm not sure what set you off? Personally, I try to avoid insults towards other TOD folks.

snide (Derogatory in a malicious, superior way) - flagellation (beating as a source of erotic or religious stimulation) (beating with a whip or strap or rope as a form of punishment)

I'm not sure what you enjoy but I mostly ride my bike for enjoyment.

Anyway, I thought it was a pretty simple concept: "Conservatism" as an ideology is often manipulated for personal gain at the expense of hard working people who have little chance of every reaping the benefits of those doing the manipulating. The ultra rich folks who enjoy Cannes are the type of people pulling the strings.

You may disagree and that can be a useful discussion but it escapes me why you are interested in "erotic or religious stimulation" as part of this discussion? Malicious - Geez!

I have learned not to taunt the rich, Dave. If we cut their taxes now, then when I/we get rich like them, I/we won't have to struggle like they did. At least that is the message I get from their spin machine.

Rich = +$400000 per year income.(John McCain, who has 7 houses made $405,000 income in 2007).