As Refineries Close, New Stresses are Added to the System

Posted by Gail the Actuary on December 5, 2009 - 10:45am

In the past several weeks, we have seen many reports such as this:

Colonial Pipeline Limits Gasoline Supply Shipments for Cycle 70

Colonial Pipeline Co., which operates the largest pipeline linking U.S. Gulf Coast refiners and East Coast markets, will limit shipments of gasoline because orders exceed the company’s ability to deliver fuel on time.

The Alpharetta, Georgia-based company issued the requirement, known as an allocation, in a bulletin to shippers for the 70th cycle. The restriction applies to shipments on Colonial pipelines north of Collins, Mississippi.

Companies will be able to ship a pro-rated portion of their original nomination, based on their shipping history over the past year, according to Colonial.

With the assistance of Jane Van Ryan at API, I contacted to Steve Baker at Colonial Pipeline, to find out what is happening. I discovered the oversubscription seems to be related to refinery shutdowns in the Northeast.

Many of you will remember that Colonial Pipeline is the big pipeline that carries finished oil products from the Gulf Coast up to the Northeast part of the United States.

I live in the Atlanta area, so I remember when there have been gasoline disruptions because of inadequate supply. This has happened twice: once following Hurricane Katrina in 2005, and again in September 2008, following two gulf hurricanes.

When I inquired, I found out that there are really two parallel pipelines. One carries only gasoline products; the other carries distillate products. The line that is running short of capacity is the gasoline pipeline. (If only one is running short of capacity, it is not too surprising that it is the gasoline line. Distillate products like diesel fuel are now in very abundant supply; gasoline is at closer to normal levels.)

When I asked why demand was so high for gasoline pipeline capacity, one of the reasons mentioned was that shutdowns in refinery capacity in the Northeast were causing more demand for Gulf Coast gasoline. (If a refinery closes, it presumably will stop importing crude oil, and will also stop producing finished products such as gasoline and diesel. This supply needs to be replaced somewhere else.)

In checking in the news, I see two different refineries recently mentioned with shut downs:

Valero to permanently close Delaware City Refinery

This is a 192,000 barrel a day plant in Delaware. The story above indicates it was partially shut down early this year. No exact date for closing was given, but it sounds to be around the end of 2009, so the final shut down hasn't really taken place yet.

Sunoco idling Eagle Point refinery, slashing dividend in half

The other refinery closing was that of Sunoco's 145,000 barrel a day Eagle Point refinery in New Jersey. This may have taken place over a period of time, but did not finish until December 1, 2009. So at this point, we really haven't really felt the full effect of these two refinery shut downs. Even so, gasoline distributors are putting in more orders for gasoline from the Gulf Coast, to help offset the expected decline in gasoline refined in the Northeast.

Another reason Mr. Baker gave for the high levels of orders is that the price of gasoline on the Gulf Coast is relatively inexpensive now. If given a choice between importing gasoline from the Gulf or gasoline from Europe, gasoline from the gulf is a getter deal. So perhaps European supply is a little on the short side, or the falling dollar makes what is available more expensive.

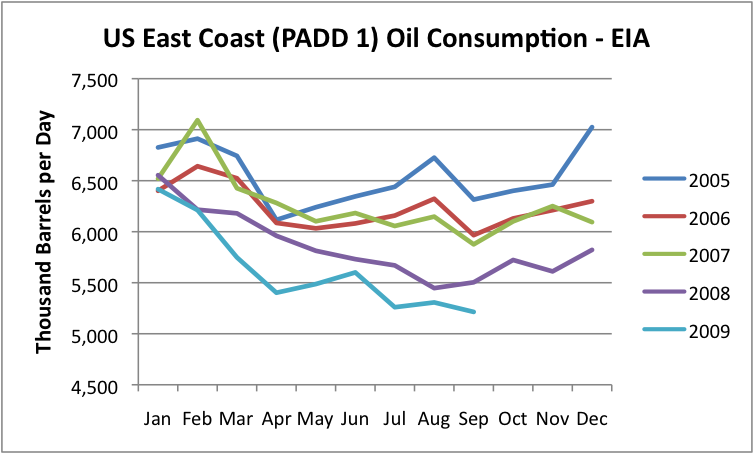

It is not too surprising that refiners are shuttering refineries in the Northeast. These are likely among the oldest refineries, and oil consumption in the East has been dropping for several years, as can be seen on the graph above. Profit margins have also been low.

Will the refinery shutdowns in the Northeast cause a gasoline supply problem? With supplies as adequate as they are now, probably not, but it is a situation to keep watching. There are several different approaches that can be taken to make up the shortfall caused by the refinery shutdowns:

1. Oil that would have been imported by the two refineries that are being shut down can perhaps be imported by other refineries in the Northeast, so the refined product will still be available in the Northeast. The amount of capacity being shut down amounts to about 20% of total refining capacity in "PADD1" (the East Coast), and production has recently been running at about 75% of capacity. If the remaining refineries run at close to full capacity, the other refineries could theoretically make up the difference--but it would be a stretch.

2. More refined products (rather than crude oil) might be imported from Europe.

3. If pipelines are full, ships could be used to transport gasoline from the Gulf Coast to the Northeast.

So there are options that can work, as long as everything is operating normally. The question is what happens when there is a shortfall, such as from a hurricane, or a supply disruption from Europe. Then it seems like there may be even more buyers dependent on the Colonial Pipeline for supply.

One thing that is annoying (to someone living in Atlanta, anyhow) is that if more customers want to use the pipeline than the total capacity, it appears that all of the orders are prorated by the same percentage. The problem I see with this is a place like Atlanta is not on the coast, so is 100% dependent on what we get from the pipeline. If Atlanta orders are prorated because someone in New Jersey would like to order more gasoline, we are stuck with getting along with whatever is available (and possibly long lines at gas stations, as with the two hurricane situations). If New Jersey or Baltimore or New York are "shorted," they at least have the option of receiving shipments by sea, either from the Gulf Coast or from Europe.

I suppose with time, and the possibility with higher prices, this will all work out. But one doesn't like to see Colonial's gasoline pipeline already being utilized at of 100% of capacity, and orders being prorated, even before the two refineries that are being closed are fully off line. The system seems to have very little slack in it. Such systems are the ones most prone to disruption.

I am totally baffled that any refineries are staying in business at all, these days. I really do not understand the economics here. As oil prices sky-rocketed exponentially from ten bucks to nearly $150/bbl (from 1998 to 2008), gas price only more-or-less linearly rose from about $1.50 to (briefly) around $4/gallon. Presumably, all the economic hit of this difference came at the refinery level. Yet enough are still in business to keep most of our happy motoring ways humming along. I am left scratching my head (and not just because of my drying scalp).

Unfortunately for you, Gail, and my sister and many others in the area, Atlanta seems to be at the end (or really at the middle, which in this case appears to be even worse) of the pipeline, much like No. Dakota. It looks as though you North Georgians will be on the brave new forefront of adjusting to both an energy insecure world, and a climate/water insecure environment.

Best wishes on both fronts.

Dohboi

Last year ethanol plants were under the gun as corn feed stock prices rose and ethanol/gasoline prices collapsed. This year it appears to be the crude oil refiners facing the bullet. Those that shut down first are the least efficient or worst managed as in the case of ethanol.

But if oil consumption is falling in the Northeast there may not really be a problem for Atlanta. Ethanol is bumping up against the 10% blending limit and if it is raised to 15% some relief is in store. And European gasoline surpluses are well known as Europeans love their diesels. Plus falling consumption due to smaller cars, conservation or whatever would enable the remaining refiners to make up the difference.

It will all work out albeit with some hiccups along the way.

Even before the refinery closures, imports to PADD1 seem to be dropping faster than PADD1 consumption. So the volume of products that were needed from the Gulf was actually rising slightly, before the permanent closure of these refineries. It certainly wasn't declining.

Colonial Pipeline looked at the question of whether to add additional pipeline capacity, and back in February 2009, announced that they had decided not to do so. This is a folder explaining why adding additional capacity was deemed so necessary (rising demand). But back in February 2009, the company announced:

I am sure Colonial can figure out that what they need is a full pipeline. There is no point in constructing a partially used one. So they would rather put buyers on allocation, than build a new pipeline that is barely used.

Morning Gail,

Thanks for the post. I'm about 2 hours north of you and, as an aside, our 6 month old poodle puppies are out playing in their first snow. They take such delight in the world around them. They are often a nice distraction from things TOD.

Question: If there is an abundance of diesel, why has it gone up more compared to gasoline as of late?.

As for Colonial, I did some survey work for them in the 90's and we were often struck by the condition of the pipeline in areas. It seemed to me that they weren't investing a lot on maintenance. I hope that has been corrected, as we are more reliant than ever upon their services. I think that the additional set of pipes would have been a good idea, if only to add redundancy.

One cannot get any information from the Colonial website about the trend in maintenance budgets over the years. One would expect that the need for maintenance is rising, as the pipeline gets older and older. Colonial talks about it 46 year history, so one would assume that at least some of the pipeline is that old.

The owners of the pipeline are oil company affiliates. We know that some of them are cutting back elsewhere (for example, Conoco Phillips). So I would not be surprised if there is pressure to keep maintenance costs down.

Does anyone have any maintenance information for Colonial? Other than the two big outages, I can't think of any others.

My experience with large fluid flow systems (steam, gasses, liquids) tells me a couple of things: failures often occur in clusters and usually occur when the system is at full capacity. Unlike the Alaska pipelines, the Colonial and Plantation systems are mostly in-ground and hidden from external view. They use "pigs" to survey the condition of the system from inside, visually and using ultra-sound, etc. To do this properly, sections of the system must be taken out of service, sometimes for extended periods. My bet is that there is a lot they don't know about their pipelines.

Besides just getting older, aren't these facilities having to handle more and more acidic (sour) crude? I would expect that the combination of old facilities and ever more corrosive liquid running through it would spell disaster for many of these operations. But perhaps I'm missing something.

Colonial is a product line, not crude. Sulfur should be even less of an issue with ULSD as the standard for middle distillate.

There have been maintenance issues in the past: Colonial pipeline to pay $4 million for 1993 oil spill

colonial pipeline - Google News Archive Search

This could get to be a problem for people up in my neck of the woods-northwestern NC ,SW Va.

I have a friend who drives a gasoline tanker.During the last delivery crunch when he couldn't load at the usual terminal, his company was trucking gasoline all the way from the coast and some stations ran dry in this area.

Will somebody explain just what PADDI I is?

There is a particular list of states in PADD 1. In fact, there is a PADD 1A, which is New England; PADD 1B which is Middle Atlantic; and PADD 1C which is lower Atlantic.

The EIA has any number of data exhibits that are available by state, or grouped into PADDs. For example, on this sheet. If you click on the drop down menu that appears on this sheet, it will give you a list of precisely which states are in PADD1. It is pretty much the list of states that border on the Atlantic Ocean.

PADD is a left over from WWII. You have to remember that continent spanning pipelines and interstates are a fairly recent development. It use to be only railroads could move resources from one part of the country to another. So planning was that much more restricted. If I remember correctly they were set up along the lines of geographically isolated areas (for that era).

http://en.wikipedia.org/wiki/Petroleum_Administration_for_Defense_District

From Wikipedia, the free encyclopedia:

"The United States is divided into five Petroleum Administration for Defense Districts, or PADDs. These were created during World War II under the Petroleum Administration for War to help organize the allocation of fuels derived from petroleum products, including gasoline and diesel (or "distillate") fuel. Today, these regions are still used for data collection purposes.

The Petroleum Administration for War was established in 1942 by executive order, and abolished in 1946. The districts are now named for the later Petroleum Administration for Defense which existed during the Korean War. It was established by the Defense Production Act of 1950, then abolished in 1954, with its role taken over by the U.S. Department of Interior's Oil and Gas Division."

http://tonto.eia.doe.gov/oog/info/twip/padddef.html

Gail – I’ve seldom dealt with the pipeliners in any great detail but I do understand their basic economic analysis. Just like with oil/NG drilling projects the time value of money is a huge factor. In their case it’s not the price of the products they transport that greatly determines profitability but volume. Most p/l projects, either products, oil or NG need a certain minimum through put to justify. If I want a NG transport company to pay for a line to transport from my well they’ll do their own independent analysis to make sure I have enough volume to justify the investment. Given the PO conversations and the fact that a lot of imported product could by pass them via sea transport to the east coast they are probably justified in their hesitation.

Not sure if it would be practical or if the end users would want to put themselves on the hook, but they could develop a utility-like arrangement where the p/l company is guaranteed a minimum return for the expansion investment. But that brings up the same problem some utility customers are starting to face now: reduced consumption requires price hikes to meet the minimum return. Basically it boils down to the cold hard fact that if consumers want guaranteed supplies they are going to have to pay for it.

I think it's unlikely that Colonial will ever expand capacity.

Imports from Mexico and Venezuela aren't growing, and our GOM production is nothing stellar, This suggests long term supply trends are unfavorable.

Then there's Peak Automobile. I suppose we may see growth in that industry again, but I think pigs will fly first.

The Colonial operators would be nuts to add pipe.

...wandering off topic here, but I wonder how this bears on the new shale-gas plays that have been added to the US NG resource base, given the possible very short lifespans of individual projects.

A very big factor dax. Initially lack of p/l's appeared to be a looming factor in the NE TX/LA shale gas plays. But the high rig count and impressive initial flow rates got them spending big bucks on p/l expansions. Haven’t seen any detailed analysis but I suspect those pipeliners are more then a little nervous today. I doubt they planned on long-lived wells but based their economics on a continued high rig count. Now with the drilling activity way off they have to be worried. As a very crude measure most major p/l projects take 4 to 8 years to recover the initial investment. But that's based upon volume assumptions. They may be hitting those volumes today but a couple of years out they could be in a lot of trouble.

My parents have land in the fayetteville shale area. The word on the street is two wells per section is needed to justify the cost of the lease and infrastructure.

Here's a Crude Oil and Products Pipelines map from the 1970 National Atlas of the United States of America. Trunk lines have been added in the interim but nothing major I'd warrant, and this is still a valuable resource 39 years later.

This Week In Petroleum features a Genealogy of Major U.S. Refiners. Anybody remember Diamond Shamrock or Amerada Hess?

EIA also has its Market Assessment of Refinery Outages Planned for October 2009 through January 2010, which includes Eagle Point's idling in its forecast, and nonetheless showing below average outages for 4Q. Maybe everything else in the country is running full steam? Nothing in the news about potential shortages, Colonial is celebrating pushing past 10 million hours without an accident though.

NC's legislation is being proactive about facing future shortages: Leaders Say State, Charlotte Will Be Ready For Future Gas Shortages

The EIA certainly tries to follow the refinery availability situation. I found its Market Assessment of Refinery Outages Planned for October 2009 through January 2010 earlier.

As refineries close for financial problems, there is likely to be less US demand for unrefined crude. Instead, we will be looking to buy refined products. There are different pipelines for refined products than unrefined crude, so there can still be strains on one part of the system, even if in total the amount looks to be lower.

I think with the oil system as with everything else, it is Liebig's Law of the Minimum that applies. If there is a major pipeline repair that is needed, or a storm outage, or an electrical outage, the system comes to a halt. There are theoretical ways around a problem (trucking gasoline to destinations), but they don't work well, because of the volumes involved. If multiple systems can be set up in advance--gasoline by boats from the Gulf to the US Northeast--that is more protective.

Gail -- regarding your comment about a greater US dependency upon imported products it's a good time to remind folks of a significant development IMO that had very little (if any) notice by the MSM. I saw one report several weeks ago noting that the prime minister of Aruba saw no reason to stand in the way of the Chinese acquisition of the Valero refinery in that country. If memory is correct this is the second largest refinery in the western hemisphere and most of its products are shipped to the US. Add that to the major Chinese acquisitions of Vz crude oil, I think it's a fairly obvious business plan on the part of the Chinese.

With regards to the plans that KLR noted above of the NC politicians to force refiners to set up secondary distribution I can't think a more significant motivation to make Colonial suspend any thoughts they had about expanding their p/l system. Those unintended consequences slap us again perhaps.

I hadn't noticed that the Chinese wanted to buy up the refinery in Aruba, but with all of their mineral-related purchases elsewhere, it stands to reason. Thanks for pointing this out.

I realized that perhaps I should have looked farther. I see that Valero on September 30 was reported to be closing 235,000 barrel a day refinery in Aruba for economic reasons. It had been shut in in June for 2 - 3 months.

Shell is considering closing the Montreal East refinery in the near future. Since the US currently imports some gasoline from Canada, this could reduce the availability of such imports.

With margins as bad as they have been, it would not be surprising if there are others.

I know this is off topic, but your post made me want to mention a few things regarding China, and its massive investments in Minerals/oil/lng ect and the conventional consensus surrounding its dire implications for the U.S.

I understand as well as anyone, the "risks" of the US being so indebted to China, or any other nation. I can understand many people holding great concern, and even outright fear, of what China could to the U.S. if China so chose to harm us, economically. No doubt, damage could and would, be done.

That said, I would like to now point out a few things most people are not aware of. I know we all come here, from diverse backgrounds, with unique skill sets, and we all come here for different reasons. I have a serous interest in Geo-political grand strategy, and food and energy security. I incorporate what I learn here, into my theoretical Geo-political "gaming scenarios".

One of the more nasty, but unappreciated tools of American power, is food. If China desired to engage in "Monetary conflict" the United States is far from defenseless. In fact it is quite possible, that if China so wanted to engage in "monetary conflict" this economic crisis has only served to strengthen the United States, and its leverage over China.

Wile the United States Exports more Wheat, then anyone else, China grows more Wheat then anyone else. Today, demand for wheat inside of China is only growing. This said, the more the "middle class" is developed in China, the more you have people moving up the "Food chain".

Consuming more meat. Cows require a lot of feed, -AND- water to produce meat.

Given "climate change" China's water supply, from the Himalaya mountains is shrinking.

Some people suggest the shrinkage is vast and drastic.

Everyday, without intended to do so, China is growing more dependent on our farms. In the event of "Monitairy Conflict" with China, no US congressional official could move to block wheat exports to China, because that would be "Protectionist".

However, if China choose to engage in "Monetary conflict"... Given our growing fiscal deficits, it would be "politically sell-able" for the US to cut not only U.S. farm Subsidies, but farms in other nations that we support and assist as well. In fact, many Nations have been demanding the U.S. cut farm subsidies for years now.

If we did this, it would then send the price of Wheat, thru the roof.

Just as China "dumping" U.S. debt would hurt the U.S. more then it would China....

These actions taken by the U.S. would hurt China, more then the U.S.

It should also be mentioned that China alone, imports 70% of ALL US Soybean Exports.

Again, No U.S. congressional rep could/would/should block the sale of the soybeans to China.

However, if China wanted to engage in "monetary conflict", I believe everyone here would agree that such a move would cause a rise in oil prices. Such a spike in fuel costs, will result in the U.S. congress mandated X amount of Soybeans be used for "Bio-Diesel" buses.

Of course, our doing this would have nothing to do with China... [cough]

we would just want more "green" and cost effective public transport.

Yes, China can cut our credit supply and it would be truly awful and damaging to our economic stability as a nation. But! We can raise intrest rates, and survive it. However, The U.S. can make drastic, and FAR more damaging cuts to China's ability to feed its people.

Further, if funding for U.S. AID food assistance operations throughout Africa, were to be cut drastically, or completely: The African nations that China is increasingly investing in, and dependant upon, for mineral and energy production could be reduced to famine stricken, failed states, in a matter of weeks.

I would wish to present these thoguhts further, but I am so off topic, I will end here.

Just food, for thought. [Pun, intended]

You make some good points, but I think it is difficult to figure out all of the linkages. We have already discovered price doesn't necessarily go up. If credit unwinds, it can go down as well, and credit unwinds are a very definite impact of oil shortages.

We need oil to grow our wheat and soybeans. If we have to barter, the food is likely to go to a country that can give us oil to enable to keep our system going--Saudi Arabia or some Middle Eastern country perhaps. But if our only problems are with China, and prices go up, maybe things will be as you say.

We are dealing with a very complicated subject.

Blue -- I see matters much the same as you. I don't consider my position debatable...just an unprovable opinion. As Gail correctly points out there are many variables. But my vision is more of rather grand joint venture between the US and China in the future. We have a market for their goods and the food to feed their population. They have the US $'s to pay for our crops. And by supporting our debt they allow us to keep our unsustainable consumption going forward for a while longer. Between their economic moves to tie up resources and our military/political power to keep their resources secure I see it as match made in heaven. Or hell if you happen to not live in either country.

I think in general you might be right however what happens to Korea and Japan ?

Asian politics although quiescent since WWII are far from dead. And of course the Russian/China/Japanese issue can heat up again. I'd argue nothing has intrinsically changed in Asia at the political level its just up till now the deep problems have been papered over. Everything that was a problem before WWII has not been solved.

Korea is esp problematic. And of course Japan has a very painful choice wither quietly in its old age or resume its militaristic approach. I personally don't think Japan has much choice and suspect they will rearm if US/Chinese relationships become to cozy.

We could even see some really strange things develop like a Russia/Japanese/Korean alliance vs China/US.

Certainly depending on how things go we could well see some people switch teams if you will.

A Brazilian(South American)/Chinese alliance vs the US/Russia could even happen.

In a sense we simply don't need one of the worlds major economies. This could be expressed as a general reduction of all the major economies or as collapse of one of the big countries somewhere in the world. I tend to think that it makes more sense for one of the big players to eventually crumble rather than a continued general contraction.

If so then a Orwellian like rearrangement makes a lot of sense as the status quo is shaken. Asia, Europe, South America and of course Mexico all I can see is the high probability for things to change fairly dramatically in some way how who knows. Mexico's collapse is probably something impossible to bet on as you can't find someone to take the other side. How that will ripple through international relations is difficult to determine. Does China save Mexico ????

Crazy maybe maybe not anything can happen now.

I agree with you memmel: all kinds of sub plots possible. Japan seems to be latching on Indonesian/Austrailan LNG as a future lifeboat. The EU appears to be figuring out how to deal with Russia. With all the different plots going on there's bound to be some interesting unintended consquences. It would be amusing to watch if there were't some truly scary possibilities.

FIRST: I thank all of you for your VERY thoughtful and respectable replies. I was not sure, I would get such kind responses! lol. It is TRULY nice to see measured, thoughtful, mature responses.

That said... I think it is possible that China, and most of Asia could suffer political and economic collapse very quickly, and with little warning. I understand many may not agree... and I respect that. But just some things to consider:

When the property bubble in China pops the way ours did here in the US, people are gunna be upset with the Chinese leadership. I think its gunna get nasty.

Another "wild card" to me, is the DPRK. [North Korea] If there is a coup attempt when Kim "eats it", [Highly Possible!] your going to have some very awful things happen in Asia. If its anything like the Berlin wall falling, it could be catastrophic for the entire region.

Your going to have a possibility, if not probability, that North Koreas FLOOD into South Korea, and parts of China. I think China would post troops around the border do that North Koreans could ONLY go south.

If this happens, South Korea is going to take a MASSIVE hit, economically. Literally MILLIONS of unskilled, malnourished, poverty stricken people... basically, "invading" the #3 Economy in Asia.

The last few paragraphs on "Oplan 5029" offers some rather horrific financial analysis as to what might happen to the the South Korean Economy in the event of "re-unification". http://www.globalsecurity.org/military/ops/oplan-5029.htm

South Koreans losing 1/3rd of their income!

[It should be noted, that Germany is STILL struggling with the effects of 1989 today]

Unrest in China... would be pretty awful. I've seen a lot of people say that a "revolution" in China would doom the dollar, but... frankly I think people would run to buy up US bonds, just to seek safety. At least until the world had a "Clear" idea as to what laws/form of Gov China was going to have in place next.

But that could take half a decade before a "democratic China" got "investor trust"...

and what would be the investment prospects by then?

But again... If China "goes", its very possible there would no longer be a government in Asia that supported the DPRK. So, I think it would be fair, to say that a political collapse in China, would also result in a collapse of DPRK as well.

Be this the case, suddenly, the #1 and #3 economies in Asia, just took MASSIVE hits. If I am an investor, I park my money in the US and EU... and don’t even think about investing in Asia for perhaps a decade?

When the USSR fell, the money was raided and sent thru NAURU [http://en.wikipedia.org/wiki/Nauru#Economy] and then invested and hidden in the "west". I don’t see why it would be much different this time if the Koreas AND China had civil and or political unrest that resulted in a collapse of one, two or all three.

And be the worst case, a "Fail" of all three, come true...

I think suddenly the EU and US investment prospects would be the only games in town.

I'm not saying any of this to argue. Just things to consider. I VERY MUCH hope, that the U.S. and China and the world can "just get along" but... with so much going on in ESP in Eurasia with religious fanatics, and nationalism... and so much going on Geo-politically with Oil and LNG... I cant see a good ending.

Armenia and Azerbaijan are "on the brink". And there is now ALL SORTS of fights going on in the region over the electrics grids, and access to water supplies that allow the dams to produce electric. This cant possibly end well.

I feel a need to question if Asia is really on "the rise"... or... on the way down?

Very nice summery of the real world out there Blue...thanks. Many might disagree with some of your points. But then many of them would have said that the old Russia and the Sha of Iran would never be toppled. If you're not familiar with the "Black Swan" book I suspect you would find it interesting. One characteristic of a BS is that almost no one sees it as a possibility. One of the more important points I took away from the book was that while one might believe that X is very unlikely to happen it doesn't mean you can take steps to minimize the negative effects or even take advantage of the situation if it does, in fact, happen.

How many would think the gov't of China could ever fall via the efforts of the common man? But King George thought the same of those damn colonialists, the Russian gov't thought the same of those crazy Afgh's attacking tanks on horseback and the Sha, with the third largest attack helicopter fleet on the planet, thought the same about his rabble.Like a man once said, it's not the dog in the fight but the fight in the dog that often determines the outcome.

I wonder if Plantation is full? It is only about 1/3 the volume but if it isn't full then there is some slack in the short term to help if Colonial is full.

You are right. Plantation Pipeline goes part way, from Louisiana to the Washington DC area. I don't see any notices that it is "on allocation" at this point, so it may have capacity for its piece of the journey. It could help take pressure off Colonial.

Steve Baker told me that Colonial had been allocating capacity now for 11 five-day periods, so this has been going on for quite a while. If Plantation were a real option, it seems like it would have solved the problem. Maybe a major part of the shortfall is for the Northeast area.

Well, of course I`m not an expert but weren`t Stoneleigh and also Kunstler saying that gas shortages would occur before too long? Maybe before too long is sooner than we expected. It does seem like almost everything in the economy is changing, large scale operations become losing propositions. I can see many shut down stores and vacant offices around my area so why should the oil business be any different? It seems like it`s just another business in the end. If it doesn`t pay then that`s it, lights out. It seems like a fragile business actually, with so much product so far away and so hard to come by because it`s miles down under the earth. And for such a luxurious hard-to-get product you must have a wealthy clientele otherwise it just isn`t worth the trouble........

Actually, gas shortages might be beneficial because they`d spur people to localize faster. Of course I know such a situation would freak a few people out too....my car-loving, automobile-dependent relatives over there for a start!!

The Atlanta area is one of the most car-dependent areas in our very car dependent country. It must have freaked some out pretty badly when they went from gas station to gas station with no gas available in almost any of them.

And of course we are all very, very dependent on water, another liquid that was at risk of shortage a while back in the same area, as I recall. Either shortage would be really bad. If both hit at the same time, it's going to be truly horrific around there.

Any thoughts of jumping ship, Gail? Your posts here are too precious to have you go down in a blaze of post-sprawl, mad max insanity.

The water shortage had a lot to do with too many electric power plants for the Georgia / Florida /Alabama area. I understand they very nearly had to take one of the big nuclear plants out of service for lack of water. This is still a very big part of the problem. We actually get quite a lot of rain. Wikipedia says Atlanta gets 50.2 inches (1.275 meters) of rain a year. This is more than almost any other major US city.

With immediate family here, it makes it difficult to leave.

Yet the Chattahoocee above Lake Lanier is not much more than a big trout stream, as is the Chestatee. The forests that still exist in the watershed above the lakes act like a big sponge, releasing the water slowly over time, nature's form of a controlled release. Its a wonderful thing until you exceed the capacity of the system. That is of course what is happening now, hence the water wars. Westpoint Lake, below Atlanta, is a mess. If I lived below Atlanta, I'd be pissed too. Some of the areas in north Ga. average as much as 60 inches/ yr. but the watershed just isn't that big. We just hit 65.50 inches so far this year (we're in the TVA watershed, but not far away). Not sure how to solve this one.

"It seems like it`s just another business in the end."

Its more than that, IMO. These pipelines are part of our essential infrastructure, similar to the interstate system or the power grid. In fact, even more so. If an interstate bridge goes down there is almost always a work-around, a detour, and the effects are generally local. If one of these pipelines fails, as in Katrina, the effects are widespread and enormous. That's why I feel there should be required redundancy built in. Ships and trucks have no hope of keeping up with demand. Further, these pipelines are vulneralble in ways that make our reliance upon them a huge liability. If the bakery down the street goes out of business you just drive to the next one. If the Colonial pipeline goes out of business, all of the bakeries do too, and you're probably not driving anywhere.

You make a good point. These pipelines, especially Colonial are really essential.

The EIA keeps pretty close tabs on refineries, but my impression is that pipelines kind of fly under their view. Pipelines seem to be joint ventures of oil related entities. I don't know if anyone really watches over them. If there are leaks, the EPA comes after them, after the fact.

It seems like leaks and general deterioration are the biggest concerns of the pipeline companies. See this paper.But an electrical power outage (outside of the pipeline's control) was what caused the big Katrina outage. If someone intentionally tried to blow up the pipeline, that could cause a huge problem. Or earthquake damage (mentioned in the presentation) could present a major problem.

Nice get. It'll take a while to work through. I noticed the ARC-GIS portions. That's what I was working on in the early 90's. We had a helluva time standardizing across platforms and data types, etc. Everyone wanted their own proprietary piece of the pie. Data conversions and accuracy were big, expensive issues. We ended up scrapping years of inaccurate data and starting from scratch in many cases. We did the same type of work for Southern Co. and their grid. Neat work at the time, converting paper drawings to highly accurate relational GIS databases. Our first GPS was a backpack that weighed about 40 lbs. My first laptop was an IBM tablet (286/20), about $8K, that was cranky as hell, but I was in heaven. It seems we've come a long way, but then again......................sometimes I miss Windows 3.2 and DOS. Where has all of this taken us?

The oil business, like any other business, is reliant on energy flow to power the necessary flow of materials and if that energy flow isn`t there then the business can`t function. I`m sorry if that isn`t what you wanted to hear, by the way!

Perhaps because of humans` long experience with steady supplies of solar energy (crops, water power, windmills, etc) we couldn`t process the information "one-shot deal" when we encountered petroleum energy. As a culture we simply had no experience with a one-off type of energy regime and so we couldn`t make a rational plan. It seems more and more clear that that is what happened.

But perhaps next time (if there is a next time) we won`t be so stupid!

I think Stoneleigh's reason for saying that gasoline will become unavailable is that she sees the economy heading for a hard reset. A lot of just-in-time supply systems will be disrupted by the ensuing chaos. And we've been slacking on routine maintenance for a while now. So once the refineries and pipelines drop below MOL, gas stations will close and there won't be an easy linear path to get it all restarted. The well-to-do will still be able to obtain hydrocarbons through private delivery.

In other news, Wile E Coyote will find that the canyon floor reduces his rate of descent.

I'm not sure I know what to make of the closing of the Valero Delaware City refinery.

While this is an old refinery (commissioned in 1956), has changed hands at least four or five times, and historically has had an atrocious environmental/safety record, Valero HAS invested several hundred million dollars in upgrades in the short time it has owned it.

The refinery, in it's present configuration, is designed to handle heavy high-sulfur crude. One would think that would make it a very profitable operation, given the supposed growing scarcity of the good stuff. However, Valero claims that that price advantage of heavy high-sulfur crude is no longer as great as it once was and is not enough to offset the higher operating costs.

Supposedly, Valero had unsuccessfully tried to sell the refinery, but evidently couldn't find any buyers. I could see Valero mothballing the refinery until more favorable economic conditions prevail, but to just walk away from such a huge investment is puzzling. Perhaps Valero as a business is highly overextended and is extremely desperate to maintain adequate cash flow.

This kind of volatility in such a vital economic sector is extremely disturbing and even downright dangerous from a national security standpoint. How can we maintain even a minimally stable energy infrastructure if the major oil companies and refiners are treating major facilities with no more permanence than property cards on a Monopoly board?

My suspicous side sometimes whispers to me that perhaps the oil industry (including the refiners) would not at all mind a crisis in the supply chain of refined products and may not be trying very hard to prevent such from happening. (No legally actionable collusion required here, just the big players knowing what needs to happen for a mutually beneficial outcome.)

The way things are going, it looks like we are not only going to be increasingly dependent on imported crude but also increasingly dependent on refined product. Not good.

Perhaps Valero is seeking greener pastures (or not so green may be the case) as much of U.S. industry has done, overseas. Another rat fleeing a sinking ship?

Ghung -- But that doesn't fit their supposed sale of Valero Aruba to the Chinese. I don't study refiners but it might be nothing more then a corporate reorganization driven by whatever factors.

Can't find the right chart but I know historically the refiners make their best returns when product/oil prices are at their lowest. It's their operating margins that determine profit. And high oil prices tend to push those margins very low.

"Perhaps Valero as a business is highly overextended and is extremely desperate to maintain adequate cash flow."

I guess that would explain both. Maybe the sinking ship is Valero itself.

Could be Ghung. Your thoughts seem to fit well with Gail's points above.

Saudi Arabia, the US & China (EIA Data)

The cumulative shortfall in Saudi net oil exports, between what the they would have (net) exported at the 2005 rate and what they actually (net) exported was 840 mb, from 2006-2008 inclusive, as US oil annual oil prices went from $57 in 2005 to $100 in 2008.

On the import side, the US and China are respectively prime examples of the OECD and non-OECD responses to rising oil prices.

The cumulative shortfall between what the US would have (net) imported at the 2005 rate and what we actually (net) imported from 2006-2008 inclusive was 687 mb.

The cumulative increase between what China would have (net) imported at the 2005 rate and what they actually (net) imported from 2006-2008 inclusive was 839 mb.

So, China not only offset our cumulative decline, their increase exceeded our cumulative decline.

This pattern is what I expect to see in the future--OECD and non-OECD countries battling it out for a share of declining net oil exports, with OECD countries generally being forced to reduce their consumption. I had been expecting more of a short term decline in US demand, primarily because of large anticipated reductions in government payrolls and government services (initially local & state, with the feds joining in later), but the stimulus spending is apparently postponing that day of reckoning. But I do think that the longer it takes for another downward leg in US consumption to occur, the less impact that it will have on global net demand.

Most companies, most governments, and most individuals are essentially basing their economic decisions on what I call the FIM--the Fantasy Island Model. On Fantasy Island, oil fields don't deplete.

In my opinion, a more realistic scenario is that oil importers worldwide, in just the past four years, have already burned through 20% to 25% of our post-2005 global cumulative supply of net oil exports.

In any case, based on our export models, governments worldwide are doing precisely the wrong thing at the wrong time--by encouraging consumption, when we should be doing everything possible to discourage consumption.

The oil infrastructure is now made up of a huge number of individual operations, each of which is treated as a profit center. We are seeing that owners are willing to walk away from them, and let the rest attempt to pick up the pieces.

I am concerned that the electrical industry now isn't all that different. With deregulation, there are lots of little separately owned components. Electrical demand is down now because of the recession, so it is difficult to make enough money to cover costs without rate increases. Adding renewables to the system further stresses the system. Some of the pieces are regulated in such a way that they can't go out of business, but I bet that some other pieces will find it increasingly difficult to pay off their debt, or will find it difficult to meet environmental regulations, and will shut down. I don't know enough about the industry to know whether this could cause a problem, but if it is an essential piece, it seems like it could.

Venezuela is highly overextended and may be one of the next sovereign debt problems (as in, default).

I recall a news report from a while back claiming OPEC increased the price of their sour crude to reduce demand as their method to cut production to force prices back up to ~$70 per barrel. This means that the bulk of OPEC's spare capacity is sour crude and there is currently no shortage of light sweet crude oil. The companies that invested in refinery capacity for sour crude during the price run up in 2007 and 2008, are now seeing their investments fail because the price of sour crude currently make refining unprofitable. The Valero Delaware City refinery seems to be a victim of OPEC's supply cutback a year ago. When demand for crude oil rises or production of light sweet crude oil declines causing supply and demand to intersect, the refining capacity for sour crude oil will not be in place. This means that OPEC's effective spare capacity is overstated. This combined with Export Land Model is going to cause a global supply crunch before most analysts expect.

The extra capicity has been killing marigins. If demaned never comes back. It's a good move. If demand comes back. It will be up in running in a few months with lower cost labor.

Perhaps just perhaps the real situation is not what we have been lead to believe.

So, what is your hypothesis?

I have a post in the works. After that then we can talk about hypothesis.

However as usual sht happens I got laid off on Friday so I'm doing a bit of scrambling. So far things look good but put a bit of a dent in working on a post.

However even before I get that out think about it why on earth after all the events that have happened would you expect that the truth and whats been reported to actually be similar ?

I'd think even without proof that people should be a lot more suspicious about whats happened. Things simply don't add up.

Heck back when Atlanta was having serious shortages after the Hurricanes it was barely reported in the news.

Maybe just perhaps if you look at all thats happened the truth is pretty simple the world is already seriously short oil.

A very simple effect that happens when you try and control prices in the face of a shortage is that you have supply problems. Does it not make sense give that oil is "cheap" now that perhaps the attempts at price control are causing the classic shortage issue when the free market does not set prices ?

http://www.econlib.org/library/Enc/PriceControls.html

For a good bit of 2008 we had expensive oil and no shortages. Yet perhaps just perhaps we are starting to see the certain effect of price controls which are shortages.

Obviously I have reason to believe this is true. But today at least while I still have a paycheck I have to go stock up on toilet paper and diapers and other consumables that kids like to use.

I'll send the paper to Nate Hagens early next week or perhaps Sunday for review.

I need to include some edits from the reviewers prob tonight.

I will be eagerly waiting... Good job!!

Thanks.

To conintue to try and get people to do a bit of critical thinking.

Consider that if we have had and attempt at price controls then obviously you have to have some means of rationing or they fail quickly.

So did we have A or B occur ?

A.) After the rapid economic collapse and hurricanes a savvy group of oil traders bought up the stranded oil and later used it to push prices down and buy up even more then held it for months betting OPEC would cut and hold prices allowing them a nice profit ?

B.) The economic collapse and formation of a large supply of oil stored off shore where not unrelated events. The hurricanes of course added icing to cake. And this stored oil was steadily rationed to keep prices contained and help slow the economic slide to manageable levels. Thats not to say everything went smoothly but all and all it seemed to have worked.

Is it A or B ?

And as I said of course eventually if it is rationing/price controls then as always it will fail. Regardless of how powerful you think you are you can't pull it off forever.

So classic economics at work or a set of coincidental negative and positive events ? After oil hits 140 a barrel ?

Question everything and think about it.

Excellent news.

Hopefully Nate and Gail find your writeup worthy of a full TOD post.

(edited: excellent news on your writing a post, bad news on losing your job :(

LOL I already have a interview I'm setting up. Took six hours from the time I got the news to find someone interested. Dunno what will happen but given my skill set I probably will find a job I could well take a big pay cut but I expect to see this over the next several years already I lived through steady pay cuts after the .com crash so it won't be the first time as long as I can work I'll be ok. I have zero debt and as needed rent a cheaper place. Whats interesting is like everyone its seems health care is the one issue thats a real sticker since I have kids. I've never come up with a good solution for that one.

Also this was not unexpected we where bleeding cash so I knew it was just a matter of time however I did not see the job market changing much so I decided to see if I'd get a decent severance and I did so...

Its actually a bit funny since I work for our London office and am just paid out of our US office. They kept my group but axed me in a generic cut but they kept the London office. Of course my CEO does not realize I wrote a lot of the core software for the product out of London that was doing well. My CEO won't even be talking to the London group till next week I'm interested to find out what happens when my boss tells him he axed one of the core programmers for the product he wanted to keep :) Its a big enough company that he does not know exactly what I do and no one in the US does since I don't work for them so I understand why this happened.

Certainly my group can make without me anyone who thinks they are not expendable is a fool however I must admit I find the situation a bit amusing :)

I guess I should not be laughing but its me that got the shaft but still its friggin funny. Its a Japanese company so I suspect they will just act like no mistakes where made no losing face but still ..

What I find really sad however is my group is small so cutting me is a huge blow to our capabilities on numbers alone it will make it significantly harder for them to succeed just as tremendous pressure is applied. So it really stacks the deck against them. They are good so they might pull it off but also the other good guys might just bail given the situation. Normally I leave well before this but like I said given the job market I felt gambling on a decent paid vacation was worth it so if I'm lucky I'll land on my feet.

If I'm really really lucky then I won't be able to find a job and will have to go learn to be a machinist I'm really tired of the computer business I've been involved for a long time and seen it all before. The same mistakes over and over again with truly new and cools stuff exceedingly rare. So in my heart I want out and I want to work with my hands as best I can given some physical constraints I have ( partial paralysis) not something I hide but its hard to do serious manual labor when you can't even lift a gallon of milk or a full glass of water. I believe I said that some of my problems communicating may be related to a car wreck and resulting brain damage but I also blew a disk in my neck did not fracture my spine thank god but quite a bit of nerve damage. I've had spinal surgery that helped a lot esp with the pain but ...

I'm bringing it up to some extent in this post to some extent just to let people know I really don't want to be a programmer but for a lot of reasons I don't have a lot of choice and one is physical. Of course certain writers make harsh assumptions about me that are simply not true since they don't know me. I really do want out of this BS world to build real stuff people need but you have to live as you can and programming is a world where its fairly easy to do good stuff even if you have some physical problems. I just recently lost a lot of the use of my write arm, fine motor skills still intact thank God so this does weigh on me. But you live life as best you can and this time around its getting slowly better.

Neurological problems are messed up some stuff works some does not no matter what your brain tells the limb to do. I'm thankful its just my upper body :)

Of course my physical therapy sessions aint gonna happen arrgh ...

Anyway perhaps to much personal info perhaps not but I hope at least a few people will be a touch more careful about judging people online. Its easy enough to make mistakes in person much less over the Internet. Sorry for the long reply but I have to imagine many people are having problems now and if your peak oil aware I think it makes it tougher and easy to fall into depression. So a bit of personal info will I hope help other people as they face the coming problems. Despite my doomerish meta view point I'm honestly really happy and outside of medical care for my kids I really don't have a lot of true worries I guess I mentally tuned out years ago I'm not sure what last piece of crap actually caused it but I do know I left the rat race mentally long ago. If you don't leave mentally and take the physical chances when they come then your probably going to have a really hard time if you face trials that are probable in the future.

I'm down to food,clothing, shelter playing with my kids and hopefully basic medical as what I care about all the rest seems to have simply disappeared over the years.

Well and beer :)

I hope things work out for you fairly quickly. Any time of transition is difficult.

Good luck Memmel!

I am most assuredly not a machinist but I worked in a large integrated shop once as a welder that did all sorts of repair and fabrication as well as offering a full line of custom machinist work in a busy industrial town.

This was in the pre computer days and there was a lot of fairly heavy physical work involved then.

I expect that since everything is mostly computerized these days , and guys wanting to do this kind of work who are really good on computers are to find even in a down economy,you can find a job easily if there is any industry nearby.

Fwiw, I hear that there has always been a chronic shortage of guys willing to work on cars who really understand computers and computerized controls.The trade schools teach mechanics the basics of running down problems by running various tests according to a decision tree.Apparently that's not always enough-I know that there are busy manufacturers reps out there who are called into dealers shops as a last resort, and I have reason to believe these guys are way better trained in computers and electronics than your ordinary mr goodwrench.

Cars and trucks are going to be around longer than you and I will be.There might be a real opportunity there for you since you are tired of the desk and skull work routine.

It is rather common for auto nuts to pay out good money to have computers reprogrammed .I have no idea how long it might take to learn this specialty but you can leave a computer , go get something to eat, come back for it , and pay out anywhere from fifty bucks for a cash "on the side" job on up to several hundred dollars for something that apparently uses up nothing but a little time once you have the data needed.

Yeah really not a lot to the computers that are in cars.

Near the end of grad school in chemistry I really wanted to go into sensor and now fabrication CNC stuff.

I designed my new web browser to allow integration of a cad/cam system even downloaded a open source one a while back.

Think of a Web client/Server that can build stuff for you and you get the idea.

As I get my project working better this little wake up call makes me want to really peruse this angle. I think as things get more messed up the ability to make spare parts for people will be cool esp if you can do it over the web.

No, memmel, C happened. When OPEC cut production to force the price back up last year, they raised the price of their least profitable grades, sour crude oil, to reduce demand putting the economic stress on the sour crude refineries.

This was being done while the price of crude oil was rising in 2007 and 2008: Heavy Sour Crude Oil, A Challenge For Refiners.

This is what OPEC did in late 2008 to restrict production: Heavy crude may hit light sweet parity on Reliance., January 5, 2009.

Gail's article today about the closing of sour crude refineries is the result nearly a year later.

So sorry, I guess nobody got the message:

Everything is perfect, you are supposed to be very happy!

Steve send me a email.

From your blog.

Turns out its 2002 by a whisker over 1999 they differ by a whopping 670kbd.

You may one small mistake the lowest price did not result in full capacity usage in 1998 so the price increase brought a bit more production online in the following years. 3.37 mbd spare capacity from the price low in 1998.

If you think about it a bit it makes sense that the actual production peak followed the price low if the low resulted in significant spare capacity.

Which seems to be the case.

Send me a email and I'll send you a draft you almost nailed it and I cheated to figure the above out :)

Your one of the few they basically got it right.

And I know I'm plastering Gail's thread with my own stuff but hell I lost my job yesterday I'm not buying a shiny new EV or Ethanol powered roadster regardless of if I get a new job or not. Of course our glorious leaders don't realize that I've just joined the swelling ranks of people who or not going to borrow a dime.

Not that I was not there any way but I was thinking about buying a EV if I could pay cash for it once they came out. No way in hell now would I waste my cash or take the risk of a loan now. I'll buy the gas I can or take the bus or ride a bike my little personal crisis cured me of thoughts I could be one of the few that could buy into the happy motoring EV future. And I assure you I'm not the only one that wont bite no matter how much cash I have since I've lost my security. To many people are going to hunker down just like me I think its simply to late to sell EV's and Ethanol/NG cars. Earlier this concern was theoretical but now its personal and obvious. Not in a million years sorry.

Translation: Don't you dare contemplate switching to another fuel while I empty your bank accounts into mine and wreck your country on the falling edge of peak oil.

Memmel,

Price controls are set by governments. I do not see any evidence of prices being set by governments. Rather, I see prices have fallen because demand dropped significantly worldwide. In the US alone we went from 21.7 mbpd to 19.8 mbpd, a solid 10% decline. And before you argue that a 10% decline should cause a 10% decrease in prices, I will remind you that prices are set at the margins. We did not see a 10% price increase as US consumption went from 19.7 to 21.7mbpd before the recession. Instead we saw a non-linear rise in oil prices. Thus it makes sense that as we head back down the consumption slope due to reasons other than declining production that we would see non-linear drops in prices. And we have.

Therefore, to bolster your position, you must demonstrate evidence of government manipulation of the price structure in an ongoing and constant attempt to set prices. I have seen no evidence of this at all in the oil market. If you lack such evidence, your assertion is dead on arrival and null before you even submit the paper to Nate. If you have such evidence, it ought to go to any of numerous congressmen or senators who would be more than thrilled to have evidence like that to further damage Obama's credibility.

Your assertion is only mildly interesting because the factual basis for it appears to be lacking.

As outlined above, while most OECD countries, e.g., the US, have shown declining consumption, many non-OECD countries, e.g., China, have shown increasing consumption. If memory serves, the last EIA estimate that I saw put estimated total global demand in 2009 down only about 2% from 2008.

Actually WT my approach concurs with this result. I.e about 2%.

Assuming we produced 67.48 mbd in 2008 ( Where on earth did that number come from :)

67.48*0.02 = 1.3mbd

For a while at least we had spare production capacity of at least 500kbd and a good bit of this was pumped. Say it was six months as a rough guess and looking at some possible numbers.

30*6*0.5 = 90 million barrels.

30*6*1.0 = 180 million barrels.

30*6*1.3 = 234 million barrels

Something like that fits pretty well with my results and also with reports of offshore storage amounts and builds onshore. Note not with the extremes that are claimed but we did have a nice mini flood of crude. Not exactly a glut but at least some respite. Of course there is a reason for the six month number.

Check your email but no doubt about it that 2% estimate is good and there is a valid reason its good. And if its a sharp drop consistent with how the financial crisis unfolded we do build a one time mini glut in the range of 234-90 million barrels. Even my approach gives this as very probable in fact at least 90 million is practically certain much over 200 gets questionable the highest I could see is something in the 200-300 million barrel range globally. I'd have to guess the US grabbed a good bit of this so maybe 100 million barrels with 50 onshore and 50 off ? Something like that has a very high probability of happening. Given the way the oil markets worked and the financial situation as far as prices go I'd say only 30-50 million barrels where actually needed to collapse prices. When the sky is falling it does not take much and I think we had more than enough. The way the price rose turned out to be consistent with the same reason I pick six months.

And it was probably a one shot deal not to happen again esp if you include export land. In any case all of it fits pretty dang well I'm pleased but like I said it was a one shot deal.

Hmm I'll try to answer.

Very short term i.e late 2008-2009 price where controlled by two things a short term oil glut and people bailing on oil futures trying to raise cash. All kinds of liquid assets crashes ummm like maybe the stock market. Last time I looked there was no shortage of stocks for sale. Mixing supply and demand with a liquidity crises is simply ludicrous.

Plenty of real producers and consumers of oil where blown out many Airlines etc.

On the producer side those that hedge out right made out like bandits those that did not got killed. We of course will probably never know for sure who was on the right side of the trade except its notable that Mexico was.

As far as US demand goes I'll have to say and you will see later I can't get anything but global numbers no way can I get individual country numbers but oil is a global commodity looking at questionable numbers from one country is simply not sufficient to talk about oil. And globally it was a very sharp monetary crisis not sudden changes in demand. If anything WT export land should show that plenty of people are willing and able to buy oil if the US consumer is not up to the task. Except of course right in the middle of the potential end of the world as we know it. But thats back to the sharp financial crisis not any sort of generic supply demand argument.

As far as this goes.

Are you sure ?

http://www.reuters.com/article/idUSTRE5AA4AA20091111

But yet ....

http://www.theoildrum.com/node/6016#comment-567083

So I'm supposed to accept as fact that the Saudi's want to price their light sweet crude using a heavy sour benchmark ok ...

Nope can't do it.

And this has no influence.

http://newsok.com/cushing-oil-storage-rate-causing-energy-worries/articl...

The EIA site is down so I can't get a graph.

Now of course since you made this statement in print.

I must bow to your superior skills at making statements and accept all the obvious truths they almost certainly explain everything.

Or not.

Just because you decided to say this does not make it true in fact given your arguments your so far off its not even funny. One things for certain 2008 and 2009 have been fascinating I'm still working over everything that went down its amazing. I wonder if we will ever know the true chain of events from the outside.

Not that I can't figure out what happened its just why ? Why pull the plug when it happened. Nothing I have suggests that it was the big one.

Right now my best guess is that it was not meant to go down like it did and the original plan was a soft landing that blew up in spades but did have a oil angle from the start. If you look back into 2008 then all kinds of interesting info pops out.

http://www.thestreet.com/story/10407812/who-traded-55000-bear-30-puts-tu...

I won't even go into how Lehman and Bear Stearns where involved in energy like all the investment banks they where in it up to their necks.

I'm not going to lay out some conspiracy theory simply because way to much ammunition is available to develop any theory you wish.

I will say that it makes sense that originally the goal was to cool the system down and bring oil prices down that makes sense even as and outsider. And it makes sense given how the unfolded that things got out of had but they certainly where capitalized on. I think the original plan was to get some slack back into the system and it was executed taking advantage of opportunities as they arose.

Needless to say some of the moves from the period are now under scrutiny and found increasingly questionable.

But I'm not even going to try to use published changes in US demand to even attempt to sort out this mess.

I can figure out what eventually happened thats fairly easy. But its better to treat March 2008 to Jan 09 as a sort of black box that resulted in a significant amount of crude floating around and the world not coming to a end along with a sharp short financially induced demand drop in the middle and some final demand level slightly lower than when we entered.

Going any deeper is steeping into a quagmire of possibilities.

I won't even try to make pompous statements about the middle I can't its way to complex and way to much was done off the cuff.

And last but not least as far as I can tell using secondary data such as VMT US consumption hase been falling steadily for some time regardless of its actual value VMT has not followed its historical trend since 2004.

http://www.fhwa.dot.gov/ohim/tvtw/09septvt/figure1.cfm

Of course its been rising lately even as oil prices increases but lets not stop simple things like facts collected from a agency reasonably isolated from oil detracting from our arguments.

In fact you can't even see the great crash on the VMT chart.

Now with this said I don't expect VMT to continue to rise much farther if oil prices continue to increase but I'm on record as stating numerous times that I expect it to flatten out steadily at least until we cross to say 200 a barrel or so. Then perhaps it might trend downwards but at a slower rate than before.

But thats a variable I watch more then predict. Given the US population significant structural changes in transportation are probably required to turn VMT downward again and thats going to be hard.

Regardless its a complex situation with lots and lots of things going on but at least up till recently offshore crude and the stuffing of Cushing have both worked to control oil prices. Even as many claim victory and that 75 is a good price for oil I claim that the ability to control prices is crumbling and based on a series of unfortunate or fortunate events depending on which side of the game you where on.

So last but not least in this long long post and the reason why I jumped in is Gail's post is actually a signal that the ability to control prices that I'm claiming is actually ending now. Of course as proof I can simply offer lets see what happens over the next several months same thing I say to everyone. Lets watch events unfold.

And its all I can say since we are in my opinion on the verge of a new and more serious part of the game of oil and money. And oil looks like it will win.

I hope you did well in the frying pan as its getting ever closer to fire time.

What data, memmel? You've not shown anything regarding oil prices other than the Saudi crude decision, which YOU simply throw out because you refuse to believe it. And on the basis of such flimsy evidence, we're supposed to accept your assertion that this is all due to price controls?

You have zero factual basis on which to stand. And further you are making the controversial statement here thus you are the one that needs to defend it with a rather deep and complete array of facts, not just your personal assertions.

An assertion is not equal to a fact, memmel, except for economists and politicians. Are you an economist or a politician?

Better yet, let's look at the facts.

From the EIA's World Oil Balance< spreadsheet, we have the following entries for world oil production over recent years:

Now clearly, from the above global data, there was a drop in global oil demand from 85.74mbpd in the first quarter of 2008 (early days of the recession) to 83.64mbpd in the second quarter of 2009 (a span of 6 quarters). Further, the data shows steady decline in production (which is demand) while we know that prices fell at the same time. If production was falling and demand had stayed high, prices would have stayed high and gone higher. But they did not.

Right there in the EIA data is a 2mbpd drop in global demand. In other words, the US drop of 2mbd was most of the world's drop over the same period. Other parts of the world did not drop but they did not go up either. Ergo demand fell or was flat.

Your assertion is that prices fell due to price controls, for which there is you have presented no evidence whatsoever. What I am asking you to provide, memmel, is evidence, not speculation. Now it's time to either put some facts on your hypothesis or simply withdraw it as unsupported by the available data.

Better yet, let's look at the facts.

You have absolutely no way to prove these numbers are true.

They are not facts any more than US unemployment numbers are facts.

No Greyzone its not time sorry. Just because your demanding something won't make it happen. I did however send a rough draft off to Nate and WT. Its still a very crappy poorly written paper but I will assure you they have it and the approach is obvious despite my poor writing. When its ready to publish it will be published if they don't think its worthy then I'll put it on a blog somewhere.

It was enough to convince me but peer review takes time.

Is it time for me to show it to you just because your demanding it ?

Before you spout facts from unreliable source you need to fact check the data.

I've spent years pondering the data issue before even considering what the facts are without good data you can't tell. Like Simmons I believe the lack of data is a critical problem. Having figured out a way around it I understand why the truth was hidden not that I agree with the decision but I can readily see why it was made.

You have no idea what the truth is at least I've done the work to get a decent idea. One has to at least have a bit of doubt to be a good scientist given the sources for most of our "facts" on oil I'm a bit surprised your so certain you can use them as proof.

Obviously I've found proof sufficient for me to be very very confident that the official numbers are pure fiction.

Consider carefully your arguments. Plenty of evidence exists which makes it reasonable to doubt the EIA numbers we even have a whistleblower floating around these days. Think about it. We have someone inside the EIA claiming the numbers are wrong and further more claiming its US pressure that behind it.

I'm confident enough that I've developed a smoking gun of sufficient proof to say as and outsider that I can confidently say I agree with with the the hint of serious issues with EIA numbers.

Are you absolutely sure you can use EIA numbers to discount what I'm trying to say ?

One last thing knowing the truth has not exactly been joyful for me. It turns out it sucks to understand with clarity how and why things have happened they way they have. Surprisingly this quote pretty much sums up the situation.

Thats all that got us into this mess. A series of decisions to ignore the truth until it grew to the point that telling the truth became impossible.

What a stupid reason to destroy a civilization. And thats what bugs me the most not the outcome but the trite or banal reason we are going down in flames.

Related of course is the concept of Moral Hazard.

http://en.wikipedia.org/wiki/Moral_hazard

I'd have to think that many people are becoming suspicious that the world might have just fallen into a moral hazard of epic proportions. If you simply look around and consider that it might of happened plenty of evidence exists to suggest it has.

Consider a bit more of the definition.

Related of course is this juicy concept.

http://en.wikipedia.org/wiki/Principal-agent_problem#The_double-sided_pr...

No grand conspiracy no evil designs just the good ole boys keeping things going and kicking the can down the road a bit fudging the numbers just a bit more each step of the way until they where so friggin deep in a hole they had no way out.

Thats what happens when you take the path of moral hazard surprisingly it seems the results of this path are seldom mentioned. No readily available economic paper seems to cover it.

However Moral Hazard on a global scale by its intrinsic nature also creates systematic risk effectively by definition. To some degree Taleb's black swans are really the response of a system deep in a moral hazard/systematic risk trap.

In my opinion there is no way out of the trap once it passes its early stages.

It always results in collapse. I suspect the point of no return is very early in the game. What obviously happened of course is that a simple mistake was made.

The assumption was made that rising prices would trigger greater oil production and the slow down was temporary. The problem of course and surprisingly this is not taught in basic Economics as far as I can tell is that this assumption can be a Moral Hazard !

If the underlying cause is actually depletion of a key resource leading to declining production then the simple rules of economics become vicious moral hazards. Eventually of course the real situation becomes clear but at that point the false assumption that higher prices would spur production have often been made to the point that even as you realize you have really created a huge moral hazard its literally to late to change course.

I find it interesting that a blind belief in simple market forces that ignored the concept of Moral Hazard resulted in our downfall. For all intents and purposes it was a religious belief in the superiority of our market systems which has ensured our destruction. Worse of course our leaders believe that they need only use their immense powers to intervene in various markets from housing and yes to oil and they can make everything right again. They are so blinded they literally don't have a clue that they have really simply increase the moral hazard and systematic risk level exponentially.

Of course they are still doing everything they can to hide the truth since its too late now to do anything and the original problem is even more dire.

Just to finish obviously I've found sufficient evidence to realize its way way to late in the game to escape the chance to get out was closed off long ago.

So GreyZone you can write your self assured posts and yes I will publish my work but all it does is at least allow those with open minds to understand why we went down. I don't really care how inflammatory your want to be it does not matter the game is up its over. Were done. Nothing your opinion or even mine or sadly at this late stage the truth can do to change the outcome. Its like looking up just in time to see if your being run over by a bus or garbage truck nice to know what took you out for a few fleeting moments but not all that useful.

In or case it turns out it was a garbage truck :(

We've been generally accepting the EIA data here for years, memmel. If you are going to postulate that data is bad, where is the proof?

Are you building an entire paper on unprovable assumptions?

No one can possibly take your position seriously unless you can provide something other than your own beliefs about what happened.