Shale Gas Estimates Perhaps Optimistic - An Interesting and Worrying Talk at ASPO

Posted by Heading Out on October 14, 2009 - 10:08am

Unfortunately I have had to miss the ASPO Meeting in Denver this week, and so cannot provide the daily reports that I have written in the past. But I notice that at least one of the talks has already caught a significant amount of press, and that is the one by Arthur Berman on the gas production from shale deposits such as the Barnett, Haynesville and Marcellus.

There has been a considerable hype in the press about the value of the gas from these shales, and the ability that they provide to bring in an “Age of Natural Gas”. Commenting on the situation last year, the CEO of Chesapeake noted:

. . .the U.S. today consumes about 63 billion cubic feet of natural gas per day - in energy BTU equivalency terms, that’s 10.5 million barrels of oil per day, or about half of the amount of oil that the U.S. consumes each day. Of that 63 bcf per day of natural gas consumption, we import about 1 bcf in the form of liquefied natural gas, or LNG, and we import about 8 bcf per day from Canada. This means that we are about 98.5% self-reliant on natural gas supply from North America and about 86% self-reliant on natural gas supply from the U.S. Contrast that with oil, where we are only about 41% North American self-reliant and only about 27% self-reliant from U.S. sources.

This picture of a large supply of natural gas has been strengthened by the increase in production from a number of the gas shale fields, at the same time that the recession hit, and as a result there has been more gas available than needed, and the price has dropped considerably as a result. This, in turn, has led to a considerable reduction in the number of rigs that have been drilling new wells.

Natural gas has been steadily increasing its share of electricity generation, rising to over 20% of the market, on its way to 25%. Natural gas is favored because of its reduced carbon footprint over coal, and it has historically been used since it is somewhat easier to start and stop gas turbines than it is coal-fired power. Thus natural gas is seen as a favored backup to the installation of wind farms, where the vagaries of the wind are backed by the ability to use natural gas when needed.

There are, however, considerable concerns about the ability of wells in the gas shale to produce to the targets that are being set up. I first noted Arthur Berman’s concern about this back in 2007 when I drew attention to a piece he had written in World Oil, where he noted the short life of most of the gas-producing wells; the very high costs for the wells and technology required to create them and, as a result, that only 28% of them return a reasonable profit. (Unfortunately the article itself is now behind a paywall).

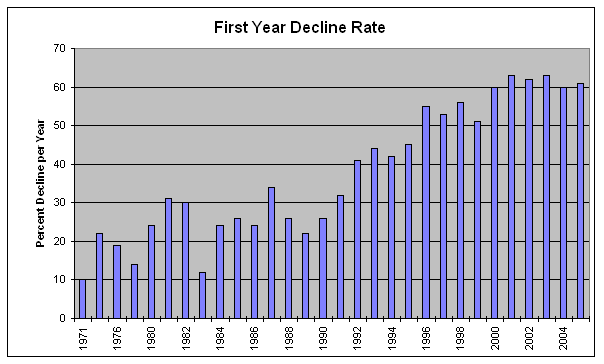

Since then I returned to the topic at Bit Tooth showing, among other data, the very high decline rate (now 60%) of many of the gas wells in Texas (where the Barnett shale is) that Swindell has reported.

There is further disquieting news that is now coming out of the Barnett field. The Ft Worth Weekly has just reported that many of those who expected to make substantial amounts of bonus money from drilling companies using their leases have had the agreements withdrawn and lost their money.

In April 2008, the Southeast Arlington Communities of Texas (SEACTX) negotiated a deal with XTO Energy that would bring in bonus money of $26,517 per acre and a royalty rate of 26.5 percent - among the highest in the Barnett Shale play. When leaders of SEACTX, representing about 7,000 property owners with about 5,000 acres, did the math, they figured that more than $100 million in upfront bonuses would be coming into their community of mostly modest to middle-class neighborhoods. . . . . . . . . . Well, that was then and this is now, when natural gas prices have fallen to less than half what they were in early 2008. And as anyone who has been following the Barnett Shale saga knows, drilling companies pulled out of those deals and others in mid-October of last year. Some property owners, whose bonus checks were processed prior to the cancellation, got paid. Tolli Thomas, a spokeswoman for SWFA, estimated that 4,000 to 5,000 people in her area got the money promised to them - and the other 20,000 or so did not.

Prices for drilling these wells run on the order of $5 million apiece, and Chesapeake has, in the past, noted that it takes $4.00/kcf to bring in enough money to cover those costs – with a good well. (Note that this is the Henry Hub price, consumers should add about $3 to this to get the residential price). Those numbers are considerably higher than the ones that Mr. Berman used with his calculation two years ago that only 28% of the wells will be financially remunerative.

He recently (April 2009) expressed similar concerns about the Haynesville wells – though his production decline numbers are stunningly higher – as much as 20-30% in a month, for an annual decline rate of 80-90%. The costs that he cites are up at the $7.5 to $9.5 million range for the wells, with a net final cost that the producer has to pay in the region of $7.25/kcf. He therefore concludes that the breakeven point for wells in the Haynesville lies at a price of around $9/kcf Henry Hub; with a minimum reserve of some 2.5 Bcf. He upgraded that opinion in June expressing a concern, that I echo, with the availability of natural gas from a variety of sources (including the Rocky Mountain Express and increased LNG shipments) which will make it difficult to sell gas from formations such as the Haynesville, at a profit.

In his most recent post on the subject some of the possible reasons for the rapid decline (which fall a little along the same explanation as I gave on chalk collapse) which are as follows:

An abnormally high-pressure gradient (0.7-0.9 psi/ft) distinguishes the Haynesville from other shale plays. It may also explain the extremely high decline rates, as pressure depletion transfers stress to the rock and allows proppant-filled and open fractures to compress, thereby reducing the effective reservoir permeability.

Unfortunately for the hopes of a new age for gas, in preparation for a meeting on the Haynesville production last week, he had calculated the numbers for some 67 wells in the Haynesville and was still coming up with decline rates of 25% a month.

He also noted:

The average EUR in our study is 1.72 Bcf/well, compared to the 6.5-7.5 Bcf/well reported by many operators. Only two wells of the 67 evaluated have an EUR greater than 6.0 Bcf. At the same time, seven wells have already produced more than 2 Bcf and one has exceeded 4 Bcf.

Petrohawk has the best well performance with an average EUR of 3.4 Bcf/ well (19 wells evaluated). Chesapeake has the most wells on production (29 wells evaluated) but we project an average EUR of only 1.2 Bcf/well.

It sounds as though I missed a really interesting and valuable talk – just have to wait for the DVD’s to come out, I guess!! I plan to reorder some of the technical talks on Sundays so that I can more fully explain his concern about the Haynesville shale.

I think that the Shale Gas debate was definitely the highlight of the conference. I tend to lean more toward Arthur Berman's point of view, and of course Matt Simmons is definitely in agreement with him. Incidentally, Arthur stayed and answered questions, literally for hours. Arthur's key point is that companies need to be far more discriminating about where they drill, focusing on the locations that have the best chances for higher recoveries.

I agree WT: always better to drill the profitable wells first so you can better afford the money loosers later. Just a little tease, of course. Watching from the inside one of the public company players charge into a shale gas play with wild enthusiasm I don't think many folks realize the pressure these public company deal with when trying to add reserves y-o-y. It's easy to be critical as they grasp at such rapidly depleting straws. But it was also like watching a drowning man grasp for inner tube with a slow leak. It might be a poor life saving choice but if that inner tube is all he sees how can he not reach for it? None of these folks believed these wells would be better then they turned out. The tech folks aren't stupid. The risk was justified only on expectations of rising NG prices. That was, and always will be, a management decision. And management exists to make the shareholders believe better times are just ahead. As I've said before folks shouldn't let the PR confuse them: the techs have always understood PO. They also understood the downside of shale gas. But, as you well know, we're never allowed to speak to the boards or shareholders. That's one reason I like hanging out at TOD: I can say things that would normally get me fired.

Great analogy.

This is the first time I have commented on any subject, although I have been reading the information and comments with interest for a number of years. On the subject of Shale gas, I fing it hard to believe the skeptics on the abundance of shale gas. BP paid CHK a bundle for their woodford shale play and for a 25 % interest in the Fayattevile shale play. STO paid a bundle for a 33% stake in CHK's Marcellus play. Chesapeake say the eurs for the shale plays they own are: Barnett 2.65bcfe, Marcellus 4.20bcfe, Fayatteville 2.40bcfe and Haynesville 6.50bcfe. Why should I not believe them? Are BP and STO so incompetent that they didn't do due dilligence? Come on guys, the gas is there.

joe -- I don't believe anyone here has said the gas isn't there. The question is whether these wise shale gas players are as infalible as you seem to think. Last year I worked with one of the biggest SG players. During the summer we had 18 rigs drilling SG and they were trying to contract as many more as possible. At the same time they were also spending millions of $'s on new leases. And then a mere 5 months later they dropped 14 of those 18 rigs and paid a $40 million penalty to do so. And if they don't gear up drilling pretty soon they'll also lose those millions spent on new leases. So which of their stories would you choose to believe. A)the SG play is a big money maker, there's all the NG out there we'll ever need and we want to drill as fast as possible. or B)the SG play is a big money loser, there not much NG that commercial and we're glad to pay $40 million for the privilege of not drilling more wells.

Same company telling the two stories only 5 months apart. Don't get me wrong. These are not stupid people. They did their diligence. I did part of that diligence for them. That's not the problem. THE PROBLEM was that the play was predicated on certain high NG prices that were assumed would escalate even higher. But, hey, don't take my opinion to heart or that of anyone else on TOD. Just listen to all those companies you reference. They are all saying the same (by their actions...not their words) thing right now: we're shuting down, for the most part, our drilling efforts in the SG plays. It is true: at $15/mcf there are many trillions of cf of NG to develop. At $3.50 per mcf not nearly so much.

i can speak to the haynesville. perfromance data just does not support the 6.5 bcf that chesapeake is claiming. most of the wells are widely spaced, typically one well per section. operators are all claiming these reserves can be recovered on 80 ac spacing.

performance from the 320 ac spaced wells shows evidence of well interference. what does that tell about their 80 ac reserves ?

remember, on the bp and sto transactions you refer to that there was a buyer and a seller involved and using your logic, why would chesapeake sell their acerage if it was that good ? these companies could also be using a much more optimistic price forecast than the current spot price would indicate.

i have no comment on the competence of the engineers for bp and sto, but it occurs to me that the main thing being taught in petroleum engineering schools is how to make a flashy power point presentation.

look at csm and texas a & m, both are pimping this 100 yr supply. they are just churning out freshly minted petroleum engineers and power point presentation preparers extraordinaire that the public traded companies want.

although contrary to media reports, csm never, i repeat never, made the claim of 100 yrs supply. csm made estimates for proven and probable reserves and possible and speculative resources. big difference.

performance just does not support the volumetric calculations being presented by public traded companies.

aurthur berman has recently posted an update on the fayetteville shale. you can access it here:

http://petroleumtruthreport.blogspot.com/

scroll down past the haynesville article referenced above.

and with respect to the collapse of natural fractures (and to a lesser extent the propped hydraulic frac's) there was an article published in 1992 by dan stright,etal discussing this phenom in the bakken formation of the williston basin. the title of the paper is:

"Reservoir Characterization of the Bakken Shale From Modeling of Horizontal Well Production Interference Data" SPE 24320.

i dont have a link, but an abstract is available through the spe elibrary.

the generation of hydrocarbons from kerogen results in an increase in volume. in an ultra-low permeability (shale) , pressure builds up and creates an hydraulically induced micro-fracture. when the pressure is depleted, the micro fractures collapse. this has a lot to do with the rapid decline from reservoirs such as the bakken and haynesville.

i have noted previously, that the pressures in the bakken and haynesville is coincidentally about equal to or greater than a normal frac' gradient (~0.7 psi/ ft depth).

By using multi-stage 20X fracing in the Canadian Bakken i.p. rates have nearly doubled. It makes for an upfront first year decline, yet allows for greater amortization of drilling and local pipeline costs. Higher multiple fracing may support a trend for greater intial field production and also lead to an earlier field demise.

i think you have it about right. in the us bakken oil play it has never been demonstrated, imo, that an higher ip rate means greater eur. it may work on the first well(s) drilled in an area as more frac' stages capture more of the natural fractures and micro-fractures, but sooner or later, the wells are competing for the same oil in place. isn't this rule of capture wonderful ?

The DVD's will be well worth the price. The whole "Natural Gas Game Changers?" section on Monday, followed by Matt Simmons in the evening really showed the wide variety of opinion on NG supplies. Most see PO as happening in 2008, now, or by 2013, the agreement on liquids peaking was very tight. Gas was really volatile in terms of any consensus on are we at or near peak. Peter Dea kicked off the session with "Abundant NG supply, an American Treasure" and was profoundly optimistic about the US having 100+ year supply of NG. I have to admit that his talk seemed a bit more in the cheerleader mode and not a critical scientific analysis. But, not being a total doomer - I hope he's at least partially right!

Arthur Berman raised some serious concerns about rapid crashes in the shale gas fields. He has studied about 4000 wells in detail using company supplied data that is available in the public domain. It seemed pretty irrefutable and he was begging others to look at his data and show him where he is wrong or could have made errors in his analysis. He struck me as a straightforward engineer/scientist and genuinely wants to debate and discuss his findings. My main take-away is to urge extreme caution toward those who invest in shale gas plays and expect huge returns. The financing of all the shale drilling looks like a replay of our current credit debacle at best and at worst a Ponzi scheme that will implode as wells die and the ROI crashes with the cash flow from these wells. No one disputes there are a few wells that are gems but as a whole, the frac jobs don;t last and they plug back up with the most spectacular fall off in flows. Hyberbolic declines cannot model this, only a deep death exponential can explain the data. Time will tell.

Mr. Berman's somewhat downer was followed by Ed Warner's talk on how he got a dead small NG play to come to life and the result is perhaps the richest NG field in the USA today, the Jonah Field. Inspiring and a strong reminder that "we don't know what we we think we know". Simply put we don;t have the mental models or ideas to understand what is really goin on below ground. Innovation and human imagination are big, big wild cards in this industry. This was not a cornucopia plea but rather a warning to include big enough error bars in our calculations for the disruptive influence of not just technology but of new ideas and world views. A valid point and echoed by other speakers. We will not know the black swan that is out there in the future looking for a place to land, and similarly we don't know of potentially game changing discoveries and technology (like the Brazil pre-salt) that could change the game. Lastly, Mr. Warner ended with a plea for the US to get back into the nuclear game. He rapidly ticked off many nuclear myths and showed data that surprised me on how despite only one new plant in the US we make more nuclear power than France and other countries that most people consider ahead of the US.

Lastly, Matt Simmons has the evening keynote talk and a couple of quotes summarize his view on gas:

"Gas has peaked", and "data on NG (production) makes oil data look pristine".

"...he was begging others to look at his data and show him where he is wrong or could have made errors in his analysis. He struck me as a straightforward engineer/scientist and genuinely wants to debate and discuss his findings. "

I know exactly how he feels.

I have been studying the topic of Peak Oil for several years; reading articles, books, The Oil Drum, everything. I think I'm pretty much up to speed on even many of the technical issues...... BUT. It has turned out to be an exercise in total futility to get other people interested in taking seriously what is undoubtedly THE most important issue today.

And here's the punch line. I work in paleontology, with GEOLOGISTS!!!! and other scientists who SHOULD be totally interested in this subject. And they aren't. They are dyed in the wool Kool Aid drinkers who adhere tightly to the Cornecopian School. They will defend their own data in their own scientific specialty, but turn the blind eye of total disinterest to all other data.

I know of only ONE person (personally) who takes Peak Oil seriously; my crazy, eccentric, black sheep older sister (who was also always the brightest member of my family, by the way).

Jabberwock,

Convincing people shouldn't be your goal.

Try to encourage people to think about small puzzle's, about the situation at hand. By doing this you are helping yourself to get a clearer look at the present day.

I also advise you to start thinking about how we have gotten into this mess. When you understand how we got here, it's much easier to explain.

History from the technical/energy point of view from 1700ad till 1900ad is so much fun to explore. The (real) efficiency gaines in old europe were stunning. We were still making big steppes on a regular basis, but as our technical advancements progressed our steps have gotten smaller ever since. IMHO we have already started to regress, and our attempts to "solve" this are getting desperate.

Our focus will shift towards the fact that less and less energy will be available for our society, because a big percentage of our remaining energy will be needed for the energy sector itself. At some point something has to give and that will be the beginning of the sharing era. People can't survive on their own because we aren't "smart" enough to know everything. So you need a big group of all sorts of people to make everything functioning in a sustainable way. Human leveraged power combined with wind powered movement and a whole lot more clever things will be "reinvented".

And in a couple of years time, new improvements(efficiency gaines) will increase living standerds again.

Because we found our fossils their was no need to explore that route, so we didn't.

More and more people are waking up to this event, and I hope a tipping point in thinking will be reached before we all go south.

Jabberwock,

If I were you, I would get your co-workers really upset and tell them that a bunch of amateurs on TOD probably are better at geological and earth sciences than they are. Tell them it all has to do with how committed one is to finding out scientific truth. Unfortunately, you probably wouldn't be able to look them in the eye again after you do this :(

My understanding is that DVDs will not be available. Instead, they will make the videos available online -- you pay them, then they give you a password and you can look at them online all you want. Check out http://aspo.tv/.

I was a bit disappointed -- I prefer the DVDs myself. But, as I understand it, it's an economy move. The resources being spent on paper, packaging, mailing, and the DVDs themselves were becoming a burden. There were a stack of unsold 2008 conference DVD sets there, one set of which I bought and have started looking at (I wasn't at the 2008 conference).

Keith

Lastly, Matt Simmons has the evening keynote talk and a couple of quotes summarize his view on gas:

"Gas has peaked", and "data on NG (production) makes oil data look pristine".

Simmons has little credibility on the topic of natural gas. In 2003 he predicted that a natural gas cliff -- a veritable natural gas armageddon -- was a certainty in the US by 2005. And yet here we are, 6 years later, swimming in a glut of natural gas, with production at a historic high last reached in 1974.

The fact is that conventional natural gas goes through a Dispersive Discovery cycle just like anything else. Additional discoveries of alternative forms or sources of natural gas will occur concurrent and shifted to that cycle. This goes under the category of you might not find something unless you are purposely looking for it. Think about that last statement and how it may have happened to you in your own daily life. (BTW, the entire concept of Dispersive Discovery and dispersive analysis did not get discovered until I started looking for it and thus came up with it, but that's another story.)

I don't know why some common logic cannot be applied to these problems. Most of them are simple bean-counting problems that I could probably teach to a grade schooler. Of course the grade schooler would have to some familiarity with probability & statistics, but that's a detail.

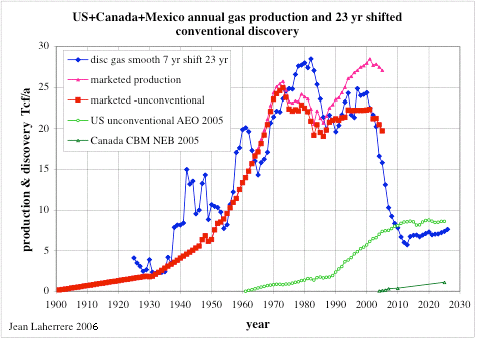

So look at what Laherrere plotted

So what would you like us to do concerning natural gas? Should we model the possibility of what that new alternative discovery curve will look like? In terms of a profile, it will likely look like a spike, since all we really have to do physically is retrace our steps and look for the unconventional NG in places where we previously looked for oil and conventional NG.

I don't know if Simmons has done this but Simmons does not speak for everyone and from what I can tell does not show his math, choosing instead to use his experience as an argument. If we want to really understand this, we probably would want to delve into the analysis.

Bottom-line is that we cannot preclude that another source for Natural Gas exists, potentially lying interstitially in some formation that we haven't investigated yet, like some peat bog. Or it could be tied up in those methane hydrates. But as Dirty Harry would say, "do you feel lucky"?

I don't know that Simmons alone can be blamed for the mis-call on NG. It was a fairly widespread opinion here at TOD that NG's peak was not far behind oil's. The shale surge does not seem to have been anticipated.

How big an influence it will ultimately have on the NG production curve is what we're all interested in.

The whole thing has made me a tad more cautious. I initially gave some advice to my condo board on NG, and saw it run up 13+. Made me smell good. Then it started diving as I saw more and more written on shale gas. And I didn't smell so good -- kind of like mercaptan. I went back to Campbell and Deffeyes and could find little or no hint of this coming.

From the interview posted, Simmons was predicting a NG peak BEFORE peak oil. The trouble with Simmons is that he's been predicting all sorts of crazy stuff that has never happened. Here he's predicting $200 oil in 2008:

http://www.cnbc.com/id/15840232?video=809266970&play=1

In fact if you go back and listen to his many interviews, most of his predictions have been proved wrong. Of course he doesn't own the peak oil theory, but if he's going to be out there making predictions, he should get called on them when proved wrong.

Anchor: Where is the price of oil going to be on labor day Matt?

Simmons: Oh I don't know.

Simmons: But we should prepare ourselves to not be shocked when oil passes $200 a barrel.

He's not predicting $200 barrel oil but warning us to prepare for high prices in the future.

If you are gullible enough to believe in price predictions, then I guess you might believe anything. I am not standing up for Simmons, since he has his own methods, but predicting something that is the derivative of some other fundamental once or twice over and you are begging for second-guessing.

I can't speak for Simmons, but the older posts here on NG cliff (e.g. my reporting on David Hughes ASPO presentation here), referred to conventional production and acknowledge decline would be offset by unconventional, though at that time coal-bed methane was more of a focus than shale gas.

Bermans presentation was impressive - tons of data. My initial take is that there are huge amounts of resource that have positive EROIs - just not positive enough to be afforded by current infrastructure and way civilization is structured (reliance on borrowing, disconnect of debt vs ability to service, etc.) That might be a good thing, for whatever system replaces the current one might use those high quality fossil fuels for something other than marginal heat/transport.

I.e. lots of shale gas, but the prices needed to extract it (sans government intervention) are ones society can't afford, only thinks it can. If government intervenes (which I expect them too, starting with refiners), they will just be playing a shell game of where the unaffordable money originates. Shale gas, and many other parts of the limits to growth debate discussed of late, have almost become belief systems - fundamentalists on both sides with about 1/3 in the middle.

I plan to write a short post on it next week. Right now I have a kopfschmerzen.

Sorry I missed your final talk, but I had to head for the airport. Sounds like it would make a good TOD post.

Incidentally, my daughter asked you the question about student loan debt. She is teaching biology to non-majors and microbiology for biology majors and for biomedical majors. As one would expect, the non-major group (lots of business majors), in general, suffer from mass delusion about their job prospects in future years. The microbiology students, in many cases a lot of them are in the 30+ age group who have been laid off from jobs, are far more realistic and very focused. BTW, a story from the front lines of the education front. Her department head said that they had opened a new science tutoring center, paying tutors $15 per hour, and they were being deluged with PhD's wanting jobs.

In any case, my daughter and son-in-law were very impressed with the conference and people there. It reinforced their decision to live simply and rent. (Of course, one might suspect that "someone" has been offering them some advice. If I am repetitive here, imagine the e-mails that friends and family members get. . . )

BTW, speaking of being repetitive, I'll add my weekly Vitamin D lecture. I have been taking a poll of medical workers, asking whether they knew what their Vitamin D level was. 13 out of 13, including a neurosurgeon at the conference who is a regular TOD reader, said no. My doc was one of the them, and she did have her level tested, finding out that is was 13 ng/mL (minimum about 30, max about 99, optimum 50-70). She is currently taking 100,000 units a week (two prescription dosages per week of 50,000 units).

Dr. Cannell, who runs the Vitamin D Council, has found that for most people the most commonly recommended maximum dosage of 2,000 units per day is inadequate to get your blood level up to the optimum range, and he cites studies showing no adverse effects at adult dosages up to 10,000 units (and probably more). My wife and I were both taking 2,500 units of D3 per day, and we were both sub-optimal, at 37 ng/mL (we are now taking 5,000 units). One of the problems is that over the age of 40, people lose the majority of their ability to synthesize Vitamin D. In any case, it's a good bet that the H1N1 virus was circulating at the conference (and at any conference of similar size).

Check out the H1N1 case histories at:

www.vitamindcouncil.org

http://www.vitamindcouncil.org/newsletter/vitamin-d-and-h1n1-swine-flu.s...

WT, thanks for the info on D units. I've been doing 2K units and thought I was ahead on this. For H1N1 I am more concerned about my two teens, as I was hospitalized with pneumonia back in the 70's with the first H1N1 round. I'll up our teen's dosage and keep the vit C up too.

I was looking for you at ASPO to say hi but missed you. Great conference. Next year I'd love to see some way to put TOD posters together with their TOD alter-ego names.

-Christopher

I, and several others I know, have had the same experience.

I take 5-10k/day,now.

WT and Vit D

For medical reasons, my wife was directed to get her level in the 30 to 60 range. we both had our blood levels checked a couple of times until we got in that range - 2,000 per day for me and 3,000 for her. BTW, for most people, the only valid time to have your blood level checked is in the spring time after a long winter of minimal sun exposure.

Many people are deficient all year round, even if they live in sunny places and get outside. Absorption varies.

Proper Vitamin D levels have been shown to reduce cancer rates by 77%, and there's suggestive evidence for heart disease, MS, and others.

My doc has started testing her patients here in the Dallas area, and she is finding that 90% of her patients are deficient, i.e., below 30. Precisely what was your blood measurement? My wife and I were taking 2,500 units and we were above minimum, but both suboptimal, at 37 ng/mL.

I suspect that your results, and ours, were all consistent with Dr. Cannell's research, i.e., that it takes 5,000 units for most people, especially 40+, to get up to the optimal range (50-70). Dr. Cannell does recommend that you adjust your dosage from there, based on subsequent testing, the time of year and amount of sun exposure.

Incidentally, for anyone at the conference, my daughter, who was there, just tested positive for H1N1. Given the incubation period, I don't know if she had it when she arrived, or if she picked it up at the conference.

Sorry to jump in here wt, but my tests just came back at 37 also.

I'm 50+ and probably had the darkest tan I've ever had this past summer.

My Dr. wasn't as convinced as yours but he still said 4,000 units/day for me wasn't a bad move.

Thanks for posting on this matter.

There is one school of thought that our declining ability to synthesize Vitamin D from sunlight, as we get older, is a primary contributor to many age related disorders.

Wow, 2500- 5000 units/day. Then the DAI's from f.i. the Institute of Medicine in the table here below are a factor 10 too low.

Seems comparable to the much higher recommended intake for vitamin C that some people advice. OTOH it must be that some people need much more than 200-600 IU vitamin D per day to come into the healthy 30-50 ng/ml range.

Daily Adequate Intake of Vitamin D

Age Child. Men Women Pregn. Lact.

Birth to 13 years 200 IU

14 to 18 years 200 IU 200 IU 200 IU 200 IU 200 IU

19 to 50 years 200 IU 200 IU 200 IU 200 IU 200 IU

51 to 70 years 400 IU 400 IU

71 + years 600 IU 600 IU

According to the Institute of Medicine, food consumption data suggests intakes of vitamin D for both younger and older women are below current recommendations. The data suggests more than 50% of younger and older women are not consuming recommended amounts of vitamin D. Their data also shows African American women are particularly prone to consuming low amounts of vitamin D in their diet.

The latter because dark skin produces less vitamin D.

Hi WT,

Its been awhile since we had the tests but my recollection is that wife was near 40 with 3,000 and I was in the upper 50s at 2,000. Both tested in the spring time. We also get some additional vit D in our calcium and multivitamin pills. Wife has MS and her MS specialist doc is convinced that Vit D (at a good blood level) is an important part of a healthy diet.

Nate-

This is something I'm interested in, and the data is confusing (at least to me, coming from another background).

I had the opportunity to discuss Berman's comments on the Barnett with the folks at IHS Energy/CERA who are focused on the shale gas story. Their comment was that Berman's data set is fairly limited whereas they have access to virtually all the wells, completion and production information. What they pointed out is that yes some wells do poorly but the whole business is statistical, there have to be enough good wells in the thousands you might drill to make up for the poor ones. Their view is that this will happen in the Barnett but that it will still be another number of years before you have enough information to really determine how successful it will be or what EUR from the play will be (they noted that their own data disagrees with Berman's conclusions). Note that companies like Cheseapeake have been doing exactly what he suggests...they go into an area, grab as much land as they can, drill some test holes, do a pilot study and then get rid of what they see as being marginal and concentrate on the good areas. The main control on shale gas is going to be costs. As long as operators can continue to drop their cost structure and try to keep marginal cost of production above price levels then shale gas will be viable business in the US. At current prices I think it is just the Haynesville and Marcellus that have costs that make sense. And if Qatar doesn't see a problem of shipping vast quantities of LNG into the US at prices below $5/Mcf then it is likely that a lot of the more expensive shale gas will not be developed (unless there is an uptick in technology).

the data on haynesville(la) wells is available to the public here:

http://sonris-www.dnr.state.la.us/www_root/sonris_portal_1.htm

what data does ihs have that berman and the public doesn't ? production is posted within 2 months of the end of month of production. initial potentials ? these too are available within months and the public traded companies are all to eager to publish their ip's(for whatever that is worth). flowing tubing pressures ? flowing tubing pressures are dropping along with rates. when the tubing pressure reaches pipeline pressures, the decline can only increase or stay the same.

they were specifically speaking about Barnett performance in response to Berman's comments. I suspect they would say it is even earlier days for Haynesville. The one thing I do know is that the F&D for Haynesville is the lowest of the lot even though its deeper. My understanding (I'm not an expert on this subject) is that has around 440 SCF/ton of rock and should yeild somewhere up to as high as 330 BCF/sq mile as compared to say Marcellus which has a gas content up to 250 BCF/ton and yield of up to 100 BCF/sq mile. I think one has to be careful as to whether it is a horizontal well you are looking at or a vertical well. Also remember that declines in the early days on the wells can be quite steep but it should flatten out at some level and remain flat for years to come. The trick is drilling enough wells so that total production remains relatively steady. The engineers I know who work with this stuff (ex Cheseapeake guys) look at decline curves during testing and compare it to standards in order to determine how good a well might or might not be. I think it is important to emphasize that shale gas extraction isn't much of a science.....the rocks aren't well understood and a lot of the issues around adsorption are poorly understood but again it is a statistical game and requires a manufacturing approach given it is in reality a marginal business.

HO - echoing Nate's comment. The two talks on shale gas were great - also another example of polarised views. I think Berman's arguments win the day - he presented a lot of careful data on individual well declines and compared those with promotional data - best viewed as propaganda.

Most shale gas forms by maturation of organic matter within the shale. It is still there because it can't escape. A well and a few fracks may help a bit but the botton line is that contact volumes are too low to make a profit at current price. It seems most operators are under a pile of debt and are making losses.

The gas market is currently flooded with loss-making gas - smart!

This play looks like it could work at higher prices, but as Nate points out will those prices be affordable by society as it is currently configured?

will those prices be affordable by society as it is currently configured?

Sure. Oil prices were a problem for the US because it's imported. At, say, 25 TCF per year, every dollar increase per 1,000 CF increases the cost to the US by $25B, or maybe by about 400K workers. If gas has to increase by $4, or $100B in total, then society has to move about 1.6M into drilling. Well, we certainly have that many unemployed...

i think it is a mistake to dismiss the shale gas plays on an economic or eroi basis, particularly the one i am most familiar with, the haynesville. many of the widely spaced haynesville wells will be economical even at today's prices. but 1) the 6.5 bcf mean eur meme is overstated, and 2) 80 ac spaced well meme is even more overstated. there is evidence of inter-competion for gas on 320 ac spaced wells. 80 acre spaced wells at 11,000 ' (3300 m) depth ? absurd.

for a rough rule of thumb, use a factor of 1/10 (performance based eur/public traded company eur).

This is a report from BNN this morning about Dawson Creek natural gas. The report claims that they have enough natural gas to supply north america for the next 30yrs.

http://www.bnn.ca/news/12908.html

Is this shale gas?

Not -- I couldn't find any details anywhere. The field I believe they are talking about is Ojay Field but couldn't find details on it either. Just a WAG on my part I don't think it's shale gas from the leasing info I found. That part of Canada does have a lot of low porosity sandstone reservoirs. When NG prices rise these plays can become hot. Also, much of the NG in Canada is not commercial due to distances from pipelines. But if a new big regional line is planned/built into such an area drilling activities tend to explode.

Maybe someone can find the details. The tech sources I searched had nothing on Ojay Field

i think they are talking about the horn river basin. nexen, quicksilver resources and apache to name a few have spewed pr's within the last few weeks or months.

where is dfc(dale from calgary)?

The formation referred to was the Montney, which is shale.

http://oilshalegas.com/montneyshale.html

Back to lurking.

They're referring to the Montney shale gas play in N.E. British Columbia, which is estimated to involve several hundred trillion cubic feet of gas-in-place, of which 50 trillion cubic feet may be recoverable.

See: www.halliburton.com/public/solutions/contents/Shale/related_docs/Canadia...

Also: www.geoconvention.org/2009abstracts/236.pdf

To the north of the Montney shale is the Horn River shale, which may be even bigger. The total shale gas reserves in N.E. B.C. have been loosely estimated at around 250 trillion cubic feet. I think that's closer to a 10 year supply for North America than 30 years.

They only thing is, they probably need a price of $6/mcf to make these plays economic. However, the players involved have deep pockets and can afford to wait for the U.S. shale gas plays to fizzle out.

Probably a lot of this gas will go into the oil sands plants nearby in northern Alberta, which I'm sure they'll appreciate. With oil at $75/bbl this gas is very economic fuel for the oil sands operations.

I wonder if its relevant that TransCanada Pipelines has just converted one of its east-running gas pipes to an oil pipeline diverted into the US? That move sort of surprised me considering that Ontario is doing a fairly large build of CCGT gas-fired generation to eliminate its coal usage.

The Canadian portion of the project involves the conversion of approximately 864 kilometres (537 miles) of existing Canadian Mainline pipeline facilities from natural gas to crude oil Keystone Pipeline

Of course it's relevant. TransCanada is perfectly capable of doing production forecasts by polling its suppliers, and obviously has forecast that its NG transmission volumes are going to decline, while its oil volumes increase. One of the reason is that the oil sands plants are huge consumers of NG, so while oil production goes up, NG available for other customers goes down.

I don't think that the Ontario government has thought this through very well. They're running a very high risk strategy. I don't think they're able to connect the dots in the big picture, which does not look good for getting NG from the west.

Look for Ontario to burn more coal in the future, notwithstanding their commitment to phase out the coal burning plants. That's what they did when their nuclear program ran into problems, and the same thing will happen if they can't get enough natural gas. Commitments are one thing, freezing in the dark is another.

Has anyone seen the Wed. Oct. 14, 2009 Denver Post? First page of the business news (5b) portrays peak oil "theorists" as chicken-littles! A big picture of two chickens handing out "information" on "their plenty-of-oil-left view", and some guy with a ponytail I recognise.

Page 5b, Denver Post.

Thanks for the update HO.

I apologize for my lack of knowledge on the subject, but I'm guessing that these high decline rates are from initial well completion to a subsequent frac job. How often are these wells refractured? What kind of production and decline is recorded after refracturing?

chemist -- If I understand your question the initial production tests are rarely commercial. And even if they are the wells are still frac'd. Refrac'ng the Barnett became a hot topic some years ago. Despite the general thought that refrac'ng wouldn't be worthwhile the initial results of such efforts were encouraging. The new flow rates weren't nearly as good as the original IP's but they were a big enough improvement over the declined rates to justify the refrac. I haven't heard of broad scale refrac'ng efforts in the other plays.

Thanks for the reply Rockman. If I've read correctly, a lot of the decline has to do with the closing of the fractures in the already tight formation as the formation pressure decreases. That being said, I'd expect some gains from adding more propant with every frac.

I'm just pondering whether a model of fast decline and yearly refrac'ing would become a paradigm for the industry. This fits into the post-peak concept of relatively more effort to access the same resource, but if the reserves are large enough it might be justified.

Here's the reddit and SU links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/energy/comments/9tzbd/shale_gas_estimates_perhap...

http://www.reddit.com/r/collapse/comments/9tzbg/shale_gas_estimates_perh...

http://www.reddit.com/r/Economics/comments/9tzbi/shale_gas_estimates_per...

http://www.reddit.com/r/reddit.com/comments/9tzbm/shale_gas_estimates_pe...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

I just got an e-mail this morning from one of the private-equity junior petes I'm invested in, saying that they are restricting flow on all their natural gas wells and coalbed methane to a bare minimum. Just enough will flow to keep the payroll going. They're not in trouble because they have no debt and a minimum staff. They specifically mentioned that they want to store the gas underground and wait for sustained $5/gigajoule minimum price.

Like many who couldn't make it to Denver this year, I'll be buying the DVD's too. The above discussion reminded me of a comment from Matt Simmons last year during one of his talks. He said he had been in a room with 15 or more of the Barnett shale field bosses, and asked anyone who thought the Net Energy was positive on any of the wells they were drilling to raise their hand. Not a single one went up. He took this as a sign that the EROEI was very low, if positive at all. When crude prices go back up, it will be the killer for many marginal fossil fuel sources. Low grade forms of fossil fuel will no longer be profitable without the cheap oil subsidy.

One question. I don't know the fine points of the new NG shale technology. Can you boots productivity by hydrofracturing the well with fines more often to prop open the microcracks, or is that not feasible: does not help, too expensive, too much energy, wrong technology, etc.

Well given that I have asked similar questions to Barnett and Haynesville shale CEOs, I suspect there is an equal chance they thought Matt was whacko, as opposed to EROI being subunity.

What did they say to you regarding Net Energy & EROEI, vs. the non-response that Matt got?

also a non response - they don't keep data in energy terms only dollars.

I can see I am going to have to hasten my post on how fracs work - basically when you pump the fluid down to fracture the rock it also carries small particles of sand or a similar material. These grains are forced into the cracks to "prop them open" after the cracking pressure is released, and thus they are called proppants. But they can be quite hard, and if the rock is soft (or becomes soft after being wetted) then it can deform around them.

Prag -- The microcracks can't be reached by the proppants. The proppant is used to hold open the much larger induced fractures. There's an odd character to many of the shale gas plays that isn't typically mentioned: much of the NG produced isn't free gas but is actually molecularly bound to organic material in the shale. When the well is produced pressures in the rock decrease. This decreased pressure cause the molecules to become unstable and the methane molecules are released from the structure. Something of a double-edged sword: lower pressures release more methane but the lower pressures cause the loading on the rock matrix to increase which, in turn, closes fractures and reduces flow rates. Obviously not the type of feedback loop that helps the situation.

My honest opinion and this is from water wells drilled into the same shale layer in the ogallala that I did extensive trace mineral anylsis on for toxic crap thats in shale like selenium is that the gas well exhibit the same properties.

If you get lucky and hit and extensive natural crack system you have a fantastic well. In the case of NG the desorption is fast enough to keep the pressure up with water its more the crack system is charged from the overburden above the shale.

So you can hit some real winners but its basically by chance unless you can really map out the natural fracture system. Think of a multi-branched lateral well on steroids something basically impossible to do with any technology its caused by movements of the shale layer over eons. In many cases these fractured regions have naturally "bled" out if you will over time with the gas diffusing. However if you hit a young one you hit the mother load.

So if its anything like water you get a few really fantastic wells then the rest suck for water I don't know but I'd guess 1 out of 10 hit. If NG is the same 10% of the wells are fantastice 20% are mediocre and the rest are basically crap.

And its a one shot deal the fracture network is extensive once its hit with one well more don't do any good. With water you of course have recharging from the overlying aquifier so as long as you don't pull it down to the point the fracture network collapses you have a excellent source of water effectively forever. Of course with NG no such luck eventually you deplete.

If this is really whats going on then these shale plays should exhibit.

http://pubs.usgs.gov/ha/ha730/ch_c/C-text5.html

http://coyotegulch.wordpress.com/category/colorado-water/ogallala-aquifer/

I actually did work related to this study many have been done.

http://www.beg.utexas.edu/environqlty/vadose/arsenic.htm

My point is we know a lot about hydrology related to shale and mixed shale/sandstone gravel system. Where it works and where it does not. Even given the large differences between water and NG and of course things like oil when your dealing with shale I simply cannot see how on earth the basics can change. There are a small number of fantastic plays but also a large number of poor ones.

My opinion of how to develop these plays is very different from current practice.

I'd drill the absolutely cheapest vertical well I could and if it intersects one of these crack system then your basically done go look in other parts of the play. The slow but stead earnings from these wells if there is any natural crack system will pay for further anaylsis. So you spend a lot of time up front simply covering the costs of understandng the play in detail. Given time you will find the sweet spots and have some nice steady and profitable wells.

So if I'm right about the geology then we are at the moment doing all the wrong things and actually ruining any chance of long term gas flow out of these formations.

The good thing is they are so large that eventually when people actually give up and do the right thing substantial opportunities will be there.

So although I don't know NG I know shale fairly well and how it works I think my understanding crosses over the divide between water and NG and time will tell if I'm right.

The turtle approach will eventually I think ensure the US has a fairly decent and steady supply of NG for the foreseeable future. Is it anything close to what we pump today ?

Probably not my best guess is anywhere from 25% to 50% of current NG production. But its a large resource and developed methodically we have at least 25% if not more of current production levels for centuries. But until we go the cheap and smart route and plan on taking our time to really understand these plays they will be boom and bust with bust increasingly killing the next boom.

Hell you can see the damn faulting in any open road cut that goes through a shale layer its not like the geological aspects are opaque. In most parts of the country you can readily find where a a road cut through a shale layer and if you take the time to pull over and take a close look you will see that the cracks caused but geologic forces are the key to these layers.

http://www.geocities.com/jghist/Roadcuts/roadcut_4.htm

http://www.msstate.edu/dept/geosciences/CT/TIG/WEBSITES/LOCAL/Summer2003...

Just stop and let the spouse smell the roses while you grok the geology. The deep road cuts for the highway system have exposed some fantastic examples of pure geology normally either hidden or too weathered to understand. Its rock science not rockets :)

your model seems to disregard the microfractures that develope when the conversion of kerogen to hydrocarbons causes a pressure increase that eventually induces a micro-hydraulic frac. the initial pore pressure in the haynesville and bakken shales, to name two, are coincidentally at or above the normal fracture gradient (0.7 psi/ft depth). drilling into an area with larger fractures and faults enhances production also.

your vertical well model seems to have been debunked, by history, in the haynesville. your vertical well model has some validity in the bakken. there are many older vertical bakken completions that will exceed the recovery from these expensive newvoodoodootech wells.

memmel -- I've evaluated many different types of potential horizontal projects. In reality I've probably spent twice as much time talking operators out of going horizontal as recommending them. You're exactly right: horizontal well bores are not a cure all. But, as you point out, developing a fracture plays pretty much requires you to hit the fracture. In many plays those fracs are very difficult to predict. A horizontal well bore increases the chances of hitting a frac significantly. Also, by laterally staging X multiple hz frac jobs it's more similiar to drilling X number of closely spaced vert wells.

But, as you well know, this all comes at a very significant increase in costs. One factor that would drive some management teams to drill hz is that increased probability of making a commercial well even if the increased costs make the well less profitable then a series of vert wells. Just human nature: survival. Drill a series of vert wells and some won't be commercial and have to be plugged. Then your boss looks at you and ask why you just lost the company money drilling a non-commercial well. Drill all hz wells successfully but with a lower rate of return and the boss will seldom ask you why you only made a 15% ROR and not a 20% ROR. Nothing matches that naked feeling of standing before management after you plug a well. But the bright light of recognition shinning on you is warm and comforting when you annouce that 20 miilion cf per day flow rate you just brought in. Even when the ROR of that well is only 2%. Let's not forget: most of the big SG players are public companies so such press releases also give the board/shareholders that same warm (though sometimes unjustified) glow.

Once again, my dear memmel, you are potentially confusing logic and common sense with how you run a public company. Please control yourself in the future.

ROCKMAN I think it's important to talk a little to the technology that is being applied in the horizontal wells. As you mentioned the mult-stage fracs make a difference but what is really helping alot is the use of micro-seismic that allows us to watch the progress of the frac in real time. Simply amazing and eventually will tell you how closely spaced your horizontal wells will have to be. Not only do horizontals give you a better chance of intersecting fractures but statistically they connect up much larger areas through the microcrack to larger crack network that gets intersected. There is some good math about how all this works from the fracture perspective in Roberto Aguillera's book on Fractured Reservoir Engineering but the actual behavior of shales as fluid pressure declines is somewhat different (lots available through SPE papers though).

An interesting aside is I found a report from Credit Suisse which came out on Oct 6 of this year. Based on their calculations the breakeven price for Haynesville in it's core producing area is now $3.63/ MMBTU, for Barnett in the core area it is $3.49/MMBTU, for horizontally developed Marcellus it is $3.68/MMBTU, for Haynesville in East Texas it is $5.04/MMBTU, for Woodford it is $5.59/MMBTU, for Marcellus developed through vertical wells it is $6.48/MMBTU. For comparison the breakeven cost for average US production is $7.27/MMBTU whereas for CBM in the Powder River basin it is $10.77/MMBTU. My understanding is that the Qataris are able to dump LNG into the US market at a price below $5/MMBTU which is likely going to be the controlling factor on what shales get developed and when and what other gas gets shutin, but will also drive cost cutting measures in the short term.

"As you mentioned the mult-stage fracs make a difference but what is really helping alot is the use of micro-seismic that allows us to watch the progress of the frac in real time."

there are two views of one such project presented here:

http://vidego.multicastmedia.com/player.php?v=k22nn7op

use the tab labeled "mocroseismic fracture mapping"

a whole world of other good presentations here from the aapg, including one from the ng supply committe at csm.

We have begun work on the EROI of the Barnett Shale. So far the EROIs look fairly high in the first year and drop off quite dramatically as production falls off. Still some more work to do. I will put a post up on this issue once I am confident enough in our numbers...

Nice keypost and discussion--My basic takeaways are:

1. Above Ground: The Price Vise or Accordian-effect, decreasing net energy as production costs continually rise faster than profits from a slower-to-rise selling price. This is due to the invisible hand not pre-pricing in depletion of a finite resource.

2. Below Ground: The Pressure Vise from fracing to get NG out, then the quick collapse or subsidence of the shale structure.

Total Result on Population Overshoot: continually increasing pressure on the human testicle festival until collapse predominates.

Very important point. A weakness in our current economic theories which we need to fix, or ignore at our peril.

A oldie but goodie on the subject.

http://www.theoildrum.com/node/5247#comment-488439

No reason to repeat myself. And you can bet after some big investors get burned badly the shale players will find the money swiftly drying up.

I would not be surprised in the least for several to have some major accounting irregularities that will show up at the tide goes out. Nothing like a few simple swindlers to scare off investors in a big way.

And I'm trying to be polite about the matter. Expect the lawsuits to start flying very soon if they are not already happening.

Memmel,

Could you develop some math model to support your ideas? Words only go so far to support an argument, and there must be some critical point (CP) that you could capture in terms of the EROEI and investments. You are implying some phase transition will occur, yet it is too vague and nebulous unless you can plot some sort of trajectory near the CP.

Thanks for your link to your previous post. Missed it the first time. Most interesting--though depressing. I hate the thought of the bankers ending up as our overlords, and yet that may not happen--but only in the real "doom" scenerios.

God bless doom!

"I would not be surprised in the least for several to have some major accounting irregularities that will show up at the tide goes out."

some of these public traded companies are showing a large percent of their gas hedged in the $ 7-10 range for 2010. i wouldn't be surprised if some of these hedges disappear like a foul smelling vaporous anal emmission if the price doesn't improve or falls going into 2010. some may be actual defaults.

Actual candor from a former President-

http://www.youtube.com/watch?v=-tPePpMxJaA

And what did my fathers choose - Reaganomics.

We have no one to blame but ourselves

#@$% the dialectics - we are the problem....

Here is proof -

http://www.wynnlasvegas.com/#homepage/

My fathers bought into this shit....

Time to look introspectively...right now!

I saw Steve Wynn (the bad one) on Faux News last Sunday and he claimed that he has never laid anyone off and said that his business adds to the economy instead of being a zero-sum game (which it is) or worse a Ponzi scheme (to the suckers).

Wynn also said verbatim "Government Has Never Increased the Standard of Living of One Single Human Being in Human History". Yet Las Vegas sits near Hoover Dam and borrows water from California.

Case closed. The irony is so rich that one can mine it.

What's going on right now is very similar to the Carter era. Printing presses run amok trying to pay for the Socialists' generous giveaway programs. Stagflation is back. The Fed had to jack up interest rates back then to quash inflation, bankrupting the S&Ls in the process. Only this time it will be much worse. As Reagan said "there's no such thing as a free lunch".

And the senile Reagan had said a free lunch consisted of "ketchup".

As Yogi said, you can look it up.

We have been quasisocialist since the 1930's.

What I meant by my castigation against dialectics is once someone agrees with a political figure they are immediately pigeon-holed into the ideologies of that particular party that the politician represents.Hegel was quite brilliant in an evil sort of way, and his thesis of two opposable factions set diametrically against one another to bring a transformation in congruity to those who are in control of both parties is, no doubt, a universal policy practiced today.

If one is somewhat compassionate and liberal in regards to the oppressed and has a disdain for the oppressive aspects of the flow of capital he is immediately labeled Democratic and by default must be for abortion, gay rights etc. etc...

If one is opposed to abortion, gay rights et. al. the individual must therefore be a 'Republican good ol'boy', and should always support the policies of the Military Industrial Complex without question, always attend church on Sundays, appreciate (and or ignore) the effects of capital flow blah blah blah...

I am speaking in fairly generalized terms,though it is painfully obvious that the majority of the Republicans and the Democrats ultimately share the same ideologies and look like the same animal to me.

The Hegelian Dialectic system works well to keep the majority of the populace off balanced and deceived, and believe me, it is an effectual deception, and fear is a very important element in its execution.Just look at the absolute lack of commonsense in people today caused by the fear of an existential threat, whether real or imagined.

It is ironic that during the term of the Carter Administration the Military Industrial Complex launched its first Trident class nuclear submarine that could destroy hundreds(sic) of independently targeted cities; all of this coinciding with the Presidency of a liberal 'bleeding heart' Democratic leader who was ostensibly detrimental to the military strength of the nation.In reality, however,it was merely the outworkings of a different party with the same agenda.

I could go on and on about how the Cold War propaganda was used to insight fear into the publics psyche and induce a paranoiapsychosis to give acquiescence to ever increasing defence spending - whose ultimate goal for TPTB - was to fill the coffers of Wall Street Corporations.

Unfortunately, this monster we have created is about to swallow us.

Oh, it is absolutely true that the current financial crisis is infinitely more destabilizing than during Mr. Carters term.

We do not have the luxury of raising interest rates to offset inflation whatsoever without causing an apocalyptic financial meltdown; we are caught between the proverbial 'rock and a hard place', economically speaking, without an option that could ease further pain.This crisis has been ongoing and predates the current Democratic Administrations term by several decades.

We really should avoid the bipartisan disputations at this point; lets leave that to Faux News.I merely posted Mr. Carters address to the nation as proof - we the people - are and were the ones who have brought us to this current financial crisis due to our profligate extraction of the one source of energy that is literally the blood of the economies health; and to the detriment of the rest of the worlds oil producing nations.

Mr. Carter did not say you WILL conserve energy right now, he simply implied we must and left that decision to the public.

And the public chose Vegas.

Precisely. They are the same animal economically (eg. in the economic theory which underpins all the actions taken). They "present" as two different ideologies during elections etc., one supports (improved gay rights / access to abortion / womens rights / ../ .. /..) while the other opposes, but they are simply fighting over the camoflage they've chosen to win votes. They occasionally will get into "huge" public tiffs over minor nuances of such things as how quickly any partiular "further enrich the wealthy" (removing regulation on "investment banks" / privatizing public functions such as prisons, police forces, military, etc / ensure healthcare insurance remains in private hands) initiative should be implemented, but in fact their economic policies are identical.

No, printing presses running amok in a desperate ploy to prop up the supposedly free market capitalist bankers...we privatize the profits and socialize the losses.

Sure, there is the $8K new home buyer tax credit and the cash for clunkers and extended unemployment benefits...but your rhetoric about Socialist's generous giveaway programs rings hollow.

Where are these new generous giveaway programs (CfC, UI and home buyer's credit are drops in the bucket)? Are you referring to Medicare Part D?

Stagflation? What Stagflation? Inflation, so far, has been paltry. Where is your proof support for this statement?

Reagan also utterly blew off any semblance of concern about energy supplies and the environment...it was 'morning in America again'.

The reason it will be much worse this time are the policies that Reagan started and the people that followed continued.

Carter was the last president to try telling the truth. The truth was even less popular than he thought.

In 1980 Americans voted to destroy their country.

Here we are.

Who was the only president to balance a Federal and State budget during his career?

there were probably more than one, prior to the woodrow wilson era. in recent history many will name clinton. and anyone can balance the budget, it just requires a lot of lying and stealing money collected for the ss trust fund.

I think I'll trust Fact Check org over your biased memory. The Clinton years showed the effects of a large tax increase that Clinton pushed through in his first year, and that Republicans incorrectly claim is the "largest tax increase in history." It fell almost exclusively on upper-income taxpayers. Clinton's fiscal 1994 budget also contained some spending restraints. ... Clinton's large budget surpluses also owe much to the Social Security tax on payrolls. Social Security taxes now bring in more than the cost of current benefits, and the "Social Security surplus" makes the total deficit or surplus figures look better than they would if Social Security wasn't counted. But even if we remove Social Security from the equation, there was a surplus of $1.9 billion in fiscal 1999 and $86.4 billion in fiscal 2000. So any way you count it, the federal budget was balanced and the deficit was erased,

Short term capital gains from the stock trading in the Tech bubble.

Probably a more important factor was divided government. A Fortune Magazine analysis showed that when one party (doesn't matter which one) is in control of both legislative houses and the executive branch, spending rises at the fastest rate.

factcheck.org is a left wing socialist disinformation site. They should call it leftwingpropaganda.org.

-- deleted --

I assume you mean Clinton. While hardly a fan of his administration, I will grant this: He tried to create a new economic sector (information technology) to keep the US going despite our adverse resource situation. It is too bad that it failed to be an adequate replacement for our abandoned manufacturing sector.

All the same, Clinton did nothing to prepare us for the end of cheap oil, and the era of cheap oil that he presided over is now gone, and the window for preparation of a soft landing is closed.

I recall the 1980s as a very productive time in US history. Perhaps you were referring to the 2008 election? The dollar has dropped 10% since Obama took over. The budget deficit has increased 300% and climbing. Obama spent more money in his first 90 days than all other presidents combined back to George Washington! And don't forget the 17% real unemployment rate. The US economy has never sunk farther, faster, than at any time in US history. As Margaret Thatcher said "The proplem with socialism is that eventually you run out of other people's money". Looks like the socialists have run out and need to crank up the printing presses.

"...The US economy has never sunk farther, faster, than at any time in US history..."

I do believe this to be caused more by the plateau in extraction of global conventional crude than by a particular administration...and you and I are partly to blame my friend.

Sorry for kicking the ubiquitous sacred bovine bull in the ass with the last post....

If high oil prices are what caused the economic collapse in 2008, then falling oil prices should have revived the economy. That didn't happen. The recent oil price increase was caused by the devalued dollar, not by any supply concerns. The record number of foreclosures in 2009 Q3 were caused by the unemployment rate. Unemployment is caused by offshoring manufacturing. If I had to blame one group it would be the liberals, socialists, democrats (same people), that have supported anti-business policies for many years. e.g. support for minimum wage increases, labor unions, lawsuits against businesses, environmental laws, and various other anti-business laws and regulations. I can't say I really blame management for going offshore. In some areas of the country, it's virtually impossible to operate a business. California, for example is one of the worst places to do business.

Good luck in the next election trying to blame the country's economic problems on peak oil. lol

Forget about those pieces of paper in your wallet you believe have intrinsic value, it takes more faith to believe that fiat currencies have value than to believe in a Creator.

The only way a Capitalist economy can survive is if it continues to grow exponentially.

It takes energy to increase GDP, not fiat paper.

Capitalism may have prevailed against Communism,but unfortunately for professional financiers,Capitalist economics will never prevail against the second law of thermodynamics.

And conservationist - if we indeed have hit the peak there may never be another election. I fear America is about to cross the Rubicon, as our recent history seems to be a parallel of the rise of the Roman Empire - and that is no laughing matter.

It takes energy to increase GDP

Energy consumption doesn't have to grow, for GDP to grow.

See the work of Ayres, et al.

Some form of energy has to grow, be it food that is converted to caloric energy for manual labor,wood, coal, or God forbid nuclear or antimatter; some form of energy has to be added to the system for it to grow.

If it is a zero growth system it has reached sustainability and nothing more, you know, analogous to how the natural world relies upon the suns energy to sustain itself.

Has Ayres found the Holy Grail of free energy?

I am having a hard time following this logic.

Some form of energy has to grow

Energy is needed, but not necessarily growth in energy. We just have to use it more efficiently.

Here's a simple example: start with one person commuting in a 10MPG SUV, move to four commuting in Priuses at 55MPG. Perform four times as much work, use 80% as much energy.

See http://energyfaq.blogspot.com/2008/06/there-are-several-studies-by-rober...

While I have no wish to tamper with your memory, the apparent productivity of the 1980s was largely illusory: The real action was the process of looting out, which began then (remember the S&L scandals?) and continues to this day.

Oil production in the US lower 48 had already peaked when Carter took office, and he soon understood that this meant we needed to find a new energy basis for our economy, and that that might imply other changes as well. His vision was rejected in 1980 as America decided to squander its remaining resources and time.

Those things are now squandered. Any industrial society--whether "socialist" (like the former Soviet Union) or "capitalist" (like the US)--will enter terminal decline when its resource base fails. That's where we are now.

Obama is irrelevant. The fate of the US was sealed well before the 2008 election.

Jimmy "Malaise" Carter is the reason the S&Ls failed. He printed up so much money that inflation was out of control. The Fed had to raise interest rates dramatically to quash that inflation. When you're in a business that collects 6% on loans and has to pay out 12% to depositers, it's kinda hard to make money.

China and India have much larger "population to resource" ratios than the US. They still have growth, because they have implemented pro-business policies.

80% of US offshore areas are off limits. California's fiscal problems could be solved if they increasd offshore production, and had a profit sharing plan. This is not a geological problem, it's a political problem. Senator Boxer is proposing to put the Mojave desert off limits to CSP plants. 1/3 of the desert area could supply enough power for the entire US and Canada. Again, not a resource problem, a political problem.

thank you for that revisionist history, i had no idea that the democrats brought about all deficits and that the search for wmd's and upper income tax cuts had nothing to do with bush jr running up $ 5 trillion in debt.

Senator Boxer is proposing to put the Mojave desert off limits to CSP plants.

Do you have a source for that?

Feinstein, Boxer, same difference. lol

http://www.nytimes.com/2009/09/19/science/earth/19mojave.html?hpw

Your original description mis-represented what Feinstein is doing.

She isn't putting the whole Mojave off limits - she's protecting a small portion that was specifically "donated to the Interior Department during the Clinton administration, with assurances from President Bill Clinton himself, the group says, that it would be protected in perpetuity. "

That's completely different.

Yeah right. What she's doing is trying to block any new solar development. If 500,000 acres is small to you, what's big? As the governator says, if they can't build in the desert where can they build?

http://www.huffingtonpost.com/2009/03/21/feinstein-seeks-to-block-_n_177...

Speaking as a native Californian who grew up in the Mojave, and noting the area of the Mojave is about 34.5 million acres (@1.4% would be used), I think we can find a way to generate electricity and impact the environment as little as possible.

Personally, I advocate power generation at the household, town and city levels over any concentrated structures.

Cheers

There's people against home PV installations as well. They don't like the aesthetics, or they don't want trees cut down to make it work. PVs don't work in the shade. Regardless of what type of energy is being developed, there's going to be some group against it for some reason. It's not that the energy supplies don't exist, it's the politics.

Conservationist, you have a 'lying problem'. You make things up

and then expect to get away with it.

Carter's deficit in 1980 was less than $80 billion which was $300

by the end of Bush I, going to a surplus of $200 billion in 2000 under Clinton and diving down to a deficit of $500 billion in 2004

under Bush II.

Carter didn't cause inflation. It was an oil shock.

Really. Have you no shame?

Oh sure Carter did a great job with the economy. lol

And Obama's 9 trillion dollar deficit and 17% real unemployment rate are all George Bush's fault.

You Democrats sure are funny! lol

I agree, with a quibble - at least half of the inflation that Volcker (Carter's fed appointee) was suppressing with his 18% interest rates was due to Johnson and Nixon/Burns era inflation expectations.

Conservationist,

I agree with you about the offshore drilling...by all means, open all areas in the U.S.(including ocean areas,and the USG should give tax credits for all such development. We would then see how eager the majors are in developing these resources, EROEI and all. This would end the specious 'Drill, Baby, Drill' B.S. argument.

Well conservationist, you write as though you missed the gas lines of the 1970s. I remember them with some vividness.

Here at the Oil Drum we are mainly concerned with the information pertaining to the resource base of our economy--and thus tend not to argue politics per se. Let me just say that if the resources are not there, then a "favorable business climate" is irrelevant and has no meaning.

While we may succeed in wrecking our environment, we are not going to get a lot more oil at an EROEI that is high enough to do us any good.

No we never had any gas lines in the town I was living in at the time (in the US), but I do recall seeing it on the news. Those lines were not caused by "resource depletion", they were caused by politics. The Arab oil embargo was in response to US support for Israel in the Arab-Israeli war.

Let me just say the resources are there. Insufficient EROEI is a common doomer myth. Did you know there is an entry about you on wiki?

http://en.wikipedia.org/wiki/Doomer