Drumbeat: October 30, 2009

Posted by Leanan on October 30, 2009 - 10:07am

U.S. natural gas rig count climbs 3 to 728 for week

The U.S. natural gas drilling rig count has gained in 13 of the last 15 weeks after bottoming at 665 on July 17, its lowest level since May 3, 2002, when there were 640 gas rigs operating.But the rig count is still down sharply since peaking above 1,600 in September of last year, standing at 824 rigs, or 53 percent, below the same week in 2008.

Many gas producers have scaled back drilling operations with credit still tight and natural gas prices around $4 per million British thermal units (mmBtu), off nearly 70 percent from July 2008 highs above $13.

The recession is dead ... long live the recession!

The world’s first peak-oil recession has come to a close, according to third-quarter numbers invented by the federal government. Apparently dumping trillions of dollars onto big banks, insurance companies, and automobile manufacturers interrupted the plummeting descent of American Empire. The stock markets skyrocketed expectedly. Predictably, so did the commodities markets.In fact, the lifeblood of western civilization is bumping up against the “Goldilocks” limit of $80/bbl, as I predicted would occur under economic growth. A minimum price of $60/bbl allows oil suppliers to make enough money to justify new projects, so per-barrel prices between $60 and $80 are supposed to be “just right,” even though today’s price is four times higher than the 20-year average. The “Goldilocks” minimum price of $60/bbl matches the “Goldilocks” maximum price of 2005. As recently as 2003, OPEC had an official “Goldilocks” zone between $22/bbl and $28/bbl. For a little historical context, consider this: In 1969, the U.S. refused a ten-year, locked-in offer of $1/bbl oil from the Shah of Iran because the price was too high.

Russia’s gas production, though currently in decline, is expected to experience a boost of up to 40 percent over 2008 by the year 2030.Still, it is natural gas from Central Asia and the Caspian that is of crucial importance for both Nabucco and South Stream, while unimpeded access to these resources will finally decide which of the two pipelines could become a viable gas exporting route. After all, every race has a winner and a loser.

Shortage of natural gas in the Middle East could impact new petrochemical projects

Increased domestic gas demand, delayed supply response, limited regional pipeline co operation, and below-market pricing are factors that affect the long-term security of gas supply here. Evolution of the region's gas industry has lagged behind that of the oil sector, despite significant gas deposits. Gas was traditionally weaker than crude oil in the Gulf, and suffered from persistent under investment in the 1990’s because there was no financial incentive to upgrade infrastructure. Also, the Middle East region is not uniformly gas rich- Qatar, Iran, Egypt and Saudi Arabia have significant gas reserves, while others like the UAE, Kuwait, Bahrain, Jordan and Syria are relatively gas-poor. Oman and Yemen have chosen to export gas that could otherwise satisfy long term domestic demand. Further, gas reserves alone do not result in available gas supply, as seen in Iran's inability to become an important gas exporter despite its enormous reserves, and limitations faced by Iraq for successful gas development. Since much of the region's gas supply is associated gas rather than non-associated gas, reserves are often not available to supply domestic markets or export markets because re-injection is critical to maintain current levels of crude oil production.

Polish firm agrees deal to import more Russian gas

WARSAW (Reuters) - Poland's gas monopoly PGNiG PGNI.WA and Russia's Gazprom agreed on increased gas deliveries to Poland under a deal that will run until 2037, PGNiG said on Friday.The deal, which still needs to be approved by both governments, follows months of negotiations between Poland and Russia and lessens risk of winter gas shortages in the ex-communist European Union member country.

ConocoPhillips Shifts to a Leaner Strategy

ConocoPhillips CEO James Mulva signaled a dramatic shift in course for the nation's third-largest oil company Wednesday, saying that after years of bulking up through acquisitions, it is now focused on being a smaller, leaner business that takes better care of its shareholders."Some will say what we're doing essentially is that we're shrinking to grow," Mulva said during a conference call to discuss the company's quarterly earnings. "That would be a fair assessment."

But the change is necessary in light of the global recession and the difficulty of accessing new oil and gas reserves around the globe, coupled with the massive costs of extracting them, he said.

The Philippines: Open books to gain sympathy, oil firms told

A MALACAÑANG official yesterday oil companies should not expect to gain public sympathy unless they open their books.Gary Olivar, deputy presidential spokesman for economic affairs, said oil companies should quit hiding behind the Oil Deregulation Law and be more transparent, more cooperative and comply with the policies of government.

Egypt’s nuclear plans threatened

CAIRO // As Egypt’s government prepares to finalise plans for the country’s first nuclear power plant by the end of this year, opposition from a prominent tourism developer risks scuttling the project.But if the proposed site at Al Dabaa, a remote strip of desert coast about 140km west of Alexandria, does not receive final approval by the end of this year as planned, it could spell the end of Egypt’s nascent civil nuclear energy plans and the beginning of an energy crisis, said Mohamed Mounir Megahed, the vice chairman for the Nuclear Power Plants Authority.

Nicaragua taps geothermal energy with Canadian firms

MANAGUA, Nicaragua (UPI) -- Nicaragua is hoping to tap into its vast geothermal power resources and has awarded two concessions to Magma Energy Corp. and its partner Polaris Geothermal Inc., both of Canada, as part of a long-term energy self-sufficiency plan.Industry experts say Nicaragua has the most geothermal energy potential of any country in Central America. Mostly trapped in volcanic mountains along the Pacific Coast, experts say geothermal energy alone can solve Nicaragua's energy crisis while efforts are under way to exploit wind power and other forms of renewable energy.

Asian car manufacturers among leaders in "world sustainability league"

Asian car manufacturers are outperforming their American and several of their European rivals in using their economic, environmental and social resources more efficiently.

An open letter to Steve Levitt

The problem of global warming is so big that solving it will require creative thinking from many disciplines. Economists have much to contribute to this effort, particularly with regard to the question of how various means of putting a price on carbon emissions may alter human behavior. Some of the lines of thinking in your first book, Freakonomics, could well have had a bearing on this issue, if brought to bear on the carbon emissions problem. I have very much enjoyed and benefited from the growing collaborations between Geosciences and the Economics department here at the University of Chicago, and had hoped someday to have the pleasure of making your acquaintance. It is more in disappointment than anger that I am writing to you now.I am addressing this to you rather than your journalist-coauthor because one has become all too accustomed to tendentious screeds from media personalities (think Glenn Beck) with a reckless disregard for the truth. However, if it has come to pass that we can’t expect the William B. Ogden Distinguished Service Professor (and Clark Medalist to boot) at a top-rated department of a respected university to think clearly and honestly with numbers, we are indeed in a sad way.

Arctic Sediments Show That 20th Century Warming Is Unlike Natural Variation

ScienceDaily — The possibility that climate change might simply be a natural variation like others that have occurred throughout geologic time is dimming, according to evidence in a Proceedings of the National Academy of Sciences paper published October 19.The research reveals that sediments retrieved by University at Buffalo geologists from a remote Arctic lake are unlike those seen during previous warming episodes.

The UB researchers and their international colleagues were able to pinpoint that dramatic changes began occurring in unprecedented ways after the midpoint of the twentieth century.

Willing to give up blue skies for climate fix?

We can probably engineer Earth's climate to cool the planet, scientists say, but are we willing to live with the downsides? Those could include creating more droughts, more ozone holes and, oh yeah, a thin cloud layer that obscures blue skies and gives astronomers fits.With potential negatives like that it's no wonder that "geoengineering," as the technique is called, has few hardcore advocates.

White House fights back on Cash for Clunkers

Obama administration goes to battle with Edmunds.com on Cash for Clunkers analysis, saying the program contributed heavily to last quarter's economic expansion.

Putting Up Produce: Yes, You Can

The worst recession in decades and a trend toward healthier eating are inspiring many Americans to grow their own food. Now the harvest season is turning many of these gardeners into canners looking to stretch the bounty of the garden into the winter.

From farm to table, a link to the past

The event is part of a larger program called RAFT Grow-Out. RAFT, which stands for Renewing America’s Food Traditions, is affiliated with Slow Food USA and made up of many smaller organizations dedicated to what RAFT calls the “save it by eating it’’ paradigm. The Grow-Out, held for the first time, provides farmers with donated heirloom seeds and connects them to chefs who create menus based around the crops. Boston-based nonprofit Chefs Collaborative is the RAFT partner working with this event. Participating restaurants include Henrietta’s Table and Hungry Mother, both in Cambridge, and Tastings Wine Bar and Bistro in Foxborough.Renewed interest in heirloom foods stems from a variety of factors. Some chefs like the taste of antiquated squash, others want to preserve crop diversity as a matter of food security.

Three Gorges Dam 'a model for disaster'

China's Yangtze River hydropower project has been a 'model for disaster', according to a river protection charity, which is concerned about new proposals for similar projects.The Three Gorges Dam, whose reservoir is due to reach its final height of 175 metres over the next few weeks, will be able to produce enough electricity to meet close to one tenth of China's current electricity demands.

However, Rivers International say the Dam has driven fish species to extinction, caused frequent toxic algae blooms and is subjecting the area to erosion and frequent landslides.

EPA requires AEP to test W.Va. coal-ash site

CHARLESTON, W.Va. (AP) -- The U.S. Environmental Protection Agency said Thursday it is requiring American Electric Power to conduct safety tests on waste impoundments at a West Virginia coal-burning plant to ensure their structural stability.Although the impoundments at the Philip Sporn plant aren't considered an immediate failure risk, EPA said it was requiring the tests because the structures have similar designs to one that failed last December in Tennessee.

City puts bicyclists directly in the path of motorists

In one of the busiest shopping districts in Long Beach, Calif., bicyclists are kings of the road in an experiment that turns frustrated motorists into serfs.The seaside city south of Los Angeles is encouraging bikers to get right in front of cars. It painted a five-foot wide green stripe down the middle of one of the two lanes in either direction of the Belmont Shore section of the city. Even though cars were whizzing by at 30 miles an hour yesterday, bikes were free to ride right in their path.

Saudis to drop WTI as price benchmark for U.S. crude

The U.S. share of world crude use has fallen to less than 23 per cent in 2008 from 26 per cent in 2001.In the past year, it has fallen by another 750,000 barrels a day, or 3.7 per cent. Countries such as China and India are expected to dominate future growth in oil demand.

As a result, the pricing of the U.S.-based WTI has begun to decline in importance. Although Argus is also a U.S. price, it is more closely linked with international oil and is seen as a more reliable indicator of global oil prices.

“What it [the Saudi move] really speaks to is the demand shift in oil away from the U.S. and to other places in the world. That's what's really driving the bus,” said Jeff Rubin, the former CIBC chief economist and author of Why Your World Is About to Get a Whole Lot Smaller: Oil and the End of Globalization.

“North American oil demand has peaked,” he said. “What this really says is that whereas WTI in the past had been a premium price, now WTI is going to be a discount price.”

Aramco to drop WTI as pricing guide for crude

Aramco’s switch to ASCI sparked speculation other exporters of sour crude to the US may follow its example. But the move should not be interpreted as a rejection of WTI’s general role as market leader, Horsnell said. “US gulf crudes tend to be assessed in terms of differentials to WTI, rather than as separate centers of independent price discovery, and we expect that to continue,” he said. “Should an active OTC or futures market based on ASCI eventually arise, then the dynamics could change. However, establishing futures contracts based on delivered US gulf sours has proved very problematic in the past and is still very far from an inevitable development. Indeed, the current regulatory climate is not exactly ideal for any innovative development of new OTC or formal exchange-based oil derivatives.”

SNAP ANALYSIS - Saudi switch aims for better value for its oil

DUBAI (Reuters) - Saudi Arabia is dropping a U.S. light sweet crude oil benchmark as the basis for pricing its sales to the United States for one more like its own sour crude and that is less swayed by the volatile futures market.

NYMEX plans two new sour crude futures contracts

NEW YORK (Reuters) - The New York Mercantile Exchange plans to launch a cash-settled futures contract tracking the Argus sour crude index by year end and another contract for physical delivery sour crude at a later date, NYMEX operator CME Group said on Thursday.CME said the NYMEX contract plans are a response to Argus Media's announcement on Wednesday that Saudi Arabia's state oil company Aramco will switch to the Argus sour crude index as the benchmark price for all grades of crude sold to the United States.

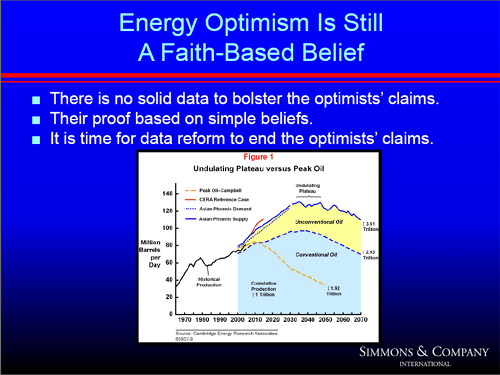

Matt Simmons: ASPO'S Peak Oil Message: Successes And Impediments

Daniel Yergin on What's Next For Global Energy

Perhaps no one is better positioned to sift through the complicated and interrelated questions surrounding "peak oil," renewable energy, climate change and energy security, than Cambridge Research Energy Associates Chairman Daniel Yergin.Yergin won a Pulitzer Prize for his book, The Pize: The Epic Quest For Oil, Money & Power, published nearly twenty years ago - and has recently written a new epilogue for the book on the current state of the great energy game.

Yergin will be sitting down for a chat on the future of global energy with Steve Clemons today from 12:30pm - 2:00pm at the New America Foundation.

Putin Warns Ukraine Over Gas Crisis

NOVO-OGARYOVO, Russia (Reuters) - Russian Prime Minister Vladimir Putin on Friday warned that Ukrainian President Viktor Yushchenko risked provoking a new gas crisis that could disrupt supplies to Europe."It looks like, we will again have problems with energy payments," Putin said after a telephone call with Ukrainian Prime Minister Yulia Tymoshenko, Yushchenko's main political foe and a frontrunner in a January 17 presidential election.

Gazprom in Europe: Russian government plans to share part of Yamal gas resources

The Russian government plans to share bits of the giant Yamal prize with international companies. However, rather than a sign of liberalism, this represents an attempt to address the fundamental challenges that the expanding Gazprom is facing in Europe.

Chevron Third-Quarter Profit Declines as Energy Demand Slumps

(Bloomberg) -- Chevron Corp., the second-largest U.S. energy company, said third-quarter profit fell 51 percent as slumping fuel demand pulled down oil and natural-gas prices.

12 dead in Jaipur oil depot blaze; Deora says fire ‘to die down on its own’

JAIPUR: Petroleum minister Murli Deora on Friday said the fire at Indian Oil Corporation's fuel depot on the outskirts of the city has to die down on its own and there was "no other solution" to douse the leaping flames.

SEG: Saleri says oil, gas key in new energy era

HOUSTON -- The world has entered a new energy era in which overall energy efficiency and oil recovery efficiency will improve, environmental harmony will grow, and oil, gas, and coal will continue to dominate.That is the view of Nansen Saleri, founder, president, and chief executive officer of Quantum Reservoir Impact LLC, Houston, and a former Saudi Aramco reservoir management chief.

When considering conventional and unconventional resources, 150-250 years of liquids production remain at output levels of 50-100 million b/d, Saleri said, relying on National Petroleum Council 2007 estimates.

Global oil recovery factors long estimated at around 35% have begun growing toward 50-60% and will ultimately reach 80%, he forecast in a presentation to the Society of Exploration Geophysicists annual meeting in Houston.

The energy world is filled with unpredictability over the outcomes of recession, price volatility, geopolitics, resource nationalism, renewables, global warming, and most of all “peak oil” versus peak demand.

Geophysicists and the rest of the oil and gas industry should focus more on peak demand than on peak oil, Saleri urged.

Exxon, Oil Majors Battle to Restore Earnings as Demand Plunges

(Bloomberg) -- Exxon Mobil Corp., PetroChina Co. and Royal Dutch Shell Plc are battling slumping fuel demand as oil majors seek to rebuild profits battered by the global fallout from the worst U.S. downturn since the Great Depression.Exxon Mobil’s U.S. refineries lost about $2.3 million a day last quarter as gasoline and diesel prices fell. Shell, whose refining earnings declined 47 percent, said the plunge in demand will keep profit margins narrow in “the short and medium term” and a quick recovery in energy usage and prices is unlikely.

Oil companies around the world are slashing costs, cutting jobs and holding back on some new investment to halt the slide in earnings, even as they seek to fund renewable energy projects. Exxon Mobil cut its capital-spending estimate for 2009 by 10 percent as third-quarter profits at the Irving, Texas- based explorer and Shell hit their lowest level in six years.

Oil companies give cool outlook

LONDON (Reuters) - Exxon Mobil Corp, Royal Dutch Shell Plc and Eni SpA dashed hopes for an imminent turnaround for the oil industry, saying sluggish economic recovery was weighing on energy demand and prices.The three posted big drops in quarterly earnings on Thursday after crude oil and natural gas prices plummeted and refining margins were squeezed.

India's Reliance Industries Q2 profit dips 6.55 pct

MUMBAI (AFP) – Indian refining and energy giant Reliance Industries Ltd said quarterly net profit dropped by 6.5 percent on Thursday as core refining margins fell following a tumble in global crude prices.

Saudi move is bid to realign oil market

LONDON (Reuters) - Saudi Aramco's decision to abandon a light sweet oil benchmark closely linked to NYMEX futures as the basis for crude sales to U.S. customers reflects growing frustration with its performance over the last two years.While it will not imperil NYMEX's status as the main forum for oil futures trading, it will increase pressure on the exchange to consider adjustments to its contract. In time NYMEX may have to allow a wider range of crudes to be delivered and add a delivery location on the U.S. Gulf Coast.

Senate Panel Backs Iran Petroleum Investment Sanction

(Bloomberg) -- The Senate Banking Committee voted unanimously today to further restrict trade with Iran and impose sanctions on companies that help the country acquire refined petroleum products.The 23-0 vote follows yesterday’s approval by the House Foreign Affairs Committee of a similar measure to sanction companies involved in supplying, shipping, financing and consulting for Iran’s petroleum sector. Iran has limited refining capacity.

Chevron tried to taint Ecuador toxic waste trial: lawyer

WASHINGTON (AFP) – Videos posted online by US oil company Chevron purporting to show rampant corruption among Ecuadoran officials are actually a set-up meant to taint an ongoing trial against the energy giant, an attorney in the case alleged."By releasing the videos, in my opinion Chevron is trying to taint a trial process that they knew they were going to lose, with the hope that the case would be dismissed in Ecuador," Steven Donziger, an attorney for Ecuadoran Amazon communities who are suing the oil giant told reporters.

Russia Cuts November Crude Oil Export Duty by 3.9%

(Bloomberg) -- Russia’s government will cut the export duty on crude oil by 3.9 percent on Nov. 1, according to an order signed by Russian Prime Minister Vladimir Putin.The levy will decrease to $231.20 a metric ton, or $31.54 a barrel, from $240.70 a ton the previous month under the order, which was published today in the official Rossiyskaya Gazeta newspaper.

Gazprom Sees Europe Gas Demand In 2020 Up 12.5% To 700 BCM/Year

LONDON -(Dow Jones)- Russia's state-controlled natural gas monopoly OAO Gazprom expects annual demand for gas in Europe to grow to 700 billion cubic meters in 2020, up 12.5% from the current level, the company said in a statement late Thursday.

Dead fish drifting in Indonesia after oil leak

JAKARTA, Indonesia – Thousands of dead fish and clumps of oil have been found drifting near Indonesia's coastline more than two months after an underwater well began leaking in the Timor Sea, officials and fishermen said.An estimated 400 barrels a day of oil has been leaking from a fissure that erupted on Aug. 21 at a rig about 150 miles (250 kilometers) off the Australian coast. PTTEP Australasia, a branch of Thai-owned PTT Exploration and Production Co. Ltd., has failed repeatedly to stop the leak but says it is still trying.

Canada's Economy Unexpectedly Shrank 0.1% in August on Energy

(Bloomberg) -- Canada’s economy unexpectedly shrank in August, suggesting the economy may not have exited a recession in the third quarter after output was little changed in July.Gross domestic product fell 0.1 percent in the month, as oil and gas extraction dropped 2.3 percent and manufacturing fell 0.7 percent, Statistics Canada said today from Ottawa. Economists expected a 0.1 percent increase, according to the median estimate of 23 analysts surveyed by Bloomberg.

The Next Economic Crisis, Spiralling Inflation

Peak Oil is not someone’s pet theory. It is not a rumour spread by left-leaning conservationists. Peak Oil is supported by hard production data. Peak Oil is a field-by-field extrapolation of what has already happened to existing oil fields. As most investors know, the US has had to import ever-increasing amounts of oil as their own supplies have decreased. But now, the exact same thing is happening in Britain’s North Sea and in Mexico.Oil is a finite resource, and many of the world’s largest oil fields are being rapidly depleted. The maximum rate of global petroleum extraction has peaked, and now the rate of production is entering terminal decline. The reason for the decline is, to a large extent, the lack of new discoveries. Most of the major discoveries were made in the 1950s and 1960s. Since then, the annual discoveries of oil have kept dropping to the point where, when we take oil out, we do not replace the reserves.

ConocoPhilips: Time to Embrace Natural Gas Transportation

Since the shale plays have been, and will continue to be, a game changer in this space, why doesn’t Mulva join other natural gas advocates like Hefner, Pickens, and McClendon and embrace natural gas transportation in America? Certainly COP will continue to profit from the fundamentals of oil supply/demand and the continuing ramping up of gasoline powered vehicles in China, India and Asia in general. This is validated by a $75/barrel price during a period of brimming oil inventories coincident with the worst financial downturn since the Great Depression.

India grants Congo $263 mln in infrastructure loans

KINSHASA (Reuters) – India has offered Democratic Republic of Congo $263 million in loans to build hydroelectric plants and repair battered infrastructure in the war-ravaged central African nation, Congo's foreign minister said on Friday.

Canadian Hydro drops plan to buy Lake Erie wind farm

Calgary-based Canadian Hydro Developers Inc. said Friday it has terminated its earlier plans to purchase a subsidiary that is developing one of the largest wind farms in the world in Ontario.The company had first agreed to the deal with Utah-based Wasatch Wind Inc. for the rights to the 4,400 megawatt project, to be built in Lake Erie, at the beginning of October. Terms of the deal had not been disclosed.

However Canadian Hydro has since been acquired by TransAlta Corp., leading to the change in strategy.

Local Motors: A New Kind of Car Company

When John B. Rogers was a Marine deployed in Iraq in 2004, he brought a book called Winning the Oil Endgame with him to the Gulf. The book, by environmental activist Amory B. Lovins, discusses how people can end their dependence on fossil fuels. Rogers says reading the volume inspired him to create a new type of car company, one he believes offers a more efficient and effective way of designing, manufacturing, and selling autos.

New energy = new transmission lines: But finding agreement on where to put them isn't easy

DENVER — Giant wind turbines and solar collectors have become the icons for our great energy transition from fossil fuels to renewable sources. But will giant electrical transmission lines ever become half as sexy?

Chinese banks to fund $1.5B Texas wind farm

China took a big leap into the U.S. renewable energy market Thursday, putting up $1.5 billion for a 36,000-acre wind farm in Texas with the power to light up 180,000 homes.The project is a joint venture with U.S. Renewable Energy Group, a private equity firm, Austin, Texas-based Cielo Wind Power LP and Shenyang Power Group of China.

Solar power execs bullish on 2010 despite earnings

ANAHEIM, California (Reuters) - Executives from solar power companies see clearer skies in 2010 for the beleaguered industry, even as quarterly reports from heavyweights like First Solar Inc and SunPower Corp have disappointed investors and dragged down shares.The industry has struggled to emerge this year from tight credit markets, a global glut of panels and falling prices.

BP Is ‘Disappointed’ With $87 Million Texas City Refinery Fine

(Bloomberg) -- BP Plc, which expects an $87 million fine in relation to its response to an explosion at the Texas City refinery, said it’s “disappointed” with the penalty from the U.S. Occupational Safety and Health Administration.OSHA this month rejected BP’s request for more time to comply with a settlement over the 2005 blast, which killed 15 workers and left hundreds injured. The London-based company, Europe’s second-largest oil producer, now anticipates a fine, spokesman Andrew Gowers said today by phone.

Argentine enviro secretary fined for dirty river

BUENOS AIRES, Argentina – Environmentalists praised a judge on Wednesday for fining Argentina's environmental secretary and two local politicians for failing to clean up the polluted river that flows sluggishly through the heart of the capital.

Tests on treasured maize ignite fears in Mexico

MEXICO CITY (AFP) – As scientists race the clock to increase food production worldwide, new trials to plant genetically-modified maize have stoked anger in Mexico, the cradle of corn.Many here are sensitive about meddling with maize, which dates back to pre-Hispanic times, when mythologies held that people were created from corn.

Some fear Mexico could one day lose the wealth of native varieties it still produces, including red and blue, to a few, tough breeds of GM maize, as well the livelihoods of hundreds of thousands of subsistence farmers.

Will U.S. go empty-handed to world climate talks?

WASHINGTON — Without a new law requiring cuts in greenhouse gas emissions, the U.S. could end up going empty-handed to the international climate talks in December.Many nations are watching to see whether the Senate will make progress on a climate and energy bill that would spell out the U.S. national emissions-reduction plan. Without an offer of such cuts from the largest source of emissions that are already in the atmosphere, there won't be a global deal at the talks in Copenhagen, Denmark .

EU sets 100 bln euro climate summit goal for poor states

BRUSSELS (AFP) – EU leaders were struggling Friday to agree how to fund the fight against climate change, with poorer eastern European nations urging their more affluent western neighbours to bear the lion's share of the burden.

China, India could shame rich nations: UN scientist

BEIJING (AFP) – China and India could use their growing clout to shame developed countries into committing to a climate change deal in Copenhagen in December, the UN's top climate scientist said on Friday.

EU Emissions Trade Cost U.K. 3 Billion Pounds, Taxpayers Say

(Bloomberg) -- The European Union carbon-permit trading program cost British consumers 3 billion pounds ($5 billion) last year as it boosted energy prices, said a taxpayer lobby group.The cost, equivalent to 117 pounds per family in the U.K., is too high and EU lawmakers should consider abolishing the program, the world’s biggest greenhouse gas market, said Matthew Sinclair, director of research at the London-based Taxpayers’ Alliance. “The EU emissions trading scheme has been an expensive failure,” he said yesterday in an e-mailed statement.

Arctic Multiyear Ice Practically Vanishing

Polar shipping routes have finally been unblocked, thanks to the virtual disappearance of the multiyear ice spanning the Arctic Ocean, according to an Arctic expert.For centuries, enormous sheets of multiyear ice reaching up to 260 feet thick have impeded the way of ships looking for a short cut through the fabled Northwest Passage from the Atlantic to the Pacific.

However, Canada’s Research Chair in Arctic System Science at the University of Manitoba, David Barber, noted that the ice is vanishing at an unbelievably fast rate.

In a presentation to Parliament, Barber said, "We are almost out of multiyear sea ice in the northern hemisphere."

Higher temperatures will harm many crops, report says

WASHINGTON -- Global warming would be bad news for all those amber waves of grain, and for the corn and soybeans that are plentiful throughout the Midwest."The grain-filling period" -- the time when the seed grows and matures -- "of wheat and other small grains shortens dramatically with rising temperatures. Analysis of crop responses suggests that even moderate increases in temperature will decrease yields of corn, wheat, sorghum, bean, rice, cotton and peanut crops," according to "Global Climate Change Impacts in the United States ," a report based on a comprehensive review of scientific literature and government data by a team of American scientists.

Methane’s impact on global warming far higher than previously thought

The effects of a critical greenhouse gas on global warming have been significantly underestimated, according to research suggesting that emissions controls and climate models may need to be revisedMethane’s impact on global temperatures is about a third higher than generally thought because previous estimates have not accounted for its interaction with airborne particles called aerosols, Nasa scientists found.

We don't usually publish articles on Friday afternoon, but we plan to put one up by Stoneleigh this afternoon--so check back then.

Hello Gail, I see Rembrandts' article:-). Anyway, I hope it is about her talking to Euarn at ASPO as featured on TAE. Excellent insights; scary stuff.

Re: Saleria (linked uptop)

If we take the midpoint of his time frame (200 years) and production (75 mbpd, total liquids), his middle case is 5,400 Gb of production (conventional + unconventional) over 200 years (which would not be URR for the world; he is asserting that it would be higher), which suggests that we are probably only about 15% depleted (middle case).

Note that Deffeyes gives the world about 900 Gb of remaining conventional crude oil reserves.

However, it appears that the new story being promulgated by the Cornucopians is that flat to declining crude oil production worldwide since 2005 is due to a lack of demand, and the current price of oil (which is high to all annual oil prices prior to 2008) simply reflects weak demand.

But of course, Sam and I are focusing on net oil exports, and Sam's best case is that by the end of 2013, four years from now, the (2005) to five net oil exporters will have shipped more than half of all the oil that they will (net) export after 2005, and we expect them to show something like the following life cycle.

Here are the five stages in the life cycle of net oil exporters (observed net export decline rates are as of 2008, relative to recent production peaks, which may or may not be final production peaks):

(1) Increasing production, and generally increasing net oil exports, e.g., Angola currently.

(2) Production peak and a near term net export decline rate (less than 5%/year), e.g., Saudi Arabia currently (2.7%/year).

(3) Intermediate net export decline rate (5% to 10%/year), e.g., Argentina currently (8.6%/year).

(4) Terminal net export decline rate (more than 10%/year), e.g., Vietnam currently (46.0%/year).

(5) Net importer status, e.g., Indonesia, UK & Egypt.

Normally, smaller producers don't have a big impact--either as they show increasing production or as they peak--but because of the accelerating net export decline rate that we see post-peak, smaller exporters with declining production may be having a disproportionate impact on the supply of net oil exports, because of accelerating net export decline rates.

But of course, the Saudis stand ready to flood the market with oil from their magical oil fields that never deplete. From yesterday's Drumbeat:

http://www.khaleejtimes.com/displayarticle.asp?xfile=data/middleeast/200...

I am reminded of prior pledges by the Saudis to keep oil prices within a defined range. Perhaps there was a typo in the following story, and they actually said that the price band was $20-$82.

http://www.independent.co.uk/news/business/news/opec-studying-plan-to-bo...

Opec studying plan to boost oil price band by a third

By Saeed Shah

Wednesday, 28 April 2004

Incidentally, US annual oil prices were $26 in 2002, $57 in 2005 and $100 in 2008.

Saudi net oil exports were 2.8 Gb in 2002, increasing to 3.3 Gb in 2005. If they had maintained their 2002 net export rate they would have (net) exported 8.4 Gb in 2003-2005 inclusive, whereas as their actual net exports were 9.4 Gb (EIA).

And Saudi net oil exports were 3.3 Gb in 2005, falling to 3.1 Gb in 2008. If they had maintained their 2005 net export rate they would have (net) exported 10.0 Gb in 2006-2008 inclusive, whereas as their actual net exports were 9.1 Gb (EIA).

So they (net) exported less oil as oil prices went from $57 to $100, an increase of $43, than they (net) exported as oil prices went from $26 to $57, an increase of $31.

And as I have noted several times, in this time frame, based on the logistic models, Saudi Arabia was at about the same stage of depletion at which the prior swing producer, Texas, peaked in 1972.

To put Saudi 2003-2008 cumulative net oil exports of 18.5 Gb in perspective, this is more than three times the URR from the largest US Lower 48 oil field, the East Texas Field, which took decades to fully deplete.

A couple of things:

First, I'm pretty fond of the H-L approach to give you a basic idea of where things are going in the long run.

It's simple to compute and an easy graphical method even when things get a little lumpy and "undulating." Additions and finds can certainly change the course of the line and there are no guarantees about it hitting the mark directly, but...

Going back to the beginning of Saudi oil production in 1936, you can come up with an approximate total production of just over 118 GB through 2008. And since raising their production back up after 1989, their production puts them on track for an URR of about 200-210 GB. At today's level, that a difference of "3 years" of production. The production curve has to change quite a bit just to get to something like 260 GB. Even if they pump at a constant rate, they march inexorably towards that number.

And your point about diminishing exports is something that few people really appreciate.

Second point, and I realized this quite by accident when I was playing with some of the data yesterday evening. Using the same H-L approach, whether the EIA is conscious of this or not, their IEO data keeps pointing to the hope that there really is between 4,000 and 4,400 GB of something that they can call "oil" I was looking at the IEO 2006 data I had plotted several years ago (2006) and the data for the IEO 2009...you keep coming out in the same general area although they are throwing more and more into the "oil" number than they seem to before.

Yet, we keep plodding toward a different outcome...about 2200 GB. And, we are halfway there.

Hi Jeffrey,

The thing is, even if not focussing on net exports for a moment, we have highly likely left the plateau behind us (we have peaked) and it is all going to go downhill from here anyway. The figure of 5400 Gb URR is ridiculous.

You have to add in what has been produced, and he is just talking about a plateau, so he is really talking about a middle case of probably around 7,000 Gb plus for URR, which is in the range of what ExxonMobil has also used.

PaulusP, Rembrandt and Skrebowski (best-case scenario) are going for 2014-2015 as the end of plateau.

Depends how you see URR. About 1500 Gb could be deep offshore, with low-moderate flow rates and most still to find. Leaves 3900 Gb with 'Peak oil' at about 30% recovered (1300 Gb). Because of underinvestment and other factors the plateau production started more early (2005) and lasts not more than 10 years.

Your link: Daniel Yergin on What's Next For Global Energy don't work. I found it with Google. This link works.

http://www.thewashingtonnote.com/archives/2009/10/live_stream_dan/

But it appears to be just an announcement of a coming live stream video, not yet available.

Ron P.

"Perhaps no one is better positioned to sift through the complicated and interrelated questions surrounding "peak oil," renewable energy, climate change and energy security, than Cambridge Research Energy Associates Chairman Daniel Yergin. "

I could think of a few others ;-)

Yeah, that quote really made me laugh. No other prognosticators (that I know of) have had a unit named after them that indicates just how far wrong they have been for years.

Re: Chevron tried to taint Ecuador toxic waste trial: lawyer, up top.

For those who may have missed it, Mark Fiore has one out on Chevron:

http://www.youtube.com/markfiore#p/a/f/2/rdJ9W39HdDU

X-

Chevron has a well placed spin machine, and are master propagandists.

However, unless they can get the venue changed (from where they originally wanted the trial to take place because they had a client state they could dictate the outcome), a loss is probable, given the obvious evidence.

It should be interesting.

So will the little price graphs in the right-hand margin be expanded to show both the WTI and the ASCI ?

Looks like the ASCI oil price will become more important to follow...

No, not unless a lot of other countries follow Saudi's lead. Right now, of all our crude oil imports, less than 7 percent come from Saudi.

U.S. Imports by Country of Origin

Ron P.

From an article of interest about Afghanistan by UK documentarian Adam Curtis. Proof everybody should have at least one historian in their life:

http://www.marketoracle.co.uk/Article14411.html

Great Link!

Thanks

There are probably similar stories like this all over the world. No wonder so many hate the US.

"The road to hell is paved with good intentions. . ."

I ‘m coming up on my two year anniversary of my membership on the Oil Drum. I had been a lurker for about a year before that. Part of my reluctance to post was simply: I came slowly to the notions about the internet, blogs and even e-mail. I am what is referred to euphemistically as technologically challenged.

Overall my story is pretty average: In 2004 I read a small book by David Goodstein, The End Of Oil. Prior to that I had never heard of Peak Oil and when I considered the facts with what I knew from being alive for half a century I came to believe that Mr. Goodstein was absolutely correct. The passengers on this planet are in for a rude awakening.

Since I woke up to this new reality my life has never been quite the same. After a period of contemplation I've made a ninety degree turn in my life which has surprised everyone who has ever known me. But it’s alright. I’m past the grieving. I still have my eyes open. I do owe a lot of people on this site heart-felt thanks but particularly Leanan for keeping the Drumbeat alive.

Joe

joe, want to expand a little on your 90-degree turn? any highlights?

Bert - Prior to this time I had been an avid soldier of civilization. I'd worked for the DOT for almost twenty years, then I moved into Real Estate and mortgage finance. I was even a limited partner on a couple of commercial developments in Las Vegas (and we all know how that worked out. ;-)

As a first step I went back to school. For 3 semesters I took strictly science and math courses. The most enlightening courses I took were Environmental Science and Physical Geography, which I initially assumed were going to be a general courses, but they were 4 credits each with labs and it was intensive and challenging. I always tried to sit in the back of the rooms but inevitably the kids would start to wonder "What is this old guy doing here?" After I finished Chemistry 111 and Trigonometry I felt I had a solid understanding of the First and Second Laws of Thermodynamics and the Scientific Method which I had glossed over earlier in my academic career. I currently have a GPA of 3.8 but I have no intention of pursuing a degree.

After that I came to San Francisco to attend film school. I'm halfway through my first project named Homelessness, The Leading Edge Of Poverty in San Francisco.

I no longer drive a car and I walk or take municipal transportation. I have almost completely stopped eating meat, I don't have a TV and I live in an adult hotel in the Mission district. My wife is planning on joining me next year (she currently lives in San Diego). The Hotel is a spontaneous community of sorts and I enjoy the fellowship of people struggling to survive in a city bereft of affordable housing.

It's odd but I don't have a road-map of where I'm going. When I was in my 20's and 30's I always had a game-plan but today I'm just playing it by ear and I like it that way. I would like to do a documentary on Ted Kaczynski, the UnAbomber, from the perspective that most of his ideas were pretty mainstream but the difference being he acted on those ideas while everyone else simply talked about the problems. We'll see.

Joe

I would like to do a documentary on Ted Kaczynski, the UnAbomber, from the perspective that most of his ideas were pretty mainstream

You'd be putting yourself between a bullet and a target.

If you go that route, you could spend time on how he was a hypocrite about how he lived - the Wal-Mart shopping and all.

Hey Joe,

Same story here. Thanks Oil Drum!!

Banks say consumers catching up on credit card, mortgage payments

We're not spending, though:

Consumer spending tumbles, incomes flat

With CC providers jacking rates up to 30%, I'm not surprised people are paying them down and not using them.

http://www.kyivpost.com

Ukrainian government imposes quarantine in nine western regions

Quarantine ordered

Ukraine shuts schools,cancels public events due H1N1

Health Ministry Confirms 33 Deaths From Flu And ARVI In Ternopil, Ivano-Frankivsk, Lviv Regions

The reason for all the fuss in Ukraine is that the virus appears to be doing what it has had difficulty doing up until now - that is make very major inroads into the population. Over 2.5% of the population in the worse hit regions are currently ill based on official government figures. It was pretty much predicted to have done this virtually everywhere by now but it hasn't so far. In fact Google Flu Trends thinks the USA may have already peaked (last week of October pretty much on cue). However if it starts spreading like it appears to be doing in Ukraine then the vast majority of the US and world population is still susceptible.

It may be temperature related - Google may have peaked the US (for now) but shows Canadian rates heading into orbit.

USA

Canada

Ukraine (Note outbreak very localised so far)

I think that the spike in higher latitudes is primarily due to less sun, and thus lower Vitamin D levels.

I have now polled 16 health care workers, and none of them knew what their 25 (OH)D blood levels were. My doc did subsequently get her level checked and it was 13 ng/mL, and she is now taking huge prescription dosages of 100,000 units per week. I was suboptimum at 37 ng/mL, and I am taking 5,000 units of D3 per day, until I get my blood level checked again.

www.vitamindcouncil.org

That is speculation.

The vitamincouncel.org site writes about studies without giving references (or I missed them). How many people participated in the different studies and were they done double-blind ? You have to know at least these 2 things before you can conclude if the results are statistically

significant and reliable.

Other sides that promote higher vit. D levels mention 30-60 ng/ml as the optimal range.

You can find sides which claim the same from vitamin C. Several grams a day would be necessary to prevent cancer, cardio-vasculair diseases, etc. It is unproven. Interesting is to calculate how many molecules 60mg of vitamin C is.

More important than megadosis of vitamins is a healthy diet, which contains f.i. many different anti-oxidants.

Dr. Cannell, who runs the Vitamin D Council website, admits up front that the seasonal flu connection to Vitamin D deficiency is so far unproven, but there is a very strong circumstantial case. But do ya think that is why I didn't say:

"The spike in higher latitudes is primarily due to less sun, and thus lower Vitamin D levels."

Dr Cannell's comments:

http://www.vitamindcouncil.org/newsletter/vitamin-d-and-h1n1-swine-flu.s...

I have found that the medical community in general is woefully ignorant about recent Vitamin D research, and as noted above, I have yet to find a health care professional who knew what their Vitamin D level was, at the time that I asked them. Incidentally, do you know what your 25(OH)D blood level is?

Regarding a healthy diet, again, do ya think but why go into a bad flu season with a Vitamin D deficiency? And if you don't know your 25(OH)D level, you don't know if you are deficient.

Keep at it, some will catch on. Amazing how the world of double-blind studies has produced so many disasters in pharmaceuticals. Perhaps because modern medicine is blind to anything that is not profitable, such as good diet and nutrition.

ok, to give extra vit D does no harm (toxic is > 50.000 IU/day for adults, most consider 2000 IU/day as acceptable maximum if used for a long period of time), and it seems (looking at some more sites) indeed that < 30ng/ml is generally considered as deficient. Normally a supplementation of 500-1500 IU/day resolves 'the problem'.

Probably a lot of people are (also) deficient of a lot of other more or less essential (not only vitamins and minerals)nutrients. It is the cooperation of hundreds of substances that does the trick.

I assume that the answer to this question is no? My doctor has started testing her patients, and she has found that 90% her patients are deficient.

Dr. Cannell's and Dr. Vieth's research explicitly contradicts this assertion. And taking 2,500 units of D3, during the spring and summer months only brought my 25(OH)D level up to 37 ng/mL, well below Dr. Cannell's target range of 50-70 (the maximum is 99 ng/mL).

Indeed, I don't know my level. I live in the tropics though, don't have a black skin and eat fish, eggs and drink (soya) milk with added vit D.

Normally a supplementation of 500-1500 IU/day resolves 'the problem'.

Clearly there are different opinions. I just read a german study which reports that all over the world a high percentage (around 50%) of people have levels < 30ng/ml, but that this was corrected in the majority of cases with 500-1500 IU/day.

Of course, the first question has to be: is 30-50 ng/ml suboptimal ?

Instead of trying to fob off the role of vitamin D, why don't you provide a theory why there is a flu season in high latitude countries. Couldn't possibly be related to the sun in your mind, right? Surely Canadians (for example) don't have enough fruits and vegetables in winter since those don't grow in the snow. If big pharma can't patent and sell it for $10 a pill then it must all be quackery...

One has to love the "scientific" appeal to "studies". Like with eggs causing heart disease based on those really legitimate 1950s "studies" with powdered eggs (i.e. oxidized cholesterol). Unlike physics, medical "studies" are bought and paid for by profit-making corporations and are not worth the paper they are printed on.

Medical research is also funded by the NIH in the USA to the tune of ~30 billion dollars a year. There is also endowments that fund quite a bit more non-for-profit research. There has been some studies done on Vitamin D -- all you have to do is search pubmed.

While you are learning about medical research, throw in a google for causes of flu seasons.

You think there is honest medical research, I have evidence that most of it is biased. For example low carb diets. The amount of nonsense "studies" about reducing nutrition free sugar intake (aka starch) is simply incredible. It is clear that the industry contrived food pyramid is being treated as a sacred cow. The Heart and Stroke and Diabetes associations are all claiming that 60% carb food intake (i.e. following the non-scientific food pyramid) is the right thing to do. Care to explain how they can justify this medieval stance? How are diabetics supposed to control their blood sugar levels with high sugar diets? Your precious "studies" perhaps?

You can keep doing your searches on pubmed, while you are at it maybe you can find a real scientific article. Based on the obvious funding bias for dietary research there is nothing to suggest that vitamin D research is any less biased.

You can trumpet NIH all you want, but like the rest of government it comes under pressure when there are billions of dollars in profits to be made by the private sector. The FDA policy on vitamin D and other food supplements says it all: if it isn't a big pharma product then it is not real medicine. So you get a clue, sunshine.

BTW, the FDA is the same collection of clowns that approved Baycol, the Bayer statin product that was killing the people who took it after a few months. Here is another fine example of the concern big pharma and the medical community have for health. Let's use a co-enzyme Q10 blocker since we all "know" that cholesterol causes arterial plaques (which are 75% polyunsaturated fats, BTW). Not the NOx people breath in during their traffic jam drive to work or the NOx they get from consuming nitrates and nitrites. You know, the body's universal cell damage repair molecule (LDL) is the real source of evil and not the free radicals and other cell damaging toxins they intake from their environment.

I am on the inside of academic medical research. Sorry, but your anecdotal examples remind me of AGW deniers.

Since you are on the inside can you explain something to me? Why is it that despite my personal experience and the experience of those that I interact with, no serious medical research has been done into the effectiveness of mega doses of vitamin c in the treatment of everything from the common cold, to allergies, to infectious diseases, to circulatory problems in the extremities of the aged (my dad).

You know what? Your answer probably won't tell me anything I don't already know or haven't already heard. In which case I will continue to believe in mega doses of vitamin C and take them as required as well as recommending them to friends and acquaintances. Also despite living in the tropics I will continue to take 2400IU or 4800IU of vitamin D per day since I am over 40 and it's just too damn hot and humid to expose yourself to the sun for more than a few minutes where I live.

I'm quite sure westexas will continue to take his vitamin D and monitor his status. Good for him! All who think this unproven anecdotally supported vitamin C or D (or any other one might care to mention) mega dose idea is a load of rubbish will continue to take Claritin, Theraflu or [insert name of favorite cold/flu/allergy OTC item here]. It's your life and your money.

When you don't hear from me on TOD for any period of time, it's not because I'm ill or suffering from a vitamin overdose. As an interesting exercise, I googled "vitamin overdose" and came up with this wikipedia page on Vitamin poisoning.

Alan from the islands

Article on the FDA-an atmosphere where the honest employee fears the dishonest employee http://www.theepochtimes.com/n2/content/view/16742

Lots of medical research has been done -- more is needed seems to be the consensus opinion. By nature, all of it is serious.

I was criticizing the conspiracy theory that medical research is all for profit not the efficacy of C or D. I personally agree with your statements regarding the the two vitamins but I also know not to dispense that advice to others with any amount of certainity.

Dr. Cannel & Dr. Vieth believe that 30-50 range is adequate for bone health, but not for long term overall health and disease prevention, which is why Cannell recommends 50-70, which is well below the maximum level of 99.

But not to be too redundant, if you don't know your blood level, you are speculating as to whether or not you are deficient. Among the other reasons is that over the age of 40 most people lose the majority of their ability to synthesize Vitamin D from sunlight, which some people believe is a leading contributor to age related problems.

Westexas, if those two doctors are right, the conclusion must be that 49 ng/ml is not enough for overall health and 51 ng/ml is enough. Very strange.

I remember you. You post under two screen names, the other one being Han IIRC. We had a similar debate some time ago about vitamin megadose therapies. While you continue to doubt, I continue to believe.

My dad recently ran out of his vitamin C supplement and didn't think it was important to let me know so I could replenish his supply. Result: impaired circulation in his lower legs, swelling and a sore the doctors describe as a pressure ulcer, Typical long term prognosis: gangrene requiring amputation of the offending limb. This has happened before and large regular doses of vitamin C were accompanied by a impressive improvement in his condition. It is working again. What do you think?

Alan from the islands

Yes, because I use two different computers; one at my work and one at home.

It is more than notable and your father (and you) must be very glad. It doesn't mean that megadosis of vitamin C are necessary for optimal health in general. This is promoted by Linus Pauling et al. I would say it is possible, not proven or probable. I take 250-500mg/day, the golden mean ?

The vitamin D discussion is about blood levels. Some doctors say that less than 50ng/ml is sub-optimal and more than 50 ng/ml is optimal. No one can prove that, never. Maybe once everyone will say that < 30ng/ml is too low for optimal bone health and best is > 70 ng/ml for general health. In this case there have to be a significant difference to know something for sure.

Poor excuse for having multiple aliases. You can log in, with the same details, on each computer. If you get logged out, just log back in again.

It's the same reason why you can access your bank from any computer in the world, as long as you've got your details handy.

Just for info here's the latest official chart from British Columbia

http://www.bccdc.ca/dis-cond/DiseaseStatsReports/influSurveillanceReport...

the virus

The virus - what one? Reports are mixed - I've seen whatever is going on as H1N1. Others claim that it is not that but something else. One called it hemmoragic. Another called it 'plague' (I think black plague and that has an insect/rodent vector).

To tie it into TOD - is anyone tracking the energy production and the effects of this whatever it is on that production?

US status

2009-2010 Influenza Season Week 42 ending October 24, 2009

"Correction in Oil" Coming, Says U.S. Global's Frank Holmes

$85 base

"there's a real [trend] toward stronger oil prices," Holmes says, citing the high correlation between money supply growth and crude prices. With the Fed's foot on the monetary gas pedal and other central bankers also keeping the printing presses on overdrive, most notably in China.

Watch Copper for a global indicator

http://finance.yahoo.com/tech-ticker/article/363734/%22Correction-in-Oil...

Good grief, what is going on here? Even the rabid Netanyahu appears to be pleased with the Iranian proposal for a compromise, but the Swedish foreign minister is having none of it! WTF???

http://news.bbc.co.uk/2/hi/middle_east/8334235.stm

It seems the Iranians (who have not been found to be in violation of any of their obligations, ever) have a pretty good reason to be wary:

http://news.antiwar.com/2009/10/29/iran-deal-on-brink-of-collapse-as-wes...

This is just getting ridiculous. So now Europeans are even more rabid than the extremist Israeli government? What's wrong with the picture here?

Jussi -

There is a LOT wrong with the picture here.

This could just be an elaborate game of chicken or good cop/bad cop, in an attempt to ratchet up the level of tensions so that any deal eventually worked out, regardless of how half-assed comes across as a relief.

However, the more cynical side of me begins to wonder whether the real purpose all these negotiations is to have them fail and thus provide a pretext for an attack on Iran, which was the hidden agenda of US/Israel in the first place. "Lord knows we tried, but it just didn't work out."

Time will tell.

The EU is very interested in regime change in Iran to get its hands on its natural gas. One big happy NATO gang out to rape and pillage the planet.

I can completely understand the Iranian position: why would you willingly lock yourself into a situation where your energy needs are supplied by other countries (ignore for a moment that practically every other country in the world has done so)?

If Iran is not allowed to practice a full fuel cycle, they make themselves dependent on the goodwill of others, something Western leaders might stop and think about next time they spout off about 'foreign oil'.

Hello TODers,

From the DB toplink, "Saudis to drop WTI as price benchmark for U.S. crude":

----------------

The U.S. share of world crude use has fallen to less than 23 per cent in 2008 from 26 per cent in 2001.

In the past year, it has fallen by another 750,000 barrels a day, or 3.7 per cent...

----------------

Although the year is not over yet, plus later revisions by IEA & EIA are usually downward, recall from my WAG of [19 @'19] that I predicted a 10% whack here in the USA for the two-year total of '08 + 09 [avg of 5% each year]. Thus, it will be interesting to see if the plummeting economy makes this 3.7% worse going forward...

http://www.theoildrum.com/node/5795/541926

---------------------

..My total WAG [Wild Ass Guess] is 52 BOE/C for the US in 2009 when the details finally come out in 2010...

..As explained by Duncan: We were essentially outbid by others by 2.46 BOE/C during this period. The slight uptick in 2007 was just the final blowout which probably extends until July '08 when the WTI hit $147, then I estimate US BOE/C goes downhill fast from there.

..From Duncan's Conclusion Section: "The Olduvai Scenario (Fig. 5): The U.S. SL falls by 90% from 2008 to 2030."

..Thus, I applied an immediate 10% whack to the 2007 BOE/C of 57.48 to get my initial WAG of 52 BOE/C for 2009. 52-19 is 33 divided by the remaining 9 years is only an average decrease of 3.67/year [154 gallons/year], which is just a little more than double the avg decrease rate of 1.78/year [74 gallons/year] of the earlier '79 to '83 decline period...

-----------------------

With all the foreclosures in housing and businesses: I would WAG that demand for other energy sources may be down by the same 3.7% or more. A lot of gut-feel here for my WAG: I hope better statistical experts can reveal their predictive SWAGs of what they expect 2009-2019 to look like.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

World’s largest cruise ship sets sail

Sigh!

Joe

If there is a WW III relatively soon, the vessel might make a decent hospital ship. ;o)

-best

I'm surprised nobody has yet built a nuclear-powered cruise ship.

The only nuke cruise ship worthy......just ask Bush2.

http://en.wikipedia.org/wiki/Nimitz_class_aircraft_carrier

Bigger maybe, but by no stretch of the imagination classier, than the SS United States.

Somebody please get that grand old lady sailing again!

I think the Three Gorges dam should be a good thing as it is a renewable energy source. The environmentalists get disturbed over any improvement it seems. The dam was presumed to kill fish. I do not know of a reservoir in the U.S. that does not have fish in it, unless the stream behind it is polluted. Some of the best bass, landlocked salmon, and other fishing is in reservoirs. Three cheers for Three Gorges.

Where to begin.

The Glen Canyon and Hoover dams change the Colorado River from a warm water river to a cold water river. The Razorback Sucker and Bonytail Chub are Endangered and Threatened. I worked on both fish in my brief stay at the US Fish & Wildlife Service. We spend millions each year keeping broodstocks of these guys in fish hatcheries, preparing them for bait for the Northern Pike. In their place, the Northern Pike (introduced) and Walleyed, both are "awesome" sport fish. I don't know the fate of White Salmon in the Colorado, but now harvesting them can only be done by looking at old photographs.

I'm not an "environmentalist" but facts are facts.

Where to begin indeed.

Dams are one of the worst offenders for damaging anadromous fisheries. The Conowingo, Holtwood, and Safe Harbor dams blocked the shad run on the Susquehanna, and the Grand Coulee Dam blocked the headwaters where Pacific salmon spawned, with a subsequent decline.

There are ways to design dams to avoid the impacts. Conowingo now has a fish elevator, restoring some of the historic Susquehanna spawning area.

Hydropower has a lot going for it as a renewable energy resource. However, it's critical that we do less harm to one aspect of the environment in using it than we cause in another.

"I think the Three Gorges dam should be a good thing as it is a renewable energy source."

The species that it has now driven to extinction aren't renewable, are they?

Just hankering to stick your finger in the environmentalists' eyes today? It's not nice to fool with mother nature..

I just spent the day up on the Penobscot River, where they are pulling out a series of dams to allow the Migratory Sea-run fish back up into the river system.. they're also doing this in Conjunction with Penn Power and Light, and several other groups, incl the Penobscot nation.

Best hopes for Mature and Sensitive Actions!

The West Atlas spill, viewed from orbit:

http://www.economist.com/sciencetechnology/displaystory.cfm?story_id=147...

Current thinking

Oct 29th 2009 From The Economist print edition

A fresh way to take the salt out of seawater

Saltworks Technology:

http://www.saltworkstech.com/technology.php

Kind of neat, but...

They're starting out by evaporating some water from a saltwater solution (this strikes me as the bottleneck of the proposed process). Why not collect the evaporated water (which is now relativly salt-free)?