A Few More Thoughts Related to Pedro Prieto's "NINJA" Post

Posted by Gail the Actuary on May 28, 2009 - 10:00am

Pedro Prieto's post yesterday called "Financial Collapse and Energy - Something Other than a NINJA Problem" was an analogy. As I think about it a little more, there are probably a few refinements that could be made, that don't change the result, but may make the parameters a little different.

I think that over time, the divergence is between the growth in resources, which Pedro estimates at 3%, and the amount that would need to be paid back net of inflation. Thus, the interest rate would be an inflation adjusted interest rate. The inflation adjusted interest would be at least as high as risk free interest rate. It might be higher, if it also includes a margin for failure of a borrower, which needs to be paid back.

If this approach is used, the upper line in Pedro's post would be growing at 3% plus the average interest rate net of inflation. This might be 5% or 6%, rather than the 8.5% used as the upper line in the illustration. I am not sure that this makes any real difference, since over a long period, one ends up with exactly the same result, if one has two compounding diverging rates, whether the spread between the higher and lower on is the spread between 8.5% and 3% or the spread is between 5% and 3%. Compounded over 50 years, 1.03 becomes 4.38, 1.05 becomes 11.47. So there is still a huge difference, so the result is exactly the same as Pedro points out.

Charlie Hall wrote to me giving his thoughts comparing the inflation adjusted DJIA to the growth in underlying resources. This too still gives a result not too different from Pedro's. Recent stock market growth is unsustainable, if resources begin to decline.

According to an e-mail Charlie sent me:

Charlie Hall agrees very much with Pedro's post (and has with the concept since his gradaute school days) as well as with the concept of Biophysical Economics put forth in the comment by George Mobus (see Charlie's own Biophysical Economics website at http://web.mac.com/biophysicalecon/iWeb/Site/Welcome.html ). He thought he could add further ammunition to Pedro's post with the following concept and figures:

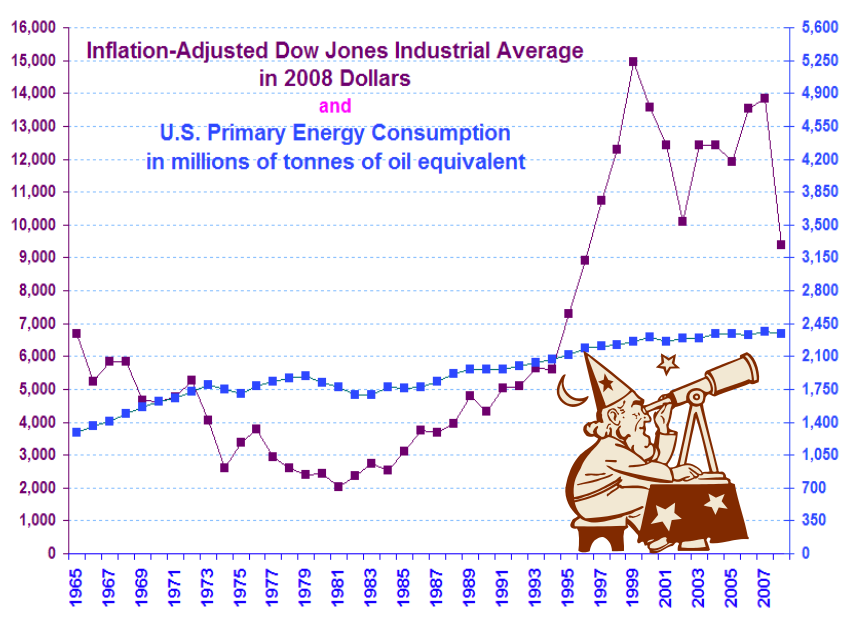

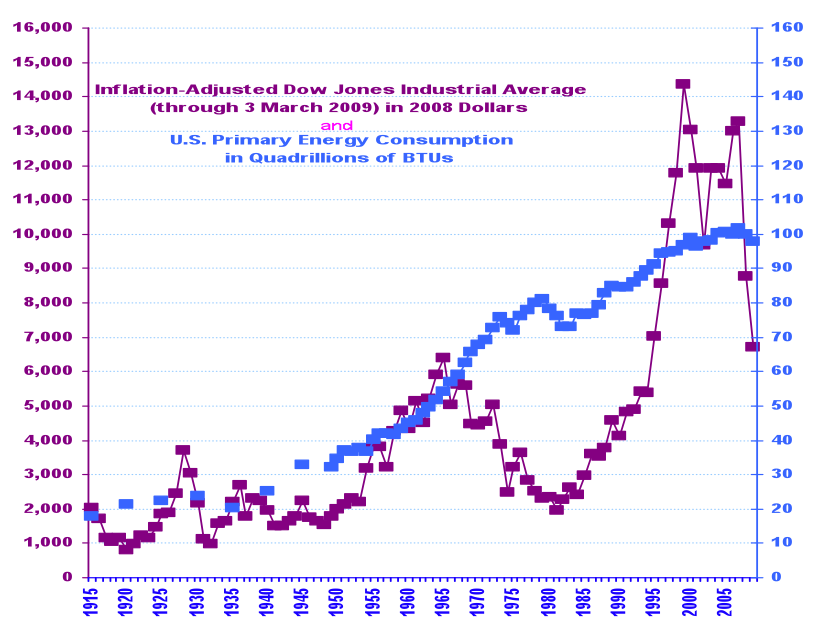

Charlie (with help from Bill Tamblyn) wanted to test the hypothesis that the Dow Jones Industrials as given every day on the news had two components, a psychological one representing mass psychology (i.e. lemming behavior such as irrational exuberance and the converse) and a second one representing real industrial production, which he reasons should be proportional to actual energy use. Thus his hypothesis was that the DJ may move up or down but it eventually has to be constrained by the real energy used (he is not really impressed with "efficiency improvements" as most seem to be just throwing more energy at a problem).

First the DJ must be corrected for inflation, as it is just prices, then the DJ and the total US energy use can be compared by adjusting the scales on each side so that the data overlap: The first attempt, starting in 1961, seemed to show something like that but was not really convincing, the second one, going as far back as 1915 and extending to the DJ's lowest point a few months back (it has since risen to about the energy line), seems to indicate that indeed the Dow Jones industrials has been "snaking around" the biophysical reality of energy use since 1915. This suggests that we may never have extended real growth in the Dow Jones unless we can get an increase in US energy use, which seems doubtful.

Charlie thinks the results give a lot of support to Pedro's post by showing a clear example of the biophysical basis and limits to our economy. This has also been shown clearly in our recent paper in American Scientist "Revisiting the limits to growth after peak oil" which is downloadable from my web site http://www.esf.edu/EFB/hall/

Gail -

In my view, trying to correlate the Dow Jones Industrial Average with anything having to do with energy is a highly dubious exercise.

Why? Just look at some of the companies that are included in the DJIA, such as: American Express, Bank of America, Citigroup, Microsoft, Verizon, JP Morgan Chase, and Walt Disney.The above businesses are minimally energy-intensive. Plus, they are businesses whose revenue and energy usage (such as electricity to run their offices) have little to do with each other.

Note that there is no longer a single steel company on the DJIA. And before too long, it is not unlikely that General Motors may no longer be included.

Sure, one can construct all sorts of graphs plotting this against that, but do they really mean anything if the causal relationship is weak or next to non-existent?

Hi,

When you adjust for inflation, which numbers are you using ?

i.e. government supplied numbers or something like shadowstats.com ?

Note: Shadow Stats's numbers are also gov't numbers, albeit previous iterations of the calculation. They happen to think the previous iterations were more accurate. That is, ST numbers are what would have been had adjustments not been made in '83 or '83.

Cheers

Pedro's theory, while interesting, seems a little too facile for me as it doesn't address deflation or changes in the composition and valuation of GDP inputs.Of course it was but a short post not a Friedmanesque sized book.

It would be tricky to do a detailed analysis that would give real relationships. The idea is right, but the parameters probably aren't right.

There is definitely a problem, paying back interest for debt, and growth masks that problem. Once the economy stops growing, we really will have difficulty paying back debt with interest. I have often said that that is the problem as we approach and hit peak oil. I believe that is what is happening now.

Actually I think its better to look at it a different way.

As commodities get more expensive esp oil prices for goods required for daily living increase food gasoline etc. This causes the demand for income to be diverted from making payments on current debts and also drops demand for future debt.

The debt cannot be reduced simply because peoples cash flow situation changes as they spend more on simply staying alive they have less to spend on other goods which are going to be forced higher in price as energy prices increase.

The economy can no longer service its current debt load and has less earning to devote to future borrowing. Defaults increase and the demand for new debt declines.

Next rising defaults will no matter what you do force interest rates higher to cover the increasing default risk. And of course your pool of potential borrowers worsens dramatically. This is probably the most important and least mentioned part of the problem.

Prudent people capable of borrowing today find that their daily living costs are increasing and their future earnings are doubtful thus they choose to save cash instead of taking on debt. This leaves only people who have no financial skills whatever left desiring debt. I'm amazed given the housing bubble that we still have a pool of greater fools left but I guess its pretty deep.

In any case the government is attempting to halt the collapse by lending to people who are really not credit worthy. This simply does no good as eventually these people will default at high rates often today it will be because of job loss so first payment defaults may be lower but your talking in many cases a few payments at most then the loan is in default. A slower case is rising costs pushes the marginal debtor into negative cash flow but eventual default is certain.

You can print and loan as much money as you wish but its simply going to be destroyed via more debt defaults yet now these debts are honored by the government so the currency is weakened making the situation worse. This will cause imported goods like oil to increase in price against fiat currencies.

With this view you see that there is really no way out of this conundrum no financial game works. Given the nature of the problem any attempts to game the system to escape by avoiding the simple truth that we have no choice but to default on all our debt massively restrict future lending to well qualified buyers with low risk loans and going to a renewable and low energy society. Any other approach must fail.

You can see that what this really means financially is that you can do little borrowing from the future. For say cars and houses this suggests that you must pay say 70-80% down and then borrow over a much shorter period say 5 years on something like a house. Interest rates must be very low and the debt is short term.

If you look at this case the lender can recover not only his capitol but all of the interest payments if the loan defaults assuming he can always sell the collateral for say 40-50% of the original purchase price. The borrower has no reasonable reason to actually default since he can readily sell to pay off the remaining loan.

Borrowing money at all becomes uncommon. We can assume that rental properties are paid for with cash yet to get a better return vs lending with interest requires very low rents which allows renters themselves to build substantial savings.

What you realize is that money itself becomes one of the least profitable business's.

Instead if you take a multi-generational view it becomes obvious that such and approach results in a build up of retained wealth after only a few generations. Each generation inherits the real property of the proceeding generation and its savings.

Loans become so uncommon the word loan may be lost.

Certainly a person can always gamble away their wealth but this is readily solved by limiting the amount of money that can be spent on anything that does not have a well defined value everyone is a trust fund baby.

Thats a perfect world view but by only allowing growth to occur have the profits of proceeding growth have been realized in general after the preceding generation is dead then you have a rock solid banking system and society. Increasingly what your doing is borrowing ever less from the past for the future. And I think this society would increasingly focus on building very long lasting goods to reduce the need for spending in any given generation. More and more stuff will become ever more durable being handed down generation after generation. One can also assume that even the simplest article will become increasingly a work of art in and of itself. Furniture valuable antiques. New replacements face and ever uphill battle to be better than what exists.

This is the alternative to the debt curve and paradoxically it leads to true wealth sure it takes a few generations and obviously it requires a effectively stagnant population but one can see that without wars or other forms of wealth destruction within a few hundred years you have a very wealthy society.

In fact the ancient economies indeed amassed immense wealth. I'd argue that no one family alive today could afford to build a pyramid with a population similar to that of ancient Egypt yet one of our first civilizations managed to do so.

Sure they where not perfect society's and had many flaws with slaves common but this does not mean they could not fairly rapidly build wealth if you took the multi-generational route. In almost all cases any ancient civilization that lasted more than a few hundred years created a tremendous amount of wealth.

I think its instructive to read and alternative view point and consider the mistakes.

http://www.ruwart.com/Healing/chap2.html

Whats sad is this is the sort of strange Capitalism/Christianity preached in the US.

No mention of the deaths in Vietnam, Iraq and all the conflicts before this.

No mention of the long history of racism in the US.

No mention of the long and painful sacrifice the average Japanese made saving across generations to finally get wealthy only to see their currency devalued.

Obviously I could go on but hopefully my description of the alternative to debt i.e only spending money after the preceding generation has both earned it and passed away highlights the differences between true wealth which is borrowing from the past and debt which is borrowing from the future.

And one should see that oil itself was a form of true wealth we borrowed millions of years of concentrated energy and burned it up in a few centuries and not only that we created a impossible debt burden on future generations. We have ravenously stolen from both the past and the future just to support a very small precentage of the global population in a warped pseudo king like lifestyle.

In a lot of ways I feel like the actor in the Matrix waking up to the true reality of what we have done. The gulf between what we have really done to ourselves our planet and our children and untold future generations vs what is claimed is as large and as chilling as the differences presented in the Matrix.

First assumption on second line

As commodities get more expensive esp oil prices for goods required for daily living increase food gasoline etc.

Most commodities have been getting cheaper(in real terms) over the last 50-100 years, oil is an exception. Wheat was $3 a bushel in 1923,( in 1923 dollars), about $6 now. Basic food prices(chicken , flour sugar,potatoes rice) have been very stable, only highly processes foods and restaurant meals have increased.

Why would they become more expensive?, we are not running out of any major commodities(oil and gas excepted) and extraction methods continually improving crop yields continually improving 1-4% per year since 1930.

Unfortunately commodities have a lot of cheap fossil energy embedded in them (e.g. on average, 10 calories of Fossil Fuels for every calorie of food, maybe as many as 50 to 1 in the case of intensive beef!)- up until very recently that energy must have become ever more affordable since we have been able to use steadily more and more and then we have used it to produce ever cheaper commodities.

Take away adequate amounts of cheap Fossil Fuel (according to the EIA data the 'low hanging fruit' has already been picked!) then it isn't profitable to produce commodities at such low prices - if wages don't rise faster than the prices they become less affordable! In the case of food, if you can't afford it and there is no adequate charity you die of starvation, a serious consequence! History tells us that the past is not necessarily a good model for the future!

xeroid,

Only a tiny part of the cost of food is the cost of energy used to produce it, energy calories are very cheap and food calories are fairly cheap. Most of the cost of food is the processing, packaging and marketing costs. A bushel or wheat or maize makes a lot of bread or cornflakes.

I don't sit in a field eating corn, I eat bread and cornflakes in a city, so it's the embedded energy in the final food on my plate that is important to my way of life - unaffordable energy means unaffordable food, no matter how low cost one particular input is.

Um, this could be a problem. Editors?

The corporations which comprise the DJIA are all global, and it is quite probable that the most energy intensive activities occur offshore. I think what really needs to be compared is stock prices of some group of corporations against the real output of those same corporations and the energy consumed by this group.

But good luck with that exercise...

"...and it is quite probable that the most energy intensive activities occur offshore..." so why with ~ 4% of the world's population does the USA use ~ 25% of oil consumption?

My first inclination for a response is "because we are energy hogs"...

A related point is that our consumption is actually responsible (indirectly) for *more* than 25% of oil consumption precisely because we maintain a negative balance of trade.

I can't help thinking that we are where we are because the hot-shot MBA's, and the new dependence upon actuarial predictions, led us astray.

As long as we keep trying to analyze, adjust, and factor in inflation we are confusing the symptom with the disease.

It is just possible that this time our business model has broken. It is just possible that Olduvai theory has some relevance. We have been ignoring the exponential function of population growth for a century or two. We have been ignoring the exponential function of the decline of finite resources for about a century.

Inflation is precisely the fudging of all the numbers to avoid the exponentiality.

I offer no solutions because I am totally confused as to what the future holds. But I posit that, indeed, this could be the "big one" and unless we totally abandon the old ways of doing business, of using what may be a failed business model, we are expediting the crossing of the two exponential graphs.

Graham

Charlie Hall said

I have just read the Hall & Day paper in AS.

They say

(They also provide some provisional assessments of EROI of historical and current fuels - but apparently without reference except an old 1981 paper.)

Hall & Day suggest that these matters should all be taught and discussed in American universities etc., but whether there is another 35 years in which this might be useful seems unlikely. Priorities, priorities ...

America has of late been a model for the future, not least for Americans themselves, but successively for those who could join the Good Ship Progress. But ...

It has also been clear for a while that there is no way that we, the 'en masse' rest of the world, can become latter-day 'Americans' , and that, if they were to be restricted to their continent, neither can Americans. With regard to future non-American populations, they do rely on 'energy' for food, but 'sufficient' food production for most recently expanded populations has been achieved by using fertilizer N produced from only a few percent of total fossil fuel (presently ~5% of global natural gas production per year). 'Americans' have been burning (in large part) the rest. I speak as a Brit who thinks of himself as a sub-American :) and who shares the dilemmas.