More thoughts from Pedro Prieto on NINJA Financial Issues and Energy

Posted by Gail the Actuary on May 30, 2009 - 10:19am

A few days ago, Pedro Prieto wrote a popular guest post called Financial Collapse and Energy - Something Other than a NINJA Problem. In it, he provides an analogy to the current financial situation.

Afterwords, some of us in a follow-up post raised questions whether the parameters (shown as 8.5% and 3% in the model) could be refined a bit.

Pedro has put together a response, which I think shows great insight. It shows that there is more than one way of looking at this question, and perhaps the way we are looking at things is too steeped in our current perspective. Pedro's response is found below the fold.

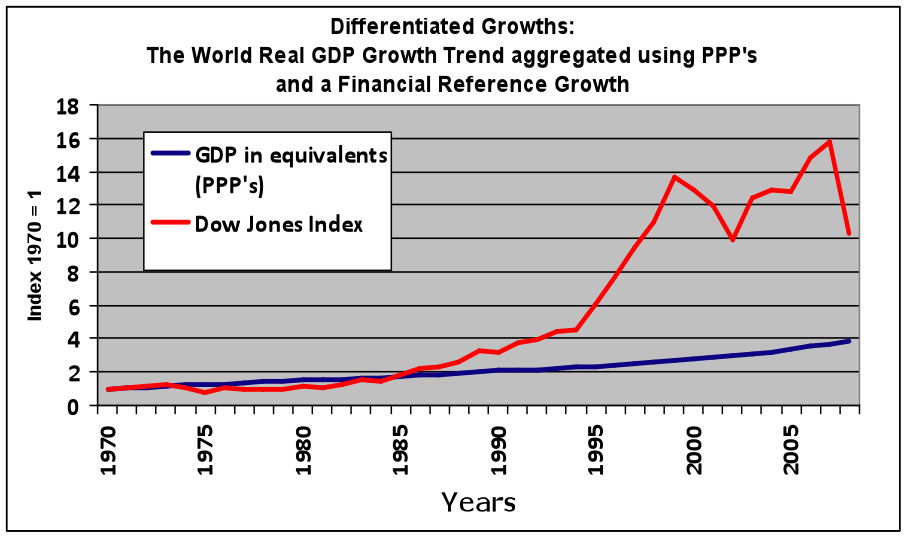

Sometimes, I am afraid that I may have been wrong in including GDP in Purchasing Power Parity (PPP’s) in Graphs 3 and 4 of my earlier document. To refresh your memory, this is Graph 3 from my earlier post:

This is like giving credit to the concept that helps economists to manoeuvre and disguise physical reality. In fact, the creation of goods and services by humankind should be given in absolute, measurable amounts. This is something I could do with oil and primary energy, since even capitalist entities or corporations like the IEA or BP offer data using measurements like tons of oil. One ton of oil (or coal of cubic feet of gas) is physically the same if extracted in 1970 or if extracted in 2008. No adjustment is required.

However, I was forced to enter GDP because it was the only available tool to measure goods produced and services rendered. If the measurement tool performs well, there should be no need to adjust the amounts by any economic parameter to balance them through time. GDP is not an accurate tool--I knew it and I mentioned it. But I was forced to give an indication of the total amount of goods and services, and I cannot do this, except as some sort of financial amount. I know that a kg of produced steel is the same in 1970 as it is in 2008, as is the service rendered to care for an elderly person, but I needed some mechanism for measuring the combined amount.

And the PPP’s in the GDP are supposed to adjust the value (effort and energy at least, in my opinion) for the same goods or services at different periods of time. In my opinion, however, in reality they are masking the devaluation of the system used for mediating exchanges (whatever that is--now generally paper money rather than gold or another medium). This mediation mechanism is therefore being distorted as it tries to match the unchanged real physical world.

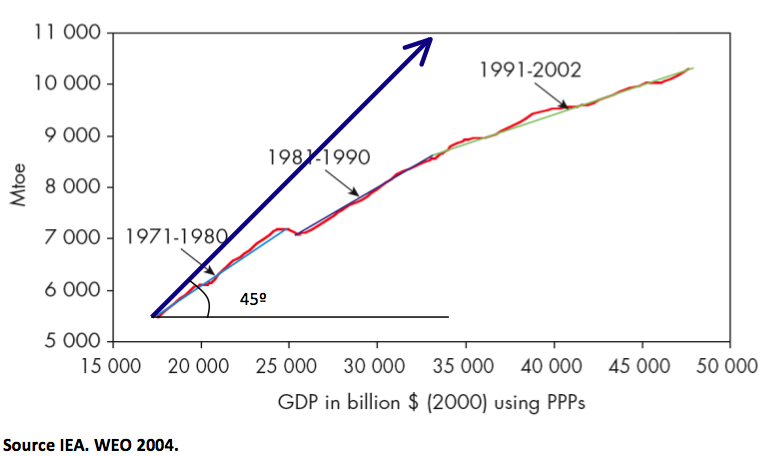

If I take the consumption of primary energy and compare it with GDP, what I observe is almost a one to one relationship (almost a straight line):

But, in fact, if we could remove the economic adjustments, the artful economic devices, and the continuous manipulations, money would have been destined for its original use. If this were done, the slope of the derivative would have been 45 degrees. That is, one physical unit produced or measurable service rendered would be equal to one monetary unit. The fact that there has been a change in the measuring system over time is probably the reason why there is now a difference between the growth of primary energy sources and the growth in GDP (Graphs 3 and 4 of my paper), and that this difference is increasing over time.

If today it is not like this, it is not the fault of the physical world and the “devalued” production of goods or services through time, but rather is a result of the perverted use of money and financial values and assets.

If we look at the interesting work of Chris Martenson, titled "Inflation", at http://www.chrismartenson.com/crashcourse/chapter-10-inflation, and we look into Chapter 10, there is something related to my analogy, as named by Gail in her last post, titled “ A Few More Thoughts Related to Pedro Prieto’s “NINJA” Post”:

In 1665, the basic cost of living [in the US] was set to a value of “5”. What is most striking about this chart to me is that from 1665 to 1776, there was absolutely no inflation. For 111 years, a dollar saved was, well, a dollar saved. Can you imagine what it would be like to live in a world where you could earn a thousand dollars, put it in a coffee can in the backyard, and your great- great grandchildren could dig it up and enjoy the same benefits from that thousand dollars as you would have had 111 years previously?

Unless we orient ourselves to a new way of living, in which we learn to make the mediation device a very constant parameter, which is always very directly related to the physical world of products created and services rendered, we will never find any solution to the inevitable collapse. And this will mean not a cosmetic change in world economics, but a Copernican change in economics, much closer to the biophysical Economics that Charles Hall is teaching everywhere.

As I see it, my fault was not so much to “forget” to adjust the Dow Jones Index throughout time (to what parameter, physical?). Instead, it was a matter of being forced to use a single economic parameter, already contaminated by neoclassical economics.

Fractional reserves, compound interest, French system of repayment (very common in Spain, in which the borrower starts paying mainly the interests and almost no principal, until the very end of the term, just in case the lender decides to totally or partially cancel his/her credit before the given period), PPP’s, rates of interest, futures, intraday operations, stock options, etc.-- The modern economic world has invented one million economic litanies and forces its citizens to sing them every day, like the Church did in the past with the Latin Litanies in the traditional religious services; believers praying with unintelligible words.

We pray in many cases more than five times every day, oriented to Wall Street especially at the opening and closing of the daily sessions; we carefully read and enunciate the litanies or mantras in our economic sepia missals. We follow the values of thousands of different stocks on television, permanently scrolling in the lower part of the screens, as we have breakfast, lunch or dinner, exactly as if we could understand what is happening out there.

We have been “monetized” and made to believe that the economy measures everything, but really, we are not measuring anything in a minimally rational form. We have been “suspended” from nowhere and pretend that we know where we are.

In this sense, I basically agree with Charles Hall's and Bill Tamblyn's comments on lemmings behaviour in the stock exchange plus some grams of salt of physical reality (see here). In this sense, I think of inflation (or any of the thousand invented words for this situation) as one of the ways or mechanisms that economists have to adjust for the sins of printing paper money without any relationship to the physical world it is supposed to represent--to return it, as much as is possible, to the real world.

I have received many letters from people who believe that bank interest is a “logical” consequence of lending money. Others cannot even imagine a world where people would lend something, obviously a resource they already had, and only pretend to be paid back by exactly the same amount, over a period of years. They are so embedded in the present culture that they cannot imagine that a human being would be willing to lift a finger to lend something if the reward would not be more than what was lent (without interest!).

Let me give an example. A farmer grows food in his fields and harvests (accumulates) resources for the needs of his family and his animals for one whole year, with some surplus, just in case. There might be a drought the next year, or something unexpected might happen (a fire, thieves, etc.). Also (and always in preindustrial societies), some extra would be produced, just in case some neighbour or relative falls sick or has an accident and cannot produce himself. This is a rational accumulation of goods and services which is based not on greed, but on mutual aid, as humans can only survive as a social species, not as lonely wolves on the steppe.

And it would be considered very bad practice in this context to lend somebody something and then ask them to pay it back with interest. That, in my understanding, was the original idea of the original religions of the Book. The original intent has been greatly perverted, and is now followed by very few.

However, what we see today in accumulated wealth has nothing to do with the way of accumulating wealth of the farmers in my story, nothing to do with security (even if they try to convince us that this is in our “national interest”). The quantity and rapid speed of amassing wealth, transforming nature, and exploiting of natural capital has no precedent in the history of mankind and has nothing to do with “security” for the future. The new system, once the payment of interest became legal, permitted and encouraged the accumulation of wealth. It accelerated the process of accumulating wealth in a very insane (and strictly unnecessary) form, and in a quantity never known in the past, especially after industrialization.

Sorry, but what are you talking about?

Your graph is very obviously not a 45-degree slope! The curve is very clearly well below the 1:1 line you draw, and equally clearly it's not even a straight line! The slope of the curve is getting farther from 1:1 as GDP gets larger. The energy:GDP ratio is decreasing, which is exactly what well-documented improvements in efficiency would have us expect.

Not only is your claim known to be wrong, your own graph directly contradicts you! How are we to believe the rest of what you say if there's such a fundamental flaw at the beginning of your argument? How are we supposed to see this as anything but a personal opinion that's held so deeply the speaker has blinded himself to dissenting information?

You need to think carefully and critically about your argument and the relevant data if you want to do anything but preach to the choir.

You know, I get criticized all the time for diving too deep into the math and not keeping it at a level that doesn't cause MEGO. Yet, I think what Pedro is trying to do is quite reasonable. Here is the relevant point:

Of course his 45 degree slope could be true depending on how he chose his units. I think his point was to show how it diverges from this linear relationship, and in a language that perhaps more people can understand.

I don't know if this was absolutely his intent, but my hair is not on fire over it.

If that's the relationship he wants to discuss, why isn't it the one graphed? Why are the axes energy vs. gdp instead of manufacturing output vs. gdp? Or, since you're including services, perhaps non-financial gdp vs. overall gdp.

The two values he said were 1:1 related aren't even linearly related. There's no reasonable way to change the units to fix that.

The curve he graphed has a constantly-decreasing slope, and looks roughly like e^(-1/x). Sure, graphing -1/x vs. ln(y) will give a straight line, but that's not any kind of meaningful comparison.

If he's trying to show there's no linear relationship, then perhaps he should not say there is one:

"If I take the consumption of primary energy and compare it with GDP, what I observe is almost a one to one relationship (almost a straight line)"

He also shouldn't be begging the question by completely ignoring efficiency gains:

"The fact that there has been a change in the measuring system over time is probably the reason why there is now a difference between the growth of primary energy sources and the growth in GDP"

This argument does not read like a conclusion of the evidence; it reads like a preconceived notion with some largely-irrelevant numbers tacked on.

***

As an aside, is there any reason every new graph in this sequence is getting its own article? There have been three articles on the same discussion in half a week, and the latter two appear to be minor additions without enough to justify a new article - witness how they have only a handful of comments (currently 14 each). It seems as though keeping the pieces of this discussion together would be more productive.

Pitt,

You have pointed out some rather large differences between what Pedro thinks should be happening and the actual data, just an illustration of; "why let the facts spoil a good theory"

Data shows that can have increasing GDP growth with very little growth in energy use.

I'm not sure I buy into his argument that one must measure goods and services in terms of derived physical quantities.

I can perform calculations in 2009 50,000 times faster than in 1980 with approximately the same amount energy.

Similarly I can cross my city twice as fast with half the energy I used in 1980 because of better roads and a more efficient car.

Again having invested in tertiary education I have a collection of skill sets which are considerably more valuable than before. ie I produce more in a smaller amount of time than previously.

These are examples where technology change and capital investment mean I in turn can produce more goods and services. All the examples above require some some sort of loan of resources. All the above are examples where the result of the loan produces measurable outcomes well in excess of the loan. Given that it is far easier to barter in money than goods and services it makes sense that the loan be given in money and the loan be repaid in money. The measure of whether it is better to loan me money rather someone else money will depend on how quickly I can repay the loan and/or how much extra money I'm willing to pay for the loan.

In a free society with money there is no way this sort of activity is going to stop. Interest bearing loans will continue into the future.

And that is why in the second figure the straight line diverges with time. So it is partly due to financial creative accounting and partly due to increases in efficiencies, as you state. If energy is the drainage plug keeping the GDP propped up, we will have to wait and see what happens when the plug gets pulled. This is elaborated a bit with the Ayres model posted on TOD a couple of days ago.

I actually would have preferred graphing that figure with the axes reversed, as usually the y-axis is the dependent and the x-axis is the independent variable -- if that was the point being made. But then again I would modify it further and plot Energy on x and GDP/Energy on the y as well. If the marginal return of GDP on Energy input was fixed, this would show as a horizontal line. This would help gauge the asymptotic properties, i.e. if the marginal turn is heading in one direction and whether it will settle in at a higher or lower value than it started at.

My point is that there are a few more ways to plot this kind of data to get some added insight.

But you still don't seem to understand basic arithmetic.

My guess is that you like most in our society you have invested in highly specialized skills that may lose their value if we are forced into a major paradigm shift.

Case in point, I have a cousin who is a highly successful heart surgeon, his skills are pretty much useless without the technology that he has access to, he would be unable to do most of the surgeries he does without the current infrastructure. He at least went to med school so he may be able to apply his knowledge to emergency first aid in exchange for a couple of chickens. As for your typical MBA I'm not sure how valuable their education will be.

There is that little niggling annoyance commonly known as an exponential function. Either you get it or you don't. You really should watch Chris Martenson's "Crash Course".

Reader Guidelines:

3) Treat members of the community with civility and respect. If you see disrespectful behavior, report it to the staff rather than further inflaming the situation.

4) Ad hominem attacks are not acceptable. If you disagree with someone, refute their statements rather than insulting them.

(As an aside, your insult doesn't actually apply; the definition of arithmetic doesn't include exponentiation, other than in the I-can-derive-all-math-from-11-axioms sense.)

Irrelevant to his point - he's giving a concrete example of how investment can increase productivity and efficiency. His skills allow him to be more productive than someone without those skills; ergo, by investing in those skills he increases society's overall productivity, and allows more to be done with the same resource inputs.

Might those skills be less useful in the future? Perhaps, but that's not what's under discussion here.

If you immediately leap to talking about exponential growth as soon as someone says "interest", you don't understand what you're talking about.

Interest is nothing more and nothing less than rent on money. Buying a house for $100,000 and then selling it for 10 yearly payments of $11,000 is functionally the same thing as lending the eventual buyers $100,000 and charging 10% (overall) interest, and there's not a hint of runaway exponential growth.

Pitt,

You and I obviously have very different definitions as to what we consider insulting.

In any case it was an oblique reference to this statement.

Perhaps, however I was making a direct reference to Chris Martenson's Crash course which was part of the original discussion.

I understand this quite well however this only works in a growing economy(multiple converging exponential functions describe this kind of growth) and it fails completely in a contracting economy with run away inflation, because the value of your money is continually shrinking, which was the topic being referenced from the Crash Course.

Like what? 98% of us (in the "developed" world) are urban dwellers in support roles, mostly superfluous in my experience, living on the fat and behaving as primary consumers while putting little back into the system unless you count project plans and meeting agendas as "more production."

True - as far as it goes. Loans on hallucinated capital (60 trillion debt) that will never be repaid and "loans" from natural resources that are ultimately finite (fossil fuels) or "loans" on renewable resources exploited faster than they can, if ever, renew (forests, soils, fish, water, etc.). The author's entire premise if I may paraphrase seems to be that we are in financial overshoot much the same as we are in ecological overshoot.

Yes. That is me. I like to think that I do my bit for society. Posting here is part of it. If the economic landscape changes dramatically I will retrain to be useful in it.

People are fallible. It is far easier to think things will continue as they used to because 99% of the time that is a correct assumption. Earlier on in this thread someone accused me of not understand exponential functions. That's pretty funny, considering I just spent several months teaching a course on thermodynamics :-)

One of the interesting things we studied were phase changes. You make a plot of temperature rise vs heat input and everything tracks along in a pretty smooth curve until you hit the phase change. After the phase change, things are different but then they settle down and track along a new path. Banks generally lend money based on how things used to be in the past. This isn't a good assumption during a phase change but it doesn't mean it's not a good idea to lend money with interest.

In any case, as I pointed out, it will continue to happen into the future. It is one of those great ideas that has given us all wealth.

I agree you do that with approximately the same marginal amount of energy. That would be true whether you refer only to the human energy of pressing keys or the small amount of energy a computer or calculator might use to run a single calculation. However. the emergy of the 50,000 times faster calculation is far greater. Not only in the computer, but the infrastructure that supports a world of computers.

cfm in Gray, ME

There is nothing wrong with money per se (money of itself).

There is nothing wrong with interest per se.

What is wrong are the promises made.

Consumer: I am thinking of buying that house for $100,000.

Lender: That is an excellent idea. I will lend you the money.

Consumer: But I'm worried if I can repay the loan.

Lender: Don't be silly. I've done the hard hard math. Of course you can.

Would I be lending you this money if I thought you couldn't repay?

Consumer: Good point.

Consumer: But it says here, interest is 50% per annum.

Lender (in sheep's clothes): Don't worry. Real estate is 101% sure to go up threefold in the next 2 years. You can't possibly lose.

Consumer (gullible): How's that?

Lender (in sheep's clothes): At the end of the 1st year your house will be worth $150,000 and you will owe us $150,000. So no worries. Are you with me so far?

Consumer (gullible): OK. That sounds logical.

Lender (in sheep's clothes): At the end of the 2nd year your house will be worth $300,000 but you will owe us a mere $225,000. So you already have a sure fire profit. And it just gets better and better from there on!

Consumer (gullible): OK. That sounds logical. Where do I sign?

Later that day, Lender is on the telephone.

Lender (in sheep's clothes): So listen. I have another default swap security I can sell you. It's AAA quality. Of course you can trust me.

GDP is not a valid measure.

The true promise of an American dollar ($$$) is that you can buy many many Chinese-manufactured goods with it (at your local Wal-marx box store).

And you can thus encourage more and more outsourcing of US manufacturing jobs.

And then you can scratch your head and wonder why unemployment keeps rising.

So perhaps one can combine the various nations and repeat this on a global level? In a resource constrained system with labor and capital moving around freely, the global quantity seems to be the measure that we desire in the long term ... race to the bottom notwithstanding.

Bingo you just joined the enlightened group :)

You need to make the leep to multi dimensioal anlysis.

http://campfire.theoildrum.com/node/5436#comment-506073

This link is probably one of the most important posts on the oil drum

because it couples population to resource using a virtual rotational velocity

component.

If you understand what I'm saying you can join the eclectic class of peak oiliest worried about growing tomatoes and in the right climate making a find bottle of wine.

Think 3D and you too will worry about the tamatoes with the perfect strawberry in reach. And the grapes deliziosa ....

Your right on the verge of embracing the now and in the case of wine the past.

The future is no different from yesterday.

Pedro I have to copy my final reply on this conversation in its entirety.

There are now six billion people on the planet you personal views converted to chemistry are measured in parts per billion. Which is often th limit of detection. Ive give you far more food for thought then most people get. Take or leave it I have a lot more to be concerned about and your personal views are barely worth consideration.

I simply don't have the time to wast for skeptics if if can execute what I feel I'm forced to do I could save millions the opinion of one of the billions is no longer important

------------------------------

Understand that skeptics are now no longer worth the resources the use to create their opinion. Its not a pretty future and its to be honest quite blunt. But suffering the skeptic is nosimply not worth the cost of not teaching the ignorant.

I suddenly and lately realize Jesus Christs true message it had nothing to do with convincing the skeptic but ensuring everyone had access to the truth.

Buddha Mohamed all recognized that enlightenment is simply a matter of offering the truth to the masses. Its a bit funny in that in comparing myself to the source of religions all I suggest is that every one must be offered the truth in making decisions.

Simple in enlightenment is the realization that I can amplify the message of some mean old coots that offer their wisdom on the oildrum I can't generate the knowledge that really helps people at best I can work as a filter but translating the knowledge embodied in the true solutionist is itself a worthy task.

Don In Maine, Tonteliia, Web, Nate, Gail, Tontelilla, Stuart, Kebab and many more offer the truth the problem widens in transmission.

People are simply not offered the chance to decide based on the real truths.

I interpret that Pedro is saying that if money (price) was a good or perfect measure of goods and services produced, the measurement of growth in money and energy consumed would be, or is, very similar. Well that seems like a tautology, and the interesting bit would be to investigate why it is not so, or where deviations appear (E.g. the impact of technological advances, consumption patterns, working hours, type of energy used for what purpose, etc. etc.)

If money begets money (interest, arbitrage, short selling, etc.) then the two lines will diverge - with growth for the one taking on an automatic and non-material spin, and growth in the other remaining tied to the real world. (A good new product may have offshoots and spur the creation of something else, but the something else will always require energy.)

Have I got the essence right? Is there more to it?

Then, what about other financial systems, past or present? E. g. Sharia finance (‘by the book’) bans interest. Lender A gives money to entrepreneur B and they decide not how B will pay back A, but how B and A will split or share the profits and losses (the risk), and at what point(s) in time. The lender might say, I want 50% of your profits in a year’s time, and I will pay 50% of your losses, whatever. (The example is simple, idealised.) Islamic banks and islamic finance have of course found all kinds of fancy ways to circumvent sharia law, and aligned themselves in various ways with the current dominant system. Islamic finance is noted, I have read, for the fact that it does not promote ‘growth’ and particularly it has not, or does not, favor or spur development of the poorer sections of society.

To me, Pedro's comment about the role of interest in primitive societies was very interesting. One of my sisters visited Uganda for several weeks, and remarked at how different the culture was there is this regard--people were much more willing to share than here, much as Pedro described. I can see how paying interest would cause this to fall down.

But we know that the idea of everyone sharing everything was falling down even in the early Christian community. The story of Ananias and Sapphira shows this. It would be difficult to make the change now--although with the huge number of claimants (through debt, derivatives and leases and other obligations) on a comparatively small amount of physical assets, we are going to have to find some way to deal with the mismatch. The idea we can all grab for more assets really isn't working.

As I think about it, perhaps some kind of graph of debt and other guarantees being covered by physical resources compared with the amount of physical resources would have been interesting. I would be willing to bet that in the years after 2000, these debt and other guarantees were growing at more than 8.5% per year, while underlying assets were growing very little. I think Nate is looking at something vaguely along these lines for a post.

Well, in the developed world, at least where I live (Switz. and France) it is very common amongst ordinary ppl to refuse to charge interest. Not particularly because interest is ‘evil’ - ppl don’t remember the history or know the ‘books’ - but because in the case of a stable currency the whole idea seems a bit complicated and smacks of practices of the disliked - banks. That money depreciates (inflation) is just taken on board. One can pay, offer, or lend at a loss. If everyone does it it all evens out.

Second, one can’t collapse financial arrangements on ppl ‘being willing to share more’ or less, or whatever. Primitive societies may be cool or now hot (they feed their neighbors instead of shooting them when they enter private property), and that is all well and fine, but it does not fix, either thru explicit rules and legislation, or habitual practice, financial transactions. And those rules vary extremely.

In my limited experience WRT Switzerland this is true. Your word on payment is more important than any interest charge. It all seems lax, but I guess it is your reputation on line, and that counts for more than anything else.

Right. I shook hands in 2007 for payment of debt for a sum that I hesitate to post here. I wanted some payment plan, for my own comfort, and proposed such without any detail (I knew better than to propose interest, though I thought I would mention it in case the counterparty wanted some) and was refused out of hand. When you can I was told - and the subject was changed. To date, I have paid off about 80% and expect to continue paying till 2010. No interest, no payment plan, no obligations, your word is your bond.

I like the Swiss. I figured my deal would fall through as I couldn't transfer the funds on the date, but they took it in stride.

Its not just paying interest that a problem. We have examples of complex societies based on barter ancient Egypt.

Underlying the move to money and interest was loss of control of means of production.

A farmer could promise to pay in grain if he had a bad year this promise can be extended into the year after that etc. As long as you have the means of production then you have the ability to make good on any debt. Losing this you lost everything.

Now I cannot really control my ability to produce even though I'm a computer programmer I'm not in full control of my means of production nor the results of the fruit of my labor.

I cannot use myself as a bank.

This is what we really gave up our own intrinsic worth.

My history is not great, but my thoughts were related. With the transition from feudalism to an industrial society, the shocks individuals face are substantially different --- bad crop versus job loss and living in a village versus being in a large urban area. It's hard for me to believe that interest payments were the only factor contributing to changing social norms. I also give some credence to the notion of some historians that agriculture itself played a central role in the emergence of hierarchical societies. Richard Manning discusses this proposition in his article "The Oil We Eat."

Pedro,

You are onto something, although I know there are many ways to protect/defend the present "world view."

One way to assess the issue of usury is to ask: Is the value of an item at the end of its repayment term reflected in the actual amount paid over the life of the loan to purchase it? For example, consider a thirty year mortgage with a minimal down payment. Calculate the total repayment using various interest rates. Is the value of the house after 30 years really the xxx dollars, even given the use of it for that time?

Or better, consider the use of credit cards, which assess fees not only to the user of the card but to the merchant as well. Merchants often have to pay 2-3% of the actual transaction.... Of course, we know how the user of the card is hammered. I would expect that banks and credit card companies garner at least 1% of GDP.

Is credit used in this way actually productive? or anything? Of course, there will be those who will argue that plastic facilitates ease of use. Up to a point, it does. But at some point, it may well become an ugly way of transferring wealth to those who have done little to earn it.

All of which is to suggest that we look at the actual cost of credit in terms of its share of GDP.

Its a lot worse than just what your saying. Easy credit inflates the prices of stuff significantly esp houses. In a world without easy credit houses would be much cheaper probably priced correctly as a depreciating asset as they age if they are not very well maintained.

In the US for example if houses could only be purchased for cash then you simply would not have your average house go much over 50k. And of course the houses themselves would have remained much smaller and simpler in general at least when first constructed.

Same for cars etc. If you have to actually pay then you can imagine we would not have spent anything close to what we did.

I can imagine that we would have lived within our oil supply and as it ran out that a natural and serious move to renewable energy would have happened and that oil usage would have been lower we would have never gotten rid of trains as most people saving for a house would not want to buy a car.

So on top of the cost of the interest you have significant inflation of the asset values themselves. I'd guess 5-10 times higher. And last but not least if you had not had the debt then one could argue that wages would have remained lower as long as they reflected the real cost of desired goods.

I'd guess real wages would not have risen that dramatically either basically as long as you could reasonably save for a house in ten years then you don't need much higher wages. I can't see the huge move to offshore work happening.

I'm not saying you can't have any loans if you pay 50% down limit the loan to only 5-10 years with effectively no interest maybe just a charge for managing the loan then

its ok and does not really change the situation vs cash. In general given this sort of society one can imagine that families would generally handle finances internally i.e parents would generally buy their children their own homes etc. This is actually quite common in Chinese families the famile is the bank. I'm not saying it does not result in issues sometimes but it generally works.