Minerals scarcity: A call for managed austerity and the elements of hope

Posted by Ugo Bardi on May 4, 2009 - 9:50am in The Oil Drum: Europe

Metal

minerals scarcity:

A call for managed austerity and the elements

of hope

Dr. A.M. Diederen, MSc.

TNO Defence, Security and Safety

P.O. Box 45, 2280 AA Rijswijk, The Netherlands

andre.diederen@tno.nl

March 10, 2009

Abstract

If we keep following the ruling paradigm of sustained global economic growth, we will soon run out of cheap and plentiful metal minerals of most types. Their extraction rates will no longer follow demand. The looming metal minerals crisis is being caused primarily by the unfolding energy crisis. Conventional mitigation strategies including recycling and substitution are necessary but insufficient without a different way of managing our world’s resources. The stakes are too high to gamble on timely and adequate future technological breakthroughs to solve our problems. The precautionary principle urges us to take immediate action to prevent or at least postpone future shortages. As soon as possible we should impose a co-ordinated policy of managed austerity, not only to address metal minerals shortages but other interrelated resource constraints (energy, water, food) as well. The framework of managed austerity enables a transition towards application (wherever possible) of the ‘elements of hope’: the most abundant metal (and non-metal) elements. In this way we can save the many critical metal elements for essential applications where complete substitution with the elements of hope is not viable. We call for a transition from growth in tangible possessions and instant, short-lived luxuries towards growth in consciousness, meaning and sense of purpose, connection with nature and reality and good stewardship for the sake of next generations.

Introducing metal minerals scarcity and managed austerity

Undoubtedly, the global economic growth of the last century, fuelled by and accompanied by exponential growth in population and consumption of resources like fossil fuels, water, food and metal minerals, is unsustainable. Now that we are nearing the second decade of the 21st century, we are beginning to notice the consequences of supply gaps of various resources. This paper focuses on the issue of metal minerals scarcity within the constellation of interconnected problems of scarcity of water and food, pollution and climate change and most notably scarcity of energy. In case of unlimited energy supply, metal minerals extraction would only be limited by the total amount of mineral resources. However, due to the scarcity of energy, the extraction rates of most types of metal minerals will cease to follow demand. Probably the only acceptable long-term solution to avoid a global systemic collapse of industrial society, caused by these resource constraints, is a path towards managed austerity. Managed austerity will have to be a combination of changes in technology and changes in both individual and collective human behaviour. Managed austerity could prevent non-desirable ‘solutions’ by doing much too little much too late (also known as ‘business as usual’) which could ultimately result in large scale conflicts, global chaos and mass starvation of the world’s population.

Energy scarcity

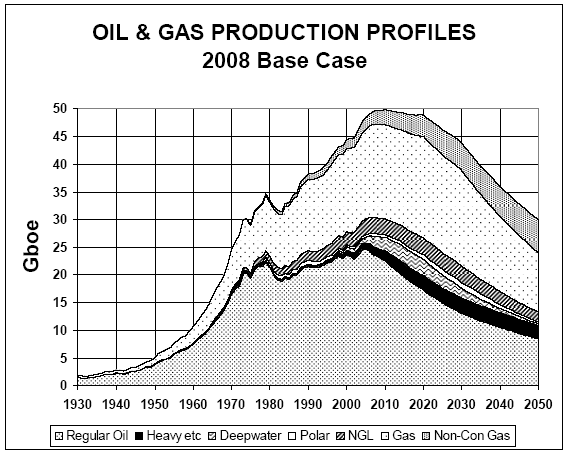

Humanity has depleted a significant part of its inheritance of highly concentrated energy resources in the form of fossil fuels. Although huge quantities of these resources remain untapped, the worldwide extraction rate (production flow) has reached a plateau and will soon begin to decline [1,2,3,4,5,6]. The result is an ever widening supply gap because sustained global economic growth requires sustained growth in available energy. Figure 1 gives the general depletion picture for oil and gas [1] in giga barrels of oil equivalent (Gboe) and the left part of the bell-shaped curve strongly resembles a logistic curve. The initial stage of growth is approximately exponential, growth slows as saturation begins (‘the low-hanging fruit has been picked’) and at maturity growth stops and a maximum is reached. The maximum production rate is referred to as the ‘peak’ and is not a sharp deflection point in the curve but rather a plateau region.

Figure 1: Depletion curve for oil and gas [1]

It is important to realise that the peak date in the depletion graph (figure 1) is not the same as the half date because production can continue for a long period after the peak. The actual depletion curve will presumably be asymmetric, having a peak date before the half date. Although the exact peak date for oil and gas is being contested (ranging from 2005 to somewhere during the next few decades), experts and authorities seem to converge on a peak date within the next few years. Oil and gas are currently the world’s most important energy sources. Transportation for instance is currently almost entirely dependent on oil. Coal will not be able to fill the energy gap after the peak in oil and gas. According to [7] coal may peak around 2025. Again, this does not imply exhaustion of coal reserves, it is quite possible that more coal will be left for extraction after the peak date than has been extracted in total in the years before. The crucial point is that a maximum production rate will be reached after which supply can no longer follow demand. It is estimated that oil, gas and coal combined will reach their ‘peak all fossil fuels’ close to 2020 [8]. All other energy resources combined (nuclear, hydro, wind, solar, biofuels, tidal, geothermal and so on) cannot fill the supply gap in time [9,10,11,12]. Timely and massive utilisation of these other energy resources is limited by various constraints like lack of concentration, intermittency, issues related to conversion and storage and last but not least the required massive input of fossil fuels and metal minerals. Therefore we will probably be confronted with a peak in global energy production within the next 10 to 15 years, despite progress in technology.

Metal minerals scarcity

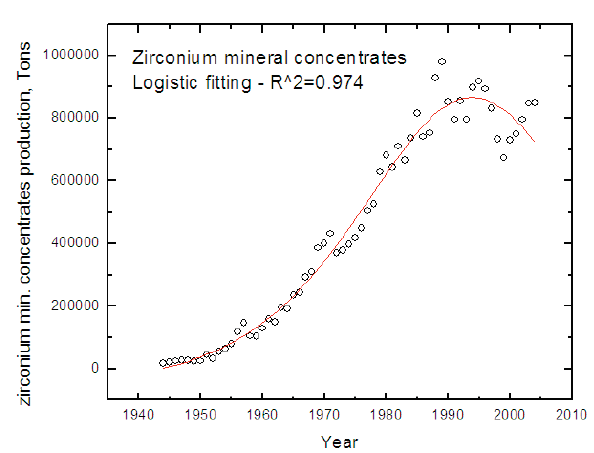

The depletion graphs of most metal minerals will resemble the curve for oil and gas (figure 1). Figure 2 gives an example for zirconium mineral concentrates [13].

Figure 2: Depletion curve for zirconium mineral concentrates [13]

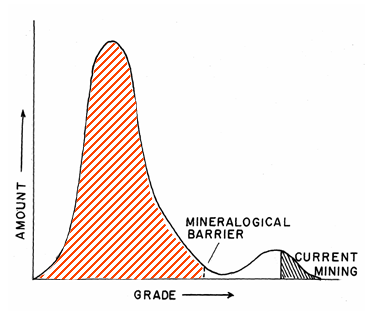

Many warnings in the past of impending metal minerals shortages have been proven wrong because of the availability of cheap and abundant fossil fuels. Every time the ratio of reserves to production of a certain metal mineral became uncomfortably small, the reserves of that mineral were being revised upwards because it became economically feasible to extract metals from the so-called reserve base or resource base. Reserves are defined as those ores that can be economically extracted at the time of determination and the term reserves need not signify that extraction facilities are in place and operative. The decades-old paradigm which states that reserves will be revised upwards (to include lower ore grades) as soon as supply gaps are looming, is no longer valid without cheap and abundant energy. Mining and extraction (concentration) consume huge amounts of energy. The energy required for extraction grows exponentially with lower ore grades. This is illustrated in figure 3 for iron ore and aluminium ore [14]. The highest ore grades have already been depleted or are already being mined. Because of energy constraints, the largest parts of mineral deposits are out of reach for economically viable exploitation, see figure 4 [15].

Figure 3: Relation between required energy for extraction and ore grade [14]

Figure 4: Mineralogical

barrier for most elements [15]

Below the so-called mineralogical barrier (the red shaded area in figure 4), one would essentially have to pull the rock chemically apart to extract all individual elements. This is of course prohibitively energy intensive. For this reason it is very doubtful that meaningful parts of the reserve base or resource base of many metal minerals will ever be upgraded to reserves [16]. It is even questionable whether all currently stated reserves are fully exploitable given the ever growing constraints with regard to energy required [13].

The trend of geologically and physically based minerals scarcity will be further enhanced by other factors. Global (‘average’) shortages will most likely be preceded by spot shortages because of geopolitics and export restrictions, as many important metal minerals are concentrated in just a few countries, often outside the western industrialized world (e.g. China).

Extraction rates and reserves of metal minerals

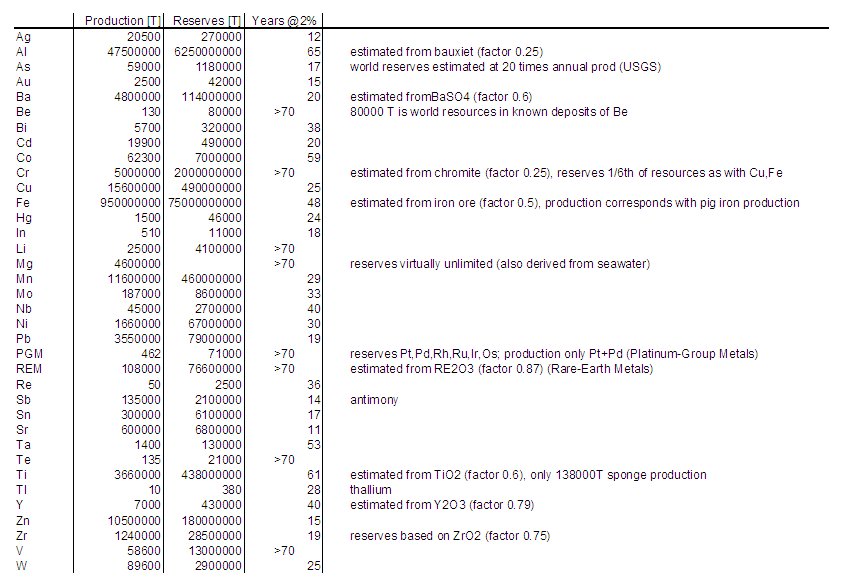

Known data of extraction and consumption rates of metal minerals and their reserves indicate that the so-called ‘peak production’ for most metal elements will lie in the near future. The data from table 1 and figures 5 through 9 support this statement.

Table 1 represents an overview presented by the US Geological Survey [17] of global annual primary production and global reserves of a large number of metal minerals. Their production goes into various products and compounds, part of them being steels, alloys and metal products. The remaining ‘lifetimes’ are calculated based on a modest consumption growth of 2% per year. The elements predicted to have a ‘lifetime’ of less than 50 years are summarized in figure 5. Of course, these minerals are not completely depleted in this period, but their peak production lies well before the estimated moment. Compare the result for zirconium with figure 2: the remaining ‘lifetime’ of zirconium is 19 years and the peak date is already behind us (1994). Although exact data fail, the elements strontium through niobium (of figure 5) will soon reach their peak production or have already passed their maximum extraction rates.

Figure 5: Years left of reserves at a sustained annual global primary

production growth of 2% (based on table 1)

Figure 6 through 9 depict in more detail global annual production rates and the known reserves. The annual primary production of iron dwarfs all other metal elements combined. Despite its huge reserves, iron will last less than 3 generations (less than 50 years) as far as cheap and abundant primary production is concerned, due to the enormous scale of its annual global consumption. The only viable long-term alternative to iron and in fact all metals at this scale of consumption would be magnesium. Magnesium reserves are virtually unlimited because of its abundance and associated accessibility in seawater [20].

Figure 6: Distribution of annual global primary production (based on table 1)

Figure 7: Distribution of annual global primary production without iron

(based on table 1)

Figure 8: Distribution of global reserves excluding magnesium (based on table 1)

Figure 9: Distribution of global reserves excluding magnesium and iron

(based on table 1)

On a trajectory of ‘business as usual’, we will have much less than 50 years left of cheap and abundant access to metal minerals. The production rate of metal minerals will start to decline well in advance of the depletion of reserves as it will take exponentially more energy input and metal minerals input to grow or even sustain the current extraction rate of metal minerals. To sustain and increase current production rates, resources have to be extracted at ever more distant locations (including deep mining and ocean floor mining) and at ever lower ore grades which require exponentially more energy to extract. In this sense it could even be stated that metal minerals scarcity aggravates energy scarcity.

Consequences of unmitigated metal minerals scarcity

During the next few decades we will encounter serious problems mining many important metal minerals at the desired extraction rates. Amongst them are all precious metals (gold, silver and platinum-group metals), zinc, tin, indium, zirconium, cadmium, tungsten, copper, manganese, nickel and molybdenum. A number of these metals are already in short supply (e.g. indium). Metals like gallium, germanium and scandium are not incorporated in table 1 by lack of data, but these metals suffer from a very low extraction rate as they are by-products (in very low concentrations) of other metal minerals; independent production growth is therefore not an option, thus making an increasing role for these elements impossible.

Besides the minerals with obvious constraints (low ratio of reserves relative to primary production), we can distinguish different ‘categories’ of metal minerals in table 1. First, several metal minerals which have a high ratio of reserves relative to primary production suffer from relatively low absolute amounts of reserves and associated low extraction rates, effectively making them non-viable large-scale substitutes for other metals which will be in short supply. It is up for debate for example whether lithium is a viable large-scale substitute for nickel in accumulators for electric energy as far as land mined lithium is concerned (it might be extracted from seawater in future [20], albeit at higher cost). Second, other metal minerals have no acceptable substitutes for their major applications, which is of special interest for those metals which will run out relatively fast at the present course, manganese being an important example. Third, even metals with a high ratio of reserves to primary annual production combined with large absolute amounts of reserves and associated extraction rates, can be susceptible to future supply constraints because they are located in just a few geographic locations. An example is chromium which is mainly located in Kazakhstan and southern Africa.

Without timely implementation of mitigation strategies, the world will soon run out of all kinds of affordable mass products and services. A few examples are given here. First, a striking example are cheap mass-produced consumer electronics like mobile phones, flat screen TVs and personal computers for lack of various scarce metals (amongst others indium and tantalum). Also, large-scale conversion towards more sustainable forms of energy production, energy conversion and energy storage would be slowed down by a lack of sufficient platinum-group metals, rare-earth metals and scarce metals like gallium. This includes large-scale application of high-efficiency solar cells and fuel cells and large-scale electrification of land-based transport. Further, a host of mass-produced products will suffer from much lower production speeds (or much increased tooling wear) during manufacturing owing to a lack of the desired metal elements (a.o. tungsten and molybdenum) for tool steels or ceramics (tungsten carbide). Among the affected mass-produced machined products are various household appliances and all types of motorized transport (cars, trains, ships and aero structures). The lack of various metal elements (a.o. nickel, cobalt, copper) for high-performance steels and electromagnetic applications will affect all sectors which apply high-performance rotating equipment. Besides transportation this includes essential sectors like electric energy generation (coal/oil/gas-based and nuclear power plants, hydropower, wind power). Also the vast areas of construction work in general (housing, infrastructure) and chemical process industries will be affected. The most striking (and perhaps ironic) consequence of a shortage of metal elements is its disastrous effect on global mining and primary production of fossil fuels and minerals: these activities require huge amounts of main and ancillary equipment and consumables (e.g. barium for barite based drilling mud).

These threats to the global economy require political, behavioural and governmental activities as well as technological breakthroughs. Of the breakthroughs, intensified recycling offers the opportunity to buy us time and innovative substitution may lead to sustainable options [18,19].

Efficiency: Jevon’s paradox

A potent partial solution for metal minerals scarcity would be a better extraction efficiency, if it wasn’t for Jevon’s paradox. Jevon’s paradox is the proposition that technological progress that increases the efficiency with which a resource is used, tends to increase (rather than decrease) the rate of consumption of that resource. So, technological progress on its own (without ‘control’) will only accelerate the depletion of reserves.

Recycling: delaying of effects

Recycling the current and constantly growing inventory of metal elements in use in various compounds and products is the obvious choice in order to buy time and avoid or diminish short- to medium-term supply gaps. Although recycling is nothing new, generally the intensity could be further enhanced. We should keep in mind though that recycling has inherent limits, because even 100% recycling (which is virtually impossible) does not account for annual demand growth. At the present course we need to continue to expand the amount of metal elements in use in order to satisfy demand from developing countries like China and India whose vast populations wish to acquire a material wealth comparable with the standard of living of the industrialized western world. Furthermore, recycling also costs lots of energy (progressively more with more intense recycling) and many compounds and products inherently dilute significant parts of their metal constituents back into the environment owing to their nature and use. So even with intense recycling, we will need a continued massive primary production to continue our present collective course.

Substitution: the elements of hope

It is self-evident that - at our current level of technology - substitution of scarce metals by less scarce metals for major applications will lead to less effective processes and products, lower product performance, a loss in product characteristics, or lead to less environmentally friendly or even toxic compounds. An important and very challenging task is therefore to realise the desired functionalities of such products with less scarce elements and to develop processes for production of these products at an economic scale. The best candidates for this sustainable substitution are a group of abundantly available elements, that we have baptised ‘elements of hope’ (see figure 10). These are the most abundant elements available to mankind and can be extracted from the earth’s crust, from the oceans and from the atmosphere. They constitute both metal and non-metal elements. Hydrocarbons for production of materials (including plastics) could be extracted progressively more from biomass, albeit at a much lower extraction rate than from concentrated (fossilized) biomass (oil, natural gas and coal). Not coincidentally, all macronutrients of nature (all flora and fauna including the human body) are found among the elements of hope: nature either uses these elements (metabolism, building blocks) or has shown to be tolerant to these elements (in their abundant natural forms). Substitution based on the elements of hope therefore is potentially inherently environmentally friendly.

Figure 10: The elements of hope; the green elements are macronutrients, the elements

within the thickened section are metals (Si being a metalloid)

Responsible application: frugal and critical elements

We can look at the remaining global reserves of metal minerals as a toolbox for future generations (see figure 11). An important part of the toolbox is reserved for the elements of hope. Another part of our toolbox is reserved for less abundant but still plentiful building blocks, the ‘frugal elements’. These elements should only be applied in mass for applications in which their unique properties are essential. In this way their remaining reserves will last longer (most notably copper and manganese). For the sake of completeness, also the non-metals belonging to this category are included in figure 11. Finally a small corner of the toolbox is reserved for all other metal elements, the ‘critical elements’, which should be saved for the most essential and critical applications. Not described in figure 11 but also belonging to the critical elements are other non-metals and the metal trace elements with high atomic mass (not previously mentioned in this paper by lack of data from [17]).

Figure 11: The toolbox

containing the elements of hope, the frugal elements and the critical

elements; (for a better resolution version of fig. 11, see this link )

PGM = Platinum-Group Metals;

REM = Rare-Earth

Metals;

the red elements are non-metals;

B,Si,Ge,As,Sb,Te

are metalloids

Conclusion: a call for action, ingenuity and responsible behaviour

Because of the surging scarcity of energy, even large-scale substitution and recycling cannot circumvent supply gaps in metal minerals. This is because production of metals consumes vast amounts of energy and so do substitution technologies and intensive recycling. The introduction of managed austerity is required to convince us all to live using less.

With this paper we call for action. We can increase the lifespan of the reserves of various materials by making a shift towards large-scale application of the elements of hope with a sensible use of the frugal and the critical elements. In order to do this mankind will have to mobilize its collective creativity and ingenuity. Technology alone is not enough to achieve this goal, nor can the challenge of metal minerals scarcity be treated as an isolated problem: it is part of a host of interrelated problems. A solution calls for nothing less than a globally co-ordinated societal response. The scarcity of energy, of food and water, of metal minerals and the effects of pollution and climate change all call for intervention by authorities to facilitate a transition towards collective responsible behaviour: managed austerity. They call for a transition from growth in tangible possessions and instant, short-lived luxuries towards growth in consciousness, meaning and sense of purpose, connection with nature and reality and good stewardship for the sake of next generations.

TABLE 1 (Table 1: Primary production and reserves in metric tons of element content, based on and derived from [17]])

(for a higher resolution version, see this link )

References

[1] Association for the Study of Peak Oil and gas (ASPO), Newsletter No. 97, compiled by C.J. Campbell, Staball Hill, Ballydehob, Co. Cork, Ireland, January 2009

[2] Energy Watch Group (EWG), Crude oil - the supply outlook, EWG-Series No 3/2007, Ottobrunn, Germany, October 2007

[3] International Energy Agency, World Energy Outlook 2008

[4] Koppelaar, R., Meerkerk, B. van, Polder, P., Bulk, J. van den, Kamphorst, F., Olieschaarstebeleid (in Dutch), slotversie, Stichting Peakoil Nederland, October 15, 2008

[5] Simmons, M.R., The energy crisis has arrived, Energy Conversation Series, United States Department of Defense, Alexandria, VA, June 20, 2006

[6] The Oil Crunch – Securing the UK’s energy future, Industry Taskforce on Peak Oil & Energy Security (ITPOES), October 2008

[7] EWG,

Coal: Resources and Future

Production, EWG-Series No 1/2007,

Ottobrunn,

Germany, March 28, 2007

[8] Sousa, L. de, Mearns, E., Olduvai revisited 2008, posted February 28, 2008 at the website The Oil Drum: Europe

[9] EWG,

Uranium Resources and Nuclear Energy,

EWG-Series No 1/2006, Ottobrunn,

Germany, December 3, 2006

[10] Savinar,

M.D., "Are We 'Running Out'? I

Thought There Was 40 Years of the Stuff

Left",

http://www.lifeaftertheoilcrash.net, originally published December

2003,

revised December 2007

[11] Peter, S., Lehmann, H., Renewable Energy Outlook 2030, Energy Watch Group / Ludwig-Boelkow-Foundation, November 2008

[12] Wirth, C.J., Peak oil: alternatives, renewables, and impacts, www.peakoilassociates.com, July 5, 2008.

[13] Bardi,

U., Pagani, M., Peak Minerals,

ASPO-Italy and Dipartimento di Chemica

dell’Università di

Firenze, posted October 15, 2007 at the website The Oil Drum:

Europe

[14] Meadows,

D., Randers, J., Meadows, D., Limits

to Growth – The 30-Year Update,

Chelsea Green Publishing Company, 2004, ISBN 1-931498-51-2

[15] Skinner, B.J., Exploring the resource base, Yale University, 2001

[16] Roper, L.D., Where have all the metals gone?, Virginia Polytechnic Institute and State University, Blacksburg, Virginia, USA, 1976

[17] United States Geological Survey (USGS), Mineral commodity summaries 2008

[18] Bardi,

U., The Universal Mining Machine,

posted January 23, 2008 at the website

The Oil Drum

[19] Gordon, R.B., Bertram, M., Graedel, T.E., Metal Stocks and Sustainability, Proceedings of the National Academy of Sciences of the U.S., v.103, n.5, January 31, 2006

[20] Bardi, U., Mining the oceans: Can we extract minerals from seawater?, posted September 22, 2008 at the website The Oil Drum: Europe

Thanks for a closer look at another piece of the "Limits to Growth" we are facing!

Most mitigation attempts assume that it will not be too difficult to build new infrastructure, but lack of minerals could be a real problem. Sometimes, if only a small amount of a rare mineral is unavailable, this can make expansion of a new technology problematic.

The article wisely steers clear of the prickly issue of uranium. Some have pointed out that newly fashionable indium is perhaps as abundant as silver but there is no silver shortage. Others suggest that there are many rich undiscovered mineral deposits they are just deeper and harder to find.

If there are strategic reserves for oil I guess there could be the same for hard rock minerals. Rather than an absolute amount a depletion protocol or relative extraction rate could be stipulated. For example if the production to reserves ratio must be constant that gives a negative exponential curve of production over time. That curve never quite exhausts the resource. The temptation of course is to exaggerate reserves to justify higher production. It also means that the resource must be used more and more efficiently to meet growing population; the major mineral example here being phosphate.

On lithium I'm not too worried as I think affordable electric cars will be slow and clunky but use improved nickel and lead batteries.

Long-time lurker here turned new member.

You are partly correct in that lithium needs to come down in cost. But it also needs to have a higher efficiency, higher charging cycles and less explosive nature (which cannot be ever achieved without radical innovation). Lithium explodes when coming in contact with water.

You see lithium is obtained from Bolivia and Chile. With Evo Morales acting like the second coming of Hugo Chavez, it will be a problem getting enough lithium on the market. :) Also, a new thing to watch for. China produces most of the rare earth elements and they have reduced exports to concentrate on domestic consumption. They tried to get one Australian mining company but failed in Rio Tinto. And now they might be successful in Lynas.

As an analyst, I can tell you that the new area of these metals are in CIGS/CIS cells and displays. Watch out for them in the future. :)

One more thing, Tesla uses 6500 Li-ion cells for its PHEV car. They need to be vigorously tested for explosiveness (Remember the exploding laptop batteries sometime back). So, GM is piggybacking on the wrong tech in Li-ion for its Volt car. NiMH is great not only because of the stability of lanthanum (another rare element from China) but its recycling network is as good as lead-acid batteries. Toyota has test cars running on NiMH

"The lithium-water reaction at normal temperatures is brisk but not violent"

I've seen a lump of lithium tossed into a tub of water. It was boring.

"Tesla Motors announced that the battery pack that will power the Tesla Roadster has been deemed safe by the United Nations Safety Requirements. The rigorous U.N. Testing Protocol for the Tesla Roadster ESS (Energy Storage System) included: altitude simulation, thermal cycling, vibration, shock and external short circuit."

It's unlikely that they would have been given authorization to sell the car without testing the battery pack. From what I've read, quite a bit of engineering went into exactly this problem.

Yes, and that's one of the nice aspects of electric vehicles: there are many different battery chemistries and many different ways to generate electricity, and they all work together - and with any electric motor - without having to do anything special. My understanding is that there are electric vehicles on the road right now being powered by Li-ion, by NiMH, and by lead-acid batteries.

Accordingly, electric vehicles have less of a choke point than internal combustion vehicles, as there is no one mineral or fuel that is key.

"Accordingly, electric vehicles have less of a choke point than internal combustion vehicles, as there is no one mineral or fuel that is key."

I understand what you are saying. But the point is that you have to consider the implications of metals scarcity in its complete context: if there is a growing gap between production flow rates and demand across a large spectrum of metals simultaneously in the next few decades, than there is no "safe haven" to substitute one specific metal with the other specific metal. You might get a cascade of multiple and simultaneuos substitutions where everyone is chasing after the same set of metals. So for instance there might be a large demand simultaneously for every metal suitable to make accumulators for electric vehicles, amongst others lithium, nickel, cadmium, zinc, lead.

Why are we stuck on the idea that cars can only be made of metals?

Sure there are some parts that probably are best suited to manufacture from metals such as copper in electric motors but renewables and composites could also play a part.

1854 - Henricg Globel, a German watchmaker, invented the first true lightbulb. He used a carbonized bamboo filament placed inside a glass bulb. ...

Electric Bamboo car

Please see my comment below on lithium, including the reference at the end - it looks very much like we have quite enough.

The Lynas deal looks like an absolute steal from where I'm sitting -the Chinese have got access to a world class 20+ year resource for 'cents on the Dollar'.

When we look back on this 'Chinese hard-Asset Grab" in decades to come it will be increasingly clear that we have "sold Manhatten for a string of beads..."

Nick.

Disclaimer: I am increasingly LONG Lynas !!

"GM is piggybacking on the wrong tech in Li-ion for its Volt car. "

Not at all. GM is using a different chemistry, which is more stable than Tesla's. Have you looked at A123systems? It was one of two chemistries that were finalists for the Volt battery cells. I haven't looked at the LG chemistry in as much detail, but it's significantly different from the cobalt li-ion used by Tesla.

"lithium is obtained from Bolivia and Chile."

Lithium is reasonably abundant, and reasonably widely distributed: it's mostly produced now in S. America, but China is expanding production, and there are substantial sources elsewhere. It can be recycled efficiently.

It's rather like uranium: in the short run there could be boom-bust cycles of supply expansion and shortfalls, but in the medium-term there aren't really resource limits.

There was a widely read analysis a couple of years ago that raised questions, but those questions have been answered pretty thoroughly. The amount used by each battery isn't that great:

One estimate is that most lithium chemistries require around 3+lb/kWh of lithium carbonate, so for a 16KWH Volt type battery we would need about 50 lbs of lithium carbonate. At $2.75/lb, that's only $137.50, or 3.4% of the likely Volt battery cost of $4k (wholesale in 2-4 years). A doubling in the price of lithium would only increase the cost of a $30K vehicle (after $7,500 credit) by $137.50. GM is assembling their battery from cells made by LG Chem, the largest li-ion cell producer in the world - I suspect LG is pretty good at getting long-term contracts for their supplies.

If you want a more detailed general discussion this is good, and for some debate go here.

I understand where you are coming from. And I agree with your assessment. However, the alternate way of looking at it is the technology.

LG Chem uses lithium-manganese oxide (LiMn2O4) chemistry while A123 uses lithium-iron phosphate (LiFePO4) chemistry. LiMn2O4 has a limited cycle life and operates poorly as the temperature goes higher. The energy density is getting better as they incorporate more elements into the overall setup. But it isnt yet there comparable with LiFePO4 yet.

Why is this so? Better battery management system to avoid short-circuiting. BMS helps to extend battery cycle life by avoiding any over-charge or discharge. But that doesnt mean that LiFePO4 is the best. It is limited by its working voltage and the maximum charge voltage which isnt high. But it makes up with a lot more charging cycles of over 2500 and a slower rate of capacity loss.

As for Tesla, they use lithium-cobalt-oxide (LiCoO2). LiCoO2 have slow charge and discharge rates. They also breakdown at high temperatures (thermal runaway).

I see research happening in Lithium Nickel Cobalt Manganese Oxide Li(NiCoMn)O2 and lithium titanate (LiTiO3) (for Eestor batteries) in addition to LiFePO4. Thats why the cost of these batteries are still high and they will be until you get the chemistry right. I dont see PHEV/EV becoming cost-effective until they get this chemistry nailed.

See an ANL study here: Cost of lithium for Electric Vehicles

Regarding the lithium presence in a battery, it varies according to the chemical composition. Find out the exact anode, cathode and electrolyte as Li will be present in all three. Find out the Li % in each and you get the amount of Li in the battery for that chemistry combination.

Sorry if this post comes as a pitch for a particular company. I do not work for any of these companies or promote their products. But as an analyst, I just wanted to clarify on what I know from talking to some of these guys in the industry.

The ANL study is quite old - the data in it is 10 years old, which is an eternity in this business. Here are some thoughts on battery cost:

A recent study Carnegie Mellon University argued that "plug-in" hybrid-electric vehicles, like the Chevy Volt, are too expensive. Are they right?

No. They assumed that the battery would cost $16,000 (or 1,000/KWH). As GM says, that's way too high. (Oddly, they also conclude that a plug-in with a 10 mile range would be better, because drivers would stop and charge every 10 miles!)

Similarly, $10,000 for the Volt's battery has been widely reported in the media, but we shouldn't rely on mass media! Really, no one knows how much the batteries cost. The $10K figure is purely speculation. Here's an example, in the CS Monitor. We see that it doesn't say $10K. Here's what the article says: "the race isn't over making a Chevy Volt battery designed to run 40 miles on a single charge that could (emphasis added) cost as much as $10,000." We can see that the reporter doesn't have a firm source for this cost figure.

Elsewhere, the article says: "Still others say that the cost of new battery power for PHEVs may drop faster and already be lower than what has been widely reported at perhaps $500 per kilowatt-hour or even less, says Suba Arunkumar, analyst for market researcher Frost & Sullivan.

"I do expect the price will come down to perhaps as low as $200 per kilowatt-hour when mass production begins in 2010 and 2011," she says."

Tesla's cost is $400/KWH - it's very likely that GM will pay $200-$300 in volume. The batteries won't be produced in large volumes for several years. They'll use less expensive materials than 1st Gen batteries; the larger format is much less expensive; and they'll have very, very large production volumes relative to most 1st-gen li-ion. Large production volumes reduce costs very quickly.

GM is pricing the Volt high purely to capture the early-adopter premium and the federal rebate - their official justification is that they're pricing in 100% replacement of the battery under warranty, which really isn't credible. We can expect the Volt to cost less than $30K with large volume production.

Is the battery too large?

Yes, they're only using 50% of the battery - a 50% depth of discharge (DOD) is very conservative. That means they have to use a 16 KWH battery to get an effective 8 KWH's. They could be more aggressive (and probably will be in the future), but they're very sensitive to the bad publicity that early battery failures would create.

Could they use a battery that allowed a deeper DOD?

No, there aren't any batteries on the market that are more durable as measured in charge cycles. Tesla's batteries aren't expected to last more than 400 cycles, and the Volt will do 5-10x as many. In theory, the Volt could have a smaller battery. That would mean a shorter range, which would still accomodate many drivers. That might more perfectly optimize costs, but then it wouldn't feel like a big step forward. It wouldn't feel like a real EV, with generator backup - instead, it would feel like an incremental hybrid. Both GM (for PR) and buyers want a large, step forward, I think.

Edit:

LG Chem uses lithium-manganese oxide (LiMn2O4) chemistry while A123 uses lithium-iron phosphate (LiFePO4) chemistry. LiMn2O4 has a limited cycle life and operates poorly as the temperature goes higher. The energy density is getting better as they incorporate more elements into the overall setup. But it isnt yet there comparable with LiFePO4 yet.

Why is this so? Better battery management system to avoid short-circuiting.

Could you expand on this? Are you suggesting that GM could have used a less sophisticated BMS if they had gone with LiFePO4?

"The amount" [of lithium] "used by each battery isn't that great ...."

Please also consider the shear absolute numbers. Take for instance cell phones. Most cell-phones contain a tiny amount of tantalum. But making half a billion new cell phones annualy and using small amounts of tantalum in roughly yet another half a billion other handheld electronic devices annualy amounts to a significant portion of annual global production of tantalum.

If you look at the references you'll see that there's quite enough lithium for all the EVs we might need.

Yes; "One of the greatest shortcomings of human beings is our incapacity to understand the exponential function."

Look also in this perspective at windenergy. Like with oilfields, extracting the easiest available oil first, they install windmills in the easiest available, most comfortable and/or best places first. After this comes the much more difficult places, like far offshore. Considering EV's what counts is the first year that the sell of internal combustion vehicles goes in terminal decline. More important than that all the big carmakers will produce EV's in 2011-2012 is: How many people can afford to buy an EV, above all when the economy is suffering ?

Good point on uranium. I think uranium is a "special" case: its application legitimates "extreme" efforts if necessary to concentrate the material. I don't have rule-of-thumb figures on uranium at hand, but I think one could make a kind of comparison with gold: we are willing to process roughly 200,000 tonnes of material to extract and concentrate 1 ton of gold. It's obvious that this isn't a viable option for almost all other metal elements, certainly not for many metals simultaneously.

I'm more concerned about availablity and affordability of certain metals to construct dozens of new nuclear fission reactors in a short timeframe, than about fueling them with uranium (or thorium).

(I posted this in another thread a while ago, but got no responses. So, sorry for the repetition, but perhaps most didn't see it last time and it is definitely on-topic here.)

As I see it, there is always the possibility to extract more given more effort/expenditure. For instance, when it comes to uranium, wikipedia states: "Kenneth S. Deffeyes and Ian D. MacGregor point out that uranium deposits seem to be log-normal distributed. There is a 300-fold increase in the amount of uranium recoverable for each tenfold decrease in ore grade."

Does anyone know whether this holds true for other mined chemical elements as well? I'd guess so, and therefore, my current hypothesis is that "reserves" in number of years are quite meaningless for those. The reason is that if you want to "run out" in 40 years instead of in 20 years, all you have to do is to increase the price of the element by 32%. (Assuming extraction costs are inversely proportional to ore grade.) Reserves are only meaningfully stated in relation to price.

OTOH, reserves could be stated in number of years if we by that mean that a certain use of the element will be impossible above a certain price. But typically, reserve statements in number of years are misused. For instance, uranium reserve statements are based on completely arbitrary prices - they are never put in relation to what nuclear reactor operators would be willing to pay before closing shop, for instance.

Good question. The problem is that nobody knows the answer. For Uranium, Deffeyes and MacGregor could arrive to their conclusion because it is possible to detect uranium deposits using their radioactivity. But for most other minerals you don't have this possibility, so their distribution in the crust is given at best as an educated guess. This is the essence of the "Mineralogical Barrier" that is not - definitely - a log normal distribution. In general, modelling this matter is extremely difficult

Actually, there is plenty of geochemical data on other elements too, but there are no easy answers, because each metal behaves differently, at least in principle, and different genetic types of deposits, even for the same metal, behave differently too. The presence of a "mineralogical barrier" is certainly the safest (most conservative) assumption, unless its absence can be demonstrated (as it can for many metals, including uranium).

I think the author does not take into account the drive of technological advances. This is essentially the revamped arguements of the Club of Rome that was saying the same thing forty years ago. It use to be said that a top of the line mens suit would cost one ounce of gold. There has been many technological advances in the extraction of gold since that was true. Gold is about 900 an ounce and an Armani suit runs 3 - 4 thousand.

You need to remember that the original beliefs about the inaccuracies of the Club of Rome report have proven false. This was shown recently in an analysis by Charles Hall and John Day that Dave Murphy wrote a post about for The Oil Drum. An independent study last year was done by Graham Turner in 2008 in Australia. It came to the same conclusion.

Japan's Science and Technology Foundation gave Meadows, one of the lead authors of the original Club of Rome study, its annual $500,000 award on April 23, 2009.

Technology has played a significant role in a few areas, like shale gas production, but in total, we are tracing the expected path fairly closely.

"This was shown recently in an analysis by Charles Hall and John Day "

Actually, no. Their analysis didn't show that at all. In fact, it showed that it did quite badly. As I said then:

First, the Limits to Growth predictions, as presented by the article, aren't very good. The birth and death projections are off quite badly (as Pitt notes, the "actual birth rate" presented in the article is dramatically incorrect). The population and industrial output per capita projections aren't any better than mainstream projections. The pollution projection cherrypicks worst offenders (CO2 and nitrogen), and yet even so misses quite badly (a projection of 3x 1972 levels, vs 2.0 and 2.1, respectively). The resource projection has to cherrypick light-sweet-oil and copper to look good (and there are some sharp objections earlier in the comments to the copper depletion assessment, to which I'd add that copper has very good substitutes for most of it's uses, and recycles very well). The only major resources that seem to fit the 50% depletion prediction are soil and fish, and calculations or sources aren't provided.

2nd, it hangs its resource case almost entirely on peak oil, and quickly dismisses wind and solar because they're not yet large energy sources. Yet, wind is cost-effective, has high EROEI, and an enormous resource base.

Both wind and solar are growing much faster than fossil fuels (roughly doubling every 2-3 years), and yet they say "the annual increase in the use of most fossil fuels is generally much greater than the total production (let alone increase) in electricity from wind turbines and photovoltaics." This is highly misleading. As an analogy, one could say that in the early 1980's that "the annual increase in the use of land line phones is generally much greater than the total production (let alone increase) in cell phones." Wind was about 1/3 of new generation in the US in 2008. It could easily provide all new generation in 5 years, and then start replacing coal.

Clearly, the overall fossil fuel resource base has declined much less than the 50% used in this article. More importantly, if one includes wind and solar resources, there is no significant decline at all - the whole question of energy "resources" becomes unimportant. Instead, we're looking at questions of investment and transition, which are entirely different.

Hi Nick,

I've listened to Dennis Meadows a couple of times, I mention this because he actively avoids using the word predictions, the authors refer to them as scenarios. Perhaps this is a more useful paper to frame the original post, Leverage Points.

If Peak Oil is nearly upon us, which I believe seems likely, then the Hirsch report would indicate that wind and solar aren't going to replace FF for much of the world. I think the problem is over simplified by saying 'we're looking at questions of investment and transition, which are entirely different.'

sunnata,"

The Hirsh report(2005) has been overtaken by developments in PHEV and EV's. It states "for now electric vehicles cannot be projected as a significant offset to gasoline use."

That was before all the major car manufactures had plans to introduce PHEV and EV's by 2011-2012.

Furthermore the Hirsh report considers fairly modest increases in CAFE to 35.5mpg after 3years and 41.25mpg 10years after peak oil. Considering that hybrids are getting better than 50mpg now, and the EU is putting in standards of >40mpg by 2010, can only think that Hirsh et al were expecting another 8 years of a Republican congress and president continuing to resist CAFE improvements.

Could one not say miniscule by comparison at this point?

Looking back of course one can see and even looking forward one could have seen that cell phones would overtake landlines. But both wind and solar are old technologies, albeit with new developments. It is quite reasonable to question whether they will be able to scale up from almost nothing in the way cell pones did. There were no great conceptual hurdles to cell phone scale up. There are several with wind and solar: intermittency, storage, transmission, conversion, and materials, just for starters.

Could one not say miniscule by comparison at this point?

No. 1/3 of all new US generation in 2008 was from wind. That's very important.

both wind and solar are old technologies, albeit with new developments.

"new developments" is an understatement. Both wind and solar power are much cheaper than they ever were before - that's critical.

There are several with wind and solar: intermittency, storage, transmission...just for starters.

Not really - I think Jerome addressed these.

conversion, and materials

I'm not sure what you mean, here.

Some interesting annual numbers (avg. of 2003-2006 unless otherwise noted):

- Current global wind generation: 260TWh, or 0.9 quads.

- Oil consumption increase: 3 quads

- Natural gas consumption increase: 3 quads

- Coal consumption increase: 7 quads

However, keep in mind that a great deal of fossil fuel energy is used to generate electricity; this is why BP uses a 3:1 ratio to compare electricity with primary energy (as the average primary->electricity efficiency is roughly 33%). Given that, the recent annual increases in oil and natural gas consumption are only barely higher than total wind production, and coal consumption is only 2-3 times higher.

Their dismissal of the contributions of renewable sources was true earlier this decade, but is now outdated. Annual increases from wind are now large enough to be comparable to increases from fossil fuel sources. The latter are still larger by a significant amount - 3-7x - but recent trends have been rapidly lowering this difference.

That's an interesting point. It's a very narrow view of the situation to fixate solely on depletion of one energy source and ignore the potential of other energy sources to compensate.

I suppose it's an easy mistake to make, though, as the situation is changing so fast. Five years ago, wind/solar production truly was ignorable, but the situation has changed and now that's no longer the case. Annual addition of wind+solar has reached the same ballpark as annual additions of fossil fuels, so well-reasoned arguments can no longer afford to ignore the potential of those energy sources.

Gail,

The "Limits to growth" focused on food, pollution and resources. Certainly food and mineral resources which had 10-50 years reserves in 1970 still have similar or more reserves. Crop yields have doubled,(in one scenario they assumed a food doubling by 2050, ie after 80 years not 40 years) but food could be an issue if everyone wants steak each day, pollution( mercury and lead) is not a serious issue, but CO2 is and in that sense the pollution issue is still a possible show stopper.

I would agree with Nick, about the Hall and Day article. Turner concludes about metals (page 26) " non-fuel materials will not provide resource constrains".

We need to remember that the limits to growth gave 9 scenarios to choose from, you can pick and choose to find a match in fact most match so far except for birth rates.

Since none of the scenarios predicted collapse until beyond 2009, what does it mean to say; "but in total, we are tracing the expected path fairly closely."

You're speaking of future technological advances.

How do you know they'll happen?

What you're telling us about is your faith. "Believe! The Lord - er, technology will come save us from ourselves!"

Maybe, maybe not. Speaking as a Jew, we've long experience of waiting for the Messiah, and our experience tells us that it's best not to hold your breath, better to plan for his not coming, and save ourselves.

There is no rational reason to expect that new technologies will do anything at all. Only faith.

Refering to your "long experience ...save ourselves"remarks...

If I were rich,I would have these words engraved in stone in lots of prominent places.

As a farmer,I have waited for the rain....We have had(broadly speaking) no starvation ,and no forced migration of farmers in America in my time,but we can still talk to the children of the farmers who experienced th Dust Bowl.When times on the farm have been bad in my corner of the country,where we are mostly one horse(read tractor) farmers,folks have been able in many cases over the last six decades or so to save themselves by taking a part time-I am as serious as a heart attack-job doing an extra forty at a furniture or textile plant.Of course the plants have mostly either closed or move over seas recently.

Over the years,most of the local farms,while still very productive, have degenerated into part time operations maintained partly for such profits as may be had, but mostly for love of the land and the work.Of course we have a few farmers around here who still manage to make a full time go of it,but if you know them,you also know that there is usually some sort of cushion such as a wife who teaches second grade,etc.

Our children have seen enough ,long since, and moved on into other work.

Some day the stream of miracles that have arrived from the universities and industrial labs and garage tinkerers which,taken collectively, have enabled us to live as we do today will fail... for a while at least.Not totally of course,there is always rain if you wait long enough.

Right now it appears that just maybe the arrival of the new exploration and drilling technology which is bringing on the boom in natural gas will enable us to muddle on for a few more years of BAU.

Suppose this particular technology were still five or ten years away? I cannot envision any other result other than widespread war and famine (conceivably even within the US)if oil goes thru the roof,unless this new gas serves to keep the price of fertilizer within reach... for a few more years...

(some readers may think I am inconsistent, but if you read carefully,you will find that when I say something in favor of for instance hybrids, it is usually qualified adding under current conditions.)

Commercial farmers could switch from hybrids to open pollinated crops pdq if necessary, but no technology exists (that can produce the quantity of food needed today except bau big ag)which can also be implemented in the real world in short order.

I am all in favor of community gardening in any form,localization, etc, but I have grave doubts as to whether such movements will mature fast enough to prevent an eventual train crash if the ff supply crashes. Those who are actually working hands in the dirt in such areas will probably be able to save themselves.Latecomers will find the growth/learning/experience curve too much to deal with in most cases.

You can garden successfully even the first year in a good spot with a little help from an experienced friend, but a backyard that had all or most of the topsoil hauled off or buried when the house was built is not a good spot.Shade from the house, from cherished trees, from the nieghbors house or tree, is as good as a death sentence.

If you expect to save yourself(assuming you see a need to do so) by gardening/farming on a small scale with little or no input of commercial fertilizers or pesticides,you better get started NOW.iF YOU WORK REALLY HARD,while you can still get truckloads of leaves all bagged up at the curb for free in most towns,you can turn that subsoil into a garden spot in maybe four or five years.

"You're speaking of future technological advances. "

Well, the key thing here is that we have all the tech we need.

EVs and PHEVs are 100 years old.

Wind turbines are scalable, high E-ROI, and cost effective.

Solar is isn't quite as cheap or high E-ROI as would be ideal, but it's cost and E-ROI are more than good enough to suffice.

We don't need any breakthroughs, just a bit of routine engineering and a buildout which is relatively modest: well within the normal investment levels for the energy business.

The only real problem we have is that we would ideally expand renewables and PHEV/EVs sufficiently quickly that we'd make some of the current infrastructure obsolete. That's not a terrible cost, but it does create thorny political problems. Worse, a lot of people's careers would be obsolete, and they're going to fight that as hard as they can. We'd do well to try to help them, instead of just giving them disrespect and creating governmental gridlocks.

"I think the author does not take into account the drive of technological advances."

You're right you have to factor in technological advances. But after the 1960's/1970's era, with some well-known exceptions (e.g. parts of the ICT-sector), generally speaking progress in technology has fallen below expectations. The problem is that at our current level of technology and complexity, further innovation might be subject to diminishing returns. So while innovation of course keeps its inherent advantages (diminishing returns are still returns), I very much doubt that technology alone will help us out here. Extreme example: experts involved in ITER claim 2040 or 2045 as the earliest time when commercial operation of nuclear fusion power plants might be operational. But we don't have 3 decades left to wait for such technofix.

Technological advances may buy us time, but without 'control', at the end of the day they will only help to deplete our resources more efficiently and more quicly.

That depends on your expectations.

If you were looking for fusion power, then sure. If you were looking for more efficient lighting, then CFL bulbs have delivered about a 4x improvement, and LED lights are poised to deliver another 4x within the next few years (they're already available, but still a little pricier). Similarly, there have been enormous improvements in batteries (Li-ion's power density is something like 4x that of 70s-era lead-acid), to the extent that electric cars are finally practical, and big improvements are continuing to come out (such as high-cycle-life lithium batteries). Also with wind and solar technologies - these are currently (wind) or nearly (solar) commercially viable, and are both highly practical, a far cry from their 70s-era status. Even boring old petrol cars have doubled in efficiency since the 70s.

I could go on, but hopefully you get the point: if you're not seeing substantial technological advances, it's because you're not looking.

Expectations for technological advance are a funny thing; we don't get to choose where breakthroughs will occur. We can bias things by putting more resources into one area or another, but it's never clear beforehand quite how close we are to a breakthrough. Accordingly, any individual expectation has a high chance of being unfulfilled, even though progress overall might be quite rapid. Fusion power might still be 30 years away, just like it was 30 years ago, but wind and solar power are now viable. The net result is a new energy source, even though 30 years ago we might have expected it to be a different one.

I agree with everything you said, except for one thing:

electric cars are finally practical

Electric cars have always been practical, they just haven't been competitive with dirt-cheap oil-based fuels.

A PHEV like the Chevy Volt was developed 100 years ago, by Ferdinand Porsche. But, when gasoline was $.20/gallon, it just didn't make any sense. It wasn't needed. A PHEV would cost roughly $.10/mile in 1909 and 2009 - that can compete with $2.50 gasoline in a Model T, (which got about 25MPG) and in the average US car (which gets about 22MPG).

Li-ion is more convenient: it takes up less space, and it weighs less. But, lead-acid would have worked just fine, if need be.

So, why wasn't it done in Europe, where fuel is more expensive? Because of the capital and regulatory barriers to entry; the lower miles/vehicle, which make capex relatively harder to justify; and the low ratio of fuel cost to capital cost, even in Europe.

Exactly. Very dangerous in case of conventional oil. I read several times that secondary recovery delays the peak of fields, however that the decline past peak could be much steeper. Easy to imagine. And oilcompanies are not different from other companies. They want to sell as much of their stuff as possible and don't care about the fate of the rest of the world. The 'oil and gas experiment' can be done only once, and it is done in a 'stupid' manner.

I think you have missed the point. The article mentions that reserve growth is based on the idea that we can use energy to expand mineral reserves by going after more diffuse ores with more energy intense strategies. But if energy is constrained, this goes up in price with greater use, which makes the cost to mine diffuse ores higher. As both of these deplete (energy and the mined mineral) it would seem that they should work synergistically and eventually hit a ceiling on useful production because, obviously, we cannot spend all of GDP (not even close to it) to mine copper and still run an industrial civilization. I believe the term used on this site is "receding horizons"...

We will have to address demand too. Really, most of the uses of most of these minerals is nonessential. We don't need aluminum packed vegetables in the quantity we use now if we relocalize most food production, for example. Most of these uses have to do with being more economically competitive (why not buy tinned goods from the other side of the world if they are cheaper?) and would go away when the practice becomes uneconomic.

There has to be way more emergy in the packaging than the food itself. I've always wondered that about yogurt too. How many calories did it take to make the container? How many calories in the food? At least the latter is on the side label.

Certainly a similiar relationship exists in precious metals. There are a great many currently uneconomical gold and silver deposits. Just check the Toronto Venture Exchange listed company websites.

Yes, there's more at lower grades. But extracting this takes more energy. Didn't you read the article?

It is in any case common sense. If in a tonne of rock in site Alpha there are 100kg of the metal I want, and then in a tonne of rock in site Bravo there are 10kg, it's obvious that getting the metal from Bravo will take more energy. And site Charlie with 1kg/t, or Delta with 0.1kg/t, and so on - more energy still.

The dollar price rising increasing "reserves" simply reflects the amount of energy which has to be spent; if you're willing to pay $100/kg I'll obviously be willing to spend more energy getting the metal from the mineral than if you're only willing to pay $10/kg. But the price can't go up forever. If we were willing to pay a billion dollars a barrel we could get oil from Titan; but it seems unlikely we'll ever do so, not many people have a billion dollars to blow.

Of course it takes more energy, and as you say, that is reflected in the price.

So my point was really that energy requirements rise very slowly. If we are willing to spend 32% more energy on extraction, we double our reserves (if other metals are distributed like uranium).

Another poster remarked that this increase will work synergistically with oil depletion. I agree, to some extent, but I belong to the crowd that believes our civilisation will have ample time to, for instance, switch to a wind powered (or even better, a gen-IV nuclear powered) ammonia economy. Thus, there is a limit to the impact of oil depletion.

switch to a wind powered (or even better, a gen-IV nuclear powered) ammonia economy

I think PHEV/EVs is the sensible path. I assume ammonia requires some conversion of vehicles, and it seems to be kind've a pain to handle.

If ammonia requires some conversion of vehicles, I don't see an advantage over PHEV/EVs. Do you have more info?

Conversion from gasoline to ammonia is not really an option, so you need to start from scratch.

To produce ammonia, you need to do electrolysis and then use the hydrogen in the Haber process to get ammonia. Then you burn it in an ICE. The electricity-to-wheel efficiency of this is less than 10%. The "price" at that efficiency should be around 2-3 kWh electricity per kilometer.

Given that efficiency, it is probably correct that EVs are preferable for most applications, so think of the ammonia economy as "at worst, we'll do that, but we'll probably find something better".

get ammonia. Then you burn it in an ICE.

I'm still not clear. Ammonia can be burned directly in an ICE, without some kind of conversion of the ICE?

Given that efficiency, it is probably correct that EVs are preferable

Yikes! That's 20x the energy per mile! Yes, I agree, that looks like a distant fall-back option.

Would it make more sense to synthesize diesel, or CNG?

"All you have to do is to increase the price ....".

That's exactly my point (and substitute price for energy): we will be forced to follow the path of ever diminishing returns. You cannot analyze one or the other metal in isolation in this context. If you consider metal minerals scarcity in its complete context, your solution of raising prices will seriously hurt us since we'll lack many metals simultaneously. Every extra effort (money, energy) you put in primary production of metals, you cannot put in other essential activities, unless of course you would still be living in a world with exponential growth.

Sure, but the question is how much it will hurt us. What is the energy requirements of global primary metal extraction today, and how much of that is electricity, how much is coal and how much is oil? My hunch is that it is not much of overall energy consumption, insignificant oil, and that the energy needs per kg increases very slowly. Please prove me wrong!

I think the precautionary principle is UnAmerican.

The world outside the United States of America should NOT expect to have any rights or access to any depleting resources, other than what we, the United States of America, allow onto the markets in the future.

Steven Chu and Obama are planning our future now, and they are not skeered. They have technology, and they have the World's Greatest Military armed with Super Duper Smart Weapons. Plus we have the world's greatest bankerz.

Seriously though, I doubt Chu or Obama understand resource limits. And even if they did, they would never be able to sell it to the public.

I get your point and second it.

Show it to ObamaChu. Show it too your neighbor.

It gets even more interesting if you take a look at how income percentages breakdown for the US population. http://www.demos.org/inequality/numbers.cfm

So assuming that income is correlated with consumption and economic clout, it becomes an even more stark picture. BTW ObamaChu work directly for that very slim segment of the economic pie. So they, in essence, are being paid not to do too much about this glaringly inconvenient little inequality.

"BTW ObamaChu work directly for that very slim segment of the economic pie."

Exactly. And the rest of the population is economic cannon fodder.

There are plenty of mineral and other resources left for that thin sliver of society that owns the Congress and Executive branch - as long as the rest of us are destitute (including most of the rest of the world's nations).

Thank godz we have a republic where the zombies smile when they vote.

Speaking for the rest of the world ;) (albeit from a currently comfortable, if vulnerable, perch in Europe), I thought the assumption was we could mostly become Americans, if lower-cost versions, courtesy of technology and growth-economics and competitive financial investment to keep it all rational and efficient as we made inevitable Progress. It had been essentially done - all we needed was to roll-it-out and deal with any pesky unreasonable roadblocks along the way. What now the prospects for this 'global industrialization and modernization project', when it is less than perhaps a third rolled-out, and given those pie charts?

Should we be surprised?

Seriously, 'the global project' looked like an impossible promise (rationalization) 30 years ago. Most must still believe it, though.

Roll on

This is why I think that we will see the real solution to peak oil and other resource constraints play out on the economic front. The obvious solution given the original graphs is to reduce the precentage of the population in the US that has financial clout to purchase resources. This means impoverishing the lower layers of the American social strata to ensure that upper layers continue to get what they want.

Probably we will continue to get close to the same overall percentage of the worlds resources say +/- 5% for some time China and India will probably grow but this will be against a backdrop of a overall shrinking in the total resource base.

What this means given a debt based economy is fewer and fewer people have access to credit as their future earning become ever more doubtful. Think about it.

The basis of our economic system is really that we have some growth and that the American worker can spend via credit all of the money he makes in thirty years today. This is done with long term loans and rolling credit. Eventually at the end of the day overall inflation is supposed to translate into wealth as people sell their homes and exist the stock market to retire to their second vacation homes.

Well its simply not going to work that way as credit is reduced because of the shrinking of the overall input of core commodities and resources the total amount of future assets that can be created declines.

This directly reduced the amount that can be safely loaned in the future and like a back to the future wave comes back to today in the form of credit defaults as growth stalls and the real economy shrinks.

Whats interesting is for credit its basically a boolean event either your credit worthy and can service your debt or you cannot. Either your capable of taking on more credit or you are not. Regardless of the dance the government plays the intrinsic situation is the same.

Now one can look at our base fractional reserve lending levels and its at 10:1 if one considers that we go back simply to a basically stagnant economy with lending at 1:1 we are talking about a 90% reduction in the part of the economy driven by credit. However we also have a secondary economy which I call the daily economy consisting of buying energy and food. This economy generally is not financed with long term credit its pretty much a cash or cash equivalent economy. We can take a guess at the ratio looking at the collapse of the housing market. The housing markets used a tremendous amount of resources and was financed with long term credit its collapse has lead to energy usage dropping about 6% while in the financial world the true impact is devastating at least a 50% decline or more in the financial economy.

I'd suggest once it all plays out we will see that our financial economy declined by 75% while our overall energy usage probably declines by only 15% or less.

As you can see the deleveraging and roll back of credit over the longer term probably cannot reduce consumption to make up for decline the interaction is complex but given the amount of leverage assuming the system does not collapse we have a increasingly tough time covering borrowing from the future for today.

The only way out is to reduce the pool of potential borrowers the trick is you keep your 10:1 leverage financial system it just simply operates for a smaller and smaller precentage of the population.

Globally this is effectively what happens right now credit availability is unevenly distributed there is no intrinsic reason that the US itself cannot accept a new underclass with demographics similar to the third world to support a smaller population that can still live a lifestyle similar to todays.

If you look at third world countries this is exactly how they operate the top of the pyramid lives exactly like they do in the US down through their supporting staff. Pay scales are quite similar and energy usage is about the same. Credit availability is effectively the same. The large population of poor skews the statistics to give a much lower per-capita energy usage but what you really have is a enclave of western level affluence in a sea of poverty with less than 10% of the population using 50% of the energy or more.

At least initially the political instability caused by rising poverty will allow one of the current political groups to tighten its hold on power.

One of the tipping point factors will be when the social support web created after the Great Depression is removed at some point you will see a ground swell of support for limiting social services. Collapsing state and local governments will probably make this a defacto situation without a vote. As people refuse to accept the crushing tax burden required to keep our current social services working as the country is overwhelmed with poverty they will simply cease to be available with no real changes in the law.

This is how its done in Communist countries all these services are supposedly available but there are few physical offices that allow you to claim your social support and you have huge lines and massive delays if you try to use the social services. I doubt for a while that the contract will be torn up it just simply will become impossible to fufill. I'd not be surprised in the least to see governments for example cut web access to jobless benefits and require you to fill out ever more paperwork in person and fewer and fewer offices.

I really don't see any reason as long as we try to follow the status quo that we simply won't see the poverty levels for the lowest rungs of the social ladder increase to allow the top to continue.

The biggest reason I reject the current concepts for our society to transform itself into a renewable one is that these proposals don't address how they deal with this much simpler and easier approach.

Its far far easier to allow the expansion of the impoverished level to include a growing precentage of the population of the first world countries. In fact by doing this it also works to remove the wage disparity that resulted in the large global trade imbalances in the first place. As wages are pushed down locally you will get localization as jobs are returned to reduce energy costs. ELP is agnostic to the way its implemented a society with dwindling real resources has no choice but to practice ELP. But it can be done in a good way or a bad way ELP is neither good nor bad intrinsically. It does not define how the fruits of a relocalized economy are distributed. As and example ELP was widely practiced in the Middle ages but obviously the serfs where probably not happy with this form of ELP.

There are only two solutions to preventing this. For the wealthy to wind down their lifestyles and allow the declining wealth to be redistributed and for a new renewable society to grow but minimizing the disparity. This does not mean we can maintain our current way of life but it would mean that we could if we worked hard ensure that the bottom is not one of deep poverty. If we also practice population control over time as population declines the per capita wealth is increased as the system becomes more renewable.

Its a slow and steady change but one thats doable if the top of the pyramid chooses.

Next assuming the above won't happen we can look at our lifestyles and change internally. I'm a big fan of Amish electricity (compressed air) since it allows local manufacture of a wide range of products which make life easier. What this approach does is leverage our scientific knowledge base to simply develop alternative lifestyles that allow people to live decent lives. This approach does not require massive renewable projects instead we identify at the consumer levels goods and services that can be substituted with local alternatives. As these become adopted the monetary system begins to operate in a closed loop with wealth cycling amongst the lower level of the pyramids and little or none actually being extracted by the top echolon. What we do is cut off the flow of wealth to the top of the pyramid by increasingly rejecting the produces and services they offer for sale. Relocalization using this method expands local employment and any concentration of wealth is is far far more likely to be reinvested expanding the level of localization. This is not communistic its really a return to a simpler form of commerce. With this transition you could then introduce banking based on Shari like laws which fits well with this sort of economy.

Both solutions are intrinsically the same and they involve cutting the wealthy off from the flow of funds to the top any real solution to our problem must work to isolate the wealthy from the creation of wealth allowing it to recirculate back in the economy to allow renewable approaches to grow even as the overall system contracts.

Thus any real solution simply must cut the wealthy off from their ability to concentrate wealth using the current system. They are certainly free to join the new system but only via investment and in a sense adoption of a local region. They could for example develop local banks again and resign themselves to taking a smaller piece of the pie and spending the money in the local economy.

It turns out the most important thing that must be recycled in a renewable economy is money.

If you can't show your plan causes money to be recycled then its not renewable.

Mega wind farms our fine not problem but they better be locally owned mega wind farms owned be the elite do no good but are simply a variant of the old landed estate model.

Certainly the wealthy can loan the local populace the money to build the mega wind farm and the sale of the electricity generated can be used to pay off the loan but this is how it must operate the ownership of resources and renewable energy generation must revert fairly quickly back to the local economy.

Once the loan is paid off future profits go to create a flow of wealth into the local economy.

This forces the wealthy to go and invest in another region as they are cut out of the flow of wealth from current investments.

Excellent points memmel!

One of the books in my meager library is Simon Velez's "GROW YOUR OWN HOUSE".

In it, among many wonderful pieces of bamboo architecture, is depicted a beautiful two story house that would cost around $5000 to build. It is made mostly of renewable resources and can be assembled by low skilled builders such as myself. However if one were to try and start building such structures you can be sure that it would not be allowed. You could never get a construction permit for something like it even though it probably surpasses our traditional cardboard energy hogs in all parameters.

Here is an excerpt from a reviewer:

http://findarticles.com/p/articles/mi_m3575/is_1279_213/ai_111105947/