Jevons’ Law: Enforcing the Age of Energy Decline - Part 1

Posted by Gail the Actuary on January 11, 2010 - 10:32am

This is a guest post by Lionel Orford. Lionel is a professional electrical engineer with an interest in peak oil and sustainability. This past year he has been researching and developing a book with the working title, "Peak Capitalism: Our Opportunity to Choose between Transformation and Collapse." His web site can be found at this link.

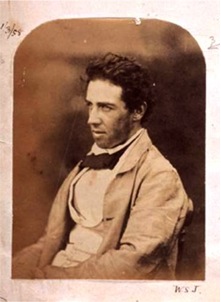

In his 1865 book “The Coal Question: An Inquiry Concerning the Progress of the Nation, and the Probable Exhaustion of our Coal-Mines,” English economist William Stanley Jevons made the observation “Of the Economy of Fuel” that when improvements in technology make it possible to use a fuel more efficiently, the consumption of the fuel tends to go up, not down.

This is known as Jevons’ Paradox. It occurs because as the efficiency of a type of machinery is improved, it becomes profitable for many more customers and feasible to apply it to new applications. This results in rapid growth of the number of machines in use and consequently, an increase in fuel consumption overall.

Jevons’ observation was made regarding the application of coal power to steam engines. The first commercially applied steam engine was invented by Thomas Newcomen to pump water out of coal mines. It used a very large amount of coal compared with the amount of useful pumping it achieved and was only viable at coal mines where coal was plentiful and ready to hand.

When James Watt recognised that a major improvement could be made by using a separate condenser vessel, he built an engine that was so much cheaper to run that applications for it blossomed. This enabled Watt to go on to further increase the level of technical sophistication and efficiency of his engines. This led to the common belief that Watt ‘invented’ the steam engine.

In 1865, when Jevons published his now famous paradox, steam engines were only efficient enough to be used where they could be frequently refuelled, such as for stationary applications (mines and mills), railway locomotives, harbour tugs and paddle steamers. They were not efficient enough to carry enough coal to cross oceans and still have room for cargo. The subsequent development of the triple expansion steam engine, which was markedly more efficient, made ocean going steam ships viable. Consumption of coal again escalated, as Jevons had predicted.

This dynamic has now played out in several technologies, notably:

• The development of modern fan jet engines for aircraft that have increased efficiency (passenger mile per unit of fuel) of jet airliners by 3 fold from the Boeing707 to the Airbus380. The result – rapid growth of air travel and fuel used.

• The development of modern high efficiency coal fired power plants. The result – exponential growth of electricity used and greenhouse gas produced.

• The development of efficient and powerful computers that can be manufactured very cheaply. The result – exponential growth of the amount of energy used for manufacture and running of computers.

As is implied by the full title of the book, Jevons’ concern was that the exponential growth of consumption of coal he was observing would result in the exhaustion of economically viable sources of coal. He warned that coal production would inevitably migrate away from the easily mined deposits near the surface to the deeper deposits that would require more capital and more labour to extract. He predicted that British coal would become increasingly expensive to the point that more and more applications would cease to be profitable. He concluded that this would result in the eventual reduction in coal production and industrial output with potentially disastrous effects for the British economy.

About a century before M King Hubbert’s prediction of Peak Oil, Jevons was making very similar observations regarding Peak Coal. The ideas of both men were denied and even ridiculed by their peers, but both have subsequently been proven correct. British coal indeed did peak in 1913 and almost no coal industry remains in Britain today.

This didn’t result in disaster for the British economy, but only because of the rise to prominence of a new fuel – petroleum – which Jevons could hardly have predicted. Oil partially replaced coal and also enabled another technological revolution that made it viable for coal to be imported into Britain.

What Jevons was noticing was that as more useful work (more utility) was obtained from a given amount of fuel compared with the amount of work it took to get that fuel, the more profitable applications there were, and hence, usage increased as more and more applications emerged. That’s the now famous part of what Jevons had to say. What is less well known is that he realised that the reverse would also be true as the work required to get the coal increased comparative to its utility.

Like Hubbert a century later, he was widely misinterpreted as saying that we were “running out of coal”, when he was actually realising something much more subtle – that coal would become too expensive to be profitable and would decline due to a lack of demand – not that there would no coal left in the ground. Indeed, something in the order of 70% of Britain’s coal endowment is still in the ground today. The parallel with our current situation regarding oil is blindingly obvious – we are not running out of oil; we may never completely run out of oil; oil will simply become too expensive as more productive capacity is needed to supply it and demand will decline accordingly.

Scientific laws are based on observations that over time prove to be such a reliable basis for predicting the behaviour of a natural phenomenon that they are elevated beyond hypotheses, beyond theories, to a status where they are recognised as laws. Examples include Newton’s Law of Gravity, Faraday’s Law of Electromagnetism and the Laws of Thermodynamics. I propose that it is now time for the recognition of Jevons’ Law:

As the utility provided by an energy source increases or decreases in comparison to the amount of utility expended to obtain it, so does the overall usage and utility provided by that energy source, over time.

I use the term ‘utility’ to mean ‘work of real economic value’ or ‘productive capacity’.

I hasten to point out that I am not putting this up as a fundamental law of the universe like the scientific laws mentioned, but contend that it is least as secure as any so called “Law” involving social sciences such as White’s Law and is actually valid over the long term, unlike that piece of techno-triumphalist nonsense - Moore’s Law. Also, I am not saying that Jevons stated this definitively, but that it can be concluded from the arguments he makes in The Coal Question.

It is important to note that this law doesn’t apply on an instantaneous basis, but has a lag effect that extends over decades. In the short term, it is possible to disobey Jevons’ Law, particularly by distorting the market – for example:

• Although the long term price of oil must be determined by its cost of production, economic booms, speculation and supply squeezes can send the price spiralling way above the cost of production, resulting in subsequent demand destruction.

• Government subsidies can push the uptake of an uneconomic energy source for social and political reasons – e.g. subsidised petrol and diesel, biofuels, wind power, nuclear power.

• For OECD economies, particularly the US, a deficit of economic productivity gained from importing oil compared with the cost of those imports has been masked by an economic feeding frenzy of consumption, financed by escalating overall debt comparative to the productive means to repay that debt.

I contend that such distortions of the market are unsustainable over the longer term. Speculators lose their money when speculative activity drives prices to levels not justified by the cost of production; countries suffer from misguided government subsidies that waste their national wealth on uneconomic programs; and debt bubbles always end in financial ruin.

In terms that are familiar to this readership, Jevons’ Law is very closely related to saying – The use of an energy source rises and falls in accordance with its Energy Returned on Energy Invested (EROEI). However, this is not strictly true because energy does not directly equate with utility.

A particular case in point: The EROEI of oil has been declining since before Jed Clampet “went out huntin’ for some food, when up through the ground came a bubblin’ crude”, but this has not caused the demand for oil to fall. I contend that this is because, even as the cost of production has steadily increased, the amount of utility obtained per barrel of oil has increased substantially faster due to increases in efficiency of machinery and the development of new applications, such as jet airliners, which provide enormous utility compared with the oil they consume. These new applications have been the basis for a whole range of service industries that also have real economic value. Jevons’ Law has held true.

We seem to have now reached the point where the investment of capital and labour needed to increase the supply of oil is no longer justified by the additional economic value that it provides. Beyond this point, the use of oil will be relentlessly forced into decline.

The oil industry is now in a vicious circle whereby huge investment is required even to maintain the supply of oil. This investment can only be justified by reliably high prices for oil in the order of $100 per barrel, but it is quite clear that the world economy cannot maintain demand for oil in that price range. Hence I am of the school of thought that argues that this investment will not be made, that decline of both demand and production is inevitable, and that Peak Oil is now behind us. Time will tell.

A declining oil supply spells certain death for our economic system because it relies on growth to remain viable and that growth is in turn reliant on commensurate growth in oil supply. It is nonsense to believe that we can continue to grow the economy by growing areas of enterprise that are not dependent on oil such as finance and other services or by continuously improving efficiency to gain more economic value from less oil. The financial and service economy is only as strong as the productive economy on which it feeds. Although some efficiency gains are possible through frugality, such as using public transport rather than private cars, these changes can only be made over many years, and such frugality would result in reductions in economic size overall, rather than growth. For example, if most of us used public transport, there would be dramatically reduced market for cars and the service industries they support. This is Jevons’ Law in action.

Furthermore, our cultural addiction to oil and economic growth has led us into a condition of overshoot, where we have been spending more to obtain oil than the economic value generated from it for decades. This has been a major factor in the accumulation of vast debts by western countries, most of all the USA. The accumulated debt seems to be way beyond our productive means to repay, which is effectively the definition of bankruptcy.

The only probable outcome from all this is ongoing economic dysfunction, as governments and the corporate sector repeatedly make futile attempts to return to business as usual, leading to the eventual collapse of the current economic system. This dysfunction is likely to be accompanied by a corresponding crash in both demand for oil and investment in new oil production.

As the economy fails, there will be great social hardship as millions of people are rendered unemployed, and there will be great political tumult as the electorate holds the government accountable for their great loss. I contend that this process is now underway and unstoppable.

However, while economic crashes happen relatively quickly, cultures change over much longer periods. When things get tough, modern countries do have a track record of dealing with their problems somehow, rather than undergoing societal collapse. Modern examples which have suffered economic collapse, but avoided societal collapse, include Germany, Argentina, Russia and, most recently, Iceland. However, if we continue to deny and mismanage our situation, we could proceed through all of Orlov’s Five Stages of Collapse, and catastrophic collapse of our society could be our fate – as it was for the Easter Islanders, the Mayans, and others.

We do have a culture capable of solving problems – but only when it is widely understood by the general populace that emergency measures and major changes are required. Once we shift to emergency mode, we can overcome our cultural resistance to change and make major changes to the way we operate our society. I believe (and hope) that once the failure of our economic system becomes obvious to all, we will have an opportunity to form the political will to make the fundamental changes required to avoid catastrophe.

In Part 2 of this article, I will examine what is required to deal prudently with the reality of energy decline and economic collapse that is imposed upon us by Jevons’ Law, so as to steer away from societal collapse.

Note: For further background on the economic issues raised in this article, I recommend Chris Martenson’s Crash Course.

Thanks for an interesting post!

It seems like that there are several things going on simultaneously:

1. Ongoing increases in real efficiency. It is hard to measure this, because Real GDP/Btu measures are affected by increased "offshoring" and a change in mix toward more services and less manufacturing (and poor inflation estimates). My guess would be that in recent years real efficiency gains have been on the order magnitude of 1% per year, but I am sure someone else has studied this more than I have.

2. Decreasing EROI for oil and other energy products. While this has been going on for a long time, one would think that the impact would be more recently because the decrease in net energy is a lot greater when one goes from, say 8:1 to 7:1 (.875 - .857 = .018) than when one goes from 100:1 to 99:1 (.9900 - .9899 = .0001)

It would seem like we are now down in the range where decreasing EROI would start offsetting increasing efficiency, unless efficiency increases are larger than I am estimating. Note: This is a different graph than I posted earlier. This updated graph is from a paper called, "A Preliminary Investigation of Energy Return on Energy Investment for Global Oil and Gas Production" by Nathon Gagnon, Charles A. S. Hall, and Lyse Brinker, published in Energies 2009, 2, 409-503.

3. The overall EROI level that society needs to function has probably gotten higher and higher over the years, as society has gotten more complex.

4. Growth in debt in recent years would tend to cover up problems with inadequate return on investment, at least temporarily.

It seems like the net impact would be in the direction you suggest, but it would be hard to precisely measure the components.

Jevon's Paradox is often named on these sites not only in combination with tech. innovation but with societal efficiency in General - which has to do with conservation. On this point I was always sceptical. I'm happy that Lionel kept these topics mostly separate.

There is a point in the analysis, however, where the discussion has nohting to do with Jevon, beginning with "Time will tell".

I also agree that our ec. system depends on growth to remain somewhat stable. However, I do not see that this necessarily needs to be tied into (or logically follow from) Jevon's Law. Where does this jump in logic come from? I see this as a problem of our monetary system - similar to the way Hubbert saw it.

What do you think?

Thanks!

Greetings from Munich.

I agree with you.

This started as a great article, with careful background,and reasoning around JP. The English example is very good.

Then it turns into the standard doomer rant.

Not that there is anything wrong with that - I am inclined in that direction - but the logic and topics have been covered many many times, up down and sideways (and much better and more thoroughly) elsewhere.

My 2 cents - if you are going to extend the logic of JP - do that - with specific examples backed up by hard data.

Don't get into an editorial diatribe. Its been done.

The JP line of reasoning, especially the "downside" of it - has not been fully discussed and explored. The link and overlap to EROI is good too.

It seems like it would be helpful to do some quantification of the pieces, and where they are headed--see my comment above. Unless one has real numbers, it is hard to draw firm conclusions.

Yes, I am saving my more serious commentary for the 2nd part of the story..

This is the weakest thing in the otherwise decent post. The part I italicized seems to be an oxymoron as this could not continue for decades without someone going bankrupt. At the very least it needs careful support in the article if it is to be believed.

Also in need of support is the assertion that the supposed overextraction of oil has been a major factor in the accumulation of debts by foreign countries. I read this to mean that the overextraction supposedly helped cause the debts, although that was not precisely what was stated.

I can't think of why debts would not have been accumulated without overextraction of oil, even supposing extraction of oil where the cost of said extraction exceeds the economic benefits obtained from it ( overextraction ) existed. Maybe all that was meant by 'factor in' was that their was an association between overextraction of oil and debt accumulation. Or maybe it was meant that the accumulation of debt could have caused the supposed overextraction. It's hard to tell.

The financial system is one factor in society and peak oil is another. The financial system has also been around for good or ill much longer than oil or even coal. Problems involving limited resources and the bounds those limits put on growth will impact the financial system, and problems with the financial system may affect how/when/and how much resources are extracted, but asserting any causal relationships would require detailed support.

One force for debt accumulation in the WEST is that others are willing to lend the west money to support a trade deficit. However everyone burns oil, both debtors and creditors. It's hard to see how overextraction of oil would be causing debt or how debt could cause overextraction of oil. Maybe an end to growth might end creditors faith in the debtors ability to pay?

Trade deficits have and would exist without novel resource concerns. They balance when currencies revaluate. Are currencies being unduly prevented from revaluating? If so, does this have to do with oil OR NOT?

Here are a few things I've noticed:

Some have complained that China has been keeping the Yuan artificially devalued WRT other currencies by accumulating foreign currency reserves in the form of foreign government debt. ( One exchanges say Dollars for Yuan to buy a boatload of cheap plastic crap. You buy the crap from the factory, and the factory pays it's workers in Yuan. Because the Chinese government does not turn around and use those dollars to buy Yuan but instead purchases US Treasuries, the Yuan is devalued representing a tax on the buying power of the average Chinese citizen. That buying power is to the PRC government which holds the foreign currency.

In the past, Japanese citizens have saved their Yen rather than investing in the Japanese economy. The savings are used by banks to buy the huge Japanese govenrment debt at extremely low interest rates given that Japan is the biggest debtor nation in terms of GDB behind only Zimbabwe. Also there has been a carry trade where the central bank of Japan exchanges Yen for US Treasury securites ( and other government securites ) to devalue the Yen, exporting deflation to boost exports.

The Japanese stock market looks as if the past 25 years have never happened. A lost quarter century of stagnant growth, probably because Japan is already developed - they already have all the capital they need. The US stock market looks to have lost about a decade.

Is it Petrodollar recycling that has boosted investment in the US ( another highly developed country ) so that it has appeared to be a good place to lend money to? Dollars are freely tradable. I find it unconvincing that others would choose to invest dollars in the US economy just because they happened to have dollars in their hands when they could easily be exchanged for any other currency.

Resource peaks are only one thing that's going on in the world. Lots of other important things are happening and they no doubt interplay with each other. I don't pretend to understand it but it's fun to try.

PeakPlus,

You are correct - this doesn't follow from Jevons' Law, but I didn't claim or imply that it does. Jevons' Law implies that as the amount of utility (work of real economic value) expended to obtain the oil goes up, demand will be forced down.

I am then pointing out the economic effects that follow from that. Yes - I also see this as a problem with our monetary system - just as Hubbert saw it, but I go further than that - the addiction to growth is deeply embedded in our culture. Jevons also realised this and remarks on it in The Coal Question. I intend to explore this in more detail in Part 2.

Lionel

On our "addiction to growth," isn't this a long-standing claim of Marxist analysis? Certainly I heard it repeatedly from a Trotskyite professor in the late 70s, who was claiming at the time that it was uniquely capitalism's flaw, and would lead to the demise of capitalism in Western Europe within a decade - that is, before 1980. Where she got the notion (of addiction to growth) I don't know, as the seminar was on 17th Century England, not modern times.

So how does this presumably Marxist meme enter so often into Oil Drum analyses? And does it serve any better at predicting some cliff we're about to go off than it served to predict the end of European capitalism for my old professor? There are so many narratives here which start with well-argued discussions of oil and other energy and raw materials depletion, but then turn crucially on the notion that "capitalism" just has no way of succeeding in a time of resource decline. The basis for supposing this always seems drastically underspecified - as if you had had the equivalent of my Trotskyite professor's assertion made in some seminar once, accepted it, but were as vague as I am on whether there's any solid historical or economic case - outside the Marxist faith - to be made for it.

Also, a "red flag" goes up in my mind whenever anyone says "addiction" in a situation not involving, say, real opiates. The thesis of addictions as a general principle of human behavior strikes me as largely ungrounded - one of those common sensical claims where everyone nods and says "yes," but really more of a black box where an argument deserves to be. Hopefully the next installment will expand on the "addiction to growth" meme, replacing "addiction" with some less loaded term, and expanding on "growth" to show why a society can't be said to continue growing (in the sense of being viable and alive) even as it's energy and raw materials inputs go through shifts and transformations, including periods of attenuation.

I'm not an expert here, but its pretty clear if you think about it. Capitalism is based on a banking system entirely dependent upon compounding growth; its used by every government to generate funds by selling bonds, its used by every depositor and every investor: the future value of money as a whole must increase or there is no incentive to activity.

The world is finite, therefore growth has a limit.

Having enjoyed, in general, hundreds of years of growth, its hard to predict what the other side of the hill might look like.

Agreed. Recognizing limits to growth doesn't make one a Marxist. Physical limits aren't dogma. Finite resources aren't politics. I see red flags when people try to equate these things.

I'm not going to try and flesh this out too much, but if the basic needs of the populous can be met at relatively low cost constant economic growth could come from value added economic sectors that are not intensive users of resources. That just takes a shift in perception in what is of high dollar value, (plenty of that in our economy). Of course even the most pie in the sky incarnation of such a future scenario is impossible without limiting resource consumption. Reality does tend to make this sort of optimistic view bump its ass a little considering the basic needs of food, clothing and shelter in the west have been kept at an artificially low cost by subsidies made possible by drawing down the principal in our fossil fuel account. But economic growth doesn't have a limit if it can maintain a sustainable resource base--we of course have never approached the threshold of that sort of scenario.

And it would be possible to create a quasi steady state economy based upon this principle. The members of the society see the economy as growing because they value Y more than X and the economy is steadily changing from production of X to production of Y. Then after the changeover is complete, switch the valuations around so that X is highly valued, and begin switching back. As long as the period to complete a complete cyle is longer than the length of social memory, this economy always has the feel of relentless growth, even though the longterm output is static. [Yes it is a slight of hand(mind), but if you can fool investors into continuing to invest, the system can function]

While it may or may not be possible for "capitalism" in some form to survive a time of declining resources and industrial output (though by no means guaranteed), the current form practised in Western countries today --based on fractional reserve lending and perpetual growth of debt-- would not be tenable. As long as debt keeps on increasing, interest payments are made and everything keeps happily humming along. As soon as aggregate debt contracts, interest cannot be paid (much less principal) and the system collapses. That's just the way the system is built.

From an accounting perspective, debt, with or without interest, can always be paid back whether the general level of debt is increasing or decreasing.

These days, money is debt. For every dollar in somebody's pocket or bank account, there is a corresponding dollar owed by somebody else. This is true whether the dollar's origin was principal or interest. When the debt is paid, the dollar vanishes out of the person's pocket and the dollar owed vanishes too.

Essentially, the total net monetary value in the system stays at zero. It starts at zero, stays at zero as money is borrowed, and just continues to be zero as debts are paid.

The economic system may well depend on growth to stay alive, but not for accounting reasons. Economic activity is a matter of money in motion, after all, not just money stuck in place. Certainly in a deflationary regime, money tends to freeze up.

I'm no economist, so these macroeconomic patterns rather boggle my mind. But I was a bookkeeper for a couple years there and can still add three digit numbers in my head (WOW!).

Money is really just a kind of mass hallucination. I guess these days the folks in Venezuela are getting their faces rubbed in that uncomfortable truth.

My background is physics, so that's how I like to look at things. Start off by ignoring the money. Look at the physical reality - natural resources, people, machinery, stockpiles of raw materials etc. How can these be organized and used in some way or other so that folks get fed, housed, etc.?

This is basically a problem in control systems design. The countless parameters involved are never known precisely and are always changing in very noisy ways. A distributed control system is surely going to work a lot more effectively than a centralized system. That's at least one dimension of the perpetual capitalist versus communist debate.

Another dimension - I've been reading Poundstone's Prisoner's Dilemma. He's got the capitalists as those advocating the Nash equilibrium, i.e. defectors. Whereas the communists advocate the solution where everyone comes out ahead, i.e. cooperation.

Mutual trust is really the foundation of society. If we find a way to keep that alive, we will never collapse. But once trust dissolves, all the resources and technology you can dream of will not put humpty-dumpty back together again.

Our capitalist system seems largely to be a matter of condensing all trust into money. Money is basically a control system tool, a way to communicate about the uses of resources. I fear that we too often have things up-side-down, that we think of trust and resources as ways to make money. That is a really dangerous instability that could trigger collapse!

Good post Jim.

"Mutual trust is really the foundation of society. If we find a way to keep that alive, we will never collapse. But once trust dissolves, all the resources and technology you can dream of will not put humpty-dumpty back together again."

Wow - now that's something to think about!

HARM - I believe you are absolutely spot on.

When I talk about growth, I am not talking about some essoteric metaphysical growth of human well being - I'm talking about growth of actual economic transactions and these are always facilitated by resources with limits. Nothing can grow forever - not even a tree in the forest, which slows to almost zero growth for a long period as the tree ages and dies. I stopped growing taller about 30 years ago but that didn't render me non-viable as a organism. The same is true of an economic system - there must be viable way to run our exchange of goods and services that is not dependent on growth, but that way must not involve a monetary system based on interest bearing debt that must continuously expand to remain solvent.

Many people confuse Capitalism with free enterprise. I all for Free Enterprise based on a rational and fair monetary system, but Capitalism, which is a system where money is bank debt is unsustainable because of its reliance on ongoing growth. Capitalism arose out of the need to create money to facilitate growth - particularly the enterprises of the New World and it depends on growth for its ongoing viability. We can no longer sustain that growth without destroying ourselves.

I'm not so sure we couldn't fake growth by monetary inflation. As HARM so succinctly put it, it is not about increasing the absolute size of economic flows, but about retaining trust. So inflating money, and continual gradual change to things that look more valuable than the current pardigm, just might do the trick of creating the illusion of neverending growth.

Lionel

To some degree I disagree with the presumption that our economic system is incapable of operating under a zero growth scenario. By the way I have undertaken the Crash Course by Chris Martenson. My arguement is as follows. I am an engineer not an economist so please forgive me if I don't get the terminology quite right.

Wealth creation comes in a number of forms including interest, but it is essentially an economic return on investment. Wealth destruction is also an intrinsic part of our economic system, also in several forms but usually in the form of failure to repay debt. From what I understand the "system" necessitates growth to equal the net of wealth creation and wealth destruction. Not just wealth creation (interest). Therefore logically, a zero growth economy only requires there to be a balance between wealth destruction (debt default) and wealth creation (interest).

It therefore seems to me, that the problem with linkage between systemic need for in interest, and growth, has been overstated. The problem we have to date has been, that interest rates have not been a true representation of the risk of loss. In the equity sector there is a much clearer understanding of the balance between risk and reward. If in the banking system there was an acceptance that interest was a representation of the risk of loss then this would obviate the systemic "need" for continual growth ie. it is not the system that is broke, but the expectation of the people using the system. Of course the change required in peoples expectations should not be underestimated in its difficulty and implications for the banking system.

If the above is incorrect then can someone please point out the flaw in the arguement.

BTW - Looking at the current economic situation it appears we have entered a period where the risk of bank default will in fact be more alligned to the intrest rates paid.

Pheonix,

I am also an engineer trying to understand economics and I also don't get the terminology right in the view of economists. However, the problem is that conventional economics is a load of BS, full of assumptions that are disconnected from reality - the Naked Emperor of the Social Sciences as Steve Keen has named it. M K Hubbert was also an engineer (of sorts) who realised this and developed his own economic theories, which I contend remain valid today – and highly relevant to this discussion.

In simplified terms, Hubbert showed that real economic production and money creation (bank lending) must expand at the same rate as the overall rate of interest for the system to remain stable. If lending expands faster than production, there are too many trading tokens relative to actual goods and services, resulting in inflation. I.e. the money reduces in value to represent its actual value relative to the goods and services available to spend it on. If lending expands slower than the interest rate, there is insufficient money to repay the loans at interest and a certain proportion of loans must default – the system becomes insolvent. So for the system to remain solvent, real production must expand at a minimum of the overall rate of interest so that the banks can be repaid at interest in money of a similar value.

Obviously, if there is no growth of real production, and lending continues to expand at the interest rate, the banks can be repaid, but in smaller trading tokens - overall they have gained nothing – all they have done is devalue their own currency. They have not made a profit and cannot continue to operate.

Yes – the original justification for bankers charging interest was that they must cover their risk of default, but this was always self serving and disingenuous. Obviously, if the rate of interest equals the default rate, the bank makes no profit and cannot continue to exist.

“Wealth creation comes in a number of forms including interest, but it is essentially an economic return on investment.” - absolutely not! Wealth is the Fruits of our labour – the outcome of real economic production. Interest is a tax on wealth, whereby the lender says I will take a cut of the wealth you produce in return for providing the trading tokens you need to go about your business.

Another tax on the wealth created by others is the profit made by wealthy individuals so that they can accumulate vast wealth relative to their own productivity. For this to occur, without direct impoverishment of the creators of this wealth, the wealth creation (economic production) must continue to expand – the pie has to get bigger and bigger.

“Looking at the current economic situation it appears we have entered a period where the risk of bank default will in fact be more alligned to the intrest rates paid.” – well said. You could also view it as the banks lending beyond the real productive capacity of the borrowers to repay – which of course ensures that there will be defaults.

It's a claim of some Marxists, and it's no surprise that you heard these claims from a Trotskyite. The growth/anti-growth debate is probably one of the main underlying disagreements between Trotskyites and all other Marxists (the ones the Trotskyites would call 'Stalinists'). I'd say most Marxists in history world wide were not very much better at recognizing limits to growth than anyone else.

So being anti-growth does not make one a Marxist or vice versa.

Who are you referring to with the word "our"? I expect the answer is modern humanity. If so, the use of the word "our" is not helpful as it implies that this is an issue specific to the culture of the writer and who ever he is talking to in the comment, and that there may be another culture out there with a viable alternative.

Jack - "our" refers to anybody that would be able to read this and others in their societies. I didn't say that there were no other cultures out there or none other were possible. Why would you want to make such a nit picking point rather than choosing to understand what I am quite clearly saying?

Thank you for your reply!

First of all, just logically:

If oil production becomes less efficient, then the demand for oil (and all that goes along with it) will generally fall. Wouldn't it make sense that demand in other energy sectors would rise - to fill in the gap? That is what an economist would usually claim. That is also the gist of the Uranium/Thorium, solar and wind freaks..

Anyway, am excited to read your second piece!

Thanks, Dom

Why would other energy consumptions go up if a F-150 commuter becomes a Civic commuter or lives closer to the work place?

Why would other energy consumptions go up if a badly insulated house gets insulation and new windows?

Why would other energy consumptions go up if old inefficient appliances are replaced by efficient appliances?

To quote Niles Crane: "Oh good! These cookies are calorie reduced! That means we can eat twice as many!"

The fallacy in your argument is that you seem to believe that conservation will cause demand destruction. Your examples do not take into account that the oil companies and the governments of the oil producing states are going to sell that oil because they want the money. If you aren't buying it because you have improved your efficiency, they'll just sell it to somebody else, who will now be able to afford it because of the increased efficiency(more work can be accomplished, so it is more valuable, even though the price has not increased).

Your examples are also too short-term to take into account longer-term system effects. For example, your hypothetical conserver's children-and their children- will want a car and a house of their own.

So even if you don't eat the cookie, someone else will. Conservation does not lead to demand destruction. In our economic system, it leads to increasing the size of the market.

(My position on this is that we should (and will have to) conserve and reduce, but we also must work for population reduction, because only these two things in concert will lead to lower energy requirements. And yes, I believe that is unlikely that we can make population reduction and sustainability happen in a pleasant way... it's still a goal we should aim for, however.)

Your examples are also too short-term to take into account longer-term system effects. For example, your hypothetical conserver's children-and their children- will want a car and a house of their own.

But they won't purposely drill a hole in their gasoline tank of their efficient car or drive aimlessly around town just to be able to consume more gasoline.

If you aren't buying it because you have improved your efficiency, they'll just sell it to somebody else, who will now be able to afford it because of the increased efficiency(more work can be accomplished, so it is more valuable, even though the price has not increased).

And next time the oil price goes up to $147 a barrel they will certainly react more sensitively to it than people who wisely diversified their portfolio beforehand.

Oy. At the risk of stating the really, really, obvious, there will be more of them. Exponential population growth is the main long-term system effect I was speaking of. Because we haven't had the courtesy to die yet, our children cannot use the fuel we use and the sunk energy costs of our cars, homes, offices, and infrastructure. They will require their own. Whether they use the energy unwisely is not at issue. If there are more of you living at the same level of energy usage, as I posited in my reply, say, for example, twice as many, you will use twice as much. Even an incremental increase in efficiency (or reduction of usage through other means) of less than 51% will not result in an overall saving(assuming 2 child fertility rate and you dying before the grandkids arrive... if not, the required improvement increases.)

We are discussing a momentary change in the delivery of a hypothetical barrel of oil that had already been (hypothetically) produced. Because it is momentary, there can be no change in the price. I actually stated that the price did not increase("even though the price has not increased)."), so your comment about the possibility of oil prices rising over time is irrelevant to my explanation. Which is convenient, because beyond figuring out that it was obviously irrelevant, I have no idea what you intended that sentence to mean.

For $12 I can get a couple six packs and some pretzels at the corner deli. The supermarket across town has better prices - the same stuff will cost me only $10. Maybe I'll drive over there and save $2. Ah, but I should factor in fuel cost, too.

Driving my old beater station wagon, the drive across town and back costs me $3 in gas. I'm better off just walking to the corner deli.

Driving my shiny new hybrid, I can get across town and back for just $1. Now, with my much greater fuel efficiency, I am better off getting my beer and pretzels at the supermarket.

The gain in fuel efficiency just increased my fuel cost from $0 to $1.

Jim - you forgot to factor in the amount of eanings you need to replace your old banger with the shiny new hybrid. Keep your old banger and walk to the corner shop. Better still, get yourself a second hand bicycle (negligible cost) and ride to the supermarket - you save money and get some exercise to work off those 6 packs.

I believe that this is the type of change we need to deal with energy and hence economic decline. Not that the optimum solution for you involves less economic production overall.

I was just trying to show a concrete example of Jevons' paradox, how an increase in fuel efficiency can lead to an *increase* in fuel expenses.

Another example could be... maybe I have a choice between a low paying job that is close by, and a higher paying job that is far away. If I have low fuel efficiency, I'll take the close by job. If I have high fuel efficiency, I'll take the far away job. Again, increased fuel efficiency leads to higher fuel cost!

It's a fun thing to think about. Take any kind of optimization problem. Slowly shift the relative costs of the various inputs. With a linear programming problem, for a while the optimum might stick at one vertex of polyhedron of valid solutions, but then it will suddenly shift to some neighboring vertex. It's this kind of jumping from one operating point to another that seems to lead to the paradox that Jevons observed. More general types of optimization problems will still involve the movement of the optimum as the relative costs shift, with the attendant paradoxes.

Personally, I do prefer the bicycle! Here is my glorious Azor:

Jevons implies that with greater efficiency of consumption the market clearing price (of the type of energy in question) would go up. In a time of declining oil supply, this would imply that the volume of oil that society could afford to extract would increase as our usage becomes more efficient. I.E. a society that uses oil for hybrid Priuses can afford to tap low (but >1) EROI whereas one that uses the oil to run Hummers would have to stop at a higher grade of ore than the more efficient society. So the paradox, is that the more efficient society ultimately consumes more of the available resource.

Now of course Jevons might not work if energy were a small part of overall cost, say the critical resource cost wise was Iron, not oil/coal. Then even though I could afford the fuel cost of more marginal uses of the fuel, I couldn't afford to build the machines that consume it. I.e., if we swicth to hybrid Priuses -but they cost $50,000 apiece, our oil demand won't go up -because we can't afford to buy enough of them, whereas with $50000 Hummers we could probably saturate the supply of oil.

I have summarized all EROEI articles of the ASPO 2009 conference in this post on my web site:

Jan 6th, 2010

Diminishing Returns of Fossil Fuel Energy Invested

http://www.crudeoilpeak.com/?p=909

Nice, and bookmarked for later use.Cheers.

As far back as 1943, Manhatten project scientists including Phil Morrison, Harrison Brown and Alvin Weinberg began to understand the energy implications of nuclear energy. Weinberg later wrote:

"Phil Morrison could hardly contain his excitement as he showed me his calculations. If uranium were burned in a breeder, the energy released through fission would exceed the amount of energy required to extract the residual 4 ppm of uranium from granitic rock."

Later Weinberg came to see that thorium was an even more inviting resource. The crustal concentration of thorium averaged 12 ppm, three times that of uranium. Thus if uranium can be recovered with a favorable ERoEI, crustal thorium would yield an ERoEI that is three times better than. In a thorium breeder, such as the LFTR, one tone of thorium will yield the energy equivalent of 3 to 4 million tons of coal. My calculation indicates that the if all world energy output were derived from thorium, and every person on earth consumed energy at modern Western European levels, in one billion years, we would use about 15% of recoverable thorium. The sun will turn into a red giant, and snuff out all life on the earth, before we run out of recoverable thorium.

Weinberg's vision was huge in scope as he later explained:

"In this essay I speculated on the very long-range future-hundreds, even thousands, of years in the future. Where will our energy come from at that distant time when coal, oil, and natural gas have been used up? Solar energy is one obvious inexhaustible source. Another, if it works, could be controlled thermonuclear energy based on deuterium from the sea (thus "Burning the Sea"). My main point, however, was to stress what Phil Morrison and then Harrison Brown had already noticed: that the residual and all but infinite uranium and thorium in granite rocks could be burned with an energy yield larger than the energy required to mine and refine the ore—but only if breeders, which could burn nearly all the fertile material, are used. I spoke of "Burning the Rocks": the breeder, no less than controlled fusion, is an inexhaustible energy system. Up till then we had thought that breeders, burning 50% instead of 2% of the uranium, extended the energy derivable from fission "only" 25-fold. But, because the breeder uses its raw material so efficiently, one can afford to utilize much more expensive—that is, dilute—ores, and these are practically inexhaustible. The breeder indeed will allow humankind to "Burn the Rocks" to achieve inexhaustible energy!"

In his autobiography Weinberg confessed:

"I became obsessed with the Idea that humankind's whole future depended on the breeder. For Society generally to achieve and maintain a standard of living of today's developed countries, depends on the avaliability of relatively cheap, inexhaustible sources of energy."

Clearly then Phillip Morrison, Harrison Brown, and Alvin Weinberg all realized that Jevon's paradox need not apply if we chose to derive energy from breeder reactors.

As far back as 1943, Manhatten project scientists including Phil Morrison, Harrison Brown and Alvin Weinberg began to understand the energy implications of nuclear energy. Weinberg later wrote:

"Phil Morrison could hardly contain his excitement as he showed me his calculations. If uranium were burned in a breeder, the energy released through fission would exceed the amount of energy required to extract the residual 4 ppm of uranium from granitic rock."

http://nucleargreen.blogspot.com/2009/06/sustainable-energy-recovery-wit...

Later Weinberg came to see that thorium was an even more inviting resource. The crustal concentration of thorium averaged 12 ppm, three times that of uranium. Thus if uranium can be recovered with a favorable ERoEI, crustal thorium would yield an ERoEI that is three times better than. In a thorium breeder, such as the LFTR, one tone of thorium will yield the energy equivalent of 3 to 4 million tons of coal. My calculation indicates that the if all world energy output were derived from thorium, and every person on earth consumed energy at modern Western European levels, in one billion years, we would use about 15% of recoverable thorium. The sun will turn into a red giant, and snuff out all life on the earth, before we run out of recoverable thorium.

Weinberg's vision was huge in scope as he later explained:

"In this essay I speculated on the very long-range future-hundreds, even thousands, of years in the future. Where will our energy come from at that distant time when coal, oil, and natural gas have been used up? Solar energy is one obvious inexhaustible source. Another, if it works, could be controlled thermonuclear energy based on deuterium from the sea (thus "Burning the Sea"). My main point, however, was to stress what Phil Morrison and then Harrison Brown had already noticed: that the residual and all but infinite uranium and thorium in granite rocks could be burned with an energy yield larger than the energy required to mine and refine the ore—but only if breeders, which could burn nearly all the fertile material, are used. I spoke of "Burning the Rocks": the breeder, no less than controlled fusion, is an inexhaustible energy system. Up till then we had thought that breeders, burning 50% instead of 2% of the uranium, extended the energy derivable from fission "only" 25-fold. But, because the breeder uses its raw material so efficiently, one can afford to utilize much more expensive—that is, dilute—ores, and these are practically inexhaustible. The breeder indeed will allow humankind to "Burn the Rocks" to achieve inexhaustible energy!"

In his autobiography Weinberg confessed:

"I became obsessed with the Idea that humankind's whole future depended on the breeder. For Society generally to achieve and maintain a standard of living of today's developed countries, depends on the avaliability of relatively cheap, inexhaustible sources of energy."

http://nucleargreen.blogspot.com/2008/11/rosy-fingered-dawn-of-second-nu...

Clearly then Phillip Morrison, Harrison Brown, and Alvin Weinberg all realized that Jevon's paradox need not apply if we chose to derive energy from breeder reactors.

Hi Charles,

Just to say that there is at least one TOD regular who greatly appreciates your contributions -- indeed you've proposed just about the only 'deus ex machina' that might actually work. A pity you appear to have been getting the silent treatment over here. Keep it coming.

Pessimism is probably more about character than openness to the views of others. If you are a pessimist, you simply are not open to hope. I do not expect to convince the pessimists gather here like vultures preparing to pick bare the bones of what they believe to be a dying civilization. I am not going to spoil their fun.

Volumes have been writen on the concept of unfounded hope as a character flaw, whereas, in my case, any pessimism I harbor is the result of an ongoing honest assesment of real conditions and current trends. Any hopes I have are a result of the same process. This morning, my pessimism has a solid lead, though I insist on a good dose of hope to keep things balanced.

Volumes have been written about irrational pessimism. A lack of openess to realist home is called defeatism.

My take is that you didn't read my post very well.

Volumes have been written about irrational pessimism. A lack of openess to realist hope is called defeatism.

Most of those in America I suspect, LOL.

Allow me to ditto CO's appreciation.

TOD is so doomerish, comments like this are allowed to stand, while my rebuttal to this (which makes claims which are highly questionable even based on its own cited evidence) disappeared and is currently invisible. The illogic of the doomer case as set out in the first link implies that even wind and solar energy are undesirable as they allow humanity to be "greedy" for energy; the only reason they are not being demonized at the moment is that they are currently too small.

Allow me to say that I do not "remain silent" on the breeder reactor ideas that appear on TOD because I have anything against nuclear power or the whole breeder reactor technology, but simply because the math and science is VERY complex and I do not feel qualified in this area.

The world's biggest breeder reactor to produce commercial power was the "Superphenix" in France, but it is no longer in service after, and very seldom was able to produce anywhere near the amount of power predicted from it. It was also very expensive, possibly as much a 9 plus billion Euro, (now about 15 billion dollars U.S.), it can only be described as a major failure. It must be admitted that "eco-green" attacks (including rocket attack) was a real issue contributing to the failure of the program, beside the technical issues the project confronted.

The Americans have not had much greater success, this being the description given in Wiki of the Enrico Fermi Nuclear Generating Station unit 1, no longer in service:

"The world's first commercial LMFBR, and the only one yet built in the USA, was the 94MWe Unit 1 at Enrico Fermi Nuclear Generating Station. Designed in a joint effort between Dow Chemical and Detroit Edison as part of the Atomic Power Development Associates consortium, groundbreaking in Lagoona Beach, Michigan (near Monroe, Michigan) took place in 1956. The plant went into operation in 1963. It shut down on October 5, 1966 due to high temperatures caused by a loose piece of zirconium which was blocking the molten sodium coolant nozzles. Partial melting damage to six subassemblies within the core was eventually found. (This incident was the basis for a controversial book by investigative reporter John G. Fuller titled We Almost Lost Detroit.) The zirconium blockage was removed in April 1968, and the plant was ready to resume operation by May 1970, but a sodium coolant fire delayed its restart until July. It subsequently ran until August 1972 when its operating license renewal was denied."

Obviously the science is very challenging, and the cost of such reactors has been very high, so failure is expensive.

This does not mean that breeder reactors will not work, because the obviously will, but whether or not they can overcome operational issues and very violent opposition by radical environmentalists remains to be seen.

As easy as it seems to be to slander solar here on TOD, to this date both PV solar and concentrating mirror solar have been able to produce far more usable energy than breeder reactors ever have, and with far less environmental and cost issues. As we often say, only time will tell...

RC

94 MWe is quite small, as I'm sure you understand. Fermi II is 1122 MWe.

Among the issues of Superphenix is the choice of oxide fuels. This requires very complicated chemistry for reprocessing. Fermi I used metal fuel, but the molten-salt electrolysis (pyroprocessing) scheme would not be developed until around the time of the IFR effort. The IFR would have been quite different from both the Superphenix and Fermi I, including doing all the fuel reprocessing on-site in the reactor hot cell.

I have to wonder what radical opponents could do to a real IFR-type reactor. The power density of a metal-fuel FBR can be huge; the EBR-II developed 65 megawatts thermal from a volume not much bigger than a football. High power density means a small reactor. The lack of pressurized coolants means a containment not much bigger than the reactor itself, which you can literally put in a hole and pile dirt over. How do you attack something that's sitting under 30 feet of dirt? You'd have to use lawyers and sit-ins; rocket-propelled grenades would be useless.

I don't think the rocket attack itself did any real damage from all I have been able to read, but the violence of the eco-green movement against nuclear was growing across France at the time, and seemed to be growing ever more militant. The issue was whether the site would have to endure increasingly bad press and ever growing security costs over its lifetime.

It seems curious to me that France has been able since those days to carry on with a rather sizable nuclear program using the old fashioned fission reactors, so maybe conditions would be ready to try the breeder or fast breeder reactors again, but the expense of such a project would mean that failure could not be an option, especially in the current economic climate. I frankly just don't know enough about the economics to make a judgement on that...the reactors seem to require a lot of raw materials, a lot of concrete, safety systems, and almost certainly security costs...how long would it take for a reactor of this type to pay for itself in delivered power? I have no idea, and reliable numbers are hard to come by.

RC

Hard to figure where to jump in here. Supposing the breeders work out OK, we are coming up on other limits to growth. Sure it might be possible to mine granite for its trace content of U, Th and perhaps minor apatite minerals for phosphorous, which we are also going to run out of soon. What about the fresh water scarcity? Desalinate seawater and recycle all waste water, I suppose. Meanwhile, the clock's ticking on the cheap fossil fuel that needs to be available for construction, capital is drying up and societies based upon the old FF-fueled growth paradigm are teetering. Longer term, the climate's changing. It may already be too late for the oceans, at least the ones that used to have fish in them. I think we missed these opportunities for nuclear power a few decades back, about when our last serious president, Carter (a nuclear engineer, BTW) was replaced by Reagan (ex-movie actor) in the US and everyone in it went around sleepwalking, and we became global bullies lead by a few greedy bankers with their economist witch doctors.

In sum, WE are the problem, both in numbers and in impacting lifestyles. THOSE are the problems to address, not its myriad symptoms. The rest is technotriumphalism, a great word that I should probably learn how to spell.

D3PO, since thorium deposits often appear in combinations with phosphorous and rare earths, the favorable ERoEI for thorium mining at even crustal levels will mean that the recovery of phosphorous and rare earths will be possible from very low grade ore. In addition, large scale desalinization using rejected heat and electricity from LFTRs, will produce large amounts of concentrated brine, from which minerals can be extracted. Thirdly, the stable fusion products from breeder reactors would be a further source of a number of rare minerals. The thorium economy will bring with it many of the supposably rare resources. This is of course very bad news, for the Oil Drum pessimists.

RC, I support a very different breeder technology, the LFTR. The LFTR would have many attractive features, and in addition it has the potential of dramatically lowering nuclear costs. It would be a very simple, easy to construct reactor, that could be started with plutonium for nuclear waste. It can be built underground. The LFTR fuel cycle is based on thorium which is 3 to 4 times more abundant than uranium in the earths crust.

'TOD is so doomerish' - I suppose that's true. It's because energy is not the only issue. If we did solve the energy problem by whatever technlogies, the impact on our soils and water, the biosphere, would continue to get worse. We might be able to beat Jevon's law, but how do we beat Malthus's law without extra planets?

I wonder why it is that he didn't call this his "Theory of Futility" :-).

He tells us that he is going to tell us a way around these issues. It does sound like a challenge, though.

Yes, it is not news to us.

Perhaps he can get a book out of it though, so good luck to the man.

I am only drinking the cool aid if dancing girls are involved.

...so the paradox is that "when improvements in technology make it possible to use a fuel more efficiently, the consumption of fuel tends to go up", as profits drive proliferation; while the Law bundles in the downside of this - that fuel costs over-ride efficiency at some point, and lack of profit drives down consumption?

daxr - Yes that's pretty well spot on how it works.

What we are now seeing is oil becoming much more expensive because much greater Utility (work of real economic value) must be expended to maintain supply from a depleting resource, causing more and more enterprises to be unable to make a profit from that oil, leading to a demand led decline.

This is basically Jevons Paradox operating in reverse of how we conventionally understand it.

LOrf

Glad you brought in the term utility.

Became part of main-stream thought 2nd half of 19thC after death of original thinker Jeremy Bentham

(Still to be seen in his glasscase in the foyer of University College, London; see picture here http://www.utilitarianism.com/bentham.htm )

Bentham's theory concerned inter alia a method of choosing actions (including societal priorities) according to promotion or otherwise of 'happiness'.

I guess that Jevons would understand the implications in the longer term of promoting a coal-based utility that subsequently was going to prove unsustainable. I can well remember in UK the realisation around 1957, after the fragile recovery from vast WWII debt, that we could not be a competitive economy on coal. And that was when we were still producing vast coal (and training Hungarian refugees to work in our pits) at around 225 million tons per year, down only somewhat from peak around 1913 of ~270-290 mt/y (pdf file) http://www.parliament.uk/commons/lib/research/rp99/rp99-111.pdf We now produce less than 20 mt/y (and that includes surface mining not technically feasible in the past, that also has a limited sustainability.)

The answer in 1957 seemed obvious - nuclear. That proved not to be the case and we went down the oil and NG route, as did everybody else with perhaps the exception of expansions of French nuclear and the Danish use of imported coal for combined heat and power (CHP) and District Heating. Our UK reprieve seems to be close to an end.

How do you know that? There were a great many failed approaches to steam power (starting with classical Greece), and the UK's efforts to develop a suitable technology appear to have fallen prey to political forces (as France's did not).

Just because politics killed one effort or even several, does not mean that there is no potential. The USA's efforts were also killed by politics (the Molten Salt Reactor and Integral Fast Reactor) but there is enough experience to show that there are no technical barriers. The UK has about 170,000 tons of uranium and equivalent in inventory. Burned in IFRs at 0.8 tons/GW-yr, this would produce about 210,000 GW-yr of energy.

It's very hard to compare this against actual UK energy consumption because the UK energy ministry obfuscates its data by publishing all figures in tons of oil equivalent, but the USA only consumes about 450 GW of electricity average so the UK, with less than 1/4 the population, could be set for a millennium with just what it's got.

EP

For example, when I was at school we read the brand new New Scientist magazine. One of the earliest editorials said just that; vis nuclear, circa 1957, we could no longer expect to be competitive running on coal, and that nuclear was the only salvation. In 1965, however, I spent a birthday with tunnelers building what was for those days a large (1GW) oil-fired power station next to a major oil docking point for super-tankers from the ME. I was also offered a job around that time checking oil pipelines being constructed in the Libyan desert, (but went back to college). During the 1970s the UK turned off the oil-burning power station I had worked on and into the 1980s we were still building a few (it turned out slightly idiosyncratic, if very safe) nuclear power stations, and the UK nuclear power authority, (lobby), were still telling us a load of rubbish about fast-breeders economics and serving us dodgy data on nuclear economics in general. (Thatcher's attempt to privatize nuclear revealed the figures, and Fast Breeder was closed forthwith. I received an entertaining personal account of the technical meeting when the data was called to account.) The French were the only ones (?) who not only grasped the strategic problems of oil for power generation but rolled out their huge, modular, government guaranteed nuclear scheme.

The prospect of North Sea oil (and huge NG assets) did not really begin to emerge until the mid-70s. The infrastructure costs were enormous and the technical work (was it most of it?) was done by US companies. However, from late 80s, NG was obvious and very cost-effective for both power generation, especially load-following, and domestic heating.

I have little idea how nuclear (and UK off-shore wind) will scale over the next 2 or 3 decades. It seems to me to be a moot point whether our economy will bear the up-front costs of either or both, and remain competitive.

Phil

I don't know what NS was like then, but today it is like the American magazine Popular Science: little rigor with a great deal of gosh-wow tittillation (quite literally, in the case of an article which used an under-dressed prostitute as a marginally relevant illustration; American mags could not get away with this).

And the UK is headed for a power crisis due, in no small part, to a lack of attention to nuclear power. As Dr. Chu wrote in this discussion, the world appears to be bankrupting itself trying to prove that it doesn't need nuclear.

The USA's electric production from oil followed a similar curve. It climbed rapidly post-war, with a first peak in 1973 and a final peak in 1978. After the second oil-price shock it went on a steep decline, and I suspect that the only reason it's as high as it is today is because of the inclusion of petroleum coke in the totals. It was largely supplanted by nuclear.

There are quite a few wrong ways to build fast breeders—an infinity of ways, actually. Fast breeders don't make sense if uranium is cheap and disposal of Pu, Am and Cm is free. But that was then. Now people are talking about uranium shortages, the disposal of nuclear waste is a much bigger issue, and the radical reduction in both fuel requirements and waste volume/half life plus the ability to destroy the wastes of previous generations of nuclear plants (as fuel!) merits a renewal of effort.

The real irony is that if Hazel O'Leary had not succeeded in killing the Integral Fast Reactor in 1994, we would not be having this discussion. The technology would either be proven and heading into production, or we wouldn't be talking about it. From all the info I have, the IFR is as much of an advance on LWRs as Watt's externally-condensing steam engine is over Newcomen's.

Black and viscous, bound to cure blue lethargy

Sugarplum petroleum for energy

Tightrope balanced payments need a small reprieve, oh please believe

We want to be, in North Sea, in North Sea oil.

That worked for about 30 years. On the other hand, the UK already has hundreds of years of uranium in stock, and thorium is not exactly in short supply. What's the way to bet?

I note that we do have energy supplies which are in the position oil was in at the turn of the 20th century: wind and nuclear, to name two. It will be hard for e.g. air transport to convert to electric power, but the application of Jevons' paradox to sectors with both petroleum-powered and electric-powered segments will drive users away from the former toward the latter. There may even be conversions.

The assumption (continually and thoughtlessly stated as gospel here at TOD) that EROI for energy production is declining over time is obviously total nonsense.

The 'lifting' cost of world oil in 2007 is 50%lower than it was back in 1980. Even the 'finding' cost is still at 1980 levels. What is clear is that both these costs are tied to the price of oil and that is determined by the underlying supply situation.

http://www.eia.doe.gov/neic/infosheets/crudeproduction.html

Technology is continually increasing the efficiency of energy extraction ahead of declining ore concentrations. Even oil sands is profitable if the oil price is high enough.

EROI is junk science.

Depletion is the problem.

You can't get any useful or proper perspective on EROI by looking at costs in currency. You need to look at the energy inputs vs the energy extracted. Then its not "obviously total nonsense" anymore.

Majorian may well right, the EROI on oil lifting etc may be as low as it was in the 80's etc etc.

Energy

Return

On

Investment

BUT

Energy

Return

On

ENERGY

Invested

That's another kettle of fish.

don't bother arguing with someone who can't even get their acronyms right. Or who deliberately slides in a red herring.

It is well understood by regular readers of TOD that EROI and EROEI are the same thing.

Majorian is right that EROEI/EROI is junk science as I have complained many times. It does have some validity though if the forms of energy input and the energy output are the same so things that are different are not being compared. This is true in the case of oil where oil is the main input and also the main output and was also true in the case of coal powered coal mines back in the day.

But in these cases simpler financial analysis should give the same result as EROEI/EROI so all the pseudosophisticated complications of EROEI/EROI are redundant.

In the case of oil as it was in the case of coal the problem can be subsumed in the simple statement: It costs more to get the oil/coal to the surface than the market is willing to pay for it. Forget EROEI/EROI.

EROEI/EROI chief use has been to denigrate efforts to find substitutes for oil by fallaciously comparing things that are different and not recognizing that other characteristics of other energy forms are important such as renewability, utility and price.

That is why EROEI/EROI is junk science and should be dumped in the energy analysis trash can. But don't hold your breath. EROEI/EROI and also Net Energy have devoted followers who care little for logic or common sense.

If you don't like EROI, a similar argument can be made in monetary terms. People's incomes are fairly fixed. If the price of oil goes up, and people find it essential for food and transportation, they have to cut back on something else (discretionary spending, debt repayments, or savings). The result is a recession and debt defaults like today.

If somebody doesn't get it after Gail posted this chart about the tenth time they are just dense.

The industrial society we have created since the early days of the industrial revolution would not be possible if there had not been a parallel revolution in agriculture, freeing up the people , enabling them to leave the farms.

The return on investment in HUMAN ENERGY in agriculture has been increasing ever since.If something happens such that eighty or ninety percent of us have to return to farming by hand to produce a surplus to feed the other ten or twenty percent of us, thereby lowering the EROEI (human ) but a factor of forty or so , and there is no longer a supply of people to operate the welfare state, the military industrial complex, or Madison Avenue , then perhaps even the blind will see the concept illustrated clearly in terms of human eroei.

It cannot be otherwise for fossil fuels and other natural non renewable resources although decreasing EROEI might very well be masked for a while by increasing efficiency and changing lifestyles.

Suppose eighty percent -or even twenty percent-of the population has to go to work in the energy field?Is anybody here unable to understand that bau is then kaput?

As the percentage of energy CONSUMED out of the TOTAL energy PRODUCED in the production process INCREASES, the NET amount of energy available for ALL OTHER purposes, from keeping the lights burning on Broadway to keeping your beer cold, DECREASES.

Perhaps it is possible to keep increasing the total energy production for a few more years or decades in the face of ever poorer quality resources in the ground.

If so the actual results will parallel the results of Westexas's ELM oil model-except we customers(the rest of the economy minus the energy production industry) are all going to be , effectively, importers, from the industry , which will consume an ever larger share of its own output in maintaining ITSELF.

Now I think it is possible and even probable that we may have an escape bolthole in nuclear.Whether there is sufficient time and will time to make use of it is another question.

I can't make up my mind as to whether it is possible to maintain anything like bau on renewables-but techno miracles are not unheard of and there might be game changing break throughs.

'They' call it 'doomer rants'.

I call theirs 'denialist trash'.

Its very obvious to a farmer type at harvest time. Did my 'costs' eat up my harvest? Or more easier said and as they state it "input vs output"...Input costs versus what I get for the crop.

Nothing on Gods green earth could be simpler and in fact so simple that us dirt clod, rednecked , flyover trash can see it in action.

Those who lived in gilded cages seem to get free birdseed but even that has a cost. Result= dead bird.

And as for me, and possibly others,,,EROEI is far clearer and cleaner than mucking it up with money and finance, as in EROI.

I seem to be recovering from the flu for now I can address arguements far better when before all I cared about was surviving this henious H1N1.

Airdale

If the price of oil goes up, and people find it essential for food and transportation, they have to cut back on something else (discretionary spending, debt repayments, or savings).

Actually, people in Europe pay close to $8 a gallon on gasoline and yet they pay at least one order of magnitude more on rent and health insurance than on gasoline.

Considering the much lower gasoline prices in the US, Americans must therefore get extremely cheap health insurance, breathtakingly cheap rent and of course free college education...

... or more d-e-b-t.

Yes indeed... there's no cheaper health insurance than no health insurance, and last time I checked, being homeless was free, too. Isn't massive income inequity a beautiful thing?

Gail, there are some implied constants in the chart you post that I would have difficulty with (but hey, maybe I am just a difficult person!). So we assume that debt payments remain constant? Why?

We have seen a sizable decrease in debt payments in the recent crisis as people reduce debt and or are basically defaulted out of debt (the less desirable option obviously). It is interesting that so much of the pie is given over to "everything else" (?). I guess that would be what the late George Carlin called "stuff". The question becomes how much of that "stuff" was in anyway useful or helpful to a better quality of life, but I would feel elitist picking on other peoples "stuff".

Now let us return to the "Food and gasoline" category. Are we making the assumption that as gasoline costs go up, people cannot reduce the amount of gasoline they consume? I reduced my gasoline consumption from a year and a half ago over 80% by simply relocating (I now find myself having to drive a bit just to keep the battery in my car charged!). Frankly, I have not bothered with shopping for a more efficient car because I now consume so little that it would not make financial sense, but if the price of gasoline goes higher I can change vehicles and my gasoline consumption would be almost marginal (already my cable and cell phone bill far exceed my gasoline cost, and if I take my heating/cooling costs in, the cost of information still costs me more than the cost of energy!)

I guess what I am trying to say I have said here before: The cost of wasted energy is so high in the U.S. that it almost becomes our friend when energy costs go up...we can cut out a huge amount of fat without any reduction in muscle. And reduction of debt payment is only a good thing no matter how you look at things.

RC

All of the categories probably change somewhat. Food and energy is adjusted somewhat by eating at home more, buying store brands, and staying closer to home on vacations. Debt repayment is often adjusted by defaults. Discretionary payments are reduced. Some people might even have savings that can be adjusted, but they were often negative before for many in the US.

Common sense would be to factor in the injection of credit as an artificial "energy" stimulus. I think this makes the concept of EROI valid and you guys ignore this. I agree with Gail, that when you factor in all inputs including inputs from (fiat) currencies you get a better sense of where we are and where we are headed. I'm not devoted to EROI/EROEI as such when they stand on their own. We will see how things play out as investment continues to dry up.

...or you could say that EROEI is the fundamental figure, if you want to look only at the utility of an energy based on an energy input/output equation. If you want to make EROI all about monetary costs then, it still bases from EROEI but factors in all manner of changeable subsidies, market conditions, currency fluctuations, etc, to get numbers that may well lead you astray in the long run. Its less useful that way.