Was Volatility in the Price of Oil a Cause of the 2008 Financial Crisis?

Posted by Gail the Actuary on December 8, 2009 - 10:26am

This is a guest post by Theramus, a college professor in a field unrelated to finance. He has looked at the relationships shown in this post as a hobby.

Summary

A cause for the financial crisis of 2008 is described that differs from conventional wisdom. It is proposed that in the early 2000s, an increase in the volatility of oil took place. This increase in oil volatility had an impact on investment risk in general, and led to incentives to promote self-interested cashing out rather than protection of shareholders. Novel data will be provided to show that a distinct series of pulsed spikes in oil price volatility initiated in the early 2000s. The oil shock of 2008, when price doubled over less than a year (peaking at ~ $140 a barrel), is shown not to be an isolated event. Instead, the oil shock of 2008 is the largest in a series of 7 prominent spikes in oil price variance that began some 7-8 years ago.

The multi-year pattern of spiking instability in oil price appears to be unprecedented, is ongoing and may be a natural process that results from initiating or being on the down-slope of the production curve since "Peak Oil".

Importantly, individual spikes in oil price variance precede corresponding spikes in volatility in the inflation rate, the S&P 500 index and the price of gold - indices tied to the confidence of financial professionals to make accurate assessments of investment risk. It is proposed that as evidence consolidated that “see-saw” changes in oil price variance were propagating increasing uncertainty into investment outcomes, the necessary and sufficient conditions emerged for:

1) Expansion of the "shadow banking system" and

2) Unregulated value extraction (i.e. looting) from this sequestered pool of capital.

Finally, data will be described as to how a volatility spike in oil price in 1986 and a subsequent crash in the stock market in October 1987 (Black Tuesday) may have provided a key teaching moment. Lessons learned on the economic impact of a large transient variance in oil price from "Black Tuesday" may have been a factor guiding the avaricious behavior of Wall Street in the lead up to the financial crisis of 2008.

Introduction

The distress of Mr. Greenspan

The former chairman of the US Federal Reserve Mr. Alan Greenspan provided the following response during questioning about his “ideology” before a committee of the US congress on the 23rd of October 2008:

"I have found a flaw… I don't know how significant or permanent it is. But I have been very distressed by that fact...."

A reflexive media and commentators jumped on a bowed Mr. Greenspan for the usual depressing reasons. However, had Mr. Greenspan let his mask slip for a moment? Notable words in his response included “…how significant or permanent…”. By using this phrasing could Mr. Greenspan have been signaling that he’d not been wrong previously (as if)? Instead, was he suggesting that conditions in the economy had changed in a manner that now made his old way of thinking flawed?

This idea explores a possible cause for Mr. Greenspan’s distress. In short, it proposes the outline of a mechanism for how volatility in the price of oil might have contributed to the apparently irrational actions of the financial industry. In particular, it speculates how a recent upsurge in the instability of oil pricing might have provided a rational basis for altering the incentives of global finance.

Consider the following hypothetical sequence of events:

1. Global oil production starts becoming constrained around the year 2000, on its way to peak, as predicted by Hubbert.

2. A new pattern of volatility in oil price emerges shortly thereafter and this pattern continues to build through the present (and into the future).

3. This new type of volatility is in the nature of being on the production down slope of a finite resource in great demand (i.e., oil).

Variance and occasional very large movements were certainly evident in the upslope of the production curve. However, the frequency and severity of oil price movements that characterize the variance on the downhill side of the production curve are envisaged to be of a different pattern and order of magnitude.

4. Owing to its singular role in the economy, increased pricing volatility in oil begins to propagate volatility (and thus uncertainty) into the price of nearly everything else.

5. The rising levels of uncertainty in pricing translate into increases in risk of investment. Indeed, due to unknowns in future prices and most especially of oil itself, real financial risks are probably rising exponentially across the board.

6. A knowledgeable and initially small number of insiders anticipate the implications (as outlined broadly in 1 through 5) of moving onto the down slope of the oil production curve 4-8 yrs earlier than the rest of us.

7. With financial risk increasing, and a still small, but growing number coming to understand what is going on, incentive begins to shift from protecting the interests of shareholders, to figuring out how to “cash out” quickly. This shift in incentive may be the fundamental change (of uncertain permanence) that is the cause of Mr. Greenspan's distress.

8. The behavior of the primary few spreads within the global financial industry and perhaps beyond. Most secondarily affected individuals are probably oblivious to the ultimate cause (i.e., oil price volatility) of their choices and actions.

A fin-de-seicle ethos becomes pervasive. There is an unspoken or perhaps even quietly discussed urgency that time is running out for you to make your “nut” (i.e., sufficient money to retire wealthy) and get out.

How the "cashing out" occurred is a matter of some complexity. But this part of the story does seem to conclude with tens, and possibly hundreds of trillions dollars in worthless ("toxic”) assets in the "shadow banking system". It is speculated that the primary mechanisms of "cashing out" did not directly involve accumulation of wealth in the "shadow banking system" per se. Instead, the evidence suggests that extraction of value involved the taking of fees, salaries, bonuses, stock options (ugh!) and other mechanisms leveraged against the "toxic assets" by the exclusive few who had access to this huge, but ultimately chimeric pool of capital.

Government bailouts of “systemically important institutions” are perhaps the most recent example of leverage against the "shadow banking system". Whatever the specifics of the “cashing out” mechanism - we know the rest - credit crisis, stock and housing market crashes, job losses and the deepest recession of the last 50 years.

Four propositions that link volatility in oil price to bad behavior in financial markets

The “hypothetical sequence” enumerated in 1 through 8 suggest at least 4 propositions for which some data can be derived.

1. Volatility in the price of oil increased after the year 2000.

2. Variance in the price of goods and services (i.e., inflation rate) after 2000 should show a correlated increase downstream of increasing volatility in the price of oil.

3. Investment risk should rise in concert with increasing volatility in the price of oil and the price of “stuff” in general.

4. And there may have been information in place prior to the 2008 crisis that enabled anticipation of the destabilizing effect of large variances in oil price on investment risk.

The author refers to these as the 4 propositions of the apocalypse - a sad attempt at playfulness and definitely in poor taste. Nonetheless, evidence will be provided to support each of the propositions. It is probably fair to point out that even though the propositions imply mechanistic linkages, the actual data presented will generally be correlative.

By the way, this essay is based on a longer wiki composed online over the last year or so. This might go some way to explain the accretive, and somewhat clumsy structure of the present essay. The longer (winded) piece can be found at http://ow.ly/hSGb.

Proposition 1: Volatility in the Price of Oil Increased after 2000

For the purpose of this analysis, I chose to use the price database of the Illinois Oil & Gas Association website. http://www.ioga.com/Special/crudeoil_Hist.htm

This site provides “Illinois Basin Posted Crude Oil Prices”. I would expect this data to be similar to that from more commonly used sources, such as West Texas Intermediate prices available from the US Energy Information Administration.

The chart in Figure 1 is a plot of monthly crude oil price from 1986 to 2009.

The sharp rise and fall in oil at the right hand of the plot corresponding to the oil shock of 2008 is a part of this story that is all too familiar to motorists.

The next problem was how to calculate an index in the volatility of oil price based on the monthly data. It was reasoned that this index of volatility should reflect the spread or variability in price over successive intervals of time. To achieve this a simple statistical approach was used.

The monthly oil prices for Jan, Feb and Mar of 1986 were $22.50, $16.00 and $14.00 respectively. First the standard deviation (SD) of the first 2 numbers (i.e., $22.50 for Jan 1986 and $16.00 for Feb 1986) was calculated as an index of their spread. This SD was 4.60. Next, the standard deviation of the 2nd and 3rd numbers for (i.e., $16.00 for Feb 1986 and $14.00 for Mar 1986) was estimated to give an SD of 1.41. These calculations were carried out for successive pairs of months for all 276 months from Jan 1986 down to Dec 2008.

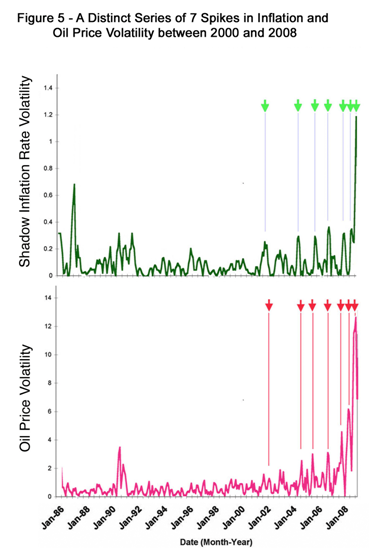

Figure 2 charts this index of rolling SD in oil price (red) together with oil price (blue). Eyeballing the "seismograph-like twitchings" of the index of volatility indicates that it is on a rising trend, particularly since 2002. An intriguing feature of the volatility plot is large "spiked twitches" that rise notably above background - more on these spikes later.

The trend in oil price volatility over time appeared to be non-linear. Microsoft Excel was used to calculate a 3-factor polynomial fit to the scatter plot (pink line - Figure 2). Interesting features of the resulting regression line include that it starts to move notably upward from around year 2000. The trend line also appears to climb in an exponential manner from 2000 through to 2009.

In conclusion, looking back from 2009 there is evidence for a rising trend in the volatility of the price of oil that commenced from around year 2000.

Proposition 2. Variance in Inflation Rate Should Show a Correlated Increase Downstream of Increasing Volatility in the Price of oil.

The monthly year-to-year inflation rates between 1986 and 2009 were used to derive an index of general price volatility in goods and services.

Monthly numbers on inflation rate issued by the US Federal Govt. (calculated from the consumer price index - CPI-U) were obtained from:

http://inflationdata.com/Inflation/Inflation_Rate/HistoricalInflation.aspx

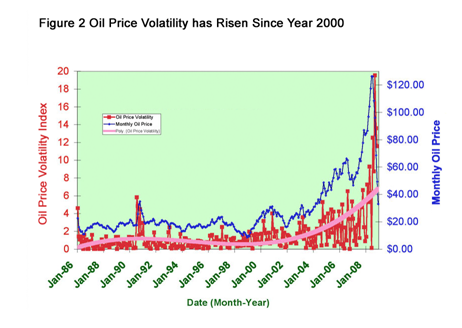

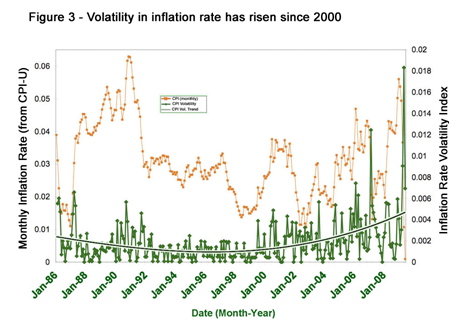

Figure 3 shows a co-plot of monthly inflation rate (orange), an index of inflation volatility based on rolling SD of the CPI-U (dark green, calculated as per the oil volatility index), and the regression trend in inflation rate volatility (light green-black core) between 1986 and 2009.

From Figure 3 it is notable that the inflation trend appears to reach it lowest point around 1997, slightly earlier than the oil trend - which as shown in Figure 2 is at a nadir around 2000. This lack of coincidence in the lowest point for the oil and CPI-U volatility plots is problematic for the "hypothetical sequence". The hypothesis suggests that oil price variance should be “upstream” of inflation volatility. One can perhaps account for this as a statistical error, the effects of more than one time-dependent factor on inflation, the result of government manipulation and so on. Nonetheless, this discrepancy is a concern and clarification is required.

What happens with if "honest" numbers on inflation rate are used?

There is a question as to whether "official" inflation numbers reflect the actual rate of inflation in the US economy. A widely known website that provides an alternate calculation of inflation is "John Williams Shadow Government Statistics": http://www.shadowstats.com/

At this site, inflation numbers are described as being calculated using methodologies that were utilized by the US Govt. in 1980s. A site newsletter indicates that this "Alternate Consumer Inflation measure, reverses the methodological gimmicks of the last 25 years". In other words, the site suggests that "cheating" on the way inflation is currently reported by the Feds has been mitigated.

When the “Shadow Stats” numbers are used the pattern observed changes significantly (Figure 4). Inflation volatility begins to pick up later into the 2000s than when the index is calculated from the official Govt. numbers (Figure 3). Indeed, it appears that volatility in the shadow inflation rate does not start a pattern of more vigorous "twitching" until after the turn of the millennium. The light green plot of the volatility regression trend confirms a low point for the shadow numbers that occurs around 2000.

Comparing the volatility trends for oil price (pink line Figure 2) and shadow inflation (light green) indices since the mid 1990s is similar. The rise in the inflation curve now lags a little behind the rise in the trend of oil price volatility. Most importantly, the low points of the curves share a near "coincident bottom" around the year 2000 and from the point of view of the “hypothetical sequence” a near “coincident bottom” is a lovely thing. The results from the shadow inflation index (Figure 4) are thus notably more in line with the predictions of the “hypothetical sequence” than those derived from the “official” Govt. statistics (Figure 3).

Resolving Granularity in the Rolling Variance Indices

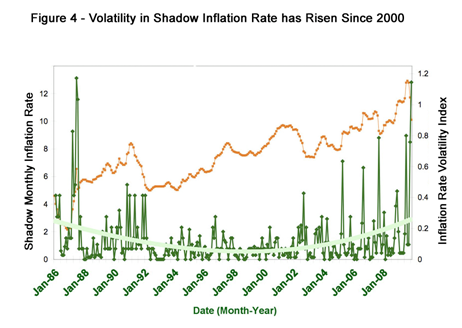

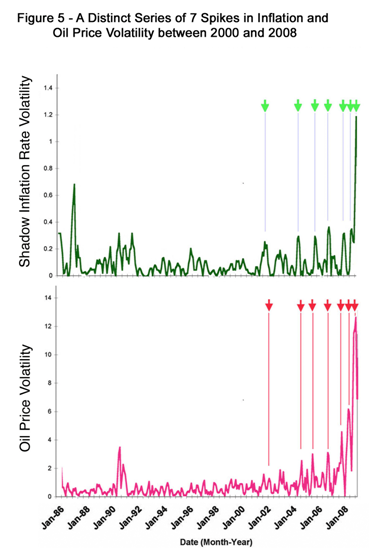

A previously noted feature of the volatility plots is the occurrence of larger twitches or spikes in variance (Figures 2-4). To improve resolution of these larger twitches, 3-month moving averages of inflation rate and oil price were calculated (Figure 5), and then the volatility indices for inflation and oil were re-calculated from these moving averages.

Prior to 2000, spiking in the two "smoothed" volatility indices occurs, but the pattern is irregular. However, after 2000 the spiked pulses of volatility appear to assume an organization. In particular, 6 distinct pulses in inflation volatility are evident in the period (green arrows on top panel) between 2004 and 2009, a recent one peaking in December 2008 being particularly large. An early “harbinger” uptick in inflation instability is also marked on the chart that peaks between 2001 and 2002.

There seems to be regularity to the pulsed spikes - and thus a temptation to assume that the sequence is an oscillating wave. However, if one looks at the spaces between the green arrows marking the pulse tops, they are NOT consistent. The time interval between the spikes gets shorter and shorter as 2009 is approached. If this is an oscillating wave, it is rather complex.

Now... if one looks at the "smoothed" oil price volatility index over the period between 2004 and 2009, almost the same pattern is seen (lower panel Figure 5). A distinct series of pulsed spikes (red arrows), each spike being separated by increasingly shorter intervals of time.

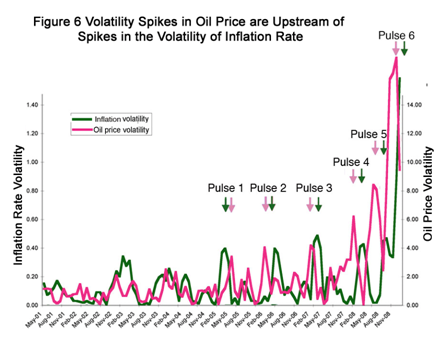

It should be noted that the words "almost the same" are used in the prior paragraph. The reason for this wording becomes apparent when the plots for oil and inflation are overlaid (Figure 6). Although the two patterns are similar, individual "pulse" peaks for inflation and oil do NOT show precise alignment over time. Instead, 5 out of the 6 inflation variance spikes lag slightly behind a pulse in oil price volatility. A further notable feature of the plots is that the volatility spikes tend to show a progressive increase in amplitude.

Pulse 2 in oil price volatility is interesting. Its initiation toward the end of 2005 corresponds roughly to the timing of Hurricane Katrina. Many in the US will remember the sharp rise in oil prices at this time and how conventional wisdom focused on the hurricane as the primarily factor causing the sharp ascent in gas price. However, the big picture view provided in Figure 5 indicates that the "Katrina-induced" spike in oil price may actually be part of a larger series of volatility pulses, including one that preceded it by a year and a third spike, which followed roughly a year later.

As with 2005, 2004 also had an active hurricane season. However, 2006 was comparatively quiet. The point is that while events such as Hurricane Katrina may act as a trigger or catalyst, they are certainly cannot be the ultimate cause of multi-year instabilities of the type illustrated in Figure 5.

In conclusion, there is evidence of a correlative link between volatility in the price of goods and services, as reflected in the shadow inflation rate that coincides with increasing volatility in the price of oil from ~2000. The strongest support for this link comes from a distinct and apparently unprecedented series of pulsed spikes of oil price instability that occurred between 2004 and 2009. Each spike in this series was matched by a coincident or later (downstream) twitch in volatility in the inflation rate.

Proposition 3. Increasing Volatility in the Price of Oil Is Causing Increased Investment Risk

Next, an analysis similar to that developed for Proposition 2 was undertaken on two indices of investment variance: One derived from the S&P 500 stock index and the second based on the price of gold.

A co-plot of "smoothed" volatility of the S&P 500 and oil price volatility over the period from 2000 to 2009 can be found at (http://ideas.wikia.com/wiki/File:SnP_Oil_overlay.jpg). The correlation between the peaks of volatility in oil price and stock (i.e., the S&P 500) are not as clean as between the oil and inflation indices over the same period (Figure 6). Between 2000 and 2004, there is turbulent "froth" in the S&P volatility index that presumably corresponds to the residue of the 1990s dot com boom. However, during the key period between 2004 and 2009, the same general pattern of correlated spike peaks observed previously for inflation rate applies.

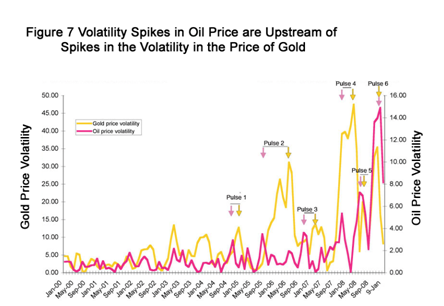

The data shown in Figure 7 provides a more substantive and juicier meal. This plot shows a "smoothened" volatility plot of the price of gold (as measured from http://www.lbma.org.uk/stats/goldfixg - gold in USD) over the period from 2000 to 2009 co-plotted with the plot of smoothed oil price volatility.

Gold is an interesting commodity. Historically, it has been treated as a safe haven by investors wishing to protect against inflation. The perception that gold acts as a store of value confers an interesting property on fluctuations in its price. The vigorousness of its movements up and down indicate the sentiment of people of means who are able to buy gold to offset investment risk.

To put this another way, volatility in the price gold provides an index of how safe or risky sophisticated investors judge the investment environment to be - a measure of the level of market uncertainty perceived by investors.

As with oil price volatility, fluctuations in the price of gold show a general rising trend over the period between 2000 and the present (Figure 7). Looking at the detailed geometry of the ups and downs within this trend, it can be seen that a downstream peak in the gold index matches Pulse 1 in oil price volatility. What comes next is a shocker. BANG ! Pulse 2 in oil price volatility (the Hurricane Katrina spike) ignites a huge surge in gold price variance. Its almost as if the pulse 1 was a warning shot and then a second confirmatory slug of oil price turbulence convinces a bunch of savvy investors to run for cover - big time.

Pulse 3 in oil occurs and there follows a modest surge in the volatility of gold price. Then the more dramatic pattern repeats. With the rise of pulse 4 in oil volatility, there is second a sharp run up in variance associated with gold price. This large spike in the gold index coincides with the first swallows (vultures?) of the credit crisis: Bear Stearns collapse, Mr. Bernanke assuring us that the sub-prime market is contained and so on. Oil price volatility spikes 5 and 6 follow, with predictable downstream spikes in gold volatility associated with both.

The patterns in Figure 7 are astonishing. Volatility in the price of oil appears to be leading investor sentiment - each variance spike heralding large changes of fluidity in the gold market.

In summary, evidence is provided for a correlative link between volatility in the price of oil and two indices of investment risk: fluctuation in the S&P 500 stock index and the price of gold. Again, six pulses in oil price instability are generally matched by unitary, downstream twitches of volatility in the stock index and gold price over period between 2004 and 2009. The detailed correspondence between the oil and gold indices is particularly striking. It is concluded the environment for investment over the last 8 or so years has been marked by risk that is increasing in a non-linear, perhaps exponential manner.

Proposition 4. Information in Place Prior to the Crisis Enabled Anticipation that Oil Volatility would Increase Investment Risk.

When Black Tuesday Came

Figure 7 provides evidence that long-term hedging in gold was occurring prior to the onset of the financial crisis in spite of the short-term unpredictability of gold as an investment. One reason for this paradoxical phenomenon is that gold is a sensitive barometer of perceived investment risk in the short term.

Proposition 4 examines how it came to be understood that oil volatility was adding unprecedented levels of uncertainty to investment outcomes through the 2000s - as reflected in indices such as the price of gold. The main question posed is whether specific information was available that could have led to a change in incentive within the financial industry from protecting shareholders to unregulated "cashing out".

Exhibit A in Proposition 4 is Figure 8. It may take a while to study and verify this complex chart. However, once you have familiarized yourself with its implications, your view of how modern economic events are shaped may be changed - perhaps not in a happy way. In a nutshell this figure shows that unitary spikes in volatility of the price of oil have occurred immediately downstream to almost all US recessions and stock market crashes since 1966.

Put aside the explanations trotted out by experts on the vagaries and fortunes of the US economy - sub-prime, the Fed, interests rates, the business cycle etc etc etc. Figure 8 teaches that the single factor common to virtually every US recession and market crash for nearly half a century is that each has been preceded by a prominent transient spike of instability in the price of oil.

The one exception with no preceding variance pulse is the shortest recession of the period, which occurred in 2001 in the wake of the dot com bubble in technology stocks. There is debate as to whether dot com actually met the formal definition of a recession, as it did not comprise 2 successive quarters of negative GDP growth. Semantics aside, it is notable that a minor volatility spike was coincident with the dot com “recession”, so the 2001 downturn might be considered as not inconsistent with the general pattern.

Looking at Figure 8 in detail, the now familiar recent 6 volatility spikes of 2000 to 2008 can be seen at the far right of the plot. Each of these transients in price variance are asterisked and referred to as "primary volatility spikes". A new, more recent pulse can be observed to be building during 2009. While the 2009 upstroke shows signs of flattening, it has already risen to the point that it is the 5th largest spike in oil volatility of the last 50 years.

The left hand of Figure 8 covering the period between 1966 and 1980 provides food for thought. Against the background of the turbulence of the last 10 years the volatility transients (asterisked) in this era are almost imperceptible. However, by expanding the Y-axis (right hand inset) we can see definite nubs of variance that coincide with the oil shocks of the early 1970s. And these were indeed “primary volatility spikes” in the context of their era, as they rise above a background which maintained at near-zero levels until ~1980.

It should be noted that the oil markets were heavily regulated by commercial and government interests during this earlier period. Hence, although squelched, volatility appeared to squeak out in spurts when it could no longer be constrained. All the same, two official recessions and a stock market crash can be recognized proximal to and downstream of notable volatility spikes between 1966 and 1979.

The period between 1980 and the early 1990s is fascinating. Within this time-frame three recessions and one stock market crash occurred. Again the "one on one" and upstream relationship of “primary volatility spikes” to economic events is maintained. Perhaps the most interesting event in this time-frame is the stock market crash known as "Black Tuesday". The crash that began on Tuesday the 19th of October 1987 appeared to come out of nowhere, occurring during a period of steady gains in growth in the US economy.

While "Black Tuesday" remains the greatest single-day loss that Wall Street has ever experienced, no convincing answer to what caused it has ever been forthcoming. There are speculations on the role of computer trading, herd behavior by market players and derivatives.

In the historical perspective provided by Figure 8 it can be seen an overlooked factor in “Black Tuesday” is that a large oil volatility transient peaked shortly prior to the 1987 market crash. This spike was caused by a failure of OPEC to stabilize prices owing to "cheating" by cartel members on production quotas. The honorable Saudi's tired of their role as a production "buffer" to counter misbehavior by OPEC siblings and temporary chaos (and hence volatility) ensued in the oil markets.

"Black Tuesday" may turn out to be one of the most significant lessons in the dark arts of the markets ever. It came like a meteor in a time before telescopes or knowledge of heavenly bodies. Its singularity and inexplicably is the "exception proving the rule" that wakeful scientists are always on the look out for. The unexpectedness of this stock market crash spared it a tidy accounting by the press and the mendacities of conventional wisdom.

With the context provided by figure 8 that "Black Tuesday" was the immediate downstream product of an unusually large spike in oil volatility now becomes a reasonable proposition. Indeed, it may be the only explanation that makes any sense - a precipitous induction of investment risk by an oil variance pulse in the absence of an economic downtown. In other words, OPEC gave us an experiment on the effects of a “primary volatility spike” controlled for the confounding influence of an accompanying decline in US GDP.

It is speculated that inquiring minds watching these events as they unfolded over 20 years ago may have become early adopters of the conclusions regarding transient instabilities in oil price and investment risk outlined in this essay.

The insights provided by the oil shocks of 1970s probably laid out the principle for anyone motivated enough to recognize the pattern. Oil volatility pulses at the beginning of the 1980s and the 1990s provided further confirmation of a correlation. But in these cases, one could have argued that the risky investment environment resulted from the economy being in recession. But "Black Tuesday" sealed the deal, by showing that a primary spike in oil price variance was sufficient, in it own right to propagate uncertainty into investment markets, even during periods of steady, positive growth in GDP.

The Number of the Beast is About Thirty or so

In the penultimate step of the data section, an attempt will be made to "drag the beast" into the "light of day". The root cause of our economic woes is postulated as to what the essay now refers to as a “primary volatility spike” – a large, transient variance in the price of oil. It is suggested that “primary volatility spikes” can be thought of as a class of discontinuous phenomena in their own right within the broader category of volatility. The focus here is on oil, but as has already demonstrated, other economic variables (e.g., inflation rate) over the last 6-7 years have also displayed similar discrete spikes.

The ability of large transient variances in oil price to cause economic shock appears to some extent to be dependent on the era in which they occurred. For example, relative to those of the last decade, the magnitude of spikes in the 1970s was small (e.g., inset Figure 8) - nonetheless the dire economic ramifications of these shocks are all too well remembered by anyone over the age of 45.

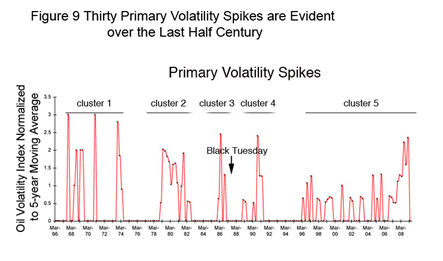

A simple arithmetic device was used to generate a visual representation of the relative magnitude and frequency of “primary volatility spikes” over the last 43 years. To do this, rolling 5-year averages were calculated from the oil volatility index from 1966 through to 2009. The rolling average for each month was then used to divide the volatility index at the corresponding point for all months between Jan 1966 and Jan 2009.

Figure 9 charts the results of this "normalization" of the time series. The plot brings into the "light of day" some 30 “primary volatility spikes”. Within the 43-year time span, these 30 or so spikes are clustered roughly into 5 groups. The first cluster of spikes is in the early 1970s, corresponding to the period in which US "Peak oil" occurred, and the second, third and fourth clusters are centered on the 1986 "Black Tuesday" spike. The fifth, largest and most recent cluster has been the main focus of this essay.

One surprise outcome of "normalization" is that it provides evidence that the latest (i.e., fifth) cluster of instability in oil pricing may have started in the mid 1990s, rather than in the early 2000s as was indicated from earlier charts in this essay. If this earlier onset is the case, it has interesting implications. For example, it could be that the initiation of cluster 5 is diagnostic of the aftermath of Hubbert's peak. If this were the case, then it would lead to the surprising inference that the worldwide crest in oil production occurred prior to 2004.

Alternately, Steve from Virginia has previously made the observation on The Oil Drum that oil price in inflation-adjusted dollars reached its minimum in about 1998-1999- a time that he refers to as "peak oil availability". After this time, it was speculated that as demand grew, supply was not able to keep up, and the effect was felt in price, rather than in increased production. Steve’s hypothesis perhaps provides a more plausible explanation of the increase in price variance after 1996 shown on Figure 9 and this interpretation would also be more in line with an emerging consensus that Hubbert’s peak probably occurred 2004-2005.

Figure 10 returns us to the theme of this essay: the effect of volatility in the price of oil on investment risk. Gold was fingered earlier on as an indicator of perceived market risk by sophisticated investors. Figure 10 provides a nice illustration of how “primary volatility spikes” tend to presage surges in the price of gold. Using this chart it is straightforward to surmise which is the likely "horse" (Therramus suggests the oil volatility spikes) and which is the "cart" (gold price) of the pair.

A small upward blip in gold price (yellow arrow, Figure 10) can even be seen to occur prior to the "Black Tuesday" stock market crash. But consistent with the hypothesis outlined in this essay, this rise in gold price and the large market crash of the following October, both occurred after the initiation of the 3rd cluster of oil price variance spikes.

Finally, note how the start of the fifth and most recent cluster of volatility in the late 1990s precedes the kick-off of a relentless climb in the value of gold over most of the 2000s. If you're curious about what happened to all that money lost during the financial crisis, then one perhaps does not have to look too much further than this veritable mountain of gold with its foothills nestling in the year 2000.

In summary, based on the data of this and preceding sections, the concept of a "primary volatility spike" or "variance transient" is introduced. It is shown that “primary volatility spikes” in the price of oil show an uncanny proximal and upstream correlation with all major US recessions and stock market crashes since 1966. Of specific interest, the stock market crash of "Black Tuesday" may have provided a controlled experiment demonstrating that a “primary volatility spike” was sufficient to cause a major induction in investment risk independent of other factors. Lessons learned over the last 40 or so years on the effect of oil variance transients on investment risk are suggested to have guided the response of the global financial industry to the present crisis. In particular, this information may have provided the rationale for shifts in incentive that led to:

1) the uncoupling of the interests of the financial industry from the broader economy,

2) the expansion and looting of the shadow banking system and

3) the aggregation of wealth by prescient actors in "value stores" such as gold.

Concluding Comments on the Financial Crisis and Conventional Wisdom on its Causes

Divining the cause or causes of the financial crisis 2008 is a problem that perhaps should be approached with trepidation and humbleness. It is easy to be off track when there are so many unknowns. The workings of complex systems such as the economy are ineffable... and well... complex.

Conventional wisdom has already coalesced around a number of probable causes. Top of the list is the hubris and greed of Wall Street. The sub-prime mortgage market is a second much vaunted cause of the crisis.

Attractive as these popular explanations are, this essay imagines an ultimate cause for the financial crisis that differs from the emerging conventional wisdom. At its most essential, this narrative is about the primacy of the laws of physics. Human frailties such as greed are viewed as a necessary, but not sufficient factors in the crisis. Similarly, the sub prime mortgage market and its devilish cousin the “shadow banking system” are seen as downstream manifestations of the deeper process of resource depletion.

This being said, one does not wish to absolve the excess of the financial industry. These people demanded to be treated like adults and left to self-regulate. Unfortunately, in the absence of vigilant supervision the moral pygmies of Wall Street took to playing with matches and eventually burnt the house down.

It should be emphasized that the hypothesis posed here does NOT constitute an organized conspiracy. Those caught up in the fin-de-seicle mentality that lubricated the financial crisis do not have to know each other or openly share their concerns. Given the right seedbed, timely ideas propagate like weeds. Simply put, the idea proposes that economic disruptions wrought by instability in the price of oil leading up to and following Hubbert’s peak provide a key to understanding the financial crisis of 2008.

Pricing unpredictability in oil - our most fundamental energy resource - is suggested here to be the sole factor that is both necessary and sufficient to explain the debacle. All else, bad behavior of Wall Street included, is proposed to self-organize and flow downstream from the effect of volatility in the price of oil on investment risk.

About Therramus:

Therramus is a neutered Tom. He can be contacted at therramus@gmail.com.

This is a most excellent analysis that is well reasoned from evidence, well presented and informative. It's also predictive, but I wonder how much so once all the curious but perhaps not early adaptors learn of the relation of oil price volatility as a leading indicator of economic downswings and gold price spikes. I guess we could ask Greenspan his opinion, or just wait out the next spike phase pair. Of course, many here, myself included are wondering how many more pairs we can handle. Anyway, bravo Terramus!

This is not a good analysis as it completely misunderstands the correct use of the standard deviation. See my comment below.

Crobar - you miss how arithemtic is being used here to support the arguments. This is NOT "normal" stats. Check out later comment of Grouneau - " I wonder if the arithmetic was provided without the term "standard deviation", if you (i.e., Crobar) would have the same problem with it. The point seems to be to get a positive definite "derivative-like" number to represent the volatility."

If he's not using "normal" stats, why does he use standard stats formulas and language. I would not have had a problem (at least not this problem) if he hadn't used this language, but he did, and it is misleading.

Thanks for reading the article and your kind comments. The potential for coupling between the patterns for oil and other economic variables was the most interesting aspect to emerge as the work proceeded.

You're right - its going to rough ahead - there may be things that need to be done to mitigate the consequences. Meaningful reform of the financial industry (e.g., re-instatement of Glass-Steagal and strict regulation of the derivatives markets) might provide the first necessary steps - especially with respect to protecting the poor and economically vulnerable.

I don't see why you chose a 2-point moving standard deviation for your "index of oil price volatility". For two data points, the standard deviation formula resolves to just the absolute value of the difference divided by the square root of 2. That measure is not normalised to the current running mean. Hence it has the unfortunate characteristic that, for the same relative change in price, it must grow as the price grows - as, indeed, it does.

What you've got is really just the dollar price change per month (over root 2) - that is absolute price volatility rather than relative price volatility. In practice, your index is as much a measure of the current price level as it is of relative volatility.

Doesn't that explain a fair bit of what you've observed? And so don't we mostly end up with another Hamilton-style oil price rise causes economic collapse story?

Thanks to Therramus for taking the time to tinker with the data and to propose a testable theory about oil price volatility. I think the idea has merit; however, like Gergyl, the use of the 2-point moving standard deviation struck me as odd.

My suggestion would be to collect daily oil price data, calculate a monthly average and calculate a monthly standard deviation, then calculate percent relative standard deviation for each month. This would give a percentage value for %RSD that might be a better measure of monthly price volatility. You could also just use the monthly price range divided by the monthly mean X 100.

*

Hi Bigdoug,

Tks for the suggestions.

I may tinker some more using the approaches you suggest.

Also would direct you to my response to Gergyl below explaining why I went with an absolute measure of oil price volatility as opposed to a mean normalized index.

Asterisk above was me trying to figure how this commenting thing works - I wanted to make sure my comment was directly under yours.

Best

Furthermode I believe the error in the estimate of the standard deviation (SD) is given by:

standard error = standard deviation / sqrt(n)

Where n is the sample size. This error is the expected error in your estimate of the actual SD from your sample of the population.

i.e. in one case the first two values are $22.50 and $16.00 giving an SD of 4.60. The error in this estimate of the SD is SD/sqrt(2) = 3.2527. So the actual sd could be anything between 1.35 and 7.85

Also, the highest standard deviation occured during the crash in oil prices, with values previous to this time being close to this error range. The error range is probably not even calculated that accurately because of the small number of samples.

Using two values to estimate the standard deviation of anything, is absolute nonsense and completely misuses this statistic.

EDIT: I should also add that the standard deviation calculation is accurate when the data is normally distributed, which price data almost always certainly is not. So you are using a statistic incorrectly on data to which it does not really apply.

I'm sure you're right. But it's the non standard deviations from the managed glut price stability that are playing hob with the system and confidence in it. Not to mention the deviant nature of the executive salaries prevalent today. I'm sure by the time all the stats have been fully analyzed on the Apocalypse we will see that we went to hell in a handbasket at N to the umpteenth too fast.

That's very cute, rock-lizard.

Consider a normally-distributed population of pins. Some have round heads, some flat, some broken. And a similarly normally-distributed population of angels, some fat, some skinny, etc. Then, what is the number of deviant angels that could straddle two pins?

cobar, I can't argue with your strick interpretation of "standard deviation", but I wonder if the arithmetic was provided without the term "standard deviation", if you would have the same problem with it. The point seems to be to get a positive definite "derivative-like" number to represent the volatility. There are any number of ways of doing so mathematically. Is there some standard definition of "volatility" that should be used instead of the one presented?

One thing we have learned from Taleb and the science of fat-tail/gray-swan statistics is that the Normal Gaussian distribution isn't like some iron-clad standard. A fat-tail distribution like the damped exponential has a standard deviation equal to the mean; and the maximum entropy principle suggests we use this kind of distribution if we have no knowledge of the variance. That is all I use for oil depletion calculations and it works out quite well.

There are many, but as WebHubble also points out above most are not applicable to data which is not normally distributed.

If the "standard deviation" was not meant, he could have just used the word "deviation" and desrcibed the formula he was using. However, it seems the formula for standard deviation was in fact used, and used incorrectly, and the "standard deviation" in my strict (the only?) sense was what was actually meant. Therefore he is using well known statistics incorrectly to give a false impression.

Yes, except that Hamilton is a respected economist with a specialization in oil markets, writes more clearly and is not anonymous.

These two pieces, in my view, are a better starting point for readers interested in this topic.

http://www.econbrowser.com/archives/2009/04/consequences_of.html

http://www.econbrowser.com/archives/2009/11/will_rising_oil.html

I don't want to take anything away from the author and do admire the effort he/she put into this. But since it has been given earlier treatment by acknowledged experts, I have trouble seeing how this lengthy piece adds much.

Having a different way of looking at things adds another perspective, even if it isn't as polished as that of someone working in the field.

The graphs aren't ones we would have thought of. They provide some new insights, and may inspire other readers to put together other graphs, which may provide even better insights.

Insights based on innapropriate and incorrect use of statistics. I appreciate that the professor is only doing this for a hobby, which is why I blame you as editor for letting this post get through.

Hi Crobar,

Statistics and derivatives are a lot alike - the intentions accounting for their invention were good but somehow human nature took over.

This being said, I'm not sure what I'm doing here is statistics - parametric or otherwise. Certainly not calculating p values and using it to gauge mean separation.

I am a simple and enumerate guy. I used SD to get a numerical estimate of spread - saw a pattern in time and then noted relationships between the first pattern and succeeding ones - that's all. The patterns in time or their relationships were not obvious from simple scans of the base index (e.g., oil price) over time - at least to me.

If you think that what I have done is not helpful to you - then so be it. However, my screwball perspective may crystallize for others what is obvious to you.

I can't help but think you are only digging yourself in deeper here:

The only similarity is that you don't seem to understand either one of them.

I don't have any problem with you writing this piece, but don't think TOD should have published it.

There is nothing wrong with being "simple and enumerate" or lacking a even a basic understanding of finance.

But is is a horrible qualification for writing a quantitative finance piece that makes such strong conclusions.

Hi Jack,

I can appreciate your irritation. You sound like you work in business, finance or economics. If I were reviewing a hypothesis from you in my field of research (developmental biology) I'm sure you'd piss me off as well - which is not to say that you may not have good points and even a worthy hypothesis. Its just my first reaction would be against unfamiliar language and an odd manner of arguing a case. Basically I'd ask myself "Who does this dude think he is?" - condescension would then likely ensue.

You'll probably note that alot of the language in the essay is borrowed from biology e.g., induction and downstream (used in developmental biology), variance transient (think voltage transient in electrophysiology) etc.

Its true - I've never read a book on finance or oil economics - and in all likelihood won't ever. Its also true that I have rarely read text books on molecular biology until I had to for teaching purposes.

On English not being my first language - I guess the Queen's English is not my tongue. I am a colonial Scot and proud of it.

I'll await your further text before responding further - I notice for example that you have not replied to my previous response to you on Professor Hamilton's work.

As a biologist, you really should have a better grounding in statistics. Most biologists I know have

to take a stats course as it is fundamental to understanding scientific results in any field. Note I am an engineer, not a financier or businessman.

I wonder why so many comments are parsing the methods instead of looking at what they are saying and speaking to that issue?

Quite likely that the energy situation did drive all or some of the greed that was spawned as a result in the financial world as those in that world are always looking for profit and playing dice with the universe(or planet). The rest of us sheeple are the ones to be sheared.

Its for sure they used the numbers game to advantage to cook books, so to speak.

So long term then what does it mean? Means to me that they won at the tables.

We keep guessing at the charts which indicate the point of peak oil. Yet we know deep down that it doesn't matter too much in the end. We played it wrong. Or those who were supposed to 'lead us' looked the other way while it was going down.

All those lauded audits? Where? All those lauded accountants? Where? All the overseers? Where?

Cooking books.

Airdale

*

Hi Airdale,

Concur that a certain amount of "missing the wood for the trees" is going on here.

It was my objective to subject the hypothesis and its data to a kind of peer review. In fact I wanted to get the sophisticated and numerate types at TOD group to look at the specific nuts and bolts of the essay... looking for errors in the math and so on.

The essay began to be posted last January at the idea Wiki and has NOT generated a single comment. Gail's posting of the essay today has generated many new inputs, including yours - all of which are appreciated.

Agreed that what has happened is an absolute scandal. The "Shadow Banking System" apparently came to accumulate 10x the annual GDP of the entire world. One has to ask -if this is not FRAUD - Where are the other 9 planets ?!

Ah yes, well you will most certainly get a very good 'going over' here on TOD.

Put on your heat proof work boots though and ride it out.

And welcome to TOD, where usually there is never a dull moment.

Airdale

It is not very usefull the way it is now. When the methodology errors are fixed, if the results hold (what seems likely), then it will be both an usefull and important essay.

As an aside, I'd like to see comparations with other comodities, like steel, and weat.

Well then are we going to fix statistical analysis endeavors or are we going to fix the planet?

There is something from the past about a fella playing a fiddle?

We are still not sure exactly what an electron is(wave vs particle-changes sometimes,etc) and certainly the Uncertainty Principle plays a large role BUT we can , if one simply treads the paths of nature make a observation as to what is happening.

You can't do it in one day. Or on vacation but there are those who do live close to nature

and could see what is happening if they weren't so busy RAPING her.

Airdale

Airdale

Really? How else are we supposed to separate fact from non-fact? We could have a discussion of this level on a drumbeat, I expect better in a full post.

Yes but you are crystallizing incorrect ideas, or at least ideas without basis, that is my problem.

If what you are doing is not statistics, why have you used statistical language and standard statistical formulas? Why not say, "here is my measure of volatility, which I have come up with and here is the formula I will use", and give the reasons for using that formula?

I suggest that you used the standard deviation because basically, it sounds more professional, and makes your argument sound more plausible and scientific to those who do not know much stats. I don't think you've done this intentionally to decieve people or anything like that, I just think it sounded good when you wrote it down, so you stuck with it.

By the way, I am an engineer, not some mathematicion or financial guru. Every scientist (you mention you are a biologist) will or at least should have done a stats course at some point and has no excuse for not knowing when and how to apply the standard deviation.

We should all open our apertures. The measure of variance is also known as the second moment of a probability distribution and the square root gives the standard deviation. My point is that someone's description in statistical terms can be converted to a probability view. Probability and statistics are really distinct concepts, and if one person screams about misuse in one view, somebody else can gain a more firm understanding in the other. (if you want this concept reinforced, read The Black Swan, or look at the ongoing war between the Frequentist and Bayesian schools, or read stuff on maximum entropy)

Crobar, I know you realize this because you were the first to suggest the caveat that the standard deviation as applied in classical statistics really only applies to Normal distributions.

So are you saying that this is a good analysis that has increased our knowlege, and that the author would understand the points you are making? I have read The Black Swan (and Fooled By Randomness which was much superior in my opinion). If you have read Taleb then you will be familiar with his ludic fallacy of weaving false stories out of the past. This is a good example of this.

I jumped on the author about the standard deviation because he dressed his analysis up as a thorough statistical review and I could prove he was using it incorrectly. I didn't even want to get into how, even if he had used enough data, and had applied the statistic correctly, and had given errors for his estimates, that the second moment cannot actually be calculated for non-normal data in any case! That, as they say, is a whole another kettle of fish.

His analysis was supposed to be frequentist, or at least used frequentist formulas and language, it was clearly not bayesian or probabilistic.

Yes, I understand where you are coming from. Therramus is looking for some correlated indicators to tie some causality to. I usually don't follow this approach as I invariably would rather start from a model that tries to predict the behavior.

The exception is upthread where I naively tied a peak curve to Steve's graph

http://www.theoildrum.com/node/6025#comment-568127

So, yes, if you don't have a model you need to the right statistical analysis to establish confidence limits. And even that may not be good enough.

Fair point on care with wording - I should have been much more assiduous in explaining how I was using SD. I'll also own up to a similar issue with my use of the word variance (i.e., SD squared). In the original Idea wiki it was discussed early on that SD was being used as a proxy for volatility. In editing down the Wiki essay from over 20,000 words to <6000 for The Oil Drum maybe I lost a few things in translation.

I agree. I respect the effort that the author has put into this. But he/she seems to lack even a basic understanding of finance and doesn't appear to have made the slightest effort to refer to existing sources of information (a five minute review of "Principles of Corporate Finance", for example, would have led to significant edits). The result is an error ridden and misdirected piece that is not anywhere near TOD standards.

Aside from the "inappropriate and incorrect use of statistics", the entire argument seems to be based on speculation dressed up as understanding.

The author speculates that volatile oil prices increase investment risk without providing any real evidence that oil prices are more volatile than they have been or that he/she has even the vaguest comprehension of what investment risk means. It seems clear that he/she doesn't realize that only a small portion of oil is transacted at spot prices and that much of the risk can be offset through hedging.

Using the price of gold as a proxy for risk is ridiculous. Gold prices have been influenced by liquidity, concern over dollar strength, fear of inflation and to some degree concern over risk.

One gets the impression the author couldn't be bothered to even open a basic finance text to get an accepted definition of risk, or worse found that those didn't support the overall argument he/she was trying to make. Cost of capital, cost of borrowing, market P/Es, and asset prices would all be better indicators of risk, but don't support the story line.

Quotes such as this one…

..show that the author doesn't even understand that correlation is not causation. Maybe he/she should have looked at copper prices. BANG. They were up too. Why?

Then as he/she tries to grope for conclusions, the author wanders into a bout of pure speculation without any evidence at all. The entire treatment of “cashing out” lacks an underlying argument, any supporting facts, or a basic understanding of what "cashing out" would actually mean.

The author refers to the “shadow banking system” several times, without any discussion of what it means. I challenge him or her to provide a definition of what the shadow banking system actually is. I am sure that neither of us know.

If I tried to write a piece like this about some engineering (or actuarial) topic in which I was miles over my head, I would get ripped to shreds on this site. But since it is finance, I guess anyone is qualified.

Just imagine if I tried to educate the engineers here about the significant lessons in their “dark arts”, after starting out by saying I am not an engineer.

I can't muster a single response to this except "what a pretentious fool".

The last sentence in the article itself reads:

I don’t even know what that means. And what about this:

Has that been edited? I am guessing that the author's first language isn't English, which excuses him/her to some degree. But editors should make sure what is written makes sense.

Sorry Gail. I do appreciate the good work that you do here, but this piece is sloppy, inaccurate, badly written and doesn’t provide one single iota of value that is not already provided by Hamilton (who the author appears oblivious of).

It is 2am here in Bangkok, so I will be offline for a while. I will be happy to reply in detail to any comments in the morning.

My own intuition on macro-finance topics leads me to believe that game theory arguments play a huge role in every market move. This might sound promising but many researchers think this leads to a dead-end since no one (and no computer) can actually solve game theory and Nash equilibrium problems. And if someone could solve them and accurately predict market movement, this would cause a correction in that market and completely invalidate that model's solution. That thorny outcome in fact describes the essence of game theory.

Then we have other people that suggest that we shouldn't even consider equilibrium arguments, which probably makes it even a harder problem.

Therein lies the conundrum of trying to figure it all out. Not that it doesn't make for entertaining reading.

Hi WebHubbleTelescope,

You seem to have a deep grasp of the processes at work here. Can't offer a cogent response - your math is above my pay grade. Nonetheless, appreciate your insights.

Best

Hi Jack!

How's Thailand?

A friend will help you move.

Unknown photographer 'Al Capone and associates'

A really good friend will help you move a body.

A new article from John Hussman, PhD:

I'm sitting here at the table beating my fist going, "Why, why ... why? Why do you think they are doing this?"

I can't believe Hussman can write this down and still dance around the obvious conclusion; the Fed is running a racket. What is the end point of the Fed's ad hoc fiscal policy? If a policy cannot be conceived as a success at the beginning, why would it be implemented? The GSE- agencies that traded trash for cash are bankrupt, the banks that have also traded their trash for cash are either effectively bankrupt or will be as they are not making good loans. The Fed knows this as they have armies of bank examiners. The insolvent banks are receiving free money from the central bank with no strings attached! What sort of monetary (or fiscal) policy is this?

Bernanke under pressure from the Senate admits that he was wrong to not recognize the property bubble. How can he not know that the securities his organization receives from property lenders can only return to par if property prices return to bubble levels? He knows and makes the trades anyway!

What Bernanke really knows is who is friends are.

A lot of other finance observers call Bernanke and the Fed onto the carpet for monetary mis- steps: Mike Shedlock's Fed Uncertainty Principle, Karl Denninger, as well as most of the other writers who share this space. Where I claim a distinction is this:

The observation on their part that the Fed expects the economy to return to normal at some point with a high level of energy- fueled growth. My observation is the Fed and much of finance are smart like me, they expect no such thing!

The game is over and they are taking the balls home. All of them. It's every man for himself and devil take the hindmost.

To believe otherwise, that there is potential business growth in the future, finance would act otherwise. Banks would be aggressively marking down their own bad loans, purging their balance sheets and competitively asking the public to critique their banking functions. The aim would be to restore confidence and gain a competitive edge against other banks. Yet NO BANK is doing this; they are engaged in paper speculations, holding loans off the books until they can be sold to the Federal Reserve for cash or traded for Treasuries whereupon these are sold for cash. They wink and nod at the FDIC. They are operate like banks did in the early 1930's, speculating on gold or other derivatives as a substitute for ordinary business until the end.

The difference was widespread uncompensated failure of banks in the Depression; free no- strings- attached funds for the banks in the present!

What Mr. Hussman refers to as compromising depositors and taxpayers to benefit bondholders. He's too careful to come right out and say the Fed is running a money laundering operation.

We have a situation where the Federal Reserve engages in a widespread international campaign to devalue the dollar, to make it cheap and generate revulsion overseas - 75% of US currency holdings are overseas - and to call it home where it can be swapped for worthless securities.

Where the Fed's primary dealers pump up equities markets to facilitate the laundering of worthless stocks such as AIG and C into cash. Where the Fed buys Treasuries directly to turn the government debt market into a cash fountain. Where the Fed swaps dollars overseas to unknown proxies under unknown terms to benefit unknown parties. Where these and other practices could never be consistent with prudent monetary practices as the consequences have repeatedly led to default and money panics ... yet the Fed does just these things!

By its actions the Fed and its closed circle of cronies has made a bet against the finance future of this country. Having made the bet - that the finance casino has run its course - the insiders are cashing out. The manner of their cashing out suggests they have no intention of coming back.

No intention of coming back! Hello!

At the practical level, cash and 'power money' is fleeing the economy. The outcome of the money laundry added to the general deflationary shrinkage of lending multipliers and the tailing off of fiscal stimulus is effective monetary tightening. Interest rates are on the razor's edge. Less public borrowing and high fuel costs are pushing on them. Money costs overseas are also rising. Japan pushes to devalue the Yen ... the circle closes on the short- dollar trade.

If Bernanke is not re- confirmed, the Fed money racket will likely collapse. Any replacement will be more of a dollar bull. The Senate vote in January becomes very important.

The consequences of a Bernanke exit will mark the end of current 'mystery markets' where trading action defies sense and sensibility. Interest rates will rise whether the Fed acquiesces or not. Stocks will decline along with the other 'laundry' trades. There will be more business failures and earnings will reflect the current, fuel constrained growth prospects. Gravity - and thermodynamics - will assert itself.

Hussman does come out and predicts an equities correction. He's being cautious and speaks 'fund manager- ese'; he's also realistic. Our markets are now crime scenes. All that is needed is the yellow tape.

http://economic-undertow.blogspot.com/2009/12/knowing-who-your-friends-a...

NOTE: The cashing out process began with Goldman shorting its own mortgage products in 2007. The smart money is already out of the market; $2 trillion is a lot of cash. The finance 'remainders' aren't rocking the boat because they are hoping to cash out, themselves. At some point the 'dumb money' is going to see what's going on and then things will get interesting.

This is meant purely to draw some discussion and a guide-to-the-eye, but that curve looks like it was heading for a peak before it went hay-wire.

And that is not a cumulative money supply; money reflects the current situation not an accumulated amount. What Steve has said in the past that you can detect peak oil just by folloing monetary indicators.

Some mechanism started detecting a peak inflection point and an open-loop mechanism kicked in to compensate?

"Why, why why do you think they are doing this?"

Steve, this anger and frustration of yours can be tamed! Just read pages 310-311 of Nicholas Georgescu-Roegen`s book The Entropy Law and the Economic Process. That`s what I did and it worked for me!

From this book:

"Pareto explained how every elite is overthrown by a jealous minority which stirs the masses by denouncing the abuses of the establishment and finally replaces it. Elites, as he said, circulate. Naturally their names and the rationalizations of their privileges change. But is important to note also that each elite inspires a new socio-political mythology by which the new situation is interpreted for the occasion, Yet the same leitmotiv runs through all these self-glorifications: "where would the people be if it were not for our services?"......But the fact that every elite performs services which do not produce a palpable, measurable result leads not only to economic privileges...but also to abuses of all kinds."

You might as well get mad about all the unnecessary cement covering over good land and messing up the ecosystem. Or you could get mad at the smog covering the sky. Or all the plastic drifting in the ocean causing tons of environmental damage. Go ahead. Along with the abuses in the banking system these are all just the natural outgrowth of humnanity`s encounter with oil. The scale is vast but the essential pattern (feeding off of an energy source and growing from it) remains intact.....

The elites know that there is no point in reaching the top where the "controls" of the system are located if they can`t use this to their advantage.

Hi Jack,

Ouch...or maybe Wow.

Was hoping to see you back this morning. Your passion for TOD appears to be strong.

Had to put on the old "ego filter" to go through your post - but did find at least one on target criticism. In fact, this issue has been bothering me for sometime now. Don't think it's a fatal flaw - but wondering if you can figure out which of your scatter shot above is still stinging ?

As an aside Professor Hamilton swiftly zeroed in on this problem in his brief correspondence with me in April.

Best

Cleaning up prior to comments closing down in a day or so.

Jack hit the road, unfortunately.

For anyone curious as to what I was referring to in the comment above it was Jack's earlier statement that -

"The entire treatment of “cashing out” lacks an underlying argument, any supporting facts, or a basic understanding of what "cashing out" would actually mean."

Fair point. This part of the story remains bothersome and fuzzy.

Gail,

Thanks for the input. Obviously, I concur.

Hi Jack,

The idea wiki essay was started in 18 January 2009 and Figure 5 showing the coupled pulses of oil and inflation rate "volatility" was added on March 9 2009 - as recorded in Wiki "history".

As such the the main element of the essay was independently in place prior to the April and November papers from Professor Hamilton.

This being said-after reading Professor Hamilton's Brooking institution paper in April 2009 I emailed him and asked is he would comment on my Wiki. He was kind enough to write back and offer some critiques- a gentleman indeed.

I will alert him to todays post - perhaps he will offer some thoughts.

Yes, and that is precisely what we might expect if we accept the premise that our economy is built on a form of energy that is exhibiting a continuously diminishing EROEI. No?

Hi Gergyl,

Tks for the comment.

You're break down of the math seems correct. I used a simple approach (by necessity - I am not a mathematician) to measure spread and used a rolling estimate of bi-monthly SD to achieve this.

The usefulness of the approach for me (and agreed it is unconventional) as I tinkered with it was in the distinct temporal pattern that resolved when graphed. The spikes in the oil volatility index (Fig 5) provided reference markers in time that enabled discernment of relationships with the other variables plotted.

To put this another way each spike in the oil index appeared to stand as a staging post for a subsequent and downstream unitary spike of heightened change in the respective volatility indices for inflation rate, the S&P 500 stock index and gold price. It was these relationships that got me thinking about a possible sequence of cause and effect.

You are correct that the index calculated provides a measure of absolute price volatility. Two things.

First, if you look at Figure 9 I do provide one graph that attempts to get at an index of relative volatility. To achieve this normalized rolling 5-year averages were calculated from the oil volatility index from 1966 through to 2009. The rolling average for each month was then used to divide the volatility index at the corresponding point for all months between Jan 1966 and Jan 2009.

Second, I did think about using mean normalized SD (i.e., coefficient of variance) but decided against it as I thought it would have provided a dampened index relative to a measurement based on the absolute variability in oil price. I surmized that the SD of oil price volatility (and not coefficient of variation) would be more proximally related to increasing investment risk - which is where I wanted to take the arguments that were developed later in the essay.

The approach used is not perfect. However, the aim was NOT to clear the forest, but to cut a narrow path through it. As you and others point out my approach tends to accentuate volatility. However, I think I faced a classic signal-noise probelm. The pattern may not have been as obvious if I'd "turned down the gain" and used an alternate approach.

A strength may not be so much in the manifestation of single peaks (which may be noise), but in the multi-year nature of the pattern that emerges - further reinforced by the correlated patterns with the other variables looked at. The human brain is capable of all sorts of narrative fallacies - but it was hard not to look at what I saw emerging as I played with the numbers and not conclude something interesting seemed to be going on.

Regarding Professor Hamilton - in reply to Jack later in the comments I point out that the core parts of my essay - namely the hypothesis and all figures up to Figure 5- were posted on line before both papers by Professor Hamilton were published on the relationship between oil price and GDP.

Some comments above are way too harsh (mine too?). The concept of a volatility impact - as opposed to a price level impact - is interesting, and doesn't get much attention in Hamilton 2009.

My point was just that your chosen volatility index is contaminated with a strong raw price signal, so some of your observations may reflect simple price increase rather than volatility. I saw the rolling average thing and understood it as an attempt to address that, but a better up-front choice of volatility index might have avoided the need. Perhaps Hamilton will suggest one.

Increasing market volatility with increasing scarcity is no surprise. I agree that the current scarcity process began in the late 90s - it's there is the raw price signal (below, log scale). But there doesn't appear to be much increase in relative volatility (wiggliness within the price channel) until quite recently. There's a strong burst of volatility from 1998 - early 2002, then nothing much until the 2008 spike and collapse. Those are the places where the price breaks the inner channel.

Hi Gergyl,

Thanks for getting back and your plot.

You're right - if I am saying anything useful (and perhaps distinct from Professor Hamilton) it is that primary volatility spikes are unitary phenomena that once above a certain threshold may propagate pulses-like effects into other important economic variables.

Maybe its my background, but I began to think about the spikes by analogy to a well known unitary phenomena in biology -the action potential e.g., such as those driving the heart beat. Extending this a little further maybe an above-threshold volatility spike in oil price triggers a reactive twitch in inflation rate instability in a manner analogous to an action potential triggering the contraction of cardiac muscle.

I could go on (and on) but lets hope the economy is not going into ventricular fibrillation !

Good plot however I think that we are now on a new channel i.e the wrenching price change was a transition point to a brand new channel just like the price minima at the start of the channel your show.

Exactly what this new channel will be is obviously not yet clear however I'd argue projecting the old channel forward is not the correct approach.

However my current estimate is that your green projection is actually either the upper or lower bound of the new channel. The MSM claims its the upper bound.

I of course feel its the lower bound. In fact if you go with the assumption that we just now entered the lower bound of our new channel then it upper bound is somewhere at 200-300 or so to early to know the slope for sure.

Or we just peaked near the top of the new channel and prices should now fall over the next several months.

I've posted several times that we need to see how things go over the next several months. Your post hopefully illustrates that its not clear yet whats happened.

Perhaps we are on the old channel I really doubt it but the next channel is not well defined it could just happen to line up with the old I'd argue that more likely its a new channel forming displaced significantly vs the old one. Regardless its literally to early to know and you absolutely need 3-4 more months of data before you can even begin to guess whats happening.

It's ace's projection from back in May, not mine. I see he's recently updated, but haven't looked to see if he's moved much. AFAIK it's just a classical elasticity calc based on his megaprojects-guided supply decline estimate. Looking good so far, but early days, as you say. Like someone said, watching paint dry...

Gergyl,

Do you have or know where I can get my hands on the raw data from which this chart was generated ? If so, would you be so kind as to email them/it to me - Therramus at gmail dot com.

I'd like to play with these numbers some. I could re-generate it myself from log transforming numbers I have in hand - but it would be helpful to have the actual data this plot was based on.

Best wishes

The way that volatility should be measured for any price series is the volatility of change, not raw prices. Otherwise changes is nominal price would improperly imply higher volatility. This can be done easily through a logarithmic transformation of the price data. The method used here exaggerates volatility.

Hi Kingfish,

Thanks for your suggestion. I may do a log transformation - though have an idea I already tried this. Will have to look at my notes. May have not gone with it because of my desire to keep the index as simple as poss.

Please also look at to my comments to Gergyl on why I went with the absolute index used. In brief, it was mainly because the focus was NOT on the amplitude of the spikes, but on their timing and in turn, the timing of oil volatility spikes in relation to the volatility of the other variables examined.

What caught my eye was not individual spikes (which when taken alone are probably difficult to distinguish from noise) - but the distinct pattern of spikes that emerged after 2004. This sequence of repeating spikes was quite unlike anything that I could see on the chart of the 40 or so years prior to 2004.

Back to the reality what our politicians think of oil prices and their function, here the new Liberal leader in Australia:

He might be right with "all sort of things suddenly become possible" but not in the sense he is using that term.

Read more in my post:

New Liberal leader did not know what peak oil is

http://www.crudeoilpeak.com/?p=727

The high volatility in oil prices is actually one of the reasons why it will be so difficult to develop alternative fuels.

Back to the reality what our politicians think of oil prices and their function, here the new Liberal leader in Australia:

*REALITY*?!!

What I'd like very much to do do is put our idiotic leaders and their delusional non scientific economist soothsayers and toss them into Dara O'Brian's "Feckin Sack" along with all the other morons and liars that are already in there and start whacking away at the whole lot of them with some sticks.

http://www.youtube.com/watch?v=VIaV8swc-fo

It's a good chuckle.

FMagyar, you do find some good ones!

One heck of a piece of work. Amazing in the detail.

I haven't read it all but one single sentence struck me hardest.

To wit:"Top of the list is the hubris and greed of Wall Street."

As we recall the financial district suffered the WTC terrorists attacks to the tune of about

3,000 dead in Sept 11,2001.

The nation as a whole turned out in sympathy and grief and literally thousands of us went to their aid. We wept, we were humbled and we did all possible to assist there.

Then the smoke cleared and life resumed and what then occurred?

This is the way they paid the US Citizens back? This is the filth they became or already were?

Many good people died then.Some apparently who were not so good people.

They then 'attacked' their own kind,the citizens of this nation. This is what we now understand. They are crooks.We now suffer as a result and many are suffering due to their actions in the financial world.Loss of jobs. Loss of investments. Loss of homes. Families barely getting by. Our nation sinking slowly to third world status.

Shadow banking? Thief on a massive scale. No punishment rendered. When if ever will punishment be meted out? Never since some of them are now in Government and still controlling.

Folks we are fighting the wrong war in the wrong places. Where is the anger and screams for punishment? Nowhere.They are still at it. They must have taken up a new screed "Take it all, every bit for we deserve it for bad times may come and we rule."

Who watches the watchmen?