North Sea Petroleum Reserves

Posted by Euan Mearns on October 5, 2009 - 10:32am in The Oil Drum: Europe

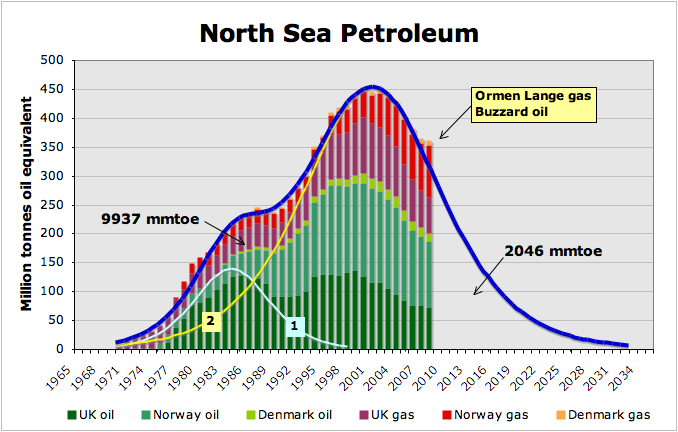

North Sea petroleum (oil+natural gas) production from 1970 to 2008 can be modeled to fit two Hubbert cycles. The first cycle represents surge production from the giant UK oil fields, Forties, Brent, Piper and Ninian. Actual cumulative production was 9937 million tonnes oil equivalent (mmtoe) 1970-2008 whilst the area beneath the two Hubbert curves is 9665 mmtoe - a difference of 2.7%.

To what extent the second Hubbert cycle will describe the decline in oil and gas production is highly pertinent but also uncertain. There are signs that the decline trajectory has already been influenced by a third cycle of giant field development with the Buzzard oil field and Ormen Lange gas field both coming on stream in 2007. The impact of this third cycle is shown below the fold.

In a February 2000 paper, The Hubbert Curve: its strengths and weaknesses, Jean Laherrere advises that the Hubbert curve works best where:

- There are a large number of fields

- Where exploration follows a natural pattern unimpeded by political events or significant economic factors

- Data from a single petroleum province can be amalgamated across international boundaries

Not many data sets meet these criteria, including those for the North Sea and it is clear from the production data that they do not follow a single Hubbert curve. The overall structure is heavily influenced by the double top in UK oil production brought about by the oil price collapse of 1986, that delayed on-going field development plans, and the Piper Alpha oil rig explosion of 1988.

The BP statistical review allows data to be combined from the four countries with significant North Sea oil and gas production - UK, Norway, Denmark and The Netherlands - but combining these data masks the fact that some production comes form outside of the North Sea. The UK has significant production on the Atlantic margin and in the Irish Sea, while Norway has significant production from the Haltenbanken area off mid-Norway. Strictly speaking these are separate petroleum basins.

Dutch production from the giant Groningen gas field is excluded from this analysis for two reasons, 1) it comprises an earlier discovery cycle to the rest of the North Sea and 2) production is capped by the Dutch government, hence it is not exempt from political influence.

Notwithstanding these known limitations, I wanted to see if production data could be fitted to two Hubbert curves in order to see what remaining reserves and future decline might look like. The chart up top is produced by trial and error on a spread sheet, where 4 variables may be changed: 1) start and end date, 2) peak date, 3) peak flow, and 4) gradient [notes 1, 2 & 3]. The chart up top shows what I consider to be a good fit, with the noted exception that 2007 and 2008 data are deviating from the expected decline. Knowing that two giant fields, belonging to a late discovery cycle for the province had just come on stream, it seemed pertinent to model these as a third cycle.

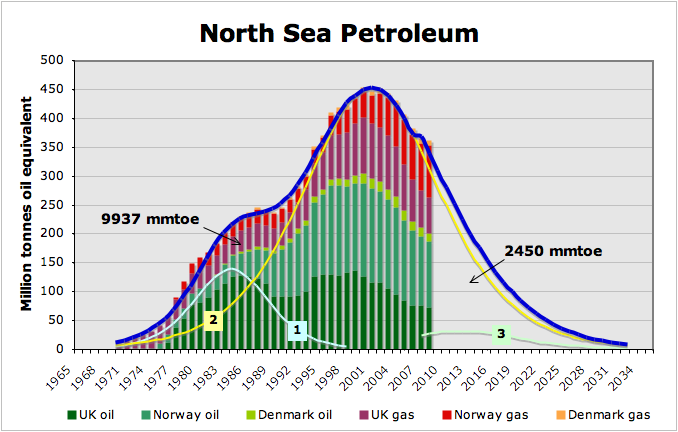

The dark blue curve equals the sum of the three Hubbert cycles. 1) is best viewed as surge production from the Forties, Brent, Piper and Ninian Fields when they came on stream in the early 1980s, 2) represents the main discovery and field development cycle of the North Sea, 3) represents a late discovery cycle, Ormen Lange in 1997 and Buzzard in 2001. Both fields came on stream in 2007.

Ormen Lange is reported to have reserves (gas and condensate) of 381 mmtoe and Buzzard 75 tonnes oil. Peak production at Ormen Lange is constrained by the capacity of the Langeled pipeline (25.5 bcm / annum, translating to 23 mmtoe / annum) and peak production at Buzzard is assumed to be 180,000 bpd, translating to 9 mmtoe / annum. Cycle 3 reflects all of these parameters but is modeled asymmetrical since production peaks will be reached early on in both fields. The chart above shows the impact of this cycle 3 model upon the eventual decline and reserves.

The remaining oil and gas reserves following this analysis are 2450 mmtoe. This is somewhat lower than official reserves for the three countries that amount to 4575 mmtoe, according to BP 2009. [note 4] Over 2 billion tonnes of oil difference is quite a substantial amount. One fly in the ointment is that the giant Troll gas field in Norway has production capped by the capacity of the platform and pipeline. This is in effect a political cap, and this gigantic resource will distort the decline phase of the Hubbert curve, extending it further to the right. I have not had time to look into adjusting the analysis for this.

One feature of the logistic curve is that decline accelerates with time. The blue line has a decline rate of 9% in 2010, accelerating to 15% in 2020 and 17% in 2030. In contrast, the decline on an exponential curve is constant. The decline rate in oil fields in known to increase with time from phase 1, to phase 2 and 3. But rates of 15 to 17% are well above the average current decline rate for the North Sea. So what is going on here?

I need to stress that I do not consider this analysis to be a forecast. It is an exercise to see how combining Hubbert logistic curve derivatives would fit the existing production data. One scenario that may bring about an acceleration in decline is field decommissioning. High oil prices in 2002 to 2008 have delayed decommissioning of many platforms; it remains to be seen if this is reversed in the lower oil price environment. One further consideration: the word on the street here in Aberdeen is that the major drilling contractors are very short of work. This will result in accelerated decline in the years ahead.

Notes

1. Long term readers of The Oil Drum will know that math is not my strong point. This appears not to be a genetic disorder since my younger son Duncan (age 16) excels at Maths. I gave him Laherrere's paper and asked if he could prepare the Hubbert equations and spread sheet for me to use.

2. There are a number of excellent mathematicians who contribute to The Oil Drum: Sam Foucher, Luis de Sousa, Jean Laherrere and Webhubbletelescope to name but a few. If there is a better way to do this then constructive criticism would be most welcome.

3. Sam Foucher modeled global oil production using a series of 7 loglets in September 2006, which is still the best multi-curve analysis of production data that I know of. I'd be interested to know how this model is standing up to the rigors of time.

4. To convert billion cubic meters gas to mmtoe, the conversion factors recommended by BP have been used - 1 BCM = 0.9 mmtoe.

Great Analysis... and since I'm the first poster I'd like to use the opportunity to ask that the Global production loglets post perhaps be updated? Please? :+)

http://www.theoildrum.com/story/2006/9/3/113719/7594

Sure would be interesting to see how it has held up.

Has anyone blurted anything out in the newspapers? We've all read this passage from Deffeyes's book:

A year later this came out in the Bend Oregon Bulletin:

Hmmm: British Oil Production - The New York Times, April 4, 1989:

Can't say you weren't warned - wasn't the UK peak around 2.5 mb/d?

If you look for reports from the late 1990s, it was confidently predicted (EIA et at) that the UK would plateau at around 3mb/day for the foreseeable future..

As far as this analysis goes.. I'm not 100% comfortable when you start adding lots of curves together, simply because the potential number of ways of adding 3 curves to get 1 graph is very large, and hence not very informative. For instance, the initial peak/dip for the UK was as much a result of Piper Alpha as discovery/production factors. Mathematically, I'd prefer to see a single curve with acknowledged error bars instead of attempting to get an unrealistic perfect fit. (Nitpicking, I know).

Back in the mid 1970s I remember Tony Benn the Energy Minister saying we would only have around 15 years of production. Later said how surprised he was by the huge amount that had and was being produced.

At one time he had a glass container that held the first oil to be extracted from the North Sea.

Deffeyes made a mistake in his book. The RRC went to a 100% allowable in 1972, when Texas production peaked. The Texas (RRC, C+C, Blue) & North Sea (EIA, C+C, Black) peaks lined up with each other:

Incidentally, according to Matt Simmons, the industry in 1999 was confidently predicting higher North Sea production. These two regions, which accounted for about 9% of total cumulative oil production worldwide through 2005, are the lands that the industry forgot, or more accurately, that they pretend don't exist--because their story is that regions (such as Texas & the North Sea) developed by private companies, using the best available technology, with virtually no restrictions on drilling tend not to see production peaks.

Mathematically, based on the logistic models, Saudi Arabia and the world in 2005 were at about the same stages of depletion at which Texas and the North Sea respectively peaked. Note that the initial Texas & North Sea decline rates were relatively low, for the first three years, with much higher decline rates in the following six years. The start of the analogous six year period for Saudi Arabia and the world is 2009.

As a well's production declines it must reach a stage where it doesn't make any sense to put the manpower onto it or the energy into it.

The effect of closing down wells before they are totally dry must lead to a premature and abrupt termination in production first at the well by well scale, then at the field scale. Thus potentially for any given field the declining curve will take a sudden downturn to zero as the operator reaches the point where his controlled shut-down costs are close to the cash in hand.

At what point do you think it becomes uneconomic for the operators to continue to work a particular well, and then a field?

I suspect that the effect on individual wells isn't that great - but there is a problem that the cost of maintaining operating infrastructure (platforms, pumping stations, etc) gradually becomes prohibitive, to that eventually even fairly productive wells, and small satellite fields, get closed or left undeveloped because the infrastructure is no longer economic. There is no offshore equivilent of a 'stripper well' afaik.

Right - in the offshore environment, keeping giant platforms operating, that are just producing a trickle of oil, eventually becomes uneconomic and they are eventually shut down. But this just removes a trickle from the production stack. However, the cost of decommissioning is so high that operators tend to do everything possible to delay this and will keep going with uneconomic production simply to delay the day they need to spend $10s millions to dismantle platforms and pipelines.

What kind of funding is in place to pay for the decommissioning? I could imagine an operator selling out to a thinly financed operator, that really doesn't have funds for decommissioning. Oil prices drop from current levels. The operator goes bankrupt, with few barrels extracted and little revenue per barrel. Who would pay for the decommissioning in this case?

Most of the Oil Majors have sold on their rights to the Remaning fields In the North Sea. Shell, BP, Occidental(Piper Alpha disaster)to smaller players. Far as I remember BP sold Forties for £1. New owners have to remove everything including rigs,under sea pipe lines, cap wells And dispose off every ashore. Anyone remember the BRENT SPAR Debacle.

http://en.wikipedia.org/wiki/Brent_Spar

Courts will probaly decide who picks up the final bill when t the Minors go bust.

There is a lot of selling and reselling of assets. Sometimes the responsibility for decommissioning stays with the original consortium of operators, some times it is sold on. Nearly all licenses are operated by consortia, so the cost does not fall on a single company. I think they will also have to allocate funds (in their accounts at least) over the life of the field to pay for decommissioning.

I've not heard of any company as yet unable to pay. The service companies that own big cranes are salivating at all the business that will go their way. CCS and decommissioning are the big growth areas in the UK energy economy.

Euan -- One clever bit the MMS has on its US OCS leases. Even if an Exxon sells an offshore property to Company A Exxon is perpetually responsible for decommissioning etc. So if Comapny A goes belly up the Feds still have someone to hammer. Do the UK regulators have a similar hook?

I think this is the case in the UK also. Decommissioning responsibility can be passed on to a third party as part of a deal, but if they go belly up, the responsibility reverts to the companies that built the installations in the first place - but I'm not 100% sure.

Gail -- On Federal leases all operators are required to carry bonds which cover abandonment costs and environmental liabilities to a degree. Additionally most operations are insured although that cost has skyrocketed since the recent hurricanes. With new insurance limits in place there's an unknown amount of uninsured liability out in the water now.

Insurance companies operate in the financial market place. As the financial crisis gets worse, more and more of them will go under, and it will be up to governments to bail them out. The timing on all of this, relative to the timing of the abandonments, is an unknown. The governments aren't getting in any better financial condition, either.

It's actually worse then that Gail. As a result of the huge claims after the last two blows the insurance companies not only raised the rates but also limited max damages. In some areas of the GOM once they hit a max exposure they'll write no more policies. I can't guess the scale but as a result the is a pretty big uninsured liability of the industry out there. Since it's a "what if" liablity I'm not sure the public companies are even required to carry it on their books.

nigwel -- As you might guess the answer varies widely. One of the biggest factors is onshore vs. offshore is the fied costs. The fixed operating cost for offshore is very high for any given field. That cost doesn't effect an individual well per se. But the cost to repair/recomplete an offshore can readily kill its economic value. The same operation on an onshore well that could cost $30,000 might run as high as $400,000 offshore. Also, relatively inexpensive techniques often used to supply artificial lift to an onshore oil well are not practical offshore sometimes for a problem as simple as lack of space.

Thus as you probably suspected offshore fields tend to be abandoned sooner then onshore fields. But there are situations when an operator will run a field in negative cash for months and sometime longer. They may be planning additional drilling but must wait for a rig to arrive. Perhaps they plan additional seismic acquisition. They might also not have plans for more activity themselves but are anticipating another new player might want to sublease/buy the position. A big benefit therein is not having to spend the many millions it costs to decommision an offshore field. Once an operator stops producing in Federal waters they have to return the lease to the gov't.

"The same operation on an onshore well that could cost $30,000 might run as high as $400,000 offshore. Also, relatively inexpensive techniques often used to supply artificial lift to an onshore oil well are not practical offshore sometimes for a problem as simple as lack of space."

Fortunately, the free market will work its magic and new technologies will develop which will push these offshore decommissioning costs way, way down. This will especially be the case if the minimum wage is eliminated and all unions are busted.

What would be the cost to abandon production on an offshore field but leave the infrastructure in place? Would it be effective to subsidize this over time as a public service?

I get your point toil but for the record in 34 years I've never run across a union worker offshore. As far as wages go I think the lowest paygrade (roustabout) I've seen was 2 or 3 times minimum wage. Not to belabor the point but the vast majority of US workers wouldn't handle the duties for that pay. On the high end, blue collar workers can do $70,000/yr and much higher. Unfortunately you have to have that job to get the check. These days it's not low pay hurting oil field hands but the lack of jobs. Thus, given your sympathy for US workers, I'm sure your hoping for the return of high oil prices so all those no longer getting a paycheck can return to their trade.

A note to Dr No - I've hidden / deleted your comment because it was so far off topic. I may do a post some time soon on 19th and 20th Century mortality.

By eye, we are looking at a fall to half the current level by 5 years time. At the current rate, that corresponds to a loss in tax of £3-4Bn.

So in addition to the cuts in services and rises in taxes we can expect to pay for the financial 'industries' incompetence, we can expect an extra £3-4bn for this decline.

Tell me again where the investment in alternative energy and energy saving technologies is going to come from?

If production follows the logistic down (and I'm not convinced that it will) then 50% of peak by 2015 certainly looks possible.

Service are going to take a hell of a hammering in the years ahead. Education is already sinking, health and social services will be next

Based on the EIA data, the observed North Sea crude (C+C) production decline rate from 1999 to 2008 is 4.8%/year (from about 6.0 mbpd to 3.9 mbpd). At this decline rate, the North Sea would be below 3.0 mbpd in 2015 (they would be at 2.8 mpbd, down about 53% from the 1999 peak).

That looks like there is only 20% left. Maybe we should start running faster in circles.

Some interresting articles have been published by Upssalla university in Sweden. Based on data provided by the Norway.

http://www.fysast.uu.se/ges/

Offtopic: At above site there is also a report about american coal. What puzzles me, is what happened around 1920. Coal production at plateau and declining energy content. ;-(

Limited time is all I have.....

ERR07 asked: "What puzzles me, is what happened around 1920."

That would have been the end of WW I. Use of coal during the war by the military was endemic. Naval vessels were all coal powered, as were our factories.

The next dip is accounted for by the rise of oil.

Mr. Mearns,

You commented that capacity was capped on the Troll Field by the platform and pipeline capacity and that this would change the Hubbert Curve.

I would contend that most if not all large fields are constrained by capacity. If there was no capacity constraint the decline curve would start from a maximum and continually decline. In the real world no one has the capital to drill all the wells in a field at once and build a pipeline and platform system sized to handle the maximum physical production from the field.

This combination of physical declines with the economic effects is in my opinion what make the Hubbert curve such a powerful tool.

Political or economic constraints can change the Hubbert Curve but it already contains normal economic constraints.

You have an interesting analysis-scary but interesting.

Fair comment, but Troll is in a league of its own, will produce on current plateau for decades, and because of its size, it can distort the whole picture. What I'm saying is that IMO it is more likely the decline is less severe than indicated.

I believe that Alaska (Prudhoe Bay) began pumping at a high rate because much infrastructure was put in place while the pipeline was being built.

That was the only way I could explain it.

http://mobjectivist.blogspot.com/2006/12/alaska-peak.html

One criticism I'd add, that applies quite widely to all the Hubert curve models, is that they all are shown ending symmetric with how they began. Natural resource exploitation would usually be quite different in the end than in the beginning.

For example, it is quite likely that the use of a resource will drop quickly when it becomes too expensive for large groups of users, resulting in one or more market collapses as the user system responds to the resource system, and it becomes of marginal utility for many prior users. They it would end in being available to the highest added value users, but for a long time probably. I think the strict "bell shaped" curve more likely applies to resources for which the exploitation effort is constant, rather than variable.

So, showing that is a problem when you don't know the future, and what the fallout will be for users as resources approach their points of vanishing returns for different groups. Wouldn't it be better to be as truthful as possible and show something that would prompt the better questions as those thresholds approach? Maybe this one would be:

It would let people ask more and better questions about the response dynamics, for example.

pfhenshaw -- A valid observation for sure. I recently re-read Hubert's work and he points out that he does not intentionally predicts a symmetric curve on the down trend side. I think he specifically states that the shape of this second half of the curve can only be constructed as the data comes in. It's also my observation that the smaller the population (anything less than all global production) will tend to show more irregularity. As was just pointed out Cantarell will be very asymmetric. But if one were to include all Mexican production it would still be so but not to the same degree. Backing off to all production in the western hemisphere dilutes the effect even more.

I'm not sure the US Hubert curve on the downside would be a good approximation for a global Hubert. Due to the huge class of private entrepreneurs in our oil patch we've bleed our old fields for a much longer extent than would be seen in most parts of the world. Again, PEMEX is a handy goat. Had the Mexican gov't allowed private MX companies into the oil biz they probably would be in much better shape today. But even the generic course of NOC's isn't easy to model. While PEMEX suffers from a lack of capital (thanks to the gov't stripping them of most of their cash flow) consider Petrobras. The BZ gov't is funneling hundreds of billions of $'s into their operations over the next 10 years. Just my guess but I suspect a BZ Hubert 30 or 40 years down the road will look quite different then a Mexican Hubert. And the KSA downside might not be as steep as other NOC's given their efforts at pressure maintenance and secondary recovery in their big fields. Then try adding the political and consumption variables to the global downside model and I'm not sure if you just don't end up with a "I don't know answer" to the shape of the Hubert backside . Which, of course, is much different than the "Yes I have a model that will predict the backside of the curve. As long as my assumptions hold true" answer.

I concur with your collapse path of oil production, but go one step farther. What leads you to believe there will be sustained low levels of production far into the future? We're talking North Sea and state of the art extraction, not Kansas.

This seems to be a persistent optimistic bias in a certain subset of doomers. I'm not saying you are wrong, just that you provide no logic to support that sustained plateau. Better would be if you merely erased that horizontal line.

This is not a quibble because others who haven't thought deeply might perceive that plateau as a period of relative stability and safety, and hence only prepare for collapse-lite.

Cold Camel

Responding to both you and Rockman, Yes it's clear that when you open up the discussion to what the real future path of production will be it's "defensible" throw up your hands with uncertainty and not discuss what contingencies might arise. It's also easy for some to focus on one favored scenario as "incontrovertably possible" and go off on some tangent that way too. I guess my suggestion is that if you try to draw all the scenarios you can it will raise more of the valid questions and make decision making more competent in the end.

In this case there seem to be two general reasons for non-symmetric depletion paths. One is the actual shape of the resource, and the reserves-to-EROI curve. While it's true we won't know that till we reach that, it's still a valid question. Once you have a curve then you can watch for the inflection points to give you the longest lead times in planning for it changing directions possible.

What we seem to have found so far is that the low cost and quick access reserves of oil are quite limited, and that the economy that relied on them being limitless is in for a rather big shock. I think that will be easier to understand if put in the context of realistic questions about what will follow.

What about the reserves of medium cost oil, or of high cost oil. How big are they? Are there discrete cost jumps for having access to each volume? For example, could we pump in viruses into depleted strata and in 100 years have a reliable trickle of low cost energy? What kind of economy do you get if it can't grow and has jettison it's expensive overhead costs to adapt to ever lower EROI resources?

That certainly does not help us much with our current straights of having planned all our finances and institutions on having ever multiplying access to cheap energy... Still, discussing the "far flung" possibilities for how we find and use oil in the future would at least help create subjects to discuss beyond the question of whether the supply of cheap oil is infinite or not. ;-)

You are suggesting that state controlled Statoil, controlled by one of the wealthiest countries in the world, is going to collapse, and that we will no longer be using gas for central heating or power generation in the course of a few years.

I'm not sure I follow you about "state control". What I think we're all talking about are the limits of control that natural systems present and over ride politics and technology, etc. What I'm suggesting is tat a likely path for economic decline due to resource depletion would be successive collapses of weaker sections of the economy to leave a residual sector that is so productive it can afford the expensive remains of the resource.

It seems to me that the high priced "dregs" of the earth's oil supply might last nearly forever, considering how small a group of users would be able to afford them. That's saying the sustainability threshold is in the user system, not the natural resource in this case... or so it looks to me.

Hypothesis: Worldwide continued debt issuance, especially in last decade, gave the economy and the markets inflated price signals with respect to continuable real economic activity. In effect, we borrowed from the future as much as we possibly could via fractional reserve banking system worldwide. If so, then many oil producing regions would have been incentivized to produce all out, using expensive technology, not caring about where oil might come from in 20 years other than new fields, discoveries elsewhere etc. As such, in certain(many?) regions, the ultimate distribution shape would not follow a logistic but some sort of skew. But by definition we can't know the end shape of an oil field/region until it's done (or nearly done) producing.

Question: What would be the geologic qualities of fields/regions that would be more prevalent to resulting in a negatively skewed distribution (i.e. where less than 50% of URR remains after passing peak in production, potentially much less - Cantarell is one example) or positive skew (>50% of recoverable is post peak but at accelerated decline from peak rate - Vigdis being one example). To what extent would different global oil regions be able to be pulled in the negative skew (early peak)? Are there some type of oil fields that have different geologic properties that would NOT be conducive to changed production profiles due to exaggerated price signals? In effect, this question might underly the increasing IEA decline rates over time on pages 220-222 in WEO 2008, even though they assume observed decline will be much less due to other factors.

The first point is that the Hubbert curve has progressively increasing decline rates built in - see text. If the distribution were to be skewed I'd go for +ve skew , that could be brought about by high oil price and indefinitely delayed decommissioning, also Troll and Ormen Lange are giants. They will have a looooong plateau before they begin to decline.

The negative skew would come about only with a collapse of society - Statoil, Shell, BP, Exxon ceasing to exist. Not likely IMO for the foreseeable future. This scenario would mean no gas or electricity - and the energy industries would be nationalised long before that would be allowed to happen. Statoil is already mostly state owned.

Sorry -I wasn't clear - what are the geologic differences (perhaps offshore vs onshore, giant field vs smaller, tight formations, etc.) that would account for price incrementally affecting positive skew. Im basically asking if ALL fields in production have the ability to depart from a normal extraction profile to accelerated extraction that would create a peak and then long decline at lower production levels, or if some % just aren't conducive to such technology, in general.

And - perhaps this was covered long ago (gawd knows alot of other stuff was), but what % of all oil fields ever discovered and produced/producing are totally or near totally finished? Less than 10%? 30%? I have no idea.

Gaaawd, those are hard questions. If you recall the CERA report, 40% of production comes from brand new fields in build up phase. Id guess that 90+% of all fields ever produced are done or near done. But that matters not since the ME OPEC supergiants are not.

There is no such thing as a normal extraction profile. But your +ve skew is probably near enough - a rapid rise to short plateau then a long slow decline phase.

I'll point out right here that your "fact" has no basis its a claim.

The fact is the one super giant field that we have good data on produced by a NOC Pemex crashed.

Others such as those in Russia did not crash but followed production pattern closer to Texas and even here data is not fully transparent.

It pays to be very careful with your facts esp for the super giants the truth in my opinion is much simpler we don't know the time evolution of these fields. Historically on land the largest fields spend most of their productive life watered out produced with stripper wells but we are just now reaching the point where horizontal well technology deployed in giant fields will begin to show its decline pattern.

Certainly aggressive measures such as initiating secondary recovery early in the life of the field with peripheral water injection followed by use of horizontals and targeted vertical wells taking advantage of the latests imaging technology will keep oil production high for a long time but if anything the decline should be steeper and potentially sudden in onset.

Show me a model that incorporate early secondary recovery and later horizontal well use and aggressive in field drilling for bypassed oil and results in a slow decline and I'll believe you.

As of right now my belief is that technology keeps production rates high until it does not.

No magic on the backside of the curve just simple aggressive extraction. Certainly bypassed oil is being produced that may have not been produced otherwise but why was the oil bypassed in the first place ?

To aggressive in production geological issues etc ...

The problem is if you start trying to assign "extra" oil to advanced technology its hard to beat your good old stripper well. Ignoring production rates outside of very tight formations I've not seen convincing evidence that more oil is produced vs running strippers for 50 years.

We have a best case scenario in the form of the US where many fields where abandoned after initial production and secondary and further recovery methods where only applied after technology had developed to extract them indeed the technology was developed to solve the problems in US fields. Its produced a symmetric production profile. But its critical to understand the timelines and history of how US fields have been produced to understand the interaction of technology with oil. Fairly long abandonment with the resulting gravity induced changes in a quiescent field are ignored for example. Even though resting of fields is known to improve production. Its technical its complex and if you look you should find that many factors worked to give the US the best production profile possible. Our early entry into oil production actually worked to ensure significant quantities of oil remained to be profitably extracted later as technology improved and as economics changed. Surprisingly for the US greed worked to our advantage as we damaged our fields and later managed to develop technologies to recover. And of course on the economic side regardless of technology US fields had to be profitably produced in competition with and influx of cheap imported oil. Even the North Sea was produced under this economic constraint for most of its productive life.

All of these factors are simply dropped in our models which is not correct at the very least a simple economic model needs to be included for regions that peaked early while oil was relatively cheap. Dropping it is really not and option.

However outside the US as the same technologies where deployed they where not used in fields that had been produced under primary extraction then often abandoned for long stretches of time instead as technology advanced it was introduced as needed to keep production up. Its simply not the same problem and not clear in the least if the production profile will follow the US indeed Mexico hints that this US may well not be the norm.

So overall global production should be asymetric with a steeper drop off or more probably a combination of the two curves that Nate has displayed. Its both.

You have a steep drop initially as production rates are no longer maintainable using advanced technology however your good old stripper well keeps chugging along so you also have a very long tail period. And of course assuming we continue to produce oil and its expensive marginal new oil fields will also fall in the tail region.

The biggest mistake I see in every single model of future oil production proposed on the oil drum lies in the period of peak production and initial decline. This area is very much a technical problem and related to how we produced the oil. Its simply wrong to backcast the long tail back through the peak with a single equation as peak and post peak oil production is controlled by two radically different forces.

The peak production rate and initial decline is almost purely technical with the time that we spend in this region determined by how long technology can keep production levels up before depletion forces them down.

Now whats the real model for oil production well we have it already and its been presented on the oil drum.

Its the shock model however its not in my opinion been formulated correctly.

In the real world what happens is initial production is under discovery control and generally exponentially increasing however from this point on the real world diverges from a single function and falls increasingly under the influence of an large number of functions which can be grouped together as shocks. The critical and vital point is that these cumulative shocks actually control oil production rates across the peak production profile and into the initial decline, Initial discovery dampens out and continued discovery is itself influenced by existing production and is no longer a pure search function. The time line for bringing fields online etc etc. Technical factor political you name it its a rich set of functions.

Its best to simply assume that all of these functions will eventually result in a simple economic equation i.e supply will meet demand at a given price as long as possible. Despite the complexity the overall driver eventually becomes a simple economic problem of course the demand side is not a simple function of supply as supply is itself not a simple function.

What we do have is a blatantly obvious signal in oil production when production levels switched over from being controlled by discovery and production to a rich set of economic political and technical functions.

Now when things get fiendishly complex you have a choice either give up or search for a simple function that can act as a model. Obviously we have a hint as to the form of the function since by definition actual production is being controlled by outside factors.

We happen to know exactly the perfect function to use to fit this sort of problem.

http://en.wikipedia.org/wiki/B%C3%A9zier_curve

Its the Bezier Curve and its perfect for our needs since small movements of the control points wiggle the curve but the time change of the control points is simple even though the curve itself is complex.

Thus instead of attempting to apply complex shocks to the direct production curve you have a very elegant out to move your functional form to a bezier and concentrate on the control points and even more beautiful is you can assign simple economic/technical etc etc real physical quantities to these points. They are not theoretical but map directly to the underlying economics. Thus these parametric equations are the true solution for resource extraction not constrained but fundamental constraints of scarcity.

Until they fail :)

Now given this its trivial to assign the most important controlling factors for as long as this equation holds.

Ours are as follows.

1.) Demand or economic side.

2.) Spare capacity i.e supply is ample given a price.

3.) Technical advancement ensuring spare capacity remains in the system.

Now I'll just jump to the conclusion its obvious that as long as the economy or demand side is revved that demand for oil across a wide range of price points remains ample. We know this happened because or economy is based on infinite growth certainly we had recessions so its not perfectly vertical but the demand side is a upward moving control point that wiggles and from historical data flattens its trajectory over time.

The technical control point is similar wiggling upwards and flattening. To use a example these are creaming curves if you will.

The spare capacity curve is the only one really tied tightly to geology and it moves as a guassian peaking then declining over time however its a very fat curve with wiggles itself at the top maybe a sort of rounded square wave with a wiggly top is a better description. Its actually the least defined curve we have as on the production side we only see what was produced not the height of the curve. The control point is a complex function of spare capacity not the absolute value as it need only be sufficient to ensure that any shortfall in demand can quickly be remedied by bringing existing capacity on line long enough for the other control points to not diverge from their trajectories. Of course sometimes this failed to happen and we have our oil shocks.

Whats important to recgonize however is the intrinsic nature of the curve demand was being goosed and by holding oil off the market prices where kept artificially high. The reality is all along this curve oil was more expensive than it needed to be and expanding debt ensured we paid the price. However this came at a real cost as it allowed us to aggressively extract oil in advance of the natural price curve if you will.

What it did was keep the differential between extraction costs and net profits artificially high allowing all but the worst sources of oil to be extracted at agressive rates and the largasse and excess profits allowed subsidizing the research and underwrite the production costs.

Of course these control points have their own shocks and it was not perfect but in my opinion the shocks don't matter the entire system effectively had the pedal to the metal for decades. The forcing function is huge and if you write it in this form you can see that even though prices where kept nominally low the actual amount of force in the system from moving the control points using financial games is immense.

Not only is it not small but in fact the entire economic system itself developed to control the control points. They are one and the same.

How does this end ?

Well its fairly obvious because the amount we have over pushed the system is pretty much identical with the overall debt in the economy. This debt is in reality oil we stole from our children and their children well out into the future that debt is really oil that was burned before it should have been if the curve was symmetric.

Thus the result is obvious oil production and the financial system will collapse simultaneously until the pressure on oil production is removed and it reverts back to a simple function controlled by geology.

And we know we slammed through the critical control point which was spare production capacity. Once we did that its over we are toast now its just a matter of watching the collapse unfold. We blew out the least well defined control point in a spectacular fashion so its actual value is now zero feel free to draw the evolution of a bezier curve when a positive control point falls rapidly to zero.

Of course now this curve is not pure but interacts directly with the real production levels so we are already on a fundamentally different curve which is the backside collapse but the bezier actually works well during the initial decline and I'd argue a new virtual control point is forming as the economy replaces spare capacity with a more planned economy. Shocking it obviously failed as real production is crashing.

However we are so far over the edge it does not really matter.

I just realized that it might not be clear whats happening now.

However it should be blatantly obvious that TPTB have desperately tried to reintroduced spare capacity as a control point using any means possible including crashing the world economy. And it should be just as obvious that OPEC spare capacity is a myth.

Its gone for good. The myth won't last much longer.

Jeezus Mike...

That is a key insight.

This is my fear/suspicion as well though I don't think its overall debt, just excess debt in relation to natural capital (which is 50-80% of overall debt). I'm trying to internalize how this happened mechanically. I think the concept is hidden in the same way that our economic system doesn't get proper signals of long term scarcity via futures prices, which are essentially arbs between current prices and storage/interest. Look at NG and CL prices last few years - which price represents future reality? The "it's copasetic until it's not" dynamic could be a doozy. Also somewhat explains stealth EROI decline, something I suspect we'll never have a chance to prove..

The longer we stay in this central bank induced levitation the quicker we run out of spare capacity as well.

Nice hypothesis but too long and unfortunately unprovable until very late in game. I got surges of both dopamine and stress hormones reading your comment. I hope some math folks here can assess possible use of Bezier curve which is over my head.

**Edit: I'd recommend parsing your comment into 2 paragraphs as best as possible -most folks won't be able to read through your comment

Details :)

No its a very broad brush and see my reply to Euan the cold war played a huge role in why the system was set up the way it was.

The only question is who really lost the cold war as near as I can tell it was our entire planet that eventually will become losers. The Chinese part of the game is fascinating I'm not sure that they will be willing to quit when we tell them its time for them to stop playing.

In fact the role Asia and Europe play as supporting partners in the cold war is itself fascinating.

Now that its over the former bit players are a bit of and issue.

Esp given we seem to have managed to run out of oil in the process :)

Its pretty awe inspiring that we reached the point that human warfare fought at a number of levels wrecked the global ecosystem and stripped the planet of resources. Never before in history has this been accomplished and hopefully it won't be repeated.

And what I find even more amazing is how so many people bought into the situation I guess after decade and decade of war you don't really know what normal is. Theoretically the "war" has been going on for almost 200 years at one level or another no wonder we can't really see what we have done. Its morphed over this time period but the intrinsic driving force of permanent war based economics has been the new normal for a very long time.

No wonder people have a hard time grasping what happens when its over and we can no longer rape the planet to support this economic model of continuous war and permanent war style economies.

We simply don't know anything else.

One more thing Nate. As technology advanced the intrinsic economy was very deflationary i.e prices should have fallen steadily for all goods and services and real wealth steadily increased. The need for debt financing should have fallen overtime as wealth accumulated. This is assuming steady exploitation of natural resources.

Even a move to renewables would have simply transitioned the economy to accumulate wealth in a more stable way.

This is the future that was seen in the 1920's and again in the 1950's. So the baseline economy actually drifts steadily downward overtime so the debt load was on top of this natural deflation.

Hopefully that gives you a idea of how much the real push was it had to overcome the natural decline in debt and then some.

I think one of main reasons that the downslope is likely to be steeper than the upslope, is the impact of debt.

As production was increasing, there was more and more debt in the world system. This had a three-fold impact:

1. It tended to hold up oil prices, so that there was a greater margin between sales price and costs, leaving more funds for reinvestment.

2. The higher prices tended to make fields that were marginally economic, economic thus opening new areas for production.

3. Debt could be used directly to fund investment.

In the years ahead, the world economy is likely to be in decline. Based on my analysis, default rates are likely to rise, and debt is likely to be harder to obtain. The resulting drop in debt can be expected to bring down production, in pretty much the opposite way that increasing debt increased production:

1 and 2. With less debt, demand will be lower, thereby lowering the price. Some fields may be rendered non-economic. Other may still be produced, but will generate a lower profit, to be plowed back into reinvestment.

3. With less debt, it will be difficult to borrow for new investment.

I agree completely but there is another side to this.

First consumer debt i.e easy debt for consumers helped keep the demand side high from personal debt to consumers in developed countries to the famous national debt often defaulted on in third world countries.

So the debt engine worked for both production and consumption.

Next the National Oil companies setting on infrastructure and relatively cheap to produce oil held back existing capacity to support prices and also and over the long run where slow to invest in replacing much less expanding capacity taking most of the profits of the NOC's. They also benefited from high priced oil while the bring online of marginal reserves generally off shore where profitable they also dampened the desire to invest back in the infrastructure in the NOC's. Thus the cheap oil or easy oil was metered out with significant substitution from more expensive sources. From time to time of course above ground events resulted in a flood of oil and collapse of prices but we can save these for a later time. Its obvious that if you simply ignore the mounting debt that everyone was a winner over the short term which lasted for decades.

Whats important about the periodic flooding of the market with oil and price collapses is it shows that this claim that oil was actually not cheap but significantly overpriced vs real supply is true. Sure it was often only 20-30 a barrel but if you where going at maximum capacity it would have really been 10 dollars a barrel thus for decades we paid and artificial 50% or more premium for oil. Now why was it considered cheap ???

Well inflationary forces aka our debt money machine was driving up debt and the illusion of wealth at a furious rate.

Overall if you look at capacity not production you see the real situation as one very long smeared out period starting at some point in the 1980's into the 2000's. Actual production levels had more to do with the interplay of global economics and politics than any intrinsic capability to produce oil as in general at least 2mbd or more of drilled ready to tap capacity was shut off at even given time.

This artificial situation is in my opinion one of key drivers of oil production for several decades.

The mistake that was made by most was assuming that because the NOC's where not maximizing production like the public companies was that at any point in time you could just jump in and dramatically boost production.

The truth is year end and year out the fields were steadily being depleted and although the investment rate was slower it was far from zero just because it was not done at a furious pace leveraging debt does not mean they stood still. They did what was needed to keep production relatively flat to slightly growing against the underlying depletion curve. They were not quite the turtles predicted. For example Pemex gets slammed all the time for lack of investment yet they put in a state of the art nitrogen injection system into Cantrell to keep production up. Its all relative and the freely flowing debt distorted the situation dramatically.

Ignoring for a moment the claims of large reserves I leave it to the reader to deduce how this race between the tortise and the hare ends when the debt driver fails to produce more oil. How much oil is left when the race is over and spare capacity is zero and dramatically rising production costs erode profit margins ?

I'll give you a hint 50% will be marked incorrect without looking at your reasoning as its certainly the wrong answer. And another hint more than 50% could theoretically be correct there is a reason for the industry claims. We only know beyond a shadow of a doubt that 50% is wrong.

I don't recall stating any facts, unlike you. Please provide the backup data to support such a sweeping claim as the one boxed above.

Personally I don't believe you have a clue about what you are talking about.

€

PS I've read on a bit further form the quote above and now know you haven't a clue what you are talking about.

LOL well probably the very first thing you need to do is forget completely about oil and think about why things are the way they are. Oil was and is a tool and the real driving force for a long time was the cold war.

With any war you have little choice but to ensure and overall planned economy to drive the war machine.

Given the stalemate caused by nuclear weapons the war moved to other less effective means of fighting.

This war set up the economic environment and structure that continued past the fall of the soviet union.

With any war a lot of dubious decisions where made along the way to win.

Whats interesting is how this military industrial complex smoothly morphed to fight a drug war and a war on terror and of course always the Iranians a secondary enemy through most of it.

Once you get that part i.e why the economic structure was created then you look at how oil fits into it.

And fit it does.

Look at it this way during most of the period the world had significant spare capacity for oil production. Obviously at any point if this capacity was brought online oil prices would crash. The amount of spare capacity actually needed to crash oil prices is almost trivial 500kbd of excess production would quickly overwhelm our oil support infrastructure until the economy grew to absorb it. 1mbd or more is devastating.

This is a critical knob to turn in a planned economy and the ability to turn this knob is what really supported the creation of the fiat currencies in the first place.

Eventually although it took a while this structure succeeded in its the entire reason for its creation which was the destruction of the Soviet Union. After this of course its had a hard time finding a valid enemy to carry on the fight and I suspect its ravaged our oil reserves in the process but its mission accomplished so who cares. We should have demobilized after 1990 but for whatever reason the system took on a life of its own and was at that point unstoppable. We chose freely to continue on war footing since we had profited handsomely in the process. All I'm saying is eventually we lost the ability to control the oil supply getting us where we are today. I can guess that the system continued because of the rogue states of Iran and North Korea and of course our self made rogue states such as Iraq. Regardless its history now.

Hold on a second Euan,

Please have a glass of your favorite Yeasty Beverage to jumpstart a synaptic wildfire, do the half-glass Peakoil Shoutout, then deeply ponder where Memmel is trying to take us in Advanced Modeling.

The 'peak & decline model' is very hard, no, it's Damn Hard to visualize and/or describe, but I think it has some merit and future utility. WHT, Memmel, my Rogue Wave Theory, plus other TODers have been thrashing this possible sharkfin model out for some time, but progress is very, very slow.

IMO, Memmel is trying to math describe/refine the many components of Sam Foucher's [Khebab] Large Seventh Loglet somehow, so that all of us can get an intuitive feel for the downslope path. It is going to take some real math & statistical wizardry to flog this dog.

You even mentioned this as a huge concern of Yours:

http://www.theoildrum.com/comments/2006/9/3/113719/7594/63

-----------------

Euan Mearns on September 9, 2006 - 10:39am

I too think Khebab's work is great - has he got this 100% right yet - I think he may be getting pretty close. I find it very useful to see different approaches and iterations of the data - but I lack intuitive feel for why the big loglet should be telling the truth - more on that later...

-----------------

Maybe your math-proficient son [kudos to him!] can help you understand what new modeling advances Memmel & WHT are striving for.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

edit: Memmel & WHT, please correct me if wrong as I don't seek to put words in your mouths. I just think we are trying to figure out some method to incorporate below ground tech advances & above ground politics to figure out what % of the 7th-loglet is realistic and what % is juiced upward to raise production earlier; ie, left-shifted, then faster decline thereafter. I sure wish I had the math chops to pursue this further.

I would be curious to see Memmel's math myself. I know he has a theory but I have never seen the direct evidence. I would like the chance to help work out the details or review his model, but the charts he shows are usually from indirect sources that I don't think he authored. He might have it all worked out in his head, and if that is the case, all the power to him -- but conventional math does involve putting symbols or plotting charts on a piece of paper. Putting the ideas down on paper is the key, just like Euan's son has so professionally done.

To both as I was writing the post it hit me that control points for drawing complex curves and Web's shocks where the same thing mathematically. Both push and pull the underlying curve.

The problem or the difference is really a matter of which variables your watching. Getting the shocks right for oil is esp if you try to include technical advances etc etc is a nigh impossible task.

I haven't done any math because modeling the shocks with real values is for all pratical purposes impossible.

What is the magnitude of a "technology shock" ?????

I have rough guesses that are alarming but there just that rough ball park figures that seem about right.

However if you think about control points of a complex curve moving overtime following a very simple basic function. I.e creaming curves or more likely their own dispersive forces then you can model them.

The key is the time evolution of the control points can be fairly simple yet the curve itself looks complex and defies direct anaylsis.

Instead of shocks you have simple continous curves for the control points with some noise and coupling equations and of course the shocks are still there but they are shocks on the control points which then move on the basis of there coupling equations.

But all these control points really are are economic/technical variables with the addition of spare capacity which ties them to the physical world.

One is GDP/Debt per capita

One is Technology

One is spare capacity.

Two move in a simple arc and spare capacity is a sort of very fat guassian or rounded square wave.

The coupling is not super tight i.e there is "slack" and oil production moves up and down as these variable evolve.

Probably the most important thing to realize is oil was not actually cheap !

A significant amount of oil was held of the market for a long time for various reasons keeping the price of oil artifically high. Starting from when texas was a swing producer on till KSA took over the role the price of oil was kept artificially high for decades. The various above ground events like the embargo and Iran/Iraq war etc etc also boosted the price as shocks but even the base price was significantly elevated.

As far as I can tell only two times was oil released on the market at its natural flow rate up until recently the double shock coincided with the end of the soviet union right when they peaked.

That was and act of economic war not a coincidence.

Keeping the price artificially high allowed early exploitation of resources such as Alaska and the North Sea which would have simply not been economic at the time if oil had been allowed to flow freely.

There is a lot more but the role of the swing producer is critical in the paremetric model as physial oil really only enters directly there aka they have significant control over price which is the economic variable. Technology driven by artificially high prices puts a upper bound on the price but its a weaker connection.

Sure discovery etc play a role but in a system with a serious amount of spar capacity generally held offline they whole system is warped away from fundamentals.

My best guess is oil probably should have been around 5-10 dollars a barrel for several decades into the 1990's probably before it even started rising in price. More and more aggresive technical approaches would have been put in place as it rose past 20-30 a barrel. And of course this is hard to describe because overall the economy would have been growing but with monetary deflation not inflation.

A purely natural production curve and naturally advancing economy would have behaved very differently.

Right now my only real question is what the heck are the units on these control points. Economic potential barrels ?

Do you simply convert GDP to barrels of oil at the prevailing inflation price at the time ?

And its not just GDP but debt and the growth rate i.e I don't think the economic controller is the GDP itself perse but the rate of change.

What is the "GDP" equivalent to a barrel of oil. Obviously we take it out of the ground burn it up and make stuff but what is that measurement ? Is it really just the headling GDP I don't think so because that also bring in debt and inflation which is wrong since the growth in natural wealth is based on what we do with a barrel of oil to create products. Plastic in a computer or car is intrinsically more valuable because of the product its in than a cheap plastic garbage can or toy.

The point is the embodied energy of oil is related to the GDP outside of its physical energy content and or its use in materials. Or maybe not really.

These are questions for Mr Nate Hagens to answer if he is interested :)

Showing these are identical with the true direct shock model is the next step.

I have to show its just a simpler way to solve the shock model.

Its the same model but anyone that knows math knows coordinate conversions are immensely powerful

turning intractable problems into simple algebra. Effectively all this is is a slick change

of coordinates. The simple solvable trajectories of the control points gives a complex curve as their

relative relationships change over time. Yet the complex curve defies analysis.

There is a killer encryption algorithm sneaking into my brain as I write this :)

I bet I could use the same trick with some twists to make one hell of a encryption algo.

In fact as usual someone has probably beat me to it and this math is already embedded in someones

encryption algorithm.

Of course I had to look and as usual in Math I'm always the last one to the party :(

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B7RKT-4PJDVHM-1...

It should come as no surprise that the "real" solution to the oil problem is closely related to known encryption methods sniff thats why I hate math some other bastard figures it out first :(

The moment you see some simple way to generate a really complicated looking curve your playing encryption games.

At the moment I'm going to bask in the insight of using a parametrized curve and following the control points vs trying to directly model the complex production curve :)

Thats enough for today even my head hurts after a while :)

In the past I've said the shark fin curves result from the system lying about its state now I can restate this in a clearer way.

Its not really lying what it has done is encrypted itself via moving the true state of the system off to some external control variables that are impossible to deduce via simple measurement of the physical state of the system. In effect systems that follow a collapse scenario undergo a natural or in this case man made encryption of their state. Certainly out right hiding the truth i.e the real state of OPEC and its reserves and spare capacity plays a role in this but as you can see to get real encryption a number of control variables are needed not just one. So instead of my very unscientific term of lying I can now say the system becomes self encrypted via the application of external control points.

This suggest that a investigation of converting the logistic to bezier form should be instructive.

http://mathworld.wolfram.com/LogisticEquation.html

Thats trivial but what would be the physical values assigned to the control points in this case ??

Same problem as above I see in a general way what they are but taking this simple function what are the units if you will you need to assign to the control points ?

Its not obvious to me yet what they are we don't have and esoteric economic model to identify the units.

Obviously they are a sort of money/wealth in a sense but what does that mean ?

And this is basically a static problem at first glance the control points are fixed to generate a logistic curve they are not even moving. You need a bit harder problem to really see their meaning.

In any case it seems they are effectively a measure of wealth/money or resources etc so the basic idea seems sound. So instructive but to trivial hmmm.

Egad, a reference to Wolfram. I was talking to a coworker today about Stephen Wolfram and he said the first chapter of Wolfram's famous book was all about himself. Apparently his ego is so big his head can't fit through a normal sized door.

His site does have a useful interactive symbolic integral solver though.

Affine transformations and parametric substitutions are my secret weapons. Everyone is totally hung up on the Logistic as a solution of a differential equation. Not the case, as the exponential search is actually a parametric substitution into a generalized growth function. The Verhulst equation drops out of this as a curious yet completely coincidental mathematical identity that has turned into the biggest canard and red herring since Hitchcock stopped making films.

Egads I got the same result :)

Yeah with the way I'm looking at it now its obviously wrong and not important. I just used it as a simple example and your exactly right its of no interest :)

Well my track record of rediscovering something someone else already knows remains intact :)

I seriously thought once of starting my own journal that only published independent discoveries of algorithms that had been known for hundreds of years for poor saps like me :)

However since your really already doing this it sounds like why convert to shocks what I'm saying is leave it in parametric form and associate the control points with physical parameters as apposed to conversion to shocks. Not that you can't do the conversion its just for me at least staying in parametric form seems a lot more powerful. I'm not surprised I'm just following in your footsteps on this but I hope this different viewpoint works.

Btw I already worked out the general solution for oil its three bezier curves.

The initial one is logistic like yes I know you hate it but the logistic along with a bazillion other growth curves fit it I'll just use logistic here since at least people have a understanding of it.

Its impossible to fit a single bezier past 1980 you can't do it and in fact you have to introduce a new bezier to describe the evolution of production this "proves" that two functions at a minimum are required to fit world oil production. Or in effect only the shock model is valid of the existing models since it is effectively identical to using multiple bezier's to fit.

Now this second curve I'm calling the economic growth curve and Nate can pull a ton of charts clearly showing how all the economic data has all kinds of inflections around 1980 its slam through every single piece of economic data we have.

Now of course this is a sort of gently rising curve the exact shape is not that important at the moment what matters is it heads off to infinity so any fit of the post 1980 data give a result that goes to infinity exactly like our economic model does. Like I said they are effectively one in the same.

Obviously this is not physical so you have to finally introduce one more bezier to get the decline side so no matter what eventually geologic peak will force oil production down.

Now of course this curve at first has no constraints except it goes to zero at infinity as apposed to infinitiy at infinity.

However you can quickly rule out results that say require more oil than the entire mass of the earth etc etc.

Next a lot of them that are even remotely close to physical require a total URR or area of 3T-4T barrels i.e almost all the smooth decliners generally need us to be below 50% URR right now to fit.

Next we assume your right and the finaly profile has a fat tail i.e a lot of future production is in a long fat tail we can think about that later but for tons and tons of reasons it makes a lot of sense for oil production to probably remain over say 15mbd for decades to come 30mbd for a while also makes a lot of sense.

So we eliminate any solutions without a fat tail.

Now however we have a bit of a dilema the problem is these fat tails move a lot of the total URR out into fairly low levels of production for decades assuming we are at least at 50% URR or the best case is symmetric then we have at most 1T barrels to partition in the tail. At least 500GB or more is in the tail region so to finish the decline curve you have to close the gap between current production levels and your fat tail.

Obviously you know what I use to close the gap a basically strait line :)

However I think this way of viewing it is very consistent with the shock model and also allows you the freedom to discuss constraints on the parametrized form without getting into the physical shock problem.

Your free to drop out the required shocks as needed to see if they are sensible. And it looks like I have a todo of converting between the two forms and I'm sure you already know how :)

But you can see how using this method we can fairly easily focus on the interesting part which is how to close the infinite economic curve and how many solutions make physical sense. Then your left eliminating

these down to a small set.

I think the price curve also comes into play to i.e you should be able to generate or incorporate price using this parametric form. But simply agreeing to two curves for the production up till lets say 2000 and ??? for a few decades followed by a fat tail is a good place to start. The economic data itself suggests another transition starting sometime after 2000 so from there until your in the fat tail region the right answer is probably wide open. The double peak of the stock market and massive expansion of debt alone singles the onset of the possible need to generate the post peak curve and fit as infinite economics was already failing at this point. It could be two but just nailing one would be a feat.

And last but not least by elimination of the need to generate the physical shock directly I feel I gain a lot of freedom in using ill defined shocks that I drop out as a solution instead of trying to do them from first principals like you do. Its just to hard for me :)

Please show or link to your results. I appreciate being able to use a second approach as a verification.

...

Same request, could you please show or graph some of your results?

...

When you say this, it sounds like you are actually doing more of a hand-waving exercise than anything else. If you don't start from some first-principles foundation I can imagine any arbitrary fundtion that will run through the points on a curve.

Thats the problem you can't construct very many shocks from first principals.

Construct a technology shock or deduce the effect of horizontal drilling or 4D seismic on oil production then your right if your model is unable to define these shocks then its not good enough. Sure you can add some shock and call it the technology shock but prove you formulated it correctly i.e your shock was derived from first principals. Horizontal drilling adds lets so 20% to reserves as it allows access to oil that could not be produced by other methods. How do you know ? Certainly initial production rates are higher for horizontal wells vs and individual vertical but what about one horizontal vs 10 verticals ? Any attempt to include how the oil industry has matured overtime as a fundamental shock is handwaving.

That does not invalidate the shock model its the correct fundamental model but without being able to easily include factors that may be important to the overall evolution of oil production its utility is limited.

Heuristics like HL are also obviously limited and arguably more error prone multi curve HL as presented in this paper probably compounds the errors intrinsic in HL in the first place. The obvious one for example of and end to discovery and the steady loss of production from shutin wells is not included in HL in effect its assuming a very steady discovery curve. I'm not going to go into all the problems with the method your well aware but my point is its limited.

Now to step away from "science" and move to engineering generally if your confronted with a problem thats not readily solved via first principals you develop a set of equations which although wrong i.e the fail at certain limits are correct within the bounds of the problem even if they need to bring in fictional forces which in truth don't exist. You find a way thats good enough. This engineering handwaving approach has turned out to be very useful.

Its great to have a good fundamental model aka the shock model I'm happy to have it. Without it I would be unwilling to even attempt handwaving but given the shock model and the fact its difficult to formulate the correct solution from first principals then its sensible to create a "handwaving" solution that is more flexible and can be recast into the shock model. This means guess first and then solve for the shocks.

How do you generate a set of equations that allows you to effectively solve for the shocks in the shock model ?

Intrinsically all I'm saying is that parametric curves can be used noting that the control points can be mapped to a sort of dimensionaless force or one of unknown dimension thus they can be mapped onto external parameters aka money or finance. This generates a curve thats simply scaled to overlap the resulting production curve. Nothing magic its "handwaving" as you say but its handwaving using a real system constraint thats practically impossible to model via first principals. Given the shock is in terms of physical oil its easy enough to see if its valid i.e possible given the underlying assumptions of dispersive discovery. If the synthetic shock is reasonable using the data and if the constraints are reasonable the its a good guess at a hard to define from first principals shock.

Better to do a bit of handwaving then to simply drop a term you can't define and can't even put a magnitude on. Trying to directly use the shock model to formulate shocks for complex economic conditions offers no easy way to even bound the shock even if you figure out a way to convert some economic number to oil.

Heck you can't even easily show the impact of Chinese coal consumption on overall increase in oil demand subsidized for coal or for the US via natural gas. I.e substitutions for oil over the last several decades have replaced many former uses for oil and still allowed demand for higher prices oil to be robust.

The substitution of coal and NG for oil in electrical and industrial usage is certainly not small yet completely missing from your shock model because its difficult to determine.

Before you completely give me hell for resorting to tricks to figure these out show me the shock model with substitution effects correctly integrated.

I looked on your site and unless it buried not once do you ever consider if something as simple as substitution has and effect on oil production and if so what that effect is. And here we have a trivial conversion using BTU's or boe to oil. The relationship is very simple.

I should have known you would post a post like this its typical and yet I still treat the shock model as the holy grail since its correct. But if nothing else before you attack me consider you have not even brought in some very basic issues. At the very least show me how you include substitution effects.

And yes its trivial to show they are important as simple example is take a resource that becomes scarce that has a perfect cheaper and more abundant substitute the future production of the first resource is directly impacted by the availability of the substitute ignoring it is not and option. Its a real shock and cannot be dropped simply because you chose not to model it.

Perturbing the discovery curve with minor short term economic shocks is simply not good enough there are other larger terms that are valid and need to be brought into the model.

In this case since you have chosen to take the high and mighty route at the minimum answer my concerns about substitution then we can discuss further if your unwilling fine but before we can even discuss what I'm trying to do lets focus on one issue thats amendable to both approaches.

You of course don't have to do anything but given your post lets start poking some holes in the shock model as formulated by all of your posts that I can find. Starting with substition show me how the term can be simply dropped given you never included it.

WHT, Memmel, Euan, Sam,

I sure hope some Hari Seldon types in the NSA/CIA, Sandia & Livermore, etc, can weigh in here to help kick this can down the road, or please go to WHT's blog to help clue him in on possible math paths. Yep, encryption, packet sending/receiving/analysis, and other esoteric skills could be off great value in this discussion to help weld some equations, error bars, and other values to the Loglets and Shock Modeling, plus maybe help kickoff modeling in a new direction.

From Sam's earlier keypost:

http://www.theoildrum.com/story/2006/9/3/113719/7594

----------------------

The Loglet Analysis

Posted by Sam Foucher on September 7, 2006 - 9:37am

..One Loglet [the Seventh] dominates the production and contains nearly 73% of the total URR and is due to peak in 2012 (see Fig. 3). The rest of the contributions come from 6 Loglets and has peaked in 1975. I wonder if this component represents the early "easy oil" from the super-giant fields.

...Compared to other curve fitting results (Fig. 4 below), the Loglets give a better result on the left side but is much more pessimistic on the production decline...

http://www.theoildrum.com/uploads/28/predictions.png

----------------------------

As Memmel mentioned upthread: essentially two halves to oil production so we might need two or more models combined to delineate the whole of Hubbert, especially for reasonable predictive probabilities for the downslope. So let's say the Six Loglets do a fairly good job of the tracking the easy-oil upslope; a smooth math Foundation of Predictive Growth & Directed Advance.