Peak Oil Not a Problem According to NY Times; Scientific American - Our Response on the Financial Aspects

Posted by Gail the Actuary on September 26, 2009 - 10:40am

Recently, we have had two new articles aiming to put to rest people's fears about peak oil. One is from the New York Times:

Oil Industry Sets a Brisk Pace of New Discoveries

It talks about the many discoveries this year, and how, if they continue at the pace they have in the first half, they will be the best since 2000.

The other is from the October Scientific American, called

Squeezing More Oil from the Ground.

It is behind a pay wall (you can get it for $5.95). There is also a draft version available on line. Its premise seems to be that there are a lot of promising areas that we have not yet explored. When you put this together with advances in drilling and the promises of secondary and tertiary recovery, there is a good chance that oil production will not peak for many years.

In this post, we will look a little more at these articles, and see why peak oil, and perhaps the financial issues associated with peak oil, are still an issue, regardless of what these articles may suggest.

New York Times Article

A few excerpts from Oil Industry Sets a Brisk Pace of New Discoveries

NY Times:

It is normal for companies to discover billions of barrels of new oil every year, but this year’s pace is unusually brisk. New oil discoveries have totaled about 10 billion barrels in the first half of the year, according to IHS Cambridge Energy Research Associates. If discoveries continue at that pace through year-end, they are likely to reach the highest level since 2000.

Two times 10 billion barrels of oil is 20 billion barrels of oil. Twenty billion barrels of oil divided by 365 is only 54.8 million barrels a day--not nearly enough, if we are currently using 72 million barrels of crude oil a day. If 10 billion barrels is an unusually large amount in the first half, the likelihood of having equal success in the second half by luck is not very good.

NY Times:

While recent years have featured speculation about a coming peak and subsequent decline in oil production, people in the industry say there is still plenty of oil in the ground, especially beneath the ocean floor, even if finding and extracting it is becoming harder. They say that prices and the pace of technological improvement remain the principal factors governing oil production capacity.

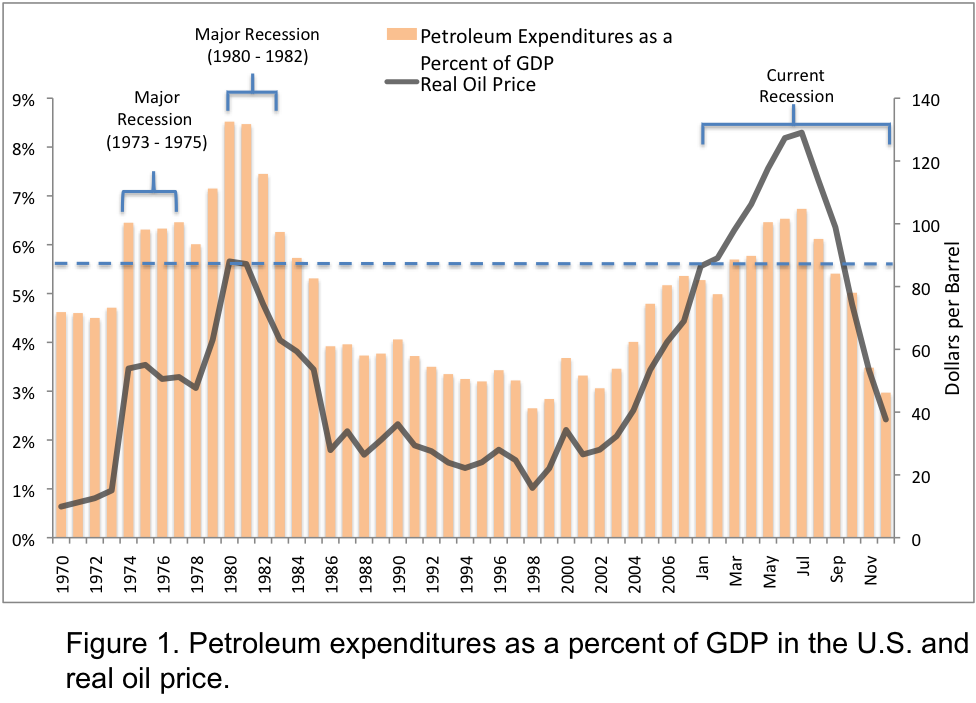

There are a lot of issues with difficult to extract oil beneath the ocean floor. While it is theoretically possible for the oil price to be high enough to extract this oil, there is a real issue with too high an oil price (resulting in wholesale oil costs of over 4% of GDP) causing a major recession. Currently, such an oil price is about $80 per barrel. So it is not clear that prices can go enough higher, and stay enough higher, for extraction.

The more difficult to extract oil also has severe challenges in terms of the amount of up front investment needed, and the long time delay before it will actually come to market. For the new very deep ocean "finds', it could be 10 years or more before we will actually get the oil extracted. By then, our oil needs, if economies continue to grow, will be much higher than today.

NY Times:

Since the early 1980s, discoveries have failed to keep up with the global rate of oil consumption, which last year reached 31 billion barrels of oil. Instead, companies have managed to expand production by finding new ways of getting more oil out of existing fields, or producing oil through unconventional sources, like Canada’s tar sands or heavy oil in Venezuela.

Companies haven't managed to expand production. Crude oil production has been on a plateau since 2005. That is the problem.

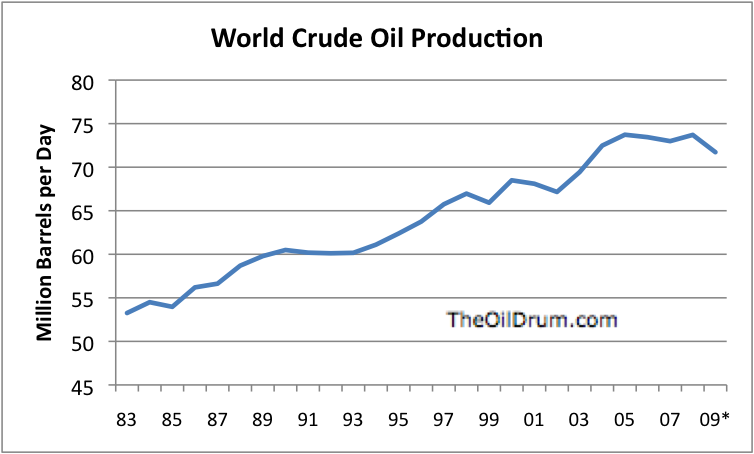

In Figure 1, note that oil production has not risen significantly since 2005. This happened, despite rising prices.

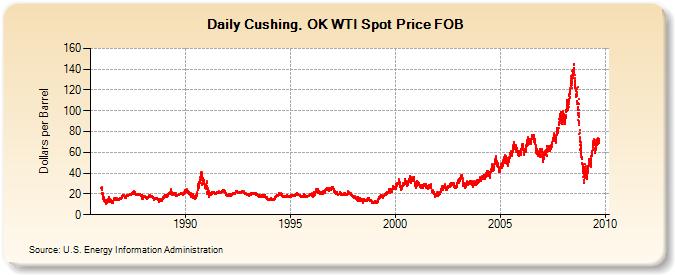

In Figure 2, note that even when oil prices rose far above their historical average price of $20 barrel in the 2003 to 2008 period, oil production in Figure 1 rose very little--virtually none after 2005. In fact, it was the lack of rise in production that was a major driver of higher prices.

When prices finally dropped, there is significant evidence that it was related to high oil prices indirectly causing problems with credit markets.

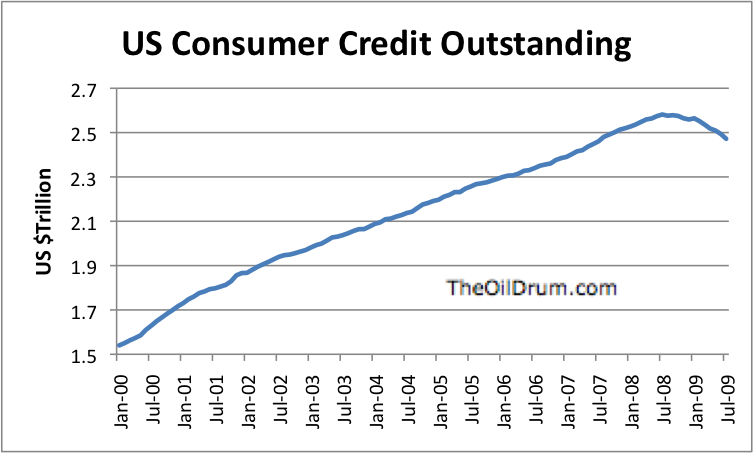

In Figure 3, note that US consumer credit reached its peak in July 2008, precisely the same month oil prices reached their peak. Once credit started contracting, purchase of goods that required oil in their manufacture (such as cars) dropped. The drop in oil price reflected the inability of purchasers to continue buying products that used oil in their manufacture. If credit had continued to expand, it is possible oil prices would have continued to rise further, but still with virtually no increase in oil supply.

NY Times:

Reserve estimates typically rise over the life of a field, which can often be productive for decades, as companies find new ways of getting more oil out of the ground.

Maybe, maybe not. We don't have very good knowledge of reserves around the world. In many places, particularly the Middle East, the reserves seem to be quite inflated. If reserve estimates are starting out from an inflated base, it is doubtful they will increase. They may still be overstated, even with huge improvements in technology.

One of the big issues is whether new technology can be implemented cheaply enough to keep the prices to a level that the consumer can afford. If new technology can only be implemented at $150 a barrel, and the economy starts crashing at $80 or $90 barrel, the new technology really may not be all that useful.

NY Times:

"The industry’s record has improved in recent years, thanks to high prices. According to Cambridge Energy Research Associates, oil companies have found more oil than they produced for the last two years through a combination of exploration and field expansions.

This comment is strange. Cambridge Energy Research Associates (CERA) is part of IHS, and IHS was quoted as saying:

In 2008, world oil reserves declined nearly 3%, primarily due to a 5.2 billion bbl decline in revisions that stemmed from reduced commodity prices.

World oil reserves (excluding oil sands) were 1,261 billion barrels at the end of 2007, according to British Petroleum. A 3% decline would amount to about 38 billion barrels--more than the 20 billion barrels hoped for this year in new discoveries.

Another question is how a 5.2 billion barrel decline (from reduced commodity prices, as stated by IHS) could cause most of this decrease, if we are talking about a $30+ billion decrease. One wonders whether the IHS statement really was intended to apply to some subset of world oil reserves. Perhaps the CERA statement should also be interpreted to apply to some subset of world reserves. It is possible the CERA statement about reserve replacement may also apply to oil and gas reserves on a combined basis, since companies generally give their oil and gas reserves on a combined "barrel of oil equivalent" basis.

These quotes regarding reserves illustrate how difficult it is to interpret statements found in newspapers about reserves. The reporters often don't understand quite what they are talking about, so the quote doesn't quite get all of the specifics needed to understand what is being described. If someone wants reserve replacement to sound favorable, he or she can often find a way to word the statement so it sounds good, whether or not the details really add up to an increase.

Price is important in all of this. If the price of oil isn't high enough, reserves may not be developed. But if the price of oil is too high, it may sink the economy, and the reserves still may not be developed.

Scientific American Article

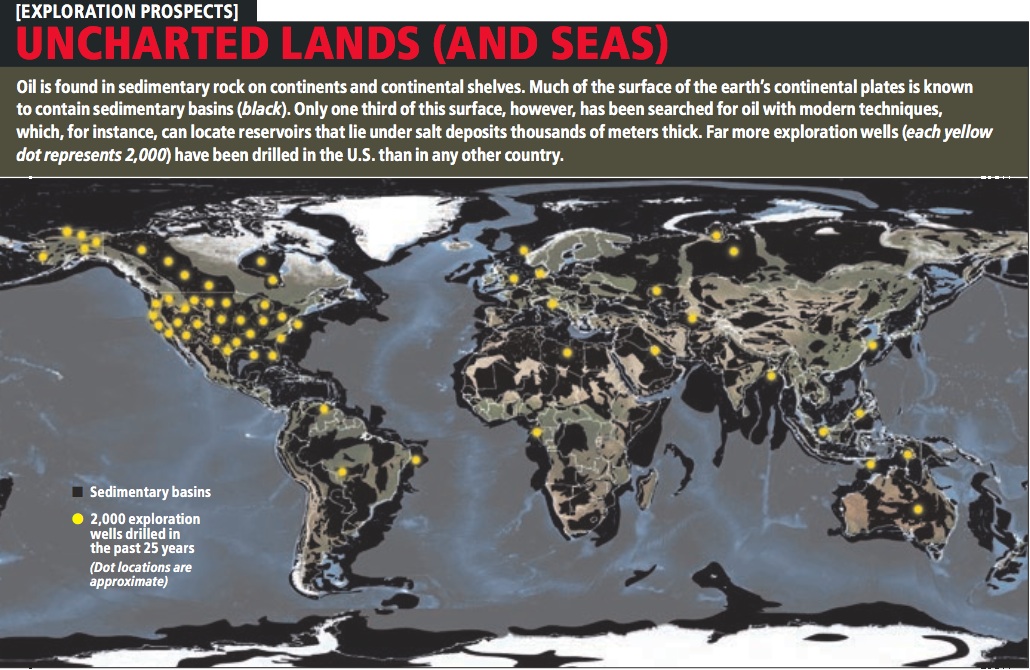

This graphic alleges that much of the world's oil deposits have not adequately been explored with modern technology. It seems to me that one doesn't really need modern technology to get at large reservoirs in easy to reach locations. It is only when one is looking for either very small deposits, or deposits in locations that are difficult to extract from that modern technology really is needed. We aren't likely to find any more Saudi Arabias, whether or not we have fancy new equipment.

The issue that arises with deposits that are in difficult to reach locations, like thousands of feet under the sea, and then under a salt dome as well, is that the oil found in those locations is almost always very expensive to extract. It is hard to believe that even with new technologies that will change--it is the location that makes oil extraction so difficult. New technology may make extraction a little easier, but it is still likely to be expensive.

Scientific American also has a graphic on tertiary recovery techniques. It says:

After primary and secondary recovery have run their course, more aggressive methods, some of them still experimental, can soften the remaining oil so it can flow toward the wells. Because these advanced methods are expensive, the battle to get more out only gets this fierce when resale prices are sufficiently high.

incendiary

Burning part of a reservoir (which requires injecting air underground) enhances the recovery rate in three ways. First, heat from the fire makes oil less viscous. Second, the combustion produces carbon dioxide, which pushes oil out. Third, the fire breaks the larger and heavier molecules of oil, making it more mobile.Chemical

Substances called surfactants, injected into a reservoir, help oil detach from the rock and flow better. Layers of surfactant engulf oil into droplets, similar to the way ordinary soap washes oily materials off a surface. A variation consists of injecting chemicals that generate the soaplike materials from components present within the oil itself.Biological

Experiments are testing the injection of bacteria (together with nutrients and, in some cases, oxygen) that grow in the interface between the oil and the rock, helping to release the oil. The bacteria are allowed to grow for several days before recovery resumes. In the future, genetically engineered microorganisms could partially digest the most viscous oil and thin it out.

Here again, the issue is price. Can these techniques be implemented cheaply enough that they can be used without raising the price of oil so high that the price is beyond what consumers can afford?

More on the Financial Issues Involved

Dave Murphy showed a graphic earlier this year that illustrated the relationship between oil prices and recession. In this graphic, Dave uses retail prices to determine his percentage of GDP. The threshold for retail oil prices seems to be about 5.5% of GDP (equivalent to 4% wholesale). The dollar per barrel cut off for causing a recession seems to be in the $80 to $90 barrel range.

It will be hard to maintain an oil price at a level that sends the US (and the world) into recession. While we usually think of oil production as being limited by geology, it seems to me that the weak link is really finances. What tends to happen is that when the price of oil gets very high, people change their purchasing patterns. People continue to buy oil products, because they need transportation to work. People also continue to buy food, and it also is a heavy user of oil. What people cut back on is expenses that can be deferred--buying a new larger house, buying a new car, going to a restaurant, contributions to charities.

This cutback in expenditures causes recessionary impacts. As things get worse, some debt holders start defaulting on their debt. This might be restaurant owners who have less business, and because of this can't pay their debt. It might be homeowners with long commutes, who cannot pay both their mortgage payments and the cost of gasoline for their long commutes. It might be governments who cannot collect enough taxes, because of dropping demand (and lower prices) for houses in their suburb. It might be a charity with lower contributions.

Eventually, the debt defaults result in a cut-back in credit like we saw in Figure 3, because of the adverse impact of the debt defaults on lenders. Once there is a cutback in credit, consumers are no longer able to purchase as many cars and other durable goods. These durable goods require oil in their manufacture. With fewer purchases of goods using oil in their manufacture, the demand for oil drops. Because of the drop in demand for oil, oil prices drop again, allowing the economy to recover a bit, as it is doing now.

But as the economy recovers, demand begins to grow again. With the rise in demand, oil prices are likely to rise again to a level where they have an adverse impact on the economy. The world economic system was damaged pretty badly with the last price spike. Another spike could have much more adverse results. Eventually, the world economy may become so damaged by oil price spikes that recovery of the world economy in the form we now know it may not be possible.

I don't know how this will work out. There could be huge international defaults. The result might be each country more on its own, with much less international trade, because countries would no longer trust each other for credit. Globalization could start unwinding.

How soon such a scenario would might occur is not certain, but it seems to me that a scenario like this, rather than the amount of reserves in the ground, is likely to determine how much oil is ultimately produced. Some countries may be able to keep up production for a while, even with a world financial crisis, but eventually oil producing companies are likely to run into barriers--parts they need for equipment that they cannot obtain, or lack of trained people to perform needed services (because such services were formerly done by an international trade partner).

It would be nice if there were a guarantee that came with oil reserves as currently reported that we really will be able to extract the oil that they represent. It seems to me this will be the case:

(1) If the world economy stays together,

(2) If the price of oil stays in a zone that is neither too high to crush the economy, nor too low to discourage the expensive investment needed for getting the oil out, and

(3) If there are enough investment dollars available, for the sizable front end investment required to produce the oil.

Those are three pretty big "if"s. Without them, it seems like oil production will be very difficult.

Thanks Gail. Heading Out has some comments also:

The NY Times is now so firmly in the Neville Chamberlain energy camp that is it difficult to see a way for them to back away from their position without looking foolish:

"I believe

it is peacethere will be no peak for our time. We thank you from the bottom of our hearts. And now I recommend you to go home and sleep quietly in your beds." (Amendment from Mr. Chamberlain's original comments in italics :)They should be ashamed.

When was the last time the NYT was of any use, about anything? It's very sad.

Bird cage liners. Late night commercials asking for you to subscribe. Oh, and paper burns well- might keep us warm post-peak. I hear that they have news, kind of like the internet but where someone will actually deliver it to your house a day later. How quaint.

Don't burn it - newspaper is a very good insulator. Just ask any of your local homeless people.

"Help! They Can't Find Any More Oil!" (Jay Yarow, the Green Sheet)..

.................................................

Really oil industry is unable to find more oil with used exploration technology.

http://binaryseismoem.weebly.com

Beliefs tend to linger on well past the point when they are no longer valid, and it takes a catastrophic collapse to really drive the point home. No conspiracy theory; these articles are just the reflection of the Western-industrial consciousness.

I think things will begin to unravel in a major way by 2011-12.

Some interesting stuff in there and I like the name: "Last_Historian" :o)

I was wondering if you had attempted to map out how westexes' ExportLandModel may impact the relationships between the powers in the coming decades -I can see ownership of energy resources being critical to ones position in the world as it rises in importance...

I think westexes is due to publish an update soon, keep an eye out for it.

Nick.

I was only looking ahead 5 or so years, so no.

Re- the Export Land Model,

Fortunately, domestic consumption is unlikely to rise, perhaps, if the rest of the world is in permanent recession due to the oil shock. An example would be Russia in 2009, where oil consumption actually fell (due to the GDP fall of c.8%) and exports increased during the economic crisis. This will remain the case until said oil exporters go autarkic, - which is a choice for big, powerful nations like Russia (and it will probably do so after 5 years or so when it really internalizes the reality of peak oil), but not smaller or weaker ones like Saudi Arabia (which is reliant on an outside power for basic security). These smaller and weaker oil exporters are, I think, going to come under the increasing domination of new empires built by the advanced industrial world.

Hello Last_Historian,

Fascinating blog, but I think you may not be aware of the strategic game changer of unmanned, remote controlled, small subs. Think of the UAV Predator, but underwater: silent, but listening; deathly still, but ready to attack on a moment's notice. Designed & controlled properly in sufficient numbers: the Iranians would not even be able to get a ship out of their harbors to lay mines or attack shipping in the Hormuz Strait. I discussed this years ago on TOD, maybe elsewhere too. If the subs are small enough: you could even send them far inland up rivers to monitor, then attack river ports.

Same goes for global sealane control if the US has enough minisubs in quantity: tell the cargo captains to sail these precise coordinates, or else he and his crew are fish-bait. You might only need 500 personnel [based on land in the US] to control 1,000 minisubs because most ships will follow their directions, thus the subs can just float beneath the surface on station. The subs only need to move for a storm when the surface ships are rerouted, or when a rogue ship tries to break from its designated sealane.

Thus, you might only need to recharge the sub-batteries and/or reload torpedoes every six months. Easy to do with a mothership sailing along with topside PVs to recharge the batt-packs for the swap function.

Imagine an enemy air force, low on fuel, trying to find, then destroy 1,000, or 2,000, or 3,000 or more minisubs in the ocean. You might as well tell them to find an equal number of specifically shaped snowflakes in a snowstorm.

A surface navy has a limited function, but a giant undersea navy of remote minisubs has an Unlimited function; it would quickly make most become land-lubbers. I have no idea how capable any Navy is in this deployment. My guess is that it would be highly classified info.

I'm not sure you have thought this through. The sea is not a benign or static environment. Salt water at high pressure is not an easy thing thing to keep out for long periods. Underwater tidal flows will prevent silent, low power 'hovering'. Especially in a narrow strait like Hormuz. You would be lucky to get a week's operation out of a battery pack.

Now, if you used UAV subs to lay thousands of intelligent bottom dwelling mines (or torpedo?) which could be activated remotely and only surface and explode when a matching sonar signal is overhead....

I'm sure the US has had such mines for several decades.

your right. ;)

On the other hand, though, German U-boats operating off of the US coast during WWII would just submerge to the floor of the contenintal shelf during the day and rest there, using minimal battery power. The subs under discussion could do the same, just surfacing when something was going on.

As for recharging the batteries, you could equip them with an engine, fuel tanks, and a snorkle, and they could operate just below the surface (except for the snorkle) long enough so that the engine could recharge the batteries. Or equip it with PV panels that can be deployed when it surfaces every so often, and fold up when it dives. With those, these things could remain in operation for a very long time.

As for your issues about operating under high-pressure salt water, I would think that the fact that these vessels would be much smaller than conventional manned subs would make a difference in how they are engineered and built. Besides, they might not have to go all that deep; being small, they would be harder to detect in any case.

You might be surprised at how small a surface object radar can paint. Now what the air war situation might be in such a scenario is a whole notha ? But I would assume that the guys that had the little subs would also have air superiority. Interesting speculations though.

The IR and radar signature of a snorkel can be quite large, yes. It would be trickier to catch something on an unmanned autonomous mini-sub that is basically an engine and weapons and sensor suite, but I imagine stealth isn't the issue anyway. You don't move these things to an area in a vacuum, and their threat works better than being used for the time being.

True True another military guy?

Very interesting.. although I suspect that communication would be a major issue. Continuous communication means being close enough to the surface to be noticeable, especially if you are using 2-way communication.

You could of course build dummy minisubs that just followed a predetermined patrol, and have solar cell 'streamers' that could randomise the shape as seen from the air, and help with recharge.

Of course, you can also defeat such a system by replying with motor boats - anything small enough to be impossible to torpedo. And nets work perfectly well to protect most rivers..

So, assuming I had control over the airspace (otherwise you don't need minisubs!), I'd use aircraft to try and detect signals, using jamming to try and break contact, then listening for transmissions to try and get locations. Small patrol craft could then home in to get kills.

Actually, the more I think about it, the more it seems more of a thereoetical problem. If you control the airspace you don't really need a swarm of minisubs. If you don't control the airspace then you have real issues trying to control and use your subs (how do they even detect targets? Passive sonar? Let alone confirm..)

So on second thoughts they don't seem a lot of use..

I have to agree. Salt water makes for a poor medium for high-speed communications links. Communication would be limited to very low frequency signals -- information can travel over the link only very, very slowly. You can make some pretty sophisticated torpedo systems, but an autonomous sub is a very difficult AI problem.

The predator aircraft are just an advanced RC plane. Don't think you can have the same kind of remote control reliability for underwater subs.

Toto,

Tou don't know how much your Buck Rogers inventions cheer me up!

:)

That might be an excellent idea, but AFAIK it remains firmly in the realm of fantasy. A program with small craft is that they have limited ammo space or defense capability, so they'll need to compete on price.

PS. An in-depth study of what a US-Iran war in the Gulf would look like.

http://belfercenter.ksg.harvard.edu/files/IS3301_pp082-117_Talmadge.pdf

http://www.armytimes.com/legacy/new/0-292925-1060102.php

There was a similar article in german at Spiegel Online yesterday, the internet version of the leading german news magazine

http://www.spiegel.de/wirtschaft/unternehmen/0,1518,650953,00.html

pointing out the big current discoveries and spreading an optimistic note.

The agenda seems quite global nowadays having the same story with similar spin at the same time across the atlantic.

I was talking to someone about new discoveries who was from the financial industry. He pointed out the recent Big Discovery in Brazil. I said "Oh that is nice, but remember that of the number mentioned of how much is in the ground we can only get out about 30%". That was big news to him, we don't empty the tank, we only get about a 1/3 of it. :-)

Ah yes, but according to the Sci_Am piece, technological breakthroughs are 101% guaranteed to be just around the corner. We vill squeeze everything there is to be squeezed out of those suckers. History says so.

As someone who has had a subscription to SciAm off and on since the 70's I finally let my subscription lapse for good last year. Their requests for renewal now go straight to my spam filter. The current editors have gone over to the far side in my opinion.

As for the New York Times, I no longer keep parakeets as pets so I don't need the liners.

Interesting, I have had a subscription to New Scientist for 40 years but have just cancelled it because it seems to have run out of real new breakthrough relevent information and runs lots of meaningless 'speculation' or Sci-Fi type articles.

At my age I want to know 'what is' not what might be in 50 years time, by then the world is likely to have changed for the worse and anyway I'll be long dead.

Ditto here.

Had a subscription to Sci_Am for almost a lifetime.

Dropped it about 2 years ago.

Then, just like the TV guys do during ratings week, Sci_Am ran a couple of decent issues and convinced me to re-up on my subscription.

Now I wake up to see this; a Sci_Fictional_American story about how just-around-the-corner breakthroughs are a scientific certainty and will certainly save us from the PO "theory". Well, at least I can say that thanks to my subscription, I was among the first to read this latest in Sci_Fictional stories. That's the consolation prize.

If it was up to me, our Scientific American subscription would be long gone. But my husband has subscribed since his childhood, and at one time had every old issue in boxes.

There are occasional things that are worthwhile. I noticed an interesting letter to the editor in this month's edition about phosphorous in the soil:

He sounds like someone we would like a guest post from.

You know, there are only 7 comments so far at the Sci_Am online magazine site, here:

http://www.scientificamerican.com/article.cfm?id=squeezing-more-oil#comm...

I would have expected a better response over there from the TOD readers who have been commenting here. Instead, we see just the BAU whining over here.

(It's not that hard to register and post a comment at the Sci_Am comments page. Come on. What are you people (yes you people) waiting for; an invitation?)

Gail

Absolutely.

Valuable quote you posted.

Soil Phosphate resource availability varies with locality and history. The US still has a wealth of local agriscience knowledge, with testing backup, and this knowledge is itself an extremely valuable resource. An inventory for each of our local areas (and I include my own in UK) could be a smart move for those involved in Transition preparation. I personally do not expect a 'sudden crash' in conventional modern agriculture in either of our countries, but a long term alternative strategy needs preparation along lines advocated by Uphoff.

Phil

I sent him an e-mail. I don't know if there is any chance he will respond.

If anyone knows him personally, that approach might be more effective.

OFF TOPIC

FMagyar,

I have been toying with the idea of getting into the residential solar area.

Just curious.........do you need a background as say an electrician?

Not to sound pompous but from the cursory look that I have taken it looks fairly straight forward.

I am just wondering if the market would be big enough to make it a viable enterprise and not just a "hobby business".

I am not trying to be flippant that is just the way I talk.

Good questions Porge,

You are right, it ain't brain surgery and anyone with normal intelligence and some basic handyman skills should be able to learn how to do it. However the licensing requirements can be byzantine to say the least.

My own background is rather eclectic to say the least. Taught ESL in Brazil, majored in Biology never really worked with that, was a commercial deep sea diver in the oil business, worked in international business import export, worked in art business, had computer graphics consulting business, owned retail toy store, sold scientific and GIS software to oil companies... became officially unemployed. I recently took a basic PV design and installation course geared to electrical contrarctors. I'm currently working in sales in the PV industry, however as I said before to actually be allowed to do installations or design work you either need to have a contractor's license or be an electrical engineer.

If you really want to get into the business I'm sure you can find a way, if an old fuddy duddy like me can do it anyone who really wants to can surely find a way.

If you want to drop me a line my email is in my profile.

OK thanks,

I have a degree in Mechanical Engineering but have never used it.

So my take away is that training and licensing is required from my starting point.

I just wonder if there is enough of a market but i guess that all depends if PO is for real or not!

What is ESL?

By the way what do you want to be when you grow up?!!

I will e-maill you when I have a coherent list of Qs.

Thanks

English as a second language.

There is certainly a need for Mechanical Engineers to do structural and wind load analysis for large scale commercial installations.

So you are already probably ahead of the curve. If you can join an existing organization and they already have the licenses they may be willing to pay for your additional training.

The company I'm affiliated with probably has more business than it can handle and I see the need continuing to rise.

Is PO for real? Umm, gee I'm not sure...

Why would anyone ever want to grow up? LOL!

No one should ever grow up!

That was Albert Einstein's secret.

Once again I am perplexed by the reasoning that an electrical engineer would be qualified as a PV contractor/installer? I would think the primary qualification would be a roofing contractor. The electrical parts are not that difficult.

I got involved with Citizenre a few years back and its too bad they can't get it off the ground (last I checked). They have a good concept and it appears to be commercially viable over the long run.

There's the rub, eh? The long run, who wants to invest in that these days.

Yes. I was thinking that electricity won't be as much of a problem as liquid fuels in the future and the up front costs of solar PV are very expensive unless financed. In a worsening economic environment it may not be the best business.

I am just trying to come up with business ideas that will help and not hurt going forward.

I could always go back to trading but that just seems like a worthless occupation and if anything supports the corrupt financial system that i want to see fail so that we can do something better.

Maybe zero/low energy structures or even communities might be a good business model.

I would share this thought. I am thinking that electric bicycles would be a good thing to get into. I think we will all be doing a lot more biking in the future. Might help the nation with rising health care costs too. It really makes me feel sad to see so many obese children in the US.

I'd step back and take a deep breath first.

I don't quite see how electric bikes would help much with obesity or health care costs. Unprotected bicycle riders will incur more medical costs due to 'accidents' than lavishly cocooned car drivers. With manual bikes, exercise may offset that, and low-ish speed may also mitigate it somewhat. But with electric bikes, exercise will be minimal - just the very thought of manually pushing all that motor and battery weight will induce exhaustion and flunk the "why bother" test. Speeds will be much higher - the very idea of crawling at a pedal-bike pace will flunk the "why waste the time" test, and there will be no push-back from tired muscles.

Also, electric bikes are conspicuously expensive pieces of apparatus - after all, there's essentially no chance of confusing an electric hub with a cheap Walmart hub, nor of mistaking the throttle control for anything else - that simply cannot be secured properly. And the attitude of virtually all police departments is that they couldn't possibly care less about bike theft. This issue is often worst in exactly the environments in which bikes might otherwise be the most useful.

On top of all that, there's the vexatious problem of what to do with the hugely expensive and somewhat large and dangerous - normally lithium - batteries at one's destination. At many of the larger sites, taking them inside with you, past the metal detectors and security guards, will simply not be an option. (Now I'm also wondering - are they allowed on the New York City or Seattle ferries in the first place? If so, how likely is that permission to outlast the first battery pack to catch fire?)

Hi Paul,

As much as I prefer any type of Human Powered Vehicle (HPV), my experience working in India in the mid 90s leads me to believe that bicycles will have a hard time competing with motor scooters and small motor cycles if cars actually become too expensive to buy and operate.

My observation, in India, was that bikes were really crowded out by these small motor vehicles. The steets were also jammed with Auto Rickshaws

Please, Paul, step back and take a deep breath.

You spouted a typical list of falsehoods about electric bikes, that prevents many people who could use them as a great solution, from actually using them. Hence we continue BAU, polluting the environment and burning up oil because "there is no good solution" (when there actually is).

Here are the items needing correcting in your post:

1. You claim electric bikes don't give exercise. False. I know personally of many people who've lost a lot of weight riding an electric bike. It is better exercise than walking, and FAR better exercise than sitting on your rear end in a car.

2. You promote the misconception that it is electric assist or pedaling. False. On nearly any electric bike, you use the assist while pedaling to achieve an overall higher speed, especially on hills.

3. "Simply cannot be secured properly" - That's funny. Actually, hub motors are harder to remove/install than standard quick release wheel. And they don't operate without a controller. And someone stealing the throttle would have to strip all the wiring off. I'm not saying it can't be done - but it is not going to be an easy, quick operation. More important, the battery (the most expensive part) can be taken inside. I do that every day to charge mine and keep it from getting stolen.

4. "dangerous" lithium batteries. False again. There are 3 different types of lithium battery. Li-CoO2 is the type used in laptops and cell phones. It is highly unstable and can have runaway fires/explosions if short-circuited. This type is not used in electric bikes! Second, there is Li-Mn. This is more stable than LiCoO2 by far. Now, many bikes are converting over to LiFePo4 (lithium iron phosphate), which is even more stable and longer-lived than LiMn. It is a bit heavier than LiCoO2, but its safety advantages far outweigh the few extra pounds (i.e. an 8-lb pack for a LiFePo4 vs 6-pound pack for LiCoO2). This is by far the most common type of safe, light, long lasting battery used on modern electric bikes. All forms of condensed energy have dangers (just think about the thousands of gallons of gasoline stored in autos on a typical ferry). But with proper enclosures and safety features, lithium batteries are certainly less dangerous than the flammable gasoline people drive around with in their cars.

5. "conspicuous" piece of apparatus. Well, who do you think a thief is going to target? Someone driving a $50k BMW, or someone riding a $1.2k electric bike? Hmmm. I see a lot of beemers, porsche's, audi's, lexi, etc around my area still. I also see plenty of carbon fiber road bikes (all worth > $2k). Talk about "conspicuous". My bike looks like a beater in comparison to any of these items. If someone stole it, they'd have to do a lot of work to make it look like something someone would want to buy.

6. You imply that electric bikes are a pain to ride because of carrying the batteries around. False again. Most people get very big grins on their faces after they try the first electric bike. I've ridden one nearly every day for the past four years, and I'm not bored with it yet (even though I get bored easily). Electric bikes are, first and foremost, fun to ride, which encourages riding more often, which in turn means less car driving and less oil use.

Finally, I will get back to responding to the original poster with a real piece of information. Yes, electric bikes are great. But there is also an explosion of competition with new people selling them coming on line all the time. My business has yet to break even, and I have some large loans to show for it. It is a good thing I have another day job to pay the bills, because the business doesn't. Further, it requires a lot of marketing, financing, managerial, and technical skills to run a company like this successfully. If you're up for those challenges - then go for it. But please don't think it will be a cake walk, it won't. I founded my business simply with the goal of promoting electric and cargo bicycles as alternatives to cars - I never expected to make much if any money from it. So I can accept the lack of profit, at least for now. But many people would not be able to do so.

Morgan

Maybe I can try to clarify a bit.

In South Florida at least, if you are already a licensed contractor such as a roofer or an electrician you can do the installation of PV panels on someones roof if you pull the necessary permits.

To do the wiring and especially tying into the local power grid you must have an Electrician's license. If you are completely off grid you can do it yourself. You need to be an Electrician to do residential installations say up to a 5KW systems that are grid connected.

You need to be electrical engineer preferably specializing in PV to do any larger commercial designing, say 25KW and greater, you have to be able to sign off on the drawings for the permits.

Most designs need to have signatures and stamps from both structural and electrical engineers before the permits are given.

The company I happen to be affiliated with has a team of engineers that do drawings for other contractors. We do structural and wind load analysis in house and and of course we have a team of electrical engineers led by someone with a PhD in electrical engineering we have done 1MW design and are working on a 2MW project at present we have done many smaller 25 to 150 KW commercial systems so we pretty much know the ropes for the permitting process. We also teach our competition and do a substantial amount of the engineering for them as well.

In a nutshell if you have a contractor's license you can do the work but you need engineers to do the drawings for the permits. So it certainly doesn't hurt if you can do both.

I hope that helps a bit.

Well, I have been a chimney sweep for over 30 years and I have often thought about this idea, though my lack of electrical experience... or at least my lack of pleasant electrical experience, as most was when I was a lot younger and a new home owner: dzzzztttt!!... has seemed an obstacle. But with much roof experience and a contractor's license, maybe it is a good time.

I wondered about Citizenre (though I guess I didn't wonder enough to google it) and wondered if it would ever get off the ground, so to speak. I didn't like the uncertainty involved with having something I depended on like that if I didn't own it. How do you repo a solar installation?

Yep, you are counting on access to a functioning credit market to get paid in full on completion of installation. You may need substantially more bonding even for a small scale PV installation business than the chimney sweep business has required, and at least one or two workman's comp insured employees are needed get installations done in a timely manner. All that said barrier, to entry is still relatively low so competition could get cut throat in a hurry. A low debt load and good reputation often get small contractors through such crunches though. You can make a go of it in the right area at the right time, just go in with your eyes wide open.

You should be able to get a lifelong job of ESL here in South Florida.......

At the risk of sounding elitist, in Brazil I was fortunate to be able to teach technical and scientific English geared to an intellectual elite composed mostly of scientists, doctors and engineers. I had to come up to speed on a lot of very specialized knowledge to be effective. Part of why I enjoyed doing it was because I learned so much from my students that I would almost have done it for free.

In South Florida we are very much in need of ESL teachers who are able to teach basic literacy, while that may be a noble calling, it is not a niche I'm interested in filling. There are plenty of people much better qualified than myself to do that.

Out here in California we have a glut of installers, not enough buyers. Drop me a note and I would be happy to put you in touch with people who can answer your questions.

About Der Speigel in Germany.

Note that the New York Times is a partner of this german weekly magazine. You can have a look to the english site at: http://www.spiegel.de/international/ So the concerne is a translation of what they read from (may be) your side of the ocean...

I put away my Oct. 2009 issue of Sigh Am-err-i-can for another day when the critical thinking juices can be rejuvenated. There is just too much in the MSM nowadays that needs critical review.

IIRC, the Don't-Worry-Be-Happy Sci_Am article was authored by an "economist" of Italian extract, not by a scientist of American or other extract. It used the BAU, illogical logic. Chief among these was the appeal to the "Lessons of History". Ah yes. We've had claims of peak before. It didn't happen then and therefore for sure it won't happen now. Technology has always come through for us. The markets have provided, yet again. Oh yea of little faith. Yeeha. Logical is as logical does.

A good counter to this illogical logic is the example Nassim Taleb gives in his book, The Black Swan. It's the one about how the 3 year old turkey concludes that this upcoming Thanksgiving Day will be no different than the previous ones. The farmer was good to Tom in the past, stuffing him with food and feast. Surely history will repeat itself.

The turkey is evidently not well-trained as a Bayesian learner.

Here's what the Wikipedia turkey has to say:

http://en.wikipedia.org/wiki/Bayesian_probability#History

See, it's highly plausible that the Turkey really had nothing to worry about...Nom, Nom, Nom.

Huge Kudos, Gail,

I am ALWAYS amazed how fast, and with such quality wordsmithing too, at your ability to bang out fascinating analysis in TOD keyposts.

MSM-Journalists don't seem to understand the key difference between flowrates and reserves--the first is always a time-dependent measurement, the second is a static measurement.

An untapped reserve can sit for years or decades but it neither shrinks or grows. If someone can find a beer bottle, that when placed inside a refrigerator constantly grows from its original 12 ounces into a Big Keg--CALL ME FIRST!

Another example: my parked ICE-vehicle is a potential 'Transportation Reserve', but it is not going anywhere. Then, only when I fire it up and start moving at any speed, say 10 mph==>then I am FLOWING along. Obviously, at 60 mph, I am flowing along much faster than 10 mph, or ZERO mph, duh!

I almost expect some journalist to say a new reserve discovery is 10 billion barrels per hour. Recall my recent weblink with the recent MSM article gaffe about 1 million bats eating 700,000 TONS of mosquitoes over the course of a summer when I am sure they wanted POUNDS. I haven't seen any bats the size of a B-2 Bomber flapping around [if I did--I would be in favor of White Nose Syndrome, LOL!]:

http://future-weapons.org/images/b2.jpg

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Don't forget all the "reserves" on Titan.

But then again, MSM reporters won't understand the joke of that. So let's keep it a secret from them.

How much would it cost to transport hydrocarbons from Titan, I'm sure MSM will come up with a good case for it sooner or later. It has to be a winner, surely. In the meantime........ :-(

Where are you going to ship the oxygen from as well... you can't have one without the other if you want to use hydrocarbons for energy!

You just run it through a Worm Hole, and put it in the center of the Earth, with the rest of the Anabolic Oil.

Haven't you been keeping up on the news?

Inquiring Minds want to know!

Anabolic oil is like abiotic oil on steroids, any questions [-)

Trekker, the Little Green Men who are trying to sell this technology to the Little People who live in the oak wood just over the event horizon from my peach orchard are balking-they say we have nothing to offer in ecxhange worthy of consideration.

Of course this data comes to me via the blue jays, and any worldly traveler such as yourself will know better than to trust a jay.Interesting conversationalists, but prone to improvise freely as suits thier agenda!

The response I always like to give wrt reserves vs. flowrate is Geothermal. The center of the earth has pretty much unlimited geothermal reserves. Good luck with the flowrate.

No dude, we're going to reach Titan with the carbon nanotube space elevator.

We'll get much better EROEI that way!

Relax. Hydrogen cars are making a come back. Plenty of hydrogen on Jupiter.

Also, you know that new black monolith they just found orbiting among the rings of Saturn? Close up photos show it has three push buttons on its face: (1) Premium Hydrocarbons, (2) Super-Premium Hydrocarbons and (3) Begin Transport to Earth via Wormhole.

The writer just got a little carried away, they meant 700 tons of mosquitoes (.0025 gram per mosquito, 3000 eaten per bat each night of about a 100 night summer gives 822 tons). I know I blow things on the napkin backs by different exponents of 10 regularly but I expect SA to fact check a little better that is for sure

We need to keep in mind what is going on in the oil market right now and the time of year. Normally at the end of the driving season the price of gas/oil declines and reaches a low sometime in January. Speculators and commercials in the oil market are no fools.

Seasonal market forces are very powerful. I have watched them for years in the grain market where they are again at work preparing for the fall harvest. But in oil this year's fall/winter decline is complicated by a very bullish oil chart:

http://futures.tradingcharts.com/chart/CO/W

Oil has been basing all summer. This normally happens before a breakout. The debate has been whether it would be up or down. The bulls point to "green shoots" and China usage and the chart looks bullish to them. But the bears point to weak American demand due to weak car sales, unemployment and the Great Recession.

Yesterday's market action makes it look like the bears are winning. There are big bucks riding on this since oil is now a major investment vehicle.

I do not put it past some of these sophisticates to arrange the timing of these articles such that they come out at critical market junctures. They know about seasonal declines and charts. They have friends and connections and some of them no doubt are in the publishing business.

The bulls have set themselves up and there are too many of them. Too many people see the good looking base and read of demand from China and the developing world. Also Peak Oil is now main stream. Everyone and his brother has heard about it and probably gotten in on the long side.

Commodities are a zero sum game, for every long contract there is a short contract. For every winner a loser. When the market sophisticates sense that so many have taken the long side and ignored the powerful seasonal factors, they see a set up.

A few key calls to friends and walla, bearish "news" appears from several sources at the same time and and at a key junction on the charts. The name of the game is Scare the Bulls. They are breaking the oil chart down just as they wanted and will make millions if not billions on the short side.

They will cover their short positions in January so taxes are not due until April of 2011. Then the game will be to run oil prices up for the 2010 summer driving season, rinse and repeat.

That's commodities. Seasonality trumps all. But the long term trend in oil prices is still up or we won't see much of the hiped "discoveries". There will be lots of peak and valley action on the way as there always has been in commodities.

These articles, plus the Lynch op-ed in the NYT, plus some other things. Yes, there is a definite, concerted media campaign being orchestrated.

My guess is that the Obama administration is in real trouble with the health care bill and knows that getting it passed is make or break for his administration. A deal has been cut to gain some crucial support, and a shift in emphasis from renewables to more oil exploration has been the price paid. The media blitz is just to soften up the public and prepare them for the official announcement of the policy change, which will probably be coming soon.

Or maybe I'm wrong, maybe it is something else going on. It does appear that SOMETHING is going on behind the scenes, though.

My 2007 “Iron Triangle” essay:

http://www.theoildrum.com/node/2767

"At least those of us trying to warn of what is coming can try to be ready with a credible plan to try to make things "Not as bad as they would otherwise be,” when it becomes apparent to a majority of Americans that we cannot have an infinite rate of increase in the consumption of a finite energy resource base. How's that for a campaign slogan?"

----------------------------------------------------------------

Actually, as a campaign slogan, we all know it loses. These people win elections by promising BAU. Most people fear change - when they vote for it, they think it means different policies that will stop inevitible changes that they fear.

WNC, I think your comments are right on target. It feels like a stepped-up coordinated, iron triangle campaign. Powerful interests are at play here as storm clouds gather. Buckle seatbelts.

I don't know about the NY Times. It's just an establishment mouthpiece and never seems to get more than superficially deep into any subject other than fashion, automobiles and expensive real estate. Here's 'emeritus' staff Keynesian economist Paul Krugman this morning:

The balance of the time, PK expends electrons cajoling the government to spend, spend and spend more until it hurts; here he undercuts his own argument by pimping tight- fistedness.

Wishful thinking is everywhere in the Times, and this example is no different. Paul thinks the US carbon problem can be solved cheaply. Sorry to break it to ya, but the price tag is to shift from industrialization and finance to a artisanal/craft economic model - will be a concurrent 70 - 80% decline in GDP. It's gonna be expensive! Here, the Republicans and industrialist- nay sayers are absolutely correct. There will be no reduction in climate gasses until most manufacturing industries are kaput. You cannot run a steel mill on solar panels.

The greatest part of that expense won't be regulatory requirements, it will be the price of oil or the equivalent price of wresting control of it from current owners. We are at the end of the period where globalization and finance manipulations can gain the developed world cheap power. We are also at the end of cash- flow and economy- of- scale pricing scheme. This is happening despite all the best efforts of the G20 and the inner, closed circle of high finance in NYC, London, Frankfurt and Shanghai.

If the metric used to determine the availability of crude oil is money - which is what every Earth inhabitant uses at some point to measure oil and oil product flow rates currently - the oil peak is simple to determine. Looking @ Gail's EIA chart, it was in 1998- 99. Since then, the market seems not to have 'priced in' any of the discoveries suggested by either the Times of Scientific American. The real indicator of oil supply relative to demand is 'Mr. Market'.

Producers are gaining more and more control of the oil market and are gathering as much of the profits available to oil use to themselves as possible. Within the fluctuations of the day-to-day market the producers are becoming price- makers. This process is visible in its effect on the general economy - a steady increase in business bankruptcies that parallels the trend increase in oil prices. With secular demand rising steadily worldwide, the oil producers will be able to sell product regardless of how many businesses go under. The legacy auto fleet and industrial base insures this. Both are massively overbuilt, contain extreme overcapacity and are operated by those totally oblivious to the consequences of their operations.

This state of affairs gives the producers leverage that steadily increases. Taking place at a rate of 80 mbpd.

The ordinary way to overcome this shift is with sufficient supply added to the market to shift the balance toward the consumers, again. (This obviously would add to capacity on the demand side as it always does.) The balancing force would be competition for market share among producers. This condition existed briefly during the beginning of the year when prices fell to $34 a barrel. Unfortunately, the cause of this decline then was not new supply but the crushing of demand as a result of +$100 prices for an extended period leading up to the decline.

The feedback cycle is: Price increase -> Business failures and economic decline -> Less demand for oil products -> oil price decrease. Businesses that are destroyed cannot be quickly revived and when they are or subsitutes arrive, the increased demand pushes up prices again.

Shifting the balance back toward consumers and into balance would take a large increase in NET oil supply. This means a an overall gain in the production side of the ledger with new supplies overtaking the secular declines in existing production and the increase in demand. Since this shift isn't apparent in the price the market does not perceive sufficient new supply currently or in the future.

This is the NYMEX crude June 2010 contract chart. (It may disappear in a few days. Current charts are found @ TFC Commodity charts.)

Two things to note: the long- term contango is disappearing. Also, the economy isn't strong enough to drive demand - and prices - higher. It also indicates the dollar is still stable. Contango in the oil market - and the 'floating storage' phenomenon - are both dollar, rather than energy plays. Traders buy with relatively more valuable dollars and sell for less valuable dollars, keeping the nominal dollar profit. Oil traders are starting to bet the world's economy is going to slow some more, killing demand and triggering a flight to dollars. Rather than dollar bears, stock market touts, Keynesian economists and G20 lapdogs, I'd keep an eye on the oil market and traders there. As 'x' mentioned above, seasonality is an issue as well.

The governor on oil prices is the oil prices themselves, feeding through the economic destruction caused by high oil prices. I suspect anything over $45 is high. We've been @ $65 - 70 for some months now, time for another deleveraging leg to take place.

Gail is right. Look out below!

Not that I have any leverage, but I wish that Krugman would start to acknowledge resource constraints in his writings. I tried to stroke him by pointing out how closely some of the math in his specialty field of economic geography corresponds to oil resource distribution.

http://mobjectivist.blogspot.com/2009/09/krugman-cities-and-oil.html

Alas, you are right, the mainstream economic profession is somehow not seeing the writing on the wall. Is this intentional, or naive thinking?

I think it has to be intentional. Can you imagine the carnage in the grossly over leveraged financial system if he basically said the era of growth is over?

What's the saying?...........Yelling fire in a crowded theater.

That which is about to fall deserves to be pushed (Nietzsche) but there is no way they are going to cause collapse.

Economists always crow about their knowledge of the effects and dangers of "sunk costs". The biggest sunk cost known to man is the entire petro-chemical establishment. Yet when it really hits home, the economists ignore it because their entire careers will be sunk if they admit to it. Could that be right?

It is difficult to get a man to understand something when his salary depends on him not understanding it. (Upton Sinclair)

The truth hurts doesn't it, Hapsburg? Oh, sure maybe not as much as jumping on a bike with the seat missing. (Police Lt. Frank Drebin)

LOL I am going to remember that one.

I read that, WHT. Are you telling us his math is 'real'?

I don't suppose you can reach Krugman any more, he's a big radio/TV star. Why would he listen to anyone? His articles and statements completely reflect establishment thinking. He'a 'Mr Inside'. For him and the system, the only answer is to fix finance.

Part of the problem is that the economy isn't, there are two economies, one on top of the other.

The production or physical economy lies underneath the finance economy. The critical thinking is directed toward the finance economy because that is where the 'action' ... and profits are. Here, the bulk of developed- country economic activity takes place. Consider that most 'retail' activity (70% of GDP in the US) consists of persons taking and changing money and keeping accounts. This is the work of countless underpaid sales clerks, tellers, cash- register operators, account reps, etc. Finance makes up a large part of consumption - that is, consumption itself is a finance activity; the changing of money for something else of 'value'. Consider consumer credit; real estate agency and brokerage, the business of appraisers, mortgage brokering and origination, auto and other durable good lending and brokerage - all this money handling is finance. The business levels above direct consumption are directly part of the commodity money industry - banks, trust agencies, credit card companies, derivatives brokerages, insurance companies, etc. All this finance leaves room for pseudo- math and other neologisms that will parlay into big money for the lucky economist.

http://economic-undertow.blogspot.com/2009/09/some-short-cuts.html

Meanwhile, the dull, boring physical economy is stuck with Ricardan value theory and comparative advantage. Here, market forces such as increases in price leading to more investment will solve the energy problem, just like they always have ...

Since all the attention is directed at finance, it takes a disaster in the productive economy to get anyone to take what happens 'down there' seriously. The oil shortage idea - and the shortage itself - has been around since 1970. It's not new, it's just boring ... and the establishment keeps trying to get those banks lending, again.

Perhaps call the finance economy an abstract interface to the real economy? In software development, there is a principal that states another level of indirection can be used to solve any problem.

It certainly starts to call into question what an economy really is. Is it a wealth aggregator or a cheap theatrical. There really is no limit to the number of Potemkin villages that can be crafted. When is doubt, throw up another oone. The establishment is congratulating itself for bringing the '... whatever it is ...' from the brink but down here realityland, things are (still) trending downhill.

There is Export Land, maybe the time is now for 'Reality Land'.

What is really happening (pulling aside and whispering) is the real economy is yelping for attention. Stand on the dog's tail long enough and he'll start barking and whining before he takes a bite out. You have all these people calling for more diversion of funds from office peddlers toward something solid. Fat chance of that; it spoils the party.

The n indirection has successfully added a zero to stock prices while not adding any to the pump price of gasoline. Yes, you are absolutely right, the problem has been solved.

... for now. Tomorrow is another day. I wonder if dispersion adds any clues to how long intellectual dishonesty remains in force when the resources that support it ... disappear.

Read this, btw, it's interesting by Steve Keen. He's a lot more accessible than Krugman, more thorough and probably has better models.

Thanks, I also mentioned the abstract interfaces because there are software people around that get paid the line of code. The more interfaces they have, the more they get paid. It doesn't add to the utility, yet they still get paid and, due to the volume of code, become maintainers of the SW for life. They are setting themselves up to become indispensable.

But like the financial industry, these people are not necessary.

Isn't that what we all do/are trying to do?

:)

Missing link, Steve

this?

http://www.debtdeflation.com/blogs

WHT,

Thanks for the link to Steve Keen's DebtWatch blog.

I for one, don't see how Keen is being any simpler or more accessible than other economists.

Porge and I discuss lower down in the Comments area how "The Economy" is a phony invisible boogey man which they, the economists, would like all of us to picture as being a living organism that has health issues; and to whom voodoo medical treatments can be applied.

Steve Keen's post here does the same thing.

He portrays Mr. Economy as a person who is walking around and visiting doctors from different schools of thought (neo-classical, etc.), hoping one of them will come up with a proper diagnosis, and then with a proper treatment.

But as any scientist might tell you, the chance of a good diagnosis is slim to none if you don't have the measurement technology to measure what is going on (to detect reality). Real medical doctors have blood tests, X-rays, MRI's, etc. Economists, on the other hand, rely on government lies as their input data. They are the equivalent of Medieval blood letters.

__________________________

Without proper measurement technology, one operates in a FIFO world.

FIFO= Fantasy In, Fantasy Out (sort of like GIGO)

Been thinking about that same question recently.

I think it's language.

Very often our vocabulary does not include words or phrases that allow for that kind of thinking. How often does one see the phrase, "Unsubstituteable Depletibles" in economic scholarship?

Wasn't the 1970s about U.S. Peak Oil? Since then, we have substituted Saudi Oil, [and North Sea, Alaska, Iran, Iraq, Mexican, etc.]. Now that those sources are reaching peak, e.g. the world peak has arrived, what do we use for a substitute? Some, above, noted Titan as a source. That seems a bit far off.

Dude !

It was a joke. Perhaps you didn't sense the sarcastic note, but it was meant as a joke.

The EROI on launching a rocket and propelling it to Titan and then back to Earth and then gliding it through a fiery (energy wasting) entry through our atmosphere is well below unity.

Of course, your typical MSM journalist would not understand that. Instead they would think, hey this is great, they found oil on the Moons of Endor.

Unless you have some calculations to back that up, I am not certain. One could launch rockets from Earth into low Earth orbit to assemble a much larger space craft. The amount of material that would need to be lifted is proportionate to the square of the radius while the volume of methane that could be recovered is proportionate to the cube. The space craft could potentially use a solar sail to catch the solar wind to propel it outward to Titan. For the return journey some of the methane could be used for maneuvering thrusters with most of the acceleration being provided by Sun's gravity. The space ship could be parked in Earth orbit or reenter the Earth's atmosphere which would dissipate the kinetic energy gained mostly from gravity.

In terms of keeping ERoEI above one it seems to me from a cursory consideration that the hard part would be lifting the methane out of Titan's gravitational field. If Titan's methane is used as the fuel, then possibly. Only the energy used on Earth to make the system work would be included as the energy input. ERoEI would be how much (energy brought back to Earth) / (how much energy on Earth was used to bring it). As someone else mentioned we would need some extra oxygen for burning and a carbon sequestration system which would consume more energy.

LOL

Used with what oxygen Dude?

How many centuries is it going to take for your solar ship to get up to speed, and when you get there, how will you slow down? Step on the brake pedal? (OMFG)

LDOL (Laughing Doubly Out Loud)

The Sun's gravity? Are you serious? Have you heard of Newton's three laws? Have you not figured out why Jupiter does not "fall" into the Sun right now and immediately? (OMFGx2)

Acceleration depends on the size of the sail and the mass of the spacecraft. One could gain additional speed using gravity assists from various planets as JPL as already done with other spacecraft.

One could use the upper atmospheres of Saturn and Titan to decelerate enough for orbital insertion. It is called aerobreaking.

Do you know enough about the composition of Titan to rule out the presence of oxygen or water? Have you considered what may lie below the surface of Enceladus which may be easier to retrieve because it has less gravity?

Gravity is a major force to consider in celestial navigation. It can work for the trajectory or against it. During the return trip, Sun's gravity is helpful.

Perhaps such a mission could be done robotically which would reduce the mass of the spacecraft and the need for speed.

As I wrote, removing the methane from Titan without making ERoEI less than one would probably be the hardest problem to solve, but that was not one of your original criticisms. The reasons you cited are probably not the limiting factors.

You sound like a NASA engineer who dismissed the possibility of foam damaging a space shuttle wing because he neglected the v2 part of 1/2 mv2. One should give prudent consideration to an issue before dismissing it as ludicrous.

that was not one of your original criticisms

I was merely pointing out how a MSM journalist would probably not understand the ridiculousness of crowing about having found hydrocarbon "reserves" on Titan.

I never intended to start a detailed calculation of the EROEI of such a project.

Note that your proposed aero-brAking would involve giving up energy as waste heat into the atmosphere of Titan. As far as I know, Earth is the only body in the Solar System that has free oxygen in its atmosphere. So once you "land" on Titan to collect your precious 2 gallons of methane, how do you propose to get off and return to Earth?

The thing is, with the ETFs one can hold one's position with little risk until the termination of the fund. With Barclay's ETN (OIL), this Barclay's note terminates in IIRC the year 2036. For those with patience, short term moves aren't fatal. One can stay long "indefinitely". Probably a bigger risk is if Barclay's as a banking institution collapses. In that case, their notes are no good either.

x, as long as OPEC has spare capacity its members will open their spigots to keep the price of crude oil between $70 / barrel and $100 / barrel. They will not allow another oil price spike that would create more demand destruction while they have control. The price of crude oil will not rise above this range until their spare capacity is gone. Maybe that will begin in Spring 2010.

Hi Blue,

You make an excellent point that I often wonder about. Let's say we are talking about 83-85 demand with 4-6 spare capacity. Then, we have demand edging up or down a bit due to the current state of the economy. With this in mind we need to factor in decline rates, reserves and discoveriers on one hand and population growth and consumption patterns in developing economies on the other hand. Add to this conserservation and efficiency (voluntary or forced) plus advances (we assume) with alternative energy sources. Plus, as Gail points out, the cost factor for "new" oil.

Barring some great new technical advance or major war, these seem to be the basic factors that will drive the price of oil - but, perhaps I missed a major factor. One could argue that environmental concerns (GW for example) could be a big driver - but I doubt that humans have that much intelligence to address this issue in any meaningful manner.

Is there a flexible computer model that can take these factors (and anything I missed) to drive an almost realtime prediction of when "spare capacity" will cease to exist? As long as there is spare capacity there is the ability to manipulate the price of oil - when this is gone, then we will begin to experience the actual consequences of PO. That predicted date is still a big mystery for me.

Some more major factors: Export Land Model, the grade of crude oil, the availability of refineries to process the particular grades and the availability of crude oil tankers. ERoEI should be included for longer term modeling.

Modeling this would be difficult because the data is incomplete and inaccurate. The IEA and EIA revise their data often.

My thinking is qualitative. I look at the IEA's decline rate of existing wells at about ~6% / year, assume ELM makes the effective decline a little worse, new production will be less than Oil Megaprojects shows due to the collapse in oil price last year, ~3% decline in demand (74 Mb/d to 72 Mb/d) and that OECD demand will seasonally increase in Spring 2010 while China's and India's demand will continue rocketing upward. Consequently I think Spring 2010 is the earliest that demand could again intersect maximum supply.

The factors you add make a lot of sense. And, I still think a model would be possible and useful - what could be more useful than understanding the fate of the planet?

The kind of model I would envision would allow for incomplete and inaccurate data. The idea would be to have adjustable parameters for all the factors we mentioned. The model could be exercised repeatedly with various scenarios using a different set of parameter values. I suspect that we would see some type of convergence for the most likely scenarios.

On the other hand, your analysis might be good enough to save a lot of time and money building a model that rivals global weather prediction models.

Two opinions on oil prices going forward:

http://asburyresearch.blogspot.com/

http://3.bp.blogspot.com/_cA-hOpUae8c/SrjMRfszWCI/AAAAAAAACWA/1FX984fe4J...

http://www.decisionpoint.com/ChartSpotliteFiles/090925_uso.html

http://www.decisionpoint.com/ChartSpotliteFiles/090925_uso-2.png

Notice that the the overall market correlates with oil prices pretty much.

oil seasonals:

http://www.spectrumcommodities.com/education/commodity/charts/cl.html

I don't think you quite credit the compounding effect on food prices and their share of household expenditure as oil prices go up. It's not just that households always have to have food, but as oil prices go up, so inexorably do food prices (with a short timelag). As they do, they very quickly squeeze the disposable incomes of the less affluent and this has a dramatic effect on their consumption of non-food items.

As this cycle gets underway it leads to a reduction in employment, locking in the decline in the economy for a certain period of time. There are lags in all of this and so ultimately as the oil price repeatedly bumps up to the maximum sustainable level, as long as the intervals between this happening are less than the time it takes for the economy to recover, it seems to me that this must lead to a gradual ratcheting down of the economy.

Of course this should in time lead to the economy rebasing at a level low enough that the oil price has to fall as consumption reduces. However we are living in a globalised world and some economies will be more resilient and so will not hit the buffers in the same way, and this will therefore have the effect of keeping the oil price more buoyant than it would be if it were just dependant on US and western domestic demand. I assume that this will be the mechanism by which the balance of world economies adjusts itself to take account of the degree to which the economy is built on oil - if so, doesn't look too good for the US in particular!

Why do these 'feel good about oil production' articals keep appearing in the MSM now (4 in the last month)? Is this a last attempt to keep things going before we drop off the production plateau?

Why? See my post above. It is increasingly starting to look like these things are not just coincidental, but that there is some behind-the-scenes orchestration going on.

If the recession is a bit better (and TPTB would like to convince us it is gone), they would like as many upbeat articles as possible. Some of these have been in the works for months, though. The draft of the Scientific American article appeared on line in April 1 (appropriate date!), and I know I offered some comments (not favorable).

Gail,

While we should not rule out conscious intentions to "extend and pretend" articles about abundant oil, it is also the case that dominant social myths take on a life of their own, as Nate H. and others here have observed. It is to be expected that the unconscious wish to preserve the status quo gives rise to such articles -and the rejection of those articles that challenge it. I saw this with East Germans who believed socialism was superior to capitalism. They never in their wildest dreams thought the Wall would fall; and when it did they thought socialism would be reformed, not abandoned. They literally had to have their nation be abolished before most -not all- of them accepted that socialism had lost. (A very few I met saw the connection to capitalism -both exploit the natural environment- and more or less anticipated what's going on today.)

Uncommonly Clever Economic Indicators

http://finance.yahoo.com/banking-budgeting/article/107795/uncommonly-cle...

Thanks Gail,

I posted in another thread that Germany in WWI didn't have famine. I was wrong. Why didn't Germany produce enough food? They were never invaded. Blockade should have been anticipated. Motorized agriculture had barely been invented. There was plenty of land, horses, and coal.

Germany starved during WWI because the German leadership believed articles like these. They thought preparations were not necessary because the war would soon be over. So they did not prepare.

The lesson I take home is not to expect foresight on a national basis. Everyone should expect to be on their own, just like every serf during every period of social chaos for the past 5000 years. Prepare to hunker down and wait it out.

Cold Camel

Hey, I'm not depressed, I'm optimistic. I see a realistic way through the coming crisis. All I have to do is hunker down, feed my neighbors and we'll be relatively ok. I'm a pretty happy guy but it boggles my mind that so many others fail to appreciate and take advantage of the opportunity. Every one of you who refuses to take action with such clear forewarning reinforces the accuracy of my judgment. You old fogeys that are full of wisdom couldn't survive the jump, but it's a shame that you lure youngsters back into the cocktail lounge for one last drink before the ship goes down. You should be chasing them to the rail and handing them your life jacket. Where did the leaders go?

Why didn't Germany prepare ?

The Just in Time Technological Fairy.

The Imperial German Army had just enough munitions (using imported Chilean nitrates) for 8 to 12 months of war. A swift successful offensive or they would run out of ammunition. There was simply no way a protracted war could be fought.

But then, two German chemists developed a way to to extract nitrogen from the air, and make both fertilizer and explosives. Industrial scale production started in 1913, months before the start of WW I.

http://en.wikipedia.org/wiki/Haber_process

See, if you need a resource badly enough, it will appear.

Alan

LOL!

The right answer to those „technological breakthroughs to be just around the corner“ freaks!

The Haber-Bosch process didn’t save Germany from starving, but streched the stupid mutual mass-slaughter from 8-12 month to over 4 years....