Shales and the gas within them

Posted by Heading Out on November 8, 2009 - 9:26am

This is Sunday, so this is a "tech talk" about getting fossil fuel out of the ground. While some previous posts have dealt with sandstone and carbonate deposits I’m going to be talking about getting gas out of shale for a couple of weeks, and so, before I started talking about Horizontal Wells, we’d better chat for a minute or so about shale. And when I don’t give an alternate reference for the information, I am likely quoting from the Primer on Natural Gas in Shale, from the Department of Energy.

Folk who live near rivers, or along their outlet to the sea are familiar with the large mud flats that can develop around the outlet. These flats, which extend out into the sea, can cover large areas. When I was in school at Lancaster in the UK, we went to Morecambe Bay when my parents came to visit, and the large areas exposed when the tide ebbed remain a lasting memory. Through geological time these beds of mud have lain under large stretches of water, and so, as the algae that floated in the water died, they fell, and were caught in the mud. The mud is largely made up of clays, which in very small sizes are shaped a bit like a plate, and so as they settle, capturing and covering the algae remains, they tend to create layers (which can later tell us some of the conditions at the time they were deposited). When conditions are right – generally with a relatively warm sea containing a lot of nutrients – the sea can host vast colonies of algae, and over geological time the death of these algae built up considerable organic matter in the mud on the sea bed.

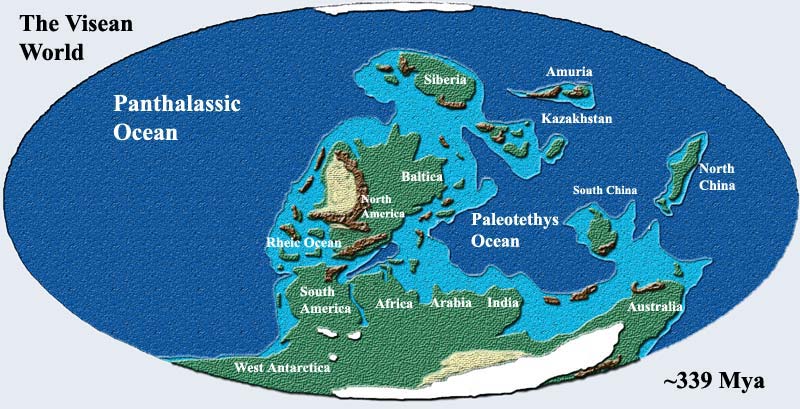

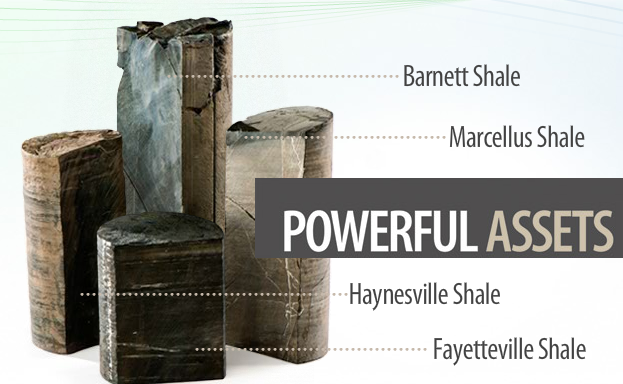

The main gas shale deposits in North America are in the Barnett shale, the Fayetteville, the Woodford, the Haynesville, and the Marcellus while, in Canada, the large fields are in the Horn River and Montney deposits. Not that there are not others, but these are the ones that the Oil and Gas Journal calls “The Magnificent Seven.” As an example the Barnett shale was deposited during the Mississippian Epoch, itself part of the Carboniferous Era, between 315 and 350 million years ago. At that time the map of the Earth looked at bit like this).

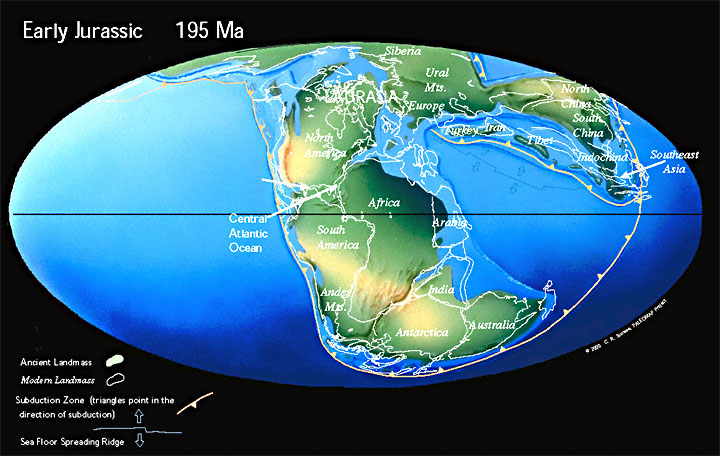

However not all the shales were deposited at that time. The Haynesville, for example is much younger, having been laid down in Jurassic Era, (remember the dinosaurs of Jurassic Park?) which was some140 to 200 million years or so ago, and when the globe looked a bit more familiar.

The mud that was deposited grew to be very thick – even after it was compressed by the weight of overlying additional sediments that turned into rock, the Barnett shale still can measure between 50 and 600 ft thick.

The individual particles that made up the mud were quite small, so that, as the material was compressed, the resulting rock became relatively impervious. Thus if the gas-generating algal remains were trapped, they were held in the shale, but dispersed throughout it, rather than concentrated in larger pore spaces, such as are found in sandstones. And, to be economic, there still needs to be a significant amount trapped within the pore space, which needs to be at least in the 5 – 12% range to hold enough gas to be worthwhile. Putting this into a different context, the Barnett, for example, is estimated to hold about 325 scf (cubic feet at a standard defined temperature and atmospheric pressure) of natural gas per ton of rock – or in about 13 cubic feet of rock. (Needless to say deep in the ground the gas is very compressed).

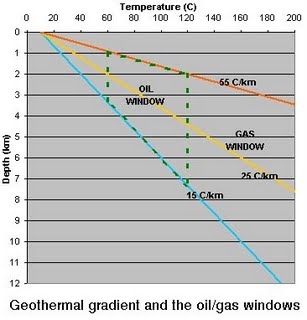

As the rock was buried deeper, so the temperature and the pressure also rose, gradually “cooking” the organic material over time. Depending on how deep the rock was buried, and the temperature, the material either turned into an oil, or if it were buried deeper and at a hotter temperature, it would turn into a gas. The relative conditions that set these bounds are sometimes referred to as the oil and gas windows for rock, and can be illustrated with a graph.

The current reservoir depths at which the different shales are now found can differ quite significantly from those at which the gas or oil was first formed, with depths for the Fayetteville being as little as 3,000 ft (0.9 km) to the Haynesville which can be at more than 14,000 ft. (4.3 km). The Barnett is around 6 - 8,000 ft (2.4 km).

Permeability, or the ease with which gas, oil or water can flow through a rock is measured in a unit called a Darcy, but it is sufficiently large that most rock permeabilities are measured in thousandths of a Darcy, or millidarcies (Md). As a point of reference for a rock with a good permeability such as the Ghawar oilfield in Saudi Arabia, Greg Croft quotes values in the 600 Md range.

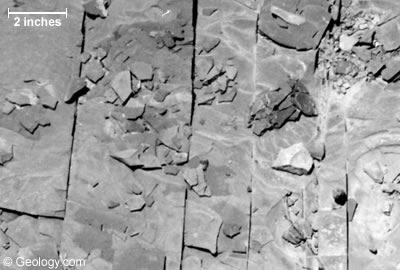

A microdarcy is one thousandth of the value of a millidarcy, and it is this unit that the permeability of gas shales are often measured. Thus the permeability of the Marcellus shale can be around 20 microdarcy and the Barnett around 10 microdarcy. The density of the rock can be seen from the sample pieces shown at the Chesapeake Web site.

These fine-grained rocks with low permeabilities mean that the producer has to rely on other paths within the rock to allow the gas to escape. Originally this was just the natural fractures that can be found in the rock. As the rock compresses vertical fractures often generate within the rock. These fractures can be quite consistent, though in contrast to the bedding, they normally occur vertically.

The problem is that conventional vertical wells don’t intersect a lot of these fractures, and thus, when the gas shales were first drilled the production was very low, and often uneconomic.

However when horizontal wells were developed it became easier to intersect a lot of these fractures as the well moved along the reservoir, and so it is time to introduce horizontal wells in the next post.

As usual this has been a very short description of a relatively complex topic, and so questions, and comments are appreciated.

Thanks for your continuing series!

I think everyone agrees that there is a lot of shale that contains gas around. Isn't one of the big questions whether it really can be pulled out of the ground at a low-ish price, say $4 mcf? If the cost will double many people's heating and air conditioning bills, it might not be considered a very acceptable solution.

There are other questions as well--how much shale gas is it feasible to get out profitably, at a relatively high price like $8 mcf? Would there be interference with water supplies? If we do have more, what should be use it for--if we use it as a substitute for coal in making electricity, it likely won't go very far, because we use so much coal. There are other uses that might be more essential.

Grin:

Gail you are getting ahead of me - I'm going to write about that in probably two weeks, but I try and keep this short enough that folk can get through them, and that means I can only cover one part of the topic at a time.

I am pretty sure if the choice is between $4 mcf or no gas, then even the US would prefer to pay $8 mcf.

$8 is still cheap in energy terms compared with $80 oil. If the US is so addicted to cheap energy it can't transition to slightly more expensive energy, then it really is an empire in terminal decline. From what I have seen, US housing is hopelessly poor design from an energy efficiency standpoint. A halving in consumption should be easily achievable for modest retrofitting costs. What it will take is a public understanding and political will.

Oh well, so much for empire.

I think you mean "If the choice is between $8 mcf gas, and no gas, the US will choose $8 gas." You say that the gas is still cheap at that price. The catch is that there is a big difference between wellhead price and retail price. The EROI comparisons that are made, and the BTUs per dollar comparisons made, are often made at the well head. Once one gets to the homeowner, the comparisons are a lot worse.

Thanks for these explanations. I have a question about the reservoir pressure mechanism, which may explain why conventional gas reservoirs have a quite continuous extraction history, whereas the gas extraction from shales tends to decline exponentially.

As far as I remember conventional gas reservoirs are permeable for groundwater, which can press the gas continuously towards the well (water drive).

However the permeability of gas shales is (or can be?) too low for groundwater, so the gas is only driven by its original gas pressure and not by the rising water table.

So extracting from conventional reservoirs would be like pouring water from a bottle of mineral water, whereas extracting shale gas is just like the flush of gas when you open a bottle of sparkling water.

Is this this description and the comparision correct or am I wrong here?

Excellent analogy in fact drillo. Especially the sparkling water model. But there are some conventional NG reservoirs that produce by pressure depletion. Typically they don't have the rapid decline rates we see with SG wells. This is a function of drainage volume. Imagine a tank holding 100,000 cu ft. If you drew the NG out at a rate of 100 cu ft per day it would take 1000 days if the pressure remained constant. This would be analogous to a water drive reservoir. But the tank is sealed and thus pressure declines as the NG is withdrawn. If you plot the production rate in a log/normal plot you see a nice straight declining line. This is one of nature’s great gifts to reservoir engineers. This is by far the most accurate method to estimate ult recovery from a conventional reservoir once you have some production history.

SG wells are a little more complicated though. First, most are over pressured. A "normal pressured" reservoir would exhibit pressures relative to the equivalent weight of a water column for the depth it occurs at. Many SG reservoirs exist at greater pressures: "geopressure". During the early production stages of a geopressured NG reservoir the decline pattern won't be as described above. Essentially it will decline at a much lower rate until the pressure approaches the "normal pressure " gradient. Second, SG reservoirs, as HO described, don't share the permeability character of most conventional NG reservoirs. Thus even if a SG well were to eventually drain 100 acres it would take much longer.

It's the combination of the two factors that make estimating ult recovery from the initial flow rate so difficult. OTOH, the geopressure allows a much initial higher flow rate then one would expect. But the low permeability limits how quickly NG can move towards the producing well. The net result is the high initial flow rate followed by a rapid decline. But once the geopressure is bled off the slow drainage phase takes over and you end with some of the lowest decline rates you ever find.

That's why ult recovery can be such a misused value. The initial high production rate looks great. And then throw in a big URR and it looks like a great investment. The investment value is completely time dependent. The IP rate gets you towards payout fast (as long as NG prices are high enough) but the decline rate starts to limit cash flow fast. Most operators start losing interest in a project if payout takes much longer then 2 years or so. The remainder of the NG produced can come out so slowly that it adds very little to the calculated rate of return. Thus even a $6 million well that ultimately produced $15 million worth of NG doesn’t look like a good investment if it takes 30 or 40 years to deliver the total cash flow. Revenue beyond the first 10 productive years adds almost no net present value to the investment thanks to the discount rate (10% to 15%) used in the economic analysis. This is THE reason why throwing out those big URR numbers to the general public is so misleading. The vast majority of the public would never understand what I’ve just written. All they’ll ever hear is that the SG plays have enough reserves to supply us for 100+ years. They will never absorb (IMHO) the fact that SG won’t supply us with 15 years of supplies at the current low pricing.

Thanks Rockman.

„The IP rate gets you towards payout fast...“So this may look attractive for (the many) investors with a get-rich-quick mindset. But less so for a sustainable base of power supply.

Now it will be interesting to see when the cash flow from these wells will dive below operation costs, so that they have to be abandoned. If the production decline from the recent drilling boom and bust won't be compensated by a simultaneous rise in gas prices the shale gas party might be over pretty soon.

drillo -- I'm not sure if "investors" make up much of the SG plays. It seemed as though the great percentage was public companies. But your "get rich quick" mentality does fit them in a way. Public companies are typically driven by one metric: increasing the reserve base...or at least replace the last year's production. The SG play was tailor made for public companies. Many thousands of drilling locations available which didn't require the type of detailed geologic study normally needed. It takes a great deal of time and manpower to generate a typical conventional prospect.

As far as abandoning a SG well when NG prices fall that might not happen to often. That can vary greatly for different trends. Typically pressure depletion reservoirs such as these have the lowest lease operating costs. As long as a SG well nets more then $1/month the great majority of operators will keep producing. Better to make $1/month then spend $5000+ to plug and abandon a well. The one big exception occurs when the well produces even a small amount of oil or water. The flowing pressure can be too low to lift the fluids out. There are some lift systems used to overcome this situation but that costs money. I've seen some comments about some SG wells having only a 4-year commercial life. That would be very unusual from what I've seen. Always exceptions of course. But we're talking generalities and that part doesn't fit to well IMHO.

Discount rates of 10-15% sound a bit high to me. Presumably these high discount rates are factoring in a perception of future risk? On the scale of society as a whole (as opposed to investors in drilling projects), a lower discount rate would seem to be more optimal. And of course if the price of the produced product (in this case NG), were to rise faster than the discount rate, then the present value could become very high because even discounted future profits would then be so high.

We have already seen that when oil prices rise above about $80 or $85 a barrel, it creates a recession. The equivalent level for natural gas seems to be about $8 or $9 mcf at the well-head.

Paying electric (from gas) and gas (for heating) bills takes a good chunk out of quite a few people's budgets. If prices go up very much, there starts to be secondary impacts--defaulting home loans, etc.

True EOS. They use that DR to compensate for risk... geologic, engineering and pricing. FYI: over long periods of time such discount rates generally yield less then a 10% rate of return. Price escalation seldom ever exceeds 2 or 3% in the economic analysis. Right now the folks who spent 100's of millions of $'s over the last couple of years would give their souls for a 0% price inflation for NG instead of the -40% or so they're seeing now. I doubt the wells drilled in the SG plays over the last couple of years will yield a ROR greater then 1 or 2% rehardless of where NG prices go in a few years.

two factors:

1) natural fractures collapse with pressure depletion, reducing their permeability.

2) gas contained in fractures (micro fractures, techtonic fractures and hydraulically induced fractures) depletes rapidly. this is sometimes called transient flow. gas entering the fractures must flow through ultra low permeability rock to reach these fractures the flow rate drops to a fraction of original. the well may eventually reach a pseudo-steady state flow if an economic limit is not reached first.

a factor offsetting pressure drop is the viscosity of the gas which is lower at a lower pressure. another is the compressibility of the rock/fracture system which may be significant at initial conditions but not so at low pressure.

That picture from geology.com is pretty amazing. How common is it to have a system of linear vertical cracks like that?

Clearly if you can drill at right angles to the crack faces, you would intersect a lot of them, and probably get a decent fraction of the gas out. If instead, your horizontal borehole was parallel to the crack system, you probably wouldn't get much (unless they are somehow interconnected). Can they tell which direction to drill in?

Which leads right in to next weeks post. (Sorry but I'm just about to go and write it). The vertical cracks are quite common, particularly in the Marcellus. Part of it may come from the cyclic nature of the bedding of the shales - remember that they were once mud at the bottom of a body of water, and if that dried up, then you might get the patterns of vertical cracks that you see in the bottom of a dried lake bed.

And yes the direction can be estimated (generally it relates to the horizontal stress field in the reservoir) and thus the wells can be drilled to intersect them. But that being said, while the cracks may help with the gas flow, over flow through the uncracked rock, the crack surfaces are normally pressed together rather tightly and without putting sand into the hydrofracs to keep the faces open they would not, by themselves, give enough gas flow to the well to justify the investment.

While I am not a sedimentologist; shale was described as being derived from clay size particles. Clay mineral particles are flat. Clay is the result of decomposition of feldspars. If one tries to build a foundation on a shale slope the foundation might slide downhill. I have seen a trailer and foundation creeped downhill on a steep hillside of shale in SW Virginia. As the clay molecules are planar, fractures sometimes developed between the planes. Any fluids or gases might fill the spaces along these fractures or between the planes. Some shales may grade towards siltstone as in the Bakken. Siltstone is generally more porous than shale, but less porous than loosely cemented sandstone.

As for the economics of shale gas; much of this depends on the pipeline infrastructure, the cost of leasing mineral rights, the royalty arrangements, cost of drilling rigs, availablilty of water, whether or not the gas formation is isolated from groundwater supplies, and government laws and regulations.

Currently shale gas ventures and LNG are in competition with each other.

Thanks for the good comment Rockman. The discount rate is intended to reflect the time value of the money. How much will you pay now for a dollar in five years? I guess we need to look over our shoulders when criticizing shale economics. Look what just happened to Berman and Fischer…Big Brother is watching all CITIZENS OF THE SHALE!

A small note on the shale photo above to avoid some confusion. The image appears to be taken as if standing on the once horizontal shale bed surface and looking down onto the top of a bedding plane (bedding produces fissile little sheets that easily break away). I say "once horizontal" because tectonic influences may situate the beds into any orientation after formation. Thus the linear fractures visible in the photo are in fact vertical. But we cannot see the vertical extent of these fractures. You are looking at their strike extent (original horizontal). In my experience as a petrologist/geologist, often these cracks do not extend more than a few centimetres. Of course they may end abruptly, with the strain then taken up by another minor fracture nearby, but not necessarily connected. Of course there may be major fractures cutting through shales, but that is not depicted in this photo.

berman and fischer are better off for it, imo.

petrohawk has quoted the permeability of the haynesville shale as 658 nanodarcies. this would be 0.658 microdarcies or 0.000658 milidarcies.

spe paper 24320 (nd bakken) concluded that the compressibility of the natural micro and techtonic fractures was on the order of 80 e-6 vol/vol/psi. if a gas reservoir is initially at 8000 psi, the gas compressibility would be ~ 125 e-6 vol/vol/psi, so the compressibility of the fractures would be significant. when the pressure in the reservoir drops to normal hydrostatic, 0.433 psi/ft, the compressibility of the natural fractures probably all but disappears (maybe 4 e-6 vol/vol/psi)

I was following along pretty well until you mentioned 'the compressibility of the micro and tectonic fractures.' When the reservoir pressure drops to normal and compressibility of natural fractures likely disappears is it easier for the remaining gas to travel through (albeit slowly at the relatively low pressure) the fractures because they are larger (no longer compressed)?

this is all based on the assumption that the fractures are held open by the internal pressure. as the pressure depletes, the fractures close. when the pressure reaches hydrostatic, i am assuming that the fractures do not compress nearly as much as when held open by internal pressure. so initially, the permeability of the fractures decline because they get narrower and then below hydrostatic pressure the loss of permeability becomes much less significant.

the closing of the fractures and loss of permeability is an attempt to explain the excessive decline observed in some of these shale gas reservoirs.

the compressibility of the pore space, which in this case includes fractures, would tend to keep the pressure high(er) and offset to an extent the loss of permeability. i think of it as a balloon.

compressibility of pore space is normally negligible for a gas reservoir, because the compressibility of the gas is so much greater than for the pore space. in this case, because of the high pressure (and therefore relatively low gas compressibility, ~ 1/p) the compressiblity of the fractures could be significant.

thanks, I felt that was direction to go but somehow 'mirrored imaged' my thinking and befuddled poor brain

Heading Out

This is a really great series. Thanks for taking the time to write it. Very well written, and at the right level for an interested layman. And in the right size - "bite size" so my eyes don't glaze over.

My only concern, along the lines of a little knowledge is a dangerous thing, is that I now think I understand this.

To GeoDD, thanks for the reply to my question of Nov. 4 about pulling pipe when dealing with vertical and horizontal pipe. You clarified problem of lubricating between rock and pipe. I am not quite clear if you answered whether you can pull out pipe for replacement of drill bit. Perhaps it is not necessary because of the special bit assembly put in place before going horizontal. Thanks again.

bio -- tripping to replace a bit is an all to common occurence. When you at 16,000' it can take 24 hours or more to make a roundtrip to replace a bit. When you're in Deep Water with a daily expense of $700,000 that's makes for an expensive replacement run.

Thanks Rockman. What about pulling after going horizontal with relatively inflexible pipe?

It there any rough average percentage rule of thumb relationship between the initial flow rate of a Shale Gas well in a particular area (say the average for the first 30 days), and the rate at which that well in will level out? I mean is is like 10%, 20%, or does it just vary so much that any average would be meaningless.

Fulton -- that's one of the big debates going on right now. Obviously it's not an exact science so you make an estimate. The cornucopians (and most of the SG players) make optimistic assumptions. The other side makes more pessimistic assumptions. All within a reasonable range of possibility but yield two fairly different answers. But the answer will come eventually...and fairly accurately. Just have to produce those wells another few years. At that point the decline will switch to a much lower and predictable rate. Then the economic truth will be known.

there are as many answers to that question as there are shale gas wells. an average can always be calculated, but is it meaningful, is it predictive? not very and not very.

a 30 day average would improve the correllation some and a peak 30 day average even more. you probably wont know how big an area that well is draining or will drain.

one problem is that there is no consistancy in the reporting of initial tests. some report a 1 day ip rate, some report an ip calculated from a shorter test, some use a 7 day or 30 day average, some states specify how a potential test is to be conducted and reported,flowing tubing pressures vary, some are reported and some not.

about 1 year's production at capacity can probably yield a ball park estimate but maybe not. what if your neighbor drills a well next door ? what if the well dies an early death because of water production ?

Dumb question ... tried to look it up ... no clear answer ... trying to follow the thread on "SG wells" ... what does SG stand for ... ?

Thanks!

SG - shale gas, natural gas (predominately methane) generated in and trapped in shale rock.

TG - tight gas, natural gas trapped in rock that does not offer high permeability (ie has low flow rates) - see Heading Out's discussion of millidarcys.

TGS - tight gas sands.

CBM - coal bed methane

HW - horizontal well

PO - peak oil

others?

is there a glossary around?

http://www.mbendi.com/indy/oilg/p0025.htm - kinda OK

I couldn't find the glossary I swore was at api.org and it's past my bedtime...

Maybe one of the staff would initiate a glossary in the FAQ or separate item in the header on the main page?