Uranium supplies are likely to be adequate until 2020

Posted by Engineer-Poet on December 1, 2009 - 10:25am

This is a guest post by Brian Wang, known as advancednano on The Oil Drum. He is an MBA and editor of nextbigfuture.com.

Michael Dittmar recently wrote a series of posts about nuclear energy that was published on The Oil Drum. In the first post of the series, he said that uranium "civilian uranium stocks are expected to be exhausted during the next few years" and "the current uranium supply situation is unsustainable".

It seems to me that this view is much too pessimistic, especially if prices rise from current levels. In this post, I will explain why. I will also talk about a bet with Dr. Dittmar regarding future production of nuclear electricity.

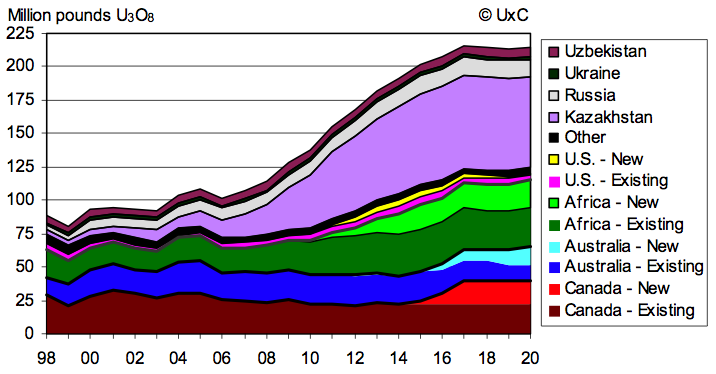

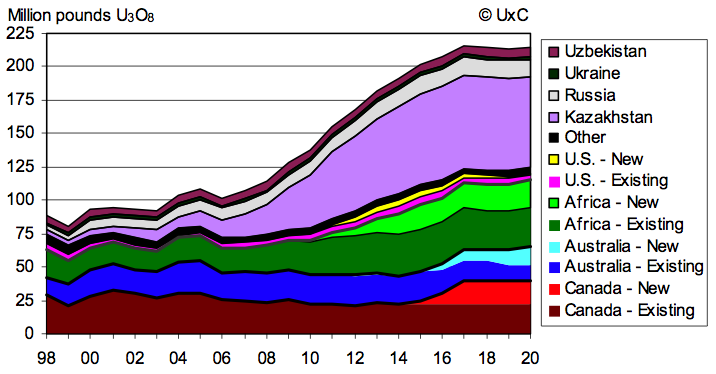

In support of my view of growing uranium production, below is a graph shown on the Ux Consulting website regarding future production. Ux Consulting describes itself as "The industry's leading source of consulting, data services, and publications on the uranium, conversion, and enrichments markets."

Forecast of future uranium production by Ux Consulting

Based on this graph, Ux Consulting expects uranium production to grow rapidly between now and 2020, with especially large gains in Kazakhstan, Africa and Canada.

Michael Dittmar recently wrote a series of posts about nuclear energy that was published on The Oil Drum. In the first post of the series, he said that uranium "civilian uranium stocks are expected to be exhausted during the next few years" and "the current uranium supply situation is unsustainable".

It seems to me that this view is much too pessimistic, especially if prices rise from current levels. In this post, I will explain why. I will also talk about a bet with Dr. Dittmar regarding future production of nuclear electricity.

In support of my view of growing uranium production, below is a graph shown on the Ux Consulting website regarding future production. Ux Consulting describes itself as "The industry's leading source of consulting, data services, and publications on the uranium, conversion, and enrichments markets."

Based on this graph, Ux Consulting expects uranium production to grow rapidly between now and 2020, with especially large gains in Kazakhstan, Africa and Canada.

The following is my summary of indications suggesting that uranium production is likely to rise significantly in the near future. Please note that the Ux Consulting chart uses million pounds U3O8; most of the other numbers are in metric tons of uranium. Historical data is given is a chart at the end of this post, in metric tons. To convert from million pounds of U308 to metric tons of uranium, multiply by 384.6.

Ux Consulting is forecasting that Kazakhstan will increase its production to 40,000 tons a year by 2020--in other words to nearly as much as current world production of uranium.

There is evidence that a rapid ramp up in production in Kazakhstan is already taking place. In 2008, Kazakhstan produced 8521 tons. In the first 9 months of 2009, Kazakhstan produced 9535 tons, which is 61% more than the corresponding period for 2008. Kazakhstan is expected to continue its growth through 2017, before plateauing at 40,000 tons a year (eyeballed from Figure 1).

Canada's production does look to be back up from 2008. Cameco (which produces most of Canada's uranium) production at the end of the third quarter of 2009 was 9.3 million pounds U3O8 compared to 8.5 million pounds over the same period in 2008. We continue to expect our share of production to be 13.1 million pounds in 2009. The first 9 months are up 2700 tons of Uranium. Canada should be up 3000 tons from 2008.

Canada has had some delays because of water flooding problems at the Cigar Lake mine. Also, the Midwest mine in Saskatchewan has been shelved until uranium prices are higher. Currently uranium is at $45/pound.

Another attempt is being made to dewater the Cigar Lake mine:

The Olympic dam mine in Australia is expected to be expanded. A decision will be made by the Australian government by July 2010.

There was an accident at the Olympic dam mine, but production is expected to be fully restored by the third quarter of 2010.

In my analysis in September 2008 of expected future Uranium supplies, I showed two projects with over 1,000 tons or more of production planned for 2009. Both of these new large 2009 projects were in Africa.

One of these planned projects was Namibia's Valencia mine, expected to produce 1,000 tU/year. It is now expected to open in 2010, which is a delay from 2009. One of the issues in this and other delayed projects is the low price of uranium--now $45 ton.

The other large project listed in my September 2008 post for 2009 was the Malawi Kayelekera project. It began exporting uranium in Sept, 2009. It is expected to produce 1,269 tons per year initially. By calendar year 2012, production is expected to increase by 15%, with minimal capital investment, because it can utilize existing excess capacity.

In total (including Kayelekera previously mentioned), Paladin's production from all its African mines is expected to amount to 5.6 Mlb U3O8 (equivalent to 2,153 tons uranium) to 6.1 Mlb U3O8 (equivalent to 2,346 tons uranium) this year. It forecasts African production of 13.8 Mlb U308 (equivalent to 5,307 tons uranium) by mid 2014. This would amount to more than double current production in five years. Planned expenditures for this expansion are US$365 million.

Niger is an area of Africa that appears to be able to ramp up production. It appears to me that Niger is on a path to 10,000 tons per year of uranium production (around 2012-2014), if the price of uranium is high enough. They are finding quality uranium mines in Niger using $5 million per year in exploration spending.

In Niger, Areva is currently building a a big new mine, the Imouraren project, whose production was originally estimated as 5,000 tons. According to Bloomberg, its cost is estimated to be 1.2 billion euros ($1.8 billion), and it is scheduled to come on stream in 2012. The project is already delayed a year because of political turbulence in the country. "We will decide in 2011-2012 whether we should scale it for 2,000 tons or 5,000 tons or even 7,000 tons," Sébastien de Montessus, director of Areva's mining business unit said. The current uranium price (US$ 55 / lb U3O8) wouldn't be enough to make an investment of $500 million to $1.5 billion profitable, De Montessus said. "The market price has to go up to $70 to $80."

According to Extract Resources Limited, the new Rossing resource in Namibia appears to have great potential. An October 7 release reads:

According to a recent article by Mineweb:

More information on Trekkopje can be found in this infomine article. This 2008 Mineweb article has the following to say about Trekkopje:

Energy Resources (Rio Tinto Subsidiary) reported uranium production for the first three quarters of the year was 4,100 tons, up 11% from 2008.

Berkeley Resources is developing uranium production in Spain. According to this Mineweb article:

Jordan is another place where uranium production is likely to expand. According to this article:

Jordan already had a lot of uranium in phosphate deposits. China National Nuclear Corporation General Manager Kang Rixin expects that the first batch of uranium from Jordanian resources will be transported home in 2010; the total quantity probably will be 700 tons. (Caijing Magazine July 5, 2009). It has been expected that the uranium from Jordan phosphate would scale to 2000 tons per year.

In addition, the French giant Areva was expected to start uranium drilling in central Jordan in November to identify the locations of crude uranium, Toukan said in October. Following a feasibility study after exploring, work will begin to usher in a uranium mine with actual production expected to start in 2012 at an annual rate of 2,000 tons, he added.

On uranium in phosphates, he put the deposits at between 100,000 and 140,000 tons.

Wali Kurdi, Chairman and CEO of the Jordan Phosphate Mines Company said earlier in the year that the Jordanian phosphate used in manufacturing phosphoric acid contains about 50 to 100 parts per million (ppm) of uranium that can be extracted via modern technological methods. (Jordan Phosphate Mines Co.)

Russia is also developing new mines, including the Elkon mine and the Gornoe mine. The Elcon mine will have "up to 5,000 tons" per year capacity. Gornoe mine is expected to have 600 tons per year capacity. Construction of Gornoe is slated to begin in 2010.

My view of future production, summarized

This is my view of future production and other sources of future uranium supply:

2009 can be expected to have roughly 50,000 tons of production, compared to 43,764 tons in 2008.

2010 should have 56,000+ tons of production. This includes another 3000 tons from Kazakhstan, Valencia in Namibia, and a full year of Malawi production.

World uranium production can be expected to exceed 100,000 tons of uranium per year in a business as usual mode before 2020. A lot more uranium seems likely to produced than the IAEA/OECD projection for Kazakhstan. The IAEA/OECD forecast for Canada is probably too high until Cigar Lake gets sorted out. It also is likely to depend upon which projects proceed based on uranium prices.

Backstopping regular mining is the large supplies of Highly Enriched Uranium (HEU) and Low Enriched Uranium (LEU) in Russia and the US (75,000 ton surplus at the DOE). Another backstop is the depleted uranium.

Eventually prices will go up and some deferred projects like 2300/t per year Midwest mine in Saskatchwan, Canada and full scale up Imouraren in Niger will occur (smaller scale opening likely).

I also predict that Cigar Lake will be producing 4000 tons per year or more before 2020.

Africa and Kazakhstan will be where most of the new uranium production is added in the years leading to 2020. There will be increases in Canada, Australia, Russia, Jordan and other places as well.

Beyond the highly enriched uranium that Russia is supplying (downblended from decommissioned nuclear bombs or unmade bombs.) The US Department of Energy (DOE) also has 75,000 tons of uranium1. Shortfalls in uranium mining from delays can be made up for by nuclear utilities being willing to pay Russia enough or to make arrangements with the DOE. The million tons of depleted uranium can also be enriched to make several tens of thousand tons of fuel. (More about depleted uranium enrichment is detailed in an upcoming article that has been written with Engineer Poet.)

Bet with Dr. Michael Dittmar regarding future uranium production

Michael Dittmar has been getting some notice around the Internet and here at The Oil Drum about a claim that uranium supplies cannot/will not be increased from uranium mines around the world. In Part 1, Dittmar offers a bet:

I am willing to take those bets as stated. I would win and be correct if the 2009 world uranium mining production numbers come out to 45,001 tons or higher and the 2010 production numbers to 47,001 tons or higher. As indicated, I think 2009 and 2010 can be expected to show much higher production even with some delayed projects and the accident at Olympic Dam.

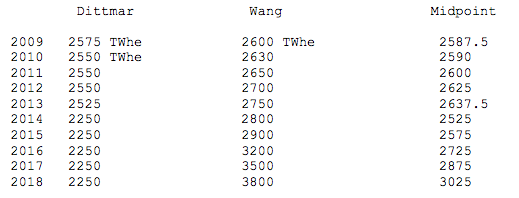

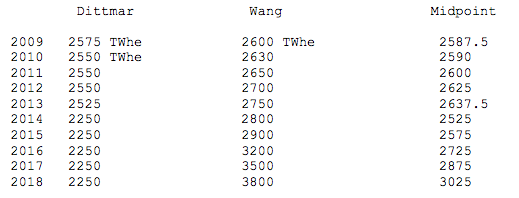

There is another series of bets with Dittmar already in play, based on a discussion between commenter advancednano and Dittmar in comments to Part 4 his series:

Under the terms of the bet, $20 is to be paid via Paypal to the other person, and a note is to be written and published recognizing that the other person was right in his prediction. (Note: Dittmar apparently is not willing to bet money.) Also I think if there is a near shutout (at least 8 out of 10 years), then there needs to be a public statement that the thesis of the losing side was wrong.

Each year: Loser must say: I lost to___ because _____ was more accurate in predicting nuclear power generation. The winner gets to add 200 words on why they were right that gets included with the loser statement.

The shutout or near shutout situation:

Loser must say: I lost X out of Y to ___ because _____ was more accurate in predicting nuclear power generation. The winner gets to add 1,000 words on why they were right and why they shutout or nearly shutout the loser.

The data to be used in determining this bet are the figures of the World Nuclear Association for the year, compared to the midpoint of the range. The amount of production for each year is expected to be published the following year. If the amount of the production is above the midpoint, Brian Wang is right, and advancednano is right and the winner; below the midpoint Dittmar is right and the winner for that year. The figure is the TWH level of generation of commercial nuclear fission or nuclear fusion.

The bet for 2009 will be close. France's production is down due to labor strikes and outages, plus electricity demand is down for the whole world because of the economy. UK's nuclear is up, and India's nuclear is up. Russia's could be down. Germany's could be down. Japan should be up. US should be up a little. China should be up slightly. For either one of us to win or lose 2009 has minimal larger implications relative to the overall trend. We are basically betting on the last quarter. By 2011-2013 we are starting to move out of the random noise. 2014 is the clear divergence where the actual fundamentals will matter a great deal. This is a link to a comment where advancednano summarizes his view of 2009 nuclear electricity production by country.

1) Details from http://www.ne.doe.gov/pdfFiles/inventory_plan_unclassified.pdf

The sales or transfers of the Department's excess uranium inventory identified in this Plan that are currently ongoing and/or planned (items 1 and 2, below) or are under consideration or may be considered by DOE in the future (items 3, 4 and 5, below) to accomplish the Plan objectives include:

This is a summary of uranium production in metric tons. (Historical figures through 2008 based on data from the World Nuclear Association. Figures for 2009 and 2010 are the author's estimates based on reported production and capacities; most are explained above.)

Kazakhstan - Already starting to ramp up

Ux Consulting is forecasting that Kazakhstan will increase its production to 40,000 tons a year by 2020--in other words to nearly as much as current world production of uranium.

There is evidence that a rapid ramp up in production in Kazakhstan is already taking place. In 2008, Kazakhstan produced 8521 tons. In the first 9 months of 2009, Kazakhstan produced 9535 tons, which is 61% more than the corresponding period for 2008. Kazakhstan is expected to continue its growth through 2017, before plateauing at 40,000 tons a year (eyeballed from Figure 1).

Canada and Australia - Leading producers historically; Canadian delays now

Canada's production does look to be back up from 2008. Cameco (which produces most of Canada's uranium) production at the end of the third quarter of 2009 was 9.3 million pounds U3O8 compared to 8.5 million pounds over the same period in 2008. We continue to expect our share of production to be 13.1 million pounds in 2009. The first 9 months are up 2700 tons of Uranium. Canada should be up 3000 tons from 2008.

Canada has had some delays because of water flooding problems at the Cigar Lake mine. Also, the Midwest mine in Saskatchewan has been shelved until uranium prices are higher. Currently uranium is at $45/pound.

Another attempt is being made to dewater the Cigar Lake mine:

The inflow on the 420 metre level that forced suspension of dewatering on August 12, 2008 has been remediated by remotely placing an inflatable seal between the shaft and the source of the inflow and subsequently backfilling and sealing the entire development behind the seal with concrete and grout. The 420 level is not part of future mine plans.

It is currently expected to take six to 12 months to dewater and secure the mine depending on what conditions are found in the shaft and the underground workings.

The Olympic dam mine in Australia is expected to be expanded. A decision will be made by the Australian government by July 2010.

There was an accident at the Olympic dam mine, but production is expected to be fully restored by the third quarter of 2010.

Africa - Major ramp up; exploration is inexpensive

In my analysis in September 2008 of expected future Uranium supplies, I showed two projects with over 1,000 tons or more of production planned for 2009. Both of these new large 2009 projects were in Africa.

One of these planned projects was Namibia's Valencia mine, expected to produce 1,000 tU/year. It is now expected to open in 2010, which is a delay from 2009. One of the issues in this and other delayed projects is the low price of uranium--now $45 ton.

The other large project listed in my September 2008 post for 2009 was the Malawi Kayelekera project. It began exporting uranium in Sept, 2009. It is expected to produce 1,269 tons per year initially. By calendar year 2012, production is expected to increase by 15%, with minimal capital investment, because it can utilize existing excess capacity.

In total (including Kayelekera previously mentioned), Paladin's production from all its African mines is expected to amount to 5.6 Mlb U3O8 (equivalent to 2,153 tons uranium) to 6.1 Mlb U3O8 (equivalent to 2,346 tons uranium) this year. It forecasts African production of 13.8 Mlb U308 (equivalent to 5,307 tons uranium) by mid 2014. This would amount to more than double current production in five years. Planned expenditures for this expansion are US$365 million.

Niger is an area of Africa that appears to be able to ramp up production. It appears to me that Niger is on a path to 10,000 tons per year of uranium production (around 2012-2014), if the price of uranium is high enough. They are finding quality uranium mines in Niger using $5 million per year in exploration spending.

In Niger, Areva is currently building a a big new mine, the Imouraren project, whose production was originally estimated as 5,000 tons. According to Bloomberg, its cost is estimated to be 1.2 billion euros ($1.8 billion), and it is scheduled to come on stream in 2012. The project is already delayed a year because of political turbulence in the country. "We will decide in 2011-2012 whether we should scale it for 2,000 tons or 5,000 tons or even 7,000 tons," Sébastien de Montessus, director of Areva's mining business unit said. The current uranium price (US$ 55 / lb U3O8) wouldn't be enough to make an investment of $500 million to $1.5 billion profitable, De Montessus said. "The market price has to go up to $70 to $80."

According to Extract Resources Limited, the new Rossing resource in Namibia appears to have great potential. An October 7 release reads:

We believe a total resource of 500 Mlbs (192,300 tons) is achievable from targets already defined. The Company is now well advanced with the Rossing South Feasibility Study on Zones 1 and 2 and the project is shaping up to be one of the world's largest uranium mines, capable of producing 15 Mlbs of U3O8 per year. (5,769 tons uranium per year)

According to a recent article by Mineweb:

Namibia is mining friendly. Paladin commissioned Langer Heinrich in 2007 on time and on budget, and continues with the process of ramping production to what could amount to 3000 tons of uranium a year, at a cash cost of USD 25/lb, by the second half of 2010. . .

Namibia's more recent potential was startlingly highlighted by the August 2007 purchase by French transnational Areva for USD 2.5bn of Uramin. Trekkopje will be a big mine.

More information on Trekkopje can be found in this infomine article. This 2008 Mineweb article has the following to say about Trekkopje:

But the uranium project could become the biggest in the country, and No. 10 in the world. Leathley said US$920-million would be pumped into the project to bring it into production. It will also be one of the top five low cost, open pit operations in the world.

The company expects the property, which is located about 70 kilometres east of the coastal town of Swakopmund and quite close of Rössing and Langer Heinrich, to produce about 8.5-million pounds of uranium oxide (3,850 tonnes) a year.

Energy Resources (Rio Tinto Subsidiary) reported uranium production for the first three quarters of the year was 4,100 tons, up 11% from 2008.

Other Mines

Berkeley Resources is developing uranium production in Spain. According to this Mineweb article:

Berkeley has 26m pounds of 450 parts per million uranium oxide at its Spanish projects; analysts familiar with the company reckon this resource will potentially triple in 2010 as Berkeley moves onto the Toronto Stock Exchange, and into production at around 1000 tons a year by 2012.

Berkeley's Salamanca project would be the restart of an old mine, one shut down in 2000 by Spanish state company ENUSA following sustained low uranium prices. Relative to other projects with a similar deposit base, Salamanca rates as very low cost on capital expenditure, with operating expenditure likely to be around USD 30/lb.

Jordan is another place where uranium production is likely to expand. According to this article:

High grade uranium was discovered at very shallow depths, at some points no more than five feet, making future mining both cheaper and easier.

Jordan already had a lot of uranium in phosphate deposits. China National Nuclear Corporation General Manager Kang Rixin expects that the first batch of uranium from Jordanian resources will be transported home in 2010; the total quantity probably will be 700 tons. (Caijing Magazine July 5, 2009). It has been expected that the uranium from Jordan phosphate would scale to 2000 tons per year.

In addition, the French giant Areva was expected to start uranium drilling in central Jordan in November to identify the locations of crude uranium, Toukan said in October. Following a feasibility study after exploring, work will begin to usher in a uranium mine with actual production expected to start in 2012 at an annual rate of 2,000 tons, he added.

On uranium in phosphates, he put the deposits at between 100,000 and 140,000 tons.

Wali Kurdi, Chairman and CEO of the Jordan Phosphate Mines Company said earlier in the year that the Jordanian phosphate used in manufacturing phosphoric acid contains about 50 to 100 parts per million (ppm) of uranium that can be extracted via modern technological methods. (Jordan Phosphate Mines Co.)

Russia is also developing new mines, including the Elkon mine and the Gornoe mine. The Elcon mine will have "up to 5,000 tons" per year capacity. Gornoe mine is expected to have 600 tons per year capacity. Construction of Gornoe is slated to begin in 2010.

Predictions, Bets, and Why Even with Mine Delays the Power Plants Will Run All Out

My view of future production, summarized

This is my view of future production and other sources of future uranium supply:

2009 can be expected to have roughly 50,000 tons of production, compared to 43,764 tons in 2008.

2010 should have 56,000+ tons of production. This includes another 3000 tons from Kazakhstan, Valencia in Namibia, and a full year of Malawi production.

World uranium production can be expected to exceed 100,000 tons of uranium per year in a business as usual mode before 2020. A lot more uranium seems likely to produced than the IAEA/OECD projection for Kazakhstan. The IAEA/OECD forecast for Canada is probably too high until Cigar Lake gets sorted out. It also is likely to depend upon which projects proceed based on uranium prices.

Backstopping regular mining is the large supplies of Highly Enriched Uranium (HEU) and Low Enriched Uranium (LEU) in Russia and the US (75,000 ton surplus at the DOE). Another backstop is the depleted uranium.

Eventually prices will go up and some deferred projects like 2300/t per year Midwest mine in Saskatchwan, Canada and full scale up Imouraren in Niger will occur (smaller scale opening likely).

I also predict that Cigar Lake will be producing 4000 tons per year or more before 2020.

Africa and Kazakhstan will be where most of the new uranium production is added in the years leading to 2020. There will be increases in Canada, Australia, Russia, Jordan and other places as well.

Beyond the highly enriched uranium that Russia is supplying (downblended from decommissioned nuclear bombs or unmade bombs.) The US Department of Energy (DOE) also has 75,000 tons of uranium1. Shortfalls in uranium mining from delays can be made up for by nuclear utilities being willing to pay Russia enough or to make arrangements with the DOE. The million tons of depleted uranium can also be enriched to make several tens of thousand tons of fuel. (More about depleted uranium enrichment is detailed in an upcoming article that has been written with Engineer Poet.)

Bet with Dr. Michael Dittmar regarding future uranium production

Michael Dittmar has been getting some notice around the Internet and here at The Oil Drum about a claim that uranium supplies cannot/will not be increased from uranium mines around the world. In Part 1, Dittmar offers a bet:

For those interested, I am offering a bet that the 2009 and 2010 numbers will not be higher than 45,000 tons and 47,000 tons, respectively.

I am willing to take those bets as stated. I would win and be correct if the 2009 world uranium mining production numbers come out to 45,001 tons or higher and the 2010 production numbers to 47,001 tons or higher. As indicated, I think 2009 and 2010 can be expected to show much higher production even with some delayed projects and the accident at Olympic Dam.

There is another series of bets with Dittmar already in play, based on a discussion between commenter advancednano and Dittmar in comments to Part 4 his series:

Under the terms of the bet, $20 is to be paid via Paypal to the other person, and a note is to be written and published recognizing that the other person was right in his prediction. (Note: Dittmar apparently is not willing to bet money.) Also I think if there is a near shutout (at least 8 out of 10 years), then there needs to be a public statement that the thesis of the losing side was wrong.

Each year: Loser must say: I lost to___ because _____ was more accurate in predicting nuclear power generation. The winner gets to add 200 words on why they were right that gets included with the loser statement.

The shutout or near shutout situation:

Loser must say: I lost X out of Y to ___ because _____ was more accurate in predicting nuclear power generation. The winner gets to add 1,000 words on why they were right and why they shutout or nearly shutout the loser.

The data to be used in determining this bet are the figures of the World Nuclear Association for the year, compared to the midpoint of the range. The amount of production for each year is expected to be published the following year. If the amount of the production is above the midpoint, Brian Wang is right, and advancednano is right and the winner; below the midpoint Dittmar is right and the winner for that year. The figure is the TWH level of generation of commercial nuclear fission or nuclear fusion.

The bet for 2009 will be close. France's production is down due to labor strikes and outages, plus electricity demand is down for the whole world because of the economy. UK's nuclear is up, and India's nuclear is up. Russia's could be down. Germany's could be down. Japan should be up. US should be up a little. China should be up slightly. For either one of us to win or lose 2009 has minimal larger implications relative to the overall trend. We are basically betting on the last quarter. By 2011-2013 we are starting to move out of the random noise. 2014 is the clear divergence where the actual fundamentals will matter a great deal. This is a link to a comment where advancednano summarizes his view of 2009 nuclear electricity production by country.

Endnotes

1) Details from http://www.ne.doe.gov/pdfFiles/inventory_plan_unclassified.pdf

The sales or transfers of the Department's excess uranium inventory identified in this Plan that are currently ongoing and/or planned (items 1 and 2, below) or are under consideration or may be considered by DOE in the future (items 3, 4 and 5, below) to accomplish the Plan objectives include:

- Down-blend 12.1 metric tons of uranium (MTU) of unallocated highly enriched uranium (HEU) to about 220 MTU of LEU of which about 170 MTU could be used for a general or special-purpose DOE LEU inventory.

- Make available for sale up to 4,461 MTU of uranium of various enrichment levels that are stored at the Portsmouth, Ohio, Gaseous Diffusion Plant. This uranium is not within commercial specification (off-spec) or in the form of uranium hexafluoride (UF6).

- Make available for sale up to 7,700 MTU of natural uranium (NU) (equivalent to 20 million pounds U3O8). This NU could be sold to licensed U.S. nuclear reactor operators for use in initial cores for new reactor build projects over a period of several years starting in 2010.

- Make available as much as 4,647 MTU of NU to be enriched to approximately 500 MTU of LEU (at an enrichment of 4.95% 235U). This LEU could be included in a DOE LEU inventory.

- DOE anticipates that it will engage in the sale of high-assay DUF6 or enter into a contract to re-enrich the DUF6 to natural uranium or LEU to realize the best value for the Government. DOE anticipates that it will also make available for sale any remaining NU. The sale of this material could reduce storage and security costs

Appendix: Historical Uranium Production

This is a summary of uranium production in metric tons. (Historical figures through 2008 based on data from the World Nuclear Association. Figures for 2009 and 2010 are the author's estimates based on reported production and capacities; most are explained above.)

| Country | 2010e | 2009e | 2009 Q1-Q3 | 2008 | 2007 | 2006 | 2005 | 2004 |

| Australia | 9200 | 8,527 | 6,996 | 8430 | 8611 | 7593 | 9516 | 8982 |

| Brazil | 330 | 330 | 248 | 330 | 299 | 190 | 110 | 300 |

| Canada | 11000 | 10,800 | 8,100 | 9000 | 9476 | 9862 | 11628 | 11597 |

| China | 769 | 769 | 577 | 769 | 712 | 750 | 750 | 750 |

| Czech Rep | 263 | 263 | 197 | 263 | 306 | 359 | 408 | 412 |

| France | 5 | 5 | 4 | 5 | 4 | 0 | 7 | 7 |

| Germany | 0 | 0 | 0 | 41 | 65 | 94 | 77 | |

| India | 271 | 271 | 203 | 271 | 270 | 230 | 230 | 230 |

| Jordan | ||||||||

| Kazakhstan | 15800 | 12,713 | 9,535 | 8521 | 6637 | 5279 | 4357 | 3719 |

| Malawi | 1200 | 400 | 100 | |||||

| Namibia | 5600 | 4,400 | 3,275 | 4366 | 2879 | 3077 | 3147 | 3038 |

| Niger | 3300 | 3,032 | 2,274 | 3032 | 3135 | 3434 | 3093 | 3282 |

| Pakistan | 45 | 45 | 34 | 45 | 45 | 45 | 45 | 45 |

| Romania | 77 | 77 | 58 | 77 | 77 | 90 | 90 | 90 |

| Russia | 4000 | 3,521 | 2,641 | 3521 | 3413 | 3400 | 3431 | 3200 |

| Ukraine | 800 | 800 | 600 | 800 | 846 | 800 | 800 | 800 |

| USA | 1600 | 1,430 | 1,073 | 1430 | 1654 | 1692 | 1039 | 878 |

| Uzbekistan | 2600 | 2,338 | 1,754 | 2338 | 2320 | 2270 | 2300 | 2016 |

| TOTAL | 56,860 | 49,722 | 37,666 | 43198 | 40725 | 39136 | 41045 | 39423 |

What strikes me as important is what a big role price plays in the ability for uranium production to ramp up--and how parallel this is to what is happening with natural gas, and wind, and biofuels, and even oil and coal. If the price is high enough, it seems likely that a lot of things can be available.

The problem as I see it is that the credit unwind affects demand of all kind. It also make obtaining funds for new investment much more difficult. So it becomes harder to follow through on plans for new production.

The forecasts shown I expect are mostly numbers "if prices are high enough". If prices stay where they are, or drop further, production will likely be much lower.

We might add: "If there are sufficient diesel supplies"

Look at the Olympic Dam mine expansion in Australia (uranium, copper). Their diesel requirements will go up 16-fold (in words: SIXTEEN) because they have to remove over-burden for 5 years.

I have summed up some stuff previously shown and discussed on the oildrum, including fmagyar's excellent link to that Dubai tower at night, in my 1st silly season article entitled:

Peak oil in 1001 nights

http://www.crudeoilpeak.com/?p=690

403 million liters/a is 106 million gallons/year, or about 6900 barrels per day. This is less than 0.01% of world consumption.

Of all the demand we can expect to be destroyed by rising prices, that's going to be among the last to go. That is, unless it can be replaced by electricity. If Australia gets a clue, installs a CANDU and electrifies the mine machinery, most of that consumption can just go ~poof~!

Engineer-Poet:

There is no prospect of Australia getting nuclear power any time before 2020 - and by then, the finite nature of the world's uranium reserves will be clear for all to see. Given the ramp-up of nuclear power plant construction now under way, any nuclear power plants built after 2020 won't have time to amortise effectively due to the increasing scarcity of uranium in the latter half of their design lives.

On the other hand, there is a highly prospective geo-thermal power scheme planned for not far away from the Olympic Dam mine. If it gets off the ground, the first stage is planned to be used to supply power to the mine - and I believe it has the support of BHP Billiton, the mine's owner. The irony of this, for advocates of sustainable energy, has been noted.

Finally, while the uranium deposit at Olympic Dam is huge, it is also extremely low grade &, at anywhere near current prices, is only viable because the uranium is a by-product of a much larger copper production. It would be interesting to see an analysis of Olympic Dam (and, in particular, the planned expansion) done on an EROEI basis.

You forget that LWRs can operate on thorium, and Lightbridge is commercializing it.

I agree that light-water reactors are a technology with a limited useful life. However, the actinides in spent LEU fuel can provide the starting fuel charge for fast-spectrum reactors cooled by liquid metal, and the U-233 in spent thorium fuel can do the same for LFTRs. This has the welcome side-effect of turning "nuclear waste" into energy, and the radiotoxicity of the fission products can drop below the raw ore in less than 1000 years. Isolating something for 1000 years is easy; we have books that are older.

All right Engineer!!!!....Thorium!!!!.........Lots and lots and lots and lots of that substance!!!!...Right here on this finite planet!!!...Seeeeeeee Doomers?...We ACTUALLY have a way to make enough electricity for....oh I don't know....Long enough for your children's children's children to grow up....

But here come the wails....We can't build them without OIL!!!....Yes, we can...plenty of methane hydrates and...(if we REALLY want to)...Transportation fuel from algae....(Yes it will be more expensive than oil from Spindletop)...But we can afford the $100/bbl...Gad, I know you guys hate humans and want our population to drop by 97%...but it ain't gonna...(sustainability, ya know).......LOLOL

I've given this thought in the past, and I'm not sure there is a supportable way to untangle the uranium EROEI at Olympic, as the other two metals mined (copper and gold) are purely a $ROEI play. One might examine the energy per ton of copper or gold only mines and subtract that from the Olympic figures, but all things not being equal it would only be a rough approximation.

Still, I'd bet that approximation would show a significant EROEI, but as you say, possibly a loss in the $RO$I at today's uranium prices.

Checking out figures, 100 million gallons/year of diesel is roughly the energy capacity of 2 ethanol plants. In Australia, conversion of bagasse to pyrolysis oil could supply more than enough fuel for the mine. Australia's bagasse availability is 15 million metric tons/year, so at 70% conversion to bio-oil and a density of 1.15 that is about 9 billion liters or the equivalent of about 4.5 billion liters of diesel.

Another side effect of the credit debt unwinding is that China is outbidding on a lot of strategic resources. These might show up in the figures of total world production, but that uranium production won't be available for the rest of the world (the products that they fabricate with the energy do, ofcourse).

Unless the Chinese forcast an impending shortage -or major price spike they have no incentive to hoard. I can see them doing that with strategic resources, such as oil and rare earths, but U fuel is more of a commodity, and it is known that if the price became high enough we could still extract it from seawater.

The incentive is very real and it is to get rid of as much foreign currency reserves as possible , dollars in particular, as they can get rid of without crashing the currency markets.When the inflation hits the price of every commodity will go up even though real estate may continue down.

And if you believe there will not be serious inflation, then you must also believe that Uncle Sam's and the rest of the first world govt's finances are sound.

In which case I got this toll bridge and I'm in a bind for some cash.....;)

Well, *known* is nothing more then a guess, *high enough* means that other energy sources will outcompete nuclear and *seawater* does *poof* to your EROI.

Well, that one would be good news. Hardly a reason to complain around here. But it is still a guess, and that is bad.

With regard the our future energy use and mix it is mostly a guess anyway. If you have certainty about this then I suggest you join the bet. I'm not.

If prices stay where they are, or drop further, production will likely be much lower.

Our primitive pre Model T steroidal submarine reactors need 59 pounds of uranium in order to split 5.4 ounces into fission products thereby producing a lifetime supply [1500 watts for 80 years, 1,000,000 kWh] of electricity. The uranium cost per kWh would be as shown below.

Uranium $/lb__ Cents/kWh

50___________0.28

100__________0.56

200__________1.12

At a sustained price of $200/lb sea water uranium is practical, making the uranium supply effectively unlimited for the foreseeable future.

So the questions are;

If the uranium supply becomes tight why would the price stay the same or drop?

How high would the price have to go to convince utilities to cancel plans for new plants and shutdown existing plants?

What are the well proven technologies that can supply a large fraction of electric power consumption without fossil fuel and at a lower cost than fission? Examples please.

Reactors with a breeding ratio of 1or higher reduce the lifetime uranium requirement to 0.34 pounds or less, reducing the uranium cost/kWh by a factor of more than 100:1. They increase the uranium supply by a factor much greater than 100 because they make much lower ore grades practical, even average rocks are more energetic than coal.

Another parallel that strikes me is that the major consulting organization (Ux Consulting) is putting out very favorable forecasts for the industry as a whole, not unlike CERA for oil and gas. But when you read Ux Consulting's Uranium Market Outlook, you see some serious concerns arising:

One difference between the two outfits is that CERA, AFAIK, has never supported its projections with details as to where all of the new oil will be coming from. Somebody correct me if I'm wrong, but it seems to me that CERA's optimistic forecasts are grounded in little more than blind faith that "new technology" will allow higher recovery from existing fields.

Of course, Ux consulting could also be blowing smoke about the new mines and mine expansions on which its projections are based. There's still a difference, though, in that the known elemental abundance of uranium implies that we are still very early in the exploration and development cycle for uranium resources, while a century of intense E&D has gone into oil.

There's no evidence that there are vast new oil fields waiting to be found, and 30 years of largely fruitless exploration to suggest that there aren't. OTOH, it would be highly anomolous, based on observed elemental abundance and known geochemical processes for ore concentration, if there weren't substantial undiscovered uranium resources on all continents.

Almost all(97%) the 2009 increase over 2008 is due to Canada 1800mtu, Malawi 400mtu?, and Kazakhstan 4132mtu.

Kazakhstan is consciously aiming to replace Canada as the world's biggest producer this year. Kazakhstan has a 817000 mtu(RAR +IR) at $60 per pound reserve mainly low grade ores, <.5% or 375000 mtu (RAR)at $60 per pound.

World Nuclear says Kazakhstan is predicting 15000mtu for 2010 and 30000mtu in 2018. The reason is it looks like the Japanese and Russians are stockpiling ore and corruption in the Kazakh government.

ANALYSIS: Kazatomprom corruption probe engulfs head, Canada’s Uranium One

http://silkroadintelligencer.com/2009/06/01/kazatomprom-corruption-probe...

Canada and Australian mines are both having production problems at their biggest mines. Cameco expects(fingers crossed) the nuclear building boom (in Asia) will turn boost prices.

http://www.fool.com/investing/general/2009/11/03/powerful-production-at-...

The price of uranium oxide is low at ~$45 per pound yellow cake off a high of $110 per pound in 2007.

Advanced,

Great demonstration of cherry-picking and hyper-optimism--based on a rise of production in one country despite low prices you predict a world wide increase of 14%.

Funny.

Kazakhstan is where the current growth is coming from. It is like the rise of Russia in oil many years back. It is not cherry picking if that is where the growth is coming from.

I surveyed all of the major producing countries and companies to get the 9 month reports and the projections from the sources for 2010 (and beyond if they had longer range plans).

Major countries: Kazakhstan, Canada, Australia, Namibia, Niger, Russia

A lot of Uranium can come from each of six countries.

Plus there are the years of supply at the DOE and Russia.

Some moderate new sources coming: Jordan, Mongolia

I have also looked at Russia's stated plans and have estimates going further into the future. As Russia was the last of the major current uranium countries.

I think the big mines will happen. The uranium is there and it is just a question of when it is yanked out of the ground based on price and other above ground factors. The uranium mines do not seem to have the depletion rate pattern of oil mines. A lot of mines have gold and/or copper or other metals that help to justify the projects moving ahead.

http://nextbigfuture.com/2009/11/nuclear-roundup-russian-uranium.html

Mining of the Elkon uranium deposit in Yakutia is to start in 2010, according to Techsnabexport director general Vladimir Smirnov. Five years later, full production of 5000 t/a is to be attained. Exploration of the deposit is completed, he said. Reserves are sufficient for a 70 year lifetime of the mine. Total resources are estimated at 600,000 t uranium. (RIA Novosti Dec. 13, 2006)

China's Uranium plan - buy uranium mine and uranium mining company interests

http://nextbigfuture.com/2009/11/guangdong-nuclear-power-plans-for-more....

There are only about 10-15 countries, 20-30 major or potential major companies, 30-60 major mines, 15-40 major prospects that have to be analyzed to get a very solid understanding of what is and will happen with traditional uranium mining. so it is easy to do the equivalent of the the wikipedia oil megaprojects analysis.

uranium mining summary up to 2008

Top uranium companies in 2008

The largest-producing uranium mines in 2008 were:

Top 10 companies (87%), Top 25 mines (about 85%)

Only about 6-12 major expansions or new mines per year.

Australian companies currently mining uranium

BHP Billiton Ltd — Owners of the world's largest Uranium deposit, and operatores of the world's largest uranium mine at Olympic Dam

Energy Resources Of Australia Ltd — Operators of the Ranger mine in the Northern Territory

Rio Tinto Ltd — Owns 64% of Energy Resources of Australia

Heathgate Resources Pty Ltd — Operators of the Beverley Mine in South Australia

Australian companies with significant uranium potential

Summit Resources Limited - In a joint venture with Valhalla Uranium/Resolute Mining on the Valhalla Deposit

Valhalla Uranium Ltd — Has the Valhalla Uranium project near Mt Isa, with 36 million lbs of uranium oxide

Resolute Mining Ltd - Owns 83.33% of Valhalla Uranium Ltd

EXCO Resources — Copper/Uranium projects near Cloncurry, Queensland

wheeler River - new discovery in Canada. McArthur river mineralization and size 100,000 tons at 20% concentration

Uzbekistan, uranium prospection and/or exploration is being performed by Areva, Navoi Mining and Milling Complex, Uran Ltd , Korea Resources Corporation , Mitsui & Co, Ltd.

Uzbekistan plans to develop seven new uranium deposits to achieve 50% production increase by 2012

I'm glad you have a backup stash of uranium in Yakutia(coldest place in the Northern Hemisphere).

Google says Elkon has a resource of 200000 mt of high cost, low grade uranium .1 to .15%. If prices remain low how will you manage to extract 18000 tons per year?

http://tiny.cc/MR31x

Prices will not remain low. I expect prices to head up 2011-2014. Elkon has gold and other metals. they will mine out more than just the uranium.

15 page pdf on Elkon, development plan from 2013-2025 (see page 4), 319,000 tons of Uranium

http://www-pub.iaea.org/mtcd/meetings/PDFplus/2009/cn175/URAM2009/Sessio...

Russia's state uranium miner plans to invest 203.6 billion roubles ($7.4 billion) by 2015 to fund a massive expansion plan as demand from the nuclear power sector grows.

the reference has the geology and other detailed info.

If prices are low, it means that other suppliers have under-bid Elkon (both for uranium and the other products) and there is no shortage. If supplies get tight, prices will not remain low.

You have drunk the Dittmar Kool-aid, assuming two contradictory things at the same time to get to your preordained conclusion. This leads to one conclusion: you are not using reason.

Nicely put, maj. Cherry picking and hyper-optimism by an MBA--why am I not surprised. It will take about 10 years for any new proposed nuke plants to go from planning to full operation, and that is when even this rosy scenario implies that supplies could become problematic.

Hmmmm.

The supplies will not be problematic in 10 years because new discoveries will be made and developed. New reactors will be coming online over the next 10 years. New reactors firing up in china, India and Russia and other places.

If you say that I cherry picked then show the non-cherry picked data. It should be easy, if I was so obvious.

New Reactors will be starting up in the USA as well in 2013 and onwards. 5-9 reactors before 2020.

If I have been over-optimistic then show the "real data". I have given country numbers and have provided references to mines and companies. So check it and tell me where I am wrong. Maj, Dohboi or any others. Not willing to do any work ? Just some internet searches. Find the real truth. Show me. so far you have no substance. There has been no substantive challenges to my article. to those who disagree - then bring it - show the data, make the predictions. I see nothing so far. I see some doubts, some factless implications and denials but no numbers, no research, no reports.

If you agree with Dittmar then join the bet for the 2009 and 2010 production. I am willing to put up money that Dittmar is wrong. How about it, put your money where your mouth is.

OT and FYI -- Kazakhstan is the 9th geographical largest country in the world while having a very low population to area ratio. We visited a friend in Almaty two summers ago. There is a large area that has been made problematic due to the Soviet Semipalatinsk nuclear test site starting in 1949. They also have rather serious fresh water problems. We did take two ski lifts to the top of the alpine skiing site to be used in the 2011 Asian Winter Games ... saw two other countries from the peak .... another folly IMHO. ... but hey, that's BAU. I liked the people and their non-judgemental acceptance of others and their differing cultures. Horse meat sold next to camel and mutton and pig in the markets. Alcohol in every store and restaurant. Helped in our case that tourists are still viewed as oddities :-)

I see this article as one looking at the world in a business as usual way and I wonder if that is justified...

Consider a commercial entity that want's to buy a new nuclear power plant. Without the help of the government this entity would have to borrow about 5 billion to get it built. The build will take 5 to 10 years (after about 10 years of procedures before building can start). To earn the capital investment back the plant has to operate for at least 40 years (and America shows that saving capital for decommission forces another 20 operating years extra). Will banks have the guts to lend that capital? From what I hear in the US, even with subsidies that are higher than the total expected build cost, the entities are unable to acquire that capital. With wind and solar becoming cheaper every year, it could be that banks and capital investors won't risk such an adventure. Maybe this leads to the situation in which nuclear energy can only grow considerably in government controlled markets and/or only with tax payers money?

Recently there have been a few interesting posts on TOD about the good Dr. Hubbert and his famous curve, which seems to miraculously affect every mined resource. Nuclear enthusiasts often say that uranium only needs to have the right price to get seemingly unlimited amounts of it. This seems to contradict the theory as depletion will accelerate with higher prices. The oil and gas industry show that you will not get everything out of your mine which is said to be available, is uranium mining different in that aspect?

It is likely that the EROI will go into a downward spiral when the most rich fields are depleting. What is the assumed EROI of a nuclear plant currently and what would it be when the resources get diluted by, say, a factor 10?

So in short my questions/wonderings are:

- Will there be enough capital flowing into the nuclear industry to let it grow significantly?

- Will the uranium RAR see any significant growth due to prospecting (in light of Hubbert's curve)?

- How long will the conventional nuclear energy have a significant EROI?

Uranium costs $1/boe and it takes 0.1% of the energy released in its fission to extract even the lowest grades currently mined. How can anyone familiar with oil depletion (and I assume that's everyone here) even dream that this smells like peak uranium?

Let's turn the question around:

Given that there's trillions of tonnes of uranium in the crust and we could never fission even a small fraction before the sun goes nova, uranium supply is essentially limited by price and the energy costs of extraction.

At what price ($/boe) and at what ore grade would uranium extraction no longer be feasible?

How close are we to this point?

Hydrogen is the most abundant element in the universe, not to mention that it is abundantly available in water that covers most of the earth. With enough energy and the right price, we could have limitless supplies. So we should plunge ahead into the wonders of a hydrogen powered future, right?

dohboi,

Sarcasm is easily misinterpreted. ;)

A specious analogy that ignores the obvious difference between hydrogen and uranium: namely that the former is (at best) an energy vector, while the latter is an energy source. Where are we mining uranium at an energy loss? Where are we producing hydrogen at a 1000:1 energy profit?

Your claim that my analogy is specious is specious! ;-P

From your earlier post: "Given that there's trillions of tonnes of uranium in the crust"

Such an irrelevant factoids are as silly as my points about hydrogen.

Perhaps you missed this article in the last Oil Drum:

http://www.newscientist.com/article/mg20427364.500-nuclear-fuel-are-we-h...

Hydrogen is the most abundant element in the universe, not to mention that it is abundantly available in water... So we should plunge ahead into the wonders of a hydrogen powered future, right?

If you are referring to fusion, yes we should pursue the R&D, but I do not think that was your point.

Where are the massive deposits of elemental hydrogen? From an energy point of view, hydrogen atoms attached to oxygen atoms in the form of water are no more valuable than carbon atoms attached to oxygen atoms, CO2, so what is your point?

Bill, you'll have to forgive dohboi for accidentally setting the font color of his sarcasm tags to white ;-)

He seems to be missing some nonsense tags. If it was really sarcasm, he should attack the stated 1000 times EROEI, not the stated abundance.

We need to remember that all uranium that is mined and turned into LWR spent fuel "waste" will become new fuel for fast-spectrum reactors that can effectively burn transuranics and make more from fertile material (depleted U and Th). Note I didn't use the word BREEDER as we don't need to breed more fuel than we are using. With breeding gain of 0, all this waste will be re-used for centuries as there's about 2 orders of magnitude of more energy still left over and all you need is a start charge to prime the process. Besides, a slightly negative gain factor is probably a desirable design feature if you want to make sure a reactor isn't a net Pu producer!

The question should be how do we properly plan and engineer a smooth transition from LWR, once-through fuel cycles to GenIV transuranic burners (e.g. IFR / PRISM) and thermal Th/U233 converters such as the Thorium Molten Salt Reator (aka LFTR). Once this transition is complete the entire issue of supply of mine-able fissile material will disappear. Factory mass-produced small modular reactors, intrinsically safe and with high-burnup, will be the way to rapidly scale up and all this LWR "waste" will be a key resource for powering these reactors.

Yes, I've read those arguments about breeding solving all our energy problems. It's a nice thought...for over at least 20 years.

The point is: in the mean while almost every new plant under construction today and scheduled to be built is not a breeding but a once-through design. If nuclear is to solve partly the peakoil situation and leave room for energy consumption growth (and solve the CO2 problem fwiw) then a massive building spree needs to start now, not in 20 years. These once-through plants will also need fuel for approx 50-60 years, otherwise they won't pay off their investments and have capital saved-up for decommission. Even if all the big energy companies start procedures to build multiple nuclear plants today then those plants won't produce any significant amount of electricity for the next 10 years or so.

To me it seems there is a huge gap between what has to happen and when it will be possible to do so using nuclear.

The first reactors proved fuel breeding in the 1950s, for heaven's sake. The U.S. Navy went nuclear in the 50s, designing reactors from scratch in only a few years after sustainable fission was first demonstrated! We now have 60 years of knowledge acquired since then. All this hand-wringing about how we can't do this or that, can't build a reactor inside a decade, is crazy given the approaching peak oil and climate change CRISES.

Producing more fuel than is consumed is not necessary to extend the lifetime of cheap nuclear fuel resources out by centuries. Science and technology for closed fuel cycles have been demonstrated. With regard to *implementing* efficient fuel cycles in the past, it has been pure politics standing in the way. I would argue politics *designed* to stop nuclear power from taking market share away from fossil fuels. Deep burn with closed fuel cycles in intrinsically safe reactors takes away just about all the arguments against N-power. Can't have that, now can we! Things like banning recycling in the U.S. (Carter), and the cancellation the Integral Fast Reactor (Clinton) just as it was about ready for prime time are deeply political. FWIW, Clinton's energy secretary was Hazel O'Leary. From here:

Nuclear power is the biggest threat to fossil fuels, especially fossil fuels used in power generation (coal and gas), we should never gloss over that point when reflecting on the political dimension of the history of nuclear power.

Large reactor plants have been built on time and on budget in Asia in recent years. The modular design concept of the AP-1000 increases build efficiencies. The NRC approval queue costs 10s of millions and the wait 5 years before a shovel can hit the dirt. This is ALL POLITICAL in origin. Nuclear can scale and scale fast if we got serious about it as a society and change the political impediments to advanced nuclear power.

I fail to see the connection between Hazel O'Leary working in the power sector and her opposition to nuclear power.

Power companies need to buy natural gas and sell into regulated electricity markets. One would think they would be the one's most likely to want to explore other energy sources. Sure, she did a stretch as the head of the gas division, but the parent company owns and operates nuclear plants.

http://en.wikipedia.org/wiki/Xcel_Energy#Nuclear_Power

True, but there's adequate fuel even under Dittmar's scenario to run them all for 60 years.

After the current crop is finished we have to worry about uranium, but Lightbridge (formerly Thorium Power) is going to be bringing thorium fuel elements to market around 2021 (they're testing in Russian reactors). That multiplies the amount of LWR fuel by a factor of at least 4. That's enough to keep a large LWR fleet running while the new builds switch to fast-spectrum converters (to burn the actinides in spent LWR and CANDU fuel and make use of the remaining U-238) and LFTRs (which can take their initial fuel loads from spent thorium fuel from LWRs, full of U-233).

Even if all the big energy companies start procedures to build multiple nuclear plants today then those plants won't produce any significant amount of electricity for the next 10 years or so. To me it seems there is a huge gap between what has to happen and when it will be possible to do so using nuclear.

Your implication is that there is some other technology available, proven on a large scale, that can eliminate coal oil and gas consumption in 10 years at an affordable cost. What is that?

Under BAU, in ten years the world will be consuming fossil fuel faster than it is now. If there is a massive depression, nuclear will be producing a higher percentage of the world’s electricity than it is now because uranium cost/kWh will still be cheap and transportation requirements are low.

We should start building conventional reactors now and we should be developing technology for the production of small factory mass produced reactors that can be built cheaply in vast numbers.

Reactors are inherently simple machines. They can be built with fewer moving parts than a steam locomotive. If the world ever decides that this is a major emergency, and gives it the priority that weapons production had in WWII, we could curtail the use of fossil fuel rapidly.

Solar panels are even simpler then reactors as they have no moving parts at all, but you also know that the amount of precision built moving parts is not what this is about. Pressure vessels, piping, ultra-high quality welding, precision turbines, terrorism proof housing, the list goes on. Nuclear is anything but simple.

Yes, maybe the one thing that can 'save' nuclear energy is the scenario you describe: an state-controlled energy sector and reduced democracy.

Unfortunately (?) we don't live in an totalitarian communist world but in a capitalist one. Or are you an advocate for more government control (and taxes)? That would not be very a republican nor liberal notion...

If you start a nuclear and solar project now, by the time the nuclear team has decided what to build, solar will have put the first MWh's on the grid already. The longer you wait the higher the capital cost get and the smaller the final reactor design must be given a fixed project price.

It would be interesting to calculate this through. The document that Majorian gave describing reactor economics gives alternatives the economic advantage. They even will if the numbers would be halved.

the one thing that can 'save' nuclear energy is the scenario you describe: an state-controlled energy sector and reduced democracy… Unfortunately (?) we don't live in an totalitarian communist world

Now you are just making things up. My recommendation is

1...Implement a $100 billion / year R&D budget that pushes all technologies as hard and fast as possible. $100 billion / year is not much to solve the two biggest problems faced by 6.5 billion people, energy and climate change. The economic return for getting it right will be many orders of magnitude larger.

2...Build demonstration plants of every technology as it becomes possible. If the first one fails, build improved models until the technology is proven to be useful or not.

3...Publish all the data.

4...Eliminate all subsidies. Note that R&D and subsidies are two completely different things. With R&D there is always the potential for a dramatic breakthrough that will change everything. Not so with subsidies.

5...Include all external costs for all technologies.

6...Allow the cost of energy to rise or fall to its real value on a totally level field.

7...Allow a well informed private sector of individuals and corporations to select the best technology for mass production.

This process will produce the best possible solution in the shortest time.

Well, I do think that is what you mean because how are you going to implement a 100 billion/year research program if it's not the government doing it? The industry will never do it by themselves.

The beauty of the German feed-in tariffs system is:

a) you, as an electricity producer, only get paid if you deliver. More efficient and lower cost will mean more profit -> strong market pressure.

b) yearly regression forces constant efficiency improvements because otherwise products won't be sold next year.

c) you, as an electricity consumer, pay less if you consume less because the feed-in tariffs are paid by the electricity consumers, not tax payer. Negawatts are very powerful and very very cheap!

d) anyone can be an energy producer instead of depending on monopolies.

So you get heavy competition which pushes innovation hard which is proven to work well. Having the industry doing this under market pressure is much more efficient then massive government programs. The built-in regressions also mean that the feed-in tariffs will stop at some point: there is no open-end. So 'subsidies' will be for a fixed period of time and with limited amount of money.

Imho, your recommendation is to pump a lot of public money around through heavy, slow institutes and monopolies with large overhead without actually producing any electricity for a long time, without incentives to make anything commercially viable and it has no real targets at all (well, publishing all the data). The institutions that feed of this money will lobby hard to keep the system going and the public will have to pay for a long time to come.

Having the people pay well ahead for something that they, if all goes well, might get later (and then have to pay for it again) is something that is not new in the nuclear business and doesn't have a good track record.

because how are you going to implement a 100 billion/year research program if it's not the government doing it? The industry will never do it by themselves.The beauty of the German feed-in tariffs system is:

Fascinating logic. $100 billion is a tiny fraction of U.S. gdp, but you think big government is needed to do it. In reality it is very simple.

1… Identify the best project manager in the world. Someone like Leslie Groves. He managed construction of the Pentagon in 16 months and the development of nuclear weapons in three years starting from a very small information base.

http://en.wikipedia.org/wiki/Leslie_Groves

2… Give that person a checkbook on the U.S. treasury and stand back.

Personally I would agree to a 2 cent/kWh fee on nuclear kWh's if all the money went into building demonstration reactors using advanced technology.

My point seven is “Allow a well informed private sector of individuals and corporations to select the best technology for mass production.” You think that is too heavy handed but you like German feed in mandates and tariffs. That is strange logic.

you, as an electricity consumer, pay less if you consume less because the feed-in tariffs are paid by the electricity consumers, not tax payer. Negawatts are very powerful and very very cheap!

I see you have bought Lovins Snake Oil, and we see how well that works in Denmark. After 35 years of a huge government mandated push in windpower they use half as many kWh's per person as the U.S. but pay four times as much for each kWh and have high carbon emissions. No Thanks.

Well giving someone a checkbook on the U.S. Treasury would mean a government operation doesn't it? And 100 billion/year might not be very much in GDP but there aren't many companies that have such a big turnover. Yeah, in my logic that means: a large government operation, no matter who runs it. German feed-in tariff is not paid from any government budget.

Yes, I've bought Lovins ideas, it works well for me: use less energy without losing comfort and cycle more. But please explain: what have Lovins's negawatts to do with Denmarks push to wind?

Your e-price might be lower but they are lower then pretty much anywhere in the EU anyway, even France probably.

I'll give some numbers considering:

France has 80% nuclear

Denmark has 25% wind

Netherlands has 2.5% wind, 50% gas

Belgium has 40% nuclear, 10% hydro.

The carbon emissions per capita:

- US: 19.1

- Netherlands: 11.2

- Belgium: 10.8

- Denmark: 9.2

- France: 5.8

http://en.wikipedia.org/wiki/List_of_countries_by_carbon_dioxide_emissio...

Carbon emissions in France and Denmark are lowest, France is 37% lower then Denmark. Belgium is higher then Denmark, not much lower then NL.

==

Oil usage per 1000 (barrel):

US: 68.672

Netherlands: 59.394

Belgium: 60.478

Denmark: 34.857

France: 32.839

http://www.nationmaster.com/graph/ene_oil_con_percap-energy-oil-consumpt...

Again France and Denmark are lowest, but very close despite the difference in 'carbon free emission' electricity production. Oil usage in Belgium is equal to the Netherlands.

==

Electricity prices without taxes:

US: 0.1163 Dollar (including taxes)

Netherlands: 0.1440 Euro

Belgium: 0.1431

Denmark: 0.1239 Euro

France: 0.0959 Euro

http://epp.eurostat.ec.europa.eu/tgm/graphToolClosed.do?tab=graph&init=1...

http://www.eia.doe.gov/cneaf/electricity/epm/table5_6_b.html

So France's electricity is 23% cheaper per kWh but the power companies are state-owned so I'm not sure how prices are determined. Belgium's 40% nuclear share doesn't translate in a low e-price and is about the same as expensive Dutch gas power. Denmark's price is at European average.

==

Electricity usage per capita (kWh):

US: 99622

Netherlands: 72934

Belgium: 76134

Denmark: 48484

France: 54785

http://www.iaea.org/inisnkm/nkm/aws/eedrb/data/FR-encc.html

==

GDP per capita ($):

US: 40100

Netherlands: 29500

Belgium: 30600

Denmark: 32200

France: 28700

http://www.iaea.org/inisnkm/nkm/aws/eedrb/data/US-gdpc.html#c1

Despite apparent wasteful investing's in windpower and high energy bills (including taxes), the Danish are quite wealthy for European standards, 11% more then the French.

==

Denmark's carbon emissions are low and raw e-price is at European average. Also, France's 60 year massive government mandate push in nuclear, which was much bigger then Denmark's wind push, haven't given them a big edge on any account. Corrected to income electricity production in France is just 12% cheaper then in Denmark. And because the Danish use less electricity their raw electricity bill is pretty much equal to that of France per capita.

Denmark is wealthy and uses litte energy per capita. These two apparently don't have to contradict. I don't see a clear signal to justify a Manhattan project * 5 every year (the Manhattan project cost was about 2 billion, ~22 billion in today's currency).

Denmark has 25% wind

Not true. Denmark makes a quantity of wind energy that equals 20% of what they use. They export half of that because they cannot use it all when wind is good.

The reality is that Denmark is part of the European grid, and wind provides about 3% of the total grid power.

Denmark is a tiny country in a unique situation. It is not an example that is applicable in general.

German feed-in tariff is not paid from any government budget.

So you write a big check to the utility instead of the government. It is still money you do not have for other things.

The carbon emissions per capita:

- US: 19.1

- Netherlands: 11.2

- Belgium: 10.8

- Denmark: 9.2

- France: 5.8

What about Sweden, 5.1 50% hydro and 50% nuclear, almost no carbon emissions related to electricity. As transportation converts to electricity they will see the biggest improvement.

Electricity prices without taxes:

If an American moves to Denmark and reduces his electricity consumption by half his electric bill will double.

I don't see a clear signal to justify a Manhattan project

What is your recommendation and why is it better than pushing every technology and picking the best whatever it is.

Bill, I'd argue with you on one point: R&D alone won't cut it, what we need is to get stuff into production. The USA spent $1 billion or so on PNGV R&D and didn't get a single vehicle into a showroom. A relatively minor amount of R&D (at breakneck speed) will get several important technologies into pre-production scale plants but then you must have some way to get the materials and labor to translate it into major deployments.

Bill, I'd argue with you on one point: R&D alone won't cut it, what we need is to get stuff into production.

I agree. I see it as two parallel tracks. I would like to see conventional plants built and two or three facilities built to mass produce floating nuclear plants using Gen III technology. The level playing field would help a lot. If coal paid for the harm its emissions do that would make nuclear much more attractive.

A relatively minor amount of R&D (at breakneck speed) will get several important technologies into pre-production scale plants but then you must have some way to get the materials and labor to translate it into major deployments.

I think the first full size examples of any new technology should be the final step in the Development process. That is why D is the expensive part of R&D, the part we have not been doing.

Coercive international treaty’s mandating expensive intermittent energy systems will not solve the problem. Developing energy systems that are reliable, safe, mass producible and cheaper than fossil fuel should be our main goal.

Ok, fair point, Denmark isn't consuming all of their homebrew wind directly. What is left goes to fill up Norwegian and Swedish hydro or displace German electricity which is for a large part (brown) coal, maybe even some gas in the Netherlands. This means that the windpower is not lost and they get a large part back when there's not enough wind. Imho this equals to France that uses Switzerland for storing it's surplus nuclear power and peakshaving as does Sweden within it's own borders. There's not much wrong with that, is it? I think it comes down to that wind or nuclear in combination with hydro will behave quite the same and that borders should not be a limiting factor.

Might be, but you brought Denmark into the discussion. France is in a unique situation as well, with the Alps next door. Besides, countries get better interconnects all the time. Brittain could be a major windpower producer/exporter someday as well with interconnects to Norway, the Netherlands and France. They sure have enough wind.

This big check is not so big: on average 30 Euro per household per year. Use less = pay less, contribute renewable energy=profit. The 100 billion/year scheme would mean 950 Dollar/year per 105,480,101 households in the US (http://quickfacts.census.gov/qfd/states/00000.html). The 30 Euro per year is based on real production, the 950 Dollar per year is based on a future promise.

Oh c'mon, that is including taxes. I did not compare raw prices without reason: the US doesn't have accessible healthcare for everyone or any of the other socialist things do they? Prices including taxes are not comparable because of the different laws.

Btw, you'd probably be able to reduce your e-use more then half and the e-price including taxes is only a bit more then double so your e-bill would be about the same, not double.

You can guess this one from my previous posts: I don't believe that massive government programs are really effective. My experience with recent large government programs are not positive. I also think that 'pushing every technology' would translate to 'pushing every nuclear technology' when it comes to it, because solar for instance is not to the likings of most big power companies. There will always be politics at play.

I think that a decentralized grid where everyone can be an energy producer is good (e.g. because awareness will lower your e-use). The German EEG law is quite simple and proven to be the most effective incentive yet developed to get renewable energy into rapid development.

I think it comes down to that wind or nuclear in combination with hydro will behave quite the same

Consider a Europe in which all countries have 80% wind. What happens when a 100 year heat wave settles over Europe with average wind output less than 5%.

100% photovoltaic backup you say? OK, you have 8 hours to collect 24 hours of energy. 2/3 of that must go through storage with 25% loss, so you must generate 122% of consumption (0.333+0.666/0.75).

A huge winter storm settles over Europe. Icing conditions shutdown the windmills. No sun for solar. 100% fossil backup, right? Now let’s say the storm is eccentric. Half of Europe is ok. How much transmission line capacity is required to support the other half, hundreds of GW?

Now add up the cost to build and maintain all of these power plants, wind farms, storage facilities, fossil fuel supplies and transmission lines. How much time to acquire land and permits for all this construction?

Consider a Europe in which all countries have 80% nuclear power with enough interconnection to handle the imbalance of a few unexpected plant outages. Refueling and maintenance outages are scheduled for spring and fall when demand is low. That compensates for seasonal variation.

Realistic cost and time estimates of the renewable grid with backup will be several times that of the nuclear grid, and the nuclear grid will have lower emissions. But that comparison is never made.

on average 30 Euro per household per year.

That is 2.5 Eu /month, 8.33kwh/month at 30 cents/kWh, 12 watts per household. Try again.

The $100 billion is about 10% of the U.S. annual energy bill. When the solutions are in place the savings will be much more than 10%. Especially considering the impact of rising fossil fuel cost without new technology. When the solutions are applied globally the direct savings will be many times that, and the indirect savings, like eliminating the health effects of burning coal, will be orders of magnitude greater than the direct savings.

It would be the greatest gift the U.S. could give the world.

I don't believe that massive government programs are really effective.

So you do not see government mandated renewable energy requirements and feed in tariffs that cost people billions of dollars in increased cost as government programs, interesting. So if the government set up a private corporation, like a utility, and called it the Defense Department, and ordered every citizen to send it a check for $2,000 each year, that would not be a massive government program?

The enormous taxes on electricity distort the economics resulting in more conservation of electricity in Europe. You take advantage of that fact in part of your analysis where it supports your position and then dismiss it in the part that contradicts your position.

Economic distortions influence decisions in a way that usually results in adverse results in a large scale analysis, in spite of apparent good results at a micro level. For example, high electricity costs, due to high taxes or mandates for expensive impractical technology, push a homebuilder towards natural gas heat instead of a heat pump.

“What about Sweden, 5.1, 50% hydro and 50% nuclear, almost no carbon emissions related to electricity. As transportation converts to electricity they will see the biggest percentage improvement.”

Consider a Europe in which all countries have 80% wind.