World Oil Production Forecast - Update November 2009

Posted by ace on November 23, 2009 - 10:45am

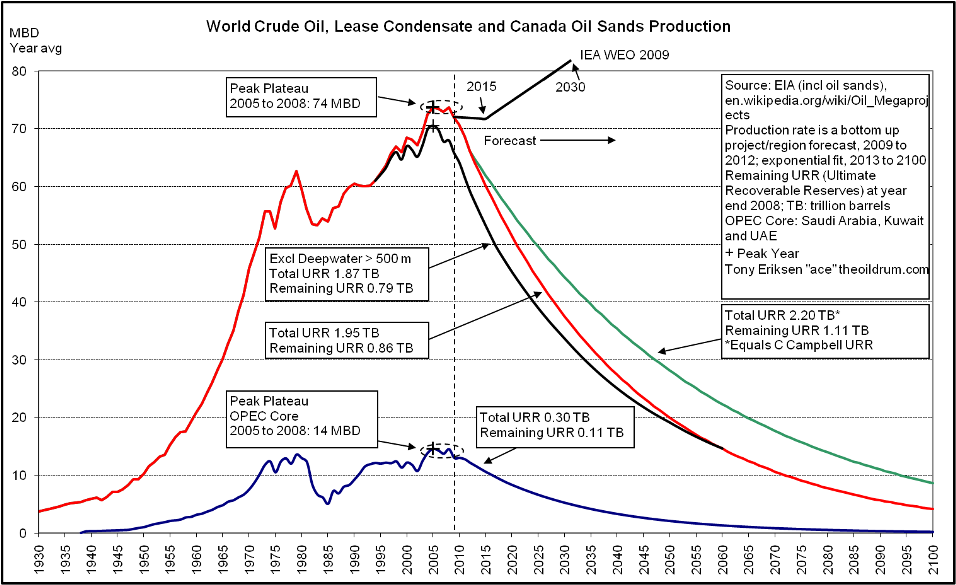

World oil production peaked in July 2008 at 74.74 million barrels/day (mbd) and now has fallen to about 72 mbd. It is expected that oil production will decline at about 2.2 mbd per year as shown below in the chart. The forecasts from the IEA WEO 2008 and 2009 are shown for comparison. The IEA 2009 forecast has dropped significantly lower than the 2008 forecast. The IEA 2009 forecast also shows a slight decline from 2009 to 2012 implying that the IEA possibly agrees that world oil peaked in July 2008.

The US Energy Information Administration (EIA) and the International Energy Agency (IEA) should make official statements about declining world oil production now to urgently increase the focus on oil conservation and alternative renewable energy sources.

World Oil Production

World crude oil, condensate and oil sands production peaked in 2005 at an annual average of 73.72 million barrels per day (mbd) according to recent EIA production data. 2008 production was slightly less than 2005 creating a peak plateau from 2005 to 2008 as shown in the chart below. Production is expected to decline further as non OPEC annual oil production peaked in 2004 and is forecast to decline at a faster rate in 2010 and beyond due mainly to big declines from Russia, Norway, the UK and Mexico. Saudi Arabia's crude oil production peaked in 2005. By 2011, OPEC will not have the ability to offset cumulative non OPEC declines and world oil production is forecast to stay below its 2005 peak.

My forecast to 2012 is based on an aggregation of individual forecasts from over 80 countries including over 300 major oil projects. My estimate of 1.95 trillion barrels (TB) of total Ultimate Recoverable Reserves (URR) of oil is used to generate the forecast beyond 2012 as shown by the red line below. If Colin Campbell's estimate of 2.20 TB is used, which is 250 billion barrels (Gb) greater than my estimate due mainly to more optimistic assumptions about OPEC reserves, the peak production date remains at 2005. This shows that an additional 250 Gb of recoverable oil reserves does not change the peak oil date and instead increased production rates occur later as indicated by the green line below. Additional reserves and the related production from prospective areas such as the arctic, Iraq, and Brazil's Santos basin are highly unlikely to produce another peak but should decrease the production decline rate after 2012.

The IEA WEO 2009 forecast is also shown on the chart below and an abrupt change in production occurs after 2015. The reason for this change is due to the IEA using one forecasting methodology up to 2015 and a different methodology after 2015. The IEA explains their two different methodologies on pages 39 and 40 from the IEA World Energy Model (WEM). The IEA's forecast to 2015 is based on over 570 sanctioned and planned projects, each with capacity greater than 5 thousand barrels per day. The IEA needs to explain this sudden change in production after 2015.

The IEA's forecast from 2015 to 2030 is not based on projects but based on the assumption that there are enough remaining oil resources coupled with enough investment to cause oil production to suddenly increase after 2015 to meet the IEA's oil demand forecast. The IEA projects that much of the sudden production increase after 2015 comes from OPEC countries most of which are referred to as closed countries by the IEA. The IEA WEM page 40 states the following in reference to OPEC closed countries: "Long-term exploration and production investments of closed countries are projected based on expert judgement supported by the analysis of the consistency of official targets with the potential from past discoveries, estimated yet-to-be-discovered reserves and enhanced oil recovery projects." The IEA also continues to accept, without any questions, the oil resource estimates by the US Geological Survey oil assessment in 2000 (USGS 2000) as shown in Fig 10 on page 26 of the IEA WEM.

OPEC is consistent with the IEA in its use of forecasting methodology for long term projection to 2030. OPEC also forecasts oil demand first and also relies on USGS 2000 resource estimates to project an oil supply increase which meets demand. The paragraph below is from page 24 of the OPEC World Oil Outlook 2007 and is OPEC's attempt to assure the world that there are sufficient resources to meet future demand.

A central tenet of the OPEC long-term supply perspective assessment is that resources are sufficient to meet future demand. The resource base, as defined by estimates from the US Geological Survey (USGS) of ultimately recoverable reserves (URR), does not constitute a constraint to supplying the rising levels of oil demanded in the reference case. Indeed, the methodologies developed and applied to derive the regional crude supply figures revolve around the assessment of remaining resources (resources minus cumulative production), so supply projections are, by definition, plausible from the resource perspective. Moreover, it is worth noting that these URR estimates have practically doubled since the early 1980s, from just 1,700 billion barrels to over 3,300 billion barrels, and it is probable that this upward revision process will continue. It should be noted that cumulative production during this period was less than one-third of this increase. In addition, these figures do not take into account the large resources of nonconventional oil.

Both the IEA and OPEC first forecast long term oil demand to 2030. Next, both agencies assume that there are sufficient oil resources to meet demand as substantiated by the USGS 2000 oil assessment. Oil extraction has become technologically more challenging and more expensive as much of the easy oil has already been produced. There is a strong likelihood that oil resources and investment will both be insufficient to increase production above the 2005 peak. However, both IEA and OPEC will probably say that falling investment caused falling oil production.

![]()

Non OPEC Oil Production

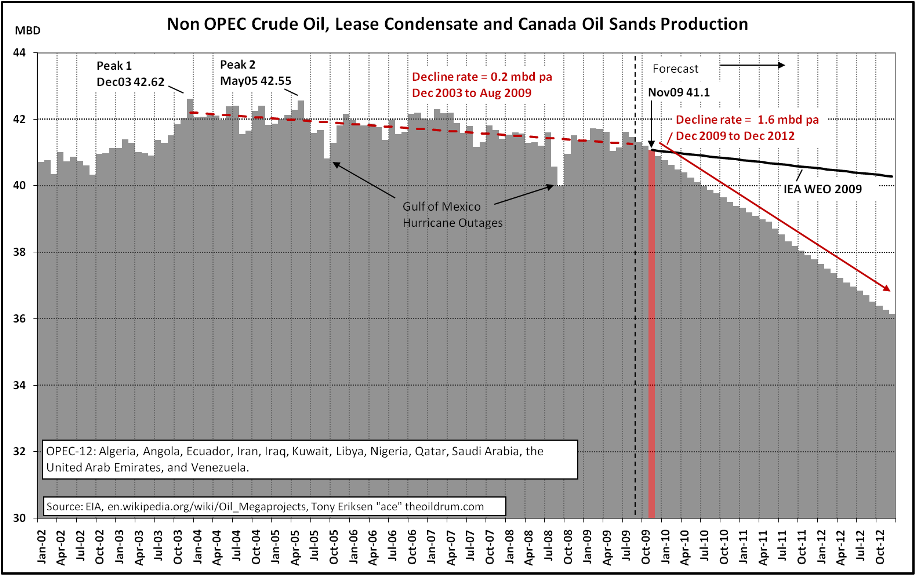

Non OPEC crude oil, condensate and oil sands production peaked in December 2003 at 42.62 mbd according to recent EIA production data. Production is expected to decline further at a rate of 1.6 mbd per year from now to December 2012. This decline is due mainly to big declines from Russia, the North Sea and Mexico.

The IEA WEO 2009 forecast is shown on the chart and projects a decreasing production rate which is roughly equal to an extrapolation of the downward trend from December 2003 to now, as shown by the dashed red line. This implies that the IEA has admitted that non OPEC oil production peaked in December 2003.

![]()

World Oil and Natural Gas Liquids Production

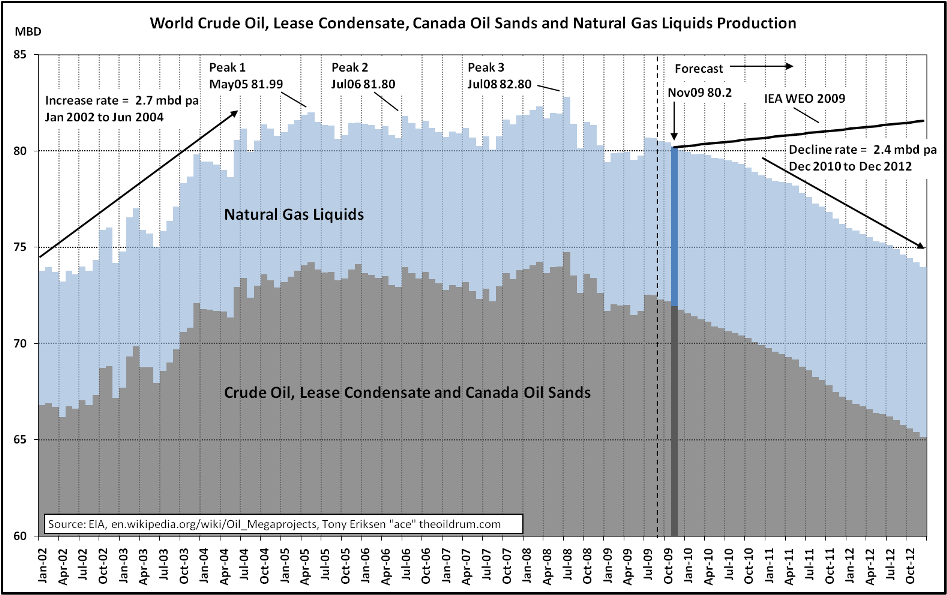

World crude oil, condensate, oil sands and natural gas liquids production peaked in July 2008 at 82.80 mbd according to recent EIA production data. Production is expected to decline further at a rate of 2.4 mbd per year from December 2010 to December 2012.

The IEA WEO 2009 forecast is shown on the chart and projects an increase due mainly to optimistic assumptions about OPEC production rates. The IEA also assumes annual increases of 0.44 mbd from new natural gas liquids capacity additions and 0.13 mbd annual increments from Canada oil sands. In a stark contrast, Colin Campbell assumes only 0.07 mbd annual increases from natural gas liquids.

![]()

World Liquids Production, Demand and Price

The definition of oil used by the International Energy Agency (IEA) also includes natural gas liquids (NGL), bio-fuels, processing gains and other liquids derived from natural gas and coal. OPEC NGLs were supposed to cause a significant net increase in world NGLs in 2009 but this has not happened yet as NGL production is struggling to exceed 8 mbd. According to the EIA NGL data, 2007 production was 7.96 mbd, 2008 was 7.91 mbd and 2009 year to date remains just below 8 mbd at 7.99 mbd. Although bio-fuels production has been growing exponentially, world liquids production has probably passed peak in July 2008 at 87.9 mbd as shown below. In 2008, US ethanol production was 0.6 mbd, Brazilian ethanol production was 0.4 mbd, and bio-fuels production outside the US and Brazil was 0.5 mbd.

The IEA WEO 2009 supply projection is approximately equal to the forecast demand in the chart below. The IEA's forecasting model first calculates the future demand and assumes that oil resources are not a constraint. Second, the capital investment is assumed to be large enough to ensure that these oil resources can be converted into production fast enough to meet demand. Consequently, the IEA supply forecast is roughly equal to the demand forecast.

The average oil price should stay above $US 75/barrel for the remainder of the year as average demand is forecast to be only slightly greater than supply to December 2009. If world demand unexpectedly weakens then prices might fall below $US 75. Furthermore, OPEC is unlikely to cut supply at its December meeting which reduces the upward pressure on oil prices. Some recent evidence of increased demand is shown by US crude oil stocks dropping from a recent peak of 26.2 days at the end of April down to 24.1 days in mid November. However, oil prices could exceed $100 in early 2010 as world liquids production may fall below forecast demand.

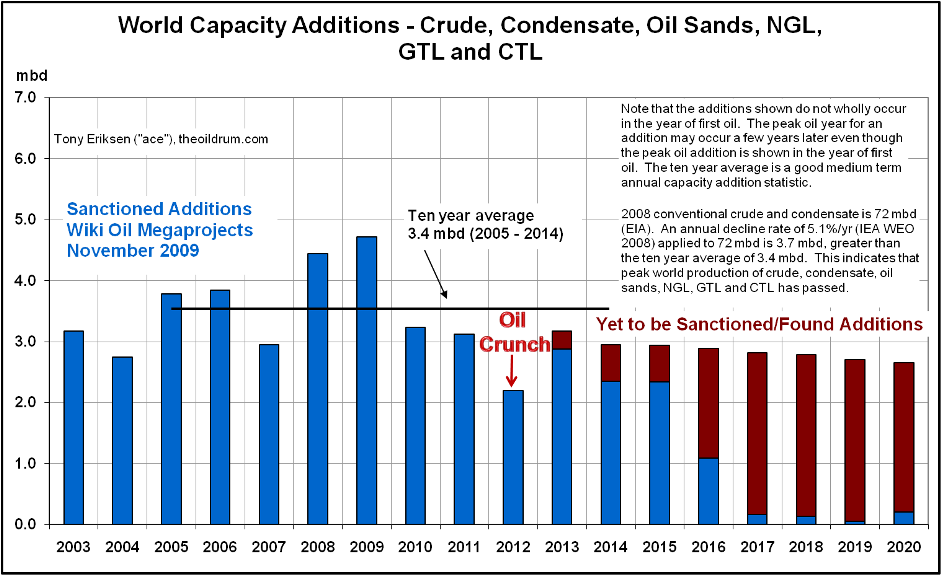

High volatility of future oil prices is also expected due partly to delays in project investment causing future annual oil capacity additions to decline sharply to 2012. This declining trend in capacity additions is shown in the chart below which is derived from this oil megaproject database. About 3.7 mbd of annual capacity additions are needed just to offset declines from existing fields. Annual capacity additions from 2010 are forecast to be less than 3.7 mbd implying that world production of crude, condensate, oil sands, NGL, GTL and CTL will continue declining. The chart below shows capacity additions from new projects and not production additions. Allowing for maintenance, unplanned outages and other incidents, future production additions may be about 15% less than capacity additions. This means that the production additions for 2010 to 2012 could be less than 3 mbd, well short of the required 3.7 mbd to offset declines from existing fields.

Many large capacity additions started in 2009 including over 1 mbd from Saudi Arabia, over 0.4 mbd from Brazil, over 0.5 mbd from Russia and almost 0.3 mbd from USA. Key producer Saudi Arabia has no more capacity additions until Manifa's 0.9 mbd scheduled to start in 2013, at the earliest. Capacity additions from Brazil, Russia and USA decline from 2009 to 2010. World capacity additions drop further in 2011 and decrease again in 2012. Consequently, an oil supply crunch is likely to occur in 2012 as shown below. The capacity additions do not include bio-fuel additions but these additions are unlikely to ease the 2012 oil crunch.

![]()

Additional Information Sources

World Oil Production Forecast - Update May 2009

World Oil Production Peaked in 2008, March 17, 2009

Saudi Arabia's Crude Oil Production Peaked in 2005, March 3, 2009

Non OPEC-12 Oil Production Peaked in 2004, February 23, 2009

USA Gulf of Mexico Oil Production Forecast Update, February 9, 2009

Thanks, Ace. I always am interested in the data and appreciate the work you put in to producing this post. It looks like the die is cast for the next three years for declining production based on current data. Even if 100 discoveries of large oil fields occurred within the next three years, we would still have an oil crunch in 2012. Either 2005 or 2008 is the likely peak for the foreseeable future. There could be another peak down the road, but the further away from those dates we get without a production increase, the less likely it is that the peak will be surpassed. My language is deliberately stochastic as definitive statements are foolish at this point.

The IEA's chief economist has already made a warning in Aug 2009 when he said that "the world will likely see an "oil crunch" within the next five years that will send prices soaring, starting as early as 2010."

http://www.scdigest.com/assets/On_Target/09-08-05-2.php?cid=2625

Would it be possible to go back through the previous outlooks and plot how the predictions have changed over time?

Knowing that, on average the 3 year IEA outlook has been 20% optimistic may be of use in evaluating the usefulness of the current predictions.

Also, is this post just an IEA outlook, or would it be nice to see the mean forecast from a few other sources (ie, as in http://www.theoildrum.com/node/2620 ) so that this isn't just IEA's outlook, but somewhere you can get an idea of what other people have predicted also.

A table showing IEA changes in their WEOs is here:

http://www.crudeoilpeak.com/?p=564

1 Most think SA has substantial add'l cpacity, plus a little more from other gulf countries. Do you agree? SA has stated that 75 is high enough, seems to be raising output a little already. Suggest you comment on what you think excess capacity exists, if any, and the potential for it to be produced to meet any near term shortfall, say in 2010/11.

2 Stocks are higher than five year avg, US consumption seems nearly certain to decline over the near term as unemployment continues to rise. Do you believe that china expansion will continue or do you think they, and the commodities they have been stockpiling, are in a bubble? And, if in a bubble, do you think that chinese fuel consumption will decline over the near term?

3 Do you think the world is emerging from the recession, will continue flat from here, or will decline from here?

I agree supply is fixed over the next two years unless SA can and will produce more. Do you think the above economic issues can substantially affect demand and price in 2010/11?

If the existing field decline rate is around 4.5%, we need 3.3 MMBD each year to break even. Fig 6 indicates we actually added spare capacity in 2008 and 2009, giving us a little bit of buffer for 2012. If there is little increase in demand, no unforeseen above ground problems and no unusual speculative pressure we might get through 2012 at lower prices than the July 2008 price spike.

No unusual speculative pressure is highly unlikely. The monthly oil chart is in a firm uptrend:

http://futures.tradingcharts.com/chart/CO/M

Please note that the normal fall decline in prices that occurred from 2001 to 2006 and again big time in 2008 has been replaced replaced by an uptrend as in 2007.

And gold is again making new highs this morning having broken out of a basing pattern:

http://futures.tradingcharts.com/chart/GD/M

The last 2 breakouts in the gold chart were good for a $300 price increase for gold. This implies a $1300 price before we start basing again.

And if we look at the dollar, it appears to be losing support at 75 on the dollar index chart:

http://futures.tradingcharts.com/chart/US/W

It's acting like it wants to breakdown and test support at 72 again.

The picture I see is unusual speculative pressure on oil prices in the near future. Markets usually go to extremes in both directions and with oil fundamentals being very bullish, the bullishness of the charts is confirmed.

Any oil price that stays long enough above 80$ will trigger a new recession. If the january 2009 price spike is going to happen, good bye recovery.

This seems a little premature to say. What are you basing that $80 limit on? I think we will emerge from every recession a little more resistant to the high price as people adjust. The problem, of course, is that the production decline will continue to be steeper and steeper for a while, though eventually, it should start to level out (the long tail). What I hope is that most people will wise up to the trend before too long and make permanent lifestyle adjustments (give up personal transport) that will permanently reduce their liquid fuel needs.

Anecdotally: I know when gas was $4.00 a gallon, it cut into my discretionary spending. At $2.50, I simply limit my driving. I don't plan to have a car by 2012. Probably, I won't be able to afford one, or at least, it won't be worth it.

80$ or more a barrel was more or less the inflation corrected oil price before the last 5 recessions set in. Of course that is not an exact figure but it was described here in some recent comments quite convincingly.

Your lifestyle adaption is really recommendable by any means but if everybody did so it would trigger a recession even without high oil prices: Everything in the global economy is based on growth. In spite of that deferred demand or at least reduced consumption wil be a must, soon IMO.

Check out Dave Murphy's post showing that an inflation-adjusted price of $80 to $85 a barrel seems to lead to recession. Others have come to the same conclusion.

There is no recovery. It's all statistical baloney from the Charisma boy-In-Chief and his stooges (just like Bush before him).

Here's an example, the Bureau of Economic Analysis claims that consumer spending rose by 1.2% for the third quarter. Yet actual retail sales tax receipts at the state and local level reported for the third quarter are down 8.2%. One of these numbers is a LIE. The BEA relies on its "models" for what they think the economy is doing. The state and local sales tax receipts are the actual data about what the economy is doing.

But which number gets reported by the Ministry of Truth, aka the Mainstream Media? Why the 1.2% increase, of course. They are LYING to you. It's a confidence game, aka a CON game.

Meanwhile real unemployment appears to be north of 22% and rising. The peak of the Great Depression was 24%.

Sometime in the next 6-8 months the stock market is going to get smoked, hard. Recovery? I don't see any green shoots, just lots of green shit, ready to hit the proverbial fan.

Would you mind sharing the source for the -8.2% number? Thanks.

Google "state tax receipts". Tons of info comes up. A large drop appears to be true.

Thanks. Similar data apparently lurks in the U.S. Census Bureau site. The numbers there are UGLY.

The -8.2 number quoted above may be from today's WSJ however.

WSJ was citing this report:

http://www.rockinst.org/newsroom/news_releases/2009/11-23-sharp_declines...

Very difficult to spin those results. They are very bad.

States are drowning in red ink because of the decline of real estate and sales tax revenues. It's on Bloomberg, Wall Street Journal, even a national association of State Budget Officers has commented about how horrible this is.

But here's one example of such data already collected for you.

You can get it yourself but you have to go state by state to collect it all.

The rise in the market (particularly the S&P) directly correlates, over 90%, to the moves in the dollar since March 2009. That has almost never been true in the past 2 decades but it is now. That rise is nowhere near as large as people make it out to be due to the fall of the dollar in the meanwhile.

In fact, if you have a trading account that can plot FOREX info against market info, plot the dollar index since March against the S&P since March. Those two puppies look like inverted twins of one another. The dollar goes down and the market surges. The dollar goes up (which has been rare since March) and the market pulls back.

Even the BLS report admits, in Table A-12, line item U-6 of the monthly employment report that real unemployment, not the juggled public U-3 numbers is at least 17.5%. And given some of the shenanigans that Bush Jr. and Clinton pulled with unemployment numbers, there is good reason to believe it is much higher, such as a recent university report suggesting over 22%.

There is no recovery. It's all crap and lies. And the rest of the world continues to edge away from the dollar (and the Euro and yen) at a slow but steady pace.

By the way, Russia added another 500,000 ounces of gold to their central bank holdings. At 1000 troy ounces per 31.1 KG that's 15550 kg of gold they added last month (to the 19 million ounces they currently hold). That's a bit over 17 tons of gold they added last month alone. India bought 200 tons. Sri Lanka bought gold. China is buying gold. Why? Because the dollar is being deliberately trashed to save the very SOBs that caused the crisis - Wall Street financial institutions.

But consumers aren't buying the recovery BS, because they are maxed out on their credit cards or busy trying to pay them off so they don't get hammered again by the likes of Citibank, which recently raised credit card rates on 2 million customers from single digits to 29.9%.

Unemployed people and employed people taking pay cuts (Google that and see what FedEx and dozens of other major corporations have done in that regard, even Microsoft) do not consume as much as they did before because they can't. This is a nascent depression and more Bernanke and Geithner lies are going to make a full blow real depression. And then, once we're down and on the floor, peak oil will seal the deal by preventing any real restructuring.

P.S. China has 7.7% GDP? REALLY? Google Ordos. Google the highway in Hunan province that has been built, ripped up and rebuilt just to inflate the GDP number. China is playing the world for the fools that most of them are.

Ordos made it onto BBC News last week. Aparently even though the city is empty many of the apartments have been bought up by speculators hoping to cash in once the recovery begins. That sounds like China could be heading towards its own housing bubble.

there is a third possible lie. maybe the retailers responsible for collecting and paying sales taxes are doing the lying. maybe they are using sales tax reciepts to manage cash flow or lack therof. maybe they are under-reporting and pocketing sales tax reciepts. it happens.

According to the IEA, Saudi Arabia can produce an additional 3.4 million b/d within 90 days. Let's look at recent history.

Recent annual US oil prices versus recent annual average Saudi net oil exports (EIA):

Oil price & net exports:

2002: $26 & 7.1 mbpd

2003: $31 & 8.3

2004: $42 & 8.6*

2005: $57 & 9.1

2006: $66 & 8.6**

2007: $72 & 8.0

2008: $100 & 8.5

*Saudi Arabia reiterated their support for the $22-$28 OPEC price band in April, 2004, and they made good on their promise to attempt to bring prices down, as they increased net oil exports in 2004 & 2005. An article from April, 2004:

http://www.independent.co.uk/news/business/news/opec-studying-plan-to-bo...

Excerpt:

But then we have the 2006, 2007 & 2008 data points.

**In early 2006, the Saudi oil minister complained of an inability of find buyers for all of their oil, "Even their light, sweet oil," as annual oil prices traded in excess of twice the upper limit of $28 that the Saudis had pledged to support only two years earlier. Of course, I guess the Saudis could have offered to sell another one mbpd for $28 per barrel, if they had the oil to sell. In any case, as I have previously described, based on the logistic models this was coincidentally at about the same stage of depletion at which Texas started having trouble finding buyers for all its oil, "Even its light, sweet oil," in 1973.

Now some of us, following Matt Simmons' lead, hold the heretical point of view that Saudi Arabia's oil fields are not immune from the laws of physics. And maybe, just maybe, when the bulk of your production comes from a group of oil fields that are several decades old, your production might be peaking.

We have a very large disconnect here.

On the one hand, we have the KSA claiming, or some analysts suggesting, that the KSA has a reserve capacity of 3mbd that can brought on line in 90 days.

On the other hand, we have the KSA not bringing any portion of that capacity on line in the multi-year run up to 145 dollar oil, when they could have been making 4-7 times their usual profit.

The only reasonable explanations I can see are:

1. The KSA is husbanding oil for the future.

2. The KSA doesn't have any spare capacity.

I add the additional detail that KSA production fell dramatically by 1.5mbd right after oil prices dropped of the 145 high in summer 08. This is important because it suggests that they were running at full throttle and they let up as soon as they could after the price spike. Quite obviously, dropping production 1.5mbd during a price spike to 145 would have been a catastrophe and would have forever shaken everybody's faith in their ability to pump what they say they can.

I don't see a third option.

If it's 1, then the KSA has accomplished, for the first time in the history of civilization, what no other government has done - the saving of resources for future generations despite the ability to reap huge profits now.

So I think it's 2.

Given the secrecy with which the KSA holds all of its field data and the massive turmoil that will result when its own population figures out that the gravy train is slowing down . . . . I'm quite shocked that most people here think it's 1.

And, IMO, the 3% decline rate suggested by the graph heading this post is wildly optimistic and depends, almost entirely, on #1 being correct.

I agree that Saudi had no spare capacity as of July 2008. Since then however they have cut production by about 1.4 million barrels per day and they have brought Khurais on line. khurais currently has about 300,000 bp/d production capacity, with peak production expected to be 1.2 mbp/d. I doubt it will ever reach that level but that is another story.

Anyway, Saudi Arabia currently has about 1.7 mb/d of spare capacity minus any depletion of older fields since July of 2008.

Ron P.

Thanks for that link. Actually it states 300 kb/d from 4 GOSPs, two in Khurais and "one in each of the other fields," by which I assume they mean South Ghawar. So Khurais's output is even more threadbare, if I'm interpreting this correctly - more like the last official number quoted by Simmons in TITD of ca. 150 kb/d.

In the wake of the IEA whistleblower story it isn't too outre to suggest that the production figures stated for KSA could be overblown to some extent, either. From Feb-Aug 2007 their stated liquids production according to the EIA was 10126.17 kb/d. No more, no less. Perhaps some flunky forgot to hit GO on a random number generator. Maybe the same flunky who handles their proven reserves took over the oil production department. .171 is to the right of the decimal point all the way back to Jan '05, through Oct '08. Just noticed this - is it some algorithm making itself manifest?

Henry Groppe has stated that official production figures all over the world are quite often out of kilter with reality, and that import volumes reported by consuming nations are much more reliable. It would be remiss to point out that he's also bullish on Saudi production, however.

No, they do not mean South Ghawar, they mean the other two fields in the Khurais project, Abu Jifan and Mazalij.

The production figures do not come from the IEA, they are a composite of several other sources including Platts, Petroconsultants, MEES and likely several others. When OPEC states their production in their Monthly Oil Market Report, they specify that they are from "external sources". OPEC members do not report their production numbers.

The numbers reported by the EIA as well as the IEA are basically guesses based on production reports from other sources.

Ron P.

""""I agree that Saudi had no spare capacity as of July 2008.""""

Interesting!

"""""Since then however they have cut production by about 1.4 million barrels per day"""""

Yes!

""""" and they have brought Khurais on line. khurais currently has about 300,000 bp/d production capacity, with peak production expected to be 1.2 mbp/d."""""

How do we know this?

If the answer to my question includes the phrase, "because the Saudis are telling us that," then I don't believe them. I think they're liars, and I don't trust their numbers at all.

Many people suppose that the KSA has a lot to gain by a spike in oil and acknowledgement that the world has peaked.

Rubbish.

KSA has the most to lose. Because, when the world first takes in that big, deep breath and thinks, "you mean we're running out of oil," the the KSA is going to be like the weakling kid holding a bag of jelly beans in a class room full of hungry bullies.

"""""I doubt it will ever reach that level but that is another story."""""

I'd love to hear the story some time.

"""""Anyway, Saudi Arabia currently has about 1.7 mb/d of spare capacity minus any depletion of older fields since July of 2008."""""

Well, I'm happy that we're in agreement that they probably don't have another 3 plus to offer.

I think we'll know soon enough.

AndrewB,

I think we will know soon enough if Saudi Arabia has genuine surplus capacity as it will probably be needed to meet demand in the next year as shown in my Fig 5 above.

HOWEVER, there is chance that voluntary demand destruction could result from next month's Copenhagen climate talks.

OPEC chief el-Badri said two days ago that "oil producing countries should be compensated for lost revenues if climate talks in Copenhagen next month agree to cut the use of oil".

http://www.presstv.ir/detail.aspx?id=111881§ionid=3510213

The IEA also wants a climate change deal at Copenhagen to limit concentration of greenhouse gases. Carbon taxes on oil consumption would bring down demand in 2030 from 105.2 mbd to 89 mbd, according to the IEA.

http://pakobserver.net/200911/23/news/business05.asp

The introduction of carbon taxes at Copenhagen would be a convenient way to drop oil demand since oil supply is declining. Guess who would get the carbon taxes - the producing countries or the consuming countries? I think that a climate change deal with new carbon taxes will be made at Copenhagen.

Hi Ace,

Do you think OECD countries would be prepared to accept those taxes knowing what it would do to their economies? Everyone still seems to be chanting the growth mantra at the moment. They had the chance to do this at Kyoto and what did we get from that? Not much at all. If we take a look at the Keeling curve then we still havnt put a dent in carbon dioxide emissions.

A carbon tax on oil could go a long way in covering falling oil production through demand destruction if they get it right.

It looks some kind of carbon tax is inevitable, even if it's a small one to start.

Carbon tax a good way forward

http://www.upstreamonline.com/live/article199807.ece

"Shell has called for government intervention in carbon markets.

Chief executive Peter Voser told the Guardian paper action needed to be taken to make expensive green projects like carbon capture and storage (CCS) economically viable."

OPEC chief el-Badri said two days ago that "oil producing countries should be compensated for lost revenues if climate talks in Copenhagen next month agree to cut the use of oil".

I wonder how the USA could get in on that.

KSA increased production in June/July last year to offset the high price. At the time there was a lot of speculation that KSA just shipped out of reserves.

However there is a possibility that KSA did have excess capacity last summer.

Great analysis Andrew.

It will be interesting to see how the transition to heavy oil production affects their creative accounting and the spin we will get.

About stocks, people hoard resources when they think (speculate, if you like) that the price will increase, and reduce stocks when they think that the price will reduce.

Hight stocks mean that most people with the resources to hold oil think it will get more expensive, as 2008 low stocks meant that they tough oil would get cheaper. Of course, they may be wrong, as they where for the bigest part of 2008 and all of 2007.

I doubt very much that the KSA intends to produce any more. They have explicitly said they want to leave what they can in the ground for future generations. Why needlessly exchange an irreplaceable asset for increasingly worthless slips of green paper?

This is the fundamental flaw in much of the analysis and forecasting that is going on right now. In the past, it was a pretty safe assumption that if the reserves were there, then they would be extracted at the fastest rate possible. Now that those who are actually paying attention have good reason to think (whether actually acknowledged in public or not) that we are past peak, the rules of the game have changed, and the old assumptions no longer apply. The name of the game now is to hold back your reserves as long as possible, because they will be worth a lot more in the future than they are now. The catch is not to hold back so much or wait so long that civilization collapses and there is no one left to buy the oil - or it is no longer possible to even get it out of the ground. It is going to be a tricky game to play, and another unsafe assumption is that all the players will make the right moves. They won't.

I disagree completely.

The KSA was more than happy to pump like maniacs when prices bumped up into here-to-fore outrageous levels - like more than 30 bucks. The KSA would pump and pump and pump and pump, thereby driving prices back down, you know, "to stabilize price and ensure that their customers didn't move to alternative sources."

So flash forward 20 or 30 years when they can now reap huge profits and they do what?

Now they choose to save?

Ridiculous.

It's the same controlling family. It's the same controlling interest.

The royal family has never and will never give a wit about future generations. They want to hold power and make money.

I think they are hiding their own peak because they know it will lead to revolution.

Time will shortly tell.

When gas is 10 bucks a gallon in the U.S. and Joe 6-pack is in the streets demanding action, we'll see how committed the KSA is to "future generations" when the U.S. gives them the "pump on our terms or receive democracy" option that Iraq got.

When peak oil is understood as a process, rather than an event, then the available data tolerates alternate explanations. In this perspective 'peak extraction capacity', a metric which the enablers of the reigning elites are trying to impose at the centre of the discussion, assumes at most minor significance.

It follows that it is not ridiculous that the Saudi's would husband their remaining resource now.

A present capacity of 'reaping huge profits is far from the only relevant information relevant to policy making.

There is the small matter of the capacity to recirculate petro-dollars 'profitably'. Is fiat money in the bank as valuable as oil in the ground? Where should the KSA invest its profits? In US equity?

There is the latest information regarding the physical characteristics of the remaining resource at home and abroad, as well as real world experience with the latest extraction technologies vs faith-based expectations of unfolding advances in this domain.

Regarding your foreign policy speculation, the US didn't have the capability to increase the rate of oil extraction from Iraq. The US is even weaker with respect to the KSA regarding the flow of oil, despite all the spending by the empire's security apparatus on weapons of mass destruction. Could the kingdom resist the empire? Well the kingdom could fall, and the empire could enjoy another shock'n awe show, but on the ground the flow of oil would most probably decline. I don't expect the pro's in the department of war would choose to gamble against this probability.

"""""When peak oil is understood as a process, rather than an event, then the available data tolerates alternate explanations.""""

This makes no sense to me. Peak oil is a moment in time. Consequences of peak oil may be an era.

"""""In this perspective 'peak extraction capacity', a metric which the enablers of the reigning elites are trying to impose at the centre of the discussion, assumes at most minor significance."""""

Once again, this makes no sense to me. Perhaps I'm not the audience you're targeting.

"""""It follows that it is not ridiculous that the Saudi's would husband their remaining resource now."""""

Obviously, if I found all the premises to be lacking in sense, the conclusion does not make sense to me.

"""""A present capacity of 'reaping huge profits is far from the only relevant information relevant to policy making."""""

I quite agree with you here. There's also maintaining power, which was next to "reaping huge profits" in my post, thereby making clear that "reaping huge profits" had company. Beyond that, there's only the idealistic concept that they are taking care of future generations, which I find, from a behavioral perspective to be virtually impossible.

"""""There is the small matter of the capacity to recirculate petro-dollars 'profitably'. Is fiat money in the bank as valuable as oil in the ground? Where should the KSA invest its profits? In US equity?"""""

It is a small matter. Buy gold. Buy mines. Buy beanie babies.

They knew 30 years ago that they'd be running out.

They knew 30 years ago that oil would someday spike.

None of their information has changed, so why would their behavior change?

Sure, oil in the ground is about a great of a resource as a country could have right now. But what's the point if you end up giving up your control/sovereignty at some point specifically because you have it.

This is a red herring. It is antithetical to human nature to save. It is extraordinarily antithetical to governments of any kind to save. Governments don't save - they spend.

"""""There is the latest information regarding the physical characteristics of the remaining resource at home and abroad, as well as real world experience with the latest extraction technologies vs faith-based expectations of unfolding advances in this domain.""""""

Once again, I find this makes no sense. I suppose I am not your target audience.

"""""Regarding your foreign policy speculation, the US didn't have the capability to increase the rate of oil extraction from Iraq."""""

Once again, I'm not sure what you're trying to say. The U.S. controls Iraq. The U.S. has access to the oil there if and when it wants it. It's not about rate of extraction - it's about controlling the oil. Drinking more yourself, preventing your enemy from drinking - whichever.

"""""The US is even weaker with respect to the KSA regarding the flow of oil, despite all the spending by the empire's security apparatus on weapons of mass destruction. Could the kingdom resist the empire? Well the kingdom could fall, and the empire could enjoy another shock'n awe show, but on the ground the flow of oil would most probably decline. I don't expect the pro's in the department of war would choose to gamble against this probability."""""

Gamble?

If option 1 is to watch your oil supply dwindle 50% in a matter of 10-15 years (my prediction), and option 2 is to find a reason to go in and bogart most of the remaining oil, then it's not a gamble at all.

At least not if what you want is more energy for you and less for others.

i know this from experience.

AndrewB

Well said Sir , in respect to Saudi Arabia except it appears that the House of Saud long ago cut thier deal with thier friendly but potentially unstable and known to be violent good buddy Uncle Sam.

The oil will flow so long as the house of Saud stands-if it's there to flow.

The only way this will change is if the US loses it's military chokehold on the Middle East and the Saudis find themselves in the position of having to find a new big brother to protect them from thie nieghbors-not to mention the rest of the world .

Of course this analysis is just my opinion but it is one held by quite a few others.

As long as the foxes guard the henhouse AND count the chickens, whats the point in counting tomorrows eggs today? The foxes always eat first.

jkissing,

The assumptions about SA are critical to any production forecast including mine.

One method to calculate SA surplus capacity is to apply extraction rates to SA remaining crude oil reserves. For more accuracy, the extraction rates should be applied to remaining recoverable reserves in fields currently in production. For example, the reserves in Manifa would be excluded as it is not producing.

The chart below shows SA oil initially in place (OIIP) split between producing and static fields in 2005 and is discussed further in http://www.theoildrum.com/node/5154

Manifa is shown as producing in the chart below but I will assume that is currently not producing so that SA OIIP for currently producing fields is assumed to be 450 Gb. If a recovery factor of 45% is applied to 450 Gb then SA total recoverable reserves (ie produced plus remaining) is about 200 Gb. Note that the average recovery factor for world fields is about 33%.

My updated chart below assumes a URR of 185 Gb. I also assume that in July 2008 SA had no surplus capacity as they took advantage of high oil prices. Note that in July 2008 the extraction rate was just over 5% which is appropriate for large fields. The average extraction rate from Jan 2005 to Dec 2007 was 4.4%. The extraction rate for 2009 has been above 4.4% and has increased to about 4.7% this month. If it's assumed that SA only has 65.5 Gb remaining recoverable reserves as at end of this month then potential average annual production capacity for the following year would be about 8.55 mbd applying an extraction rate of 5% and assuming that 3.1 Gb is produced over the following year.

The EIA August 2009 production was 8.48 mbd. The difference between 8.55 mbd and 8.48 mbd is about 0.1 mbd which is an estimate of the lower bound of SA crude surplus capacity on an annual average basis.

Next, an upper bound can be calculated. Instead of assuming a URR of 185 Gb, a higher URR of 200 Gb could be assumed for those fields currently in production as discussed in reference to the first chart above. The 15 Gb difference between 200 Gb and 185 Gb is probably about equal to the URR of Khurais and Khursaniyah which recently started production. It's now assumed that SA has 80.5 Gb recoverabe reserves remaining in fields in production. Thus, average annual production capacity for the following year would be about 10.50 mbd applying an extraction rate of 5% and assuming that 3.8 Gb is produced over the following year.

The EIA August 2009 production was 8.48 mbd. The difference between 10.50 mbd and 8.48 mbd is about 2.0 mbd which is an estimate of the upper bound of SA crude surplus capacity on an annual average basis.

Based on the above, SA surplus annual average capacity for the following year is between 0.1 mbd and 2.0 mbd. For comparison the EIA is estimating SA surplus capacity at 2.6 mbd in 2009Q3 http://www.eia.doe.gov/emeu/steo/pub/3ctab.pdf

The IEA is estimating SA surplus capacity at 3.45 mbd in Sep 2009.

http://omrpublic.iea.org/omrarchive/09oct09sup.pdf

However, both EIA and IEA accept official statements on reserves and surplus capacities from SA without any independent verification. In addition, both the EIA and IEA qualify their surplus capacity by stating it can only be sustained for 90 days.

I certainly believe in PO and have personally done what I can to spread the word. However, I am suspicious of predictions of a new trend that is both quite different from past trends and that begin immediately. I agree that SA will decline, but whether this decline begins in 2010 or 2020 is both significant and IMO difficult to predict. Many such past predictions have been wrong.

Another current difficulty in forecasting supply and demand is that we are in an unprecedented economic situation that is reducing demand vs. what it would otherwise have been in most regions around the world. We know OPEC has cut production to shore up prices, and this effort has been largely successful, aided IMO by commodity speculators that have less reason (in the face of very high storage) than mid-2008 (when storage was very low.) The difference between low storage then and high now is reduced demand over and above OPEC cuts. IMO unemployment will go higher and demand lower for at least another year, meaning that OPEC should be contemplating cuts and not, as rumored, higher production. Perhaps, as some say, it is more about crushing Iran on account of SA nuclear fears... quite credible, SA is thought to have brought down the Soviet Union in the same way. In this case production might rise in spite of the weak economy and high storage.

I assume, but do not know, that the uncertainty regarding future demand and price is affecting current investments. OPEC (excluding SA) is rumored to be avoiding new investments. there is certainly a case to be made that a lack of current investments will reduce future production, which would bring forward PO and usefully extend the tail. At any rate IMO OPEC has the ability to restore world production if demand returns through 2011, but that lack of new projects in 2012 might will cause a shortage. Many think such a shortage will result in sharply higher prices, the alternative view is that prices simply rise until recession returns. The lag implies volatility and investment opportunity.

THere is enormous potential for the US to reduce consumption, say by a third, or 7MB/d, over time from the peak... such a transition is clearly underway and therefore easier to project IMO than SA decline. Higher demand by developing countries will not necessarily lead to higher price even if production declines if and when the US hits a price limit, say 80-100/b. Forget about Hummers, they're already gone.

IMO there is too much uncertainty regarding SA to predict its production, and too many variables to predict price. However, I appreciate the effort. I enjoy reading both your studies and others posted here on TOD.

"IMO there is too much uncertainty regarding SA to predict its production"

I agree that there is uncertaintly but there is reasonable likelihood that SA crude production will stay below 9 mbd on an annual average basis.

My chart below shows that Saudi Arabia's crude production will decline from its recent 2005 peak. There is a possibility that SA statements saying it has 260 Gb of remaining oil is true but I doubt it. Assuming that produced plus remaining oil is 260 Gb it is still unlikely that annual production could surpass the 2005 peak.

I've got to say Ace, I think that decline rate looks wrong. It maybe what the megaprojects data says, but such a steep fall away without some event seems unlikely to me. Rather I'd expect a progressive increase in decline rate, with a number of reversals, culminating in some induced event (say Iran not exporting for a year) that resulted in switched mental models and true entry into 'decline age mentality' and hoarding.

Say half your overall decline rate at worst, over the next two years.

The Lower 48 and North Sea case histories are interesting. Their initial decline rates, over the first three years after their respective production peaks, were fairly low, but they showed much higher decline rates over the following six years.

Based on the logistic models, conventional world crude oil production in 2005 was at about the same stage of depletion at which the Lower 48 and the North Sea peaked. I suspect that the decline in demand is masking an accelerating rate of decline in world crude production,

But as always, I think that the real story is net oil exports. Sam's best case is that the (2005) top five Cumulative Net Oil Exports (CNOE) depletion rate is about 9%/year from 2005-2013. These five exporters account for about half of total world net oil exports. A conservative estimate for the bottom half would be a 5%/year depletion rate. If we average the two, we would get an estimate of about 7%/year for the post-2005 global CNOE depletion rate, which suggests that we will consume about half of post-2005 global CNOE in the 2005-2015 time period.

Regarding the bottom half of net exporters, consider three examples--Canada, Mexico & Venezuela. Their combined net exports dropped from 5.0 mbpd in 2004 to 4.0 mbpd in 2008, with all three showing year over year net export declines in 2008.

Note that the ELM and actual case histories show that the CNOE depletion rate is much higher than the annual net export decline rate, e.g., the observed three year net export decline rate for the combined output from Indonesia, UK and the Egypt was only about 3%/year, but their combined post-peak CNOE were being depleted at a rate of about 25%/year over the initial three year production decline.

westexas,

The difference, I'd postulate, between peaking in an individual area and peaking in global production is the global wakeup call and price increases that result. If the North Sea peaks, its against a backdrop of somewhere else on the rise. Doesn't help the UK balance of trade, but doesn't have major global impacts.

When it becomes obvious the global oil production has peak, its a whole different matter. Emergency expansion programmes come to the fore, money is no object - and hoarding begins.

As I've said before, I see exportland (ELM) as a particular example of a general system level effect. As production becomes limited the declines are felt unequally with a variety of related mechanisms progressively separating the 'haves' from the 'have nots'. Others examples are price spikes, rationing, military or economic strong arm tactics, etc. Its important to see these as a whole because the interaction defines the real world shape of impacts that are felt.

The net result is that some regions see precipitous decline rates and collapse, whilst others gentle rises. The average however will stretch out the gentle declining plateau until some major defining event that changes mindsets and expectations.

As a 'for instance' of how I think this changes the decline slope, think of Mexico. As things stand its heading towards zero exports 2011-2014. In a hoarding, post peak, world the US is likely to see imports only from Canada and Mexico (and maybe some Nigeria, maybe). That's a sizeable lurch downwards in US oil availability - and I don't see the US accepting Mexico continuing with its domestic usage as before. Thus I think action will be taken that slices through Mexico's domestic usage (rationing), to continue to feed oil northwards - postponing what exportland would suggest.

Some net oil exporters have shown, to some degree, a decline in consumption, but we have looked at 23 former and current net oil exporters that have shown production declines. So far, we have not found a single example of an oil exporting country cutting their consumption enough to keep their net export decline rate above their production decline rate.

Yep, but 'so far' we are still in the BAU oil increase mode. As I keep banging on, the oil decline mode is a whole different game with different rules and behaviours.

I'm not saying the US would give Mexico the choice of whether to cut domestic usage - rather the reverse.

Possibly, but the world is not nearly as simple as you are implying-why do you think China is being treated with kid gloves by every proposed CO2 reduction scheme? It is because the fossil fuels need to continue to flow to China to drive the world economy forward over the coming decades-your model of USA action would have been accurate 30 years ago but not any longer.

Somewhat related-Denninger featured a SNL skit that hits the mark http://market-ticker.denninger.net/

Try Don’t Buy Stuff You Can Not Afford :: ASPO-USA: Association for the Study of Peak Oil and Gas, too, if you're in need of economic related chuckles.

garyp - I get what you are saying but do you really think that

a) The US government will actually threaten Mexico to stop consuming and send the oil north and

b) The Mexicans, whose economy will be just as shot to bits, will accept the imperial dic-tats from the US?

Me, can't see it. If the US dictated who much oil the Mexicans could consume and the Mexican government went along with it there would be bloody revolution. Short of actually invasion by the US I can't see how the amount of exports to the US will not decline..

It wouldn't done like that in any event-Mexican domestic prices would be raised under some pretence-raised enough so that internal consumption declined-not predicting it, but that is how it is done.

The approved mechanism would be something like the Mexican government being told to invite US peacekeepers in to forestall the drug gangs. The US then insists on rationing of Mexican oil usage (through caps and price increases) to match the rationing that would be happening in the US at that point. The US would focus on control of the oil infrastructure and the border area, taking military action to wipe out any large groupings of drug lords as targets present themselves.

The end game has the US in control of Mexico's production, and probably some swift pipeline laid to redirect output northwards.

Think Iraq, but without the US being even less nice, as a model.

I was just down in Guerrero, and the revolution is alive and well. Mexico has a long history of resistance, and is reasonably politically literate, unlike the US.

A US invasion of Mexico, or even more neo colonial economic action, will not work out well for all involved.

Hightrekker,

Any additional commentary on Mexican political conditions as seen from the ground would be very welcome.

Additionally do you have opinions that you are willing to share in regard to our huge Hispanic population (and thier political mood ) in the Southwest?

Hello hightrekker,

I second oldfarmermac's invite. I'm interested, also, in what you mean by "revolution," and your perspective on the police, army, drug cartels, and the impact of decline in oil. Or, anything else you might like to share from your travels.

Gary -- I agree with your view for the potential for some intervention effort by the US. But it won't be easy to design IMO. The big factor I haven't seen mentioned yet is China. I haven't seen any reports of China buying into Mexican production...still against the Mex. constitution. But they have other techniques. Consider the multi-billion "loan" they recently made to Petrobras. No details but I wouldn't be surprised if access to Brazil oil was part of the deal. Consider Venezuela...another significant supplier of oil to the US. China has made many trades with Vz locking up their crude...especially the heavy stuff the Gulf Coast refineries had always assumed would be there's when the sweet sources dried up.

Difficult to see military action being an option...at least not in the short term. Getting heavy-handed on the political side won't be too productive either IMO. Most folks don't realize that nations just can't throw away contracts they've signed like they did in the old days. Lots of press about this country or that changing the rules on oil trades. What doesn't make the headlines is the price many countries end up paying for those sins. The world courts have a huge stick to use on offending countries today: the international banking system. I've seen the bankers use this clout with severe results. Results that are often kept from the public.

You'll note I didn't say Venezuela or Brazil were exporting to the US?

I'm not considering this type of scenario was in the too short term, its post tipping point with the new drivers and behaviours. Those drivers/behaviours would likely be borne from much of the financial system getting trashed - which lets face it, is on the cards in the depression of a decline world. That would make a mess of many of those contracts. That kind of world also utilises the threat of military force, and of mutual defence pacts for oil.

The main point was to illustrate how the interaction of different decline drivers would derail predicted inequalities like exportland - which are created with an eye to today's drivers and behaviours. How the great game plays out is much more complicated and unstable than that.

Plus, of course, this is a scenario - not a prediction.

This idea of forcing Mexico to continue exports to the US is some kind of neo-conservative wet dream. First of all, you would run into the inescapable problems that you ran into in Iraq - oil burns and pipelines don't work if they have big holes in them. All it takes is a few nutbars with matches and high explosives to cut the national oil exports to zero. Guns are useful, too, and the Mexicans can buy all the automatic weapons designed to fire armor-piercing ammunition they need from US gun shops.

Second, and more importantly, Mexican oil production is in a freefall because of the collapse of production at Cantarell. They haven't had any success getting production out of their other fields, so it's not going to be long before the country is a net oil importer. They can probably get the oil they need from Canada or Venezuela, but that will be oil diverted from US consumers.

Canadian production is very reliable, and the obvious market is the US, but remember, it goes to the highest bidder. After the mouthing-off done by the politicians in California, some Canadian companies are investing in million-barrel crude carriers. Just in case there are difficulties selling to the US, you know.

China is already heavily invested in the Canadian oil industry. At the moment the oil is going to the US regardless, but the Chinese are not fools and are deeply into long-term planning, unlike some countries I could name.

How do you not allow Mexico to consume oil? Invade?

The choice is:

- accept declining oil import from Mexico

- accept a dysfunctional Mexiko, revolution, war (?)

The latter will result in piracy, blown-up pipelines and facilities, possible insurgence activity within the US borders. Nasty.

How many times has the US intervened in Latin American politics for the interests of our corporations? Dozens? Scores?

If we take over countries by coups and juntas for bananas, why wouldn't we for oil? We tried this recently in Venezuela, but it didn't quite work how we planned.

You don't have to militarily invade a country to control its policies. Read 'Confessions of an Economic Hitman' and 'Shock Doctrine' for some idea of how it's done.

In regard to any group forcing a country to reduce its consumption, I think that a more likely scenario is that the rest of the world decides that it is everyone's long term interest to see the US economy crash sooner rather than later.

You will note that I suggested Canada and Mexico were the only ones still sending oil in the direction of the US in this scenario? And that there was a sharp curtailing of other sources?

I wonder if China, basically alone, can make that happen?

It's generally postulated that as things are now it would be economic suicide for China to have the US economy outright fail, but interests have a way of changing.

Would it beneficial to Russia for our economy to fail?

We are an importer - a consumer - while some economies in the world need us to consume there may come a day in the not too distant future when it is in others best interest for us to stop consuming so much of the world's natural resources even if that means so they can consume more of those very same resources.

Pete

Pete -- I've been promoting the concept of MADOR: Mutually Assured Distribution Of Resources. A play on the old Mutual Assured Destruction theme of the cold war. Last I heard the EU was importing as much China product as the US. But our edged may be the amount of US debt paper China is holding. Depending upon who's numbers you believe China is pulling in as much as $500 million/day from all the various US debt. OTOH, it seems the US policy of printing gobs of $'s and driving the value of that debt down via inflation won't sit too well with China. But that may be just one more good reason for China to nurse us along.

IMO the main reason for China to nurse us along is that we buy more Chinese junk than any other country. At least that is my understanding. Last I looked there was a connection between joblessness and ability to purchase. And, looking at our "Recovery", already billed, in advance, to be 'jobless,' should put some hesitation in China's ambitions. They might just end up with the ability to produce megatons of goods with no one to sell to.

If you gave a party and no one showed up, would it still be a party?

What you are missing is that you have not been paying for the Chinese goods. You personally paid for your item, and China lent the money for your bloated government spending. Without China, not only do you not have the cheap goods, you don't have the government programs either.

The Chinese recently and uncharacteristicly have been rather blunt when it comes to US Imperial and economic policies, which are intertwined as most here understand. The Chinese interest is for the USA to remain solvent so China's many dollars retain most of their value. So if the USA wants to continue to be economically bailed out by China, then it will have to end its Imperalist adventures, which pose the greatest problem solvency-wise. And China with many billions invested in South America cannot be happy with the US Empire's military expansion in Colombia.

The Cold War was large-scale political theatre that killed millions. It's been replaced by a new type of geopolitical theatre that's already killed hundreds of thousands, with millions more seemingly guaranteed unless nations end their competition for energy and start to share what remains. Such cooperation is anethema to Me-First nationalists like Cheney, Biden, Bush, and Obama and those pulling their strings.

The Planet's people face two choices: They can cooperate and work together to solve the shared planetary problems, or they can choose to try and be the "Last Man Standing" by competing and refusing to help solve the planetary problems.

Before long the only leverage the US will have is it's nukes. Scary, huh?

Rockman, MADOR sounds a bit like The Oil Depletion Protocol, aka the Rimini Protocol.

aangle...I had not seen that site before...thanks. Unfortunately my MADOR vision isn't based upon a moral and fair adjustment. I see it more a situation where the US and China use their financial, political and, perhaps at times, military abilities to usurp energy from the weaker nations. We've had such dynamics established many decades ago by individual countries. I just see a logical progression where the US and China would see the advantage of cooperating in such efforts. Of course, this could work well as long as there is enough energy for us to share. When the volume isn't sufficient then it may become very dicey for the US.

I think the US is close to the limits of its ability to use strong arm tactics both politically and materially and that we won't be pulling off any more invasions and occupations unless or until the s is really in the fan and things are so bad domestically that nobody gives a damn about international relations anymore.

It is true that in the past oil monarchs often sold as fast as possible but the reasons they did so were and are more complex than simple immediate greed.There were actual surplus supplies.Higher sales at times meant increased security and political dominance.Sales proceeds could be invested and earnings on investments were expected to exceed price increases of oil in the ground.

Nowadays oil need not be saved in the ground "for future generations"-it will probably go up faster than any available investments in the short or medium term.

Oil exporters are walking a political tightrope every day in a world that becomes more dangerous by the day.If I were an enlightened Saudi I would probably be grateful for Uncle Sam's velveted fist but also maybe glad the Chinese are rising-sometimes it's better for a little country to exist between two larger and more powerful countries that are enemies or potential enemies.Alliances are tricky things.

Certainly the House of Saud would have been involved in lots of bloody fights over the last half century without us around to keep the playground bullies away.I doubt they would still be in power otherwise.

My guess is that the US economy will continue to slide, dragging down a lot of other countries with it, thereby keeping the brakes on consumption to a far greater extent than is assumed by most forecasters.

Of course this will only postpone the time that prices start climbing steadily for maybe a year or two.

We are cursed ,as some Chines sage once said, "to live in interesting times."

If I had any money and was willing to risk it in the stock market I would be buying up renewables stocks on dips.

There will be another huge buying spree and investment spree in this field once the investment and brokerage industry and the msm come to grips with the true state oil the overall energy situation.

I don't expect renewables to solve our problems as a society but they will surely solve the financial problems of lots of individual investors-if the entire house of cards stands for another decade.

This is exactly what I've been doing this year (I'm 50% ahead at the moment, but that's easy in a rising market... I would have made at least as much by investing in banks or plastic widgets).

My strategic thinking is that even if the rest of the economy tanks, renewable energy companies are likely to flourish. Reality is that they are likely to be killed by financing problems, as they require a high level of capital investment.

But what the heck. I have a philosophical objection to stocking my money in something inert like gold... I want it to do some good. Or die trying.

Do you think ELM is applicable in a country like Nigeria?

Rgds

WeekendPeak

It certainly would be if the local kleptocracy employed more of their oil cash flow on economic development. Instead, they leave the oil-producing regions wallowing in squalour and pollution, which quite naturally leads to armed rebellion and curtailment of production...

What about their partners in crime, the big oil companies? One would think that their interest would be to favour economic development in order to stabilize production... On the other hand, economic development entails greater (subsidised) domestic oil consumption, less (profitable) exports.

No need for conspiracy theories to see the convergence of interests. Economic development in Nigeria is not in the interest of oil-importing countries.

This is true of all underdeveloped resource-exporting countries, in a world economy increasingly dominated by scarcity.

What we can say is that the Nigerian net export decline rate is in excess of the production decline rate, as of 2008 (EIA).

I totally agree with you on this, except that I wonder why you don't think that total world oil won't to some extent be masked similarly by other power sources? I realize there is a difference between oil and electricity, but still, energy is energy in a lot of ways too. Won't world peak push demand to alternate sources?

On the trade issue, this could (and will) be a problem in some areas of course, but on the aggregate? Let's not forget that the world economy is not just oil. Can China really be cut off completely when they have access to the vast majority of world reserves of rare earth ores? Can the world get by without the US crop yield? (and how important will its coal and shale gas reserves be in the future?) What about India and its thorium reserves and Australia and its uranium reserves? Can the Middle East horde oil and still expect the world to export crops to it? (not to mention, not invade it). Is there nothing Russia needs from the rest of the world?

Ace, I think you’re near term projection for non OPEC production is a little low. I expect November 09 non OPEC production to be about 41.5 mb/d or perhaps a little higher. This is because the US and Russia have recently increased their production levels.

The US has brought several new Gulf of Mexico projects on line late last year and early this year and they are just now spinning up to near full production. I expect US production to reach a post Katrina peak in late 2009 and begin a slow decline next year as far fewer GOM projects are scheduled for 2010 and later.

Russia reached a new post Soviet Union peak in August and is holding that level through November. November may even be a little higher than August. That however is all about to change but not until next year.

Russia 2010 oil output to fall -Bernstein analysts

Of course all those eight new fields have not all ramped up to full production. Most are close however except the largest of them all, Vancor. Vancor, by the end of the year, will be producing at about 50% of full production or about 225,000 mb/d. Production from that level is expected to rise to about half a million barrels per day by 2014. I expect that the slow rise to full production is because they must drill more wells in this arctic field.

Taking all this into consideration I expect non OPEC production to start to drop, early next year, at less than your predicted 1.6 mb/d. That is almost 4 percent and I just don't think it will drop that fast by next year. I think it will drop at about half that rate until the decline accelerates by about 2012.

Ron P.

That's actually 225,000 barrels per day, not 225,000 mbpd

An additional 225,000 MBPD would definitely help with this little problem of peak oil. 225,000 BPD - not so much.

Please help us spread Ace's work here around the interwebs! Help us spread awareness and educate. This is the perfect post to send to friends, family, colleagues, neighbors, etc.

"How do I help" you ask?

Well, here's the digg, reddit and SU links for this post: create an account on these sites (it's really easy) and upvote these articles. The more upvotes they get, the more people see them. It's that simple.

http://digg.com/d31Ao7G

http://www.reddit.com/r/reddit.com/comments/a7b4o/world_oil_production_p...

http://www.reddit.com/r/worldnews/comments/a7b4l/world_oil_production_pe...

http://www.reddit.com/r/collapse/comments/a7b4f/world_oil_production_pea...

http://www.reddit.com/r/Green/comments/a7b4d/world_oil_production_peaked...

http://www.reddit.com/r/environment/comments/a7b4c/world_oil_production_...

http://www.reddit.com/r/Economics/comments/a7b49/world_oil_production_pe...

http://www.reddit.com/r/energy/comments/a7b45/world_oil_production_peake...

http://www.stumbleupon.com/submit?url=http%3A%2F%2Fwww.theoildrum.com%2F...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

(we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.)

I have been a long time TOD member. And I will say (with tongue in cheek) that the great thing with having so many experts on this site is that there are so many different forcasts. If you don't like one, just wait a little.

So I really like this above one from Ace. This is more negative than his previous ones, and more negative than most here, and I agree with it (based on subjective feelings only)

But could I humbly ask Khebab (because he has done this before)or someone else, to consolidate all the major (new) forcasts, and somehow summarize the main points of difference between them, pro and con, and post that. How and why they arrive at their conclusions

Then we can have an informed debate

and also include WT's ELM, as it applies. so for example in Ace's forcast of a decline of 2.2mbd/year, I think this will come directly out of the hide of the total export capacity. so given total exports are approx 40 mbd, then the decline rate in available oil for the OECD and other importers is 5.5%

What do you think the chance of Khebab doing that as a posting?

I tend to agree with Ace's forecase, though my feeling is that it might be a tad optimistic. OTOH, I just saw the DOW is up about 140 today, and I just cannot figure out what Universe they are living in. Certainly not this one.

OTOH, I just saw the DOW is up about 140 today, and I just cannot figure out what Universe they are living in.

Come now. You didn't expect mountains of great news this week?

The holiday festivities start Friday. Maybe we'll find Bin Laden...

Wall Street is driving up their end-of-year bonuses. That's what universe they live in.

DOW up about 1%, dollar down about 1%. Go research the correlation from March to right now between the dollar and the stock market indices. Most of this "rise" is really the fall of the dollar.

And he'll be dressed as Santa...

Hmmm, it's more negative so you really like it. Sounds like something you should tell your psychiatrist.

With regards to previous forecasts, the 2007 forecast shows prouduction for Nov 2009 around 70 mbd. Add in deliberate OPEC production cuts and he was off by 3-4 mbd. So there is obviously some error in his modeling.

http://i129.photobucket.com/albums/p237/1ace11/CC200703.jpg

Also, this comment makes no sense:

If demand were greater than supply, there would be shortages.

The bottom line is that there is no reason production levels can't be maintained, even if there were no new discoveries. And there are always new discoveries. The only reason production has declined since 2008 (wow, 1 whole year), is because of the worldwide recession and lower demand.

Do you still not get it? The only reason production levels can be maintained at or near levels of demand is because demand is diminished by the recession, and IMO soon to be depression, caused by demand exceeding supply. Supply of a finite resource depends, not on demand, but on physical reality. E.g., you can't pump a gallon out of a one quart jar!

And that, sir, is what peak oil is about. We are down to less than a gallon and whenever demand exceeds capacity to pump, prices peak. We will see more and more of that as we slide down Hubbert's peak.

And, while I did not make the statement that I liked the post referred to, I should point out that I could 'like' the informative value, but not that I like the message. You are attacking the messenger because you dislike what was said. You should try to listen more, understand what was said, and if you disagree do so for good reason. But please adhere to some modicum of logic in so doing. Straw men, ad hominem arguments and equivocation on terms are easy to do, and sometimes difficult to detect. On TOD, though, someone will usually call you.

If you disagree with a premise, please state why, and be ready to let us all know the source of your great wisdom. I am always interested in facts, and stand ready for correction when in error.

Thanks.

This is true but, we're not talking about a one quart jar. We're talking about 1.9 trillion barrels (in the article posted). I've read other estimates has high as 10 trillion barrels. Even with the 1.9 trillion number, there's no reason you can't pump 74 mbd for the next 40 years with existing reserves (no new discoveries needed). Of course there have always been new discoveries, so even the 40 year projection is too short.

Are you a troll? Do you even understand the basics of this subject?

Seriously dude, go take a peak oil primer course...

Do you understand how many times and how many people have predicted the end of oil production over the past 100 years? Does it not matter to anyone that they've always been proved wrong?

Yes I know the magic 4 words - "it's different this time"

That's what they always say.

Go pay a visit to Mr. Bayes.

If you don't make the visit, he will catch up to you. He always does.

I don't know which fairy tale you're living in, but in the one I'm thinking of, the little boy actually DID get eaten by the wolf, in the end.

Let us say you have a billion $ in a trust fund but you can only withdraw $1000 per month. Technically you are a billionaire but you cannot live like one.

What matters is not the size of the reserves but the maximum possible rate of extraction. For various reasons, sometimes oil production is not scalable (e.g. tar sands) or even possible (e.g. shale oil sands).

Let's say you have an oil field with 100 rigs that depletes 2%/yr. All you would have to do to maintain the same production level is add 2 rigs every year. For tar sand and shale operations, you just add to the size of your operation. More people and resources = more oil produced. There are experts who say oil production can not only be maintained, but increased. It all boils down to who you believe.

We will know in a few short months if the above forecast is correct or not.

It is not quite that simple. That theory might work in the tar sands if you have sufficient capital, equipment, labor, etc., and you do not mind digging up huge tracts of western Canada. However, that will not work in a field like Ghawar or many of the old giant oil fields that underpin total world production. The oil in these fields is finite and it has been and is being depleted. Once the oil column shrinks to a certain thickness just adding drilling rigs won’t be enough. In fact, it is likely that they have in effect been doing exactly this over the last five years or so with all of their horizontal drilling that has been documented from time to time on this website. I have worked fields like that in my career and I guarantee you that eventually decline will happen. Just look at Cantarell.