The Bakken Shale - Has it Moved the Oil Needle?

Posted by Gail the Actuary on November 2, 2009 - 10:00am

This is a post by Piccolo, a petroleum engineer working in the petroleum industry.

In April 2008, we published an initial assessment of the Bakken Shale and compared it to the USGS estimates of the resource: “The Bakken – How much will it help?” That piece covered production up to October 2007; the current article extends that analysis 18 months to March 2009. With this installment I would like to look at phases of development as they relate to geographical movement of the play, and discuss whether the Bakken is making an impact on total US production. In other words, has the Bakken moved the needle on US production?

Total production of the Bakken

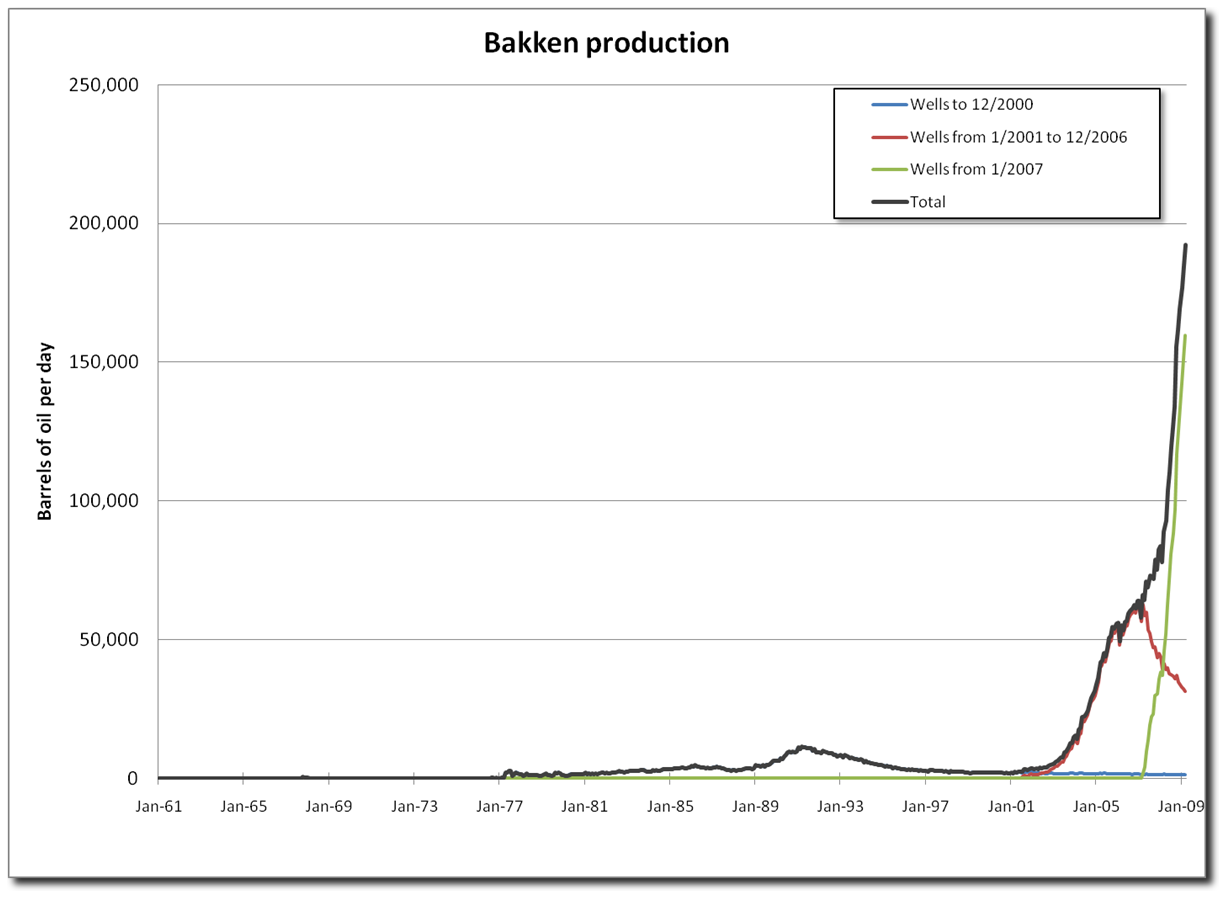

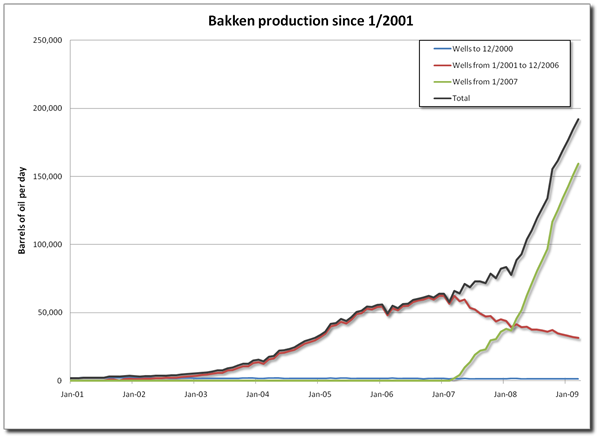

The Bakken formation is one of many producing formations of the Williston basin in the northern US and southern Canada. For this analysis we are concentrating on the US production only (Figure 1). Production has been divided into three segments according to when and where the wells were drilled; the detail of those segments is discussed below. The black curve in Figure 1 represents the entire US Bakken production, and the three others show constituent incremental production streams that make up the total. Figure 2 provides the same information as Figure 1, but is a more detailed look at the period of 2001 to present.

The Bakken began production in 1961 with a few vertical wells. Production remained flat until around 1989 when horizontal well technology became more widely adopted in the industry. Horizontal well completions during the 1980s and 1990s were primarily of two types; open hole or cased and cemented completions. In open hole completions, no cemented casing was placed across the producing formation and the formation was allowed to produce naturally, or with minimal stimulation such as a small volume of acid. In many cases, a perforated liner (a piece of casing with holes in it) was run across the producing formation to keep the wellbore open and allow future access if needed. The other common completion option was to run casing, cement it in place, and then perforate it. This was a more expensive option than an open hole completion, but would allow for more targeted stimulation either by pumping acid or by pumping sand to create a hydraulic fracture (a “frac”).

In the 1990s hydraulic fracturing technology in horizontal wells continuously improved, but mass application of very large multi-stage frac jobs took off only in the late 1990s with the advent of shale plays such as the Barnett Shale in Texas. This technology was applied to the Bakken in 2000/2001 and production increased tremendously, with an incremental increase of about 60,000 barrels per day (the red curve). This production increase mainly occurred from wells drilled in Montana, as we shall see below. Beginning in about 2005, the development focus began shifting to the North Dakota side, setting the stage for an even larger production increase (the green curve in Figures 1 and 2).

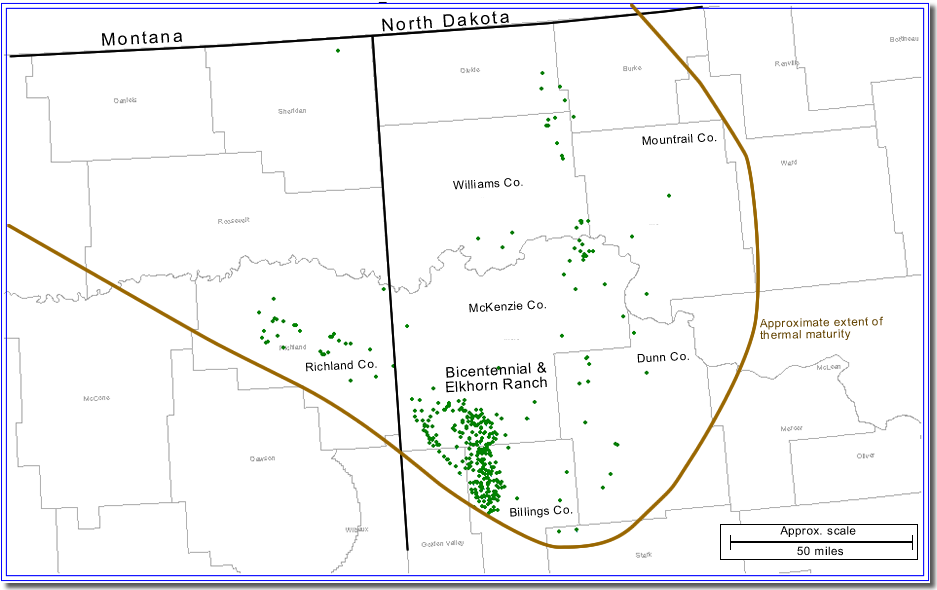

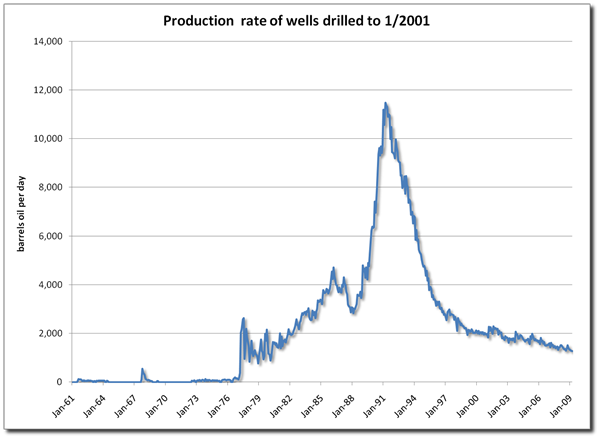

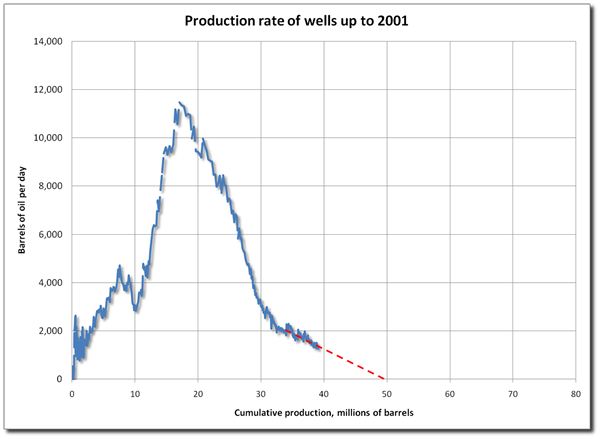

Development up to 2001

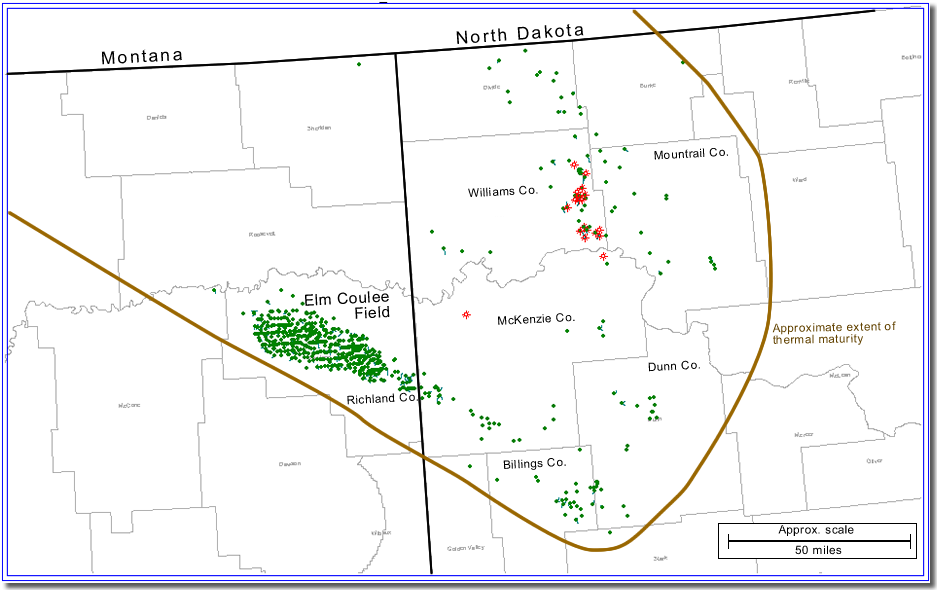

The majority of wells up to 2001 mainly occurred in western North Dakota (Figure 3) in the Bicentennial and Elkhorn Ranch areas. Most of these wells were vertical, but beginning in the late 1980s horizontal wells became more common (more on this topic later in the piece). The production associated with the nearly 200 producing wells is shown in Figures 4 and 5. The wells produced about 10 million barrels up to 1988 and thereafter a significant production increase was created by new horizontal wells. The new wells pushed production up to nearly 14,000 barrels per day, the peak occurring in 1991, after which a steep decline ensued. The production decline was about 45% per year up to 1997, after which the decline rate lessened to about 7% per year. This behavior is typical of fractured reservoirs – an initial steep decline followed by a long tail with a less serious decline. We can estimate from Figure 5 that these wells together may ultimately produce around 50 million barrels. It’s likely that with workovers, recompletions, re-frac’ing of wells, and other techniques, that ultimate recovery will exceed 50 million barrels.

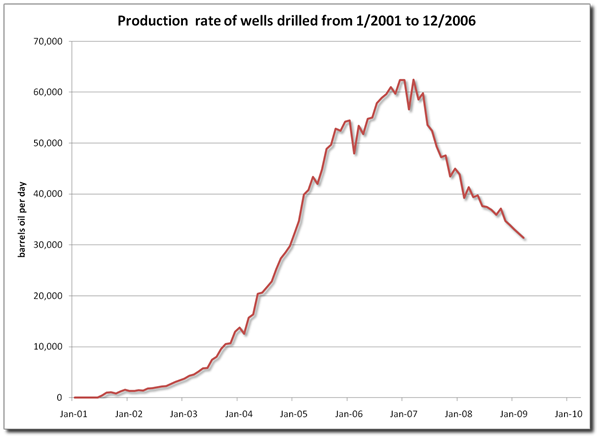

Development 2001 through 2006

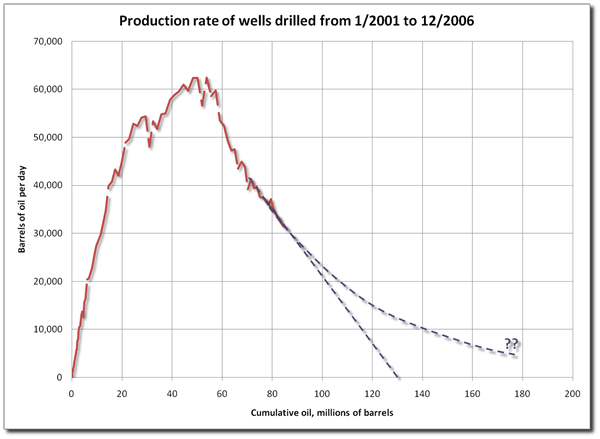

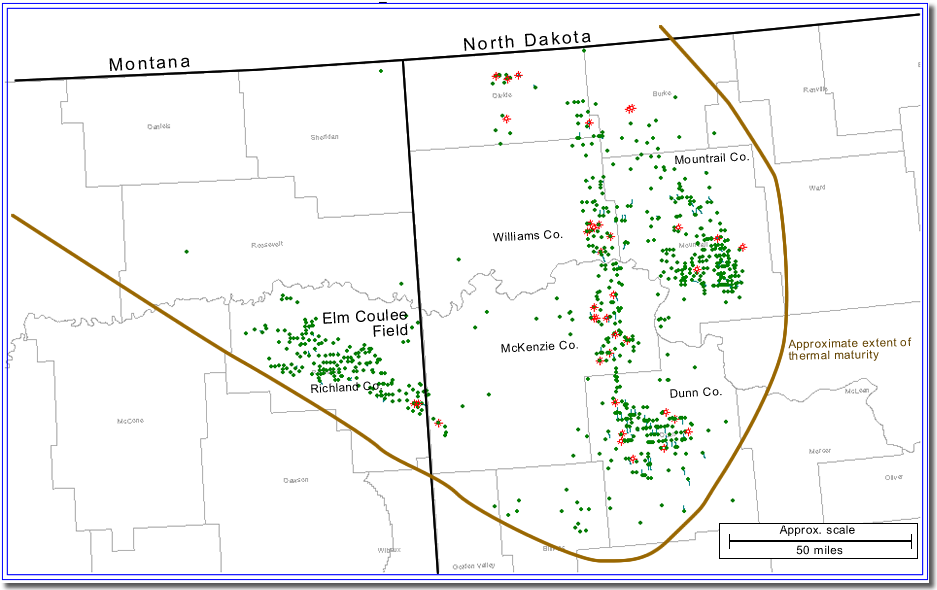

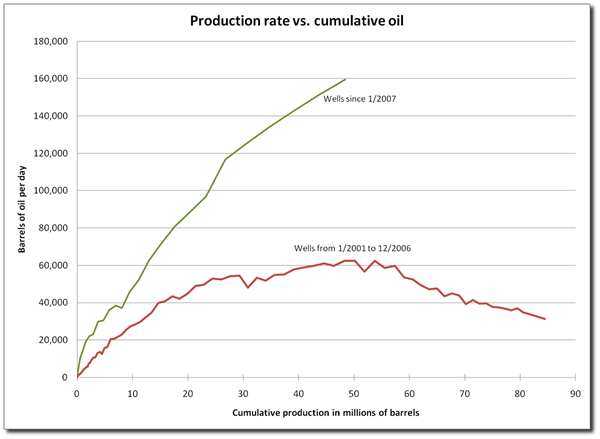

In 2000-2001, hydraulic fracturing of horizontal wells greatly improved production rates in Elm Coulee field in Richland County, Montana (Figure 6). The well count in the Elm Coulee area went from a few dozen wells prior to 2001, to around 600 wells by December 2006. Looking at only the Bakken wells drilled from 1/2001 to 12/2006, the corresponding production increase was tremendous (at least relative to past success), adding an incremental 65,000 barrels per day at the peak, which occurred in 2007 (Figure 7). Current production decline is in the neighborhood of 25% per year. On the current trend, the wells might produce at least 130 million barrels (Figure 8). With the likely flattening of the decline curve, the recovery could be up to 200 million barrels, possibly more.

Development 1/2007 to 3/2009

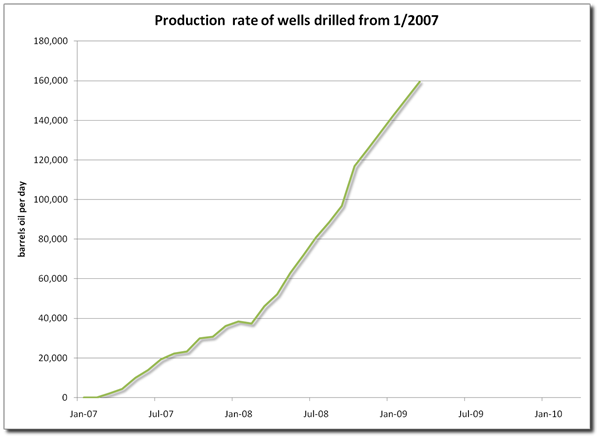

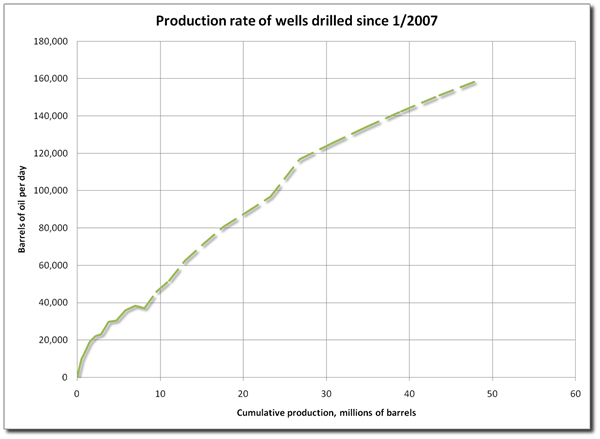

Since 2007, development has continued in Montana’s Elm Coulee field, but the bulk of the activity has moved to North Dakota (Figure 9). The production rate from wells drilled since 1/2007 (Figure 10) shows a rapid increase in incremental rate to 160,000 barrels per day and rising. (This includes wells drilled up to December 2008; production rate data for January to March 2009 was incomplete so estimates for those months were based on the previous trend.) The cumulative production (Figure 11) shows that about 50 million barrels were produced up to 3/2009. Comparing this phase of development to the previous phase (Figure 12), current phase is far exceeding production of the previous phase. It is too early to predict what reserves may be recovered from this tranche of wells, but overall it is reasonable to think that they should be double or triple the reserves expected from the 2001 to 2006 group of wells.

On an individual well basis, ultimate recovery from the better recent North Dakota wells is reportedly in the range of 500,000 to 800,000 barrels, compared to 100,000 to 400,000 barrels per well in Elm Coulee. The reasons for these astoundingly good wells are the topic of another discussion, but improved frac technology and more frac stages are likely to be big contributors. In addition, the productive reservoir section on the North Dakota side is thicker and more widely distributed, typical of an unconventional resource play. If the predictions prove to be accurate and are repeatable over a wide area, this would likely be the most prolific onshore play in the US, at least in the last 20 or 30 years.

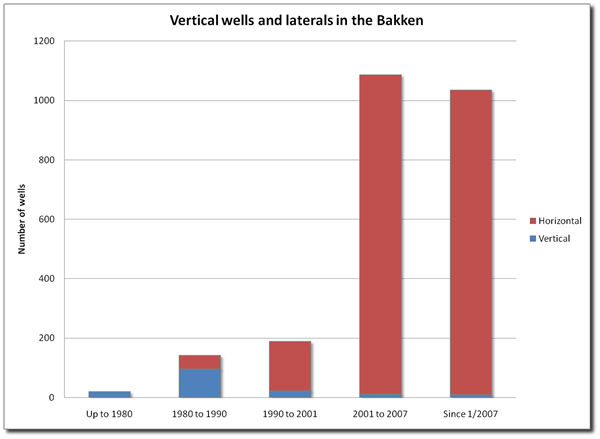

A statistical look at well numbers

Figure 13 clearly shows the dramatic shift from vertical to horizontal wells that occurred in the 1990s. (The horizontal well count Figure 13 is actually number of laterals and not strictly the number of horizontal wells; that is, many wells are drilled where two or more subsurface laterals are connected to a wellhead. Usually these are called multilaterals. For purposes of this discussion, I’ve used the terms horizontal well and horizontal lateral interchangeably.) The Bakken formation is now developed almost exclusively with horizontal (or multilateral) well technology, and vertical wells are rarely drilled.

The other big shift, mentioned above, is the geographical focus of development. This can be seen in Figure 14, which shows early focus in North Dakota (the 1990s), later focus in Montana, and then a shift back to North Dakota starting in 2005.

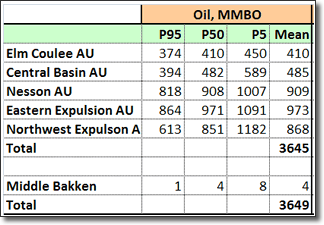

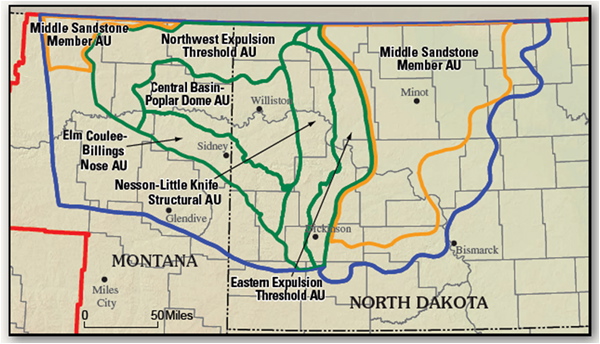

Comparison to the 2008 USGS estimate

The 2008 USGS study (Figure 15) estimates 3,600 million barrels of “undiscovered oil resources” in the “Bakken-Lodgepole Total Production System.” For a more detailed discussion of oil resources, and technically and economically recoverable reserves the reader is referred to my original post. In that post I took a stab at what was meant by the USGS term of “undiscovered oil resources” by defining it this way: "the volume of hydrocarbons that theoretically could be produced if enough wells were drilled to drain the entire known area of Bakken oil accumulation."

It is interesting to compare the phases of development outlined above, to the USGS map of Assessment Units (AU’s) in Figure 16. The majority of production from wells drilled up to 2007 came from the Elm Coulee- Billings Nose AU. Ultimate recovery from those wells based on current information is in the range of 200 to 250 million barrels of oil (MMBO). That compares to a USGS mean ultimate recovery of 410 MMBO. Since 2007, development has been mainly in the Nesson-Little Knife Structural AU and the Easter Expulsion Threshold AU. The post 1/2007 wells have recovered 50 MMBO and production is rising rapidly. But production must increase for some time and many more wells are needed to approach the 1882 MMBO estimated technical reserves of the USGS study.

Bakken production – a drop in the bucket or a big boost to US production?

So, let’s put the Bakken production in perspective. From the point of view of combining technology with geology to increase oil production, the Bakken is a shining example. It’s no mean feat to increase production as rapidly as is indicated in Figure 1, and it’s a credit to the oil industry, the free market system, and the serendipity of geology; land owners, oil producers, service companies, and mother nature (geology) have all contributed to make this a top class oil development.

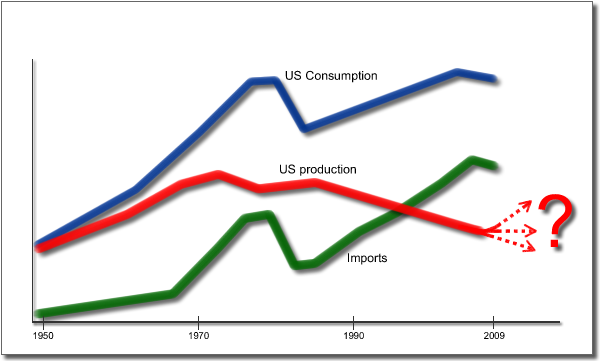

But what about from the perspective of US production and consumption (Figure 15)? The EIA estimates that US oil consumption in 2008 was equivalent to 17.8 million barrels per day, declining from a high of 19.4 million barrels per day in 2005. US production continued its long slow decline to a level of 6.7 million barrels per day (including natural gas liquids). Bakken production in 2008 averaged about 118,000 barrels, or about 1.8% of US domestic production, and about 0.7% of US consumption. The Bakken displaced about 1.1% of the US net 2008 imports of 11.1 million barrels per day.

Domestic production with and without Bakken production is shown below; graphically the change in US production due to the Bakken is barely perceptible. (The dashed black line in figure 15 is US production without the Bakken; the red line is total US production. The divergence between the two lines is imperceptible except during at the very end of 2008.) To answer the question originally posed, the Bakken, even with its high and rapidly increasing production rate, has barely moved the needle on US production.

The longer term take away from the Bakken experience may be that indeed there are additional oil resources in the US that can be developed with technology, but the resource must be enormous and be pursued over a long period of time to have any impact. It is not clear at this time whether there are other onshore oil plays that will match the Bakken. It can be argued, though, that there is a good analogy in the development of US gas shales: development of the Barnet, Woodford, Devonian, Haynesville, and other gas shales the last 10 years has been extensive enough to “move the needle” on US gas production. But the argument is diminished somewhat, when one considers the difference in properties between gas and oil; the viscosity of oil is approximately 100 times more than gas, making it extremely challenging to recover oil from tight shales on the same scale as we have seen in gas development. Nevetheless, the industry is doing what it can, with active oil shale developments: Tuscaloosa Marine Shale, the oil leg of the Barnett shale, and the Eagleford shale, to mention a few. It’s too early to tell whether these will be as prolific as the Bakken.

Conclusions

1. The focus of Bakken Shale development has shifted from the Elm Coulee field in Montana to several counties in North Dakota.

2. Total Bakken production was approaching 200,000 barrels per day and rapidly increasing as of March 2009. Cumulative production was about 160 million barrels.

3. The current phase of development has greater reserve potential than the previous two phases combined.

4. The 2008 Bakken production rate of 118,000 barrels per day constituted 1.8% of US domestic production and 0.7% of total US petroleum usage.

5. It’s too early to say whether other shales as prolific as the Bakken can be developed in the US.

Thanks very much for this interesting update on Bakken! It is something that is hard to find. I understand it uses Bakken specific data from the IHS data base, so excludes the non-Bakken production from ND and MT.

I put together a couple of graphs using EIA and Baker-Hughes data for ND and MT in total. These will include non-Bakken as well as Bakken data, so won't tell the whole story, but I thought might give some additional perspectives.

The above graph of Baker Hughes drilling rig counts for ND and MT seems to indicate that ND drilling rig counts crashed after the drop in oil prices. They started picking back up again, once oil reached about $65 or $70 a barrel (WTI). MT counts were down already, so there was less impact. There was a little longer lag in the beginning of the drop (November vs September), compared to some other parts of the country, but I suspect this might be because of the longer lease terms on the horizontal wells used in Bakken.

The above graph shows EIA oil per day production for MT and ND. Comparing this graph with your Figures 1 and 2 indicates that there seems to have been quite a bit of non-Bakken oil production back in the 2000-2001 timeframe. This makes it harder to figure out Bakken-specific information from the graph. The non-Bakken production has likely been declining--but one doesn't know how much.

One thing that the graph seems to confirm is the quick drop in oil production after drilling stops. One can definitely see this in Montana data. But this also seems to be occurring with the North Dakota data. One wonders if the recent dip in oil production is related to the drop in drilling rigs only a few months earlier. (The EIA data is through June 2009).

I am sure there is a lot of estimation involved in figuring out how much each well will ultimately produce. We have read about a lot of controversy on the gas side about how much the wells will ultimately produce. One wonders if such a controversy will hit the oil side as well--or if this is a non-issue.

hardly a non-issue. public traded companies are using the same slight of hand(and power point presentations) as the gas ponzians. my analysis of many of these wells indicates a rough rule of thumb of 1/2. in other words performance will support about 1/2 the eur's being flashed before the salivating analysts and "investors".

a common mistake i see being perpetuated is the idea that all bakken reservoirs are elm coulee's.

the drop in nd bakken oil production beginning in about 11-08 is in part the result of decreased drilling. another factor is that frac'ing and completions essentially came to a standstill during the winter months because of the expense and difficulty of frac'ing in winter months.

i don't see any reference in this article to the bakken containing volitile oil. this oil reservoir will turn into a gas reservoir. many petroleum engineers dont seem know what a volitile oil is.

Could you explain more about the "volitile oil" issue? (Maybe the US spelling is "volatile".)

I ran across a news article on the problem of volatile organic compounds:

Bakken pollution catches everyone by surprise (Dated Oct. 23, 2009)

So, it's a learning experience for them?

They need to find out about Vapor Recovery Units (VRUs), which I would have thought would be a standard feature on the oil stock tanks, but apparently not in North Dakota.

Apparently it is Guy. I knew a couple of guys that made a good living from selling VRU's in Texas 15 years ago. Not exactly new technology.

In addition to the possibility of the Title V requirements, they also face the possibility of needing to meet the requirements of 40 CFR 63, Subpart HH (starts at 40 CFR 63.760) for the control of Hazardous Air Pollutants.

Failure to meet these requirements puts them into what is know as the High Priority Violator (HPV) program. It starts a clock for discovery and resolution. If ND is not following these HPV guidelines, then it is all EPA Region VIII in Denver that runs that show.

My guess is they get an NOV (Notice of Violation) with a recommendation for enforcement. Under those circumstances, if this turns out to be a widespread problem, the various parties will likely enter into a consent agreement, with a time table for correction and some level of fines (though ND, if fully delegated, has a wide latitude in enforcement discretion).

These types of problems crop up from time to time when something completely unexpected and out of the ordinary raises up it's head.

the composition of the bakken oil is roughly 1/3 intermediate components, h2 - h6, the same components that make up most of gasoline. the bakken reservoir temperature is generally in the range of 240 deg f. gasoline at low pressures and high temperature evaporates. when the pressure in the bakken depletes, much of the "oil" evaporates. owing to the low viscosity of "gas", the vapor races ahead of the oil and leaves behind a slightly heavier oil and a significant fraction of what was originally called "oil" is produced as "gas".

the volatile components vented from the stock tanks are the h2 - h6 components. crude oil stored in the stock tank contains some h2 - h6 components. over time some of these components will evaporate at atmospheric conditions. and the tanks need to be vented as they are filled and emptied, so some of the volatile components enter the atmosphere.

a vapor recovery unit, mentioned below, is the obvious solution. an operator flaring a million cf/d of gas is probably not real concerned with the venting of a relatively small volume of gas off the stock tanks. and notice one of the ndic's solution to volitile hc emissions is - flare the gas.

I tried to get natural gas production information for Bakken, but the data is fairly old. I find it hard to believe that there are enough natural gas pipelines. Annual data through 2007 suggests that the big increase was in venting and flaring, not in natural gas production. Not great for GHG emissions!

I am sure one of the issues is the price difference between oil and gas. No one would want to sell the product as gas, if they could get away with selling it as oil. Perhaps refrigeration is the answer.

gas(at least that which is not flared or vented) is being processed through a gas plant to remove the liquids as ngl. i believe the gas plants in this case are cryogenic design. much of ngls will be recovered, but at a higher cost than for crude oil.

recovery at a higher pressure would result in greater recovery of crude oil, but at a lower rate. plus the volume removed would have to be replaced with nitrogen or co2. the operators are not real eager to do that because they want to recover their costs asap, some of them may never recover their costs.

The data indicates the gas vented and flared increased 8-fold from 2003 to 2007. The gas flared is not really a problem, but they apparently have not thought about the implications of venting large amounts of hydrocarbons to the atmosphere.

Apparently this is all new to them.

how do you figure that ?

waste is not a problem ?

co2 is not a problem ?

pressure depletion is not a problem ?

I'd have to qualify that. Flaring not a serious problem compared to venting unburned complex hydrocarbons to the atmosphere.

Some of the vented gases are nasty (e.g. carcinogenic) and burning them is the obvious and cheap way to mitigate the problem. Methane is also a much worse greenhouse gas than CO2. As for waste and pressure depletion, these may or may not be serious depending on economics and reservoir characteristics.

It's all relative - minor problems compared to serious problems. The real concern is that the government of ND doesn't seem to have thought much about the issues involved in developing the Bakken shales. They really should.

The factors you mentioned are all important, and could have been discussed. See my comment below on the desire to stay with a more global view.

Very readable and informative key post. Many thanks.

It is clear that the Bakken Shale is a small but useful supplement to the domestic US oil production. New technology has found a way to extract oil from previously unproductive geology, albeit at a relatively high cost per barrel (I assume) and with very high flow drop off rates from individual wells.

It has many features that are promising. It is on home ground and easy terrain. No geopolitical issues and local infrastructure already in place.

However the questions that remain to be answered, are just how extensive are the geological formations that will yield economic flow rates of oil using this technology, and just how expensive (in terms of finance and energy) is this technology? How far and how quickly could it be scaled up if the oil is out there?

It is extremely unlikely to prevent or reverse global peak oil, or even sustain US supply in the face of ELM. So the question remains, will the US economy hold up sufficiently that it can afford the high extraction costs in the face of ever tightening overall energy supply? In other words could the US economy collapse so fast that even this domestic supply of energy is simply left in the ground?

I think we will find out the answer in the next 3 to 5 years.

To focus on expense, ND production jumped 49 kb/d for 2008, the same year BHP's Neptune field came online. This latter cost ca. $1.2 billion; what was the aggregate cost of all the activity in the Bakken? Perhaps you have an answer, piccolo; your data is very welcome, and thanks for sharing.

The BHP Neptune comment is an interesting observation. I may have to think about doing something on the cost side in a future post.

I neglected to point out that it will produce, at peak, 45 kb/d, so comparable to the gain for ND.

for 2008, 424 bakken wells were drilled in nd, this would equate to roughly $2 billion for drilling alone.

Hmmm, $2 billion for a production increment of a bit over 100,000 BPD.

So a capital cost of $200B/MMBPD, about twice Kashagan's approx $100B/MMBPD.

And these were the good parts of the Bakken.

Same old story in the oil patch Greg...you work with what you've got. ND operators can't look for a Neptune. OTOH, chasing the Bakken, especially using someone elses money, can be very rewarding. One of the problems judging a hot drilling play is the question of how much of the activity is by players spending their own capital and how much is from the promotors. Not being critical of these guys but a good promotor can make a profit drilling marginal wells. If they make up a big part of the mix it can lead to mixed signals based upon rig/completion count.

I can imagine how the story told to stockholders goes--the oil production will continue virtually forever. The price of oil will be $400 barrel, or $1,000 a barrel, in not too may years. So the net present value of future production is huge. Only those assumptions aren't necessarily all that realistic.

The practicality of very long term production remains to be seen. It would seem like having pipelines for all of these small amounts of oil would be very expensive. When companies start out drilling, the pipelines would be close to full. But in not too long, production will be down to 20% or less of the initial production. It seems like at some point, the amount of oil will be too small to transport by pipeline. Someone upthread mentioned gathering oil by truck. That may be the way to transport it in the future, provided trucks are available and roads are in reasonable condition.

It remains to be seen whether the economy can support hugely high prices. So far, it doesn't look that way.

Gail -- Not sure of the details in ND but oil is almost always collected by tanker truck except in the case of very large fields. The oil would typically be trucked to a gathering depot which could be connected to a region oil pipeline if it's large enough. From what I gather about the players in the trend they've scattered the drilling activity so a centralized oil gathering system wouldn't be practical to tie individual wells. Also the reason they are flaring so much NG. Unless you are moving a large volume of oil for an extended period of time pipeline economics seldom work.

Oh...and that stocks sounds good...where where can I buy some?

Interesting

It would be helpful to know if Piccolo has any investments in, or works for, companies that have Bakken holdings.

In addition, it would probably be helpful to look at some data from producing leases where new wells are not being added, which would give us some idea of the actual production decline rates for these wells.

Way back when, I posted a comment in Drumbeat saying that I needed someone to look into Bakken. "Piccolo" responded that he was willing to do an analysis, even though he had absolutely no connection with Bakken. He worked for a company that had nothing to do with Bakken, but he could obtain the data he needed for the project through the data subscription his employer had. So this and the previous articles are really research projects on his part.

Thanks, so the second part shouldn't be a problem--some actual production case histories where new wells are not being added.

the decline rate in the parshall field of nd is typically 60% for the 1st year followed by 60% for the 2nd year. i only exaggerate slightly. production from the parshall field has been curtailed because of 1)reduced drilling activity 2) a shut down of frac'ing during the past winter and 3) voluntary curtailment because of limited pipeline capacity. eog has recently constructed a rail loading facility for oil transport.

wells drilled in dunn county,nd(marathon, conoco/phillips and others) seem to have a lower initial rate and lower decline rate.

I can confirm that I have no interest in any production or land in the Bakken play, in Montana, or North Dakota, nor am I working for a company with interest in the play. So this is an outsider's analysis. That's part of the reason I have restricted my comments mainly to global trends and minimized my comments on local detail.

For future posts on the Bakken (I have no firm plans for this yet), it would be a definite advantage to collaborate with someone who is involved in Bakken operations.

The question about individual decline rates is timely, and may be a topic for future post.

And well appreciated Piccolo. It's especially interesting to see it measured against US total production. The plays seems, at times, to be one focus in the debate between the anti "drill, baby, drill" folks and the cornucopians. I view each group as being right/wrong at the same time. Your analysis goes a long way to substantiating my position. It's great that this play, as well as others, can add to domestic production and reduce our balance of trade. The anti-drilling folks miss (often intentionally IMO) this aspect. OTOH, the cornucopians throw around the ult recovery numbers since they are so much bigger/impressive then the gain in daily production rates. By anyone's measure multi-billion bo recovery does generate warm and cozy feelings until, of course, you consider the extraction costs and time lag to get this recovery.

I wish we had studies similar to Poccolo's for all the major resource plays. These would end all the associated debates IMHO. We would still have unknowns with respect to future discoveries. But the resource plays, with the huge "proven" reserves, seem to have a much greater impact on society's perception. And in the end, I think perceptions will continue to drive US policies...whether those perceptions are correct or not.

As I have put it before, oil & gas companies can and will make money in post-peak regions, but consumers should not assume that oil companies' ability to make money will mean that they can make a material difference, especially for oil. Having said that, we can at least put people to work, and be net producers of energy.

Westexas, (and any of you other guys who do this energy thing for a living):

Do you expect to own a ng fueled car someday?

I was actually thinking about it, but the NG powered Civics are pretty expensive, and then there are the problems with the company that was doing home compressor stations (which are quite expensive):

http://earth2tech.com/2009/05/01/fuelmaker-assets-finally-find-a-buyer-n...

Probably a better choice for us would be to relocate to a more walkable area along a mass transit (still discussing this topic with my lovely bride; the key question is the size of our housing unit along said mass transit line).

It sounds to me like the proposed housing is much more expensive per square foot.

Wouldn't it be cheaper to buy a Prius? If gasoline prices skyrocket, the Prius will hold it's value (or appreciate), so it's a cheap solution. And, if gas prices jump, you could then add a large battery and a plug for $7K, and be almost free of gas consumption. OTOH, in 2-4 years PHEVs like the Chevy Volt will be available for a premium of roughly $5K.

Either of these will be much less expensive than the penalty you're considering paying for housing. Not to mention the cost of moving, which could easily be much, much more.

No mac. Last fall I bought a nice mid-size SUV (Kia Sorento). Paid $17,000 and it gets 23 mpg. Probably one of the nicest/most confortable cars I've owned. Not 4-wheel drive but good ground clearence when I go to a well site. As long as I can buy good/inexpensive ICE cars there's not much financial incentive to go NG. And that doesn't even address the logistics of owning such a ride. I tend to own a car until it's almost worthless...8+ years. In 8 years the Sorento goes to my then 16 yo daughter. I've already told her she needs to sign up for car shop in school when the time comes.

No, NG fueled cars don't make sense from my perspective. What I have at the moment is a Toyota Matrix 4WD that gets about 30 mpg, which is good enough for most practical purposes.

It's not that NG is impractical as a fuel. When I worked for oil companies they ran the company vehicles on NG. However, they had all the equipment necessary to handle it and compress it for the vehicles. They also got it more or less for free as a by-product of the oil operations.

The economics for individuals isn't nearly as favorable, because we don't get NG for free and we don't have NG compressors at home.

Most of the NG produced here in Alberta will be going to the oil sands plants in future, which will provide synthetic oil with about a 4:1 EROEI of oil produced vs NG consumed. That's more efficient than consuming the NG directly.

When I worked in Calgary, I walked, bicycled, or rode electric trains powered by wind generators to work. That seemed the efficient way to commute - it used no fossil fuels at all, and freed up more oil to send to you guys in the excited states of America. And thank you for buying Canadian.

Hi Mac, Yes, I do have a CNG 2 WD pickup, bought used. I use it irregularly, get good mileage on it, but bought it because I anticipate that at some point in time we will see conventional fuels become hard to get, albiet temporarily. I kind of tinker anyway, and would have a round trip of about 150 miles to go around and shut all of my local production off. The system which it uses was designed before a lot of the newer emission bells and whistles, but according to the company which originally installed it, it shouldn't need all of the extra emission controls. They were still around and I took it in to have everything checked out. They changed the padding on one tank - it has 3 - and charged me like $125. It is dual fuel w/ gasoline and automatically switches back to gasoline if the NG runs out. Oil is always clean and has plenty of power - 350 Chevy engine - and I really can't tell the difference between NG and gasoline as to power.

Here's the digg, reddit and SU links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://digg.com/d318t4J

http://www.reddit.com/r/reddit.com/comments/a06wf/the_bakken_shale_has_i...

http://www.reddit.com/r/energy/comments/a06ox/the_bakken_shale_has_it_mo...

http://www.reddit.com/r/collapse/comments/a06pp/the_bakken_shale_has_it_...

http://www.stumbleupon.com/submit?url=http%3A%2F%2Fwww.theoildrum.com%2F...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

It should be noted that Piccolo indicated 18 months ago that

This looks likely to be wrong and is wrong already if the Montana and Sask oil is included.

North Dakota oil production has reached new highs and the two month lag in monthly statistics will likely show about 250,000 barrels of oil per day in October or November. The latest monthly statistics are 231,252 barrels of oil per day (bopd) for August 2009.

Saskatchewan has about 50,000 barrels of oil per day from the Bakken (and had a peak of 58,000 barrels of oil per day from the Bakken). The drop off was due to the financial crisis, but production should increase with technology increasing the number of fractures per well and financing improving.

Montana still has about 50,000 bopd from its part of the Bakken.

http://nextbigfuture.com/2009/10/north-dakota-oil-production-reaches-new...

51600 barrel per days of pipeline capacity is being added in 2010 for North Dakota.

There is the Three Forks Sanish oil which is increasing the amount of oil from the same area. It is underneath the Bakken. If it is a mostly separate formation there is speculation that it could double the recoverable oil in North Dakota.

Multiple frac drilling is heading up to wells with 60 fracs. This improves the economics of the drilling.

Multi-frac drilling can be applied to revive other old oil plays in North America and the world.

http://nextbigfuture.com/2009/10/horizontal-drilling-technology-and.html

Deep sea oil for the USA are on the wikipedia megaprojects list

Tahiti oil platform: Daily production is expected to ramp up to approximately 125,000 barrels of crude oil and 70 million cubic feet of natural gas before the end of the year (2009).

Thunder Hawk in Mississippi Canyon 734 commenced production on July 8th. Current production levels at this semi-submersible floating production unit are approaching 27,000 barrels a day of gross production from two wells.

BHP Billiton Ltd. (BHP) said in Sept 10, 2009 its Shenzi oil field in the Gulf of Mexico was exceeding nominal capacity of 100,000 barrels per day, and is achieving sustained rates of 120,000 barrels a day.

USA Chinook, Cascade 3/2010 Petrobras ODW Crude 80,000 bopd

USA Clipper 7/2010 ATP_Oil_and_Gas ODW Crude 10,000 bopd

USA Perdido Hub (Great White; Tobago; Silvertip) 2/2010 Shell 100,000 bopd

USA Phoenix 2010 Helix OFF Crude 25,000 bopd

USA Telemark Hub (Mirage; Morgus; Telemark) 1/2010 ATP Oil 15,000 bopd

US field production is at the range of 2005 numbers and has been edging upwards (at least looks flat since 2005)

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS1...

I think three forks and Bakken will head to 1 million bopd by 2013-2015. And other old fields will contribute using the multi-frac drilling.

"Prediction is very difficult, especially about the future." Credited to Niels Bohr

Admittedly, I was a bit hasty in my prediction of peak rate. However, I will go out on another limb and say that 1 million barrels per day is going to be really tough, especially if the decline rates mentioned by a poster above are wide spread. Let's hope you're right and I'm wrong. If it did reach 1 million barrels per day, it would absolutely be "moving the needle" on national production.

i am not so sure that is true. public traded companies are promoting that idea, no doubt. available data, on the bakken at least, indicates that more frac stages means a higher initial rate and steeper decline.

not sure if you intended to imply that the bakken in nd is producing 250 kbpd. the 250kbpd is for all of nd, the bakken is probably more like 100 kbpd.

So true re: multi-stage fracs Elwood. The big shale gas player I worked with last year was using multi-stages to up production but the costs was cutting deep into the profit. That's why they ran away so fast when NG prices began to fall. I understand from one of my engineers they are moving back into driling ops faster then he expected. Just a guess but I suspect a good bit of the reason may the reduction in completion costs now that competition has all but disappeared. Certainly not doing it because of NG prices.

This fraccing obviously costs a lot of money in terms of energy expended, time, and chemicals and so forth. Can you say something in general about how the expense breaks down?

And might the necessary chemicals run short?

How much if any of the chemicals can be recovered from the oil and gas for reuse?

Thanks in advance!

about a year ago, the cost of each frac stage was quoted as $200,000. costs have no doubt come down substantially since then. i have heard an estimate of $ 75,000 but i question if costs have come down that much.

ceramic beads used for propant have been in short supply in the past. china came to the rescue, but the quality of china produced is questionable.

and to answer your earlier question, no i dont plan to own a ng powered car.

To add to elwood's comments: the chemicals aren't very exotic so not much shortage potential. The recovered fluids are generally trash and thus discarded. A large portion of the high cost fracs was profit and the effort to recover the capital costs for the equipment. The pumps trucks are huge investments. But when times get tough they forget about the front end costs and go strictly for cash flow.

I hope so, at least it is coming on faster than the slope is declining but then the slope produces about a third of what used to. Any other really nice big fast producing patch of puddles out there? By 2015 the slope will be down a million and a third bopd from its heyday--a mere twenty years ago.

One formation that seems to come up quite a bit recently is the Three Forks - Sanish formation, which is located under (deeper than) the Bakken formation. According to this article:

..and the EROEI for this is not too bad, I assume? Be interesting to track it over time, especially since the additional oil in each area obviously takes a lot more work to get out. The average may be good, the tail not so?

If the costs for drilling wells are as high as they seem to be, it is not clear that the EROEI is very good.

I tried to see what I could find for costs. These are some that Northern Oil is bragging about.

This would seem to indicate that initial well costs are of the order of magnitude of $3 million.

Whiting Petroleum Corporation Announces Third Quarter 2009 Financial and Operating Results

Encore Acquisition Company

Perhaps some with more experience than I have can give their thoughts on how these costs compare--indications for EROI.

This is some very good info on costs. Thanks for tracking it down.

the nog estimate is "out there", i flat dont believe it. i suspect that not all costs are included. note they refer to drill and complete but nothing about equipment costs.

whiting is drilling mostly 2 mile long laterals and their estimate of $ 5 million seems to be in line with reality. i have similar doubts about eac's estimate.

three of the smaller players in the bakken, brigham expl, northern oil and gas, and kodiak oil and gas have all recently issued stock offerings. this play is really no place for an undercapitalized operator.

eac has been acquired by denbury resources. the stock market thinks they paid too much.

Like elwood I have some doubts about those costs also. They may be correct for a well drilled today. But last year an 18 stage frac would have cost a couple of million at least. And a well with a 10,000' lateral would have easily costs several million. But, the service companies are hurting and much of the drill/completion costs are in sunk hardware costs. The actual out of pocket costs for drilling such wells is much lower then most would guess. Some chemicals, fuel, steel pipe and payroll. But I would still like to see the operators break dowwn those costs.

Outstanding analysis. But I don't know what the point of the analysis is.

Most of us are just trying to raise a family, and the Bakken has made North Dakota the only economically stable state at this time (according to a report out today, November 2, 2009 -- google "economically stable state") with the lowest unemployment rate in the nation (essentially 0).

It also appears that the Bakken is just one of three formations of interest. Some opine that the Three Forks Sanish (the formation below the Bakken) might be even more prolific than the Bakken, and now oil companies are targeting the Lodgepole, some of the wells being conventional. This activity will guarantee jobs for those interested in living and working in North Dakota for the next 50 to 75 years, by which time much will have changed anyway.

The US has centuries of fossil fuel available -- natural gas and coal -- more than enough to bridge us toward alternative forms of energy. Any dependence we have on foreign countries for our oil is strictly political. All the graphs comparing US consumption, with imports and US production, are nice, but again, I'm not sure what the point is. With a different political will on US independence, we could easily be just that -- independent.

I think the point is rather obvious. Data needs to remain free and unleashed from the shackles of corporate interests. If all data is open, then we can all make better decisions and create a better policy.

I have a feeling that depletion management will become a policy branch of either the government or some think-tank.

Otherwise I believe the point of the article was to engender an "Outstanding analysis" response from lakesideinvestor. With that, piccolo achieved his goal.

Lake:

Obviously you did not understood the USGS numbers in this post and that's why you missed the point.

Total possible recoverable oil from Bakken formation may be 3.5 billion barrels, economically recoverable oil more likely at 1.8 billion barrels. Thus the total Bakken production would supply US with about 150 days of imports (being about 12 mmbpd now).

How does this bring us significantly closer to oil production independence?

It doesn't.

Even if Bakken production were to double in the next five years it would mostly make up for declines in other US onshore areas, not move US toward oil energy independence.

The 3.5 billion estimate was of the 400 billion barrels in place when there were about 8 fracs in a horizontal well and before including any Three forks - sanish oil.

So the horizontal drilling technology is rapidly improving. There is a lot of testing of different methods to get at more of the 400 billion barrels of oil. And there could be more oil in place based on the Three forks-Sanish and other formations.

In 1997 the USGS said that 150 million barrels of oil could be recovered from the Bakken and we are already about double that 1997 amount.

The improved horizontal drilling can make other older in place oil fields productive.

There is a lot of motivation and incentive to unlock more of the $30+ trillion resource. A lot of R&D and test wells using more new techniques.

The point was to look at what the data is telling us about Bakken production, and then compare it to US production. As stated in the piece, the great increases in Bakken production are a credit to the oil industry, land owners, service companies, etc., with a little help from Mother Nature. And yes indeed, there may be further increases from Three Forks Sanish and Lodgepole.

As great as the Bakken production increase has been, it has not had much impact as a percentage of total US production, not to mention consumption. Unfortunately, US oil production has been on decline since 1971, even with the Gulf of Mexico, the Alaska North slope, and prolific plays like the Austin Chalk and the Bakken.

We need all the Bakken's we can get to supplement US production, but in spite of our best efforts, with the best technology, and the most rigs of any country in the world, we have not been able to reverse the US year-on-year oil decline. (Gas production has been a brighter picture, because the decline has recently been abated with the advent of the gas shales.) I personally wish we could find 10 new Bakken's in the continental US, but I've been in the industry long enough to know that for onshore oil, the discovery size is decreasing, cost/bbl is increasing, and EROI is deteriorating.

For North Dakota, I hope the rising oil production and the commensurate activity lasts many years.

In a few short decades the oil boom in ND will be a fading shadow of its current glory, the missile fields may or may not be abandoned or significantly reduced in scale, the fertilizer and other agrochemicals and diesel to power the equipment may be scarce, the last folks who remember Lawrence Welk will be gone, and the wind will still blow strong and the Ghosts of North Dakota will tell the tale.

I've been to many of the places depicted at this site below; I highly recommend these as an adventure objective if you have some free time to spend in NoDak. Take pictures and memories, leave footprints...the ghosts may be watching!

http://www.ghostsofnorthdakota.com/

I thought the book at the link below was good; I especially was intrigued by the authors' premise that the increasing size of railroad grain cars over time from 50T to 100T caused the slow death of many a ND town. Many of the Ghost Towns/near ghost towns happen to be located along the many RR spur lines, many running SE to NW in the state.

http://www.amazon.com/Silent-Towns-Prairie-Dakotas-Disappearing/dp/15751...

Maybe some of the recently (and soon-to-be)developed wind farms will still be humming along after the oil declines...

Hopefully the missile fields will not be full of craters...

this is a dumb question - but if you google "oil shale" you get info about sites in colorado where they extract synthetic oil by breaking up the rock, heating it, and condensing an oil-like substance. how is bakken shale oil different from this? they seem like very different extraction techniques. don't we need a way to distinguish one shale oil from another?

hosehead -- if I understand correctly the CO "oil shales" don't contain oil. They are more like to Canadian tar sands (again...tar and not oil). The tar sands have to be cracked via a heat input to generate oil. The Bakken and Barnett Shales actually contain live oil. A deeply buried tar sand could never be produced. there are actually a good many such reservoirs around the world. In general we call them "dead oil" for obvious reasons.

Oh, yes it could. The "tar" is not tar, it is an extremely heavy form oil oil called "bitumen". However, if you heat it or dilute it with solvents, it will flow toward a well.

However, it took about $1 billion in research to find an effective method to do it.

Why do you think they are reversing the pipelines that used to carry oil north from Texas, to carry Canadian oil south to Texas? Because there are insane amounts of this stuff in Canada. Most of it is too deep to mine, but that's not a problem any more.

The same processes would probably work for the Venezuelan oil sands as well, but the Venezuelans are not on the right page politically to do it.

Guy -- I'm a S La geologist...when I say "deep" I mean deep....10,000'+. And I agree the in situ process can work. The real question will always be economics. I think Shell's last press release stated they hoped to have figured out how to make it economic in the next 10+ years.

A minor point: in my part of the world we call bitumin tar or pitch.

I don't think that any of the 2.4 trillion or so barrels of extremely heavy oil or bitumen in place in the Canadian and Venezuelan oil sands is deeper than 3300 feet. It would be unusual to find heavy oil much deeper than that.

Shell and everybody else is getting back into the game again. At this point in time there are about $100 billion in oil sands projects coming off the back burner and going onto the front burner again. They need about $80/bbl to make it work, and that's about what the price is right now. The assumption is that by the time the projects go on stream, the oil price will be over $100/bbl, from which point it's all gravy.

According to my Oxford English Dictionary, bitumen is "naturally-occurring asphalt from the Middle East, used as mortar, etc". Bitumen is a Latin word which the Romans used for the tar-like substance found in ancient Babylon. Babylon being in modern-day Iraq, the stuff was actually heavy crude oil.

Tar is "a very thick viscid black or dark colored flammable liquid obtained by the destructive distillation of wood, coal or other organic substances." Tar comes from Old Norse tjara, derived from tree. They used to make tar by heating tree sap. People became very familiar with it in the 19th century when they began to produce tar from coal on a large scale.

Although the two look similar, the difference is significant from a Peak Oil perspective because bitumen can be refined into gasoline and diesel fuel, whereas tar cannot.

I would second Rockman's comment. "Oil shale" is an ambiguous term that the industry uses to describe very different forms of hydrocarbon contained in rock. In one case it's solid material that must be mined, and in the other case the hydrocarbon is flows readily from the pores in the rock. The common theme is that the rocks in both cases are very fine-grained material with the catch-all name of "shale."

The difference is that the Colorado "oil shales" aren't shale and they don't contain oil.

What is termed "oil shale" actually contains an oil precursor called "kerogen". It's not oil, but it can be turned into oil by destructive distillation. The rock it is contained in is usually a hard rock called marl. This makes producing it on a commercial scale quite a technological challenge.

The Bakken shale is actually shale, and it actually does contain oil. The problem is that the shale has very low porosity and permeability, which makes the oil difficult to extract.

By contrast, the Canadian "tar sands" do not contain tar, they contain an extremely heavy grade of oil called "bitumen". But they are actually contained in sand, which makes them a lot easier to extract.

There are some differences. The bitumen found Alberta is only very loosely bound to the sand that it is mixed with. The sand is actually surrounded by a layer of water ("waater wet", and the bitumen is on the outside. The fact that the water layer exists makes it possible to extract the bitumen using relatively low energy techniques.

As I understand it, the oil shale seems to be bound much tighter, and needs to be heated to higher temperatures, making the likely EROI lower.

As I remember it, the original USGS unofficial estimate (by an individual) for Original Oil In Place was 400B bbls. The recentl report officially stated that roughly 1% was recoverable with existing tech and prices.

What about the other 99%? Any speculation about technological change that would make more of that recoverable?

Please wait for a reply from Daniel Yergin to your question. He is busy developing the technology (is that the technology to answer your question or produce the oil though?). Please note that he is trying to cover his a$$ for all of the wild predictions he has made, so you may have to wait for a while. At least he now has a new line - energy conservation is part of why we have plenty of oil to last us (now) 40 years.

advancednano has tried to address the question above.