Natural Gas Revisited

Posted by Gail the Actuary on June 3, 2009 - 8:16am

It seems like the question I get asked more than any other one is "What are the prospects for natural gas?"

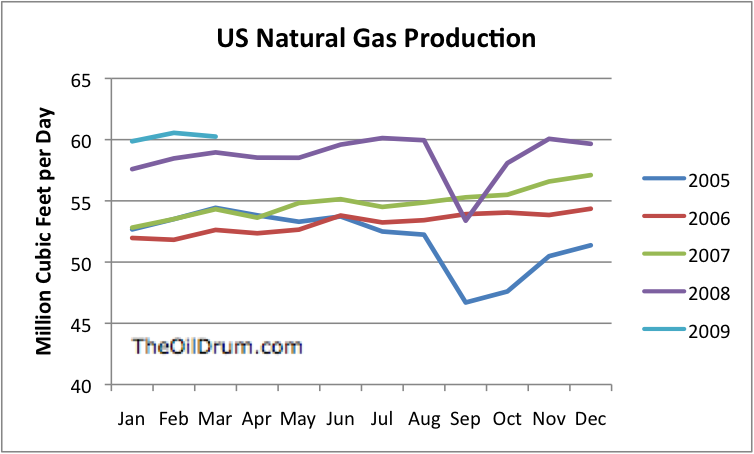

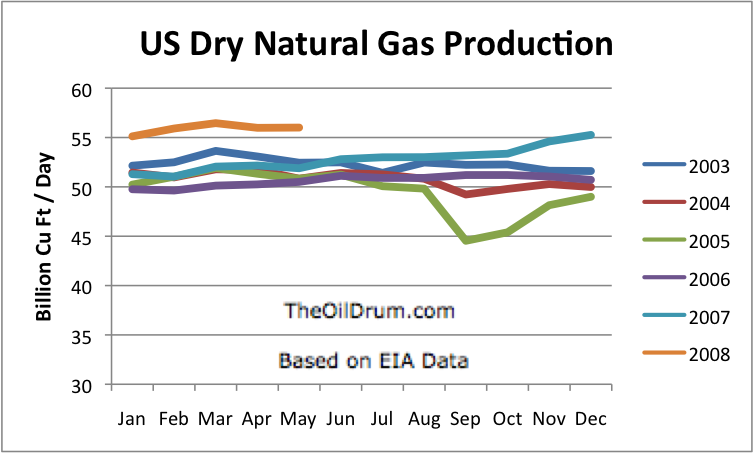

I wrote a post in September, 2008, saying that it looked like there was a reasonable chance natural gas production could be ramped up. I still think that is true. In fact, through March 2009, US natural gas production is up, although it is not rising as rapidly as in 2008. The dips in production in September 2005 and September 2008 are from drops in production due to hurricanes.

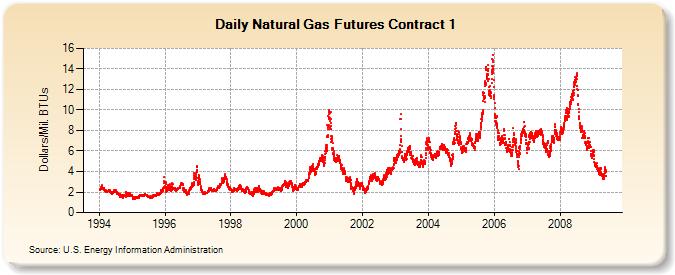

What has happened since September 2008 is a serious drop in prices, because demand did not rise to match the new higher production. Such a drop in prices makes the price too low for nearly all producers.

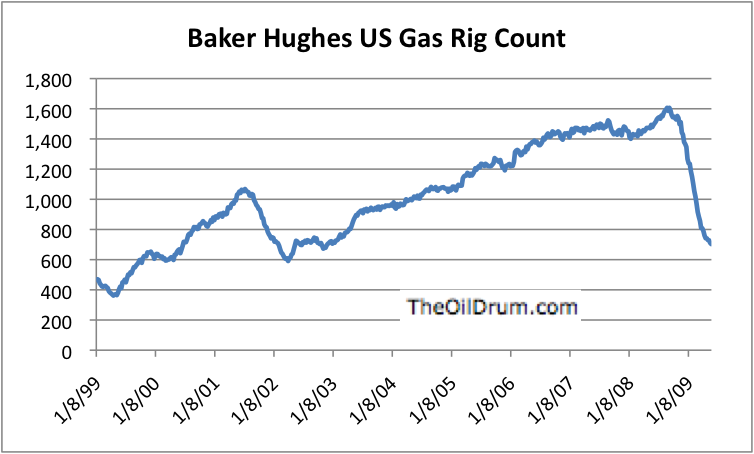

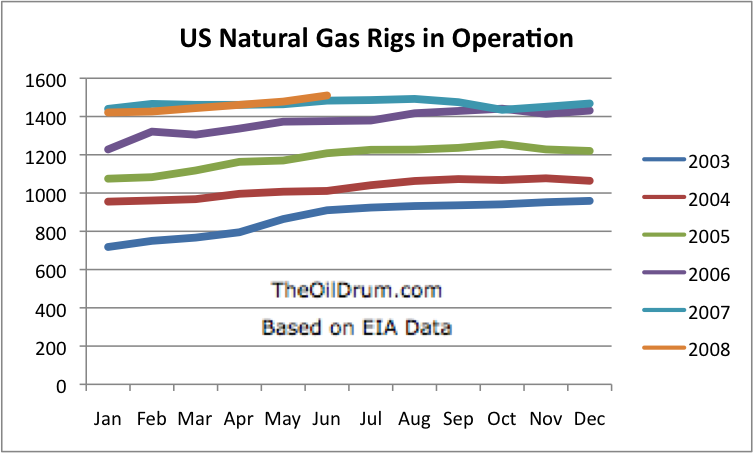

At this point, natural gas prices are back at 2002 levels. This is too low a level to be profitable, and natural gas producers have reduced the number of drilling rigs by more than half since September 2008. With fewer drilling rigs, natural gas production can be expected to decline in the not too distant future, perhaps late 2009 or sometime in 2010.

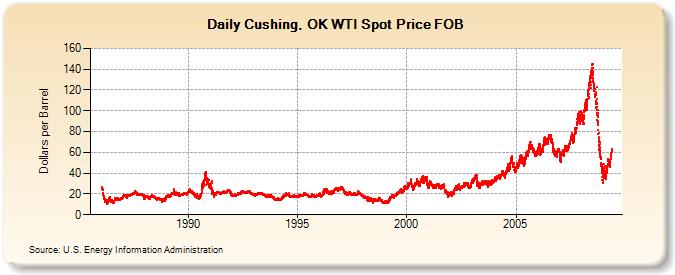

Natural gas acts fairly differently than oil. Oil prices have begun to turn back up again, while natural gas prices have not.

The problem is that with natural gas, the amount of storage is not very large. If production is too high, there is no place to store the excess. Demand doesn't change very quickly, because the infrastructure is pretty well fixed. Homeowners and businesses have whatever furnaces and hot waters they have, and don't change them, just because of a short-term change in natural gas price. Electricity can do some fuel switching between coal and natural gas, but long term contracts prevent this from happening very quickly.

In my post last September, I mentioned some of these issues as possibilities standing in the way of ramping up natural gas production. It is very difficult to get a balance between supply and demand, since there is so little margin for error, and since infrastructure doesn't change quickly.

With the new lower price, producers are leaving the business. Some drilling rigs will likely be permanently dismantled. After being "burned" this time, producers are not going to be so willing to come back in again.

It seems likely that if natural gas prices were in the $8 to $10 range, instead of the $3 to $4 range, natural gas production could continue to rise. This would be helpful in many ways. Natural gas could be used to power at least some vehicles, if oil is less available. Natural gas is needed as a chemical feedstock for plastics and other products. Natural gas is also used in electricity production. Without it, it would be very difficult to balance out electricity generated from wind.

It seems to me that if we want to have an increase in natural gas production (or at least, not a big decrease), the US government will need to get involved, and help bring prices to a more reasonable level, and stabilize them at that level. Constant prices, rather than big increases or decreases are what is needed. The government may also need to be involved in helping build more storage capacity, and in deciding exactly what should be done with the additional gas. Should more natural gas vehicles be built, or should more gas be used for electricity?

I think natural gas has a lot of possibilities, but somehow, we will need to encourage it, or it too will decline, with oil production.

September 2008 Post

Can US Natural Gas Production be Ramped Up?

Navigant Consulting Inc (NCI) recently prepared a report called North American Natural Gas Supply Assessment on behalf of a natural gas organization called the American Clean Skies Foundation. In this report, NCI estimates the amounts shale gas and tight gas production can be increased in the next decade. These estimates suggest that US natural gas production can be ramped up by nearly 50% by 2020. How reasonable are these estimates? What obstacles are there to such a big ramp up?

My analysis indicates that NCI is correct in some respects. There is indeed a great deal of unconventional natural gas resources in the United States, and recent improvements in technology point to the possibility of significantly greater production.

There are two major problems, however. One is that short-term demand is not very flexible. It is very easy to flood the market with more natural gas than the market can absorb. The other is that there are a number of obstacles ahead for companies selling natural gas. It is likely that these obstacles, rather than a lack of natural gas, will curtail the rise in natural gas production. As a result, the full ramp up in production is not very likely.

Recent EIA Data for Natural Gas

Let's start by looking at EIA natural gas data. EIA has recently reported a big increase in US natural gas production (8.8%, comparing the first five months of 2008 with the first five months of 2007). Some have suggested that the EIA numbers must be wrong. It seems to me that what we may be seeing is the effect of a recent technological breakthrough.

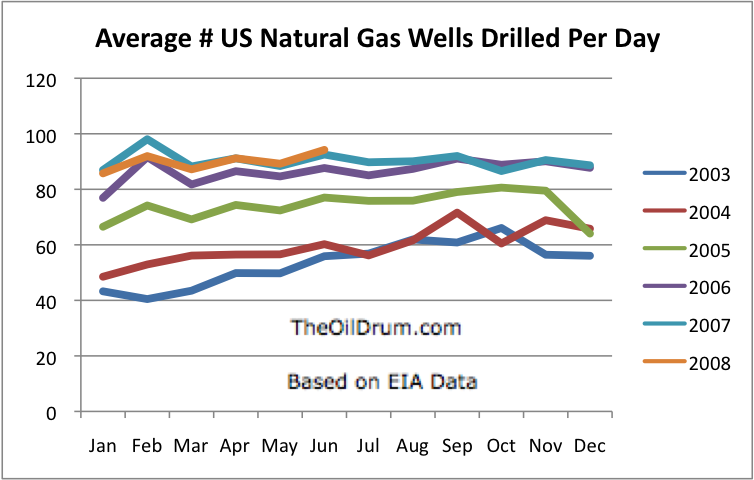

Until fairly recently, many of us had noticed a pattern of increased drilling being required to achieve the same quantity of natural gas production. Most of us interpreted this to reflect declining Energy Return on Energy Invested (EROEI).

In the last few months, there has been a sudden shift in the data. EIA data shows that recent production is rising at the same time that the drilling of new wells is leveling off. Average daily dry gas production during the first five months of 2008 is up 8.1% over the same period in 2007. (Because 2008 is a leap year, total dry gas production has increased 8.8% for the five month period.)

One can look at many other measures as well, and see a similar pattern. The number of well feet drilled per day levels off and even drops, in late 2007 and early 2008, at the same time natural gas production increases. My interpretation of what is happening is that there has been a technological breakthrough, probably in the area of shale gas production of natural gas. Because of this breakthrough, companies are able to produce more gas, with less drilling effort.

There are several reasons I believe that the data reflects a technological breakthrough, rather than, say, an error in EIA data. First, when I look at individual company reports, the ones that show drilling activity seem to show the same kind of pattern--more success with fewer wells drilled. Also, even where there is not information on the number of wells drilled, the company reports talk about increased productivity of wells, due to the increased use of horizontal drilling and better fracturing techniques. Finally, the increased natural gas in the system is having the expected impact on storage and prices, as I will discuss later in this post.

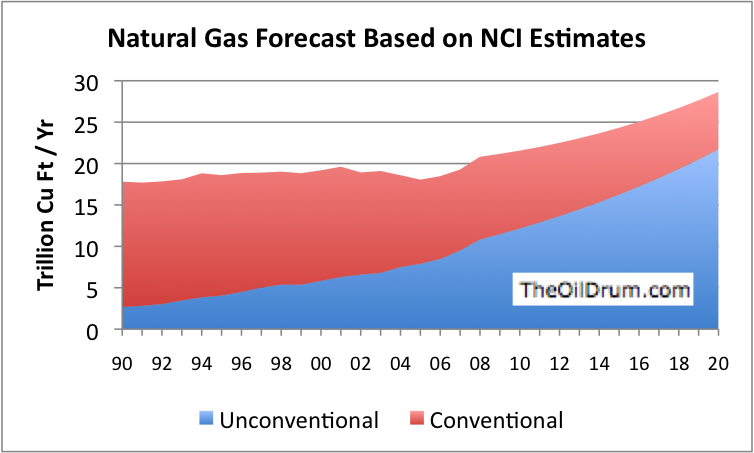

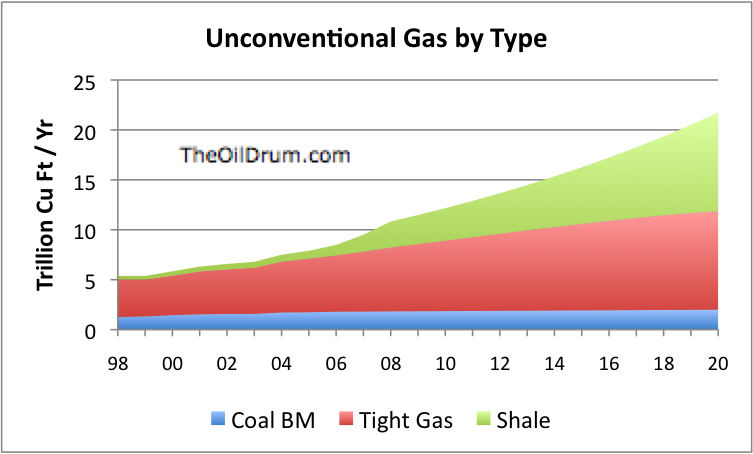

EIA does not break out recent production into unconventional vs. conventional. In fact, the most recent break out of unconventional is for 2006, given in the backup data to Figure 80 of the Annual Energy Outlook:

It is clear from looking at this figure that unconventional gas has been rising rapidly. EIA's forecast for the future looks unreasonably pessimistic alongside its production history. The other two major categories (onshore conventional and offshore conventional) are both declining rapidly (but miraculously are forecast to rise in the future).

The EIA graph in Figure 5 shows that there is the potential for an increase in gas production from Alaska, once a pipeline is built. The EIA forecasts that this will happen in 2020. The amount of the increase appears to be about 10% of current US natural gas production. If this in fact takes place, on my Figure 1, there will be a small bump up in production in 2020, bringing the 2020 production total from 29 trillion cubic feet to 31 trillion cubic feet.

If there is an increase in overall natural gas production, one might reasonably assume that the increase in unconventional natural gas is finally overpowering the decline in conventional production. EIA data by state and information from company financial reports both point to success with shale gas, particularly Barnett shale in Texas. If the recent increase in production in fact relates to shale gas, this would tend to tie what is happening now to what the Navicgant Consulting, Inc.(NCI) analysis is forecasting for the years ahead.

Navigant Estimates

NCI in its report does not make an estimate of total US natural gas production. Instead, it makes estimates of shale gas and tight gas production, in very general terms. In Figure 1, I put these estimates together with some rough estimates of the remaining pieces to get an estimate of expected future natural gas production. (I used a 3% annual decline rate for conventional natural gas.)

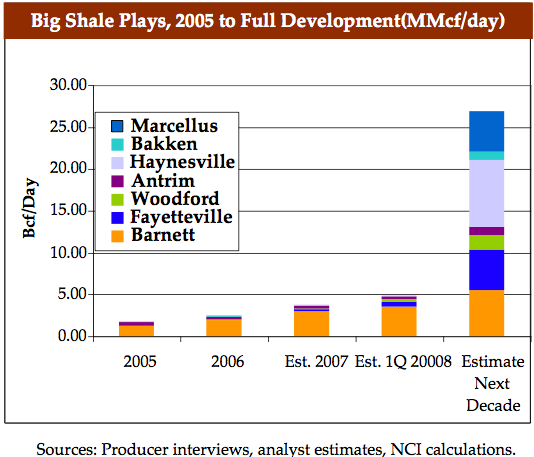

NCI's forecast of shale gas production is in terms of how much sustainable production might be expected from the various shale formations:

The timing is not given very precisely, just "next decade". In Figure 1, I assume that this higher level of production will not be reached until 2020. Because of the imprecision of the wording, a person could argue that production might reach this higher level as early as 2015.

With my interpretation of the NCI report, indications are that shale gas is now the big source of growth, and will continue to be in the future. Tight gas production will also continue to grow.

Previous unconventional gas posts

Many readers will remember that I have written previously about unconventional natural gas:

US Natural Gas: Lessons from BP's Tight Gas Facility in Wamsutter WY

In these posts, I talk about how widespread shale gas and tight gas are. I also talk about the advances BP has been making in its Wamsutter, Wyoming tight gas facility. With this as a background, it is easy for me to believe that if all of the resources are there, there is a reasonable possibility that US unconventional production can be ramped up further. I think there are obstacles that may get in the way of this, however.

Short term problem: overwhelming the system with too much gas, and causing price to drop

What happens when one increases natural gas production by 8% per day? There are a few places this can go--a little to offset a decline in imports from Canada, a little to use as exports to Canada and Mexico, and a little to meet the growing demand of electric utilities. Liquefied natural gas (LNG) imports can be reduced to their contractual minimum. On the industrial side, some factories with spare capacity can use some additional natural gas. It is difficult for these uses to absorb the 8% growth in production, however.

How could you individually increase your own natural gas use? You could turn up the thermostat to heat your house more in the winter, or you could use more electric appliances if you have electricity from natural gas. There really isn't much else you could do, without purchasing something new (for example, a clothes dryer that runs on natural gas, or a car that runs on natural gas). It is not a whole lot different for business users of natural gas.

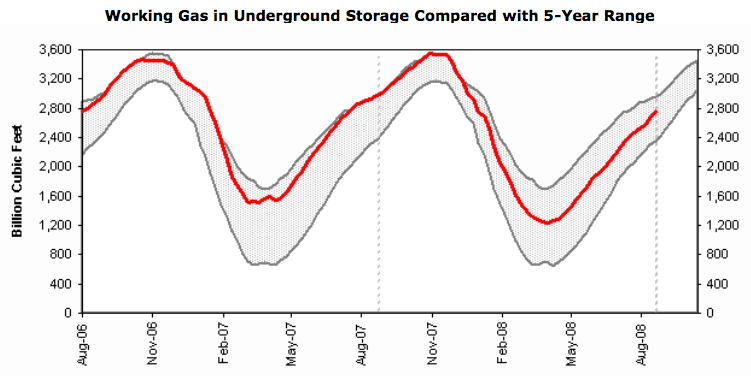

Once demand is satisfied, the remainder is added to natural gas underground storage. This past week, 102 billion cubic feet were added to storage; the week before 88 billion cubic feet were added to storage. The US is currently producing about 56 billion cubic feet of natural gas a day, so over the past two weeks we have put about 20% of production into storage.

The problem is that natural gas underground storage is not terribly large, and it hasn't been increased recently in size to accommodate the new larger natural gas production. Historical data suggests that the practical limit of working storage is 3,600 billion cubic feet. This is a bit over two months' production. As of August 22, 2008, the amount of natural gas in working storage was 2,757 billion cubic feet, leaving only 843 (= 3,600 - 2,757) billion cubic feet of "space" available.

Once storage fills up, there is no other place for the natural gas to go. To make matters worse, it is very difficult for producers to shut production in, if there is no space available for storage, so producers will mostly continue to produce, whether or not there is space available.

Once traders realize that there is a significant chance that natural gas production will exceed storage space, prices start to drop. It seems to me that this is part of what has happened with natural gas prices recently. One consideration in deciding whether the supply will exceed the storage space is the long range weather forecast. The forecast is for a warm fall, meaning that little heat will be needed. We are also in the midst of an economic slowdown, and this is also likely to reduce natural gas use.

All of this makes for a bad situation for natural gas producers--lots of supply, but not enough demand, and prices dropping disproportionately to the prices of other fuels. In another post in the next few days, I will talk various approaches that have been proposed to increase demand, so as prevent this problem. I will also talk about the quantity of gas that might be available.

Other obstacles to growth

It seems to me that the main issue is not whether there is enough natural gas in the ground. It is whether we will be able to get it out and transport it to users. It seems likely to me that one or more of the following will reduce growth to significantly below what theoretical studies would suggest:

Not enough distribution pipeline and underground storage

Every company adding new production will realize that it needs pipeline to connect its gas to an appropriate processing center. It may not be as obvious that the distribution system as a whole is likely to need to be expanded, if significantly more natural gas is produced. For example, if natural gas is to be used to replace heating oil in the Northeast, it is likely that both more underground storage and more distribution pipeline will be needed. (See this post by Heading Out.) Expanding the distribution system is likely to be expensive and take several years.

Worn out pipelines

Matt Simmons has repeatedly stated that pipeline infrastructure is nearing the end of its useful life. If this is true for natural gas, this could be a problem.

Not enough of the right kind of drilling rigs

If everyone wants new horizontal drilling rigs, this will be a bottleneck to growth, until enough new rigs of the correct type can be built.

Not enough pipe

There have been articles in the press about steel for drilling pipe and casing being in short supply.

Not enough trained manpower

This is a problem in any industry that tries to ramp up quickly.

Reduced credit availability

Banks have cut back on their lending. Natural gas companies that have depended on a lot of leverage in the past will find this business model very difficult to maintain. I expect them to either slow down their rates of growth, or partner with an oil major who is in a better position financially.

Counter-party risk

Quite a few of the natural gas companies are major participants in the derivative markets. We know that many banks are in financial difficulty. If banks in financial difficulty are counter-parties on transactions, their defaults may cause financial problems for the natural gas companies.

Issues with water re-injection or disposal

Unconventional gas production requires re-fracturing of wells from time to time. The fluid used in re-fracturing must be disposed of properly. There was recently considerable opposition to shale gas drilling in New York because of water issues.

Declining profitability

This is closely tied to EROEI. If there continue to be advances in technology, I would not expect this to be a problem. Some of the sites may prove to be more difficult to extract than the NCI forecasts, and this could be a problem. There is also the possibility of external impacts, such as higher taxes.

Peak oil

Peak oil will reduce the availability of oil for every use. It is hard to think of an allocation scheme that would fully protect the unconventional natural gas industry. The workers all need cars to get to work; food needs to be transported to the location where there workers are working; and drilling rigs often diesel powered. Any oil disruption could interfere with natural gas drilling.

Lots of good points Gail. I can verify that trying to match the number of NG wells drilled or total footage drilled to some constant expectation won't produce useful results. The effectiveness of horizontal drilling has had its impact for quit a few years now. The big uptick in productivity has been on the fracing side. Several years ago 1 or 2 frac's per well were common. Now 10+ has become the rule in many plays. The best way to envision a frac is to imagine a small well being drilled away from the original horizontal well. Now imagine 10 fracs being pumped at 400' intervals along the horizontal well path. Each of these fracs act its own separate offshoot well.

This is a little difficult to document but this has been the result: It’s not that we don’t need to drill as much footage to develop all the reservoirs out there. You still need to get the well out there X thousands of feet. So the total number of wells needed to fully develop all the NG in one area of a play hasn’t decreased. We’ve just greatly increased the recovery per given area. Good news for the consumer: we’ll recover much more NG per unit area then was estimated just a few years ago. A little good news for the operators: less wells drilled but much more expensive due to multistage fracs.

The bad news in general: the effect is to increase the volatility of the situation. With less wells to drill the production ramps up much quicker. First, this puts pressure on the local gathering system: difficult to expand the pipeline system fast enough. Second, it pushes a surge of NG to the market. Even without the economic downturn the volume of new supply would have exceeded demand. It would have just taken a little longer.

Didn’t have time to read the NCI report but if they didn’t include a price model with their projection of a 50% increase in NG supplies over the next X years then it’s as useless as many of the other reports out there IMO. We do have 10’s of thousands of PROVEN unconventional NG wells that could be drilled. But those reserves are only proven at a much higher price level then currently exists. On any given day the volume of NG that could be developed in the future will vary greatly (at least a 5 to 10 times factor IMO) on the price model one uses. At $3.50/mcf we have X trillion cf of proven NG. At $14/mcf we 10X trillions cf of proven recoverable NG (just a WAG on my part but probably on that magnitude).

Logically, as you point out, gov’t intervention to stabilize the NG market makes sense. But I have virtually no expectation of that political will ever developing.

Thanks for the info. The production data (together with the drilling record) certainly suggests there was a technological breakthrough somewhere along the line. EROI can actually go down, rather than up!

But politically, the idea of supporting higher natural gas prices would be difficult. It would probably have to be put in place with production controls, that would gradually change over time, as new infrastructure was added. Not likely to happen.

Hm, Gail, I don't know if RM is saying that.

He says more fracing is taking place, greater investment despite fewer wells.

Added in edit: RM says

How that nets out on energy seems unclear.

Still, fascinating post.

Gail,

I'm still in break-time from TOD mode so not sure if this has been discussed.

Matt Simmons has hinted in recent presentations that there is something fishy about UG NG production figures. In his latest presentations he's now coming flat out and saying they are not real.

See the following slides from this presentation http://www.simmonsco-intl.com/files/OTC%20Topical%20Luncheon.pdf

There's also more slides in the latest presentation at http://www.simmonsco-intl.com/files/Oklahoma%20State%20University.pdf

For example

Any comments?

Everything except "Deep GOM Shelf" and "GOM Deepwater" decline between 60-80% the first year. Removing half the rigs just must make a large difference very soon.

The majors are the ones involved in offshore work. Offshore production was very much impacted by the two hurricanes, and the same time that onshore production surged. Breaking out the production the way he does, he is basically breaking out mostly offshore from 100% onshore. The remaining part is also onshore. It can be expected to act like the rest of the onshore--that is, have a big increase.

I think Simmons is worried about nothing. To me, the data looks right.

I haven't seen the article (I'm supposed to get a copy later today--maybe someone else has a copy?), but reportedly Natural Gas Daily has an article about the EIA looking at revising their NG production methodology--because of the discrepancy between what their numbers show and what public companies are reporting.

did you get a copy ? the api will allow a free trial subscription hook.

Excerpt down below. The article noted that Raymond James showed an increase of less than 1% in natural gas production from public companies from Q4 2007 to Q1 2008, while the EIA showed a 3% increase in total production, although Raymond James is showing more of increase in Q1 2009 than the EIA.

I was in a meeting with Matt and a group of people in his office a few weeks ago, and Matt was quite adamant that he though that there were problems with the EIA natural gas numbers. He is concerned that the decline in drilling will put the industry in a position where we may not be able to catch up with demand--perhaps as soon as late 2010. He also thinks the Qatar reserves are significantly overstated.

Here is an excerpt:

From the June 4, 2009 Gas Daily:

EIA reviewing accuracy of production estimates

Matt Simmons also says that the shale gas fields go into decline very rapidly. What affect does this have on projections?

The effect it has on projections is that new fields have to come on line continuously. Many times you see these characteristic layered NG production plots. The successive layers have a delineated shape primarily due to this fast depletion.

If the new introduction ever stops it all will end rather abruptly.

Hi Gail,

As always, a very thought-provoking post. Once again, we run up against the economics as the primary underlying problem with production. As you point out, government intervention is probably necessary to put a floor under prices to ensure that the gas actually gets produced.

I live in New York and last year took my Permaculture certificate course down in the Catskills, in the heart of the Marcellus play. To expand on the issues around opposition to current hydro-fracking practices in the area, here are a couple of points:

Boone Pickens proposed last year switching the vehicle fleet to NG, while replacing the electricity production with wind. What are your thoughts on what this would do in evening out the fluctuations in the price cycle?

Regarding water, this is another issue that needs to be looked at. The water injection is at many feet below the water table, and the track record seems to be pretty good in the past. But if there is a lot more fracing and it is near populated areas, one wants to be pretty sure that things are working out as planned.

Regarding switching vehicles to natural gas, the tricky part is the way to switch just the right number (in the right locations) to natural gas. Our pipelines and storage are not all that adequate. If a number of vehicles were added in the Northeast, we could end up with not enough natural gas to run our electric power plants there.

The vehicles that are added would have to be limited in number, and added near where the natural gas is produced. I would think it might be used primarily for short-range commercial vehicle, that could fill-up fairly frequently in the same location.

One thing I forgot to mention is that Pepacton and Cannonsville reservoirs, ie. all the drinking water for NYC is right there as well.

Another issue is the resale of the leases. On the one hand, the drilling rights and royalties could potentially bring wealth to some of the poorest counties in NY State. On the other hand, with rapid whipsaw crash of prices, I've heard that Chesapeake and others are selling off their rights- to Chinese companies is what I heard, but can't verify. Once somethings on the market, it never comes off.

Basically my feeling about energy is that it counts as infrastructure, and ought to be managed as heavily regulated geographic monopolies. This would go back to the 60s model of things. A floor price could be guaranteed. I don't believe de-regulation of energy (or telecom or other infrastructures that used to be PSC-regulated) has in any way made infrastructure cheaper or easier or better. It's fascinating that we now want stability without, somehow, government intervention...

I'm no expert in gas drilling.

The bigger picture I see here is that new technology has increased the available reserves and maximum drilling rate, but at lower EROEI, which translates into a sharply higher cost for the marginal BTU.

This has coincided with the collapse in demand we have seen from the wider economy.

So we have a classic imbalance between demand , supply and price, which all other things being equal, will cause price/production swings until the two are in balance again.

Of course, all other things are not equal. We are facing sharply more expensive oil at the same time, and the supply of oil is not going to significantly increase (or do anything other than decline) regardless of price.

This must mean that the US economy has to adapt to more expensive oil and (in the medium term) gas at the same time. As these two together represent more than half the primary energy supply in the US, this can only mean a contraction in the economy until it becomes sharply more energy efficient or other energy sources can be expanded to make up the difference (or a bit of both). Neither of these are likely in the short term.

The real question is - what price for energy can the US economy support? If the answer is 'less than the cost of drilling unconventional gas in large quantities' then the drill rigs will stay idle.

Ralph,

In terms of energy value, 6 mcf natural gas is approximately equal to one barrel of oil. At $3.50 mcf, this is only equivalent to $21 barrel. At $10 mcf, it is equivalent to $60 oil. So in some sense, it is not like the cost of natural gas has to be sky high, to get production up.

For driving cars, we are used to paying prices at this level for fuel. Natural gas at a $10 mcf makes for fairly expensive electricity, but we have lived with it in the past.

Does this calculation include the low efficiency of ICEs vs. electric motors?

here is some interesting data from the doe:

number of ng wells producing, annual basis, through 2007

http://tonto.eia.doe.gov/dnav/ng/hist/na1170_nus_8a.htm

Gail --

There are a lot of good bits of information here, that help us keep our eye on the ball with respect to natural gas. American Clean Skies Foundation is underwritten by Chesapeake Energy which of course has a vested interest in shale gas plays. The Navigant report is plenty credible, but I'm a little puzzled as to why Clean Skies would need it.

Chesapeake has claimed that shale gas needs a price in the $7-8/mcf range to grow production, which is consistent with your estimate.

There is a lot of natural gas resource there, by any measure. But a lot of dynamic ('volatile') pieces as well. One of them is LNG. The U.S. also has a lot of spare LNG capacity as a result of recent investments. Now that those dedicated trains are moving, it's very hard to shut them off. One colleague told me spot cargoes were landing in Asia at $3.20/mmBtu i.e., less than the traditional spread to oil in those markets. It's hard to see U.S. natural gas prices, and therefore production, making headway in that environment.

The last piece is oil itself, which the markets watch as a signal that overall energy demand is picking up. If the oil rally continues (switching to the financial side), we'll probably see natural gas get dragged along in spurts and the whole complex will pop simultaneously. Which brings me to your statement that:

We like to think of ourselves (in the U.S.) as the exemplar of what markets can accomplish. But the last couple of years have certainly shown that both end-users and producers hate price volatility at least at the recent extremes. Are the markets too free, or not free enough?

It is really both oil and gas prices that need to be stabilized. Several of us wrote "Advice to Obama" posts at the beginning of the year. In my post, I suggested that oil and gas prices needed to be stabilized. I think in a way the situation is a little like farm price supports. If you expect to have it when you need it, you need to see that the producers are properly rewarded.

LNG is a problem, as you say at least now with prices already low. The amount is relatively smaller. To encourage US production, one almost needs to keep it out. With North Sea production declining, it seems like LNG is at most a temporary problem. Europe is likely to need LNG pretty quickly, as its local supplies dry up.

I keep hearing about shale gas in the context of North America. Are there no similar resources in Europe, and China?

Gail -

You say:

"All of this makes for a bad situation for natural gas producers--lots of supply, but not enough demand, and prices dropping disproportionately to the prices of other fuels. In another post in the next few days, I will talk various approaches that have been proposed to increase demand, so as prevent this problem. I will also talk about the quantity of gas that might be available."

Uh, why exactly is it my interest to have natural gas demand increase so gas suppliers can be more profitable? And why exactly are you so anxious to have this 'problem' solved? I thought one of the underlying beliefs of most TODers is that using less energy is a good rather than a bad thing.

Excuse me if I lack compassion for the poor gas suppliers. In our locale we were clobbered real good during the 2006 -2007 period when, partly as the result of utility deregulation in Delaware, we saw gas prices increase by something like 60% even though there was no real shortage. I say that if the gas suppliers can reap huge profits on the upside, they should also take some pain on the downside.

joule -- Don't know the details of your utility deregs but I've seen it happen in other areas. Can go like this sometimes: local utility regs fix the price of NG to some degree. Sometimes by allowing prices to increase only at a slower rate then the rest of the market. As a result NG seller will ship the NG to more profitable markets. If that's somewhat like your situation then you're correct...there was no shortage for lack of NG in the system. But there was a local shortage due to NG being sold in other markets.

This will probably be a continuing problem in the future. Might even get a lot worse. Utilities may try to lessen the economic impact of NG price spikes by limiting price increases. But unless the utility has a contract with its NG suppliers that require a fixed delivered volume regardless of market conditions

The feds tried to do something like this back in the oil crunch. They allowed oil prices to increase only a fixed percentage when it was sold to a buyer. As a result a tanker of oil might be sold between 10 or 15 different buyers while it was at sea. It was called a "daisy chain" back then. Besides not limiting the oil price spike it greatly disrupted the distribution pattern: you didn't know who would own the oil when it reached a US port and thus didn't know where it would end up. And it also made some folks multi-millionaires by just signing a dozen purchase contracts a day.

ROCKMAN -

Thanks for the clarification.

I think we need to put some restrictions on this blatant 'arbitraging' of oil and gas. They are both far too essential for the functioning of our society to have their prices manipulated by large wheeler-dealers. It is particularly galling that some of this is probably being done with bailout money!

I am of the opinion that one of the main reasons that most utility companies hate wind power with a passion is that no fuel is involved. So, with wind they cannot play games with fuel-price escalators, fuel surcharges, and other mechanisms for passing along the cost of fuel increase directly to the consumer with perhaps the bypassing of a few crumbs to their own coffers.

This also brings up a point I'd like to make: neither energy suppliers nor public utilities have a genuine interest in conserving energy, all of their PR notwithstanding. In fact, there is a direct conflict of interest in doing so: energy conservation = lower demand; lower demand = lower prices; and lower prices = less profits. After all, how many companies in our supposed free-market economy truly want its customers to use LESS of its product?

I agree about increased restriction joule. This could be an area where a trade off might be developed. Restrictions on the arbitrage with some sort of carrot of price stability. Volitility hurts one end of the spectrum or the other. Again, I'm not sure what this sytem would look like. Neither side would be anxious to give up the advantage when it plays to their benefit. My greatest doubt is with the gov't to develop such a program without the politics dominating the process. I'm sure their are a few clever folks here who could devise such a system. But politics on both sides would likely crush such a logical design.

Our oil supply is drying up. In the US, we have two local alternatives -- natural gas and coal, both of which can be available in reasonable supply. I can see objections to coal, but natural gas is relatively better. It can fairly easily be used to power vehicles--much more easily than making electric cars with batteries, for example. I think that there is a chance that our standard of living could decline less (and fewer die of starvation), if we could figure out how to utilize the natural gas we have.

Gail -

In general, I happen to like natural gas.

I just don't have any great enthusiasm for enriching gas suppliers at my expense. Nor do I think it makes much sense to deliberately implement ways of increasing the demand for natural gas just to maintain profits for the gas suppliers. There's got to be a better way of doing things.

Then we have the question of whether it is really in our long-term interests to burn such enormous quantities of natural gas for heating and electricity generation rather than using for its much more valuable role as a feedstock for the manufacture of nitrogen fertilizers and essential organic chemicals. I view it almost like burning your furniture to keep warm.

RE: NG storage.

It would seem to me that one promising area of research would be the synthesis of propane from methane. This would allow storage and use as LPG, for which an extensive storage and transport infrastructure is in place.

"saying that it looked like there was a reasonable chance natural gas production could be ramped up. I still think that is true."

I don't understand. That what is true? That NG production could be ramped up? Or that there is a reasonable chance it could be ramped up?

The natural gas is there. The technology is there. What is missing is making it work with the economics. So the reasonable chance has to do with the difficulty of making the economics work.

Uuuuum. I have no idea what you are trying to say.

Obviously economics play a part. Nobody says otherwise. Not that I know of.

Look at your own graph. Production rises steadily for the last five years. VERY steadily. Only hurricanes interrupted the march.

This goes through at least one business cycles and heavy volatility in price. As well as all fluctuations in the oil market. What is it that I'm missing?

Try again.

Previously, "everyone" thought natural gas production was going to go down. Then new technology came along, and everything looks fine--except we can't find a way to keep the price up high enough for those drilling the gas wells to stay in business.

The way drilling rigs are being withdrawn, companies are selling off land, and people are retiring from the business, it looks like decline is around the corner again.

I think stability is overrated.

Natural gas producers are going to learn to more quickly increase and decrease drilling on shales as natural prices rise and fall. They'll figure it out.

I think talk about attempts to stabilize prices are a waste because we know that politically that's just not going to happen. Better to discuss proposals that have a better chance of happening.

We figured it out long ago pundit. When NG prices start to rise we START to increase the effort. When they collapse we pull the plug IMMEDIATELY. Been that way for the 35 years I've been in the oil patch. You don't want to stabilize prices that's fine. The industry has just shut down NG development to a large degree in a record breaking time. It will stay down until there are clear signs that the imbalance between supply and demand has ended. At that time prices will start to run up. The country can sit back and suffer ever increasing prices and potential supply disruptions while we take several years to ramp back up. The process that led to increases in NG supplies we saw the last couple of years didn't start a couple of years ago. They begin in earnest 5+ years ago.

Companies depend on the capital market to fuel the process. After the collapse those markets just witnessed I suspect they'll want to see the US NG consumer really suffer before they start feeding the process again. I'm sure many think that as soon as the curves start reversing themselves and future supply issues become apparent the oil patch will start buying leases like crazy and rebuilding all those drilling rigs that will be sold for scrap the next couple of years. There are few matters in the future I feel comfortable predicting. But this is one of them: it won't happen like that. It will take a prolonged period of pain by the consumers before they see any relief coming from domestic NG drilling IMO. It might even have the potential to send us into another recession just as we are digging ourselves out of the current mess. This is the volatility we've been talking about. And it will probably become increasing more painful for the both sides as we go forward.

Peak oil will reduce the availability of oil for every use. It is hard to think of an allocation scheme that would fully protect the unconventional natural gas industry. The workers all need cars to get to work; food needs to be transported to the location where there workers are working; and drilling rigs often diesel powered. Any oil disruption could interfere with natural gas drilling.

All this can be powered by natural gas.

It takes planning and investment to get the natural gas vehicles in place. There would also need to be refueling stations along the way, because they cannot go as far between refueling as gasoline powered vehicles. Maybe this will happen quickly, but I wouldn't bet on it.

It is Liebig's Law of the Minimum that comes into play.

"because they cannot go as far between refueling as gasoline powered vehicles"

Can you source this? I think you are confusing NG with electric cars.

NG powers a huge percentage of the US bus metro bus fleet. There are hundreds (and maybe thousands of stations) and home-refueling hookups are currently available and cheap (as opposed to gasoline).

Please learn about this subject before you write about it again.

The problem is that even with compression, the gas tanks take up a big space. Natural gas is usually used with things like metro bus fleets that stay close to refueling stations. This link says:

With respect to cars, we read:

I would suggest you improve your manners. Such behavior is not appreciated here.

Gail et al certainly don't need any defense from me but exactly where are all these "thousands" of CNG fueling stations? I live in Houston, one of the largest cities in the country which also has a near fatal love of car ownership, and we have exactly 2 CNG station available to the public. And they were done just as a demontartion projects. I used to commute past one of them for years and never once...not once...saw a car fueling there.

Rude behavior doesn't really bother me. In the oil patch we tend to be rude and crude at times. But ignorance is never tolerated.

"Please learn about this subject before you write about it again."

YOU ARE RUDE! I don't care who you are! and i'll it say again when needed! I speak for many on this website, your comment was uncalled for and unwelcomed, unless you can prove you are an expert on the subject, in which case you should be posting an article on it yourself. complete with references! Since you appear to be "the expert"

We at The Oil Drum pride ourselves for not be rude to each other in our discussions. And we would all appreciate you being considerate to others, ESPECIALLY the author of the article! Not everyone here is in the oil and gas industry, some have more knowledge than others about it. so, in the future, while your on this webswite, please keep that in mind, and please refrain from being brash and/or slamming someone on this website, with such rude behaviour as demonstrated before, unless you have something to positively share with us all on this.

Gail, thanks for the article, it is much appreciated! job well done! now,! if nat gas could just get over $6!

One gallon of gasoline currently costs $7.20 per gallon in Germany and many people still use SUVs to drive to work.

http://benzinpreis.de/statistik.phtml

Do you expect oil prices to go well beyond $7.20 per gallon in the near future, such that NG refueling stations cannot be built for the NG employee in time?

GM does sell CNG/gasoline vehicles (dual fuel = not dependent on CNG stations) in Europe (approx. 200 miles range on CNG only). I would expect they could do the same in the US.

Diesel engines can dual fuel on diesel and natural gas with about 70% displacement of diesel fuel, maintaining the ability to run on diesel if natural gas is unavailable.

A similar application for diesel powered farm equipment allowing them to dual fuel on locally produced biomethane would increase resilience for the farming system and reduce the risk of oil price or availablity shocks.

What conversion is needed (CNG tank, lines, engine settings, etc)? How expensive is the conversion?

Nick,

Iran converted 400,000 vehicles to duel gasoline/CNG it can't be that expensive. A LPG conversion is about $2,500 in Australia.

I can't claim to be an expert, but I understand you need a CNG/LNG tank, some valves and an injector for the natural gas.

There are two options, either injecting the gas into the air intake or special injectors that inject diesel and natural gas into the cylinder at high pressure at different timings.

I can't find any figures for the cost but would estimate it would be quite cheap if you mass produced the components.

http://www.cleanairfleets.org/pdf/Margo%20Melendez%20061103.pdf

http://www.cleanairpower.com/duel-fuel-engines2.php

The impact of shale gas on volatility seems interesting to me. In the short term, it would seem that shale gas would increase volatility as it is harder to shut in production, however, in the medium term, it would seem that the very fast decline rates for the fields would reduce volatility, as the impacts of fewer wells drilled in response to falling prices would be felt more quickly.

LNG, counter to the conventional wisdom, has increased volatility in the gas market, at least in the US. While LNG should provide a cap on prices, at least at the regional level, however in the US the decreased worldwide demand has caused a flood of LNG into the US, even with the highly depressed nat gas prices.

Anybody have an idea if LNG will bring any kind of stability to US nat gas markets in the future?

Dax -- Here's one possible answer: increased imported NG reduces domestic development. Import enough at cheap prices and the domestic NG drilling market all but shuts down as far as new wells go. At that point we become more dependent upon another imported energy commodity just as we are for oil. Let imported LNG depress the local market at current levels for a few years and there will be little left of the domestic NG development industry to come back anytime soon. The imported oil dependency did't seem to kill volitility in it's market too well the last 12 months.

Just one possible view.

It seems to me that someone a while back said that it was now profitable to produce natural gas, just for the natural gas liquids it produced. This left producers with the left-over natural gas, which they were willing to sell at a loss. Hence the low LNG prices.

I am not convinced anything other than government intervention will bring price stability to markets.

Gail -- I didn't save the link but I read an article which highlighted a Persian Gulf field which held upwards of a trillion cf of NG and had a condensate yiled of 40 to 50 bbls per million cf. If those numbers are correct then that's about 1 million bbls recoverable which is around $60 million on the current market. Not huge by PG standards but it's there. If they can compress, sell and ship the NG for net of $1.00/mcf (guessing $4/mcf to a US terminal) then they make another $1 billion. Just a WAG but that is about the cost of a major LNG facility.

Of course, ME reserve numbers always have to be viewed with some doubt.

Rockman,Gail,or anyone with serious expertise,

There is APPARENTLY-according to my understanding of the coverage here of ng- plenty of recoverable gas within the US to meet our needs for a few decades at least,even if we use a lot as transportation fuel.This if true is extremely good news of course.

Once the market turns around and the drilling is resumed in earnest,about how much longer will it be after that before we are sure that all that gas is really there at say 90 dollars per barrell of oil or less equivalent?

farmer -- I wish I could give you a simple answer like X years at current consumption rates. But no one can. The recent surge in shale gas drilling has proven up 10's of thousands of POTENTIAL DRILLING LOCATIONS and X TRILLION cf of NG. But how much will be developed and in what time frame will depend entirely on pricing. At $3.50/mcf relatively few of those wells will get drilled. At $14/mcf many, many thousand will be drilled. The good news is that this INPLACE reserve has been proven to a great expense. Unlike speculating how much oil/NG might be off the east coast or in the Arctic Basin, this NG has been proven to exist and also be recovered with existing technology. No "pie in the sky" fantasy.

The biggest problem I see is the time lag between the point when demand starts to outpace supply and when new drilling efforts can have an impact. As I mentioned earlier, the ramp up in NG rates we saw in the last 2 years took a good 5+ years to develop. If demand starts growing quickly just as rates continue to decline due to the recent cut back in drilling, consumers could be hit with 2 to 4 years of spiking prices and perhaps even shortages IMO.

"....however in the US the decreased worldwide demand has caused a flood of LNG into the US, even with the highly depressed nat gas prices."

net imports are about 8 bcfd. lng, which is included in imports, is about 1 bcfd. there has been no dramatic increase in lng imports through 3-09. lng imports were over 3 bcfd in early '07.

http://www.eia.doe.gov/oil_gas/natural_gas/data_publications/natural_gas...

Gail I think your missing the Henry Hub issues in 2008

http://www.reuters.com/article/rbssIntegratedOilGas/idUSN0243476720080902

And some significant amount of deepwater GOM production brought online in 2007/2008.

Depending on the timings of all of this I'd suggest its covering the falling rig count on land at the moment.

I haven't seen the detail data I would need, but my impression is that the little producers have been vastly outperforming the majors. The majors are the ones primarily in the GOM, so I wouldn't think that has been the major issue.

Thanks for this.

Curious if anyone knows the longterm outlook for natural gas. It seems foolhardy to rely too heavily on an energy source that would only get us a few decades (pulling that number out of thin air here) unless we did so as a bridge to something more sustainable. Hubbert was pretty good at modeling the longeterm outlook for oil. Anything like this possible for gas, or are there simply too many unknowns given changing technology?

"Hubbert was pretty good at modeling the longeterm outlook for oil. Anything like this possible for gas"

In fact, Hubbert tried it for US nat gas in the 70's, and predicted that production would fall off a cliff in the 80's. As we see, that was very wide of the mark.

With natural gas, there seems to be a huge amount in place. The question is what we can do economically, and whether Liebig's Law of the Minimum will get in the way.

I don't think there are very good models for unconventional natural gas. Jean Laherrere has been doing some modeling, I believe, but it mostly relates to conventional.

Modeling of NG production is tough. I would suggest that the shale gas counts as a new series of discoveries of essentially a lower grade of gas. So we have a delayed production peak from the original discoveries of conventional gas, starting to overlap with an ongoing peak of discoveries of the shale gas. When you superimpose these two shifted humps, it looks like an extended plateau or even a gradual rise. Hubbert did not guess right on the new stuff.

Why didn't these two sets of discoveries coincide? For one, I don't think prospectors were necessarily looking for shale gas way back when, and so when the time was right, these became the thing to look for. So we are getting new discoveries across the states.

It may happen again with methane hydrates, essentially an even lower grade of methane. As the grades of these resources lowers, depletion looks more like an intense mining effort, where just the necessary amount is extracted to meet society's needs. It becomes harder to plunder like we did with oil, as it takes much more energy and effort to do the extraction.

In the extreme case, I imagine a model of salt extraction from the oceans would be a very dull and uninteresting model.

I'd cut some slack on Hubbert. He predicted global crude peak production by 2000 back in 1969. So he missed the peak by 5 years, because it was really 2005. Projecting out 30+ years he's off by 5, or a ±20% error. Better than a lot of folks, like most of them, and most making forecast attempts over shorter time frames.

See you on the other side, bro.

Well said. I just wish everybody else here paid that kind of attention to detail.

In 1976, Hubbert said that oil would peak about 1995, but that OPEC actions might push this out a decade. The Iranian revolution of 1979 had some of the same effects as an OPEC action.

According to figure 8.23 in chapter 8, "Energy Resources" by M. King Hubbert in "Resources and Man", NAS,NRC (1969) there are two predictions, a conservative cycle with an ultimate Q quantity of 1.350 trillion barrels (peak in 1990*) and another, more liberal cycle with an ultimate Q quantity of 2.100 trillion barrels (peak in 2000). Of course, anyone is free to amend their predictions at a later date.

He also mentioned it's pretty much over for oil by 2032, for anyone planning out that far (about 23 years from now).

*Hubbert called the conservative peak at 1990, not 1995, back in 1969. Please excuse my poor initial graph reading.

I think the boom in NGVs is only a few years away. I believe PHEVs like the GM Volt will disappoint potential buyers with the price and low all battery range. If that is say 40 km then by contrast the 'non-petrol' range for the Honda Civic NGV will be more like 350 km I believe. The current lack of filling stations could be overcome by CNG/petrol dual fuel cars. On long trips you fill up with whatever fuel you can get.

The other increase in demand for NG I think will be a proliferation of combined cycle peaking plants say around 250 MW capacity. If wind power is mandated or various forms of generous credits are continued then these gas peaking plants will be needed for load balancing. It may prove necessary to limit the ratio of gas fired kilowatt hours to wind kwh's in order to conserve gas.

If cap-and-trade schemes for CO2 become world wide that will boost demand for gas fired electricity as it has less than 50% of the emissions of coal. However I believe that baseload power is a task better done by nuclear with even lower CO2 emissions. Since all cap-and-trade schemes are likely to be weak this will be a slow changeover.

Therefore I think it is unwise to encourage frivolous gas use now since supply will become crucial some years hence. Perhaps a minimum price should be set by legislation.

Boof,

Probably the best use of CNG will be in retro-fitting existing vehicles( if we have a sudden supply shortage).

PHEV's such as the Volt, are reported to have a 60km range using only 50% of the 16kWh battery, this is likely to be conservative so range will probably increase. For most peoples daily commute 60km is more than adequate, and CO2 emissions will be less if NG is used in combination with wind and solar to replace coal fired electricity. Plug-in Prius' will probably only have 10km all electric range but for some this will be adequate most of the time, especially if they can re-charge at work, shopping or rail-line parking stations.

"this is likely to be conservative so range will probably increase."

From a commercial POV I think it unlikely they would post conservative figures, more like hyped-up ones.

JMO.

If electric vehicles do go commercially viable, I predict much better range and "fuel" economy within a few yearly models just as a factor of size/weight. ICEs can add a bigger tank to a large vehicle with few drawbacks (given cheap gasoline). Electric vehichles really make more sense when they are small and light. They will go farther and require smaller batteries and thus less charging time. The trade off of these things dfor a smaller size will appeal to consumers in the same way that sporty cars can be small in exchange for more acceleration. Until recently, the American consumer saw no reason not to get a bigger inefficient car.

Boof,

It seems that for one reason or another not exactly clear to anybody outside Honda management that Honda has bailed out of the ngv market.

There is an in depth article at the Cutting Edge site by Edwin Black on this development.He is not one of my favorite news dogs but he seems to have his coonup the tree this time.

I thought Honda opened a factory in the US to make these cars. Somebody thinks the Opel Zafira turbo CNG van could be re-badged as GM and it would sell in the US

http://www.cngchat.com/forum/showthread.php?t=1793

A dual fuel van solves both the problems of luggage space and lack of filling stations.

It seemed like the US was angling towards greater NG usage for truck transport, especially with the incessat Pickens ads to push the idea forward nationally. However, California voted down an initiative to expand NG usage and NG for transport stocks dropped at the time like a stone. Also, I understand Gore encouraged Obama to avoid NG use for transport due to CO2 ramifications, and that seemed to end Pickens idea.

Now, sometimes good ideas get rejected only later to become instituted with those in charge claiming it was obviously the correct choice. Maybe as we approach the next peak in oil prices that could still happen.

public traded companies have made these estimates based on some questionable assumptions.

1) the assumption that production will follow an hyperbolic decline and produce at a low rate forever. most of these projections are little more than a wag. there is simply not enough history to support the projections.

it has been claimed that becasue some (vertical)shale gas wells have been in production for decades, this new crop of long reach hz multi-staged frac'ed wells will also produce forever. fantacy

2) the assumption that initial potential is an indicator of recoverable reserves. again not enough history to make this leap of faith. fantacy

3) the assumption that widely spaced wells will preform the same as 160, 80, or 40 acre spaced wells. more fantacy.

imo, it helps to keep things in perspective. the largest domestic ng field, hugoton, is expected to ultimately recover 81 tcf and has been on production for 70 - 80 yrs.

Funny that we do not understand what leads to hyperbolic decline versus exponential decline in the first place. As you infer, true hyperbolic decline can lead to a mathematical incongruity of infinite reserves, leading to a low rate of production forever!

What I find is that a seeming hyperbolic decline is likely due more to incremental reserve accounting rather than proportional draw-down (which leads to an exponential decline behavior). Theoretically, diffusion (ala d'arcy) could also play a role as it provides a counter-balance of incremental reserve to offset exponential decline.

I think if we could understand this behavior it will go a long way to improve our projections.

exponential decline is a result of basic material balance, flow rate(from a purely depletion reservoir) is proportional to the amount remaining.

ideally, a reservoir consisting of a fracture network connected to lower, but not negligible, permeability would produce a hyperbolic decline. if flow into the well is dominated by flow from fractures, with very little or negligible contribution from intergranular porosity, the decline may be essentially exponential.

a case in point is provided by the parshall bakken field in the williston basin of north dakota. parshall is/was producing from a fractured reservoir above the bubble point. decline for the parshall wells has been exponential with a decline rate ca 60% for more than 2 yrs. only now that some of the wells have fallen below the bubble point has the decline moderated.

and how does this relate to ng ? bakken oil

is a volitile oil and parshall oilfield will probably turn into parshall associated gas field before abandonment. this happened to the very first hz bakken well drilled in 1987.

Here is an interesting discussion on the use of natural gas for power generation from this month's Power Engineering magazine.

http://pepei.pennnet.com/display_article/361776/6/ARTCL/none/none/1/Spec...

"If you go back and look at gas history and where the big hurricanes are, you take the big hurricanes out of it and gas prices have classically been relatively low......"

huh ?

http://tonto.eia.doe.gov/dnav/ng/hist/n9190us3m.htm

Jim,

I am no expert in ng conversions, but most farmers are at least accomplished amatuer mechanics and I know enough to add a few useful comments from having been in contact with people who do them.

A gasoline to gas conversion is a pretty simple if you are working on a large older truck or farm tractor or other machine with easy access to the engine and a convenient place to mount the tanks.I have helped convert a "two ton" Ford truck originally built to run on compressed gas to gasoline and converting it back would be a snap.(Such trucks can be had sometimes at bargain prices and small farmers,loggers,and others in need of cheap trucks are ready buyers.)

Converting a late model car or small truck can be a killer because:(1)these vehicles are not really designed to be easily repairable,and there is virtually no free space available under the hood.Changing the water pump,for example, on a farm tractor, a commercial truck,or a vintage car is a very quick and easy job,but the same job on a modern car may take twenty times as long because you must r and r half a dozen or more other components in tight quarters just to get a good look at the water pump.(2)There are so many different models,engine families,options combinations,etc that although all the conversions are in principle pretty much the same,in practice,they vary a great deal.This means that the conversion shop must stock or order numerous variations of the installation kit,which runs up the costs considerably,and that the mechanic,unless he does nothing else except conversions,is constantly scratching his head trying to figure out just how to assemble the 3d puzzle.

Big rigs otoh are much better suited to conversions.Fuel tanks can be mounted along the sides under the cargo box or the sides of the truck or truck tractor itself.The lines just plug up like extension cords.There is plenty of room under the hood,and the engine and every thing else is designed with easy access in mind to minimize repair costs and down time.Engines are improved from year to year,but a given engine design or family of engines is usually manufactured for a decade or longer,and the exterior parts are highly interchangeable from year to year,and even from make to make sometimes.Furthermore most fleet operators standardize on a given make of engine even if they run different makes of trucks.(Heavy trucks are built to order,and the buyer specifies the make and model of engine,transmission,etc.)The mechanics see the same equipment day after day,which considering these trucks typically run a hundred thousand miles or more per year should be no suprise.

Given the relative ease of conversion,the heavy use these trucks get,the enormous amounts of diesel they burn,and the amount of money on the line,converting a large number of them will not be a big issue if it becomes necessary due to shortages of diesel,or desirable if diesel becomes relatively much more expensive than gas.

I do not believe that the lack of fueling stations is nearly as big an obstacle as it appears to be, because large numbers of these trucks run so called dedicated routes that go from point A to point B over and over again.A single fueling station every couple of hundred miles along the interstates would enable a large numbers of truckers to run on ng with no problems.

A dozen such stations for example on I95 or I81 could serve the needs of many thousands of trucks that never get more than a few miles from either of these interstates.Considering that each of them would use the equivalent of 100 to three hundred gallons of diesel per day,this should be enough stations for commercial ng fueling to achieve critical mass and grow on it's own once the first few dozen well located stations are operational.

Loaded trailers that have to go where gas is unavailable can go as far on gas as possible,and switched to a diesel tractor in about five minutes.The paper work takes longer than the switch.

yes, you make some good points. For fleet vehicles I think CNG is a viable alternative and have spoken with the Natural Gas Vehicle America http://www.ngvc.org/about_ngv/index.html president, Richard Kolodziej about this. He was a presenter at our conference on Michigan's Future last year www.futuremichigan.com and was very high on future opportunities.

The concern is how much gas is actually available over the long term and I found it interesting that some power industry executives feel there will be a bubble lasting about 5 years so they do not want to bank on the long term use of natural gas in combusion turbines for power generation. This would seem to confirm Matt Simmons position regarding long term gas supply.

There is a lot of info out there both pro and con regarding unconventional natural gas supplies and I am trying to get a reality check on this.

Gail, the 8% increase in production in 2008 vs 2007 just isn't right. There is no evidence in operating rigs, and more importantly in gas wells drilled, to support such a surge. For it to have been caused by technology would mean that the new technology raised initial well production by a multiple greater than 3, which is just not believable. Also, with the recession having started in late 2007, with the housing market already in trouble, with auto production already well down, with jobs still moving offshore, there was no significant increase in demand. An increase of 1.5 Tcf would have to go somewhere, and storage was not excessive at the end of the injection season. Total injection was a little over 2 Tcf if memory serves, in spite of a pretty serious hurricane season, but available gas would have been north of 3 Tcf, even after accounting for a decline in Canadian exports to the USA.

My guess is that the EIA uses some model that includes a regular increase in demand, and that demand declined, giving an apparent increase in production that didn't happen. Murray

"My guess is that the EIA uses some model that includes a regular increase in demand, and that demand declined, giving an apparent increase in production that didn't happen."

the methodology is outlined in the appendix to the current monthly report. i believe supply and demand are estimated independently. the difference is resolved with a monthly "balancing item".

the doe is apparently looking at revisions to their production estimates as reported in the api's gas daily, refered to by westex.

http://www.eia.doe.gov/oil_gas/natural_gas/data_publications/natural_gas...

I decided to go get the details. They look like this: (from EIA tables)

Gross withdrawals 2007 = 24.6 Tcf, 2008 = 26.1 Tcf up 6%

Marketed production 2007 20.02 Tcf, 2008 = 21.44 Tcf up 7%

Would someone be kind enough to explain the difference?

Now the problem.

Marketed production in 2008 up 1400 Bcf from 2007.

Pipeline imports down 200 Bcf

Lng imports down 400 Bcf

Exports up 200 Bcf

Cold Q1 2008, - Consumption up maybe 200 Bcf

Balance to put somewhere 400 Bcf

But peak storage down 160 Bcf

Where did 560 Bcf go?

I have difficulty believing that total consumption was up that much

especially with demand dropping sharply in Q4 2008.

My guess is that marketed production is overstated by at least 500 Bcf

which would put growth at about 4.5%.

if you will look at table 1 of the monthly gas report pdf, "balancing items" accounts for just over -400 bcf.

dry gas production 20561 bcf

supplemental fuel 55

imports 2975

net withdrawls 32

total 23629

balancing items -408

consumption 23215

a 6 bcf discrepancy

balancing items go negative at the start of cold weather and recover during warmer weather. i believe the reason is because of the compressibility of gas in the vast pipeline system.