The cost of wind, the price of wind, the value of wind

Posted by Jerome a Paris on May 6, 2009 - 10:01am in The Oil Drum: Europe

I'd like to try to clear some of the confusion that surrounds the economics of wind power, as it is often fed and used by the opponents of wind to dismiss it. As I noted recently, even the basic economics of energy markets are often wilfully misunderstood by commentators, so it's worth going in more detail through concepts like levelised cost and marginal cost, and identify how different electricity producers have different impacts on electricity (market) prices (which may or may not be reflected in retail prices) and have different externalities. Value for society of a generation source may also include other items that are harder to acount in purely monetary terms (and/or whose very value may be disputed), such as the long term risk of depletion of the fuel, or energy security issues, such as dependency on unstable and/or unfriendly foreign countries or vulnerable infrastructure.

Depending on which concept you favor, your preferred energy policies will be rather different. Follow me below the fold for a tour.

The usual disclosure: my job is to finance, among other energy projects, wind farms. My earlier articles on wind power can all be found here

Costs

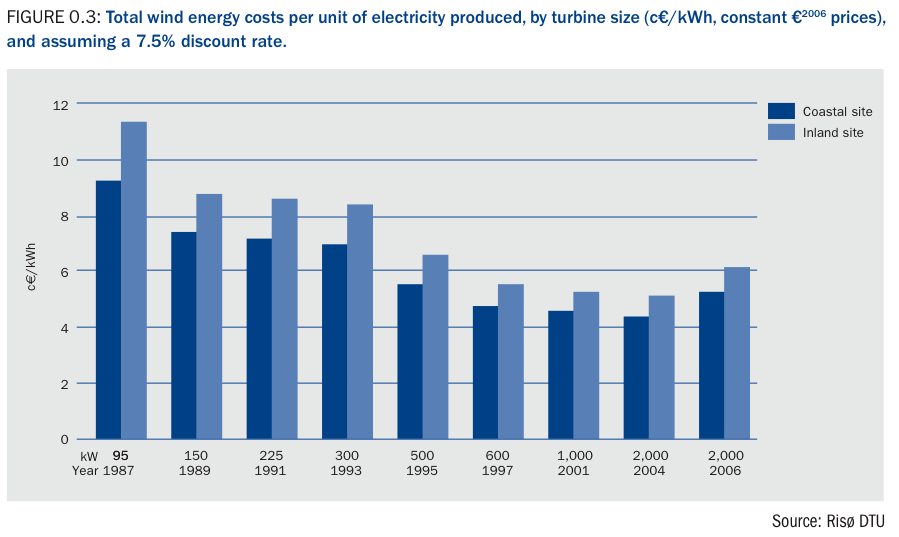

The cost of wind is, simply enough, what you actually need to spend to generate the electricity. The graph below shows how these costs have changed over the past decade: a long, slow decline as technology improved, followed, over the past 3 years, by an increase as the cost of commodities (in the case of wind, mainly steel) increased, and as strong demand for turbines allowed the manufacturers (or their subcontractors) to push up their prices:

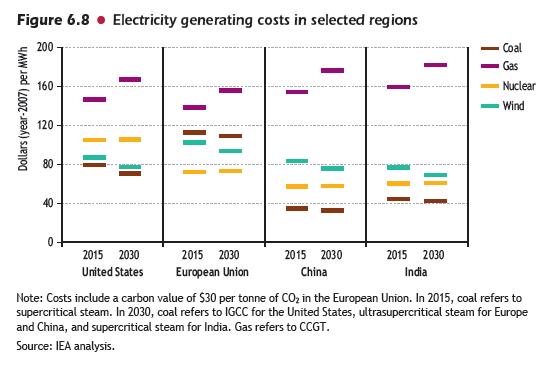

The most recent Energy Outlook by the International Energy Agency suggests that wind power currently costs €60/$80 per MWh, which makes it, today, pretty close to what the traditional generation sources (nuclear, coal, gas) cost:

Source: World Energy Outlook 2008 (available on order only)

In the case of wind, it is important to note that most of the costs are upfront, i.e. you need to spend money to manufacture and then install the wind turbines (and build the transmission line to connect to the grid, if necessary), but once this is done, there are very few other actual costs: some maintenance and some spare parts now and then.

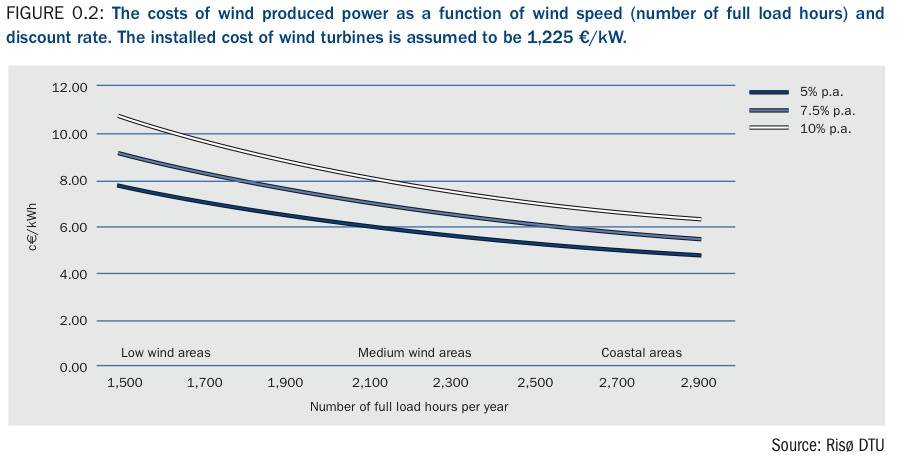

This means that the levelised cost of wind (ie, the average cost over the long run, when initial investment costs are spread out over the useful life of the wind turbines) is going to be highly dependent on the discount rate, i.e. the hypotheses used to spread the initial cost of investment over each MWh of production over the useful life of the wind turbine, both in terms of duration, and the rate used. The graph below shows the sensitivity of the cost of wind depending on the discount rate used (over 20 years):

Source: Economics of wind (pdf) by the European Wind Energy Association

The discount rate is the cost of capital applied to the project, it will depend on whether you can find debt (whose price can depend on your credit rating) or need to provide equity (which is usually more expensive); altogether this means that most of the revenue generated by a wind farm at any point during its lifespan will go to repay the initial investment rather than to actual short term production costs; moving the discount rate from 5% to 10% increases levelised costs by approximately 40% (whereas for a gas project, it would typically be less than 20%).

Source: the Economist, 2005

Note: this reflects price for gas at 3-4$/MBTU

As a consequence, the marginal cost of wind is essentially zero, i.e., at a given point in time, it costs you nothing to produce an extra MWh (all you need is more wind). In contrast, the marginal cost of a gas-fired plant is going to be significant, as each new kWh requires some fuel input: that marginal cost is very closely related to the price of the supply of the volume of gas needed to produce that additional MWh.

The cost structure of wind and gas-fired power plants are completely different, as the graph to the right (from the Economist) shows: one includes mostly finance costs, the other mostly fuel costs (with nuclear closer to the economics of wind, and coal closer to the economics of gas).

It is worth emphasizing that "letting the markets decide" is NOT a technology-neutral choice when it comes to investment in power generation: public funding (such as can be available to State-owned or municipal utilities) is cheaper than commercial fund of investment: given that different technologies have different sensitivities to the discount rate, preferring "market" solutions will inevitably favor fuel-burning technologies, whereas public investment would tilt more towards capital-intensive technologies like wind and nuclear.

This also means that, once the investment is made, the cost of wind is essentially fixed, while that of gas-fired electricity is going to be very variable, depending on the cost of the fuel. The good news for wind is that its cost is extremely predictable; the bad news is that it's not flexible at all, and cannot adjust to electricity price variations.

Or, more precisely, wind producers take the risk that prices may be lower than their fixed cost at any given time. Given that, as a zero-marginal cost producer, the marginal cash flow is always better when producing than not, wind is fundamentally a "price-taker," i.e., the decision to produce will not depend on the price; however, the ability to repay the initial debt will depend on the level of the price, and if prices are too low for too long, the wind farm may go bankrupt. Meanwhile, gas producers take a risk, at any time, on the relative position, of the prices of gas and of electricity (what the industry calls the "spark spread"). This is a short term risk: gas-fired plants have the technical ability to choose to not produce (subject to relatively minor technical constraints) at any given time, they can thus avoid any cash flow losses, and the very fact that they shut down will influence both the gas price (by lowering demand) and the electricity price (by reducing supply). In fact, as we'll see in a minute, electricity prices are directly driven, most of the time, by gas prices, and thus gas-fired plants are "price-makers" and thus their costs are what drive electricity prices.

This suggests, once again, that selecting market mechanisms to set electricity prices (rather than regulating them) is, again, not technology neutral: here as well, deregulated markets are structurally more favorable to fossil fuel-based generation sources than publicly regulated price environments.

At this point, the conclusions on the cost of wind power (ignoring externalities, including network issues, which I discuss below) are that they don't seem to be that different from those of traditional power sources (nukes, gas, coal), but that they have a very different relationship to prices.

So let's talk about prices.

Prices

There are two aspects here: the price received by wind producers, and the price paid by buyers, which may be different.

The price of wind energy is what wind energy producers get for their production. It may, or may not, be related to the cost of the generation, but you'd expect the price to be higher than the cost, otherwise investment would not happen. But the question is, of course, whether the price needs to be higher all the time, or just on average, and if so, for what duration.

Given, as we've seen before, that wind has fixed prices, all a wind producer requires is a price which is slightly above what its long term costs are. That makes investment in wind profitable and actually rather safe (which means that a fairly low return on capital is required). The problem, as we've seen, is that wind is a price-taker and, unless producers are able to find long term power purchase agreements (PPAs) with electricity consumers at such prices, it is subject to the vagaries of market prices. And when your main burden is to repay your debt, and you don't have enough cash for too long (because prices are below your cost for that period), you go under right away, even though you can generate a lot of cash (remember that wind is a zero-marginal cost producer and can generate income whatever the market price is) - which means that a bankrupt wind farm will always be a good business to take over; it's just that it may not be a good business to invest in if prices are too volatile...

And thus it is not that surprising that the most effective system to support the development of wind power has been so called feed-in tariffs whereby the wind producers get a guaranteed, fixed price over a long duration (typically 15 to 20 years) at a level set high enough to cover costs. The fixed price is paid by the utility that's responsible for electricity distribution in the region where the wind farm is located, and it is allowed by the regulator to pass on the cost of that tariif (ie the difference between the fixed rate and the wholesale market price) to ratepayers. It's simple to design, it's effective and, as we'll see, it's actually also the cheapest way to promote wind. Other mechanisms include quotas which can be traded (that's what green certificates or renewable portfolio standards amount to) or direct subsidies, usually via tax mechanisms. Apart from tax benefits, which are borne by taxpayers, all other schemes impose a cost surcharge on electricity consumers (although, as we'll see below, in the case of feed-in tariffs, that surcharge may not exist in reality, as we'll see below).

But there's an even trickier aspect to wind and electricity prices: in market environments, marginal cost rules, i.e. the price for electricity is determined, most of the time, by the most expensive producers needed at that time to fulfill demand. Demand is, apart from some industrial use, not price sensitive in the very short term, and is almost fixed (people switching lights and A/C on, etc...), so supply has to adapt, and the price of the last producers that needs to be switched on will determine the price for everybody else.

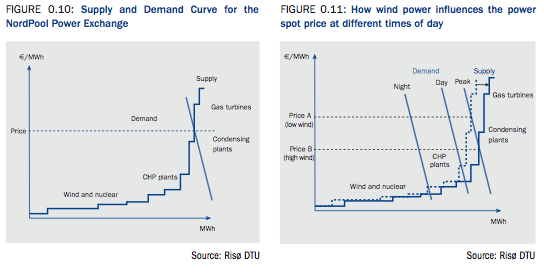

Source: Economics of wind (pdf) by the European Wind Energy Association

If you look at the above graph, you see a typical 'dispatch curve', i.e. the line representing generation capacity, ranked by price. Hydro is usually the cheapest (on the left), followed by nuclear and/or coal, and then you have gas-fired plants and CHP (combined heat and power) plants, followed to the far right by peaker plants, usually gas- or oil-fired.

You take you demand curve (the quasi vertical lines you can see on the right graph), and the intersection of the two gives you the price. As is logical, night time demand is lower and requires a lower price than normal daytime prices, and even less than peak demand which requires expensive power generators to be switched on.

The righthand graph shows what happens when wind comes into the picture: as a very low marginal price generator, it is added to the dispatch curve on the left, and pushes out all other generators, to the extent is available at that time. By injecting "cheap" power into the system, it lowers prices. The impact on prices is pretty low at night, but can become significant during the day, and very high at peak times (subject, once again, to actual availability of wind at that time).

Source: Economics of wind (pdf) by the European Wind Energy Association

As the graph above suggests, the impact on price of significant wind injections is high throughout the day, and highest at times of high demand. When there's a lot of wind, you end up with prices that get flattened at the price of base load, i.e. the marginal cost of nukes or coal, and wind no longer has any influence on price.

But the consequence of this is that the more wind you have into the system, the lower the price for electricity. With gas, it's the opposite: the more gas you need, the higher the price will be (in the short term, because you need more expensive plants to be turned on; in the long run because you push the demand for gas up, and thus the price of gas, and thus of gas-burning plants, up).

In fact, if you get to a significant share of wind in a system that uses market prices, you get to a point where wind drives prices down to levels where wind power loses money all the time! (That may sound impossible, but it does happen because the difference between the low marginal cost and the higher long term cost is so big).

There are two lessons here:

- wind power has a strongly positive effect for consumers, by driving prices down for them during the day.

- it is difficult for wind power generators to make money under market mechanisms unless wind penetration remains very low; this means that if wind is seen as a desirable, ways need to be found to ensure that the revenues that wind generators actually get for electricity are not driven by the market prices that they make possible.

That's actually the point of feed-in tariffs, which provide stable, predictable revenue to wind producers, and ensure that their maximum production is injected into the system at all times, which influences market prices by making supply of more expensive producers unnecessary. And these tariffs make sense for consumers. The higher fixed price is added to the bill for the buyers of electricity, but as that bill is lower than it would have otherwise been, the actual cost is much lower than it appears. As I've noted in earlier diaries, studies in Germany, Denmark and Spain prove that the net cost of feed-in tariffs in these countries is actually negative, i.e. a apparent fixed cost imposed on consumers ends up reducing their bills!

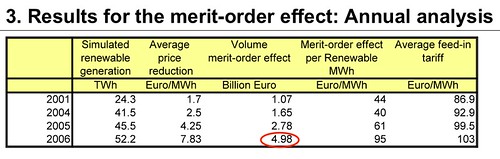

Assessment of the impact of renewable electricity generation on the German electricity sector (pdf)

Mario Ragwitz, Frank Sensfuss, Fraunhofer Institute, presentation to EWEC 2008

The table above indicates that renewable energy (mostly wind, plus some solar) injections into the German electricity system caused, on average over the year, prices to be reduced by about 8 euros/MWh - about 15%. That translated into savings of 5 billion euros over the year for electricity buyers (utilities and other wholesale consumers), or 95 EUR/MWh of renewable energy injected. With a feed-in tariff of, on average, 103 EUR/MWh (which includes the high price for solar; wind tariffs are around 85EUR/MWh), the net cost of renewables is thus under 10 EUR/MWh, to be compared to a average wholesale price of 40-50 EUR/MWh. Thanks to the feed-in tariff, a wind MWH costs one fifth of a coal MWh!

In other words, by guaranteeing a high price to wind generators, you ensure that they are around to bring prices down. And that trick can only work with low marginal cost producers, thus not with any fuel-based generator, which would need to pay for its fuel in any case, and might end up requiring a higher price than the guaranteed level to break even, if fuel prices increased (as they would if such a scheme came up and encouraged investment in such plants) .

So we get an glimpse of the fact that there is value in wind power for consumers which is not reflected directly through electricity prices, and is only remotely related to the actual cost of wind.

Value / externalities

Which brings us to our last point, the "value" of wind power, which has to include the other impacts of wind onto the system that are not captured by monetary mechanisms. This is also what economists call externalities, i.e. the impact of economic behavior or decisions which are not reflected in the costs or prices of the economic entity taking the decision. Pollution is a typical externality, but so is the impact on the grid of bringing in a new producer.

Regulation is meant to put a price on these items, in order to reflect the "true cost" of a given economic action, i.e. in this case a decision to invest in a wind farm or a gas-fired plant or otherwise. Amongst the externalities we need to discuss here are the intermittency of wind, carbon emissions (which, in this case, is an existing, improperly priced, externality of existing technologies which wind can help to avoid), and security of supply.

Intermittency and balancing costs

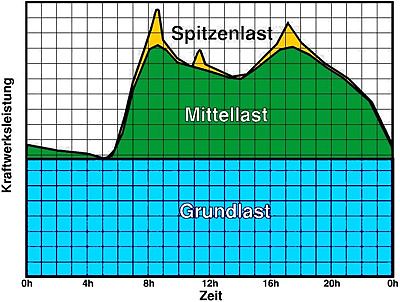

A traditional argument against wind (its availability is variable, and cannot be counted upon to fulfill demand), which people may be surprised to find listed here as an externality - but that's what it is. In a market, you are not obliged to sell; the fact that the electricity grid requires demand to be provided at all times is a separate service, which is not the same thing as supplying electricity - it's continuity of supply. But while wind is criticized for its intermittency, I never hear coal or nuclear blasted because the reserve requirements of the system need to be sized to be at least as big as the largest plant around, should that plant (which is inevitably a multi-GW coal or nuclear plant) happen to drop off. The market for MWh and the market for "spare MWh on short notice" are quite different animals, and the Germans actually treat them separately:

From wikipedia

The Germans distinguish between permanent base load (i.e. the minimum consumption of any time, which effectively requires permanent generation, "Grundlast" in the graph above), semi-base load (or the predictable portion of the daily demand curve, "Mittellast" in the graph above), and peak/unpredictable demand (i.e. the short term variations of supply availability and demand - "Spitzenlast" in the graph above). Wind is now predictable with increasing accuracy with a few hours advance, and can, for the most part, be part of semi-base load; i.e., low winds can be treated just like a traditional plant being on maintenance: reduced, but expected, availability of a given asset.

(for contrasting views on this topic, you can read these two articles: Wind is reliable and Critique of wind integration into the grid on Claverton).

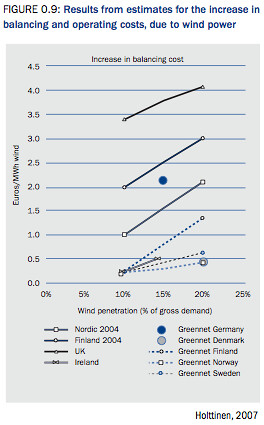

The reality here is that the service "reliability of supply" is well-understood, and the technical requirements (having stand-by capacity for the potentially required volumes) are well-known, there is plenty of experience on how to provide them ("spinning reserves", i.e. gas-fired plants available to be fired up, or interruptible supply contracts with some industrial users who accept to be switched off at short notice) and experience and the relevant regulations have made it possible to put a price on that service.

Source: Economics of wind (pdf) by the European Wind Energy Association

In the case of wind, the cost of the service (which a wind producer needs to pay to the grid operator in order to be able to provide its service, which is the same of kWh) is estimated at 2-4 EUR/MWh, i.e. 5% or less of the cost of wind. And, given that the relevant regulations exist, that externality can be easily internalised - and in that case, added to the cost of producing windpower - or deducted from the price wind generators can get for selling their "naked" MWh.

Carbon emissions

The second externality to mention is carbon emissions. In that case, it is not an externality caused by wind generation, it is an externality which is created by existing power generators, which is not properly accounted for yet today, but which wind generation avoids. In other words, there is a benefit for society to replace fossil fuel-burning generation by wind, but it is not priced in yet (or, in other words, the indirect cost of coal-burning is paid by the inhabitants of low-lying islands rather than by the consumers of that electricity).

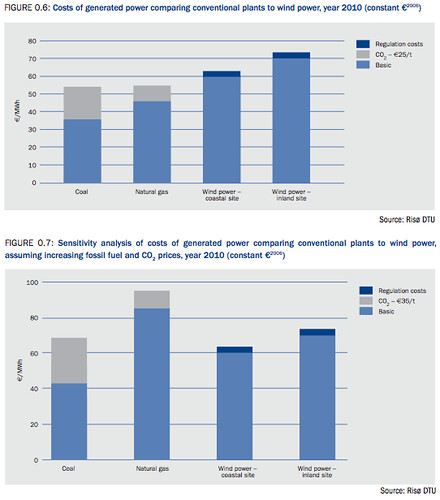

Attempts to price carbon emissions are moving forward, with the European ETS (emissions trading system) and the expected "cap-and-trade" mechanism in the USA; these require carbon-spewing generators to pay for that privilege and materialize a new cost for them, which will be added to their cost of generating electricity (but not to that of wind, as it emits no carbon dioxide in the process).

Source: Economics of wind (pdf) by the European Wind Energy Association

The grey area in the bars above is the added cost of producing electricity from coal or gas, for two different prices of carbon (note that the bottom graph also changes the cost of fuel, which increases the other component of cost for coal and gas). It has a significant impact on the net cost of production for these sources, and on the respective competitively of competing technologies. Note that the graph above includes the grid-related costs for wind discussed above, in dark blue.

It is no less legitimate to include the cost of carbon as it is to include the cost of stand-by capacity in the calculation of the cost of electricity. If we consider the power grid as a fully integrated system, then there is very little reason to include some externalities and not others - other, that is, than force of habit and lobbying by the incumbents who designed the rules around their exiting generation mix.

Security of supply

A power plant is an investment that can last 25 to 50 years (or even more, in the case of dams). Once built, it will create patterns of behavior that will similarly last for a very long time. A gas-fired plant will require supply of gas for 25 years or more (and the corresponding infrastructure, and attached services, employees ... and lobbyists). Given worries about resource depletion (usually downplayed) and about the unreliability of some suppliers (hysterically exaggerated, cf the "New Cold War" hype about Putin's Russia), it is not unreasonable to suggest that security of supply has a cost.

This may be reflected in long term supply arrangements with firm commitments by gas-producing countries to deliver agreed volumes of gas over many years - but, given all the Russia-angst we hear, this does not seem to be enough (most supplies from Russia are under long term contracts). Wind, which requires no fuel, and thus no imports, neatly avoids that problem, but how can that be valued in economic terms? That question has no satisfactory reply today, but it is clear that the value is more than nil.

Another aspect of this is that "security of supply" is usually understood to mean "at reasonable prices." Fuel-fired power plants will need to buy gas or coal in 10, 15 or 20 years time and it is impossible today to hedge the corresponding price risk. Given prevalent pricing mechanisms, individual plants may not care so much (they will pass on fuel price increases to consumers), but consumers may not be so happy with the result. Again, here, wind, with its fixed price over many years, provides a very valuable alternative: a guarantee that its costs will not increase over time. Markets should theoretically be able to value this, but futures markets are not very liquid for durations beyond 5 years, and thus, in practice, they don't do it. This is where governments can step in, to provide a value today to the long term option embedded in wind (i.e. a "call" at a low price). This is what feed-in tariffs do, fundamentally, by setting a fixed price for wind production which is high enough for producers to be happy with their investment today, and low enough to provide a hedge against cost increases elsewhere in the system (and indeed, last year, when oil and gas prices were very high, feed-in tariffs in several countries ended up being below the prevailing wholesale price: the subsidy went the other way round...).

Note that the regulatory framework will decide who gets access to that value: if wind is sold at a fixed price, it is the buyer of that power that will benefit from the then-cheap supply (and that may be a private buyer under a PPA, or the grid operator; depending on regulatory mechanics, that benefit may be kept by that entity, or have to be reflected into retail tariffs for end consumers). If wind producers get support in the form of tax credits or "green certificates", it is wind producers that will capture the windfall of high power prices. So the question is not just how to make that value appear, but also how to share it. Both are political questions to which there are no obvious answers.

:: ::

So wind power has value as a low-emissions, home-grown, fixed cost supplier. It also tends to create significant numbers of largely non-offshoreable jobs, which may be an argument in today's context. It also has, in a market pricing mechanism, the effect of lowering prices for consumers thanks to its zero-marginal cost. Its drawbacks, i.e. mainly intermittency, can be priced and taken into account by the system. (Birds/bat are not a serious issue, despite the hype; esthetics are a very subjective issue which can usually be sidestepped by avoiding certain locations - the US is big enough, and Europe has the North Sea)

Altogether, wind seems to be an excellent deal for consumers - and an obvious pain (in terms of both lower volumes, and lower prices) for competing sources of power, except maybe those specialising in on-demand capacity.

In other words: sticking with mostly coal or nuclear is a political choice, not an economic one.

Jerome,

Thanks again, for another informative post, I always find your posts of great interest.

Ditto, this should more than refute offhand lay comments about "wind is just too expensive".

Wonderful, clear introduction to the pricing of wind energy. I learned more from reading this article than from everything else I've read about wind to date.

Thank you!

same here

thanks Jerome

In the graph 'Grundlast' appears to be about 50% of the peak so I'm not sure if the final comment about not needing mostly coal or nuclear is valid. You want renewables to displace deep baseload (say 99% reliable) to well under 50% of peak. 20% would be great if achievable.

I'm suspicious of the 'merit order effect' and will study the pdf later. In the case of solar PV I look at it this way; in a middle class suburb two adjoining houses have an executive couple and struggling self funded retirees. The execs install $20-30k of PV and get a FIT of 45c/kwh. Next door's rates go up from 17c to 20c/kwh yet this is purportedly less than if the billion dollar power company (with low cost of capital) installed its own generators. This merit-order-effect must be pretty good.

Or the market is simply directed - the German framework includes creating the industry and infrastructure to support a business model - while recognizing that without incentives, the market does little on its own.

There is no question that a number of technical hurdles and limitations exist in creating a competing model to what currently exists - one of those hurdles being the opposition of those currently profiting in the regulated market.

The government balances various interests - and currently, profit is assured by the rate setting mechanisms which also attempt to prevent manipulation and gouging. That this authority is extended to creating competition in a market that wishes to see none is simply a political decision - much like the decision to phase out nuclear generation in Germany.

It might not work - but the German solar and wind industries, not to mention the various industries behind them, are at least within an allowable distance of being called profitable.

And your example of a 3c rise for the couple next door implies that the energy company is only supplying ca 9 customers, each buying only 1 kw. Which might be an useful starting point to develop a realistic ratio - for example, the PV system delivers a total of 15 kilowatt hours a day, even though a typical customer would use something on the order of 30 or 50 kilowatt hours a day. The residential customer ends up paying for electricity regardless - forcing a market for energy that is not directly controlled by monopolistic companies is a legitimate goal for an elected government to pursue, regardless of what those companies may think.

The counterargument is that the FIT is set by government regulation, not by the market. In that sense it is little different to the ethanol production credit. The producers are probably getting paid too much. I suggest feed-in tariffs be removed after a few years to see what customers really want to pay. Alternative incentive schemes include green energy quotas with no price support

http://en.wikipedia.org/wiki/Feed-in_Tariff

Electricity suppliers like hydro do very well in spot markets; in Australia recently spot electricity sold for $10 a kwh, that's 1,000 cents a kwh.

There is also an equity effect with FIT in that the poor (pensioners etc) stay poor and the rich (corporations etc) stay rich.

It isn't a counter argument - it is an argument. Electricity rates are already controlled by government regulation, from pollution controls to allowable margins. Simply extending that authority to foster competition, for reasons that may not be 'market oriented,' simply allows for the fact that the 'market' is not the only factor in deciding a society's interests, however imperfectly.

As for the rich getting richer in their position of the owners of capital - that remains true in both cases, the only difference being the scale, not the reality.

Solar panels on the house provide electricity transmission as well as electricity. Every kilowatt on site is a kilowatt that isn't crowding out the kilowatt for your house in the transmission line and heating up the transmission line. Lower transmission line temperature is lower electricity losses and lower chance of overload blackout.

Boof

Being realistic, I don't think wind can (nor should) replace all of the baseload, but it could replace a significant chunk. I personally think that a good chunk of nuclear (20% of installed capacity and 50% of kWh), a large chunk of wind (50% of installed capacity and 40% of kWh) and a large fleet of peak capacity (hydro where available, gas otherwise - 30% of capacity, 10% of kWh) would be a pretty good solution (with, of course, overall capacity being rather larger than it is today).

Jerome, thanks for this entry.

I have a question. In this long (necessarily so) essay, you mention that the 'best' way to "support wind" is with the Feed-in Tariff. OK. So...without this FT, no wind? I mean you *seem* to be making this out to be 100% based on this subsidy, without which none of the numbers seem to work, or am I getting this wrong?

David

David,

I suspect what Jerome means is that, without a feed-in tariff, wind is at the mercy of the markets, i.e. depending on economic conditions, investing in wind may seem like a really neat idea or... not at all. e.g. from about 2003 to 2007, wind was an objectively good investment, even without the guarantee of feed-in tariff, whereas currently investment is slackening because costs are higher and there are no guarantees of future electricity prices.

Of course, if "the market" had a realistic idea of future fossil fuel prices, there would be no need for feed-in tariffs, and everyone would be building wind farms.

dwalters

in previous years, banks (including mine) have been able to finance wind under almost all regulatory frameworks (tax based like the US PTC, market based green certificates, fixed price green certificates, etc... Feed-in tariff allow to avoid volume risk (the risk that you may not sell your power, or that you may have to pay some penalties as balancing costs) and price risk - these risk can be hedged in other ways: long term contracts, financial hedges, better wind prediction tools, etc... but this is more difficult in today's environment.

FIT has proved to be the easiest and cheapest, altogether, but it's not the only one that works.

Thanks Jerome, I'm going to have to digest this slowly and thoughtfully... Question : Can Mr Putin damage or destroy the European wind industry by selling gas at a discount? Might that not be an interesting strategy for him, to consolidate Russia's economic power?

I'm something of a born-again capitalist, and I have recently (since last December) started buying stocks... it's been a baptism of fire. I'm currently shifting into small-cap alternative energy companies (wind, small hydro, landfill methane electric). Partly because of my moral and political principles (of course!) and partly out of sheer greed... These companies currently face a severe cashflow squeeze, because essentially all the costs are upfront, as you outline... therefore their stock prices are way down, because of the risk of bankruptcy. On condition that they survive, their stock will presumably take off again when credit gets easier (and the carbon credit market recovers).

On the morality aspect, one can question whether buying shares on the stock market is actually helping the company... but they are likely to need to issue new shares, which will enable me to contribute actual cash.

Does anybody know why nuclear in the IEA chart is more expensive than wind in the US but less expensive than in the rest of the world? Could it be that the US included the cost of waste disposal etc. whereas at least in Europe this is seen as a governmental thing?

Great article by the way. Thanks.

I hear through news reports that it is cheap for Europeans because they can dump into the lawless seas off the coast of Somalia.

You heard wrong. European nuclear waste is re-processed; American nuclear waste is stored. I had the idea that re-processing was the more expensive of the two options, but the economics have changed somewhat : re-processing extracts quite a lot of useable fuel.

On the other hand, I don't know what the Russians do with their waste; I wouldn't be surprised if they dumped it off Somalia.

I'm trying to reconcile what you write against David Mackay's book, Sustainable Energy — without the hot air.

I wonder if you could comment on the rough numbers cited in this excerpt from his chapter on Off Shore Wind.

actually, the cost of a MW offshore is closer to £3 million now, so his cost is a low estimate. On the other hand, the cost fo the ships is already included in that budget, as should have been obvious.

Offshore wind is more costly than onhore right now, but this is expected to improve as the sector becomes industrialised and enjoys economies of scale. Right now, onshore wind is profitable with a 8c/kWh tariff; offshore require 12-15c/kWh.

Thank you for the comment, Jerome.

MacKay is very up front about the precision of his numbers and calculations and the fact that he is trying to get his reader to understand the concepts and what the physical limits are, so that he or she can make critical assessments about what is bandied about in the media and amongst the generally uninformed. I would presume that people like yourself fall into the category that he considers poor folks . So I just wanted to see if you thought his numbers were at least in the ballpark of economic reality.

FMagyar,

MacKay has made a serious error in his calculations of on-shore wind energy resources. In the interests of simplicity he has taken the average wind speed (6m/sec at 10 meters height). In fact the better locations in Scotland and off-shore islands have much higher wind speeds at the 100m hub height of wind turbines(10-12m/sec). This means MacKay has underestimated the potential of these regions by X5-X10. These regions are also distant to villages and more likely to be used in future wind farms once transmission lines are built.

Some of the wind farms initially built were in poorer locations but close to electric transmission lines, so his calculations are not good examples of what is possible in UK.

Neil, I assume you are referring to this explanation for his bar graph of wind speeds of various British locations:

I interpret this as simply giving the source for those numbers of wind speed cited.

He does go on to say the following about variation of wind speed in relation to height:

(He includes the mathematical formulas of how this is derived here)

Then says:

So I think it is not that he is seriously mistaken in his calculations but rather as you yourself state, interested more in getting a concept across and trying to keep the explanation clear and simple. He says, I as excerpted in my previous comment that he isn't interested in accuracy to the level that is needed by engineers and economists to spec out specific projects, we will leave that part to Jerome ;-)

FMagyar - "So I think it is not that he is seriously mistaken in his calculations but rather as you yourself state"

I actually wrote to him about this. You cannot calculate the amount of power that a wind turbine will deliver based on the average wind speed as this reference will explain:

http://www.windpower.org/en/tour/wres/bottle.htm

He does use the average wind speed to estimate the number of wind turbines you would need to power Britain. The true answer is much less as several of those wind sites will give far far more power than the average wind speed would give you.

He replied to my query with basically he was close enough - I guess it is if you want to make wind power seem worse than it is.

Unfortunately, that's much the same conclusion I came to about a previous draft. Using the formulas he cites, even his choice of Bedford's summer windspeed - one of the lower entries in the table - implies a speed of 6m/s at turbine height, whereas the more favourable sites such as Kirkwall provide an average wind speed of 10m/s, or about 5x the power density he calculates.

I also question the value and intention of his examples. A petrol car may burn 40KWh/day of energy, but that's by no means directly comparable to 40KWh/day of electricity; we burn 120KWh of fossil fuels to get 40KWh of electricity and call that a good deal. By comparing raw btu count, any system which directly generates electricity will be innately and unfairly disadvantaged. A more appropriate comparison would be to household electricity use (11kWh/day or about 5kWh/person/day) or total per capita use (15kWh/person/day).

Comparing heat btus to electrical kWh will always grossly inflate the contribution of fossil fuels, and it's often the sign of a biased argument. There's a reason BP has a 3:1 conversion factor in their energy review.

Ender and Pitt,

Thanks for your comments and links, I'll try to digest all the information given, It seems I may have to read Mackay with a somewhat larger sprinkling of NaCl.

Coincidentally, I just completed a webpage project for a science & technology policy class on "true" energy costs (market costs plus externalities). http://atoc.colorado.edu/~englishj/Energyhome.html To my knowledge, nobody has tried to combine all the externalities for different energy technologies. (Perhaps this could be its own post on your website?) I'm curious to hear what you all think, but my analysis agrees with a lot of the points Jerome is making here. I didn't go into as much of the complex economic theory - I just tried to quantify all the externalities and add them up. (my expertise area is climate research).

jaymongrel, nice project, I just took a very quick look. However I noticed that you only address PV under Solar, Is there a specific reason you do not include passive or thermal, even if it is only for heating buildings and water?

The main reason was to try to keep the page as simple as possible. I did look at some different ways to utilize solar (PV, thermal etc) and found that all of them were pretty expensive from a utility electricity generation standpoint ($15-20/MWh).

Jay,

Here are some candidates for external costs for nuclear:

1) the balance of trade implications of buying plants from French (Areva) and Japanese (Westinghouse/Toshiba?) vendors, and importing most fuel.

2) the intangible of the example we're setting for countries like Iran, Egypt, and others, who are thinking about nuclear power. Nuclear power in Iran and other places makes us nervous, while those countries feel they have a pretty good right to develop nuclear just like us (a little too much like us).

3) Price-Anderson liability limits.

4) the opportunity cost of the 8-10 year delay from proposal to commissioning (as compared to wind).

What do you think?

All good reasons not to have nuclear replace wind, and in fact to have wind deployment as a higher priority.

Not all good reasons (or even strictly factual reasons) for not doing nuclear at all.

Short term - Wind and heat pumps

Medium term - Nuclear and electric transport

Longer term - Solar, Geothermal, Pumped hydro and international HVDC

Call me long view paranoid but for some reason massive geothermal scrares the heck out of me, I picture a dead cold rock orbiting till the sun eats it. Probably no fear of destroying the fine heat engine gravity fires here with the little efforts we can soon manage, but harvesting daily solar and lunar inputs just has a long term safer feeling to me.

Thanks to the laws of thermodynamics that will happen anyway. Heat flows out from the core inevitably.

We might as well take advantage of some of those flows while we're here.

I don't know that the entire system is that simple (as a rock cooling under the gaze of the sun), the moon tugs on the fluid regions below the crust, gravity crunches toward the center, solar radiation strikes and on and on...Massive geothermal is such a long time out (possibly multiple civilization collaspses and rebirths assuming the species hangs around) mine is probably a very stupid paranoia, but seeing how well we have screwed things around with our current misunderstandings of systems and our limited ability to affect them, a time when technology would allow the massive-we seem to have limitless appetite for energy-geothermal to be tapped would set the stage for maybe the biggest screwup we are capable of.

We just might be able to get a handle on harvesting daily energy inputs above the crust without having to understand the full complexity of things...and if somehow we find that all the tidal, wind and direct solar we someday harvest is having unforeseen ill consequences (what twisted opti/pessimtic thought), the offending power generation systems could be removed. If we start acceleralting the cooling of the earth's core no such remedy exists.

Way out there stuff. A bit more scifi than I should have added to Jerome's extremely informative post.

Nick - I agree that those are all important items to consider (and difficult to quantify). To address each of them: (1) Fortunately for us, France and Japan are our allies (for now). (2) I don't think coal plants and their particulate, radiation, mercury and carbon dioxide emissions are a good example either! (3) Some of the price-anderson costs are included in subsidies; although a horrific accident could cost a lot of $$, fortunately our nuclear plants are pretty safe and have an impeccable safety record. (4) Good point - the high financing costs are included in capital costs, but opportunity costs are not directly included.

Yes, I agree that these are difficult to quantify. Still, we should probably give it a try. On the points:

1) You're thinking of security of supply, which is another valid point. I was just thinking of the effects on the US's trade deficit. After all, it was financing the trade deficit that caused the current credit crunch, and presumably we'll be paying interest for quite a while on our borrowing.

2) I agree: I think we should put our emphasis on wind and solar, and add this point to the external costs for coal.

3.1) How are P-A costs included in subsidies?

3.2) Insurance is something that we buy because of the scale of the potential liability, even if the % chance of occurrence is very small. There is an additional cost to that scale beyond the simple calculation of expected value (cost multiplied by % chance of occurrence), and the fact that private insurers are unwilling to provide full liability insurance tells us something about the magnitude of that additional cost.

4) Perhaps the most important opportunity cost is that of mitigating climate change, for which there is a very large time factor: interventions in the next 10 years will have much larger effects, due to the possibility of run-away positive feedback (I'm sure you know this, but I thought others would benefit).

1) Oh, I see. The global free market side of me says that trade deficit doesn't matter - we can make it up in other ways. But the intuitive side of me says that we already have a bloated trade deficit and it's in our best interest to develop energy within the US since it is a $3 trillion market.

3) The first $10B of nuclear insurance is covered by private industry. Beyond that is a gov't risk/cost.

4) I agree.

What I love about this post is that it illustrates that things that are different can not be compared. My old nemesis EROEI is again shown to be fallacious. If producing one form of energy in this case electricity can have such different cost structures, it is obvious that comparing energy outputs across different forms is rediculous. The marginal cost and therefore the efficiency of electricity production can vary from the vary highest to zero.

Nonetheless there are still many EROEI/Net Energy believers who still don't get it. Perhaps it is because they are so fixated on oil which has more homogeneous production methods where comparisons are more likely to be valid. When one moves into other of the myriad energy forms and production methods, the EROEI/Net Energy model breaks down hopelessly and is invalid.

X, just admit it, you never read that post. You just spotted another opportunity to tout your "home made"-slogan - no ?

That said, I also start to lose faith in WT's and other HighTech renewables due to EROEI and more - b/C industrial-societies has no actual and formulated plan with them, at least not visible to me anyway. Info on renewables lately just blures before my eyes, so for the sake of my sanity I just started look at them as the new fad. Not any solution to anything ...

But when the "24/7- All switches and buttons ON everywhere - all the time "-paradigm is gone

, then maybe I may start to "believe" again. But not before that. We have to reshape main operations in our societies to utilize energy "when around", aka the way they used windmills in the good ol' days.Those folks back then were very pleased "with themselves and their mill ..." I'd reckon.

Nobody ever said that EROEI is the same as cost structure. The fact that you think anything in Jerome's post directly relates to the EREOI concept is laughable. The fact that you keep repeating this straw-man argument nonsense is also laughable. We'll all just keep saying so, to keep casual passersby from being misled.

Thank you for the analysis - useful stuff.

However, over here, on the Isle of Wight, one of the largest local employers, Vestas, has closed its factory. The direct job losses are around 600 and the indirect losses are bound to be a multiple of this number. The Island always has a shortage of well-paid jobs. My neighbour, a young mechanical engineer, will be obliged to move elsewhere, for example. Almost simultaneously, Vestas reported a record profit and blamed this closure on the delays in planning.

As a microcosm of the UK, the Island is quite illustrative - there is not a single turbine in operation as the local gentry don't like them and want to keep the views pristine.

I have not looked at TOD for some time as it is clear to me that the financial and political angles are going to determine what gets build and what does not get built.

I tend to get that news from theAutomaticEarth

Unfortunately, as this episode with Vestas demonstrates all too clearly, there is a shortage of real capital out there as well as of common-sense.

Alfred your remarks about what gets built having to do with financial and political angles may be might be a bit better stated by leaving out " financial" as some of the financial arguments are valid, and the ones that aren't are pretty well summed up under "politics" any way.Generally speaking,I couldn't agree with you more.

Any one who has seriously tried to keep up with the "news" for any length of time -by which I mean at a minimum reading a couple of daily papers most of the time and reading a book or two that deals with current events at least once every couple of years knows that big time business and public policy decisions are seldom if ever made with the best interests of the public in mind, or even public interests in mind.Politicians generally try to make sure the interests of their most important constituents are protected and to get reelected.Every thing else is secondary to these two twin first goals.

If we are reasonably lucky,maybe as much as a half of all the public money that will be spent on renewables in the next decade might actually generate some sort of useful return.We will see tax credits and feed in tariffs set in some cases so as to simply give away public money.I read a piece about a brewery some where up in New England recently that got such a deal a on solar thermal installation that a few thousand bucks out of the company pocket wound up generating an ungodly rate of return ,something like 30 or 35 percent annually-and they were bragging about it.My thought at the time was that if I was involved in such a give away as a politician,I would rather the public didn't hear about it,but no, the tone was that since the credits were only tax money,we have invented a scheme to manufacture prosperity out of thin air.

Can you imagine how mad this makes a free market conservative who has to pay income taxes to support a subsidy to a brewery?how unfair to other brewers who can"t get the same deal?

On the other hand,we have a few thousand(?) engineers and physicists earning exceedingly comfortable livings pursueing fusion power that absolutely noboby believes will become a commercial reality in less than any where from forty years to infinity.The hangers on ranging from the snack truck drivers to the bull dozer drivers to the manufacturers of concrete,etc, have bled us for tens of billions more piled on top of the academics take.

About the best that we can hope for, given day to day realiies, is that enough money ,regardless of its source,gets spent on enough alternatives that a couple of clear winners emerge before it is too late do you and me any good.

The general baseline for a company without a guaranteed twenty year contract is 20%. That profit has to cover the loss making investments as well as the profitable ones.

If you have a twenty year contract, 1% over the cost of your bonds is good enough. Assuming that your customers are reliable, like a city or something.

I didn't understand where the costs of all the energy sources came from, but I'll make this comment.

It is very imporant that a comparison is made of old plants and new plants. wind might not be able compete with old coal plants, but it might do very well against new coal plants. new wind might compete against new nuclear, but not old nuclear.

The biggest cost difference is new plants verses old plants. Just as I might be living in a 1950 house that cost 30 000 to build, my neighbor a few miles away is building the same square foot house for 200 000 dollars today. I didn't see the distinction in your cost comparison.

I think you will find that new nuclear and new coal costs are quite a bit higher than the numbers you showed.

Jerome --

Thank you for the excellent brief on wind turbine economics, which stands in pretty well for economic analysis of 'intermittent' renewable energy generally.

You make a cogent point that these sources provide low cost energy and effectively no capacity (a little, but not a lot). This is an important consideration for interconnected systems. The optimal ratio of baseload to peaking capacity is around 70/30, at adequate reserves. As you pointed out, if you have too much baseload generation in a dispatch market extreme price volatility is the result, as unexpected constraints on baseload cause sudden jumps into the peaker regime. Interestingly, this is true whether the baseload resources you are talking about are coal, gas CC, nuclear, or wind.

Thus, when detractors of wind say 'you have to back it up because it is intermittent' their statement should be re-cast as 'when you add baseload resource to the system, some peaking needs to go in as well to keep the system in balance.'

Now then, what do 'renewable peakers' look like? Demand response? Batteries? Hmm....

Thanks for your explanation of these things.

I would agree with you that the reason for wind is to provide security of supply, if other supply sources are in question. I think this is especially an issue in Europe, where natural gas supplies are not certain; there is some pressure to phase out nuclear; and coal is less available / higher priced than in the US.

On the cost and price situations, it seems like one needs to take a little more of a step back approach, though.

It is wonderful if through the current marginal pricing scheme wind can be sold for less than its actual cost, but this is not the situation one needs to encourage new investors to build more wind turbines. Somehow, there has to be reasonable assurance that there will be enough funds to cover underlying costs and plus provide a profit to the investor. Thus, the underlying costs are what is fundamental. A pricing scheme which will give enough total funds is needed as well, such as feed in tariffs.

Likewise, it is helpful that a bankrupt owner of wind turbines can be bought out, but one needs to prevent this from happening in the first place. Lehman Brothers financed a lot of the first round of wind, and we know what happened to them. Somehow, the pricing has to be brought up to a level that there will be enough financing for new wind turbines.

One of the questions is what is the right interest rate. You show 5%. 7.5%, and 10%. To really get financing, won't wind turbine purchasers need to offer a higher yet interest rate, perhaps 12.5% or 15%? Or perhaps the buyers are countries, printing more money, but it is hard to see this lasting for long.

Also what do the feed in rates need to be, and how do these compare to other costs? I know that I just read this article saying that the cap price for wind procurement was raised from CAN $.095 per kWh to CAN $ .125 per kWh, because the previous rate was too low to get investors. Assuming $1.00 US equals $ .85 US, this would be equivalent to a rate of US $.106 for wind, for something like a feed in rate.

A rate of US $.106 is approximately the required wind rate I had expected, based on presentations I have seen. This rate is higher than both current US coal costs (without carbon tax) and current natural gas costs. I think of US coal costs as being about US $ .05 per kWh. With natural gas prices so low now, I would expect that they are about in this same range as coal.

Admittedly we are in a strange situation right now, with lack of funds available for financing big projects, and low prices for coal and natural gas. To get more funds for financing wind, it seems like the interest rates will need to be higher, and that will send the needed price above US $.106. It is hard to convince people in the US to come up with these funds, when it looks like we have a glut of cheap natural gas, and coal demand is slack as well, so plenty of production can be obtained for much lower cost elsewhere.

Gail -- well put into a nice little nut shell as usual: "we have a glut of cheap natural gas, and coal demand is slack as well, so plenty of production can be obtained for much lower cost elsewhere." And we all know this wont' last long...maybe a couple of years is my WAG. And then we'll see another price spike of some magnitude. As high as last year? Maybe...maybe not. But all the renewable pros will jump up on the band wagon and start pitching their wares again. And then does the economy shrink again (assuming it has regained some viable life at this point)?

Back to the same brick wall all the possible solutions run into: volatility. Wind as well as all the other big ticket items requires a solid 5 years of fairly predictable income to reach payout and generate an attractive rate of return. I sit in meetings now where I see major projects shunned because no one can offer and attractive, and more importantly, credible future price forecast. My current client just announced a major switch in resource allocation from "long term" projects to "short term investments". Long term allocations will be reduced from 30 - 40% to 15% or less of expenditures. This probably represents several billions of $’s being reallocated. The logic is simple: don't propose a project that depends heavily upon a price forecast being accurate out beyond 3 or 4 years.

It easy to imagine the same philosophy taking hold across the board be it for conventional energy source or alternatives. Simple street short hand: no pay(out) -- no play. And we've chatted before about the gov't coming up with some miraculous plan to moderate this volatility. With the divisive positions taken by both of our great political parties this possibility seems less likely then ever IMO.

To really get financing, won't wind turbine purchasers need to offer a higher yet interest rate, perhaps 12.5% or 15%?

Why?

How much financing is actually available at the rates quoted, unless a government is backing up the project? Isn't that part of the problem?

I can only see the financial crisis getting worse, not better. I can't imagine that good rates on financing projects will be around for long.

I recently read an article saying that in the nuclear industry, borrowing costs were brought down from 15% per year to 5% per year as a result of federal guarantees. There, we are talking about companies with poor credit ratings looking for 40 year loans. Maybe wind isn't quite a bad, but the credit situation still seems very tight. To get more credit, it seems like a higher interest rate is likely what is needed--perhaps not 15%, but may 12.5%.

Gail, they don't do 40 year loans for nuclear or industry in general. They are generally 5, 10 and 15 year notes. I could be wrong but most nuclear in the US was 15 years, I believe.

David

Thanks.

Were they actually paying nuclear plants off in, say, 15 years? This would make the later years of operation look quite favorable.

Or are the loans set up assuming refinancing after n years? This is more what I would expect.

I know commercial real estate is often done assuming refinancing after n years. I also know that there has been some concern recently about property values dropping so much that those refinancing will have to put down more cash. It doesn't seem like that could happen with, say, wind turbines, but if the refinancing isn't there when it comes time to refinance, there will be a big problem.

I don't think refinancing, Gail, per se, is involved. There was a huge write off and refi that took place in the late 1980s after interest rates came down. My understanding is that most plants are paid off today in the U.S. because they did do a refinance and write offs of overly expensive plants due to the high 1970s interest rates (20%!!).

This has driven the price down for nuclear energy for the old plants. Several things about this:

1. Nuclear energy from these older plants brings the overall average of cost for nuclear down to 1.7 cents a KWhr. That is very low. Those are not externalized costs but include all the O&M, fuel, labor, licensing, regulation, etc.

2. The longer the plant stay online past the note being paid off, the cheaper and cheaper the power is vs the original investment. This makes the newer GEN III plants they are building in China now and other countries more attractive: they all have 60 year lifespans, maybe longer. Thus the ROI is quite nice and spans generations.

3. The *shorter* the note, the better even if initial price-per-KWh goes up. The shorter the note the less overall interest is paid and thus overall is cheaper for the rate payer. The current debate in the US about utilities collecting rate increases to pay for nuclear energy has an interesting duality to it. On the one hand, there is something that simply 'stinks' about paying for something you won't see the return on for about 5 years, at least. But on the other hand at the end of the day (meaning when the note is paid off) you end up paying a lot LESS in the long run and power is that much cheaper.

David

Lending to wind farms is less plentiful, but whan it happens it's actually not more expensive than before. Bank margins have increased from 1 to 3%, roughly, but at the same time, the cost of funds for banks (the base rate) has gone down from 4 to 2%. So altogether, bank lending costs a total 5% in yearly interest, now like two years ago.

And with debt still representing 75% of the total cost, even increasing cost of equity will not take you to crazy overall numbers.

It is hard to visualize this low cost of funds lasting very long.

Of course, now there are a huge number of mortgages with locked in low rates, and lenders getting their funds short, so I am sure they are hoping the low interest rates last. Otherwise, we have a replay of the S&L crisis.

Again, why?

If the cost of borrowing hasn't increased despite a meltdown in the world's financial system, what is your rationale for believing that the cost is about to shoot up?

If your intuition tells you something is true, that's a sign of what to look for evidence of, but it's not evidence in and of itself. Intuition is efficient, but data is reliable; use the former to find the latter, but ultimately the latter is the only one useful for communication purposes.

I ran across something else today that relates to this issue. It is an interview with Shell's Chief Executive. In it he says:

(emphasis added)

So this is my point. Pointing to the low price of wind, when the price doesn't even cover its cost of capital, is nice, but it doesn't get players into the field. Somehow, the price has to be high enough to cover basic costs, plus make a profit.

It looks like a handful of players can borrow funds at very low interest rates, but if these funds are not widely available, or if marginal pricing doesn't offer a high enough price to cover costs, development of wind is a no-go.

You are quoting an oil company executive about wind power. I have no doubt that he's going to make it sound as marginal as possible, as Shell has been pulling back from many wind projects and he needs some sort of excuse.

Carbon-based energy costs will rise in the future and there won't be any more such excuses.

Jerome,

I can't help thinking that in order to get a grip on the complexities of dealing with the subjest matter / variables at hand (i.e. electricity costs via different forms of production) the study has pretty much embedded these variables against a backdrop of a "BAU Future".

I.e. they have not taken into account any 'black swan' type thinking wrt. Energy -like for example a) oil availability declining by 50% by 2030, b) a collapse in project financing due to the effects of a), etc.

In order to produce sensible figures they have -of course- had to discount much of this stuff but it would still be interesting to see some scenario analysis -e.g. how would $300+ oil affect the outcome?

Nick.

Jerome -

Very thorough and informative analysis, as usual.

Since wind power is such an inherently high-initial cost/low operating-cost type of system, and since the 'levelized costs' are spread out across the useful operating life of the system, then it would appear to me that it is extremely important to get a clear picture of what sort of useful operating life one can realistically expect.

As with many large stationary mechanical systems, a wind power system doesn't just happily spin along and then suddenly fall apart one day some 30 years into the future. Rather things wear out or fail at different rates.

The fixed structures, largely consisting of the base and the tower, should with proper corrosion protection and regular maintenance last indefinitely (well, almost).

The blades probably will eventually suffer fatigue failure due to all that flexing, and would probably have to be replaced after some (hopefully) fairly long service life, not unlike the wings of a jet airplane.

Rotating mechanical components such as the variable-pitch mechanism, bearings, rotors etc., probably have a fairly predictable service life and their repair and replacement can probably be predicted with a reasonable degree of accuracy. Ditto for the electricals. Typically, the larger the system, the more economically feasible it is to rebuild and refurbish (which is why large diesel trucks are often operating on their second or third rebuilt engine, whereas it usually doesn't pay to totally refurbish a typical automobile).

So, it appears to me that what we have here is an operating life not represented by a single number, but rather a somewhat predictable replacement time-line extending far into the future with somewhat predictable costs associated with the various component replacements.

I guess where I'm going with this line of thought is that it may be a somewhat simplistic and flawed approach to levelize the wind power costs over a single assumed operating life. Rather, the levelization process would appear to take place over several incremental cost outlays superimposed over each other. This of course is further complicated by varying discount rates.

It seems to me that the life-span depends very much on the availability of replacement parts, trained labor, and all the infrastructure to replace these parts (highways, heavy equipment). Maintenance is needed every five years, and perhaps more often. Clearly one also has to have a functioning financial system and a political system that is not too much in disarray.

It seems to me that the life-span of wind is quite closely tied to that of the oil economy. If the oil economy goes badly downhill, it is doubtful that the wind turbines will last five years longer. If the oil economy keeps humming away, then wind infrastructure will also.

If I were a lender, I would charge a higher interest rate because of this situation.

Gail;

While I think that factor ( Lifespan => Oil Availability ) may apply, but weighted proportionally towards the largest turbines, that a rescaling towards a New Optimal size will be quite possible. Still, I'm sure that the energy environment will impact the high-tech end of Windpower.

I just wondered if you have come to the same conclusion for Nuclear Reactors, as this is one of the vulnerabilities for Nuclear Energy that seems to be particularly leaning it's shadow over Fission's future? Especially since it applies to every stage, from Fuel refinement, Plant Construction, Daily Operation, Maintenance, Replacement parts, Waste Mgmt and Decommisioning.

Bob

Jokuhl,

I think small wind turbines will be more sustainable than large ones. They also can be used independent of the grid for tasks like pumping water, so I expect them to have longer life.

I think our ability to decommission nuclear plant will go away fairly quickly. Also, funding for decommissioning using bonds only works as long as the financial system works (or the bonds retain value).

It is hard to see nuclear lasting much beyond the oil economy either. We are very dependent on imports and operating fancy machinery--also maintaining the electric grid.

Gail -

Well, while I suppose it is true that if our entire industrial base, our entire transportation infrastructure, and our entire oil supply completely fell apart, then it would be difficult maintaining wind turbines. But wouldn't that be true of absolutely anything involving machinery of any kind? So, I really don't understand why you seem to have singled this out as an issue uniquely pertinent to wind power. (?)

In fact, I would go so far as to posit that in comparison to either a gas turbine, a coal-fired power plant, a nuclear power plant, or arguably even solar, wind power is the least vulnerable to the concerns you raise about support systems. Why? Because i) it is quite low-tech relative to all the others, and ii) it requires no more specialized supplies or highly trained personnel that any sort of thing involving moderately large machinery. Mechanically, a wind turbine is less complex than something like a diesel locomotive or a container ship. So, if things get that bad, I would expect to see train service and global shipping vanish before wind farms.

Plus, I respectfully disagree with your statement that the life-span of wind is closely tied to that of the oil economy. I'm confident that it can be easily shown that over the course of the life of a wind farm, the amount of oil expended in both construction and maintenance is minimal in comparison to the total amount of electrical energy generated. On the contrary, I would say that the life-span of wind is very loosely tied to that of the oil economy. Hell, if push came to shove, one could use coal-fired vehicles, coal-fired electrical power, and coal fired construction vessels, to build and maintain wind farms. (Remember, the Panama Canal was built with coal-fired steam shovels and coal-fired locomotives.)

I see this as essentially either an non-issue or a red herring.

By the way, I am also getting a distinct sense of deja vu here in again tying to counter these concerns that you seem to continually bring up regarding the downside of wind power.

Wind turbines are very carefully balanced to prevent vibration. Parts have to be very carefully precision tuned. Blades are made of very high tech materials, but sometimes crack and need to be replaced The whole process looks easy, but everything I have read says that that it is not--especially for the large turbines. For small one, like farmers used to have, you are correct.

I think in general, after oil supply decline passes a certain level, pretty much everything even slightly high tech is likely to go. We won't be able to keep coal fired electricity going either, for example.

Gail -

Again, I think you are picturing the manufacture and operation of large wind turbines as something quite esoteric. It is hardly that.

Balancing any large rotating object, while hardly trivial, is not all that difficult. It is done all the time. Yes, large wind turbine blades may at the end of their life suffer from fatigue problems. So what? Like most things mechanical, they have to be replaced after a certain period of service life.

The components of a wind turbine do not have to be more 'carefully precision tuned' than the components in the car that you are currently driving.

As far as the blades being made of high-tech material, I would hardly call fiber-reinforced resin (aka fiberglass) a high-tech material, as it has been in widespread use for well over half a century. Carbon fiber and resin is a bit newer and more sophisticated, but neither is it rocket science. It is already in widespread use in the aviation industry. Yes, making large objects out of either requires a certain amount of technical 'art', but so what? Most other manufacturing does also.

Yes, the construction and maintenance of large wind turbines require a certain amount of knowhow, but that is true of any sort of power plant. I say, that if you can build and maintain a diesel-electric locomotive, you can probably do the same for a wind turbine. Give or take.

If wind turbines are too high-tech for you, then what do you think about nuclear power plants, which are at all levels about four orders of magnitude more complex? I really don't have a good sense for what you think is the best way forward to maintain at least some semblance of a modern industrial society.

For if wind turbines are too 'high-tech' for you, then what in your opinion is low-tech enough to be worthy? Ox carts?

Again, it's not at all clear to me where you are really trying to go with this general argument against wind power.

My argument has to do with high tech industry in general, especially when it requires transporting large objects. I can't see nuclear doing very well either. It is more an argument regarding networked systems, and the whole system being likely to fail when one major component fails.

Gail,I have been following your posts long enough that I think I can safely characterize your pov as being perhaps a bit on the pessimistic side regarding our long term prospects,in comparision to Joule and many others who seem to be a lot more positive in respect to maintaining a long term industrial base.

I see where you are coming from,and some times when I contemplate just how many disasters we have as a spieces visited upon ourselves without learning anything about not touching the hot stove again (to see if it is still hot, of course!!)I am sure that you are right in wondering if we can for instance maintain a wind industry a few decades (or maybe just years) down the road.

One thing that gives me a certain amount of comfort, which you may be overlooking,is that there is a very good chance that once it is obvious to every body that collapse is imminent,the more powerful central governments will probably be able to enforce draconian rationing schemes which will enable us to keep up at least a bare bones electrical grid, highway system,railroad system,mechanized agriculture, and so forth.I expect that such a scheme would mean that if I want a chicken drumstick,I will have to maintain my own well concealed chicken coop even on my own farm,but it is better than uncontrolled collapse.

I think that scenario would give us a window potentially large enough to work out a solution to peak oil that will provide us a dignified if very modest standard of living a couple of generations down the road.It won't be what we have now, but you can't really miss what you never had,so maybe the commuter of 2050 will be happy with his bicycle.

I'm not sure about the core of the "chicken or egg"-story here told, whether it was the WT-farm itself selfdestructing on her owner, or if it was the owner who could not afford to pet this WT-farm anymore ... in retrospect the answer is simply not interesting any more, b/c there is no more power comming out of this one - any time soon

this WT farm cannot be too old IMO - but looks like it's been in this shape for quite some time.

Spooky and Easter-island like. Who's gonne pick it down ?

If I were a lender (which I am, since I purchase bonds) I would assume that the increased value of wind-generated electricity due to the scarcity of other energy sources, would more than compensate for increased maintenance costs if " the oil economy goes badly downhill". In an energy-limited economy, maintenance and infrastructure effort would be directed at energy producers.

I saw Mike Rowe do maintenance on a wind turbine on TV. How much trained labor can there be?

Why are you assuming that an economy capable of maintaining a wind turbine must be an oil economy? Isn't the entire point of the exercise to transition to a functioning non-oil economy?

Wind turbines need a technological society; that is not the same as needing oil.

I am not sure why you feel that wind would be particularly hard hit by oil shortages.

Certainly the coal industry is far more dependent on oil input for mining and transport than the wind farms are. While I am certainly no expert on repairing powerplants, given the choice of trying to repair a high speed steam turbine or nuclear reactor or a windmill with limited resources, I am pretty sure the windmill would be my choice.

Everybody knows it is coming. Sure there is an intense initial fixed cost, but the marginal costs look exciting. The most important thing I think said is that most of the jobs created cannot be outsourced. If we can get the government to subsidize some of the initial costs, the huge increase in demand could quickly change our energy infrastructure.

Eric T. http://www.jazdoilandgas.com

Great economic analysis of integrating wind into the power grid Jerome! I would be interested in using some of this material to help background our Michigan Great Lakes Offshore Wind council members www.michiganglowcouncil.org

Building a windmill is like borrowing short to lend long. It isn't enough to be profitable. You have to be solvent every single day. For that matter it's like fooling with the futures market. It doesn't matter if you're right if they sell out your position on a margin call.

robert,

Some wind development companies have borrowed 100% long term so that the wind farms will be completely paid off. Other investors are pension funds looking for long term reliable income. As Jerome pointed out they will always be profitable because operating expenses are so low.

There's lots of ways to structure either the financing or the supply contract so that you stay out of bankruptcy court. My point is only that this is necessary. Jerome suggests a FIT which is fine. Low operating expenses doesn't make an operation profitable. As Warren Buffet pointed out, the tooth fairy doesn't pay the capital costs. That's in reference to investors who only look at EBITDA.

Low long-term interest rates are death to pension plans. Many (most) were hoping for 9%+ yields as one point--primarily from stock market growth, and planned their funding based on it. Now they are in really tough shape.

The CEO already got his bonus based on reported earnings based on pension funds making a 9% yield. He doesn't care what if anything the pension fund actually earns.

In a way, pension plans have some things in common with lenders who borrow short and lend long. Only the pension plans make promises long, and then attempt to fund them based on whatever interest they can really get, and whatever stock market returns they can really get.

Pension plans are another shoe to drop when all of our financial problems start unwinding. Without reasonably high interest rates on bonds and good levels of appreciation in the stock markets, pension plans will have a difficult time making good on their promises. The Pension Benefit Guaranty Corporation, which guarantees pensions up to a selected level, doesn't have much in funds on hand. It will need government funds to make good on its guarantees.